|

시장보고서

상품코드

1796196

엔터테인먼트 컨텐츠 및 상품 시장 예측(-2030년) : 음악 장비 및 기념품, 레코드, 사인 상품, 라이프스타일 및 가정용품, 스포츠 용품, 수집품, 애니메이션 컨텐츠 제작, 영화, TV/OTT, 의류별Entertainment Content and Goods Market by Music Equipment and Memorabilia, Vinyl Record, Signed Merchandise, Lifestyle and Home Goods, Sporting Equipment, Collectible, Animated Content Creation, Film, TV/OTT and Apparel - Global Forecast to 2030 |

||||||

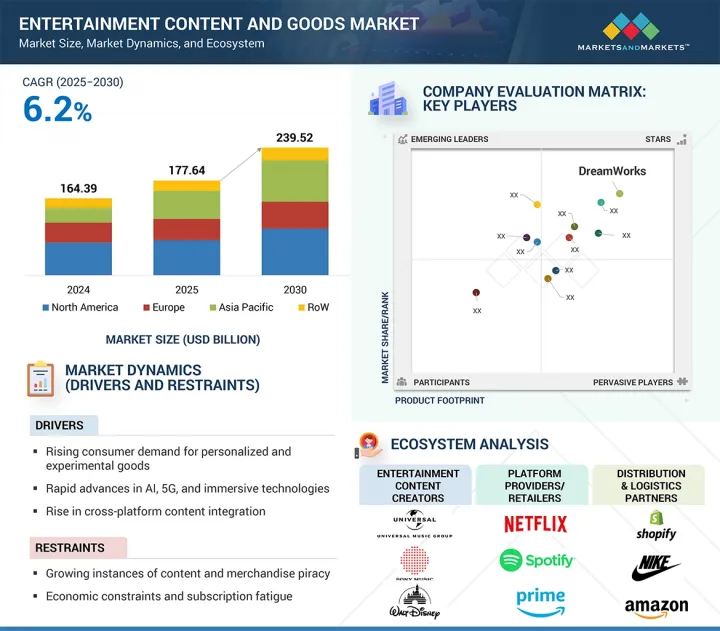

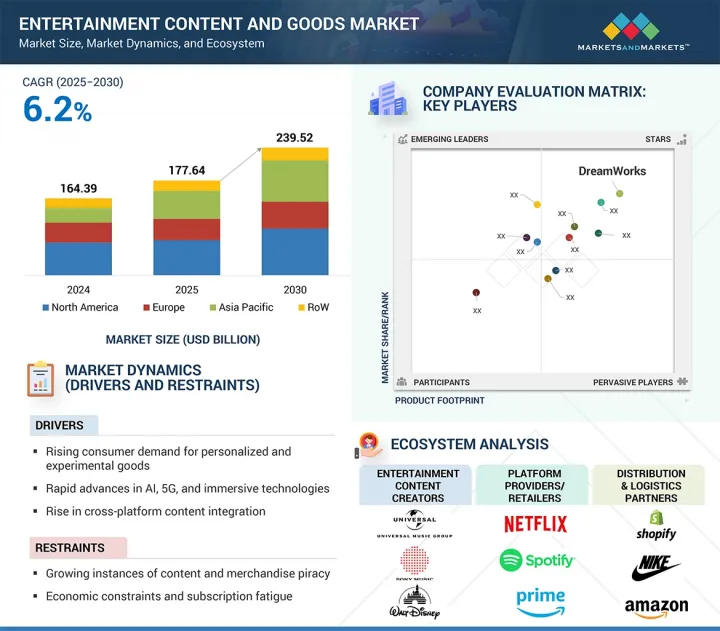

세계의 엔터테인먼트 컨텐츠 및 상품 시장은 2025년 1,776억 4,000만 달러에서 예측 기간 중 CAGR 6.2%로 추이하며, 2030년에는 2,395억 2,000만 달러에 달할 것으로 예측됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상연도 | 2021-2030 |

| 기준연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 금액(달러) |

| 부문별 | 음악 아티스트 상품 유형·라이선스 상품 유형·애니메이션 컨텐츠 제작·지역별 |

| 대상 지역 | 북미·유럽·아시아태평양·기타 지역 |

엔터테인먼트 컨텐츠 및 굿즈 시장을 촉진하는 주요 요인으로는 디지털 컨텐츠의 세계 소비 확대, 팬덤 문화 확산, 개인화된 한정판 상품에 대한 수요 증가 등을 꼽을 수 있습니다. 이러한 요인들로 인해 엔터테인먼트 기업은 제품 및 서비스를 다양화하고, 여러 채널에서 지적 재산을 수익화해야 하는 상황에 직면해 있습니다.

AR/VR, NFT, AI를 통한 컨텐츠 생성과 같은 기술 혁신은 관객의 참여를 높이고 몰입형 브랜드 경험을 가능하게 합니다. 또한 D2C 플랫폼과 소셜 커머스의 확대로 상품과 한정 컨텐츠에 대한 접근이 가속화되고 있습니다. 반면, 지적재산권 침해, 소비자 취향의 변화, 높은 컨텐츠 제작 비용 등의 문제는 시장의 확장성을 제약할 수 있습니다. 또한 디지털 인프라의 불균일성과 신흥 시장에서의 팬 수익화 전략의 지역적 격차도 일부 시장의 성장을 저해하는 요인으로 작용할 수 있습니다.

"라이선스 상품 유형별로는 라이프스타일, 팬 기어, 기념품 부문이 예측 기간 중 가장 높은 CAGR을 나타낼 것으로 예측됩니다. "

이 부문은 개인화되고, 팀 지향적이며, 정서적 공감을 불러일으키는 제품에 대한 소비자 수요 증가로 인해 예측 기간 중 가장 높은 CAGR을 보일 것으로 예측됩니다. 이 부문에는 음악, 프로 스포츠 팀, 선수, 리그, 스포츠 이벤트에서 영감을 얻은 의류, 액세서리, 홈 데코레이션, 컬렉션 아이템이 포함됩니다. 관객들이 구체적인 상품을 통해 자기표현과 팬덤을 추구하는 경향이 강해짐에 따라 라이선스 라이프스타일 상품과 기념품은 엔터테인먼트 기업의 중요한 수입원으로 부상하고 있습니다.

디지털 전환은 이러한 성장을 더욱 가속화하고 있으며, 스포츠 브랜드와 리그는 D2C 채널, 한정판, 소셜 커머스 전략을 활용하여 팬 참여와 상품 판매를 확대하고 있습니다. AR 기능, QR을 통한 진위 확인, NFT와 연동된 기념품은 상품의 쌍방향성과 소장가치를 높이고 있습니다. Fanatics Inc.(미국), Nike Inc.(미국), Adidas AG(독일)와 같은 기업은 독점적인 리테일 협업과 선수 중심의 컬렉션을 통해 세계 시장을 위한 라이선스 제품 포트폴리오를 확장하고 있습니다.

디지털 컨텐츠와 실물 상품을 결합한 하이브리드 팬 경험의 인기 상승도 이 부문의 확대에 기여하고 있습니다. 브랜드 생태계가 더욱 몰입형화되고 팬덤 문화가 진화함에 따라 라이프스타일 상품과 기념품은 세계 엔터테인먼트 기업의 컨텐츠 수익화 전략에서 점점 더 중요한 요소로 자리 잡고 있습니다.

세계의 엔터테인먼트 컨텐츠 및 상품 시장을 조사했으며, 시장 개요, 시장 성장에 대한 각종 영향요인의 분석, 기술·특허의 동향, 법규제 환경, 사례 연구, 시장 규모 추이·예측, 각종 구분·지역/주요 국가별 상세 분석, 경쟁 구도, 주요 기업의 개요 등을 정리하여 전해드립니다.

목차

제1장 서론

제2장 조사 방법

제3장 개요

제4장 주요 인사이트

제5장 시장 개요

- 시장 역학

- 촉진요인

- 억제요인

- 기회

- 과제

- 밸류체인 분석

- 에코시스템 분석

- 고객 사업에 영향을 미치는 동향/혼란

- 기술 분석

- 가격 분석

- 사례 연구 분석

- 2025-2026년의 주요 컨퍼런스와 이벤트

제6장 엔터테인먼트 컨텐츠 및 상품 시장 : 음악 아티스트 상품 유형별

- 의류

- 프린트 T셔츠

- 후디·스웨트셔츠

- 캡·모자·비니

- 액세서리

- 백

- 신발

- 워치

- 기타

- 라이프스타일 및 가정용품

- 머그컵·드링크웨어

- 포스터·아트워크

- 문구류

- 음악 장비·기념품

- 바이닐 레코드

- 사인 상품

- 기기

제7장 엔터테인먼트 컨텐츠 및 상품 시장 : 라이선스 상품별

- 라이선스 스포츠웨어

- 공식 팀 저지와 T셔츠

- 브랜드 스포츠 캡과 헤드웨어

- 스포츠 팀 후디와 아우터웨어

- 스포츠 용품과 팬용 액세서리

- 팀 브랜드 백

- 스포츠 에디션 신발

- 스마트워치와 피트니스 밴드

- 기타 브랜드 액세서리

- 스포츠 용품

- 볼

- 라켓

- 장갑·패드

- 기타

- 라이프스타일, 팬 기어, 기념품

- 보틀·드링크웨어

- 스카프·리스트밴드

- 수집품

- 포스터·캘린더·포토북

- 기타

제8장 엔터테인먼트 컨텐츠 및 상품 시장 : 애니메이션 컨텐츠 제작별

- 컨텐츠 유형별

- 필름

- TV /OTT

- 애니메이션 스타일별

- 2D 애니메이션

- 3D 애니메이션

- 스톱 모션 애니메이션

- 믹스드 미디어

제9장 엔터테인먼트 컨텐츠 및 상품 시장 : 지역별

- 북미

- 거시경제 전망

- 미국

- 캐나다

- 멕시코

- 유럽

- 거시경제 전망

- 독일

- 영국

- 프랑스

- 이탈리아

- 기타

- 아시아태평양

- 거시경제 전망

- 중국

- 일본

- 한국

- 인도

- 기타

- 기타 지역

- 거시경제 전망

- 중동 및 아프리카

- 남미

제10장 경쟁 구도

- 개요

- 주요 참여 기업의 전략/강점

- 경쟁 시나리오

제11장 기업 개요

- 주요 기업

- MERCHBAR, INC.

- FANATICS INC.

- NIKE, INC.

- ADIDAS AG

- NEW ERA CAP

- PUMA SE

- THE WALT DISNEY COMPANY

- DREAMWORKS ANIMATION

- ILLUMINATION

- PARAMOUNT

- 기타 기업

- NETFLIX, INC.

- UNIVERSAL MUSIC GROUP N.V.

- SONY MUSIC ENTERTAINMENT

- WARNER MUSIC GROUP INC.

- AMAZON.COM, INC.

제12장 부록

KSA 25.09.01The entertainment content and goods market is anticipated to be valued at USD 177.64 billion in 2025 and USD 239.52 billion by 2030, growing at a CAGR of 6.2% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Music Artist Goods Type, Licensed Goods Type, Animated Content Creation, and Region |

| Regions covered | North America, Europe, APAC, RoW |

Key factors driving the entertainment content and goods market include the increasing global consumption of digital content, rising fandom culture, and demand for personalized, limited-edition merchandise. These factors compel entertainment companies to diversify their offerings and monetize intellectual property across multiple channels.

Technological advancements, such as AR/VR, NFTs, and AI-driven content creation, enhance audience engagement and enable immersive brand experiences. Furthermore, the expansion of direct-to-consumer platforms and social commerce accelerates access to merchandise and exclusive content. However, challenges such as IP infringement, fluctuating consumer preferences, and high content production costs can constrain market scalability. Additionally, inconsistent digital infrastructure and regional disparities in fan monetization strategies may hinder growth in certain emerging markets.

"By licensed goods type, the lifestyle, fan gear, and memorabilia segment is expected to register the highest CAGR from 2025 to 2030."

The lifestyle, fan gear, and memorabilia segment is projected to register the highest CAGR in the entertainment content and goods market during the forecast period, driven by rising consumer demand for personalized, team-driven, and emotionally resonant merchandise. This segment includes apparel, accessories, home decor, and collectible items inspired by music, professional sports teams, athletes, leagues, and sporting events. As audiences increasingly seek to express identity and fandom through tangible goods, licensed lifestyle and memorabilia products are emerging as key revenue drivers for entertainment companies.

Digital transformation further amplifies this growth, with sports brands and leagues leveraging direct-to-consumer channels, limited-edition drops, and social commerce strategies to boost fan engagement and merchandise sales. Augmented reality (AR) features, QR-enabled authenticity checks, and NFT-linked memorabilia enhance product interactivity and collectability. Companies such as Fanatics Inc. (US), Nike, Inc. (US), and Adidas AG (Germany) are expanding their licensed merchandise portfolios through exclusive retail collaborations and athlete-driven collections tailored for global audiences.

The growing popularity of hybrid fan experiences, combining digital content with physical goods, also contributes to segment expansion. As brand ecosystems become more immersive and fandom culture evolves, lifestyle and memorabilia goods are positioned to become increasingly integral to the content monetization strategies of leading entertainment players worldwide.

By animated content creation, the TV/OTT segment is projected to account for the largest market share from 2025 to 2030."

The TV/OTT segment is expected to account for the largest share of the animated content creation market from 2025 to 2030, driven by the rising demand for high-quality, serialized animated programming across streaming platforms and traditional broadcast channels. With the global surge in OTT consumption, fueled by increased internet penetration and mobile device usage, animation has become a preferred format for engaging audiences across age groups, particularly children, young adults, and fandom-based communities.

TV and OTT platforms heavily invest in original animated content to differentiate offerings, retain subscribers, and capture niche viewer segments. Streaming giants such as Netflix, Disney+, Amazon Prime Video, and regional platforms, including Voot and Tencent Video, commission exclusive animated series, reboots of legacy IPs, and culturally localized content to meet rising viewer expectations. The flexibility of animation to support diverse storytelling formats, from educational series to adult comedy and fantasy, further expands its applicability and appeal.

In addition, the integration of advanced production technologies, such as 2D/3D hybrid animation, motion capture, and AI-based rendering, enhances visual quality and production efficiency. As content consumption habits evolve and demand for on-demand, serialized storytelling grows, the TV/OTT segment is expected to maintain its leadership in animated content creation, supported by robust platform investments and global audience engagement.

"North America is projected to account for the largest market share from 2025 to 2030."

The North America region is projected to hold the largest share of the global entertainment content and goods market from 2025 to 2030, owing to a mature entertainment ecosystem, widespread digital infrastructure, and high consumer spending on content and branded merchandise. The US remains a global hub for entertainment production and IP commercialization, with major players such as The Walt Disney Company, Warner Bros. Entertainment, Universal Music Group, and Paramount headquartered in the region. These companies leverage extensive distribution networks and fan engagement platforms to monetize content across film, television, music, gaming, and consumer products.

The region's dominance is further supported by the widespread adoption of streaming services, direct-to-consumer retail channels, and fan-based commerce. The growing trend of limited-edition merchandise drops, exclusive artist collaborations, and immersive fan experiences, including virtual concerts and AR/VR-driven activations, is enhancing consumer engagement and driving high-margin sales. Moreover, the integration of emerging technologies such as NFTs and AI-generated content accelerates innovation across content creation and merchandise offerings.

Strong IP protection laws, advanced content monetization models, and a well-established retail infrastructure provide a conducive environment for sustained growth. With a culture that values entertainment as a lifestyle, North America is expected to maintain its leading position in the global entertainment content and goods market.

The breakdown of the profile of primary participants in the entertainment content and goods market is as follows:

- By Company Type: Tier 1 - 40%, Tier 2 - 35%, Tier 3 - 25%

- By Designation Type: C Level Executives - 40%, Director Level - 30%, Others - 30%

- By Region Type: Asia Pacific - 35%, North America - 25%, Europe - 25%, RoW - 15%

Notes: Other designations include sales, marketing, and product managers.

The three tiers of the companies are based on their total revenues as of 2024: Tier 1: >USD 1 billion, Tier 2: USD 500 million-1 billion, and Tier 3: USD 500 million.

The major players in the entertainment content and goods market with a significant geographical presence include The Walt Disney Company (US), Universal Music Group N.V. (Netherlands), Warner Bros. Entertainment Inc. (US), Sony Music Entertainment (US), Paramount (US), and others.

Research Coverage

The report segments the entertainment content and goods market and forecasts its size by music artist goods type, licensed goods type, animated content creation, and region. It also comprehensively reviews drivers, restraints, opportunities, and challenges influencing market growth. The report covers qualitative aspects in addition to quantitative aspects of the market.

Reasons to buy the report

The report will help the market leaders/new entrants in this market with information on the closest approximate revenues for the overall entertainment content and goods market and related segments. This report will help stakeholders understand the competitive landscape and gain more insights to strengthen their position in the market and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of key drivers (rising consumer demand for personalized and experiential entertainment goods, rapid advances in AI, 5G, and immersive technologies, rise in cross-platform content integration), restraints (growing instances of content and merchandise piracy, economic constraints and subscription fatigue), opportunities (increasing collaboration between innovative brands and artists, rising integration of blockchain and non-fungible tokens into digital goods, growing digitally connected population in emerging economies), and challenges (high cost of premium merchandise production, increasing competition among entertainment platforms, rapidly changing consumer preferences and volatility in market trends)

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product/service launches in the entertainment content and goods market

- Market Development: Comprehensive information about lucrative markets -the report analyses the entertainment content and goods market across varied regions

- Market Diversification: Exhaustive information about new products, untapped geographies, and recent developments such as partnerships, collaborations, acquisitions, agreements, and expansions in the entertainment content and goods market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players, including The Walt Disney Company (US), Universal Music Group N.V. (Netherlands), Warner Music Group Inc. (US), Sony Music Entertainment (US), Paramount (US), Netflix, Inc. (US), Fanatics Inc. (US), DreamWorks Animation (US), Illumination (US), Amazon.com, Inc. (US), PUMA SE (Germany), New Era Cap (US), Adidas AG (Germany), Merchbar, Inc. (US), and Nike, Inc. (US).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 List of key secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 List of primary interview participants

- 2.1.3.2 Breakdown of primaries

- 2.1.3.3 Key data from primary sources

- 2.1.3.4 Key industry insights

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to arrive at market size using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to arrive at market size using top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 FACTOR ANALYSIS

- 2.3.1 DEMAND-SIDE ANALYSIS

- 2.3.2 SUPPLY-SIDE ANALYSIS

- 2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ENTERTAINMENT CONTENT AND GOODS MARKET

- 4.2 ENTERTAINMENT CONTENT AND GOODS MARKET, BY MUSIC ARTIST GOODS TYPE

- 4.3 ENTERTAINMENT CONTENT AND GOODS MARKET, BY LICENSED GOODS TYPE

- 4.4 ENTERTAINMENT CONTENT AND GOODS MARKET, BY ANIMATED CONTENT CREATION

- 4.5 ENTERTAINMENT CONTENT AND GOODS MARKET, BY REGION

- 4.6 ENTERTAINMENT CONTENT AND GOODS MARKET, BY GEOGRAPHY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising consumer demand for personalized and experiential entertainment goods

- 5.2.1.2 Rapid advances in AI, 5G, and immersive technologies

- 5.2.1.3 Rise in cross-platform content integration

- 5.2.2 RESTRAINTS

- 5.2.2.1 Growing instances of content and merchandise piracy

- 5.2.2.2 Economic constraints and subscription fatigue

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing collaboration between innovative brands and artists

- 5.2.3.2 Rising integration of blockchain and non-fungible tokens into digital goods

- 5.2.3.3 Growing digitally connected population in emerging economies

- 5.2.4 CHALLENGES

- 5.2.4.1 High cost of premium merchandise production

- 5.2.4.2 Increasing competition among entertainment platforms

- 5.2.4.3 Rapidly changing consumer preferences and volatility in market trends

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.6 TECHNOLOGY ANALYSIS

- 5.6.1 KEY TECHNOLOGIES

- 5.6.1.1 Content streaming infrastructure

- 5.6.1.2 Digital rights management (DRM)

- 5.6.1.3 E-commerce merchandise platforms

- 5.6.2 COMPLEMENTARY TECHNOLOGIES

- 5.6.2.1 Artificial intelligence (AI)

- 5.6.2.2 Blockchain

- 5.6.2.3 Augmented reality (AR) and virtual reality (VR)

- 5.6.3 ADJACENT TECHNOLOGIES

- 5.6.3.1 Generative AI

- 5.6.3.2 Web3 and decentralized platforms

- 5.6.3.3 3D printing

- 5.6.1 KEY TECHNOLOGIES

- 5.7 PRICING ANALYSIS

- 5.7.1 PRICING TREND OF ENTERTAINMENT CONTENT AND GOODS, BY TYPE, 2021-2024

- 5.8 CASE STUDY ANALYSIS

- 5.8.1 NEW BELGIUM BREWING AND TUBI'S IN-HOUSE CONTENT STUDIO PARTNERED TO INTEGRATE VOODOO RANGER SKELETON MASCOT INTO THE FREAK BROTHERS TO BOOST BRAND IDENTITY

- 5.8.2 INFOSYS HELPS GLOBAL MUSIC AND ENTERTAINMENT COMPANY IMPLEMENT CENTRALIZED PLATFORM TO ENABLE UNIFORM PROCESSING WORKFLOWS

- 5.8.3 LG UPLUS INSTALLS MICROSOFT TEAMS TO MODERNIZE WORKPLACE COMMUNICATION AND CONTENT COLLABORATION

- 5.9 KEY CONFERENCES AND EVENTS, 2025-2026

6 ENTERTAINMENT CONTENT AND GOODS MARKET, BY MUSIC ARTIST GOODS TYPE

- 6.1 INTRODUCTION

- 6.2 APPAREL

- 6.2.1 RISE IN ARTIST-LED FASHION COLLABORATIONS WITH GLOBAL BRANDS AND MERCHANDISING SPECIALISTS TO BOLSTER SEGMENTAL GROWTH

- 6.2.2 PRINTED T-SHIRTS

- 6.2.3 HOODIES AND SWEATSHIRTS

- 6.2.4 CAPS, HATS, AND BEANIES

- 6.3 ACCESSORIES

- 6.3.1 EXPANDING DIRECT-TO-FAN COMMERCE CHANNELS TO CONTRIBUTE TO SEGMENTAL GROWTH

- 6.3.2 BAGS

- 6.3.3 SHOES

- 6.3.4 WATCHES

- 6.3.5 OTHER ACCESSORIES

- 6.4 LIFESTYLE AND HOME GOODS

- 6.4.1 EVOLVING GIFTING CULTURE AND AESTHETICALLY CURATED WORK-FROM-HOME ENVIRONMENTS TO FUEL SEGMENTAL GROWTH

- 6.4.2 MUGS AND DRINKWARE

- 6.4.3 POSTERS AND ARTWORK

- 6.4.4 STATIONERY

- 6.5 MUSIC EQUIPMENT AND MEMORABILIA

- 6.5.1 GROWING POPULARITY OF RETRO-STYLE MUSIC EXPERIENCES TO AUGMENT SEGMENTAL GROWTH

- 6.5.2 VINYL RECORDS

- 6.5.3 SIGNED MERCHANDISE

- 6.5.4 MUSICAL INSTRUMENTS

7 ENTERTAINMENT CONTENT AND GOODS MARKET, BY LICENSED GOODS TYPE

- 7.1 INTRODUCTION

- 7.2 LICENSED SPORTSWEAR

- 7.2.1 BURGEONING DEMAND FOR SUSTAINABLE, LIMITED-EDITION, AND INFLUENCER-BACKED MERCHANDISE TO DRIVE MARKET

- 7.2.2 OFFICIAL TEAM JERSEYS AND TEES

- 7.2.3 BRANDED ATHLETIC CAPS AND HEADWEAR

- 7.2.4 SPORTS TEAM HOODIES AND OUTERWEAR

- 7.3 ATHLETIC AND FAN ACCESSORIES

- 7.3.1 INCREASING USE OF CELEBRITY-THEMED BAGS, SHOES, WATCHES, AND OTHER PERSONAL ACCESSORIES TO BOOST SEGMENTAL GROWTH

- 7.3.2 TEAM-BRANDED BAGS

- 7.3.3 SPORTS EDITION FOOTWEAR

- 7.3.4 SMARTWATCHES AND FITNESS BANDS

- 7.3.5 OTHER BRANDED ACCESSORIES

- 7.4 SPORTING EQUIPMENT

- 7.4.1 FAN-DRIVEN PERSONALIZATION AND BRAND COLLABORATIONS TO FUEL SEGMENTAL GROWTH

- 7.4.2 BALLS

- 7.4.3 RACKETS

- 7.4.4 GLOVES AND PADS

- 7.4.5 OTHER SPORTING EQUIPMENT

- 7.5 LIFESTYLE, FAN GEAR, AND MEMORABILIA

- 7.5.1 PERSONALIZATION TRENDS AND EXPANDING OMNICHANNEL RETAIL STRATEGIES TO DRIVE MARKET

- 7.5.2 BOTTLES AND DRINKWARE

- 7.5.3 SCARVES AND WRISTBANDS

- 7.5.4 COLLECTIBLES

- 7.5.5 POSTERS, CALENDARS, AND PHOTOBOOKS

- 7.5.6 OTHER LICENSED PRODUCTS

8 ENTERTAINMENT CONTENT AND GOODS MARKET, BY ANIMATED CONTENT CREATION

- 8.1 INTRODUCTION

- 8.2 BY CONTENT TYPE

- 8.2.1 FILMS

- 8.2.1.1 Increasing investment in immersive storytelling and global appetite for cross-generational content to fuel segmental growth

- 8.2.2 TV/OTT

- 8.2.2.1 Surging demand for binge-worthy series and animation to contribute to segmental growth

- 8.2.1 FILMS

- 8.3 BY ANIMATION STYLE

- 8.3.1 2D ANIMATION

- 8.3.2 3D ANIMATION

- 8.3.3 STOP-MOTION ANIMATION

- 8.3.4 MIXED MEDIA

9 ENTERTAINMENT CONTENT AND GOODS MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 9.2.2 US

- 9.2.2.1 Strong commercialization of intellectual property to accelerate market growth

- 9.2.3 CANADA

- 9.2.3.1 Growing emphasis on content development and fan engagement to boost market growth

- 9.2.4 MEXICO

- 9.2.4.1 Rising digitally active population and disposable incomes to fuel market growth

- 9.3 EUROPE

- 9.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 9.3.2 GERMANY

- 9.3.2.1 Widespread use of streaming services and online gaming platforms to augment market growth

- 9.3.3 UK

- 9.3.3.1 Integration of AR/VR technologies into entertainment content to foster market growth

- 9.3.4 FRANCE

- 9.3.4.1 Synergy between content production and consumer goods to expedite market growth

- 9.3.5 ITALY

- 9.3.5.1 Availability of limited-edition goods, vintage content collectibles, and localized merchandise to drive market

- 9.3.6 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 9.4.2 CHINA

- 9.4.2.1 Strong mobile-first consumption habits to contribute to market growth

- 9.4.3 JAPAN

- 9.4.3.1 Advanced animation studios and strong legacy IP portfolios to boost market growth

- 9.4.4 SOUTH KOREA

- 9.4.4.1 Growing popularity of official light sticks and digital collectibles to fuel market growth

- 9.4.5 INDIA

- 9.4.5.1 Expansion of OTT platforms and surge in regional language content to drive market

- 9.4.6 REST OF ASIA PACIFIC

- 9.5 ROW

- 9.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 9.5.2 MIDDLE EAST & AFRICA

- 9.5.2.1 Growing monetization of local cultural IPs to contribute to market growth

- 9.5.3 SOUTH AMERICA

- 9.5.3.1 Increasing investment in local entertainment content production to augment market growth

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 10.2.1 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.2.1.1 Company footprint

- 10.2.1.2 Region footprint

- 10.2.1.3 Music artist goods type footprint

- 10.2.1.4 Licensed goods type footprint

- 10.2.1.5 Animated content creation footprint

- 10.2.1 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.3 COMPETITIVE SCENARIO

- 10.3.1 PRODUCT/SERVICE LAUNCHES

- 10.3.2 DEALS

- 10.3.3 EXPANSIONS

11 COMPANY PROFILES

- 11.1 INTRODUCTION

- 11.2 KEY PLAYERS

- 11.2.1 MERCHBAR, INC.

- 11.2.1.1 Business overview

- 11.2.1.2 Products/Solutions/Services offered

- 11.2.1.3 Recent developments

- 11.2.1.3.1 Deals

- 11.2.2 FANATICS INC.

- 11.2.2.1 Business overview

- 11.2.2.2 Products/Solutions/Services offered

- 11.2.2.3 Recent developments

- 11.2.2.3.1 Product/Service launches

- 11.2.2.3.2 Deals

- 11.2.3 NIKE, INC.

- 11.2.3.1 Business overview

- 11.2.3.2 Products/Solutions/Services offered

- 11.2.3.3 Recent developments

- 11.2.3.3.1 Product/Service launches

- 11.2.3.3.2 Deals

- 11.2.4 ADIDAS AG

- 11.2.4.1 Business overview

- 11.2.4.2 Products/Solutions/Services offered

- 11.2.4.3 Recent developments

- 11.2.4.3.1 Product/Service launches

- 11.2.4.3.2 Deals

- 11.2.5 NEW ERA CAP

- 11.2.5.1 Business overview

- 11.2.5.2 Products/Solutions/Services offered

- 11.2.5.3 Recent developments

- 11.2.5.3.1 Product/Service launches

- 11.2.5.3.2 Deals

- 11.2.6 PUMA SE

- 11.2.6.1 Business overview

- 11.2.6.2 Products/Solutions/Services offered

- 11.2.6.3 Recent developments

- 11.2.6.3.1 Product/Service launches

- 11.2.6.3.2 Deals

- 11.2.7 THE WALT DISNEY COMPANY

- 11.2.7.1 Business overview

- 11.2.7.2 Products/Solutions/Services offered

- 11.2.7.3 Recent developments

- 11.2.7.3.1 Product/Service launches

- 11.2.7.3.2 Deals

- 11.2.7.3.3 Expansions

- 11.2.8 DREAMWORKS ANIMATION

- 11.2.8.1 Business overview

- 11.2.8.2 Products/Solutions/Services offered

- 11.2.8.3 Recent developments

- 11.2.8.3.1 Deals

- 11.2.9 ILLUMINATION

- 11.2.9.1 Business overview

- 11.2.9.2 Products/Solutions/Services offered

- 11.2.9.3 Recent developments

- 11.2.9.3.1 Product/Service launches

- 11.2.9.3.2 Deals

- 11.2.10 PARAMOUNT

- 11.2.10.1 Business overview

- 11.2.10.2 Products/Solutions/Services offered

- 11.2.10.3 Recent developments

- 11.2.10.3.1 Product/Service launches

- 11.2.10.3.2 Deals

- 11.2.1 MERCHBAR, INC.

- 11.3 OTHER PLAYERS

- 11.3.1 NETFLIX, INC.

- 11.3.2 UNIVERSAL MUSIC GROUP N.V.

- 11.3.3 SONY MUSIC ENTERTAINMENT

- 11.3.4 WARNER MUSIC GROUP INC.

- 11.3.5 AMAZON.COM, INC.

12 APPENDIX

- 12.1 INSIGHTS FROM INDUSTRY EXPERTS

- 12.2 DISCUSSION GUIDE

- 12.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.4 CUSTOMIZATION OPTIONS

- 12.5 RELATED REPORTS

- 12.6 AUTHOR DETAILS