|

시장보고서

상품코드

1796197

GPU 서버 시장 예측(-2030년) : 배포별, 폼팩터별, 기능별, 냉각 기술별, 용도별, 최종 용도 산업별, 지역별GPU Server Market by Deployment (On-premises, Cloud-based), Form Factor (Rack-mounted Server, Blade Server, Tower Server), Function (Training, Inference), Cooling Technology, Application, End-user Industry and Region - Global Forecast to 2030 |

||||||

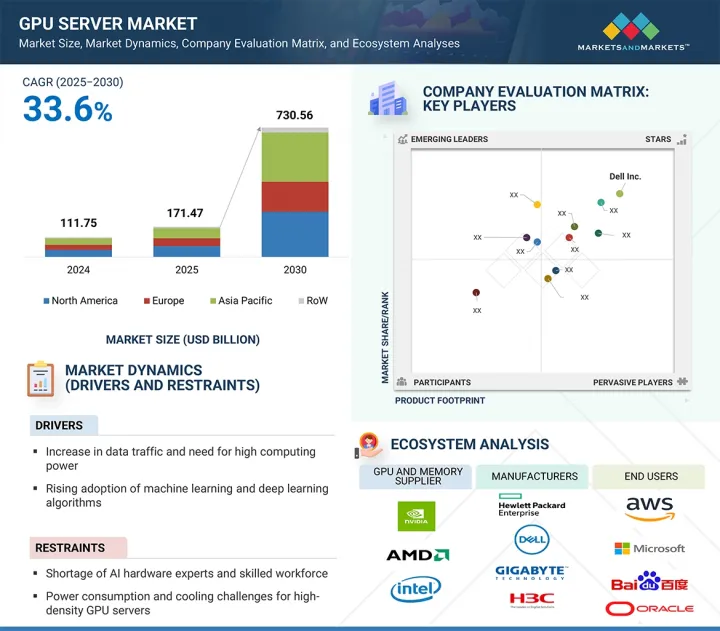

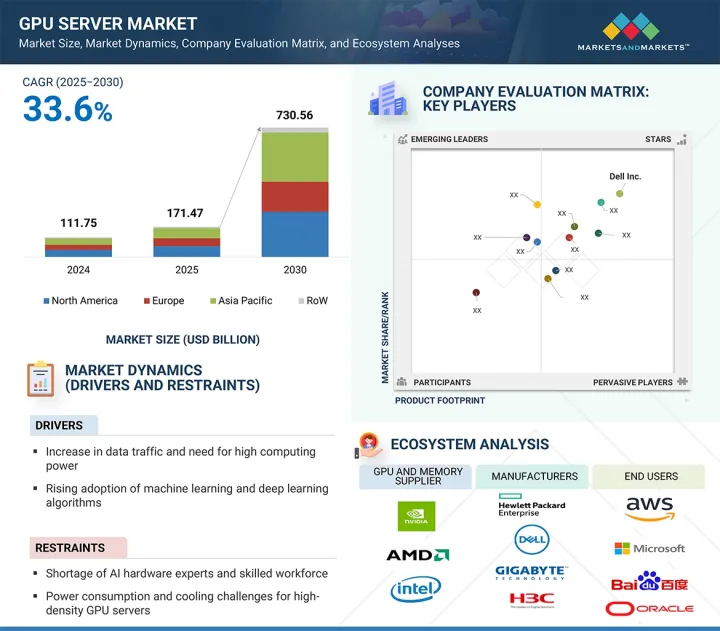

세계의 GPU 서버 시장 규모는 2025년 1,714억 7,000만 달러에서 2030년까지 7,305억 6,000만 달러에 달할 것으로 예측되며, 2025-2030년에 CAGR로 33.6%의 성장이 전망됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상연도 | 2021-2030년 |

| 기준연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 10억 달러 |

| 부문 | 기능, 배포, 폼팩터, 냉각 기술, 용도, 최종사용자, 지역 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 기타 지역 |

클라우드 기반 AI 솔루션이 각 산업에서 채택되고 있는 점, 머신러닝과 딥러닝 알고리즘의 채택이 증가하고 있는 점, 의료 분야에서 AI의 잠재력이 높아지고 있는 점이 시장 성장에 기여하고 있습니다. 클라우드 서비스 프로바이더의 데이터센터에 대한 투자 증가가 GDP 성장을 촉진하고 있습니다. 따라서 가상 환경이 대중화됨에 따라 GPU 서버가 탑재된 데이터센터는 더 많은 컴퓨팅 부하를 견딜 수 있고, 더 부드럽고 반응성이 높은 가상 환경을 제공할 수 있을 것으로 보입니다. 메타버스와 VR 앱의 등장으로 GPU 서버 시장에 기회가 찾아오고 있습니다.

"폼팩터별로는 랙마운트 서버 부문이 2030년 가장 큰 시장 점유율을 차지할 것으로 예측됩니다. "

고성장 중인 랙마운트 서버는 대규모 데이터센터에서 널리 채택되고 있으며, 그 기능적 유용성은 복잡한 AI 기반 워크로드를 실행하는 데 있습니다. GPU 서버의 폼팩터별 분류에서는 랙마운트 서버가 가장 우세하며, GPU 서버를 확장성과 공간 활용성이라는 특성을 가진 고밀도 컴퓨팅 유닛으로 바꾸고 있습니다. 이는 AI 트레이닝, 데이터 분석, HPC 워크로드에 완벽하게 적합하며, 하나의 섀시에 여러 개의 GPU가 탑재되어 랙 간 경쟁할 수 있게 됩니다. 하이퍼스케일 데이터센터와 기업 데이터센터에 설치되는 공간 효율적인 인프라를 필요로 하는 대규모 AI 모델에 대한 수요 증가와 더 나은 열 관리 및 전력 관리도 채택을 촉진하는 요인으로 작용하고 있습니다. AI와 클라우드 컴퓨팅의 규모가 확대되는 가운데, 랙마운트 GPU 서버에 대한 수요는 여전히 강세를 보이고 있습니다.

"최종 사용 산업별로는 클라우드 서비스 프로바이더 부문이 예측 기간 중 GPU 서버 시장에서 가장 큰 점유율을 차지할 것으로 보입니다. "

클라우드 서비스 프로바이더는 IoT 기기, 소셜미디어 웹사이트, 기업 용도에서 생성되는 복잡한 데이터세트를 처리하는 데 큰 이점을 제공합니다. 다양한 산업 분야에서 AI 기술이 광범위하게 적용되면서 클라우드 서비스 프로바이더(CSP)가 제공하는 AI 기반 클라우드 서비스에 대한 수요가 급증하고 있습니다. GPU 서버를 통해 이들 프로바이더는 전례 없는 속도로 방대한 양의 데이터를 분석 및 처리할 수 있게 됩니다. 클라우드 서비스 프로바이더(CSP)는 기업, 개발자, 연구기관에 탄력적인 온디맨드 방식의 GPU 기능 활용을 제공하므로 GPU 서버 시장의 성장 동력이 되고 있습니다. AWS, Microsoft Azure, Google Cloud 등 주요 CSP들은 AI/ML 트레이닝, 딥러닝, 데이터 분석, 하이엔드 렌더링 등 다양한 연산 집약적 용도를 호스팅하기 위해 GPU 지원 인프라에 대규모 투자를 하고 있습니다. 하고 있습니다. 주요 추진 요인은 효율적이고 민첩하며 확장 가능한 컴퓨팅 성능에 대한 수요 증가, AI 및 생성 모델의 빠른 채택, 물리적 자산에 대한 투자 없이 제품을 더 빨리 시장에 출시하고자 하는 비즈니스 니즈 등입니다.

"국가별로는 미국이 2030년 북미 GPU 서버 시장에서 가장 큰 점유율을 차지할 것으로 예측됩니다. "

미국이 2030년 북미 GPU 서버 시장에서 가장 큰 점유율을 차지할 것으로 예측됩니다. 이는 AI 기술의 발전, AI의 장점에 대한 인식 증가, 지원적인 생태계, 정부의 구상, 해당 지역의 특정 산업별 이용 사례 등에 기인합니다. 미국에서는 AI 기술의 발전, 장점에 대한 인식 증가, 지원적인 생태계, 정부의 구상, 특정 산업의 이용 사례로 인해 AI 기술 채택이 증가하고 있습니다. AI 알고리즘과 처리 능력의 지속적인 향상으로 더 많은 기업이 AI 솔루션을 통합할 수 있게 되었습니다. 머신러닝과 딥러닝 용도의 부상으로 인해 집중적인 컴퓨팅 작업을 처리할 수 있는 강력한 GPU 서버에 대한 수요가 크게 증가하고 있습니다. Dell Inc.(미국), Hewlett Packard Enterprise Development LP(미국) 등 GPU 서버 시장의 주요 기업이 미국에 본사를 두고 있으며, 시장 성장을 더욱 촉진하고 있습니다.

세계의 GPU 서버 시장에 대해 조사분석했으며, 주요 촉진요인과 억제요인, 경쟁 구도, 향후 동향 등의 정보를 제공하고 있습니다.

목차

제1장 서론

제2장 조사 방법

제3장 개요

제4장 중요 인사이트

- GPU 서버 시장의 기업에 매력적인 기회

- GPU 서버 시장 : 냉각 기술별

- GPU 서버 시장 : 폼팩터별

- GPU 서버 시장 : 기업 유형별

- GPU 서버 시장 : 국가별

제5장 시장 개요

- 서론

- 시장 역학

- 촉진요인

- 억제요인

- 기회

- 과제

- 밸류체인 분석

- 에코시스템 분석

- 가격결정 분석

- 주요 기업이 제공하는 GPU 서버의 가격대(2024년)

- GPU 서버의 평균 판매 가격 동향 : 지역별(2021-2024년)

- 투자와 자금조달 시나리오

- 고객 비즈니스에 영향을 미치는 동향/혼란

- 기술 분석

- 주요 기술

- 보완 기술

- 인접 기술

- 사례 연구 분석

- AIVRES의 GPU 서버가 UPSTAGE의 OCR 팩용 AI 개발을 촉진

- SEEWEB, LENOVO 및 NVIDIA와 제휴하여 AI 접근성을 확대하는 GPU-COMPUTING-AS-A-SERVICE 모델을 발표

- SHARONAI, LENOVO의 고GPU 밀도 Truscale 서버로 AI 기능을 확장

- ELEUTHERAI, NVIDIA TRITON 서버를 사용하여 LLM 추론 퍼포먼스를 향상

- ELEUTHERAI, NVIDIA TRITON 추론 서버를 사용하여 LLM의 지연을 삭감

- 특허 분석

- 무역 분석

- 수입 시나리오(HS 코드 847150)

- 수출 시나리오(HS 코드 847150)

- Porter's Five Forces 분석

- 주요 이해관계자와 구입 기준

- 기준과 규제 상황

- 규제기관, 정부기관, 기타 조직

- 표준

- 주요 컨퍼런스와 이벤트(2025-2026년)

- GPU 서버 시장에 대한 2025년 미국 관세의 영향

- 서론

- 주요 관세율

- 가격의 영향 분석

- 국가/지역에 대한 영향

- 최종사용자에 대한 영향

제6장 GPU 서버 유형

- 서론

- 엔트리 레벨 GPU

- 미드레인지 GPU

- 하이엔드 GPU

제7장 GPU 서버 시장 : 냉각 기술별

- 서론

- 공랭

- 액랭

- 하이브리드 냉각

제8장 GPU 서버 시장 : 배포별

- 서론

- 온프레미스

- 클라우드 기반

제9장 GPU 서버 시장 : 기능별

- 서론

- 트레이닝

- 추론

제10장 GPU 서버 시장 : 폼팩터별

- 서론

- 랙 마운트 서버

- 블레이드 서버

- 타워 서버

제11장 GPU 서버 시장 : 용도별

- 서론

- 생성형 AI

- 룰 기반 모델

- 통계 모델

- 딥러닝

- GAN

- 오토인코더

- CNN

- Transformer 모델

- 기계학습

- 자연언어처리

- 컴퓨터 비전

제12장 GPU 서버 시장 : 최종사용자별

- 서론

- 클라우드 서비스 프로바이더

- 기업

- 의료

- BFSI

- 자동차

- 소매·E-Commerce

- 미디어·엔터테인먼트

- 기타 기업

- 정부기관

제13장 GPU 서버 시장 : 지역별

- 서론

- 북미

- 북미의 거시경제 전망

- 미국

- 캐나다

- 멕시코

- 유럽

- 유럽의 거시경제 전망

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 아시아태평양의 거시경제 전망

- 중국

- 일본

- 한국

- 인도

- 기타 아시아태평양

- 기타 지역

- 기타 지역의 거시경제 전망

- 중동

- 아프리카

- 남미

제14장 경쟁 구도

- 개요

- 주요 참여 기업의 전략/강점(2021-2024년)

- 시장 점유율 분석(2024년)

- 매출 분석(2022-2024년)

- 기업의 평가와 재무 지표

- 브랜드의 비교

- 기업 평가 매트릭스(2024년)

- 스타트업/중소기업 평가 매트릭스(2024년)

- 경쟁 시나리오

제15장 기업 개요

- 주요 기업

- DELL INC.

- HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP

- LENOVO

- HUAWEI TECHNOLOGIES CO., LTD.

- IBM

- H3C TECHNOLOGIES CO., LTD.

- CISCO SYSTEMS, INC.

- SUPER MICRO COMPUTER, INC.

- FUJITSU

- INSPUR CO., LTD.

- ADLINK TECHNOLOGY INC.

- QUANTA COMPUTER INC.

- WISTRON CORPORATION

- ASUSTEK COMPUTER INC.

- ZTE CORPORATION

- 기타 기업

- NVIDIA CORPORATION

- ADVANCED MICRO DEVICES, INC.

- GIGABIT TECHNOLOGIES PVT. LTD

- AIVRES

- AIME

- WIWYNN CORPORATION

- MITAC COMPUTING TECHNOLOGY CORPORATION

- NEC CORPORATION

- 2CRSI GROUP

- PENGUIN COMPUTING

- SYSTEM76

- SERVER SIMPLY

제16장 부록

KSA 25.09.01The global GPU server market is projected to grow from USD 171.47 billion in 2025 to USD 730.56 billion by 2030, at a CAGR of 33.6% from 2025 to 2030.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Function, Deployment, Form Factor, Cooling Technology, Application, End user, and Region |

| Regions covered | North America, Europe, APAC, RoW |

The growth in the market is attributed to the rising adoption of cloud-based AI solutions across industries, increasing adoption of machine learning and deep learning algorithms, and the growing potential of AI in the healthcare sector. Increased investment in cloud service providers' data centers is bolstering the GDP growth. Therefore, as virtual environments become rampant, data centers with GPU servers will stand to bear heavier computation loads and provide smooth and responsive virtual experiences. With the rise of the Metaverse and VR apps, opportunities are posed for the GPU server market.

"By form factor, the rack-mounted server segment is expected to account for the largest market share in 2030."

The high-growth rack-mount servers are witnessing extensive adoption across large data centers, and their functional utility is in running complex AI-based workloads. In the form-factor-based distinction within the spectrum of GPU servers, rack-mounted servers are certainly the most dominant ones, converting GPU servers into a high-density computing unit with properties of scalability and efficient utilization of space. This fits exactly to AI training, data analytics, and HPC workloads, turning into a single chassis with more than one GPU and competition across racks. Some adoption drivers are the ramp-up demand for large-scale AI models, necessitating space-efficient infrastructure established in hyperscale and enterprise data centers, and better thermal and power management. The adoption preference for rack-mount GPU servers remains strong in the growing dimension and scale of AI and cloud computing capacities.

"By end user industry, the cloud service providers segment is expected to capture the largest share of the GPU server market during the forecast period."

Cloud service providers provide immense benefits in processing complex data sets produced by IoT devices, social media websites, and enterprise applications. The widespread deployment of AI technologies in different verticals is fueling the need for AI-based cloud services provided by cloud service providers (CSPs). GPU servers enable these providers to analyze and process immense volumes of data at unprecedented velocities. Cloud service providers (CSPs) are the key drivers of growth in the GPU server market as they offer businesses, developers, and research institutions elastic, on-demand use of GPU capabilities. Top CSPs such as AWS, Microsoft Azure, and Google Cloud are significantly investing in GPU-enabled infrastructure to host various compute-intensive applications such as AI/ML training, deep learning, data analytics, and high-end rendering. The primary driving forces are the increasing need for efficient, agile, and scalable compute power, rapid adoption of AI and generative models, and the business need to bring products to market faster without investing in physical assets.

"By country, the US is expected to hold the largest share of the GPU server market in North America in 2030."

The US is expected to hold the largest share of the GPU server market in North America in 2030. This is due to advancements in artificial intelligence technologies, increased recognition of its benefits, a supportive ecosystem, government initiatives, and industry-specific use cases in the region. The US is experiencing an increase in the adoption of AI technologies driven by advancements in artificial intelligence technologies, increased recognition of its benefits, a supportive ecosystem, government initiatives, and industry-specific use cases. Continuous improvements in AI algorithms and processing capabilities are enabling more businesses to integrate AI solutions. The rise of machine learning and deep learning applications has generated significant demand for powerful GPU servers capable of handling intensive computational tasks. Key players in the GPU server market, including Dell Inc. (US) and Hewlett Packard Enterprise Development LP (US), are headquartered in the US, further fueling the market growth.

Extensive primary interviews were conducted with key industry experts in the GPU server market space to determine and verify the market size for various segments and subsegments gathered through secondary research. The breakup of primary participants for the report is shown below: The study contains insights from various industry experts, from component suppliers to Tier 1

Companies and OEMs. The breakup of the primaries is as follows:

- By Company Type: Tier 1 - 40%, Tier 2 - 35%, and Tier 3 - 25%

- By Designation: C-level Executives - 45%, Directors - 35%, and Others - 20%

- By Region: North America - 30%, Europe - 22%, Asia Pacific - 40%, and RoW - 8%

Note: Three tiers of companies are defined based on their total revenue as of 2024; tier 1: revenue more than or equal to USD 500 million, tier 2: revenue between USD 100 million and USD 500 million, and tier 3: revenue less than or equal to USD 100 million. Other designations include sales and marketing executives and researchers, as well as members of various GPU server organizations.

NVIDIA Corporation (US), Dell Inc. (US), Hewlett Packard Enterprise Development LP (US), Lenovo (Hong Kong), Huawei Technologies Co., Ltd. (China), IBM (US), H3C Technologies Co., Ltd. (China), Cisco Systems, Inc. (US), Fujitsu (Japan), and INSPUR Co., Ltd. (China), among others are some key players in the GPU server market.

The study includes an in-depth competitive analysis of these key players in the GPU server market, as well as their company profiles, recent developments, and key market strategies.

Research Coverage:

This research report categorizes the GPU server market based on cooling technology (air cooling, liquid cooling, hybrid cooling), form factor (rack-mounted servers, blade servers, tower servers), function (training, inference), deployment (on-premises, cloud-based), application (generative ai, machine learning, natural language processing, computer vision), end-user industry(cloud service providers (CSP), enterprises, government organizations), and region (North America, Europe, Asia Pacific and RoW). The report describes the major drivers, restraints, challenges, and opportunities pertaining to the GPU server market and forecasts the same till 2030. The report also consists of leadership mapping and analysis of all the companies included in the GPU server ecosystem.

Key Benefits of Buying the Report

The report will help the market leaders/new entrants in this market by providing information on the closest approximations of the revenue numbers for the overall GPU server market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (increase in data traffic and need for high computing power, increasing adoption of machine learning and deep learning algorithms, rising adoption of cloud-based AI solutions across industries) restraints (shortage of AI hardware experts and skilled workforce, power consumption and cooling challenges for high-density GPU servers), opportunities (growing potential of AI in healthcare sector, increasing investments in data centers by cloud service providers, emergence of Metaverse and Virtual Reality (VR)) and challenges (data security and privacy concerns) influencing the growth of the GPU server market

- Product Development/Innovation: Detailed insights into upcoming technologies, research and development activities, and the latest product and service launches in the GPU server market

- Market Development: Comprehensive information about lucrative markets - the report analyzes the GPU server market across varied regions.

- Market Diversification: Exhaustive information about new products and services, untapped geographies, recent developments, and investments in the GPU server market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players, such as NVIDIA Corporation (US), Dell Inc. (US), Hewlett Packard Enterprise Development LP (US), Lenovo (Hong Kong), Huawei Technologies Co., Ltd. (China), IBM (US), H3C Technologies Co., Ltd. (China), Cisco Systems, Inc. (US), Fujitsu (Japan), and INSPUR Co., Ltd. (China) NVIDIA Corporation (US), Dell Inc. (US), Hewlett Packard Enterprise Development LP (US), Lenovo (Hong Kong), Huawei Technologies Co., Ltd. (China), IBM (US), H3C Technologies Co., Ltd. (China), Cisco Systems, Inc. (US), Fujitsu (Japan), and INSPUR Co., Ltd. (China) in the GPU server market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of primary interview participants

- 2.1.2.2 Breakdown of primaries

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Key industry insights

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to estimate market size using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to estimate market size using top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RISK ANALYSIS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN GPU SERVER MARKET

- 4.2 GPU SERVER MARKET, BY COOLING TECHNOLOGY

- 4.3 GPU SERVER MARKET, BY FORM FACTOR

- 4.4 GPU SERVER MARKET, BY ENTERPRISE TYPE

- 4.5 GPU SERVER MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Proliferation of connected devices

- 5.2.1.2 Increasing adoption of machine learning and deep learning algorithms

- 5.2.1.3 Shift toward cloud-based AI solutions

- 5.2.2 RESTRAINTS

- 5.2.2.1 Shortage of hardware experts and skilled workforce

- 5.2.2.2 Power consumption and cooling challenges for high-density AI servers

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Deployment of AI across global healthcare systems

- 5.2.3.2 Increasing investments in data centers by cloud service providers

- 5.2.3.3 Emergence of metaverse and VR

- 5.2.4 CHALLENGES

- 5.2.4.1 Data security and privacy concerns

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 PRICING ANALYSIS

- 5.5.1 PRICE RANGE OF GPU SERVERS OFFERED BY KEY PLAYERS, 2024

- 5.5.2 AVERAGE SELLING PRICE TREND OF GPU SERVERS, BY REGION, 2021-2024

- 5.6 INVESTMENT AND FUNDING SCENARIO

- 5.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 High-performance computing (HPC)

- 5.8.1.2 GenAI

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 High-speed interconnects

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Quantum AI

- 5.8.1 KEY TECHNOLOGIES

- 5.9 CASE STUDY ANALYSIS

- 5.9.1 AIVRES' GPU SERVER BOOSTS AI DEVELOPMENT FOR UPSTAGE'S OCR PACK

- 5.9.2 SEEWEB COLLABORATES WITH LENOVO AND NVIDIA TO LAUNCH GPU-COMPUTING-AS-A-SERVICE MODEL FOR EXPANDING AI ACCESSIBILITY

- 5.9.3 SHARONAI EXPANDS AI CAPABILITIES WITH LENOVO'S GPU-DENSE TRUSCALE SERVERS

- 5.9.4 ELEUTHERAI BOOSTS LLM INFERENCE PERFORMANCE USING NVIDIA TRITON SERVER

- 5.9.5 ELEUTHERAI REDUCES LLM LATENCY USING NVIDIA TRITON INFERENCE SERVER

- 5.10 PATENT ANALYSIS

- 5.11 TRADE ANALYSIS

- 5.11.1 IMPORT SCENARIO (HS CODE 847150)

- 5.11.2 EXPORT SCENARIO (HS CODE 847150)

- 5.12 PORTER'S FIVE FORCES ANALYSIS

- 5.12.1 THREAT OF NEW ENTRANTS

- 5.12.2 THREAT OF SUBSTITUTES

- 5.12.3 BARGAINING POWER OF SUPPLIERS

- 5.12.4 BARGAINING POWER OF BUYERS

- 5.12.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.13.2 BUYING CRITERIA

- 5.14 STANDARDS AND REGULATORY LANDSCAPE

- 5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.2 STANDARDS

- 5.15 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.16 IMPACT OF 2025 US TARIFF ON GPU SERVER MARKET

- 5.16.1 INTRODUCTION

- 5.16.2 KEY TARIFF RATES

- 5.16.3 PRICE IMPACT ANALYSIS

- 5.16.4 IMPACT ON COUNTRY/REGION

- 5.16.4.1 US

- 5.16.4.2 Europe

- 5.16.4.3 Asia Pacific

- 5.16.5 IMPACT ON END USER

- 5.16.5.1 Cloud service providers (CSPs)

- 5.16.5.2 Enterprises

6 TYPE OF GPU SERVERS

- 6.1 INTRODUCTION

- 6.2 ENTRY LEVEL GPU

- 6.3 MID-RANGE GPU

- 6.4 HIGH-END GPU

7 GPU SERVER MARKET, BY COOLING TECHNOLOGY

- 7.1 INTRODUCTION

- 7.2 AIR COOLING

- 7.2.1 LOW OPERATIONAL AND CAPITAL EXPENDITURE TO DRIVE MARKET

- 7.3 LIQUID COOLING

- 7.3.1 ESCALATING THERMAL DEMANDS OF HIGH-PERFORMANCE COMPUTING AND AI WORKLOADS TO FUEL MARKET GROWTH

- 7.4 HYBRID COOLING

- 7.4.1 RISING AI-DRIVEN WORKLOADS TO FUEL SEGMENTAL GROWTH

8 GPU SERVER MARKET, BY DEPLOYMENT

- 8.1 INTRODUCTION

- 8.2 ON-PREMISES

- 8.2.1 INCREASING INVESTMENTS IN ORCHESTRATION TOOLS FOR RESOURCE ALLOCATION AND GPU MANAGEMENT TO FOSTER MARKET GROWTH

- 8.3 CLOUD-BASED

- 8.3.1 GROWING EMPHASIS ON INTEGRATING AI CAPABILITIES WITH SUSTAINABLE PRACTICES TO FUEL MARKET GROWTH

9 GPU SERVER MARKET, BY FUNCTION

- 9.1 INTRODUCTION

- 9.2 TRAINING

- 9.2.1 INCREASING ADOPTION OF DEEP LEARNING TECHNOLOGIES TO ENHANCE MODEL PRECISION TO SUPPORT MARKET GROWTH

- 9.3 INFERENCE

- 9.3.1 ONGOING ADVANCEMENTS IN GPU TO OFFER IMPROVED ENERGY EFFICIENCY AND LOW LATENCY TO BOOST DEMAND

10 GPU SERVER MARKET, BY FORM FACTOR

- 10.1 INTRODUCTION

- 10.2 RACK-MOUNTED SERVERS

- 10.2.1 SUITABILITY FOR AI TRAINING, DATA ANALYTICS, AND HPC WORKLOADS TO FOSTER MARKET GROWTH

- 10.3 BLADE SERVERS

- 10.3.1 INCREASING PRESSURE ON DATA CENTERS TO OPTIMIZE ENERGY AND SPACE UTILIZATION TO SUPPORT MARKET GROWTH

- 10.4 TOWER SERVERS

- 10.4.1 RISING APPLICATIONS IN SMES, RESEARCH LABS, AND EDGE COMPUTING ENVIRONMENTS TO FUEL MARKET GROWTH

11 GPU SERVER MARKET, BY APPLICATION

- 11.1 INTRODUCTION

- 11.2 GENERATIVE AI

- 11.2.1 RULE-BASED MODELS

- 11.2.1.1 Ability to process data and make consistent, traceable, and reliable decisions to boost demand

- 11.2.2 STATISTICAL MODELS

- 11.2.2.1 Rising demand for improved predictions and enhanced accuracy to fuel market growth

- 11.2.3 DEEP LEARNING

- 11.2.3.1 Proliferation of AI in healthcare, automotive, and consumer electronics to drive market

- 11.2.4 GENERATIVE ADVERSARIAL NETWORKS (GANS)

- 11.2.4.1 Growing application for generating high-quality images and videos for entertainment and marketing to boost demand

- 11.2.5 AUTOENCODERS

- 11.2.5.1 Benefits offered for latency-sensitive tasks like video streaming or real-time decision-making to fuel market growth

- 11.2.6 CONVOLUTIONAL NEURAL NETWORKS (CNNS)

- 11.2.6.1 Increasing demand for advanced image and video analytics to foster market growth

- 11.2.7 TRANSFORMER MODELS

- 11.2.7.1 Ability to capture long-range dependencies within data to support market growth

- 11.2.1 RULE-BASED MODELS

- 11.3 MACHINE LEARNING

- 11.3.1 ABILITY TO PERFORM MASSIVE MATRIX MULTIPLICATIONS TO DRIVE MARKET

- 11.4 NATURAL LANGUAGE PROCESSING

- 11.4.1 DEPLOYMENT IN CHATBOTS, SENTIMENT ANALYSIS, MACHINE TRANSLATION, AND EXTENSIVE LANGUAGE MODELS TO FUEL MARKET GROWTH

- 11.5 COMPUTER VISION

- 11.5.1 ACCELERATED COMPUTATION OF INTRICATE VISUAL DATA AND REDUCED LATENCY TO BOOST DEMAND

12 GPU SERVER MARKET, BY END USER

- 12.1 INTRODUCTION

- 12.2 CLOUD SERVICE PROVIDERS

- 12.2.1 RISING DEMAND FOR COST-EFFECTIVE, FLEXIBLE, AND SCALABLE COMPUTING POWER TO FUEL MARKET GROWTH

- 12.3 ENTERPRISES

- 12.3.1 HEALTHCARE

- 12.3.1.1 Ability to process and analyze vast amounts of medical data quickly and efficiently to drive market

- 12.3.2 BFSI

- 12.3.2.1 Rising need to improve customer service and mitigate risks to fuel market growth

- 12.3.3 AUTOMOTIVE

- 12.3.3.1 Accelerated development of autonomous driving algorithms and ADAS to offer lucrative growth opportunities

- 12.3.4 RETAIL & E-COMMERCE

- 12.3.4.1 Growing need for real-time data processing for personalized product recommendations, and customer behavior analysis to drive market

- 12.3.5 MEDIA & ENTERTAINMENT

- 12.3.5.1 Rise of streaming platforms, gaming, and digital content consumption to augment market growth

- 12.3.6 OTHER ENTERPRISES

- 12.3.1 HEALTHCARE

- 12.4 GOVERNMENT ORGANIZATIONS

- 12.4.1 INCREASING RELIANCE ON AI FOR NATIONAL SECURITY AND DEFENSE SIMULATIONS TO FOSTER MARKET GROWTH

13 GPU SERVER MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 NORTH AMERICA

- 13.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 13.2.2 US

- 13.2.2.1 Continuous improvements in AI algorithms and processing capabilities to foster market growth

- 13.2.3 CANADA

- 13.2.3.1 Expanding data center infrastructure to support market growth

- 13.2.4 MEXICO

- 13.2.4.1 Accelerating digital transformation and increasing adoption of cloud computing to drive market

- 13.3 EUROPE

- 13.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 13.3.2 UK

- 13.3.2.1 Significant investments in data center infrastructure to support market growth

- 13.3.3 GERMANY

- 13.3.3.1 Surging adoption in automotive sector to drive market

- 13.3.4 FRANCE

- 13.3.4.1 Growing ecosystem of AI startups to boost demand

- 13.3.5 ITALY

- 13.3.5.1 Emphasis on modernizing industrial sector and developing smart cities to support market growth

- 13.3.6 SPAIN

- 13.3.6.1 Rising availability of data and advancements in AI technology to accelerate market growth

- 13.3.7 REST OF EUROPE

- 13.4 ASIA PACIFIC

- 13.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 13.4.2 CHINA

- 13.4.2.1 Rapid expansion of cloud computing and proliferation of IoT devices to fuel market growth

- 13.4.3 JAPAN

- 13.4.3.1 Increasing collaboration among academic institutions, government agencies, and private companies to advance AI research to boost demand

- 13.4.4 SOUTH KOREA

- 13.4.4.1 Development of advanced AI chips and server solutions to fuel market growth

- 13.4.5 INDIA

- 13.4.5.1 Government-led initiatives to enhance e-governance to boost demand

- 13.4.6 REST OF ASIA PACIFIC

- 13.5 ROW

- 13.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 13.5.2 MIDDLE EAST

- 13.5.2.1 Growing emphasis on digital transformation and technological innovation to foster market growth

- 13.5.2.2 GCC

- 13.5.2.2.1 UAE

- 13.5.2.2.1.1 Establishment of regulatory frameworks to support market growth

- 13.5.2.2.2 Rest of GCC

- 13.5.2.2.1 UAE

- 13.5.2.3 Rest of Middle East

- 13.5.3 AFRICA

- 13.5.3.1 Expansion of data center capacity to drive market

- 13.5.4 SOUTH AMERICA

- 13.5.4.1 Surging demand for cloud services to fuel market growth

14 COMPETITIVE LANDSCAPE

- 14.1 OVERVIEW

- 14.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2024

- 14.3 MARKET SHARE ANALYSIS, 2024

- 14.4 REVENUE ANALYSIS, 2022-2024

- 14.5 COMPANY VALUATION AND FINANCIAL METRICS

- 14.6 BRAND COMPARISON

- 14.7 COMPANY EVALUATION MATRIX, 2024

- 14.7.1 STARS

- 14.7.2 EMERGING LEADERS

- 14.7.3 PERVASIVE PLAYERS

- 14.7.4 PARTICIPANTS

- 14.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 14.7.5.1 Company footprint

- 14.7.5.2 Region footprint

- 14.7.5.3 Function footprint

- 14.7.5.4 Deployment footprint

- 14.7.5.5 Application footprint

- 14.7.5.6 End user footprint

- 14.8 STARTUPS/SME EVALUATION MATRIX, 2024

- 14.8.1 PROGRESSIVE COMPANIES

- 14.8.2 RESPONSIVE COMPANIES

- 14.8.3 DYNAMIC COMPANIES

- 14.8.4 STARTING BLOCKS

- 14.8.5 COMPETITIVE BENCHMARKING

- 14.9 COMPETITIVE SCENARIOS

- 14.9.1 PRODUCT LAUNCHES

- 14.9.2 DEALS

- 14.9.3 OTHER DEVELOPMENTS

15 COMPANY PROFILES

- 15.1 KEY PLAYERS

- 15.1.1 DELL INC.

- 15.1.1.1 Business overview

- 15.1.1.2 Products/Solutions/Services offered

- 15.1.1.3 Recent developments

- 15.1.1.3.1 Deals

- 15.1.1.4 MnM view

- 15.1.1.4.1 Key strengths/Right to win

- 15.1.1.4.2 Strategic choices

- 15.1.1.4.3 Weaknesses/Competitive threats

- 15.1.2 HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP

- 15.1.2.1 Business overview

- 15.1.2.2 Products/Solutions/Services offered

- 15.1.2.3 Recent developments

- 15.1.2.3.1 Product launches

- 15.1.2.3.2 Deals

- 15.1.2.4 MnM view

- 15.1.2.4.1 Key strengths/Right to win

- 15.1.2.4.2 Strategic choices

- 15.1.2.4.3 Weaknesses/Competitive threats

- 15.1.3 LENOVO

- 15.1.3.1 Business overview

- 15.1.3.2 Products/Solutions/Services offered

- 15.1.3.3 Recent developments

- 15.1.3.3.1 Product launches

- 15.1.3.3.2 Deals

- 15.1.3.3.3 Expansions

- 15.1.3.4 MnM view

- 15.1.3.4.1 Key strengths/Right to win

- 15.1.3.4.2 Strategic choices

- 15.1.3.4.3 Weaknesses/Competitive threats

- 15.1.4 HUAWEI TECHNOLOGIES CO., LTD.

- 15.1.4.1 Business overview

- 15.1.4.2 Products/Solutions/Services offered

- 15.1.4.3 Recent developments

- 15.1.4.3.1 Deals

- 15.1.4.4 MnM view

- 15.1.4.4.1 Key strengths/Right to win

- 15.1.4.4.2 Strategic choices

- 15.1.4.4.3 Weaknesses/Competitive threats

- 15.1.5 IBM

- 15.1.5.1 Business overview

- 15.1.5.2 Products/Solutions/Services offered

- 15.1.5.3 Recent developments

- 15.1.5.3.1 Products launches

- 15.1.5.3.2 Deals

- 15.1.5.4 MnM view

- 15.1.5.4.1 Key strengths/Right to win

- 15.1.5.4.2 Strategic choices

- 15.1.5.4.3 Weaknesses/Competitive threats

- 15.1.6 H3C TECHNOLOGIES CO., LTD.

- 15.1.6.1 Business overview

- 15.1.6.2 Products/Solutions/Services offered

- 15.1.6.3 Recent developments

- 15.1.6.3.1 Product launches

- 15.1.6.3.2 Deals

- 15.1.7 CISCO SYSTEMS, INC.

- 15.1.7.1 Business overview

- 15.1.7.2 Products/Solutions/Services offered

- 15.1.7.3 Recent developments

- 15.1.7.3.1 Deals

- 15.1.8 SUPER MICRO COMPUTER, INC.

- 15.1.8.1 Business overview

- 15.1.8.2 Products/Solutions/Services offered

- 15.1.8.3 Recent developments

- 15.1.8.3.1 Product launches

- 15.1.8.3.2 Deals

- 15.1.9 FUJITSU

- 15.1.9.1 Business overview

- 15.1.9.2 Products/Solutions/Services offered

- 15.1.9.3 Recent developments

- 15.1.9.3.1 Deals

- 15.1.10 INSPUR CO., LTD.

- 15.1.10.1 Business overview

- 15.1.10.2 Products/Solutions/Services offered

- 15.1.10.3 Recent developments

- 15.1.10.3.1 Product launches

- 15.1.10.3.2 Deals

- 15.1.11 ADLINK TECHNOLOGY INC.

- 15.1.11.1 Business overview

- 15.1.11.2 Products/Solutions/Services offered

- 15.1.11.3 Recent developments

- 15.1.11.3.1 Deals

- 15.1.12 QUANTA COMPUTER INC.

- 15.1.12.1 Business overview

- 15.1.12.2 Products/Solutions/Services offered

- 15.1.13 WISTRON CORPORATION

- 15.1.13.1 Business overview

- 15.1.13.2 Products/Solutions/Services offered

- 15.1.13.3 Recent developments

- 15.1.13.3.1 Deals

- 15.1.14 ASUSTEK COMPUTER INC.

- 15.1.14.1 Business overview

- 15.1.14.2 Products/Solutions/Services offered

- 15.1.15 ZTE CORPORATION

- 15.1.15.1 Business overview

- 15.1.15.2 Products/Solutions/Services offered

- 15.1.15.3 Recent developments

- 15.1.15.3.1 Product launches

- 15.1.1 DELL INC.

- 15.2 OTHER PLAYERS

- 15.2.1 NVIDIA CORPORATION

- 15.2.2 ADVANCED MICRO DEVICES, INC.

- 15.2.3 GIGABIT TECHNOLOGIES PVT. LTD

- 15.2.4 AIVRES

- 15.2.5 AIME

- 15.2.6 WIWYNN CORPORATION

- 15.2.7 MITAC COMPUTING TECHNOLOGY CORPORATION

- 15.2.8 NEC CORPORATION

- 15.2.9 2CRSI GROUP

- 15.2.10 PENGUIN COMPUTING

- 15.2.11 SYSTEM76

- 15.2.12 SERVER SIMPLY

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS