|

시장보고서

상품코드

1797400

물 재활용 및 재사용 시장 : 수자원별, 설비별, 용량별, 최종 용도별, 지역별 - 예측(-2030년)Water Recycle and Reuse Market by Equipment, Capacity, End Use, and Water Sources - Global Forecast to 2030 |

||||||

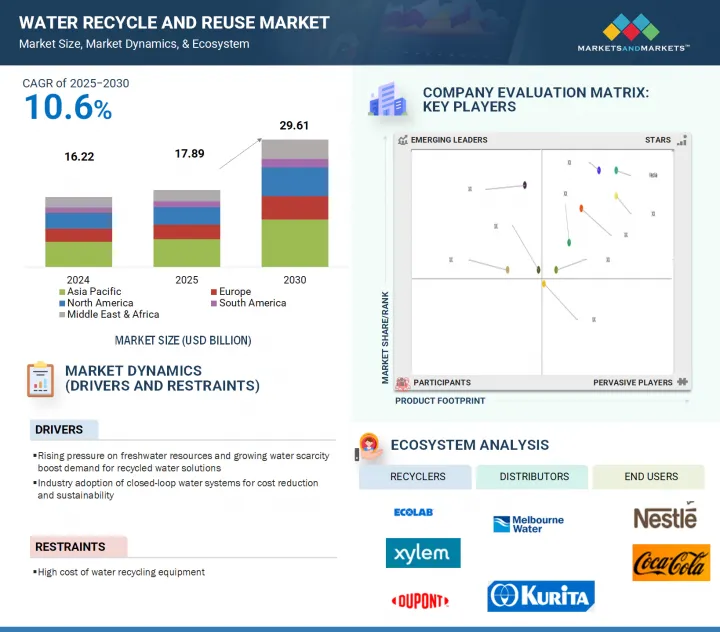

물 재활용 및 재사용 시장 규모는 2025년 178억 9,000만 달러에서 2030년에는 296억 1,000만 달러로 성장할 것으로 예측 기간 중 연평균 복합 성장률(CAGR)은 10.6%를 보일 것으로 예측됩니다.

물 재활용 및 재사용에 대한 수요 증가는 기후 변화의 영향, 담수 이용 가능량의 감소, 장기적인 물 안보의 필요성에 의해 촉진되고 있습니다. 도시 인구 증가와 기존 인프라에 대한 압력으로 인해 지자체와 산업계는 더 나은 물 관리 방법을 도입해야 합니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2021-2030년 |

| 기준연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 검토 단위 | 금액(100만 달러/10억 달러) |

| 부문 | 장비별, 용량별, 최종 사용자별, 수자원 및 지역 |

| 대상 지역 | 아시아태평양, 북미, 유럽, 중동 및 아프리카, 남미 |

기술 발전과 더욱 엄격한 환경 규제 및 지속가능성 확보 노력에 대한 수요 증가로 인해 처리 시스템은 소형화, 경제성, 사용자 친화적으로 변하고 있습니다. 이러한 추세는 물 재사용의 보급을 촉진하고 있습니다. 세 가지 최종 사용 부문(주거, 상업, 산업) 모두에서 물 재사용이 증가하고 있습니다. 주거용 물은 정수와 화장실 세척에, 상업용 물은 냉방과 세척에, 공업용 물은 공정용수로 재사용되고 있습니다. 이 세 가지 분야는 시장 성장에 중요한 역할을 하고 있습니다.

3차 설비는 물 재활용 및 재사용 시장에서 가장 빠르게 성장하는 분야로, 주로 고도처리 솔루션에 대한 수요 증가로 인해 가장 빠르게 성장하고 있습니다. 산업용 냉각수, 보일러 급수, 직간접적인 식수 재사용 등 물 재사용의 용도가 급속히 확대되고 있으며, 초정수 정화가 요구되고 있습니다. 막 여과, 자외선(UV) 소독, 활성탄, 이온 교환을 포함한 3차 처리 공정은 미세한 부유 물질, 영양소, 의약품 및 기타 미량 오염 물질을 효과적으로 제거합니다. 이는 수질 규제가 엄격하고 물 부족이 심각한 지역에서 특히 중요합니다. 자원 절약, 지속 가능한 물 사용, 순환 경제 실천, 제로 배출에 대한 관심이 높아진 것도 물 회수를 극대화하는 3차 시스템에 대한 수요를 증가시키고 있습니다.

50,001-100,000리터 부문은 예측 기간 동안 물 재활용 및 재사용 시장에서 가장 빠른 성장을 기록할 것으로 예측됩니다. 이 용량 범위는 산업용, 상업용, 지자체 등 중규모에서 대규모 용도에 적합합니다. 확장성과 비용의 균형이 잘 잡혀 있어 지속 가능한 사업을 추진하고자 하는 제조 공장, 복합 상업시설, 대학, 중규모 커뮤니티에 이상적인 솔루션입니다. 많은 지역에서 환경 규제가 강화되고 담수 부족이 심화됨에 따라 많은 조직이 이 용량 범위 내에서 분산형 물 재사용 시스템을 도입하기 시작했습니다. 이러한 시스템은 물 이용 효율을 높이고 폐수 배출량을 줄입니다. 또한, 정부의 장려책과 민관 파트너십은 특히 도시 및 도시 근교에서 분산형 물 재사용 시스템 도입을 촉진하고 지원하고 있습니다.

산업 폐수는 산업화, 물 소비량 증가, 담수 사용량 감소를 위한 정책적 압력으로 인해 물 재활용 및 재사용 시장에서 가장 빠르게 성장하는 분야입니다. 섬유, 화학, 석유 및 가스, 식품 가공, 발전 등의 산업에서는 다량의 폐수가 발생합니다. 이 폐수를 미처리 상태로 방치하면 환경을 위협하고 지역사회의 담수 자원을 고갈시킬 수 있습니다. 이러한 문제에 대해 폐물 재활용은 비용 효율적이고 지속 가능한 해결책으로 인식하는 산업계가 늘고 있습니다. 폐수를 재활용함으로써 기업은 물 조달 비용을 절감하고, 물 부족 지역에서의 운영을 유지하며, 환경 규제 및 표준을 준수할 수 있습니다. 한외여과, 역삼투압, 생물학적 처리 시스템 등 최근 처리 기술의 발전으로 복잡한 산업 폐수 처리가 더욱 관리하기 쉬워졌습니다.

물 재활용 및 재사용 시장에서 산업용 최종 용도 분야가 가장 빠르게 성장하고 있습니다. 이러한 성장의 원동력은 제조업, 화학, 섬유, 식음료, 에너지 관련 산업의 물 수요 증가에 기인합니다. 신흥국을 중심으로 전 세계적으로 산업 활동이 확대됨에 따라 담수 소비량도 크게 증가하고 있습니다. 이러한 문제를 해결하기 위해 공업용수 사용자는 폐수를 처리하여 현장에서 재사용하는 물 재활용 시스템을 도입하고 있습니다. 이는 환경 규제 요건을 충족시킬 뿐만 아니라 도시 물 공급에 대한 의존도를 낮추는 데에도 도움이 됩니다. 기업들은 물 조달 및 폐기 관련 비용을 절감하고, 지속 가능한 노력을 지원하며, 담수에 대한 장기적인 접근을 보장하기 위해 이러한 시스템을 채택하고 있습니다. 또한, 공업용수 사용에 대한 사회적 감시와 규제 압력이 높아지면서 새로운 첨단 처리 기술에 대한 투자로 이어지고 있습니다.

중동 및 아프리카는 극심한 물 부족, 도시화, 산업 수요로 인해 물 재활용 및 재사용 시장이 가장 빠르게 성장하고 있습니다. 사우디아라비아, 아랍에미리트, 남아프리카공화국 등의 국가들은 심각한 물 부족에 직면해 있으며, 그 수요를 충족시키기 위해 비재래식 수자원에 의존하고 있습니다. 이들 지역의 정부는 장기적인 물 안보를 보장하기 위해 첨단 인프라와 처리 기술에 많은 투자를 하고 있습니다. 대규모 인프라 프로젝트 개발, 인구 증가, 석유 및 가스, 화학, 제조 등의 분야에서 수요가 증가함에 따라 지속 가능한 물 관리의 필요성도 증가하고 있습니다. 이러한 변화는 사우디아라비아의 '비전 2030'이나 UAE의 '물 안보 전략 2036'과 같이 폐수 재사용이 국가 전략의 중요한 요소로 자리 잡은 이니셔티브로 상징됩니다. 막분리 활성오니법, 역삼투막, 스마트 워터 시스템과 같은 신기술의 채택이 빠르게 진행될 것으로 예상되며, 이 지역은 세계 물 재활용 및 재사용 시장의 성장의 초점이 될 것으로 예측됩니다.

세계의 물 재활용 및 재사용 시장에 대해 조사했으며, 수자원별, 설비별, 용량별, 최종 용도별, 지역별 동향, 시장 진출기업 프로파일 등의 정보를 정리하여 전해드립니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 프리미엄 인사이트

제5장 시장 개요

- 서론

- 시장 역학

- 생성형 AI

- 물 재활용 및 재사용 시장에 대한 영향

제6장 업계 동향

- 서론

- 고객의 비즈니스에 영향을 미치는 동향/혼란

- 밸류체인 분석

- 2025년 미국 관세의 영향-물 재활용 및 재사용 시장

- 투자 상황과 자금조달 시나리오

- 지표 가격 분석

- 생태계 분석

- 기술 분석

- 특허 분석

- 무역 분석

- 2025년-2026년 주요 컨퍼런스 및 이벤트

- 관세 및 규제 상황

- 기준과 규제 상황

- Porter의 Five Forces 분석

- 주요 이해관계자와 구입 기준

- 거시경제 전망

- 사례 연구 분석

제7장 물 재활용 및 재사용 시장(수원 별)

- 서론

- 도시 하수

- 산업 폐수

- 농업 배수

- 우수

제8장 물 재활용 및 재사용 시장(설비별)

- 서론

- 주요 설비

- 2차 설비

- 3차 설비

제9장 물 재활용 및 재사용 시장(용량별)

- 서론

- 25,000리터 미만

- 25,001-50,000리터

- 50,001-100,000리터

- 10만 리터 이상

제10장 물 재활용 및 재사용 시장(최종 용도별)

- 서론

- 주택

- 상업

- 산업

제11장 물 재활용 및 재사용 시장(지역별)

- 서론

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 기타

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 이탈리아

- 프랑스

- 영국

- 스페인

- 기타

- 중동 및 아프리카

- GCC 국가

- 남아프리카공화국

- 기타

- 남미

- 아르헨티나

- 브라질

- 기타

제12장 경쟁 구도

- 서론

- 주요 시장 진출기업의 전략/강점

- 시장 점유율 분석, 2024년

- 매출 분석, 2021년-2024년

- 기업 평가 매트릭스 : 주요 시장 진출기업, 2024년

- 기업 평가 매트릭스 : 스타트업/중소기업, 2024년

- 브랜드/제품 비교

- 기업 평가와 재무 지표

- 경쟁 시나리오와 동향

제13장 기업 개요

- 주요 시장 진출기업

- VEOLIA

- ECOLAB INC.

- XYLEM

- DUPONT

- HITACHI, LTD.

- KUBOTA CORPORATION

- ALFA LAVAL

- THERMAX LIMITED

- PENTAIR

- AQUATECH

- 기타 기업

- ION EXCHANGE

- PRAJ INDUSTRIES

- FLUENCE CORPORATION LIMITED

- DELOACH INDUSTRIES, INC.

- KOVALUS SEPARATION SOLUTIONS

- VORTEX ENGINEERING LTD

- AQUA-AEROBIC SYSTEMS, INC.

- HYDRO INTERNATIONAL LTD.

- ECOLOGIX ENVIRONMENTAL SYSTEMS, LLC

- BIOMICROBICS, INC

- NEWTERRA

- MITA WATER TECHNOLOGIES S.R.L.

- ALAR

- PARKSON CORPORATION

- BIOKUBE

제14장 부록

LSH 25.09.02The water recycle and reuse market is projected to grow from USD 17.89 billion in 2025 to USD 29.61 billion by 2030, registering a CAGR of 10.6% during the forecast period. The increasing demand for water recycle and reuse is fueled by the effects of climate change, shrinking freshwater availability, and the need for long-term water security. Increasing urban populations and pressure on existing infrastructure are forcing municipalities and industries to implement better water management practices.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) |

| Segments | Equipment, Capacity, End Use, Water Source, and Region |

| Regions covered | Asia Pacific, North America, Europe, Middle East & Africa, and South America |

Treatment systems are becoming more compact, affordable, and user-friendly, driven by advancements in technology and the growing demand for stricter environmental regulations and sustainability commitments. This trend is encouraging increased adoption of water reuse practices. In all three end-use sectors (residential, commercial, and industrial), water reuse is on the rise. Residential users are reusing water for landscaping and flushing toilets, commercial users are using it for cooling and cleaning, and industries are utilizing it as process water. These three sectors play a crucial role in market growth.

"Tertiary equipment is projected to register the fastest growth in the water recycle and reuse market in terms of value."

Tertiary equipment is the fastest-growing segment of the water recycle and reuse market, primarily due to the increasing demand for advanced treatment solutions. Applications for water reuse, such as industrial cooling, boiler feedwater, and both direct and indirect potable reuse, are rapidly expanding and require ultra-clean water purification. Tertiary treatment processes, including membrane filtration, ultraviolet (UV) disinfection, activated carbon, and ion exchange, effectively remove fine suspended solids, nutrients, pharmaceuticals, and other micropollutants. This is particularly important in regions with stringent water quality regulations and significant water scarcity. The rising emphasis on resource conservation, sustainable water use, circular economy practices, and zero-discharge initiatives is also driving the demand for tertiary systems that maximize water recovery.

"50,001 to 100,000 liters segment will register the fastest growth in the water recycle and reuse market in terms of value."

The 50,001 to 100,000 liters segment is projected to register the fastest growth in the water recycling and reuse market during the forecast period. This capacity range is well-suited for medium to large-scale applications, including industrial, commercial, and municipal uses. It strikes a balance between scalability and cost, making it an ideal solution for manufacturing plants, commercial complexes, universities, colleges, and mid-sized communities looking to promote sustainable operations. As many regions tighten environmental regulations and face increasing freshwater scarcity, numerous organizations are beginning to implement decentralized water reuse systems within this capacity range. These systems enhance water use efficiency and reduce wastewater discharge. Additionally, government incentives and public-private partnerships are driving and supporting the adoption of decentralized water reuse systems, particularly in urban and peri-urban areas.

"Industrial wastewater segment is projected to register the fastest growth in the water recycle and reuse market in terms of value."

Industrial wastewater is the fastest-growing segment of the water recycling and reuse market, driven by industrialization, increasing water consumption, and pressures from policies aimed at reducing freshwater use. Industries such as textiles, chemicals, oil and gas, food processing, and power generation generate large volumes of wastewater. If left untreated, this wastewater can threaten the environment and deplete freshwater resources in local communities. In response to these challenges, industries are increasingly viewing wastewater recycling as a cost-effective and sustainable solution. By recycling their wastewater, companies can lower water procurement costs, maintain operations in water-scarce areas, and comply with environmental regulations and standards. Recent advancements in treatment technologies, including ultrafiltration, reverse osmosis, and biological treatment systems, are making the treatment of complex industrial wastewater more manageable.

"Industrial segment is projected to register the fastest growth in the water recycle and reuse market in terms of value."

The industrial end-use segment is the fastest-growing sector in the water recycle and reuse market. This growth is driven by the increasing demand for water in manufacturing, chemicals, textiles, food and beverage, and energy-related industries. As industrial activity expands globally, particularly in emerging economies, the consumption of freshwater is rising significantly. To address this challenge, industrial water users are implementing water recycling systems to treat their wastewater for on-site reuse. This not only helps them meet environmental regulatory requirements but also reduces their reliance on municipal water supplies. Companies are adopting these systems to lower costs associated with water procurement and disposal, support sustainability efforts, and ensure long-term access to fresh water. Increased public scrutiny and regulatory pressures regarding industrial water usage have also led to investments in new and advanced treatment technologies.

"Middle East & Africa is the fastest-growing market for water recycle and reuse."

The Middle East & Africa is the fastest-growing market for water recycle and reuse due to extreme water scarcity, urbanization, and industrial demand. Countries such as Saudi Arabia, the UAE, and South Africa face significant water stress and rely on non-conventional water sources to meet their needs. Governments in these regions are making substantial investments in advanced infrastructure and treatment technologies to ensure long-term water security. As mega infrastructure projects continue to develop, populations increase, and demand from sectors such as oil & gas, chemicals, and manufacturing expands, the need for sustainable water management is also rising. This shift is exemplified by initiatives like Saudi Arabia's Vision 2030 and the UAE's Water Security Strategy 2036, where reusing wastewater is a key element of national strategy. The adoption of new technologies, such as membrane bioreactors, reverse osmosis, and smart water systems, is expected to grow rapidly, positioning this region as a focal point for growth in the global water recycling and reuse market.

In-depth interviews were conducted with chief executive officers (CEOs), marketing directors, other innovation and technology directors, and executives from various key organizations operating in the water recycle and reuse market, and information was gathered from secondary research to determine and verify the market size of several segments.

- By Company Type: Tier 1 - 50%, Tier 2 - 30%, and Tier 3 - 20%

- By Designation: Managers - 15%, Directors - 20%, and Others - 65%

- By Region: North America - 30%, Europe - 25%, Asia Pacific - 35%, the Middle East & Africa - 5%, and South America - 5%

The water recycle and reuse market comprises major players such as Veolia (France), Xylem (US), Ecolab Inc. (US), Fluence Corporation Limited (US), DuPont (US), Hitachi, Ltd. (Japan), KUBOTA Corporation (Japan) ALFA LAVAL (Sweden), Melbourne Water (Australia), and Siemens (Germany). The study includes an in-depth competitive analysis of these key players in the water recycle and reuse market, with their company profiles, recent developments, and key market strategies.

Research Coverage

This report segments the market for water recycle and reuse market on the basis of equipment, capacity, end use, water source, and region, and provides estimations for the overall value of the market across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, products & services, key strategies, and expansions associated with the water recycle and reuse market.

Key benefits of buying this report

This research report is focused on various levels of analysis - industry analysis (industry trends), market ranking analysis of top players, and company profiles, which together provide an overall view of the competitive landscape; emerging and high-growth segments of the water recycle and reuse market; high-growth regions; and market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of drivers: (rising pressure on freshwater resources and growing water scarcity boost demand for recycled water solutions), restraints (high cost of installation of water recycling equipment), opportunities (corporate water stewardship initiatives creating new growth opportunities for water reuse), and challenges (health and safety concerns) influencing the growth of the water recycle and reuse market.

- Market Penetration: Comprehensive information on the water recycle and reuse market offered by top players in the global water recycle and reuse market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, product launches, expansions, collaborations, acquisitions, and partnerships in the water recycle and reuse market.

- Market Development: Comprehensive information about lucrative emerging markets. The report analyzes the water recycle and reuse market across regions.

- Market Capacity: Recycling capacity of the companies are provided wherever available with upcoming capacities for the water recycle and reuse market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the water recycle and reuse market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SNAPSHOTS

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key primary sources

- 2.1.2.3 Key participants from primary interviews

- 2.1.2.4 Breakdown of interviews with experts

- 2.1.2.5 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 BASE NUMBER CALCULATION

- 2.2.1 SUPPLY-SIDE ANALYSIS

- 2.2.2 DEMAND-SIDE ANALYSIS

- 2.3 GROWTH FORECAST

- 2.3.1 SUPPLY SIDE

- 2.3.2 DEMAND SIDE

- 2.4 MARKET SIZE ESTIMATION

- 2.4.1 BOTTOM-UP APPROACH

- 2.4.2 TOP-DOWN APPROACH

- 2.5 DATA TRIANGULATION

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 GROWTH FORECAST

- 2.8 RISK ASSESSMENT

- 2.9 FACTOR ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN WATER RECYCLE AND REUSE MARKET

- 4.2 WATER RECYCLE AND REUSE MARKET, BY EQUIPMENT

- 4.3 WATER RECYCLE AND REUSE MARKET, BY CAPACITY

- 4.4 WATER RECYCLE AND REUSE MARKET, BY END USE

- 4.5 WATER RECYCLE AND REUSE MARKET, BY WATER SOURCE

- 4.6 WATER RECYCLE AND REUSE MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising pressure on freshwater resources and growing water scarcity boost demand for recycled water solutions

- 5.2.1.2 Industry adoption of closed-loop water systems for cost reduction and sustainability

- 5.2.1.3 Strict environmental regulations boosting water recycling across major economies

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of installation of water recycling equipment

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Expansion of potable reuse programs

- 5.2.3.2 Corporate water stewardship initiatives

- 5.2.4 CHALLENGES

- 5.2.4.1 Maintaining quality of recycled water

- 5.2.4.2 Health and safety concerns

- 5.2.1 DRIVERS

- 5.3 GENERATIVE AI

- 5.3.1 INTRODUCTION

- 5.4 IMPACT ON WATER RECYCLE AND REUSE MARKET

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.3 VALUE CHAIN ANALYSIS

- 6.3.1 WASTEWATER COLLECTION

- 6.3.2 TREATMENT

- 6.3.3 DISTRIBUTION AND STORAGE

- 6.3.4 END USERS

- 6.4 IMPACT OF 2025 US TARIFF - WATER RECYCLE AND REUSE MARKET

- 6.4.1 INTRODUCTION

- 6.4.2 KEY TARIFF RATES

- 6.4.3 PRICE IMPACT ANALYSIS

- 6.4.4 IMPACT ON REGION

- 6.4.4.1 North America

- 6.4.4.2 Europe

- 6.4.4.3 Asia Pacific

- 6.4.5 IMPACT ON EQUIPMENT

- 6.5 INVESTMENT LANDSCAPE AND FUNDING SCENARIO

- 6.6 INDICATIVE PRICING ANALYSIS

- 6.6.1 INDICATIVE PRICING OF WATER RECYCLE AND REUSE MARKET, BY EQUIPMENT, 2024

- 6.6.2 INDICATIVE PRICING OF WATER RECYCLE AND REUSE MARKET AMONG KEY PLAYERS, EQUIPMENT, 2024

- 6.7 ECOSYSTEM ANALYSIS

- 6.8 TECHNOLOGY ANALYSIS

- 6.8.1 KEY TECHNOLOGIES

- 6.8.2 COMPLEMENTARY TECHNOLOGIES

- 6.8.3 ADJACENT TECHNOLOGIES

- 6.9 PATENT ANALYSIS

- 6.9.1 METHODOLOGY

- 6.9.2 PATENTS GRANTED WORLDWIDE, 2015-2024

- 6.9.3 INSIGHTS

- 6.9.4 LEGAL STATUS OF PATENTS

- 6.9.5 JURISDICTION ANALYSIS

- 6.9.6 TOP APPLICANTS

- 6.9.7 LIST OF MAJOR PATENTS

- 6.10 TRADE ANALYSIS

- 6.10.1 IMPORT SCENARIO (HS CODE 842121)

- 6.10.2 EXPORT SCENARIO (HS CODE 842121)

- 6.11 KEY CONFERENCES AND EVENTS, 2025-2026

- 6.12 TARIFF AND REGULATORY LANDSCAPE

- 6.12.1 TARIFF ANALYSIS

- 6.13 STANDARDS AND REGULATORY LANDSCAPE

- 6.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.13.2 STANDARDS

- 6.14 PORTER'S FIVE FORCES ANALYSIS

- 6.14.1 THREAT OF NEW ENTRANTS

- 6.14.2 THREATS OF SUBSTITUTES

- 6.14.3 BARGAINING POWER OF SUPPLIERS

- 6.14.4 BARGAINING POWER OF BUYERS

- 6.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.15.2 BUYING CRITERIA

- 6.16 MACROECONOMIC OUTLOOK

- 6.16.1 GDP TRENDS AND FORECASTS OF MAJOR ECONOMIES

- 6.17 CASE STUDY ANALYSIS

- 6.17.1 ADVANCED MEMBRANE BIOREACTOR SYSTEM ENABLES WATER REUSE AT COCA-COLA FEMSA'S ALCORTA PLANT

- 6.17.2 FRIESLANDCAMPINA'S WATER REUSE AND PRODUCT RECOVERY PARTNERSHIP WITH VEOLIA

- 6.17.3 LOS ANGELES COUNTY STORMWATER-TO-SEWER DIVERSION PROGRAM

7 WATER RECYCLE AND REUSE MARKET, BY WATER SOURCE

- 7.1 INTRODUCTION

- 7.2 MUNICIPAL WASTEWATER

- 7.2.1 URBAN MUNICIPAL WASTEWATER REUSE EXPANDS TO MEET RISING DEMAND AND WATER SCARCITY CHALLENGES

- 7.3 INDUSTRIAL WASTEWATER

- 7.3.1 RISING INDUSTRIAL WATER DEMAND TO DRIVE ADOPTION OF ON-SITE AND CENTRALIZED REUSE SYSTEMS

- 7.4 AGRICULTURAL DRAINAGE

- 7.4.1 AGRICULTURAL DRAINAGE REUSE GAINS GROUND AMID WATER SCARCITY AND SUSTAINABLE IRRIGATION NEEDS

- 7.5 STORMWATER RUNOFF

- 7.5.1 URBAN STORMWATER REUSE EXPANDS THROUGH GREEN INFRASTRUCTURE AND INTEGRATED DRAINAGE SOLUTIONS

8 WATER RECYCLE AND REUSE MARKET, BY EQUIPMENT

- 8.1 INTRODUCTION

- 8.2 PRIMARY EQUIPMENT

- 8.2.1 PRIMARY TREATMENT FUELS COST-EFFECTIVE AND EFFICIENT WASTEWATER REUSE OPERATIONS

- 8.2.2 SCREENS

- 8.2.3 GRIT CHAMBER

- 8.2.4 PRIMARY CLARIFIERS

- 8.3 SECONDARY EQUIPMENT

- 8.3.1 INCREASED ORGANIC LOAD AND EFFLUENT REGULATIONS DRIVING NEED FOR ADVANCED SECONDARY TREATMENT SOLUTIONS

- 8.3.2 AERATION TANKS

- 8.3.3 SECONDARY CLARIFIERS

- 8.3.4 BIOREACTORS

- 8.3.5 AIR BLOWERS/DIFFUSERS

- 8.4 TERTIARY EQUIPMENT

- 8.4.1 POTABLE AND INDUSTRIAL REUSE REQUIREMENTS FUELS DEMAND

- 8.4.2 MEMBRANE FILTRATION SYSTEMS

- 8.4.3 DISINFECTION SYSTEMS

- 8.4.4 SAND/MULTIMEDIA FILTERS

- 8.4.5 ACTIVATED CARBON FILTERS

- 8.4.6 ION EXCHANGE SYSTEMS

9 WATER RECYCLE AND REUSE MARKET, BY CAPACITY

- 9.1 INTRODUCTION

- 9.2 <25,000 LITERS

- 9.2.1 COST-EFFECTIVE WATER SOLUTIONS DRIVING ADOPTION IN SMALL FACILITIES

- 9.3 25,001-50,000 LITERS

- 9.3.1 DEMAND FOR 25,001-50,000 LITERS CAPACITY TREATMENT PLANTS INCREASING IN ARID REGIONS

- 9.4 50,001-100,000 LITERS

- 9.4.1 URBANIZATION AND INDUSTRIALIZATION FUEL DEMAND FOR MID-SCALE WATER TREATMENT SYSTEMS

- 9.5 ABOVE 100,000 LITERS

- 9.5.1 MEGA INFRASTRUCTURE PROJECTS BOOSTING DEMAND FOR LARGE-CAPACITY WATER TREATMENT PLANT

10 WATER RECYCLE AND REUSE MARKET, BY END USE

- 10.1 INTRODUCTION

- 10.2 RESIDENTIAL

- 10.2.1 RISING WATER SCARCITY SPURS RESIDENTIAL REUSE INITIATIVES ACROSS GREEN COMMUNITIES

- 10.3 COMMERCIAL

- 10.3.1 RISING SUSTAINABILITY GOALS DRIVE COMMERCIAL ADOPTION OF RECYCLED WATER

- 10.4 INDUSTRIAL

- 10.4.1 INDUSTRIAL WATER REUSE ACCELERATES WITH LARGE-SCALE PROJECTS

11 WATER RECYCLE AND REUSE MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 ASIA PACIFIC

- 11.2.1 CHINA

- 11.2.1.1 Growing reuse of municipal wastewater in China driven by infrastructure

- 11.2.2 JAPAN

- 11.2.2.1 Government initiatives on water reclamation projects to support market

- 11.2.3 INDIA

- 11.2.3.1 Government initiatives and policies toward clean and green cities fueling demand

- 11.2.4 SOUTH KOREA

- 11.2.4.1 Government practices toward water recycling and water management to drive market

- 11.2.5 REST OF ASIA PACIFIC

- 11.2.1 CHINA

- 11.3 NORTH AMERICA

- 11.3.1 US

- 11.3.1.1 Federal and state funding propelling large-scale water reuse projects

- 11.3.2 CANADA

- 11.3.2.1 Industrial reuse in mining and oil sands driving demand for water recycle and reuse in Canada

- 11.3.3 MEXICO

- 11.3.3.1 Increasing awareness of sustainability goals to drive demand

- 11.3.1 US

- 11.4 EUROPE

- 11.4.1 GERMANY

- 11.4.1.1 Strong environmental regulations encouraging advanced wastewater treatment and reuse

- 11.4.2 ITALY

- 11.4.2.1 Adoption of advanced treatment technologies boosting water recovery efficiency

- 11.4.3 FRANCE

- 11.4.3.1 Innovative water reuse projects to secure drinking water supplies

- 11.4.4 UK

- 11.4.4.1 Push for Net-Zero Water Utilities

- 11.4.5 SPAIN

- 11.4.5.1 Robust infrastructure and technological advancements driving sustainable water management

- 11.4.6 REST OF EUROPE

- 11.4.1 GERMANY

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 GCC COUNTRIES

- 11.5.1.1 Saudi Arabia

- 11.5.1.1.1 Extreme water stress to drive need for water recycling and reuse

- 11.5.1.2 UAE

- 11.5.1.2.1 Government mandates promoting treated wastewater use

- 11.5.1.3 Rest of GCC countries

- 11.5.1.1 Saudi Arabia

- 11.5.2 SOUTH AFRICA

- 11.5.2.1 Agriculture sector to drive demand for recycled water

- 11.5.3 REST OF MIDDLE EAST & AFRICA

- 11.5.1 GCC COUNTRIES

- 11.6 SOUTH AMERICA

- 11.6.1 ARGENTINA

- 11.6.1.1 Agricultural irrigation needs increasing reliance on treated wastewater

- 11.6.2 BRAZIL

- 11.6.2.1 Corporate sustainability initiatives promoting industrial water reuse and zero-liquid discharge practices.

- 11.6.3 REST OF SOUTH AMERICA

- 11.6.1 ARGENTINA

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.3 MARKET SHARE ANALYSIS, 2024

- 12.4 REVENUE ANALYSIS, 2021-2024

- 12.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- 12.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.5.5.1 Company footprint

- 12.5.5.2 Region footprint

- 12.5.5.3 Equipment Footprint

- 12.5.5.4 Capacity footprint

- 12.5.5.5 End use footprint

- 12.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 RESPONSIVE COMPANIES

- 12.6.3 DYNAMIC COMPANIES

- 12.6.4 STARTING BLOCKS

- 12.6.5 COMPETITIVE BENCHMARKING

- 12.6.5.1 Detailed list of key startups/SMEs

- 12.6.5.2 Competitive benchmarking of key startups/SMEs

- 12.7 BRAND/PRODUCT COMPARISON

- 12.8 COMPANY VALUATION AND FINANCIAL METRICS

- 12.9 COMPETITIVE SCENARIO AND TRENDS

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

- 12.9.3 EXPANSIONS

- 12.9.4 OTHER DEVELOPMENTS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 VEOLIA

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Deals

- 13.1.1.3.2 Expansions

- 13.1.1.3.3 Other developments

- 13.1.1.4 MnM view

- 13.1.1.4.1 Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 ECOLAB INC.

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Deals

- 13.1.2.3.2 Expansions

- 13.1.2.4 MnM view

- 13.1.2.4.1 Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 XYLEM

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Deals

- 13.1.3.3.2 Expansions

- 13.1.3.3.3 Other developments

- 13.1.3.4 MnM view

- 13.1.3.4.1 Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 DUPONT

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Product launches

- 13.1.4.3.2 Deals

- 13.1.4.4 MnM view

- 13.1.4.4.1 Right to win

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 HITACHI, LTD.

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Deals

- 13.1.5.3.2 Other developments

- 13.1.5.4 MnM view

- 13.1.5.4.1 Right to win

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses and competitive threats

- 13.1.6 KUBOTA CORPORATION

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Deals

- 13.1.6.3.2 Other developments

- 13.1.6.4 MnM view

- 13.1.6.4.1 Right to win

- 13.1.6.4.2 Strategic choices

- 13.1.6.4.3 Weaknesses and competitive threats

- 13.1.7 ALFA LAVAL

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Deals

- 13.1.7.3.2 Other developments

- 13.1.7.4 MnM view

- 13.1.7.4.1 Right to win

- 13.1.7.4.2 Strategic choices

- 13.1.7.4.3 Weaknesses and competitive threats

- 13.1.8 THERMAX LIMITED

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Expansions

- 13.1.8.3.2 Other developments

- 13.1.8.4 MnM view

- 13.1.8.4.1 Right to win

- 13.1.8.4.2 Strategic choices

- 13.1.8.4.3 Weaknesses and competitive threats

- 13.1.9 PENTAIR

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Other developments

- 13.1.9.4 MnM view

- 13.1.9.4.1 Right to win

- 13.1.9.4.2 Strategic choices

- 13.1.9.4.3 Weaknesses and competitive threats

- 13.1.10 AQUATECH

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Deals

- 13.1.10.4 MnM view

- 13.1.10.4.1 Right to win

- 13.1.10.4.2 Strategic choices

- 13.1.10.4.3 Weaknesses and competitive threats

- 13.1.1 VEOLIA

- 13.2 OTHER PLAYERS

- 13.2.1 ION EXCHANGE

- 13.2.2 PRAJ INDUSTRIES

- 13.2.3 FLUENCE CORPORATION LIMITED

- 13.2.4 DELOACH INDUSTRIES, INC.

- 13.2.5 KOVALUS SEPARATION SOLUTIONS

- 13.2.6 VORTEX ENGINEERING LTD

- 13.2.7 AQUA-AEROBIC SYSTEMS, INC.

- 13.2.8 HYDRO INTERNATIONAL LTD.

- 13.2.9 ECOLOGIX ENVIRONMENTAL SYSTEMS, LLC

- 13.2.10 BIOMICROBICS, INC

- 13.2.11 NEWTERRA

- 13.2.12 MITA WATER TECHNOLOGIES S.R.L.

- 13.2.13 ALAR

- 13.2.14 PARKSON CORPORATION

- 13.2.15 BIOKUBE

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS