|

시장보고서

상품코드

1797402

아스팔트 첨가제 시장 : 유형별, 기술별, 용도별, 지역별 - 예측(-2030년)Asphalt Additive Market by Type, Technology, Application, and Region - Global Forecast to 2030 |

||||||

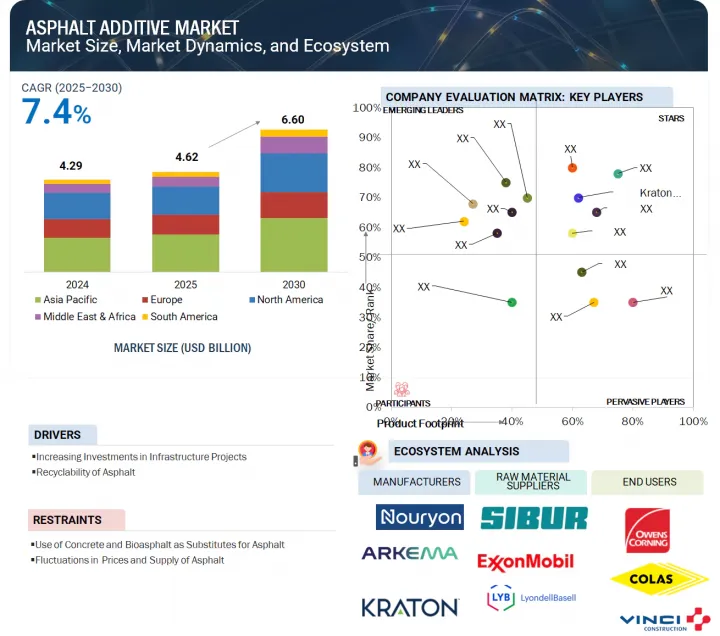

세계의 아스팔트 첨가제 시장 규모는 2025년 46억 2,000만 달러에서 2030년까지 66억 달러에 이를 것으로 예측되며, 예측 기간에 CAGR 7.4%의 성장이 전망됩니다.

신흥 경제권에서 인프라 부문의 급속한 확대로 인해 도로 신설 및 복구 프로젝트 수요가 크게 증가하고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2021-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 100만 달러, 킬로톤 |

| 부문 | 용도, 유형, 기술, 지역 |

| 대상 지역 | 북미, 아시아태평양, 유럽, 중동 및 아프리카, 남미 |

도시화가 가속화되고 교통망이 확장됨에 따라 무거운 교통 하중과 다양한 기후 조건을 견딜 수 있는 고성능 포장에 대한 요구가 증가하고 있습니다. 이러한 건설 활동의 급증은 아스팔트 혼합물의 내구성, 강도 및 수명을 향상시키는 아스팔트 첨가제에 대한 수요를 직접적으로 촉진하고 있습니다. 이러한 첨가제는 도로의 품질을 향상시키고, 유지보수 필요성을 줄이며, 개발도상국 전체의 지속 가능한 인프라 개발을 지원하는 데 필수적입니다.

"용도별로는 지붕재 부문이 예측 기간 동안 두 번째로 큰 시장 점유율을 차지할 것으로 예측됩니다. "

내구성과 내후성이 뛰어난 지붕 솔루션에 대한 수요가 증가함에 따라 예측 기간 동안 지붕 응용 분야는 금액과 수량 모두에서 시장 점유율 2위를 차지할 것으로 예측됩니다. 아스팔트 첨가제는 자외선, 열, 습기, 노화에 대한 저항력을 높여 지붕재의 성능을 향상시키는 데 필수적입니다. 아스팔트 첨가제의 사용은 지붕 시스템의 수명을 연장하고 건물의 에너지 효율을 촉진합니다. 특히 주거 및 상업 부문의 건설 활동이 활발해짐에 따라 지붕용 아스팔트 첨가제의 채택이 더욱 활발해지고 있습니다.

"기술별로는 웜믹스 부문이 예측 기간 동안 두 번째로 큰 시장 점유율을 차지할 것으로 예측됩니다. "

웜 믹스 기술 부문은 환경적 및 운영상의 이점으로 인해 예측 기간 동안 금액 기준으로 두 번째 시장 점유율을 차지할 것으로 예측됩니다. 이 기술을 통해 아스팔트를 저온에서 생산 및 도포할 수 있어 에너지 사용과 온실가스 배출을 줄일 수 있습니다. 또한, 작업성과 다짐성을 향상시키고, 포장시기를 확대하며, 현장의 안전성을 높입니다. 건설에서 지속가능성이 강조됨에 따라 선진시장과 신흥 시장 모두 웜 믹스 기술의 채택이 증가하고 있습니다.

"유형별로는 박리 방지제 및 접착 촉진제가 예측 기간 동안 두 번째 점유율을 차지할 것으로 예측됩니다. "

아스팔트 첨가제 시장에서 박리 방지제 및 접착 촉진제 부문은 예측 기간 동안 금액 기준으로 두 번째 점유율을 차지할 것으로 예측됩니다. 이러한 첨가제는 아스팔트 바인더와 골재와의 결합을 강화하는 데 중요하며, 박리 및 표면 열화를 방지하는 데 도움이 됩니다. 물에 의한 손상을 줄이고, 구멍이 뚫리거나 파헤쳐지는 위험을 낮추어 포장의 수명을 연장하고 내구성을 향상시킵니다. 수분이 많은 지역이나 동결융해가 잦은 지역에서는 특히 효과적입니다.

"북미가 예측 기간 동안 두 번째 점유율을 차지할 것입니다. "

북미는 예측 기간 동안 아스팔트 첨가제 시장에서 금액과 수량 모두에서 두 번째 점유율을 차지할 것으로 예측됩니다. 이러한 성장은 잘 구축된 인프라 네트워크와 도로 정비 및 업그레이드에 대한 지속적인 투자에 기인합니다. 이 지역에서는 특히 이상기후와 교통량 증가에 대응하기 위해 포장의 내구성과 성능 강화에 중점을 두고 있습니다. 또한, 지속 가능한 건설 방식에 대한 관심이 높아지고 웜 믹스 아스팔트와 같은 첨단 기술의 채택으로 아스팔트 첨가제에 대한 수요가 증가하고 있습니다. 정부의 규제와 교통 인프라에 대한 자금 지원도 이 지역 시장 성장을 크게 뒷받침하고 있습니다.

세계의 아스팔트 첨가제 시장에 대해 조사 분석했으며, 주요 촉진요인과 억제요인, 경쟁 구도, 향후 동향 등의 정보를 전해드립니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요 지견

- 아스팔트 첨가제 시장 기업에 있어서 매력적인 기회

- 아스팔트 첨가제 시장 : 유형별

- 아스팔트 첨가제 시장 : 기술별

- 아스팔트 첨가제 시장 : 용도별

- 아시아태평양 아스팔트 첨가제 시장 : 용도별, 국가별

- 아스팔트 첨가제 시장 : 주요 국가별

제5장 시장 개요

- 서론

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

- Porter의 Five Forces 분석

- 주요 이해관계자와 구입 기준

- 거시경제 지표

제6장 산업 동향

- 공급망 분석

- 원재료 공급업체

- 제조업체

- 유통 네트워크

- 최종사용자

- 가격 결정 분석

- 주요 기업이 제공하는 아스팔트 첨가제 평균 판매 가격(2024년)

- 아스팔트 첨가제 평균 판매 가격 동향 : 지역별(2022년-2024년)

- 고객의 비즈니스에 영향을 미치는 동향/혼란

- 생태계 분석

- 사례 연구 분석

- BASF 폴리머 개질별로 밤포장 유연성 향상

- KRATON 폴리머 강화에 의한 첨단 바인더 성능

- 기술 분석

- 주요 기술

- 보완 기술

- 무역 분석

- 수입 시나리오(HS코드 381129)

- 수출 시나리오(HS코드 381129)

- 규제 상황

- 규제기관, 정부기관, 기타 조직

- 규제 구조

- 주요 컨퍼런스 및 이벤트

- 투자 및 자금조달 시나리오

- 특허 분석

- 접근

- 문서 유형

- 주요 출원자

- 관할 분석

- 2025년 미국 관세의 영향 - 개요

- 서론

- 주요 관세율

- 가격 영향 분석

- 국가/지역에 대한 영향

- 용도에 대한 영향

- 아스팔트 첨가제 시장에 대한 AI/생성형 AI의 영향

제7장 아스팔트 첨가제 시장 : 용도별

- 서론

- 도로 건설 및 포장

- 지붕

- 공항 건설

- 기타

제8장 아스팔트 첨가제 시장 : 유형별

- 서론

- 폴리머 개질제

- 박리 방지제 및 접착 촉진제

- 유화제

- 화학 개질제

- 재생제

- 섬유

- 플럭스 오일

- 착색 아스팔트

- 기타

제9장 아스팔트 첨가제 시장 : 기술별

- 서론

- 핫 믹스

- 콜드 믹스

- 웜 믹스

제10장 아스팔트 첨가제 시장 : 지역별

- 서론

- 북미

- 미국

- 캐나다

- 멕시코

- 중동 및 아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

- 이집트

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 콜롬비아

- 기타 남미

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 인도네시아

- 말레이시아

- 호주

- 기타 아시아태평양

- 유럽

- 독일

- 프랑스

- 영국

- 이탈리아

- 러시아

- 스페인

- 기타 유럽

제11장 경쟁 구도

- 서론

- 시장 평가 프레임워크

- 시장 점유율 분석

- 매출 분석

- 브랜드/제품 비교

- SYLVAROAD RP 1000(KRATON CORPORATION)

- EVOTHERM(INGEVITY)

- SOLPRENE SBS(DYNASOL)

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업 평가 매트릭스 : 스타트업 기업/기타 기업과 중소기업(2024년)

- 기업 평가와 재무 지표

- 경쟁 시나리오

제12장 기업 개요

- 주요 기업

- KRATON CORPORATION

- INGEVITY CORPORATION

- DYNASOL GROUP

- NOURYON

- ARKEMA SPECIALTY SURFACTANTS

- THE DOW CHEMICAL COMPANY

- BASF SE

- HONEYWELL INTERNATIONAL INC

- HUNTSMAN CORPORATION

- EVONIK INDUSTRIES AG

- SASOL CHEMICALS

- KAO CORPORATION

- SINOPEC

- TOTALENERGIES

- ITERCHIMICA SPA

- 기타 기업

- LCY

- ERGON ASPHALT & EMULSIONS, INC.

- MCASPHALT INDUSTRIES LIMITED

- BULLDOG PLANT & EQUIPMENT LTD

- WACKER CHEMIE AG

- ENGINEERED ADDITIVES LLC

- PETROCHEM SPECIALITIES

- AMAZ CHEMICALS LLP

- NINGBO CHANGHONG POLYMER SCIENTIFIC AND TECHNICAL INC.

제13장 인접 시장

- 서론

- 제한 사항

- 접착 촉진제 시장

- 시장의 정의

- 접착 촉진제 시장 : 유형별

- 접착 촉진제 시장 : 용도별

- 접착 촉진제 시장 : 지역별

제14장 부록

LSH 25.09.01The global asphalt additive market is expected to grow from USD 4.62 billion in 2025 to USD 6.60 billion by 2030, with a CAGR of 7.4% during the forecast period. The rapid expansion of the infrastructure sector in emerging economies is significantly increasing the demand for new road construction and rehabilitation projects.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) and Volume (Kilotons) |

| Segments | By Application, Type, Technology, and Region |

| Regions covered | North America, Asia Pacific, Europe, the Middle East & Africa, and South America |

As urbanization accelerates and transportation networks broaden, there is a growing need for high-performance pavements capable of withstanding heavy traffic loads and various climate conditions. This surge in construction activity is directly boosting the demand for asphalt additives, which improve the durability, strength, and longevity of asphalt mixtures. These additives are essential for enhancing road quality, lowering maintenance requirements, and supporting the development of sustainable infrastructure across developing regions.

"By application, the roofing segment is expected to account for the second-largest market share during the forecast period."

The roofing application segment is expected to account for the second-largest share of the market by value and volume during the forecast period, driven by the increasing demand for durable, weather-resistant roofing solutions. Asphalt additives are essential in improving the performance of roofing materials by increasing resistance to UV radiation, heat, moisture, and aging. Their use extends the lifespan of roofing systems and promotes energy efficiency in buildings. Rising construction activity, especially in residential and commercial sectors, is further boosting the adoption of asphalt additives in roofing applications.

"By technology, the warm mix segment is expected to account for the second-largest market share during the forecast period."

The warm mix technology segment is expected to hold the second-largest market share by value during the forecast period, due to its environmental and operational benefits. This technology enables asphalt to be produced and applied at lower temperatures, reducing energy use and greenhouse gas emissions. It also improves workability and compaction, extends the paving season, and enhances site safety. As sustainability becomes a key focus in construction, the adoption of warm mix technology is increasing across both developed and emerging markets regions.

"By type, the anti-strip and adhesion promoters segment will account for the second-largest share during the forecast period."

The anti-strip and adhesion promoters segment is projected to hold the second-largest share of the asphalt additive market by value during the forecast period. These additives are crucial for enhancing the bond between asphalt binder and aggregates, which helps prevent stripping and surface deterioration. By reducing water-induced damage and lowering the risk of potholes and rutting, they extend pavement life and increase durability. Their use is especially beneficial in regions with high moisture levels or frequent freeze-thaw cycles.

"North America will account for the second-largest share during the forecast period."

The North America region is expected to account for the second-largest share of the asphalt additive market in both value and volume during the forecast period. This growth is driven by its well-established infrastructure network and ongoing investments in road maintenance and upgrades. The region emphasizes enhancing the durability and performance of pavements, especially in response to extreme weather and heavy traffic. Furthermore, the increasing focus on sustainable construction practices and the adoption of advanced technologies like warm mix asphalt are boosting demand for asphalt additives. Government regulations and funding for transportation infrastructure also significantly support market growth in the region.

Profile break-up of primary participants for the report:

- By Company Type: Tier 1 - 65%, Tier 2 - 20%, and Tier 3 - 15%

- By Designation: C Level- 25%, Director Level- 30%, and Others - 45%

- By Region: North America - 30%, Asia Pacific - 40%, Europe - 20%, Middle East & Africa - 7%, and South America - 3%

Kraton Corporation (US), Arkema SA (France), Ingevity Corporation (US), Nouryon (Netherlands), and BASF SE (Germany) are some of the major players operating in the asphalt additive market. These players have adopted expansions to increase their market share and business revenue.

Research Coverage:

The report defines, segments, and projects the asphalt additive market based on type, application, technology, and region. It provides detailed information regarding the major factors influencing the market's growth, such as drivers, restraints, opportunities, and challenges. It strategically profiles asphalt additive manufacturers, comprehensively analyzing their market shares and core competencies, and tracks and analyzes competitive developments, such as product launches, acquisitions, agreements, and others.

Reasons to Buy the Report:

The report is expected to assist market leaders and new entrants by providing them with the closest estimates of revenue figures for the asphalt additive market and its segments. It is also anticipated to help stakeholders gain a better understanding of the market's competitive landscape, acquire insights to enhance their business positioning, and develop effective go-to-market strategies. Additionally, it enables stakeholders to gauge the market's pulse and offers information on key drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of drivers (Increasing investments in infrastructure projects, recyclability of asphalt), opportunities (Increasing use of warm mix asphalt, use of asphalt additives in roofing applications, advancement in aerospace sector), restraint (Use of concrete and bioasphalt as substitutes for asphalt, fluctuation in prices and supply of asphalt), and challenges (Lack of awareness about asphalt additives among road builders and contractors) influencing the growth of the asphalt additive market.

- Product development/innovation: Detailed insights on upcoming technologies and research & development activities in the asphalt additive market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the asphalt additive market across varied regions.

- Market Diversification: Exhaustive information about new products, various types, untapped geographies, recent developments, and investments in the asphalt additive market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players such as Kraton Corporation (US), Arkema SA (France), Ingevity Corporation (US), Nouryon (Netherlands), and BASF SE (Germany) in the asphalt additive market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNIT CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key primary participants

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 GROWTH FORECAST

- 2.4.1 SUPPLY-SIDE ANALYSIS

- 2.4.2 DEMAND-SIDE ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ASPHALT ADDITIVES MARKET

- 4.2 ASPHALT ADDITIVES MARKET, BY TYPE

- 4.3 ASPHALT ADDITIVES MARKET, BY TECHNOLOGY

- 4.4 ASPHALT ADDITIVES MARKET, BY APPLICATION

- 4.5 ASIA PACIFIC: ASPHALT ADDITIVES MARKET, BY APPLICATION & COUNTRY

- 4.6 ASPHALT ADDITIVES MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing investments in infrastructure projects

- 5.2.1.2 Recyclability of asphalt

- 5.2.2 RESTRAINTS

- 5.2.2.1 Use of concrete and bioasphalt as substitutes for asphalt

- 5.2.2.2 Fluctuations in prices and supply of asphalt

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing use of warm mix asphalt

- 5.2.3.2 Use of asphalt additives in roofing applications

- 5.2.3.3 Advancements in aerospace sector

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of awareness about asphalt additives among road builders and contractors

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF SUBSTITUTES

- 5.3.2 BARGAINING POWER OF SUPPLIERS

- 5.3.3 BARGAINING POWER OF BUYERS

- 5.3.4 THREAT OF NEW ENTRANTS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.4.2 BUYING CRITERIA

- 5.5 MACROECONOMIC INDICATORS

- 5.5.1 GDP TRENDS AND FORECAST

6 INDUSTRY TRENDS

- 6.1 SUPPLY CHAIN ANALYSIS

- 6.1.1 RAW MATERIAL SUPPLIERS

- 6.1.2 MANUFACTURERS

- 6.1.3 DISTRIBUTION NETWORKS

- 6.1.4 END-USERS

- 6.2 PRICING ANALYSIS

- 6.2.1 AVERAGE SELLING PRICE OF ASPHALT ADDITIVES OFFERED BY KEY PLAYERS, 2024

- 6.2.2 AVERAGE SELLING PRICE TREND OF ASPHALT ADDITIVES, BY REGION, 2022-2024

- 6.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.4 ECOSYSTEM ANALYSIS

- 6.5 CASE STUDY ANALYSIS

- 6.5.1 BOOSTING PAVEMENT FLEXIBILITY WITH BASF'S POLYMERIC MODIFIERS

- 6.5.2 ADVANCED BINDER PERFORMANCE WITH KRATON POLYMER ENHANCEMENTS

- 6.6 TECHNOLOGY ANALYSIS

- 6.6.1 KEY TECHNOLOGIES

- 6.6.1.1 Warm mix asphalt (WMA) technology

- 6.6.1.2 Rejuvenation and recycling technologies

- 6.6.2 COMPLIMENTARY TECHNOLOGIES

- 6.6.2.1 Asphalt mixing and blending systems

- 6.6.1 KEY TECHNOLOGIES

- 6.7 TRADE ANALYSIS

- 6.7.1 IMPORT SCENARIO (HS CODE 381129)

- 6.7.2 EXPORT SCENARIO (HS CODE 381129)

- 6.8 REGULATORY LANDSCAPE

- 6.8.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.8.2 REGULATORY FRAMEWORK

- 6.8.2.1 ASTM D977 - Standard specification for emulsified asphalts

- 6.8.2.2 BS EN 12591:2009 - Bitumen and bituminous binders - specifications for paving grade bitumen

- 6.9 KEY CONFERENCES AND EVENTS

- 6.10 INVESTMENT AND FUNDING SCENARIO

- 6.11 PATENT ANALYSIS

- 6.11.1 APPROACH

- 6.11.2 DOCUMENT TYPES

- 6.11.3 TOP APPLICANTS

- 6.11.4 JURISDICTION ANALYSIS

- 6.12 IMPACT OF 2025 US TARIFF - OVERVIEW

- 6.12.1 INTRODUCTION

- 6.12.2 KEY TARIFF RATES

- 6.12.3 PRICE IMPACT ANALYSIS

- 6.12.4 IMPACT ON COUNTRY/REGION

- 6.12.4.1 US

- 6.12.4.2 Europe

- 6.12.4.3 Asia Pacific

- 6.12.5 IMPACT ON APPLICATIONS:

- 6.13 IMPACT OF AI/GEN AI ON ASPHALT ADDITIVES MARKET

7 ASPHALT ADDITIVES MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.2 ROAD CONSTRUCTION & PAVING

- 7.2.1 HIGH GOVERNMENT INVESTMENTS FOR INFRASTRUCTURE DEVELOPMENT IN EMERGING ECONOMIES TO DRIVE SEGMENT

- 7.3 ROOFING

- 7.3.1 GROWING CONSTRUCTION SECTOR IN NORTH AMERICA TO DRIVE SEGMENT

- 7.4 AIRPORT CONSTRUCTION

- 7.4.1 GROWTH OF AEROSPACE SECTOR TO INCREASE DEMAND

- 7.5 OTHERS

8 ASPHALT ADDITIVES MARKET, BY TYPE

- 8.1 INTRODUCTION

- 8.2 POLYMERIC MODIFIERS

- 8.2.1 GROWING USE OF HIGH-PERFORMANCE BINDERS TO DRIVE DEMAND

- 8.3 ANTI-STRIP AND ADHESION PROMOTERS

- 8.3.1 CLIMATE RESILIENCE TO DRIVE MARKET GROWTH

- 8.4 EMULSIFIERS

- 8.4.1 SHIFT TOWARD LOW-EMISSION PAVEMENT TECHNOLOGIES TO DRIVE DEMAND

- 8.5 CHEMICAL MODIFIERS

- 8.5.1 IMPROVED BINDER DURABILITY AND COST-EFFICIENCY TO DRIVE DEMAND

- 8.6 REJUVENATORS

- 8.6.1 GROWING USE OF RAP AND RAS TO DRIVE MARKET

- 8.7 FIBERS

- 8.7.1 IMPROVING TENSILE STRENGTH AND CRACK RESISTANCE TO DRIVE DEMAND

- 8.8 FLUX OIL

- 8.8.1 ENHANCED ASPHALT FLEXIBILITY AND SUSTAINABILITY TO DRIVE DEMAND

- 8.9 COLORED ASPHALT

- 8.9.1 ENHANCED ROAD DURABILITY AND HEAT MANAGEMENT TO DRIVE DEMAND

- 8.10 OTHERS

9 ASPHALT ADDITIVES MARKET, BY TECHNOLOGY

- 9.1 INTRODUCTION

- 9.2 HOT MIX

- 9.2.1 ENABLES HIGH-HEAT PROCESSING WITH SUPERIOR COMPACTION AND DURABILITY

- 9.3 COLD MIX

- 9.3.1 ENABLES COST-EFFICIENT, EMISSION-FREE ROAD BUILDING WITH ADVANCED EMULSION FORMULATIONS

- 9.4 WARM MIX

- 9.4.1 ENABLES LOW-TEMPERATURE PAVING THROUGH FOAMING SYSTEMS AND WAX-BASED ADDITIVES

10 ASPHALT ADDITIVES MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 US

- 10.2.1.1 Construction and infrastructure developments to boost market

- 10.2.2 CANADA

- 10.2.2.1 Increased investments in building & construction to drive market

- 10.2.3 MEXICO

- 10.2.3.1 Growing population and automobile sector to drive demand

- 10.2.1 US

- 10.3 MIDDLE EAST & AFRICA

- 10.3.1 SAUDI ARABIA

- 10.3.1.1 Infrastructural developments to drive market

- 10.3.2 UAE

- 10.3.2.1 Growth in housing units to increase demand

- 10.3.3 EGYPT

- 10.3.3.1 Increasing investments in road networks

- 10.3.4 REST OF MIDDLE EAST & AFRICA

- 10.3.1 SAUDI ARABIA

- 10.4 SOUTH AMERICA

- 10.4.1 BRAZIL

- 10.4.1.1 Infrastructural developments to boost market

- 10.4.2 ARGENTINA

- 10.4.2.1 Growing investments in road building to boost demand

- 10.4.3 COLOMBIA

- 10.4.3.1 Growth in urbanization to create demand for road construction

- 10.4.4 REST OF SOUTH AMERICA

- 10.4.1 BRAZIL

- 10.5 ASIA PACIFIC

- 10.5.1 CHINA

- 10.5.1.1 Growth in construction of green buildings to propel demand

- 10.5.2 INDIA

- 10.5.2.1 Investments to upgrade infrastructure and buildings to fuel market

- 10.5.3 JAPAN

- 10.5.3.1 Government investments in construction industry to boost market

- 10.5.4 SOUTH KOREA

- 10.5.4.1 Investments in construction industry to increase demand

- 10.5.5 INDONESIA

- 10.5.5.1 Rising construction industry to increase market demand

- 10.5.6 MALAYSIA

- 10.5.6.1 Expansion of construction industry to lead to market growth

- 10.5.7 AUSTRALIA

- 10.5.7.1 Government's five-year infrastructure investment plan to boost market demand

- 10.5.8 REST OF ASIA PACIFIC

- 10.5.1 CHINA

- 10.6 EUROPE

- 10.6.1 GERMANY

- 10.6.1.1 Infrastructure investments to drive market

- 10.6.2 FRANCE

- 10.6.2.1 Increase in use of new technologies to boost market demand

- 10.6.3 UK

- 10.6.3.1 Major infrastructure projects to boost market

- 10.6.4 ITALY

- 10.6.4.1 Growing demand for eco-friendly materials to drive market

- 10.6.5 RUSSIA

- 10.6.5.1 New road developments to propel demand for asphalt additives

- 10.6.6 SPAIN

- 10.6.6.1 Expansion of construction industry to drive market

- 10.6.7 REST OF EUROPE

- 10.6.1 GERMANY

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 MARKET EVALUATION FRAMEWORK

- 11.3 MARKET SHARE ANALYSIS

- 11.3.1 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS

- 11.4 REVENUE ANALYSIS

- 11.5 BRAND/PRODUCT COMPARISON

- 11.5.1 SYLVAROAD RP 1000 (KRATON CORPORATION)

- 11.5.2 EVOTHERM (INGEVITY)

- 11.5.3 SOLPRENE SBS (DYNASOL)

- 11.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.6.1 COMPANY EVALUATION AND MAPPING

- 11.6.2 STARS

- 11.6.3 EMERGING LEADERS

- 11.6.4 PERVASIVE PLAYERS

- 11.6.5 PARTICIPANTS

- 11.6.6 COMPANY FOOTPRINT

- 11.6.6.1 Asphalt Additives: Region footprint analysis

- 11.6.6.2 Asphalt Additives: Product type footprint analysis

- 11.6.6.3 Asphalt Additives: Technology footprint analysis

- 11.6.6.4 Asphalt Additives: Application footprint analysis

- 11.7 COMPANY EVALUATION MATRIX: STARTUPS/OTHER ADDITIONAL PLAYERS AND SMES, 2024

- 11.7.1 MAPPING OF STARTUPS/OTHER ADDITIONAL PLAYERS AND SMES, 2024

- 11.7.2 PROGRESSIVE COMPANIES

- 11.7.3 RESPONSIVE COMPANIES

- 11.7.4 STARTING BLOCKS

- 11.7.5 DYNAMIC COMPANIES

- 11.7.6 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.7.6.1 Detailed list of key startups/SMEs

- 11.7.6.2 Competitive benchmarking of key startups/SMEs

- 11.8 COMPANY VALUATION AND FINANCIAL METRICS

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 DEALS

- 11.9.3 EXPANSIONS

- 11.9.4 OTHER DEVELOPMENTS

12 COMPANY PROFILES

- 12.1 MAJOR PLAYERS

- 12.1.1 KRATON CORPORATION

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Deals

- 12.1.1.3.2 Expansions

- 12.1.1.4 MnM view

- 12.1.1.4.1 Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 INGEVITY CORPORATION

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Deals

- 12.1.2.3.2 Expansions

- 12.1.2.4 MnM view

- 12.1.2.4.1 Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 DYNASOL GROUP

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Other developments

- 12.1.3.4 MnM view

- 12.1.3.4.1 Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 NOURYON

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Product launches

- 12.1.4.3.2 Expansions

- 12.1.4.4 MnM view

- 12.1.4.4.1 Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses and competitive threats

- 12.1.5 ARKEMA SPECIALTY SURFACTANTS

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Product launches

- 12.1.5.3.2 Deals

- 12.1.5.3.3 Other developments

- 12.1.5.4 MnM view

- 12.1.5.4.1 Right to win

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses and competitive threats

- 12.1.6 THE DOW CHEMICAL COMPANY

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.6.3 MnM view

- 12.1.6.3.1 Right to win

- 12.1.6.3.2 Strategic choices

- 12.1.6.3.3 Weaknesses and competitive threats

- 12.1.7 BASF SE

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Product launches

- 12.1.7.3.2 Deals

- 12.1.7.4 MnM view

- 12.1.7.4.1 Right to win

- 12.1.7.4.2 Strategic choices

- 12.1.7.4.3 Weaknesses and competitive threats

- 12.1.8 HONEYWELL INTERNATIONAL INC

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.8.3 MnM view

- 12.1.8.3.1 Right to win

- 12.1.8.3.2 Strategic choices

- 12.1.8.3.3 Weaknesses and competitive threats

- 12.1.9 HUNTSMAN CORPORATION

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Deals

- 12.1.10 EVONIK INDUSTRIES AG

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Product launches

- 12.1.10.3.2 Expansions

- 12.1.11 SASOL CHEMICALS

- 12.1.11.1 Business overview

- 12.1.11.2 Products/Solutions/Services offered

- 12.1.11.3 Recent developments

- 12.1.11.3.1 Deals

- 12.1.12 KAO CORPORATION

- 12.1.12.1 Business overview

- 12.1.12.2 Products/Solutions/Services offered

- 12.1.12.3 Recent developments

- 12.1.12.3.1 Expansions

- 12.1.13 SINOPEC

- 12.1.13.1 Business overview

- 12.1.13.2 Products/Solutions/Services offered

- 12.1.14 TOTALENERGIES

- 12.1.14.1 Business overview

- 12.1.14.2 Products/Solutions/Services offered

- 12.1.15 ITERCHIMICA SPA

- 12.1.15.1 Business overview

- 12.1.15.2 Products/Solutions/Services offered

- 12.1.15.3 Recent developments

- 12.1.15.3.1 Deals

- 12.1.15.3.2 Expansions

- 12.1.1 KRATON CORPORATION

- 12.2 OTHER PLAYERS

- 12.2.1 LCY

- 12.2.2 ERGON ASPHALT & EMULSIONS, INC.

- 12.2.3 MCASPHALT INDUSTRIES LIMITED

- 12.2.4 BULLDOG PLANT & EQUIPMENT LTD

- 12.2.5 WACKER CHEMIE AG

- 12.2.6 ENGINEERED ADDITIVES LLC

- 12.2.7 PETROCHEM SPECIALITIES

- 12.2.8 AMAZ CHEMICALS LLP

- 12.2.9 NINGBO CHANGHONG POLYMER SCIENTIFIC AND TECHNICAL INC.

13 ADJACENT MARKETS

- 13.1 INTRODUCTION

- 13.2 LIMITATIONS

- 13.3 ADHESION PROMOTERS MARKET

- 13.3.1 MARKET DEFINITION

- 13.3.2 ADHESION PROMOTERS MARKET, BY TYPE

- 13.3.3 ADHESION PROMOTERS MARKET, BY APPLICATION

- 13.3.4 ADHESION PROMOTERS MARKET, BY REGION

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS