|

시장보고서

상품코드

1797403

전기생리학 시장 : 제품별, 적응증별, 최종사용자별, 지역별 - 예측(-2030년)Electrophysiology Market by Product (Lab Devices, Ablation Catheters, Diagnostic Catheters ), End Use-Global Forecast to 2030 |

||||||

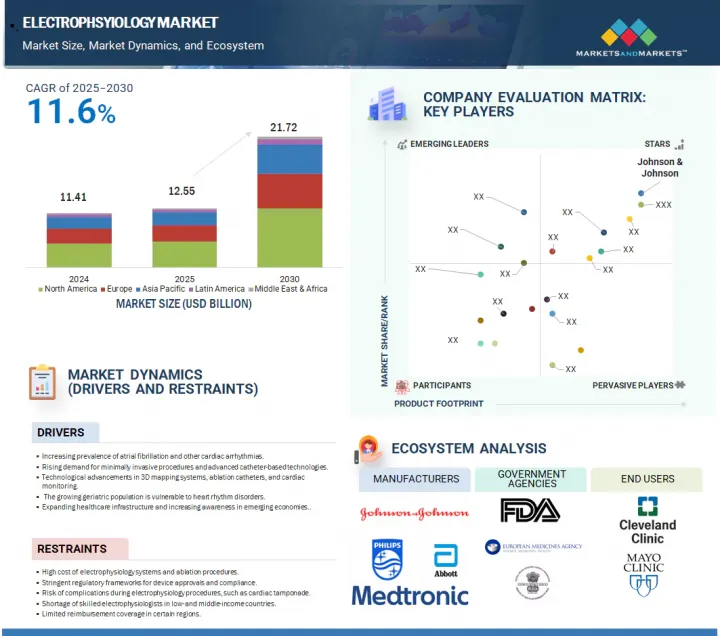

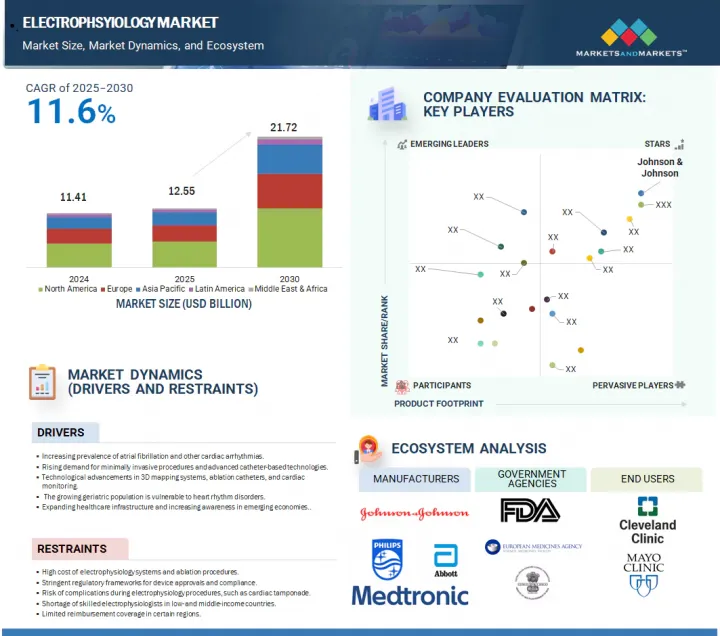

세계의 전기생리학 시장 규모는 2025년 125억 5,000만 달러에서 2030년에는 217억 2,000만 달러에 이르고, 예측 기간 중 연평균 복합 성장률(CAGR)은 11.6%를 나타낼 전망입니다.

예상되는 전기생리학 시장의 성장은 기술 발전과 연구 자금 증가에 의해 이루어질 것입니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2024-2030년 |

| 기준연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 검토 단위 | 금액(10억 달러) |

| 부문 | 제품별, 적응증별, 최종사용자별, 지역별 |

| 대상 지역 | 북미, 아시아태평양, 유럽, 중동 및 아프리카, 남미 |

가치 기반 치료와 조기 개입을 향한 전 세계적인 변화는 이식형 루프 레코더와 웨어러블 심전도 장치와 같은 진단 EP 도구의 광범위한 채택을 촉진하고 있습니다. 또한, 코로나19 이후 원격 의료의 성장으로 원격 부정맥 모니터링 및 후속 치료에 대한 접근성이 향상되고 있습니다. 심장 프로그램에 대한 정부 투자 증가, 민관 파트너십의 투자 증가, AI와 로봇 내비게이션 시스템의 지속적인 통합은 수술의 효율성과 표준화를 더욱 향상시킬 것입니다. 전반적으로 이러한 요인들은 전 세계 전기 생리학 시장의 강력한 확장에 박차를 가하고 있습니다.

전기 생리학 시장은 전기 생리학 검사 장비, 전기 생리학 절제 카테터, 전기 생리학 진단 카테터, EP 액세스 제품, 기타 부문으로 분류됩니다. 전기생리학(EP) 절제 카테터 분야의 확대는 여러 가지 요인에 의해 추진되고 있습니다. 특히 전 세계적으로 심방세동(AF) 및 기타 심장 부정맥의 발생률이 증가하고 있으며, 특히 고령층에서 발생률이 증가함에 따라 효과적인 치료법에 대한 수요가 증가하고 있습니다. 또한, 접촉력 감지, 관류 팁 디자인, 펄스 필드 절제술과 같은 카테터 기술의 혁신은 안전성, 정확성, 유효성을 향상시켜 전기생리학자들 사이에서 채택이 증가하고 있습니다.

제품별로 전기생리학 시장은 심방세동, 심방조동, 심방결절재진입빈맥(AVNRT), 울프-퍼킨슨-화이트(WPW) 증후군, 기타 적응증으로 나뉩니다. 전기생리학(EP) 시장에서 심방세동(AF) 분야의 확대는 인구통계학적, 라이프스타일, 임상적, 기술적 영향에 기인한 바가 큽니다. 전 세계적으로 고령화, 비만, 고혈압, 당뇨병, 좌식생활 등 증가로 인해 심방세동 유병률이 눈에 띄게 증가하고 있습니다. 이러한 심방세동의 부담 증가는 심방세동 진단 및 치료 중재에 대한 수요 증가를 촉진하고 있습니다. 또한, 향상된 카테터 절제술, 최첨단 매핑 시스템, 정교한 심장 내 영상 기술 등 EP 시술에 있어서의 획기적인 발전은 중재시술의 효과와 안전성 프로파일을 모두 크게 향상시켰습니다. 이러한 기술 혁신은 심방세동 치료의 패러다임 변화를 반영하고 있으며, 임상의들이 절제술 치료의 조기와 빈도를 늘리도록 유도하고 있습니다.

북미 전기생리학 분야는 주로 심방세동을 중심으로 한 심장 부정맥의 발병률 증가에 힘입어 강력한 성장세를 보이고 있습니다. 이러한 추세는 인구 고령화, 비만, 당뇨, 고혈압 등 동반질환의 높은 유병률과 상관관계가 있습니다. 그 결과, 고급 진단 및 치료용 전기생리학적 시술에 대한 수요가 증가하고 있습니다. 3D 전기해부학 매핑, 고주파 및 냉동 절제 기술의 강화, 펄스 필드 절제술의 도입과 같은 최근의 기술 혁신은 시술의 정확성, 환자 안전 및 임상 결과를 크게 향상시켰습니다. 이러한 발전으로 인해 표준 순환기내과 워크플로우에 전기생리학적 치료의 통합이 진행되고 있습니다.

예측 기간 동안 아시아태평양은 전기 생리학 시장에서 큰 성장을 이룰 것으로 예측됩니다. 이 지역에는 인도, 중국, 일본, 호주, 한국, 기타 아시아태평양 등 주요 시장이 포함됩니다. 아시아태평양 전기 생리학 시장은 몇 가지 상호 연관된 요인으로 인해 눈에 띄게 가속화되고 있습니다. 중국, 인도, 일본, 한국 등 아시아태평양 주요 국가에서는 의료비가 급증하고 있으며, 의료 제공업체들은 첨단 의료 기술 도입을 서두르고 있습니다. 의료 인프라가 개선되면서 첨단 전기생리학적 기기에 대한 접근이 용이해지면서 이러한 전환이 가속화되고 있습니다. 또한, 고령화, 도시화, 생활습관 변화 등 인구통계학적 변화로 인한 심혈관 질환의 유병률 증가는 효과적인 진단 및 치료 방법의 시급한 필요성을 강조하고 있습니다. 전기생리학적 시술은 심장 질환의 평가 및 관리에 크게 의존하고 있으며, 그 결과 이 지역의 관련 진단 및 치료 장비에 대한 수요를 촉진하고 있습니다.

세계의 전기생리학 시장을 조사했으며, 제품별, 적응증별, 최종사용자별, 지역별 동향, 시장 진출기업 프로파일 등의 정보를 정리하여 전해드립니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 프리미엄 인사이트

제5장 시장 개요

- 서론

- 시장 역학

- 업계 동향

- 기술 분석

- Porter의 Five Forces 분석

- 주요 이해관계자와 구입 기준

- 규제 분석

- 상환 시나리오 분석

- 특허 분석

- 무역 분석

- 가격 분석

- 2025년-2026년 주요 컨퍼런스 및 이벤트

- 미충족 요구와 최종사용자 기대

- 밸류체인 분석

- 공급망 분석

- 생태계 분석

- 사례 연구 분석

- 인접 시장 분석

- 고객의 비즈니스에 영향을 미치는 동향/혼란

- 투자 및 자금조달 시나리오

- AI/생성형 AI가 전기생리학 시장에 미치는 영향

- 2025년 미국 관세가 전기생리학 시장에 미치는 영향

제6장 전기생리학 시장(제품별)

- 서론

- 전기생리학 실험장치

- 전기생리학 절제 카테터

- 전기생리학 진단용 카테터

- 전기생리학 액세스 디바이스

- 기타

제7장 전기생리학 시장(적응증별)

- 서론

- 심방세동

- 심방조동

- ATRIOVENTRICULAR NODAL REENTRY TACHYCARDIA (AVNRT)

- WOLFF-PARKINSON-WHITE (WPW) SYNDROME(WPW)

- 기타

제8장 전기생리학 시장(최종사용자별)

- 서론

- 병원 및 심장센터

- 외래수술센터(ASC)

- 기타

제9장 전기생리학 시장(지역별)

- 서론

- 북미

- 북미의 거시경제 전망

- 미국

- 캐나다

- 유럽

- 유럽의 거시경제 전망

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타

- 아시아태평양

- 아시아태평양의 거시경제 전망

- 일본

- 중국

- 인도

- 호주

- 한국

- 기타

- 라틴아메리카

- 라틴아메리카의 거시경제 전망

- 브라질

- 멕시코

- 기타

- 중동 및 아프리카

- 중동 및 아프리카의 거시경제 전망

- GCC 국가

- 기타

제10장 경쟁 구도

- 서론

- 주요 시장 진출기업의 전략/강점

- 매출 분석, 2020년-2024년

- 시장 점유율 분석, 2024년

- 기업 평가 매트릭스 : 주요 시장 진출기업, 2024년

- 기업 평가 매트릭스 : 스타트업/중소기업, 2024년

- 기업 평가와 재무 지표

- 브랜드/제품 비교

- 주요 시장 진출기업 R&D평가

- 경쟁 시나리오

제11장 기업 개요

- 주요 시장 진출기업

- JOHNSON & JOHNSON SERVICES, INC.

- ABBOTT

- MEDTRONIC

- KONINKLIJKE PHILIPS N.V.

- GE HEALTHCARE

- BOSTON SCIENTIFIC CORPORATION

- JAPAN LIFELINE CO., LTD.

- STEREOTAXIS, INC.

- MICROPORT SCIENTIFIC CORPORATION

- BIOTRONIK

- TELEFLEX INCORPORATED

- ACUTUS MEDICAL, INC.

- MERIT MEDICAL SYSTEMS

- OSYPKA MEDICAL

- COOK

- 기타 기업

- EPMAP-SYSTEM

- CATHRX LTD.

- EP SOLUTIONS

- CATHVISION

- TZ MEDICAL, INC.

- APN HEALTH, LLC

- LEPU MEDICAL TECHNOLOGY(BEIJING) CO.,LTD.

- CARDIOFOCUS

- SCHWARZER CARDIOTEK

- IMRICOR

제12장 부록

LSH 25.09.02The global electrophysiology market is expected to reach USD 21.72 billion by 2030 from USD 12.55 billion in 2025, at a CAGR of 11.6% during the forecast period. The projected growth in the electrophysiology market is driven by technological advancements and increased research funding.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Product, Indication, End User, and Region |

| Regions covered | North America, Asia Pacific, Europe, the Middle East & Africa, and South America |

The worldwide shift toward value-based care and early intervention also encourages wider adoption of diagnostic EP tools like implantable loop recorders and wearable ECG devices. Additionally, the growth of telehealth after COVID-19 has improved access to remote arrhythmia monitoring and follow-up care. Increased government investment in cardiac programs, rising investments from public-private partnerships, and ongoing integration of AI and robotic navigation systems further improve procedure efficiency and standardization. Overall, these factors are fueling strong global expansion of the electrophysiology market.

"On the basis of product, the electrophysiology ablation catheters commanded the largest share in the electrophysiology market in 2024."

The electrophysiology market is categorized into several segments: electrophysiology laboratory devices, electrophysiology ablation catheters, electrophysiology diagnostic catheters, EP access products, and additional device types. The expansion of the electrophysiology (EP) ablation catheter sector is propelled by multiple factors. Notably, there is an increasing global incidence of atrial fibrillation (AF) and other cardiac arrhythmias, particularly within aging demographics, which heightens the demand for effective therapeutic interventions. Additionally, innovations in catheter technologies-such as contact force sensing, irrigated-tip designs, and pulsed field ablation-are enhancing safety, accuracy, and efficacy, thereby facilitating increased adoption among electrophysiologists.

"On the basis of indication, the atrial fibrillation devices segment held the largest share in the electrophysiology market in 2024."

By product, the electrophysiology market is segmented into atrial fibrillation, atrial flutter, atrioventricular nodal reentry tachycardia (AVNRT), wolff-parkinson-white (WPW) syndrome, and other indications. The expansion of the atrial fibrillation (AF) segment within the electrophysiology (EP) market is largely attributed to a convergence of demographic, lifestyle, clinical, and technological influences. The increasing global demographic of aging individuals, alongside rising rates of obesity, hypertension, diabetes, and sedentary behaviors, has led to a notable surge in AF prevalence. This growing burden of AF is driving heightened demand for EP diagnostics and therapeutic interventions. Moreover, significant advancements in EP procedural techniques, such as enhanced catheter ablation methods, state-of-the-art mapping systems, and sophisticated intracardiac imaging technologies, have markedly improved both the efficacy and safety profiles of interventions. These innovations are prompting clinicians to adopt ablation procedures earlier in the treatment continuum and with greater frequency, reflecting a paradigm shift in the management of AF.

"By region, North America accounted for the largest market share in 2024."

The electrophysiology sector in North America is experiencing robust expansion, primarily driven by the rising incidence of cardiac arrhythmias, notably atrial fibrillation. This trend correlates with an aging demographic and a high prevalence of comorbidities such as obesity, diabetes, and hypertension. Consequently, there is an escalating demand for advanced diagnostic and therapeutic electrophysiological procedures. Recent innovations-including 3D electro-anatomical mapping, enhanced radiofrequency and cryoablation technologies, and the introduction of pulsed-field ablation-have markedly improved procedural accuracy, patient safety, and clinical outcomes. These advancements are facilitating greater integration of electrophysiology practices within standard cardiology workflows.

"Asia Pacific to register the highest CAGR during the forecast period."

During the forecast period, the Asia Pacific (APAC) region is poised to experience considerable growth in the electrophysiology market. This region encompasses key markets such as India, China, Japan, Australia, South Korea, and Rest of Asia Pacific. The APAC electrophysiology market is witnessing a notable acceleration due to several interrelated factors. The escalating healthcare costs in major APAC countries-including China, India, Japan, and South Korea-are driving healthcare providers to adopt advanced medical technologies at an expedited pace. Enhanced healthcare infrastructure is facilitating this transition, allowing for greater accessibility to sophisticated electrophysiological devices. Moreover, the rising prevalence of cardiovascular diseases, attributable to demographic shifts such as aging populations, urbanization, and changing lifestyles, underscores the urgent need for effective diagnosis and treatment methodologies. Electrophysiology procedures, significantly relied upon for assessing and managing cardiac disorders, are consequently fueling demand for associated diagnostic and therapeutic devices within the region.

A breakdown of the primary participants referred to for this report is provided below:

- By Company Type: Tier 1-40%, Tier 2-30%, and Tier 3- 30%

- By Designation: C-level-27%, Director-level-18%, and Others-55%

- By Region: North America-50%, Europe-20%, Asia Pacific-15%, Latin America-10%, and the Middle East & Africa-5%

Key players in the electrophysiology market are Johnson & Johnson Services, Inc.(US), Abbott (US), Medtronic (Ireland), Koninklijke Philips N.V. (Netherlands), GE Healthcare (US), Boston Scientific Corporation (US), Japan Lifeline Co., Ltd (Japan), Stereotaxis, Inc.(US), MicroPort Scientific Corporation (China), BIOTRONIK (Germany), Teleflex Incorporated (US), Acutus Medical, Inc. (US), Merit Medical Systems (US), OSYPKA MEDICAL (Germany), Cook (US), Epmap-System (Germany), CathRx Ltd. (Australia), EP Solutions (Switzerland), CathVision (Denmark), TZ Medical, Inc. (US), APN Health, LLC (US), Lepu Medical Technology(Beijing)Co., Ltd (China), CardioFocus (US), Schwarzer Cardiotek (Germany), and Imricor (US).

Study Coverage:

The report analyzes the electrophysiology market and aims at estimating the market size and future growth potential of this market based on various segments such as devices & consumables, cancer type, procedure, end user, and region. The report also includes a competitive analysis of the key players in this market, along with their company profiles, service offerings, recent developments, and key market strategies.

Reasons to Buy the Report

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall pressure monitoring market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

This report provides insights into the following pointers

- The report studies the electrophysiology market based on product, indication, end user, and region

- The report analyzes factors (such as drivers, restraints, opportunities, and challenges) affecting the market growth.

- The report evaluates the opportunities and challenges in the market for stakeholders and provides details of the competitive landscape for market leaders.

- The report studies micro markets concerning their growth trends, prospects, and contributions to the global electrophysiology market.

- The report forecasts the revenue of market segments with respect to five major regions.

Key Benefits of Buying the Report:

The report will help the market leaders/new entrants/smaller firms in this market with investment evaluation viability within the Electrophysiology market through a thorough analysis of comprehensive data, thereby facilitating robust risk assessment and enabling well-informed investment determinations. Benefit from meticulous market segmentation encompassing application, end-user, and regional dimensions, affording tailored insights for precise segment targeting. The report also provides an all-encompassing evaluation of encapsulating pivotal trends, growth catalysts, challenges, and prospects, thereby empowering strategic decision-making with astute discernment.

The report provides insights on the following pointers:

- Analysis of key drivers (technological innovations for advanced, effective, and easy-to-use electrophysiological devices; high geriatric population and increased prevalence of cardiovascular diseases; rising investments, funds, and grants for cardiac surgeries and electrophysiology; increasing cardiovascular disease incidence and procedural volume), restraints (high product cost and inadequate reimbursement in developing and under-resourced healthcare settings, unfavorable healthcare reforms in US); opportunities (substantial growth opportunities in emerging economies, popularity of ambulatory surgical centers offering cost-effective outpatient electrophysiology services), and challenges (global shortage of skilled and experienced personnel) influencing the growth of the electrophysiology market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the electrophysiology market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the Electrophysiology market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the electrophysiology market.

Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as Johnson & Johnson Services, Inc. (US), Abbott (US), Medtronic (Ireland), Koninklijke Philips N.V. (Netherlands), GE HealthCare (US), and Boston Scientific Corporation (US), among others.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION & REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key primary sources

- 2.1.2.2 Objectives of primary research

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Breakdown of primaries

- 2.1.2.5 Key insights from primaries

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 REVENUE SHARE ANALYSIS

- 2.2.2 BOTTOM-UP APPROACH (SUPPLY-SIDE ANALYSIS)

- 2.2.3 TOP-DOWN APPROACH (UTILIZATION RATE AND ADOPTION PATTERN)

- 2.2.4 COMPANY PRESENTATIONS & PRIMARY INTERVIEWS

- 2.3 GROWTH FORECAST

- 2.4 DATA TRIANGULATION

- 2.5 STUDY ASSUMPTIONS

- 2.6 RESEARCH IMITATIONS

- 2.6.1 SCOPE-RELATED LIMITATIONS

- 2.6.2 METHODOLOGY-RELATED LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ELECTROPHYSIOLOGY MARKET OVERVIEW

- 4.2 NORTH AMERICA: ELECTROPHYSIOLOGY MARKET, BY PRODUCT AND COUNTRY

- 4.3 ELECTROPHYSIOLOGY MARKET: REGIONAL MIX

- 4.4 ELECTROPHYSIOLOGY MARKET: GEOGRAPHICAL GROWTH OPPORTUNITIES

- 4.5 ELECTROPHYSIOLOGY MARKET: EMERGING VS. DEVELOPED MARKETS

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Technological innovations for advanced, effective, and easy-to-use electrophysiological devices

- 5.2.1.1.1 Rising use of non-invasive cardiac mapping

- 5.2.1.1.2 Increasing use of improved intracardiac ablation systems

- 5.2.1.1.3 Rising use of MRI-guided ablation procedures

- 5.2.1.1.4 Increasing ultrasound guidance in electrophysiology labs

- 5.2.1.2 High geriatric population and increased prevalence of cardiovascular diseases

- 5.2.1.3 Rising investments, funds, and grants for cardiac surgeries and electrophysiology

- 5.2.1.4 Increasing cardiovascular disease incidence and procedural volume

- 5.2.1.1 Technological innovations for advanced, effective, and easy-to-use electrophysiological devices

- 5.2.2 RESTRAINTS

- 5.2.2.1 High product cost and inadequate reimbursement in developing and under-resourced healthcare settings

- 5.2.2.2 Unfavorable healthcare reforms in US

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Substantial growth opportunities in emerging economies

- 5.2.3.2 Popularity of ambulatory surgical centers offering cost-effective outpatient electrophysiology services

- 5.2.4 CHALLENGES

- 5.2.4.1 Global shortage of skilled and experienced personnel

- 5.2.1 DRIVERS

- 5.3 INDUSTRY TRENDS

- 5.3.1 INTEGRATION OF DIGITAL TECHNOLOGIES, ARTIFICAL INTELLIGENCE, AND REMOTE MONITORING IN ELECTROPHYSIOLOGY

- 5.3.2 ROBOTIC-ASSISTED ABLATION AND NAVIGATION TECHNOLOGIES FOR BETTER TRACTION IN ELECTROPHYSIOLOGY

- 5.4 TECHNOLOGY ANALYSIS

- 5.4.1 KEY TECHNOLOGIES

- 5.4.1.1 3D mapping and navigation systems

- 5.4.1.2 Cryoablation and radiofrequency ablation technologies

- 5.4.2 COMPLEMENTARY TECHNOLOGIES

- 5.4.2.1 Cardiac imaging technologies

- 5.4.2.2 Robotic navigation systems

- 5.4.3 ADJACENT TECHNOLOGIES

- 5.4.3.1 AI-enabled intravascular optical coherence tomography (OCT)

- 5.4.3.2 AI-driven view guidance in intra-cardiac echocardiography (ICE)

- 5.4.1 KEY TECHNOLOGIES

- 5.5 PORTER'S FIVE FORCES ANALYSIS

- 5.5.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.5.2 BARGAINING POWER OF BUYERS

- 5.5.3 BARGAINING POWER OF SUPPLIERS

- 5.5.4 THREAT OF SUBSTITUTES

- 5.5.5 THREAT OF NEW ENTRANTS

- 5.6 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.6.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.6.2 KEY BUYING CRITERIA

- 5.7 REGULATORY ANALYSIS

- 5.7.1 REGULATORY FRAMEWORK

- 5.7.1.1 North America

- 5.7.1.1.1 US

- 5.7.1.1.2 Canada

- 5.7.1.2 Europe

- 5.7.1.3 Asia Pacific

- 5.7.1.3.1 Japan

- 5.7.1.3.2 China

- 5.7.1.3.3 India

- 5.7.1.4 Latin America

- 5.7.1.4.1 Brazil

- 5.7.1.5 Middle East & Africa

- 5.7.1.5.1 UAE

- 5.7.1.1 North America

- 5.7.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.7.1 REGULATORY FRAMEWORK

- 5.8 REIMBURSEMENT SCENARIO ANALYSIS

- 5.9 PATENT ANALYSIS

- 5.9.1 PATENT PUBLICATION TRENDS FOR ELECTROPHYSIOLOGY MARKET

- 5.9.2 LIST OF KEY PATENTS

- 5.10 TRADE ANALYSIS

- 5.10.1 IMPORT DATA FOR HS CODE 901890, 2020-2024

- 5.10.2 EXPORT DATA FOR HS CODE 901890, 2020-2024

- 5.11 PRICING ANALYSIS

- 5.11.1 INDICATIVE SELLING PRICE TREND OF ELECTROPHYSIOLOGY PRODUCTS, BY KEY PLAYER, 2022-2024

- 5.11.2 AVERAGE SELLING PRICE TREND OF ELECTROPHYSIOLOGY PRODUCTS, BY REGION, 2022-2024

- 5.12 KEY CONFERENCES & EVENTS, 2025-2026

- 5.13 UNMET NEEDS & END-USER EXPECTATIONS

- 5.14 VALUE CHAIN ANALYSIS

- 5.15 SUPPLY CHAIN ANALYSIS

- 5.16 ECOSYSTEM ANALYSIS

- 5.17 CASE STUDY ANALYSIS

- 5.17.1 JOHNSON & JOHNSON TO EXPAND CARTO SUITE AND LEVERAGE AI FOR DECISION SUPPORT, VISUALIZATION, AND REMOTE DATA SHARING

- 5.17.2 ABBOTT TO INTRODUCE ENSITE OMNIPOLAR TECHNOLOGY (OT) FOR ORIENTATION-INDEPENDENT MAPPING WITH PRECISE SIGNAL CLARITY

- 5.17.3 PHILLIPS TO LAUNCH KODEX-EPD SYSTEM FOR ENABLING HIGH-RESOLUTION ANATOMICAL AND ELECTRICAL MAPPING WITHOUT DIRECT CATHETER CONTACT

- 5.18 ADJACENT MARKET ANALYSIS

- 5.19 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.20 INVESTMENT & FUNDING SCENARIO

- 5.21 IMPACT OF AI/GEN AI ON ELECTROPHYSIOLOGY MARKET

- 5.22 IMPACT OF 2025 US TARIFF ON ELECTROPHYSIOLOGY MARKET

- 5.22.1 KEY TARIFF RATES

- 5.22.2 PRICE IMPACT ANALYSIS

- 5.22.3 IMPACT ON COUNTRY/REGION

- 5.22.3.1 North America

- 5.22.3.1.1 US

- 5.22.3.2 Europe

- 5.22.3.3 Asia Pacific

- 5.22.3.1 North America

- 5.22.4 IMPACT ON END-USE INDUSTRIES

- 5.22.4.1 Hospitals & clinics

- 5.22.4.2 Ambulatory surgery centers

6 ELECTROPHYSIOLOGY MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- 6.2 ELECTROPHYSIOLOGY LABORATORY DEVICES

- 6.2.1 3D MAPPING SYSTEMS

- 6.2.1.1 Development of alternative technologies to limit market growth

- 6.2.2 ELECTROPHYSIOLOGY RECORDING SYSTEMS

- 6.2.2.1 Increasing public-private funding for developing advanced novel recording systems to augment market growth

- 6.2.3 RADIOFREQUENCY (RF) ABLATION SYSTEMS

- 6.2.3.1 Cost-effectiveness and technological advancements to spur segment growth

- 6.2.4 INTRACARDIAC ECHOCARDIOGRAPHY (ICE) ULTRASOUND IMAGING SYSTEMS

- 6.2.4.1 Rising lifestyle- and age-related disorders to drive adoption for cardiac disease treatment

- 6.2.5 ELECTROPHYSIOLOGY X-RAY SYSTEMS

- 6.2.5.1 High incidence of cardiovascular disorders and availability of technologically advanced equipment to boost market growth

- 6.2.6 REMOTE MAGNETIC & ROBOTIC NAVIGATION SYSTEMS

- 6.2.6.1 Favorable reimbursement scenario to propel market growth

- 6.2.1 3D MAPPING SYSTEMS

- 6.3 ELECTROPHYSIOLOGY ABLATION CATHETERS

- 6.3.1 CRYOABLATION CATHETERS

- 6.3.1.1 Therapeutic advantages and better clinical studies to drive market growth

- 6.3.2 RADIOFREQUENCY (RF) ABLATION CATHETERS

- 6.3.2.1 Technologically-advanced and safer catheters to drive adoption among healthcare professionals

- 6.3.3 MICROWAVE ABLATION (MWA) CATHETERS

- 6.3.3.1 Smaller diameter antennas, faster procedure times, and larger heating zones to aid market growth

- 6.3.4 LASER ABLATION CATHETERS

- 6.3.4.1 Launch of technologically-advanced laser ablation catheters to drive adoption in healthcare settings

- 6.3.1 CRYOABLATION CATHETERS

- 6.4 ELECTROPHYSIOLOGY DIAGNOSTIC CATHETERS

- 6.4.1 CONVENTIONAL ELECTROPHYSIOLOGY DIAGNOSTIC CATHETERS

- 6.4.1.1 Development of technologically-advanced fixed and steerable diagnostic catheters to favor market growth

- 6.4.2 ADVANCED ELECTROPHYSIOLOGY DIAGNOSTIC CATHETERS

- 6.4.2.1 Advanced electrophysiology diagnostic catheters to improve patient outcomes and optimize surgical procedures

- 6.4.3 ULTRASOUND ELECTROPHYSIOLOGY DIAGNOSTIC CATHETERS

- 6.4.3.1 Availability of advanced ultrasound catheters and focus on supportive regulatory frameworks to drive segment

- 6.4.1 CONVENTIONAL ELECTROPHYSIOLOGY DIAGNOSTIC CATHETERS

- 6.5 ELECTROPHYSIOLOGY ACCESS DEVICES

- 6.5.1 LAUNCH OF ADVANCED ACCESS DEVICES TO ENHANCE EFFICIENCY DURING ABLATION CATHETER MAPPING AND POSITIONING

- 6.6 OTHER ELECTROPHYSIOLOGY PRODUCTS

7 ELECTROPHYSIOLOGY MARKET, BY INDICATION

- 7.1 INTRODUCTION

- 7.2 ATRIAL FIBRILLATION

- 7.2.1 DEVELOPMENT OF ADVANCED CARDIAC MAPPING SYSTEMS FOR EARLY DISEASE DIAGNOSIS TO DRIVE MARKET

- 7.3 ATRIAL FLUTTER

- 7.3.1 HIGH SUCCESS RATE OF RADIOFREQUENCY CATHETER ABLATION FOR TREATING ATRIAL FLUTTER TO PROPEL MARKET GROWTH

- 7.4 ATRIOVENTRICULAR NODAL REENTRY TACHYCARDIA (AVNRT)

- 7.4.1 INCREASING EFFICACY OF ELECTROPHYSIOLOGY DEVICES FOR TREATMENT OF AVNRT TO AID MARKET GROWTH

- 7.5 WOLFF-PARKINSON-WHITE (WPW) SYNDROME

- 7.5.1 PREFERENCE FOR RADIOFREQUENCY ABLATION OVER SURGERY TO AUGMENT MARKET GROWTH

- 7.6 OTHER INDICATIONS

8 ELECTROPHYSIOLOGY MARKET, BY END USER

- 8.1 INTRODUCTION

- 8.2 HOSPITALS & CARDIAC CENTERS

- 8.2.1 PRESENCE OF BETTER CATHETERIZATION AND ELECTROPHYSIOLOGY LABORATORIES IN HOSPITALS TO SUPPORT MARKET GROWTH

- 8.3 AMBULATORY SURGERY CENTERS

- 8.3.1 DEMAND FOR MINIMAL HOSPITAL STAYS AND HIGH INCIDENCE OF CARDIOVASCULAR DISEASES TO FUEL MARKET GROWTH

- 8.4 OTHER END USERS

9 ELECTROPHYSIOLOGY MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 9.2.2 US

- 9.2.2.1 US to dominate North American electrophysiology market during forecast period

- 9.2.3 CANADA

- 9.2.3.1 Growing government research funding to support market growth

- 9.3 EUROPE

- 9.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 9.3.2 GERMANY

- 9.3.2.1 Rising prevalence of atrial fibrillation and associated arrhythmias to propel market growth

- 9.3.3 UK

- 9.3.3.1 High geriatric population and rise in cardiac diseases to fuel market growth

- 9.3.4 FRANCE

- 9.3.4.1 Favorable government healthcare policies and schemes to support market growth

- 9.3.5 ITALY

- 9.3.5.1 Rising incidence of cardiovascular diseases to drive adoption of electrophysiology devices

- 9.3.6 SPAIN

- 9.3.6.1 Rising number of cardiac ablation procedures to drive adoption of electrophysoiology products

- 9.3.7 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 9.4.2 JAPAN

- 9.4.2.1 Favorable reimbursement scenario and presence of universal healthcare policies to boost market growth

- 9.4.3 CHINA

- 9.4.3.1 Growing geriatric population and rising prevalence of cardiovascular diseases to favor market growth

- 9.4.4 INDIA

- 9.4.4.1 Favorable government healthcare initiatives to support market growth

- 9.4.5 AUSTRALIA

- 9.4.5.1 Increasing target disease burden and rising government funding to spur market growth

- 9.4.6 SOUTH KOREA

- 9.4.6.1 Supportive government initiatives to drive market

- 9.4.7 REST OF ASIA PACIFIC

- 9.5 LATIN AMERICA

- 9.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 9.5.2 BRAZIL

- 9.5.2.1 Modernization of healthcare facilities to propel market growth

- 9.5.3 MEXICO

- 9.5.3.1 Favorable investment scenario for medical device manufacturers to fuel market growth

- 9.5.4 REST OF LATIN AMERICA

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 9.6.2 GCC COUNTRIES

- 9.6.2.1 Kingdom of Saudi Arabia

- 9.6.2.1.1 Rising number of private hospitals and increasing government financial support to fuel market growth

- 9.6.2.2 UAE

- 9.6.2.2.1 High clinical demand, increased government investment, and technological progress to aid market growth

- 9.6.2.3 Rest of GCC Countries

- 9.6.2.1 Kingdom of Saudi Arabia

- 9.6.3 REST OF MIDDLE EAST & AFRICA

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 10.2.1 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN ELECTROPHYSIOLOGY MARKET

- 10.3 REVENUE ANALYSIS, 2020-2024

- 10.4 MARKET SHARE ANALYSIS, 2024

- 10.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- 10.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.5.5.1 Company footprint

- 10.5.5.2 Region footprint

- 10.5.5.3 Product footprint

- 10.5.5.4 Indication footprint

- 10.5.5.5 End-user footprint

- 10.6 COMPANY EVALUATION MATRIX, STARTUPS/SMES, 2024

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 RESPONSIVE COMPANIES

- 10.6.3 DYNAMIC COMPANIES

- 10.6.4 STARTING BLOCKS

- 10.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.6.5.1 Detailed list of key startups/SMEs

- 10.6.5.2 Competitive benchmarking of startups/SMEs

- 10.7 COMPANY VALUATION & FINANCIAL METRICS

- 10.7.1 FINANCIAL METRICS

- 10.7.2 COMPANY VALUATION

- 10.8 BRAND/PRODUCT COMPARISON

- 10.9 R&D ASSESSMENT OF KEY PLAYERS

- 10.10 COMPETITIVE SCENARIO

- 10.10.1 PRODUCT LAUNCHES & APPROVALS

- 10.10.2 DEALS

- 10.10.3 OTHER DEVELOPMENTS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 JOHNSON & JOHNSON SERVICES, INC.

- 11.1.1.1 Business overview

- 11.1.1.2 Products offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product launches and approvals

- 11.1.1.3.2 Deals

- 11.1.1.4 MnM view

- 11.1.1.4.1 Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses & competitive threats

- 11.1.2 ABBOTT

- 11.1.2.1 Business overview

- 11.1.2.2 Products offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Product launches

- 11.1.2.3.2 Deals

- 11.1.2.4 MnM view

- 11.1.2.4.1 Right to win

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses & competitive threats

- 11.1.3 MEDTRONIC

- 11.1.3.1 Business overview

- 11.1.3.2 Products offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Product approvals

- 11.1.3.3.2 Deals

- 11.1.3.4 MnM view

- 11.1.3.4.1 Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses & competitive threats

- 11.1.4 KONINKLIJKE PHILIPS N.V.

- 11.1.4.1 Business overview

- 11.1.4.2 Products offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Deals

- 11.1.4.4 MnM view

- 11.1.4.4.1 Right to win

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses & competitive threats

- 11.1.5 GE HEALTHCARE

- 11.1.5.1 Business overview

- 11.1.5.2 Products offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Product approvals and enhancements

- 11.1.5.3.2 Deals

- 11.1.5.4 MnM view

- 11.1.5.4.1 Right to win

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses & competitive threats

- 11.1.6 BOSTON SCIENTIFIC CORPORATION

- 11.1.6.1 Business overview

- 11.1.6.2 Products offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Product approvals

- 11.1.6.3.2 Deals

- 11.1.7 JAPAN LIFELINE CO., LTD.

- 11.1.7.1 Business overview

- 11.1.7.2 Products offered

- 11.1.8 STEREOTAXIS, INC.

- 11.1.8.1 Business overview

- 11.1.8.2 Products offered

- 11.1.8.3 Recent developments

- 11.1.8.3.1 Product approvals

- 11.1.8.3.2 Deals

- 11.1.9 MICROPORT SCIENTIFIC CORPORATION

- 11.1.9.1 Business overview

- 11.1.9.2 Products offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Product approvals

- 11.1.9.3.2 Other developments

- 11.1.10 BIOTRONIK

- 11.1.10.1 Business overview

- 11.1.10.2 Products offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Expansions

- 11.1.11 TELEFLEX INCORPORATED

- 11.1.11.1 Business overview

- 11.1.11.2 Products offered

- 11.1.11.3 Recent developments

- 11.1.11.3.1 Deals

- 11.1.12 ACUTUS MEDICAL, INC.

- 11.1.12.1 Business overview

- 11.1.12.2 Products offered

- 11.1.12.3 Recent developments

- 11.1.12.3.1 Product approvals

- 11.1.13 MERIT MEDICAL SYSTEMS

- 11.1.13.1 Business overview

- 11.1.13.2 Products offered

- 11.1.13.3 Recent developments

- 11.1.13.3.1 Deals

- 11.1.14 OSYPKA MEDICAL

- 11.1.14.1 Business overview

- 11.1.14.2 Products offered

- 11.1.15 COOK

- 11.1.15.1 Business overview

- 11.1.15.2 Products offered

- 11.1.1 JOHNSON & JOHNSON SERVICES, INC.

- 11.2 OTHER PLAYERS

- 11.2.1 EPMAP-SYSTEM

- 11.2.2 CATHRX LTD.

- 11.2.3 EP SOLUTIONS

- 11.2.4 CATHVISION

- 11.2.5 TZ MEDICAL, INC.

- 11.2.6 APN HEALTH, LLC

- 11.2.7 LEPU MEDICAL TECHNOLOGY (BEIJING) CO.,LTD.

- 11.2.8 CARDIOFOCUS

- 11.2.9 SCHWARZER CARDIOTEK

- 11.2.10 IMRICOR

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS