|

시장보고서

상품코드

1797406

희토류 시장 : 유형별, 용도별, 지역별 - 예측(-2030년)Rare Earth Metals Market by Type (Lanthanum Oxide, Cerium Oxide, Neodymium Oxide, Europium Oxide, Terbium Oxide), Application (Permanent Magnets, Catalysts, Glass Polishing, Phosphors, Metal Alloys, Ceramics), and Region - Global Forecast to 2030 |

||||||

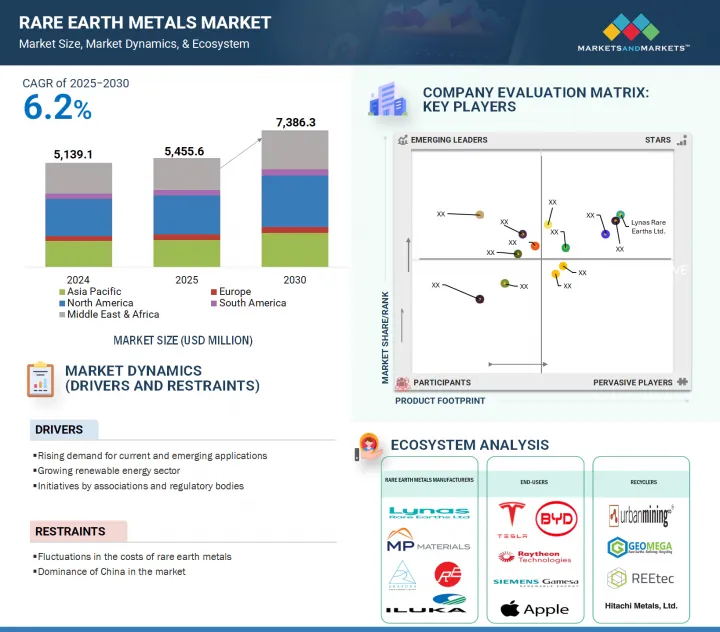

세계의 희토류 시장 규모는 2024년에 51억 3,910만 달러로 평가되었고, 2030년까지 73억 8,630만 달러에 이를 것으로 예측되며, CAGR 6.2%의 성장이 전망됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2021-2030년 |

| 기준연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 10억 달러, 톤 |

| 부문 | 유형, 용도, 지역 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 중동 및 아프리카, 남미 |

희토류 시장은 현대 기술 솔루션과 청정 에너지 응용을 가능하게 하는 희토류의 중요성과 중요한 역할로 인해 수요가 증가하고 있습니다. 네오디뮴, 디스프로슘, 프라세오디뮴 등을 포함한 이들 금속은 전기자동차 모터, 풍력 터빈 발전기, 수많은 전자기기의 동력원으로 사용되는 고강도 영구 자석에 필수적인 부품입니다.

세계적으로 탈탄소화 및 재생에너지에 대한 요구가 높아지면서 자동차, 풍력, 전자 등 각 부문에서 희토류에 대한 수요도 증가하고 있습니다. 최근 국방 시스템, 의료기기, 로봇 공학의 발전은 산업 분야에서 희토류의 관련성을 더욱 확대시키고 있습니다. 소수의 주요 공급업체에 대한 의존도를 낮추기 위해 안정적이고 다양한 희토류 공급망을 확보하려는 국가들이 늘어나면서 전 세계적으로 탐사, 채굴, 가공 활동이 활발해지고 있습니다. 또한, 아시아태평양, 북미, 유럽에서는 청정 기술 채택과 인프라 구축에 대한 정부 인센티브가 희토류에 대한 수요를 더욱 증가시키고 있습니다. 희토류에 대한 의존도가 높아짐에 따라 희토류는 세계 에너지 및 디지털 전환의 전략적 자원으로 간주되고 있습니다.

유형별로는 테르븀 산화물 부문이 예측 기간 동안 가장 높은 CAGR로 성장할 것으로 예측됩니다.

유형별로는 첨단 전자, 친환경 기술, 에너지 효율적인 조명 시스템 개발의 새로운 응용 분야로 인해 테르븀 산화물 부문이 예측 기간 동안 가장 높은 CAGR을 나타낼 것으로 예측됩니다. 산화테르븀은 형광등, LED 조명, TV, 스마트폰, 모니터 등 디스플레이 기기에 사용되는 형광체 생산에 필수적인 소재입니다. 테르븀 산화물은 독특한 발광 특성을 가지고 있어 녹색 형광체에 필수적인 동시에 오늘날의 디스플레이 기술에서 연색성과 광 출력을 향상시킬 수 있습니다. 테르븀 도펀트는 고체 장비에 사용되며, 광자기 저장에도 중요한 역할을 합니다. 희토류 유래 영구자석의 성장으로 전기자동차, 소형 전자기기, 로봇, 풍력 터빈에 사용되는 네오디뮴 유래 자석의 열 안정성과 자기 성능을 향상시킬 수 있다는 점에서 테르븀에 대한 관심도 높아지고 있습니다. 희토류 및 영구자석 개발뿐만 아니라 연료전지 기술 및 차세대 청정에너지 시스템으로의 응용 가능성도 연구되고 있어 테르븀의 용도는 점점 더 넓어지고 있습니다. 세계 산업계가 에너지 효율 향상, 소형화, 전자기기 성능 향상을 추구함에 따라 테르븀 산화물 및 관련 테르븀 원소 수요도 증가할 것으로 보입니다. 이러한 발전을 종합하면, 테르븀 산화물은 예측 기간 동안 희토류 시장에서 가장 빠르게 성장하는 유형 부문이 될 것입니다.

용도별로는 영구 자석 부문이 예측 기간 동안 가장 높은 CAGR로 성장할 것으로 예측됩니다.

용도별로는 전기자동차, 풍력에너지, 소비자 가전, 산업 자동화 등 빠르게 성장하는 산업에서 영구자석이 차지하는 중요성으로 인해 영구 자석 부문이 예측 기간 동안 가장 높은 CAGR을 나타낼 것으로 예측됩니다. 희토류 기반 영구 자석, 네오디뮴 철 붕소(NdFeB) 자석, 사마륨 코발트(SmCo) 자석은 높은 자기 강도, 내열성, 에너지 효율을 가지고 있으며, 소형 모터/발전기 등 성능이 중요한 시스템에 사용하기에 적합합니다.

세계의 희토류 시장에 대해 조사 분석했으며, 주요 촉진요인과 억제요인, 경쟁 구도, 향후 동향 등의 정보를 전해드립니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요 지견

- 희토류 시장 기업에 있어서 매력적인 기회

- 희토류 시장 : 유형별

- 희토류 시장 : 용도별

- 아시아태평양 희토류 시장 : 유형별, 국가별

- 희토류 시장 : 주요 국가별

제5장 시장 개요

- 서론

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

제6장 산업 동향

- 고객의 비즈니스에 영향을 미치는 동향/혼란

- 가격 결정 분석

- 밸류체인 분석

- 생태계 분석

- 기술 분석

- 주요 기술

- 보완 기술

- 인접 기술

- 희토류 시장에 대한 생성형 AI의 영향

- 특허 분석

- 서론

- 접근

- 주요 출원자

- 무역 분석

- HS코드 280530 관련 수입 데이터

- HS코드 280530 관련 수출 데이터

- 주요 컨퍼런스 및 이벤트(2025년)

- 관세 및 규제 상황

- 희토류 시장 관련 관세

- 규제기관, 정부기관, 기타 조직

- 규제 구조

- Porter의 Five Forces 분석

- 주요 이해관계자와 구입 기준

- 사례 연구 분석

- MP MATERIALS : 미국의 희토류 자석 생산 회복

- GEOMEGA RESOURCES : 파일럿 규모 희토류 자석 재활용

- 도시 광산 기업 : 자석에서 자석으로의 클로즈드 루프 재활용

- 거시경제 분석

- 서론

- GDP 동향과 예측

- 재생에너지 인프라 확대

- 세계의 차량 플릿 전력화

- 투자 및 자금조달 시나리오

- 희토류 시장에 대한 2025년 미국 관세의 영향

- 서론

- 주요 관세율

- 가격 영향 분석

- 다양한 지역에의 중요 영향

- 최종 용도 부문에 대한 영향

제7장 희토류 시장 : 유형별

- 서론

- 산화 세륨

- 산화 란타늄

- 산화 네오디뮴

- 산화 이트륨

- 산화 프라세오디뮴

- 산화 사마륨

- 산화 가돌리늄

- 산화 디스프로슘

- 산화 테르븀

- 산화 유로퓸

- 기타 유형

제8장 희토류 시장 : 용도별

- 서론

- 영구자석

- 촉매

- 유리 연마

- 형광체

- 세라믹

- 합금

- 유리 첨가제

- 기타 용도

제9장 지역 분석

- 서론

- 아시아태평양

- 중국

- 일본

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 기타 유럽

- 기타 지역

- 브라질

- 기타

제10장 경쟁 구도

- 개요

- 주요 시장 진출기업의 전략/강점

- 매출 분석

- 시장 점유율 분석

- 기업 평가와 재무 지표

- 브랜드/제품 비교

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업 평가 매트릭스 : 스타트업/중소기업(2024년)

- 경쟁 시나리오

제11장 기업 개요

- 주요 기업

- LYNAS RARE EARTHS LTD

- AUSTRALIAN STRATEGIC MATERIALS LTD.

- ARAFURA RARE EARTHS

- CHINA RARE EARTH HOLDINGS LIMITED.

- SHENGHE RESOURCES HOLDING CO., LTD.

- CHINA NORTHERN RARE EARTH(GROUP) HIGH-TECH CO., LTD.

- CANADA RARE EARTH CORPORATION

- NORTHERN MINERALS

- MP MATERIALS

- AVALON ADVANCED MATERIALS INC.

- 기타 기업

- UCORE RARE METALS INC.

- EUTECTIX LLC

- AMERICAN RARE EARTHS

- RAINBOW RARE EARTHS LIMITED

- RARE ELEMENT RESOURCES

- ENERGY TRANSITION MINERALS LTD.

- NEO

- ILUKA RESOURCES LIMITED

- PENSANA PLC

- ALTONA RARE EARTHS PLC

- APPIA RARE EARTHS & URANIUM CORP.

- FRONTIER RARE EARTHS LIMITED

- NAMIBIA CRITICAL METALS INC.

- MITSUBISHI CORPORATION RTM JAPAN LTD.

- HASTINGS TECHNOLOGY METALS LIMITED

제12장 인접 시장과 관련 시장

- 서론

- 제한 사항

- 희토류 침출 화학제품 시장

- 시장의 정의

- 시장 개요

제13장 부록

LSH 25.09.02The market for rare earth metals was valued at USD 5,139.1 million in 2024, and is projected to reach USD 7,386.3 million by 2030, at a CAGR of 6.2%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) Volume (Metric Ton) |

| Segments | Type, Application, and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, South America |

The market for rare earth metals is experiencing increased demand, driven by their importance and important role in enabling modern technology solutions and clean energy applications. These metals, which include neodymium, dysprosium, praseodymium, etc., are essential components in high-strength permanent magnets used to power electric vehicle motors, wind turbine generators, and numerous electronic devices.

As the global call for decarbonization and renewable energy strengthens, so does the call for rare earth elements from the automotive, wind energy, and electronics sectors. Recent advances in defense systems, medical devices, and robotics further expand the relevance of rare earth metals to industry. As more countries focus on acquiring stable and diversified supply chains for rare earths to lessen dependence on a small number of key suppliers, exploration, mining and processing activity is on the rise across the globe. Furthermore, government incentives for clean technology adoption and infrastructure construction in Asia Pacific, North America, and Europe provide additional demand for rare earths. With increasing reliance, rare earth metals are now increasingly viewed as strategic resources for global energy and digital transition.

Based on type, the terbium oxide segment is expected to grow at the highest CAGR during forecast period

Based on type, the terbium oxide segment is projected to register the highest CAGR during the forecast period because of its emerging applications in the development of advanced electronics, green technologies, and energy-efficient lighting systems. Terbium oxide is a crucial material in the production of phosphors used in fluorescent lamps, LED lights, and display devices, such as televisions, smartphones, and monitors. It has unique luminescent properties that make terbium oxide essential in green phosphors, while allowing for improved color rendering and light output in today's display technology. Terbium dopants are used in solid-state devices and also play a role in magneto-optical storage. The growth of rare earth-based permanent magnets has also increased interest in terbium due to its ability to improve the thermal stability and magnetic performance of neodymium-based magnets in electric vehicles, small electronics, robots, and wind turbines. In addition to rare earth metals and permanent magnet development, ongoing research into fuel cell technology and possible applications in next-generation clean energy systems continues to broaden the range of uses of terbium. As industries globally seek to enhance energy efficiency, miniaturize, and the performance of electronic equipment, the demand for terbium oxide and the related terbium elements will grow as well. Collectively, these developments lend themselves to terbium oxide being the fastest-growing type segment of the rare earth metals market during the forecast period.

Based on application, the permanent magnets segment is projected to grow at the highest CAGR during the forecast period

Based on application, the permanent magnets segment projected to grow at the highest CAGR during the forecast period owing to their importance in fast growing industries, i.e., electric vehicles, wind energy, consumer electronics, and industrial automation. Rare earth-based permanent magnets, neodymium-iron-boron (NdFeB), and samarium-cobalt (SmCo) magnets possess higher magnetic strength, heat resistance, and energy efficiency, and also lend favorably to utilization in performance-based systems, such as small size motors/generators. These motors/generators are ideally needed as automakers embrace electrification of vehicles at a much faster pace. As electric vehicles (EVs) are deployed at a high rate, demand for these smaller, more efficient motors becomes stronger. The same can be said of the infrastructure for renewable energy, particularly, wind energy, in the form of offshore and onshore turbines. In general, an increased need for powerful magnets capable of producing energy conversion systems to convert generator acceleration. Permanent magnets have wide ranging applications in daily use items like smart phones, headphones, and appliances, just to name a few. Demand is growing and therefore should be assumed to see healthy growth based on global transitioning to clean technology, smart applications, and decarbonized sources of electricity. Without reservation, permanent magnets would be the fastest advancing application in the rare earth metals market from both a volume and value perspective.

Asia Pacific region to grow at highest CAGR during forecast period

The Asia Pacific region is expected to achieve the highest CAGR in the rare earth metals market during the forecast period, driven by its large industrial base, rapid technology development, and increasing demand for clean energy solutions. The industrialized nations in this region, such as China, Japan, South Korea, and India, are leading the adoption of technologies that depend on rare earths, like electric vehicles, renewable energy systems, and advanced electronics. China is the clear leader in the entire rare earths value chain, including mining, refining, and magnet production, providing a vast competitive edge for the entire region. The production of electric vehicles, increased installations of wind power, and solid consumer electronics manufacturing are therefore contributing to the rapid demand in the Asia Pacific, which is supported by international government efforts to reduce carbon emissions, enhance domestic supply chains, and support high-tech manufacturing investments. The extraordinary demand for rare earths in the region is equally supported by the many leading manufacturers and existing rare earth processing capacity. Consumption is expected to grow further with urbanization, digital transformation, and energy transition. Therefore, Asia Pacific is expected to remain the fastest-growing region in the rare earth metals market throughout the forecast period.

- By Company Type: Tier 1: 40%, Tier 2: 25%, Tier 3: 35%

- By Designation: C Level: 35%, Director Level: 30%, Others: 35%

- By Region: North America: 25%, Europe: 20%, Asia Pacific: 45%, Middle East & Africa: 5%, and South America: 5%.

Companies Covered:

Lynas Rare Earths Ltd. (Australia), Australian Strategic Materials Ltd. (Australia), Arafura Rare Earths Limited (Australia), Shenghe Resources Holding Co. Ltd (China), China Rare Earth Holdings Limited (China), Baotou HEFA Rare Earth Co. Ltd. (China), Canada Rare Earth Corporation (Canada), Northern Minerals (Australia), MP Materials (US), and Avalon Advanced Materials Inc. (Canada) are some key players in rare earth metals market.

Research Coverage

The market study covers the rare earth metals market across various segments. It aims to estimate the market size and the growth potential of this market across different segments based on type, application, and region. The study also includes an in-depth competitive analysis of the key players in the market, their company profiles, key observations related to their products and business offerings, recent developments undertaken by them, and key growth strategies adopted by them to improve their positions in the rare earth metals market.

Key Benefits of Buying the Report

The report is expected to help the market leaders/new entrants in this market share the closest approximations of the revenue numbers of the overall rare earth metals market and its segments and subsegments. This report is projected to help stakeholders understand the competitive landscape of the market, gain insights to improve the position of their businesses, and plan suitable go-to-market strategies. The report also aims to help stakeholders understand the pulse of the market and provides them with information on the key market drivers, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of Key Drivers (Growing renewable energy sector & Initiatives by associations and regulatory bodies), restraints (Fluctuations in the costs of rare earth metals), opportunities (Magnet-to-Magnet closed-loop manufacturing and Strategic Procurement Partnerships with Governments), and challenges (Limited Recycling Infrastructure and High Environmental and Regulatory Compliance Costs) influencing the growth of the rare earth metals market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and product & service launches in the rare earth metals market.

- Market Development: Comprehensive information about profitable markets - the report analyzes the rare earth metals market across varied regions.

Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the rare earth metals market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like as Lynas Rare Earths Ltd. (Australia), Australian Strategic Materials Ltd. (Australia), Arafura Rare Earths Limited (Australia), Shenghe Resources Holding Co. Ltd (China), China Rare Earth Holdings Limited (China), Baotou HEFA Rare Earth Co. Ltd. (China), Canada Rare Earth Corporation (Canada), Northern Minerals (Australia), MP Materials (US), Avalon Advanced Materials Inc. (Canada), and others in the rare earth metals market. The report also helps stakeholders understand the pulse of the rare earth metals market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNIT CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.1.2 List of secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key primary participants

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Breakdown of interviews with experts

- 2.1.2.4 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- 2.2.2 BOTTOM-UP APPROACH

- 2.3 BASE NUMBER CALCULATION

- 2.3.1 SUPPLY-SIDE APPROACH

- 2.4 GROWTH FORECAST

- 2.5 DATA TRIANGULATION

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 FACTOR ANALYSIS

- 2.8 RESEARCH LIMITATIONS

- 2.9 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN RARE EARTH METALS MARKET

- 4.2 RARE EARTH METALS MARKET, BY TYPE

- 4.3 RARE EARTH METALS MARKET, BY APPLICATION

- 4.4 ASIA PACIFIC: RARE EARTH METALS MARKET, BY TYPE AND COUNTRY

- 4.5 RARE EARTH METALS MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.1.1 DRIVERS

- 5.1.1.1 Rising demand for current and emerging applications

- 5.1.1.2 Growing renewable energy sector

- 5.1.1.3 Initiatives by associations and regulatory bodies

- 5.1.2 RESTRAINTS

- 5.1.2.1 Fluctuations in costs of rare earth metals

- 5.1.2.2 Dominance of China

- 5.1.3 OPPORTUNITIES

- 5.1.3.1 Strategic procurement partnerships with governments

- 5.1.3.2 Magnet-to-magnet closed-loop manufacturing

- 5.1.4 CHALLENGES

- 5.1.4.1 High environmental and regulatory compliance costs

- 5.1.4.2 Limited recycling infrastructure

- 5.1.1 DRIVERS

6 INDUSTRY TRENDS

- 6.1 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.2 PRICING ANALYSIS

- 6.2.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TYPE

- 6.3 VALUE CHAIN ANALYSIS

- 6.4 ECOSYSTEM ANALYSIS

- 6.5 TECHNOLOGY ANALYSIS

- 6.5.1 KEY TECHNOLOGIES

- 6.5.1.1 Ligand-assisted displacement (LAD) chromatography

- 6.5.1.2 Bio-leaching

- 6.5.2 COMPLEMENTARY TECHNOLOGIES

- 6.5.2.1 Siderophores

- 6.5.2.2 Supercritical CO2

- 6.5.3 ADJACENT TECHNOLOGIES

- 6.5.3.1 Biosorption

- 6.5.3.2 Recycling of e-waste/magnets

- 6.5.1 KEY TECHNOLOGIES

- 6.6 IMPACT OF GEN AI ON RARE EARTH METALS MARKET

- 6.7 PATENT ANALYSIS

- 6.7.1 INTRODUCTION

- 6.7.2 APPROACH

- 6.7.3 TOP APPLICANTS

- 6.8 TRADE ANALYSIS

- 6.8.1 IMPORT DATA RELATED TO HS CODE 280530, BY COUNTRY, 2020-2024 (USD THOUSAND)

- 6.8.2 EXPORT DATA RELATED TO HS CODE 280530, BY COUNTRY, 2020-2024 (USD THOUSAND)

- 6.9 KEY CONFERENCES AND EVENTS IN 2025

- 6.10 TARIFF AND REGULATORY LANDSCAPE

- 6.10.1 TARIFF RELATED TO RARE EARTH METALS MARKET

- 6.10.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.10.3 REGULATORY FRAMEWORK

- 6.11 PORTER'S FIVE FORCES ANALYSIS

- 6.11.1 THREAT OF NEW ENTRANTS

- 6.11.2 THREAT OF SUBSTITUTES

- 6.11.3 BARGAINING POWER OF SUPPLIERS

- 6.11.4 BARGAINING POWER OF BUYERS

- 6.11.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.12 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.12.2 BUYING CRITERIA

- 6.13 CASE STUDY ANALYSIS

- 6.13.1 MP MATERIALS: RESTORE US RARE EARTH MAGNET PRODUCTION

- 6.13.2 GEOMEGA RESOURCES: PILOT-SCALE RARE-EARTH MAGNET RECYCLING

- 6.13.3 URBAN MINING COMPANY: CLOSED-LOOP MAGNET-TO-MAGNET RECYCLING

- 6.14 MACROECONOMIC ANALYSIS

- 6.14.1 INTRODUCTION

- 6.14.2 GDP TRENDS AND FORECASTS

- 6.14.3 EXPANSION OF RENEWABLE ENERGY INFRASTRUCTURE

- 6.14.4 ELECTRIFICATION OF GLOBAL VEHICLE FLEET

- 6.15 INVESTMENT AND FUNDING SCENARIO

- 6.16 IMPACT OF 2025 US TARIFF ON RARE EARTH METALS MARKET

- 6.16.1 INTRODUCTION

- 6.16.2 KEY TARIFF RATES

- 6.16.3 PRICE IMPACT ANALYSIS

- 6.16.4 KEY IMPACT ON VARIOUS REGIONS

- 6.16.4.1 US

- 6.16.4.2 Europe

- 6.16.4.3 Asia Pacific

- 6.16.5 END-USE SECTOR IMPACT

7 RARE EARTH METALS MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 CERIUM OXIDE

- 7.2.1 CERIUM OXIDE DEMAND ACCELERATES WITH EMISSION CONTROL AND PRECISION POLISHING GROWTH

- 7.3 LANTHANUM OXIDE

- 7.3.1 LANTHANUM OXIDE SUPPORTS GROWTH IN OPTICAL, FUEL, AND SEMICONDUCTOR APPLICATIONS

- 7.4 NEODYMIUM OXIDE

- 7.4.1 RISING DEMAND FOR NEODYMIUM OXIDE DRIVEN BY EVS AND RENEWABLE TECHNOLOGIES

- 7.5 YTTRIUM OXIDE

- 7.5.1 YTTRIUM OXIDE EMERGES AS CRITICAL MATERIAL FOR CERAMICS AND CLEAN ENERGY

- 7.6 PRASEODYMIUM OXIDE

- 7.6.1 SURGING CLEAN TECH APPLICATIONS PROPEL GLOBAL DEMAND FOR PRASEODYMIUM OXIDE

- 7.7 SAMARIUM OXIDE

- 7.7.1 SAMARIUM OXIDE POWERS HIGH-TEMPERATURE MAGNETS, NUCLEAR, AND OPTICAL ADVANCEMENTS

- 7.8 GADOLINIUM OXIDE

- 7.8.1 GADOLINIUM OXIDE GAINS MOMENTUM IN MRI, NUCLEAR, AND OPTOELECTRONIC APPLICATIONS

- 7.9 DYSPROSIUM OXIDE

- 7.9.1 DYSPROSIUM OXIDE GAINS STRATEGIC IMPORTANCE AMID EV AND NUCLEAR SECTOR GROWTH

- 7.10 TERBIUM OXIDE

- 7.10.1 TERBIUM OXIDE DEMAND SURGES WITH GROWTH IN DISPLAYS AND EV MAGNET SYSTEMS

- 7.11 EUROPIUM OXIDE

- 7.11.1 EUROPIUM OXIDE DEMAND RISES WITH PHOSPHOR AND ANTI- COUNTERFEIT APPLICATIONS GROWTH

- 7.12 OTHER TYPES

8 RARE EARTH METALS MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 PERMANENT MAGNETS

- 8.2.1 GLOBAL CLEAN ENERGY EXPANSION INCREASES RELIANCE ON RARE EARTH PERMANENT MAGNETS

- 8.3 CATALYSTS

- 8.3.1 RARE EARTH CATALYSTS DRIVE CLEANER EMISSIONS AND EFFICIENT INDUSTRIAL CONVERSIONS

- 8.4 GLASS POLISHING

- 8.4.1 CERIUM-BASED COMPOUNDS LEAD IN HIGH-PRECISION GLASS POLISHING APPLICATIONS GLOBALLY

- 8.5 PHOSPHORS

- 8.5.1 RARE EARTH PHOSPHORS ENABLE HIGH-EFFICIENCY LUMINESCENCE ACROSS DISPLAYS, LIGHTING, AND IMAGING

- 8.6 CERAMICS

- 8.6.1 RARE EARTH METALS STRENGTHEN FUNCTIONAL CERAMICS FOR ELECTRONICS, ENERGY, AND STRUCTURAL USE

- 8.7 METAL ALLOYS

- 8.7.1 RARE EARTH-INFUSED METAL ALLOYS ENHANCE STRENGTH, STABILITY, AND HIGH-TEMPERATURE PERFORMANCE

- 8.8 GLASS ADDITIVES

- 8.8.1 RARE EARTH GLASS ADDITIVES DELIVER ADVANCED FUNCTIONALITIES FOR OPTICS, LASERS, AND PHOTONICS

- 8.9 OTHER APPLICATIONS

9 REGIONAL ANALYSIS

- 9.1 INTRODUCTION

- 9.2 ASIA PACIFIC

- 9.2.1 CHINA

- 9.2.1.1 Largest consumer and producer of rare earth metals

- 9.2.2 JAPAN

- 9.2.2.1 New sources of rare-earth metals will make country self-sufficient

- 9.2.3 REST OF ASIA PACIFIC

- 9.2.1 CHINA

- 9.3 NORTH AMERICA

- 9.3.1 US

- 9.3.1.1 Large aerospace & defense industry to drive market

- 9.3.2 CANADA

- 9.3.2.1 Rising wind power and automotive sectors to drive market

- 9.3.1 US

- 9.4 EUROPE

- 9.4.1 GERMANY

- 9.4.1.1 Rising demand for electric vehicles to drive market

- 9.4.2 UK

- 9.4.2.1 Growing electric vehicle and wind turbine sectors to drive market

- 9.4.3 FRANCE

- 9.4.3.1 Rise in demand from high-technology and low-carbon industries to drive market

- 9.4.4 REST OF EUROPE

- 9.4.1 GERMANY

- 9.5 REST OF THE WORLD (ROW)

- 9.5.1 BRAZIL

- 9.5.1.1 Abundant reserves, technological advancements, and electronics, automotive, and renewable energy industries to drive market

- 9.5.2 OTHERS

- 9.5.1 BRAZIL

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYERS STRATEGIES/ RIGHT TO WIN

- 10.3 REVENUE ANALYSIS

- 10.4 MARKET SHARE ANALYSIS

- 10.5 COMPANY VALUATION AND FINANCIAL METRICS

- 10.5.1 COMPANY VALUATION

- 10.5.2 FINANCIAL METRICS

- 10.6 BRAND/PRODUCT COMPARISON

- 10.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- 10.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.7.5.1 Company footprint

- 10.7.5.2 Region footprint

- 10.7.5.3 Type footprint

- 10.7.5.4 Application footprint

- 10.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- 10.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.8.5.1 Detailed list of key startups/SMEs

- 10.8.5.2 Competitive benchmarking of key startups/SMEs

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 DEALS

- 10.9.2 EXPANSIONS

- 10.9.3 OTHER DEVELOPMENTS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 LYNAS RARE EARTHS LTD

- 11.1.1.1 Business overview

- 11.1.1.2 Products/Solutions/Services offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Expansions

- 11.1.1.4 MnM view

- 11.1.1.4.1 Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses & competitive threats

- 11.1.2 AUSTRALIAN STRATEGIC MATERIALS LTD.

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Solutions/Services offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Deals

- 11.1.2.3.2 Expansions

- 11.1.2.3.3 Other developments

- 11.1.2.4 MnM view

- 11.1.2.4.1 Right to win

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses & competitive threats

- 11.1.3 ARAFURA RARE EARTHS

- 11.1.3.1 Business overview

- 11.1.3.2 Products/Solutions/Services offered

- 11.1.3.3 MnM view

- 11.1.3.3.1 Right to win

- 11.1.3.3.2 Strategic choices

- 11.1.3.3.3 Weaknesses & competitive threats

- 11.1.4 CHINA RARE EARTH HOLDINGS LIMITED.

- 11.1.4.1 Business overview

- 11.1.4.2 Products/Solutions/Services offered

- 11.1.4.3 MnM view

- 11.1.4.3.1 Right to win

- 11.1.4.3.2 Strategic choices

- 11.1.4.3.3 Weaknesses & competitive threats

- 11.1.5 SHENGHE RESOURCES HOLDING CO., LTD.

- 11.1.5.1 Business overview

- 11.1.5.2 Products/Solutions/Services offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Deals

- 11.1.5.4 MnM view

- 11.1.5.4.1 Right to win

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses & competitive threats

- 11.1.6 CHINA NORTHERN RARE EARTH (GROUP) HIGH-TECH CO., LTD.

- 11.1.6.1 Business overview

- 11.1.6.2 Products/Solutions/Services offered

- 11.1.6.3 MnM view

- 11.1.6.3.1 Right to win

- 11.1.6.3.2 Strategic choices

- 11.1.6.3.3 Weaknesses & competitive threats

- 11.1.7 CANADA RARE EARTH CORPORATION

- 11.1.7.1 Business overview

- 11.1.7.2 Products/Solutions/Services offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Deals

- 11.1.7.3.2 Expansions

- 11.1.7.3.3 Other developments

- 11.1.7.4 MnM view

- 11.1.8 NORTHERN MINERALS

- 11.1.8.1 Business overview

- 11.1.8.2 Products/Solutions/Services offered

- 11.1.8.3 Recent developments

- 11.1.8.3.1 Deals

- 11.1.8.4 MnM view

- 11.1.9 MP MATERIALS

- 11.1.9.1 Business overview

- 11.1.9.2 Products/Solutions/Services offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Deals

- 11.1.9.3.2 Expansion

- 11.1.9.3.3 Other developments

- 11.1.9.4 MnM view

- 11.1.10 AVALON ADVANCED MATERIALS INC.

- 11.1.10.1 Business overview

- 11.1.10.2 Products/Solutions/Services offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Deals

- 11.1.10.4 MnM view

- 11.1.1 LYNAS RARE EARTHS LTD

- 11.2 OTHER PLAYERS

- 11.2.1 UCORE RARE METALS INC.

- 11.2.2 EUTECTIX LLC

- 11.2.3 AMERICAN RARE EARTHS

- 11.2.4 RAINBOW RARE EARTHS LIMITED

- 11.2.5 RARE ELEMENT RESOURCES

- 11.2.6 ENERGY TRANSITION MINERALS LTD.

- 11.2.7 NEO

- 11.2.8 ILUKA RESOURCES LIMITED

- 11.2.9 PENSANA PLC

- 11.2.10 ALTONA RARE EARTHS PLC

- 11.2.11 APPIA RARE EARTHS & URANIUM CORP.

- 11.2.12 FRONTIER RARE EARTHS LIMITED

- 11.2.13 NAMIBIA CRITICAL METALS INC.

- 11.2.14 MITSUBISHI CORPORATION RTM JAPAN LTD.

- 11.2.15 HASTINGS TECHNOLOGY METALS LIMITED

12 ADJACENT & RELATED MARKET

- 12.1 INTRODUCTION

- 12.2 LIMITATIONS

- 12.3 RARE EARTH METALS LEACHING CHEMICALS MARKET

- 12.3.1 MARKET DEFINITION

- 12.3.2 MARKET OVERVIEW

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS