|

시장보고서

상품코드

1797407

수소 감지 시장 : 센서 기술별, 실장 유형별, 감지 범위별, 프로세스 스테이지별, 용도별, 지역별 - 예측(-2030년)Hydrogen Detection Market by Electrochemical, Metal Oxide Semiconductor (MOS), Catalytic, Thermal Conductivity, Micro-Electromechanical Systems (MEMS), Detection Range (0-1000 ppm, 0-5000 ppm, 0-20,000 ppm, >0-20,000 ppm) - Global Forecast to 2030 |

||||||

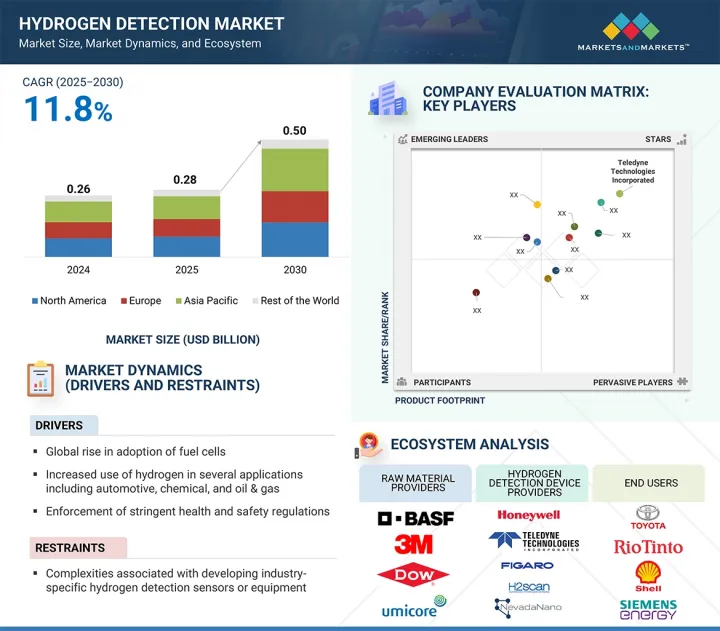

세계의 수소 감지 시장 규모는 2025년 2억 8,000만 달러에서 2030년에는 5억 달러에 이르고, 예측 기간 중 연평균 복합 성장률(CAGR)은 11.8%를 나타낼 전망입니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2021-2030년 |

| 기준연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 검토 단위 | 금액(10억 달러) |

| 부문별 | 센서 기술별, 실장 유형별, 감지 범위별, 프로세스 스테이지별, 용도별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 기타 지역 |

수소 감지 시장은 연료전지의 보급, 다양한 산업 분야에서 수소 사용 증가, 전 세계적으로 강화된 안전 및 보건 규제 시행으로 인해 크게 성장하고 있습니다. 이러한 요인들로 인해 산업계는 작업장 안전, 누출 방지, 규제 준수 유지를 위해 첨단 수소 감지 시스템에 투자하고 있습니다. 그러나 산업별 수소 감지 센서 개발의 복잡성으로 인해 시장은 문제에 직면해 있습니다. 자동차, 에너지, 화학 등 다양한 분야의 고유한 요구사항에 맞게 솔루션을 조정하는 것은 개발 시간, 비용, 기술적 장애물을 증가시켜 전체 시장 확대를 다소 억제할 수 있습니다.

0-1000 ppm의 검출 범위 부문은 예측 기간 동안 수소 검출 시장에서 두 번째로 빠른 성장세를 보일 것으로 예측됩니다. 이 범위는 운전 안전과 규정 준수를 보장하기 위해 조기 누출 감지가 필요한 용도에 필수적입니다. 저농도 수소 모니터링은 배터리 에너지 저장 시스템(BESS), 연구소, 반도체 공장, 연료전지 전기자동차(FCEV) 서비스 구역 등 제한된 민감한 환경에서 특히 중요합니다. 이러한 환경에서는 작은 수소 누출도 감지하지 못하면 위험한 상황으로 이어질 수 있기 때문에 이 범위의 센서는 예방적 유지 보수 및 위험 감소에 필수적입니다.

밀폐된 산업 및 상업 환경에서 수소의 도입이 증가함에 따라, 폭발성 농도를 피하기 위해 조기에 감지해야 하는 세계 안전 규정 준수가 점점 더 엄격해지고 있습니다. 이 때문에 0-1000ppm 범위의 높은 감도와 신뢰성을 가진 센서에 대한 수요가 증가하고 있습니다. Nissha FIS 및 Drager와 같은 주요 기업들은 이러한 목적으로 설계된 전기화학, 열전도, 금속 산화물 기반 센서를 제공합니다. 이 솔루션은 고정식 설비 및 휴대용 감지기에 널리 사용되고 있으며, 다양한 수소 이용 사례에서 이 제품군 시장 입지를 더욱 강화하고 있습니다.

석유 및 가스 산업은 예측 기간 동안 수소 감지 시장 부문을 지배할 것으로 예측됩니다. 수소는 일반적으로 수소화 분해, 탈황 등 석유 정제 및 석유화학 공정에서 부산물로 발생, 사용, 생성됩니다. 이러한 작업에서 수소는 인화성이 높고 공기 중으로 빠르게 확산되기 때문에 수소 누출을 발견하지 못하면 큰 재앙으로 이어질 수 있습니다. 그 결과, 수소 감지 시스템은 정유소의 안전 프로토콜과 위험 감소 전략에 필수적인 요소로 자리 잡게 되었습니다. 또한, OSHA와 같은 규제 감독 기관과 ATEX 및 IECEx와 같은 국제 안전 표준의 준수에 따라 엄격한 규정 준수 요구 사항이 부과되기 때문에 운영자는 신뢰할 수 있는 실시간 가스 모니터링 장치를 도입해야 합니다. 파이프라인, 저장 시설, 해양 플랫폼, 수소 기반 발전 장치에서 수소 감지 통합은 특히 석유 메이저들이 청색 수소 및 탄소 포집 기술에 대한 투자를 늘리면서 확대되고 있습니다. 또한, 전통적 산유지역의 인프라 노후화로 인해 누출 감지 시스템 개보수의 필요성이 높아지고 있습니다. 탈탄소화를 향한 세계 추진력이 에너지 환경을 재편하는 가운데, 석유 및 가스 산업은 전통적인 수소 공정과 청정 수소 이니셔티브 모두에서 전략적 역할을 담당하고 있으며, 수소 감지 시장에서의 선도적 지위를 계속 유지할 것으로 보입니다.

유럽은 청정 에너지 전환에 대한 강한 의지, 엄격한 환경 규제, 정부 지원 이니셔티브에 힘입어 예측 기간 동안 수소 감지 분야에서 두 번째로 빠르게 성장하는 지역 시장으로 성장할 것으로 예측됩니다. 독일, 프랑스, 영국, 네덜란드 등 개발도상국들은 국가 전략 및 수소 인프라 개발 자금 지원을 통해 수소 도입을 추진하고 있습니다. 예를 들어, 유럽 정부는 수소 충전소 및 생산 기지 구축을 지원하고 있으며, 이는 신뢰할 수 있는 수소 누출 감지 시스템에 대한 큰 수요를 창출하고 있습니다. 또한, 이 지역의 자동차, 에너지, 화학 산업은 탈탄소화 목표를 달성하기 위해 수소 솔루션을 통합하고 있으며, 이는 정확하고 효율적인 수소 감지 기술의 필요성을 더욱 높이고 있습니다. 현지 기업들도 첨단 센서 기술에 적극적으로 투자하고 있으며, 안전 및 운영 요구사항에 대한 지역 내 역량을 강화하고 있습니다. 유럽은 협력적인 정책 프레임워크와 산업 혁신의 리더십을 바탕으로 세계 수소 감지 시장에서 강력한 경쟁자로 자리매김하고 있습니다.

세계의 수소 감지 시장에 대해 조사했으며, 센서 기술별, 구현 유형별, 감지 범위별, 공정 단계별, 용도별, 지역별 동향, 시장 진출기업 프로파일 등의 정보를 정리하여 전해드립니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 프리미엄 인사이트

제5장 시장 개요

- 서론

- 시장 역학

- 밸류체인 분석

- 생태계 분석

- 고객의 비즈니스에 영향을 미치는 동향과 혼란

- 기술 분석

- 가격 분석

- Porter의 Five Forces 분석

- 주요 이해관계자와 구입 기준

- 사례 연구 분석

- 무역 분석

- 특허 분석

- 규제 상황

- 2025년-2026년 주요 컨퍼런스 및 이벤트

- AI/생성형 AI가 수소 감지 시장에 미치는 영향

- 2025년 미국 관세가 수소 감지 시장에 미치는 영향-개요

제6장 수소 감지 시장 다양한 기술 영향

- 서론

- 수소 분류

- 수소 감지 시장의 새로운 동향

- 첨단 센싱 재료

- 양자 센서

- 사물인터넷(IoT) 및 인공지능(AI)

- 원격 모니터링을 위한 무선 접속

- 센서 소형화

제7장 수소 감지 주요 응용 분야

- 서론

- 수소 감지 주요 응용 분야

- 안전과 프로세스 관리

- 수소 누출 검출

- 프로세스 모니터링 및 위험 경감

- 경보 및 슛다운 시스템 통합

- 배출 및 컴플라이언스 모니터링

제8장 수소 감지 시장(센서 기술별)

- 서론

- 전기화학

- MOS

- 촉매

- 열전도율

- MEMS

제9장 수소 감지 시장(실장 유형별)

- 서론

- 고정형

- 가동형

제10장 수소 감지 시장(감지 범위별)

- 서론

- 0-1,000 PPM

- 0-5,000 PPM

- 0-20,000 PPM

- 0-20,000 PPM

제11장 수소 감지 시장(프로세스 단계별)

- 서론

- 생성

- 보존

- 전달

- 사용

제12장 수소 감지 시장(용도별)

- 서론

- 석유 및 가스

- 자동차 및 운송

- 화학제품

- 금속 및 광업

- 에너지 및 전력

- 기타

제13장 수소 감지 시장(지역별)

- 서론

- 북미

- 북미의 거시경제 전망

- 미국

- 캐나다

- 멕시코

- 유럽

- 유럽의 거시경제 전망

- 영국

- 독일

- 프랑스

- 기타

- 아시아태평양

- 아시아태평양의 거시경제 전망

- 일본

- 중국

- 인도

- 기타

- 기타 지역

- 남미

- 중동 및 아프리카

제14장 경쟁 구도

- 개요

- 주요 시장 진출기업의 전략/강점, 2020년-2025년

- 시장 점유율 분석, 2024년

- 매출 분석, 2020년-2024년

- 기업 평가와 재무 지표

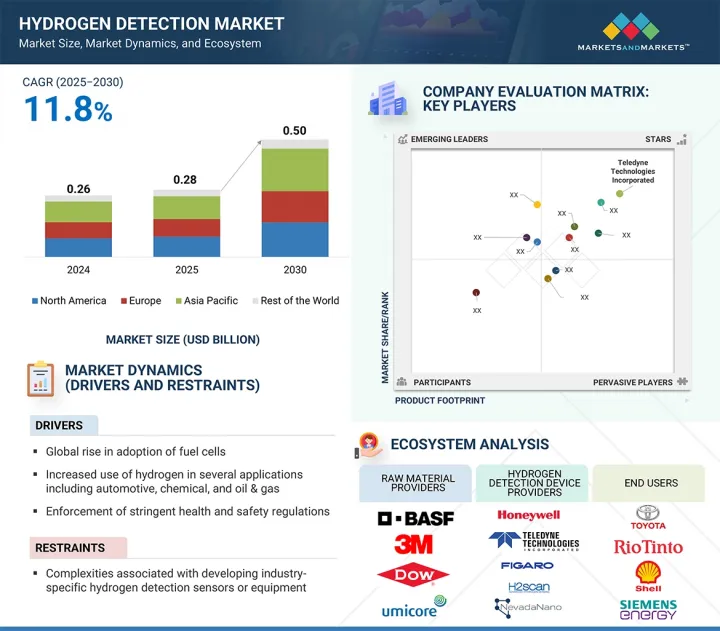

- 기업 평가 매트릭스 : 주요 시장 진출기업, 2024년

- 기업 평가 매트릭스 : 스타트업/중소기업, 2024년

- 브랜드/제품 비교

- 경쟁 시나리오

제15장 기업 개요

- 주요 시장 진출기업

- TELEDYNE TECHNOLOGIES INCORPORATED

- HONEYWELL INTERNATIONAL INC.

- FIGARO ENGINEERING INC.

- H2SCAN

- NISSHA FIS, INC.

- HYDROGEN SENSE TECHNOLOGY CO., LTD.

- NEVADANANO

- DRAGERWERK AG & CO. KGAA

- MSA SAFETY INCORPORATED

- SGX SENSORTEC

- 기타 기업

- AEROQUAL

- ALPHASENSE

- NEOXID GROUP

- BOSCH SENSORTEC GMBH

- MEMBRAPOR

- EAGLE EYE POWER SOLUTIONS LLC

- ELTRA GMBH

- EVIKON MCI OU

- INTERNATIONAL GAS DETECTORS

- MAKEL ENGINEERING INC.

- MPOWER ELECTRONICS INC.

- PROSENSE GAS AND FLAME DETECTORS

- SENKO INTERNATIONAL INC.

- R.C. SYSTEMS

- WINSEN

제16장 부록

LSH 25.09.02The global hydrogen detection market is estimated to be valued at USD 0.50 billion by 2030, up from USD 0.28 billion in 2025, at a CAGR of 11.8% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Sensor Technology, Implementation Type, Detection Range, Process Stage, Application, and Region |

| Regions covered | North America, Europe, APAC, RoW |

The hydrogen detection market is experiencing significant growth driven by the widespread adoption of fuel cells, the increasing use of hydrogen across various industrial applications, and the enforcement of stringent health and safety regulations worldwide. These factors encourage industries to invest in advanced hydrogen detection systems to ensure workplace safety, prevent leaks, and maintain regulatory compliance. However, the market faces challenges due to the complexities involved in developing industry-specific hydrogen detection sensors. Tailoring solutions to meet the unique requirements of different sectors, such as automotive, energy, or chemicals, can increase development time, costs, and technical hurdles, slightly restraining overall market expansion.

"By detection range, 0-1000 ppm is expected to register the second-fastest growth during the forecast period."

The 0-1000 ppm detection range segment is expected to witness the second-fastest growth in the hydrogen detection market during the forecast period. This range is essential for applications that require early leak detection to ensure operational safety and regulatory compliance. Low-level hydrogen monitoring is particularly important in confined and sensitive environments such as battery energy storage systems (BESS), laboratories, semiconductor fabs, and fuel cell electric vehicle (FCEV) service areas. In such setups, even minor hydrogen leaks can lead to hazardous conditions if undetected, making sensors within this range crucial for preventive maintenance and risk mitigation.

The increasing deployment of hydrogen in enclosed industrial and commercial environments has prompted stricter adherence to global safety regulations, which require early-stage detection to avoid explosive concentrations. This has driven demand for sensors with high sensitivity and reliability in the 0-1000 ppm range. Leading players such as Nissha FIS and Drager offer electrochemical, thermal conductivity, and metal oxide-based sensors designed for this purpose. These solutions are being widely adopted across fixed installations and portable detectors, further strengthening the market position of this range across diverse hydrogen use cases.

By application, the oil & gas segment is projected to account for the largest market share during the forecast period."

The oil & gas industry is expected to dominate the hydrogen detection market's application segment throughout the forecast period. Hydrogen is commonly generated, used, or produced as a byproduct in several oil refining and petrochemical processes, such as hydrocracking and desulfurization. In such operations, undetected hydrogen leaks can lead to catastrophic incidents due to its high flammability and rapid dispersion in air. As a result, hydrogen detection systems are integral to refinery safety protocols and risk mitigation strategies. Additionally, regulatory oversight from bodies such as OSHA and adherence to international safety standards like ATEX and IECEx enforce strict compliance requirements, prompting operators to deploy highly reliable, real-time gas monitoring equipment. The integration of hydrogen detection in pipelines, storage facilities, offshore platforms, and hydrogen-based power generation units is expanding, especially as oil majors increase investment in blue hydrogen and carbon capture technologies. Moreover, aging infrastructure in traditional oil-producing regions is driving the need for retrofitted leak detection systems. As the global push toward decarbonization reshapes the energy landscape, the oil & gas industry's strategic role in both conventional hydrogen processes and clean hydrogen initiatives will continue to support its leading position in the hydrogen detection market.

By region, Europe is expected to register the second-fastest growth during the forecast period.

Europe is projected to emerge as the second-fastest-growing regional market for hydrogen detection during the forecast period, driven by the region's strong commitment to clean energy transition, stringent environmental regulations, and supportive government initiatives. Countries such as Germany, France, the UK, and the Netherlands are advancing hydrogen adoption through national strategies and funding for hydrogen infrastructure development. For example, European governments are supporting the rollout of hydrogen refueling stations and production hubs, creating significant demand for reliable hydrogen leak detection systems. Additionally, the region's well-established automotive, energy, and chemical industries are integrating hydrogen solutions to achieve decarbonization goals, further contributing to the need for accurate and efficient hydrogen detection technologies. Local companies are also actively investing in advanced sensor technologies, enhancing the region's capability to meet rising safety and operational requirements. Europe's coordinated policy frameworks and its leadership in industrial innovation position it as a strong contender in the global hydrogen detection market.

The break-up of the profile of primary participants in the hydrogen detection market-

- By Company Type: Tier 1 - 40%, Tier 2 - 25%, Tier 3 - 35%

- By Designation Type: C Level - 25%, Director Level - 40%, Others - 35%

- By Region Type: Asia Pacific - 40%, Europe - 25%, North America- 30%, Rest of the World - 5%

Note: Other designations include sales, marketing, and product managers.

The three tiers of the companies are based on their total revenues as of 2024: Tier 1: >USD 1 billion, Tier 2: USD 500 million-1 billion, and Tier 3: USD 500 million.

The major players in the hydrogen detection market with a significant global presence include Teledyne Technologies Incorporated (US), Honeywell International (US), H2San (US), Figaro Engineering (Japan), Nissha FIS (Japan), and others.

Study Coverage

The report segments the hydrogen detection market and forecasts its size by sensor technology, implementation type, detection range, process stage, application, and region. It also provides a comprehensive review of drivers, restraints, opportunities, and challenges influencing market growth. The report covers qualitative aspects in addition to quantitative aspects of the market.

Reasons to buy the report:

The report will help the market leaders/new entrants in this market with information on the closest approximate revenues for the overall hydrogen detection market and related segments. This report will help stakeholders understand the competitive landscape and gain more insights to strengthen their position in the market and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, opportunities, and challenges.

The report provides insights into the following pointers:

- Analysis of key drivers (high adoption of fuel cells globally, increased use of hydrogen in several applications, enforcement of stringent health and safety regulations worldwide), restraints (complexities involved in developing industry-specific hydrogen detection sensors or equipment), opportunities (shifting focus of OEMs to low-carbon energy systems, rising deployment of IoT-enabled gas detection systems), and challenges (production and revenue losses due to unwanted downtime of detection equipment, technical issues associated with integration of sensing elements)

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the hydrogen detection market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the hydrogen detection market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the hydrogen detection market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players, including Teledyne Technologies Incorporated (US), Honeywell International (US), H2San (US), Figaro Engineering (Japan), and Nissha FIS (Japan).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of key primary interview participants

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Breakdown of primaries

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.3.1 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN HYDROGEN DETECTION MARKET

- 4.2 HYDROGEN DETECTION MARKET, BY SENSOR TECHNOLOGY

- 4.3 HYDROGEN DETECTION MARKET, BY DETECTION RANGE AND PROCESS STAGE

- 4.4 HYDROGEN DETECTION MARKET, BY APPLICATION

- 4.5 HYDROGEN DETECTION MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 High adoption of fuel cells globally

- 5.2.1.2 Increased use of hydrogen across industries

- 5.2.1.3 Enforcement of stringent health and safety regulations worldwide

- 5.2.1.4 Substantial investment in expanding hydrogen ecosystem

- 5.2.2 RESTRAINTS

- 5.2.2.1 Prolonged development timelines and technical/regulatory barriers

- 5.2.2.2 High cost of advanced hydrogen detection technologies

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising demand for portable and wearable hydrogen detectors in field operations

- 5.2.3.2 Advent of miniaturized, low-power sensors to detect hydrogen leaks in EVs and drones

- 5.2.3.3 Emergence of AI-powered predictive maintenance platforms for gas detection systems

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of standardized performance metrics and globally harmonized calibration protocols

- 5.2.4.2 Cybersecurity issues associated with IoT-integrated hydrogen detection networks

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.6 TECHNOLOGY ANALYSIS

- 5.6.1 KEY TECHNOLOGIES

- 5.6.1.1 Electrochemical sensing

- 5.6.1.2 Optical sensing

- 5.6.2 COMPLEMENTARY TECHNOLOGIES

- 5.6.2.1 Energy harvesting

- 5.6.3 ADJACENT TECHNOLOGIES

- 5.6.3.1 Gas chromatography

- 5.6.1 KEY TECHNOLOGIES

- 5.7 PRICING ANALYSIS

- 5.7.1 PRICING OF HYDROGEN DETECTION EQUIPMENT OFFERED BY KEY PLAYERS, BY TECHNOLOGY, 2024

- 5.7.2 PRICING TREND OF HYDROGEN DETECTION EQUIPMENT, BY TECHNOLOGY, 2021-2024

- 5.7.3 AVERAGE SELLING PRICE TREND OF HYDROGEN DETECTION EQUIPMENT, BY REGION, 2021-2024

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- 5.8.1 THREAT OF NEW ENTRANTS

- 5.8.2 THREAT OF SUBSTITUTES

- 5.8.3 BARGAINING POWER OF SUPPLIERS

- 5.8.4 BARGAINING POWER OF BUYERS

- 5.8.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.9 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.9.2 BUYING CRITERIA

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 HEMPFLAX ACHIEVES ISCC PLUS CERTIFICATION WITH DEKRA TO STRENGTHEN SUSTAINABILITY LEADERSHIP

- 5.10.2 SANDERSON DESIGN GROUP AND PLANET MARK COLLABORATE ON NET-ZERO ROADMAP FOR SUSTAINABLE OPERATIONS

- 5.10.3 SGS SA AND JAMES HARDIE COLLABORATE ON LCA FOR SUSTAINABLE GYPSUM FIBER BOARDS

- 5.11 TRADE ANALYSIS

- 5.11.1 IMPORT SCENARIO (HS CODE 9027)

- 5.11.2 EXPORT SCENARIO (HS CODE 9027)

- 5.12 PATENT ANALYSIS

- 5.13 REGULATORY LANDSCAPE

- 5.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.2 SAFETY STANDARDS

- 5.14 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.15 IMPACT OF AI/GEN AI ON HYDROGEN DETECTION MARKET

- 5.16 IMPACT OF 2025 US TARIFF ON HYDROGEN DETECTION MARKET - OVERVIEW

- 5.16.1 INTRODUCTION

- 5.16.2 KEY TARIFF RATES

- 5.16.3 PRICE IMPACT ANALYSIS

- 5.16.4 KEY IMPACTS ON COUNTRIES/REGIONS

- 5.16.4.1 US

- 5.16.4.2 Europe

- 5.16.4.3 Asia Pacific

- 5.16.5 IMPACT ON APPLICATIONS

6 IMPACT OF DIFFERENT TECHNOLOGIES ON HYDROGEN DETECTION MARKET

- 6.1 INTRODUCTION

- 6.2 CLASSIFICATION OF HYDROGEN

- 6.3 EMERGING TRENDS IN HYDROGEN DETECTION MARKET

- 6.3.1 ADVANCED SENSING MATERIALS

- 6.3.2 QUANTUM SENSORS

- 6.3.3 INTERNET OF THINGS (IOT) AND ARTIFICIAL INTELLIGENCE (AI)

- 6.3.4 WIRELESS CONNECTIVITY FOR REMOTE MONITORING

- 6.3.5 MINIATURIZATION OF SENSORS

7 KEY APPLICATION AREAS OF HYDROGEN DETECTION

- 7.1 INTRODUCTION

- 7.2 KEY APPLICATION AREAS OF HYDROGEN DETECTION

- 7.2.1 SAFETY AND PROCESS CONTROL

- 7.2.2 HYDROGEN LEAK DETECTION

- 7.2.3 PROCESS MONITORING AND HAZARD MITIGATION

- 7.2.4 ALARM AND SHUTDOWN SYSTEM INTEGRATION

- 7.2.5 EMISSION AND COMPLIANCE MONITORING

8 HYDROGEN DETECTION MARKET, BY SENSOR TECHNOLOGY

- 8.1 INTRODUCTION

- 8.2 ELECTROCHEMICAL

- 8.2.1 EXCELLENCE IN DETECTING TOXIC AND COMBUSTIBLE GASES IN INDUSTRIAL AND SAFETY-CRITICAL SETTINGS TO SPUR DEMAND

- 8.3 MOS

- 8.3.1 ABILITY TO DETECT HYDROGEN IN PPB CONCENTRATIONS TO FOSTER SEGMENTAL GROWTH

- 8.4 CATALYTIC

- 8.4.1 SUITABILITY FOR HIGH-TEMPERATURE-RANGE OPERATIONS TO PROPEL SEGMENTAL GROWTH

- 8.5 THERMAL CONDUCTIVITY

- 8.5.1 PROFICIENCY IN DETECTING HYDROGEN LEAKAGE IN PIPELINES AND INDUSTRIAL PROCESSES TO SPIKE DEMAND

- 8.6 MEMS

- 8.6.1 DURABILITY AND RESISTANCE TO ENVIRONMENTAL INTERFERENCE TO STIMULATE DEMAND

9 HYDROGEN DETECTION MARKET, BY IMPLEMENTATION TYPE

- 9.1 INTRODUCTION

- 9.2 FIXED

- 9.2.1 ELEVATING USE IN HIGH-RISK INDUSTRIAL PROCESSES TO ENSURE OPERATIONAL SAFETY AND ACCELERATE SEGMENTAL GROWTH

- 9.3 PORTABLE 94 9.3.1 EXCELLENCE IN INSPECTING CONFINED OR HARD-TO-REACH AREAS TO SPIKE DEMAND

10 HYDROGEN DETECTION MARKET, BY DETECTION RANGE

- 10.1 INTRODUCTION

- 10.2 0-1,000 PPM

- 10.2.1 OIL & GAS REFINERIES, FUEL CELL PRODUCTION, AND STORAGE FACILITIES TO CONTRIBUTE TO SUBSTANTIAL DEMAND

- 10.3 0-5,000 PPM

- 10.3.1 APPLICATIONS REQUIRING MODERATE CONCENTRATION OF HYDROGEN GAS TO SUPPORT SEGMENTAL GROWTH

- 10.4 0-20,000 PPM

- 10.4.1 SURGING DEMAND FROM COGENERATION SYSTEMS, TURBINES, AND GAS-FIRED POWER PLANTS TO FUEL SEGMENTAL GROWTH

- 10.5 >0-20,000 PPM

- 10.5.1 RISING USE IN ELECTROLYSIS PLANTS, HYDROGEN GENERATION STATIONS, AND HYDROGEN STORAGE FACILITIES TO DRIVE MARKET

11 HYDROGEN DETECTION MARKET, BY PROCESS STAGE

- 11.1 INTRODUCTION

- 11.2 GENERATION

- 11.2.1 USE OF CLEAN ENERGY SOURCES IN HYDROGEN PRODUCTION TO ACCELERATE DEPLOYMENT

- 11.3 STORAGE

- 11.3.1 EMPHASIS ON SETTING SAFE HYDROGEN STORAGE INFRASTRUCTURE TO BOOST DEMAND

- 11.4 TRANSPORTATION

- 11.4.1 EXPANSION OF HYDROGEN SUPPLY CHAINS TO CREATE GROWTH OPPORTUNITIES

- 11.5 USAGE

- 11.5.1 IMPLEMENTATION OF DECARBONIZATION AND GREEN HYDROGEN INITIATIVES TO DRIVE MARKET

12 HYDROGEN DETECTION MARKET, BY APPLICATION

- 12.1 INTRODUCTION

- 12.2 OIL & GAS

- 12.2.1 STRINGENT SULFUR-CONTENT REGULATIONS TO BOOST DEMAND

- 12.3 AUTOMOTIVE & TRANSPORTATION

- 12.3.1 RISING USE OF FUEL CELL ELECTRIC VEHICLES TO DRIVE MARKET

- 12.4 CHEMICAL

- 12.4.1 NECESSITY TO SYNTHESIZE AMMONIA IN CHEMICAL PROCESSING PLANTS TO PROPEL MARKET

- 12.5 METAL & MINING

- 12.5.1 RISING FOCUS ON OPERATIONAL SAFETY BY PREVENTING EXPLOSIVE ATMOSPHERE TO SPIKE DEMAND

- 12.6 ENERGY & POWER

- 12.6.1 EVOLVING SAFETY REGULATIONS AND TRANSITION TO CLEAN ENERGY TO FOSTER MARKET GROWTH

- 12.7 OTHER APPLICATIONS

13 HYDROGEN DETECTION MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 NORTH AMERICA

- 13.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 13.2.2 US

- 13.2.2.1 Accelerated rollout of fuel cell electric vehicles to drive market

- 13.2.3 CANADA

- 13.2.3.1 Government focus on developing sustainable hydrogen economy to support market growth

- 13.2.4 MEXICO

- 13.2.4.1 Structural energy reforms and substantial demand from oil and chemicals industries to boost market

- 13.3 EUROPE

- 13.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 13.3.2 UK

- 13.3.2.1 Hydrogen transport and storage reforms to elevate demand

- 13.3.3 GERMANY

- 13.3.3.1 Flagship initiatives aimed at scaling hydrogen economy to augment market growth

- 13.3.4 FRANCE

- 13.3.4.1 Surging demand for FCVs to create opportunities for market players

- 13.3.5 REST OF EUROPE

- 13.4 ASIA PACIFIC

- 13.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 13.4.2 JAPAN

- 13.4.2.1 Launch of hydrogen-based power generation projects to escalate demand

- 13.4.3 CHINA

- 13.4.3.1 Growing hydrogen deployment in transportation and industrial sectors to drive market

- 13.4.4 INDIA

- 13.4.4.1 Energy transition plans and initiatives to develop hydrogen infrastructure to augment market growth

- 13.4.5 REST OF ASIA PACIFIC

- 13.5 ROW

- 13.5.1 SOUTH AMERICA

- 13.5.1.1 Rising use of biofuels in transportation sector to elevate demand

- 13.5.2 MIDDLE EAST & AFRICA

- 13.5.2.1 Abundance of oil and energy resources to contribute to market growth

- 13.5.1 SOUTH AMERICA

14 COMPETITIVE LANDSCAPE

- 14.1 OVERVIEW

- 14.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2025

- 14.3 MARKET SHARE ANALYSIS, 2024

- 14.4 REVENUE ANALYSIS, 2020-2024

- 14.5 COMPANY VALUATION AND FINANCIAL METRICS

- 14.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 14.6.1 STARS

- 14.6.2 EMERGING LEADERS

- 14.6.3 PERVASIVE PLAYERS

- 14.6.4 PARTICIPANTS

- 14.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 14.6.5.1 Company footprint

- 14.6.5.2 Region footprint

- 14.6.5.3 Detection range footprint

- 14.6.5.4 Sensor technology footprint

- 14.6.5.5 Implementation type footprint

- 14.6.5.6 Application footprint

- 14.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 14.7.1 PROGRESSIVE COMPANIES

- 14.7.2 RESPONSIVE COMPANIES

- 14.7.3 DYNAMIC COMPANIES

- 14.7.4 STARTING BLOCKS

- 14.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 14.7.5.1 Detailed list of startups/SMEs

- 14.7.5.2 Competitive benchmarking of key startups/SMEs

- 14.8 BRAND/PRODUCT COMPARISON

- 14.9 COMPETITIVE SCENARIO

- 14.9.1 PRODUCT LAUNCHES

- 14.9.2 DEALS

- 14.9.3 EXPANSIONS

- 14.9.4 OTHER DEVELOPMENTS

15 COMPANY PROFILES

- 15.1 KEY PLAYERS

- 15.1.1 TELEDYNE TECHNOLOGIES INCORPORATED

- 15.1.1.1 Business overview

- 15.1.1.2 Products offered

- 15.1.1.3 Recent developments

- 15.1.1.3.1 Product launches

- 15.1.1.3.2 Other developments

- 15.1.1.4 MNM view

- 15.1.1.4.1 Key strengths/Right to win

- 15.1.1.4.2 Strategic choices

- 15.1.1.4.3 Weaknesses/Competitive threats

- 15.1.2 HONEYWELL INTERNATIONAL INC.

- 15.1.2.1 Business overview

- 15.1.2.2 Products offered

- 15.1.2.3 Recent developments

- 15.1.2.3.1 Product launches

- 15.1.2.3.2 Deals

- 15.1.2.4 MNM view

- 15.1.2.4.1 Key strengths/Right to win

- 15.1.2.4.2 Strategic choices

- 15.1.2.4.3 Weaknesses/Competitive threats

- 15.1.3 FIGARO ENGINEERING INC.

- 15.1.3.1 Business overview

- 15.1.3.2 Products offered

- 15.1.3.3 Recent developments

- 15.1.3.3.1 Product launches

- 15.1.3.3.2 Deals

- 15.1.3.4 MNM view

- 15.1.3.4.1 Key strengths/Right to win

- 15.1.3.4.2 Strategic choices

- 15.1.3.4.3 Weaknesses/Competitive threats

- 15.1.4 H2SCAN

- 15.1.4.1 Business overview

- 15.1.4.2 Products offered

- 15.1.4.3 Recent developments

- 15.1.4.3.1 Product launches

- 15.1.4.4 MNM view

- 15.1.4.4.1 Key strengths/Right to win

- 15.1.4.4.2 Strategic choices

- 15.1.4.4.3 Weaknesses/Competitive threats

- 15.1.5 NISSHA FIS, INC.

- 15.1.5.1 Business overview

- 15.1.5.2 Products offered

- 15.1.5.3 MNM view

- 15.1.5.3.1 Key strengths/Right to win

- 15.1.5.3.2 Strategic choices

- 15.1.5.3.3 Weaknesses/Competitive threats

- 15.1.6 HYDROGEN SENSE TECHNOLOGY CO., LTD.

- 15.1.6.1 Business overview

- 15.1.6.2 Products offered

- 15.1.7 NEVADANANO

- 15.1.7.1 Business overview

- 15.1.7.2 Products offered

- 15.1.7.3 Recent developments

- 15.1.7.3.1 Product launches

- 15.1.7.3.2 Deals

- 15.1.7.3.3 Expansions

- 15.1.7.3.4 Other developments

- 15.1.8 DRAGERWERK AG & CO. KGAA

- 15.1.8.1 Business overview

- 15.1.8.2 Products offered

- 15.1.9 MSA SAFETY INCORPORATED

- 15.1.9.1 Business overview

- 15.1.9.2 Products offered

- 15.1.10 SGX SENSORTEC

- 15.1.10.1 Business overview

- 15.1.10.2 Products offered

- 15.1.1 TELEDYNE TECHNOLOGIES INCORPORATED

- 15.2 OTHER PLAYERS

- 15.2.1 AEROQUAL

- 15.2.2 ALPHASENSE

- 15.2.3 NEOXID GROUP

- 15.2.4 BOSCH SENSORTEC GMBH

- 15.2.5 MEMBRAPOR

- 15.2.6 EAGLE EYE POWER SOLUTIONS LLC

- 15.2.7 ELTRA GMBH

- 15.2.8 EVIKON MCI OU

- 15.2.9 INTERNATIONAL GAS DETECTORS

- 15.2.10 MAKEL ENGINEERING INC.

- 15.2.11 MPOWER ELECTRONICS INC.

- 15.2.12 PROSENSE GAS AND FLAME DETECTORS

- 15.2.13 SENKO INTERNATIONAL INC.

- 15.2.14 R.C. SYSTEMS

- 15.2.15 WINSEN

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS