|

시장보고서

상품코드

1797408

전력 변압기 시장(-2030년) : 정격 전력(소형, 중형, 대형), 냉각 유형(유냉식, 공랭식), 단계(단상, 삼상), 최종사용자(유틸리티, 주택&상업 및 산업), 지역별Power Transformer Market by Power Rating (Small, Medium, Large), Cooling Type (Oil-cooled, Air-cooled), Phase (Single Phase, Three Phase), End Use (Utilities, Residential & Commercial, Industrial), and Region - Global Forecast to 2030 |

||||||

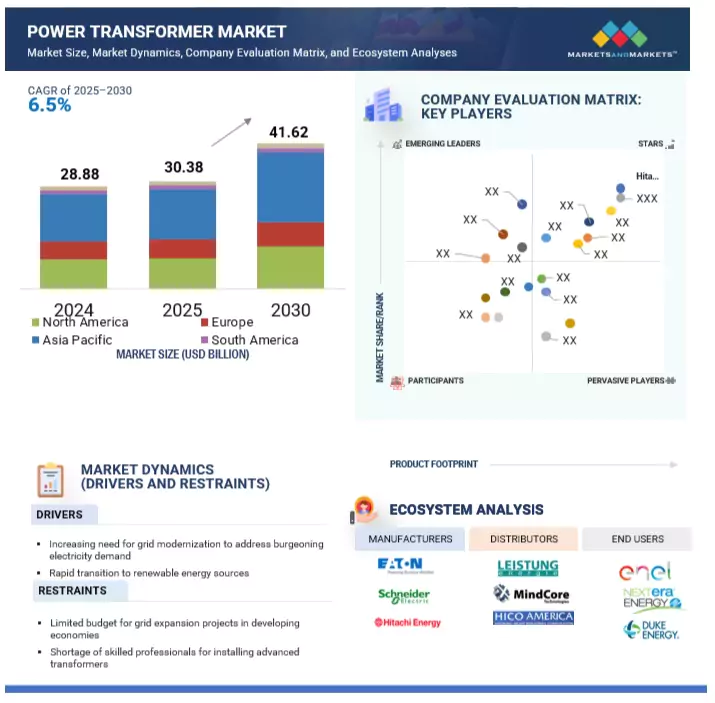

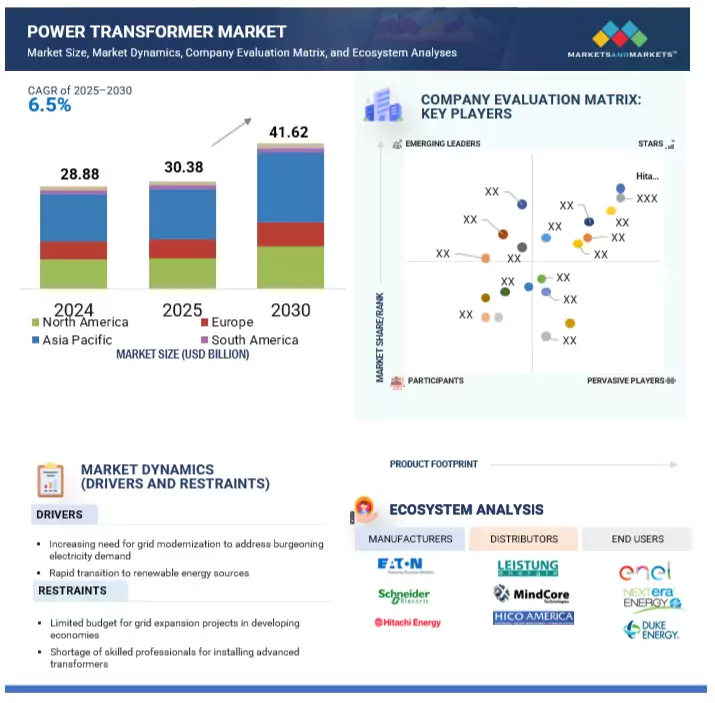

세계의 전력 변압기 시장 규모는 2025년 303억 8,000만 달러에서 예측 기간에는 CAGR 6.5%로 성장을 지속하여, 2030년에는 416억 2,000만 달러로 성장할 것으로 예측됩니다.

이러한 성장 궤도는 주로 선진국과 신흥국의 급속한 산업화, 제조 활동의 확대, 선진국과 신흥국의 지속적인 인프라 개발로 인한 전 세계 전력 수요 증가에 의해 주도되고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2020-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 금액(달러) 및 Unit |

| 부문별 | 정격 전력, 단계, 냉각 유형, 최종사용자별 |

| 대상 지역 | 아시아태평양, 북미, 유럽, 중동 및 아프리카, 남미 |

특히 산업 부문은 이러한 수요의 주요 견인차 역할을 하고 있으며, 현대의 시설은 견고하고 효율적인 전력 공급 시스템을 필요로 하며, 그 중 전력용 변압기는 필수 불가결한 존재입니다. 산업용도 외에도 시장에서는 상업 부문, 서비스 부문, 주거 부문 수요도 확대되고 있습니다. 상업 활동은 생산성을 유지하기 위해 무정전 전력 공급에 대한 의존도가 높아지고 있으며, 의료, 교육, 접객업 등 서비스 부문은 디지털 인프라와 서비스 제공을 지원하기 위해 전력 소비가 급증하고 있습니다. 한편, 인구 증가와 도시화가 진행됨에 따라 주택가에서도 안정적이고 안정적인 전력 공급의 필요성이 높아지고 있습니다. 이러한 추세를 종합하면, 다양한 최종 용도에서 안정적인 에너지 분배를 실현하는 데 있어 전력용 변압기가 중요한 역할을 하고 있음을 알 수 있습니다.

"정격 전력별로는 대형(600MVA 이상)이 예측 기간 동안 가장 빠르게 성장할 전망"

이 부문은 예측 기간 동안 가장 높은 CAGR을 보일 것으로 예측됩니다. 전 세계적으로 재생에너지로의 전환과 유틸리티 규모의 풍력 및 태양광 발전 프로젝트가 확대됨에 따라 장거리 고전압을 효율적으로 처리할 수 있는 대용량 송전 시스템에 대한 수요가 증가하고 있으며, 이에 따라 대형 변압기가 필수적으로 요구되고 있습니다. 급속한 산업화 및 도시화가 진행되는 지역에서는 에너지 소비 증가를 뒷받침하기 위해 전력망을 확장하고 현대화함으로써 이러한 대용량 변압기의 필요성이 더욱 가속화되고 있습니다. 또한, 전력 공급의 신뢰성과 안정성을 향상시키기 위해 국경을 초월한 송전망의 상호 연결 추세도 대형 변압기에 대한 수요를 증가시키고 있습니다. 선진국에서는 노후화된 인프라를 첨단 에너지 효율이 높은 시스템으로 교체하는 노력도 이러한 성장에 기여하고 있습니다. 이러한 발전으로 대형 변압기는 기존 및 재생 에너지 시스템을 지원하는 견고하고 미래 지향적인 에너지 네트워크를 구현하는 데 있어 중요한 역할을 할 수 있는 존재로 자리매김하고 있습니다.

"단계별로는 삼상 변압기 부문이 2030년 가장 큰 점유율을 차지할 것으로 예측됩니다."

이는 효율적인 송배전을 위해 대용량 솔루션을 필요로 하는 상업, 산업, 유틸리티 분야에서 널리 활용되고 있기 때문입니다. 삼상 변압기는 고부하 용도에 적합하며, 우수한 효율, 안정적인 전력 공급, 에너지 손실 감소를 실현합니다. 이러한 특성으로 인해 대량 및 지속적인 전력 수요가 있는 환경에서 없어서는 안 될 존재가 되었습니다. 전 세계 에너지 소비가 산업 활동과 인프라 개발의 확대와 함께 증가함에 따라 신뢰할 수 있는 고성능 변압기에 대한 수요는 지속적으로 증가하고 있습니다. 또한, 삼상 변압기는 재생에너지를 전력망에 통합하는 데 중요한 역할을 하며, 깨끗하고 지속 가능한 에너지 시스템으로의 세계 전환을 지원하고 있습니다. 삼상 변압기는 대규모 전력 부하를 효율적으로 관리하고 다양한 고 수요 분야에서 유연하게 활용할 수 있어 예측 기간 동안 전력 변압기 시장을 선도하는 부문으로 자리매김할 것으로 예측됩니다.

세계의 전력용 변압기(Power Transformer) 시장을 조사했으며, 시장 개요, 시장 성장에 영향을 미치는 각종 영향요인 분석, 기술 및 특허 동향, 법 및 규제 환경, 사례 분석, 시장 규모 추이 및 예측, 각종 부문별/지역별/주요 국가별 상세 분석, 경쟁 구도, 주요 기업 개요 등의 정보를 정리하여 전해드립니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 프리미엄 인사이트

제5장 시장 개요

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

- Porter의 Five Forces 분석

- 공급망 분석

- 기술 분석

- 2024년 주요 컨퍼런스 및 이벤트

- 생태계 분석

- 특허 분석

- 사례 연구 분석

- 무역 분석

- 가격 분석

- 투자 및 자금조달 시나리오

- 관세 및 규제 상황

- 고객 사업에 영향을 미치는 동향/혼란

- 주요 이해관계자와 구입 기준

- 전력 변압기 시장 생성형 AI/AI의 영향

- 2025년 미국 관세가 전력 변압기 시장에 미치는 영향

제6장 전력 변압기 시장 : 정격전력별

- 최대 60MVA

- 61-600MVA

- 600MVA 이상

제7장 전력 변압기 시장 : 냉각 방식별

- 유냉식

- 공랭식

제8장 전력 변압기 시장 : 위상별

- 단상

- 삼상

제9장 전력 변압기 시장 : 최종사용자별

- 유틸리티

- 주택 및 상업시설

- 산업용

- 석유 및 가스

- 금속 및 광업

- 자동차

- 식품 및 음료

- 발전

- 데이터센터

- 기타

제10장 전력 변압기 시장 : 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 이탈리아

- 프랑스

- 스페인

- 기타

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 호주

- 기타

- 중동 및 아프리카

- GCC 국가

- 남아프리카공화국

- 기타

- 남미

- 브라질

- 아르헨티나

- 기타

제11장 경쟁 구도

- 주요 시장 진출기업의 전략/강점

- 시장 점유율 분석

- 매출 분석

- 기업 평가와 재무 지표

- 브랜드/제품 비교

- 기업 평가 매트릭스 : 주요 기업

- 기업 평가 매트릭스 : 스타트업/중소기업

- 경쟁 시나리오

제12장 기업 개요

- 주요 기업

- SIEMENS ENERGY

- HITACHI ENERGY LTD.

- TOSHIBA ENERGY SYSTEMS & SOLUTIONS CORPORATION

- HD HYUNDAI ELECTRIC CO., LTD.

- GE VERNOVA

- SCHNEIDER ELECTRIC

- CG POWER AND INDUSTRIAL SOLUTIONS LTD.

- MITSUBISHI ELECTRIC CORPORATION

- HYOSUNG HEAVY INDUSTRIES

- BHARAT HEAVY ELECTRICALS LIMITED

- FUJI ELECTRIC CO., LTD.

- SGB SMIT

- WEG

- TRANSFORMERS AND RECTIFIERS(INDIA) LIMITED

- NIAGARA POWER TRANSFORMER LLC

- LS ELECTRIC CO., LTD.

- HAMMOND POWER SOLUTIONS

- DAELIM TRANSFORMER

- BEST TRANSFORMER

- WILSON POWER SOLUTIONS LTD.

- 기타 기업

- ORMAZABAL

- ABC TRANSFORMERS(P) LTD.

- VIJAY POWER

- JSHP TRANSFORMER

- CHINT GROUP

제13장 부록

LSH 25.09.01The global power transformer market is projected to grow from USD 30.38 billion in 2025 to USD 41.62 billion by 2030, at a CAGR of 6.5% during the forecast period. This upward trajectory is primarily driven by the rising global demand for electricity, fueled by rapid industrialization, expanding manufacturing activities, and ongoing infrastructure development across developed and emerging economies.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) and Volume (Units) |

| Segments | By Power Rating, By Phase, By Cooling Type, and By End Use |

| Regions covered | Asia Pacific, North America, Europe, the Middle East and Africa, and South America |

The industrial sector, in particular, is a major contributor to this demand, as modern facilities require robust and efficient power distribution systems, where power transformers are crucial. In addition to industrial applications, the market is experiencing growing demand from the commercial, service, and residential sectors. Commercial operations increasingly rely on uninterrupted power to maintain productivity, while the service sectors, including healthcare, education, and hospitality, are seeing a surge in electricity consumption to support digital infrastructure and service delivery. Meanwhile, population growth and urbanization drive the need for a reliable and consistent power supply in residential areas. Together, these trends underscore the critical role of power transformers in ensuring stable energy distribution across diverse end-use sectors.

"By power rating, large (above 600 MVA) is anticipated to be the fastest-growing segment from 2025 to 2030"

The large (above 600 MVA) segment is expected to exhibit the highest CAGR from 2025 to 2030. The global shift toward renewable energy and the deployment of utility-scale wind and solar projects result in the rising demand for high-capacity transmission systems capable of efficiently handling high voltages over long distances, making large transformers essential. In rapidly industrializing and urbanizing regions, expanding and modernizing power grids to support rising energy consumption further accelerates the need for these high-capacity units. Additionally, the increasing trend of cross-border grid interconnections aimed at improving power supply reliability and stability boosts the demand for large power transformers. In developed economies, efforts to replace aging infrastructure with advanced, energy-efficient systems also contribute to this growth. These developments position large power transformers as critical enablers of resilient, future-ready energy networks, supporting traditional and renewable power systems.

"Based on phase type, the three-phase transformers segment is projected to hold the largest market share in 2030"

The three-phase transformer segment is expected to hold the largest market share in 2030. It is driven by its widespread use across commercial, industrial, and utility sectors that require high-capacity solutions for efficient power transmission and distribution. These transformers are well-suited for high-load applications, offering superior efficiency, stable power flow, and reduced energy losses. These factors make transformers essential in settings with substantial and continuous power demands. As global energy consumption rises alongside expanding industrial operations and infrastructure development, the demand for reliable and high-performance transformers continues to grow. Moreover, three-phase transformers are critical in integrating renewable energy sources into the grid, supporting the global shift toward cleaner and more sustainable energy systems. Their ability to manage larger electrical loads efficiently and their versatility across various high-demand sectors solidify their position as the leading segment in the power transformer market over the forecast period.

"North America is expected to be the second fastest-growing region in the power transformer market during the forecast period"

North America is projected to be the second fastest-growing region in the power transformer market during the forecast period due to a strong focus on upgrading aging grid infrastructure, integrating renewable energy sources, and meeting increasing electricity demand driven by data centers, electric vehicles, and industrial automation. The proactive approach to modernizing transmission and distribution networks and government initiatives supporting clean energy transitions significantly boosts the demand for high-efficiency power transformers. In addition, the presence of major industry players, technological advancements, and regulatory policies emphasizing energy reliability and grid resilience further contribute to the robust growth in the power transformer market during the forecast period.

Breakdown of Primaries:

Through in-depth interviews with subject-matter experts, C-level executives of leading market players, industry consultants, and other specialists, significant qualitative and quantitative data were obtained and confirmed, along with future market prospects. The primary interviews were distributed as follows:

By Company Type: Tier 1 - 45%, Tier 2 - 40%, and Tier 3 - 15%

By Designation: C-Level Executives - 35%, Directors- 25%, and Others - 40%

By Region: North America - 18%, Europe - 15%, Asia Pacific - 50%, Middle East & Africa - 10%, and South America - 7%

Note: "Others" include sales managers, engineers, and regional managers

The tiers of the companies are defined based on their total revenue as of 2022: Tier 1: >USD 1 billion, Tier 2: USD 500 million-1 billion, and Tier 3: <USD 500 million.

International giants primarily dominate the power transformer market. Some leading companies operating in the power transformer market include Hitachi Energy (Japan), General Electric (US), Siemens (Germany), Mitsubishi Electric (Japan), Eaton Corporation (Ireland), Hyundai Electric (South Korea), Schneider Electric (France), Fuji Electric (Japan), Toshiba Energy System & Solution Corporation (Japan), and CG Power and Industrial Solutions (India).

Research Coverage:

This report presents a comprehensive analysis of the power transformer market, offering detailed definitions, descriptions, and forward-looking projections across key parameters. The study is segmented by phase (single-phase and three-phase), power rating [small (up to 60 MVA), medium (61-600 MVA), and large (above 600 MVA)], cooling type (oil-cooled and air-cooled), and end use (industrial, residential & commercial, and utilities). It also provides a regional breakdown covering Asia Pacific, North America, Europe, the Middle East & Africa, and South America. The report delivers qualitative and quantitative insights, highlighting key market drivers, restraints, opportunities, and challenges shaping the industry. In addition, it includes an in-depth assessment of market dynamics, value-based forecasts, competitive landscape analysis, and emerging trends, offering a holistic view of the current state and future outlook of the global power transformer market.

Key Benefits of Buying the Report

The report is thoughtfully designed to meet the needs of seasoned industry leaders and new entrants in the power transformer market. It provides dependable revenue projections for the overall market and its various sub-segments, making it a crucial tool for stakeholders looking to understand the competitive environment deeply. This information helps stakeholders develop effective market strategies for their businesses. Furthermore, the report serves as a key resource for stakeholders to grasp the current market scenario, offering vital insights into the drivers, constraints, challenges, and opportunities for growth. With these insights, stakeholders can make well-informed decisions and keep up with the rapidly changing dynamics of the Power Transformers industry.

- Analysis of key drivers (Growing electricity demand, Rising integration of renewable energy sources), restraints (Cost pressures and lead times, Limited market penetration in developing economies), opportunities (Rise of decentralized generation, Smart grid development and rise of advanced transformers), and challenges (Aging infrastructure and shortage of skilled workforce, Cybersecurity threats amid power grid digitalization) influencing the growth of the power transformer market.

- Product Development/ Innovation: Product development and innovation are pivotal in advancing the power transformer market. With continuous technological progress, manufacturers increasingly focus on creating high-performance, energy-efficient, safe transformer solutions. These innovations often incorporate smart features, advanced materials, and eco-friendly insulation technologies to meet the evolving demands of modern power distribution systems. Research and development efforts also aim to produce transformers that align with global sustainability goals and environmental standards. In the power transformer segment, companies leverage cutting-edge design techniques and technologies to meet but exceed industry requirements, delivering solutions that enhance the efficiency, reliability, and longevity of power networks. This ongoing emphasis on innovation underscores the industry's commitment to addressing emerging challenges and improving the overall functionality and adaptability of power transformers in a rapidly changing energy landscape.

- Market Development: Market development in the power transformer market is a continuous and strategic process, driven by the pursuit of new geographic opportunities and diversified application areas. Companies in this sector are actively expanding their footprint by entering untapped regions and adapting their products to cater to evolving customer needs across various industries. This includes aligning offerings with emerging trends, such as integrating renewable energy sources and modernizing aging grid infrastructure. Through these efforts, businesses broaden their customer base and refine their solutions to address the specific requirements of different end-use segments. Market development strategies often involve partnerships, joint ventures, and alliances to strengthen market positioning and enhance global reach. By staying responsive to shifting energy demands and technological advancements, companies ensure sustained growth, improved competitiveness, and long-term relevance in the dynamic and essential power transformer market.

- Market Diversification: Market diversification in the power transformer market is a strategic approach aimed at reducing dependency on specific products or markets while unlocking new growth opportunities and enhancing overall business resilience. Companies achieve this by expanding their product portfolios-offering a range of transformer types, voltage capacities, and application-specific solutions-to meet the varying needs of diverse customer segments. This can involve targeting niche markets, developing customized solutions for specialized industries, or adapting products to suit emerging technologies, such as renewable energy integration and smart grid infrastructure. Geographic diversification is another key element, allowing companies to enter new regions or countries with distinct energy demands and regulatory landscapes. Successful diversification relies on a deep understanding of industry trends, customer requirements, and technological innovations, enabling businesses to remain agile in a rapidly evolving market. By embracing a well-rounded diversification strategy, companies can better manage economic uncertainties, capture emerging opportunities, and sustain a competitive edge in the dynamic power transformer landscape.

- Competitive Assessment: An extensive analysis of the market presence, growth plans, and service offerings of major competitors in the power transformer market has been conducted. This research has been applied to notable firms including Hitachi Energy (Japan), Siemens Energy (Germany), Toshiba Energy System & Solution Corporation (Japan), General Electric (US), Hyundai Electric (South Korea), Fuji Electric (Japan), MGM Transformer Company (California), and CG Power and Industrial Solutions (India). The assessment provides an in-depth understanding of these big players' competitive positions, illuminating their growth-oriented strategies and range of offerings in the power transformer market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of primary interview participants

- 2.1.2.2 Key industry insights

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Breakdown of primaries

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION METHODOLOGY

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to arrive at market size using bottom-up analysis (demand side)

- 2.2.1.2 Regional analysis

- 2.2.1.3 Country-level analysis

- 2.2.1.4 Demand-side assumptions

- 2.2.1.5 Demand-side calculations

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to arrive at market size using top-down analysis (supply side)

- 2.2.2.2 Supply-side assumptions

- 2.2.2.3 Supply-side calculations

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET GROWTH FORECAST

- 2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RISK ASSESSMENT

- 2.7 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN POWER TRANSFORMER MARKET

- 4.2 POWER TRANSFORMER MARKET, BY REGION

- 4.3 POWER TRANSFORMER MARKET IN ASIA PACIFIC, BY PHASE AND COUNTRY

- 4.4 POWER TRANSFORMER MARKET, BY POWER RATING

- 4.5 POWER TRANSFORMER MARKET, BY PHASE

- 4.6 POWER TRANSFORMER MARKET, BY COOLING TYPE

- 4.7 POWER TRANSFORMER MARKET, BY END USER

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising focus on grid modernization to meet peak power demand

- 5.2.1.2 Increasing emphasis on renewable energy capacity expansion

- 5.2.2 RESTRAINTS

- 5.2.2.1 Limited budget for grid expansion projects in developing economies

- 5.2.2.2 Shortage of skilled professionals for installing advanced transformers

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rise of decentralized power generation

- 5.2.3.2 Shift from traditional to smart grid infrastructure

- 5.2.4 CHALLENGES

- 5.2.4.1 Cybersecurity threats posed by grid digitalization

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF SUBSTITUTES

- 5.3.2 BARGAINING POWER OF SUPPLIERS

- 5.3.3 BARGAINING POWER OF BUYERS

- 5.3.4 THREAT OF NEW ENTRANTS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 SUPPLY CHAIN ANALYSIS

- 5.5 TECHNOLOGY ANALYSIS

- 5.5.1 KEY TECHNOLOGIES

- 5.5.1.1 High-temperature superconducting (HTS) transformers

- 5.5.2 COMPLEMENTARY TECHNOLOGIES

- 5.5.2.1 Artificial intelligence-based digital fault protection relays

- 5.5.3 ADJACENT TECHNOLOGIES

- 5.5.3.1 Digital twin technology

- 5.5.1 KEY TECHNOLOGIES

- 5.6 KEY CONFERENCES AND EVENTS, 2024

- 5.7 ECOSYSTEM ANALYSIS

- 5.8 PATENT ANALYSIS

- 5.9 CASE STUDY ANALYSIS

- 5.9.1 ABB IMPLEMENTS ONLINE OIL RECLAMATION SERVICE TO ADDRESS DETERIORATING OIL CONDITION OF TRANSFORMERS AT DEESIDE POWER STATION

- 5.9.2 SPECIALIZED EQUIPMENT AND ECO-FRIENDLY TECHNIQUES ADDRESS OIL LEAKS AND ENHANCE TRANSFORMER SAFETY AT CENTRAL CITY SUBSTATION

- 5.9.3 COMPREHENSIVE TESTING AND MAINTENANCE PROGRAMS HELP ADDRESS MINOR LEAKS AND OPERATIONAL HAZARDS OF AGING TRANSFORMERS AT BIG RIVER SUBSTATION

- 5.10 TRADE ANALYSIS

- 5.10.1 IMPORT SCENARIO (HS CODE 850423 AND HS CODE 850434)

- 5.10.2 EXPORT SCENARIO (HS CODE 850423 AND HS CODE 850434)

- 5.11 PRICING ANALYSIS

- 5.11.1 INDICATIVE PRICING ANALYSIS, BY POWER RATING

- 5.11.2 AVERAGE SELLING PRICE TREND, BY REGION

- 5.12 INVESTMENT AND FUNDING SCENARIO

- 5.13 TARIFF AND REGULATORY LANDSCAPE

- 5.13.1 TARIFF ANALYSIS

- 5.13.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.3 CODES AND REGULATIONS

- 5.14 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 IMPACT OF GEN AI/AI IN POWER TRANSFORMER MARKET

- 5.16.1 ADOPTION OF GEN AI/AI IN POWER TRANSFORMER MARKET

- 5.16.2 IMPACT OF GEN AI/AI ON POWER TRANSFORMER MARKET, BY REGION

- 5.17 IMPACT OF 2025 US TARIFF ON POWER TRANSFORMER MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 IMPACT ON COUNTRIES/REGIONS

- 5.17.4.1 US

- 5.17.4.2 Europe

- 5.17.4.3 Asia Pacific

- 5.17.5 IMPACT ON END USERS

6 POWER TRANSFORMER MARKET, BY POWER RATING

- 6.1 INTRODUCTION

- 6.2 UP TO 60 MVA

- 6.2.1 UTILITY SUBSTATION EXPANSION AND RURAL ELECTRIFICATION TO FUEL DEMAND

- 6.3 61-600 MVA

- 6.3.1 RAPID INDUSTRIALIZATION AND GRID INTERCONNECTION PROJECTS TO ACCELERATE SEGMENTAL GROWTH

- 6.4 ABOVE 600 MVA

- 6.4.1 BULK POWER TRANSMISSION AND CROSS-BORDER INTERCONNECTORS TO DRIVE DEMAND

7 POWER TRANSFORMERS MARKET, BY COOLING TYPE

- 7.1 INTRODUCTION

- 7.2 OIL-COOLED

- 7.2.1 EXCELLENT THERMAL PROPERTIES AND RELIABILITY TO FOSTER SEGMENTAL GROWTH

- 7.3 AIR-COOLED

- 7.3.1 SIMPLICITY AND LOW-MAINTENANCE REQUIREMENTS TO SUPPORT MARKET GROWTH

8 POWER TRANSFORMER MARKET, BY PHASE

- 8.1 INTRODUCTION

- 8.2 SINGLE-PHASE

- 8.2.1 LOW MANUFACTURING COSTS AND EASY INSTALLATION TO CONTRIBUTE TO SEGMENTAL GROWTH

- 8.3 THREE-PHASE

- 8.3.1 BALANCED POWER DISTRIBUTION AND HIGH EFFICIENCY TO DRIVE MARKET

9 POWER TRANSFORMER MARKET, BY END USER

- 9.1 INTRODUCTION

- 9.2 UTILITIES

- 9.2.1 INCREASING GOVERNMENT INVESTMENT IN SMART GRID TECHNOLOGIES TO DRIVE MARKET

- 9.3 RESIDENTIAL & COMMERCIAL

- 9.3.1 GROWING DEMAND FOR DISTRIBUTION TRANSFORMERS TO ENSURE UNINTERRUPTED POWER SUPPLY TO FOSTER SEGMENTAL GROWTH

- 9.4 INDUSTRIAL

- 9.4.1 OIL & GAS

- 9.4.1.1 Increasing need for high-efficiency transformers to facilitate pipeline operations to drive market

- 9.4.2 METALS & MINING

- 9.4.2.1 Growing demand for amorphous core transformers for mineral extraction, refining, and processing to foster segmental growth

- 9.4.3 AUTOMOTIVE

- 9.4.3.1 Expansion of electric vehicle charging infrastructure to boost segmental growth

- 9.4.4 FOOD & BEVERAGES

- 9.4.4.1 Increasing reliance on food refrigeration and freezing units to contribute to market growth

- 9.4.5 POWER GENERATION

- 9.4.5.1 Rising emphasis on grid modernization and sustainability to fuel demand

- 9.4.6 DATA CENTERS

- 9.4.6.1 Growing demand for UPS transformers to ensure uninterrupted operation to fuel segmental growth

- 9.4.7 OTHER INDUSTRIES

- 9.4.1 OIL & GAS

10 POWER TRANSFORMER MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 US

- 10.2.1.1 Rising preference for renewable energy sources to contribute to market growth

- 10.2.2 CANADA

- 10.2.2.1 Increasing government initiatives to support grid modernization and increase energy efficiency to drive market

- 10.2.3 MEXICO

- 10.2.3.1 Growing population and industrialization to contribute to market growth

- 10.2.1 US

- 10.3 EUROPE

- 10.3.1 GERMANY

- 10.3.1.1 Rising emphasis on transitioning to sustainable energy sources to maintain grid resilience to propel market

- 10.3.2 UK

- 10.3.2.1 Increasing focus on achieving net-zero carbon footprint and modernizing grid to fuel market growth

- 10.3.3 ITALY

- 10.3.3.1 Mounting government investment in power transmission and distribution networks to drive market

- 10.3.4 FRANCE

- 10.3.4.1 Rising concerns about aging infrastructure to contribute to market growth

- 10.3.5 SPAIN

- 10.3.5.1 Escalating private investment in smart grid infrastructure to foster market growth

- 10.3.6 REST OF EUROPE

- 10.3.1 GERMANY

- 10.4 ASIA PACIFIC

- 10.4.1 CHINA

- 10.4.1.1 Rapid industrialization and infrastructural development to accelerate market growth

- 10.4.2 INDIA

- 10.4.2.1 Growth of electric vehicle charging infrastructure to drive market

- 10.4.3 JAPAN

- 10.4.3.1 Heightened emphasis on integrating smart grids and renewable energy to fuel market growth

- 10.4.4 SOUTH KOREA

- 10.4.4.1 Robust energy infrastructure and grid modernization efforts to drive demand

- 10.4.5 AUSTRALIA

- 10.4.5.1 Shift to renewable energy sources to contribute to market growth

- 10.4.6 REST OF ASIA PACIFIC

- 10.4.1 CHINA

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 GCC COUNTRIES

- 10.5.1.1 Saudi Arabia

- 10.5.1.1.1 Transition from petroleum to balanced mix of natural gas and renewable energy for power generation to drive market

- 10.5.1.2 UAE

- 10.5.1.2.1 Implementation of initiatives to increase access to reliable and sustainable electricity to augment market growth

- 10.5.1.3 Rest of GCC countries

- 10.5.1.1 Saudi Arabia

- 10.5.2 SOUTH AFRICA

- 10.5.2.1 Increasing investment in power infrastructure due to industrialization to fuel market growth

- 10.5.3 REST OF MIDDLE EAST & AFRICA

- 10.5.1 GCC COUNTRIES

- 10.6 SOUTH AMERICA

- 10.6.1 BRAZIL

- 10.6.1.1 Increasing electricity consumption due to economic development and urbanization to accelerate market growth

- 10.6.2 ARGENTINA

- 10.6.2.1 Rising power generation from renewable sources to fuel market growth

- 10.6.3 REST OF SOUTH AMERICA

- 10.6.1 BRAZIL

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2025

- 11.3 MARKET SHARE ANALYSIS, 2024

- 11.4 REVENUE ANALYSIS, 2020-2024

- 11.5 COMPANY VALUATION AND FINANCIAL METRICS

- 11.6 BRAND/PRODUCT COMPARISON

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- 11.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.7.5.1 Company footprint

- 11.7.5.2 Region footprint

- 11.7.5.3 Phase footprint

- 11.7.5.4 Power rating footprint

- 11.7.5.5 Cooling type footprint

- 11.7.5.6 End user footprint

- 11.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- 11.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.8.5.1 Detailed list of key startups/SMEs

- 11.8.5.2 Competitive benchmarking of key startups/SMEs

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 DEALS

- 11.9.3 EXPANSIONS

- 11.9.4 OTHER DEVELOPMENTS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 SIEMENS ENERGY

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Services/Solutions offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Product launches

- 12.1.1.3.2 Deals

- 12.1.1.3.3 Expansions

- 12.1.1.3.4 Other developments

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 HITACHI ENERGY LTD.

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Services/Solutions offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Product launches

- 12.1.2.3.2 Deals

- 12.1.2.3.3 Expansions

- 12.1.2.3.4 Other developments

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 TOSHIBA ENERGY SYSTEMS & SOLUTIONS CORPORATION

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Services/Solutions offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Other developments

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 HD HYUNDAI ELECTRIC CO., LTD.

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Services/Solutions offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Other developments

- 12.1.4.4 MnM view

- 12.1.4.4.1 Key strengths

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses and competitive threats

- 12.1.5 GE VERNOVA

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Services/Solutions offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Product launches

- 12.1.5.3.2 Deals

- 12.1.5.3.3 Expansions

- 12.1.5.3.4 Other developments

- 12.1.5.4 MnM view

- 12.1.5.4.1 Key strengths

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses and competitive threats

- 12.1.6 SCHNEIDER ELECTRIC

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Services/Solutions offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Product launches

- 12.1.6.3.2 Deals

- 12.1.6.3.3 Expansions

- 12.1.6.3.4 Other developments

- 12.1.7 CG POWER AND INDUSTRIAL SOLUTIONS LTD.

- 12.1.7.1 Business Overview

- 12.1.7.2 Products/Services/Solutions offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Deals

- 12.1.7.3.2 Expansions

- 12.1.7.3.3 Other developments

- 12.1.8 MITSUBISHI ELECTRIC CORPORATION

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Services/Solutions offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Deals

- 12.1.8.3.2 Other developments

- 12.1.9 HYOSUNG HEAVY INDUSTRIES

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Services/Solutions offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Expansions

- 12.1.9.3.2 Other developments

- 12.1.10 BHARAT HEAVY ELECTRICALS LIMITED

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Services/Solutions offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Product launches

- 12.1.10.3.2 Expansions

- 12.1.10.3.3 Other developments

- 12.1.11 FUJI ELECTRIC CO., LTD.

- 12.1.11.1 Business overview

- 12.1.11.2 Products/Services/Solutions offered

- 12.1.11.3 Recent developments

- 12.1.11.3.1 Other developments

- 12.1.12 SGB SMIT

- 12.1.12.1 Business overview

- 12.1.12.2 Products/Services/Solutions offered

- 12.1.12.3 Recent developments

- 12.1.12.3.1 Deals

- 12.1.13 WEG

- 12.1.13.1 Business overview

- 12.1.13.2 Products/Services/Solutions offered

- 12.1.13.3 Recent developments

- 12.1.13.3.1 Deals

- 12.1.13.3.2 Expansions

- 12.1.13.3.3 Other developments

- 12.1.14 TRANSFORMERS AND RECTIFIERS (INDIA) LIMITED

- 12.1.14.1 Business overview

- 12.1.14.2 Products/Services/Solutions offered

- 12.1.15 NIAGARA POWER TRANSFORMER LLC

- 12.1.15.1 Business overview

- 12.1.15.2 Products/Services/Solutions offered

- 12.1.16 LS ELECTRIC CO., LTD.

- 12.1.16.1 Business overview

- 12.1.16.2 Products/Services/Solutions offered

- 12.1.16.3 Recent developments

- 12.1.16.3.1 Deals

- 12.1.16.3.2 Expansions

- 12.1.16.3.3 Other development

- 12.1.17 HAMMOND POWER SOLUTIONS

- 12.1.17.1 Business overview

- 12.1.17.2 Products/Services/Solutions offered

- 12.1.18 DAELIM TRANSFORMER

- 12.1.18.1 Business overview

- 12.1.18.2 Products/Services/Solutions offered

- 12.1.19 BEST TRANSFORMER

- 12.1.19.1 Business overview

- 12.1.19.2 Products/Solutions/Services offered

- 12.1.20 WILSON POWER SOLUTIONS LTD.

- 12.1.20.1 Business overview

- 12.1.20.2 Products/Services/Solutions offered

- 12.1.20.3 Recent developments

- 12.1.20.3.1 Other developments

- 12.1.1 SIEMENS ENERGY

- 12.2 OTHER PLAYERS

- 12.2.1 ORMAZABAL

- 12.2.2 ABC TRANSFORMERS (P) LTD.

- 12.2.3 VIJAY POWER

- 12.2.4 JSHP TRANSFORMER

- 12.2.5 CHINT GROUP

13 APPENDIX

- 13.1 INSIGHTS FROM INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS