|

시장보고서

상품코드

1798379

요실금 케어 용품 시장 : 제품별, 유형별, 사용법별, 성별, 최종사용자별, 지역별 - 예측(-2030년)Incontinence Care Products Market by Product (Absorbents, Non-absorbents ), Type, Usage, Gender, End User, Region - Global Forecast to 2030 |

||||||

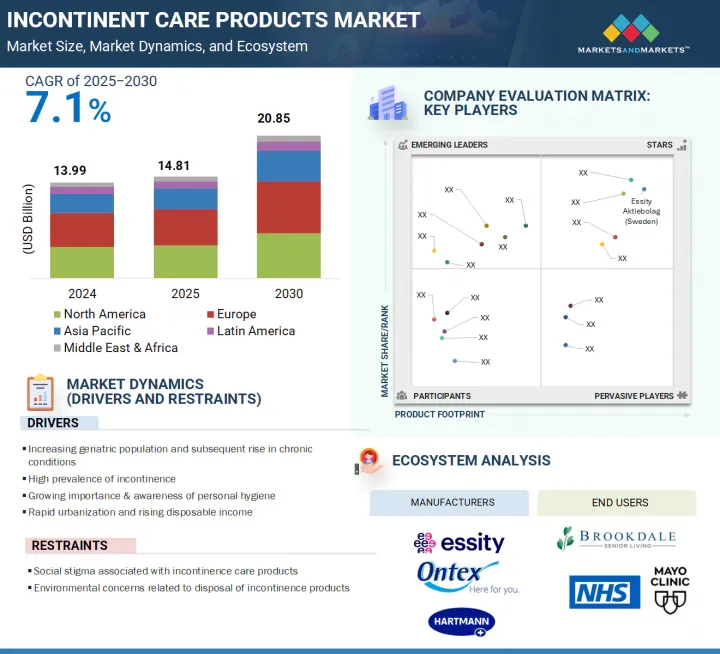

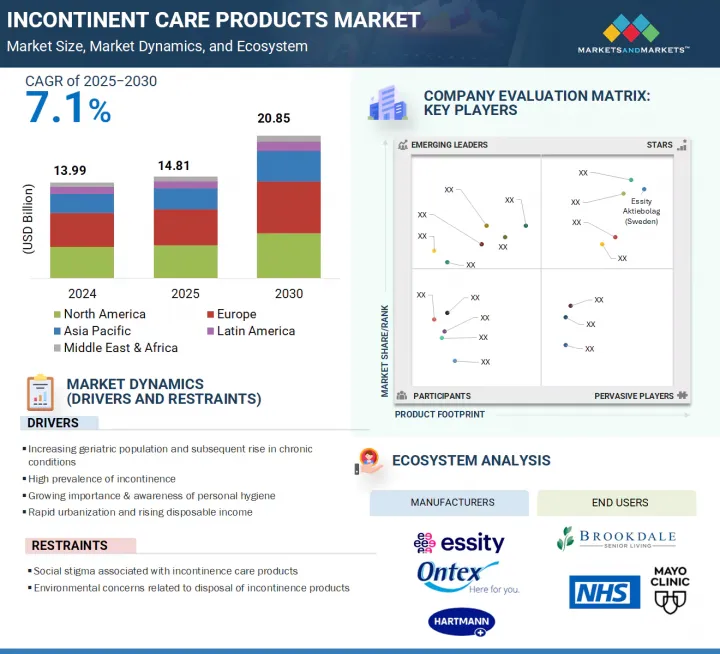

세계의 요실금 케어 용품 시장 규모는 2025년 148억 1,000만 달러에서 2030년까지 208억 5,000만 달러에 이를 것으로 예측되며, 예측 기간에 CAGR 7.1%의 성장이 전망됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2024-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 10억 달러 |

| 부문 | 제품, 유형, 사용법, 성, 최종사용자, 지역 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 라틴아메리카, 중동 및 아프리카 |

인구 통계, 의료, 라이프스타일이 결합하여 요실금 관리 용품(ICP) 시장의 성장을 가속하고 있습니다. 주요 성장 촉진요인은 노령 인구 증가이며, 노령 인구는 노화 관련 질환의 결과로 요실금과 변실금에 걸리기 쉽습니다. 또한, 초박형 흡수체, 소변 누출 방지 장벽, 통기성 천 등의 신규 제품 개발도 시장 성장을 견인할 것으로 보입니다.

제품별로는 흡수체 부문이 예측 기간 동안 가장 높은 CAGR을 나타낼 것으로 예측됩니다.

2024년, 흡수제 부문은 예측 기간 동안 가장 높은 CAGR을 기록했습니다. 흡수제 부문의 성장은 특히 노인과 임신 후 여성의 요실금 비율 증가로 인해 정기적이고 확실한 보호가 필요하기 때문입니다. 또한 통기성 소재 도입, 누출 방지 설계 등 흡수체 케어의 기술 혁신도 시장 성장에 기여할 것으로 예측됩니다.

유형별로는 요실금 부문이 예측 기간 동안 가장 높은 CAGR로 성장할 것으로 예측됩니다.

노화에 따른 골반저근육의 약화, 전립선 문제, 갱년기나 출산에 따른 호르몬 변화가 요실금의 주요 원인입니다. 정부 주도의 인식 제고, 진단율 향상, 신흥 경제권에서의 인식 제고 프로그램 개발도 이 부문의 성장을 가속하고 있습니다.

2024년 유럽은 요실금 관리 용품 시장에서 가장 큰 시장 점유율을 차지했습니다.

유럽은 요실금 용품에 대한 국민건강보험 적용 등 강력한 정부 지원의 혜택을 받고 있으며, 특히 요양원, 노인요양시설 등 시설 환경에서의 채택이 크게 활성화되어 있습니다. 이 지역의 주요 시장 진출기업들도 시장 성장을 가속하는 요인이 될 것으로 예측됩니다.

세계의 요실금 케어 용품 시장에 대해 조사 분석했으며, 주요 촉진요인과 억제요인, 경쟁 구도, 향후 동향 등의 정보를 전해드립니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요 지견

- 요실금 케어 용품 시장 개요

- 유럽 요실금 케어 용품 시장 : 제품별(2024년)

- 지역적 성장 기회

- 요실금 케어 용품 시장 : 지역 목표 구성

- 요실금 케어 용품 시장 : 신흥 시장과 선진 시장

제5장 시장 개요

- 서론

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

- 고객의 비즈니스에 영향을 미치는 동향/혼란

- 가격 결정 분석

- 평균 판매 가격 동향 : 주요 기업별(2022년-2024년)

- 평균 판매 가격 동향 : 지역별(2022년-2024년)

- 평균 판매 가격 동향 : 제품별

- 밸류체인 분석

- 연구 및 제품 개발

- 원재료 조달

- 제조

- 유통, 마케팅, 판매, 애프터서비스

- 공급망 분석

- 저명 기업

- 중소기업

- 최종사용자

- 기술 분석

- 주요 기술

- 보완 기술

- 특허 분석

- 무역 분석

- 요실금 케어 용품(흡수체) 무역 분석

- 요실금 케어 용품(비흡수체) 무역 분석

- 주요 컨퍼런스 및 이벤트(2025년-2026년)

- 규제 분석

- 규제기관, 정부기관, 기타 조직

- 규제 상황

- Porter의 Five Forces 분석

- 주요 이해관계자와 구입 기준

- 요실금 케어 용품 시장에 대한 AI/생성형 AI의 영향

- 서론

- 요실금 케어 용품 시장에서 AI의 가능성

- AI 이용 사례

- AI를 도입하고 있는 주요 기업

- 요실금 케어 용품 시장에서 생성형 AI의 전망

- 요실금 케어 용품 시장에 대한 트럼프 관세 영향

- 서론

- 주요 관세율

- 가격 결정에 대한 관세 영향

- 다양한 지역에 대한 중요 영향

- 최종 이용 산업에 대한 영향

제6장 요실금 케어 용품 시장 : 제품별

- 서론

- 흡수체

- 패드 및 가이드

- 속옷 및 브리프

- 침대 프로텍터

- 기타 흡수체

- 비흡수체

- 카테터

- 배액 백

- 자극 장치

- 기타 비흡수체

제7장 요실금 케어 용품 시장 : 유형별

- 서론

- 요실금

- 변실금

제8장 요실금 케어 용품 시장 : 사용법별

- 서론

- 일회용

- 재사용 가능

제9장 요실금 케어 용품 시장 : 성별

- 서론

- 여성

- 남성

제10장 요실금 케어 용품 시장 : 최종사용자별

- 서론

- 홈케어

- 병원 및 외래수술센터(ASC)

- 기타 최종사용자

제11장 요실금 케어 용품 시장 : 지역별

- 서론

- 유럽

- 유럽의 거시경제 전망

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 북미

- 북미의 거시경제 전망

- 미국

- 캐나다

- 아시아태평양

- 아시아태평양의 거시경제 전망

- 중국

- 일본

- 인도

- 한국

- 기타 아시아태평양

- 라틴아메리카

- 라틴아메리카의 거시경제 전망

- 브라질

- 멕시코

- 기타 라틴아메리카

- 중동 및 아프리카

제12장 경쟁 구도

- 개요

- 주요 시장 진출기업의 전략/강점

- 매출 분석(2022년-2024년)

- 시장 점유율 분석(2024년)

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업 평가 매트릭스 : 중소기업/스타트업(2024년)

- 경쟁 시나리오

제13장 기업 개요

- 주요 기업

- ESSITY AKTIEBOLAG

- KIMBERLY-CLARK CORPORATION

- THE PROCTER & GAMBLE COMPANY

- ONTEX BV

- PAUL HARTMANN AG

- COLOPLAST A/S

- UNICHARM CORPORATION

- CARDINAL HEALTH, INC

- MEDLINE INDUSTRIES, LP

- MCKESSON CORPORATION

- ABENA A/S

- ATTINDAS HYGIENE PARTNERS GROUP

- HOLLISTER INCORPORATED

- DYNAREX CORPORATION

- 기타 기업

- CONVATEC GROUP PLC

- BECTON, DICKINSON AND COMPANY

- DENTSPLY SIRONA

- STRYKER CORPORATION

- FIRST QUALITY ENTERPRISES, INC.

- PRINCIPLE BUSINESS ENTERPRISES, INC.

- TZMO SA

- PRIMARE INTERNATIONAL LTD.

- DRYLOCK TECHNOLOGIES

- NORTHSHORE CARE SUPPLY

- NOBEL HYGIENE PVT. LTD.

제14장 부록

LSH 25.09.02The global incontinence care products market is projected to reach USD 20.85 billion by 2030 from USD 14.81 billion in 2025, at a CAGR of 7.1% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Product, Type, Usage, Gender, End User, and Region |

| Regions covered | North America, Europe, APAC, LATAM, MEA |

A combination of demographic, medical, and lifestyle forces is fueling the growth of the incontinence care products (ICP) market. A key growth driver is the expanding geriatric population, which is susceptible to urinary & fecal incontinence as a result of age-related diseases. Moreover, new developments in products, such as ultra-thin absorbents, anti-leak barriers, and breathable cloths, are also expected to fuel market growth.

By product, the absorbents segment is expected to register the highest CAGR during the forecast period.

By product, the incontinence care products market is categorized into absorbents and non-absorbents. In 2024, the absorbents segment experienced the highest CAGR during the forecast period. The growth of the absorbents segment is attributed to the rising rate of urinary incontinence, especially in elderly people and women after pregnancy, which requires regular and secure protection. Innovations in the technology of absorbent care, such as the introduction of breathable material and anti-leak designs, are also expected to contribute to market growth.

By type, the urinary incontinence segment is expected to grow at the highest CAGR during the forecast period.

By type, the urinary incontinence segment is categorized into urinary and fecal incontinence. The urinary incontinence segment is the fastest-growing segment during the forecast period. Aging-related weakening of pelvic floor muscles, prostate problems, and hormonal changes following menopause and childbirth are the primary causes of urinary incontinence. Government-sponsored awareness, improved diagnosis rates, and the development of awareness programs in emerging economies also fuel growth in the segment.

In 2024, Europe accounted for the largest market share of the incontinence products market.

The global incontinence care products market is segmented into North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. In 2024, Europe accounted for the largest market share. The region benefits from strong government support, including national health insurance coverage for incontinence products, which significantly boosts adoption, especially in institutional settings like nursing homes and elderly care facilities. The region's leading market players are also expected to drive market growth.

A breakdown of the primary participants referred to for this report is provided below:

- By Company Type: Tier 1 (27%), Tier 2 (38%), and Tier 3 (35%)

- By Designation: C-level Executives (28%), Director-level Executives (32%), and Others (40%)

- By Region: North America (25%), Europe (40%), the Asia Pacific (32%), Latin America (2%), and the Middle East & Africa (1%)

Note 1: Companies are classified into tiers based on their total revenue. As of 2024, Tier 1 = >USD 10.0 billion, Tier 2 = USD 1.0 billion to USD 10.0 billion, and Tier 3 = <USD 1.0 billion.

Note 2: C-level executives include CEOs, CFOs, COOs, and VPs.

Note 3: Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

The players operating in the incontinence care products market include Essity Aktiebolag (Sweden), Kimberly-Clark Corporation (US), The Procter & Gamble Company (US), PAUL HARTMANN AG (Germany), Ontex BV (Belgium), Unicharm Corporation (Japan), Coloplast A/S (Denmark), Cardinal Health, Inc. (US), Medline Industries, LP (US), McKesson Corporation (US), ABENA A/S (Denmark), Attindas Hygiene Partners Group (US), and Hollister Incorporated (US), among others.

Research Coverage

This report examines the incontinence care products market by focusing on product, type, usage, gender, end user, and region. It also explores the various elements influencing market growth, including drivers, restraints, opportunities, and challenges, while providing insights into the competitive landscape among market leaders. Additionally, the report analyzes micromarkets by assessing their individual growth trends and forecasting the revenue of market segments across five major regions and their respective countries.

Reasons to Buy the Report

The report will help established and new or smaller firms understand the current market trends, allowing them to increase their market share. Companies that purchase the report can implement one or more of the following strategies to enhance their market presence.

This report provides insights into the following pointers:

- Analysis of key drivers (Increasing geriatric population and subsequent rise in chronic conditions, the high prevalence of incontinence, the growing importance & awareness of personal hygiene, the rapid urbanization & rising disposable income, and the increasing cases of obesity), restraints (social stigma associated with incontinence care products, and environmental concerns related to disposal of incontinence products), opportunities (development of bio-based superabsorbent polymers, the increasing adoption of smart diapers, and expansion of home healthcare), and challenges (underreporting of fecal incontinence and disparities in reimbursement for incontinence care products)

- Market Penetration: Complete knowledge of the spectrum of products presented by the leading companies in the incontinence care products market

- Product Development/Innovation: Comprehensive understanding of the forthcoming trends, research and development initiatives, and product launches within the incontinence care products market

- Market Development: Complete knowledge about profitable developing regions

- Market Diversification: Exhaustive knowledge of new products, expanding geographies, and current changes in the incontinence care products industry helps to diversify the market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players like Essity Aktiebolag (Sweden), Kimberly-Clark Corporation (US), The Procter & Gamble Company (US), PAUL HARTMANN AG (Germany), and Ontex BV (Belgium)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY RESEARCH

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary sources

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Key industry insights

- 2.1.1 SECONDARY RESEARCH

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach 1: Company revenue estimation approach

- 2.2.1.2 Approach 2: Presentations of companies and primary interviews

- 2.2.1.3 Growth forecast

- 2.2.2 TOP-DOWN APPROACH

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN & DATA TRIANGULATION

- 2.4 MARKET SHARE ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.5.1 PARAMETRIC ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 INCONTINENT CARE PRODUCTS MARKET OVERVIEW

- 4.2 EUROPE: INCONTINENT CARE PRODUCTS MARKET, BY PRODUCT (2024)

- 4.3 GEOGRAPHIC GROWTH OPPORTUNITIES

- 4.4 INCONTINENT CARE PRODUCTS MARKET: GEOGRAPHICAL MIX

- 4.5 INCONTINENT CARE PRODUCTS MARKET: EMERGING VS. DEVELOPED MARKETS

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing geriatric population and subsequent rise in chronic conditions

- 5.2.1.2 High prevalence of incontinence

- 5.2.1.3 Growing importance & awareness of personal hygiene

- 5.2.1.4 Rapid urbanization and rising disposable income

- 5.2.1.5 Increasing cases of obesity

- 5.2.2 RESTRAINTS

- 5.2.2.1 Social stigma associated with incontinence care products

- 5.2.2.2 Environmental concerns related to disposal of incontinence products

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Development of bio-based superabsorbent polymers

- 5.2.3.2 Increasing adoption of smart diapers

- 5.2.3.3 Expansion of home healthcare

- 5.2.4 CHALLENGES

- 5.2.4.1 Underreporting of fecal incontinence

- 5.2.4.2 Disparities in reimbursement for incontinence care products

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE TREND, BY KEY PLAYER, 2022-2O24

- 5.4.2 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2024

- 5.4.3 AVERAGE SELLING PRICE TREND, BY PRODUCT

- 5.5 VALUE CHAIN ANALYSIS

- 5.5.1 RESEARCH & PRODUCT DEVELOPMENT

- 5.5.2 RAW MATERIAL PROCUREMENT

- 5.5.3 MANUFACTURING

- 5.5.4 DISTRIBUTION, MARKETING & SALES, AND POST-SALES SERVICES

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.6.1 PROMINENT COMPANIES

- 5.6.2 SMALL & MEDIUM-SIZED ENTERPRISES

- 5.6.3 END USERS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Super Absorbent Polymers (SAPs)

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 Sensor technology

- 5.7.1 KEY TECHNOLOGIES

- 5.8 PATENT ANALYSIS

- 5.9 TRADE ANALYSIS

- 5.9.1 TRADE ANALYSIS FOR INCONTINENT CARE PRODUCTS (ABSORBENTS)

- 5.9.1.1 Import data for HS code 961900

- 5.9.1.2 Export data for HS code 961900

- 5.9.2 TRADE ANALYSIS FOR INCONTINENT CARE PRODUCTS (NON-ABSORBENTS)

- 5.9.2.1 Import data for HS code 901839

- 5.9.2.2 Export data for HS code 901839

- 5.9.1 TRADE ANALYSIS FOR INCONTINENT CARE PRODUCTS (ABSORBENTS)

- 5.10 KEY CONFERENCES & EVENTS, 2025-2026

- 5.11 REGULATORY ANALYSIS

- 5.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11.2 REGULATORY LANDSCAPE

- 5.11.2.1 North America

- 5.11.2.1.1 US

- 5.11.2.1.2 Canada

- 5.11.2.2 Europe

- 5.11.2.3 Asia Pacific

- 5.11.2.3.1 China

- 5.11.2.3.2 Japan

- 5.11.2.3.3 India

- 5.11.2.3.4 South Korea

- 5.11.2.4 Latin America

- 5.11.2.4.1 Brazil

- 5.11.2.4.2 Mexico

- 5.11.2.5 Middle East

- 5.11.2.6 Africa

- 5.11.2.1 North America

- 5.12 PORTER'S FIVE FORCES ANALYSIS

- 5.12.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.12.2 BARGAINING POWER OF SUPPLIERS

- 5.12.3 BARGAINING POWER OF BUYERS

- 5.12.4 THREAT FROM SUBSTITUTES

- 5.12.5 THREAT FROM NEW ENTRANTS

- 5.13 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.13.2 BUYING CRITERIA

- 5.14 IMPACT OF AI/GENERATIVE AI ON INCONTINENT CARE PRODUCTS MARKET

- 5.14.1 INTRODUCTION

- 5.14.2 POTENTIAL OF AI IN INCONTINENT CARE PRODUCTS MARKET

- 5.14.3 AI USE CASES

- 5.14.4 KEY COMPANIES IMPLEMENTING AI

- 5.14.5 FUTURE OF GENERATIVE AI ON INCONTINENT CARE PRODUCTS MARKET

- 5.15 TRUMP TARIFF IMPACT ON INCONTINENT CARE PRODUCTS MARKET

- 5.15.1 INTRODUCTION

- 5.15.2 KEY TARIFF RATES

- 5.15.3 IMPACT OF TARIFFS ON PRICING

- 5.15.4 KEY IMPACT ON VARIOUS REGIONS

- 5.15.4.1 North America

- 5.15.4.2 Europe

- 5.15.4.3 Asia Pacific

- 5.15.5 END-USER INDUSTRY IMPACT

6 INCONTINENT CARE PRODUCTS MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- 6.2 ABSORBENTS

- 6.2.1 PADS & GUARDS

- 6.2.1.1 Ease of use to drive market

- 6.2.2 UNDERWEAR & BRIEFS

- 6.2.2.1 Increased absorbency to fuel demand

- 6.2.3 BED PROTECTORS

- 6.2.3.1 Gradual shift towards home-based care to fuel demand

- 6.2.4 OTHER ABSORBENTS

- 6.2.1 PADS & GUARDS

- 6.3 NON-ABSORBENTS

- 6.3.1 CATHETERS

- 6.3.1.1 Intermittent catheters

- 6.3.1.1.1 Reduced risk of infections to boost market

- 6.3.1.2 Indwelling catheters

- 6.3.1.2.1 Rising usage by critically ill patients to boost demand

- 6.3.1.3 External catheters

- 6.3.1.3.1 Ease of use to boost demand

- 6.3.1.1 Intermittent catheters

- 6.3.2 DRAINAGE BAGS

- 6.3.2.1 Increasing rates of catheterization to support market uptake

- 6.3.3 STIMULATION DEVICES

- 6.3.3.1 Growing use in home settings to drive market

- 6.3.4 OTHER NON-ABSORBENTS

- 6.3.1 CATHETERS

7 INCONTINENT CARE PRODUCTS MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 URINARY INCONTINENCE

- 7.2.1 GROWING PREVALENCE AMONG WOMEN TO DRIVE MARKET

- 7.3 FECAL INCONTINENCE

- 7.3.1 INCREASE IN GERIATRIC POPULATION TO SUPPORT MARKET GROWTH

8 INCONTINENT CARE PRODUCTS MARKET, BY USAGE

- 8.1 INTRODUCTION

- 8.2 DISPOSABLE

- 8.2.1 EASY AVAILABILITY AND CONVENIENCE TO DRIVE MARKET

- 8.3 REUSABLE

- 8.3.1 ENVIRONMENTAL SUSTAINABILITY TO FUEL DEMAND

9 INCONTINENT CARE PRODUCTS MARKET, BY GENDER

- 9.1 INTRODUCTION

- 9.2 FEMALE

- 9.2.1 HIGHER RATE OF INCONTINENCE DUE TO HORMONAL CHANGES TO PROPEL MARKET

- 9.3 MALE

- 9.3.1 RISING PREVALENCE OF BPH TO SUPPORT MARKET GROWTH

10 INCONTINENT CARE PRODUCTS MARKET, BY END USER

- 10.1 INTRODUCTION

- 10.2 HOME CARE

- 10.2.1 COST-EFFICIENCY AND HIGH COMFORT TO PROPEL MARKET

- 10.3 HOSPITALS & AMBULATORY SURGERY CENTERS (ASCS)

- 10.3.1 AVAILABILITY OF CRITICAL CARE SERVICES TO DRIVE DEMAND

- 10.4 OTHER END USERS

11 INCONTINENT CARE PRODUCTS MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 EUROPE

- 11.2.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 11.2.2 GERMANY

- 11.2.2.1 Growing incidence of neurological conditions to boost demand

- 11.2.3 UK

- 11.2.3.1 High prevalence of chronic diseases to drive market

- 11.2.4 FRANCE

- 11.2.4.1 Large target population to support market growth

- 11.2.5 ITALY

- 11.2.5.1 Growing awareness initiatives for urinary & fecal incontinence to fuel market

- 11.2.6 SPAIN

- 11.2.6.1 Increasing prevalence of CKD to drive market

- 11.2.7 REST OF EUROPE

- 11.3 NORTH AMERICA

- 11.3.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 11.3.2 US

- 11.3.2.1 Rising prevalence of incontinence to drive market

- 11.3.3 CANADA

- 11.3.3.1 High incidence of Alzheimer's disease to fuel market

- 11.4 ASIA PACIFIC

- 11.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 11.4.2 CHINA

- 11.4.2.1 Rising prevalence of incontinence among women to propel market

- 11.4.3 JAPAN

- 11.4.3.1 Established healthcare system and favorable reimbursements to drive market

- 11.4.4 INDIA

- 11.4.4.1 R&D initiatives on innovative product development to boost market

- 11.4.5 SOUTH KOREA

- 11.4.5.1 Increasing prevalence of Urinary incontinence to boost market

- 11.4.6 REST OF ASIA PACIFIC

- 11.5 LATIN AMERICA

- 11.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 11.5.2 BRAZIL

- 11.5.2.1 Advancements in ICP products to support market uptake

- 11.5.3 MEXICO

- 11.5.3.1 Rising prevalence of fecal incontinence to support market growth

- 11.5.4 REST OF LATIN AMERICA

- 11.6 MIDDLE EAST & AFRICA

- 11.6.1 IMPROVEMENTS IN HEALTHCARE INFRASTRUCTURE TO SUPPORT MARKET GROWTH

- 11.6.2 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN INCONTINENT CARE PRODUCTS MARKET

- 12.3 REVENUE ANALYSIS, 2022-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- 12.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.5.5.1 Company footprint

- 12.5.5.2 Region footprint

- 12.5.5.3 Product footprint

- 12.5.5.4 Type footprint

- 12.5.5.5 End-user footprint

- 12.6 COMPANY EVALUATION MATRIX: SMES/STARTUPS, 2024

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 STARTING BLOCKS

- 12.6.3 RESPONSIVE COMPANIES

- 12.6.4 DYNAMIC COMPANIES

- 12.7 COMPETITIVE SCENARIO

- 12.7.1 PRODUCT LAUNCHES

- 12.7.2 DEALS

- 12.7.3 EXPANSIONS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 ESSITY AKTIEBOLAG

- 13.1.1.1 Business overview

- 13.1.1.2 Products offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches

- 13.1.1.3.2 Deals

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses & competitive threats

- 13.1.2 KIMBERLY-CLARK CORPORATION

- 13.1.2.1 Business overview

- 13.1.2.2 Products offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Product launches

- 13.1.2.3.2 Deals

- 13.1.2.3.3 Expansions

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses & competitive threats

- 13.1.3 THE PROCTER & GAMBLE COMPANY

- 13.1.3.1 Business overview

- 13.1.3.2 Products offered

- 13.1.3.3 MnM view

- 13.1.3.3.1 Key strengths

- 13.1.3.3.2 Strategic choices

- 13.1.3.3.3 Weaknesses & competitive threats

- 13.1.4 ONTEX BV

- 13.1.4.1 Business overview

- 13.1.4.2 Products offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Product launches

- 13.1.4.3.2 Expansions

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses & competitive threats

- 13.1.5 PAUL HARTMANN AG

- 13.1.5.1 Business overview

- 13.1.5.2 Products offered

- 13.1.5.3 MnM view

- 13.1.5.3.1 Key strengths

- 13.1.5.3.2 Strategic choices

- 13.1.5.3.3 Weaknesses & competitive threats

- 13.1.6 COLOPLAST A/S

- 13.1.6.1 Business overview

- 13.1.6.2 Products offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Product launches

- 13.1.6.3.2 Expansions

- 13.1.7 UNICHARM CORPORATION

- 13.1.7.1 Business overview

- 13.1.7.2 Products offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Product launches

- 13.1.8 CARDINAL HEALTH, INC

- 13.1.8.1 Business overview

- 13.1.8.2 Products offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Expansions

- 13.1.9 MEDLINE INDUSTRIES, LP

- 13.1.9.1 Business overview

- 13.1.9.2 Recent developments

- 13.1.9.2.1 Deals

- 13.1.10 MCKESSON CORPORATION

- 13.1.10.1 Business overview

- 13.1.10.2 Products offered

- 13.1.11 ABENA A/S

- 13.1.11.1 Business overview

- 13.1.11.2 Products offered

- 13.1.11.3 Recent developments

- 13.1.11.3.1 Expansions

- 13.1.12 ATTINDAS HYGIENE PARTNERS GROUP

- 13.1.12.1 Business overview

- 13.1.12.2 Products offered

- 13.1.12.3 Recent developments

- 13.1.12.3.1 Product launches

- 13.1.13 HOLLISTER INCORPORATED

- 13.1.13.1 Business overview

- 13.1.13.2 Products offered

- 13.1.13.3 Recent developments

- 13.1.13.3.1 Expansions

- 13.1.14 DYNAREX CORPORATION

- 13.1.14.1 Business overview

- 13.1.14.2 Products offered

- 13.1.1 ESSITY AKTIEBOLAG

- 13.2 OTHER PLAYERS

- 13.2.1 CONVATEC GROUP PLC

- 13.2.2 BECTON, DICKINSON AND COMPANY

- 13.2.3 DENTSPLY SIRONA

- 13.2.4 STRYKER CORPORATION

- 13.2.5 FIRST QUALITY ENTERPRISES, INC.

- 13.2.6 PRINCIPLE BUSINESS ENTERPRISES, INC.

- 13.2.7 TZMO SA

- 13.2.8 PRIMARE INTERNATIONAL LTD.

- 13.2.9 DRYLOCK TECHNOLOGIES

- 13.2.10 NORTHSHORE CARE SUPPLY

- 13.2.11 NOBEL HYGIENE PVT. LTD.

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS