|

시장보고서

상품코드

1798381

Wi-Fi 칩셋 시장 : IEEE 규격별, 밴드별, MIMO 구성별, 최종 용도별, 업계별 - 예측(-2030년)Wi-Fi Chipset Market by IEEE Standard (802.11be, 802.11ax, 802.11ac), Band (Single & Dual Band, Triband), MIMO Configuration (SU-MIMO, MU-MIMO), End-use Application (Consumer, Smart Home, AR/VR, Networking Devices) and Vertical - Global Forecast to 2030 |

||||||

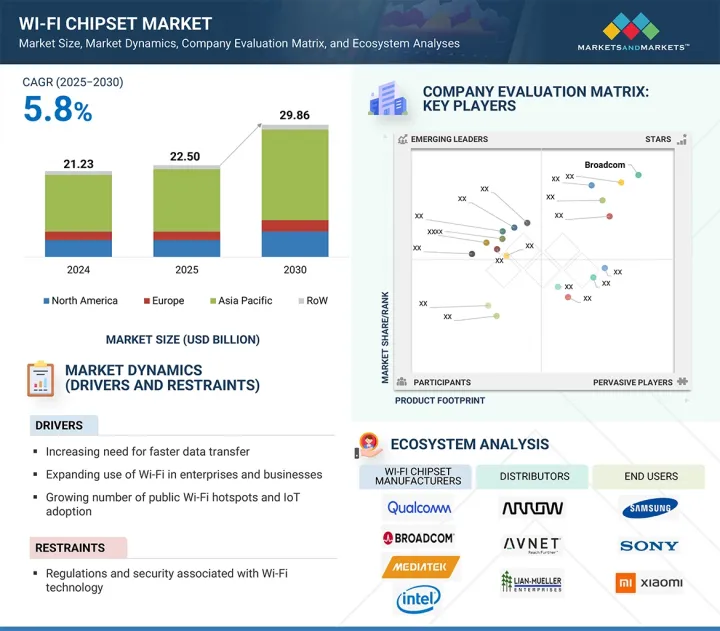

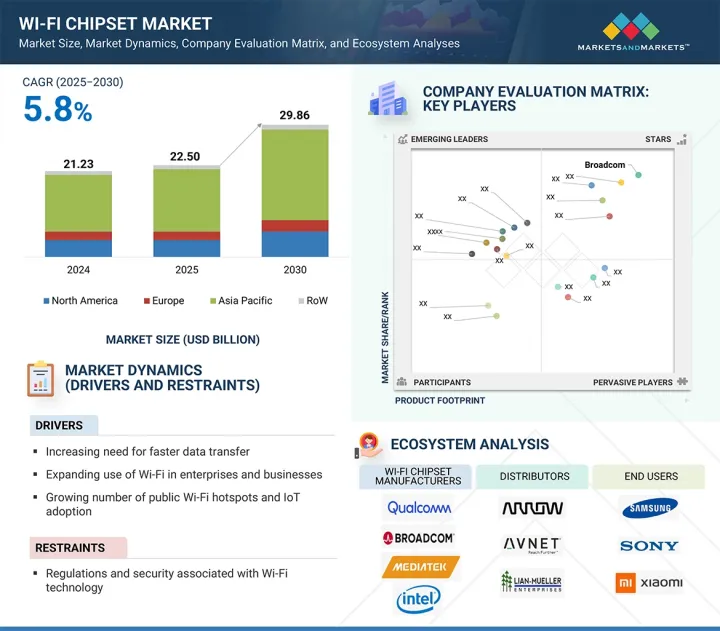

세계의 Wi-Fi 칩셋 시장 규모는 2025년에 225억 달러, 2030년까지 298억 6,000만 달러에 이를 것으로 예측되며, 예측 기간에 CAGR 5.8%의 성장이 전망됩니다.

시장의 주요 촉진요인 중 하나는 소비자, 기업 및 산업 분야에서 고속 인터넷 연결에 대한 수요가 증가하고 있다는 점입니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2021-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 10억 달러 |

| 부문 | IEEE 규격, 밴드, MIMO 구성, 업계, 최종 용도, 지역 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 기타 지역 |

스마트 기기, 스트리밍 서비스, 원격 근무, 온라인 게임 등의 확산에 따라 안정적이고 빠른 무선 통신에 대한 요구가 증가하고 있습니다. Wi-Fi 칩셋은 원활한 데이터 전송, 낮은 지연, 높은 네트워크 효율을 실현합니다. 또한, Wi-Fi 6, 6E, 7과 같은 고급 표준의 출시로 칩셋의 업그레이드가 가속화되고 있습니다. 이러한 추세는 OEM 및 서비스 제공업체들이 차세대 Wi-Fi 솔루션을 채택하도록 유도하고 시장 성장을 가속하고 있습니다.

"트라이밴드 부문은 예측 기간 동안 Wi-Fi 칩셋 시장에서 가장 높은 CAGR을 나타낼 것으로 예측됩니다. "

Wi-Fi 칩셋 시장의 트라이밴드 부문은 고밀도 환경에서 더 높은 대역폭과 네트워크 혼잡 완화에 대한 요구가 증가함에 따라 주도하고 있습니다. 트라이밴드 칩셋은 2.4GHz, 5GHz, 6GHz(Wi-Fi 6E/7)에서 작동하며, 네트워크 효율을 향상시키고 더 많은 장치의 동시 연결을 지원합니다. 따라서 스마트홈, 엔터프라이즈 네트워크, 게임용에 적합합니다. 데이터 소비와 커넥티드 기기의 보급이 증가함에 따라 트라이밴드 와이파이 칩셋에 대한 수요가 급증하여 이 부문의 견조한 성장을 견인할 것으로 예측됩니다.

"소비자 기기 최종 용도 부문이 2030년에 가장 큰 시장 점유율을 차지할 것으로 예측됩니다. "

스마트폰, 노트북, 태블릿, 스마트 TV, 스마트 TV, 홈 오토메이션 제품에 Wi-Fi 기술이 광범위하게 통합됨에 따라 소비자 기기 부문이 2030년 Wi-Fi 칩셋 시장에서 가장 큰 점유율을 차지할 것으로 예측됩니다. 초고속 인터넷, 비디오 스트리밍, 온라인 게임, 스마트 홈 생태계에 대한 전 세계적인 수요 증가로 인해 안정적인 무선 연결에 대한 요구가 계속 증가하고 있습니다. 소비자들이 Wi-Fi 6 및 Wi-Fi 7과 같은 첨단 기술을 점점 더 많이 채택함에 따라 칩셋 제조업체는 진화하는 성능 표준을 충족하기 위해 생산 규모를 확대하고 있습니다. 가전제품의 출하량이 지속적으로 증가함에 따라 이 부문은 전체 시장 수요에 지속적으로 크게 기여하고 있습니다.

"2030년, 중국이 아시아태평양 와이파이 칩셋 시장에서 가장 큰 점유율을 차지할 것입니다. "

중국의 Wi-Fi 칩셋 시장은 탄탄한 가전제품 제조 생태계와 스마트 기기에 대한 강력한 국내 수요에 힘입어 성장하고 있습니다. 이 나라는 스마트폰, 스마트 TV, 노트북, IoT 기기에 광범위하게 Wi-Fi 칩셋을 통합하는 주요 OEM 및 ODM의 거점입니다. 디지털 전환을 지원하기 위한 정부의 이니셔티브, 광범위한 5G-Advanced 네트워크 구축, 스마트시티 개발은 채택을 더욱 가속화할 것입니다. 또한, 중국은 기업, 산업 및 주거용 Wi-Fi 6 및 Wi-Fi 7 기술에 투자하여 그 입지를 강화하고 있습니다. 현지 칩셋 설계자의 존재감 증가와 R&D 비용 증가는 공급망 역량과 기술 혁신 강화에 기여하고 있습니다. 이처럼 대량 생산, 양호한 정책 환경, 최종 사용자 수요 증가가 결합하여 중국은 이 지역의 Wi-Fi 칩셋 시장에서 압도적인 위치를 차지하고 있습니다.

세계의 Wi-Fi 칩셋 시장에 대해 조사 분석했으며, 주요 촉진요인과 억제요인, 경쟁 구도, 향후 동향 등의 정보를 전해드립니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요 지견

- Wi-Fi 칩셋 시장 기업에 있어서 매력적인 기회

- Wi-Fi 칩셋 시장 : 최종 용도별

- Wi-Fi 칩셋 시장 : IEEE 규격별

- Wi-Fi 칩셋 시장 : 밴드별

- 아시아태평양 Wi-Fi 칩셋 시장 : 최종 용도별, 국가별

- Wi-Fi 칩셋 시장 : 지역별

제5장 시장 개요

- 서론

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

- 밸류체인 분석

- 생태계 분석

- 기술 분석

- 주요 기술

- 보완 기술

- 인접 기술

- Porter의 Five Forces 분석

- 사례 연구 분석

- ARUBA Wi-Fi 6 네트워크와 HPE 엣지 라인 서버가 초저지연인 기업 클라우드 접속을 실현

- SOUTHSTAR DRUG, Huawei Wi-Fi 6 네트워크를 활용해 사업 경영을 강화

- DUBAI INTERNATIONAL FINANCIAL CENTRE, 사용자 경험 향상 싶은 Huawei와 제휴해 Wi-Fi 6을 도입

- ATRIA CONVERGENCE TECHNOLOGIES, Huawei Wi-Fi 6을 활용해 상업 기업과 주민에게 강화된 접속을 제공

- 시멘 대학 말레이시아 교, AIRENGINE Wi-Fi 6을 채택 해 고속 네트워크 범위를 제공

- 가격 결정 분석

- 주요 기업이 제공하는 Wi-Fi 칩셋 가격대 : 최종 용도별(2024년)

- Wi-Fi 칩셋 탑재 소비자 디바이스 평균 판매 가격 동향 : 지역별(2021년-2024년)

- 특허 분석

- 무역 분석

- 수입 시나리오(HS코드 851762)

- 수출 시나리오(HS코드 851762)

- 주요 컨퍼런스 및 이벤트(2025년-2026년)

- 규제

- Wi-Fi 칩셋 시장에 대한 AI/생성형 AI의 영향

- Wi-Fi 칩셋 시장에 대한 2025년 미국 관세의 영향

- 서론

- 주요 관세율

- 가격 영향 분석

- 국가/지역에 대한 영향

- 각 업계에 대한 영향

제6장 Wi-Fi 칩셋 시장 : IEEE 규격별

- 서론

- IEEE 802.11 BE(Wi-Fi 7)

- IEEE 802.11 AX(Wi-Fi 6/6 E)

- IEEE 802.11 AC

- IEEE 802.11 AD

- IEEE 802.11 B/G/N

제7장 Wi-Fi 칩셋 시장 : 밴드별

- 서론

- 싱글 밴드 및 듀얼 밴드

- 트라이 밴드

제8장 Wi-Fi 칩셋 시장 : MIMO 구성별

- 서론

- SU-MIMO

- MU-MIMO

- 1x1

- 2x2

- 3x3

- 4x4

- 8x8

제9장 Wi-Fi 칩셋 시장 : 업계별

- 서론

- 소비자 일렉트로닉스

- 기업

- 의료

- 은행, 금융서비스 및 보험(BFSI)

- 소매

- 자동차

- 산업

- 기타 업계

제10장 Wi-Fi 칩셋 시장 : 최종 용도별

- 서론

- 소비자 디바이스

- 스마트폰

- 태블릿

- 랩톱 및 PC

- 카메라

- 스마트홈 디바이스

- 스마트 스피커

- 스마트 TV

- 기타 가전

- 게임기

- AR/VR 디바이스

- 이동 로봇

- 드론

- 네트워크 디바이스

- 게이트웨이 및 라우터

- 액세스 포인트

- MPOS

- 차량내 인포테인먼트

- 기타 최종 용도

제11장 Wi-Fi 칩셋 시장 : 지역별

- 서론

- 북미

- 북미의 거시경제 전망

- 미국

- 캐나다

- 멕시코

- 유럽

- 유럽의 거시경제 전망

- 독일

- 프랑스

- 영국

- 이탈리아

- 기타 유럽

- 아시아태평양

- 아시아태평양의 거시경제 전망

- 중국

- 일본

- 한국

- 기타 아시아태평양

- 기타 지역

- 기타 지역 거시경제 전망

- 중동 및 아프리카

- 남미

제12장 경쟁 구도

- 개요

- 주요 시장 진출기업의 전략/강점(2021년-2025년)

- 매출 분석(2022년-2024년)

- 시장 점유율 분석(2024년)

- 기업 평가와 재무 지표

- 브랜드 비교

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업 평가 매트릭스 : 스타트업/중소기업(2024년)

- 경쟁 시나리오

제13장 기업 개요

- 주요 기업

- QUALCOMM TECHNOLOGIES, INC.

- BROADCOM

- MEDIATEK

- INTEL CORPORATION

- REALTEK SEMICONDUCTOR CORP.

- INFINEON TECHNOLOGIES AG

- NXP SEMICONDUCTORS

- SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC

- RENESAS ELECTRONICS CORPORATION

- ESPRESSIF SYSTEMS

- 기타 기업

- MORSE MICRO

- SENSCOMM SEMICONDUCTOR CO., LTD

- PHARROWTECH

- EDGEWATER WIRELESS INC.

- PERASO TECHNOLOGIES INC.

- KORE WIRELESS

- U-BLOX

- QUECTEL

- TENSORCOM, INC.

- TEXAS INSTRUMENTS INCORPORATED

- SILEX TECHNOLOGY AMERICA, INC.

- NEWRACOM

- BEKEN CORPORATION

- BLUETRUM TECHNOLOGY CO., LTD.

- BESTECHNIC

제14장 부록

LSH 25.09.02The global Wi-Fi chipset market is projected to reach USD 22.50 billion in 2025 and USD 29.86 billion by 2030, registering a CAGR of 5.8% during the forecast period. One key factor driving the Wi-Fi chipset market is the rising demand for high-speed internet connectivity across consumer, enterprise, and industrial applications.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By IEEE Standard, by Band, By MIMO-Configuration, Vertical, End-use Application, and Region |

| Regions covered | North America, Europe, APAC, RoW |

With the proliferation of smart devices, streaming services, remote work, and online gaming, there is an increasing need for reliable and faster wireless communication. Wi-Fi chipsets enable seamless data transfer, lower latency, and higher network efficiency. Moreover, the rollout of advanced standards, such as Wi-Fi 6, 6E, and 7, accelerates chipset upgrades. These trends compel OEMs and service providers to adopt next-generation Wi-Fi solutions, boosting market growth.

"Triband segment is expected to witness the highest CAGR in the Wi-Fi chipset market during the forecast period"

The tri-band segment in the Wi-Fi chipset market is driven by the increasing need for higher bandwidth and reduced network congestion in high-density environments. Tri-band chipsets operate across 2.4 GHz, 5 GHz, and 6 GHz (with Wi-Fi 6E and 7), improving network efficiency and supporting more simultaneous device connections. This makes them ideal for smart homes, enterprise networks, and gaming applications. As data consumption and connected device adoption continue to rise, the demand for tri-band Wi-Fi chipsets is expected to surge, fuelling robust growth in this segment.

"Consumer devices end-use application segment is projected to account for the largest market share in 2030"

The consumer devices segment is expected to capture the largest share of the Wi-Fi chipset market in 2030, due to the widespread integration of Wi-Fi technology in smartphones, laptops, tablets, smart TVs, and home automation products. Rising global demand for high-speed internet, video streaming, online gaming, and smart home ecosystems continues to drive the need for reliable wireless connectivity. As consumers increasingly adopt advanced technologies such as Wi-Fi 6 and Wi-Fi 7, chipset manufacturers are scaling production to meet evolving performance standards. The consistent growth in consumer electronics shipments ensures the segment remains the dominant contributor to overall market demand.

"China to account for largest share of Asia Pacific Wi-Fi chipset market in 2030"

The Wi-Fi chipset market in China is driven by its robust consumer electronics manufacturing ecosystem and strong domestic demand for smart devices. The country is home to leading OEMs and ODMs that integrate Wi-Fi chipsets extensively across smartphones, smart TVs, laptops, and IoT devices. Government initiatives supporting digital transformation, widespread 5G advanced networks deployment, and smart city development further accelerate adoption. Moreover, China's investment in Wi-Fi 6 and Wi-Fi 7 technologies for enterprise, industrial, and residential applications strengthens its position. The growing presence of local chipset designers and increased R&D expenditure contribute to enhanced supply chain capabilities and technological innovation. This combination of high-volume production, favorable policy environment, and expanding end users' demand positions China as the dominant contributor to the region's Wi-Fi chipset market.

Extensive primary interviews were conducted with key industry experts in the Wi-Fi chipset market space to determine and verify the market size for various segments and subsegments gathered through secondary research. The breakup of primary participants for the report is shown below:

The study contains insights from various industry experts, from component suppliers to Tier 1 companies and OEMs. The breakup of the primaries is as follows:

- By Company Type: Tier 1 - 20%, Tier 2 - 55%, and Tier 3 - 25%

- By Designation: C-level Executives - 50%, Directors - 25%, and Managers - 25%

- By Region: North America - 60%, Europe - 20%, Asia Pacific - 10%, and RoW - 10%

Note: RoW includes the Middle East, Africa, and South America. Other designations include product managers, sales managers, and marketing managers. The 3 tiers of the companies have been defined based on their total/segmental revenue as of 2020: Tier 1 = >USD 1,000 million, Tier 2 = USD 100 million to USD 1,000 million, and Tier 3 = <USD 100 million.

Qualcomm Technologies, Inc. (US), Broadcom (US), MediaTek (Taiwan), Intel Corporation (US), Realtek Semiconductor Corp. (Taiwan), Infineon Technologies AG (Germany), NXP Semiconductors (Netherlands), Semiconductor Components Industries, LLC (US), Renesas Electronics Corporation (Japan), and Espressif Systems (China) are some key players in the Wi-Fi chipset market.

The study includes an in-depth competitive analysis of these key players in the Wi-Fi chipset market, with their company profiles, recent developments, and key market strategies.

Study Coverage:

This research report categorizes the Wi-Fi chipset market based on IEEE standard (IEEE 802.11BE (Wifi 7), IEEE 802.11AX (Wifi 6 and 6E), IEEE 802.11AC, IEEE 802.11AD, IEEE 802.11), band (single & dual band, triband), MIMO configuration (SU-MIMO, MU-MIMO), vertical (consumer electronics, enterprise, healthcare, BFSI, retail, automotive, industrial, and other verticals), end-use application (consumer devices, cameras, smart home devices, gaming devices, AR/VR devices mobile robots, drones, networking devices, MPOS (Mobile Point of Sale), in-vehicle infotainment, and other applications), and region [North America (US, Canada, Mexico), Europe (Germany France, UK, Italy, Rest of Europe), Asia Pacific (China Japan, South Korea, Rest of Asia Pacific), and RoW (Middel East & Africa, South America)]. The report describes the major drivers, restraints, challenges, and opportunities pertaining to the Wi-Fi chipset market and forecasts the same till 2030. The report also consists of leadership mapping and analysis of all the companies included in the Wi-Fi chipset ecosystem.

Key Benefits of Buying the Report

The report will help the market leaders/new entrants in this market by providing information on the closest approximations of the revenue numbers for the overall Wi-Fi chipset market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (growing number of public Wi-Fi hotspots and adoption of IoT, expanding use of Wi-Fi in enterprises and businesses, and mounting need for faster data transfer), restraints (regulations and security associated with Wi-Fi technology), opportunities (use of Wi-Fi technology in indoor and outdoor location systems and advancements in AR and VR), and challenges (overcrowding of unlicensed wireless frequency spectrum, coexistence issues with use of GHz 5 GHz band Wi-Fi with LTE in LTE-U) influencing the growth of the Wi-Fi chipset market

- Product Development/Innovation: Detailed insights into upcoming technologies, research and development activities, and the latest product and service launches in the Wi-Fi chipset market

- Market Development: Comprehensive information about lucrative markets - the report analyzes the Wi-Fi chipset market across varied regions

- Market Diversification: Exhaustive information about new products and services, untapped geographies, recent developments, and investments in the Wi-Fi chipset market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players, such as Qualcomm Technologies, Inc. (US), Broadcom (US), MediaTek (Taiwan), Intel Corporation (US), and Realtek Semiconductor Corp. (Taiwan), in the Wi-Fi chipset market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primaries

- 2.1.2.3 Key industry insights

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN WI-FI CHIPSET MARKET

- 4.2 WI-FI CHIPSET MARKET, BY END-USE APPLICATION

- 4.3 WI-FI CHIPSET MARKET, BY IEEE STANDARD

- 4.4 WI-FI CHIPSET MARKET, BY BAND

- 4.5 WI-FI CHIPSET MARKET IN ASIA PACIFIC, BY END-USE APPLICATION AND COUNTRY

- 4.6 WI-FI CHIPSET MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising demand for connected devices with advent of IoT

- 5.2.1.2 Growing focus on improving business and enterprise customer engagement

- 5.2.1.3 Mounting need for faster data transfer

- 5.2.1.4 Increasing internet penetration in developed regions

- 5.2.2 RESTRAINTS

- 5.2.2.1 Identity theft, hacking, and jamming threats

- 5.2.2.2 High power consumption by advanced Wi-Fi technologies

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Improved location capabilities of Wi-Fi chipsets

- 5.2.3.2 Rising integration of AR and VR technologies into consumer electronics and enterprise solutions

- 5.2.3.3 Emergence of 802.11be standard

- 5.2.4 CHALLENGES

- 5.2.4.1 Overcrowding of unlicensed wireless frequency spectrums

- 5.2.4.2 Coexistence issues related to use of 5 GHz Wi-Fi band

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 TECHNOLOGY ANALYSIS

- 5.5.1 KEY TECHNOLOGIES

- 5.5.1.1 Radio frequency (RF) front-end design

- 5.5.1.2 System-on-Chip (SoC)

- 5.5.1.3 Complementary metal-oxide semiconductors

- 5.5.2 COMPLEMENTARY TECHNOLOGIES

- 5.5.2.1 Bluetooth and Bluetooth Low Energy (BLE)

- 5.5.2.2 Power management integrated circuits (PMICs)

- 5.5.3 ADJACENT TECHNOLOGIES

- 5.5.3.1 Cellular connectivity (4G/5G/6G)

- 5.5.3.2 Zigbee/Thread/LoRa/Z-Wave

- 5.5.3.3 Ultra-wideband (UWB)

- 5.5.1 KEY TECHNOLOGIES

- 5.6 PORTER'S FIVE FORCES ANALYSIS

- 5.6.1 THREAT OF NEW ENTRANTS

- 5.6.2 THREAT OF SUBSTITUTES

- 5.6.3 BARGAINING POWER OF SUPPLIERS

- 5.6.4 BARGAINING POWER OF BUYERS

- 5.6.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.7 CASE STUDY ANALYSIS

- 5.7.1 ARUBA WI-FI 6 NETWORK AND HPE EDGELINE SERVERS HELP ENTERPRISE CONNECT TO CLOUD WITH ULTRA-LOW LATENCY

- 5.7.2 SOUTHSTAR DRUG LEVERAGES HUAWEI'S WI-FI 6 NETWORK TO ENHANCE BUSINESS OPERATIONS

- 5.7.3 DUBAI INTERNATIONAL FINANCIAL CENTRE PARTNERS WITH HUAWEI TO LAUNCH WI-FI 6 TO IMPROVE USER EXPERIENCE

- 5.7.4 ATRIA CONVERGENCE TECHNOLOGIES USES HUAWEI'S WI-FI 6 TO PROVIDE ENHANCED CONNECTIONS ACROSS COMMERCIAL ENTERPRISES AND RESIDENTS

- 5.7.5 XIAMEN UNIVERSITY MALAYSIA ADOPTS AIRENGINE WI-FI 6 TO PROVIDE HIGH-SPEED NETWORK COVERAGE

- 5.8 PRICING ANALYSIS

- 5.8.1 PRICING RANGE OF WI-FI CHIPSETS OFFERED BY KEY PLAYERS, BY END-USE APPLICATION, 2024

- 5.8.2 AVERAGE SELLING PRICE TREND OF CONSUMER DEVICES POWERED BY WI-FI CHIPSETS, BY REGION, 2021-2024

- 5.9 PATENT ANALYSIS

- 5.10 TRADE ANALYSIS

- 5.10.1 IMPORT SCENARIO (HS CODE 851762)

- 5.10.2 EXPORT SCENARIO (HS CODE 851762)

- 5.11 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.12 REGULATIONS

- 5.13 IMPACT OF AI/GEN AI ON WI-FI CHIPSET MARKET

- 5.13.1 INTRODUCTION

- 5.14 IMPACT OF 2025 US TARIFF ON WI-FI CHIPSET MARKET

- 5.14.1 INTRODUCTION

- 5.14.2 KEY TARIFF RATES

- 5.14.3 PRICE IMPACT ANALYSIS

- 5.14.4 IMPACT ON COUNTRIES/REGIONS

- 5.14.4.1 US

- 5.14.4.2 Europe

- 5.14.4.3 Asia Pacific

- 5.14.5 IMPACT ON VERTICALS

6 WI-FI CHIPSET MARKET, BY IEEE STANDARD

- 6.1 INTRODUCTION

- 6.2 IEEE 802.11BE (WI-FI 7)

- 6.2.1 MOUNTING DEMAND FOR ULTRA-HIGH-SPEED, LOW-LATENCY CONNECTIVITY TO BOOST SEGMENTAL GROWTH

- 6.3 IEEE 802.11AX (WI-FI 6 & 6E)

- 6.3.1 INCREASING USE TO EXPAND SPECTRAL EFFICIENCY AND ACHIEVE POWER EFFICIENCY TO AUGMENT SEGMENTAL GROWTH

- 6.4 IEEE 802.11AC

- 6.4.1 ABILITY TO OFFER PERFORMANCE AND DENSITY GAIN IN MODERN SMARTPHONES, TABLETS, AND PCS TO BOOST SEGMENTAL GROWTH

- 6.5 IEEE 802.11AD

- 6.5.1 ABILITY TO INCREASE POSSIBILITY OF FREQUENCY RE-USE AND SECURITY DUE TO LIMITED RANGE TO FUEL SEGMENTAL GROWTH

- 6.6 IEEE 802.11B/G/N

- 6.6.1 HIGH THROUGHPUT, RANGE, AND COVERAGE OF WI-FI NETWORKS TO CONTRIBUTE TO SEGMENTAL GROWTH

7 WI-FI CHIPSET MARKET, BY BAND

- 7.1 INTRODUCTION

- 7.2 SINGLE & DUAL-BAND

- 7.2.1 INCREASING USE IN ENTRY-LEVEL AND MID-TIER CONSUMER ELECTRONICS APPLICATIONS TO ACCELERATE SEGMENTAL GROWTH

- 7.3 TRI-BAND

- 7.3.1 RISING NETWORK CONGESTION TO CONTRIBUTE TO SEGMENTAL GROWTH

8 WI-FI CHIPSET MARKET, BY MIMO CONFIGURATION

- 8.1 INTRODUCTION

- 8.2 SU-MIMO

- 8.2.1 INCREASING THROUGHPUT AND COST TRADE-OFFS TO DRIVE MARKET

- 8.3 MU-MIMO

- 8.3.1 1X1

- 8.3.1.1 Rising deployment in budget smartphones and tablets to augment segmental growth

- 8.3.2 2X2

- 8.3.2.1 High data transfer rate and use in smartphones to contribute to segmental growth

- 8.3.3 3X3

- 8.3.3.1 Growing incorporation in high-end laptops to bolster segmental growth

- 8.3.4 4X4

- 8.3.4.1 Increasing use in premium in-vehicle infotainment systems, enterprise-grade access points, and high-end consumer devices to drive market

- 8.3.5 8X8

- 8.3.5.1 Support for simultaneous spatial streams and low power consumption to fuel segmental growth

- 8.3.1 1X1

9 WI-FI CHIPSET MARKET, BY VERTICAL

- 9.1 INTRODUCTION

- 9.2 CONSUMER ELECTRONICS

- 9.2.1 HIGH ADOPTION OF SMART APPLIANCES, SMARTPHONES, AND LAPTOPS TO BOOST SEGMENTAL GROWTH

- 9.3 ENTERPRISE

- 9.3.1 GROWING EMPHASIS ON OPERATIONAL EFFICIENCY, WORKPLACE FLEXIBILITY, AND CENTRALIZED DATA MANAGEMENT TO DRIVE MARKET

- 9.4 HEALTHCARE

- 9.4.1 RAPID DIGITALIZATION TO ENHANCE CARE DELIVERY TO AUGMENT MARKET GROWTH

- 9.5 BFSI

- 9.5.1 RISING IMPORTANCE OF SHARING CRITICAL INFORMATION ACROSS DEPARTMENTS TO FUEL SEGMENTAL GROWTH

- 9.6 RETAIL

- 9.6.1 GROWING FOCUS ON IMPROVING CUSTOMER EXPERIENCE AND OPERATIONAL EFFICIENCY TO FOSTER SEGMENTAL GROWTH

- 9.7 AUTOMOTIVE

- 9.7.1 INCREASING IOT DEPLOYMENT TO MODERNIZE VEHICLE INFRASTRUCTURE TO EXPEDITE SEGMENTAL GROWTH

- 9.8 INDUSTRIAL

- 9.8.1 RISING ADOPTION OF INNOVATIVE TECHNOLOGIES TO TACKLE CONNECTIVITY PROBLEMS TO ACCELERATE SEGMENTAL GROWTH

- 9.9 OTHER VERTICALS

10 W-FI CHIPSET MARKET, BY END-USE APPLICATION

- 10.1 INTRODUCTION

- 10.2 CONSUMER DEVICES

- 10.2.1 SMARTPHONES

- 10.2.1.1 Rising internet connectivity for personal and business purposes to augment segmental growth

- 10.2.2 TABLETS

- 10.2.2.1 Growing popularity of wireless technologies to contribute to segmental growth

- 10.2.3 LAPTOPS & PCS

- 10.2.3.1 Increasing preference for ultrabooks to accelerate segmental growth

- 10.2.1 SMARTPHONES

- 10.3 CAMERAS

- 10.3.1 RISING GOVERNMENT SPENDING ON SECURITY SYSTEMS IN DEVELOPING COUNTRIES TO FUEL SEGMENTAL GROWTH

- 10.4 SMART HOME DEVICES

- 10.4.1 SMART SPEAKERS

- 10.4.1.1 Improvement in form factors and innovations to bolster segmental growth

- 10.4.2 SMART TVS

- 10.4.2.1 Rapid advances in wireless connectivity technology and price optimization to expedite segmental growth

- 10.4.3 OTHER APPLIANCES

- 10.4.1 SMART SPEAKERS

- 10.5 GAMING DEVICES

- 10.5.1 REQUIREMENT FOR HIGH-SPEED INTERNET CONNECTION TO FOSTER SEGMENTAL GROWTH

- 10.6 AR/VR DEVICES

- 10.6.1 DEPLOYMENT OF ADVANCED TECHNOLOGIES IN RETAIL SECTOR TO ENHANCE CONSUMER EXPERIENCE TO FUEL SEGMENTAL GROWTH

- 10.7 MOBILE ROBOTS

- 10.7.1 EMPHASIS ON IMPROVING EFFICIENCY AND ENERGY CONSUMPTION IN INDUSTRIES TO BOOST SEGMENTAL GROWTH

- 10.8 DRONES

- 10.8.1 GROWING FOCUS ON IMPROVING STABILITY AND ANTENNA CONNECTION TO ACCELERATE SEGMENTAL GROWTH

- 10.9 NETWORKING DEVICES

- 10.9.1 GATEWAYS & ROUTERS

- 10.9.1.1 Burgeoning demand for faster internet connectivity to augment segmental growth

- 10.9.2 ACCESS POINTS

- 10.9.2.1 Ability to establish connections between various devices to boost segmental growth

- 10.9.1 GATEWAYS & ROUTERS

- 10.10 MPOS

- 10.10.1 RISE IN CASELESS TRANSACTIONS TO CONTRIBUTE TO SEGMENTAL GROWTH

- 10.11 IN-VEHICLE INFOTAINMENT

- 10.11.1 EVOLVING CONSUMER PREFERENCES FOR CONNECTED MOBILITY TO DRIVE MARKET

- 10.12 OTHER END-USE APPLICATIONS

11 WI-FI CHIPSET MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 11.2.2 US

- 11.2.2.1 Increasing R&D of low-power, high-throughput wireless technologies to accelerate market growth

- 11.2.3 CANADA

- 11.2.3.1 Early rollout of Wi-Fi 7 technologies across residential and enterprise sectors to fuel market growth

- 11.2.4 MEXICO

- 11.2.4.1 Mounting demand for networking equipment and embedded systems to boost market growth

- 11.3 EUROPE

- 11.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 11.3.2 GERMANY

- 11.3.2.1 Rapid digitalization to upgrade industrial, residential, and public infrastructure to foster market growth

- 11.3.3 FRANCE

- 11.3.3.1 Mounting demand for high-speed connectivity across consumer, industrial, and enterprise sectors to drive market

- 11.3.4 UK

- 11.3.4.1 Growing focus on bringing gigabit-capable broadband to underserved and hard-to-reach areas to augment market growth

- 11.3.5 ITALY

- 11.3.5.1 Accelerated broadband and rural connectivity initiatives to bolster market growth

- 11.3.6 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 11.4.2 CHINA

- 11.4.2.1 Rise in semiconductor manufacturing, smart infrastructure development, and digital economy expansion to drive market

- 11.4.3 JAPAN

- 11.4.3.1 Strong focus on high-performance connectivity in enterprises to contribute to market growth

- 11.4.4 SOUTH KOREA

- 11.4.4.1 Mounting adoption of Wi-Fi 7 technology and robust telecom infrastructure to fuel market growth

- 11.4.5 REST OF ASIA PACIFIC

- 11.5 ROW

- 11.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 11.5.2 MIDDLE EAST & AFRICA

- 11.5.2.1 Rising smartphone adoption and e-learning programs to contribute to market growth

- 11.5.2.2 GCC

- 11.5.2.3 Africa & Rest of Middle East

- 11.5.3 SOUTH AMERICA

- 11.5.3.1 Surging remote work and online education to expedite market growth

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 12.3 REVENUE ANALYSIS, 2022-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS

- 12.6 BRAND COMPARISON

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.7.5.1 Company footprint

- 12.7.5.2 Region footprint

- 12.7.5.3 IEEE standard footprint

- 12.7.5.4 Vertical footprint

- 12.7.5.5 End-use application footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.8.5.1 Detailed list of key startups/SMEs

- 12.8.5.2 Competitive benchmarking of key startups/SMEs

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 QUALCOMM TECHNOLOGIES, INC.

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches

- 13.1.1.3.2 Deals

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths/Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses/Competitive threats

- 13.1.2 BROADCOM

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Product launches

- 13.1.2.3.2 Deals

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths/Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses/Competitive threats

- 13.1.3 MEDIATEK

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product launches

- 13.1.3.3.2 Deals

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths/Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses/Competitive threats

- 13.1.4 INTEL CORPORATION

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 MnM view

- 13.1.4.3.1 Key strengths/Right to win

- 13.1.4.3.2 Strategic choices

- 13.1.4.3.3 Weaknesses/Competitive threats

- 13.1.5 REALTEK SEMICONDUCTOR CORP.

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.2.1 Deals

- 13.1.5.3 MnM view

- 13.1.5.3.1 Key strengths/Right to win

- 13.1.5.3.2 Strategic choices

- 13.1.5.3.3 Weaknesses/Competitive threats

- 13.1.6 INFINEON TECHNOLOGIES AG

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Product launches

- 13.1.6.3.2 Deals

- 13.1.7 NXP SEMICONDUCTORS

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Product launches

- 13.1.8 SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.9 RENESAS ELECTRONICS CORPORATION

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Product launches

- 13.1.9.3.2 Deals

- 13.1.10 ESPRESSIF SYSTEMS

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Product launches

- 13.1.10.3.2 Deals

- 13.1.1 QUALCOMM TECHNOLOGIES, INC.

- 13.2 OTHER PLAYERS

- 13.2.1 MORSE MICRO

- 13.2.2 SENSCOMM SEMICONDUCTOR CO.,LTD

- 13.2.3 PHARROWTECH

- 13.2.4 EDGEWATER WIRELESS INC.

- 13.2.5 PERASO TECHNOLOGIES INC.

- 13.2.6 KORE WIRELESS

- 13.2.7 U-BLOX

- 13.2.8 QUECTEL

- 13.2.9 TENSORCOM, INC.

- 13.2.10 TEXAS INSTRUMENTS INCORPORATED

- 13.2.11 SILEX TECHNOLOGY AMERICA, INC.

- 13.2.12 NEWRACOM

- 13.2.13 BEKEN CORPORATION

- 13.2.14 BLUETRUM TECHNOLOGY CO., LTD.

- 13.2.15 BESTECHNIC

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS