|

시장보고서

상품코드

1798385

블록체인 시장(-2030년) : 제공 구분(플랫폼 서비스(프로페셔널 매니지드)), 프로바이더(애플리케이션, 인프라, 미들웨어), 유형(퍼블릭, 프라이빗, 하이브리드, 컨소시엄), 전개 모드(클라우드, On-Premise)Blockchain Market by Offering (Platforms, Services (Professional, Managed)), Provider (Application, Infrastructure, Middleware), Type (Public, Private, Hybrid, Consortium), Deployment Mode (Cloud, On-Premises) - Global Forecast to 2030 |

||||||

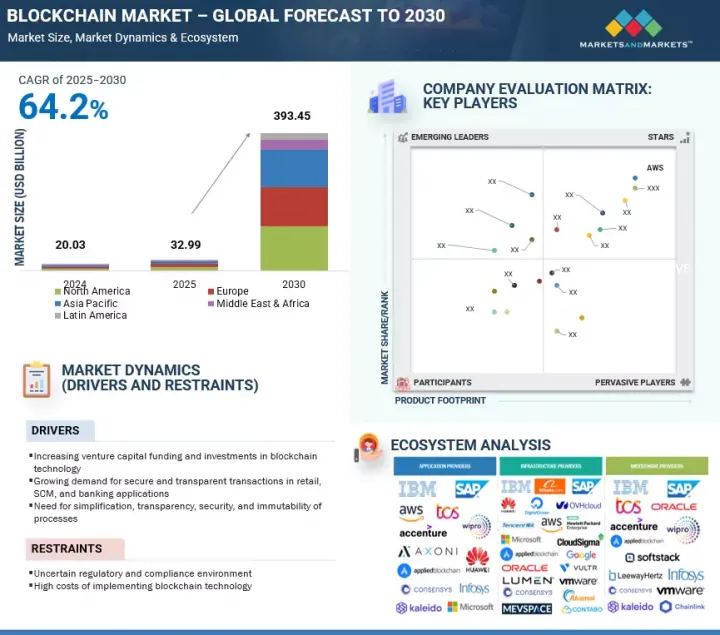

세계의 블록체인 시장 규모는 2025년 329억 9,000만 달러에서 2030년까지 3,934억 5,000만 달러에 이르고, 예측 기간 동안 CAGR 64.2%를 보일 것으로 예측됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2019-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 금액(달러) |

| 부문별 | 제공 구분, 제공업체, 유형, 배포 모드, 조직 규모, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양 및 기타 지역 |

실시간 통찰력에 대한 수요와 신흥 분야로의 확대로 인해 블록체인 도입은 기존 영역을 넘어 가속화되고 있습니다. 제조업과 물류에 있어서는 블록체인 대응의 IoT 센서가 실시간 감시, 예지보전, 이상검출을 가능하게 하여 Industry 4.0 에코시스템의 효율 향상과 다운타임 삭감에 공헌하고 있습니다. 병행하여 블록체인은 녹색 에너지 거래, 디지털 헬스, 지속가능 IT 등의 새로운 분야에도 진출하고 있습니다. 인도의 IT기업은 블록체인을 활용한 그린 크레딧의 대처를 선구적으로 전개하고 있으며, SEWA와 같은 단체는 서비스가 깨끗한 사람들을 위해 안전하고 검증 가능한 건강 기록을 보장하는 블록체인 기반의 디지털 헬스 여권을 도입하고 있습니다.

"제공 구분별로는 플랫폼 부문이 예측 기간 동안 최대 점유율을 차지할 전망"

플랫폼 부문이 시장을 지배하는 이유는 기업이 업계를 넘어 블록체인 용도를 구축하고 배포하기 위한 기반이 되는 확장 가능하고 안전하며 유연한 인프라를 제공하기 때문입니다. IBM, Microsoft Azure, Amazon Managed Blockchain, Oracle, SAP와 같은 주요 공급업체는 암호화 대장, 스마트 계약 및 멀티클라우드 배포를 원활하게 처리하는 엔터프라이즈를 위한 권한 환경을 제공합니다.

2025년 인도의 BaaS(Blockchain as a Service) 플랫폼인 Qila는 프랑스에 최초의 허브를 설립하여 유럽으로 진출해 서유럽 시장으로부터의 수익의 30%를 목표로 한다고 발표해 세계에서 턴키형 블록체인 솔루션에 대한수요의 높이를 부각시켰습니다. 한편 IBM과 SAP가 지원하는 오픈소스 Hyperledger Fabric은 Linux Foundation의 Decentralized Trust 프로젝트에 통합되어 플랫폼 기반 개발에 대한 지속적인 투자를 보여줍니다. 기업이 업무 효율성, 데이터 프라이버시 유지, 시장 출시까지의 시간 단축을 요구하면서 플랫폼 공급자는 필수적인 존재이며 블록체인 시장에서 가장 큰 점유율을 견인하고 있습니다.

"지역별로는 유럽이 두 번째로 큰 지역 점유율을 차지할 것으로 예상"

유럽은 강력한 규제 측면에서의 리더십, 견고한 인프라 개발, 활발한 민간 파트너십을 통해 블록체인 시장에서 두 번째 규모를 차지할 것으로 추정됩니다. 유럽 중앙은행(ECB)의 디지털 유로 구상은 70개 이상의 민간 부문 파트너를 끌어들이면서 2025년 시험 운영 시작을 향해 전진하고 있으며, 유럽을 중앙 은행의 디지털 통화 통합의 선구자로 자리매김하고 있습니다. 동시에 EU의 블록체인 규제 샌드박스는 스타트업 및 금융기관을 대상으로 컴플라이언스 장벽을 줄이고 블록체인 용도의 조기 테스트를 가능하게 합니다. 게다가 Stuttgart의 BX Digital은 블록체인 기반 자산 결제 플랫폼과 관련하여 스위스 승인을 받았으며 그 지위를 강화했습니다. 또한 BNPParibas, 독일 거래소(Deutsche Borse) 및 Goldman Sachs와 같은 주요 금융 기관은 Canton Network 컨소시엄 하에서 블록 체인 인프라를 공동 개발하고 있습니다. 이러한 동향이 종합적으로 유럽의 큰 존재감을 뒷받침하고 있습니다.

본 보고서에서는 세계의 블록체인 시장을 조사했으며, 시장 개요, 시장 성장 영향요인 분석, 기술 및 특허 동향, 법규제 환경, 사례 연구, 시장 규모 추이와 예측, 각종 구분 및 지역/주요 국가별 상세 분석, 경쟁 구도, 주요기업 프로파일 등을 정리했습니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요 인사이트

제5장 시장 개요와 업계 동향

- 시장 역학

- 성장 촉진요인

- 억제요인

- 기회

- 과제

- 사례 연구 분석

- 밸류체인 분석

- 에코시스템

- Porter's Five Forces 분석

- 주요 이해관계자와 구매 기준

- 가격 분석

- 기술 분석

- 특허 분석

- 무역 분석

- 고객의 사업에 영향을 미치는 동향과 혼란

- 규제 상황

- 주요 회의 및 이벤트

- 블록체인 시장 : 비즈니스 모델 분석

- 투자 및 자금조달 시나리오

- 블록체인 기술의 구현

- 집중형 및 허가형 블록체인과 분산형 및 비허가형 블록체인의 비교

- 생성형 AI가 블록체인 시장에 미치는 영향

- 2025년 미국 관세의 영향 개요

제6장 블록체인 시장 : 제공 구분별

- 플랫폼

- 서비스

- 전문 서비스

- 매니지드 서비스

제7장 블록체인 시장 : 제공업체별

- 애플리케이션 프로바이더

- 인프라 제공업체

- 미들웨어 공급자

제8장 블록체인 시장 : 유형별

- 퍼블릭

- 프라이빗

- 하이브리드

- 컨소시엄

제9장 블록체인 시장 : 전개 모드별

- On-Premise

- 클라우드

- 하이브리드

제10장 블록체인 시장 : 조직 규모별

- 중소기업

- 대기업

제11장 블록체인 시장 : 산업별

- 운송 및 물류

- 농업 및 식품

- 제조

- 에너지 및 유틸리티

- 헬스케어 및 생명과학

- 미디어, 광고, 엔터테인먼트

- 은행 및 금융 서비스

- 보험

- IT 및 통신

- 소매 및 E커머스

- 정부

- 부동산 및 건설

- 기타

제12장 블록체인 시장 : 지역별

- 북미

- 블록체인 시장 성장 촉진요인

- 거시경제 전망

- 규제 상황

- 미국

- 캐나다

- 유럽

- 블록체인 시장 성장 촉진요인

- 거시경제 전망

- 규제 상황

- 영국

- 독일

- 프랑스

- 이탈리아

- 기타

- 아시아태평양

- 블록체인 시장 성장 촉진요인

- 거시경제 전망

- 규제 상황

- 중국

- 호주 및 뉴질랜드

- 싱가포르

- 일본

- 인도

- 기타

- 중동 및 아프리카

- 블록체인 시장 성장 촉진요인

- 거시경제 전망

- 규제 상황

- GCC 국가

- 남아프리카

- 기타

- 라틴아메리카

- 블록체인 시장 성장 촉진요인

- 거시경제 전망

- 규제 상황

- 브라질

- 멕시코

- 기타

제13장 경쟁 구도

- 주요 진입기업의 전략/강점

- 수익 분석

- 시장 점유율 분석

- 브랜드 및 제품 비교

- 기업평가와 재무지표

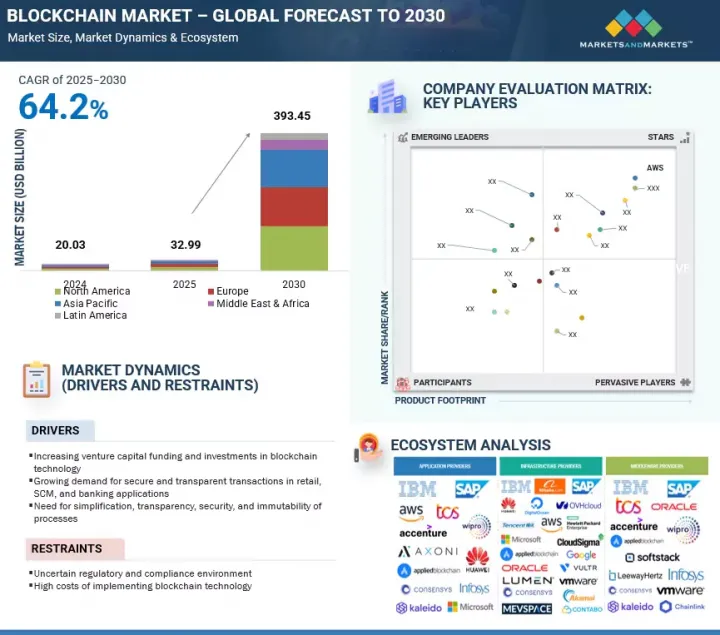

- 기업 평가 매트릭스 : 주요 기업

- 기업 평가 매트릭스 : 스타트업/중소기업

- 기업 평가 매트릭스 : 블록체인 인프라 시장 : 주요 기업

- 경쟁 시나리오와 동향

제14장 기업 프로파일

- 주요 기업

- AWS

- IBM

- ORACLE

- HUAWEI

- ACCENTURE

- OVHCLOUD

- TCS

- ALIBABA

- MICROSOFT

- PANGAEA

- SAP

- HPE

- TENCENT CLOUD

- HETZNER

- WIPRO

- INFOSYS

- LUMEN TECHNOLOGIES

- DIGITALOCEAN

- VMWARE

- AKAMAI TECHNOLOGIES

- APPLIED BLOCKCHAIN

- CONSENSYS

- CONTABO

- LEEWAYHERTZ

- VULTR

- CLOUDSIGMA

- MEVSPACE

- SCALEWAY

- KALEIDO

- CHAINLINK LABS

- ALCHEMY

- BLOCKDAEMON

- QUBETICS

- COREWEAVE

제15장 인접 시장

제16장 부록

JHS 25.09.03The global blockchain market size is projected to grow from USD 32.99 billion in 2025 to USD 393.45 billion by 2030 at a compound annual growth rate (CAGR) of 64.2% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/USD Billion) |

| Segments | By Offering, Provider, Type, Deployment Mode, Organization Size, and Region |

| Regions covered | North America, Europe, Asia Pacific, and Rest of the World |

The demand for real-time insights and the expansion into emerging sectors are accelerating blockchain adoption beyond traditional domains. In manufacturing and logistics, blockchain-enabled IoT sensors facilitate real-time monitoring, predictive maintenance, and anomaly detection-boosting efficiency and reducing downtime in Industry 4.0 ecosystems. In parallel, blockchain is entering new verticals such as green energy trading, digital health, and sustainable IT. Indian IT firms are pioneering blockchain-based green credit initiatives, while organizations like SEWA have introduced blockchain-backed digital health passports, ensuring secure and verifiable health records for underserved populations.

"By offering, the platforms segment is projected to account for the largest market share during the forecast period."

The platforms segment dominates the market because it provides the essential foundation-scalable, secure, and flexible infrastructure-for businesses to build and deploy blockchain applications across industries. Leading providers such as IBM, Microsoft Azure, Amazon Managed Blockchain, Oracle, and SAP offer enterprise-grade, permissioned environments that handle encrypted ledgers, smart contracts, and multi-cloud deployments seamlessly. In 2025, Qila, an India-born BaaS platform, expanded to Europe by establishing its first hub in France and aiming for 30% of revenue from Western markets, highlighting global demand for turnkey blockchain solutions. Meanwhile, open-source frameworks like Hyperledger Fabric, backed by IBM and SAP, are being integrated into the Linux Foundation's Decentralized Trust project, illustrating ongoing investment in core platform development. As enterprises seek to streamline operations, maintain data privacy, and accelerate time to market, platform providers remain indispensable and are driving the largest market share in blockchain.

"By region, Europe is estimated to account for the second-largest regional share."

Europe is estimated to account for the second-largest blockchain market due to strong regulatory leadership, robust infrastructure development, and active public-private partnerships. The European Central Bank's digital euro initiative, involving over 70 private sector partners, is advancing toward a 2025 pilot launch, positioning Europe as a pioneer in central bank digital currency integration. Simultaneously, the EU Blockchain Regulatory Sandbox is supporting startups and financial institutions by easing compliance hurdles and enabling early testing of blockchain applications. Further strengthening its position, Stuttgart's BX Digital recently gained Swiss approval for a blockchain-based asset settlement platform. Additionally, leading financial firms like BNP Paribas, Deutsche Borse, and Goldman Sachs are co-developing blockchain infrastructure under the Canton Network consortium. These developments collectively drive Europe's substantial market presence.

Breakdown of primaries

The study contains insights from various industry experts, from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: Tier 1 - 35%, Tier 2 - 45%, and Tier 3 - 20%

- By Designation: C-level - 40%, Managers & other Levels - 60%

- By Region: North America - 38%, Europe - 26%, Asia Pacific - 21%, Middle East & Africa - 10%, Latin America - 5%

The key players in the blockchain market include AWS (US), IBM (US), Oracle (US), Huawei (China), Accenture (Ireland), OVHcloud (France), TCS (India), Google (US), Alibaba (China), Microsoft (US), SAP (Germany), HPE (US), Tencent (China), Wipro (India), Infosys (India), Lumen Technologies (US), and DigitalOcean (US).

The study includes an in-depth competitive analysis of the key players in the blockchain market, their company profiles, recent developments, and key market strategies.

Research Coverage

The report segments the blockchain market and forecasts its size by offering (platforms, services), provider (application providers, infrastructure providers, middleware providers), type (public, private, hybrid, consortium), organization size (large enterprises, SMEs), deployment mode (on-premises, cloud, hybrid), vertical (transportation & logistics, agriculture & food, manufacturing, energy & utilities, healthcare & life sciences, media, advertising, & entertainment, banking & financial services, insurance, IT & telecom, government, retail & eCommerce, real estate & construction, and other verticals), and region (North America, Europe, Asia Pacific, Middle East & Africa, and Latin America).

The study also includes an in-depth competitive analysis of the market's key players, their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report

The report will help market leaders and new entrants with information on the closest approximations of the revenue numbers for the overall blockchain market and its subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (increasing venture capital funding and investments in blockchain technology, growing demand for secure and transparent transactions in retail, SCM, and banking applications, need for simplification, transparency, security, and immutability of processes, high adoption of blockchain solutions for payments, smart contracts, and digital identities, low operational costs offered), restraints (uncertain regulatory and compliance environment, high costs of implementing blockchain technology), opportunities (increasing government initiatives to boost demand for blockchain platforms and services, amalgamation of blockchain, IoT, and Al, rising demand for real-time data analysis, enhanced visibility, and proactive maintenance, potential of blockchain technology in novel industries), and challenges (security, privacy, and control of blockchain transactions, limited availability of technical skillsets to implement blockchain technology)

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and product & service launches in the blockchain market

- Market Development: Comprehensive information about lucrative markets - the report analyzes the blockchain market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the blockchain market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as AWS (US), IBM (US), Oracle (US), Huawei (China), Accenture (Ireland), OVHcloud (France), TCS (India), Google (US), Alibaba (China), Microsoft (US), SAP (Germany), HPE (US), Tencent (China), Wipro (India), Infosys (India), Lumen Technologies (US), DigitalOcean (US) in the blockchain market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primary profiles

- 2.1.2.2 Key industry insights

- 2.2 DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 REVENUE ESTIMATES

- 2.4 MARKET FORECAST

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 LIMITATIONS & RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN BLOCKCHAIN MARKET

- 4.2 BLOCKCHAIN MARKET, BY OFFERING

- 4.3 BLOCKCHAIN MARKET, BY SERVICE

- 4.4 BLOCKCHAIN MARKET, BY PROVIDER

- 4.5 BLOCKCHAIN MARKET, BY TYPE

- 4.6 BLOCKCHAIN MARKET, BY DEPLOYMENT MODE

- 4.7 BLOCKCHAIN MARKET, BY ORGANIZATION SIZE

- 4.8 BLOCKCHAIN MARKET, BY KEY REGION AND VERTICAL

- 4.9 BLOCKCHAIN MARKET: INVESTMENT SCENARIO

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increase in venture capital funding and investments in blockchain technology

- 5.2.1.2 Growing demand for secure and transparent transactions in retail, SCM, and banking applications

- 5.2.1.3 Need for simplification, transparency, security, and immutability of processes

- 5.2.1.4 High adoption of blockchain solutions for payments, smart contracts, and digital identities

- 5.2.1.5 Low operational costs offered

- 5.2.2 RESTRAINTS

- 5.2.2.1 Uncertain regulatory and compliance environment

- 5.2.2.2 High cost of implementing blockchain technology

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increase in government initiatives to boost demand for blockchain platforms and services

- 5.2.3.2 Integration of blockchain, IoT, and AI

- 5.2.3.3 Rise in demand for real-time data analysis, enhanced visibility, and proactive maintenance

- 5.2.3.4 Potential of blockchain technology in novel industries

- 5.2.3.4.1 Blockchain gaming

- 5.2.3.4.2 Seafood tracking

- 5.2.3.4.3 Trucking

- 5.2.4 CHALLENGES

- 5.2.4.1 Security, privacy, and control of blockchain transactions

- 5.2.4.2 Limited availability of technical skillsets to implement blockchain technology

- 5.2.1 DRIVERS

- 5.3 CASE STUDY ANALYSIS

- 5.3.1 KEY CASE STUDIES

- 5.3.1.1 Smart Dubai Initiative used blockchain technology for smart transformation

- 5.3.1.2 Rockefeller Foundation established 'ID2020' with support from Accenture

- 5.3.1.3 Blockchain technology enabled retailers to manage their supply chain and inventory cost-effectively

- 5.3.1.4 Estonian government adopted blockchain technology for eSolutions

- 5.3.1.5 Blockchain helped businesses create framework of linked data records through immutable ledger

- 5.3.1.6 IBM partnered with Walmart (US) to track pork in China and mangoes in US to ensure food safety

- 5.3.1.7 Retailers implemented blockchain solutions to ensure customer identification documents are independently checked and verified

- 5.3.1.8 Warranteer Digital offered blockchain application for retailers to improve overall efficiency

- 5.3.1.9 IBM collaborated with Maersk to develop global trade digitalization platform

- 5.3.2 OTHER CASE STUDIES

- 5.3.2.1 IBM Blockchain helped Home Depot streamline supply chain

- 5.3.2.2 Oracle's blockchain platform helped HealthSync transform its supply chain operations

- 5.3.2.3 Walmart used IBM's blockchain platform to reduce wastage of food by improving food safety and traceability

- 5.3.2.4 Virgin Diamond used Netobjex's digital twin platform

- 5.3.2.5 Bumble Bee Seafoods collaborated with SAP to trace the fish supply chain in an Indonesian village

- 5.3.2.6 ICICI Bank and Emirates NBD partnered with EdgeVerve Finacle to pilot first blockchain-based network

- 5.3.2.7 Arab Jordan Investment Bank (AJIB) leveraged Oracle's blockchain platform for cross-border money transfers

- 5.3.2.8 Platon Finance partnered with Broadcom (Symantec) to strengthen crypto platform security

- 5.3.1 KEY CASE STUDIES

- 5.4 VALUE CHAIN ANALYSIS

- 5.4.1 COMPONENT/HARDWARE SUPPLIERS

- 5.4.2 PLANNING & DESIGNING

- 5.4.3 INFRASTRUCTURE & DEPLOYMENT

- 5.4.4 SOLUTION & SERVICE PROVIDERS

- 5.4.5 SYSTEM INTEGRATORS

- 5.4.6 SALES & DISTRIBUTION CHANNELS

- 5.4.7 END USERS

- 5.5 ECOSYSTEM

- 5.6 PORTER'S FIVE FORCES ANALYSIS

- 5.6.1 THREAT OF NEW ENTRANTS

- 5.6.2 THREAT OF SUBSTITUTES

- 5.6.3 BARGAINING POWER OF SUPPLIERS

- 5.6.4 BARGAINING POWER OF BUYERS

- 5.6.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.7 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.7.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.7.2 BUYING CRITERIA

- 5.8 PRICING ANALYSIS

- 5.8.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY PLATFORM

- 5.8.2 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY REGION

- 5.8.3 INDICATIVE PRICING ANALYSIS FOR KEY PLAYERS

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Distributed Ledger Technology (DLT)

- 5.9.1.2 Tokenization

- 5.9.1.3 AI

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 Cloud computing

- 5.9.2.2 IoT

- 5.9.2.3 Digital identity

- 5.9.2.4 Secure multi-party computation (SMC)

- 5.9.3 ADJACENT TECHNOLOGIES

- 5.9.3.1 5G

- 5.9.3.2 Digital twins

- 5.9.1 KEY TECHNOLOGIES

- 5.10 PATENT ANALYSIS

- 5.10.1 LIST OF TOP PATENTS IN BLOCKCHAIN MARKET, 2023-2025

- 5.11 TRADE ANALYSIS

- 5.11.1 IMPORT SCENARIO (HS CODE 8471)

- 5.11.2 EXPORT SCENARIO (HS CODE 8471)

- 5.12 TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.13 REGULATORY LANDSCAPE

- 5.13.1 TARIFFS RELATED TO BLOCKCHAIN PRODUCTS

- 5.13.2 REGULATORY IMPLICATIONS AND INDUSTRY STANDARDS

- 5.13.2.1 Payment Card Industry Data Security Standard (PCI DSS)

- 5.13.2.2 Health Insurance Portability and Accountability Act (HIPAA)

- 5.13.2.3 Sarbanes-Oxley Act (SOX)

- 5.13.2.4 American Blockchains Act of 2023

- 5.13.2.5 General Data Protection Regulation (GDPR)

- 5.13.2.6 Bank Secrecy Act (BSA)

- 5.13.2.7 Executive Order 14067 (2022)

- 5.13.2.8 MiCA (Markets in Crypto-Assets Regulation)

- 5.13.2.9 DORA (Digital Operational Resilience Act)

- 5.13.2.10 Financial Services and Markets Act 2023 (FSMA)

- 5.13.2.11 UK Cryptoasset Regulation Framework

- 5.13.2.12 Payment Services Act (PSA)

- 5.13.2.13 MAS Guidelines

- 5.13.2.14 Prevention of Money Laundering Act (PMLA)

- 5.13.3 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14 KEY CONFERENCES & EVENTS

- 5.15 BLOCKCHAIN MARKET: BUSINESS MODEL ANALYSIS

- 5.16 INVESTMENT & FUNDING SCENARIO

- 5.17 IMPLEMENTATION OF BLOCKCHAIN TECHNOLOGY

- 5.18 COMPARISON BETWEEN CENTRALIZED/PERMISSIONED AND DECENTRALIZED/PERMISSIONLESS BLOCKCHAINS

- 5.18.1 TYPES OF BLOCKCHAIN TECHNOLOGY

- 5.18.1.1 Private blockchain

- 5.18.1.2 Public blockchain

- 5.18.1.3 Permissioned/Hybrid blockchain

- 5.18.1 TYPES OF BLOCKCHAIN TECHNOLOGY

- 5.19 IMPACT OF GENERATIVE AI ON BLOCKCHAIN MARKET

- 5.19.1 TOP USE CASES AND MARKET POTENTIAL

- 5.19.2 IMPACT OF GEN AI ON INTERCONNECTED AND ADJACENT ECOSYSTEMS

- 5.19.2.1 Decentralized Finance (DeFi)

- 5.19.2.2 Web3 & Decentralized Identity (DID)

- 5.19.2.3 Supply Chain

- 5.19.2.4 NFTs & Digital Assets

- 5.19.2.5 Digital Twins & Real-World Asset Tokenization (RWA)

- 5.20 IMPACT OF 2025 US TARIFF OVERVIEW

- 5.20.1 INTRODUCTION

- 5.20.2 KEY TARIFF RATES

- 5.20.3 PRICE IMPACT ANALYSIS

- 5.20.3.1 Strategic shifts and emerging trends

- 5.20.4 IMPACT ON COUNTRY/REGION

- 5.20.4.1 US

- 5.20.4.2 Europe

- 5.20.4.3 Asia Pacific

- 5.20.5 IMPACT ON END-USE INDUSTRIES

6 BLOCKCHAIN MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.1.1 OFFERING: BLOCKCHAIN MARKET DRIVERS

- 6.2 PLATFORMS

- 6.2.1 NEED FOR TRACKING, DOCUMENTING, AND FACILITATING TRANSACTIONS TO DRIVE DEMAND FOR BLOCKCHAIN PLATFORMS

- 6.3 SERVICES

- 6.3.1 FOCUS ON SEAMLESS DEPLOYMENT AND MAINTENANCE OF BLOCKCHAIN TECHNOLOGY AMONG BUSINESSES TO BOOST GROWTH

- 6.3.2 PROFESSIONAL SERVICES

- 6.3.2.1 Technology advisory & consulting

- 6.3.2.2 Development & integration

- 6.3.2.3 Support & maintenance

- 6.3.3 MANAGED SERVICES

7 BLOCKCHAIN MARKET, BY PROVIDER

- 7.1 INTRODUCTION

- 7.1.1 PROVIDERS: BLOCKCHAIN MARKET DRIVERS

- 7.2 APPLICATION PROVIDERS

- 7.2.1 NEED FOR COMPANIES TO LEVERAGE BENEFITS OF BLOCKCHAIN TECHNOLOGY TO DRIVE POPULARITY OF APPLICATION PROVIDERS

- 7.3 INFRASTRUCTURE PROVIDERS

- 7.3.1 INFRASTRUCTURE MANAGEMENT TO HELP MANAGE BACKEND OPERATIONS OF BLOCKCHAIN APPLICATIONS FOR BUSINESSES

- 7.4 MIDDLEWARE PROVIDERS

- 7.4.1 BLOCKCHAIN MIDDLEWARE PROVIDERS TO ENSURE QUICK DEVELOPMENT OF APPLICATIONS AND INTERFACES

8 BLOCKCHAIN MARKET, BY TYPE

- 8.1 INTRODUCTION

- 8.1.1 TYPES: BLOCKCHAIN MARKET DRIVERS

- 8.2 PUBLIC

- 8.2.1 NEED FOR MAINTAINING SAFETY AND TRANSPARENCY OF NETWORKS TO DRIVE DEMAND FOR PUBLIC BLOCKCHAIN SERVICES

- 8.3 PRIVATE

- 8.3.1 PRIVATE BLOCKCHAIN TO PROVIDE OPPORTUNITIES TO LEVERAGE BLOCKCHAIN TECHNOLOGY FOR BUSINESS-TO-BUSINESS USE CASES

- 8.4 HYBRID

- 8.4.1 BLEND OF ESSENTIAL FEATURES OF PUBLIC AND PRIVATE BLOCKCHAIN TO MAKE TRANSACTIONS MORE SECURE

- 8.5 CONSORTIUM

- 8.5.1 CONSORTIUM BLOCKCHAIN TO OFFER ENHANCED SECURITY AND CONTROL WHILE STILL ENABLING COLLABORATION AMONG TRUSTED PARTIES

9 BLOCKCHAIN MARKET, BY DEPLOYMENT MODE

- 9.1 INTRODUCTION

- 9.1.1 DEPLOYMENT MODE: BLOCKCHAIN MARKET DRIVERS

- 9.2 ON-PREMISES

- 9.2.1 ON-PREMISE MODEL APPEALS TO ORGANIZATIONS SEEKING MAXIMUM UPTIME AND RELIABILITY

- 9.3 CLOUD

- 9.3.1 CLOUD BLOCKCHAIN TO PROVIDE ROBUST SECURITY MEASURES AND CONTINUOUS UPDATES, ENSURING BLOCKCHAIN NETWORKS REMAIN SECURE AND UP-TO-DATE

- 9.4 HYBRID

- 9.4.1 HYBRID DEPLOYMENT MODE TO OFFER FLEXIBILITY AND SECURITY TO ORGANIZATIONS

10 BLOCKCHAIN MARKET, BY ORGANIZATION SIZE

- 10.1 INTRODUCTION

- 10.1.1 ORGANIZATION SIZE: BLOCKCHAIN MARKET DRIVERS

- 10.2 SMES

- 10.2.1 NEED FOR GROWTH AND DEVELOPMENT OF SMES TO BOOST POPULARITY OF BLOCKCHAIN SERVICES

- 10.3 LARGE ENTERPRISES

- 10.3.1 FINANCIAL CAPACITY OF LARGE ENTERPRISES TO INCORPORATE NEW TECHNOLOGIES TO DRIVE ADOPTION OF BLOCKCHAIN SERVICES

11 BLOCKCHAIN MARKET, BY VERTICAL

- 11.1 INTRODUCTION

- 11.1.1 VERTICAL: BLOCKCHAIN MARKET DRIVERS

- 11.2 TRANSPORTATION & LOGISTICS

- 11.2.1 NEED FOR CLOSE COORDINATION BETWEEN MULTIPLE PARTIES TO BOLSTER ADOPTION OF BLOCKCHAIN SERVICES

- 11.2.2 TRANSPORTATION & LOGISTICS: BLOCKCHAIN APPLICATIONS

- 11.2.2.1 Financing

- 11.2.2.2 Mobility solutions

- 11.2.2.3 Smart contracts

- 11.2.2.4 Other transportation & logistics applications

- 11.3 AGRICULTURE & FOOD

- 11.3.1 DEMAND FOR SUSTAINABLE FOOD ECOSYSTEM AND FOOD CERTIFICATION TO SPUR GROWTH

- 11.3.2 AGRICULTURE & FOOD: BLOCKCHAIN APPLICATIONS

- 11.3.2.1 Product traceability, tracking, and visibility

- 11.3.2.2 Payment & settlement

- 11.3.2.3 Smart contracts

- 11.3.2.4 Improved quality control & food safety

- 11.4 MANUFACTURING

- 11.4.1 USE OF SMART TAGS AND RFID SENSORS TO ENSURE TRACEABILITY IN MANUFACTURING INDUSTRY

- 11.4.2 MANUFACTURING: BLOCKCHAIN APPLICATIONS

- 11.4.2.1 Predictive maintenance

- 11.4.2.2 Asset tracking & management

- 11.4.2.3 Business process optimization

- 11.4.2.4 Logistics & supply chain management

- 11.4.2.5 Quality control & compliance

- 11.4.2.6 Other manufacturing applications

- 11.5 ENERGY & UTILITIES

- 11.5.1 POWER GRID SUPPLY AND CRITICAL INFRASTRUCTURE MANAGEMENT TO GAIN TRACTION USING BLOCKCHAIN TECHNOLOGY

- 11.5.2 ENERGY & UTILITIES: BLOCKCHAIN APPLICATIONS

- 11.5.2.1 Grid management

- 11.5.2.2 Energy trading

- 11.5.2.3 GRC management

- 11.5.2.4 Payment schemes

- 11.5.2.5 Supply chain management

- 11.5.2.6 Other energy & utility applications

- 11.6 HEALTHCARE & LIFE SCIENCES

- 11.6.1 NEED TO SECURE CRITICAL PATIENT DATA ACROSS NODES TO BOOST DEMAND FOR BLOCKCHAIN

- 11.6.2 HEALTHCARE & LIFE SCIENCES: BLOCKCHAIN APPLICATIONS

- 11.6.2.1 Clinical data exchange & interoperability

- 11.6.2.2 Supply chain management

- 11.6.2.3 Claims adjudication & billing management

- 11.6.2.4 Other healthcare & life science applications

- 11.7 MEDIA, ADVERTISING, AND ENTERTAINMENT

- 11.7.1 TRACTION ACROSS DIGITAL ADVERTISING APPLICATIONS USING BLOCKCHAIN-BASED SMART CONTRACTS TO DRIVE USE OF BLOCKCHAIN SOLUTIONS

- 11.7.2 MEDIA, ADVERTISING, AND ENTERTAINMENT: BLOCKCHAIN APPLICATIONS

- 11.7.2.1 Licensing & rights management

- 11.7.2.2 Digital advertising

- 11.7.2.3 Smart contracts

- 11.7.2.4 Content security

- 11.7.2.5 Online gaming

- 11.7.2.6 Payments

- 11.7.2.7 Other media, advertising, and entertainment applications

- 11.8 BANKING & FINANCIAL SERVICES

- 11.8.1 RISE IN DEMAND FOR DECENTRALIZED BANKING PLATFORMS TO DRIVE MARKET FOR BLOCKCHAIN

- 11.8.2 BANKING & FINANCIAL SERVICES: BLOCKCHAIN APPLICATIONS

- 11.8.2.1 Payments, clearing, and settlement

- 11.8.2.2 Exchanges & remittance

- 11.8.2.3 Smart contracts

- 11.8.2.4 Identity management

- 11.8.2.5 Compliance management/KYC

- 11.8.2.6 Other banking & financial service applications

- 11.9 INSURANCE

- 11.9.1 RAPID AUTOMATION ACROSS INSURANCE AND RISK MANAGEMENT SERVICES TO DRIVE ADOPTION OF BLOCKCHAIN PLATFORMS

- 11.9.2 INSURANCE: BLOCKCHAIN APPLICATIONS

- 11.9.2.1 GRC management

- 11.9.2.2 Death & claims management

- 11.9.2.3 Payments

- 11.9.2.4 Identity management & fraud detection

- 11.9.2.5 Smart contracts

- 11.9.2.6 Other insurance applications

- 11.10 IT & TELECOM

- 11.10.1 NEED FOR PROTECTING SENSITIVE TELECOM DATA TO FUEL DEMAND FOR BLOCKCHAIN SOLUTIONS

- 11.10.2 IT & TELECOM: BLOCKCHAIN APPLICATIONS

- 11.10.2.1 OSS/BSS processes

- 11.10.2.2 Identity management

- 11.10.2.3 Payments

- 11.10.2.4 Smart contracts

- 11.10.2.5 Connectivity provisioning

- 11.10.2.6 Other IT & telecom applications

- 11.11 RETAIL & ECOMMERCE

- 11.11.1 AUTOMATION ACROSS RETAIL CHANNELS FOR CURBING DATA THEFT TO PROPEL GROWTH

- 11.11.2 RETAIL & ECOMMERCE: BLOCKCHAIN APPLICATIONS

- 11.11.2.1 Compliance management

- 11.11.2.2 Identity management

- 11.11.2.3 Loyalty & rewards management

- 11.11.2.4 Payments

- 11.11.2.5 Smart contracts

- 11.11.2.6 Supply chain management

- 11.11.2.7 Other retail & eCommerce applications

- 11.12 GOVERNMENT

- 11.12.1 RISE IN CONCERNS ABOUT IDENTITY THEFT AND BUSINESS FRAUD TO DRIVE SEGMENT GROWTH

- 11.12.2 GOVERNMENT: BLOCKCHAIN APPLICATIONS

- 11.12.2.1 Asset registry

- 11.12.2.2 Identity management

- 11.12.2.3 Payments

- 11.12.2.4 Smart contracts

- 11.12.2.5 Voting

- 11.13 REAL ESTATE & CONSTRUCTION

- 11.13.1 TENANCY AGREEMENTS CREATED USING SMART CONTRACTS TO EASE PROCESS OF TRANSACTIONS BETWEEN PARTIES

- 11.13.2 REAL ESTATE & CONSTRUCTION: BLOCKCHAIN APPLICATIONS

- 11.13.2.1 Tokenization & asset management

- 11.13.2.2 Smart contracts

- 11.13.2.3 Other real estate & construction applications

- 11.14 OTHER VERTICALS

12 BLOCKCHAIN MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 NORTH AMERICA

- 12.2.1 NORTH AMERICA: BLOCKCHAIN MARKET DRIVERS

- 12.2.2 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 12.2.3 NORTH AMERICA: REGULATORY LANDSCAPE

- 12.2.4 US

- 12.2.4.1 Blockchain technology adopted by US federal government to streamline and modernize processes

- 12.2.5 CANADA

- 12.2.5.1 Canada to advance blockchain with sustainability, inclusion, and industry-wide applications

- 12.3 EUROPE

- 12.3.1 EUROPE: BLOCKCHAIN MARKET DRIVERS

- 12.3.2 EUROPE: MACROECONOMIC OUTLOOK

- 12.3.3 EUROPE: REGULATORY LANDSCAPE

- 12.3.4 UK

- 12.3.4.1 BFSI industry uses blockchain for risk management and secure financial transactions

- 12.3.5 GERMANY

- 12.3.5.1 Germany strengthened blockchain ecosystem through digital bond innovation

- 12.3.6 FRANCE

- 12.3.6.1 Utilization of AI, IoT, and blockchain for industrial revolution and digital transformation

- 12.3.7 ITALY

- 12.3.7.1 Substantial stability in blockchain projects with rise in investments

- 12.3.8 REST OF EUROPE

- 12.4 ASIA PACIFIC

- 12.4.1 ASIA PACIFIC: BLOCKCHAIN MARKET DRIVERS

- 12.4.2 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 12.4.3 ASIA PACIFIC: REGULATORY LANDSCAPE

- 12.4.4 CHINA

- 12.4.4.1 Blockchain innovation accelerated through infrastructure investment, stablecoin deployment, and global digital finance expansion

- 12.4.5 AUSTRALIA & NEW ZEALAND

- 12.4.5.1 Australia and New Zealand to drive blockchain growth through institutional pilots and government-led sector integration

- 12.4.6 SINGAPORE

- 12.4.6.1 Supportive regulation and tokenization infrastructure to drive blockchain institutionalization in Singapore

- 12.4.7 JAPAN

- 12.4.7.1 Supply chain 4.0 and web3 integration to fuel Japan's blockchain growth

- 12.4.8 INDIA

- 12.4.8.1 Government to embrace blockchain services to enhance transparency and efficiency in operations

- 12.4.9 REST OF ASIA PACIFIC

- 12.5 MIDDLE EAST & AFRICA

- 12.5.1 MIDDLE EAST & AFRICA: BLOCKCHAIN MARKET DRIVERS

- 12.5.2 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 12.5.3 MIDDLE EAST & AFRICA: REGULATORY LANDSCAPE

- 12.5.4 GCC COUNTRIES

- 12.5.4.1 Central and commercial banks and financial service firms to team up with Fintech and blockchain companies

- 12.5.4.2 KSA

- 12.5.4.3 UAE

- 12.5.4.4 Rest of GCC countries

- 12.5.5 SOUTH AFRICA

- 12.5.5.1 Need for generating awareness about blockchain technology to promote growth

- 12.5.6 REST OF MIDDLE EAST & AFRICA

- 12.6 LATIN AMERICA

- 12.6.1 LATIN AMERICA: BLOCKCHAIN MARKET DRIVERS

- 12.6.2 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 12.6.3 LATIN AMERICA: REGULATORY LANDSCAPE

- 12.6.4 BRAZIL

- 12.6.4.1 Integration of blockchain technology into digital identity applications, documents, and authenticity/identity verification to boost growth

- 12.6.5 MEXICO

- 12.6.5.1 Government initiatives and cross-border innovations to drive blockchain adoption across public services and financial ecosystems

- 12.6.6 REST OF LATIN AMERICA

13 COMPETITIVE LANDSCAPE

- 13.1 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 13.2 REVENUE ANALYSIS

- 13.3 MARKET SHARE ANALYSIS

- 13.4 BRAND/PRODUCT COMPARISON

- 13.5 COMPANY VALUATION AND FINANCIAL METRICS

- 13.5.1 COMPANY VALUATION

- 13.5.2 FINANCIAL METRICS USING EV/EBIDTA

- 13.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.6.1 STARS

- 13.6.2 EMERGING LEADERS

- 13.6.3 PERVASIVE PLAYERS

- 13.6.4 PARTICIPANTS

- 13.6.5 COMPANY FOOTPRINT: KEY PLAYERS

- 13.6.5.1 Company footprint

- 13.6.5.2 Offering footprint

- 13.6.5.3 Service footprint

- 13.6.5.4 Vertical footprint

- 13.6.5.5 Regional footprint

- 13.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.7.1 PROGRESSIVE COMPANIES

- 13.7.2 RESPONSIVE COMPANIES

- 13.7.3 DYNAMIC COMPANIES

- 13.7.4 STARTING BLOCKS

- 13.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES

- 13.7.5.1 Detailed list of key startups/SMEs

- 13.7.5.2 Competitive benchmarking of key startups/SMEs

- 13.8 COMPANY EVALUATION MATRIX: BLOCKCHAIN INFRASTRUCTURE MARKET (KEY PLAYERS), 2024

- 13.8.1 STARS

- 13.8.2 EMERGING LEADERS

- 13.8.3 PERVASIVE PLAYERS

- 13.8.4 PARTICIPANTS

- 13.8.5 COMPANY FOOTPRINT: KEY PLAYERS (INFRASTRUCTURE)

- 13.8.5.1 Overall company footprint

- 13.9 COMPETITIVE SCENARIO AND TRENDS

- 13.9.1 PRODUCT LAUNCHES

- 13.9.2 DEALS

- 13.9.3 EXPANSIONS

14 COMPANY PROFILE

- 14.1 KEY PLAYERS

- 14.1.1 AWS

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Solutions/Services offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Product launches/developments

- 14.1.1.3.2 Deals

- 14.1.1.4 MnM view

- 14.1.1.4.1 Key strengths

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses & competitive threats

- 14.1.2 IBM

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Solutions/Services offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Deals

- 14.1.2.4 MnM view

- 14.1.2.4.1 Key strengths

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses & competitive threats

- 14.1.3 ORACLE

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Solutions/Services offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Product launches/developments

- 14.1.3.3.2 Deals

- 14.1.3.4 MnM view

- 14.1.3.4.1 Key strengths

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses & competitive threats

- 14.1.4 HUAWEI

- 14.1.4.1 Business overview

- 14.1.4.2 Products/Solutions/Services offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Deals

- 14.1.4.4 MnM view

- 14.1.4.4.1 Key strengths

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses & competitive threats

- 14.1.5 ACCENTURE

- 14.1.5.1 Business overview

- 14.1.5.2 Products/Solutions/Services offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Deals

- 14.1.5.4 MnM view

- 14.1.5.4.1 Key strengths

- 14.1.5.4.2 Strategic choices

- 14.1.5.4.3 Weaknesses & competitive threats

- 14.1.6 OVHCLOUD

- 14.1.6.1 Business overview

- 14.1.6.2 Products/Solutions/Services offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Deals

- 14.1.6.3.2 Expansions

- 14.1.7 TCS

- 14.1.7.1 Business overview

- 14.1.7.2 Products/Solutions/Services offered

- 14.1.8 GOOGLE

- 14.1.8.1 Business overview

- 14.1.8.2 Products/Solutions/Services offered

- 14.1.8.3 Recent developments

- 14.1.8.3.1 Product launches/developments

- 14.1.8.3.2 Deals

- 14.1.9 ALIBABA

- 14.1.9.1 Business overview

- 14.1.9.2 Products/Solutions/Services offered

- 14.1.9.3 Recent developments

- 14.1.9.3.1 Deals

- 14.1.10 MICROSOFT

- 14.1.10.1 Business overview

- 14.1.10.2 Products/Solutions/Services offered

- 14.1.10.3 Recent developments

- 14.1.10.3.1 Deals

- 14.1.11 PANGAEA

- 14.1.11.1 Business overview

- 14.1.11.2 Products/Solutions/Services offered

- 14.1.12 SAP

- 14.1.12.1 Business overview

- 14.1.12.2 Products/Solutions/Services offered

- 14.1.13 HPE

- 14.1.13.1 Business overview

- 14.1.13.2 Products/Solutions/Services offered

- 14.1.14 TENCENT CLOUD

- 14.1.15 HETZNER

- 14.1.16 WIPRO

- 14.1.17 INFOSYS

- 14.1.18 LUMEN TECHNOLOGIES

- 14.1.19 DIGITALOCEAN

- 14.1.20 VMWARE

- 14.1.21 AKAMAI TECHNOLOGIES

- 14.1.22 APPLIED BLOCKCHAIN

- 14.1.23 CONSENSYS

- 14.1.24 CONTABO

- 14.1.25 LEEWAYHERTZ

- 14.1.26 VULTR

- 14.1.27 CLOUDSIGMA

- 14.1.28 MEVSPACE

- 14.1.29 SCALEWAY

- 14.1.30 KALEIDO

- 14.1.31 CHAINLINK LABS

- 14.1.32 ALCHEMY

- 14.1.33 BLOCKDAEMON

- 14.1.34 QUBETICS

- 14.1.35 COREWEAVE

- 14.1.1 AWS

15 ADJACENT MARKETS

- 15.1 INTRODUCTION

- 15.2 LIMITATIONS

- 15.3 BLOCKCHAIN SECURITY MARKET

- 15.3.1 MARKET DEFINITION

- 15.4 BLOCKCHAIN IDENTITY MANAGEMENT MARKET

- 15.4.1 MARKET DEFINITION

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS