|

시장보고서

상품코드

1800732

공캡슐 시장 : 유형별, 원재료별, 기능성별, 용도별, 사이즈별, 최종사용자별 - 예측(-2030년)Empty Capsules Market by Type, Raw Material, Functionality, Application, Size, End User - Global Forecast to 2030 |

||||||

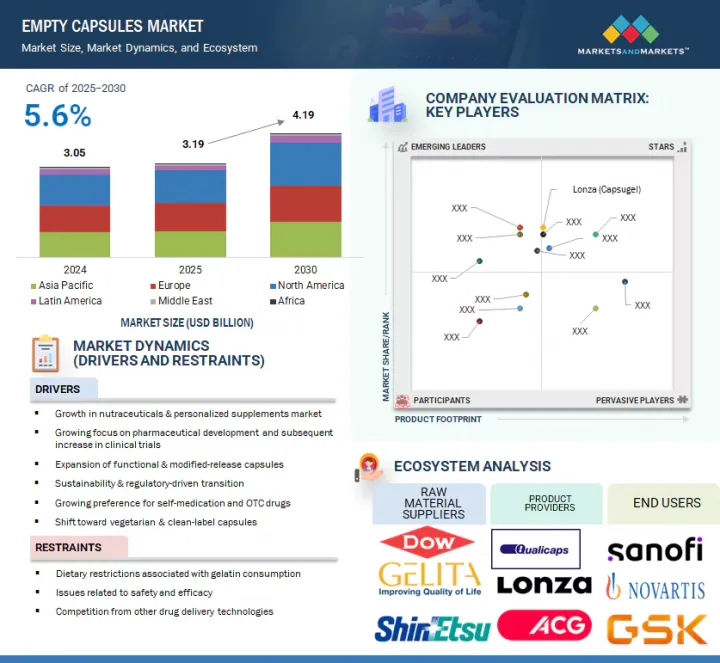

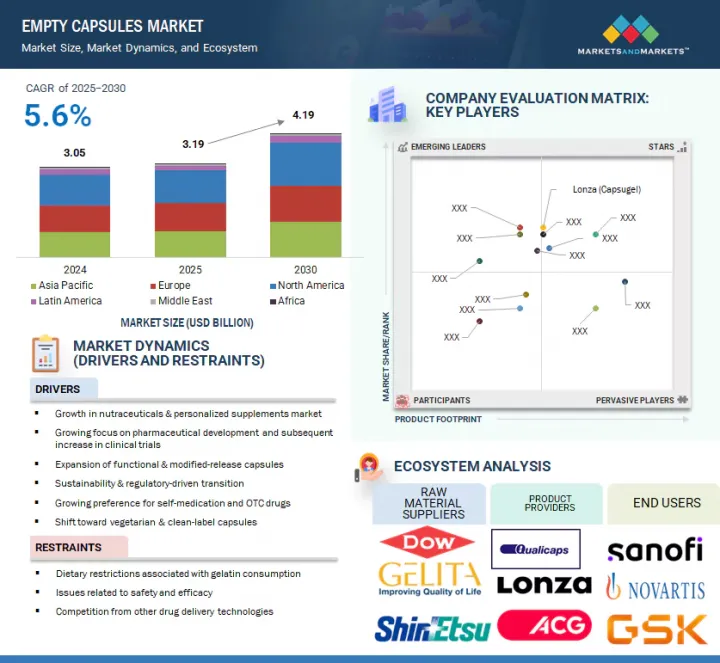

세계의 공캡슐 시장 규모는 2025년 추정 31억 9,000만 달러에서 2030년까지 41억 9,000만 달러에 달할 것으로 예측되며, 2025-2030년 동안 5.6%의 CAGR로 성장할 것으로 전망됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2024-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 10억 달러 |

| 부문 | 유형, 원재료, 기능성, 사이즈, 치료 용도, 최종사용자, 지역 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 라틴아메리카, 중동 및 아프리카 |

이 시장은 건강기능식품 및 맞춤형 보충제에 대한 수요 증가, 의약품 연구개발의 성장, 기능성 캡슐 및 방출 제어 캡슐의 기술 혁신에 의해 활성화되고 있습니다. 채식주의자 및 클린 라벨 지향으로의 현저한 변화, 지속가능성을 중시하는 규제는 그 확산을 더욱 촉진하고 있습니다. 향후 성장은 신흥 시장에서의 현지 생산과 생분해성 캡슐의 창출을 통해 이루어질 가능성이 높습니다.

"돼지 유래 캡슐은 젤라틴 캡슐 시장에서 가장 큰 원료 부문으로 가장 높은 CAGR로 성장할 것으로 예상됩니다."

돼지 젤라틴 캡슐 시장은 가장 큰 원료 카테고리이며, 비용 효율성과 광범위한 가용성으로 인해 예측 기간 동안 가장 높은 성장률을 보일 것으로 예상됩니다. 돼지 젤라틴은 우수한 겔화 특성으로 인해 고체형 및 방출 제어형을 포함한 다양한 약물에 적합하기 때문에 제약 산업 및 건강보조식품 산업에서 널리 사용되고 있습니다.

"제약 산업 부문이 2024년 최종사용자 부문에서 가장 높은 점유율을 차지했습니다."

제약 산업은 공캡슐의 가장 큰 최종사용자이며, 처방약, OTC 의약품, 치료약의 전달에 널리 사용됩니다. 이 캡슐은 일반적으로 항생제, 진통제, 항고혈압제, 만성질환을 관리하는 다른 약물과 같은 고체 약물의 경구 투여에 사용됩니다. 캡슐은 삼키기 쉽고, 정확한 투여가 가능하며, 다양한 약물을 캡슐화할 수 있어 제약 부문에서 선호하는 제형입니다.

북미는 2025-2030년 세계 공캡슐 시장에서 가장 큰 시장이 될 것입니다.

2024년 북미, 특히 미국과 캐나다가 선진화된 제조 인프라와 탄탄한 규제 프레임워크에 힘입어 의약품 및 건강보조식품에 대한 수요가 강해지면서 공캡슐의 최대 시장이 될 것으로 예상됩니다. 기술 혁신에 대한 지속적인 투자를 통해 즉시 방출 및 방출 제어 약물전달과 같은 다양한 용도의 고품질 캡슐이 개발되고 있습니다. 예방 의료와 웰빙에 대한 소비자의 관심에 힘입어 건강기능식품에 대한 수요가 증가하면서 시장 성장을 더욱 촉진하고 있습니다. 또한, 이 지역은 방출 제어 캡슐 및 장용성 코팅 캡슐을 포함한 새로운 약물전달 형태의 채택을 촉진하는 양호한 규제 환경의 혜택을 누리고 있습니다. 또한, 아시아태평양은 의약품 생산능력의 확대, 낮은 생산 비용, 정부 지원 정책으로 인해 이 기간 동안 가장 빠른 성장을 보일 것으로 예상됩니다. 중국, 인도, 한국과 같은 국가들은 숙련된 노동자 인구, 저렴한 비용, 유리한 정책으로 인해 중요한 제조 거점이 되고 있습니다.

세계의 공캡슐 시장에 대해 조사 분석했으며, 주요 촉진요인과 저해요인, 경쟁 상황, 향후 동향 등의 정보를 전해드립니다.

목차

제1장 소개

제2장 조사 방법

제3장 주요 요약

제4장 중요한 인사이트

- 현황 : 세계의 공캡슐 시장, CAGR, 예측(2025-2030년)

- 북미의 공캡슐 시장 : 유형별, 국가별(2024년)

- 공캡슐 시장 : 치료 용도별(2024년)

- 공캡슐 시장 : 최종사용자별(2024년)

- 공캡슐 시장 : 지리적 성장 기회

제5장 시장 개요

- 소개

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

- 산업 동향

- AI 통합 및 개별화된 의약품·보충제 처방과 투여

- 임상시험에서 주문형 제조 시스템과 분산 캡슐 기반 제제

- 임상 연구의 스마트 캡슐과 섭취 가능한 센서의 통합

- 고객 비즈니스에 영향을 미치는 동향/혼란

- 가격 책정 분석

- 공캡슐 평균판매가격 동향 : 유형별(2022-2024년)

- 공캡슐 평균판매가격 동향 : 지역별(2022-2024년)

- 공캡슐 가격에 영향을 미치는 요인

- 기술 분석

- 주요 기술

- 보완 기술

- 인접 기술

- 밸류체인 분석

- 생태계 분석

- 원재료 벤더

- 제품 프로바이더

- 최종사용자

- 규제 당국

- 새로운 비즈니스 모델과 생태계의 변화

- Porter's Five Forces 분석

- 주요 이해관계자와 구입 기준

- 구매 프로세스의 주요 이해관계자

- 주요 구입 기준

- 채용 장벽과 내부 마찰

- 특허 분석

- 특허 조사 방법

- 특허 출원 건수 : 서류 유형별

- 혁신과 특허 출원

- 주요 출원자

- 특허 참고 리스트

- 주요 회의와 이벤트(2025-2026년)

- 무역 분석

- HS 코드 960200 수입과 수출 데이터

- HS 코드 960200 수출입량

- 관세 데이터와 규제 분석

- 관세 데이터 분석

- 규제 프레임워크

- 규제기관, 정부기관, 기타 조직

- 규제상 과제

- 지속가능성에 대한 영향

- 고객 상황

- 미충족 수요와 화이트 스페이스

- 캡슐 구입/조달 모델

- 예산 배분 동향

- 성장 기회 전략적 분석

- 투자와 자금 조달 시나리오

- 공캡슐 시장에 대한 AI/생성형 AI의 영향

- 공캡슐 생산의 AI 시장 가능성

- AI 이용 사례

- AI를 도입하고 있는 주요 기업

- 공캡슐 생태계에서 생성형 AI의 미래

- 공캡슐 시장에 대한 트럼프 관세의 영향(2025년)

- 소개

- 주요 관세율

- 가격의 영향 분석

- 국가/지역에 대한 영향

- 최종 이용 산업에 대한 영향

- 공캡슐 제조 공정

- 원재료 조달

- 처리

- 품질 관리·포장

- 공캡슐 생산능력

- 상호연결 시장 : 의약용 젤라틴 시장 인사이트

제6장 공캡슐 시장 : 유형별

- 소개

- 젤라틴 캡슐

- 비젤라틴 캡슐

제7장 공캡슐 시장 : 원재료별

- 소개

- 젤라틴 캡슐 시장 : 원재료별

- 돼지 젤라틴

- 소 유래 젤라틴

- 골분 젤라틴

- 기타 젤라틴 원료

- 비젤라틴 캡슐 시장 : 원재료별

- 하이드록시프로필 메틸셀룰로오스(HPMC)

- 풀루란·전분

제8장 공캡슐 시장 : 기능별

- 소개

- 즉방성 캡슐

- 방출 제어 캡슐

- 지연 방출 캡슐

제9장 공캡슐 시장 : 사이즈별

- 소개

- 사이즈 0

- 사이즈 00

- 사이즈 1

- 사이즈 2

- 사이즈 000

- 사이즈 3

- 사이즈 4

- 사이즈 5

제10장 공캡슐 시장 : 치료 용도별

- 소개

- 항생제·항균제

- 식이보충제

- 제산제·정장제

- 항빈혈제

- 항염증제

- 심혈관 치료제

- 기침약·감기약

- 기타 치료 용도

제11장 공캡슐 시장 : 최종사용자별

- 소개

- 제약 산업

- 뉴트라슈티컬 산업

- 화장품 산업

- 연구소

제12장 공캡슐 시장 : 지역별

- 소개

- 북미

- 북미의 공캡슐 시장 : 유형별

- 북미의 거시경제 전망

- 미국

- 캐나다

- 유럽

- 유럽의 공캡슐 시장 : 유형별

- 유럽의 거시경제 전망

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 네덜란드

- 기타 유럽

- 아시아태평양

- 아시아태평양의 공캡슐 시장 : 유형별

- 아시아태평양의 거시경제 전망

- 중국

- 인도

- 일본

- 한국

- 호주

- 뉴질랜드

- 기타 아시아태평양

- 라틴아메리카

- 라틴아메리카의 공캡슐 시장 : 유형별

- 라틴아메리카의 거시경제 전망

- 브라질

- 멕시코

- 기타 라틴아메리카

- 중동

- 중동의 공캡슐 시장 : 유형별

- 중동의 거시경제 전망

- GCC 국가

- 기타 중동

- 아프리카

제13장 경쟁 구도

- 소개

- 주요 진출 기업의 전략/강점

- 매출 분석(2020-2024년)

- 시장 점유율 분석(2024년)

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업 평가 매트릭스 : 스타트업/중소기업(2024년)

- 기업 평가와 재무 지표

- 브랜드/제품의 비교

- 경쟁 시나리오

제14장 기업 개요

- 주요 기업

- CAPSUGEL(LONZA)

- ACG

- QUALICAPS(ROQUETTE FRERES)

- SUHEUNG

- HEALTHCAPS INDIA

- NECTAR LIFESCIENCES LTD.

- SUNIL HEALTHCARE LIMITED

- NATURAL CAPSULES LIMITED

- QINGDAO YIQING BIOTECHNOLOGY CO., LTD.(BAOTOU DONGBAO BIO-TECH CO., LTD.)

- COMED CHEMICALS LIMITED

- ANHUI HUANGSHAN CAPSULE CO., LTD.

- FORTCAPS(KUMAR ORGANIC PRODUCTS LIMITED)

- SHANDONG HEALSEE CAPSULE LTD.(SHANDONG HEAD GROUP CO., LTD.)

- CAPSCANADA

- FARMACAPSULAS

- SHANXI GUANGSHENG MEDICINAL CAPSULE CO., LTD.

- ERAWAT PHARMA LIMITED

- 기타 기업

- SAVIOURCAPS

- SHANXI JC BIOLOGICAL TECHNOLOGY CO.

- ROXLOR

- MEDISCA INC.

- ZHEJIANG YUEXI CAPSULE CO., LTD.

- SHAOXING KANGKE CAPSULE CO., LTD.

- ZHEJIANG HUILI CAPSULES CO., LTD.

- SHAOXING ZHONGYA CAPSULE CO., LTD.

- SHING LIH FANG ENTERPRISE CO., LTD.

- LEFANCAPS

- CHEMCAPS LIMITED

- BIOCAPS ENTERPRISE

- SNAIL PHARMA INDUSTRY

- BRIGHT PHARMA CAPS

- SHREE PHARMA CAPS

- HEXIN CAPSULE CO., LTD.

- WUHAN CARMA TECHNOLOGY CO., LTD.

- AIPAK PHARMA

제15장 부록

KSM 25.09.04The global empty capsules market is projected to reach USD 4.19 billion by 2030 from an estimated USD 3.19 billion in 2025, at a CAGR of 5.6% from 2025 to 2030.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Type, Raw Material, Functionality, Size, Therapeutic Application, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, Middle East, and Africa |

The market is fueled by increasing demand for nutraceuticals and personalized supplements, growth in pharmaceutical R&D, and innovations in functional and modified-release capsules. A significant shift toward vegetarian and clean-label options and sustainability-focused regulations is further driving adoption. Future growth is likely to come from localized production in emerging markets and the creation of biodegradable capsules.

"The porcine-derived capsules will continue to be the largest raw material segment in the gelatin capsules market, growing at the highest CAGR."

The gelatin empty capsules market is segmented based on raw material into porcine gelatin, bovine-derived gelatin, bone meal, and other gelatin sources. The non-gelatin capsules market is further categorized into hydroxypropyl methylcellulose (HPMC) and pullulan & starch. The porcine gelatin capsule market is the largest raw material category and is expected to experience the highest growth rate during the forecast period, due to its cost-effectiveness and wide availability. Porcine gelatin is widely used in the pharmaceutical and nutraceutical industries because of its excellent gelling properties, making it suitable for various drug formulations, including solid and controlled-release types.

"Pharmaceutical industry segment reported the highest share of the end user segment in 2024."

Based on end users, the empty capsules market is categorized into pharmaceutical industry, nutraceutical industry, cosmetic industry, and research laboratories. The pharmaceutical industry is the largest end user of empty capsules, widely using them for delivering prescription drugs, over-the-counter (OTC) medications, and therapeutic treatments. These capsules are commonly used for oral administration of solid drugs like antibiotics, pain relievers, antihypertensives, and other medications for managing chronic diseases. Capsules are a preferred dosage form in the pharmaceutical sector because they are easy to swallow, provide accurate dosing, and can encapsulate a broad range of drugs.

North America accounted for the largest global empty capsules market from 2025 to 2030.

In 2024, North America, especially the US and Canada, will be the largest market for empty capsules due to strong demand in pharmaceuticals and nutraceuticals, supported by advanced manufacturing infrastructure and robust regulatory frameworks. Ongoing investments in technology and innovation have led to the development of high-quality capsules for various applications, such as immediate and controlled-release drug delivery. The rising demand for dietary supplements, driven by consumer interest in preventive healthcare and wellness, further fuels market growth. The region also benefits from a favorable regulatory environment, which encourages the adoption of new drug delivery formats, including controlled-release and enteric-coated capsules. Additionally, the Asia Pacific region is expected to see the fastest growth during this period, thanks to expanding pharmaceutical manufacturing capabilities, lower production costs, and supportive government policies. Countries like China, India, and South Korea are becoming key manufacturing hubs due to their large skilled labor pools, low costs, and favorable policies.

The primary interviews conducted for this report can be categorized as follows:

- By Respondent: Supply Side-70% and Demand Side-30%

- By Designation: Managers-45%, CXO and Directors-30%, and Executives-25%

- By Region: North America-40%, Europe-25%, the Asia Pacific-20%, Latin America-10%, and the Middle East & Africa-5%

List of Key Companies Profiled in the Report:

Key players in the Empty capsules market include Lonza (Capsugel) (Switzerland), ACG (India), Suheung (South Korea), Roquette (Qualicaps) (France), Shanxi Guangsheng Medicinal Capsule Co., Ltd (China), Nectar Lifesciences (India), Sunil Healthcare (India), Natural Capsules Limited (India), Baotou Dongbao Bio-Tech Co Ltd. (China), Anhui Huangshan Capsule Co., Ltd. (China), CapsCanada(Lyfe Group) (Canada), Farmacapsulas (Colombia), Healthcaps India (India), Erawat Pharma (India), Comed Chemicals Ltd (India), Fortcaps Healthcare Limited (India), and Shandong Healsee Capsule Ltd. (China).

Research Coverage:

This research report categorizes the empty capsules market, by type (gelatin capsules, non-gelatin capsules), by raw materials (gelatin [porcine-derived gelatin, bovine-derived gelatin, bone meal-derived gelatin, other gelatin sources], non-gelatin [hpmc, pullulan & starch]), functionality (immediate-release, sustained-release, delayed-release), size (Size 000, Size 00, Size 0, Size 1, Size 2, Size 3, Size 4, Size 5), therapeutic application (antibiotic & antibacterial drugs, dietary supplements, antacid & ant flatulent preparations, anti-anaemic preparations, anti-inflammatory drugs, cardiovascular therapy drugs, cough & cold drugs, other therapeutic applications), end user (pharmaceutical industry, nutraceutical industry, cosmetic industry, research laboratories) and region (North America, Europe, Asia Pacific, Latin America, Middle East, and Africa).

The scope of the report covers detailed information about major factors such as drivers, restraints, challenges, and opportunities that influence the growth of the empty capsules market. A thorough analysis of key industry players has been conducted to provide insights into their business overview, products, and key strategies, including new product launches, collaborations, and partnership agreements.

Key Benefits of Buying the Report:

The report will assist market leaders and new entrants by providing close estimates of revenue in the overall empty capsules market and its subsegments. It will also help stakeholders better understand the competitive landscape and gain insights to more effectively position their businesses and develop appropriate go-to-market strategies. This report will enable stakeholders to grasp the market's pulse and offer information on the key drivers, restraints, opportunities, and challenges within the market.

The report provides insights on the following pointers:

- Analysis of key drivers (growth in nutraceuticals & personalized supplements market, growing focus on pharmaceutical development and subsequent increase in clinical trials, expansion of functional & modified-release capsules, sustainability & regulatory-driven transition, increasing preference for self-medication and OTC drugs, shift toward vegetarian & clean-label capsules) restraints (dietary restrictions associated with gelatin consumption, issues related to safety and efficacy, competition from other drug delivery technologies), opportunities (geographic expansion & localized production in emerging economies, development of biodegradable and sustainable capsules), and challenges (challenges associated with logistics and storage of empty capsules, raw material availability & supply chain dependence)

- Product Development/Innovation: Detailed insights on upcoming products, technologies, research & development activities in the empty capsules market

- Market Development: Comprehensive information about lucrative markets - the report analyses the market across varied regions.

- Market Diversification: Exhaustive information about untapped geographies, recent developments, and investments in the empty capsules market

- Competitive Assessment: In-depth assessment of market shares, company revenue, growth strategies, and product offerings of leading players. A detailed analysis of the key industry players has been done to provide insights into their key strategies, product launches/approvals, acquisitions, partnerships, agreements, collaborations, expansions, other recent developments, investment and funding activities, brand/product comparative analysis, and vendor valuation and financial metrics of the empty capsules market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 EMPTY CAPSULES MARKET SEGMENTATION & REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 UNITS CONSIDERED

- 1.3.4.1 Currency/Value units

- 1.3.4.2 Volume units

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key sources of secondary data

- 2.1.1.2 Key objectives of secondary research

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakdown of primaries

- 2.1.2.2 Key objectives of primary research

- 2.1.1 SECONDARY DATA

- 2.2 MARKET ESTIMATION METHODOLOGY

- 2.2.1 GLOBAL EMPTY CAPSULES MARKET ESTIMATION, 2024

- 2.2.1.1 Company revenue analysis (bottom-up approach)

- 2.2.1.2 Volume-based estimation

- 2.2.1.3 MNM repository analysis

- 2.2.1.4 Primary research

- 2.2.2 SEGMENTAL MARKET ASSESSMENT (TOP-DOWN APPROACH)

- 2.2.1 GLOBAL EMPTY CAPSULES MARKET ESTIMATION, 2024

- 2.3 MARKET GROWTH RATE PROJECTIONS

- 2.4 DATA TRIANGULATION

- 2.5 STUDY ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

- 3.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 3.2 STRATEGIC IMPERATIVES FOR STAKEHOLDERS IN EMPTY CAPSULES MARKET

- 3.3 DISRUPTIVE TRENDS SHAPING EMPTY CAPSULES MARKET

4 PREMIUM INSIGHTS

- 4.1 SNAPSHOT: GLOBAL EMPTY CAPSULES MARKET, CAGR, AND FORECAST (2025-2030)

- 4.2 NORTH AMERICA: EMPTY CAPSULES MARKET, BY TYPE AND COUNTRY (2024)

- 4.3 EMPTY CAPSULES MARKET, BY THERAPEUTIC APPLICATION (2024)

- 4.4 EMPTY CAPSULES MARKET, BY END USER (2024)

- 4.5 EMPTY CAPSULES MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing demand for nutraceuticals and personalized supplements

- 5.2.1.2 Growing focus on pharmaceutical development and increase in clinical trials

- 5.2.1.3 Increased demand for functional and modified-release capsules in pharmaceutical and nutraceutical industries

- 5.2.1.4 Advancements in capsule delivery technologies

- 5.2.1.5 Shift toward vegetarian, vegan, and clean-label capsules

- 5.2.1.6 Growing preference for self-medication and OTC drugs

- 5.2.2 RESTRAINTS

- 5.2.2.1 Dietary restrictions associated with gelatin consumption

- 5.2.2.2 Issues related to safety and efficacy of gelatin capsules

- 5.2.2.3 Competition from alternative drug delivery technologies

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Geographic expansion and localized production in emerging economies

- 5.2.3.2 Development of biodegradable and sustainable capsules in life sciences industry

- 5.2.4 CHALLENGES

- 5.2.4.1 Challenges associated with logistics and storage of empty capsules

- 5.2.4.2 Lack of adequate raw material and increased supply chain dependence

- 5.2.1 DRIVERS

- 5.3 INDUSTRY TRENDS

- 5.3.1 AI-INTEGRATED AND PERSONALIZED DRUG AND SUPPLEMENT FORMULATION AND DOSING

- 5.3.2 ON-DEMAND MANUFACTURING SYSTEMS AND DECENTRALIZED CAPSULE-BASED FORMULATIONS IN CLINICAL TRIALS

- 5.3.3 INTEGRATION OF SMART CAPSULES AND INGESTIBLE SENSORS IN CLINICAL RESEARCH

- 5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE TREND OF EMPTY CAPSULES, BY TYPE, 2022-2024

- 5.5.2 AVERAGE SELLING PRICE TREND OF EMPTY CAPSULES, BY REGION, 2022-2024

- 5.5.3 FACTORS IMPACTING EMPTY CAPSULES PRICING

- 5.6 TECHNOLOGY ANALYSIS

- 5.6.1 KEY TECHNOLOGIES

- 5.6.1.1 Advanced quality control systems

- 5.6.1.2 Automated encapsulation machines

- 5.6.2 COMPLEMENTARY TECHNOLOGIES

- 5.6.2.1 3D printing

- 5.6.2.2 Enteric capsule technologies

- 5.6.3 ADJACENT TECHNOLOGIES

- 5.6.3.1 Nanotechnology

- 5.6.3.2 AI in capsule manufacturing

- 5.6.1 KEY TECHNOLOGIES

- 5.7 VALUE CHAIN ANALYSIS

- 5.8 ECOSYSTEM ANALYSIS

- 5.8.1 RAW MATERIAL VENDORS

- 5.8.2 PRODUCT PROVIDERS

- 5.8.3 END USERS

- 5.8.4 REGULATORY AUTHORITIES

- 5.8.5 EMERGING BUSINESS MODELS AND ECOSYSTEM SHIFT

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- 5.9.1 THREAT OF NEW ENTRANTS

- 5.9.2 THREAT OF SUBSTITUTES

- 5.9.3 BARGAINING POWER OF SUPPLIERS

- 5.9.4 BARGAINING POWER OF BUYERS

- 5.9.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.10 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.10.2 KEY BUYING CRITERIA

- 5.10.3 ADOPTION BARRIER & INTERNAL FRICTION

- 5.11 PATENT ANALYSIS

- 5.11.1 PATENT METHODOLOGY

- 5.11.2 NUMBER OF PATENTS FILED, BY DOCUMENT TYPE

- 5.11.3 INNOVATION & PATENT APPLICATIONS

- 5.11.4 TOP APPLICANTS

- 5.11.5 INDICATIVE LIST OF PATENTS

- 5.12 KEY CONFERENCES & EVENTS, 2025-2026

- 5.13 TRADE ANALYSIS

- 5.13.1 IMPORT AND EXPORT DATA FOR HS CODE 960200

- 5.13.1.1 Import data for HS code 960200, 2020-2024

- 5.13.1.2 Export data for HS code 960200, 2020-2024

- 5.13.2 IMPORT AND EXPORT VOLUME FOR HS CODE 960200

- 5.13.2.1 Import volume for HS code 960200, 2020-2024

- 5.13.2.2 Export volume for HS code 960200, 2020-2024

- 5.13.1 IMPORT AND EXPORT DATA FOR HS CODE 960200

- 5.14 TARRIF DATA & REGULATORY ANALYSIS

- 5.14.1 TARIFF DATA ANALYSIS

- 5.14.2 REGULATORY FRAMEWORK

- 5.14.2.1 Manufacturing process standards

- 5.14.2.2 Regulations for capsule supplier change

- 5.14.2.3 Regulatory information on colorants

- 5.14.3 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.4 REGULATORY CHALLENGES

- 5.14.5 SUSTAINABILITY IMPACT

- 5.15 CUSTOMER LANDSCAPE

- 5.15.1 UNMET NEEDS & WHITE SPACES

- 5.15.2 CAPSULE PURCHASE/PROCUREMENT MODELS

- 5.15.3 BUDGET ALLOCATION TREND

- 5.15.4 STRATEGIC ANALYSIS OF GROWTH OPPORTUNITIES

- 5.16 INVESTMENT & FUNDING SCENARIO

- 5.17 IMPACT OF AI/GEN AI ON EMPTY CAPSULES MARKET

- 5.17.1 MARKET POTENTIAL OF AI IN EMPTY CAPSULES PRODUCTION

- 5.17.2 AI USE CASES

- 5.17.3 KEY COMPANIES IMPLEMENTING AI

- 5.17.4 FUTURE OF GENERATIVE AI IN EMPTY CAPSULES ECOSYSTEM

- 5.18 IMPACT OF 2025 TRUMP TARIFF ON EMPTY CAPSULES MARKET

- 5.18.1 INTRODUCTION

- 5.18.2 KEY TARIFF RATES

- 5.18.3 PRICE IMPACT ANALYSIS

- 5.18.4 IMPACT ON COUNTRY/REGION

- 5.18.4.1 North America

- 5.18.4.1.1 US

- 5.18.4.2 Europe

- 5.18.4.3 Asia Pacific

- 5.18.4.1 North America

- 5.18.5 IMPACT ON END-USE INDUSTRIES

- 5.18.5.1 Pharmaceutical & biotech companies

- 5.18.5.2 Nutraceutical industry

- 5.18.5.3 Cosmetic industry

- 5.19 EMPTY CAPSULES MANUFACTURING PROCESS

- 5.19.1 SOURCING OF RAW MATERIAL

- 5.19.1.1 Identify source

- 5.19.1.2 Impact of source variation on product quality

- 5.19.1.3 Certification for sustainable and ethical sourcing

- 5.19.1.4 Impact of market dynamics on raw material sourcing

- 5.19.1.5 Role of industry associations on raw material sourcing

- 5.19.2 PROCESSING

- 5.19.3 QUALITY CONTROL & PACKAGING

- 5.19.1 SOURCING OF RAW MATERIAL

- 5.20 EMPTY CAPSULES PRODUCTION CAPACITY

- 5.21 INTERCONNECTED MARKET: INSIGHTS ON PHARMACEUTICAL GELATIN MARKET

6 EMPTY CAPSULES MARKET, BY TYPE

- 6.1 INTRODUCTION

- 6.2 GELATIN CAPSULES

- 6.2.1 PROVEN SAFETY, VERSATILITY, EASE OF MANUFACTURING, QUICK DISINTEGRATION, AND HIGH BIOAVAILABILITY TO DRIVE ADOPTION

- 6.2.2 GELATIN EMPTY CAPSULES VOLUME MARKET, BY REGION

- 6.3 NON-GELATIN CAPSULES

- 6.3.1 SHIFT OF CONSUMER DEMAND TOWARD CLEAN-LABEL, VEGAN, AND SUSTAINABLE SOLUTIONS TO PROPEL MARKET GROWTH

- 6.3.2 NON-GELATIN EMPTY CAPSULES VOLUME MARKET, BY REGION

7 EMPTY CAPSULES MARKET, BY RAW MATERIAL

- 7.1 INTRODUCTION

- 7.2 GELATIN CAPSULES MARKET, BY RAW MATERIAL

- 7.2.1 PORCINE GELATIN

- 7.2.1.1 Cost-effectiveness, high availability, and quick dissolving properties to support use in hard capsule production

- 7.2.2 BOVINE-DERIVED GELATIN

- 7.2.2.1 Reduced cattle slaughter to limit market growth

- 7.2.3 BONEMEAL GELATIN

- 7.2.3.1 Rising demand for bonemeal capsules in pharmaceutical industry to encourage market growth

- 7.2.4 OTHER GELATIN SOURCES

- 7.2.1 PORCINE GELATIN

- 7.3 NON-GELATIN CAPSULES MARKET, BY RAW MATERIAL

- 7.3.1 HYDROXYPROPYL METHYLCELLULOSE (HPMC)

- 7.3.1.1 Chemical & thermal stability, faster dissolution, and low brittleness in low humidity to favor market growth

- 7.3.2 PULLULAN & STARCH

- 7.3.2.1 Increasing demand for transparent, vegan, and non-GMO capsules to accelerate market growth

- 7.3.1 HYDROXYPROPYL METHYLCELLULOSE (HPMC)

8 EMPTY CAPSULES MARKET, BY FUNCTIONALITY

- 8.1 INTRODUCTION

- 8.2 IMMEDIATE-RELEASE CAPSULES

- 8.2.1 RAPID ABSORPTION, LOW PRODUCTION COST, AND BROAD APPLICATIONS TO AUGMENT MARKET GROWTH

- 8.3 SUSTAINED-RELEASE CAPSULES

- 8.3.1 CONTROLLED DRUG RELEASE FOR CHRONIC DISEASE MANAGEMENT TO SPUR MARKET GROWTH

- 8.4 DELAYED-RELEASE CAPSULES

- 8.4.1 DEMAND FOR ENTERIC-COATED CAPSULES AND ADVANCEMENTS IN PH-SENSITIVE POLYMER COATINGS TO DRIVE MARKET

9 EMPTY CAPULES MARKET, BY SIZE

- 9.1 INTRODUCTION

- 9.2 SIZE 0

- 9.2.1 RISING DEMAND FOR MID-DOSE FORMULATIONS TO FUEL MAKET GROWTH

- 9.3 SIZE 00

- 9.3.1 INCREASED NEED FOR ENCAPSULATING SINGLE-DOSE HERBAL EXTRACTS TO BOOST MARKET GROWTH

- 9.4 SIZE 1

- 9.4.1 NEED FOR COMPACT, LOW-TO-MID DOSE FORMULATIONS WITH HIGH SWALLOWABILITY TO BOOST ADOPTION

- 9.5 SIZE 2

- 9.5.1 DOSE ACCURACY, COMPATIBILITY WITH DIETARY PREFERENCES, AND STANDARD MANUFACTURING EQUIPMENT TO SPUR MARKET

- 9.6 SIZE 000

- 9.6.1 POPULARITY OF HIGH-DOSE CAPSULES IN SPORTS NUTRITION, FUNCTIONAL MEDICINES, AND HERBAL FORMULATIONS TO DRIVE MARKET

- 9.7 SIZE 3

- 9.7.1 NEED FOR PRECISE AND LOW-DOSE DELIVERY TO AUGMENT MARKET GROWTH

- 9.8 SIZE 4

- 9.8.1 FOCUS ON DOSE PERSONALIZATION AND PATIENT-CENTRIC CARE TO FUEL ADOPTION IN PEDIATRIC DOSING AND GERIATRIC MEDICATIONS

- 9.9 SIZE 5

- 9.9.1 MINIMAL CAPACITY AND SMALL FOOTPRINT TO BE USEFUL IN SPECIALTY SEGMENTS

10 EMPTY CAPSULES MARKET, BY THERAPEUTIC APPLICATION

- 10.1 INTRODUCTION

- 10.2 ANTIBIOTIC & ANTIBACTERIAL DRUGS

- 10.2.1 HIGH INCIDENCE OF INFECTIOUS DISEASES AND FOCUS ON INNOVATIVE CAPSULE FORMULATIONS TO DRIVE MARKET

- 10.3 DIETARY SUPPLEMENTS

- 10.3.1 HIGH UPTAKE OF MULTIVITAMINS TO BOOST MARKET DEMAND

- 10.4 ANTACID & ANTIFLATULENT PREPARATIONS

- 10.4.1 POPULARITY OF GENERIC MEDICATIONS AND LIFESTYLE CHANGES IN EMERGING ECONOMIES TO SPUR MARKET GROWTH

- 10.5 ANTIANEMIC PREPARATIONS

- 10.5.1 RISING PREVALENCE OF ANEMIA TO SUPPORT MARKET FOR IRON & FOLIC ACID DEFICIENCY CAPSULES

- 10.6 ANTI-INFLAMMATORY DRUGS

- 10.6.1 EXPANSION OF GENERIC THERAPEUTICS MARKET FOR OBESITY TO PROPEL MARKET GROWTH

- 10.7 CARDIOVASCULAR THERAPY DRUGS

- 10.7.1 SEDENTARY LIFESTYLE AND HIGH PREVALENCE OF DIABETES TO BOOST MARKET GROWTH

- 10.8 COUGH & COLD DRUGS

- 10.8.1 RISING ENVIRONMENTAL POLLUTION AND INCREASING NUMBER OF PASSIVE SMOKERS TO FAVOR MARKET GROWTH

- 10.9 OTHER THERAPEUTIC APPLICATIONS

11 EMPTY CAPSULES MARKET, BY END USER

- 11.1 INTRODUCTION

- 11.2 PHARMACEUTICAL INDUSTRY

- 11.2.1 INCREASING FOCUS ON ADVANCED DRUG DISCOVERY & DEVELOPMENT TO PROPEL MARKET GROWTH

- 11.3 NUTRACEUTICAL INDUSTRY

- 11.3.1 GROWING DEMAND FOR DIETARY SUPPLEMENTS TO BOOST MARKET DEMAND

- 11.4 COSMETIC INDUSTRY

- 11.4.1 RISING FOCUS ON PERSONALIZED BEAUTY AND HOLISTIC WELLNESS TO SUPPORT MARKET GROWTH

- 11.5 RESEARCH LABORATORIES

- 11.5.1 GROWING FOCUS ON CLINICAL TRIALS TO SUPPORT ADOPTION IN PRECISE DOSING AND PHARMACEUTICAL TESTING

12 EMPTY CAPSULES MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.1.1 GLOBAL EMPTY CAPSULES MARKET VOLUME

- 12.2 NORTH AMERICA

- 12.2.1 NORTH AMERICAN EMPTY CAPSULES VOLUME MARKET, BY TYPE

- 12.2.2 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 12.2.3 US

- 12.2.3.1 US to dominate North American empty capsules market during forecast period

- 12.2.4 CANADA

- 12.2.4.1 Rising per capita healthcare spending and growing elderly population to propel market growth

- 12.3 EUROPE

- 12.3.1 EUROPEAN EMPTY CAPSULES VOLUME MARKET, BY TYPE

- 12.3.2 MACROECONOMIC OUTLOOK FOR EUROPE

- 12.3.3 GERMANY

- 12.3.3.1 Rising consumer demand for capsule-based pharma and nutraceutical formulations to aid market growth

- 12.3.4 UK

- 12.3.4.1 High demand for nutraceuticals and rapid shift toward plant-based lifestyles to augment market growth

- 12.3.5 FRANCE

- 12.3.5.1 Popularity of self-care trends and regulatory push for plant-based capsules to propel market growth

- 12.3.6 ITALY

- 12.3.6.1 High R&D spending in pharmaceutical manufacturing industry to support market growth

- 12.3.7 SPAIN

- 12.3.7.1 Low production costs and consolidation of biotechnology sector to fuel market growth

- 12.3.8 NETHERLANDS

- 12.3.8.1 Expanding clinical research activity and strong nutraceutical innovation ecosystem to drive market

- 12.3.9 REST OF EUROPE

- 12.4 ASIA PACIFIC

- 12.4.1 ASIA PACIFIC EMPTY CAPSULES VOLUME MARKET, BY TYPE

- 12.4.2 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 12.4.3 CHINA

- 12.4.3.1 Rapidly growing pharmaceutical, cosmetic, and nutraceutical industries to augment market growth

- 12.4.4 INDIA

- 12.4.4.1 Surge in demand for dietary supplements and presence of highly skilled medical professionals to favor market growth

- 12.4.5 JAPAN

- 12.4.5.1 Increased demand for high-quality generic oral drugs to boost market demand

- 12.4.6 SOUTH KOREA

- 12.4.6.1 Increased government focus on domestic drug production and R&D to support market growth

- 12.4.7 AUSTRALIA

- 12.4.7.1 Rising incidence of chronic diseases among geriatric population and increasing demand for supplements to fuel market growth

- 12.4.8 NEW ZEALAND

- 12.4.8.1 Increasing prevalence of lifestyle-related disorders and expanding therapeutic supplement use to propel market growth

- 12.4.9 REST OF ASIA PACIFIC

- 12.5 LATIN AMERICA

- 12.5.1 LATIN AMERICAN EMPTY CAPSULES VOLUME MARKET, BY TYPE

- 12.5.2 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 12.5.3 BRAZIL

- 12.5.3.1 High export of generics to support market growth

- 12.5.4 MEXICO

- 12.5.4.1 Well-developed healthcare regulatory environment and increased demand for chronic disease treatment to favor market growth

- 12.5.5 REST OF LATIN AMERICA

- 12.6 MIDDLE EAST

- 12.6.1 MIDDLE EASTERN EMPTY CAPSULES VOLUME MARKET, BY TYPE

- 12.6.2 MACROECONOMIC OUTLOOK FOR MIDDLE EAST

- 12.6.3 GCC COUNTRIES

- 12.6.3.1 Saudi Arabia

- 12.6.3.1.1 Favorable government-led healthcare reforms and increased pharmaceutical production capabilities to aid market growth

- 12.6.3.2 UAE

- 12.6.3.2.1 Favorable government strategies and high per capita health expenditure to fuel market growth

- 12.6.3.3 Rest of GCC Countries

- 12.6.3.1 Saudi Arabia

- 12.6.4 REST OF MIDDLE EAST

- 12.7 AFRICA

- 12.7.1 DEVELOPMENT OF PHARMACEUTICAL SECTOR TO SPUR MARKET GROWTH

- 12.7.2 AFRICAN EMPTY CAPSULES VOLUME MARKET, BY TYPE

- 12.7.3 MACROECONOMIC OUTLOOK FOR AFRICA

13 COMPETITIVE LANDSCAPE

- 13.1 INTRODUCTION

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 13.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN EMPTY CAPSULES MARKET, JANUARY 2022-JULY 2025

- 13.3 REVENUE ANALYSIS, 2020-2024

- 13.4 MARKET SHARE ANALYSIS, 2024

- 13.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.5.1 STARS

- 13.5.2 EMERGING LEADERS

- 13.5.3 PERVASIVE PLAYERS

- 13.5.4 PARTICIPANTS

- 13.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.5.5.1 Company footprint

- 13.5.5.2 Region footprint

- 13.5.5.3 Type footprint

- 13.5.5.4 Functionality footprint

- 13.5.5.5 End-user footprint

- 13.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.6.1 PROGRESSIVE COMPANIES

- 13.6.2 RESPONSIVE COMPANIES

- 13.6.3 DYNAMIC COMPANIES

- 13.6.4 STARTING BLOCKS

- 13.6.5 COMPETITIVE BENCHMARKING

- 13.6.5.1 Detailed list of key startups/SMEs

- 13.6.5.2 Competitive benchmarking of startups/SMEs

- 13.7 COMPANY VALUATION & FINANCIAL METRICS

- 13.7.1 FINANCIAL METRICS

- 13.7.2 COMPANY VALUATION

- 13.8 BRAND/PRODUCT COMPARISON

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 PRODUCT LAUNCHES & APPROVALS

- 13.9.2 DEALS

- 13.9.3 EXPANSIONS

- 13.9.4 OTHER DEVELOPMENTS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 CAPSUGEL (LONZA)

- 14.1.1.1 Business overview

- 14.1.1.2 Products offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Product launches

- 14.1.1.3.2 Other developments

- 14.1.1.4 MnM view

- 14.1.1.4.1 Key strengths

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses & competitive threats

- 14.1.2 ACG

- 14.1.2.1 Business overview

- 14.1.2.2 Products offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Expansions

- 14.1.2.3.2 Other developments

- 14.1.2.4 MnM view

- 14.1.2.4.1 Key strengths

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses & competitive threats

- 14.1.3 QUALICAPS (ROQUETTE FRERES)

- 14.1.3.1 Business overview

- 14.1.3.2 Products offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Deals

- 14.1.3.3.2 Expansions

- 14.1.3.4 MnM view

- 14.1.3.4.1 Key strengths

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses & competitive threats

- 14.1.4 SUHEUNG

- 14.1.4.1 Business overview

- 14.1.4.2 Products offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Product launches & approvals

- 14.1.5 HEALTHCAPS INDIA

- 14.1.5.1 Business overview

- 14.1.5.2 Products offered

- 14.1.6 NECTAR LIFESCIENCES LTD.

- 14.1.6.1 Business overview

- 14.1.6.2 Products offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Deals

- 14.1.7 SUNIL HEALTHCARE LIMITED

- 14.1.7.1 Business overview

- 14.1.7.2 Products offered

- 14.1.8 NATURAL CAPSULES LIMITED

- 14.1.8.1 Business overview

- 14.1.8.2 Products offered

- 14.1.8.3 Recent developments

- 14.1.8.3.1 Deals

- 14.1.9 QINGDAO YIQING BIOTECHNOLOGY CO., LTD. (BAOTOU DONGBAO BIO-TECH CO., LTD.)

- 14.1.9.1 Business overview

- 14.1.9.2 Products offered

- 14.1.9.3 Recent developments

- 14.1.9.3.1 Product launches

- 14.1.10 COMED CHEMICALS LIMITED

- 14.1.10.1 Business overview

- 14.1.10.2 Products offered

- 14.1.11 ANHUI HUANGSHAN CAPSULE CO., LTD.

- 14.1.11.1 Business overview

- 14.1.11.2 Products offered

- 14.1.12 FORTCAPS (KUMAR ORGANIC PRODUCTS LIMITED)

- 14.1.12.1 Business overview

- 14.1.12.2 Products offered

- 14.1.12.3 Recent developments

- 14.1.12.3.1 Deals

- 14.1.13 SHANDONG HEALSEE CAPSULE LTD. (SHANDONG HEAD GROUP CO., LTD.)

- 14.1.13.1 Business overview

- 14.1.13.2 Products offered

- 14.1.14 CAPSCANADA

- 14.1.14.1 Business overview

- 14.1.14.2 Products offered

- 14.1.15 FARMACAPSULAS

- 14.1.15.1 Business overview

- 14.1.15.2 Products offered

- 14.1.16 SHANXI GUANGSHENG MEDICINAL CAPSULE CO., LTD.

- 14.1.16.1 Business overview

- 14.1.16.2 Products offered

- 14.1.16.3 Recent developments

- 14.1.16.3.1 Other developments

- 14.1.17 ERAWAT PHARMA LIMITED

- 14.1.17.1 Business overview

- 14.1.17.2 Products offered

- 14.1.1 CAPSUGEL (LONZA)

- 14.2 OTHER PLAYERS

- 14.2.1 SAVIOURCAPS

- 14.2.2 SHANXI JC BIOLOGICAL TECHNOLOGY CO.

- 14.2.3 ROXLOR

- 14.2.4 MEDISCA INC.

- 14.2.5 ZHEJIANG YUEXI CAPSULE CO., LTD.

- 14.2.6 SHAOXING KANGKE CAPSULE CO., LTD.

- 14.2.7 ZHEJIANG HUILI CAPSULES CO., LTD.

- 14.2.8 SHAOXING ZHONGYA CAPSULE CO., LTD.

- 14.2.9 SHING LIH FANG ENTERPRISE CO., LTD.

- 14.2.10 LEFANCAPS

- 14.2.11 CHEMCAPS LIMITED

- 14.2.12 BIOCAPS ENTERPRISE

- 14.2.13 SNAIL PHARMA INDUSTRY

- 14.2.14 BRIGHT PHARMA CAPS

- 14.2.15 SHREE PHARMA CAPS

- 14.2.16 HEXIN CAPSULE CO., LTD.

- 14.2.17 WUHAN CARMA TECHNOLOGY CO., LTD.

- 14.2.18 AIPAK PHARMA

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS