|

시장보고서

상품코드

1800737

의료기기 유지관리 시장(-2030년) : 기기(MRI, X선, CT, 초음파, 환자 모니터링, 치과용 기기), 프로바이더(OEM, ISO), 서비스(예방, 시정), 계약 서비스(커스터마이즈, 애드온), 최종사용자(병원, ASC)Medical Equipment Maintenance Market by Device (MRI, X-ray, CT, Ultrasound, Patient Monitoring, Dental Equipment), Provider (OEM, ISO), Service (Preventive, Corrective), Contract Service (Customized, Add-on), End User (Hospital, ASCs) - Forecast to 2030 |

||||||

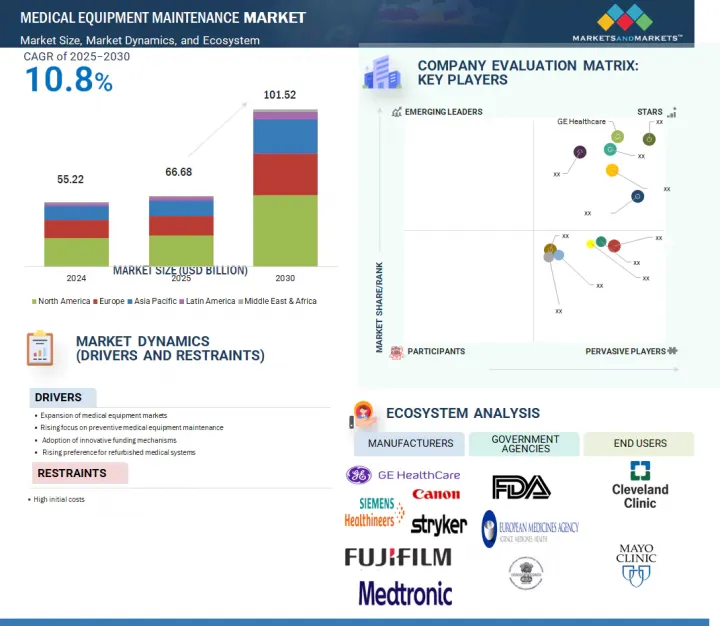

세계의 의료기기 유지관리 시장 규모는 2025년 606억 8,000만 달러에서 예측 기간중 CAGR 10.8%로 성장을 지속하여, 2030년에는 1,015억 2,000만 달러에 이를 것으로 예측됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2024-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 금액(달러) |

| 부문 | 디바이스 유형, 서비스 유형, 서비스 제공업체, 계약 유형, 최종사용자, 지역 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 라틴아메리카, 중동 및 아프리카 |

신흥국을 중심으로 의료비 증가가 의료 인프라 강화와 환자 치료 수준 향상을 위한 첨단 의료기기 도입을 촉진하고 있습니다. 이러한 첨단 의료기기의 조달 증가는 지속적인 성능과 운영의 신뢰성을 보장하기 위해 신뢰할 수 있는 유지보수 서비스의 필요성이 매우 중요하다는 점을 강조하고 있습니다.

의료 서비스 제공업체가 진화하는 의료 수요를 충족시키기 위해 첨단 기술 도입을 우선시하는 가운데, 견고한 유지보수 솔루션 확보에 중점을 두고 있습니다. 그 결과, 유지보수 서비스는 첨단 의료기기의 기능성과 내구성을 보호하고, 확대되는 의료 예산 하에서 최적의 의료 서비스 제공과 환자 치료 결과를 달성하는 데 있어 점점 더 중요한 역할을 하고 있습니다.

"장비 유형별로는 2024년 진단용 영상기기 부문이 가장 큰 시장 점유율을 차지할 것으로 예측됩니다."

진단용 영상 장비는 정확한 진단과 효과적인 치료 계획을 수립하는 데 필수적인 요소이므로 정확성과 신뢰성이 중요합니다. 이러한 높은 수준을 유지하기 위해서는 정기적이고 세심한 유지보수가 매우 중요합니다. 적절한 유지보수를 통해 영상 시스템이 항상 정확하고 신뢰할 수 있는 결과를 지속적으로 제공하고 진단 오류의 위험을 최소화할 수 있습니다. 이러한 신뢰성은 임상적 신뢰감을 강화하고, 보다 적절한 의사결정을 지원하며, 환자의 치료결과를 향상시킬 수 있습니다.

"서비스 유형별로는 2024년 예방적 유지보수 부문이 가장 큰 비중을 차지할 것으로 보입니다."

예방적 유지보수에는 초기 투자가 수반될 수 있지만, 장기적으로 고가의 수리, 교체, 가동 중단 등의 사태를 피할 수 있어 비용 대비 효율성이 강조되고 있습니다. 예방적 유지보수는 잠재적인 문제를 체계적으로 사전에 해결함으로써 장비 고장 및 결함의 위험을 줄이고, 고가의 긴급 대응의 필요성을 최소화합니다. 이러한 사전 예방적 접근 방식은 의료 장비의 건전성과 서비스 수명을 유지할 뿐만 아니라 의료 현장의 중단 없는 작업과 효율적인 환자 치료 제공을 보장합니다.

"지역별로는 2024년 북미가 가장 큰 시장 점유율을 보일 것"이라고 밝혔습니다.

2024년 북미는 의료기기 조달, 유지보수 및 고도화를 위한 막대한 의료비 지출에 힘입어 세계 의료기기 유지보수 시장을 주도할 것으로 예측됩니다. 이 지역에서는 고령화 인구의 요구와 높은 의료수준에 부응하기 위해 의료기기의 신뢰성, 효율성, 안전성을 확보하기 위한 투자가 활발히 이루어지고 있습니다. 이러한 투자에는 최첨단 의료기기 도입과 장비 성능 및 수명을 최적화하기 위한 견고한 유지보수 프로그램이 포함되어 있습니다.

세계의 의료기기 유지보수(Medical Equipment Maintenance) 시장을 조사했으며, 시장 개요, 시장 성장에 영향을 미치는 각종 영향요인 분석, 기술 및 특허 동향, 법 및 규제 환경, 사례 분석, 시장 규모 추이 및 예측, 각종 부문별/지역별/주요 국가별 상세 분석, 경쟁 구도, 주요 기업 개요 등의 정보를 정리하여 전해드립니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 프리미엄 인사이트

제5장 시장 개요

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

- 업계 동향

- 기술 분석

- Porter의 Five Forces 분석

- 규제 상황

- 특허 분석

- 규제 분석

- 2025-2026년 주요 컨퍼런스 및 이벤트

- 주요 이해관계자와 구입 기준

- 밸류체인 분석

- 공급망 분석

- 생태계 분석

- 가격 분석

- 투자 및 자금조달 시나리오

- 미충족 요구/최종사용자 기대

- 고객 사업에 영향을 미치는 동향/혼란

- AI/생성형 AI가 의료기기 유지관리 시장에 미치는 영향

- 의료기기 유지관리 시장에 대한 트럼프 관세의 영향

제6장 의료기기 유지관리 시장 : 기기 유형별

- 진단용 영상 기기

- MRI 시스템

- CT 스캐너

- X선 시스템

- 초음파 시스템

- 혈관조영 시스템

- 맘모그래피 시스템

- 핵영상 시스템

- 투시 시스템

- 환자 모니터링 및 생명 유지 디바이스

- 인공호흡기

- 마취 모니터링 기기

- 투석 장비

- 주입 펌프

- 기타

- 내시경 기기

- 외과 기기

- 안과 기기

- 의료용 레이저

- 전기 외과 기기

- 방사선 치료 기기

- 치과 기기

- 치과용 방사선 기기

- 치과용 레이저 기기

- 기타

- 실험실 장비

- 내구성 의료 장비

제7장 의료기기 유지관리 시장 : 서비스 유형별

- 예방 유지관리

- 시정 유지관리

- 운영 유지관리

제8장 의료기기 유지관리 시장 : 서비스 제공업체별

- 멀티 벤더 OEM

- 싱글 벤더 OEM

- 독립계 서비스 조직

- 사내 유지관리

제9장 의료기기 유지관리 시장 : 계약 형태별

- 프리미엄 계약

- 베이직 계약

- 커스터마이즈 계약

- 애드온 계약

제10장 의료기기 유지관리 시장 : 최종사용자별

- 병원 및 클리닉

- 외래수술센터(ASC)

- 치과의원

- 진단 영상 센터

- 투석 센터

- 기타

제11장 의료기기 유지관리 시장 : 지역별

- 북미

- 북미의 거시경제 전망

- 미국

- 캐나다

- 유럽

- 유럽의 거시경제 전망

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타

- 아시아태평양

- 아시아태평양의 거시경제 전망

- 일본

- 중국

- 인도

- 호주

- 한국

- 기타

- 라틴아메리카

- 라틴아메리카의 거시경제 전망

- 브라질

- 멕시코

- 기타

- 중동 및 아프리카

- 중동 및 아프리카의 거시경제 전망

- GCC 국가

- 기타

제12장 경쟁 구도

- 주요 시장 진출기업의 전략/강점

- 매출 점유율 분석

- 시장 점유율 분석

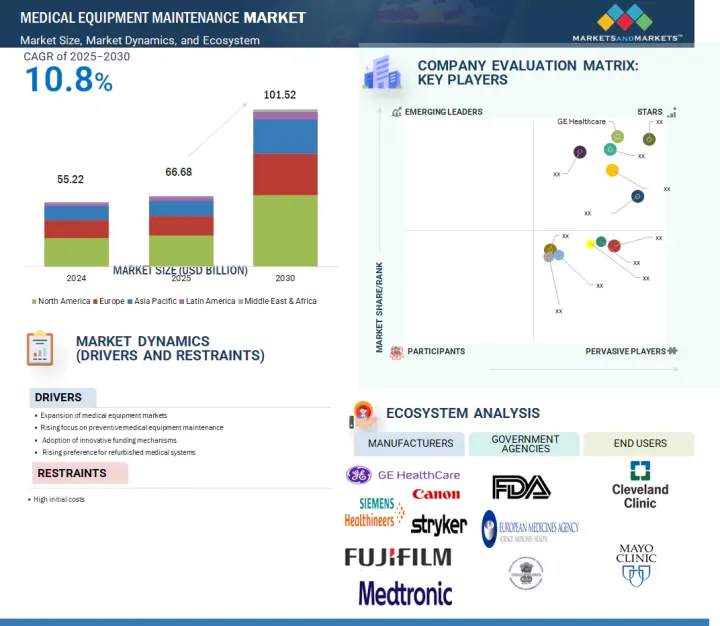

- 기업 평가 매트릭스 : 주요 기업

- 기업 평가 매트릭스 : 스타트업/중소기업

- 브랜드/서비스 비교

- 기업 평가와 재무 지표

- 경쟁 시나리오

제13장 기업 개요

- 주요 기업

- GE HEALTHCARE

- SIEMENS HEALTHINEERS AG

- KONINKLIJKE PHILIPS N.V.

- MEDTRONIC

- FUJIFILM HOLDINGS CORPORATION

- OLYMPUS CORPORATION

- STRYKER

- CANON INC.

- DRAGERWERK AG & CO. KGAA

- HITACHI, LTD.

- B. BRAUN SE

- ELEKTA

- SHIMADZU CORPORATION

- AGFA-GEVAERT GROUP

- STERIS

- 기타 기업

- ALTHEA GROUP

- BCAS BIO-MEDICAL SERVICES LTD.

- AGENOR

- GRUPO EMPRESARIAL ELECTROMEDICO

- CARESTREAM HEALTH

- KARL STORZ GMBH & CO. KG

- AVENSYS UK LTD.

- THE INTERMED GROUP

- CROTHALL HEALTHCARE

- TRIMEDX HOLDINGS LLC

제14장 부록

LSH 25.09.05The global medical equipment maintenance market is projected to reach USD 101.52 billion by 2030 from USD 60.68 billion in 2025, growing at a CAGR of 10.8% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Device Type, Service Type, Service Provider, Contract Type, End User, and Region |

| Regions covered | North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa |

Rising healthcare expenditures, particularly notable in emerging economies, are driving the acquisition of advanced medical equipment to bolster healthcare infrastructure and improve patient care standards. This uptick in procuring sophisticated medical devices highlights the critical need for reliable maintenance services to ensure sustained performance and operational integrity.

With healthcare providers prioritizing the adoption of advanced technologies to meet the evolving healthcare demands of their populations, there is a parallel emphasis on securing robust maintenance solutions. As a result, maintenance services play an increasingly vital role in safeguarding the functionality and longevity of advanced medical equipment, thereby facilitating optimal healthcare delivery and patient outcomes amidst expanding healthcare budgets.

By device type, the diagnostic imaging equipment segment accounted for the largest market share in 2024.

The market is categorized by device type into diagnostic imaging equipment, patient monitoring & life support devices, surgical equipment, radiotherapy devices, laboratory equipment, endoscopic devices, medical lasers, electrosurgical equipment, dental equipment, radiotherapy devices, ophthalmology equipment, and durable medical equipment. The diagnostic imaging equipment segment accounted for the largest market share in 2024. Diagnostic imaging equipment is critical in ensuring accurate diagnoses and effective treatment planning, making precision and reliability essential. Regular and meticulous maintenance is crucial to maintaining these high standards. Proper upkeep ensures that imaging systems consistently deliver accurate, dependable results, minimizing the risk of diagnostic errors. This reliability reinforces clinical confidence, supports better decision-making, and improves patient outcomes.

By service type, the preventive maintenance segment accounted for the largest share of the market in 2024.

The medical equipment maintenance market is segmented by service type into operational, corrective, and preventive maintenance. The preventive maintenance segment accounted for the largest share of the market in 2024. Although the initial investment in preventive maintenance may entail upfront costs, its long-term cost-effectiveness is highlighted by its ability to avert expensive repairs, replacements, and downtime commonly associated with reactive maintenance practices. Preventive maintenance mitigates the risk of equipment failures and malfunctions by systematically addressing potential issues before they escalate, thus minimizing the need for costly emergency interventions. This proactive approach not only preserves the integrity and longevity of medical equipment but also sustains uninterrupted workflow in healthcare settings, ensuring efficient delivery of patient care.

In 2024, by region, North America accounted for the largest market share of the medical equipment maintenance market.

The medical equipment maintenance market is segmented into North America, Europe, Latin America, the Asia Pacific, and the Middle East & Africa. North America leads the global medical equipment maintenance market, fueled by substantial healthcare expenditure directed towards procuring, maintaining, and enhancing medical devices. With a focus on meeting the evolving needs of an aging population and elevated healthcare standards, the region invests significantly in ensuring the reliability, efficiency, and safety of medical equipment. These investments encompass the acquisition of state-of-the-art devices and robust maintenance programs aimed at optimizing equipment performance and longevity.

A breakdown of the primary participants referred to for this report is provided below:

- By Company Type: Tier 1-48%, Tier 2-36%, and Tier 3- 16%

- By Designation: Director-level-14%, C-level-10%, and Others-76%

- By Region: North America-40%, Europe-32%, the Asia Pacific-20%, Latin America- 5%, and the Middle East & Africa- 3%

The prominent players in the medical equipment maintenance market are Siemens Healthineers AG (Germany), GE Healthcare (US), Medtronic (Ireland), Koninklijke Philips N.V. (Netherlands), FUJIFILM Holdings Corporation (Japan), Olympus Corporation (Japan), Stryker (US), Canon Inc. (Japan), Dragerwerk AG & Co. KGaA (Germany), Hitachi, Ltd (Japan), and B. Braun SE (Germany), among others.

Research Coverage

This report studies the medical equipment maintenance market based on device type, service type, service provider, contract type, end user, and region. It also covers the factors affecting market growth, analyzes the various opportunities and challenges in the market, and provides details of the competitive landscape for market leaders. Furthermore, the report analyzes micro markets concerning their growth trends. It forecasts the revenue of the market segments concerning five main regions (and the respective countries in these regions).

Reasons to Buy the Report

The report will enable established and entrants/smaller firms to gauge the market's pulse, which, in turn, would help them garner a larger market share. Firms purchasing the report could use one or a combination of the following strategies to strengthen their market presence.

This report provides insights on the following pointers:

- Analysis of key drivers (growth in medical equipment markets, rising focus on preventive medical equipment maintenance, adoption of innovative funding mechanisms, increasing purchase of refurbished medical systems), restraints (high initial cost and significant maintenance expenditure), opportunities (innovation in service offerings and use of IoT, growing medical device sector in emerging economies across Central and Eastern Europe and Asia Pacific), and challenges (survival of small players in the highly fragmented and competitive market and regulatory pressure & compliance, dearth of skilled technicians and biomedical engineers) influencing the growth of medical equipment maintenance market

- Market Penetration: Comprehensive information on the product portfolios offered by the top players in the medical equipment maintenance market

- Service Development/Innovation: Detailed insights on the upcoming trends, R&D activities, and service developments in the medical equipment maintenance market

- Market Development: Comprehensive information on lucrative emerging regions

- Market Diversification: Exhaustive information about new services, growing geographies, and recent developments in the medical equipment maintenance market

- Competitive Assessment: In-depth assessment of market segments, growth strategies, revenue analysis, and services of the leading market players.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Indicative list of secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION AND FORECAST

- 2.2.1 REVENUE MAPPING-BASED MARKET ESTIMATION

- 2.2.2 END-USER-BASED MARKET ESTIMATION

- 2.3 TOP-DOWN APPROACH

- 2.3.1 GROWTH RATE PROJECTION

- 2.3.2 PRIMARY RESEARCH VALIDATION

- 2.4 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 MEDICAL EQUIPMENT MAINTENANCE MARKET OVERVIEW

- 4.2 EUROPE: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE TYPE AND COUNTRY

- 4.3 MEDICAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE PROVIDER

- 4.4 MEDICAL EQUIPMENT MAINTENANCE MARKET, BY END USER

- 4.5 MEDICAL EQUIPMENT MAINTENANCE MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growth in medical equipment market

- 5.2.1.2 Rising focus on preventive medical equipment maintenance

- 5.2.1.3 Adoption of innovative funding mechanisms

- 5.2.1.4 Increasing purchase of refurbished medical systems

- 5.2.2 RESTRAINTS

- 5.2.2.1 High initial cost and significant maintenance expenditure

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Innovations in service offerings and use of IoT

- 5.2.3.2 Emergence of independent service organizations

- 5.2.3.3 Growth potential of medical devices sector in emerging economies

- 5.2.4 CHALLENGES

- 5.2.4.1 Highly fragmented and competitive market

- 5.2.4.2 Issues regarding regulatory compliance

- 5.2.4.3 Shortage of skilled biomedical engineers and technicians

- 5.2.1 DRIVERS

- 5.3 INDUSTRY TRENDS

- 5.3.1 PREFERENCE FOR MULTI-VENDOR CONTRACTS

- 5.3.2 CONSOLIDATION OF DIALYSIS CENTERS AND HOSPITALS

- 5.3.3 EQUIPMENT SERVICE PROVIDERS AND GROUP PURCHASING

- 5.4 TECHNOLOGY ANALYSIS

- 5.4.1 KEY TECHNOLOGIES

- 5.4.1.1 Predictive and prescriptive maintenance

- 5.4.1.2 Intelligent maintenance systems

- 5.4.2 COMPLEMENTARY TECHNOLOGIES

- 5.4.2.1 Real-time Location Systems (RTLS)

- 5.4.2.2 IoT and sensor networks

- 5.4.3 ADJACENT TECHNOLOGIES

- 5.4.3.1 Digital twins

- 5.4.1 KEY TECHNOLOGIES

- 5.5 PORTER'S FIVE FORCES ANALYSIS

- 5.5.1 THREAT OF NEW ENTRANTS

- 5.5.2 THREAT OF SUBSTITUTES

- 5.5.3 BARGAINING POWER OF SUPPLIERS

- 5.5.4 BARGAINING POWER OF BUYERS

- 5.5.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.6 REGULATORY LANDSCAPE

- 5.6.1 REGULATORY FRAMEWORK

- 5.6.1.1 North America

- 5.6.1.2 Europe

- 5.6.1.3 Asia Pacific

- 5.6.1.4 Latin America

- 5.6.1.5 Middle East & Africa

- 5.6.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.6.1 REGULATORY FRAMEWORK

- 5.7 PATENT ANALYSIS

- 5.7.1 JURISDICTION AND TOP APPLICANT ANALYSIS

- 5.8 REGULATORY ANALYSIS

- 5.8.1 IMPORT DATA FOR HS CODE 9018

- 5.8.2 EXPORT DATA FOR HS CODE 9018

- 5.9 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.10 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS, BY END USER

- 5.10.2 BUYING CRITERIA

- 5.11 VALUE CHAIN ANALYSIS

- 5.12 SUPPLY CHAIN ANALYSIS

- 5.13 ECOSYSTEM ANALYSIS

- 5.14 PRICING ANALYSIS

- 5.14.1 AVERAGE SELLING PRICE, BY KEY PLAYER

- 5.14.1.1 Average selling price of maintenance services for CT scanners, by key player

- 5.14.1.2 Average selling price of maintenance services for mammography machines, by key player

- 5.14.1.3 Average selling price of maintenance services for C-Arm/X-ray imaging systems, by key player

- 5.14.2 AVERAGE SELLING PRICE TREND, BY REGION

- 5.14.2.1 Average selling price trend of maintenance services for CT scanners, by region

- 5.14.2.2 Average selling price trend of maintenance services for mammography machines, by region

- 5.14.2.3 Average selling price trend of maintenance services for C-Arm/X-ray imaging systems, by region

- 5.14.1 AVERAGE SELLING PRICE, BY KEY PLAYER

- 5.15 INVESTMENT AND FUNDING SCENARIO

- 5.16 UNMET NEEDS/END-USER EXPECTATIONS

- 5.17 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.18 IMPACT OF AI/GEN AI ON MEDICAL EQUIPMENT MAINTENANCE MARKET

- 5.18.1 INTRODUCTION

- 5.18.2 MARKET POTENTIAL OF AI IN MEDICAL EQUIPMENT MAINTENANCE

- 5.18.3 AI USE CASES

- 5.18.4 KEY COMPANIES IMPLEMENTING AI

- 5.19 TRUMP TARIFF IMPACT ON MEDICAL EQUIPMENT MAINTENANCE MARKET

- 5.19.1 INTRODUCTION

- 5.19.2 KEY TARIFF RATES

- 5.19.3 PRICE IMPACT ANALYSIS

- 5.19.4 IMPACT ON COUNTRY/REGION

- 5.19.5 IMPACT ON END-USE SEGMENTS

6 MEDICAL EQUIPMENT MAINTENANCE MARKET, BY DEVICE TYPE

- 6.1 INTRODUCTION

- 6.2 DIAGNOSTIC IMAGING EQUIPMENT

- 6.2.1 MRI SYSTEMS

- 6.2.1.1 Increasing use of MRI in diagnostics and research to expedite growth

- 6.2.2 CT SCANNERS

- 6.2.2.1 Growing emphasis on maintaining state-of-the-art CT systems to drive market

- 6.2.3 X-RAY SYSTEMS

- 6.2.3.1 Growing demand for OEM-based X-ray maintenance services to boost market

- 6.2.4 ULTRASOUND SYSTEMS

- 6.2.4.1 Cost-effective and easy preventive maintenance measures to promote growth

- 6.2.5 ANGIOGRAPHY SYSTEMS

- 6.2.5.1 Increasing obsolescence of angiography systems to amplify growth

- 6.2.6 MAMMOGRAPHY SYSTEMS

- 6.2.6.1 Preference for mammography over general breast ultrasound to accelerate growth

- 6.2.7 NUCLEAR IMAGING SYSTEMS

- 6.2.7.1 Growing prevalence of cancer and increasing development of novel radiotracers to propel market

- 6.2.8 FLUOROSCOPY SYSTEMS

- 6.2.8.1 Increasing adoption of refurbished fluoroscopy equipment to spur growth

- 6.2.1 MRI SYSTEMS

- 6.3 PATIENT MONITORING & LIFE SUPPORT DEVICES

- 6.3.1 VENTILATORS

- 6.3.1.1 Rising prevalence of chronic respiratory diseases to encourage growth

- 6.3.2 ANESTHESIA MONITORING EQUIPMENT

- 6.3.2.1 Need for optimal performance and minimized risk to contribute to growth

- 6.3.3 DIALYSIS EQUIPMENT

- 6.3.3.1 Growing number of renal care centers to drive market

- 6.3.4 INFUSION PUMPS

- 6.3.4.1 Growing adoption of infusion pumps on rental basis to propel market

- 6.3.5 OTHER PATIENT MONITORING & LIFE SUPPORT DEVICES

- 6.3.1 VENTILATORS

- 6.4 ENDOSCOPIC DEVICES

- 6.4.1 INCREASING OFFERINGS FOR AFFORDABLE AND BUNDLED SERVICES TO ADVANCE GROWTH

- 6.5 SURGICAL EQUIPMENT

- 6.5.1 INCREASING NUMBER OF SURGERIES AND RISING GERIATRIC POPULATION TO BOOST MARKET

- 6.6 OPHTHALMOLOGY EQUIPMENT

- 6.6.1 RISING TECHNOLOGICAL ADVANCEMENTS IN OPHTHALMIC LASERS TO AUGMENT GROWTH

- 6.7 MEDICAL LASERS

- 6.7.1 GROWING ADOPTION OF MINIMALLY AND NON-INVASIVE AESTHETIC PROCEDURES TO DRIVE MARKET

- 6.8 ELECTROSURGICAL EQUIPMENT

- 6.8.1 RISING DEMAND FOR MAINTENANCE DUE TO SAFETY AND PERFORMANCE NEEDS TO AID GROWTH

- 6.9 RADIOTHERAPY DEVICES

- 6.9.1 STRINGENT REGULATORY GUIDELINES TO SUPPORT GROWTH

- 6.10 DENTAL EQUIPMENT

- 6.10.1 DENTAL RADIOLOGY EQUIPMENT

- 6.10.1.1 Reduced technological complexity and ease of utilization to bolster growth

- 6.10.2 DENTAL LASER DEVICES

- 6.10.2.1 Growing adoption of dental lasers due to shorter and painless operations to drive market

- 6.10.3 OTHER DENTAL EQUIPMENT

- 6.10.1 DENTAL RADIOLOGY EQUIPMENT

- 6.11 LABORATORY EQUIPMENT

- 6.11.1 INCREASING ADOPTION OF AUTOMATED SYSTEMS TO FAVOR GROWTH

- 6.12 DURABLE MEDICAL EQUIPMENT

- 6.12.1 GROWING AWARENESS ABOUT IN-HOUSE MAINTENANCE SERVICES TO BOOST MARKET

7 MEDICAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE TYPE

- 7.1 INTRODUCTION

- 7.2 PREVENTIVE MAINTENANCE

- 7.2.1 NEED FOR IMPROVED SAFETY FOR PATIENTS AND OPERATORS TO AID GROWTH

- 7.3 CORRECTIVE MAINTENANCE

- 7.3.1 INCREASED ADOPTION OF REFURBISHED EQUIPMENT TO FOSTER GROWTH

- 7.4 OPERATIONAL MAINTENANCE

- 7.4.1 REDUCED EQUIPMENT DOWNTIME AND DECREASED MAINTENANCE COSTS TO SPUR GROWTH

8 MEDICAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE PROVIDER

- 8.1 INTRODUCTION

- 8.2 MULTI-VENDOR OEMS

- 8.2.1 AVAILABILITY OF 24/7 TECHNICAL ASSISTANCE AND STRONG TECHNICAL KNOWLEDGE TO STIMULATE GROWTH

- 8.3 SINGLE-VENDOR OEMS

- 8.3.1 PREFERENCE OF HEALTHCARE PROVIDERS FOR CONSISTENT STYLE, USABILITY, AND FUNCTIONS TO DRIVE MARKET

- 8.4 INDEPENDENT SERVICE ORGANIZATIONS

- 8.4.1 REDUCED OPERATING EXPENSES AND EXPERTISE IN HANDLING DIFFERENT BRANDS TO PROMOTE GROWTH

- 8.5 IN-HOUSE MAINTENANCE

- 8.5.1 GROWING NEED TO CURTAIL HEALTHCARE COSTS TO FUEL MARKET

9 MEDICAL EQUIPMENT MAINTENANCE MARKET, BY CONTRACT TYPE

- 9.1 INTRODUCTION

- 9.2 PREMIUM CONTRACTS

- 9.2.1 BETTER RETURNS ON INVESTMENT AND REDUCED COMPLEXITY TO BOLSTER GROWTH

- 9.3 BASIC CONTRACTS

- 9.3.1 AFFORDABLE PRICING OF BASIC MEDICAL DEVICE MAINTENANCE CONTRACTS TO FAVOR GROWTH

- 9.4 CUSTOMIZED CONTRACTS

- 9.4.1 INCREASED POPULARITY OF TAILOR-MADE MAINTENANCE SERVICES FOR MEDICAL DEVICES TO FACILITATE GROWTH

- 9.5 ADD-ON CONTRACTS

- 9.5.1 EASY INTRODUCTION OF NEW SERVICES FOR CLIENTS TO PROPEL MARKET

10 MEDICAL EQUIPMENT MAINTENANCE MARKET, BY END USER

- 10.1 INTRODUCTION

- 10.2 HOSPITALS & CLINICS

- 10.2.1 INCREASING NUMBER OF SURGERIES AND DIAGNOSTIC IMAGING PROCEDURES TO FACILITATE GROWTH

- 10.3 AMBULATORY SURGICAL CENTERS

- 10.3.1 LESS TIME-CONSUMING TREATMENTS AND COST-EFFECTIVE DIAGNOSIS TO CONTRIBUTE TO GROWTH

- 10.4 DENTAL CLINICS

- 10.4.1 LOWER COST REQUIREMENTS AND HIGHER PATIENT PREFERENCE FOR OUTPATIENT CARE TO AID GROWTH

- 10.5 DIAGNOSTIC IMAGING CENTERS

- 10.5.1 RISING SHIFT TOWARD OUTSOURCING TO SPECIALIZED IMAGING FACILITIES TO FAVOR GROWTH

- 10.6 DIALYSIS CENTERS

- 10.6.1 INCREASING NUMBER OF PRIVATE AND PUBLIC DIALYSIS CENTERS IN EMERGING ECONOMIES TO BOOST MARKET

- 10.7 OTHER END USERS

11 MEDICAL EQUIPMENT MAINTENANCE MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 11.2.2 US

- 11.2.2.1 Increasing incidence of lifestyle diseases and adoption of advanced imaging equipment to aid growth

- 11.2.3 CANADA

- 11.2.3.1 Growing shift toward value-based healthcare to drive market

- 11.3 EUROPE

- 11.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 11.3.2 GERMANY

- 11.3.2.1 Robust infrastructure for manufacturing medical imaging technologies and high-quality medical equipment to aid growth

- 11.3.3 UK

- 11.3.3.1 Rising emphasis on public-private partnerships and strong government healthcare initiatives to promote growth

- 11.3.4 FRANCE

- 11.3.4.1 Growing adoption of cost-effective in-house maintenance strategies to boost market

- 11.3.5 ITALY

- 11.3.5.1 Increasing demand for preventive care and remote monitoring to augment growth

- 11.3.6 SPAIN

- 11.3.6.1 Growing investments in advanced technologies to propel market

- 11.3.7 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 11.4.2 JAPAN

- 11.4.2.1 Aging population and favorable government policies to promote growth

- 11.4.3 CHINA

- 11.4.3.1 Growing demand for advanced and premium-priced medical equipment to fuel market

- 11.4.4 INDIA

- 11.4.4.1 Increasing healthcare expenditure and public healthcare investment to expedite growth

- 11.4.5 AUSTRALIA

- 11.4.5.1 Growing reliance on complex medical technologies to boost market

- 11.4.6 SOUTH KOREA

- 11.4.6.1 Increasing focus on improved healthcare structure to spur growth

- 11.4.7 REST OF ASIA PACIFIC

- 11.5 LATIN AMERICA

- 11.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 11.5.2 BRAZIL

- 11.5.2.1 Rising awareness about advanced diagnostic and treatment procedures to bolster growth

- 11.5.3 MEXICO

- 11.5.3.1 Growing focus on improved diagnostic access to drive market

- 11.5.4 REST OF LATIN AMERICA

- 11.6 MIDDLE EAST & AFRICA

- 11.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 11.6.2 GCC COUNTRIES

- 11.6.2.1 Kingdom of Saudi Arabia (KSA)

- 11.6.2.1.1 Rising access to advanced medical technologies to stimulate growth

- 11.6.2.2 United Arab Emirates (UAE)

- 11.6.2.2.1 Increasing prevalence of non-communicable diseases to facilitate growth

- 11.6.2.3 Rest of GCC Countries

- 11.6.2.1 Kingdom of Saudi Arabia (KSA)

- 11.6.3 REST OF MIDDLE EAST & AFRICA

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN MEDICAL EQUIPMENT MAINTENANCE MARKET

- 12.3 REVENUE SHARE ANALYSIS, 2022-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- 12.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.5.5.1 Company footprint

- 12.5.5.2 Region footprint

- 12.5.5.3 Device type footprint

- 12.5.5.4 Service type footprint

- 12.5.5.5 Contract type footprint

- 12.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 RESPONSIVE COMPANIES

- 12.6.3 DYNAMIC COMPANIES

- 12.6.4 STARTING BLOCKS

- 12.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.6.5.1 Detailed list of key startups/SMEs

- 12.6.5.2 Competitive benchmarking of key startups/SMEs

- 12.7 BRAND/SERVICE COMPARISON

- 12.8 COMPANY VALUATION AND FINANCIAL METRICS

- 12.8.1 FINANCIAL METRICS

- 12.8.2 COMPANY VALUATION

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 SERVICE LAUNCHES

- 12.9.2 DEALS

- 12.9.3 EXPANSIONS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 GE HEALTHCARE

- 13.1.1.1 Business overview

- 13.1.1.2 Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Deals

- 13.1.1.3.2 Expansions

- 13.1.1.3.3 Other developments

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 SIEMENS HEALTHINEERS AG

- 13.1.2.1 Business overview

- 13.1.2.2 Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Deals

- 13.1.2.3.2 Expansions

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 KONINKLIJKE PHILIPS N.V.

- 13.1.3.1 Business overview

- 13.1.3.2 Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Deals

- 13.1.3.3.2 Expansions

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 MEDTRONIC

- 13.1.4.1 Business overview

- 13.1.4.2 Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Deals

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 FUJIFILM HOLDINGS CORPORATION

- 13.1.5.1 Business overview

- 13.1.5.2 Services offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Deals

- 13.1.5.4 MnM view

- 13.1.5.4.1 Key strengths

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses and competitive threats

- 13.1.6 OLYMPUS CORPORATION

- 13.1.6.1 Business overview

- 13.1.6.2 Services offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Deals

- 13.1.6.3.2 Expansions

- 13.1.7 STRYKER

- 13.1.7.1 Business overview

- 13.1.7.2 Services offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Expansions

- 13.1.8 CANON INC.

- 13.1.8.1 Business overview

- 13.1.8.2 Services offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Service launches

- 13.1.8.3.2 Deals

- 13.1.8.3.3 Expansions

- 13.1.9 DRAGERWERK AG & CO. KGAA

- 13.1.9.1 Business overview

- 13.1.9.2 Services offered

- 13.1.10 HITACHI, LTD.

- 13.1.10.1 Business overview

- 13.1.10.2 Services offered

- 13.1.11 B. BRAUN SE

- 13.1.11.1 Business overview

- 13.1.11.2 Services offered

- 13.1.11.3 Recent developments

- 13.1.11.3.1 Expansions

- 13.1.12 ELEKTA

- 13.1.12.1 Business overview

- 13.1.12.2 Services offered

- 13.1.12.3 Recent developments

- 13.1.12.3.1 Service launches

- 13.1.12.3.2 Deals

- 13.1.13 SHIMADZU CORPORATION

- 13.1.13.1 Business overview

- 13.1.13.2 Services offered

- 13.1.13.3 Recent developments

- 13.1.13.3.1 Service launches

- 13.1.13.3.2 Deals

- 13.1.14 AGFA-GEVAERT GROUP

- 13.1.14.1 Business overview

- 13.1.14.2 Services offered

- 13.1.15 STERIS

- 13.1.15.1 Business overview

- 13.1.15.2 Services offered

- 13.1.15.3 Recent developments

- 13.1.15.3.1 Expansions

- 13.1.1 GE HEALTHCARE

- 13.2 OTHER PLAYERS

- 13.2.1 ALTHEA GROUP

- 13.2.2 BCAS BIO-MEDICAL SERVICES LTD.

- 13.2.3 AGENOR

- 13.2.4 GRUPO EMPRESARIAL ELECTROMEDICO

- 13.2.5 CARESTREAM HEALTH

- 13.2.6 KARL STORZ GMBH & CO. KG

- 13.2.7 AVENSYS UK LTD.

- 13.2.8 THE INTERMED GROUP

- 13.2.9 CROTHALL HEALTHCARE

- 13.2.10 TRIMEDX HOLDINGS LLC

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 SUPPLY-SIDE DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS