|

시장보고서

상품코드

1800740

매니지드 보안 서비스(MSS) 시장(-2030년) : 서비스 유형(보안 운영&감시(SOCaaS, SIEM-as-a-Service), 첨단 위협 감지(MDR, MXDR), ID&데이터 보호), 유형(Fully Managed, Co-Managed)Managed Security Services (MSS) Market by Service Type (Security Operations & Monitoring (SOCaaS, SIEM-as-a-Service), Advanced Threat Detection (MDR, MXDR), Identity & Data Protection), Type (Fully Managed, Co-Managed) - Global Forecast to 2030 |

||||||

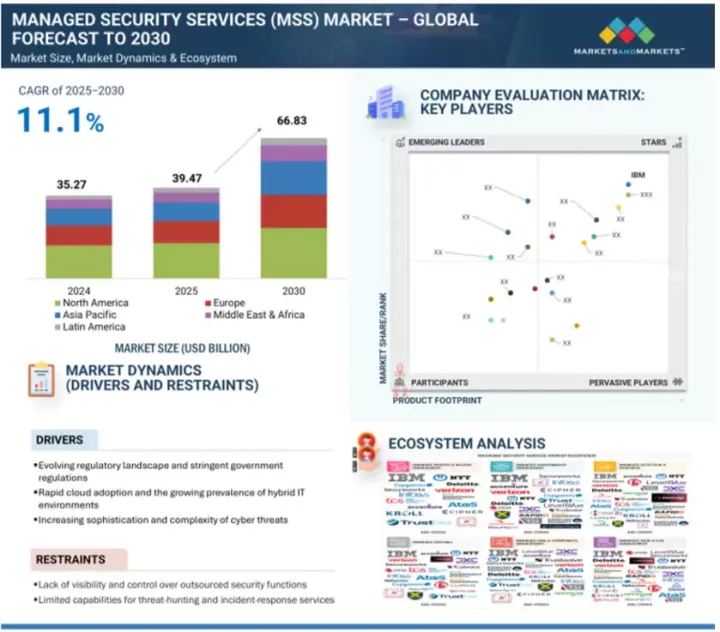

세계의 매니지드 보안 서비스(MSS) 시장 규모는 2025년 394억 7,000만 달러에서 예측 기간중 CAGR 11.1%로 성장을 지속하여, 2030년에는 668억 3,000만 달러로 성장할 것으로 예측됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2019-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 금액(달러) |

| 부문별 | 서비스 유형, 유형, 조직 규모, 산업, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 중동 및 아프리카, 라틴아메리카 |

이러한 성장의 배경에는 사이버 위협의 복잡성, 클라우드 및 하이브리드 인프라 도입 확대, 전문가 주도의 24시간 365일 모니터링 및 사고 대응에 대한 긴급한 요구가 있습니다. 기업들은 사내 기술 격차를 해소하고, 운영 부담을 줄이고, 분산된 환경 전반에서 일관된 보안을 보장하기 위해 MSS 제공업체를 이용하고 있습니다.

그러나 데이터 주권에 대한 우려, 레거시 시스템과의 통합 문제, 벤더 종속 가능성, 아웃소싱된 보안 운영에 대한 가시성 및 관리 부족으로 인해 시장 성장이 제한되고 있습니다. 이러한 우려에도 불구하고, 확장 가능하고 성과 지향적인 사이버 보안 솔루션에 대한 수요 증가로 인해 BFSI(은행, 금융, 보험), 헬스케어, 정부, 제조, 중요 인프라 분야에서 MSS의 채택이 증가하고 있습니다.

"유형별로는 공동 관리형 보안 서비스 부문이 예측 기간 동안 가장 높은 CAGR을 나타낼 것으로 예측됩니다."

이 부문의 급속한 성장은 조직이 내부 통제와 외부 전문 지식 사이의 균형 잡힌 접근 방식을 요구하고 있기 때문입니다. 사이버 위협이 증가하고 IT가 복잡해짐에 따라 많은 기업들이 중요한 업무를 완전히 아웃소싱하지 않고도 보안 태세를 강화하기 위해 공동 관리 모델을 채택하고 있습니다. 이러한 접근 방식을 통해 사내 팀은 MSS 제공업체와 협력하여 24시간 365일 모니터링, 신속한 사고 대응, 지속적인 컴플라이언스 지원을 받을 수 있습니다.

"지역별로는 북미가 가장 큰 점유율을 차지하는 반면, 아시아태평양이 예측 기간 동안 가장 빠르게 성장할 것으로 예측됩니다."

북미는 높은 디지털 성숙도, 증가하는 사이버 위협에 대한 노출, 강력한 규제 및 컴플라이언스 태세로 인해 시장을 선도하고 있습니다. 미국 및 캐나다에서는 산업을 막론하고 복잡해지는 IT 환경 관리와 숙련된 사이버 보안 인력의 만성적인 부족에 대한 대응이 큰 과제로 대두되고 있습니다. 이에 따라 24시간 365일 모니터링, 위협 감지, 사고 대응, 컴플라이언스 지원을 제공하는 MSS에 대한 수요가 급증하고 있습니다.

한편, 아시아태평양은 예측 기간 동안 가장 높은 CAGR로 성장할 것으로 예측됩니다. 이러한 성장은 인도, 중국, 동남아시아 등 신흥 경제국의 급속한 디지털화, 클라우드 도입 확대, 사이버 사고 증가에 따른 것으로 분석됩니다. 이 지역의 많은 중소-중견기업들은 MSSP를 통해 내부 인프라에 많은 투자를 하지 않고도 저렴하고 확장 가능한 사이버 보안 솔루션에 접근할 수 있습니다. 또한, 각국 정부의 국가적 사이버 보안 태세 강화 및 컴플라이언스 이행 노력은 이 지역 전체에서 MSS 도입을 더욱 가속화시키고 있습니다.

세계의 매니지드 보안 서비스(MSS) 시장을 조사했으며, 시장 개요, 시장 성장에 영향을 미치는 각종 영향요인 분석, 기술 및 특허 동향, 법 및 규제 환경, 사례 분석, 시장 규모 추이와 예측, 각종 부문별/지역별/주요 국가별 상세 분석, 경쟁 구도, 주요 기업 개요 등의 정보를 정리하여 전해드립니다. 을 정리하였습니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 프리미엄 인사이트

제5장 시장 개요와 업계 동향

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

- 사례 연구 분석

- 밸류체인 분석

- 생태계 분석

- MSS 시장 생성형 AI의 영향

- Porter의 Five Forces 분석

- 주요 이해관계자와 구입 기준

- 가격 분석

- 기술 분석

- 특허 분석

- 규제 상황

- 2025년 미국 관세의 영향

- 고객 사업에 영향을 미치는 동향/혼란

- MSS 시장 : 비즈니스 모델

- 2025년 주요 컨퍼런스 및 이벤트

- 투자 및 자금조달 시나리오

제6장 매니지드 보안 서비스(MSS) 시장 : 서비스 유형별

- 매니지드 네트워크 및 경계 보안 서비스

- 매니지드 방화벽 서비스

- 매니지드 침입 감지 및 방지 서비스

- 매니지드 통합 위협 관리

- 매니지드 DDoS 방어

- 어셋 디스커버리 및 네트워크 분할

- Web&DNS 보안 게이트웨이 서비스

- 매니지드 엔드포인트&용도 보안 서비스

- 매니지드 엔드포인트 감지&대응

- 매니지드 안티 멀웨어/안티 바이러스

- 패치 관리 서비스(Patch Management-as-a-Service)

- 애플리케이션 화이트 리스팅 및 제어

- API 보안 감시 및 위협 방어

- OAuth 및 세션 토큰 악용 감지

- CI/CD 파이프라인 보안 감시

- 매니지드 백업 및 이뮤타브르스트레이지

- 매니지드 클라우드 보안 서비스

- 매니지드 클라우드 보안 태세 관리

- 매니지드 클라우드 워크로드 보호 플랫폼

- 매니지드 클라우드 액세스 보안 브로커 서비스

- SaaS 보안 태세 관리

- 컨테이너 및 Kubernetes 보안 관리

- 매니지드 보안 운영 및 감시 서비스

- SOC-as-a-Service(보안 오퍼레이션 센터 서비스)

- 매니지드 SIEM 서비스

- 매니지드 사고 대응 서비스

- OT/ICS SOC 모니터링

- 매니지드 첨단 위협 감지 서비스

- 매니지드 감지 및 대응

- 매니지드 확장 감지 및 대응

- Threat Intelligence-as-a-Service(위협 인텔리전스 서비스)

- Threat Hunting-as-a-Service(위협 헌팅 서비스)

- 랜섬웨어 복구 서비스

- Disaster Recovery & Business Continuity-as-a-Service(재해 복구 및 사업 지속 서비스)

- 매니지드 공격 보안 및 평가 서비스

- 매니지드 침입 테스트 서비스

- 취약성 평가 및 관리

- Red Teaming-as-a-Service(레드 팀 서비스)

- 보안 침입 테스트(앱, 네트워크, API)

- ICS/SCADA 보안 테스트

- SOURCE CODE ANALYSIS-AS-A-SERVICE(원시 코드 분석)

- 매니지드 ID 및 데이터 보호 서비스

- 매니지드 ID 및 액세스 관리

- 다중 인증

- 매니지드 싱글 사인 온

- 데이터 유출 방지

- 매니지드 암호화 및 키 수명주기 관리

- IDfederation와 롤 프로비저닝 서비스

- 매니지드 리스크 및 컴플라이언스 관리 서비스

- 컴플라이언스 관리 및 보고

- 리스크 자문 및 평가 서비스

- 거버넌스, 리스크 및 컴플라이언스 플랫폼 통합 서비스

- 피싱 시뮬레이션 서비스

- 내부 위협 감시 및 행동 분석

- 보안 의식 향상 및 트레이닝 서비스

제7장 매니지드 보안 서비스(MSS) 시장 : 유형별

- 완전 관리형 보안 서비스

- 공동 관리 보안 서비스

제8장 매니지드 보안 서비스(MSS) 시장 : 조직 규모별

- 대기업

- 중소기업

제9장 매니지드 보안 서비스(MSS) 시장 : 산업별

- 은행, 금융서비스 및 보험(BFSI)

- 정부

- 헬스케어 및 생명과학

- 통신

- 정보기술 및 정보기술 대응 서비스

- 소매 및 E-Commerce

- 에너지 및 유틸리티

- 제조

- 기타

제10장 매니지드 보안 서비스(MSS) 시장 : 지역별

- 북미

- 시장 성장 촉진요인

- 거시경제 전망

- 규제 상황

- 미국

- 캐나다

- 유럽

- 시장 성장 촉진요인

- 거시경제 전망

- 규제 상황

- 영국

- 독일

- 프랑스

- 이탈리아

- 러시아

- 기타

- 아시아태평양

- 시장 성장 촉진요인

- 거시경제 전망

- 규제 상황

- 중국

- 일본

- 인도

- 호주

- 싱가포르

- 말레이시아

- 인도네시아

- 태국

- 필리핀

- 기타

- 중동 및 아프리카

- 시장 성장 촉진요인

- 거시경제 전망

- 규제 상황

- 중동

- 아프리카

- 라틴아메리카

- 시장 성장 촉진요인

- 거시경제 전망

- 규제 상황

- 브라질

- 멕시코

- 기타

제11장 경쟁 구도

- 주요 시장 진출기업의 전략/강점

- 매출 분석

- 시장 점유율 분석

- 브랜드/제품 비교

- 기업 평가와 재무 지표

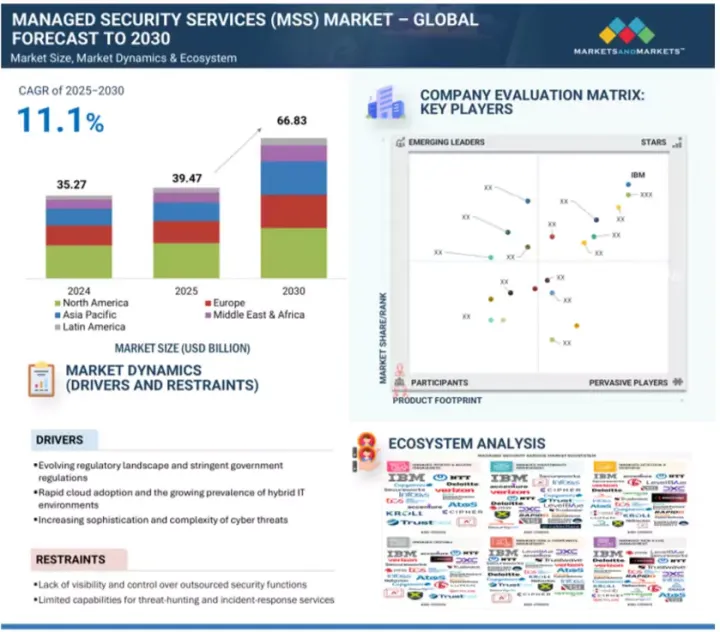

- 기업 평가 매트릭스 : 주요 기업

- 기업 평가 매트릭스 : 스타트업/중소기업

- 경쟁 시나리오

제12장 기업 개요

- 주요 기업

- IBM

- NTT

- LEVELBLUE

- ACCENTURE

- DXC TECHNOLOGY

- SECNAP

- DELOITTE

- SECUREWORKS

- TRUSTWAVE

- VERIZON

- FUJITSU

- HPE

- TCS

- ATOS

- ORANGE CYBERDEFENSE

- RAPID7

- TREND MICRO

- KUDELSKI SECURITY

- CROWDSTRIKE

- F5

- CAPGEMINI

- INFOSYS

- LUMEN TECHNOLOGIES

- KROLL

- 기타 기업

- NETSURION

- ATLAS SYSTEMS

- CIPHER

- RSI SECURITY

- SECURITY HQ

- LIGHTEDGE

- LRQA NETTITUDE

- TECEZE

- CYFLARE

- ASCEND TECHNOLOGIES

- AVERTIUM

- DIGITALXRAID

- TRUSTNET

제13장 인접 시장

제14장 부록

LSH 25.09.05The global managed security services (MSS) market size is projected to grow from 39.47 billion in 2025 to USD 66.83 billion by 2030 at a compound annual growth rate (CAGR) of 11.1% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/USD Billion) |

| Segments | By Service Type, Type, Organization size, Vertical, and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

This growth is driven by the rising complexity of cyber threats, increasing cloud and hybrid infrastructure adoption, and the urgent need for 24/7 expert-led monitoring and incident response. Organizations are turning to MSS providers to bridge internal skill gaps, reduce operational overhead, and ensure consistent security across distributed environments.

However, market growth is restrained by data sovereignty concerns, integration issues with legacy systems, potential vendor lock-in, and the lack of visibility and control in outsourced security operations. Despite these concerns, the growing need for scalable, outcome-based cybersecurity solutions is fueling MSS adoption across the BFSI, healthcare, government, manufacturing, and critical infrastructure sectors.

"By type, the co-managed security services segment accounts for the highest CAGR during the forecast period"

The co-managed security services segment is witnessing rapid growth in the market as organizations increasingly seek a balanced approach between internal control and external expertise. With rising cyber threats and growing IT complexity, many enterprises are turning to co-managed models to strengthen their security posture without fully outsourcing critical operations. This approach allows in-house teams to work alongside managed security service providers (MSSPs) to ensure 24/7 monitoring, faster incident response, and continuous compliance support.

"By organization size, the SMEs segment is expected to register the highest CAGR during the forecast period"

SMEs are rapidly becoming prominent adopters of MSS due to the growing frequency of cyberattacks targeting smaller organizations with limited internal security capabilities. As digital transformation accelerates across the SME landscape, many are adopting cloud, mobile, and hybrid IT environments, which significantly expand their attack surfaces. However, constrained cybersecurity budgets and a lack of skilled resources often make it challenging for SMEs to build robust in-house security operations.

MSSPs offer an ideal solution by providing cost-effective, subscription-based access to advanced threat detection, continuous monitoring, and incident response capabilities. Rising awareness of regulatory compliance obligations, increasing risks of ransomware attacks, and the need for business continuity are prompting SMEs to invest in MSS offerings such as SOC-as-a-Service, SIEM-as-a-Service, and MDR. MSS's flexibility, scalability, and affordability make it particularly attractive to SMEs seeking to strengthen their security posture while focusing on core business operations.

"North America to hold the largest market share, while Asia Pacific is expected to witness the fastest growth during the forecast period"

North America continues to dominate the managed security services landscape due to its high concentration of digitally mature enterprises, increasing cyber threat exposure, and strong regulatory and compliance frameworks. In the US and Canada, organizations across industries face growing challenges in managing complex IT environments and addressing the persistent shortage of skilled cybersecurity professionals. This has led to a surge in demand for managed security services that offer 24/7 monitoring, threat detection, incident response, and compliance support.

Meanwhile, the Asia Pacific (APAC) region is projected to grow at the highest CAGR during the forecast period. This growth is fueled by rapid digitalization, expanding cloud adoption, and increasing cyber incidents across emerging economies such as India, China, and Southeast Asia. Many SMEs and mid-sized enterprises in the region are turning to MSSPs to access affordable, scalable cybersecurity solutions without investing heavily in internal infrastructure. Government initiatives to strengthen national cybersecurity postures and compliance enforcement are further accelerating MSS adoption across APAC.

Breakdown of primaries

The study contains insights from various industry experts, from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: Tier 1 - 35%, Tier 2 - 45%, and Tier 3 - 20%

- By Designation: C-level - 40%, Managerial & Other Levels - 60%

- By Region: North America - 40%, Europe - 25%, Asia Pacific - 35%

The key players in the MSS market include IBM (US), NTT (Japan), LevelBlue (US), Accenture (Ireland), DXC Technology (US), Secnap (US), Deloitte (US), Secureworks (US), Trustwave (US), Verizon (US), Fujitsu (Japan), HPE (US), TCS (India), Atos (France), Orange Cyberdefense (France), Rapid7 (US), TrendMicro (Japan), Kudelski Security (Switzerland), CrowdStrike (US), F5 (US), Capgemini (France), Infosys (India), Lumen (US), Kroll (US), Netsurion (US), Atlas Systems (US), Cipher (US), RSI Security (US), SecurityHQ (UK), Lightedge (US), LRQA (UK), Teceze (UK), CyFlare (US), Ascend Technologies (US), Avertium (US), DigitalXRAID (UK), and TrustNet (US). The study includes an in-depth competitive analysis of the key players in the MSS market, their company profiles, recent developments, and key market strategies.

Research Coverage

The report segments the MSS market and forecasts its size by service type (managed network & perimeter security services, managed endpoint & application security services, managed cloud security services, managed security operations & monitoring services, managed advanced threat detection services, managed offensive security & assessment services, managed identity and data protection services), by type (fully managed security services, co-managed security services), by organization size (large enterprises, and small and medium sized enterprises (SMEs)), by vertical (banking, financial services, and insurance (BFSI), government, retail & ecommerce, healthcare & life sciences, IT & ITeS, telecommunications, energy & utilities, manufacturing, other verticals (education, travel & hospitality, media & entertainment) and by region (North America, Europe, Asia Pacific, Middle East & Africa, and Latin America).

The study also includes an in-depth competitive analysis of the market's key players, their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report

The report will help market leaders and new entrants with information on the closest approximations of the revenue numbers for the overall MSS market and the subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Analysis of key drivers (Increasing need for 24/7 security monitoring and incident response, Intensifying complexity of cyber threats, Evolving regulatory landscape and stringent government regulations, Surge in cloud adoption and prevalence of hybrid environments), restraints (Lack of visibility and control over outsourced security functions, Limited capabilities for threat-hunting and incident-response services, Enterprises' reluctance to outsource operations), opportunities (Emergence of industry-specific MSS offerings, Growing adoption of cloud technology and IoT devices, Rising demand for advanced cybersecurity measures), and challenges (Balancing scalability with operational efficiency, Rising cyberattacks on infrastructure of managed security service providers, Shortage of security professionals, Limited capital funding in emerging economies)

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the MSS market

- Market Development: Comprehensive information about lucrative markets - analysis of the MSS market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the MSS market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as IBM (US), NTT (Japan), LevelBlue (US), Accenture (Ireland), DXC Technology (US), Secnap (US), Deloitte (US), Secureworks (US), Trustwave (US), Verizon (US), Fujitsu (Japan), HPE (US), TCS (India), Atos (France), Orange Cyberdefense (France), Rapid7 (US), TrendMicro (Japan), Kudelski Security (Switzerland), CrowdStrike (US), F5 (US), Capgemini (France), Infosys (India), Lumen (US), Kroll (US), Netsurion (US), Atlas Systems (US), Cipher (US), RSI Security (US), SecurityHQ (UK), Lightedge (US), LRQA (UK), Teceze (UK), CyFlare (US), Ascend Technologies (US), Avertium (US), DigitalXRAID (UK), and TrustNet (US)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primary interviews

- 2.1.2.2 Key insights from industry experts

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- 2.2.2 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 MARKET FORECAST

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN MANAGED SECURITY SERVICES MARKET

- 4.2 MANAGED SECURITY SERVICES MARKET, BY SERVICE TYPE

- 4.3 MANAGED SECURITY SERVICES MARKET, BY TYPE

- 4.4 MANAGED SECURITY SERVICES MARKET, BY ORGANIZATION SIZE

- 4.5 MANAGED SECURITY SERVICES MARKET, BY VERTICAL

- 4.6 MANAGED SECURITY SERVICES MARKET, BY REGION

- 4.7 MARKET INVESTMENT SCENARIO

5 MARKET OVERVIEW AND INDUSTRY TRENDS (STRATEGIC DRIVERS WITH QUANTITATIVE IMPLICATIONS)

Unpacking the Forces Shaping Managed Security Services (MSS) Adoption & Future Growth Opportunities

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing need for continuous security monitoring and incident response

- 5.2.1.2 Intensifying complexity of cyber threats

- 5.2.1.3 Evolving regulatory landscape and stringent government regulations

- 5.2.1.4 Surge in cloud adoption and prevalence of hybrid environments

- 5.2.2 RESTRAINTS

- 5.2.2.1 Lack of visibility and control over outsourced security functions

- 5.2.2.2 Limited capabilities for threat-hunting and incident-response services

- 5.2.2.3 Reluctance of enterprises to outsource operations

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Emergence of industry-specific MSS offerings

- 5.2.3.2 Growing adoption of cloud technology and IoT devices

- 5.2.3.3 Rising demand for advanced cybersecurity measures

- 5.2.4 CHALLENGES

- 5.2.4.1 Balancing scalability with operational efficiency

- 5.2.4.2 Rising cyberattacks on infrastructure of managed security service providers

- 5.2.4.3 Shortage of security professionals

- 5.2.4.4 Limited capital funding in emerging economies

- 5.2.1 DRIVERS

- 5.3 CASE STUDY ANALYSIS

- 5.3.1 NTT SECURES SYNTHOMER'S GLOBAL OPERATIONS WITH MANAGED SECURITY AND ADVANCED THREAT DETECTION

- 5.3.2 VERIZON EMPOWERS FUJIFILM WITH 24/7 GLOBAL THREAT DETECTION THROUGH ADVANCED SOC SERVICES

- 5.3.3 DXC TECHNOLOGY HELPED INAIL ENCOUNTER CYBER THREATS WITH AUTOMATION AND ML

- 5.3.4 LUMEN TECHNOLOGIES HELPED NET PROTECTIONS SECURE ITS NETWORK

- 5.3.5 TRUSTWAVE HELPED AUGMEDIX PROTECT VITAL HEALTHCARE INFORMATION

- 5.4 VALUE CHAIN ANALYSIS

- 5.4.1 ASSESSING SECURITY & ARCHITECTURE PLANNING

- 5.4.2 SERVICE DESIGN & OFFERING

- 5.4.3 CHANNEL PARTNERS/MSS DISTRIBUTORS

- 5.4.4 END USER GROUP

- 5.4.5 SECURITY MONITORING & THREAT DETECTION

- 5.4.6 INCIDENT RESPONSE

- 5.4.7 MEASURES FOR REMEDIATION

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 IMPACT OF GENERATIVE AI ON MANAGED SECURITY SERVICES MARKET

- 5.6.1 GENERATIVE AI

- 5.6.2 TOP USE CASES AND MARKET POTENTIAL IN MANAGED SECURITY SERVICES MARKET

- 5.6.3 IMPACT OF GENERATIVE AI ON INTERCONNECTED AND ADJACENT ECOSYSTEMS

- 5.6.3.1 SIEM & XDR Platforms

- 5.6.3.2 Soar Systems

- 5.6.3.3 Cloud Security

- 5.6.3.4 Artificial Intelligence (AI)/Machine Learning (ML) Analytics

- 5.6.3.5 IoT & Managed Security Services

- 5.7 PORTER'S FIVE FORCES ANALYSIS

- 5.7.1 THREAT OF NEW ENTRANTS

- 5.7.2 THREAT OF SUBSTITUTES

- 5.7.3 BARGAINING POWER OF SUPPLIERS

- 5.7.4 BARGAINING POWER OF BUYERS

- 5.7.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.8 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.8.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.8.2 BUYING CRITERIA

- 5.9 PRICING ANALYSIS

- 5.9.1 AVERAGE SELLING PRICE OFFERED BY KEY PLAYERS, BY TYPE, 2024

- 5.9.2 INDICATIVE PRICING ANALYSIS, 2024

- 5.10 TECHNOLOGY ANALYSIS

- 5.10.1 KEY TECHNOLOGIES

- 5.10.1.1 AI/ML and managed security services

- 5.10.1.2 Cloud-based security solutions

- 5.10.1.3 Security information and event management

- 5.10.1.4 Security orchestration, automation, and response

- 5.10.2 COMPLEMENTARY TECHNOLOGIES

- 5.10.2.1 Threat intelligence platforms

- 5.10.2.2 Identity threat detection and response

- 5.10.3 ADJACENT TECHNOLOGIES

- 5.10.3.1 Zero-trust architecture

- 5.10.3.2 IoT and managed security services

- 5.10.3.3 Extended and detection response

- 5.10.1 KEY TECHNOLOGIES

- 5.11 PATENT ANALYSIS

- 5.12 REGULATORY LANDSCAPE

- 5.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12.2 KEY REGULATIONS

- 5.12.2.1 Payment Card Industry Data Security Standard (PCI-DSS)

- 5.12.2.2 General Data Protection Regulation (GDPR)

- 5.12.2.3 California Consumer Privacy Act (CCPA)

- 5.12.2.4 Gramm-Leach-Bliley Act of 1999 (GLBA)

- 5.12.2.5 Personal Information Protection and Electronic Documents Act (PIPEDA)

- 5.12.2.6 Federal Information Security Management Act (FISMA)

- 5.12.2.7 Health Insurance Portability and Accountability Act (HIPAA)

- 5.12.2.8 Sarbanes-Oxley Act (SOX)

- 5.12.2.9 International Organization for Standardization (ISO) - Standard 27001

- 5.13 IMPACT OF 2025 US TARIFF - MANAGED SECURITY SERVICES MARKET

- 5.13.1 INTRODUCTION

- 5.13.2 KEY TARIFF RATES

- 5.13.3 PRICE IMPACT ANALYSIS

- 5.13.4 IMPACT ON COUNTRY/REGION

- 5.13.4.1 North America

- 5.13.4.2 Europe

- 5.13.4.3 Asia Pacific

- 5.13.5 IMPACT ON END-USE INDUSTRIES

- 5.14 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.15 MANAGED SECURITY SERVICES MARKET: BUSINESS MODELS

- 5.16 KEY CONFERENCES & EVENTS IN 2025

- 5.17 INVESTMENT AND FUNDING SCENARIO

6 MANAGED SECURITY SERVICES MARKET, BY SERVICE TYPE (MARKET SIZE & FORECAST TO 2030 - IN VALUE (USD))

Detailed breakdown of market share and growth across service type

- 6.1 INTRODUCTION

- 6.1.1 SERVICE TYPE: MANAGED SECURITY SERVICE MARKET DRIVERS

- 6.2 MANAGED NETWORK & PERIMETER SECURITY SERVICES

- 6.2.1 GROWING HYBRID AND MULTI-CLOUD ENVIRONMENTS TO DRIVE DEMAND FOR MANAGED NETWORK DEFENSE

- 6.2.2 MANAGED FIREWALL SERVICES

- 6.2.3 MANAGED INTRUSION DETECTION & PREVENTION SERVICES

- 6.2.4 MANAGED UNIFIED THREAT MANAGEMENT

- 6.2.5 MANAGED DISTRIBUTED DENIAL OF SERVICE PROTECTION

- 6.2.6 ASSET DISCOVERY & NETWORK SEGMENTATION

- 6.2.7 WEB AND DNS SECURITY GATEWAY SERVICES

- 6.3 MANAGED ENDPOINT & APPLICATION SECURITY SERVICES

- 6.3.1 INCREASING ENDPOINT PROLIFERATION AND SOPHISTICATED MALWARE TO FUEL DEMAND FOR ENDPOINT & APPLICATION SECURITY

- 6.3.2 MANAGED ENDPOINT DETECTION AND RESPONSE

- 6.3.3 MANAGED ANTI-MALWARE/ANTIVIRUS

- 6.3.4 PATCH MANAGEMENT-AS-A-SERVICE

- 6.3.5 APPLICATION WHITELISTING AND CONTROL

- 6.3.6 API SECURITY MONITORING & THREAT PROTECTION

- 6.3.7 OAUTH & SESSION TOKEN ABUSE DETECTION

- 6.3.8 CI/CD PIPELINE SECURITY MONITORING

- 6.3.9 MANAGED BACKUP & IMMUTABLE STORAGE

- 6.4 MANAGED CLOUD SECURITY SERVICES

- 6.4.1 CLOUD MIGRATION AND SHARED RESPONSIBILITY CHALLENGES TO ACCELERATE ADOPTION OF MANAGED CLOUD SECURITY

- 6.4.2 MANAGED CLOUD SECURITY POSTURE MANAGEMENT

- 6.4.3 MANAGED CLOUD WORKLOAD PROTECTION PLATFORM

- 6.4.4 MANAGED CLOUD ACCESS SECURITY BROKER SERVICES

- 6.4.5 SAAS SECURITY POSTURE MANAGEMENT

- 6.4.6 CONTAINER & KUBERNETES SECURITY MANAGEMENT

- 6.5 MANAGED SECURITY OPERATIONS & MONITORING SERVICES

- 6.5.1 RISING NEED FOR RAPID INCIDENT RESPONSE TO BOOST DEMAND FOR SOC-AS-A-SERVICE AND SIEM-AS-A-SERVICE

- 6.5.2 SECURITY OPERATIONS CENTER-AS-A-SERVICE

- 6.5.3 MANAGED SIEM-AS-A-SERVICE

- 6.5.4 MANAGED INCIDENT RESPONSE SERVICES

- 6.5.5 OT/ICS SOC MONITORING

- 6.6 MANAGED ADVANCED THREAT DETECTION SERVICES

- 6.6.1 EVOLVING THREAT LANDSCAPE AND SURGE IN RANSOMWARE ATTACKS TO BOOST DEMAND FOR THREAT DETECTION & RECOVERY SERVICES

- 6.6.2 MANAGED DETECTION AND RESPONSE

- 6.6.3 MANAGED EXTENDED DETECTION AND RESPONSE

- 6.6.4 THREAT INTELLIGENCE-AS-A-SERVICE

- 6.6.5 THREAT HUNTING-AS-A-SERVICE

- 6.6.6 RANSOMWARE RECOVERY SERVICES

- 6.6.7 DISASTER RECOVERY & BUSINESS CONTINUITY-AS-A-SERVICE

- 6.7 MANAGED OFFENSIVE SECURITY & ASSESSMENT SERVICES

- 6.7.1 PROACTIVE CYBER DEFENSE AND COMPLIANCE TO BOOST ADOPTION OF SECURITY TESTING & RED TEAMING

- 6.7.2 MANAGED PENETRATION TESTING SERVICES

- 6.7.3 VULNERABILITY ASSESSMENT & MANAGEMENT

- 6.7.4 RED TEAMING-AS-A-SERVICE

- 6.7.5 SECURITY EXPLOITATION TESTING (APP, NETWORK, API)

- 6.7.6 ICS/SCADA SECURITY TESTING

- 6.7.7 SOURCE CODE ANALYSIS-AS-A-SERVICE

- 6.8 MANAGED IDENTITY & DATA PROTECTION SERVICES

- 6.8.1 GROWING IDENTITY-BASED ATTACKS AND ZERO-TRUST MODELS TO FUEL DEMAND FOR MANAGED IAM & DATA PROTECTION

- 6.8.2 MANAGED IDENTITY & ACCESS MANAGEMENT

- 6.8.3 MULTI-FACTOR AUTHENTICATION

- 6.8.4 MANAGED SINGLE SIGN-ON

- 6.8.5 DATA LOSS PREVENTION

- 6.8.6 MANAGED ENCRYPTION & KEY LIFECYCLE MANAGEMENT

- 6.8.7 IDENTITY FEDERATION AND ROLE PROVISIONING SERVICES

- 6.9 MANAGED RISK & COMPLIANCE MANAGEMENT SERVICES

- 6.9.1 EXPANDING ESG COMPLIANCE REQUIREMENTS TO FUEL DEMAND FOR RISK & COMPLIANCE-AS-A-SERVICE

- 6.9.2 COMPLIANCE MANAGEMENT & REPORTING

- 6.9.3 RISK ADVISORY & ASSESSMENT SERVICES

- 6.9.4 GOVERNANCE, RISK & COMPLIANCE PLATFORM INTEGRATION SERVICES

- 6.9.5 PHISHING SIMULATION-AS-A-SERVICE

- 6.9.6 INSIDER THREAT MONITORING & BEHAVIORAL ANALYTICS

- 6.9.7 SECURITY AWARENESS & TRAINING-AS-A-SERVICE

7 MANAGED SECURITY SERVICES MARKET, BY TYPE (MARKET SIZE & FORECAST TO 2030 - IN VALUE (USD))

Detailed breakdown of market share and growth across type

- 7.1 INTRODUCTION

- 7.1.1 TYPE: MANAGED SECURITY SERVICE MARKET DRIVERS

- 7.2 FULLY MANAGED SECURITY SERVICES

- 7.2.1 SHORTAGE OF SKILLED CYBERSECURITY PROFESSIONALS TO DRIVE SHIFT TOWARD FULLY OUTSOURCED SECURITY MODELS

- 7.3 CO-MANAGED SECURITY SERVICES

- 7.3.1 ENTERPRISES SEEKING HYBRID CONTROL MODELS TO FUEL DEMAND FOR CO-MANAGED SERVICES

8 MANAGED SECURITY SERVICES MARKET, BY ORGANIZATION SIZE (MARKET SIZE & FORECAST TO 2030 - IN VALUE (USD))

Detailed breakdown of market share and growth across organization sizes

- 8.1 INTRODUCTION

- 8.1.1 ORGANIZATION SIZE: MANAGED SECURITY SERVICE MARKET DRIVERS

- 8.2 LARGE ENTERPRISES

- 8.2.1 COMPLEX IT ECOSYSTEMS AND HIGHER COMPLIANCE BURDENS TO DRIVE LARGE ENTERPRISE MSS ADOPTION

- 8.3 SMALL AND MEDIUM-SIZED ENTERPRISES

- 8.3.1 RISING CYBER THREAT EXPOSURE AND COST EFFICIENCY NEEDS TO ACCELERATE MSS ADOPTION AMONG SMES

9 MANAGED SECURITY SERVICES MARKET, BY VERTICAL (MARKET SIZE & FORECAST TO 2030 - IN VALUE (USD))

Industry-specific market sizing, growth, and key trends

- 9.1 INTRODUCTION

- 9.1.1 VERTICAL: MANAGED SECURITY SERVICE MARKET DRIVERS

- 9.2 BFSI

- 9.2.1 RISE IN CYBER THREATS AND REGULATORY PRESSURE TO DRIVE ADOPTION OF MANAGED SECURITY SERVICES

- 9.3 GOVERNMENT

- 9.3.1 NATIONAL SECURITY IMPERATIVES TO FUEL GOVERNMENT INVESTMENT IN MANAGED SECURITY SERVICES

- 9.4 HEALTHCARE & LIFE SCIENCES

- 9.4.1 STRINGENT COMPLIANCE REQUIREMENTS TO SPUR DEMAND FOR MANAGED SECURITY SERVICES

- 9.5 TELECOMMUNICATIONS

- 9.5.1 RISING DIGITAL RELIANCE DRIVES TELECOM COMPANIES TO INVEST IN MANAGED SECURITY SOLUTIONS

- 9.6 INFORMATION TECHNOLOGY & INFORMATION TECHNOLOGY-ENABLED SERVICES

- 9.6.1 ESCALATING CYBER THREATS TO PROMPT IT & ITES SECTOR TO EMBRACE SECURITY SERVICES

- 9.7 RETAIL & ECOMMERCE

- 9.7.1 DATA BREACHES TO FUEL RELIANCE ON ROBUST SECURITY SERVICES

- 9.8 ENERGY & UTILITIES

- 9.8.1 NEED FOR CRITICAL INFRASTRUCTURE PROTECTION TO DRIVE ADOPTION OF SECURITY SERVICES

- 9.9 MANUFACTURING

- 9.9.1 INDUSTRY 4.0 CHALLENGES TO BOOST DEMAND FOR REAL-TIME SYSTEMS

- 9.10 OTHER VERTICALS

10 MANAGED SECURITY SERVICES MARKET, BY REGION (MARKET SIZE & FORECAST TO 2030 - IN VALUE (USD))

Regional market sizing, forecasts, and regulatory landscapes

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 NORTH AMERICA: MANAGED SECURITY SERVICES MARKET DRIVERS

- 10.2.2 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 10.2.3 NORTH AMERICA: REGULATORY LANDSCAPE

- 10.2.4 US

- 10.2.4.1 Rapid technological innovations and presence of large numbers of vendors to fuel demand for MSS solutions

- 10.2.5 CANADA

- 10.2.5.1 Increased cyberattacks, growth in digital infrastructure, and prevalence of internet to drive market

- 10.3 EUROPE

- 10.3.1 EUROPE: MANAGED SECURITY SERVICES MARKET DRIVERS

- 10.3.2 EUROPE: MACROECONOMIC OUTLOOK

- 10.3.3 EUROPE: REGULATORY LANDSCAPE

- 10.3.4 UK

- 10.3.4.1 Increased government regulations and rising number of security breaches to boost demand for managed security services

- 10.3.5 GERMANY

- 10.3.5.1 Rising incidents of cyberattacks and demand for innovative and customized security solutions to drive market

- 10.3.6 FRANCE

- 10.3.6.1 Stringent government regulations and increasing rate of security incidents to propel market

- 10.3.7 ITALY

- 10.3.7.1 Increasing sophisticated cyberattacks and presence of international vendors to fuel demand for security services

- 10.3.8 RUSSIA

- 10.3.8.1 Rising cyber warfare and regulatory directives are reshaping managed security services landscape

- 10.3.9 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 ASIA PACIFIC: MANAGED SECURITY SERVICES MARKET DRIVERS

- 10.4.2 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 10.4.3 ASIA PACIFIC: REGULATORY LANDSCAPE

- 10.4.4 CHINA

- 10.4.4.1 Increasing investments in IoT projects, rising cybercrime rates, and implementation of new amendments to drive market

- 10.4.5 JAPAN

- 10.4.5.1 Surge in security breaches and government initiatives to safeguard economic security to propel market

- 10.4.6 INDIA

- 10.4.6.1 Fast adoption of cloud technology, thriving fintech sector, and increased digitalization to boost demand for MSS

- 10.4.7 AUSTRALIA

- 10.4.7.1 Rising cyberattacks, strict government regulations, and the need for scalability and cost-effective solutions to drive market

- 10.4.8 SINGAPORE

- 10.4.8.1 Initiatives such as Cybersecurity Strategy and Cyber Security Agency to promote MSS adoption

- 10.4.9 MALAYSIA

- 10.4.9.1 Need for scalability and cost-effectiveness to drive market

- 10.4.10 INDONESIA

- 10.4.10.1 Rising threat landscape, regulatory push, and cloud adoption to boost MSS demand

- 10.4.11 THAILAND

- 10.4.11.1 Digital transformation and rising cybercrime to boost MSS adoption

- 10.4.12 PHILIPPINES

- 10.4.12.1 Digital adoption surge, regulatory enforcement, and cyber threats to drive MSS adoption

- 10.4.13 REST OF ASIA PACIFIC

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 MIDDLE EAST & AFRICA: MANAGED SECURITY SERVICES MARKET DRIVERS

- 10.5.2 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 10.5.3 MIDDLE EAST & AFRICA: REGULATORY LANDSCAPE

- 10.5.4 MIDDLE EAST

- 10.5.4.1 Implementation of National Cybersecurity Strategy to assess cybersecurity risks to drive market

- 10.5.4.2 GCC Countries

- 10.5.4.2.1 Rising cyber risk maturity and digital-first mandates to drive market growth

- 10.5.4.2.2 KSA

- 10.5.4.2.3 UAE

- 10.5.4.2.4 Rest of GCC countries

- 10.5.4.3 Rest of Middle East

- 10.5.5 AFRICA

- 10.5.5.1 Need for strong cyber defense governance policy and increased public awareness regarding cyber threats to propel market

- 10.6 LATIN AMERICA

- 10.6.1 LATIN AMERICA: MANAGED SECURITY SERVICES MARKET DRIVERS

- 10.6.2 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 10.6.3 LATIN AMERICA: REGULATORY LANDSCAPE

- 10.6.4 BRAZIL

- 10.6.4.1 Rising cybercrimes and need to secure and improve endpoints, networks, and applications to propel market

- 10.6.5 MEXICO

- 10.6.5.1 Government initiatives to fight against increasing cybercrimes to drive market

- 10.6.6 REST OF LATIN AMERICA

11 COMPETITIVE LANDSCAPE

Strategic Profiles of Leading Players & Their Playbooks for Market Dominance

- 11.1 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.2 REVENUE ANALYSIS, 2020-2024

- 11.3 MARKET SHARE ANALYSIS, 2024

- 11.4 BRAND/PRODUCT COMPARISON

- 11.5 COMPANY VALUATION AND FINANCIAL METRICS

- 11.5.1 COMPANY VALUATION

- 11.5.2 FINANCIAL METRICS OF KEY VENDORS

- 11.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.6.1 STARS

- 11.6.2 EMERGING LEADERS

- 11.6.3 PERVASIVE PLAYERS

- 11.6.4 PARTICIPANTS

- 11.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.6.5.1 Company footprint

- 11.6.5.2 Regional footprint

- 11.6.5.3 Type footprint

- 11.6.5.4 Vertical footprint

- 11.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.7.1 PROGRESSIVE COMPANIES

- 11.7.2 RESPONSIVE COMPANIES

- 11.7.3 DYNAMIC COMPANIES

- 11.7.4 STARTING BLOCKS

- 11.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.7.5.1 Detailed list of key startups/SMEs

- 11.7.5.2 Competitive benchmarking of key startups/SMEs

- 11.8 COMPETITIVE SCENARIO

- 11.8.1 PRODUCT LAUNCHES & DEVELOPMENTS

- 11.8.2 DEALS

12 COMPANY PROFILES

In-depth look at their Strengths, Weaknesses, Product Portfolios, Recent Developments, and Strategic Moves

- 12.1 KEY PLAYERS

- 12.1.1 IBM

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Product launches/developments

- 12.1.1.3.2 Deals

- 12.1.1.4 MnM view

- 12.1.1.4.1 Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 NTT

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Product launches/developments

- 12.1.2.3.2 Deals

- 12.1.2.4 MnM view

- 12.1.2.4.1 Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 LEVELBLUE

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Product launches/developments

- 12.1.3.4 MnM view

- 12.1.3.4.1 Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 ACCENTURE

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Product launches/developments

- 12.1.4.3.2 Deals

- 12.1.4.3.3 Expansions

- 12.1.4.4 MnM view

- 12.1.4.4.1 Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses and competitive threats

- 12.1.5 DXC TECHNOLOGY

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Deals

- 12.1.5.4 MnM view

- 12.1.5.4.1 Right to win

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses and competitive threats

- 12.1.6 SECNAP

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Product launches/developments

- 12.1.6.3.2 Deals

- 12.1.7 DELOITTE

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Product launches/developments

- 12.1.7.3.2 Deals

- 12.1.7.3.3 Expansions

- 12.1.8 SECUREWORKS

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Product launches/developments

- 12.1.8.3.2 Deals

- 12.1.8.3.3 Expansions

- 12.1.9 TRUSTWAVE

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Product launches/developments

- 12.1.9.3.2 Deals

- 12.1.10 VERIZON

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Product launches/developments

- 12.1.10.3.2 Deals

- 12.1.11 FUJITSU

- 12.1.11.1 Business overview

- 12.1.11.2 Products/Solutions/Services offered

- 12.1.11.3 Recent developments

- 12.1.11.3.1 Deals

- 12.1.11.3.2 Expansions

- 12.1.12 HPE

- 12.1.12.1 Business overview

- 12.1.12.2 Products/Solutions/Services offered

- 12.1.12.3 Recent developments

- 12.1.12.3.1 Product launches/developments

- 12.1.12.3.2 Deals

- 12.1.13 TCS

- 12.1.13.1 Business overview

- 12.1.13.2 Products/Solutions/Services offered

- 12.1.13.3 Recent developments

- 12.1.13.3.1 Deals

- 12.1.14 ATOS

- 12.1.14.1 Business overview

- 12.1.14.2 Products/Solutions/Services offered

- 12.1.14.3 Recent developments

- 12.1.14.3.1 Product launches/developments

- 12.1.14.3.2 Deals

- 12.1.15 ORANGE CYBERDEFENSE

- 12.1.15.1 Business overview

- 12.1.15.2 Products/Solutions/Services offered

- 12.1.15.3 Recent developments

- 12.1.15.3.1 Product launches/developments

- 12.1.15.3.2 Deals

- 12.1.16 RAPID7

- 12.1.16.1 Business overview

- 12.1.16.2 Products/Solutions/Services offered

- 12.1.16.3 Recent developments

- 12.1.16.3.1 Product launches/developments

- 12.1.16.3.2 Deals

- 12.1.16.3.3 Expansions

- 12.1.17 TREND MICRO

- 12.1.17.1 Business overview

- 12.1.17.2 Products/Solutions/Services offered

- 12.1.17.3 Recent developments

- 12.1.17.3.1 Product launches/developments

- 12.1.17.3.2 Deals

- 12.1.17.3.3 Expansions

- 12.1.18 KUDELSKI SECURITY

- 12.1.18.1 Business overview

- 12.1.18.2 Products/Solutions/Services offered

- 12.1.18.3 Recent developments

- 12.1.18.3.1 Product launches/developments

- 12.1.18.3.2 Deals

- 12.1.19 CROWDSTRIKE

- 12.1.19.1 Business overview

- 12.1.19.2 Products/Solutions/Services offered

- 12.1.19.3 Recent developments

- 12.1.19.3.1 Product launches/developments

- 12.1.19.3.2 Deals

- 12.1.19.3.3 Expansions

- 12.1.20 F5

- 12.1.20.1 Business overview

- 12.1.20.2 Products/Solutions/Services offered

- 12.1.20.3 Recent developments

- 12.1.20.3.1 Product launches/developments

- 12.1.20.3.2 Deals

- 12.1.21 CAPGEMINI

- 12.1.21.1 Business overview

- 12.1.21.2 Products/Solutions/Services offered

- 12.1.22 INFOSYS

- 12.1.22.1 Business overview

- 12.1.22.2 Products/Solutions/Services offered

- 12.1.22.3 Recent developments

- 12.1.22.3.1 Deals

- 12.1.23 LUMEN TECHNOLOGIES

- 12.1.23.1 Business overview

- 12.1.23.2 Products/Solutions/Services offered

- 12.1.23.3 Recent developments

- 12.1.23.3.1 Product launches/developments

- 12.1.23.3.2 Deals

- 12.1.23.3.3 Expansions

- 12.1.24 KROLL

- 12.1.24.1 Business overview

- 12.1.24.2 Products/Solutions/Services offered

- 12.1.24.3 Recent developments

- 12.1.24.3.1 Deals

- 12.1.24.3.2 Expansions

- 12.1.1 IBM

- 12.2 OTHER PLAYERS

- 12.2.1 NETSURION

- 12.2.2 ATLAS SYSTEMS

- 12.2.3 CIPHER

- 12.2.4 RSI SECURITY

- 12.2.5 SECURITY HQ

- 12.2.6 LIGHTEDGE

- 12.2.7 LRQA NETTITUDE

- 12.2.8 TECEZE

- 12.2.9 CYFLARE

- 12.2.10 ASCEND TECHNOLOGIES

- 12.2.11 AVERTIUM

- 12.2.12 DIGITALXRAID

- 12.2.13 TRUSTNET

13 ADJACENT MARKETS

- 13.1 INTRODUCTION TO ADJACENT MARKETS

- 13.2 LIMITATIONS

- 13.3 ADJACENT MARKETS

- 13.3.1 CYBERSECURITY MARKET

- 13.3.2 SOC-AS-A-SERVICE MARKET

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS