|

시장보고서

상품코드

1801768

LiDAR 시뮬레이션 시장 예측(-2032년) : 자율성 레벨별, 방법별, 레이저 파장별, LiDAR 유형별, 차종별, 용도별, 지역별LiDAR Simulation Market by LiDAR Type, Method, Laser Wavelength, Vehicle Type, Level of Autonomy, Application, and Region - Global Forecast to 2032 |

||||||

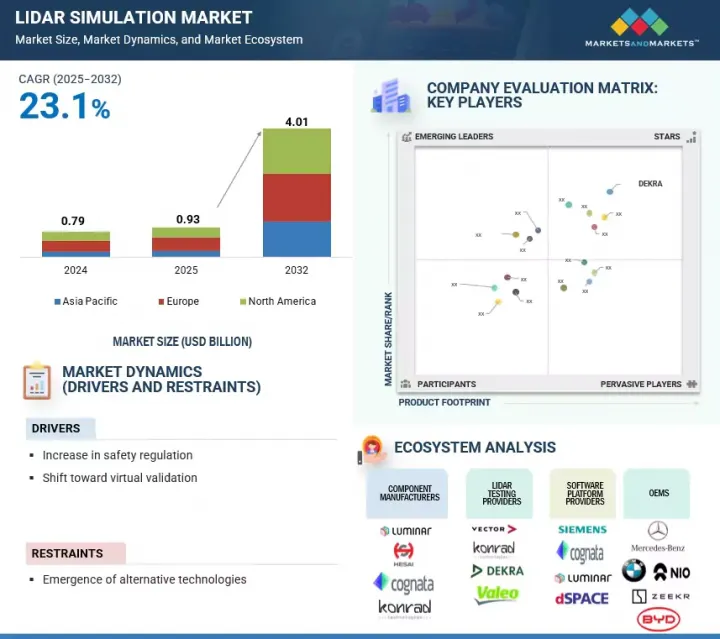

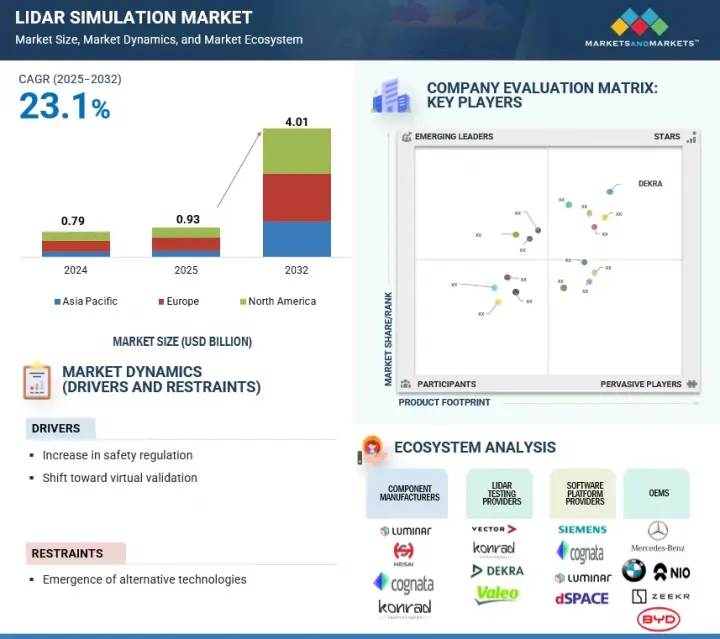

세계의 LiDAR 시뮬레이션 시장 규모는 2025년 9억 3,000만 달러에서 2032년에는 40억 1,000만 달러에 달할 것으로 예측되며, 예측 기간 중 CAGR은 23.1%에 달할 것으로 보이고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상연도 | 2021-2032년 |

| 기준연도 | 2024년 |

| 예측 기간 | 2025-2032년 |

| 검토 단위 | 금액(100만 달러) |

| 부문 | 자율성 레벨별 방법별, 레이저 파장별, LiDAR 유형별, 차종별, 용도별, 지역별 |

| 대상 지역 | 아시아태평양, 유럽, 북미 |

LiDAR 시뮬레이션 시장은 첨단운전자보조시스템(ADAS)와 자율주행차에 LiDAR 센서의 통합이 진행되면서 안전성과 인지 능력이 향상되고 있는 것을 배경으로 급성장하고 있습니다. 이러한 성장은 전 세계에서 엄격한 안전 규제에 의해 촉진되고 있습니다. 예를 들어 EU의 일반 안전 규정 2(GSR2)는 LiDAR 지원 자동 긴급 제동(AEB)과 같은 기능을 의무화하고 있으며, OEM은 LiDAR 시스템의 대규모 시뮬레이션 및 검증을 위해 노력하고 있습니다.

또한 LiDAR의 기술 발전으로 인해 고급 시뮬레이션 모델이 광범위하게 채택되고 있습니다. 또한 전기자동차 증가로 인해 복잡한 센서 융합 및 자율 내비게이션을 지원하기 위한 현실적이고 확장 가능한 LiDAR 시뮬레이션에 대한 수요가 더욱 증가하고 있습니다. 솔리드 스테이트 LiDAR의 높은 생산 능력과 경쟁력 있는 가격으로 인해 아시아태평양, 특히 중국은 신규 진출기업에게 시장 진입 가능성을 확대하고 기회를 창출하고 있습니다.

자율성 수준별로는 전 세계에서 자동차에 이 기술이 탑재되는 사례가 증가함에 따라 예측 기간 중 레벨 2/2.5 부문이 가장 큰 점유율을 차지할 것으로 예측됩니다. 미국, 유럽, 중국, 중국, 인도, 일본 및 기타 아시아 시장을 포함한 각 지역의 법적 승인에 힘입어 레벨 2 승용차의 부분 자동화가 점점 더 많이 받아들여지고 있습니다. LiDAR 기술과 통합된 어댑티브 크루즈 컨트롤, 차선 유지 보조 등의 기능을 갖춘 이 차량들은 많은 모델에서 표준으로 장착되고 있습니다. 2025년까지 전 세계에서 2,800만 대에서 3,000만 대의 차량이 도입될 것으로 예상되는 가운데, 안전과 규제 준수를 보장하기 위해서는 광범위한 테스트가 필수적이며, 특히 Euro NCAP 2025와 같은 표준에서는 대중 차량용 센서의 신뢰성을 중요시하고 있습니다. 레벨 2/2.5 시스템은 성숙도가 높고 복잡도가 낮기 때문에 복잡도가 높고 덜 검토된 레벨 3, 4에 비해 개발 리스크가 낮고, 시험 인프라에 많은 투자가 이루어지고 있습니다. 레벨 2.5가 널리 채택되면서 시장에서의 입지는 강화되었지만, 자율성 수준이 상대적으로 제한적이기 때문에 획기적인 혁신의 기회는 제한되어 있습니다.

세계의 LiDAR 시뮬레이션 시장에 대해 조사했으며, 자율성 레벨별, 방법별, 레이저 파장별, LiDAR 유형별, 차종별, 용도별 지역별 동향 및 시장에 참여하는 기업의 개요 등을 정리하여 전해드립니다.

목차

제1장 서론

제2장 조사 방법

제3장 개요

제4장 주요 인사이트

제5장 시장 개요

- 서론

- 시장 역학

- AI/생성형 AI의 영향

- 고객 비즈니스에 영향을 미치는 동향/혼란

- 공급망 분석

- 에코시스템 분석

- 투자와 자금조달 시나리오

- 특허 분석

- 사례 연구 분석

- 기술 분석

- 규제 상황

- 2025-2026년의 주요 컨퍼런스와 이벤트

- 주요 이해관계자와 구입 기준

- 소프트웨어 정의 차량에서 LiDAR 테스트의 영향

- 자동차용 LiDAR와 V2X 기술의 통합

- LiDAR OTA(Over-The-Air) 테스트의 최소 실행 가능성 요건

- 퍼포먼스 매트릭스와 KPI의 인사이트

제6장 LiDAR 시뮬레이션 시장(자율성 레벨별)

- 서론

- 레벨2/2.5

- 레벨 3

- 레벨4/5

- 업계 전문가로부터의 인사이트

제7장 LiDAR 시뮬레이션 시장(방법별)

- 서론

- 시험 방법

- 시뮬레이션 방법

- 업계 전문가로부터의 인사이트

제8장 LiDAR 시뮬레이션 시장(레이저 파장별)

- 서론

- 단파 적외선 스펙트럼

- 장파 적외선 스펙트럼

- 업계 전문가로부터의 인사이트

제9장 LiDAR 시뮬레이션 시장(LiDAR 유형별)

- 서론

- 기계식 라이더

- 솔리드 스테이트 라이더

- 업계 전문가로부터의 인사이트

제10장 LiDAR 시뮬레이션 시장(차종별)

- 서론

- 승용차

- 상용차

- 업계 전문가로부터의 인사이트

제11장 LiDAR 시뮬레이션 시장(용도별)

- 서론

- 지능형 주차 어시스트

- 나이트 비전

- 정체 어시스트

- 로드 매핑과 로컬라이제이션

- 기타

- 업계 전문가로부터의 인사이트

제12장 LiDAR 시뮬레이션 시장(지역별)

- 서론

- 아시아태평양

- 거시경제 전망

- 중국

- 인도

- 일본

- 한국

- 유럽

- 거시경제 전망

- 독일

- 프랑스

- 이탈리아

- 영국

- 스페인

- 북미

- 거시경제 전망

- 미국

- 캐나다

제13장 경쟁 구도

- 개요

- 주요 참여 기업의 전략/강점

- 시장 점유율 분석

- 매출 분석

- 기업 평가 매트릭스 : 주요 참여 기업, 2024년

- 기업 평가

- 재무 지표

- 브랜드 비교

- 경쟁 시나리오

제14장 제안

- 아시아태평양은 예측 기간 중 가장 급성장하는 시장이 된다.

- 솔리드 스테이트 LiDAR 부문은 예측 기간 중 대폭적인 성장을 달성할 전망

- 시뮬레이션 부문이 예측 기간 중 큰 점유율을 차지한다.

- 결론

제15장 기업 개요

- 주요 참여 기업

- AVL

- DEKRA

- VALEO

- ROBOSENSE

- LUMINAR TECHNOLOGIES, INC.

- VECTOR INFORMATIK GMBH

- APPLIED INTUITION, INC.

- COGNATA

- DSPACE

- IPG AUTOMOTIVE GMBH

- HESAI TECHNOLOGY

- 기타 기업

- XENOMATIX

- CEPTON, INC.

- INNOVIZ TECHNOLOGIES LTD.

- QUANERGY SOLUTIONS, INC.

- IBEO AUTOMOTIVE SYSTEM GMBH

- DORLECO

- ANYVERSE SL

- SIEMENS

- ANYSIS INC.

- SICK AG

제16장 부록

KSA 25.09.05The global LiDAR simulation market is projected to reach USD 4.01 billion by 2032, growing from USD 0.93 billion in 2025 at a CAGR of 23.1% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Million) |

| Segments | LiDAR Type, Vehicle Type, Level of Autonomy, Method, Laser Wavelength, Application, and Region |

| Regions covered | Asia Pacific, Europe, and North America |

The LiDAR simulation market is rapidly growing, driven by the increasing integration of LiDAR sensors in advanced driver-assistance systems (ADASs) and autonomous vehicles to enhance safety and perception capabilities. This growth is propelled by stringent global safety regulations. An example is the EU's General Safety Regulation 2 (GSR2), which mandates features like LiDAR-enabled automatic emergency braking (AEB), pushing OEMs toward extensive simulation and validation of LiDAR systems.

Additionally, technological advancements in LiDAR have enabled a wider adoption of sophisticated simulation models. Also, the rise in electric vehicles further boosts the demand for realistic and scalable LiDAR simulations to support complex sensor fusion and autonomous navigation. With its higher production capacity and competitive pricing for solid-state LiDARs, Asia Pacific, specifically China, is expanding market accessibility for new players and creating opportunities.

"The level 2/2.5 segment is projected to account for the largest share during the forecast period."

By level of autonomy, the level 2/2.5 segment is projected to account for the largest share of the market during the forecast period due to the increase in the installation of this technology in vehicles worldwide. Partial automation in passenger vehicles at level 2 is increasingly embraced, supported by legal approvals across regions, including the US, Europe, China, India, Japan, and other Asian markets. Equipped with features such as adaptive cruise control and lane-keeping assist integrated with LiDAR technology, these vehicles are becoming standard on many models. With an anticipated global fleet of 28 to 30 million units by 2025, extensive testing is critical to ensure safety and regulatory compliance, particularly with standards like Euro NCAP 2025 emphasizing sensor reliability for mass-market vehicles. The established maturity and low complexity of level 2/2.5 systems, compared to the more complex and less explored levels 3 and 4, have lowered development risks and attracted substantial investment in testing infrastructure. While the widespread adoption of level 2.5 strengthens its market position, its relatively limited autonomy level constrains opportunities for groundbreaking innovation.

- FIGURE 1 DIFFERENT LEVELS OF AUTONOMY OFFERED BY SAE

Source: Secondary Research, SAE, and MarketsandMarkets Analysis

"The commercial vehicles segment is projected to be the fastest-growing market during the forecast period."

The demand for LiDAR simulation in commercial vehicles (CVs) is growing faster due to the increasing adoption of autonomous technologies in logistics and freight transport. LiDAR enhances safety and efficiency by enabling precise object detection and mapping over long distances. The commercial vehicles sector is witnessing rapid advancements in autonomous driving, focusing on LiDAR-enabled level 3 and level 4 technologies. For example, Daimler Trucks (Germany) has planned to launch SAE Level 4 autonomous trucks by 2027, on its fifth-generation Freightliner (US) Cascadia model in partnership with Torc Robotics (US). The truck will have redundant safety systems and integrated computing and sensor kits.

Additionally, the rise in e-commerce and last-mile delivery demands robust LiDAR systems, accelerating investment in testing infrastructure. The push for automation is significant, but high costs (e.g., LiDAR units still above USD 400) and supply chain disruptions could slow deployment in cost-sensitive commercial vehicle markets like India or Africa. The e-commerce boom supports growth, but economic shifts or alternative technologies (e.g., radar fusion) could challenge LiDAR's dominance, suggesting a niche-driven surge rather than a universal trend.

"Asia Pacific is projected to be the fastest-growing market during the forecast period."

Asia Pacific is projected to be the fastest-growing market, owing to the rising prominence of premium vehicles in the region. China is the most significant player in the LiDAR simulation market. Leading players in China include BYD, Zeekr, XPeng, and NIO. These players offer electric vehicle LiDAR combined with camera and radar to increase China's autonomy level. For example, BYD aims to pivot from its current "God's Eye" level 2+ system to level 3 capability via over-the-air updates.

Additionally, hybrid solid-state LiDAR technology in China is being increasingly adopted in vehicles like the Zeekr Qianli Haohan H9. The vehicle features a multi-LiDAR setup (5 units). These hybrid solid-state LiDARs are popular due to their low cost and high performance. South Korea, too, has been rapidly adopting level 3 autonomy supported by government regulations, allowing models like the Genesis G90 to be used since 2022 and aiming for level 4 commercialization by 2027. OEMs like Hyundai and Kia lead this deployment, supported by pilot zones and policies targeting 50% autonomous vehicles by 2035. Japan, an early adopter of models like the Honda Legend Hybrid since 2021, also has a market presence for level 3 autonomy.

In-depth interviews were conducted with CEOs, marketing directors, other innovation and technology directors, and executives from various key organizations operating in this market.

- By Company Type: OEMS: 20%, LiDAR Simulation Companies: 80%

- By Designation: Directors: 20%, C-Level Executives: 50%, Others: 30%

- By Region: Asia Pacific: 50%, North America: 20%, and Europe: 30%

The LiDAR simulation market is dominated by major players, including Dekra (Germany), AVL (Austria), Valeo (France), RoboSense (China), Luminar Technologies (US), Vector Informak GmbH (Germany), Applied Intuition (US), Cognata (Israel), dSpace GmbH (Germany), and IPG Automotive GmbH (Germany). These companies are expanding their portfolios to strengthen their LiDAR simulation market position.

Research Coverage:

The report covers the LiDAR simulation market by LiDAR Type (Mechanical LiDAR and Solid-state LiDAR), Vehicle Type (Passenger Cars and Commercial Vehicles), Level of Autonomy (Level 2/2.5, Level 3, and Level 4/5), Method (Testing Method and Simulation Method), Laser Wavelength (Short Infrared Spectrum and Long Wave Infrared Spectrum), Application (Intelligent Park Assist, Night Vision, Traffic Jam Assist, Road Mapping & Localization, and Others), and Region (North America, Asia Pacific, and Europe). The report also covers the competitive landscape and company profiles of significant LiDAR simulation market players. The study further includes an in-depth competitive analysis of the key market players, their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report:

- The report will help market leaders/new entrants with information on the closest approximations of revenue numbers for the LiDAR simulation market and its subsegments.

- This report will help stakeholders understand the competitive landscape and gain more insights, enabling them to position their businesses better and plan suitable go-to-market strategies.

- The report will help stakeholders understand the market pulse and provide information on key market drivers, restraints, challenges, and opportunities.

- The report will help stakeholders understand the current and future pricing trends of the LiDAR simulation market.

The report provides insight into the following pointers:

- Analysis of key drivers (Increase in safety regulation and shift toward virtual validation), key restraint (Emergence of alternative technologies), key opportunity (Cost reduction and scalability of testing infrastructure and development of advanced simulation and validation tool), and key challenge (Upfront cost of LiDAR)

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and product & service launches in the LiDAR simulation market

- Market Development: Comprehensive information about lucrative markets across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the LiDAR simulation market

- Competitive Assessment: In-depth assessment of market share, growth strategies, and service offerings of leading players, namely Dekra (Germany), AVL (Austria), Valeo (France), RoboSense (China), Luminar Technologies (US), Vector Informak GmbH (Germany), Applied Intuition (US), Cognata (Israel), dSpace GmbH (Germany), and IPG Automotive GmbH (Germany), among others

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 UNIT CONSIDERED

- 1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interview participants

- 2.1.2.2 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN LIDAR SIMULATION MARKET

- 4.2 LIDAR SIMULATION MARKET, BY LIDAR TYPE

- 4.3 LIDAR SIMULATION MARKET, BY VEHICLE TYPE

- 4.4 LIDAR SIMULATION MARKET, BY LEVEL OF AUTONOMY

- 4.5 LIDAR SIMULATION MARKET, BY METHOD

- 4.6 LIDAR SIMULATION MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Stringent safety regulations

- 5.2.1.2 Shift toward virtual validation

- 5.2.2 RESTRAINTS

- 5.2.2.1 Emergence of alternative techniques

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Cost reduction and scalability of testing infrastructure

- 5.2.3.2 Development of advanced simulation and validation tools

- 5.2.4 CHALLENGES

- 5.2.4.1 Upfront cost of LiDAR

- 5.2.1 DRIVERS

- 5.3 IMPACT OF AI/GEN AI

- 5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 INVESTMENT & FUNDING SCENARIO

- 5.7.1 FUNDING SCENARIO, 2021-2025

- 5.8 PATENT ANALYSIS

- 5.9 CASE STUDY ANALYSIS

- 5.9.1 ADVANCED DATA ANNOTATION TO CREATE ROBUST ENVIRONMENT FOR VIRTUAL VALIDATION

- 5.9.2 APPLIED INTUITION'S SENSOR SIM PLATFORM INTEGRATION INTO VOLVO CARS

- 5.9.3 INTEGRATING HIGH-PERFORMANCE LIDAR SENSORS WITH ADVANCED SIMULATION AND AUTOMATED TESTING PLATFORMS

- 5.9.4 IMPLEMENTING MATERIAL-AWARE LIDAR SIMULATION FRAMEWORK THAT DISTINGUISHES BETWEEN MULTIPLE MATERIAL CLASSES AND SUBCLASSES

- 5.9.5 HESAI ENABLED AUTOMOTIVE OEMS TO VIRTUALLY TEST LIDAR SENSORS

- 5.10 TECHNOLOGY ANALYSIS

- 5.10.1 KEY TECHNOLOGIES

- 5.10.1.1 Sensor fusion algorithms

- 5.10.1.2 Solid-state LiDAR

- 5.10.1.3 Frequency-modulated continuous wave (FMCW) LiDAR

- 5.10.1.4 4D LiDAR

- 5.10.2 COMPLIMENTARY TECHNOLOGIES

- 5.10.2.1 Automated testing & manufacturing software

- 5.10.2.2 Hardware-in-the-Loop (HIL) test benches

- 5.10.2.3 Hybrid radar

- 5.10.3 ADJACENT TECHNOLOGIES

- 5.10.3.1 Radar and camera systems

- 5.10.3.2 3D simulation platforms

- 5.10.3.3 Silicon CMOS Readout Integrated Circuits (ROICs)

- 5.10.1 KEY TECHNOLOGIES

- 5.11 REGULATORY LANDSCAPE

- 5.11.1 REGULATORY BODIES AND THEIR TESTING PARAMETERS FOR NEW CAR MODELS

- 5.11.2 REGULATIONS AND LEGISLATION FOR AUTONOMOUS VEHICLES

- 5.11.3 REGULATIONS ON USAGE OF AUTONOMOUS VEHICLES, BY KEY COUNTRY

- 5.11.4 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12 KEY CONFERENCES & EVENTS, 2025-2026

- 5.13 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.13.2 BUYING CRITERIA

- 5.14 IMPACT OF LIDAR TESTING ON SOFTWARE-DEFINED VEHICLES

- 5.15 INTEGRATION OF AUTOMOTIVE LIDAR WITH V2X TECHNOLOGIES

- 5.16 MINIMUM VIABILITY REQUIREMENTS OF LIDAR OTA (OVER-THE-AIR) TESTING

- 5.17 INSIGHTS INTO PERFORMANCE MATRIX AND KPI

6 LIDAR SIMULATION MARKET, BY LEVEL OF AUTONOMY

- 6.1 INTRODUCTION

- 6.2 LEVEL 2/2.5

- 6.2.1 INCREASE IN DEMAND FOR ACTIVE SAFETY SYSTEMS TO DRIVE GROWTH

- 6.3 LEVEL 3

- 6.3.1 RISING DEMAND FOR HIGH DEGREE OF AUTOMATION TO DRIVE MARKET

- 6.4 LEVEL 4/5

- 6.4.1 LEVEL 4/5 AUTONOMY GRANTS FULL AUTOMATION TO VEHICLES

- 6.5 INSIGHTS FROM INDUSTRY EXPERTS

7 LIDAR SIMULATION MARKET, BY METHOD

- 7.1 INTRODUCTION

- 7.2 TESTING METHOD

- 7.2.1 DEMAND FOR OPTICAL BENCH TESTING TO DRIVE MARKET

- 7.2.2 ENVIRONMENTAL CHAMBER TESTING

- 7.2.3 EMC/EMI TESTING

- 7.2.4 SAFETY TESTING (LASER CLASSIFICATION)

- 7.2.5 LIDAR OTA TESTING

- 7.3 SIMULATION METHOD

- 7.3.1 SIMULATION METHOD IS PIVOTAL IN VALIDATING AND OPTIMIZING SENSOR PERFORMANCE ACROSS COMPLEX DRIVING SCENARIOS

- 7.3.2 LIDAR SENSOR MODELING

- 7.3.3 VIRTUAL ENVIRONMENT CREATION

- 7.3.4 WEATHER AND LIGHTNING SIMULATION

- 7.3.5 HARDWARE-IN-THE-LOOP (HIL) AND SOFTWARE-IN-THE-LOOP (SIL) TESTING

- 7.4 INSIGHTS FROM INDUSTRY EXPERTS

8 LIDAR SIMULATION MARKET, BY LASER WAVELENGTH

- 8.1 INTRODUCTION

- 8.2 SHORT WAVE INFRARED SPECTRUM

- 8.2.1 ABILITY OF SHORT WAVE INFRARED LIDAR TO ENHANCE DETECTION IN CHALLENGING WEATHER CONDITIONS TO BOOST ITS POPULARITY

- 8.3 LONG WAVE INFRARED SPECTRUM

- 8.3.1 ABILITY OF LONG WAVE INFRARED LIDAR TO PRODUCE HIGH-QUALITY IMAGES TO BOOST DEMAND

- 8.4 INSIGHTS FROM INDUSTRY EXPERTS

9 LIDAR SIMULATION MARKET, BY LIDAR TYPE

- 9.1 INTRODUCTION

- 9.2 MECHANICAL LIDAR

- 9.2.1 FOCUS ON INCREASING VEHICLE SAFETY TO DRIVE MARKET

- 9.3 SOLID-STATE LIDAR

- 9.3.1 COST BENEFITS OF SOLID-STATE LIDAR TO DRIVE MARKET

- 9.4 INSIGHTS FROM INDUSTRY EXPERTS

10 LIDAR SIMULATION MARKET, BY VEHICLE TYPE

- 10.1 INTRODUCTION

- 10.2 PASSENGER CARS

- 10.2.1 DEMAND FOR PERSONAL CARS AND ELECTRIC PASSENGER CARS EQUIPPED WITH ADVANCED SAFETY FEATURES TO DRIVE MARKET

- 10.3 COMMERCIAL VEHICLES

- 10.3.1 INCREASE IN AUTONOMOUS FLEET AND DEMAND FOR SAFETY FEATURES TO FUEL MARKET GROWTH

- 10.4 INSIGHTS FROM INDUSTRY EXPERTS

11 LIDAR SIMULATION MARKET, BY APPLICATION

- 11.1 INTRODUCTION

- 11.2 INTELLIGENT PARKING ASSIST

- 11.3 NIGHT VISION

- 11.4 TRAFFIC JAM ASSIST

- 11.5 ROAD MAPPING AND LOCALIZATION

- 11.6 OTHERS

- 11.7 INSIGHTS FROM INDUSTRY EXPERTS

12 LIDAR SIMULATION MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 ASIA PACIFIC

- 12.2.1 MACROECONOMIC OUTLOOK

- 12.2.2 CHINA

- 12.2.2.1 Rapid, large-scale deployment of level 3 and 4 autonomous vehicles to drive market

- 12.2.3 INDIA

- 12.2.3.1 Focus on enforcing vehicle safety standards to boost demand

- 12.2.4 JAPAN

- 12.2.4.1 Emphasis on automation under strict safety certification criteria to boost growth

- 12.2.5 SOUTH KOREA

- 12.2.5.1 Steady growth toward high levels of vehicle autonomy to boost market

- 12.3 EUROPE

- 12.3.1 MACROECONOMIC OUTLOOK

- 12.3.2 GERMANY

- 12.3.2.1 Country's commitment toward integrating LiDAR into its premium and electric vehicle segments to drive demand

- 12.3.3 FRANCE

- 12.3.3.1 Country's focus on levels 3 and 4 automation to spur growth

- 12.3.4 ITALY

- 12.3.4.1 Emphasis on testing and deploying levels 3 and 4 autonomous vehicles to boost market

- 12.3.5 UK

- 12.3.5.1 Rapid upward trend in vehicle autonomy to boost growth

- 12.3.6 SPAIN

- 12.3.6.1 Introduction of legal frameworks to enable high levels of autonomy to drive market

- 12.4 NORTH AMERICA

- 12.4.1 MACROECONOMIC OUTLOOK

- 12.4.2 US

- 12.4.2.1 Focus on maintaining competitiveness in autonomous driving technologies to boost growth

- 12.4.3 CANADA

- 12.4.3.1 Steady rise in vehicle autonomy to drive demand for LiDAR simulation

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 13.3 MARKET SHARE ANALYSIS

- 13.4 REVENUE ANALYSIS

- 13.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.5.1 STARS

- 13.5.2 EMERGING LEADERS

- 13.5.3 PERVASIVE PLAYERS

- 13.5.4 PARTICIPANTS

- 13.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.6 COMPANY VALUATION

- 13.7 FINANCIAL METRICS

- 13.8 BRAND COMPARISON

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 PRODUCT LAUNCHES & DEVELOPMENTS

- 13.9.2 DEALS

- 13.9.3 EXPANSIONS

- 13.9.4 OTHER DEVELOPMENTS

14 RECOMMENDATIONS

- 14.1 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- 14.2 SOLID-STATE LIDAR SEGMENT TO ACHIEVE SIGNIFICANT GROWTH DURING FORECAST PERIOD

- 14.3 SIMULATION SEGMENT TO ACCOUNT FOR SIGNIFICANT SHARE DURING FORECAST PERIOD

- 14.4 CONCLUSION

15 COMPANY PROFILES

- 15.1 KEY PLAYERS

- 15.1.1 AVL

- 15.1.1.1 Business overview

- 15.1.1.2 Products offered

- 15.1.1.3 Recent developments

- 15.1.1.3.1 Product launches & developments

- 15.1.1.3.2 Deals

- 15.1.1.3.3 Expansions

- 15.1.1.3.4 Other developments

- 15.1.1.4 MnM view

- 15.1.1.4.1 Key strengths

- 15.1.1.4.2 Strategic choices

- 15.1.1.4.3 Weaknesses and competitive threats

- 15.1.2 DEKRA

- 15.1.2.1 Business overview

- 15.1.2.2 Products offered

- 15.1.2.3 Recent developments

- 15.1.2.3.1 Expansions

- 15.1.2.4 MnM view

- 15.1.2.4.1 Key strengths

- 15.1.2.4.2 Strategic choices

- 15.1.2.4.3 Weaknesses and competitive threats

- 15.1.3 VALEO

- 15.1.3.1 Business overview

- 15.1.3.2 Products offered

- 15.1.3.3 Recent developments

- 15.1.3.4 MnM view

- 15.1.3.4.1 Key strengths

- 15.1.3.4.2 Strategic choices

- 15.1.3.4.3 Weaknesses and competitive threats

- 15.1.4 ROBOSENSE

- 15.1.4.1 Business overview

- 15.1.4.2 Products offered

- 15.1.4.3 MnM view

- 15.1.4.3.1 Key strengths

- 15.1.4.3.2 Strategic choices

- 15.1.4.3.3 Weaknesses and competitive threats

- 15.1.5 LUMINAR TECHNOLOGIES, INC.

- 15.1.5.1 Business overview

- 15.1.5.2 Products offered

- 15.1.5.3 Recent developments

- 15.1.5.3.1 Product launches & developments

- 15.1.5.3.2 Deals

- 15.1.5.3.3 Other developments

- 15.1.5.4 MnM view

- 15.1.5.4.1 Key strengths

- 15.1.5.4.2 Strategic choices

- 15.1.5.4.3 Weaknesses and competitive threats

- 15.1.6 VECTOR INFORMATIK GMBH

- 15.1.6.1 Business overview

- 15.1.6.2 Products offered

- 15.1.6.3 Recent developments

- 15.1.7 APPLIED INTUITION, INC.

- 15.1.7.1 Business overview

- 15.1.7.2 Products offered

- 15.1.7.3 Recent developments

- 15.1.7.3.1 Product launches & developments

- 15.1.7.3.2 Deals

- 15.1.7.3.3 Other developments

- 15.1.8 COGNATA

- 15.1.8.1 Business overview

- 15.1.8.2 Products offered

- 15.1.8.3 Recent developments

- 15.1.8.3.1 Deals

- 15.1.8.3.2 Other developments

- 15.1.9 DSPACE

- 15.1.9.1 Business overview

- 15.1.9.2 Products offered

- 15.1.9.3 Recent developments

- 15.1.9.3.1 Product launches & developments

- 15.1.9.3.2 Deals

- 15.1.9.3.3 Other developments

- 15.1.10 IPG AUTOMOTIVE GMBH

- 15.1.10.1 Business overview

- 15.1.10.2 Products offered

- 15.1.10.3 Recent developments

- 15.1.10.3.1 Product launches & developments

- 15.1.10.3.2 Deals

- 15.1.10.3.3 Expansions

- 15.1.11 HESAI TECHNOLOGY

- 15.1.11.1 Business overview

- 15.1.11.2 Products offered

- 15.1.11.3 Recent developments

- 15.1.11.3.1 Product launches & developments

- 15.1.1 AVL

- 15.2 OTHER KEY PLAYERS

- 15.2.1 XENOMATIX

- 15.2.2 CEPTON, INC.

- 15.2.3 INNOVIZ TECHNOLOGIES LTD.

- 15.2.4 QUANERGY SOLUTIONS, INC.

- 15.2.5 IBEO AUTOMOTIVE SYSTEM GMBH

- 15.2.6 DORLECO

- 15.2.7 ANYVERSE SL

- 15.2.8 SIEMENS

- 15.2.9 ANYSIS INC.

- 15.2.10 SICK AG

16 APPENDIX

- 16.1 INSIGHTS FROM INDUSTRY EXPERTS

- 16.2 DISCUSSION GUIDE

- 16.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.4 CUSTOMIZATION OPTIONS

- 16.4.1 LIDAR SIMULATION MARKET, BY LEVEL OF AUTONOMY & LIDAR TYPE

- 16.4.2 LIDAR SIMULATION MARKET, BY VEHICLE TYPE (ICE AND ELECTRIC), AT REGIONAL LEVEL

- 16.5 RELATED REPORTS

- 16.6 AUTHOR DETAILS