|

시장보고서

상품코드

1801769

컨테이너형 배터리 에너지 저장 시스템(BESS) 시장 예측(-2030년) : 배터리 유형별, 용량별, 컨테이너 사이즈별, 용도별, 지역별Containerized Battery Energy Storage System (BESS) Market by Battery Type (Lithium-ion, Advanced Lead-acid, Sodium-based Batteries), Capacity (<1,000 kWh, 1,000-5,000 kWh, >5,000 kWh), Container Size (10 Feet, 20 Feet, 40 Feet) - Global Forecast to 2030 |

||||||

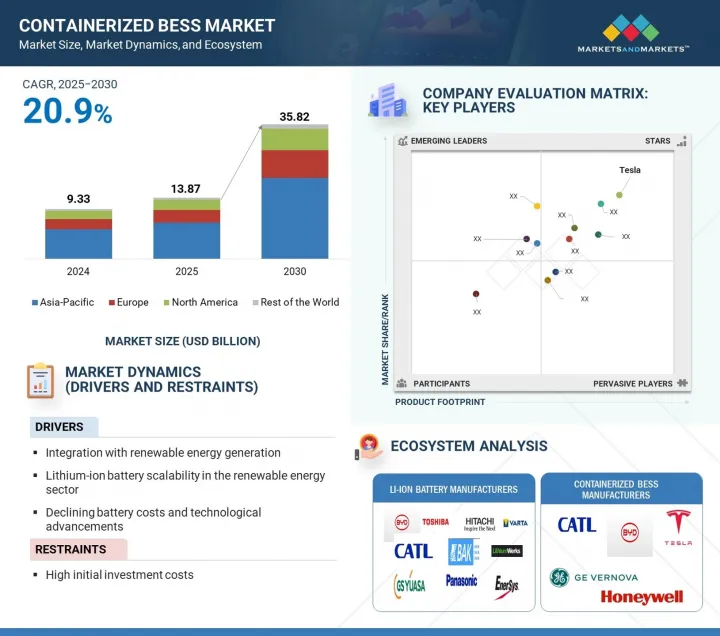

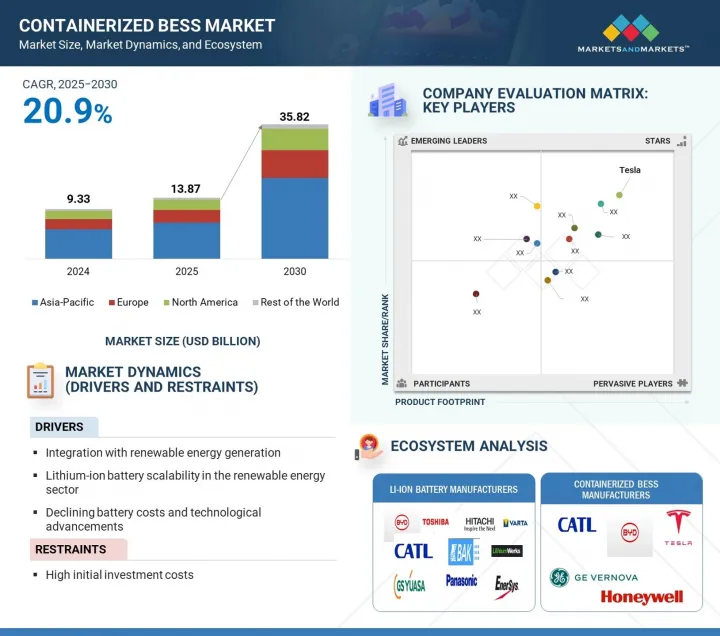

세계의 컨테이너형 배터리 에너지 저장 시스템(BESS) 시장 규모는 20.9%의 CAGR로 확대하며, 2025년 138억 7,000만 달러에서 2030년에는 358억 2,000만 달러로 성장할 것으로 예측됩니다.

컨테이너형 BESS 시장은 재생에너지 도입 증가, 전력망 현대화 노력, 유연하고 신속한 구축이 가능한 스토리지 솔루션에 대한 수요로 인해 강력한 성장세를 보이고 있습니다. 이 시스템은 모듈성, 확장성, 빠른 설치, 그리드 지원, 상업용 백업, 오프 그리드에 이상적입니다.

| 조사 범위 | |

|---|---|

| 조사 대상연도 | 2021-2030년 |

| 기준연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 검토 단위 | 금액(10억 달러) |

| 부문별 | 배터리 유형별, 용량별, 컨테이너 사이즈별, 용도별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 기타 지역 |

리튬이온 배터리 기술, 향상된 배터리 관리 시스템, 통합 온도 제어의 발전으로 성능, 안전성 및 수명주기 가치가 향상되었습니다. 아시아태평양, 유럽, 북미 등의 지역에서는 정부의 인센티브와 청정에너지 정책으로 인해 투자가 가속화되고 있습니다. 에너지의 회복력과 탈탄소화가 최우선 과제로 떠오르고 있는 가운데, 컨테이너형 BESS는 차세대 전력 인프라의 중요한 실현 요소로 부상하고 있습니다.

20피트 컨테이너형 BESS 유닛은 저장 용량, 이동성, 배치 용이성의 이상적인 균형으로 인해 가장 큰 시장 점유율을 차지할 것으로 예측됩니다. 이 컨테이너는 상업 및 산업(C&I) 시설에서 유틸리티 규모의 그리드 지원까지 다양한 용도에서 높은 지지를 받고 있는 중간 크기의 모듈형 컨테이너로, 대형 유닛의 물류 문제 없이 유연성을 제공합니다. 20피트의 크기는 전 세계 배송 및 운송 표준을 준수하면서도 공간 대비 용량 효율성이 뛰어납니다. 또한 20피트 컨테이너는 맞춤형 구성을 지원하며, 리튬이온 배터리 팩, 인버터, 배터리 관리 시스템(BMS), 열 제어 장치를 컴팩트한 설치 공간에 통합할 수 있습니다. 특히 도시 지역과 분산형 에너지 프로젝트에서 쌓기 쉽고, 현장 적응성이 뛰어나며, 인허가 및 시운전을 신속하게 처리할 수 있으며, 그 인기가 더욱 높아지고 있습니다. 분야와 지역을 불문하고 분산형 및 모듈형 에너지 저장에 대한 수요가 지속적으로 증가하고 있는 가운데, 20피트 컨테이너는 컨테이너형 BESS 시장에서 확장성, 효율성 및 배포의 민첩성을 전략적으로 결합하여 선호되는 표준으로 자리 잡고 있습니다.

유틸리티 분야는 송전망의 안정성, 운영의 유연성, 대규모 재생에너지의 통합을 보장하는 데 중요한 역할을 하므로 컨테이너형 BESS 시장에서 큰 시장 점유율을 차지할 것으로 예측됩니다. 전력회사가 실시간으로 전력 수요 및 공급의 균형을 맞추기 위해 노력하는 가운데, 컨테이너형 BESS는 피크 부하를 관리하고, 주파수 변동성을 완화하며, 빠른 응답의 보조 서비스를 가능하게 하는 모듈식 확장형 솔루션을 제공합니다. 이러한 시스템은 에너지 버퍼 역할을 하며, 수요가 적은 시기에는 잉여 전력을 저장했다가 수요가 급증할 때 이를 방출하여 부하 평준화를 지원하고 피크시 발전소 의존도를 낮추는 역할을 합니다. 변전소나 송전노드, 재생에너지 발전소 인근에 쉽게 도입할 수 있으며, 대규모 인프라 개보수 없이도 송전망의 응답성을 높일 수 있습니다. 태양광, 풍력 등 간헐적인 재생에너지의 비율이 증가함에 따라 변동성을 관리하고 억제를 방지하기 위해 첨단 에너지 저장이 필요합니다. 인도, 유럽, 북미 등지에서 정부가 지원하는 프로젝트(계통연계형 커뮤니티 저장 및 재생에너지 코로케이션 시스템 포함)는 탄력적이고 저탄소적인 전력망 구축에 있으며, 이 기술의 가치를 입증하고 있습니다. 탈탄소화 및 에너지 전환 목표가 가속화됨에 따라 컨테이너형 BESS는 전 세계 전력회사에 필수적인 자산이 될 것으로 보입니다.

아시아태평양은 탄탄한 배터리 제조 생태계, 급속한 산업화, 청정 에너지에 대한 강력한 정책적 집중에 힘입어 세계 컨테이너형 BESS 시장을 독식할 준비가 되어 있습니다. 중국, 한국, 일본, 인도 등 국가들은 재생에너지 통합, 그리드 현대화, 에너지 저장장치 배치에 대한 대규모 투자를 주도하고 있으며, 이 지역을 컨테이너형 BESS 채택의 세계 핫스팟으로 만들고 있습니다. 아시아태평양에는 CATL, BYD, LG Energy Solution, 삼성SDI와 같은 주요 배터리 제조업체가 있으며, 첨단 기술과 지역 밀착형 공급망에 힘입어 비용 효율적이고 확장성이 뛰어난 컨테이너형 솔루션을 가능하게 합니다.

이 지역에서는 전기자동차, 스마트그리드, 산업자동화에 대한 수요가 증가하고 있으며, 특히 도시 및 외딴 지역에서는 유연하고 신속하게 배치할 수 있는 에너지 저장 시스템의 필요성이 증가하고 있습니다. 보조금, 전기저장 의무화, 재생에너지 목표 등 정부의 지원정책이 신흥 시장과 선진국 시장 모두에서 인프라 도입을 가속화하고 있습니다. 또한 이 지역은 중요한 배터리 재료에 대한 접근성과 낮은 생산 비용으로 인해 경쟁력을 높이고 있습니다. 에너지 안보, 탈탄소화, 전기화 추진이 강화되면서 아시아태평양은 컨테이너형 배터리 시스템의 가장 크고 빠르게 성장하는 시장으로 부상할 것으로 예측됩니다.

세계의 컨테이너형 배터리 에너지 저장 시스템(BESS) 시장에 대해 조사했으며, 배터리 유형별, 용량별, 컨테이너 사이즈별, 용도별, 지역별 동향 및 시장에 참여하는 기업의 개요 등을 정리하여 전해드립니다.

목차

제1장 서론

제2장 조사 방법

제3장 개요

제4장 주요 인사이트

제5장 시장 개요

- 서론

- 시장 역학

- 고객 비즈니스에 영향을 미치는 동향/혼란

- 밸류체인 분석

- 에코시스템 분석

- 투자와 자금조달 시나리오

- 기술 분석

- 특허 분석

- 무역 분석

- 주요 컨퍼런스와 이벤트

- 규제 상황

- Porter's Five Forces 분석

- 주요 이해관계자와 구입 기준

- 가격 분석

- AI의 영향

- 2025년 미국 관세의 영향 개요

- 주요 관세율

- 가격 영향 분석

- 국가/지역에 대한 영향

- 최종 용도 산업에 대한 영향

제6장 컨테이너형 BESS 기술 동향

- 서론

- 모듈식 & 스케일러블 아키텍처

- 배터리 화학의 진보

- 강화된 전력 변환과 제어의 통합

- 안전성, 열관리, 컴플라이언스

- 신속한 배포와 운송성

- 재생에너지와 마이크로그리드와의 통합

- 소프트웨어와 AI별 시장 최적화

- 컨테이너 혁신과 커스터마이즈

- 지역화와 현지 제조

- 지속가능성과 수명주기관리

제7장 컨테이너형 BESS 시장(배터리 유형별)

- 서론

- 리튬이온 배터리

- 첨단 납축전지

- 기타

제8장 컨테이너선 베스 시장(용량별)

- 서론

- 1,000KWH 미만

- 1,000-5,000KWH

- 5,000KWH 이상

제9장 컨테이너 BESS 시장(컨테이너 사이즈별)

- 서론

- 10피트

- 20피트

- 40피트

제10장 컨테이너 화 BESS 시장(용도별)

- 서론

- 주택

- 상업 및 산업

- 유틸리티

제11장 컨테이너선 시장(지역별)

- 서론

- 북미

- 북미의 거시경제 전망

- 미국

- 캐나다

- 멕시코

- 유럽

- 유럽의 거시경제 전망

- 독일

- 영국

- 프랑스

- 이탈리아

- 기타

- 아시아태평양

- 아시아태평양의 거시경제 전망

- 중국

- 일본

- 한국

- 인도

- 기타

- 기타 지역

- 거시경제 전망은 연속

- 중동

- 아프리카

- 남미

제12장 경쟁 구도

- 서론

- 주요 참여 기업의 전략/강점, 2021-2024년

- 매출 분석, 2021-2024년

- 시장 점유율 분석, 2024년

- 기업 평가와 재무 지표

- 브랜드 비교

- 기업 평가 매트릭스 : 주요 참여 기업, 2024년

- 기업 평가 매트릭스 : 스타트업/중소기업, 2024년

- 경쟁 시나리오

제13장 기업 개요

- 주요 참여 기업

- TESLA

- BYD COMPANY LTD.

- CONTEMPORARY AMPEREX TECHNOLOGY CO., LIMITED(CATL)

- EATON

- HONEYWELL INTERNATIONAL INC.

- ABB

- DELTA ELECTRONICS, INC.

- GE VERNOVA

- NGK INSULATORS, LTD.

- FLUENCE

- ALTAS COPCO GROUP

- CUMMINS INC.

- ALPHA ESS CO., LTD.

- SUNGROW

- 기타 기업

- EVESCO LLC

- TLS OFFSHORE CONTAINERS

- GC SOLAR

- APEX ENERGY AUSTRALIA

- SHANGHAI OE INDUSTRIAL CO., LTD.

- EXIDE INDUSTRIES LTD.

- RCT SYSTEMS

- POM SYSTEMS & SERVICES PVT LTD.

- ZECONEX

- AGGREKO

- MICROGREEN SOLAR CORPORATION

제14장 부록

KSA 25.09.05At a CAGR of 20.9%, the global containerized BESS market is projected to grow from USD 13.87 billion in 2025 to USD 35.82 billion by 2030. The containerized BESS market is witnessing strong growth driven by rising renewable energy adoption, grid modernization efforts, and the need for flexible, rapid-deployment storage solutions. These systems offer modularity, scalability, and faster installation, making them ideal for grid support, commercial backup, and off-grid applications.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Battery Type, Capacity, Container Size, Application, and Region |

| Regions covered | North America, Europe, APAC, RoW |

Advancements in lithium-ion battery technologies, enhanced battery management systems, and integrated thermal controls are improving performance, safety, and lifecycle value. Government incentives and clean energy policies across regions such as Asia Pacific, Europe, and North America are accelerating investments. As energy resilience and decarbonization become top priorities, containerized BESS is emerging as a key enabler of next-generation power infrastructure.

"20-foot containers emerge as optimal choice for scalable storage"

20-foot containerized BESS units are expected to capture the largest market share, owing to their ideal balance between storage capacity, mobility, and ease of deployment. These containers offer a mid-size, modular format that is highly favored across a wide range of applications, from commercial and industrial (C&I) installations to utility-scale grid support, providing flexibility without the logistical challenges of larger units. The 20-foot size offers superior space-to-capacity efficiency while maintaining compliance with global shipping and transport standards. Additionally, 20-foot containers support customizable configurations, enabling integration of lithium-ion battery packs, inverters, battery management systems (BMS), and thermal control units, all within a compact footprint. Their popularity is further boosted by ease of stacking, site adaptability, and faster permitting and commissioning timelines, especially in urban or distributed energy projects. As demand for distributed and modular energy storage continues to rise across sectors and geographies, 20-foot containers stand out as the preferred standard, offering a strategic mix of scalability, efficiency, and deployment agility in the containerized BESS market.

"Utilities lead the charge with scalable containerized grid storage solutions in the market."

The utilities segment is projected to hold a significant market share in the containerized BESS market, driven by its critical role in ensuring grid stability, operational flexibility, and large-scale renewable integration. As utilities strive to balance electricity supply and demand in real time, containerized BESS provides a modular and scalable solution for managing peak loads, mitigating frequency fluctuations, and enabling fast-response ancillary services. These systems act as energy buffers, storing excess power during low-demand periods and discharging it when demand surges, thereby supporting load leveling and reducing reliance on peaking power plants. Their ease of deployment at substations, transmission nodes, and near renewable energy generation sites enhances grid responsiveness without extensive infrastructure upgrades. Utility-scale adoption is further fueled by the growing share of intermittent renewables like solar and wind, which require advanced energy storage to manage variability and prevent curtailment. Government-supported projects in regions like India, Europe, and North America-including grid-connected community storage and renewable co-location systems-demonstrate the technology's value in building resilient, low-carbon power networks. As decarbonization and energy transition targets accelerate, containerized BESS will become an indispensable asset for utilities globally.

"Asia Pacific to lead containerized BESS market amid surging renewables and manufacturing strength"

The Asia Pacific region is poised to dominate the global containerized BESS market, supported by its robust battery manufacturing ecosystem, rapid industrialization, and strong policy focus on clean energy. Countries such as China, South Korea, Japan, and India are spearheading large-scale investments in renewable energy integration, grid modernization, and energy storage deployment, making the region a global hotspot for containerized BESS adoption. Asia Pacific is home to leading battery manufacturers like CATL, BYD, LG Energy Solution, and Samsung SDI, enabling cost-effective and scalable containerized solutions backed by advanced technology and localized supply chains.

The region's rising demand for electric vehicles, smart grids, and industrial automation is fueling the need for flexible and rapid-deployment energy storage systems, especially in urban and remote areas. Supportive government policies, including subsidies, storage mandates, and renewable energy targets, are accelerating infrastructure rollouts across both developing and developed markets. Moreover, the region's access to critical battery materials and lower production costs is giving it a competitive edge. As the push for energy security, decarbonization, and electrification intensifies, the Asia Pacific is set to emerge as the largest and fastest-growing market for containerized battery energy storage systems.

Breakdown of primaries

A variety of executives from key organizations operating in the containerized BESS market were interviewed in-depth, including CEOs, marketing directors, and innovation and technology directors.

- By Company Type: Tier 1 - 45%, Tier 2 - 30%, and Tier 3 - 25%

- By Designation: Directors - 35%, C-level - 45%, and Others - 20%

- By Region: North America - 30%, Europe - 25%, Asia Pacific - 35%, and RoW - 10%

Note: Three tiers of companies are defined based on their total revenue as of 2024: tier 1 = revenue more than USD 5 billion; tier 2 = revenue between USD 500 million and USD 5 billion; and tier 3 = revenue less than USD 500 million. Other designations include sales managers, marketing managers, and product managers.

Major players profiled in this report are as follows: Tesla (US), BYD (China), CATL (China), Honeywell International, Inc. (US), Eaton (Ireland), ABB (Switzerland), Delta Electronics, Inc. (Taiwan), Fluence (US), Atlas Copco Group (Sweden), GE Vernova (US), Cummins, Inc. (US), NGK Insulators (Japan), Sungrow (China), Alpha ESS Co., Ltd. (China), Microgreen Solar Corporation (Canada), EVESCO LLC (US), TLS Offshore Containers (China), GC Solar (South Africa), Aggreko (Scotland), Apex Energy Australia (Australia), Shanghai OE Industrial Co., Ltd. (China), Exide Technologies (France), RCT Systems (US), Zeconex (China), Xiamen Kehua Digital Energy Tech Co., Ltd. (China), and Exide Industries (India). These leading companies possess a wide portfolio of products, establishing a prominent presence in established as well as emerging markets.

The study provides a detailed competitive analysis of these key players in the containerized BESS market, presenting their company profiles, most recent developments, and key market strategies.

Research Coverage

In this report, the containerized BESS market has been segmented based on battery type, capacity, container size, application, and region. The battery type segment includes lithium-ion battery, advanced lead-acid battery, and other batteries, which go on to include sodium-based batteries. The capacity segment includes below 1,000 kWh, 1,000-5,000 kWh, and above 5,000 kWh. The container size segment includes 10-foot, 20-foot, and 40-foot containers. The application segment comprises residential, commercial & industrial, and utilities. The market has been segmented into four regions: North America, Asia Pacific, Europe, and Rest of the World (RoW).

Reasons to Buy the Report

The report will help the leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall market and the sub-segments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the containerized BESS market's pulse and provides information on key market drivers, restraints, challenges, and opportunities.

Key Benefits of Buying the Report

- Analysis of key Drivers (integration with renewable energy generation, lithium-ion battery scalability in renewable energy sector, declining battery costs and technological advancements), Restraints (high initial investment costs), Opportunities (rising demand for off-grid and remote energy solutions, expansion of EV charging infrastructure and urban grid support, favorable policies and incentives for clean energy and storage), and Challenges (complex system integration and site-specific requirements, battery degradation, safety risks, and thermal management challenges) influencing the growth of the containerized BESS market

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and new product launches in the containerized BESS market

- Market Development: Comprehensive information about lucrative markets - the report analyses the containerized BESS market across varied regions

- Market Diversification: Exhaustive information about new products/services, untapped geographies, recent developments, and investments in the containerized BESS market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Tesla (US), BYD (China), CATL (China), Honeywell International, Inc. (US), Eaton (Ireland), and ABB (Switzerland)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 YEARS CONSIDERED

- 1.3.3 INCLUSIONS AND EXCLUSIONS

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 List of major secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 Primary interviews with experts

- 2.1.3.2 Key data from primary sources

- 2.1.3.3 Key industry insights

- 2.1.3.4 Breakdown of primaries

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- 2.2.1.1 Estimation of market size using top-down approach

- 2.2.2 BOTTOM-UP APPROACH

- 2.2.2.1 Estimation of market size using bottom-up approach

- 2.2.1 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN CONTAINERIZED BESS MARKET

- 4.2 CONTAINERIZED BESS MARKET, BY BATTERY TYPE

- 4.3 CONTAINERIZED BESS MARKET, BY APPLICATION

- 4.4 ASIA PACIFIC: CONTAINERIZED BESS MARKET, BY APPLICATION AND COUNTRY

- 4.5 CONTAINERIZED BESS MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Integration with renewable energy generation

- 5.2.1.2 Lithium-ion battery scalability in renewable energy sector

- 5.2.1.3 Declining battery costs and technological advancements

- 5.2.2 RESTRAINTS

- 5.2.2.1 High initial investment costs

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rise in demand for off-grid and remote energy solutions

- 5.2.3.2 Expansion of EV charging infrastructure and urban grid support

- 5.2.3.3 Favorable policies and incentives for clean energy and storage

- 5.2.4 CHALLENGES

- 5.2.4.1 Complex system integration and site-specific requirements

- 5.2.4.2 Battery degradation, safety risks, and thermal management challenges

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 INVESTMENT AND FUNDING SCENARIO

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Sodium-sulfur Battery

- 5.7.1.2 Cobalt-free Battery

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 Metal-air battery

- 5.7.2.2 Liquid metal battery

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 Potassium Metal Battery

- 5.7.3.2 Zinc-Manganese Battery

- 5.7.3.3 Lithium-sulfur battery

- 5.7.3.4 Lithium metal battery

- 5.7.1 KEY TECHNOLOGIES

- 5.8 PATENT ANALYSIS

- 5.9 TRADE ANALYSIS

- 5.9.1 IMPORT SCENARIO

- 5.9.2 EXPORT SCENARIO

- 5.10 KEY CONFERENCES & EVENTS

- 5.11 REGULATORY LANDSCAPE

- 5.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11.2 STANDARDS AND REGULATIONS RELATED TO CONTAINERIZED BESS MARKET

- 5.12 PORTER'S FIVE FORCES ANALYSIS

- 5.12.1 THREAT OF NEW ENTRANTS

- 5.12.2 THREAT OF SUBSTITUTES

- 5.12.3 BARGAINING POWER OF SUPPLIERS

- 5.12.4 BARGAINING POWER OF BUYERS

- 5.12.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.13.2 BUYING CRITERIA

- 5.14 PRICING ANALYSIS

- 5.14.1 AVERAGE SELLING PRICE TREND

- 5.14.2 AVERAGE SELLING PRICE OF LITHIUM-ION BATTERY PACKS, BY KEY PLAYER, 2024

- 5.14.3 AVERAGE SELLING PRICE TREND OF LITHIUM-ION BATTERIES, BY REGION

- 5.15 IMPACT OF AI

- 5.15.1 INTRODUCTION

- 5.15.2 IMPACT ON MARKET

- 5.15.3 TOP USE CASES & MARKET POTENTIAL

- 5.16 IMPACT OF 2025 US TARIFF OVERVIEW

- 5.16.1 INTRODUCTION

- 5.17 KEY TARIFF RATES

- 5.18 PRICE IMPACT ANALYSIS

- 5.19 IMPACT ON COUNTRY/REGION

- 5.19.1 US

- 5.19.2 EUROPE

- 5.19.3 ASIA PACIFIC

- 5.20 IMPACT ON END-USE INDUSTRIES

6 TECHNOLOGY TRENDS IN CONTAINERIZED BESS

- 6.1 INTRODUCTION

- 6.2 MODULAR & SCALABLE ARCHITECTURES

- 6.3 ADVANCEMENTS IN BATTERY CHEMISTRIES

- 6.4 ENHANCED POWER CONVERSION AND CONTROL INTEGRATION

- 6.5 SAFETY, THERMAL MANAGEMENT & COMPLIANCE

- 6.6 RAPID DEPLOYMENT AND TRANSPORTABILITY

- 6.7 INTEGRATION WITH RENEWABLE ENERGY AND MICROGRIDS

- 6.8 MARKET OPTIMIZATION THROUGH SOFTWARE & AI

- 6.9 CONTAINER INNOVATIONS & CUSTOMIZATION

- 6.10 REGIONALIZATION AND LOCAL MANUFACTURING

- 6.11 SUSTAINABILITY AND LIFECYCLE MANAGEMENT

7 CONTAINERIZED BESS MARKET, BY BATTERY TYPE

- 7.1 INTRODUCTION

- 7.2 LITHIUM-ION BATTERIES

- 7.2.1 DRIVING SCALABILITY AND PERFORMANCE IN CONTAINERIZED ENERGY STORAGE SYSTEMS

- 7.3 ADVANCED LEAD-ACID BATTERIES

- 7.3.1 OFFERING COST-EFFECTIVE, RESILIENT SOLUTIONS FOR MODULAR CONTAINERIZED STORAGE

- 7.4 OTHER BATTERY TYPES

8 CONTAINERIZED BESS MARKET, BY CAPACITY

- 8.1 INTRODUCTION

- 8.2 BELOW 1,000 KWH

- 8.2.1 ENABLING DECENTRALIZED ENERGY STORAGE FOR RESIDENTIAL AND COMMUNITY USE WITH COMPACT CONTAINERIZED SYSTEMS

- 8.3 BETWEEN 1,000 AND 5,000 KWH

- 8.3.1 BRIDGING GRID FLEXIBILITY AND COMMERCIAL ENERGY RESILIENCE WITH MID-SCALE CONTAINERIZED STORAGE

- 8.4 ABOVE 5,00O KWH

- 8.4.1 OFFERING POWER GRID-SCALE ENERGY TRANSITION AND RENEWABLE INTEGRATION WITH HIGH-CAPACITY CONTAINERIZED SYSTEMS

9 CONTAINERIZED BESS MARKET, BY CONTAINER SIZE

- 9.1 INTRODUCTION

- 9.2 10 FEET

- 9.2.1 INCREASING USE OF COMPACT BATTERIES IN MEDICAL DEVICES

- 9.3 20 FEET

- 9.3.1 RISING FOCUS ON BATTERY DEVELOPMENT FOR ELECTRIC VEHICLES

- 9.4 40 FEET

- 9.4.1 DEPLOYED IN LARGE-SCALE RENEWABLE ENERGY PROJECTS, UTILITY-SCALE GRID STORAGE, AND INDUSTRIAL FACILITIES WITH HIGH ENERGY DEMANDS

10 CONTAINERIZED BESS MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- 10.2 RESIDENTIAL

- 10.2.1 EMPOWERING HOUSEHOLDS WITH ENERGY INDEPENDENCE, SOLAR INTEGRATION, AND EV READINESS

- 10.3 COMMERCIAL & INDUSTRIAL

- 10.3.1 ADOPTED BY COMMERCIAL USERS FOR COST SAVINGS, BACKUP RELIABILITY, AND THIRD-PARTY ENERGY-AS-A-SERVICE MODELS

- 10.3.2 RETAIL

- 10.3.3 HOSPITALITY

- 10.3.4 HEALTHCARE

- 10.3.5 GOVERNMENT

- 10.3.6 EDUCATION

- 10.3.7 OIL & GAS

- 10.3.8 MINING

- 10.3.9 WAREHOUSING & LOGISTICS

- 10.3.10 TELECOMMUNICATIONS

- 10.3.11 INDUSTRIAL MANUFACTURING

- 10.3.12 MARINE

- 10.4 UTILITIES

- 10.4.1 REINFORCING GRID RELIABILITY, ENABLING RENEWABLE INTEGRATION, AND SUPPORTING UTILITY-SCALE FLEXIBILITY

11 CONTAINERIZED BESS MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 MACROECONOMIC OUTLOOK IN NORTH AMERICA

- 11.2.2 US

- 11.2.2.1 US to drive large-scale containerized BESS growth through policy support and state-led deployments

- 11.2.3 CANADA

- 11.2.3.1 Canada accelerated containerized BESS adoption through government funding, tax incentives, and large-scale clean energy projects

- 11.2.4 MEXICO

- 11.2.4.1 Mexico positions containerized BESS as key enabler of its clean energy goals amid new regulations and rising renewable capacity

- 11.3 EUROPE

- 11.3.1 MACROECONOMIC OUTLOOK IN EUROPE

- 11.3.2 GERMANY

- 11.3.2.1 Strong policy framework and commitment to Germany's energy shift

- 11.3.3 UK

- 11.3.3.1 UK scaled up advanced energy storage deployment to support net-zero goals

- 11.3.4 FRANCE

- 11.3.4.1 France ramped up grid-scale energy storage under 2024 decarbonization push

- 11.3.5 ITALY

- 11.3.5.1 Expanded deployment to support renewable integration and grid flexibility under national climate targets

- 11.3.6 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 MACROECONOMIC OUTLOOK IN ASIA PACIFIC

- 11.4.2 CHINA

- 11.4.2.1 China accelerated deployment with advanced sodium-ion and vanadium flow technologies

- 11.4.3 JAPAN

- 11.4.3.1 Japan strengthened containerized BESS rollout through solar integration and battery innovation leadership

- 11.4.4 SOUTH KOREA

- 11.4.4.1 South Korea scaled containerized BESS amid clean energy targets and battery supply chain investments

- 11.4.5 INDIA

- 11.4.5.1 India accelerated containerized BESS adoption to meet ambitious renewable and energy resilience targets

- 11.4.6 REST OF ASIA PACIFIC

- 11.5 REST OF THE WORLD (ROW)

- 11.5.1 MACROECONOMIC OUTLOOK IN ROW

- 11.5.2 MIDDLE EAST

- 11.5.2.1 Rapid economic development and urbanization to support investment in renewable energy

- 11.5.2.2 GCC countries

- 11.5.2.3 Rest of Middle East

- 11.5.3 AFRICA

- 11.5.3.1 Pilot-scale deployments for microgrids and rural electrification, along with international support and public-private partnerships

- 11.5.4 SOUTH AMERICA

- 11.5.4.1 Rise in government investments in region and industry events to deploy renewable energy and offer innovation in modularity and scalability

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2024

- 12.3 REVENUE ANALYSIS, 2021-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.4.1 SHARE ANALYSIS FOR OVERALL MARKET

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS

- 12.5.1 COMPANY VALUATION

- 12.5.2 FINANCIAL METRICS

- 12.6 BRAND COMPARISON

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.7.5.1 Company footprint

- 12.7.5.2 Regional Footprint

- 12.7.5.3 Container Size footprint

- 12.7.5.4 Capacity footprint

- 12.7.5.5 Application footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.8.5.1 Detailed list of key startups/SMEs

- 12.8.5.2 Competitive benchmarking of key startups/SMEs

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

- 12.9.3 OTHER DEVELOPMENTS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 TESLA

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 MnM view

- 13.1.1.3.1 Key strengths/Right to win

- 13.1.1.3.2 Strategic choices

- 13.1.1.3.3 Weaknesses and competitive threats

- 13.1.2 BYD COMPANY LTD.

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 MnM view

- 13.1.2.3.1 Key strengths/Right to win

- 13.1.2.3.2 Strategic choices

- 13.1.2.3.3 Weaknesses and competitive threats

- 13.1.3 CONTEMPORARY AMPEREX TECHNOLOGY CO., LIMITED (CATL)

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product launches

- 13.1.3.3.2 Deals

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths/Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 EATON

- 13.1.4.1 Business overview

- 13.1.4.2 Product/Solution/Service offered

- 13.1.4.3 MnM view

- 13.1.4.3.1 Key strengths/Right to win

- 13.1.4.3.2 Strategic choices

- 13.1.4.3.3 Weaknesses and competitive threats

- 13.1.5 HONEYWELL INTERNATIONAL INC.

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Developments

- 13.1.5.4 MnM view

- 13.1.5.4.1 Key strengths/Right to win

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses and competitive threats

- 13.1.6 ABB

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Deals

- 13.1.7 DELTA ELECTRONICS, INC.

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.8 GE VERNOVA

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Deals

- 13.1.9 NGK INSULATORS, LTD.

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Deals

- 13.1.10 FLUENCE

- 13.1.10.1 Business overview

- 13.1.10.2 Product/Solution/Service offered

- 13.1.11 ALTAS COPCO GROUP

- 13.1.11.1 Business overview

- 13.1.11.2 Product/Solution/Service offered

- 13.1.11.3 Recent developments

- 13.1.11.3.1 Product launches

- 13.1.11.3.2 Deals

- 13.1.12 CUMMINS INC.

- 13.1.12.1 Business overview

- 13.1.12.2 Product/Solution/Service offered

- 13.1.13 ALPHA ESS CO., LTD.

- 13.1.13.1 Business overview

- 13.1.13.2 Product/Solution/Service offered

- 13.1.14 SUNGROW

- 13.1.14.1 Business overview

- 13.1.14.2 Product/Solution/Service offered

- 13.1.14.3 Recent developments

- 13.1.14.3.1 Deals

- 13.1.1 TESLA

- 13.2 OTHER PLAYERS

- 13.2.1 EVESCO LLC

- 13.2.2 TLS OFFSHORE CONTAINERS

- 13.2.3 GC SOLAR

- 13.2.4 APEX ENERGY AUSTRALIA

- 13.2.5 SHANGHAI OE INDUSTRIAL CO., LTD.

- 13.2.6 EXIDE INDUSTRIES LTD.

- 13.2.7 RCT SYSTEMS

- 13.2.8 POM SYSTEMS & SERVICES PVT LTD.

- 13.2.9 ZECONEX

- 13.2.10 AGGREKO

- 13.2.11 MICROGREEN SOLAR CORPORATION

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS