|

시장보고서

상품코드

1802924

디지털 워크플레이스 시장 예측(-2030년) : 유형별, 배포 모드별, 조직 규모별, 업계별, 지역별Digital Workplace Market by Type (Security and Compliance (IAM, DLP, Threat Detection & Response), End-user Computing, Communication and Collaboration (UCaaS, Video Conferencing)), Deployment Mode (Cloud), Vertical, Region - Global forecast to 2030 |

||||||

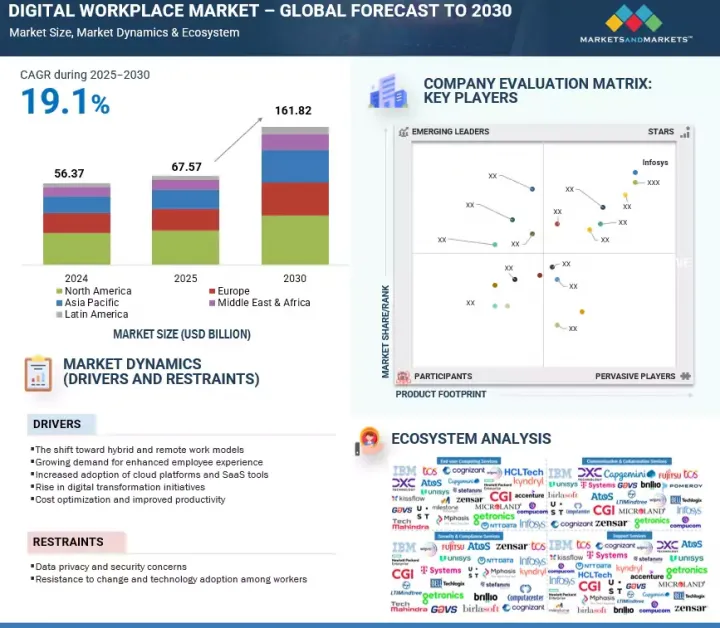

세계의 디지털 워크플레이스 시장 규모는 2025년 675억 7,000만 달러에서 2030년에는 1,618억 2,000만 달러로 성장하며, 예측 기간 중 연평균 성장률(CAGR)은 19.1%에 달할 것으로 예측됩니다.

디지털 전환에 대한 관심이 높아지면서 조직 운영 방식을 재구성하고 디지털 워크플레이스 솔루션에 대한 수요가 증가하고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상연도 | 2019-2030년 |

| 기준연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 검토 단위 | 금액(100만 달러/10억 달러) |

| 부문 | 유형별, 배포 모드별, 조직 규모별, 업계별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 중동 및 아프리카, 라틴아메리카 |

기업은 원격 및 하이브리드 모델을 지원하기 위해 워크플로우를 재설계하고 있으며, 마이크로소프트 팀즈(Microsoft Teams)나 구글 워크스페이스(Google Workspace)와 같은 툴이 협업에 필수적인 요소로 자리 잡고 있습니다. 2024년 4월, 유니레버는 AI를 활용한 새로운 디지털 워크플레이스 플랫폼을 출시하여 직원 경험을 개인화하고, 사내 커뮤니케이션을 간소화하며, 전 세계 직원들의 업무 툴을 통합하는 등 새로운 디지털 워크플레이스 플랫폼을 구축했습니다. 동시에 비용 최적화와 생산성 향상도 계속해서 중요한 원동력이 되고 있습니다. 예를 들어 지멘스는 2025년 2월에 클라우드 기반 디지털 워크플레이스 프레임워크를 구축하여 지능형 자동화 및 자원에 대한 통합 액세스를 통해 인프라 비용을 절감하고 팀의 생산성을 향상시켰습니다.

클라우드 부문은 확장성, 접근성, 비용 효율성으로 인해 디지털 워크플레이스 서비스 시장에서 가장 큰 시장 점유율을 차지하고 있습니다. 모든 업종의 기업이 원격근무 대응, IT 프로세스 최적화, 인프라의 손쉬운 관리를 위해 클라우드 호스트의 디지털 워크플레이스 툴을 채택하고 있습니다. 클라우드를 도입하면 직원들은 필요한 업무 툴와 용도를 어디서든, 어떤 기기에서든 사용할 수 있으므로 원격 근무 및 하이브리드 근무 환경에 적합합니다. 또한 IT 팀은 On-Premise 유지보수를 위한 오버헤드 없이 업데이트, 보안 패치, 시스템 모니터링을 중앙에서 관리할 수 있습니다. 클라우드 플랫폼은 협업 툴, 엔드포인트 관리, 직원 경험 솔루션을 쉽게 통합하여 서비스 프로바이더가 통합 디지털 워크플레이스 서비스를 제공하는 작업을 간소화할 수 있도록 지원합니다. Wipro, HCLTech, TCS와 같은 벤더들은 클라우드 네이티브 생태계를 제공하고 있으며, 상호운용성과 빠른 가치 실현 시간으로 인해 기업의 채택이 증가하고 있습니다. 소매, 의료, 전문 서비스 등 역동적인 인력 산업에서 클라우드를 도입하면 대규모 하드웨어 투자 없이도 비즈니스 크리티컬한 시스템에 상시 접속할 수 있습니다. 클라우드 기반 분석, 자동화, 셀프 서비스 포털도 서비스 프로바이더들이 서비스 제공을 개선하기 위해 도입하고 있습니다. 이러한 영업 지출 모델에서 자본 지출 모델로의 전환 추세는 클라우드의 종량제 모델과 일치하며, 디지털 워크플레이스에서 유연성과 대응력을 필요로 하는 조직은 클라우드를 채택하는 것이 편리하고 전략적인 결정이 될 수 있습니다.

미국은 최신 워크플레이스 기술을 가장 먼저 도입하고, 주요 서비스 프로바이더들의 존재감이 강해 북미 디지털 워크플레이스 시장에서 가장 큰 시장 점유율을 차지하고 있습니다. IBM, 액센츄어, 코그니젠트, DXC 테크놀러지 등의 기업이 미국에서 큰 영향력을 행사하고 있으며, 업계 전반에 걸쳐 디지털 솔루션의 신속한 배포를 가능하게 하고 있습니다. 하이브리드 업무와 원격 근무 모델로 전환하면서 클라우드 기반 협업 플랫폼, 가상 데스크톱, AI를 활용한 생산성 향상 툴이 널리 채택되고 있습니다. 2024년 5월, JP모건 체이스는 자동화와 머신러닝을 활용하여 각 부서의 업무를 효율화하는 새로운 디지털 워크플레이스 기반을 도입했습니다. 미국은 기업의 SaaS 도입도 선도하고 있으며, Microsoft 365, Slack과 같은 플랫폼이 기업 워크플로우에 깊숙이 통합되어 있습니다. BFSI, 헬스케어, 제조 등 안전하고 확장성이 높은 디지털 워크플레이스 모델을 필요로 하는 분야의 강력한 수요가 이러한 성장에 기여하고 있습니다. 연방 정부 및 공공 기관도 레거시 시스템을 현대화하고 사내 커뮤니케이션을 개선하기 위해 디지털 워크플레이스 전략을 채택하고 있습니다. 사이버 보안, 디지털 인프라, 직원 경험 플랫폼에 대한 강력한 투자는 이 시장에서 미국의 입지를 강화하고 있습니다. 이러한 발전으로 미국은 디지털 워크플레이스 시장에서 주도적인 역할을 유지할 수 있습니다.

세계의 디지털 워크플레이스 시장에 대해 조사했으며, 유형별, 배포 모드별, 조직 규모별, 업계별, 지역별 동향 및 시장에 참여하는 기업의 개요 등을 정리하여 전해드립니다.

목차

제1장 서론

제2장 조사 방법

제3장 개요

제4장 주요 인사이트

제5장 시장 개요와 업계 동향

- 서론

- 시장 역학

- 사례 연구 분석

- 밸류체인 분석

- 에코시스템

- Porter's Five Forces 분석

- 가격 분석

- 기술 분석

- 특허 분석

- 고객 비즈니스에 영향을 미치는 동향과 혼란

- 주요 이해관계자와 구입 기준

- 규제 상황

- 2026년의 주요 컨퍼런스와 이벤트

- 투자와 자금조달 시나리오

- 생성형 AI가 디지털 워크플레이스 시장에 미치는 영향

- 2025년 미국 관세의 영향-개요

제6장 디지털 워크플레이스 시장(유형별)

- 서론

- 최종사용자 컴퓨팅

- 커뮤니케이션과 협업

- 보안과 컴플라이언스

- 지원 서비스

제7장 디지털 워크플레이스 시장(배포 모드별)

- 서론

- 온프레미스

- 클라우드

- 하이브리드

제8장 디지털 워크플레이스 시장(조직 규모별)

- 서론

- 대기업

- 중소기업

제9장 디지털 워크플레이스 시장(업계별)

- 서론

- BFSI

- 정부·공공 부문

- 제조

- 헬스케어·생명과학

- IT·통신

- 소매·E-Commerce

- 에너지·유틸리티

- 기타

제10장 디지털 워크플레이스 시장(지역별)

- 서론

- 북미

- 북미 : 거시경제 전망

- 북미 : 디지털 워크플레이스 시장 성장 촉진요인

- 미국

- 캐나다

- 유럽

- 유럽 : 거시경제 전망

- 유럽 : 디지털 워크플레이스 시장 성장 촉진요인

- 영국

- 독일

- 프랑스

- 이탈리아

- 기타

- 아시아태평양

- 아시아태평양 : 거시경제 전망

- 아시아태평양 : 디지털 워크플레이스 시장 성장 촉진요인

- 중국

- 일본

- 인도

- 기타

- 중동 및 아프리카

- 중동 및 아프리카 : 거시경제 전망

- 중동 및 아프리카 : 디지털 워크플레이스 시장 성장 촉진요인

- 중동

- 아프리카

- 라틴아메리카

- 라틴아메리카 : 거시경제 전망

- 라틴아메리카 : 디지털 워크플레이스 시장 성장 촉진요인

- 브라질

- 멕시코

- 기타

제11장 경쟁 구도

- 주요 참여 기업의 전략/강점

- 매출 분석

- 시장 점유율 분석

- 브랜드/제품 비교

- 기업 평가와 재무 지표

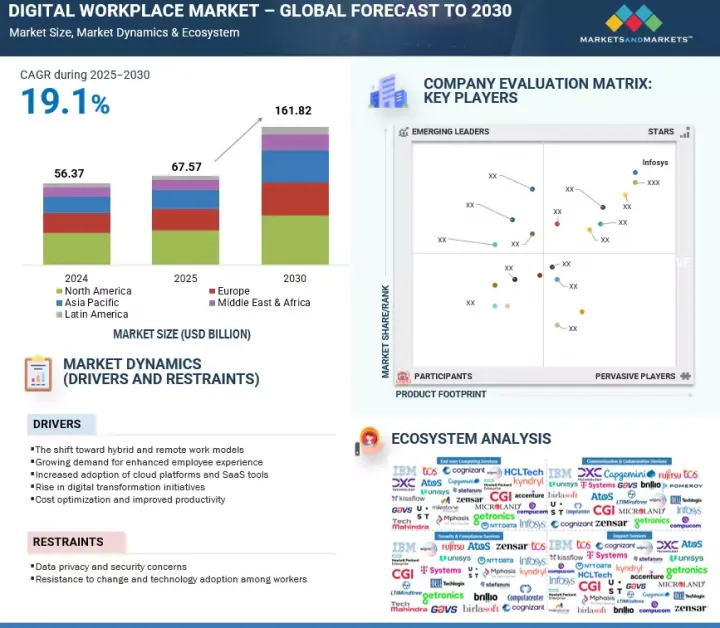

- 기업 평가 매트릭스 : 주요 참여 기업, 2024년

- 기업 평가 매트릭스 : 스타트업/중소기업, 2024년

- 경쟁 시나리오와 동향

제12장 기업 개요

- 주요 참여 기업

- TCS

- WIPRO

- DXC TECHNOLOGY

- HCLTECH

- INFOSYS

- FUJITSU

- ATOS

- NTT DATA

- IBM

- COGNIZANT

- ACCENTURE

- KYNDRYL

- HPE

- CAPGEMINI

- UNISYS

- TECH MAHINDRA

- 기타 기업

- STEFANINI

- COMPUTACENTER

- COMPUCOM

- T-SYSTEMS

- GETRONICS

- CGI

- MILESTONE TECHNOLOGIES

- MPHASIS

- BIRLASOFT

- NEUREALM(GAVS TECHNOLOGIES)

- UST

- MICROLAND

- BRILLIO

- BELL TECHLOGIX

- POMEROY

- LTIMINDTREE

- KISSFLOW

- GROUPE.IO

- AXERO SOLUTIONS

- YOROSIS TECHNOLOGIES

- WORKGRID SOFTWARE

- FLEXSIN

제13장 인접 시장/관련 시장

제14장 부록

KSA 25.09.08The global digital workplace market size is projected to grow from USD 67.57 billion in 2025 to USD 161.82 billion by 2030 at a Compound Annual Growth Rate (CAGR) of 19.1% during the forecast period. The rise in digital transformation initiatives is reshaping how organizations operate, driving demand for digital workplace solutions.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/USD Billion) |

| Segments | Type, Deployment Mode, Organization Size, Vertical, and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

Companies are redesigning workflows to support remote and hybrid models, with tools like Microsoft Teams and Google Workspace becoming essential for collaboration. In April 2024, Unilever launched a new AI-powered digital workplace platform to personalize employee experiences, streamline internal communications, and unify work tools across its global workforce. At the same time, cost optimization and productivity gains remain key drivers. For instance, in February 2025, Siemens rolled out a cloud-based digital workplace framework to reduce infrastructure costs and improve team productivity through intelligent automation and unified access to resources.

"By deployment mode, the cloud segment is expected to hold the largest market share during the forecast period."

The cloud segment holds the largest market share in the digital workplace services market due to its scalability, accessibility, and cost-effectiveness. Businesses of all industries are adopting cloud-hosted digital workplace tools to accommodate remote workforces, optimize IT processes, and manage infrastructure easily. Cloud deployment allows employees to use the necessary workplace tools and applications anywhere and on any device, which makes it suitable for use in remote and hybrid work environments. It also enables IT teams to centrally manage updates, security patches, and system monitoring without the overhead of maintaining on-premises. Cloud platforms enable an easy integration of collaboration tools, endpoint management, and employee experience solutions, simplifying the task of service providers to offer unified digital workplace services. Vendors such as Wipro, HCLTech, and TCS provide cloud-native ecosystems that enterprises are increasingly adopting because of their interoperability and shorter time-to-value. Cloud deployment in dynamic workforce industries like retail, healthcare, and professional services provides constant access to business-critical systems without significant hardware investments. The cloud-based analytics, automation, and self-service portals are also being incorporated by service providers to improve service delivery. This increasing trend of operating expenditure model to capital expenditure model also fits the pay-as-you-go model of cloud, which is a convenient and strategic decision to adopt the cloud in organizations that need flexibility and responsiveness in their digital workplace.

The US is expected to hold the largest market size in the North American region during the forecast period.

The US holds the largest market share in the North American digital workplace market due to its early adoption of modern workplace technologies and strong presence of major service providers. Companies such as IBM, Accenture, Cognizant, and DXC Technology have a significant presence in the US, enabling rapid deployment of digital solutions across industries. The shift toward hybrid and remote working models has led to widespread adoption of cloud-based collaboration platforms, virtual desktops, and AI-powered productivity tools. In May 2024, JPMorgan Chase implemented a new digital workplace infrastructure designed to streamline operations across departments using automation and machine learning. The US also leads in enterprise SaaS adoption, with platforms such as Microsoft 365 and Slack being deeply integrated into corporate workflows. Strong demand from sectors such as BFSI, healthcare, and manufacturing, all of which require secure and scalable digital workplace models, contributes to this growth. The federal government and public sector agencies are also adopting digital workplace strategies to modernize legacy systems and improve internal communication. Strong investment in cybersecurity, digital infrastructure, and employee experience platforms strengthens the US position in this market. These developments collectively enable the US to maintain a leading role in the digital workplace market.

Breakdown of primaries

The study contains insights from various industry experts, from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: Tier 1 - 35%, Tier 2 - 45%, and Tier 3 - 20%

- By Designation: Managerial and Other Levels - 60%, C-Level - 40%

- By Region: North America - 35%, Europe - 20%, Asia Pacific - 20%, Middle East & Africa - 20%, Latin America - 5%

Major vendors in the global digital workplace market include Atos (France), Cognizant (US), IBM (US), Wipro (India), TCS (India), Infosys (India), DXC Technology (US), Accenture (Ireland), Capgemini (France), Fujitsu (Japan), HCL Technology (India), HPE (US), Kyndryl (US), NTT Data (Japan), Unisys (US), Tech Mahindra (Pune), Stefanini (Brazil), Computacenter (England), CompuCom (US), T-Systems (Germany), Getronics (Netherlands), CGI (Canada), Milestone Technologies (US), Mphasis (India), Birlasoft (India), Neurealm (US), UST (US), Microland (India), Brillio (US), Bell Techlogix (US), Pomeroy (US), LTIMindtree (India), Kissflow (US), and Groupe.io (US).

The study includes an in-depth competitive analysis of the key players in the digital workplace market, their company profiles, recent developments, and key market strategies.

Research Coverage

The report segments the digital workplace market and forecasts its size type (end-user computing, communication and collaboration, security and compliance, and support services), deployment mode (on-premises, cloud, and hybrid), organization size (large enterprises and SMEs), and vertical (banking, financial services, and insurance, retail & e-commerce, government & public sector, healthcare & life sciences, manufacturing, telecommunications, energy & utilities, other verticals (education and media & entertainment)).

The study also includes an in-depth competitive analysis of the market's key players, their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report

The report will help market leaders and new entrants with information on the closest approximations of the revenue numbers for the overall digital workplace market and its subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (the shift toward hybrid and remote work models, Growing demand for enhanced employee experience, increased adoption of cloud platforms and SaaS tools, Rise in digital transformation initiatives, cost optimization and improved productivity), restraints (Data privacy and security concerns, resistance to change and technology adoption among workers), opportunities (rising demand for Experience-Level Agreements (XLAs), integration of AI, automation and analytics, integration with digital twin and IoT technologies, employee upskilling and learning platforms), and challenges (Fragmented tool ecosystems, evolving cybersecurity threat landscape, ensuring consistent user experience across devices and locations)

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the digital workplace market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the digital workplace market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the digital workplace market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players in digital workplace market strategies, including Atos (France), Cognizant (US), IBM (US), Wipro (India), and TCS (India).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primary profiles

- 2.1.2.2 Key industry insights

- 2.2 DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- 2.4 MARKET REVENUE ESTIMATION

- 2.5 MARKET FORECAST

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 STUDY LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 OVERVIEW OF DIGITAL WORKPLACE MARKET

- 4.2 DIGITAL WORKPLACE MARKET, BY TYPE

- 4.3 DIGITAL WORKPLACE MARKET, BY END-USER COMPUTING

- 4.4 DIGITAL WORKPLACE MARKET, BY COMMUNICATION AND COLLABORATION

- 4.5 DIGITAL WORKPLACE MARKET, BY SECURITY AND COMPLIANCE

- 4.6 DIGITAL WORKPLACE MARKET, BY SUPPORT SERVICES

- 4.7 DIGITAL WORKPLACE MARKET, BY DEPLOYMENT MODE

- 4.8 DIGITAL WORKPLACE MARKET, BY ORGANIZATION SIZE

- 4.9 DIGITAL WORKPLACE MARKET, BY VERTICAL

- 4.10 MARKET INVESTMENT SCENARIO

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Shift toward hybrid and remote work models

- 5.2.1.2 Growing demand for enhanced employee experience

- 5.2.1.3 Increased adoption of cloud platforms and SaaS tools

- 5.2.1.4 Rise in digital transformation initiatives

- 5.2.1.5 Cost optimization and improved productivity

- 5.2.2 RESTRAINTS

- 5.2.2.1 Data privacy and security concerns

- 5.2.2.2 Resistance to change and technology adoption among workers

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising demand for experience-level agreements (XLAs)

- 5.2.3.2 Integration of AI, automation, and analytics

- 5.2.3.3 Integration with digital twin and IoT technologies

- 5.2.3.4 Employee upskilling and learning platforms

- 5.2.4 CHALLENGES

- 5.2.4.1 Fragmented tool ecosystems

- 5.2.4.2 Evolving cybersecurity threat landscape

- 5.2.4.3 Ensuring consistent user experience across devices and locations

- 5.2.1 DRIVERS

- 5.3 CASE STUDY ANALYSIS

- 5.3.1 ACCENTURE'S DIGITAL WORKPLACE SOLUTION HELPED TECHSOL MODERNIZE EMPLOYEE EXPERIENCE

- 5.3.2 HCLTECH ENABLED EDUCORE TO CREATE HYBRID DIGITAL LEARNING WORKPLACE

- 5.3.3 INFOSYS HELPED RETAILVERSE MODERNIZE FRONTLINE WORKER EXPERIENCE

- 5.4 VALUE CHAIN ANALYSIS

- 5.4.1 TECHNOLOGY PROVIDERS

- 5.4.2 PLANNING & DESIGNING

- 5.4.3 SYSTEM INTEGRATION

- 5.4.4 MANAGED SERVICE PROVIDERS

- 5.4.5 END-USER GROUPS

- 5.5 ECOSYSTEM

- 5.6 PORTER'S FIVE FORCES ANALYSIS

- 5.6.1 THREAT OF NEW ENTRANTS

- 5.6.2 THREAT OF SUBSTITUTES

- 5.6.3 BARGAINING POWER OF SUPPLIERS

- 5.6.4 BARGAINING POWER OF BUYERS

- 5.6.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.7 PRICING ANALYSIS

- 5.7.1 AVERAGE SELLING PRICE OF KEY PLAYERS, BY SERVICE TYPE

- 5.7.2 INDICATIVE PRICING ANALYSIS, BY PLATFORM AND SERVICE, 2025

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Machine Learning (ML) and Artificial Intelligence (AI)

- 5.8.1.2 Cloud Computing

- 5.8.1.3 AR/VR (Augmented Reality/Virtual Reality)

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Internet of Things (IoT)

- 5.8.2.2 Analytics

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Real-time Authentication (RTA)

- 5.8.1 KEY TECHNOLOGIES

- 5.9 PATENT ANALYSIS

- 5.9.1 LIST OF TOP PATENTS IN DIGITAL WORKPLACE MARKET, 2023-2025

- 5.10 TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.11 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.11.2 BUYING CRITERIA

- 5.12 REGULATORY LANDSCAPE

- 5.12.1 INTERNATIONAL ORGANIZATION FOR STANDARDIZATION

- 5.12.2 NATIONAL INSTITUTE OF STANDARDS AND TECHNOLOGY

- 5.12.3 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT

- 5.12.4 CALIFORNIA CONSUMER PRIVACY ACT (CCPA)

- 5.12.5 GENERAL DATA PROTECTION REGULATION

- 5.12.6 SARBANES-OXLEY ACT (SOX)

- 5.12.7 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13 KEY CONFERENCES & EVENTS, 2026

- 5.14 INVESTMENT & FUNDING SCENARIO

- 5.15 IMPACT OF GENERATIVE AI ON DIGITAL WORKPLACE MARKET

- 5.15.1 TOP USE CASES AND MARKET POTENTIAL

- 5.15.2 IMPACT OF GEN AI ON INTERCONNECTED AND ADJACENT ECOSYSTEMS

- 5.15.2.1 IT Service Management (ITSM) & Helpdesks

- 5.15.2.2 Digital Experience Platforms (DXPs)

- 5.15.2.3 Knowledge Management Systems

- 5.15.2.4 Unified Endpoint Management (UEM)

- 5.15.2.5 Security & Identity Management

- 5.16 IMPACT OF 2025 US TARIFF - OVERVIEW

- 5.16.1 INTRODUCTION

- 5.16.2 KEY TARIFF RATES

- 5.16.3 PRICE IMPACT ANALYSIS

- 5.16.3.1 Strategic shifts and emerging trends

- 5.16.4 IMPACT ON COUNTRY/REGION

- 5.16.4.1 US

- 5.16.4.2 Europe

- 5.16.4.3 APAC

- 5.16.5 IMPACT ON END-USE INDUSTRIES

6 DIGITAL WORKPLACE MARKET, BY TYPE

- 6.1 INTRODUCTION

- 6.1.1 TYPE: DIGITAL WORKPLACE MARKET DRIVERS

- 6.2 END-USER COMPUTING

- 6.2.1 INCREASING DEMAND FOR CLOUD-BASED END-USER COMPUTING SOLUTIONS DRIVING GROWTH OF DIGITAL WORKPLACE MARKET

- 6.2.2 VIRTUAL DESKTOP INFRASTRUCTURE

- 6.2.2.1 Enabling secure and scalable workspaces with virtual desktop infrastructure

- 6.2.3 DEVICE MANAGEMENT

- 6.2.3.1 Managing enterprise devices efficiently through centralized control solutions

- 6.2.4 APPLICATION VIRTUALIZATION

- 6.2.4.1 Assist in supporting remote and hybrid work models

- 6.2.5 WORKFLOW AUTOMATION TOOLS

- 6.2.5.1 Accelerating business processes with intelligent workflow automation tools

- 6.3 COMMUNICATION AND COLLABORATION

- 6.3.1 ENHANCING TEAM PRODUCTIVITY WITH SEAMLESS COMMUNICATION AND COLLABORATION SERVICES

- 6.3.2 UNIFIED COMMUNICATIONS-AS-A-SERVICE (UCAAS)

- 6.3.2.1 Streamlining enterprise communication with UCAAS

- 6.3.3 VIDEO CONFERENCING MANAGEMENT

- 6.3.3.1 Optimizing remote collaboration through video conferencing management

- 6.3.4 COLLABORATION PLATFORM ADMINISTRATION

- 6.3.4.1 Enabling seamless teamwork through collaboration platform administration services

- 6.4 SECURITY AND COMPLIANCE

- 6.4.1 SAFEGUARD USER IDENTITIES, DEVICES, APPLICATIONS, AND COMMUNICATION CHANNELS IN DISTRIBUTED ENVIRONMENTS

- 6.4.2 IDENTITY AND ACCESS MANAGEMENT (IAM)

- 6.4.2.1 Rise of hybrid work models, multi-device access, and cloud-based applications drive the market growth

- 6.4.3 DATA LOSS PREVENTION

- 6.4.3.1 Help organizations enforce security policies and ensure compliance with data protection regulations

- 6.4.4 ENDPOINT SECURITY

- 6.4.4.1 Protecting digital work environments with robust endpoint security solutions

- 6.4.5 THREAT DETECTION AND RESPONSE

- 6.4.5.1 Enhancing workplace security with threat detection and response tools

- 6.4.6 COMPLIANCE MONITORING

- 6.4.6.1 Rising data privacy laws and remote work environments drive adoption of compliance monitoring services

- 6.5 SUPPORT SERVICES

- 6.5.1 ENABLING SEAMLESS OPERATIONS WITH RELIABLE WORKPLACE SUPPORT SERVICES

- 6.5.2 CONSULTING AND ADVISORY SERVICES

- 6.5.2.1 Assist in navigating complexities of hybrid work environments

- 6.5.3 TRAINING AND DEVELOPMENT SERVICES

- 6.5.3.1 Help organizations to maintain agility, enhance digital literacy, and support long-term business transformation

- 6.5.4 TECHNICAL SUPPORT

- 6.5.4.1 Ensuring workplace continuity with scalable technical support services

7 DIGITAL WORKPLACE MARKET, BY DEPLOYMENT MODE

- 7.1 INTRODUCTION

- 7.1.1 DEPLOYMENT MODE: DIGITAL WORKPLACE MARKET DRIVERS

- 7.2 ON-PREMISES

- 7.2.1 MANAGING DATA WITHIN SECURED DATABASES AND MINIMIZING EXPOSURE TO EXTERNAL THREATS

- 7.3 CLOUD

- 7.3.1 REDUCING IT BURDEN AND COSTS THROUGH CLOUD-ENABLED DIGITAL WORKPLACES

- 7.4 HYBRID

- 7.4.1 FLEXIBLE, SECURE DIGITAL WORKPLACE TRANSFORMATION AT SCALE WITH HYBRID DEPLOYMENT

8 DIGITAL WORKPLACE MARKET, BY ORGANIZATION SIZE

- 8.1 INTRODUCTION

- 8.1.1 ORGANIZATION SIZE: DIGITAL WORKPLACE MARKET DRIVERS

- 8.2 LARGE ENTERPRISES

- 8.2.1 IMPROVED WORKPLACE EXPERIENCE DUE TO DIGITAL WORKPLACE SERVICES

- 8.3 SMALL & MEDIUM-SIZED ENTERPRISES

- 8.3.1 SMES' RAPID DIGITAL ADOPTION SIGNIFICANTLY DRIVES DIGITAL WORKPLACE MARKET GROWTH

9 DIGITAL WORKPLACE MARKET, BY VERTICAL

- 9.1 INTRODUCTION

- 9.1.1 VERTICAL: DIGITAL WORKPLACE MARKET DRIVERS

- 9.2 BFSI

- 9.2.1 REDUCE OPERATIONAL COSTS, IMPROVE TIME-TO-MARKET FOR NEW OFFERINGS, AND ENHANCE CUSTOMER ENGAGEMENT

- 9.3 GOVERNMENT & PUBLIC SECTOR

- 9.3.1 USE OF VAST AMOUNTS OF CONFIDENTIAL AND SENSITIVE INFORMATION IN GOVERNMENT ENTITIES TO ENCOURAGE MARKET EXPANSION

- 9.4 MANUFACTURING

- 9.4.1 MODERNIZING MANUFACTURING WORKFLOWS WITH DIGITAL WORKPLACE INTEGRATION

- 9.5 HEALTHCARE & LIFE SCIENCES

- 9.5.1 ENABLING SMARTER CARE DELIVERY THROUGH DIGITAL WORKPLACE INTEGRATION

- 9.6 IT & TELECOMMUNICATIONS

- 9.6.1 EMPOWERING IT & TELECOMMUNICATIONS WORKFORCES WITH SMART, SCALABLE DIGITAL WORKPLACE SERVICES

- 9.7 RETAIL & E-COMMERCE

- 9.7.1 ENHANCING RETAIL AND E-COMMERCE EFFICIENCY WITH INTELLIGENT DIGITAL WORKPLACE INTEGRATION

- 9.8 ENERGY & UTILITIES

- 9.8.1 ACCELERATING DIGITALIZATION WITH SEAMLESS WORKPLACE COLLABORATION AND CONNECTIVITY

- 9.9 OTHER VERTICALS

10 DIGITAL WORKPLACE MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 10.2.2 NORTH AMERICA: DIGITAL WORKPLACE MARKET DRIVERS

- 10.2.3 US

- 10.2.3.1 Increasing adoption of hybrid work model and connectivity to drive market

- 10.2.4 CANADA

- 10.2.4.1 Public policy alignment, hybrid work, and connectivity to drive digital workplace market

- 10.3 EUROPE

- 10.3.1 EUROPE: MACROECONOMIC OUTLOOK

- 10.3.2 EUROPE: DIGITAL WORKPLACE MARKET DRIVERS

- 10.3.3 UK

- 10.3.3.1 Hybrid work, AI, and compliance fuel digital workplace services expansion and efficiency

- 10.3.4 GERMANY

- 10.3.4.1 Advancing hybrid work and AI integration drives Germany's digital workplace market growth

- 10.3.5 FRANCE

- 10.3.5.1 Implementation of modernization and AI integration driving market growth

- 10.3.6 ITALY

- 10.3.6.1 Demand for system integration and intelligent workflow enablement driving the market growth

- 10.3.7 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 10.4.2 ASIA PACIFIC: DIGITAL WORKPLACE MARKET DRIVERS

- 10.4.3 CHINA

- 10.4.3.1 Infrastructure modernization and talent development to boost market

- 10.4.4 JAPAN

- 10.4.4.1 Aging workforce and policy innovation to boost market growth

- 10.4.5 INDIA

- 10.4.5.1 Government digital infrastructure and hybrid work drive India's workplace services growth

- 10.4.6 REST OF ASIA PACIFIC

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 10.5.2 MIDDLE EAST & AFRICA: DIGITAL WORKPLACE MARKET DRIVERS

- 10.5.3 MIDDLE EAST

- 10.5.3.1 GCC

- 10.5.3.1.1 UAE

- 10.5.3.1.2 KSA

- 10.5.3.1.3 Rest of GCC

- 10.5.3.2 Rest of Middle East

- 10.5.3.1 GCC

- 10.5.4 AFRICA

- 10.5.4.1 Expanding workforce and accelerating digital transformation across businesses to accelerate market growth

- 10.5.4.1.1 South Africa

- 10.5.4.1.2 Rest of Africa

- 10.5.4.1 Expanding workforce and accelerating digital transformation across businesses to accelerate market growth

- 10.6 LATIN AMERICA

- 10.6.1 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 10.6.2 LATIN AMERICA: DIGITAL WORKPLACE MARKET DRIVERS

- 10.6.3 BRAZIL

- 10.6.3.1 Increased digitalization and investment in infrastructure to drive market

- 10.6.4 MEXICO

- 10.6.4.1 Digital identity, hybrid work, and infrastructure to drive adoption of digital workplace solutions

- 10.6.5 REST OF LATIN AMERICA

11 COMPETITIVE LANDSCAPE

- 11.1 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.1.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY DIGITAL WORKPLACE VENDORS, 2023-2025

- 11.2 REVENUE ANALYSIS

- 11.3 MARKET SHARE ANALYSIS

- 11.4 BRAND/PRODUCT COMPARISON

- 11.5 COMPANY VALUATION AND FINANCIAL METRICS

- 11.5.1 COMPANY VALUATION

- 11.5.2 FINANCIAL METRICS USING EV/EBIDTA

- 11.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.6.1 STARS

- 11.6.2 EMERGING LEADERS

- 11.6.3 PERVASIVE PLAYERS

- 11.6.4 PARTICIPANTS

- 11.6.5 COMPANY FOOTPRINT: KEY PLAYERS

- 11.6.5.1 Company footprint

- 11.6.5.2 Type footprint

- 11.6.5.3 Deployment mode footprint

- 11.6.5.4 Vertical footprint

- 11.6.5.5 Regional footprint

- 11.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.7.1 PROGRESSIVE COMPANIES

- 11.7.2 RESPONSIVE COMPANIES

- 11.7.3 DYNAMIC COMPANIES

- 11.7.4 STARTING BLOCKS

- 11.7.5 COMPETITIVE BENCHMARKING: STARTUPS

- 11.7.5.1 Detailed list of key startups

- 11.7.5.2 Competitive benchmarking of key startups

- 11.8 COMPETITIVE SCENARIO AND TRENDS

- 11.8.1 PRODUCT LAUNCHES

- 11.8.2 DEALS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 TCS

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 Recent developments

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 WIPRO

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 DXC TECHNOLOGY

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 Recent developments

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 HCLTECH

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 Recent developments

- 12.1.4.4 MnM view

- 12.1.4.4.1 Key strengths

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses and competitive threats

- 12.1.5 INFOSYS

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 Recent developments

- 12.1.5.4 MnM view

- 12.1.5.4.1 Key strengths

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses and competitive threats

- 12.1.6 FUJITSU

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.6.3 Recent developments

- 12.1.7 ATOS

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.7.3 Recent developments

- 12.1.8 NTT DATA

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.8.3 Recent developments

- 12.1.9 IBM

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.9.3 Recent developments

- 12.1.10 COGNIZANT

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.10.3 Recent developments

- 12.1.11 ACCENTURE

- 12.1.11.1 Business overview

- 12.1.11.2 Products/Solutions/Services offered

- 12.1.11.3 Recent developments

- 12.1.12 KYNDRYL

- 12.1.12.1 Business overview

- 12.1.12.2 Products/Solutions/Services offered

- 12.1.12.3 Recent developments

- 12.1.13 HPE

- 12.1.13.1 Business overview

- 12.1.13.2 Products/Solutions/Services offered

- 12.1.13.3 Recent developments

- 12.1.14 CAPGEMINI

- 12.1.14.1 Business overview

- 12.1.14.2 Products/Solutions/Services offered

- 12.1.15 UNISYS

- 12.1.15.1 Business overview

- 12.1.15.2 Products/Solutions/Services offered

- 12.1.16 TECH MAHINDRA

- 12.1.16.1 Business overview

- 12.1.16.2 Products/Solutions/Services offered

- 12.1.16.3 Recent developments

- 12.1.1 TCS

- 12.2 OTHER KEY PLAYERS

- 12.2.1 STEFANINI

- 12.2.2 COMPUTACENTER

- 12.2.3 COMPUCOM

- 12.2.4 T-SYSTEMS

- 12.2.5 GETRONICS

- 12.2.6 CGI

- 12.2.7 MILESTONE TECHNOLOGIES

- 12.2.8 MPHASIS

- 12.2.9 BIRLASOFT

- 12.2.10 NEUREALM (GAVS TECHNOLOGIES)

- 12.2.11 UST

- 12.2.12 MICROLAND

- 12.2.13 BRILLIO

- 12.2.14 BELL TECHLOGIX

- 12.2.15 POMEROY

- 12.2.16 LTIMINDTREE

- 12.2.17 KISSFLOW

- 12.2.18 GROUPE.IO

- 12.2.19 AXERO SOLUTIONS

- 12.2.20 YOROSIS TECHNOLOGIES

- 12.2.21 WORKGRID SOFTWARE

- 12.2.22 FLEXSIN

13 ADJACENT/RELATED MARKETS

- 13.1 INTRODUCTION

- 13.2 LIMITATIONS

- 13.3 WORKPLACE SAFETY MARKET

- 13.4 REMOTE WORKPLACE SERVICES MARKET

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS