|

시장보고서

상품코드

1804840

신생아 케어 장비 시장 : 제품별, 최종사용자별, 지역별 - 예측(-2030년)Neonatal Care Equipment Market by Product (Neonatal Incubators, Convertible Warmers & Incubators, Respiratory Care Devices, Monitoring Devices ), End User - Global Forecast to 2030 |

||||||

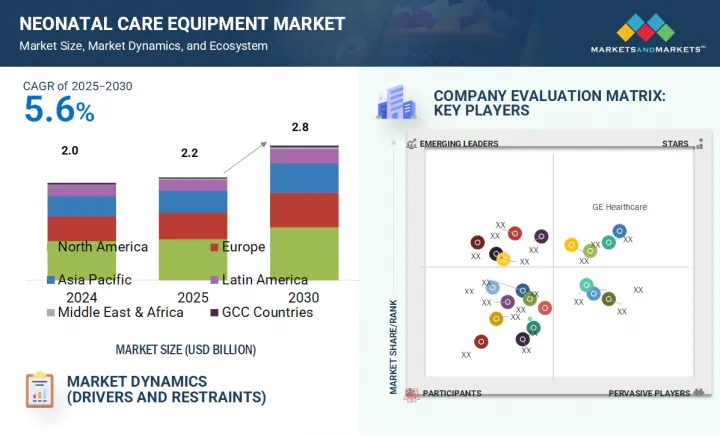

신생아 케어 장비 시장 규모는 예측 기간 중에 5.6%의 연평균 복합 성장률(CAGR)로 확대되어 2025년 20억 6,000만 달러에서 2030년에는 28억 4,000만 달러에 이를 것으로 예측됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2024년-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 검토 단위 | 금액(10억 달러) |

| 부문 | 제품별, 최종사용자별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 라틴아메리카, 중동 및 아프리카, GCC 국가 |

신생아 케어 장비의 기술 발전은 신생아 건강 관리의 상황을 크게 변화시키고 있습니다. 하이브리드 워머 인큐베이터 시스템과 같은 기술 혁신은 오픈 워머와 폐쇄형 인큐베이터의 장점을 결합하여 유연성을 제공하고 취약한 신생아를 장비 간 이동시킬 필요성을 줄여줍니다. 자동 산소 공급 시스템은 산소 농도를 실시간으로 정확하게 조절할 수 있어 저산소증 및 고산소증과 관련된 위험을 최소화할 수 있습니다. 인큐베이터와 보온기에 내장된 광선치료기를 통해 신생아를 방해하지 않고 신생아 황달을 지속적으로 치료할 수 있습니다.

또한, 무선 모니터링 시스템은 원활하고 정확한 실시간 데이터를 제공하면서 이동성을 높이고, 케이블의 복잡성을 줄이며, 감염 위험을 줄입니다. 이러한 첨단 기술은 미숙아 및 중증 신생아의 임상 결과를 개선할 뿐만 아니라 병원과 신생아 중환자실(NICU)의 인프라를 업그레이드하는 원동력이 되고 있습니다. 그 결과, 이러한 기술 혁신은 효율성, 안전성 및 치료의 질을 향상시킴으로써 세계 신생아 케어 장비 시장의 지속적인 성장을 가속하고 있습니다.

제품별로는 신생아 인큐베이터 부문이 2024년 세계 신생아 케어 장비 시장에서 가장 큰 점유율을 차지할 것으로 예측됩니다. 조산아나 저체중아는 체온 조절 능력이 없기 때문에 저체온증에 걸리기 쉽습니다. 신생아 인큐베이터는 신생아의 생존, 성장 및 발달을 지원하는 안정적이고 통제된 온열 환경을 제공하는 데 중요한 역할을 합니다. 그 결과, 인큐베이터는 신생아 중환자실(NICU)의 중요한 구성요소가 되었습니다. 신생아 인큐베이터는 미숙아 관리에 필수적인 역할을 하기 때문에 신생아 의료기기 시장에서 가장 큰 점유율을 차지하고 있습니다.

최종 사용자별로는 일반 병원이 2024년 신생아 케어 장비 시장에서 가장 큰 시장 점유율을 차지할 것으로 예측됩니다. 일반병원은 특히 소아과 전문센터가 부족한 신흥국 및 중진국에서 신생아 분만의 주요 액세스 포인트 역할을 하고 있습니다. 종합병원에서는 일상적인 출산부터 고위험 출산까지 대량 출산을 관리하기 위해 종합적인 신생아 관리 장비가 필요합니다. 신생아 의료 제공의 중심이 되는 것은 넓은 서비스 범위와 접근성입니다. 그 결과, 신생아 의료기기 시장에서 일반 병원 부문은 지속적인 수요와 광범위한 환자 유입으로 인해 가장 큰 시장 점유율을 차지하고 있습니다.

북미는 예측 기간 동안 신생아 케어 장비 시장에서 가장 큰 점유율을 차지할 것으로 예측됩니다. 북미, 특히 미국과 캐나다는 높은 의료비 지출과 강력한 상환 체계로 인해 신생아 케어 장비 시장을 선도하고 있습니다. GDP의 상당 부분을 의료에 투자하고 있으며, 시설이 잘 갖추어진 신생아실이 확보되어 있습니다. 메디케이드, 메디케어, 민간보험 등의 프로그램을 통해 인큐베이터, 인공호흡기, 모니터 등 고가의 첨단 장비에 대한 접근이 쉬워지고 있습니다. 이러한 탄탄한 재정적, 인프라적 지원으로 최첨단 신생아 의료기술이 널리 채택되어 북미는 신생아 의료기기의 주요 지역 시장으로 부상하고 있습니다.

세계의 신생아 케어 장비 시장에 대해 조사했으며, 제품별, 최종사용자별, 지역별 동향, 시장 진출기업 프로파일 등의 정보를 정리하여 전해드립니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 프리미엄 인사이트

제5장 시장 개요

- 서론

- 시장 역학

- 업계 동향

- 고객의 비즈니스에 영향을 미치는 동향/혼란

- 가격 분석

- 밸류체인 분석

- 공급망 분석

- 생태계 분석

- 투자 및 자금조달 시나리오

- 기술 분석

- 특허 분석

- 무역 분석

- 2025년-2026년 주요 컨퍼런스 및 이벤트

- 사례 연구 분석

- 규제 분석

- Porter의 Five Forces 분석

- 주요 이해관계자와 구입 기준

- 미충족 요구/최종사용자 기대

- 인접 시장 분석

- AI/생성형 AI가 신생아 케어 장비 시장에 미치는 영향

- 2025년 미국 관세가 신생아 케어 장비 시장에 미치는 영향

제6장 신생아 케어 장비 시장(제품별)

- 서론

- 신생아 인큐베이터

- 신생아 호흡 케어 기기

- 컨버터블 워머 및 인큐베이터

- 신생아 광선 요법 기기

- 신생아 모니터링 장비

- 신생아 진단 영상 컴포넌트

- 유아용 워머

- 기타

제7장 신생아 케어 장비 시장(최종사용자별)

- 서론

- 종합병원

- 소아병원

- 산과 및 출산센터

- 기타

제8장 신생아 케어 장비 시장(지역별)

- 서론

- 북미

- 북미의 거시경제 전망

- 미국

- 캐나다

- 유럽

- 유럽의 거시경제 전망

- 독일

- 프랑스

- 영국

- 이탈리아

- 스페인

- 기타

- 아시아태평양

- 아시아태평양의 거시경제 전망

- 일본

- 중국

- 인도

- 한국

- 호주

- 뉴질랜드

- 기타

- 라틴아메리카

- 라틴아메리카의 거시경제 전망

- 브라질

- 멕시코

- 기타

- 중동 및 아프리카

- 높은 출생률과 지역 보건 개혁이 신생아용 기기 수요를 자극

- 중동 및 아프리카의 거시경제 전망

- GCC 국가

- 전략적인 정부 지출, 스마트 NICU 기술 도입, 디지털 모자 케어에의 주력으로 시장 성장 촉진

- GCC 국가의 거시경제 전망

제9장 경쟁 구도

- 서론

- 주요 시장 진출기업의 전략/강점

- 매출 분석, 2020년-2024년

- 시장 점유율 분석, 2024년

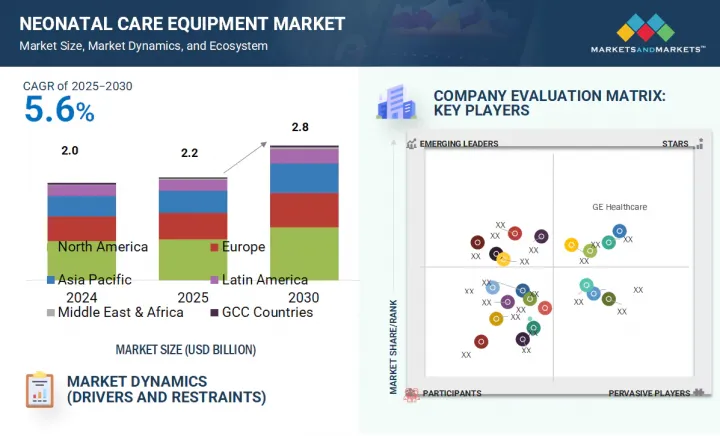

- 기업 평가 매트릭스 : 주요 시장 진출기업, 2024년

- 기업 평가 매트릭스 : 스타트업/중소기업, 2024년

- 기업 평가와 재무 지표

- 브랜드/제품 비교

- 경쟁 시나리오

제10장 기업 개요

- 주요 시장 진출기업

- GE HEALTHCARE

- DRAGERWERK AG & CO. KGAA

- KONINKLIJKE PHILIPS N.V.

- MASIMO

- FISHER & PAYKEL HEALTHCARE LIMITED

- NIHON KOHDEN CORPORATION

- INSPIRATION HEALTHCARE GROUP PLC

- MEDTRONIC

- CARDINAL HEALTH

- ICU MEDICAL, INC.

- UTAH MEDICAL PRODUCTS, INC.

- AMBU A/S

- BECTON, DICKINSON AND COMPANY(BD)

- ATOM MEDICAL CORP.

- HAMILTON MEDICAL

- 기타 기업

- NATUS MEDICAL

- SPACELABS HEALTHCARE

- VENTEC LIFE SYSTEMS

- PHOENIX MEDICAL SYSTEMS

- NONIN

- ANALOGIC CORPORATION

- VYAIRE MEDICAL

- VYGON GROUP

- COOK

- APEX MEDICAL DEVICES

제11장 부록

LSH 25.09.11The neonatal care equipment market is projected to reach USD 2.84 billion by 2030 from USD 2.06 billion in 2025, at a CAGR of 5.6% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Product, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa, and GCC Countries |

Technological advancements in neonatal care equipment are significantly transforming the landscape of newborn healthcare. Innovations such as hybrid warmer-incubator systems combine the benefits of open warmers and closed incubators, offering flexibility and reducing the need to transfer fragile infants between devices. Automated oxygen delivery systems enable precise and real-time regulation of oxygen levels, minimizing risks associated with hypoxia or hyperoxia. Integrated phototherapy units, embedded within incubators or warmers, allow for continuous treatment of neonatal jaundice without disturbing the infant.

Additionally, wireless monitoring systems enhance mobility, reduce cable clutter, and lower the risk of infection, all while providing seamless and accurate real-time data. These advanced technologies are not only improving clinical outcomes for premature and critically ill neonates but are also driving hospitals and neonatal intensive care units (NICUs) to upgrade their infrastructure. As a result, these innovations are fueling consistent growth in the global neonatal care equipment market by enhancing efficiency, safety, and care quality.

Based on product, the neonatal incubators segment held the largest share of the global neonatal care equipment market in 2024. Preterm and low-birth-weight infants lack the ability to regulate their body temperature, making them highly vulnerable to hypothermia. Neonatal incubators play a critical role in providing a stable and controlled thermal environment that supports survival, growth, and development in these infants. As a result, incubators are a vital component of Neonatal Intensive Care Units (NICUs). Owing to their essential role in managing preterm births, the neonatal incubators segment holds the largest market share in the neonatal care equipment market.

Based on end users, general hospitals held the largest market share in the neonatal care equipment market in 2024. General hospitals act as the primary access point for neonatal deliveries, particularly in developing and middle-income countries where specialized pediatric centers are limited. They manage a high volume of both routine and high-risk childbirths, necessitating the availability of comprehensive neonatal care equipment. Their broad service coverage and accessibility make them central to neonatal care delivery. Consequently, the general hospitals segment accounts for the largest market share in the neonatal care equipment market, driven by consistent demand and widespread patient inflow.

North America is expected to account for the largest share of the neonatal care equipment market during the forecast period. North America, particularly the US and Canada, leads the neonatal care equipment market due to high healthcare spending and strong reimbursement frameworks. A substantial share of GDP is dedicated to healthcare, ensuring well-equipped neonatal units. Programs such as Medicaid, Medicare, and private insurance facilitate access to advanced and often expensive devices such as incubators, ventilators, and monitors. This robust financial and infrastructural support enables widespread adoption of cutting-edge neonatal technologies, positioning North America as the dominant regional market for neonatal care equipment.

A breakdown of the primary participants (supply-side) for the neonatal care equipment market referred to in this report is provided below:

- By Company Type: Tier 1:34%, Tier 2: 38%, and Tier 3: 28%

- By Designation: C Level: 26%, Director Level: 35%, and Others: 39%

- By Region: North America: 17%, Europe: 39%, Asia Pacific: 28%, Latin America: 8%, Middle East & Africa: 3%, GCC Countries: 5%

Prominent players in the neonatal care equipment market are GE Healthcare (US), Dragerwerk AG & Co. KGaA (Germany), Koninklijke Philips N.V. (Netherlands), Masimo (US), Fisher & Paykel Healthcare (New Zealand)

Research Coverage

The report evaluates the neonatal care equipment market and estimates the market size and future growth potential based on various segments, including product, end user, and region. The report also includes a competitive analysis of the major players in this market, along with company profiles, product offerings, recent developments, and key market strategies.

Reasons to Buy the Report

The report will assist the market leader/new entrants in the market with data on the nearest approximations of the revenue numbers for the overall neonatal care equipment market and the subsegments. The report will assist stakeholders in understanding the competitive landscape and gaining further insights into better placing their businesses and making appropriate go-to-market strategies. The report assists the stakeholders in understanding the market pulse and gives them data on influential drivers, hindrances, obstacles, and opportunities in the market.

This report provides insights into the following points:

- Analysis of key drivers (rising number of preterm and low-weight births, public-private initiatives to strengthen patient care, increasing incidence of HAIs among newborns, changing clinical risks for congenital and obstetric complications, growing number of neonatal care facilities worldwide), restraints (premium pricing of advanced neonatal care equipment, growing preference for refurbished devices across emerging countries), opportunities (development of integrated and multifunctional neonatal care equipment, market opportunities in emerging economies) and challenges (limited access in low-income regions, regulatory and compliance complexities)

- Product Enhancement/Innovation: Comprehensive details about product launches and anticipated trends in the global neonatal care equipment market

- Market Development: Thorough knowledge and analysis of the profitable rising markets by product, end user, and region

- Market Diversification: Comprehensive information about newly launched products and services, expanding markets, current advancements, and investments in the global neonatal care equipment market

- Competitive Assessment: Thorough evaluation of the market shares, growth plans, offerings, and capacities of the major competitors in the global neonatal care equipment market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATON & REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key sources of secondary data

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key objectives of primary research

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 SUPPLY-SIDE ANALYSIS (REVENUE SHARE ANALYSIS)

- 2.2.2 COMPANY PRESENTATIONS & PRIMARY INTERVIEWS

- 2.2.3 DEMAND-SIDE ANALYSIS

- 2.2.4 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 MARKET SHARE ESTIMATION

- 2.5 STUDY ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 NEONATAL CARE EQUIPMENT MARKET OVERVIEW

- 4.2 ASIA PACIFIC: NEONATAL CARE EQUIPMENT MARKET, BY PRODUCT AND COUNTRY

- 4.3 NEONATAL CARE EQUIPMENT MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- 4.4 NEONATAL CARE EQUIPMENT MARKET, REGIONAL MIX, 2023-2030

- 4.5 NEONATAL CARE EQUIPMENT MARKET: EMERGING VS. DEVELOPED MARKETS

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising number of preterm and low-weight births

- 5.2.1.2 Increased public-private initiatives for better patient care

- 5.2.1.3 Growing incidence of healthcare-associated infections (HAIs) among newborns

- 5.2.1.4 Changing clinical risks in congenital and obstetric complications

- 5.2.1.5 Increasing number of neonatal care facilities worldwide

- 5.2.2 RESTRAINTS

- 5.2.2.1 Premium pricing of advanced neonatal care equipment

- 5.2.2.2 Growing preference for refurbished devices in emerging economies

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Development of integrated and multifunctional neonatal care equipment

- 5.2.3.2 High growth opportunities in emerging economies

- 5.2.4 CHALLENGES

- 5.2.4.1 Limited access to neonatal care in low-income regions

- 5.2.4.2 Regulatory and compliance complexities

- 5.2.1 DRIVERS

- 5.3 INDUSTRY TRENDS

- 5.3.1 INTEGRATION OF ADVANCED MATERIALS AND SUSTAINABILITY INITIATIVES

- 5.3.2 SHIFT TOWARD PROCEDURE-SPECIFIC STERILE KITS AND MODULAR DESIGNS

- 5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE TREND OF NEONATAL CARE PRODUCTS, BY KEY PLAYER, 2022-2024

- 5.5.2 AVERAGE SELLING PRICE TREND OF NEONATAL INCUBATORS, BY REGION, 2022-2024

- 5.6 VALUE CHAIN ANALYSIS

- 5.7 SUPPLY CHAIN ANALYSIS

- 5.8 ECOSYSTEM ANALYSIS

- 5.8.1 ROLE IN ECOSYSTEM

- 5.9 INVESTMENT & FUNDING SCENARIO

- 5.10 TECHNOLOGY ANALYSIS

- 5.10.1 KEY TECHNOLOGIES

- 5.10.1.1 Advanced neonatal ventilation and CPAP systems

- 5.10.1.2 Phototherapy technologies (LED and fiber-optic)

- 5.10.2 COMPLEMENTARY TECHNOLOGIES

- 5.10.2.1 Heated humidifiers and respiratory gas conditioning units

- 5.10.3 ADJACENT TECHNOLOGIES

- 5.10.3.1 Point-of-care diagnostics (POCT)

- 5.10.3.2 Fetal monitoring systems

- 5.10.1 KEY TECHNOLOGIES

- 5.11 PATENT ANALYSIS

- 5.11.1 INNOVATIONS AND PATENT REGISTRATIONS, 2023-2025

- 5.12 TRADE ANALYSIS

- 5.12.1 IMPORT DATA FOR HS CODE 901890

- 5.12.2 EXPORT DATA FOR HS CODE 901890

- 5.13 KEY CONFERENCES & EVENTS, 2025-2026

- 5.14 CASE STUDY ANALYSIS

- 5.14.1 BOSTON CHILDREN'S HOSPITAL TO MODERNIZE NICU INFRASTRUCTURE FOR IMPROVED CARE AMONG PREMATURE INFANTS

- 5.14.2 INDIAN MINISTRY OF HEALTH TO DEPLOY LOW-COST LED PHOTOTHERAPY UNITS FOR REDUCING NEONATAL JAUNDICE-RELATED MORTALITY

- 5.14.3 MOUNT SINAI HOSPITAL TO IMPLEMENT PREDICTIVE NEONATAL MONITORING FOR REDUCING LATE-ONSET SEPSIS AND APNEA IN PRETERM INFANTS

- 5.15 REGULATORY ANALYSIS

- 5.15.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.15.2 REGULATORY LANDSCAPE

- 5.15.2.1 North America

- 5.15.2.1.1 US

- 5.15.2.1.2 Canada

- 5.15.2.2 Europe

- 5.15.2.3 Asia Pacific

- 5.15.2.3.1 China

- 5.15.2.3.2 Japan

- 5.15.2.3.3 India

- 5.15.2.4 Latin America

- 5.15.2.4.1 Brazil

- 5.15.2.4.2 Mexico

- 5.15.2.5 Middle East

- 5.15.2.6 Africa

- 5.15.2.1 North America

- 5.16 PORTER'S FIVE FORCES ANALYSIS

- 5.16.1 BARGAINING POWER OF SUPPLIERS

- 5.16.2 BARGAINING POWER OF BUYERS

- 5.16.3 THREAT OF NEW ENTRANTS

- 5.16.4 THREAT OF SUBSTITUTES

- 5.16.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.17 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.17.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.17.2 BUYING CRITERIA

- 5.18 UNMET NEEDS/END-USER EXPECTATIONS

- 5.19 ADJACENT MARKET ANALYSIS

- 5.20 IMPACT OF AI/GEN AI ON NEONATAL CARE EQUIPMENT MARKET

- 5.20.1 MARKET POTENTIAL OF AI/GEN AI

- 5.20.2 AI USE CASES

- 5.20.3 KEY COMPANIES IMPLEMENTING AI

- 5.20.4 FUTURE OF AI/GEN AI

- 5.21 IMPACT OF 2025 US TARIFF ON NEONATAL CARE EQUIPMENT MARKET

- 5.21.1 KEY TARIFF RATES

- 5.21.2 PRICE IMPACT ANALYSIS

- 5.21.3 IMPACT ON END-USE INDUSTRIES

6 NEONATAL CARE EQUIPMENT MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- 6.2 NEONATAL INCUBATORS

- 6.2.1 HIGH PRETERM BIRTH BURDEN AND INCREASED TECH INTEGRATION TO AID MARKET GROWTH

- 6.3 NEONATAL RESPIRATORY CARE DEVICES

- 6.3.1 NEONATAL VENTILATORS

- 6.3.1.1 Increasing burden of neonatal respiratory distress syndrome to augment segment growth

- 6.3.2 CONTINUOUS POSITIVE AIRWAY PRESSURE DEVICES

- 6.3.2.1 Development of affordable and non-invasive CPAP devices to aid global newborn care programs

- 6.3.3 RESUSCITATORS

- 6.3.3.1 Availability of advanced, low-cost kits to drive segment growth

- 6.3.4 OTHER NEONATAL RESPIRATORY CARE DEVICES

- 6.3.1 NEONATAL VENTILATORS

- 6.4 CONVERTIBLE WARMERS & INCUBATORS

- 6.4.1 MULTI-STAGE THERMAL CARE NEEDS AND REQUIRMENT FOR SPACE OPTIMIZATION TO BOOST DEMAND

- 6.5 NEONATAL PHOTOTHERAPY EQUIPMENT

- 6.5.1 CONVENTIONAL NEONATAL PHOTOTHERAPY EQUIPMENT

- 6.5.1.1 Affordability and accessibility to drive continued use of conventional neonatal phototherapy equipment

- 6.5.2 FIBRE-OPTIC NEONATAL PHOTOTHERAPY EQUIPMENT

- 6.5.2.1 Parent-friendly design and home-based care to accelerate market growth

- 6.5.1 CONVENTIONAL NEONATAL PHOTOTHERAPY EQUIPMENT

- 6.6 NEONATAL MONITORING DEVICES

- 6.6.1 BLOOD PRESSURE MONITORS

- 6.6.1.1 Need for critical hemodynamic monitoring to boost adoption of neonatal blood pressure monitors

- 6.6.2 CARDIAC MONITORS

- 6.6.2.1 Non-invasive monitoring and early detection of cardiac issues to propel segment growth

- 6.6.3 PULSE OXIMETERS

- 6.6.3.1 Global push for universal newborn SpO2 screening and growing need for real-time oxygen titration in NICUs to spur market growth

- 6.6.4 CAPNOGRAPHS

- 6.6.4.1 High incidence of neonatal respiratory distress and emphasis on safe airway management in critical care to propel segment growth

- 6.6.5 EXTRACORPOREAL MEMBRANE OXYGENATION SYSTEMS

- 6.6.5.1 Rising incidence of meconium aspiration syndrome and persistent pulmonary hypertension to favor market growth

- 6.6.6 INTEGRATED MONITORING DEVICES

- 6.6.6.1 Real-time vital tracking and AI integration to drive segment growth

- 6.6.1 BLOOD PRESSURE MONITORS

- 6.7 NEONATAL DIAGNOSTIC IMAGING COMPONENTS

- 6.7.1 ULTRASOUND TRANSDUCERS

- 6.7.1.1 Increasing use of point-of-care ultrasound (POCUS) in NICUs to propel market growth

- 6.7.2 X-RAY DETECTORS

- 6.7.2.1 Need for ultra-low dose and portable imaging to drive adoption of neonatal x-ray detectors in NICUs

- 6.7.1 ULTRASOUND TRANSDUCERS

- 6.8 INFANT WARMERS

- 6.8.1 ELECTRIC WARMERS

- 6.8.1.1 Tech-enabled and portable designs to drive demand for electric infant warmers in low-resource settings

- 6.8.2 NON-ELECTRIC WARMERS

- 6.8.2.1 Low-cost and power-free solutions to augment market growth

- 6.8.1 ELECTRIC WARMERS

- 6.9 OTHER NEONATAL PRODUCTS

7 NEONATAL CARE EQUIPMENT MARKET, BY END USER

- 7.1 INTRODUCTION

- 7.2 GENERAL HOSPITALS

- 7.2.1 LARGE PATIENT BASE AND INTEGRATED NICU FACILITIES TO AUGMENT MARKET GROWTH

- 7.3 PEDIATRIC HOSPITALS

- 7.3.1 AVAILABILITY OF PEDIATRIC SPECIALISTS FOR CRITICAL NEONATAL CASES TO AID MARKET GROWTH

- 7.4 MATERNITY & BIRTHING CENTERS

- 7.4.1 EXPANDING MATERNAL HEALTH COVERAGE AND POPULARITY OF MIDWIFE-LED BIRTHING MODELS TO DRIVE MARKET

- 7.5 OTHER END USERS

8 NEONATAL CARE EQUIPMENT MARKET, BY REGION

- 8.1 INTRODUCTION

- 8.2 NORTH AMERICA

- 8.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 8.2.2 US

- 8.2.2.1 US to dominate North American neonatal care equipment market during forecast period

- 8.2.3 CANADA

- 8.2.3.1 Strong public healthcare funding and expanding neonatal intensive care infrastructure to propel market growth

- 8.3 EUROPE

- 8.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 8.3.2 GERMANY

- 8.3.2.1 Public-private collaborations and increased focus on product innovations to fuel market growth

- 8.3.3 FRANCE

- 8.3.3.1 High healthcare spending and focus on domestic NICU manufacturing to aid market growth

- 8.3.4 UK

- 8.3.4.1 NHS-led digitization and high preterm care standards to drive neonatal care equipment modernization

- 8.3.5 ITALY

- 8.3.5.1 Regionally decentralized healthcare system to boost market growth

- 8.3.6 SPAIN

- 8.3.6.1 High healthcare spending and investments through the Digital Health Strategy to propel market growth

- 8.3.7 REST OF EUROPE

- 8.4 ASIA PACIFIC

- 8.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 8.4.2 JAPAN

- 8.4.2.1 Low neonatal mortality and advanced health infrastructure to propel adoption of innovative neonatal care equipment

- 8.4.3 CHINA

- 8.4.3.1 High premature birth rates and favorable government initiatives to fuel market growth

- 8.4.4 INDIA

- 8.4.4.1 High birth volume, increased prevalence of preterm deliveries, and favorable public healthcare programs to drive market

- 8.4.5 SOUTH KOREA

- 8.4.5.1 Innovation-driven neonatal care and increased private maternity and pediatric clinics to favor market growth

- 8.4.6 AUSTRALIA

- 8.4.6.1 Advanced public health infrastructure and government prioritization of maternal & child health to drive market

- 8.4.7 NEW ZEALAND

- 8.4.7.1 Government-funded healthcare and maternal & child health equity reforms to drive neonatal care expansion

- 8.4.8 REST OF ASIA PACIFIC

- 8.5 LATIN AMERICA

- 8.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 8.5.2 BRAZIL

- 8.5.2.1 Government-backed healthcare initiatives and active local manufacturing ecosystem to bolster market growth

- 8.5.3 MEXICO

- 8.5.3.1 Universal neonatal health coverage and expansion of NICUs to fuel market growth

- 8.5.4 REST OF LATIN AMERICA

- 8.6 MIDDLE EAST & AFRICA

- 8.6.1 HIGH BIRTH RATES AND REGIONAL HEALTH REFORMS TO CATALYZE NEONATAL EQUIPMENT DEMAND

- 8.6.2 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 8.7 GCC COUNTRIES

- 8.7.1 STRATEGIC GOVERNMENT SPENDING, ADOPTION OF SMART NICU TECHNOLOGIES, AND FOCUS ON DIGITAL MATERNAL-CHILD CARE TO DRIVE MARKET

- 8.7.2 MACROECONOMIC OUTLOOK FOR GCC COUNTRIES

9 COMPETITIVE LANDSCAPE

- 9.1 INTRODUCTION

- 9.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 9.2.1 KEY STRATEGIES ADOPTED BY MAJOR PLAYERS IN NEONATAL CARE EQUIPMENT MARKET, 2021-2025

- 9.3 REVENUE ANALYSIS, 2020-2024

- 9.4 MARKET SHARE ANALYSIS, 2024

- 9.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 9.5.1 STARS

- 9.5.2 EMERGING LEADERS

- 9.5.3 PERVASIVE PLAYERS

- 9.5.4 PARTICIPANTS

- 9.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 9.5.5.1 Company footprint

- 9.5.5.2 Region footprint

- 9.5.5.3 Product footprint

- 9.5.5.4 End-user footprint

- 9.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 9.6.1 PROGRESSIVE COMPANIES

- 9.6.2 RESPONSIVE COMPANIES

- 9.6.3 DYNAMIC COMPANIES

- 9.6.4 STARTING BLOCKS

- 9.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 9.6.5.1 Detailed list of key startups/SMEs

- 9.6.5.2 Competitive benchmarking of startups/SMEs

- 9.7 COMPANY VALUATION & FINANCIAL METRICS

- 9.7.1 FINANCIAL METRICS

- 9.7.2 COMPANY VALUATION

- 9.8 BRAND/PRODUCT COMPARISON

- 9.9 COMPETITIVE SCENARIO

- 9.9.1 PRODUCT LAUNCHES/APPROVALS/ENHANCEMENTS

- 9.9.2 DEALS

10 COMPANY PROFILES

- 10.1 KEY PLAYERS

- 10.1.1 GE HEALTHCARE

- 10.1.1.1 Business overview

- 10.1.1.2 Products offered

- 10.1.1.3 Recent developments

- 10.1.1.3.1 Product launches/approvals/enhancements

- 10.1.1.4 MnM view

- 10.1.1.4.1 Right to win

- 10.1.1.4.2 Strategic choices

- 10.1.1.4.3 Weaknesses & competitive threats

- 10.1.2 DRAGERWERK AG & CO. KGAA

- 10.1.2.1 Business overview

- 10.1.2.2 Products offered

- 10.1.2.3 Recent developments

- 10.1.2.3.1 Product launches/approvals/enhancements

- 10.1.2.4 MnM view

- 10.1.2.4.1 Right to win

- 10.1.2.4.2 Strategic choices

- 10.1.2.4.3 Weaknesses & competitive threats

- 10.1.3 KONINKLIJKE PHILIPS N.V.

- 10.1.3.1 Business overview

- 10.1.3.2 Products offered

- 10.1.3.3 Recent developments

- 10.1.3.3.1 Deals

- 10.1.3.4 MnM view

- 10.1.3.4.1 Right to win

- 10.1.3.4.2 Strategic choices

- 10.1.3.4.3 Weaknesses & competitive threats

- 10.1.4 MASIMO

- 10.1.4.1 Business overview

- 10.1.4.2 Products offered

- 10.1.4.3 Recent developments

- 10.1.4.3.1 Deals

- 10.1.4.4 MnM view

- 10.1.4.4.1 Right to win

- 10.1.4.4.2 Strategic choices

- 10.1.4.4.3 Weaknesses & competitive threats

- 10.1.5 FISHER & PAYKEL HEALTHCARE LIMITED

- 10.1.5.1 Business overview

- 10.1.5.2 Products offered

- 10.1.5.3 MnM view

- 10.1.5.3.1 Right to win

- 10.1.5.3.2 Strategic choices

- 10.1.5.3.3 Weaknesses & competitive threats

- 10.1.6 NIHON KOHDEN CORPORATION

- 10.1.6.1 Business overview

- 10.1.6.2 Products offered

- 10.1.6.3 Recent developments

- 10.1.6.3.1 Product launches/approvals/enhancements

- 10.1.7 INSPIRATION HEALTHCARE GROUP PLC

- 10.1.7.1 Business overview

- 10.1.7.2 Products offered

- 10.1.8 MEDTRONIC

- 10.1.8.1 Business overview

- 10.1.8.2 Products offered

- 10.1.8.3 Recent developments

- 10.1.8.3.1 Product launches/approvals/enhancements

- 10.1.9 CARDINAL HEALTH

- 10.1.9.1 Business overview

- 10.1.9.2 Products offered

- 10.1.10 ICU MEDICAL, INC.

- 10.1.10.1 Business overview

- 10.1.10.2 Products offered

- 10.1.11 UTAH MEDICAL PRODUCTS, INC.

- 10.1.11.1 Business overview

- 10.1.11.2 Products offered

- 10.1.12 AMBU A/S

- 10.1.12.1 Business overview

- 10.1.12.2 Products offered

- 10.1.13 BECTON, DICKINSON AND COMPANY (BD)

- 10.1.13.1 Business overview

- 10.1.13.2 Products offered

- 10.1.14 ATOM MEDICAL CORP.

- 10.1.14.1 Business overview

- 10.1.14.2 Products offered

- 10.1.14.3 Recent developments

- 10.1.14.3.1 Other developments

- 10.1.15 HAMILTON MEDICAL

- 10.1.15.1 Business overview

- 10.1.15.2 Products offered

- 10.1.1 GE HEALTHCARE

- 10.2 OTHER PLAYERS

- 10.2.1 NATUS MEDICAL

- 10.2.2 SPACELABS HEALTHCARE

- 10.2.3 VENTEC LIFE SYSTEMS

- 10.2.4 PHOENIX MEDICAL SYSTEMS

- 10.2.5 NONIN

- 10.2.6 ANALOGIC CORPORATION

- 10.2.7 VYAIRE MEDICAL

- 10.2.8 VYGON GROUP

- 10.2.9 COOK

- 10.2.10 APEX MEDICAL DEVICES

11 APPENDIX

- 11.1 DISCUSSION GUIDE

- 11.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 11.3 CUSTOMIZATION OPTIONS

- 11.4 RELATED REPORTS

- 11.5 AUTHOR DETAILS