|

시장보고서

상품코드

1804842

단백질 A 수지 시장 : 제품별, 유래별, 매트릭스 유형별, 용도별, 최종사용자별 - 예측(-2030년)Protein A Resin Market by Product (Bulk Resin, Lab-scale Columns), Source (Recombinant Protein A), Matrix Type (Agarose-Based Protein A), Application (Monoclonal Antibody Purification, FC-Fusion Protein Purification) & End User - Global Forecast to 2030 |

||||||

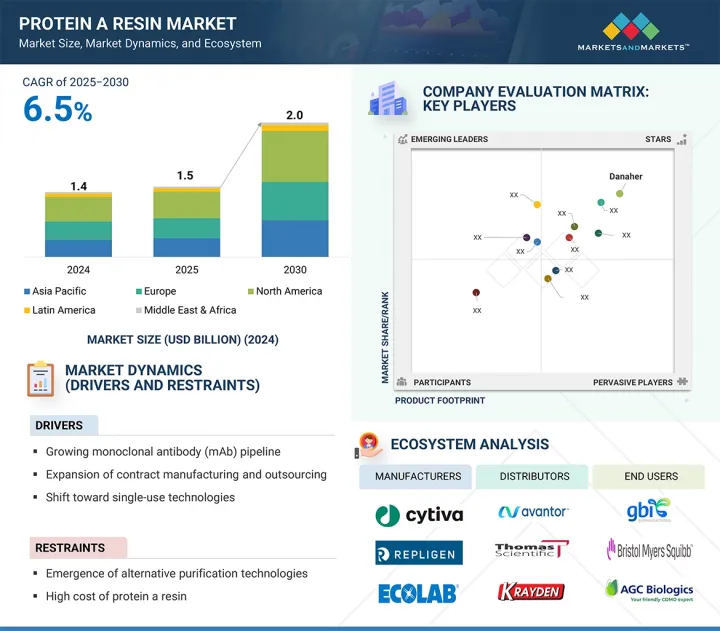

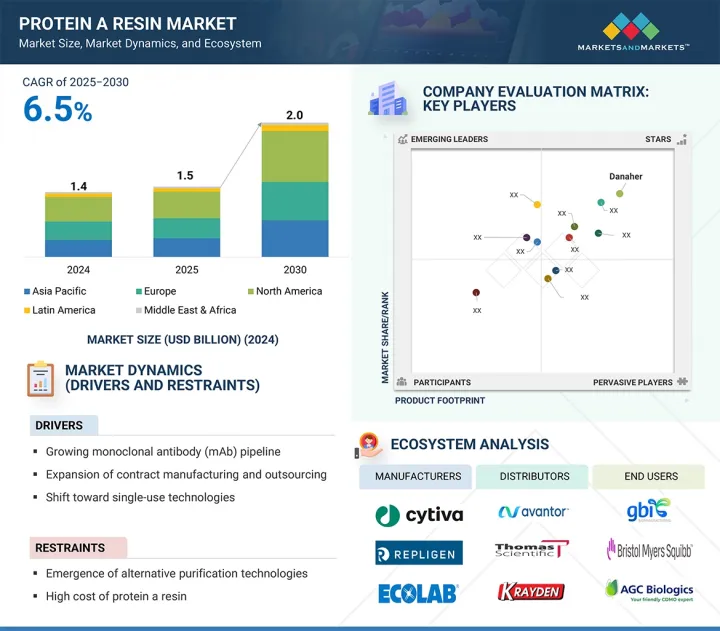

세계의 단백질 A 수지 시장 규모는 2025년 15억 달러에서 2030년까지 20억 달러에 이를 것으로 예측되어 예측 기간에 CAGR 6.5%의 성장이 전망됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2024-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 10억 달러 |

| 부문 | 제품, 유래, 매트릭스 유형, 용도, 최종사용자, 지역 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 라틴아메리카, 중동 및 아프리카 |

시장 성장은 CDMO를 통한 아웃소싱 서비스 증가에 기인하며, 주요 기업들은 선진국 시장 전반에 걸쳐 다중 플랜트 바이오 제조 역량을 확대하고 있습니다. 단일클론항체(mAb) 파이프라인은 전 세계적으로 확대되고 있으며, FDA 승인과 새로운 이중 특이성 항체, 항체-약물 복합체의 출시가 잇따르고 있습니다. 이에 따라 최종 사용자의 정제 요구가 높아져 단백질 A 수지 시장의 확대가 예상됩니다.

"제품별로는 벌크 수지가 2024년 단백질 A 수지 시장에서 가장 큰 점유율을 차지했습니다. "

제품을 기준으로 단백질 A 수지 시장은 벌크 수지, 프리팩 컬럼, 실험실 스케일 컬럼, 기타로 분류됩니다. 프리팩 형태와 달리, 벌크 수지는 스테인레스 스틸 컬럼 셋업에서 대량 정제 공정의 산업 표준입니다. 자체 충전 및 밸리데이션이 필요하지만, 벌크 레진은 사이클 당 비용과 정제된 단일클론항체 1g당 비용이 훨씬 저렴합니다. 재사용이 가능하기 때문에 최종 사용자가 선호하고 있습니다. 대부분의 제품 유형은 50 사이클에서 200 사이클 이상까지 대응하고 있으며, 최소한의 수지 교체로 장기간 생산이 가능합니다. 이 특징은 상업 생산의 경제 효율성과 생산성 목표를 직접적으로 향상시킵니다. 이러한 요인으로 인해 벌크 수지는 최종 사용 산업에서 선호되는 선택이 되었습니다.

"매트릭스 유형별로는 아가로스계 단백질 A 수지 부문이 예측 기간 동안 가장 큰 점유율을 차지할 것으로 예측됩니다. "

단백질 A 수지 시장은 매트릭스 유형에 따라 아가로스계, 유리/실리카계, 유기 고분자계로 분류됩니다. 이 중 아가로스계 단백질 A 수지가 가장 큰 시장 점유율을 차지하고 있습니다. 이 수지는 내구성 향상, 기계적 특성 강화, 적절한 pH 수준에서 금속 도펀트 흡수 능력이 높은 것으로 알려져 있습니다. 최근 아가로스 기반 수지의 개발로는 Praesto CH1 및 DurA Cycle A50과 같은 차세대 제품이 있으며, 내구성이 향상되고, 결합능력이 증가하며, 이중 특이성 및 단편과 같은 복잡한 항체 포맷에 대한 적합성이 개선되고 있습니다. 이들 신제품은 내알칼리성을 강화한 리간드를 채택하여 재사용 기간을 연장하고 비용 효율성을 향상시켰습니다.

"용도별로 보면, 2024년에는 단일클론항체 정제 부문이 가장 큰 점유율을 차지할 것으로 예측됩니다. "

용도에 따라 단백질 A 수지 시장은 mAb 정제, Fc 융합 단백질 정제 및 기타 용도로 나뉩니다. mAb 정제가 단백질 A 수지 시장에서 가장 큰 점유율을 차지하는 것은 주로 대규모 바이오 의약품 제조에서 그 역할이 확립되어 있기 때문입니다. mAb는 생물학적 치료제 중 가장 광범위하게 생산되는 카테고리로, 다운스트림 공정의 1차 포획 단계에 대량의 단백질 A 수지를 필요로 합니다. Protein A 수지는 Fc 영역에 대한 결합 특이성이 높고, 제품의 순도와 일관성에 대한 규제 기준에 부합하기 때문에 선호됩니다. 또한, 제약회사 및 CMO의 바이오 제조 설비의 대부분은 mAb 생산에 특화되어 있으며, 이 부문에서 단백질 A 수지에 대한 수요는 당연히 증가할 것입니다.

"최종 사용자별로는 제약 및 바이오 제약 기업 부문이 2024년 가장 큰 점유율을 차지했습니다. "

제약 및 바이오 제약 기업은 치료용 단백질, 특히 단클론 항체(mAb) 및 Fc 융합 단백질의 주요 제조업체로서 단백질 A 수지 시장에서 큰 점유율을 차지하고 있습니다. 이들 기업은 단백질 A 수지가 다운스트림 정제 공정에서 광범위하게 사용되는 대규모 생산 시설을 운영하고 있으며, 상업적 공급 요구와 규제 준수 표준을 충족하기 위해 대량의 수지가 필요합니다. 또한, 이들 기업 내에서는 일관된 공급망과 품질 관리를 우선시하기 때문에 단백질 A 수지를 외주 파트너에게만 의존하지 않고 직접 조달하는 체제를 강화하고 있습니다. 이 생물학적 제제의 핵심을 담당하는 단백질 A 수지에 대한 구조적 의존성으로 인해 제약 및 바이오 제약 회사는 시장의 지배적인 최종 사용자 부문이 되었습니다.

세계의 단백질 A 수지(Protein A Resin) 시장에 대해 조사 분석했으며, 주요 촉진요인과 저해요인, 경쟁 구도, 향후 동향 등의 정보를 전해드립니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요 지견

- 단백질 A 수지 시장 개요

- 아시아태평양의 단백질 A 수지 시장 : 국가별, 최종사용자별

- 단백질 A 수지 시장 : 지역적 성장 기회

제5장 시장 개요

- 서론

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

- 고객의 비즈니스에 영향을 미치는 동향/혼란

- 가격 결정 분석

- 평균 판매 가격 동향 : 주요 기업별

- 평균 판매 가격 동향 : 지역별

- 밸류체인 분석

- 연구개발

- 원재료 조달·제조

- 유통·마케팅 및 판매

- 애프터서비스

- 공급망 분석

- 저명한 기업

- 중소기업

- 최종사용자

- 생태계 분석

- 투자 및 자금조달 시나리오

- 기술 분석

- 주요 기술

- 보완 기술

- 인접 기술

- 특허 분석

- 무역 분석

- HS코드 3504 수입 데이터

- HS코드 3504 수출 데이터

- 주요 컨퍼런스 및 이벤트(2025년-2026년)

- 사례 연구 분석

- 사례 연구 1: 프로테인 A 수지 사업의 공급망 회복탄력성 강화를 위한 Purolite(Ecolab)의 전략적 생산 능력 확장

- 사례 연구 2: 사이티바의 단백질 A 수지 재사용 주기 향상을 위한 공정 혁신

- 사례 연구 3: 유연한 바이오프로세싱 수요 증가에 대응하기 위한 토소의 일회용 전략

- 규제 분석

- 규제기관, 정부기관, 기타 조직

- 규제 구조

- Porter의 Five Forces 분석

- 주요 이해관계자와 구입 기준

- 미충족 요구

- 2025년 미국 관세의 영향 - 단백질 A 수지 시장

세계의

- 서론

- 주요 관세율

- 가격 영향 분석

- 국가 및 지역에 대한 영향

- 최종 이용 산업에 대한 영향

- 단백질 A 수지 시장에 대한 AI/생성형 AI의 영향

- 단백질 A 수지 용도 AI/생성형 AI 시장 장래성

- AI 이용 사례

- AI/생성형 AI를 도입하고 있는 주요 기업

- 단백질 A 수지 에코시스템 AI/생성형 AI 미래

제6장 단백질 A 수지 시장 : 제품별

- 서론

- 벌크 수지

- 프리패키지 컬럼

- 실험실 스케일 컬럼

- 기타 제품

제7장 단백질 A 수지 시장 : 유래별

- 서론

- 재조합 프로테인 A

- 천연 프로테인 A

제8장 단백질 A 수지 시장 : 매트릭스 유형별

- 서론

- 아가로스계 프로테인 A

- 유리/실리카계 프로테인 A

- 유기 폴리머계 프로테인 A

제9장 단백질 A 수지 시장 : 용도별

- 서론

- 단일클론항체 정제

- FC 융합단백질 정제

- 기타 용도

제10장 단백질 A 수지 시장 : 최종사용자별

- 서론

- 제약 기업 및 바이오의약품 기업

- CRO 및 CDMO

- 학술연구기관

- 기타 최종사용자

제11장 단백질 A 수지 시장 : 지역별

- 서론

- 북미

- 북미의 거시경제 전망

- 미국

- 캐나다

- 유럽

- 유럽의 거시경제 전망

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 아시아태평양의 거시경제 전망

- 일본

- 중국

- 인도

- 호주

- 한국

- 기타 아시아태평양

- 라틴아메리카

- 라틴아메리카의 거시경제 전망

- 브라질

- 멕시코

- 기타 라틴아메리카

- 중동 및 아프리카

- 중동 및 아프리카의 거시경제 전망

- GCC 국가

- 기타 중동 및 아프리카

제12장 경쟁 구도

- 서론

- 주요 시장 진출기업의 전략/강점

- 주요 기업의 매출 분석(2020년-2024년)

- 시장 점유율 분석(2024년)

- 기업 평가와 재무 지표

- 브랜드/제품 비교

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업 평가 매트릭스 : 스타트업/중소기업(2024년)

- 경쟁 시나리오

제13장 기업 개요

- 주요 기업

- DANAHER

- THERMO FISHER SCIENTIFIC INC.

- AGILENT TECHNOLOGIES, INC.

- BIO-RAD LABORATORIES, INC

- MERCK KGAA

- REPLIGEN CORPORATION

- TOSOH BIOSCIENCE

- ECOLAB INC.

- NOVASEP HOLDING

- AVANTOR, INC.

- OROCHEM TECHNOLOGIES, INC.

- KANEKA CORPORATION

- JSR CORPORATION

- GENSCRIPT

- 기타 기업

- BIO-WORKS

- GENO TECHNOLOGY, INC.

- PROMEGA CORPORATION

- SUZHOU NANOMICRO TECHNOLOGY CO., LTD.

- TRANSGEN BIOTECH CO., LTD

- RESYN BIOSCIENCES(PTY) LTD

- BIOTOOLOMICS LTD.

- CALIBRE SCIENTIFIC(PROTEIN ARK)

- SUNRESIN NEW MATERIALS CO., LTD.

- BEAVER

제14장 부록

LSH 25.09.11The global protein A resin market is projected to reach USD 2.0 billion by 2030 from USD 1.5 billion in 2025, at a CAGR of 6.5% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Product, Source, Matrix Type, Application, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Market growth is attributed to increased outsourced services through CDMOs, with major players expanding multi-plant biomanufacturing capacities across developed markets. The global monoclonal antibody (mAb) pipeline is growing, marked by high FDA approvals and new bispecific and antibody-drug conjugate launches. This has helped boost purification requirements among end users, which is expected to increase the market for protein A resin.

"Based on product, bulk resins held the largest share of the protein A resin market in 2024."

Based on products, the protein A resin market is divided into bulk resin, pre-packed columns, lab-scale columns, and others. Unlike pre-packed formats, bulk resin is the industry standard for high-volume purification processes in stainless-steel column setups. While it requires in-house packing and validation, bulk resin provides a much lower cost per cycle and per gram of purified monoclonal antibody. It is the preferred choice among end users because of its reusability. Most types can support 50 to over 200 cycles, enabling long-term production runs with minimal resin replacement. This feature directly enhances the economic efficiency and productivity goals of commercial manufacturing. All these factors make bulk resin the favored choice in the end-use industries.

"Based on matrix type, the agarose-based protein A resin segment accounted for the largest share during the forecast period."

The protein A resin market is categorized by matrix type into agarose-based, glass/silica-based, and organic polymer-based varieties. Among these, agarose-based protein A resins represent the largest market share. They are known for their improved durability, stronger mechanical properties, and higher capacity to absorb metal dopants at suitable pH levels. Recent developments in agarose-based resins include next-generation products such as Praesto CH1 and DurA Cycle A50, which offer better durability, increased binding capacity, and improved compatibility with complex antibody formats like bispecifics and fragments. These new products feature engineered ligands with enhanced alkaline resistance, enabling longer reuse and better cost efficiency.

"Based on applications, the monoclonal antibodies purification segment has acquired the largest share in 2024."

Based on applications, the protein A resin market is divided into mAb purification, Fc-fusion protein purification, and other applications. mAb purification holds the largest share in the protein A resin market mainly because of its established role in large-scale biopharmaceutical manufacturing. mAbs are the most widely produced category of biologic therapeutics, requiring large amounts of protein A resin for the primary capture steps in downstream processing. Protein A resin is preferred due to its Fc region binding specificity and compliance with regulatory standards for product purity and consistency. Moreover, a significant portion of the installed biomanufacturing capacity across pharmaceutical companies and contract manufacturing organizations is dedicated to mAb production, which naturally increases demand for protein A resin in this segment.

"Based on end users, the pharmaceutical and biopharmaceutical companies segment accounted for the largest share in 2024."

Pharmaceutical and biopharmaceutical companies account for the major share in the protein A resin market due to their role as the primary manufacturers of therapeutic proteins, particularly monoclonal antibodies (mAbs) and Fc-fusion proteins. These companies operate large-scale production facilities where protein A resin is extensively used in downstream purification processes, requiring significant resin volumes to meet commercial supply needs and regulatory compliance standards. Additionally, in-house manufacturing setups within these organizations prioritize consistent supply chains and quality control, further reinforcing direct procurement of protein A resins rather than relying solely on outsourced partners. This structural reliance on protein A resin for core biologics manufacturing activities positions pharmaceutical and biopharmaceutical companies as the dominant end-user segment in the market.

"North America is expected to hold a significant market share in the protein A resin market throughout the forecast period."

The protein A resin market includes five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America held a significant market share for protein A resin. Its dominant position is due to increased manufacturing capacity, focusing on commercial-scale and clinical trial supply production. Investment trends show that US federal and state support promotes domestic biomanufacturing for pandemic preparedness and reducing reliance on international supply chains. Small- to mid-sized biotech firms are increasingly partnering with CDMOs. These factors have helped North America secure the largest market share in 2024.

A breakdown of the primary participants referred to for this report is provided below:

- By Company Type: Tier 1 (35%), Tier 2 (45%), and Tier 3 (20%)

- By Designation: C-level Executives (35%), Directors (25%), and Others (40%)

- By Region: North America (40%), Europe (30%), Asia Pacific (20%), Latin America (5%), and the Middle East & Africa (5%)

The key players profiled in the protein A resin market are Danaher Corporation (US), Repligen Corporation (US), Merck KGaA (Germany), Thermo Fisher Scientific (US), Agilent Technologies (US), GenScript (China), Bio-Rad Laboratories, Inc. (US), Orochem Technologies Inc. (US), Kaneka Corporation (Japan), Abcam Plc. (UK), Ecolab (US), and Tosoh Biosciences LLC (Japan).

Research Coverage

The research report analyzes the protein A resin market by product, matrix type, source, application, end user, and region. It explores the factors driving market growth, examines the challenges and opportunities faced by various industries, and presents details on the competitive landscape, including market leaders and small to medium-sized enterprises. Additionally, it estimates the revenue generated by different market segments across five regions and includes a micromarket analysis.

Reasons to Buy the Report

The report will help market leaders and new entrants by providing accurate revenue estimates for the protein A resin market and subsegments. It will assist stakeholders in understanding the competitive landscape, enabling them to position their businesses more effectively and develop suitable go-to-market strategies. Additionally, the report offers insights into market dynamics, including key drivers, restraints, challenges, and opportunities.

This report provides insightful data on the following pointers:

- Market Penetration: In-depth coverage of product portfolios offered by the top players in the protein A resin market.

- Product Development/Innovation: In-depth coverage of product portfolios offered by the top players in the protein A resin market.

- Market Development: Insightful data on profitable developing areas.

- Market Diversification: Details about recent developments and advancements in the protein A resin market.

- Competitive Assessment: Extensive assessment of the products, growth tactics, revenue projections, and market categories of the top competitors.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION & REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY RESEARCH

- 2.1.1.1 Key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.1.3 Objectives of secondary research

- 2.1.2 PRIMARY RESEARCH

- 2.1.2.1 Key primary sources

- 2.1.2.2 Key supply and demand-side participants

- 2.1.2.3 Breakdown of primary interviews

- 2.1.2.4 Objectives of primary research

- 2.1.2.5 Key primary insights

- 2.1.1 SECONDARY RESEARCH

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Company revenue estimation

- 2.2.1.2 Customer-based market estimation

- 2.2.1.3 Primary interviews

- 2.2.2 TOP-DOWN APPROACH

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 GROWTH RATE ASSUMPTIONS

- 2.4 DATA TRIANGULATION

- 2.5 STUDY ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 PROTEIN A RESIN MARKET OVERVIEW

- 4.2 ASIA PACIFIC: PROTEIN A RESIN MARKET, BY COUNTRY AND END USER

- 4.3 PROTEIN A RESIN MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Strong monoclonal antibody pipeline to drive demand

- 5.2.1.2 Advent of continuous bioprocessing to drive adoption

- 5.2.1.3 Increased utilization due to expansion of bispecific antibodies

- 5.2.2 RESTRAINTS

- 5.2.2.1 High manufacturing cost and pricing pressure

- 5.2.2.2 Issues associated with scaling up resin production

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising outsourcing to CDMOs

- 5.2.3.2 Innovative therapeutic indications

- 5.2.4 CHALLENGES

- 5.2.4.1 Limited resin reusability and fouling concerns

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE TREND, BY KEY PLAYER

- 5.4.2 AVERAGE SELLING PRICE TREND, BY REGION

- 5.5 VALUE CHAIN ANALYSIS

- 5.5.1 RESEARCH & DEVELOPMENT

- 5.5.2 RAW MATERIAL PROCUREMENT AND MANUFACTURING

- 5.5.3 DISTRIBUTION AND MARKETING & SALES

- 5.5.4 AFTER-SALES SERVICES

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.6.1 PROMINENT COMPANIES

- 5.6.2 SMALL & MEDIUM-SIZED ENTERPRISES

- 5.6.3 END USERS

- 5.7 ECOSYSTEM ANALYSIS

- 5.8 INVESTMENT & FUNDING SCENARIO

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Recombinant protein A ligand engineering

- 5.9.1.2 Alkaline-stable ligand development

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 Automated column packing systems

- 5.9.2.2 In-line monitoring and PAT (process analytical technology) tools

- 5.9.3 ADJACENT TECHNOLOGIES

- 5.9.3.1 Continuous chromatography systems

- 5.9.3.2 Affinity membrane technology

- 5.9.1 KEY TECHNOLOGIES

- 5.10 PATENT ANALYSIS

- 5.10.1 INNOVATIONS AND PATENT REGISTRATIONS

- 5.11 TRADE ANALYSIS

- 5.11.1 IMPORT DATA FOR HS CODE 3504

- 5.11.2 EXPORT DATA FOR HS CODE 3504

- 5.12 KEY CONFERENCES & EVENTS, 2025-2026

- 5.13 CASE STUDY ANALYSIS

- 5.13.1 CASE STUDY 1: STRATEGIC CAPACITY EXPANSION BY PUROLITE (ECOLAB) TO STRENGTHEN SUPPLY CHAIN RESILIENCE IN PROTEIN A RESIN BUSINESS

- 5.13.2 CASE STUDY 2: PROCESS INNOVATION BY CYTIVA TO ENHANCE REUSE CYCLES IN PROTEIN A RESINS

- 5.13.3 CASE STUDY 3: TOSOH'S SINGLE-USE STRATEGY TO TAP INTO GROWING DEMAND FOR FLEXIBLE BIOPROCESSING

- 5.14 REGULATORY ANALYSIS

- 5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.2 REGULATORY FRAMEWORK

- 5.14.2.1 North America

- 5.14.2.1.1 US

- 5.14.2.1.2 Canada

- 5.14.2.2 Europe

- 5.14.2.2.1 UK

- 5.14.2.2.2 Germany

- 5.14.2.2.3 France

- 5.14.2.2.4 Italy

- 5.14.2.2.5 Spain

- 5.14.2.3 Asia Pacific

- 5.14.2.3.1 Japan

- 5.14.2.3.2 China

- 5.14.2.3.3 India

- 5.14.2.3.4 Australia

- 5.14.2.4 Latin America

- 5.14.2.4.1 Brazil

- 5.14.2.4.2 Mexico

- 5.14.2.5 Middle East & Africa

- 5.14.2.5.1 UAE

- 5.14.2.5.2 South Africa

- 5.14.2.1 North America

- 5.15 PORTER'S FIVE FORCES ANALYSIS

- 5.15.1 THREAT OF NEW ENTRANTS

- 5.15.2 THREAT OF SUBSTITUTES

- 5.15.3 BARGAINING POWER OF SUPPLIERS

- 5.15.4 BARGAINING POWER OF BUYERS

- 5.15.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.16 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.16.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.16.2 BUYING CRITERIA

- 5.17 UNMET NEEDS

- 5.18 IMPACT OF 2025 US TARIFFS-PROTEIN A RESIN MARKET

- 5.18.1 INTRODUCTION

- 5.18.2 KEY TARIFF RATES

- 5.18.3 PRICE IMPACT ANALYSIS

- 5.18.4 IMPACT ON COUNTRIES/REGIONS

- 5.18.4.1 North America

- 5.18.4.1.1 US

- 5.18.4.2 Europe

- 5.18.4.3 Asia Pacific

- 5.18.4.1 North America

- 5.18.5 IMPACT ON END-USE INDUSTRIES

- 5.19 IMPACT OF AI/GEN AI ON PROTEIN A RESIN MARKET

- 5.19.1 MARKET POTENTIAL OF AI/GEN AI IN PROTEIN A RESIN APPLICATIONS

- 5.19.2 AI USE CASES

- 5.19.3 KEY COMPANIES IMPLEMENTING AI/GEN AI

- 5.19.4 FUTURE OF AI/GEN AI IN PROTEIN A RESIN ECOSYSTEM

6 PROTEIN A RESIN MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- 6.2 BULK RESINS

- 6.2.1 BULK RESINS TO HOLD LARGEST MARKET SHARE

- 6.3 PREPACKED COLUMNS

- 6.3.1 CONSISTENCY AND LOW CROSS-CONTAMINATION RISK TO SUPPORT ADOPTION

- 6.4 LAB-SCALE COLUMNS

- 6.4.1 FLEXIBILITY, LOW SAMPLE CONSUMPTION, AND HIGH THROUGHPUT TO DRIVE USAGE

- 6.5 OTHER PRODUCTS

7 PROTEIN A RESIN MARKET, BY SOURCE

- 7.1 INTRODUCTION

- 7.2 RECOMBINANT PROTEIN A

- 7.2.1 COST-EFFICIENCY OF RECOMBINANT PROTEINS TO DRIVE MARKET GROWTH

- 7.3 NATURAL PROTEIN A

- 7.3.1 ADVANTAGES OF RECOMBINANT PROTEIN A TO RESTRICT NATURALLY SOURCED COUNTERPARTS

8 PROTEIN A RESIN MARKET, BY MATRIX TYPE

- 8.1 INTRODUCTION

- 8.2 AGAROSE-BASED PROTEIN A

- 8.2.1 AGAROSE-BASED PROTEIN A TO DOMINATE MARKET

- 8.3 GLASS/SILICA-BASED PROTEIN A

- 8.3.1 LOW PH TOLERANCE OF SILICA-BASED RESINS TO LIMIT MARKET GROWTH

- 8.4 ORGANIC POLYMER-BASED PROTEIN A

- 8.4.1 INCREASING POPULARITY OF ORGANIC POLYMERS TO DRIVE MARKET GROWTH

9 PROTEIN A RESIN MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 MONOCLONAL ANTIBODY PURIFICATION

- 9.2.1 GROWING DEMAND, RAPID EXPANSION OF APPLICATIONS, AND INCREASING APPROVALS TO ENSURE LARGEST SHARE

- 9.3 FC-FUSION PROTEIN PURIFICATION

- 9.3.1 INNOVATION AND PATENTED PUBLICATIONS TO DRIVE MARKET

- 9.4 OTHER APPLICATIONS

10 PROTEIN A RESIN MARKET, BY END USER

- 10.1 INTRODUCTION

- 10.2 PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES

- 10.2.1 EXTENSIVE USE IN BIOLOGICAL DRUG PRODUCTION TO ENSURE STRONG DEMAND

- 10.3 CROS & CDMOS

- 10.3.1 EXPANSION OF BIOLOGICS AND BIOSIMILARS TO DRIVE MARKET GROWTH

- 10.4 ACADEMIC & RESEARCH INSTITUTES

- 10.4.1 INCREASING R&D IN DRUG DISCOVERY TO DRIVE USE OF PROTEIN A RESINS

- 10.5 OTHER END USERS

11 PROTEIN A RESIN MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 11.2.2 US

- 11.2.2.1 Expansion in biomanufacturing and domestic capacity to drive market

- 11.2.3 CANADA

- 11.2.3.1 Policy-led capacity build and CDMO growth to drive the market

- 11.3 EUROPE

- 11.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 11.3.2 GERMANY

- 11.3.2.1 Increased capital expenditure from manufacturers to drive market

- 11.3.3 UK

- 11.3.3.1 Government policies and public-private partnerships to drive market

- 11.3.4 FRANCE

- 11.3.4.1 CDMO capacity expansion and public programs to drive market growth

- 11.3.5 ITALY

- 11.3.5.1 Increased Cap Ex from major end-user categories to grow the demand for protein A resin

- 11.3.6 SPAIN

- 11.3.6.1 Increased CDMO and CRO likely to grow demand for protein A resin

- 11.3.7 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 11.4.2 JAPAN

- 11.4.2.1 CDMO capacity expansions, policy backing, and CDMO investment to propel market

- 11.4.3 CHINA

- 11.4.3.1 Robust biopharmaceutical expansion to grow demand

- 11.4.4 INDIA

- 11.4.4.1 Growth of pharma and biotech industries to drive demand for protein A resins

- 11.4.5 AUSTRALIA

- 11.4.5.1 Increasing demand for protein-based therapeutics to drive growth

- 11.4.6 SOUTH KOREA

- 11.4.6.1 Developments in biopharmaceutical sector to drive market growth

- 11.4.7 REST OF ASIA PACIFIC

- 11.5 LATIN AMERICA

- 11.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 11.5.2 BRAZIL

- 11.5.2.1 Biomanufacturing emphasis and public-private partnerships to catalyze demand

- 11.5.3 MEXICO

- 11.5.3.1 Supportive government initiatives to grow demand for protein A resin

- 11.5.4 REST OF LATIN AMERICA

- 11.6 MIDDLE EAST & AFRICA

- 11.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 11.6.2 GCC COUNTRIES

- 11.6.2.1 Favorable government policies to propel market growth

- 11.6.3 REST OF MIDDLE EAST & AFRICA

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN PROTEIN A RESIN MARKET

- 12.3 REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.4.1 MARKET RANKING OF KEY PLAYERS, 2024

- 12.5 COMPANY VALUATION & FINANCIAL METRICS

- 12.6 BRAND/PRODUCT COMPARISON

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.7.1 STARS

- 12.7.2 PERVASIVE PLAYERS

- 12.7.3 EMERGING LEADERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.7.5.1 Company footprint

- 12.7.5.2 Region footprint

- 12.7.5.3 Product footprint

- 12.7.5.4 Matrix type footprint

- 12.7.5.5 Application footprint

- 12.7.5.6 End-user footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING OF STARTUPS/SMES, 2024

- 12.8.5.1 Detailed list of key startups/SMEs

- 12.8.5.2 Competitive benchmarking of key startups/SMEs

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES & APPROVALS

- 12.9.2 DEALS

- 12.9.3 EXPANSIONS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 DANAHER

- 13.1.1.1 Business overview

- 13.1.1.2 Products offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches

- 13.1.1.3.2 Deals

- 13.1.1.3.3 Expansions

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses & competitive threats

- 13.1.2 THERMO FISHER SCIENTIFIC INC.

- 13.1.2.1 Business overview

- 13.1.2.2 Products offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Deals

- 13.1.2.3.2 Expansions

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses & competitive threats

- 13.1.3 AGILENT TECHNOLOGIES, INC.

- 13.1.3.1 Business overview

- 13.1.3.2 Products offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Deals

- 13.1.3.3.2 Expansions

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses & competitive threats

- 13.1.4 BIO-RAD LABORATORIES, INC

- 13.1.4.1 Business overview

- 13.1.4.2 Products offered

- 13.1.5 MERCK KGAA

- 13.1.5.1 Business overview

- 13.1.5.2 Products offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Expansions

- 13.1.5.3.2 Other developments

- 13.1.6 REPLIGEN CORPORATION

- 13.1.6.1 Business overview

- 13.1.6.2 Products offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Deals

- 13.1.6.4 MnM view

- 13.1.6.4.1 Right to win

- 13.1.6.4.2 Strategic choices

- 13.1.6.4.3 Weaknesses and competitive threats

- 13.1.7 TOSOH BIOSCIENCE

- 13.1.7.1 Business overview

- 13.1.7.2 Products offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Expansions

- 13.1.8 ECOLAB INC.

- 13.1.8.1 Business overview

- 13.1.8.2 Products offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Product launches

- 13.1.8.3.2 Deals

- 13.1.8.3.3 Expansions

- 13.1.8.4 MnM view

- 13.1.8.4.1 Key strengths

- 13.1.8.4.2 Strategic choices

- 13.1.8.4.3 Weaknesses & competitive threats

- 13.1.9 NOVASEP HOLDING

- 13.1.9.1 Business overview

- 13.1.9.2 Products offered

- 13.1.10 AVANTOR, INC.

- 13.1.10.1 Business overview

- 13.1.10.2 Products offered

- 13.1.11 OROCHEM TECHNOLOGIES, INC.

- 13.1.11.1 Business overview

- 13.1.11.2 Products offered

- 13.1.12 KANEKA CORPORATION

- 13.1.12.1 Business overview

- 13.1.12.2 Products offered

- 13.1.13 JSR CORPORATION

- 13.1.13.1 Business overview

- 13.1.13.2 Products offered

- 13.1.14 GENSCRIPT

- 13.1.14.1 Business overview

- 13.1.14.2 Products offered

- 13.1.1 DANAHER

- 13.2 OTHER PLAYERS

- 13.2.1 BIO-WORKS

- 13.2.2 GENO TECHNOLOGY, INC.

- 13.2.3 PROMEGA CORPORATION

- 13.2.4 SUZHOU NANOMICRO TECHNOLOGY CO., LTD.

- 13.2.5 TRANSGEN BIOTECH CO., LTD

- 13.2.6 RESYN BIOSCIENCES (PTY) LTD

- 13.2.7 BIOTOOLOMICS LTD.

- 13.2.8 CALIBRE SCIENTIFIC (PROTEIN ARK)

- 13.2.9 SUNRESIN NEW MATERIALS CO., LTD.

- 13.2.10 BEAVER

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS