|

시장보고서

상품코드

1804843

산업 서비스 시장 : 서비스 유형별, 용도별, 최종 이용 산업별, 지역별 - 예측(-2030년)Industrial Services Market by SCADA, DCS, MES, Robotics, PLC, Safety System, Industrial PC, 3D Printing, Motor & Drive, PLC, HMI, Service Type (Engineering & Consulting, Installation & Commissioning, Improvement & Maintenance) - Global Forecast to 2030 |

||||||

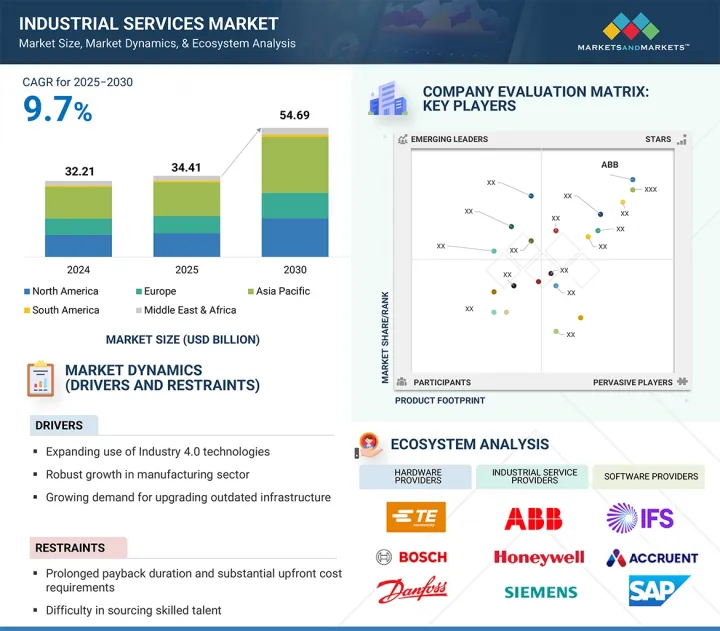

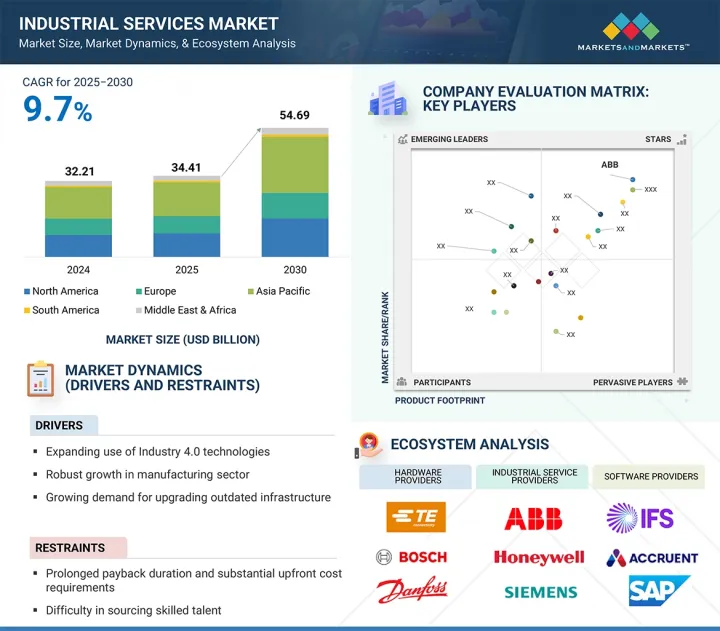

산업 서비스 시장 규모는 2025년 344억 1,000만 달러에서 2030년에는 546억 9,000만 달러로 성장하여 CAGR 9.7%를 보일 것으로 예측됩니다.

산업 서비스는 장비의 신뢰성, 규제 준수 및 업무 효율성을 보장하기 위해 모든 분야에서 점점 더 중요해지고 있습니다. 제조업에서는 이러한 서비스를 통해 예지보전, 공정 최적화, 디지털 시스템 통합을 가능하게 하여 인더스트리 4.0의 변화를 지원합니다. 제약업계에서는 이러한 서비스를 통해 적정 제조 기준(GMP) 준수, 클린룸 유지보수, 제조 환경 검증이 확실하게 이루어집니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2021-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 검토 단위 | 금액(10억 달러) |

| 부문별 | 서비스 유형별, 용도별, 최종 이용 산업별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 기타 지역 |

에너지 및 전력-공공 부문은 송전망 유지보수, 인프라 업그레이드, 안전 준수 등을 위해 산업 서비스를 활용하고 있습니다. 물류 및 운송 분야에서는 장비 교정, 시설 관리 등의 서비스가 합리적인 운영을 지원하고 있습니다. 자동화, 지속가능성, 규제 표준이 점점 더 중요해지는 가운데, 산업 서비스는 진화하는 산업 환경에서 원활하고 컴플라이언스를 준수하는 운영에 필수적인 지원을 제공합니다.

플랜트 효율 향상, 운영 비용 절감, 장비 수명주기 연장에 대한 관심이 높아짐에 따라 운영 개선 및 유지보수 서비스 분야는 예측 기간 동안 가장 높은 CAGR을 나타낼 것으로 예측됩니다. 산업계가 예지 및 예방적 유지보수 전략을 우선시하는 가운데, 계획되지 않은 다운타임을 최소화하고 안전 및 환경 규제 준수를 보장하는 서비스에 대한 수요가 증가하고 있습니다. 또한, 인더스트리 4.0으로의 전환으로 인해 데이터 기반 유지보수 및 프로세스 최적화 도구의 채택이 가속화되고 있습니다. 이러한 서비스는 실시간 모니터링, 성능 벤치마킹, 고급 분석을 가능하게 하여 업무 전반의 효율성을 향상시킵니다. 성숙 시장의 노후화된 산업 인프라와 신흥국의 산업화 진전은 이 부문의 성장에 더욱 기여하고 있습니다. 기업들은 또한 비용 예측 가능성과 운영 탄력성을 향상시키기 위해 유지보수 아웃소싱 및 통합 서비스 계약에 투자하고 있습니다. 전반적으로 신뢰성, 안전성, 성능 향상을 지원하는 이 분야의 역할은 산업 서비스 시장 성장의 중요한 촉진제 역할을 하고 있습니다.

석유 및 가스 산업은 운영의 신뢰성, 안전, 규제 준수에 대한 의존도가 높기 때문에 예측 기간 동안 산업 서비스 시장에서 두 번째 점유율을 차지할 것으로 예측됩니다. 리그, 파이프라인, 정유공장 등 복잡한 인프라와 중요한 자산을 보유한 이 산업은 전문적인 유지보수, 검사, 공정 최적화 서비스를 통한 지속적인 지원이 필요합니다. 산업 서비스는 계획되지 않은 다운타임을 최소화하고, 자산의 무결성을 보장하며, 장비의 수명을 연장하는 데 필수적입니다. 실시간 의사결정과 업무 효율성을 높이기 위해 예측 분석, 원격 모니터링, 디지털 트윈 기술을 도입하는 사례가 증가하고 있습니다. 또한, 이 부문의 엄격한 환경 및 안전 규제는 컴플라이언스 관리 및 리스크 완화 서비스에 대한 수요를 촉진하고 있습니다. 세계 에너지 수요가 지속되고 석유 및 가스 회사들이 기존 프로젝트와 재생에너지 프로젝트에 투자하는 가운데, 견고한 산업 서비스에 대한 수요는 계속 증가하고 있습니다. 이러한 요인들이 복합적으로 작용하여, 이 부문 시장에서의 존재감은 강력하게 지속되고 있습니다.

독일은 특히 자동차, 엔지니어링, 기계 분야에서 강력한 제조거점을 바탕으로 예측 기간 동안 유럽 산업 서비스 시장을 독점할 것으로 예측됩니다. 정밀 엔지니어링과 산업 혁신의 세계적인 거점인 독일은 업무 효율성, 규정 준수 및 기술 진보를 보장하기 위해 첨단 산업 서비스에 크게 의존하고 있습니다. 자동화, 근로자 안전, 규제 준수를 중시하는 이 나라는 유지보수, 물류, 엔지니어링 서비스에 대한 수요를 더욱 증가시키고 있습니다. 특히 자동차 부문은 생산 최적화 및 공급망 관리를 위한 산업 서비스의 주요 수요처로 남아 있습니다. 재생에너지와 지속가능성에 중점을 두고 있는 독일에서는 풍력 및 태양광 발전 인프라 및 유지 보수에 대한 산업 서비스 수요도 증가하고 있습니다. 스텔란티스(Stellantis)와 릴리(Lilly)와 같은 기업들의 첨단 제조 시설에 대한 전략적 투자는 산업 활동의 확장을 강조하고 있습니다. 정부의 지원과 성숙한 연구 및 혁신 생태계와 함께 독일은 유럽 최고의 산업 서비스 시장으로 성장하고 있습니다.

세계의 산업 서비스 시장에 대해 조사했으며, 서비스 유형별/용도별/최종 이용 산업별/지역별 동향, 시장 진출기업 프로파일 등의 정보를 정리하여 전해드립니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 프리미엄 인사이트

제5장 시장 개요

- 서론

- 시장 역학

- 고객의 비즈니스에 영향을 미치는 동향/혼란

- 밸류체인 분석

- 생태계 분석

- 기술 분석

- 특허 분석

- 무역 분석

- 관세 분석

- Porter의 Five Forces 분석

- 주요 이해관계자와 구입 기준

- 사례 연구 분석

- 기준과 규제 상황

- 2025-2026년 주요 컨퍼런스 및 이벤트

- AI가 산업 서비스 시장에 미치는 영향

- 2025년 미국 관세의 영향 - 개요

제6장 산업 서비스 시장(서비스 유형별)

- 서론

- 엔지니어링 및 컨설팅

- 설치 및 시운전

- 운영 개선 및 유지보수

제7장 산업 서비스 시장(용도별)

- 서론

- MES

- DCS

- PLC

- SCADA 시스템

- 모터 및 드라이브

- 산업용 로봇

- 산업용 3D 프린터

- 기능 안전 시스템

- 산업용 PC

- 휴먼 머신 인터페이스(HMI)

제8장 산업 서비스 시장(최종 이용 산업별)

- 서론

- 자동차

- 항공우주

- 화학제품

- 식품 및 음료

- 금속 및 광업

- 석유 및 가스

- 의약품

- 에너지 및 전력

- 물 및 폐수

- 반도체

- 종이 및 펄프

- 기타

제9장 산업 서비스 시장(지역별)

- 서론

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 기타

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 기타

- 기타 지역

- 남미

- 중동

- 아프리카

제10장 경쟁 구도

- 서론

- 주요 시장 진출기업의 전략/강점, 2022년-2025년

- 매출 분석, 2020년-2024년

- 시장 점유율 분석, 2024년

- 기업 평가와 재무 지표

- 기업 평가 매트릭스 : 주요 기업, 2024년

- 기업 평가 매트릭스 : 스타트업/중소기업, 2024년

- 경쟁 시나리오

제11장 기업 개요

- 주요 시장 진출기업

- ABB

- SCHNEIDER ELECTRIC

- SIEMENS

- ROCKWELL AUTOMATION

- HONEYWELL INTERNATIONAL INC.

- GE VERNOVA

- EMERSON ELECTRIC CO.

- YOKOGAWA ELECTRIC CORPORATION

- EATON

- MITSUBISHI ELECTRIC CORPORATION

- 기타 기업

- ATS CORPORATION

- METSO

- YASKAWA ELECTRIC CORPORATION

- SKF

- ATLAS COPCO AB

- PARKER HANNIFIN CORP

- DANAHER CORPORATION

- CUMMINS INC.

- WARTSILA

- ALSTOM SA

- INGERSOLL RAND

- INTECH

- PRIME CONTROLS, LP

- WUNDERLICH-MALEC ENGINEERING, INC.

- SAMSON AG

제12장 부록

LSH 25.09.11The industrial services market is projected to grow from USD 34.41 billion in 2025 to USD 54.69 billion by 2030, registering a CAGR of 9.7%. Industrial services are increasingly critical across sectors because they ensure equipment reliability, regulatory compliance, and operational efficiency. In the manufacturing industry, these services enable predictive maintenance, process optimization, and integration of digital systems to support Industry 4.0 transformation. In the pharmaceuticals sector, these services ensure adherence to Good Manufacturing Practices (GMPs), cleanroom maintenance, and validation of production environments.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By service type, application, end-use industry, and region |

| Regions covered | North America, Europe, APAC, RoW |

The energy & power and utilities sector leverages industrial services for grid maintenance, infrastructure upgrades, and safety compliance. In logistics and transportation, services such as equipment calibration and facility management support streamlined operations. With increasing emphasis on automation, sustainability, and regulatory standards, industrial services offer essential support for smooth and compliant operations across evolving industrial environments.

"Operational Improvement & Maintenance Services to Exhibit Highest CAGR During Forecast Period"

The operational improvement & maintenance services segment is expected to record the highest CAGR during the forecast period due to the increasing focus on enhancing plant efficiency, reducing operational costs, and extending equipment life cycles. As industries prioritize predictive and preventive maintenance strategies, demand for services that minimize unplanned downtime and ensure compliance with safety and environmental regulations is rising. Additionally, the shift toward Industry 4.0 accelerates the adoption of data-driven maintenance and process optimization tools. These services enable real-time monitoring, performance benchmarking, and advanced analytics, driving efficiency across operations. Aging industrial infrastructure in mature markets and growing industrialization in emerging economies further contribute to the segment's growth. Companies also invest in maintenance outsourcing and integrated service contracts to improve cost predictability and operational resilience. Overall, the segment's role in supporting reliability, safety, and performance improvement positions it as a key driver for the growth of the industrial services market.

"Oil & Gas Segment to Hold Second-largest Share of Industrial Services Market, by End-use Industry Throughout Forecast Period"

The oil & gas industry is expected to hold the second-largest share of the industrial services market throughout the forecast period due to its high dependency on operational reliability, safety, and regulatory compliance. With complex infrastructure and critical assets such as rigs, pipelines, and refineries, the industry requires continuous support through specialized maintenance, inspection, and process optimization services. Industrial services are vital in minimizing unplanned downtime, ensuring asset integrity, and extending equipment lifespan. The adoption of predictive analytics, remote monitoring, and digital twin technologies is increasing within the sector to enhance real-time decision-making and operational efficiency. Additionally, the sector's strict environmental and safety regulations drive demand for compliance management and risk mitigation services. As global energy demand continues and oil & gas companies invest in conventional and renewable projects, the need for robust industrial services remains high. These factors collectively contribute to the segment's strong and sustained market presence.

"Germany to Dominate Industrial Services Market in Europe During Forecast Period"

Germany is expected to dominate the industrial services market in Europe during the forecast period due to its strong manufacturing base, particularly in the automotive, engineering, and machinery sectors. As a global hub for precision engineering and industrial innovation, Germany relies heavily on advanced industrial services to ensure operational efficiency, compliance, and technological advancement. The country's emphasis on automation, worker safety, and regulatory adherence further drives the demand for maintenance, logistics, and engineering services. The automotive sector, in particular, remains a major consumer of industrial services for production optimization and supply chain management. Germany's focus on renewable energy and sustainability initiatives also increases the need for industrial services in wind and solar infrastructure maintenance. Strategic investments from companies such as Stellantis and Lilly in high-tech manufacturing facilities highlight growing industrial activity. Combined with government support and a mature research and innovation ecosystem, these factors position Germany as the leading industrial services market in Europe.

- By Company Type: Tier 1 - 10%, Tier 2 - 55%, and Tier 3 - 35%

- By Designation: Directors - 45%, Managers - 25%, and Others - 30%

- By Region: North America - 55%, Europe - 20%, Asia Pacific - 15%, and RoW - 10%

ABB (Switzerland), Honeywell International Inc. (US), Rockwell Automation (US), Schneider Electric (France), Siemens (Germany), GE Vernova (US), Emerson Electric Co. (US), Yokogawa Electric Corporation (Japan), Eaton (Ireland), Mitsubishi Electric Corporation (Japan), ATS Corporation (Canada), Metso (Finland), Yaskawa Electric Corporation (Japan), SKF (Sweden), Atlas Copco AB (Sweden) are some key players in the industrial services market.

The study includes an in-depth competitive analysis of these key players in the industrial services market, with their company profiles, recent developments, and key market strategies.

Research Coverage

This research report categorizes the industrial services market by service type (engineering & consulting, installation & commissioning, operational improvement & maintenance), application (manufacturing execution systems, DCS, PLCs, SCADA systems, motors & drives, industrial robotics, industrial 3D printing solutions, safety systems, industrial PCs, human-machine interfaces), end-use industry (automotive, aerospace, chemicals, food & beverages, metals & mining, oil & gas, pharmaceuticals, energy & power, water & wastewater, semiconductor, paper & pulp, and other end-use industries), and by region (North America, Europe, Asia Pacific, and Rest of the World). The report's scope covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the industrial services market. A thorough analysis of the key industry players has provided insights into their business overview, solutions, and products; key strategies include contracts, partnerships, agreements, product launches, and mergers and acquisitions in the industrial services market. This report covers the competitive analysis of upcoming startups in the industrial services ecosystem.

Reasons to Buy This Report

The report will help market leaders and new entrants with information on the closest approximations of the revenue numbers for the overall industrial services market and its subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (expanding use of industry 4.0 technologies, robust growth in the manufacturing sector, growing demand for upgrading outdated infrastructure, rising strategic focus on international growth among manufacturing firms), restraints (prolonged payback duration and substantial upfront cost requirements, difficulty in sourcing skilled talent), opportunities (increasing focus on sustainability and emission control, rising focus on strengthening digital security frameworks), and challenges (technology disruption accelerating obsolescence risks, intensely competitive market landscape)

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and product & service launches in the industrial services market

- Market Development: Comprehensive information about lucrative markets by analyzing the industrial services market across varied regions

- Market Diversification: Exhaustive information about newly launched products and services, untapped geographies, recent developments, and investments in the industrial services market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players in the industrial services market, such as ABB (Switzerland), Honeywell International Inc. (US), Rockwell Automation (US), Schneider Electric (France), Siemens (Germany), GE Vernova (US), Emerson Electric Co. (US), Yokogawa Electric Corporation (Japan), Eaton (Ireland), and Mitsubishi Electric Corporation (Japan), among others.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 LIMITATIONS

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Intended participants and key opinion leaders in primary interviews

- 2.1.2.2 List of major participants in primary interviews

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Breakdown of primaries

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.3.1 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to arrive at market size using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to arrive at market size using top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RISK ASSESSMENT

- 2.6 STUDY LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN INDUSTRIAL SERVICES MARKET

- 4.2 INDUSTRIAL SERVICES MARKET IN NORTH AMERICA, BY COUNTRY AND APPLICATION

- 4.3 INDUSTRIAL SERVICES MARKET IN ASIA PACIFIC, BY APPLICATION

- 4.4 GLOBAL INDUSTRIAL SERVICES MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing adoption of Industry 4.0 technology

- 5.2.1.2 Booming manufacturing sector worldwide

- 5.2.1.3 Pressing need to upgrade outdated infrastructure

- 5.2.1.4 Rising focus of manufacturing firms on expanding their market reach

- 5.2.2 RESTRAINTS

- 5.2.2.1 High capital barriers and delayed returns

- 5.2.2.2 Shortage of skilled workforce

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Global shift toward sustainability, energy efficiency, and emission reduction

- 5.2.3.2 Rising focus on strengthening digital security frameworks

- 5.2.4 CHALLENGES

- 5.2.4.1 Obsolescence risks stemming from rapid technological advancements

- 5.2.4.2 Intensely competitive market landscape

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 TECHNOLOGY ANALYSIS

- 5.6.1 KEY TECHNOLOGIES

- 5.6.1.1 Internet of Things (IoT)

- 5.6.1.2 Augmented reality (AR) and virtual reality (VR)

- 5.6.1.3 Automation and robotics

- 5.6.1.4 Big data analytics

- 5.6.1.5 Artificial intelligence (AI)

- 5.6.2 COMPLEMENTARY TECHNOLOGIES

- 5.6.2.1 Blockchain and supply chain management

- 5.6.2.2 Edge computing and 5G

- 5.6.2.3 Digital twins and predictive maintenance

- 5.6.2.4 Cybersecurity solutions and data encryption

- 5.6.3 ADJACENT TECHNOLOGIES

- 5.6.3.1 5G connectivity

- 5.6.3.2 Renewable energy technologies

- 5.6.3.3 Smart building technologies

- 5.6.3.4 Food safety technologies

- 5.6.1 KEY TECHNOLOGIES

- 5.7 PATENT ANALYSIS

- 5.8 TRADE ANALYSIS

- 5.9 TARIFF ANALYSIS

- 5.10 PORTER'S FIVE FORCES ANALYSIS

- 5.10.1 THREAT OF NEW ENTRANTS

- 5.10.2 THREAT OF SUBSTITUTES

- 5.10.3 BARGAINING POWER OF SUPPLIERS

- 5.10.4 BARGAINING POWER OF BUYERS

- 5.10.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.11 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.11.2 BUYING CRITERIA

- 5.12 CASE STUDY ANALYSIS

- 5.12.1 INDIA-BASED CEMENT MANUFACTURER COLLABORATED WITH ABB TO OPTIMIZE OPERATIONS

- 5.12.2 NESTLE PARTNERED WITH SCHNEIDER ELECTRIC TO IMPROVE OPERATIONAL EFFICIENCY

- 5.12.3 BP COLLABORATED WITH GENERAL ELECTRIC TO ENHANCE PERFORMANCE AND RELIABILITY OF INDUSTRIAL EQUIPMENT AND MACHINERY

- 5.12.4 PROCTER & GAMBLE COLLABORATED WITH ROCKWELL AUTOMATION TO IMPROVE MANUFACTURING PROCESSES, REDUCE DOWNTIME, AND ENHANCE PRODUCT QUALITY

- 5.13 STANDARDS AND REGULATORY LANDSCAPE

- 5.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.2 STANDARDS AND REGULATIONS RELATED TO INDUSTRIAL SERVICES

- 5.13.2.1 ISO 9001:2015 - Quality Management Systems

- 5.13.2.2 ISO 14001:2015 - Environmental Management Systems

- 5.13.2.3 ISO 45001:2018 - Occupational Health and Safety Management Systems

- 5.13.2.4 ASME B31.3 - Process Piping

- 5.13.2.5 NFPA 70 - National Electrical Code (NEC)

- 5.13.2.6 API 510 - Pressure Vessel Inspection Code: In-service Inspection, Rating, Repair, and Alteration

- 5.13.2.7 OSHA 29 CFR 1910 - Occupational Safety and Health Standards

- 5.13.2.8 IEC 61511 - Functional Safety - Safety Instrumented Systems for Process Industry Sector

- 5.14 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.15 IMPACT OF AI ON INDUSTRIAL SERVICES MARKET

- 5.15.1 INTRODUCTION

- 5.15.2 AI-SPECIFIC USE CASES

- 5.16 IMPACT OF 2025 US TARIFFS - OVERVIEW

- 5.16.1 INTRODUCTION

- 5.16.2 KEY TARIFF RATES

- 5.16.3 PRICE IMPACT ANALYSIS

- 5.16.4 IMPACT ON COUNTRIES/REGIONS

- 5.16.4.1 US

- 5.16.4.2 Europe

- 5.16.4.3 Asia Pacific

- 5.16.5 IMPACT ON END-USE INDUSTRIES

6 INDUSTRIAL SERVICES MARKET, BY SERVICE TYPE

- 6.1 INTRODUCTION

- 6.2 ENGINEERING & CONSULTING

- 6.2.1 GROWING COMPLEXITY OF LARGE-SCALE INDUSTRIAL PROJECTS TO BOOST DEMAND

- 6.3 INSTALLATION & COMMISSIONING

- 6.3.1 NEED FOR APPROPRIATE SETUP, INTEGRATION, AND VERIFICATION OF INDUSTRIAL SYSTEMS TO FUEL SEGMENTAL GROWTH

- 6.4 OPERATIONAL IMPROVEMENT & MAINTENANCE

- 6.4.1 RISING NEED FOR SCHEDULED MAINTENANCE TO ENSURE CONTINUOUS OPERATIONS TO BOOST DEMAND

7 INDUSTRIAL SERVICES MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.2 MES

- 7.2.1 GROWING ADOPTION OF INDUSTRY 4.0 AND SMART FACTORY INITIATIVES TO BOOST DEMAND

- 7.3 DCS

- 7.3.1 GREATER EMPHASIS ON IMPROVING PLANT EFFICIENCY AND MINIMIZING MANUAL INTERVENTION TO ELEVATE DEMAND

- 7.4 PLC

- 7.4.1 EXCELLENCE IN IDENTIFYING POTENTIAL FAILURES IN ADVANCE TO STIMULATE ADOPTION

- 7.5 SCADA SYSTEM

- 7.5.1 STRONG FOCUS ON OPTIMIZING INDUSTRIAL OPERATIONS TO STIMULATE DEMAND

- 7.6 MOTOR & DRIVE

- 7.6.1 GROWING INCLINATION TOWARD PREDICTIVE ANALYTICS AND SMART MAINTENANCE TO DRIVE MARKET

- 7.6.2 DIGITAL TECHNOLOGIES USED IN MOTORS AND DRIVES

- 7.6.2.1 Artificial intelligence

- 7.6.2.2 Smart sensors

- 7.6.2.3 Connectivity technologies

- 7.7 INDUSTRIAL ROBOT

- 7.7.1 DEPLOYMENT OF COLLABORATIVE ROBOTS IN ASSEMBLY AND INSPECTION APPLICATIONS TO PROPEL MARKET

- 7.8 INDUSTRIAL 3D PRINTER

- 7.8.1 SURGING USE OF ADDITIVE MANUFACTURING IN PROTOTYPING AND COMPLEX PART PRODUCTION TO FACILITATE MARKET GROWTH

- 7.9 FUNCTIONAL SAFETY SYSTEM

- 7.9.1 POTENTIAL TO ENSURE SYSTEM INTEGRITY AND SAFETY TO PROMOTE ADOPTION

- 7.9.2 BURNER MANAGEMENT SYSTEM (BMS)

- 7.9.3 EMERGENCY SHUTDOWN (ESD) SYSTEM

- 7.9.4 FIRE & GAS MONITORING AND CONTROL SYSTEM

- 7.9.5 HIGH-INTEGRITY PRESSURE PROTECTION SYSTEM (HIPPS)

- 7.9.6 TURBOMACHINERY CONTROL (TMC) SYSTEM

- 7.10 INDUSTRIAL PC

- 7.10.1 URGENT NEED FOR REAL-TIME DATA COLLECTION, ANALYSIS, AND PROCESSING TO FOSTER MARKET GROWTH

- 7.11 HUMAN-MACHINE INTERFACE

- 7.11.1 INTEGRATION OF HMI SYSTEMS WITH CLOUD AND EDGE COMPUTING FOR SCALABLE CONTROL TO CONTRIBUTE TO MARKET GROWTH

8 INDUSTRIAL SERVICES MARKET, BY END-USE INDUSTRY

- 8.1 INTRODUCTION

- 8.2 AUTOMOTIVE

- 8.2.1 GROWING USE OF DIGITAL TWIN AND REAL-TIME MONITORING TECHNOLOGIES DURING AUTOMOBILE PRODUCTION TO ACCELERATE MARKET GROWTH

- 8.3 AEROSPACE

- 8.3.1 INCREASING INVESTMENTS IN AEROSPACE TECHNOLOGIES TO ACCELERATE MARKET GROWTH

- 8.4 CHEMICALS

- 8.4.1 HIGH PRIORITY FOR OPERATIONAL EXCELLENCE AND RISK MANAGEMENT TO ACCELERATE ADOPTION

- 8.5 FOOD & BEVERAGES

- 8.5.1 RISING USE OF ADVANCED PROCESS CONTROL TECHNOLOGIES TO ACHIEVE HIGH-SPEED PRODUCTION TO FOSTER MARKET GROWTH

- 8.6 METALS & MINING

- 8.6.1 ELEVATING USE OF ADVANCED CONTROL SYSTEMS AND REAL-TIME ANALYTICS FOR SAFER AND EFFICIENT OPERATIONS TO FACILITATE MARKET GROWTH

- 8.7 OIL & GAS

- 8.7.1 SURGING DEMAND FOR ASSET MANAGEMENT SOLUTIONS FROM OIL & GAS COMPANIES TO DRIVE MARKET

- 8.8 PHARMACEUTICALS

- 8.8.1 INCREASING SIGNIFICANCE OF PROCESS STANDARDIZATION AND GMP COMPLIANCE TO ACCELERATE MARKET GROWTH

- 8.9 ENERGY & POWER

- 8.9.1 RISING ADOPTION OF SMART GRID TECHNOLOGIES AND CONDITION MONITORING TO SUPPORT MARKET GROWTH

- 8.10 WATER & WASTEWATER

- 8.10.1 INCREASING INVESTMENT IN SUSTAINABLE WATER MANAGEMENT INITIATIVES TO DRIVE MARKET

- 8.11 SEMICONDUCTOR

- 8.11.1 RISING DEMAND FOR HIGH-PERFORMANCE CHIPS AND PRECISION MANUFACTURING TO FUEL MARKET GROWTH

- 8.12 PAPER & PULP

- 8.12.1 STRINGENT WASTE DISPOSAL AND ENVIRONMENTAL COMPLIANCE STANDARDS TO BOOST DEMAND

- 8.13 OTHER END-USE INDUSTRIES

9 INDUSTRIAL SERVICES MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 US

- 9.2.1.1 Increasing adoption of automation to enhance manufacturing productivity to fuel market growth

- 9.2.2 CANADA

- 9.2.2.1 Strategic government funding to support industrial modernization and innovation to foster market growth

- 9.2.3 MEXICO

- 9.2.3.1 Evolution of country as manufacturing hub to boost demand

- 9.2.1 US

- 9.3 EUROPE

- 9.3.1 UK

- 9.3.1.1 Growing adoption of Industry 4.0 and zero-emission initiatives across industries to promote market growth

- 9.3.2 GERMANY

- 9.3.2.1 Rising focus of automobile manufacturers on precision engineering to boost demand

- 9.3.3 FRANCE

- 9.3.3.1 Increasing investment in improving aerospace infrastructure to support market growth

- 9.3.4 ITALY

- 9.3.4.1 Strategic investments in energy infrastructure and advanced manufacturing to propel market

- 9.3.5 REST OF EUROPE

- 9.3.1 UK

- 9.4 ASIA PACIFIC

- 9.4.1 CHINA

- 9.4.1.1 Rising investments in robotics and AI technologies to drive market

- 9.4.2 JAPAN

- 9.4.2.1 Expansion of semiconductor and electronics manufacturing to contribute to market growth

- 9.4.3 INDIA

- 9.4.3.1 Rising demand for cybersecurity and infrastructure support services to fuel market growth

- 9.4.4 SOUTH KOREA

- 9.4.4.1 Increasing investment in AI-related services to fuel market growth

- 9.4.5 REST OF ASIA PACIFIC

- 9.4.1 CHINA

- 9.5 ROW

- 9.5.1 SOUTH AMERICA

- 9.5.1.1 Infrastructure development and automation initiatives to facilitate market growth

- 9.5.2 MIDDLE EAST

- 9.5.2.1 Saudi Arabia

- 9.5.2.1.1 Rising demand for green hydrogen and clean energy technologies to create growth opportunities

- 9.5.2.2 UAE

- 9.5.2.2.1 Thriving petrochemicals and logistics sectors to accelerate market growth

- 9.5.2.3 Qatar

- 9.5.2.3.1 Expansion of LNG projects to promote market growth

- 9.5.2.4 Kuwait

- 9.5.2.4.1 Oil refinery modernization initiatives to support market growth

- 9.5.2.5 Oman

- 9.5.2.5.1 Emphasis on renewable energy projects to favor market growth

- 9.5.2.6 Bahrain

- 9.5.2.6.1 Government incentives for industrial service providers to fuel market growth

- 9.5.2.7 Rest of Middle East

- 9.5.2.1 Saudi Arabia

- 9.5.3 AFRICA

- 9.5.3.1 South Africa

- 9.5.3.1.1 Mining sector expansion to drive market

- 9.5.3.2 Other African countries

- 9.5.3.1 South Africa

- 9.5.1 SOUTH AMERICA

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2025

- 10.3 REVENUE ANALYSIS, 2020-2024

- 10.4 MARKET SHARE ANALYSIS, 2024

- 10.5 COMPANY VALUATION AND FINANCIAL METRICS

- 10.6 COMPANY EVALUATION MATRIX: KEY COMPANIES, 2024

- 10.6.1 STARS

- 10.6.2 EMERGING LEADERS

- 10.6.3 PERVASIVE PLAYERS

- 10.6.4 PARTICIPANTS

- 10.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.6.5.1 Company footprint

- 10.6.5.2 Region footprint

- 10.6.5.3 Service type footprint

- 10.6.5.4 Application footprint

- 10.6.5.5 End-use industry footprint

- 10.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.7.1 PROGRESSIVE COMPANIES

- 10.7.2 RESPONSIVE COMPANIES

- 10.7.3 DYNAMIC COMPANIES

- 10.7.4 STARTING BLOCKS

- 10.7.5 COMPETITIVE BENCHMARKING: KEY STARTUPS/SMES, 2024

- 10.7.5.1 Detailed list of startups/SMEs

- 10.7.5.2 Competitive benchmarking of key startups/SMEs

- 10.8 COMPETITIVE SCENARIO

- 10.8.1 SOLUTION/SERVICE LAUNCHES

- 10.8.2 DEALS

- 10.8.3 EXPANSIONS

- 10.8.4 OTHER DEVELOPMENTS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 ABB

- 11.1.1.1 Business overview

- 11.1.1.2 Services offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Solution/Service launches

- 11.1.1.3.2 Deals

- 11.1.1.4 MnM view

- 11.1.1.4.1 Key strengths/Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses/Competitive threats

- 11.1.2 SCHNEIDER ELECTRIC

- 11.1.2.1 Business overview

- 11.1.2.2 Services offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Solution/Service launches

- 11.1.2.3.2 Deals

- 11.1.2.4 MnM view

- 11.1.2.4.1 Key strengths/Right to win

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses/Competitive threats

- 11.1.3 SIEMENS

- 11.1.3.1 Business overview

- 11.1.3.2 Services offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Solution/Service launches

- 11.1.3.3.2 Deals

- 11.1.3.3.3 Expansions

- 11.1.3.3.4 Other developments

- 11.1.3.4 MnM view

- 11.1.3.4.1 Key strengths/Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses/Competitive threats

- 11.1.4 ROCKWELL AUTOMATION

- 11.1.4.1 Business overview

- 11.1.4.2 Services offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Solution/Service launches

- 11.1.4.3.2 Deals

- 11.1.4.4 MnM view

- 11.1.4.4.1 Key strengths/Right to win

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses/Competitive threats

- 11.1.5 HONEYWELL INTERNATIONAL INC.

- 11.1.5.1 Business overview

- 11.1.5.2 Services offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Deals

- 11.1.5.4 MnM view

- 11.1.5.4.1 Key strengths/Right to win

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses/Competitive threats

- 11.1.6 GE VERNOVA

- 11.1.6.1 Business overview

- 11.1.6.2 Services offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Deals

- 11.1.6.3.2 Expansions

- 11.1.6.3.3 Other developments

- 11.1.7 EMERSON ELECTRIC CO.

- 11.1.7.1 Business overview

- 11.1.7.2 Services offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Deals

- 11.1.8 YOKOGAWA ELECTRIC CORPORATION

- 11.1.8.1 Business overview

- 11.1.8.2 Services offered

- 11.1.8.3 Recent developments

- 11.1.8.3.1 Solution/Service launches

- 11.1.8.3.2 Deals

- 11.1.9 EATON

- 11.1.9.1 Business overview

- 11.1.9.2 Services offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Deals

- 11.1.9.3.2 Other developments

- 11.1.10 MITSUBISHI ELECTRIC CORPORATION

- 11.1.10.1 Business overview

- 11.1.10.2 Services offered

- 11.1.1 ABB

- 11.2 OTHER COMPANIES

- 11.2.1 ATS CORPORATION

- 11.2.2 METSO

- 11.2.3 YASKAWA ELECTRIC CORPORATION

- 11.2.4 SKF

- 11.2.5 ATLAS COPCO AB

- 11.2.6 PARKER HANNIFIN CORP

- 11.2.7 DANAHER CORPORATION

- 11.2.8 CUMMINS INC.

- 11.2.9 WARTSILA

- 11.2.10 ALSTOM SA

- 11.2.11 INGERSOLL RAND

- 11.2.12 INTECH

- 11.2.13 PRIME CONTROLS, LP

- 11.2.14 WUNDERLICH-MALEC ENGINEERING, INC.

- 11.2.15 SAMSON AG

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS