|

시장보고서

상품코드

1804846

난연제 시장 : 유형별, 용도별, 최종 이용 산업별, 지역별 예측(-2030년)Flame Retardants Market by Type (Aluminum Trihydrate, Antimony Oxide, Brominated), Application (Epoxy, Polyolefin, Unsaturated Polyester), End-Use Industry (Building & Construction, Electronics & Appliances), and Region - Global Forecast to 2030 |

||||||

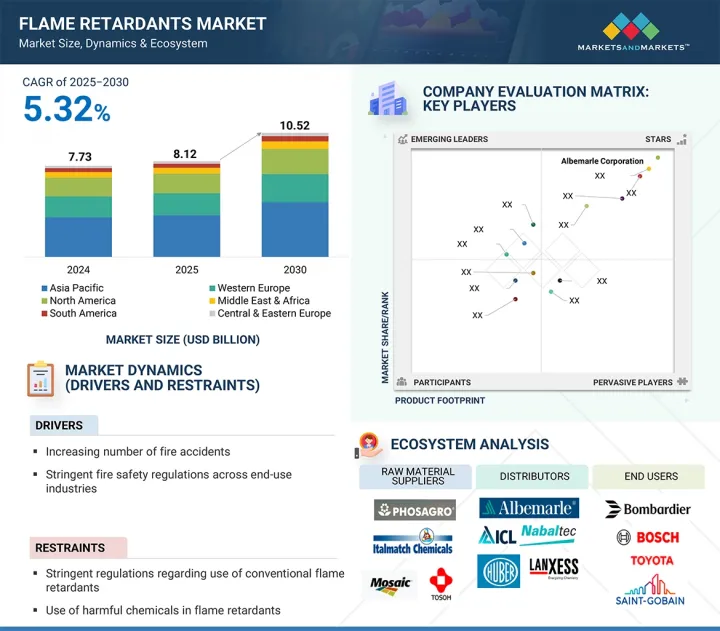

세계의 난연제 시장 규모는 2024년 77억 3,000만 달러에서 2030년에는 105억 2,000만 달러에 이를 것으로 예측되며, CAGR 5.32%를 나타낼 전망입니다.

난연제는 화재 예방이 필수적인 건축 및 건설, 전자, 자동차 및 운송, 섬유, 전선 및 케이블 산업에서 광범위하게 사용됩니다. 난연제의 주요 기능은 재료의 가연성을 차단하고 화재 확산을 제한하여 다양한 산업 분야의 안전 기준 향상에 필수적입니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2020-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 대상 유닛 | 금액(100만 달러) 및 킬로톤(KT) |

| 부문 | 유형별, 용도별, 최종 이용 산업별, 지역별 |

| 대상 지역 | 아시아태평양, 서유럽, 중동 유럽, 북미, 중동, 아프리카, 남미 |

국제 화재 안전 기준이 더욱 엄격해지고 위험 완화 문제가 부각됨에 따라, 산업계는 안전 규범을 충족하고 생명과 자산을 보호하기 위해 난연 솔루션에 대한 선호도가 높아지고 있습니다. 난연성 소재의 사용 증가는 난연제 시장 성장의 주요 촉진요인 중 하나입니다.

브롬계 난연제는 2024년 기준 글로벌 난연제 시장에서 가치 측면에서 두 번째로 큰 점유율을 보유하고 있습니다. 이는 높은 난연 효율, 비용 효율성, 폴리스티렌, 폴리우레탄, 에폭시 등 다양한 폴리머와의 호환성 덕분입니다. 엄격한 화재 안전 규정을 충족하기 위해 신뢰성 있는 성능이 필요한 전자제품 및 가전, 건축 자재, 섬유 분야에서 광범위하게 적용됩니다. 환경 문제로 일부 지역에서 규제 제한이 강화되고 있음에도 불구하고, 강력한 기능적 효율성과 핵심 응용 분야에서의 확고한 사용은 여전히 상당한 시장 지위를 유지하는 데 기여하고 있습니다.

금액 기준으로 불포화 폴리에스테르 부문은 2024년 세계 난연제 시장에서 3위를 차지했습니다. 화재 안전 기준 준수가 필수적인 자동차 및 건설 부품에서의 광범위한 사용이 이러한 우위를 주도합니다. 이러한 수지는 본질적으로 가연성이므로 엄격한 규제 기준을 충족하기 위해 난연제 첨가가 필요합니다. 이 부문의 성장은 또한 안전성과 긴 수명을 보장하기 위해 난연 성능이 중요한 산업 및 인프라 응용 분야에서 섬유 강화 복합재 및 성형 부품의 사용 증가에 의해 주도됩니다.

자동차 및 운송 산업은 2024년 세계의 난연제 시장에서 금액 기준으로 3위의 최종 이용 산업이었습니다. 이는 차량 내부 및 전기 시스템에 플라스틱 및 복합재와 같은 가벼우면서도 가연성 소재의 사용이 확대되고 안전 규제가 강화된 데 크게 기인합니다. 배터리 시스템과 배선에 대한 첨단 열 관리 및 화재 안전 솔루션이 필요한 전기차(EV) 수요 증가 역시 해당 산업의 난연제 의존도를 높이는 데 기여했습니다. 상용차, 항공, 철도 운송 분야의 엄격한 화재 안전 규정도 난연성 소재의 꾸준한 사용을 촉진했습니다.

서유럽는 세계의 난연제 시장에서 금액 기준으로 2위 시장으로 건설, 전자, 자동차, 섬유 등의 분야에서 방염에 관한 선진적인 규제 프레임워크이 지배적이었습니다. 특히 독일, 프랑스, 이탈리아를 중심으로 한 강력한 제조업 기반과 비할로겐계 및 친환경 난연제의 조기 도입 역시 수요를 뒷받침하고 있습니다. 또한 주요 산업 플레이어들의 영향력과 난연제 기술에 대한 지속적인 연구 개발은 서유럽이 글로벌 플레이어로서의 입지를 강화하는 데 기여했습니다.

본 보고서에서는 세계의 난연제 시장에 대해 조사했으며, 유형별, 용도별, 최종 이용 산업별, 지역별 동향 및 시장 진출기업 프로파일 등을 정리했습니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요 인사이트

제5장 시장 개요

- 소개

- 시장 역학

- Porter's Five Forces 분석

- 주요 이해관계자와 구매 기준

- 거시경제지표

제6장 업계 동향

- 공급망 분석

- 원재료 공급자

- 제조업체

- 유통 네트워크

- 최종 사용자

- 가격 분석

- 고객사업에 영향을 주는 동향 및 혼란

- 생태계 분석

- 사례 연구 분석

- 기술 분석

- 무역 분석

- 규제 상황

- 주요 회의 및 이벤트

- 투자 및 자금조달 시나리오

- 특허 분석

- 미국 관세의 영향(2025년) : 개요

- AI/생성형 AI가 난연제 시장에 미치는 영향

제7장 난연제 시장(유형별)

- 소개

- 삼수화 알루미늄(ATH)

- 안티몬 산화물

- 브롬계

- 염소계

- 인

- 질소

- 기타

- 붕산아연

- 수산화마그네슘

- 붕소 난연제

제8장 난연제 시장(용도별)

- 소개

- 에폭시

- 폴리올레핀

- 불포화 폴리에스테르

- 폴리염화비닐(PVC)

- 폴리우레탄

- ABS와 혼합

- 폴리스티렌

- 기타

제9장 난연제 시장(최종 이용 산업별)

- 소개

- 건축 및 건설

- 전자기기 및 가전제품

- 자동차 및 운송

- 와이어 및 케이블

- 섬유

- 기타

제10장 난연제 시장(지역별)

- 소개

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 북미

- 미국

- 캐나다

- 멕시코

- 서유럽

- 독일

- 프랑스

- 영국

- 스페인

- 이탈리아

- 중유럽 및 동유럽

- 튀르키예

- 러시아

- 중동 및 아프리카

- 사우디아라비아

- 이스라엘

- 남미

- 브라질

- 아르헨티나

제11장 경쟁 구도

- 소개

- 주요 진입기업의 전략 및 강점

- 시장 점유율 분석(2024년)

- 수익 분석(2021-2024년)

- 기업평가 매트릭스 : 주요 진입기업(2024년)

- 기업평가 매트릭스 : 스타스업 및 중소기업(2024년)

- 브랜드 및 제품 비교 분석

- 기업평가와 재무지표

- 경쟁 시나리오

제12장 기업 프로파일

- 주요 진출기업

- ALBEMARLE CORPORATION

- ICL GROUP LTD.

- LANXESS AG

- JM HUBER CORPORATION

- NABALTEC AG

- BASF SE

- ADEKA CORPORATION

- AVIENT CORPORATION

- CLARIANT AG

- ITALMATCH CHEMICALS SPA

- 기타 기업

- GREENCHEMICALS SRL

- CHEMISCHE FABRIK BUDENHEIM KG

- STAHL HOLDINGS BV

- GULEC CHEMICALS GMBH

- OTSUKA CHEMICAL CO., LTD.

- KISUMA CHEMICALS

- AMFINE CHEMICAL CORPORATION

- THOR GROUP LTD.

- DONGYING JINGDONG CHEMICAL CO., LTD.

- QINGDAO FUNDCHEM CO., LTD.

- SMC GLOBAL

- PRESAFER(QINGYUAN) PHOSPHOR CHEMICAL CO., LTD

- JIANGYIN HANFENG TECHNOLOGY CO., LTD.

- ZHEJIANG XUSEN FLAME RETARDANT CO., LTD.

- POLYNOMOUS INDUSTRIES PVT. LTD.

제13장 인접 시장과 관련 시장

제14장 부록

HBR 25.09.12The global flame retardants market size is projected to reach USD 10.52 billion by 2030 from USD 7.73 billion in 2024, at a CAGR of 5.32 %. Their usage is widespread in building & construction, electronics, automotive & transportation, textiles, and wire & cable industries, where fire prevention is a critical requirement. The main function of flame retardants is to stop flammability and limit the fire spread in materials, making them essential for enhancing safety standards in diverse industries.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) and Volume (Kiloton) |

| Segments | Type, Application, End-use Industry, and Region |

| Regions covered | Asia Pacific, Western Europe, Central & Eastern Europe, North America, Middle East & Africa, and South America |

As international fire safety standards are getting more stringent and the issue of risk mitigation becomes more prominent, industries are becoming more inclined towards flame-retardant solutions to meet safety norms and save lives and assets. Increased use of fire-resistant materials is one of the key drivers of growing the market for flame retardants.

"Brominated segment accounted for the second-largest market share of the flame retardants market, in 2024"

Brominated flame retardants hold the second-largest share of the global flame retardants market, in terms of value, in 2024. This is fueled by their high flame suppression efficiency, cost-effectiveness, and compatibility with a wide range of polymers such as polystyrene, polyurethane, and epoxy. They are extensively applied in electronics & appliances, building & construction materials, and textiles, where reliable performance is necessary to meet strict fire safety regulations. Their strong functional efficiency and established use in vital applications continue to support their substantial market position, despite increasing regulatory restrictions in some regions due to environmental concerns.

"Unsaturated polyesters segment was the third largest application of the global flame retardants market, in terms of value, in 2024."

In terms of value, the unsaturated polyesters segment was the third-largest application of the global flame retardants market in 2024. Its widespread use in automotive and construction components, where adherence to fire safety standards is crucial, drives this dominance. These resins are inherently flammable, necessitating the incorporation of flame retardants to meet stringent regulatory standards. The expansion of this segment is also driven by the growing use of fiber-reinforced composites and molded components in industrial and infrastructure applications, where flame retardant performance is critical to ensure safety and long life.

"Automotive & transportation industry was the third largest end-use industry of flame retardants market, in terms of value, in 2024."

The automotive & transportation industry was the third-largest end-use industry in the global flame retardants market, in terms of value, in 2024. This is heavily attributed to the growing safety mandates and expanding use of lightweight, flammable materials like plastics and composites in vehicle interiors and electrical systems. The rising demand for electric vehicles (EVs), which need advanced thermal management and fire safety solutions for battery systems and wiring, further contributed to the dependence of the sector on flame retardants. Stringent fire safety mandates in commercial vehicles, aviation, and railway transport also encouraged steady usage of flame retardant material.

"Western Europe was the second largest region in the flame retardants market, in terms of value, in 2024."

Western Europe was the second-largest market in the global flame retardants market in terms of value, which was dominated by its advanced regulatory framework for fire protection in industries such as sectors like construction, electronics, automotive, and textiles. The region's strong manufacturing industry, especially in Germany, France, and Italy, and early adoption of non-halogenated and eco-friendly flame retardants also underpins demand. Moreover, the influence of major industry players and ongoing R&D in flame retardant technologies has bolstered the strength of Western Europe as a global player.

- By Company Type: Tier 1 - 55%, Tier 2 - 25%, and Tier 3 - 20%

- By Designation: Directors - 50%, Managers - 30%, and Others - 20%

- By Region: North America - 40%, Europe - 35%, Asia Pacific - 20%, Rest of World - 5%

The key players profiled in the report include Albemarle Corporation (US), ICL Group Ltd. (Israel), LANXESS AG (Germany), J.M. Huber Corporation (US), Nabaltec AG (Germany), BASF SE (Germany), ADEKA Corporation (Japan), Avient Corporation (US), Clariant AG (Switzerland), and Italmatch Chemicals S.p.A. (Italy).

Research Coverage

This report segments the market for flame retardants based on type, application, end-use industry, and region and provides estimations of value (USD Million) for the overall market size across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, services, and key strategies, associated with the market for flame retardants.

Reasons to Buy this Report

This research report is focused on various levels of analysis - industry analysis (industry trends), market share analysis of top players, and company profiles, which together provide an overall view of the competitive landscape, emerging and high-growth segments of the flame retardants market; high-growth regions; and market drivers, restraints, and opportunities.

The report provides insights into the following points:

- Market Penetration: Comprehensive information on flame retardants offered by top players in the global market

- Analysis of key drivers (Increasing number of fire accidents, stringent fire safety regulations, and growth of end-use industries), restraints (stringent regulations regarding use of conventional flame retardants, high loading levels of mineral-based flame retardants alter properties of final products, and the use of harmful chemicals in flame retardants), opportunities (development of more effective synergist compounds, rising demand for wires & cables, and rising demand for non-halogenated and sustainable flame retardants), and challenges (supply challenges from Asia Pacific and growing emphasis on environmental protection and sustainability) influencing the growth of flame retardants market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the flame retardants market

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the markets for flame retardants across regions.

- Market Diversification: Exhaustive information about new products, untapped regions, and recent developments in the global flame retardants market

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the flame retardants market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNIT CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key primary participants

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 GROWTH FORECAST

- 2.4.1 SUPPLY-SIDE ANALYSIS

- 2.4.2 DEMAND-SIDE ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN FLAME RETARDANTS MARKET

- 4.2 FLAME RETARDANTS MARKET, BY REGION

- 4.3 ASIA PACIFIC FLAME RETARDANTS MARKET, BY END-USE INDUSTRY AND COUNTRY

- 4.4 FLAME RETARDANTS MARKET, BY TYPE

- 4.5 FLAME RETARDANTS MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing number of fire accidents

- 5.2.1.2 Strict fire safety guidelines

- 5.2.1.3 Growth of end-use industries

- 5.2.2 RESTRAINTS

- 5.2.2.1 Stringent regulations for conventional flame retardants

- 5.2.2.2 High loading levels of mineral-based flame retardants altering properties of final products

- 5.2.2.3 Use of harmful chemicals in flame retardants

- 5.2.2.4 High cost of raw materials

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Development of more effective synergist compounds

- 5.2.3.2 Rising demand for wires and cables

- 5.2.4 CHALLENGES

- 5.2.4.1 Supply challenges from Asia Pacific

- 5.2.4.2 Growing emphasis on environmental protection and sustainability

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.4.2 BUYING CRITERIA

- 5.5 MACROECONOMIC INDICATORS

- 5.5.1 GDP TRENDS AND FORECAST

6 INDUSTRY TRENDS

- 6.1 SUPPLY CHAIN ANALYSIS

- 6.1.1 RAW MATERIAL SUPPLIERS

- 6.1.2 MANUFACTURERS

- 6.1.3 DISTRIBUTION NETWORKS

- 6.1.4 END USERS

- 6.2 PRICING ANALYSIS

- 6.2.1 AVERAGE SELLING PRICE OF FLAME RETARDANTS BY KEY PLAYERS, 2024

- 6.2.2 AVERAGE SELLING PRICE TREND OF FLAME RETARDANTS, BY REGION, 2022-2030

- 6.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.4 ECOSYSTEM ANALYSIS

- 6.5 CASE STUDY ANALYSIS

- 6.5.1 ENHANCING SAFETY AND DURABILITY IN FLUID LEVEL MONITORING WITH RTP COMPANY'S FLAME RETARDANT COMPOUND

- 6.5.2 SUSTAINABLE FLAME RETARDANCY IN POLYOLEFIN FILM AND SHEET PRODUCTION WITH CLARIANT AG'S ADDWORKS LXR 920

- 6.6 TECHNOLOGY ANALYSIS

- 6.6.1 KEY TECHNOLOGIES

- 6.6.1.1 Halogenated Flame Retardants (HFRs)

- 6.6.1.2 Phosphorus-Based Flame Retardants

- 6.6.2 COMPLIMENTARY TECHNOLOGIES

- 6.6.2.1 Synergists

- 6.6.1 KEY TECHNOLOGIES

- 6.7 TRADE ANALYSIS

- 6.7.1 IMPORT SCENARIO (HS CODE 382490)

- 6.7.2 EXPORT SCENARIO (HS CODE 382490)

- 6.8 REGULATORY LANDSCAPE

- 6.8.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.8.2 REGULATORY FRAMEWORK

- 6.8.2.1 ISO 16000-31:2010

- 6.8.2.2 EU Regulation (EU) No 2019/1021 - Persistent Organic Pollutants (POPs)

- 6.9 KEY CONFERENCES AND EVENTS

- 6.10 INVESTMENT AND FUNDING SCENARIO

- 6.11 PATENT ANALYSIS

- 6.11.1 APPROACH

- 6.11.2 DOCUMENT TYPES

- 6.11.3 TOP APPLICANTS

- 6.11.4 JURISDICTION ANALYSIS

- 6.12 IMPACT OF 2025 US TARIFF - OVERVIEW

- 6.12.1 INTRODUCTION

- 6.12.2 KEY TARIFF RATES

- 6.12.3 PRICE IMPACT ANALYSIS

- 6.12.4 IMPACT ON COUNTRY/REGION

- 6.12.4.1 US

- 6.12.4.2 Europe

- 6.12.4.3 Asia Pacific

- 6.12.5 IMPACT ON END-USE INDUSTRIES

- 6.13 IMPACT OF AI/GEN AI ON FLAME RETARDANTS MARKET

7 FLAME RETARDANTS MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 ALUMINUM TRIHYDRATE (ATH)

- 7.2.1 RAPID DEVELOPMENT OF INFRASTRUCTURE TO DRIVE MARKET

- 7.3 ANTIMONY OXIDES

- 7.3.1 NEED TO ACHIEVE FIRE SAFETY STANDARDS TO DRIVE MARKET

- 7.4 BROMINATED

- 7.4.1 HIGHER COST-EFFICIENCY TO DRIVE DEMAND

- 7.5 CHLORINATED

- 7.5.1 VERSATILE APPLICATION ACROSS POLYMERS TO FUEL DEMAND

- 7.6 PHOSPHORUS

- 7.6.1 LOW VOLATILITY OF PHOSPHORUS FLAME RETARDANTS TO FUEL DEMAND

- 7.7 NITROGEN

- 7.7.1 SHIFT TOWARD NON-HALOGENATED FLAME RETARDANTS TO DRIVE MARKET

- 7.8 OTHER TYPES

- 7.8.1 ZINC BORATE

- 7.8.2 MAGNESIUM HYDROXIDE

- 7.8.3 BORON FLAME RETARDANTS

8 FLAME RETARDANTS MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 EPOXY

- 8.3 POLYOLEFINS

- 8.4 UNSATURATED POLYESTERS

- 8.5 POLYVINYL CHLORIDE (PVC)

- 8.6 POLYURETHANE

- 8.7 ABS & BLENDS

- 8.8 POLYSTYRENE

- 8.9 OTHER APPLICATIONS

9 FLAME RETARDANTS MARKET, BY END-USE INDUSTRY

- 9.1 INTRODUCTION

- 9.2 BUILDING & CONSTRUCTION

- 9.2.1 STRINGENT FIRE SAFETY REGULATIONS TO DRIVE MARKET

- 9.3 ELECTRONICS & APPLIANCES

- 9.3.1 GROWING USE OF PLASTIC PARTS TO DRIVE DEMAND FOR FLAME RETARDANTS

- 9.4 AUTOMOTIVE & TRANSPORTATION

- 9.4.1 STRICT MONITORING OF FIRE SAFETY REQUIREMENTS TO DRIVE MARKET

- 9.5 WIRE & CABLES

- 9.5.1 RISING ENERGY AND TELECOM INFRASTRUCTURE TO DRIVE DEMAND

- 9.6 TEXTILES

- 9.6.1 INCREASING AWARENESS OF FIRE SAFETY TO DRIVE MARKET

- 9.7 OTHER END-USE INDUSTRIES

10 FLAME RETARDANTS MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 ASIA PACIFIC

- 10.2.1 CHINA

- 10.2.1.1 Growing industrial activities to drive market

- 10.2.2 JAPAN

- 10.2.2.1 Advanced electronics sector to drive market

- 10.2.3 INDIA

- 10.2.3.1 Rapid industrialization to drive demand

- 10.2.4 SOUTH KOREA

- 10.2.4.1 Government initiatives in industrial sector to drive market

- 10.2.1 CHINA

- 10.3 NORTH AMERICA

- 10.3.1 US

- 10.3.1.1 Strong industrial infrastructure to fuel growth

- 10.3.2 CANADA

- 10.3.2.1 Focus on advanced research & development to drive demand

- 10.3.3 MEXICO

- 10.3.3.1 Expanding manufacturing sector to support market growth

- 10.3.1 US

- 10.4 WESTERN EUROPE

- 10.4.1 GERMANY

- 10.4.1.1 Automotive industry leadership to boost market

- 10.4.2 FRANCE

- 10.4.2.1 Increasing fire safety norms in public infrastructure to fuel demand

- 10.4.3 UK

- 10.4.3.1 Stringent regulatory framework to propel market

- 10.4.4 SPAIN

- 10.4.4.1 Growth in residential and commercial renovation activities to drive market

- 10.4.5 ITALY

- 10.4.5.1 Adoption of flame retardants in furniture and upholstery:

- 10.4.1 GERMANY

- 10.5 CENTRAL & EASTERN EUROPE

- 10.5.1 TURKEY

- 10.5.1.1 Rise in electrical and appliance production to boost demand

- 10.5.2 RUSSIA

- 10.5.2.1 Growing construction activities to drive demand

- 10.5.1 TURKEY

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 SAUDI ARABIA

- 10.6.1.1 Growth in local manufacturing to fuel demand

- 10.6.2 ISRAEL

- 10.6.2.1 Growth in defense manufacturing to drive demand

- 10.6.1 SAUDI ARABIA

- 10.7 SOUTH AMERICA

- 10.7.1 BRAZIL

- 10.7.1.1 Economic momentum to drive adoption across sectors

- 10.7.2 ARGENTINA

- 10.7.2.1 Rising vehicle sales likely to spur market growth

- 10.7.1 BRAZIL

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.3 MARKET SHARE ANALYSIS, 2024

- 11.4 REVENUE ANALYSIS, 2021-2024

- 11.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- 11.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.5.5.1 Company footprint

- 11.5.5.2 Region footprint

- 11.5.5.3 Type footprint

- 11.5.5.4 End-use industry footprint

- 11.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- 11.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.6.5.1 Detailed list of key startups/SMEs

- 11.6.5.2 Competitive benchmarking of key startups/SMEs

- 11.7 BRAND/PRODUCT COMPARISON ANALYSIS

- 11.8 COMPANY VALUATION AND FINANCIAL METRICS

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 DEALS

- 11.9.3 EXPANSIONS

- 11.9.4 OTHER DEVELOPMENTS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 ALBEMARLE CORPORATION

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Deals

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 ICL GROUP LTD.

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Product launches

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 LANXESS AG

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Product launches

- 12.1.3.3.2 Deals

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 J.M. HUBER CORPORATION

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Deals

- 12.1.4.3.2 Expansions

- 12.1.4.3.3 Other developments

- 12.1.4.4 MnM view

- 12.1.4.4.1 Key strengths

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses and competitive threats

- 12.1.5 NABALTEC AG

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Expansions

- 12.1.5.3.2 Other developments

- 12.1.5.4 MnM view

- 12.1.5.4.1 Key strengths

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses and competitive threats

- 12.1.6 BASF SE

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Product launches

- 12.1.6.3.2 Deals

- 12.1.7 ADEKA CORPORATION

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.7.3 MnM view

- 12.1.7.3.1 Key strengths

- 12.1.7.3.2 Strategic choices

- 12.1.7.3.3 Weaknesses and competitive threats

- 12.1.8 AVIENT CORPORATION

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Product launches

- 12.1.9 CLARIANT AG

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Product launches

- 12.1.9.3.2 Deals

- 12.1.9.3.3 Expansions

- 12.1.9.3.4 Other developments

- 12.1.10 ITALMATCH CHEMICALS S.P.A.

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Product launches

- 12.1.10.3.2 Deals

- 12.1.10.3.3 Expansions

- 12.1.1 ALBEMARLE CORPORATION

- 12.2 OTHER PLAYERS

- 12.2.1 GREENCHEMICALS S.R.L.

- 12.2.2 CHEMISCHE FABRIK BUDENHEIM KG

- 12.2.3 STAHL HOLDINGS B.V.

- 12.2.4 GULEC CHEMICALS GMBH

- 12.2.5 OTSUKA CHEMICAL CO., LTD.

- 12.2.6 KISUMA CHEMICALS

- 12.2.7 AMFINE CHEMICAL CORPORATION

- 12.2.8 THOR GROUP LTD.

- 12.2.9 DONGYING JINGDONG CHEMICAL CO., LTD.

- 12.2.10 QINGDAO FUNDCHEM CO., LTD.

- 12.2.11 SMC GLOBAL

- 12.2.12 PRESAFER (QINGYUAN) PHOSPHOR CHEMICAL CO., LTD

- 12.2.13 JIANGYIN HANFENG TECHNOLOGY CO., LTD.

- 12.2.14 ZHEJIANG XUSEN FLAME RETARDANT CO., LTD.

- 12.2.15 POLYNOMOUS INDUSTRIES PVT. LTD.

13 ADJACENT & RELATED MARKETS

- 13.1 INTRODUCTION

- 13.2 LIMITATION

- 13.3 PLASTIC ADDITIVES MARKET

- 13.3.1 MARKET DEFINITION

- 13.3.2 MARKET OVERVIEW

- 13.4 PLASTIC ADDITIVES MARKET, BY REGION

- 13.4.1 ASIA PACIFIC

- 13.4.2 NORTH AMERICA

- 13.4.3 EUROPE

- 13.4.4 MIDDLE EAST & AFRICA

- 13.4.5 SOUTH AMERICA

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS