|

시장보고서

상품코드

1804850

불화수소산 시장 예측(-2030년) : 등급(AHF, DHF(농도 50% 이상), DHF(농도 50% 미만)), 용도, 지역별(아시아태평양, 북미, 유럽, 남미, 중동 및 아프리카)Hydrofluoric Acid Market by Grade (AHF, DHF (above 50% concentration), DHF (below 50% concentration)), Application, and Region (Asia Pacific, North America, Europe, South America, Middle East & Africa) - Global Forecast to 2030 |

||||||

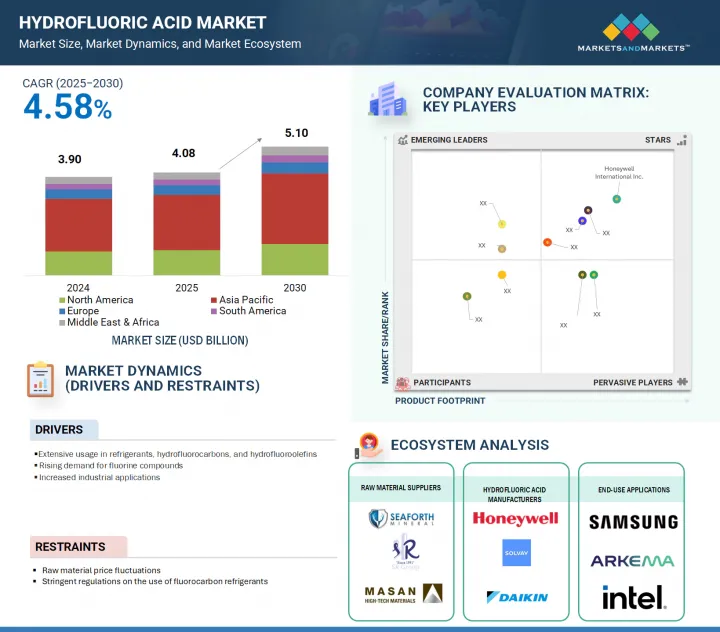

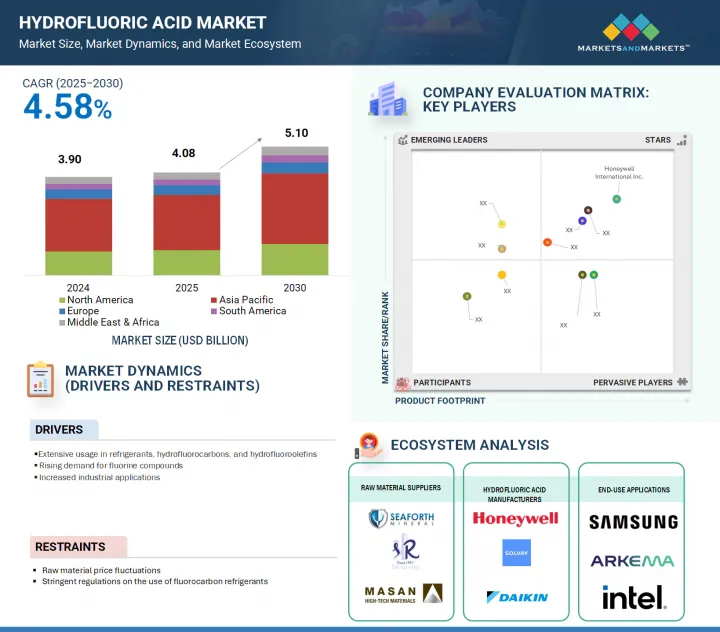

불화수소산 시장 규모는 2024년 39억 달러에서 예측 기간 중 CAGR 4.58%로 추이하며, 2030년에는 51억 달러에 달할 것으로 예측됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상연도 | 2020-2030년 |

| 기준연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 금액(달러)·킬로톤 |

| 부문 | 등급, 용도, 지역 |

| 대상 지역 | 아시아태평양, 북미, 유럽, 중동 및 아프리카, 남미 |

"등급별로는 무수불화수소산(AHF)이 시장에서 가장 높은 CAGR로 성장할 것입니다. "

무수불화수소산(AHF)은 고순도와 다용도로 인해 인기가 높아지고 있습니다. '무수'는 수분을 포함하지 않는 것을 의미하며, 특정 용도에서 이점이 될 수 있습니다. 수요 증가의 가장 큰 요인은 냉장고, 에어컨 등 가전제품의 냉매로 사용되는 HFC, HFO와 같은 불화탄소 생산에 중요한 역할을 하는 HFC와 HFO의 생산에 있습니다. 기존 냉매가 단계적으로 폐지되고 있는 가운데, AHF는 보다 친환경적인 새로운 대체품 생산에 여전히 필수적인 역할을 하고 있습니다.

"용도별로는 탄화불소 제조가 가장 큰 비중을 차지할 것으로 예측됩니다. "

불화탄소(HFC)를 생산하기 위한 불화수소산의 사용은 여러 가지 이유로 증가하고 있습니다. 전 세계 많은 사람들과 기업이 에어컨, 냉장고, 냉동고를 사용하고 있으며, 이러한 장비의 작동에는 HFC가 필요합니다. 이러한 제품의 구매가 증가함에 따라 HFC 수요도 증가하고, 그 제조에 필수적인 불화수소산에 대한 수요도 증가합니다. 또한 CFC나 HCFC와 같은 오래된 냉매는 오존층을 파괴하므로 현재 단계적으로 폐지되고 있습니다.

"아시아태평양은 예측 기간 중 가장 큰 시장 점유율을 차지할 것으로 예측됩니다. "

아시아태평양에서 불화수소산의 사용은 여러 가지 요인으로 인해 빠르게 증가하고 있습니다. 첫째, 이 지역은 반도체 및 전자제품 제조의 중심지입니다. 둘째, 원자재 수급이 용이하고 저렴하므로 제조비용이 낮다는 장점이 있습니다. 셋째, 빠른 경제 성장으로 가계 소득이 증가하면서 자동차, 냉장고, 에어컨 등 가전제품 구매가 증가하고 있습니다.

세계의 불화수소산 시장을 조사했으며, 시장 개요, 시장 성장에 대한 각종 영향요인의 분석, 기술·특허의 동향, 법규제 환경, 사례 연구, 시장 규모 추이·예측, 각종 구분·지역/주요 국가별 상세 분석, 경쟁 구도, 주요 기업의 개요 등을 정리하여 전해드립니다.

목차

제1장 서론

제2장 조사 방법

제3장 개요

제4장 주요 인사이트

제5장 시장 개요

- 시장 역학

- 촉진요인

- 억제요인

- 기회

- 과제

- 고객 사업에 영향을 미치는 동향/혼란

- 가격 분석

- 밸류체인 분석

- 에코시스템 분석

- 기술 분석

- 특허 분석

- 무역 분석

- 2025-2026년의 주요 컨퍼런스와 이벤트

- 규제 상황

- Porter's Five Forces 분석

- 주요 이해관계자와 구입 기준

- 사례 연구 분석

- 거시경제 전망

- 투자와 자금조달 시나리오

- 2025년 미국 관세가 불화수소산 시장에 미치는 영향

- 가격 영향 분석

- 국가·지역에 대한 영향

- 최종사용자 산업에 대한 영향

제6장 불화수소산 시장 : 등급별

- AHF

- DHF(농도 50% 이상)

- DHF(농도 50% 미만)

제7장 불화수소산 시장 : 용도별

- 플루오로카본의 제조

- 불소 유도체의 제조

- 금속 산세

- 유리 에칭과 클리닝

- 정유

- 우라늄 연료의 제조

- 기타

제8장 불화수소산 시장 : 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 러시아

- 기타

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 대만

- 기타

- 남미

- 브라질

- 아르헨티나

- 기타

- 중동 및 아프리카

- GCC 국가

- 남아프리카공화국

- 기타

제9장 경쟁 구도

- 개요

- 주요 참여 기업의 전략/강점

- 매출 분석

- 시장 점유율 분석

- 시장 순위 분석

- 기업 평가와 재무 지표

- 브랜드/제품 비교

- 기업 평가 매트릭스 : 주요 기업

- 스타트업/중소기업용 기업 평가 매트릭스

- 경쟁 시나리오

제10장 기업 개요

- 주요 기업

- HONEYWELL INTERNATIONAL INC.

- SOLVAY

- STELLA CHEMIFA CORPORATION

- DAIKIN

- LANXESS

- MERCK KGAA

- DONGYUE GROUP LTD.

- ORBIA

- YINGPENG GROUP

- FLUORCHEMIE GROUP

- 기타 기업

- DERIVADOS DEL FLUOR

- SODEREC INTERNATIONAL

- MORITA CHEMICAL INDUSTRIES

- FUBAO GROUP

- GULF FLUOR

- ZHEJIANG SANMEI CHEMICAL IND. CO., LTD.

- FUJIAN SHAOWU YONGFEI CHEMICAL CO., LTD.

- SHAOWU HUAXIN CHEMICAL CO., LTD.

- FLUORSID S.P.A.

- SRF

- JIANGXI CHINAFLUORINE CHEMICAL CO., LTD.

- BUSS CHEMTECH AG

- FUJIAN KINGS FLUORIDE INDUSTRY CO., LTD.

- NAVIN FLUORINE ADVANCED SCIENCES LIMITED

- THE CHEMOURS COMPANY

제11장 인접 시장과 관련 시장

제12장 부록

KSA 25.09.16The hydrofluoric acid market was valued at USD 3.90 billion in 2024 and is projected to reach USD 5.10 billion by 2030 at a CAGR of 4.58%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/USD Billion), Volume (Kilotons) |

| Segments | Grade, Application, and Region |

| Regions covered | APAC, North America, Europe, Middle East & Africa, and South America |

"Anhydrous hydrofluoric acid (AHF) will grow at the highest CAGR in the market, by grade."

Anhydrous hydrofluoric acid (AHF) is increasingly popular due to its high purity and versatility. The term "anhydrous" indicates it is water-free, which benefits specific applications. A major factor driving demand is its role in producing fluorocarbons such as HFCs and HFOs, commonly used as refrigerants in appliances like refrigerators and air conditioners. Even as older refrigerants are phased out, manufacturing newer, more eco-friendly alternatives still depends on AHF.

"Fluorocarbon production will hold the largest share of the applications market."

The use of hydrofluoric acid to produce hydrofluorocarbons (HFCs) is increasing for several reasons. Many people and businesses worldwide use air conditioners, refrigerators, and freezers, which require HFCs to operate. As more people purchase these products, the demand for HFCs grows, increasing the need for hydrofluoric acid to produce them. Second, some older refrigerants, like CFCs and HCFCs, damage the ozone layer and are now being phased out.

"The Asia Pacific is expected to hold the largest market share during the forecast period."

Hydrofluoric acid usage is rapidly increasing in the Asia Pacific due to several factors. First, this region has become the central hub for semiconductor and electronics manufacturing. Second, production costs are lower because raw materials are easily accessible and cheaper. Third, the region's fast-growing economy leads to higher household incomes, resulting in increased purchases of cars, refrigerators, air conditioners, and other appliances.

In-depth interviews have been conducted with chief executive officers (CEOs), Directors, and other executives from various key organizations operating in the marketplace.

By Company Type: Tier 1: 25%, Tier 2: 42%, and Tier 3: 33%

By Designation: C-level Executives: 20%, Directors: 30%, and Other Designations: 50%

By Region: North America: 20%, Europe: 10%, Asia Pacific: 40%, South America: 10%, and Middle East & Africa 20%

Notes: Other designations include sales, marketing, and product managers.

Tier 1: >USD 1 Billion; Tier 2: USD 500 million-1 Billion; and Tier 3: <USD 500 million

The report covers the following Companies: Honeywell International Inc. (US), Solvay (Belgium), Stella Chemifa Corporation (Japan), Daikin (Japan), LANXESS (Germany), Merck KGaA (Germany), Dongyue Group Ltd. (China), Orbia (Mexico), Yingpeng Group (China), and Fluorchemie Group (Germany).

The study includes an in-depth competitive analysis of these key players in the hydrofluoric acid market, with their company profiles, recent developments, and key market strategies.

Research Coverage

This research report categorizes the hydrofluoric acid market based on grade [AHF, DHF (Below 50% Concentration), and DHF (Above 50% Concentration)], application (production of fluorocarbons, production of fluorinated derivatives, metal pickling, glass etching and cleaning, oil refining, production of uranium fuel, and other applications), and region (the Asia Pacific, North America, Europe, South America, and the Middle East & Africa). The report's scope covers detailed information regarding the drivers, restraints, challenges, and opportunities influencing the growth of the hydrofluoric acid market. A thorough analysis of the key industry players has provided insights into their business overview, products offered, and key strategies associated with the hydrofluoric acid market, such as partnerships, agreements, product launches, expansions, and acquisitions. This report covers a competitive analysis of upcoming startups in the hydrofluoric acid market ecosystem.

Reasons to Buy the Report

The report will offer market leaders/new entrants information on the closest approximations of the revenue numbers for the overall hydrofluoric acid market and the subsegments. This report will help stakeholders understand the competitive landscape, gain more insights into positioning their businesses better, and plan suitable go-to-market strategies. The report will help stakeholders understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following points:

- Analysis of key drivers (extensive usage in refrigerants, hydrofluorocarbons, and hydrofluoroolefins; rising demand for fluorine compounds; and increased industrial applications) restraints (raw material price fluctuations, stringent regulations on using fluorocarbon refrigerants), opportunities (use of hydrofluoric acid in glass etching & cleaning), and challenges (toxicity & hazardous effects, high transportation costs)

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and product & service launches in the hydrofluoric acid market.

- Market Development: Comprehensive information about profitable markets-the report analyzes the hydrofluoric acid market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the hydrofluoric acid market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as Honeywell International Inc. (US), Solvay (Belgium), Stella Chemifa Corporation (Japan), Daikin (Japan), LANXESS (Germany), Merck KGaA (Germany), Dongyue Group Ltd. (China), Orbia (Mexico), Yingpeng Group (China), Fluorchemie Group (Germany)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key primary insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 LIMITATIONS

- 2.6 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN HYDROFLUORIC ACID MARKET

- 4.2 HYDROFLUORIC ACID MARKET IN ASIA PACIFIC, BY APPLICATION AND COUNTRY

- 4.3 HYDROFLUORIC ACID MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Extensive usage in refrigerants, hydrofluorocarbons, and hydrofluoroolefins

- 5.2.1.2 Rising demand for fluorine compounds

- 5.2.1.3 Increased industrial applications of hydrofluoric acid

- 5.2.2 RESTRAINTS

- 5.2.2.1 Raw material price fluctuations

- 5.2.2.2 Stringent regulations on use of fluorocarbon refrigerants

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Use of hydrofluoric acid in glass etching and cleaning applications

- 5.2.4 CHALLENGES

- 5.2.4.1 Toxic and hazardous effects of hydrofluoric acid

- 5.2.4.2 High transportation cost

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE TREND, BY KEY PLAYER

- 5.4.2 HYDROFLUORIC ACID MARKET: PRICE FLUCTUATIONS

- 5.4.3 AVERAGE SELLING PRICE TREND, BY REGION

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Fluorspar Processing and HF Synthesis

- 5.7.1.2 Fluorocarbon Production Technology

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 Corrosion-Resistant Materials and Equipment

- 5.7.2.2 Waste Gas Treatment and Scrubbing Technologies

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 Uranium Hexafluoride (UF6) Conversion Technology

- 5.7.3.2 Semiconductor Etching and Cleaning Systems

- 5.7.1 KEY TECHNOLOGIES

- 5.8 PATENT ANALYSIS

- 5.8.1 INTRODUCTION

- 5.8.2 APPROACH

- 5.9 TRADE ANALYSIS

- 5.9.1 EXPORT SCENARIO (HS CODE 281111)

- 5.9.2 IMPORT SCENARIO (HS CODE 281111)

- 5.10 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.11 REGULATORY LANDSCAPE

- 5.11.1 REGULATORY LANDSCAPE

- 5.11.1.1 Regulatory bodies, government agencies, and other organizations

- 5.11.2 REGULATORY FRAMEWORK

- 5.11.2.1 751 (RP-751)

- 5.11.2.2 CEN/TS 17340:2020

- 5.11.2.3 ISO 3139:1976

- 5.11.1 REGULATORY LANDSCAPE

- 5.12 PORTER'S FIVE FORCES ANALYSIS

- 5.12.1 THREAT OF NEW ENTRANTS

- 5.12.2 THREAT OF SUBSTITUTES

- 5.12.3 BARGAINING POWER OF SUPPLIERS

- 5.12.4 BARGAINING POWER OF BUYERS

- 5.12.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.13.2 BUYING CRITERIA

- 5.14 CASE STUDY ANALYSIS

- 5.14.1 CASE STUDY 1: ELECTRO CHEMICAL ENGINEERING & MANUFACTURING CO.

- 5.14.2 CASE STUDY 2: CLINICAL BENEFIT OF OPTIMIZED HYDROFLUORIC ACID ETCHING FOR LITHIUM DISILICATE CERAMIC BONDING

- 5.14.3 CASE STUDY 3: CLINICAL BENEFIT OF OPTIMIZED HYDROFLUORIC ACID ETCHING FOR LITHIUM DISILICATE CERAMIC BONDING

- 5.15 MACROECONOMIC OUTLOOK

- 5.15.1.1 Introduction

- 5.15.1.2 GDP trends and forecasts

- 5.16 INVESTMENT AND FUNDING SCENARIO

- 5.17 IMPACT OF 2025 US TARIFF ON HYDROFLUORIC ACID MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 KEY RECIPROCAL TARIFF RATES

- 5.18 PRICE IMPACT ANALYSIS

- 5.19 IMPACT ON COUNTRIES/REGIONS

- 5.19.1 US

- 5.19.2 EUROPE

- 5.19.3 ASIA PACIFIC

- 5.20 IMPACT ON END-USE INDUSTRIES

6 HYDROFLUORIC ACID MARKET, BY GRADE

- 6.1 INTRODUCTION

- 6.2 AHF

- 6.2.1 AHF TO HOLD LARGEST MARKET SHARE DUE TO DEMAND AS FEEDSTOCK FOR FLUOROCARBONS

- 6.3 DHF (ABOVE 50% CONCENTRATION)

- 6.3.1 APPLICATIONS IN FLUORINATED DERIVATIVES, METAL PICKLING, AND FUEL ADDITIVES TO PROPEL GROWTH

- 6.4 DHF (BELOW 50% CONCENTRATION)

- 6.4.1 RISING USE IN GLASS ETCHING & CLEANING APPLICATIONS TO SUPPORT MARKET GROWTH

7 HYDROFLUORIC ACID MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.2 PRODUCTION OF FLUOROCARBONS

- 7.2.1 GROWING DEMAND FOR REFRIGERATORS TO PROPEL MARKET

- 7.3 PRODUCTION OF FLUORINATED DERIVATIVES

- 7.3.1 INCREASING DEMAND FOR FLUOROPOLYMERS TO FUEL MARKET GROWTH

- 7.4 METAL PICKLING

- 7.4.1 FLOURISHING METAL INDUSTRY TO DRIVE MARKET

- 7.5 GLASS ETCHING & CLEANING

- 7.5.1 GROWING SEMICONDUCTOR INDUSTRY TO INCREASE DEMAND FOR HYDROFLUORIC ACID

- 7.6 OIL REFINING

- 7.6.1 HIGH-OCTANE RATING FUELS TO BOOST SEGMENT GROWTH

- 7.7 PRODUCTION OF URANIUM FUEL

- 7.7.1 INCREASING FOCUS ON NUCLEAR ENERGY TO PROPEL DEMAND

- 7.8 OTHER APPLICATIONS

8 HYDROFLUORIC ACID MARKET, BY REGION

- 8.1 INTRODUCTION

- 8.2 NORTH AMERICA

- 8.2.1 US

- 8.2.1.1 Extensive use in production of fluorocarbons to fuel market growth

- 8.2.2 CANADA

- 8.2.2.1 Use of fluorine derivatives in oil & gas refineries to drive market

- 8.2.3 MEXICO

- 8.2.3.1 Easy availability of raw materials to propel market

- 8.2.1 US

- 8.3 EUROPE

- 8.3.1 GERMANY

- 8.3.1.1 Rising semiconductor industries to fuel market growth

- 8.3.2 UK

- 8.3.2.1 Strong semiconductor industry to fuel growth

- 8.3.3 FRANCE

- 8.3.3.1 Government initiatives to propel market

- 8.3.4 ITALY

- 8.3.4.1 Increasing demand for glass etching & cleaning agents to drive market

- 8.3.5 RUSSIA

- 8.3.5.1 Oil and crude steel production to impact market growth

- 8.3.6 REST OF EUROPE

- 8.3.1 GERMANY

- 8.4 ASIA PACIFIC

- 8.4.1 CHINA

- 8.4.1.1 Growing industrialization to drive market

- 8.4.2 JAPAN

- 8.4.2.1 Electronic industry to govern market growth

- 8.4.3 INDIA

- 8.4.3.1 Growing electronic manufacturing companies to drive market

- 8.4.4 SOUTH KOREA

- 8.4.4.1 Semiconductor chip manufacturing to propel market

- 8.4.5 TAIWAN

- 8.4.5.1 Vast semiconductor manufacturing industry to fuel market growth

- 8.4.6 REST OF ASIA PACIFIC

- 8.4.1 CHINA

- 8.5 SOUTH AMERICA

- 8.5.1 BRAZIL

- 8.5.1.1 HFO production to create new opportunities for market growth

- 8.5.2 ARGENTINA

- 8.5.2.1 Air conditioning system sales to drive market growth

- 8.5.3 REST OF SOUTH AMERICA

- 8.5.1 BRAZIL

- 8.6 MIDDLE EAST & AFRICA

- 8.6.1 GCC COUNTRIES

- 8.6.1.1 Saudi Arabia

- 8.6.1.1.1 Government initiatives for developmental activities to propel market

- 8.6.1.2 UAE

- 8.6.1.2.1 Strategic investment in chemical and semiconductor industry to propel market

- 8.6.1.3 Rest of GCC countries

- 8.6.1.1 Saudi Arabia

- 8.6.2 SOUTH AFRICA

- 8.6.2.1 Potential fluorspar reserves to boost market

- 8.6.3 REST OF MIDDLE EAST & AFRICA

- 8.6.1 GCC COUNTRIES

9 COMPETITIVE LANDSCAPE

- 9.1 OVERVIEW

- 9.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 9.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- 9.3 REVENUE ANALYSIS, 2020-2024

- 9.4 MARKET SHARE ANALYSIS, 2024

- 9.5 MARKET RANKING ANALYSIS

- 9.6 COMPANY VALUATION & FINANCIAL METRICS

- 9.7 BRAND/PRODUCT COMPARISON

- 9.8 COMPANY EVALUATION MATRIX, KEY PLAYERS, 2024

- 9.8.1 STARS

- 9.8.2 EMERGING LEADERS

- 9.8.3 PERVASIVE PLAYERS

- 9.8.4 PARTICIPANTS

- 9.8.5 COMPANY FOOTPRINT: KEY PLAYERS

- 9.8.5.1 Company footprint

- 9.8.5.2 Region footprint

- 9.8.5.3 Application footprint

- 9.8.5.4 Grade footprint

- 9.9 COMPANY EVALUATION MATRIX, STARTUPS/SMES, 2024

- 9.9.1 PROGRESSIVE COMPANIES

- 9.9.2 RESPONSIVE COMPANIES

- 9.9.3 DYNAMIC COMPANIES

- 9.9.4 STARTING BLOCKS

- 9.9.5 COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- 9.9.5.1 Detailed list of key startups/SMEs

- 9.9.5.2 Competitive benchmarking of key startups/SMEs

- 9.10 COMPETITIVE SCENARIO

- 9.10.1 EXPANSIONS

- 9.10.2 DEALS

- 9.10.3 OTHER DEVELOPMENTS

10 COMPANY PROFILES

- 10.1 KEY PLAYERS

- 10.1.1 HONEYWELL INTERNATIONAL INC.

- 10.1.1.1 Business overview

- 10.1.1.2 Products/Solutions/Services offered

- 10.1.1.3 Recent developments

- 10.1.1.3.1 Deals

- 10.1.1.4 MnM view

- 10.1.1.4.1 Right to win

- 10.1.1.4.2 Strategic choices

- 10.1.1.4.3 Weaknesses and competitive threats

- 10.1.2 SOLVAY

- 10.1.2.1 Business overview

- 10.1.2.2 Products/Solutions/Services offered

- 10.1.2.3 Recent developments

- 10.1.2.3.1 Deals

- 10.1.2.4 MnM view

- 10.1.2.4.1 Right to win

- 10.1.2.4.2 Strategic choices

- 10.1.2.4.3 Weaknesses and competitive threats

- 10.1.3 STELLA CHEMIFA CORPORATION

- 10.1.3.1 Business overview

- 10.1.3.2 Products/Solutions/Services offered

- 10.1.3.3 MnM view

- 10.1.3.3.1 Right to win

- 10.1.3.3.2 Strategic choices

- 10.1.3.3.3 Weaknesses and competitive threats

- 10.1.4 DAIKIN

- 10.1.4.1 Business overview

- 10.1.4.2 Products/Solutions/Services offered

- 10.1.4.3 Recent developments

- 10.1.4.3.1 Expansions

- 10.1.4.3.2 Other developments

- 10.1.4.4 MnM view

- 10.1.4.4.1 Right to win

- 10.1.4.4.2 Strategic choices

- 10.1.4.4.3 Weaknesses and competitive threats

- 10.1.5 LANXESS

- 10.1.5.1 Business overview

- 10.1.5.2 Products/Solutions/Services offered

- 10.1.5.3 Recent developments

- 10.1.5.3.1 Other developments

- 10.1.5.4 MnM view

- 10.1.5.4.1 Right to win

- 10.1.5.4.2 Strategic choices

- 10.1.5.4.3 Weaknesses and competitive threats

- 10.1.6 MERCK KGAA

- 10.1.6.1 Business overview

- 10.1.6.2 Products/Solutions/Services offered

- 10.1.6.3 MnM view

- 10.1.6.3.1 Right to win

- 10.1.6.3.2 Strategic choices

- 10.1.6.3.3 Weaknesses and competitive threats

- 10.1.7 DONGYUE GROUP LTD.

- 10.1.7.1 Business overview

- 10.1.7.2 Products/Solutions/Services offered

- 10.1.7.3 MnM view

- 10.1.8 ORBIA

- 10.1.8.1 Business overview

- 10.1.8.2 Products/Solutions/Services offered

- 10.1.8.3 Recent developments

- 10.1.8.3.1 Deals

- 10.1.8.4 MnM view

- 10.1.9 YINGPENG GROUP

- 10.1.9.1 Business overview

- 10.1.9.2 Products/Solutions/services offered

- 10.1.9.3 MnM view

- 10.1.10 FLUORCHEMIE GROUP

- 10.1.10.1 Business overview

- 10.1.10.2 Products/Solutions/Services offered

- 10.1.10.3 MnM view

- 10.1.1 HONEYWELL INTERNATIONAL INC.

- 10.2 OTHER PLAYERS

- 10.2.1 DERIVADOS DEL FLUOR

- 10.2.2 SODEREC INTERNATIONAL

- 10.2.3 MORITA CHEMICAL INDUSTRIES

- 10.2.4 FUBAO GROUP

- 10.2.5 GULF FLUOR

- 10.2.6 ZHEJIANG SANMEI CHEMICAL IND. CO., LTD.

- 10.2.7 FUJIAN SHAOWU YONGFEI CHEMICAL CO., LTD.

- 10.2.8 SHAOWU HUAXIN CHEMICAL CO., LTD.

- 10.2.9 FLUORSID S.P.A.

- 10.2.10 SRF

- 10.2.11 JIANGXI CHINAFLUORINE CHEMICAL CO., LTD.

- 10.2.12 BUSS CHEMTECH AG

- 10.2.13 FUJIAN KINGS FLUORIDE INDUSTRY CO., LTD.

- 10.2.14 NAVIN FLUORINE ADVANCED SCIENCES LIMITED

- 10.2.15 THE CHEMOURS COMPANY

11 ADJACENT & RELATED MARKETS

- 11.1 INTRODUCTION

- 11.1.1 HYDROCHLORIC ACID MARKET

- 11.1.1.1 Market definition

- 11.1.1.2 By Grade

- 11.1.1.3 By Application

- 11.1.1.4 By End-use industry

- 11.1.1.5 By Region

- 11.1.2 REFRIGERANTS MARKET

- 11.1.2.1 Market definition

- 11.1.2.2 By Type

- 11.1.2.3 By Application

- 11.1.2.4 By Region

- 11.1.1 HYDROCHLORIC ACID MARKET

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS