|

시장보고서

상품코드

1807076

상처 드레싱 시장 : 유형별, 상처 유형별, 최종 사용자별, 지역별 예측(-2030년)Wound Dressings Market by Type (Advanced, Traditional), Wound Type, End User - Global Forecast to 2030 |

||||||

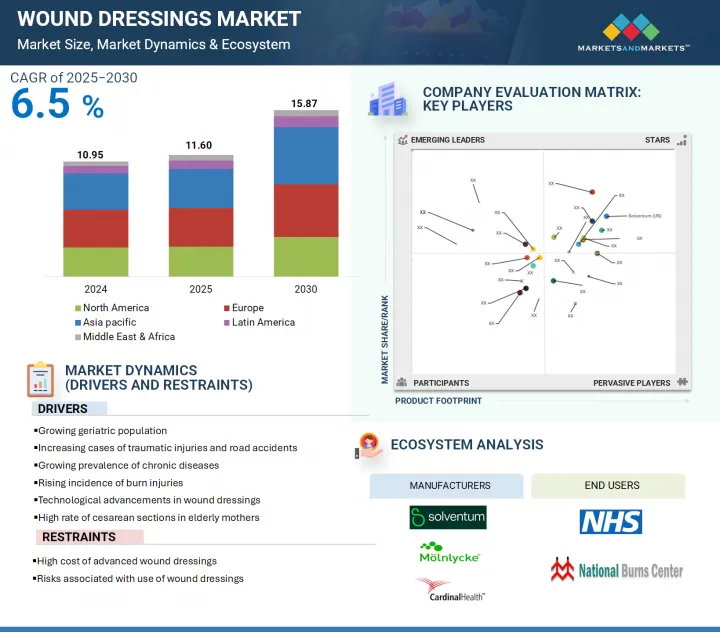

세계의 상처 드레싱 시장 규모는 2025년 116억 달러에서 2030년까지 158억 7,000만 달러에 이를 것으로 예측되며, 예측 기간 중 CAGR은 6.5%가 될 것으로 보입니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2024-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 검토 단위 | 금액(10억 달러) |

| 부문 | 유형별, 상처 유형별, 최종 사용자별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 라틴아메리카, 중동 및 아프리카 |

시장은 주로 열상 발생률 증가, 만성 상처, 수술 상처, 외상성 상처 유병률 증가, 노인 여성의 제왕절개율 증가, 교통 사고 증가로 인한 것입니다. 그러나 첨단 상처 드레싱의 높은 가격과 한정적인 채용이 예측 기간 동안 시장 성장을 방해할 것으로 예측되고 있습니다.

유형별로 보면, 상처 드레싱 시장은 기존 상처 드레싱와 첨단 상처 드레싱으로 구분됩니다. 2024년에는 첨단 상처 드레싱 부문이 상처 드레싱 시장의 유형별 점유율에서 최대를 차지했습니다. 이는 당뇨족궤양, 정맥성 허벅지 궤양, 욕창과 같은 만성 상처의 발생률이 증가하고 있으며, 전문적이고 효과적인 치료법이 필요하다는 것이 주요 요인입니다. 또한 당뇨병의 유병률 상승, 상처 관리에 대한 환자의 의식 증가, 상처 케어 기술의 진보, 원내 감염(HAI) 증가 등의 요인도 첨단 상처 드레싱의 왕성한 수요로 이어지고 있습니다. 이러한 제품은 치유를 가속화하고 감염 위험을 줄이고 환자의 결과를 개선하기 위해 더욱 채용되고 있습니다.

상처 유형별로 시장은 외과 상처 및 외상 상처, 당뇨족궤양, 욕창, 정맥 하퇴 궤양, 화상 및 기타 상처로 구분됩니다. 상처 유형별로 보면, 2024년 상처 드레싱 시장에서는 외과 상처 및 외상 상처 분야가 가장 큰 점유율을 차지하고 있습니다. 이 큰 점유율은 주로 세계 수술 수 증가, 사고 및 넘어짐으로 인한 외상 발생률 증가로 인한 것입니다. 또한, 만성 질환과 수술을 받기 쉬운 노인 인구 증가와 교통 사고의 세계적인 증가가 이 부문의 이점에 기여합니다. 또한 수술 절차의 지속적인 개선, 수술 후 관리, 병원 및 재택 관리의 현장에서 상처 드레싱의 사용 증가로 이 분야는 예측 기간 동안 가장 높은 CAGR을 나타낼 것으로 예측됩니다.

세계 상처 피복 시장은 5개의 주요 지역(북미, 유럽, 아시아태평양, 라틴아메리카, 중동 및 아프리카)으로 분류됩니다. 그 중에서도 아시아태평양은 고령화 사회와 만성상처의 원인이 되는 생활습관병 유병률의 상승을 배경으로 급성장하고 있습니다. 고품질의 건강 관리 서비스에 대한 수요가 증가함에 따라 병원 인프라와 첨단 의료 기술에 대한 많은 투자가 고급 상처 치료용 드레싱 재료의 보급에 박차를 가하고 있습니다. 또한 인도, 태국, 싱가포르 등의 국가에서 의료 관광 산업이 성장하고 있기 때문에 수술이 증가하고 있으며 효과적인 수술 후 상처 케어의 필요성이 높아지고 있습니다. 환자의 치료 성적 향상과 회복 기간 단축에 의료 제공자가 강한 관심을 갖고 있기 때문에 아시아태평양 시장은 예측 기간 동안 가장 높은 CAGR을 나타낼 것으로 예측됩니다.

본 보고서에서는 세계의 상처 드레싱 시장에 대해 조사했으며, 유형별, 상처 유형별, 최종 사용자별, 지역별 동향 및 시장 진출기업 프로파일 등을 정리했습니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요 인사이트

제5장 시장 개요

- 소개

- 시장 역학

- 고객의 비즈니스에 영향을 미치는 동향/혼란

- 가격 분석

- 밸류체인 분석

- 공급망 분석

- 생태계 분석

- 투자 및 자금조달 시나리오

- 기술 분석

- 특허 분석

- 무역 분석

- 2025-2026년의 주된 회의와 이벤트

- 사례 연구 분석

- 규제 분석

- Porter's Five Forces 분석

- 주요 이해관계자와 구매 기준

- AI가 상처 드레싱 시장에 미치는 영향

- 2025년 미국 관세가 상처 드레싱 시장에 미치는 영향

제6장 상처 드레싱 시장(유형별)

- 소개

- 첨단 상처 드레싱

- 기존 상처 드레싱

제7장 상처 드레싱 시장(상처 유형별)

- 소개

- 외과 상처 및 외상 상처

- 당뇨족궤양

- 욕창

- 정맥성 다리 궤양

- 화상 및 기타 상처

제8장 상처 드레싱 시장(최종 사용자별)

- 소개

- 병원, ASCS, 클리닉

- 재택 케어

- 기타

제9장 상처 드레싱 시장(지역별)

- 소개

- 북미

- 북미의 거시경제 전망

- 미국

- 캐나다

- 유럽

- 유럽의 거시 경제 전망

- 독일

- 프랑스

- 영국

- 이탈리아

- 스페인

- 러시아

- 기타

- 아시아태평양

- 아시아태평양의 거시 경제 전망

- 중국

- 일본

- 인도

- 호주

- 기타

- 라틴아메리카

- 라틴아메리카의 거시 경제 전망

- 브라질

- 멕시코

- 기타

- 중동 및 아프리카

- 의료시설 수요 증가가 시장을 견인

제10장 경쟁 구도

- 개요

- 주요 진입기업의 전략 및 강점, 2024년

- 수익 분석, 2022-2024년

- 시장 점유율 분석, 2024년

- 기업 평가 매트릭스: 주요 진입기업, 2024년

- 기업 평가 매트릭스: 스타트업 및 중소기업, 2024년

- 기업 평가 및 재무지표

- 브랜드 및 제품 비교

- 경쟁 시나리오

제11장 기업 프로파일

- 주요 진출기업

- SOLVENTUM

- MOLNLYCKE AB

- CARDINAL HEALTH

- SMITH NEPHEW

- CONVATEC GROUP PLC

- PAUL HARTMANN AG

- COLOPLAST GROUP

- OWENS & MINOR

- INTEGRA LIFESCIENCES CORPORATION

- ESSITY AKTIEBOLAG

- B. BRAUN SE

- ADVANCED MEDICAL SOLUTIONS GROUP PLC

- MATIV HOLDINGS, INC.

- 기타 기업

- URGO GROUP

- DEROYAL INDUSTRIES, INC.

- LOHMANN & RAUSCHER GMBH & CO. KG

- MEDLINE INDUSTRIES, LP

- WINNER MEDICAL CO., LTD.

- ADVANCIS(UK)

- HOLLISTER INCORPORATED

- DERMARITE INDUSTRIES, LLC

- MIL LABORATORIES PVT. LTD.

- GENTELL

- SHIELDLINE

- FOCUS HEALTH GROUP

제12장 부록

JHS 25.09.16The global wound dressings market is projected to reach USD 15.87 billion by 2030 from USD 11.60 billion in 2025, at a CAGR of 6.5% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Type, Wound Type, and End User |

| Regions covered | North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

The market is primarily driven by the rising incidence of burn injuries, increasing prevalence of chronic, surgical, and traumatic wounds, a high rate of cesarean sections among elderly women, and a growing number of road accidents. However, the high cost and limited adoption of advanced wound dressings are anticipated to hinder market growth during the forecast period.

The advanced wound dressings segment accounted for the largest share of the wound dressings market, by type.

Based on type, the wound dressings market is segmented into traditional wound dressings and advanced wound dressings. In 2024, the advanced wound dressings segment captured the largest share of the wound dressings market by type. This can be largely attributed to the growing incidence of chronic wounds such as diabetic foot ulcers, venous leg ulcers, and pressure ulcers, which require specialized and more effective treatment approaches. Additionally, factors such as the rising prevalence of diabetes, increased awareness among patients regarding wound management, advancements in wound care technologies, and the growing burden of hospital-acquired infections (HAIs) are contributing to the strong demand for advanced wound dressings. These products offer faster healing, reduced infection risk, and improved patient outcomes, further driving their adoption.

The surgical and traumatic wounds accounted for the largest market share in the wound dressings market.

Based on wound type, the market has been segmented into surgical and traumatic wounds, diabetic foot ulcers, pressure ulcers, venous leg ulcers, and burns & other wounds. Based on wound type, the surgical and traumatic wounds segment held the largest share of the wound dressings market in 2024. The significant share is primarily due to the rising number of surgical interventions worldwide and the increasing incidence of traumatic injuries resulting from accidents and falls. Furthermore, the growing elderly population, who are more prone to chronic conditions and surgeries, as well as the global rise in road traffic accidents, contribute to the segment's dominance. This segment is also projected to witness the highest CAGR during the forecast period, owing to continuous improvements in surgical techniques, post-operative care, and the increasing use of wound dressings in hospital and home care settings.

Asia Pacific is the fastest-growing region of the wound dressings market, by region.

The global wound dressings market is categorized into five key regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Among these, the Asia Pacific region is experiencing rapid growth, driven by an aging population and a rising prevalence of lifestyle-related conditions that contribute to chronic wounds. The increasing demand for high-quality healthcare services, along with substantial investments in hospital infrastructure and advanced medical technologies, is fueling the uptake of advanced wound care dressings. Additionally, the growing medical tourism industry in countries such as India, Thailand, and Singapore has led to a rise in surgical procedures, thereby increasing the need for effective post-operative wound care. With a strong focus among healthcare providers on enhancing patient outcomes and shortening recovery periods, the Asia Pacific market is expected to register the highest compound annual growth rate (CAGR) during the forecast period.

A breakdown of the primary participants referred to for this report is provided below:

- By Company Type: Tier 1: 40%, Tier 2: 30%, and Tier 3: 30%

- By Designation: C Level: 27%, Director Level: 18%, and Others: 55%

- By Region: North America: 51%, Europe: 21%, Asia Pacific: 18%, Latin America: 6%, and Middle East & Africa: 4%

Note 1: Companies are classified into tiers based on their total revenue. As of 2023, Tier 1 = >USD 10.00 billion, Tier 2 = USD 1.00 billion to USD 10.00 billion, and Tier 3 = <USD 1.00 billion.

Note 2: C-level primaries include CEOs, CFOs, COOs, and VPs.

Note 3: Other designations include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

The major players operating in the wound dressings market are Solventum (US), Smith+ Nephew (UK), Convatec Group PLC (UK), Coloplast Group (Denmark), Cardinal Health (US), Molnlycke AB (Sweden), Integra LifeSciences Corporation (US), PAUL HARTMANN AG (Germany), B.Braun SE (Germany), Essity Aktiebolag (Sweden), Advanced Medical Solutions Group plc (UK), Mativ Holdings, Inc. (US), Owens & Minor (US), Lohmann & Rausher GmbH & Co. KG (Germany), Medline Industries, LP (US), DeRoyal Industries, Ine. (US), Winner Medical Co., LTD. (China), Advancis (UK), Hollister Incorporated (US), DermaRite Industries, LLC. (US), Mil Laboratories Pvt. Ltd. (India), Urgo Group (France), Gentell (US), Shield Line (US), and Focus Health Group (US)

Research Coverage

This report studies the wound dressings market based on type, wound type, end user, and country. The report also studies factors (such as drivers, restraints, opportunities, and challenges) affecting market growth and provides details of the competitive landscape for market leaders. Furthermore, the report analyzes micro markets with respect to their individual growth trends. It forecasts the revenue of the market segments with respect to five major regions (and the respective countries in these regions).

Reasons to Buy the Report

The report will enable established firms as well as entrants/smaller firms to gauge the pulse of the market, which, in turn, would help them to garner a larger market share. Firms purchasing the report could use one or a combination of the strategies mentioned below to strengthen their market presence.

This report provides insights on the following pointers:

- Analysis of key drivers (growing geriatric population, increasing cases of traumatic injuries, growing prevalence of chronic diseases

rising incidence of burn injuries, rising use of regenerative medicine for wound management,

and government initiatives and reimbursement policies), restraints (high cost of advanced wound care products, risks associated with use of advanced wound care products

and antimicrobial resistance challenges), opportunities (Growth opportunities in emerging economies, technological advancement in wound care, and home-care optimized solutions), challenges (lack of trained healthcare professionals, Limited awareness in underdeveloped regions, and data security and privacy concerns)

- Market Penetration: Comprehensive information on the product portfolios offered by the top players in the wound dressings market

- Product Development/Innovation: Detailed insights on the upcoming trends, R&D activities, and product launches in the wound dressings market

- Market Development: Comprehensive information on lucrative emerging regions

- Market Diversification: Exhaustive information about new products, growing geographies, and recent developments in the wound dressings market

- Competitive Assessment: In-depth assessment of market segments, growth strategies, revenue analysis, and products of the leading market players

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED & REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach 1: Company revenue estimation approach

- 2.2.1.2 Approach 2: Presentations of companies and primary interviews

- 2.2.1.3 Approach 3: Primary interviews

- 2.2.1.4 Growth forecast

- 2.2.1.5 CAGR projections

- 2.2.2 TOP-DOWN APPROACH

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN & DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.4.1 STUDY-RELATED ASSUMPTIONS

- 2.4.2 PARAMETRIC ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 WOUND DRESSINGS MARKET OVERVIEW

- 4.2 ASIA PACIFIC: WOUND DRESSINGS MARKET SHARE, BY END USER AND COUNTRY

- 4.3 WOUND DRESSINGS MARKET: GEOGRAPHIC SNAPSHOT

- 4.4 WOUND DRESSINGS MARKET, REGIONAL MIX, 2025 VS. 2030

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing burden of chronic illnesses and conditions that impair natural wound healing

- 5.2.1.2 Rising cases of burn-related injuries globally

- 5.2.1.3 Increasing number of road accidents and trauma injuries

- 5.2.1.4 Elevated rate of cesarean deliveries in elderly mothers

- 5.2.1.5 Technological advancements in wound dressings

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of advanced wound dressings

- 5.2.2.2 Potential risks and complications linked to wound dressings

- 5.2.2.3 Antimicrobial resistance challenges

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growth opportunities in emerging economies

- 5.2.3.2 Supportive government initiatives and favorable reimbursement frameworks

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of trained healthcare professionals

- 5.2.4.2 Gaps in awareness and accessibility across emerging markets

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE TREND, BY PRODUCT, 2023-2025

- 5.4.2 AVERAGE SELLING PRICE TREND OF WOUND DRESSING PRODUCTS FOR KEY WOUND TYPES, BY KEY PLAYER, 2023-2025

- 5.4.3 AVERAGE SELLING PRICE TREND, BY REGION, 2023-2025

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.7 ECOSYSTEM ANALYSIS

- 5.8 INVESTMENT & FUNDING SCENARIO

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Bioactive wound dressings

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 Antimicrobial coating technology

- 5.9.3 ADJACENT TECHNOLOGIES

- 5.9.3.1 Negative-pressure wound therapy

- 5.9.1 KEY TECHNOLOGIES

- 5.10 PATENT ANALYSIS

- 5.11 TRADE ANALYSIS

- 5.11.1 IMPORT SCENARIO

- 5.11.2 EXPORT SCENARIO

- 5.12 KEY CONFERENCES & EVENTS, 2025-2026

- 5.13 CASE STUDY ANALYSIS

- 5.13.1 CASE STUDY 1: HYDROCOLL HYDROCOLLOID DRESSINGS ACCELERATE HEALING IN CHRONIC WOUNDS

- 5.13.2 CASE STUDY 2: BIATAIN SILICONE ENHANCES COMFORT AND HEALING IN CHRONIC WOUNDS

- 5.13.3 CASE STUDY 3: MEPILEX UP REDUCES LEAKAGE AND IMPROVES LIFE QUALITY IN VENOUS LEG ULCERS

- 5.14 REGULATORY ANALYSIS

- 5.14.1 REGULATORY LANDSCAPE

- 5.14.1.1 North America

- 5.14.1.1.1 US

- 5.14.1.1.2 Canada

- 5.14.1.2 Europe

- 5.14.1.2.1 Germany

- 5.14.1.2.2 UK

- 5.14.1.2.3 France

- 5.14.1.3 Asia Pacific

- 5.14.1.3.1 China

- 5.14.1.3.2 Japan

- 5.14.1.3.3 India

- 5.14.1.4 Latin America

- 5.14.1.5 Middle East

- 5.14.1.1 North America

- 5.14.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.2.1 North America

- 5.14.2.2 Europe

- 5.14.2.3 Asia Pacific

- 5.14.2.4 Latin America

- 5.14.2.5 Rest of the World

- 5.14.1 REGULATORY LANDSCAPE

- 5.15 PORTER'S FIVE FORCES ANALYSIS

- 5.15.1 BARGAINING POWER OF SUPPLIERS

- 5.15.2 BARGAINING POWER OF BUYERS

- 5.15.3 THREAT OF NEW ENTRANTS

- 5.15.4 THREAT OF SUBSTITUTES

- 5.15.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.16 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.16.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.16.2 BUYING CRITERIA

- 5.17 IMPACT OF AI ON WOUND DRESSINGS MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 MARKET POTENTIAL OF AI IN WOUND DRESSINGS MARKET

- 5.17.3 IMPACT OF AI ON WOUND DRESSINGS MARKET: USE CASES

- 5.17.4 KEY COMPANIES IMPLEMENTING AI

- 5.17.5 FUTURE OF AI IN WOUND DRESSINGS MARKET

- 5.18 IMPACT OF US 2025 TARIFFS ON WOUND DRESSINGS MARKET

- 5.18.1 INTRODUCTION

- 5.18.2 KEY TARIFF RATES

- 5.18.3 PRICE IMPACT ANALYSIS

- 5.18.4 IMPACT ON COUNTRY/REGION

- 5.18.4.1 North America

- 5.18.4.2 Europe

- 5.18.4.3 Asia Pacific

- 5.18.5 IMPACT ON END-USE INDUSTRIES

- 5.18.5.1 Hospitals, ASCs, and clinics

6 WOUND DRESSINGS MARKET, BY TYPE

- 6.1 INTRODUCTION

- 6.2 ADVANCED WOUND DRESSINGS

- 6.2.1 FOAM DRESSINGS

- 6.2.1.1 Silicone dressings

- 6.2.1.1.1 Ability of silicone dressings to expedite wound closure and reduce risk of maceration to drive market

- 6.2.1.2 Non-silicone dressings

- 6.2.1.2.1 Advantages such as scar removal and wound healing to drive demand for non-silicone dressings

- 6.2.1.1 Silicone dressings

- 6.2.2 HYDROCOLLOID DRESSINGS

- 6.2.2.1 Ability to promote granulation and formation of new tissues in open wounds to boost adoption

- 6.2.3 FILM DRESSINGS

- 6.2.3.1 Non-absorbable nature of film dressings to limit adoption

- 6.2.4 ALGINATE DRESSINGS

- 6.2.4.1 Growing incidence of pressure and diabetic foot ulcers to fuel growth

- 6.2.5 HYDROGEL DRESSINGS

- 6.2.5.1 Ability to provide relief and cooling effect on skin to drive use of hydrogel dressings

- 6.2.6 COLLAGEN DRESSINGS

- 6.2.6.1 Favorable reimbursement scenario for collagen dressings to support market

- 6.2.7 HYDROFIBER DRESSINGS

- 6.2.7.1 Combination of properties of hydrocolloids and alginates to boost adoption of hydrofiber dressings

- 6.2.8 WOUND CONTACT LAYERS

- 6.2.8.1 Ability to protect wound beds from bacterial and fungal growth to drive growth

- 6.2.9 SUPERABSORBENT DRESSINGS

- 6.2.9.1 Use of superabsorbent dressings for fragile skin to promote growth

- 6.2.10 OTHER ADVANCED WOUND DRESSINGS

- 6.2.1 FOAM DRESSINGS

- 6.3 TRADITIONAL WOUND DRESSINGS

- 6.3.1 GAUZES

- 6.3.1.1 Wide usage of gauzes in surgeries and wound packing to propel market growth

- 6.3.2 TAPES

- 6.3.2.1 Importance of secure fixation, comfort, and reduced trauma to drive demand

- 6.3.3 BANDAGES

- 6.3.3.1 Wide usage of bandages to support market growth

- 6.3.4 ABSORBENT PADS

- 6.3.4.1 Wide usage of absorbent pads in wound dressing and exudate management to drive market

- 6.3.5 OTHER TRADITIONAL WOUND DRESSINGS

- 6.3.1 GAUZES

7 WOUND DRESSINGS MARKET, BY WOUND TYPE

- 7.1 INTRODUCTION

- 7.2 SURGICAL & TRAUMATIC WOUNDS

- 7.2.1 GROWING VOLUME OF SURGICAL PROCEDURES PERFORMED AND INCREASING INCIDENCE OF BURN INJURIES TO SUPPORT MARKET GROWTH

- 7.3 DIABETIC FOOT ULCERS

- 7.3.1 INCREASING PREVALENCE OF DIABETES TO PROPEL MARKET GROWTH

- 7.4 PRESSURE ULCERS

- 7.4.1 GROWING PREVALENCE OF PRESSURE ULCERS TO SUPPORT MARKET GROWTH

- 7.5 VENOUS LEG ULCERS

- 7.5.1 RISING GERIATRIC POPULATION TO SUPPORT GROWTH OF THIS SEGMENT

- 7.6 BURNS & OTHER WOUNDS

- 7.6.1 HIGH INCIDENCE OF BURN INJURIES IN EMERGING COUNTRIES TO PROPEL GROWTH

8 WOUND DRESSINGS MARKET, BY END USER

- 8.1 INTRODUCTION

- 8.2 HOSPITALS, ASCS, AND CLINICS

- 8.2.1 RISING NEED FOR BETTER WOUND MANAGEMENT AND GROWING NUMBER OF HOSPITAL READMISSIONS TO SUPPORT MARKET GROWTH

- 8.3 HOME CARE SETTINGS

- 8.3.1 NEED TO CONTROL RISING HEALTHCARE COSTS TO DRIVE MARKET GROWTH

- 8.4 OTHER END USERS

9 WOUND DRESSINGS MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 9.2.2 US

- 9.2.2.1 Rising diabetes prevalence and supportive reimbursement policies to drive market growth

- 9.2.3 CANADA

- 9.2.3.1 Government-backed efforts to support market development

- 9.3 EUROPE

- 9.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 9.3.2 GERMANY

- 9.3.2.1 Rising diabetes cases and chronic wound burden to boost market growth

- 9.3.3 FRANCE

- 9.3.3.1 Rising chronic wound cases to drive market expansion in France

- 9.3.4 UK

- 9.3.4.1 Increase in R&D activity to propel market growth

- 9.3.5 ITALY

- 9.3.5.1 Growing number of injury-related cases in Italy to propel growth

- 9.3.6 SPAIN

- 9.3.6.1 Rising life expectancy and aging population to boost wound care adoption in Spain

- 9.3.7 RUSSIA

- 9.3.7.1 Government initiatives to raise diabetes awareness to support market expansion in Russia

- 9.3.8 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 9.4.2 CHINA

- 9.4.2.1 Increasing incidence of diabetic foot ulcers (DFUs) to encourage growth

- 9.4.3 JAPAN

- 9.4.3.1 Evolving healthcare delivery and infrastructure landscape to fuel market

- 9.4.4 INDIA

- 9.4.4.1 Booming medical tourism to speed up market growth

- 9.4.5 AUSTRALIA

- 9.4.5.1 Growing number of medical manufacturing companies to drive market

- 9.4.6 REST OF ASIA PACIFIC

- 9.5 LATIN AMERICA

- 9.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 9.5.2 BRAZIL

- 9.5.2.1 Evolving healthcare infrastructure in country to contribute to growth

- 9.5.3 MEXICO

- 9.5.3.1 Expanding hospital infrastructure to aid growth

- 9.5.4 REST OF LATIN AMERICA

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 GROWING DEMAND FOR HEALTHCARE FACILITIES TO DRIVE MARKET

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2024

- 10.2.1 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN WOUND DRESSINGS MARKET

- 10.3 REVENUE ANALYSIS, 2022-2024

- 10.4 MARKET SHARE ANALYSIS, 2024

- 10.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- 10.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.5.5.1 Company footprint

- 10.5.5.2 Region footprint

- 10.5.5.3 Type footprint

- 10.5.5.4 Wound type footprint

- 10.5.5.5 End-user footprint

- 10.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 RESPONSIVE COMPANIES

- 10.6.3 DYNAMIC COMPANIES

- 10.6.4 STARTING BLOCKS

- 10.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.6.5.1 Detailed list of key startups/SMEs

- 10.6.5.2 Competitive benchmarking of key startups/SMEs

- 10.7 COMPANY VALUATION & FINANCIAL METRICS

- 10.7.1 COMPANY VALUATION

- 10.7.2 FINANCIAL METRICS

- 10.8 BRAND/PRODUCT COMPARISON

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES & APPROVALS

- 10.9.2 DEALS

- 10.9.3 EXPANSIONS

- 10.9.4 OTHER DEVELOPMENTS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 SOLVENTUM

- 11.1.1.1 Business overview

- 11.1.1.2 Products offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product launches & approvals

- 11.1.1.3.2 Other developments

- 11.1.1.4 MnM view

- 11.1.1.4.1 Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses & competitive threats

- 11.1.2 MOLNLYCKE AB

- 11.1.2.1 Business overview

- 11.1.2.2 Products offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Deals

- 11.1.2.3.2 Other developments

- 11.1.2.4 MnM view

- 11.1.2.4.1 Right to win

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses & competitive threats

- 11.1.3 CARDINAL HEALTH

- 11.1.3.1 Business overview

- 11.1.3.2 Products offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Deals

- 11.1.3.3.2 Expansions

- 11.1.3.4 MnM view

- 11.1.3.4.1 Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses & competitive threats

- 11.1.4 SMITH+NEPHEW

- 11.1.4.1 Business overview

- 11.1.4.2 Products offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Deals

- 11.1.4.3.2 Expansions

- 11.1.4.3.3 Other developments

- 11.1.4.4 MnM view

- 11.1.4.4.1 Right to win

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses & competitive threats

- 11.1.5 CONVATEC GROUP PLC

- 11.1.5.1 Business overview

- 11.1.5.2 Products offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Product launches

- 11.1.5.3.2 Deals

- 11.1.5.4 MnM view

- 11.1.5.4.1 Right to win

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses & competitive threats

- 11.1.6 PAUL HARTMANN AG

- 11.1.6.1 Business overview

- 11.1.6.2 Products offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Other developments

- 11.1.7 COLOPLAST GROUP

- 11.1.7.1 Business overview

- 11.1.7.2 Products offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Product launches

- 11.1.8 OWENS & MINOR

- 11.1.8.1 Business overview

- 11.1.8.2 Products offered

- 11.1.8.3 Recent developments

- 11.1.8.3.1 Deals

- 11.1.8.3.2 Other developments

- 11.1.9 INTEGRA LIFESCIENCES CORPORATION

- 11.1.9.1 Business overview

- 11.1.9.2 Products offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Other developments

- 11.1.10 ESSITY AKTIEBOLAG

- 11.1.10.1 Business overview

- 11.1.10.2 Products offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Other developments

- 11.1.11 B. BRAUN SE

- 11.1.11.1 Business overview

- 11.1.11.2 Products offered

- 11.1.12 ADVANCED MEDICAL SOLUTIONS GROUP PLC

- 11.1.12.1 Business overview

- 11.1.12.2 Products offered

- 11.1.12.3 Recent developments

- 11.1.12.3.1 Deals

- 11.1.13 MATIV HOLDINGS, INC.

- 11.1.13.1 Business overview

- 11.1.13.2 Products offered

- 11.1.13.3 Recent developments

- 11.1.13.3.1 Deals

- 11.1.1 SOLVENTUM

- 11.2 OTHER PLAYERS

- 11.2.1 URGO GROUP

- 11.2.2 DEROYAL INDUSTRIES, INC.

- 11.2.3 LOHMANN & RAUSCHER GMBH & CO. KG

- 11.2.4 MEDLINE INDUSTRIES, LP

- 11.2.5 WINNER MEDICAL CO., LTD.

- 11.2.6 ADVANCIS (UK)

- 11.2.7 HOLLISTER INCORPORATED

- 11.2.8 DERMARITE INDUSTRIES, LLC

- 11.2.9 MIL LABORATORIES PVT. LTD.

- 11.2.10 GENTELL

- 11.2.11 SHIELDLINE

- 11.2.12 FOCUS HEALTH GROUP

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS