|

시장보고서

상품코드

1807079

안료 분산제 시장 : 안료 유형별, 분산제 유형별, 용도별, 최종 이용 산업별, 지역별 예측(-2030년)Pigment Dispersion Market by Dispersion Type (Water-based, Solvent-based), Application (Automotive Paint & Coatings, Decorative Paints & Coatings), Pigment Type, End-use Industry (Building & Construction, Packaging), and Region - Global Forecast to 2030 |

||||||

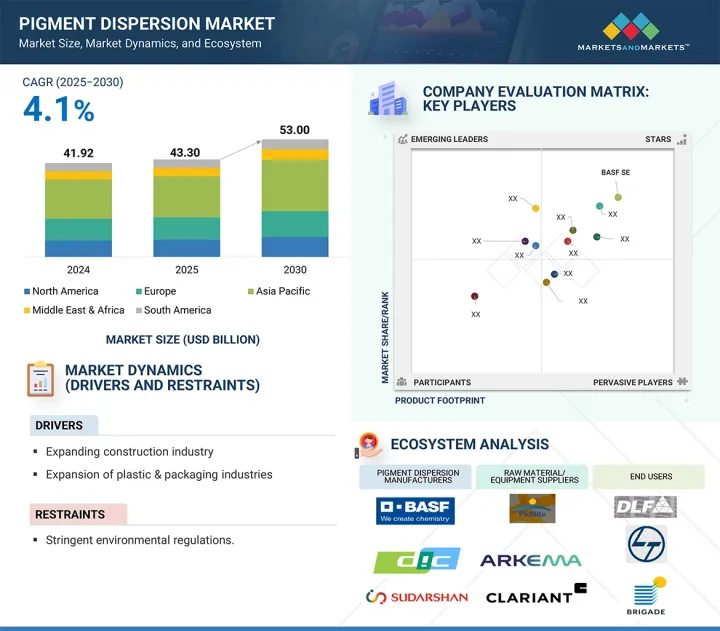

세계의 안료 분산제 시장 규모는 2025년 433억 달러에서 2030년까지 530억 달러에 이를 것으로 예측되며, 예측 기간 중 CAGR은 4.1%가 될 것으로 보입니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2022-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 검토 단위 | 금액(100만 달러), 킬로톤 |

| 부문 | 안료 유형별, 분산 유형별, 용도별, 최종 이용 산업별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 남미, 중동 및 아프리카 |

안료 분산제는 페인트, 코팅제, 플라스틱, 잉크, 섬유와 같은 최종 용도에서 일관된 색상, 불투명도 및 성능을 보장하는 매체에서 안료의 안정적이고 균일한 확산을 수반합니다. 이 분산제는 안료가 응집하지 않고 균일하게 분산되어 최종 제품에 생생한 색상과 내구성을 제공합니다.

수성, 용제성 및 기타 제형에서 이용 가능한 안료 분산제는 외관과 기능이 중요한 다양한 산업에 필수적입니다. 안료 분산제 시장의 성장은 몇 가지 중요한 요인에 의해 견인되고 있습니다. 특히 아시아태평양의 급속한 도시화와 인프라 개발은 페인트 및 코팅 수요를 증가시켜 안료 분산제의 사용을 촉진하고 있습니다. 지속가능한 솔루션으로의 세계적인 변화는 환경 규제의 엄격화와 VOC 배출에 대한 의식이 높아짐에 따라 수성 분산제의 채용을 가속화하고 있습니다. 또한 포장, 자동차, 섬유 등 최종 용도 산업의 확대도 소비자 수요와 공업생산 증가에 힘입어 시장의 성장에 기여하고 있습니다. 또한 분산기술의 개선으로 제품의 품질이 향상되고 용도의 선택이 넓어지는 한편, 특히 신흥경제국에서는 정부의 지원정책에 의해 현지생산과 기술 혁신에 유리한 조건이 갖추어지고 있습니다. 이러한 요소를 종합하면 안료 분산제는 전통적인 산업 부문과 신흥 산업 부문 모두에서 중요한 구성 요소로 자리매김하고 있습니다.

산업용 도료 및 코팅은 안료 분산제의 중요한 응용 분야이며 자동차, 기계, 해양, 항공우주, 건설 등의 산업에 서비스를 제공합니다. 이 페인트는 아름다움과 기능적 보호를 모두 위해 만들어졌으며 부식, 화학 물질, 자외선 및 마모를 견딜 수 있습니다. 안료 분산제는 일관된 색상, 불투명도 및 안정성을 보장하는 동시에 내열성 및 내구성과 같은 성능을 향상시키는 데 필수적입니다. 고성능으로 오래 지속되는 페인트를 필요로 하는 산업이 증가함에 따라 안료 분산제는 보다 엄격한 품질, 환경 및 안전 기준을 충족하도록 진화하고 있습니다. 특히 유럽이나 북미와 같은 선진지역에서는 환경친화적인 저 VOC 처방으로의 이행이 진행되고 있어 고도의 수성 분산제의 채용이 가속화되고 있습니다. 동시에 인도, 중국, 동남아시아를 중심으로 한 아시아태평양의 급속한 산업 성장으로 대규모 인프라 정비 및 제조 프로젝트가 추진되어 산업용 도료 수요가 증가하고 있습니다. 또한, 나노 안료 분산제 및 하이브리드 배합과 같은 기술 혁신은 항공우주 및 전자 제품과 같은 첨단 분야에서 응용 분야의 선택을 넓히고 있습니다.

자동차 산업은 안료 분산제 수요를 견인하는 주요 최종 용도 분야이며, 그 이유는 미관과 보호의 양면에서 자동차 코팅에 중요한 역할을 하기 때문입니다. 안료 분산제는 선명한 색상, 자외선 안정성, 내식성, 오래 지속되는 마감을 보장하기 위해 차체 외장 페인트, 인테리어 부품 및 플라스틱 트림에 사용됩니다. 소비자의 선호도가 특히 선명하고 메탈릭한 셰이드의 시각적으로 매력적이고 내구성 있는 자동차로 이동함에 따라 고품질 안료 분산제에 대한 수요가 증가하고 있습니다. 게다가 전기자동차(EV)와 경량 소재를 향한 세계적인 움직임은 에너지 효율과 표면 내구성을 향상시키는 첨단 코팅의 필요성을 더욱 향상시키고 있습니다. 아시아태평양, 특히 인도와 중국 등 지역에서는 가처분 소득 증가, 도시화, EV에 대한 정부 우대 조치 등에 힘입어 자동차 생산과 판매가 강력한 성장세를 보이고 있습니다. 이러한 자동차 생산 대수 증가는 페인트 및 코팅제, 나아가 안료 분산제의 소비량 증가에 직결됩니다.

아시아태평양은 급속한 산업화, 도시 확대, 건설, 자동차, 포장, 섬유 등 최종 이용 산업의 번영을 통해 안료 분산제 세계 시장에서 가장 큰 점유율을 차지하고 있습니다. 중국, 인도, 일본, 한국과 같은 국가들은 강력한 제조거점, 소비자 수요 증가, 정부 지원 정책에 따라 이러한 성장을 이끌고 있습니다. 세계의 제조 거점인 중국은 페인트, 코팅제, 플라스틱 산업에서 지배적인 지위를 유지하고 있으며, 그 결과 안료 분산제가 대량으로 소비되고 있습니다. 인도에서는 스마트 시티 미션과 부동산 개발 증가와 같은 이니셔티브에 힘입어 건설 및 인프라가 전례없는 성장을 이루고 있으며, 이것이 장식용 페인트와 산업용 페인트 수요를 밀어 올리고 있습니다. 또한 인도의 섬유 부문 확대와 포장 산업의 성장으로 고성능 안료의 요구가 더욱 커지고 있습니다. 일본과 한국은 첨단 용도와 기술 진보를 통해 공헌하고 있습니다. 일본은 인프라 개수와 스마트 시티 프로젝트에 주력하고 있으며, 한국에서는 Samsung 반도체 클러스터와 국제 금융 센터 재개발 등 대규모 건설이 진행되고 있습니다. 전반적으로 아시아태평양의 많은 인구, 중간층 증가, 자동차 생산 증가, 급속한 도시화로 안료 분산제 제조업체들에게 아시아태평양은 가장 급성장하고 있는 유망한 시장으로 기술 혁신과 사업 확대 기회를 충분히 제공합니다.

본 보고서에서는 세계의 안료 분산제 시장에 대해 조사했으며, 안료 유형별, 분산 유형별, 용도별, 최종 이용 산업별, 지역별 동향 및 시장 진출기업프로파일 등을 정리했습니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요 인사이트

제5장 시장 개요

- 소개

- 시장 역학

제6장 업계 동향

- Porter's Five Forces 분석

- 밸류체인 분석

- 거시경제지표

- 가격 분석

- 무역 분석

- 생태계 분석

- 고객사업에 영향을 주는 동향/혼란

- 기술 분석

- 2025-2026년의 주된 회의와 이벤트

제7장 안료 분산제 시장(안료 유형별)

- 소개

- 유기 안료

- 무기 안료

제8장 안료 분산제 시장(분산제 유형별)

- 소개

- 수성 분산제

- 용제계 분산제

제9장 안료 분산제 시장(용도별)

- 소개

- 자동차용 페인트 및 코팅

- 장식 페인트 및 코팅

- 공업용 페인트 및 코팅

- 잉크

- 플라스틱

- 기타

제10장 안료 분산제 시장(최종 이용 산업별)

- 소개

- 건축 및 건설

- 자동차

- 포장

- 종이 및 인쇄

- 섬유

- 기타

제11장 안료 분산제 시장(지역별)

- 소개

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 인도네시아

- 기타

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 프랑스

- 영국

- 이탈리아

- 스페인

- 기타

- 중동 및 아프리카

- GCC 국가

- 남아프리카

- 기타

- 남미

- 브라질

- 아르헨티나

- 기타

제12장 경쟁 구도

- 소개

- 수익 분석

- 시장 점유율 분석

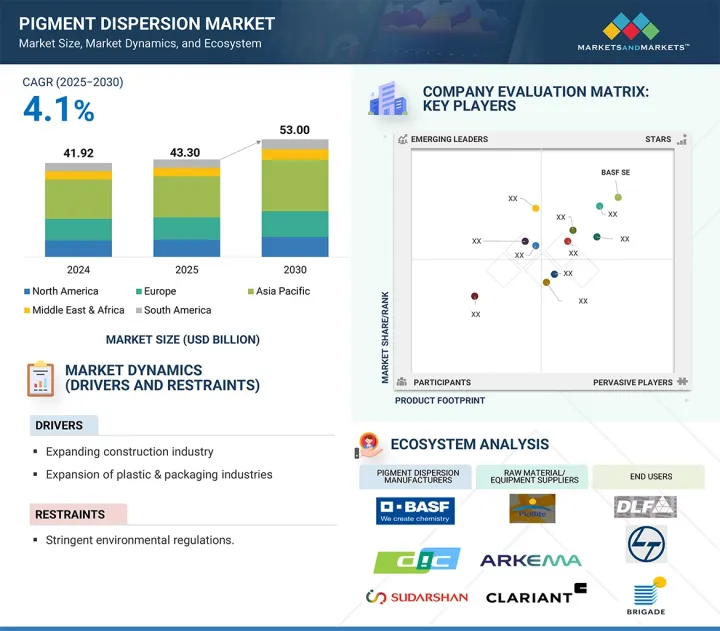

- 기업 평가 매트릭스: 주요 진입기업, 2024년

- 기업 평가 매트릭스: 스타트업 및중소기업, 2024년

- 경쟁 시나리오와 동향

제13장 기업 프로파일

- 주요 진출기업

- BASF SE

- DIC CORPORATION

- SUDARSHAN CHEMICAL INDUSTRIES LIMITED

- VIBRANTZ

- CABOT CORPORATION

- DYSTAR SINGAPORE PTE LTD

- LANXESS

- PENN COLOR INC.

- PIDILITE PIGMENT

- ARALON COLOR GMBH

- 기타 기업

- AUM FARBENCHEM

- ACHITEX MINERVA SPA

- CHROMATECH INCORPORATED

- DCL CORPORATION

- DECORATIVE COLOR & CHEMICAL, INC.

- DCC GROUP COMPANY LIMITED

- KEMITEKS

- MANALI PIGMENTS PVT. LTD.

- MIKUNI-COLOR LTD.

- RPM INTERNATIONAL INC.

- SYNTHESIA, AS

- TIARCO CHEMICALS

- TENNANTS TEXTILE COLOURS LTD.

- VIPUL ORGANICS LTD.

- QUAKER COLOR

제14장 부록

JHS 25.09.16The pigment dispersion market is expected to reach USD 53.00 billion by 2030, up from USD 43.30 billion in 2025, growing at a CAGR of 4.1% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million), Volume (Kiloton) |

| Segments | Type, Pigment Type, Application, End-use Industry, and Region |

| Regions covered | North America, Europe, Asia Pacific, South America, and Middle East & Africa |

Pigment dispersion involves the stable and uniform spread of pigments in a medium, ensuring consistent color, opacity, and performance in end-use applications like paints, coatings, plastics, inks, and textiles. These dispersions guarantee that pigments are evenly distributed without clumping, resulting in vibrant color and durability in finished products.

Available in water-based, solvent-based, and other formulations, pigment dispersions are vital to various industries where appearance and function matter. The growth of the pigment dispersion market is driven by several key factors. Rapid urbanization and infrastructure development, especially in Asia-Pacific, are increasing demand for paints and coatings, thereby boosting pigment dispersion use. The global shift toward sustainable solutions is speeding up the adoption of water-based dispersions due to stricter environmental regulations and rising awareness of VOC emissions. Expanding end-use industries such as packaging, automotive, and textiles are also contributing to market growth, supported by growing consumer demand and industrial production. Furthermore, improvements in dispersion technologies have enhanced product quality and expanded application options, while supportive government policies, particularly in emerging economies, are creating favorable conditions for local manufacturing and innovation. Collectively, these factors position pigment dispersions as crucial components in both traditional and emerging industrial sectors.

"Industrial paint & coating segment is the second fastest-growing segment in the pigment dispersion market during the forecast period."

Industrial paints and coatings are a key application area for pigment dispersions, serving industries such as automotive, machinery, marine, aerospace, and construction. These coatings are made for both aesthetic appeal and functional protection-resisting corrosion, chemicals, UV rays, and wear. Pigment dispersions are essential because they ensure consistent color, opacity, and stability, while also improving performance features like heat resistance and durability. As industries increasingly require high-performance, long-lasting coatings, pigment dispersions are evolving to meet stricter quality, environmental, and safety standards. The move toward eco-friendly, low-VOC formulations-particularly in developed regions like Europe and North America-is accelerating the adoption of advanced water-based dispersions. At the same time, rapid industrial growth in Asia-Pacific, especially in India, China, and Southeast Asia, is driving large-scale infrastructure and manufacturing projects, increasing demand for industrial coatings. Additionally, technological innovations such as nano-pigment dispersions and hybrid formulations are broadening application options in advanced sectors like aerospace and electronics.

"The automotive segment is the second-largest in the pigment dispersion market."

The automotive industry is a major end-use sector driving demand for pigment dispersions, due to their vital role in vehicle coatings for both aesthetics and protection. Pigment dispersions are used in exterior body paints, interior components, and plastic trims to ensure vibrant color, UV stability, corrosion resistance, and long-lasting finishes. As consumer preference shifts toward visually appealing and durable vehicles, especially in vibrant and metallic shades, the demand for high-quality pigment dispersions continues to increase. Additionally, the global move toward electric vehicles (EVs) and lightweight materials further boosts the need for advanced coatings that improve energy efficiency and surface durability. Regions like Asia-Pacific, especially India and China, are experiencing strong growth in automotive production and sales, supported by rising disposable incomes, urbanization, and government incentives for EVs. This increase in automotive output directly leads to higher consumption of paints, coatings, and consequently, pigment dispersions.

.

.

The Asia Pacific region is projected to be the largest market for pigment dispersion during the forecast period.

Asia Pacific holds the largest share in the global pigment dispersion market, driven by rapid industrialization, urban expansion, and thriving end-use industries such as construction, automotive, packaging, and textiles. Countries like China, India, Japan, and South Korea are leading this growth due to strong manufacturing bases, rising consumer demand, and supportive government policies. China, as the world's manufacturing hub, continues to dominate the paints, coatings, and plastics industries, resulting in significant consumption of pigment dispersions. India is experiencing unprecedented growth in construction and infrastructure, supported by initiatives like the Smart Cities Mission and increasing real estate development, which boost demand for decorative and industrial coatings. Additionally, India's expanding textile sector and growing packaging industry are further increasing the need for high-performance pigments. Japan and South Korea contribute through advanced applications and technological progress. Japan's focus on infrastructure renovation and smart city projects, along with large-scale construction efforts in South Korea-such as the Samsung semiconductor cluster and international finance center redevelopment-are driving demand for specialized coatings and dispersions. Overall, the region's large population, growing middle class, rising automotive production, and rapid urbanization make Asia-Pacific the fastest-growing and most promising market for pigment dispersion manufacturers, offering ample opportunities for innovation and expansion.

Extensive primary interviews were conducted to determine and verify the market size for several segments and subsegments and the information gathered through secondary research.

The break-up of primary interviews is given below:

- By Department: Tier 1: 40%, Tier 2: 25%, and Tier 3: 35%

- By Designation: C Level: 35%, Director Level: 30%, and Executives: 35%

- By Region: North America: 25%, Europe: 35%, Asia Pacific: 30%, South America: 5%, Middle East & Africa 5%

BASF SE (Germany), DIC Corporation (Japan), Sudarshan Chemical (India), Vibrantz (US), Cabot Corporation (US), Heubach GmbH (Germany), Penn Colors (US), Pidilite (India), Lanxess (Germany), DyStar Industries (Singapore), Achitex Minerva S.p.A (Italy), Aralon Color GmbH (Germany), Chromatech Inc. (US), DCL Corporation (Canada), and AUM Farbenchem (India), among others, are some of the key players in the pigment dispersion market.

The study includes an in-depth competitive analysis of these players in the market, with their company profiles, recent developments, and key strategies.

Research Coverage

The market study covers the pigment dispersion market across various segments. It aims to estimate the market size and growth potential in different segments based on type, pigment type, end-use industry, and region. The study also includes an in-depth competitive analysis of key players in the market, their company profiles, important observations about their products and offerings, recent developments, and key growth strategies they are using to enhance their position in the pigment dispersion market.

Key Benefits of Buying the Report

The report aims to assist market leaders and new entrants in approximating the revenue figures of the overall pigment dispersion market and its segments. It is designed to help stakeholders understand the competitive landscape, gain insights to strengthen their business positions, and develop effective go-to-market strategies. Additionally, the report provides insights into the market's current pulse, including key drivers, restraints, challenges, and opportunities.

The report provides insights into the following points:

- Analysis of key drivers (growing construction industry, expansion of plastic and packaging sectors), restraints (strict environmental regulations, fluctuations in raw material costs), opportunities (growth in emerging markets, increasing importance of aesthetics in packaging), challenges (disposal and waste management concerns)

- Market Development: Comprehensive information about lucrative markets - the report analyzes the pigment dispersion market across varied regions

Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in pigment dispersion market

- Competitive Assessment: In-depth assessment of market share, growth strategies, product and service offerings of leading players like BASF SE (Germany), DIC Corporation (Japan), Sudarshan Chemical (India), Vibrantz (US), Cabot Corporation (US), Heubach GmbH (Germany), Penn Colors (US), Pidilite (India), Lanxess (Germany), DyStar Industries (Singapore), Achitex Minerva S.p.A (Italy), Aralon Color GmbH (Germany), Chromatech Inc. (US), DCL Corporation (Canada), and AUM Farbenchem (India), among others, are the top manufacturers covered in the pigment dispersion market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 PIGMENT DISPERSIONS MARKET SEGMENTATION

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 LIMITATIONS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of interviews with experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 ASSUMPTIONS

- 2.5 LIMITATIONS & RISKS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN PIGMENT DISPERSIONS MARKET

- 4.2 PIGMENT DISPERSIONS MARKET, BY DISPERSION TYPE

- 4.3 PIGMENT DISPERSIONS MARKET, BY APPLICATION TYPE

- 4.4 PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY

- 4.5 ASIA PACIFIC: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY AND COUNTRY

- 4.6 PIGMENT DISPERSIONS MARKET, BY MAJOR COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Expanding construction industry

- 5.2.1.2 Growing plastics and packaging industries

- 5.2.1.3 Urbanization and industrialization in emerging economies

- 5.2.2 RESTRAINTS

- 5.2.2.1 Stringent environmental regulations

- 5.2.2.2 Volatility in raw material prices

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing global emphasis on sustainability and environmental compliance

- 5.2.3.2 Increasing importance of esthetics in packaging

- 5.2.3.3 Innovation in nano-pigment and high-performance dispersion technologies

- 5.2.4 CHALLENGES

- 5.2.4.1 Disposal and waste management concerns

- 5.2.1 DRIVERS

6 INDUSTRY TRENDS

- 6.1 PORTER'S FIVE FORCE ANALYSIS

- 6.1.1 BARGAINING POWER OF BUYERS

- 6.1.2 BARGAINING POWER OF SUPPLIERS

- 6.1.3 THREAT OF NEW ENTRANTS

- 6.1.4 THREAT OF SUBSTITUTES

- 6.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.2 VALUE CHAIN ANALYSIS

- 6.2.1 RAW MATERIAL SUPPLIERS

- 6.2.2 MANUFACTURERS

- 6.2.3 DISTRIBUTORS

- 6.2.4 END USERS

- 6.3 MACROECONOMIC INDICATORS

- 6.3.1 GLOBAL GDP TRENDS

- 6.4 PRICING ANALYSIS

- 6.4.1 AVERAGE SELLING PRICE TREND, BY REGION

- 6.5 TRADE ANALYSIS

- 6.5.1 IMPORT SCENARIO (HS CODE 321290)

- 6.5.2 EXPORT SCENARIO (HS CODE 321290)

- 6.6 ECOSYSTEM ANALYSIS

- 6.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.8 TECHNOLOGY ANALYSIS

- 6.8.1 KEY TECHNOLOGIES

- 6.8.1.1 High-speed dispersions

- 6.8.1.2 Ultrasonic dispersion

- 6.8.1 KEY TECHNOLOGIES

- 6.9 KEY CONFERENCES & EVENTS IN 2025-2026

7 PIGMENT DISPERSIONS MARKET, BY PIGMENT TYPE

- 7.1 INTRODUCTION

- 7.2 ORGANIC PIGMENTS

- 7.2.1 AZO PIGMENTS

- 7.2.1.1 Rising demand in paints, printing inks, plastics, and textiles to drive market

- 7.2.2 PHTHALOCYANINE PIGMENTS

- 7.2.2.1 Outstanding color fastness, strong chromatic strength, and excellent durability to boost market

- 7.2.3 HIGH-PERFORMANCE PIGMENTS

- 7.2.3.1 Excellent lightfastness and heat stability properties to fuel demand

- 7.2.4 OTHER ORGANIC PIGMENTS

- 7.2.1 AZO PIGMENTS

- 7.3 INORGANIC PIGMENTS

- 7.3.1 TITANIUM DIOXIDE

- 7.3.1.1 Cost-effectiveness to propel market growth

- 7.3.2 IRON OXIDE

- 7.3.2.1 Rising infrastructure developments to drive demand

- 7.3.3 CARBON BLACK

- 7.3.3.1 Wide demand in rubber and plastic applications to support growth

- 7.3.4 OTHER INORGANIC PIGMENTS

- 7.3.1 TITANIUM DIOXIDE

8 PIGMENT DISPERSIONS MARKET, BY DISPERSION TYPE

- 8.1 INTRODUCTION

- 8.2 WATER-BASED DISPERSIONS

- 8.2.1 LOW VOC PROPERTY TO FUEL MARKET GROWTH

- 8.3 SOLVENT-BASED DISPERSIONS

- 8.3.1 OUTSTANDING DURABILITY WITH ENHANCED RESISTANCE TO PROPEL GROWTH

9 PIGMENT DISPERSIONS MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 AUTOMOTIVE PAINTS & COATINGS

- 9.2.1 GROWTH OF AUTOMOTIVE INDUSTRY TO BOOST DEMAND

- 9.3 DECORATIVE PAINTS & COATINGS

- 9.3.1 RAPID GROWTH IN RESIDENTIAL CONSTRUCTION TO PROPEL MARKET

- 9.4 INDUSTRIAL PAINTS & COATINGS

- 9.4.1 INDUSTRIALIZATION TO SUPPORT MARKET GROWTH

- 9.5 INKS

- 9.5.1 GROWING DIGITAL PRINTING INDUSTRY TO DRIVE MARKET

- 9.6 PLASTICS

- 9.6.1 OUTSTANDING WEATHER AND UV RESISTANCE AND HIGH LEVEL OF LIGHTFASTNESS TO BOOST MARKET

- 9.7 OTHER APPLICATIONS

10 PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY

- 10.1 INTRODUCTION

- 10.2 BUILDING & CONSTRUCTION

- 10.2.1 STRONG GROWTH IN CONSTRUCTION SECTOR TO PROPEL GROWTH

- 10.3 AUTOMOTIVE

- 10.3.1 GROWING CONSUMER DEMAND AND GLOBAL SHIFT TOWARD ELECTRIC MOBILITY TO DRIVE MARKET GROWTH

- 10.4 PACKAGING

- 10.4.1 PROTECTION OF GOODS DURING DISTRIBUTION, TRANSPORTATION, AND STORAGE TO PROPEL MARKET

- 10.5 PAPER & PRINTING

- 10.5.1 INCREASING DEMAND IN EMERGING COUNTRIES TO FUEL MARKET

- 10.6 TEXTILE

- 10.6.1 UNIFORM COLORATION, EXCELLENT WASH FASTNESS, AND VIBRANT SHADES TO SPUR DEMAND

- 10.7 OTHER END-USE INDUSTRIES

11 PIGMENT DISPERSIONS MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 ASIA PACIFIC

- 11.2.1 CHINA

- 11.2.1.1 Cost-effective labor and low-cost raw materials to drive market

- 11.2.2 INDIA

- 11.2.2.1 Rising disposable income to propel market

- 11.2.3 JAPAN

- 11.2.3.1 Presence of multinational automobile companies to boost market growth

- 11.2.4 SOUTH KOREA

- 11.2.4.1 Strong construction industry to drive market

- 11.2.5 INDONESIA

- 11.2.5.1 Government focus on renovation of existing infrastructure and investment in residential development to drive market

- 11.2.6 REST OF ASIA PACIFIC

- 11.2.1 CHINA

- 11.3 NORTH AMERICA

- 11.3.1 US

- 11.3.1.1 Strong investments in R&D and technological advancements to drive market

- 11.3.2 CANADA

- 11.3.2.1 Strong construction and automotive industry to propel market

- 11.3.3 MEXICO

- 11.3.3.1 Growing investment in construction sector to drive market

- 11.3.1 US

- 11.4 EUROPE

- 11.4.1 GERMANY

- 11.4.1.1 Presence of large industrial base to propel market

- 11.4.2 FRANCE

- 11.4.2.1 Growth in paints & coatings sector to boost market

- 11.4.3 UK

- 11.4.3.1 Government initiatives for construction sector to boost market

- 11.4.4 ITALY

- 11.4.4.1 Increasing construction activities to propel market growth

- 11.4.5 SPAIN

- 11.4.5.1 Increasing capital spending on construction projects to drive market

- 11.4.6 REST OF EUROPE

- 11.4.1 GERMANY

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 GCC COUNTRIES

- 11.5.1.1 Saudi Arabia

- 11.5.1.1.1 Rapid infrastructural development to propel demand

- 11.5.1.2 UAE

- 11.5.1.2.1 Robust construction industry and strong consumer demand for luxury vehicles to boost market

- 11.5.1.3 Rest of GCC Countries

- 11.5.1.1 Saudi Arabia

- 11.5.2 SOUTH AFRICA

- 11.5.2.1 Ongoing infrastructure developments to boost consumption

- 11.5.3 REST OF MIDDLE EAST & AFRICA

- 11.5.1 GCC COUNTRIES

- 11.6 SOUTH AMERICA

- 11.6.1 BRAZIL

- 11.6.1.1 Growth in automotive sector to drive market

- 11.6.2 ARGENTINA

- 11.6.2.1 Growth of building & construction industry to propel market

- 11.6.3 REST OF SOUTH AMERICA

- 11.6.1 BRAZIL

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.1.1 STRATEGIES ADOPTED BY KEY PIGMENT DISPERSION MANUFACTURERS, JANUARY 2020-JUNE 2025

- 12.2 REVENUE ANALYSIS

- 12.3 MARKET SHARE ANALYSIS

- 12.4 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.4.1 STARS

- 12.4.2 PERVASIVE PLAYERS

- 12.4.3 EMERGING LEADERS

- 12.4.4 PARTICIPANTS

- 12.4.5 STRENGTH OF PRODUCT PORTFOLIO

- 12.4.6 BUSINESS STRATEGY EXCELLENCE

- 12.5 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.5.1 PROGRESSIVE COMPANIES

- 12.5.2 RESPONSIVE COMPANIES

- 12.5.3 DYNAMIC COMPANIES

- 12.5.4 STARTING BLOCKS

- 12.5.5 STRENGTH OF PRODUCT PORTFOLIO

- 12.5.6 BUSINESS STRATEGY EXCELLENCE

- 12.6 COMPETITIVE SCENARIO AND TRENDS

- 12.6.1 PRODUCT LAUNCHES

- 12.6.2 DEALS

- 12.6.3 EXPANSIONS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 BASF SE

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Expansions

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 DIC CORPORATION

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Deals

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 SUDARSHAN CHEMICAL INDUSTRIES LIMITED

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Deals

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 VIBRANTZ

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Deals

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 CABOT CORPORATION

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Expansions

- 13.1.5.4 MnM view

- 13.1.5.4.1 Key strengths

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses and competitive threats

- 13.1.6 DYSTAR SINGAPORE PTE LTD

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 MnM view

- 13.1.7 LANXESS

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Deals

- 13.1.7.4 MnM view

- 13.1.8 PENN COLOR INC.

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Product launches

- 13.1.8.3.2 Deals

- 13.1.8.3.3 Expansions

- 13.1.8.4 MnM view

- 13.1.9 PIDILITE PIGMENT

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.9.3 MnM view

- 13.1.10 ARALON COLOR GMBH

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.10.3 MnM view

- 13.1.1 BASF SE

- 13.2 OTHER PLAYERS

- 13.2.1 AUM FARBENCHEM

- 13.2.2 ACHITEX MINERVA S.P.A

- 13.2.3 CHROMATECH INCORPORATED

- 13.2.4 DCL CORPORATION

- 13.2.5 DECORATIVE COLOR & CHEMICAL, INC.

- 13.2.6 DCC GROUP COMPANY LIMITED

- 13.2.7 KEMITEKS

- 13.2.8 MANALI PIGMENTS PVT. LTD.

- 13.2.9 MIKUNI-COLOR LTD.

- 13.2.10 RPM INTERNATIONAL INC.

- 13.2.11 SYNTHESIA, A.S.

- 13.2.12 TIARCO CHEMICALS

- 13.2.13 TENNANTS TEXTILE COLOURS LTD.

- 13.2.14 VIPUL ORGANICS LTD.

- 13.2.15 QUAKER COLOR

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS