|

시장보고서

상품코드

1807083

금속가공유 시장 : 유형별, 제품 유형별, 최종 사용 산업별, 지역별 예측(-2030년)Metalworking Fluids Market by Type (Straight Oils, Soluble Oils, Semi-synthetic Fluids, Synthetic Fluids), Product Type (Removal Fluid, Protecting Fluids, Forming Fluids, Treating Fluids), End-use Industry, and Region - Global Forecast to 2030 |

||||||

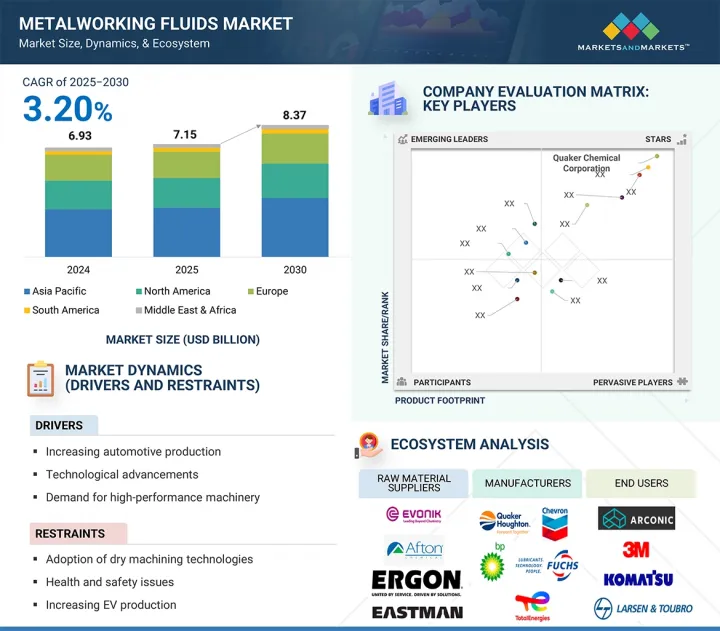

세계의 금속가공유 시장 규모는 2025년부터 2030년까지 CAGR 3.20%로 안정적으로 추이해 2030년 83억 7,000만 달러 규모에 이를 것으로 예측되고 있습니다.

금속가공유는 산업용 가공 공정에 필수적인 존재이며, 그 주요 특성은 냉각효과, 윤활작용, 방청작용, 칩 처리 등입니다. 이러한 유제는 많은 제조업에서 정밀 금속 절삭, 연삭, 프레스 가공, 성형에 중요한 역할을 합니다. 금속가공유 산업은 주로 운송기기 제조 분야에 의해 견인되고 있으며, 2024년에는 이 분야가 최대 시장 점유율을 차지했습니다. 급속한 산업화, 인프라 개발, 기술 혁신 등의 요인이 자동차, 항공우주, 철도, 중수송 기기 산업에서 수요 증가에 기여하고 있습니다. 이 분야에서는 새로운 수송 시스템에 사용되는 가볍고 내열성이 높은 첨단 재료의 가공을 가능하게 하기 위해 첨단 금속 가공유제가 활용되고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2020-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 금액(달러) |

| 부문 | 제품 유형, 최종 이용 산업, 지역 |

| 대상 지역 | 아시아태평양, 유럽, 북미, 중동, 아프리카, 남미 |

또한 제조 공장에서 하이테크 CNC 장비와 자동화의 도입은 보다 고품질의 효율적인 가공유제를 필요로 합니다. 이것은 최적의 가공을 보장하고 공구의 수명을 연장합니다. 각종 수송산업에 있어서 정밀공구의 채용 확대는 현대의 제조환경에서 금속가공유에 대한 주목이 높아지고 있음을 부각하고 있습니다.

"유형별로는 수용성유가 2024년 시장에서 최대 점유율을 차지했습니다."

이 유제에는 유화 가능한 성분이 들어 있으며 물과 혼합 한 후 기계에 분무됩니다. 냉각 성능이 높고, 적당한 윤활 성능도 겸비하고 있기 때문에 뛰어난 성능을 발휘합니다. 이 조합은 금속 절삭, 연삭, 성형 등 다양한 용도로 효율적으로 사용할 수 있습니다. 고효율 및 저비용이기 때문에 특히 성능을 희생하지 않고 운영 효율을 중시하는 주요 산업에서 널리 이용되고 있습니다.

"제품 유형별로는 가공 및 재료 제거 용도에 대한 수요를 반영하여 제거유가 최대의 점유율을 나타냈습니다."

선삭, 드릴링, 밀링 및 연삭과 같은 가공 공정에서 이러한 오일은 주로 피삭재에서 금속 조각을 물리적으로 절단하거나 제거하는 데 사용됩니다. 부품 제조가 재료 제거에 기반한 가공 기술에 크게 의존하기 때문에 점유율이 높아지고 있습니다. 제거유는 열 방출, 칩 배출, 윤활 등의 요소가 우수하며, 공구 수명, 치수 정밀도, 칩 표면 마감를 유지하는 데 가장 중요한 요소입니다.

"지역별로는 아시아태평양이 2024년 최대 점유율을 나타냈습니다."

이것은 활발한 산업 부문, 급속한 도시화, 자동차, 기계 제조 및 금속 가공 산업의 지속적인 발전으로 인한 것입니다. 중국, 인도, 일본, 한국 등 국가들은 인프라 개발과 최신 제조 설비에 투자하고 있으며, 그 결과 금속 가공유제가 다양한 산업용도로 널리 이용되고 있습니다. 제조 기지인 것 외에도 이들 국가들은 외국 직접 투자에 유리한 정부 정책과 지역 인센티브의 혜택을 받고 있습니다. 이러한 노력은 지역 생산 능력을 높이고 고성능 가공 솔루션, 특히 고급 금속 가공 유제에 대한 수요를 증가시키고 있습니다.

본 보고서에서는 세계의 금속가공유 시장을 조사했으며, 시장 개요, 시장 성장 영향요인 분석, 기술 및 특허 동향, 법규제 환경, 사례연구, 시장 규모 추이와 예측, 각종 구분 및 지역/주요 국가별 상세 분석, 경쟁 구도, 주요기업 프로파일 등을 정리했습니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요 인사이트

제5장 시장 개요

- 시장 역학

- 성장 촉진요인

- 억제요인

- 기회

- 과제

- Porter's Five Forces 분석

- 주요 이해관계자와 구매 기준

- 거시경제지표

제6장 업계 동향

- 공급망 분석

- 가격 분석

- 고객의 사업에 영향을 미치는 동향/혼란

- 생태계 분석

- 기술 분석

- 사례 연구 분석

- 무역 분석

- 규제 상황

- 2025-2026년 주요 회의 및 이벤트

- 투자 및 자금조달 시나리오

- 특허 분석

- 2025년 미국 관세가 반도체용 액체 시장에 미치는 영향

- AI/생성형 AI가 금속가공유 시장에 미치는 영향

제7장 금속가공유 시장 : 유형별

- 스트레이트 오일

- 수용성유

- 반합성유

- 합성유

제8장 금속가공유 시장 : 제품 유형별

- 제거유

- 방청유

- 성형유

- 처리유

제9장 금속가공유 시장 : 최종 사용자별

- 수송기기 제조

- 금속가공

- 기계

- 기타

제10장 금속가공유 시장 : 지역별

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 러시아

- 북미

- 미국

- 캐나다

- 멕시코

- 남미

- 브라질

- 아르헨티나

- 중동 및 아프리카

- GCC 국가

- 이집트

- 남아프리카

제11장 경쟁 구도

- 주요 진입기업의 전략 및 강점

- 시장 점유율 분석

- 수익 분석

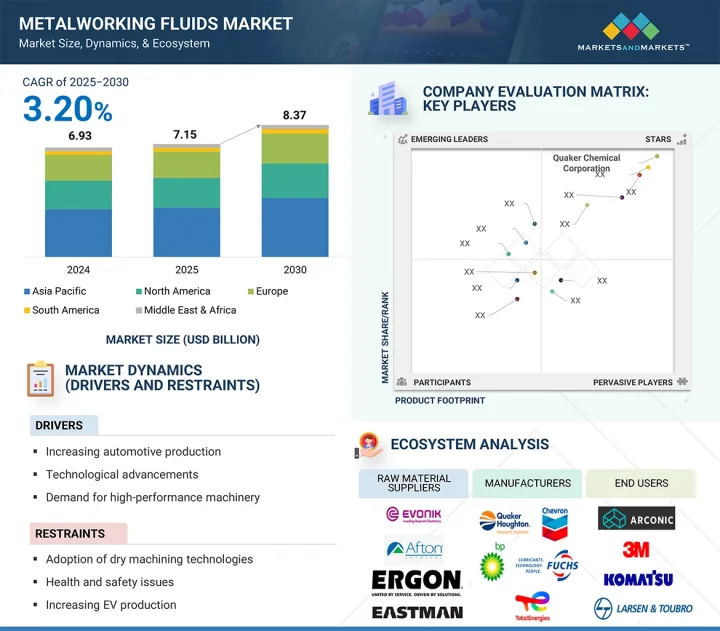

- 기업 평가 매트릭스 : 주요 기업

- 기업 평가 매트릭스 : 스타트업 및 중소기업

- 브랜드 및 제품 비교

- 기업 평가와 재무지표

- 경쟁 시나리오

제12장 기업 프로파일

- 주요 기업

- QUAKER HOUGHTON

- TOTALENERGIES SE

- CHEVRON CORPORATION

- EXXON MOBIL CORPORATION

- PJSC LUKOIL

- FUCHS SE

- IDEMITSU KOSAN CO., LTD.

- BP PLC

- SAUDI ARAMCO

- CHINA PETROLEUM & CHEMICAL CORPORATION

- CHEM ARROW CORPORATION

- 기타 기업

- PHILLIPS 66 COMPANY

- ENEOS HOLDINGS, INC.:

- GULF OIL INTERNATIONAL LTD

- HINDUSTAN PETROLEUM CORPORATION LIMITED

- APAR INDUSTRIES LTD.

- PETROFER

- ENI SPA

- MOTUL SA

- KLUBER LUBRICATION MUNCHEN GMBH & CO. KG

- VERTEX LUBRICANTS

- METALFLOW SA

- DENNISON LUBRICANTS, INC.

- COSMO OIL LUBRICANTS CO., LTD.

- RAYCO CHEMICAL

제13장 인접 시장과 관련 시장

제14장 부록

JHS 25.09.16The global market for metalworking fluids is expected to grow steadily, at an estimated CAGR of 3.20% from 2025 to 2030, reaching a market size of USD 8.37 billion by 2030. Metalworking fluids form an inseparable part of industrial machining processes, the main characteristics of such fluids being cooling effects, lubrication, corrosion prevention, and swarf issues. These fluids play a major role in precision metal cutting, grinding, stamping, and forming in many manufacturing industries. The metalworking fluids industry is primarily driven by the transportation equipment manufacturing sector, which holds the largest market share in 2024. Factors such as rapid industrialization, infrastructure development, and technological innovations have contributed to the increased demand in the automotive, aerospace, railway, and heavy transport equipment industries. These sectors utilize advanced metalworking fluids to facilitate the machining of modern lightweight and heat-resistant materials used in new transportation systems.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) |

| Segments | Type, Product Type, End-use Industry, and Region |

| Regions covered | Asia Pacific, Europe, North America, Middle East & Africa, and South America |

Furthermore, the implementation of high-tech CNC equipment and automation in manufacturing plants requires even higher quality and more efficient fluids. This ensures optimal processing and extends the lifespan of the tools. The rising adoption of precision tooling across various transportation industries highlights the growing emphasis on metalworking fluids in contemporary manufacturing environments.

"Soluble oils accounted for the largest share of the metalworking fluids market in 2024."

Soluble oils held the largest market share in 2024. These oils contain emulsifiable components that are mixed with water and then sprayed onto machinery. They perform exceptionally well, providing a high cooling rate alongside a moderate lubricating rate. This combination allows them to work efficiently in various metal cutting, grinding, and forming applications. They are widely utilized because of their high efficiency and affordability, particularly in major industries that prioritize operational effectiveness without sacrificing performance. The semi-synthetic fluids segment accounted for the second-largest share. They consist of synthetic and mineral oil emulsions that balance between the performance offered by fully synthetic fluids and the lubrication ability of straight oils. Pure oils are the basic oils and are very good lubricants in heavy-duty machining, but they lack in the cooling aspect, so they can only be used in certain areas of high-torque machines. Niche, high-precision operations utilize synthetic fluids where resistance to thermal breakdown and cleanliness are amongst the objectives. Rising environmental standards and the increasing trend to bio-based fluids are further shaping other formulation trends, where soluble oils and semi-synthetic oils are preferred due to their recyclable and reduced-risk characteristics.

"Removal fluids accounted for the largest share of the market, reflecting demand in machining and material removal applications."

As per product type, the removal fluids segment accounted for the largest share of the metalworking fluids market in 2024. In machining operations like turning, drilling, milling, and grinding, these fluids are mostly applied in physical cutting or removing pieces of metal from a workpiece. The share is high due to dominance in manufacturing techniques, which are based on material removal in fabrication parts. The removal fluids come in a design that promises a good dissipation of heat, chip escape, and lubrication, the most important factors that would sustain the tool life, dimensional accuracy, and the surface finish of the chip.

Forming fluids are mainly used in non-cutting processes such as stamping, forging, rolling, and extrusion. The fluids aid extreme-pressure jobs, reducing friction and wear where the metals are worked on, not machined away. Protective fluids are used to prevent corrosion during storage and transportation, ensuring that they do not corrode before removal. Finally, heating functions and surface conditioning are accomplished using fluids that are treated. As more pressure is established on operational efficiency, fluid recycling, and environmental compliance, developing multifunctional and durable fluids in general, and removal fluids in particular, is emerging as a game-changer in the metalworking fluids market.

"Asia Pacific dominates the global metalworking fluids market, with the largest regional share in 2024."

The Asia Pacific region dominated the metalworking fluids market in 2024. This is due to its vibrant industrial sector, rapid urbanization, and ongoing development in the automobile, machine building, and metalworking industries. Countries such as China, India, Japan, and South Korea are investing in infrastructure development and modern manufacturing equipment, which ensures that metalworking fluids are widely used across various industrial applications. In addition to being manufacturing hubs, these countries benefit from favorable government policies and local incentives for foreign direct investment. These initiatives are enhancing regional production capabilities and increasing the demand for high-performance machining solutions, including advanced metalworking fluids.

Other regions, such as North America and Europe, will also maintain a strong presence in the market due to their superior manufacturing systems and innovations in synthetic and sustainable metalworking solutions. However, the Asia Pacific will continue to be a key area for market growth through 2030, driven by rising competition, increasing energy efficiency regulations, and growing domestic consumption.

- By Company Type: Tier 1 - 55%, Tier 2 - 25%, and Tier 3 - 20%

- By Designation: Directors - 50%, Managers - 30%, and Others - 20%

- By Region: North America - 40%, Europe - 35%, Asia Pacific - 20%, and the Rest of the World - 5%

The key players profiled in the report include Quaker Houghton (US), TotalEnergies SE (France), Chevron Corporation (US), Exxon Mobil Corporation (US), PJSC LUKOIL (Russia), FUCHS SE (Germany), Idemitsu Kosan Co., Ltd. (Japan), BP p.l.c. (UK), Saudi Aramco (Saudi Arabia), and China Petroleum & Chemical Corporation (SINOPEC) (China).

Research Coverage

This report segments the metalworking fluids market based on type, product type, end-use industry, and region, and provides estimations of value (USD million) for the overall market size across various regions. The report also provides a detailed analysis of key industry players to provide insights into their business overviews, services, and key strategies associated with the metalworking fluids market.

Reasons to Buy this Report

This research report is focused on various levels of analysis - industry analysis (industry trends), market share analysis of top players, and company profiles, which together provide an overall view of the competitive landscape, emerging and high-growth segments of the metalworking fluids market, high-growth regions, and market drivers, restraints, opportunities, and challenges.

The report provides insights into the following points:

- Market Penetration: Comprehensive information on metalworking fluids offered by top players in the global market.

- Analysis of key drivers (increasing automotive production, technological advancements, and demand for high-performance machinery), restraints (adoption of dry machining technologies, health and safety issues, and increasing EV production), opportunities (product innovation and differentiation and data-driven fluid management systems), and challenges (fluctuating raw material prices and stringent environmental regulations) influencing the growth of the metalworking fluids market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the metalworking fluids market.

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the markets for metalworking fluids across regions.

- Market Diversification: Exhaustive information about new products, untapped regions, and recent developments in the global metalworking fluids market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the metalworking fluids market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNIT CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Interviews with experts - demand and supply sides

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 GROWTH FORECAST

- 2.4.1 SUPPLY-SIDE ANALYSIS

- 2.4.2 DEMAND-SIDE ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN METALWORKING FLUIDS MARKET

- 4.2 METALWORKING FLUIDS MARKET, BY REGION

- 4.3 ASIA PACIFIC METALWORKING FLUIDS MARKET, BY TYPE AND COUNTRY

- 4.4 METALWORKING FLUIDS MARKET, BY PRODUCT TYPE AND REGION

- 4.5 METALWORKING FLUIDS MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing automobile production

- 5.2.1.2 Technological advancements in metalworking techniques

- 5.2.1.3 Rising demand for high-performance machinery

- 5.2.2 RESTRAINTS

- 5.2.2.1 Adoption of dry machining technologies

- 5.2.2.2 Health and safety issues associated with metalworking fluids

- 5.2.2.3 Increasing electric vehicle (EV) production

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Product innovation and differentiation

- 5.2.3.2 Implementation of data-driven fluid management systems

- 5.2.4 CHALLENGES

- 5.2.4.1 Fluctuating raw material prices

- 5.2.4.2 Stringent environmental regulations related to metalworking fluids

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.4.1 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- 5.4.2 BUYING CRITERIA

- 5.5 MACROECONOMIC INDICATORS

- 5.5.1 GDP TRENDS AND FORECAST FOR MAJOR ECONOMIES

6 INDUSTRY TRENDS

- 6.1 SUPPLY CHAIN ANALYSIS

- 6.2 PRICING ANALYSIS

- 6.2.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY END USE, 2024

- 6.2.2 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2030

- 6.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.4 ECOSYSTEM ANALYSIS

- 6.5 TECHNOLOGY ANALYSIS

- 6.5.1 KEY TECHNOLOGIES

- 6.5.1.1 Emulsification technology

- 6.5.1.2 Nanofluid technology

- 6.5.2 COMPLEMENTARY TECHNOLOGIES

- 6.5.2.1 Advanced filtration systems

- 6.5.1 KEY TECHNOLOGIES

- 6.6 CASE STUDY ANALYSIS

- 6.6.1 STEEL HOT-MILL ROLLING: 65% FEWER KICK-OUT DELAYS

- 6.6.2 METAL FORMING: BETTER FLUID MAINTENANCE AND ODOR ELIMINATION

- 6.7 TRADE ANALYSIS

- 6.7.1 IMPORT SCENARIO (HS CODE 340319)

- 6.7.2 EXPORT SCENARIO (HS CODE 340319)

- 6.8 REGULATORY LANDSCAPE

- 6.8.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.9 KEY CONFERENCES AND EVENTS, 2025-2026

- 6.10 INVESTMENT AND FUNDING SCENARIO

- 6.11 PATENT ANALYSIS

- 6.11.1 APPROACH

- 6.11.2 DOCUMENT TYPE

- 6.11.3 TOP APPLICANTS

- 6.11.4 JURISDICTION ANALYSIS

- 6.12 IMPACT OF 2025 US TARIFF ON SEMICONDUCTOR FLUIDS MARKET

- 6.12.1 INTRODUCTION

- 6.12.2 KEY TARIFF RATES

- 6.12.3 PRICE IMPACT ANALYSIS

- 6.12.4 IMPACT ON COUNTRIES/REGIONS

- 6.12.4.1 US

- 6.12.4.2 Europe

- 6.12.4.3 Asia Pacific

- 6.12.5 IMPACT ON END USES

- 6.13 IMPACT OF AI/GEN AI ON METALWORKING FLUIDS MARKET

7 METALWORKING FLUIDS MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 STRAIGHT OILS

- 7.2.1 EFFECTIVENESS IN MACHINING AND FORMING APPLICATIONS TO DRIVE MARKET

- 7.3 SOLUBLE OILS

- 7.3.1 GROWTH OF METAL FABRICATION PROCESS TO DRIVE MARKET

- 7.4 SEMI-SYNTHETIC FLUIDS

- 7.4.1 ENHANCED PERFORMANCE AND AFFORDABILITY OF SEMI-SYNTHETIC FLUIDS TO DRIVE MARKET

- 7.5 SYNTHETIC FLUIDS

- 7.5.1 SUPERIOR COOLING CAPABILITIES OF SYNTHETIC FLUIDS TO FUEL DEMAND

8 METALWORKING FLUIDS MARKET, BY PRODUCT TYPE

- 8.1 INTRODUCTION

- 8.2 REMOVAL FLUIDS

- 8.2.1 STRINGENT ENVIRONMENTAL REGULATIONS TO DRIVE MARKET

- 8.3 PROTECTING FLUIDS

- 8.3.1 ANTI-CORROSION PROPERTY OF PROTECTING FLUIDS TO DRIVE MARKET

- 8.4 FORMING FLUIDS

- 8.4.1 ENHANCED PROCESS EFFICIENCY OF FORMING FLUIDS TO DRIVE MARKET

- 8.5 TREATING FLUIDS

- 8.5.1 ENHANCEMENT OF MECHANICAL PROPERTIES OF TREATING FLUIDS TO FUEL DEMAND

9 METALWORKING FLUIDS MARKET, BY END USE

- 9.1 INTRODUCTION

- 9.2 TRANSPORT EQUIPMENT MANUFACTURING

- 9.2.1 GROWING AUTOMOBILE PRODUCTION TO DRIVE MARKET

- 9.3 METAL FABRICATION

- 9.3.1 GROWING MANUFACTURING SECTOR IN EMERGING ECONOMIES TO DRIVE MARKET

- 9.4 MACHINERY

- 9.4.1 DEMAND FOR HIGH-PERFORMANCE MACHINERY TO DRIVE MARKET

- 9.5 OTHER END USES

10 METALWORKING FLUIDS MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 ASIA PACIFIC

- 10.2.1 CHINA

- 10.2.1.1 Growing manufacturing sector to drive market

- 10.2.2 JAPAN

- 10.2.2.1 High automobile production to drive demand

- 10.2.3 INDIA

- 10.2.3.1 Expanding infrastructure and construction sectors to drive market

- 10.2.4 SOUTH KOREA

- 10.2.4.1 Rapid industrialization to drive market

- 10.2.1 CHINA

- 10.3 EUROPE

- 10.3.1 GERMANY

- 10.3.1.1 Increase in automobile production to fuel demand

- 10.3.2 UK

- 10.3.2.1 Increasing investments in infrastructure development to drive market

- 10.3.3 FRANCE

- 10.3.3.1 Metal fabrication industry to dominate market

- 10.3.4 SPAIN

- 10.3.4.1 Growth of automotive industry to drive market

- 10.3.5 ITALY

- 10.3.5.1 Expanding manufacturing sector to drive market

- 10.3.6 RUSSIA

- 10.3.6.1 Booming automotive industry to propel market

- 10.3.1 GERMANY

- 10.4 NORTH AMERICA

- 10.4.1 US

- 10.4.1.1 Technological innovations to create lucrative opportunities for market growth

- 10.4.2 CANADA

- 10.4.2.1 Expanding manufacturing sector to propel market

- 10.4.3 MEXICO

- 10.4.3.1 Increasing demand from automotive sector to drive market

- 10.4.1 US

- 10.5 SOUTH AMERICA

- 10.5.1 BRAZIL

- 10.5.1.1 Significant investments in automotive industry to accelerate market growth

- 10.5.2 ARGENTINA

- 10.5.2.1 Developing automotive industry to drive demand

- 10.5.1 BRAZIL

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 GCC COUNTRIES

- 10.6.1.1 Saudi Arabia

- 10.6.1.1.1 Strategic initiatives aimed at diversifying economy to drive market

- 10.6.1.1 Saudi Arabia

- 10.6.2 EGYPT

- 10.6.2.1 High availability and low cost of raw materials to drive market

- 10.6.3 SOUTH AFRICA

- 10.6.3.1 Advancements in machining technologies to drive demand

- 10.6.1 GCC COUNTRIES

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.3 MARKET SHARE ANALYSIS

- 11.4 REVENUE ANALYSIS

- 11.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- 11.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.5.5.1 Company footprint

- 11.5.5.2 Region footprint

- 11.5.5.3 Type footprint

- 11.5.5.4 Product type footprint

- 11.5.5.5 End use footprint

- 11.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- 11.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.6.5.1 Detailed list of key startups/SMEs

- 11.6.5.2 Competitive benchmarking of key startups/SMEs

- 11.7 BRAND/PRODUCT COMPARISON

- 11.8 COMPANY VALUATION AND FINANCIAL METRICS

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 DEALS

- 11.9.3 EXPANSIONS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 QUAKER HOUGHTON

- 12.1.1.1 Business overview

- 12.1.1.2 Products offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Deals

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths/Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses/Competitive threats

- 12.1.2 TOTALENERGIES SE

- 12.1.2.1 Business overview

- 12.1.2.2 Products offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Deals

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths/Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses/Competitive threats

- 12.1.3 CHEVRON CORPORATION

- 12.1.3.1 Business overview

- 12.1.3.2 Products offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Deals

- 12.1.3.3.2 Expansions

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths/Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses/Competitive threats

- 12.1.4 EXXON MOBIL CORPORATION

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Deals

- 12.1.4.3.2 Expansions

- 12.1.4.4 MnM view

- 12.1.4.4.1 Key strengths/Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses/Competitive threats

- 12.1.5 PJSC LUKOIL

- 12.1.5.1 Business overview

- 12.1.5.2 Products offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Deals

- 12.1.5.3.2 Expansions

- 12.1.5.4 MnM View

- 12.1.5.4.1 Key strengths/Right to win

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses/Competitive threats

- 12.1.6 FUCHS SE

- 12.1.6.1 Business overview

- 12.1.6.2 Products offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Product launches

- 12.1.6.3.2 Deals

- 12.1.6.3.3 Expansions

- 12.1.7 IDEMITSU KOSAN CO., LTD.

- 12.1.7.1 Business overview

- 12.1.7.2 Products offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Expansions

- 12.1.8 BP P.L.C.

- 12.1.8.1 Business overview

- 12.1.8.2 Products offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Deals

- 12.1.8.3.2 Expansions

- 12.1.9 SAUDI ARAMCO

- 12.1.9.1 Business overview

- 12.1.9.2 Products offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Deals

- 12.1.10 CHINA PETROLEUM & CHEMICAL CORPORATION

- 12.1.10.1 Business overview

- 12.1.10.2 Products offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Others

- 12.1.11 CHEM ARROW CORPORATION

- 12.1.11.1 Business overview

- 12.1.11.2 Products offered

- 12.1.1 QUAKER HOUGHTON

- 12.2 OTHER PLAYERS

- 12.2.1 PHILLIPS 66 COMPANY

- 12.2.2 ENEOS HOLDINGS, INC.:

- 12.2.3 GULF OIL INTERNATIONAL LTD

- 12.2.4 HINDUSTAN PETROLEUM CORPORATION LIMITED

- 12.2.5 APAR INDUSTRIES LTD.

- 12.2.6 PETROFER

- 12.2.7 ENI S.P.A.

- 12.2.8 MOTUL S.A.

- 12.2.9 KLUBER LUBRICATION MUNCHEN GMBH & CO. KG

- 12.2.10 VERTEX LUBRICANTS

- 12.2.11 METALFLOW S.A.

- 12.2.12 DENNISON LUBRICANTS, INC.

- 12.2.13 COSMO OIL LUBRICANTS CO., LTD.

- 12.2.14 RAYCO CHEMICAL

13 ADJACENT AND RELATED MARKETS

- 13.1 INTRODUCTION

- 13.2 LIMITATIONS

- 13.3 FIRE-RESISTANT LUBRICANTS MARKET

- 13.3.1 MARKET DEFINITION

- 13.3.2 MARKET OVERVIEW

- 13.4 FIRE-RESISTANT LUBRICANTS MARKET, BY REGION

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS