|

시장보고서

상품코드

1808085

구강 세정액 시장 : 제품 유형별, 적응증별, 유통 채널별, 지역별 - 예측(-2030년)Oral Rinses Market by Product Type, Indication, Distribution Channel, Region - Global Forecast to 2030 |

||||||

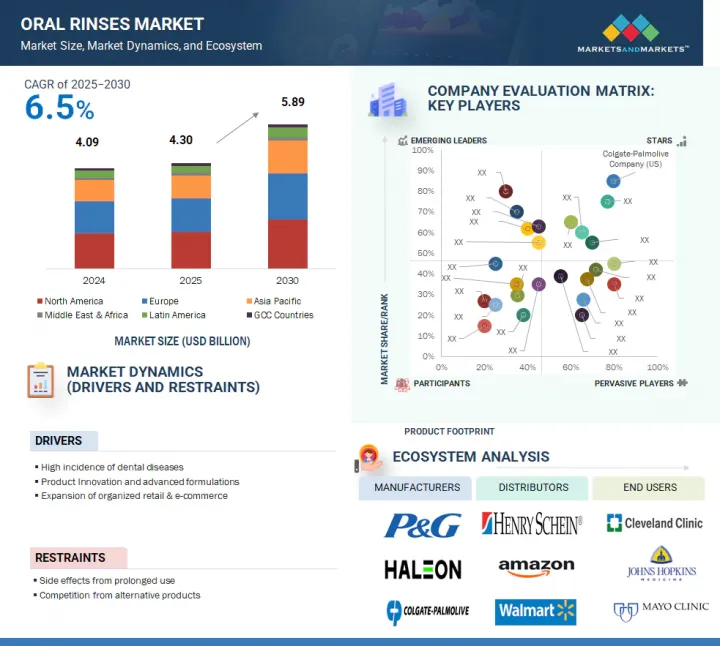

세계의 구강 세정액 시장 규모는 2025년 43억 달러로 추정되고, 2030년까지 58억 9,000만 달러에 이를 것으로 예측되며, 예측 기간 CAGR 6.5%로 성장이 예상됩니다.

첨단 오랄 케어 제품에 대한 의식 증가와 세계 인구 증가가 구강 세정액 시장의 성장을 가속할 것으로 예측됩니다. 플루오르화물, 에센셜 오일, 허브 활성제, 알코올 프리 베이스의 사용을 포함한 제제 기술의 끊임없는 혁신은 제품의 효능, 안전성 및 소비자에게 호소력을 향상시키고 있습니다. 이러한 개선은 구강 세정액의 효능, 이용가능성, 매력을 높여 보다 넓은 고객층이나 임상 용도에 이용되도록 하고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2024-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 10억 달러 |

| 부문 | 제품 유형별, 적응증별, 유통 채널별, 지역별 |

| 대상 지역 | 아시아태평양, 북미, 라틴아메리카, 중동 및 아프리카, GCC 국가 |

치과 질환 증가 및 추가 구강 관리가 필요한 노인 증가로 수요가 증가하고 있습니다. 그러나, 치료용 구강 세정액의 비용이 높고, 시장에 따라서는 소비자의 수용성 및 어드히어런스가 낮기 때문에 보다 광범위한 시장 채용은 제한될 가능성이 있습니다.

제품 유형별로, 치료용 구강 세정액 부문은 세계의 구강 세정액 시장에서 가장 큰 점유율을 차지했습니다.

치료용 세정액 부문은 큰 기능적 이점과 임상적 뒷받침으로 구강 위생 시장을 독점하고 있습니다. 이러한 제형은 박테리아 부하를 효과적으로 감소시키고, 치주질환의 위험을 완화하며, 에나멜의 완전성을 촉진하는 활성제를 풍부하게 포함합니다. 이 제품은 단순히 증상을 완화하는 것이 아니라 구강 위생 문제의 병인에 대처하도록 특별히 설계되었습니다. 치과의사에 의한 전문적인 추천, 장기적인 구강의 건강 유지를 중시하는 소비자 증가, 구강 건강 및 전신 상태와의 상관관계에 대한 의식의 고조 등이, 이러한 제품을 채용하는 주요한 촉진요인이 되고 있습니다. 이러한 제품은 임상 환경과 소매점 모두에서 이용하기 쉽기 때문에 시장 침투가 더욱 진행되고 있습니다.

적응증별로, 일반 구강 건강 부문은 세계의 구강 세정액 시장에서 가장 큰 점유율을 차지했습니다.

일반 구강 건강 부문은 광대한 포지셔닝을 통해 제조업체가 예방적 구강 케어를 중시하는 개인을 포함한 다양한 소비자층을 캡처할 수 있기 때문에 최대 시장 점유율을 차지할 것으로 예측됩니다. 이 부문의 성장 요인으로는 접근성 향상, 약간의 규제 제약, 소매점의 인지도 향상 등이 있습니다. 게다가, 브랜드 중심의 전략적 마케팅 시책은 일반용 마우스 워시를 매일 퍼스널케어 법에 통합하는 데 있어서 세계적으로 매우 중요하며, 이로써 시장의 우위성이 강화되고 있습니다. 이 부문은 상대적으로 안정적인 수요 궤도를 보여주며 장기 투자 전략에 매력적인 전망이 되고 있습니다. 업계의 주요 기업은 이 범주를 매출 수와 시장 점유율 확대의 첫 번째 요소로 인식하고 포트폴리오 내에서 일관되게 우선순위를 매기고 있습니다.

유통 채널별로, 소비자를 위한 매장 부문은 세계의 구강 세정액 시장에서 가장 큰 점유율을 차지했습니다.

그것의 광대한 물리적 존재, 높은 점내 브랜드 인지도, 일상적인 구매자에게 편리함으로 소비자 소매점이 구강 세정액 시장을 독점하고 있습니다. 슈퍼마켓과 일반 소매점에서는 다양한 제품에 직접 액세스할 수 있으므로 소비자는 브랜드를 쉽게 비교할 수 있습니다. 또한 이러한 장소에서는 충동적인 구매 행동을 자극하는 홍보 전략과 인센티브가 자주 수행됩니다. 구강 관리 제품을 일상적인 식료품 쇼핑에 통합하면 이 채널의 판매 수가 크게 증가합니다. 또한 일용소비재(FMCG) 판매업체와의 협력관계가 확립되어 진열 전략이 최적화되어 시장 경쟁 우위가 높아지고 있습니다.

이 보고서는 세계의 구강 세정액 시장에 대한 조사 분석을 통해 주요 촉진요인 및 억제요인, 경쟁 구도, 미래 동향 등의 정보를 제공합니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요한 지견

- 구강 세정액 시장 개요

- 아시아태평양 구강 세정액 시장 : 제품 유형별, 국가별

- 구강 세정액 시장 : 지리적 성장 기회

- 구강 세정액 시장 : 지역의 구성

- 구강 세정액 시장 : 선진국 시장 및 신흥국 시장(2025년, 2030년)

제5장 시장 개요

- 서문

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

- 산업 동향

- 주요 제약 기업에 의한 소비자 의료 부문의 전략적 분할

- 클린 라벨 소비자 시프트 중, 천연의 허브 배합 구강 세정액 증가

- 기술 분석

- 주요 기술

- 보완 기술

- 인접 기술

- 가격 설정 분석

- 구강 세정액의 평균 판매 가격 동향 : 주요기업별(2022-2024년)

- 구강 세정액의 평균 판매 가격 동향 : 지역별(2022-2024년)

- 생태계 분석

- 상환 시나리오 분석

- 밸류체인 분석

- Porter's Five Forces 분석

- 주요 이해관계자 및 구매 기준

- 공급망 분석

- 무역 분석

- HS코드 330690의 수입 데이터(2020-2024년)

- HS코드 330690의 수출 데이터(2020-2024년)

- 규제 분석

- 규제 틀

- 규제기관, 정부기관, 기타 조직

- 특허 분석

- 구강 세정액 시장에서의 특허 공보의 동향

- 관할 분석 : 구강 세정액 시장의 상위 특허출원자

- 주요 특허 목록

- 주요 컨퍼런스 및 이벤트(2025-2026년)

- 인접 시장 분석

- 고객 사업에 영향을 주는 동향 및 혼란

- 언멧 니즈 및 최종 사용자의 기대

- 언멧 요구

- 최종 사용자의 기대

- 구강 세정액 시장에 대한 AI 및 생성형 AI의 영향

- 사례 연구 분석

- 화학 요법 유발성 구강 점막염을 효과적으로 관리하는 CAPHOSOL 구강 세정액

- 인공 호흡기를 장착한 환자의 인공호흡기 관련 폐렴(VAP)을 예방하는 항균성 구강 세정액

- 클로르헥시딘에 부작용 없이 효과가 있는 허브 구강 세정액

- 투자 및 자금조달 시나리오

- 구강 세정액 시장에 대한 미국 관세의 영향(2025년)

- 서문

- 주요 관세율

- 주요 관세율

- 가격의 영향 분석

- 국가 및 지역에 미치는 영향

- 최종 이용 산업에 미치는 영향

제6장 구강 세정액 시장 : 제품 유형별

- 서문

- 치료용 세정액

- 화장용 세정액

- 기타 세정액

제7장 구강 세정액 시장 : 적응증별

- 서문

- 일반 구강 건강

- 치은염 및 치주병

- 구취

- 드라이 마우스

- 기타 적응증

제8장 구강 세정액 시장 : 유통 채널별

- 서문

- 소비자용 점포

- 소매 약국 및 치과 진료소

- 온라인 유통

제9장 구강 세정액 시장 : 지역별

- 서문

- 북미

- 북미의 거시경제 전망

- 미국

- 캐나다

- 유럽

- 유럽의 거시 경제 전망

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 스위스

- 폴란드

- 기타 유럽

- 아시아태평양

- 아시아태평양의 거시 경제 전망

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타 아시아태평양

- 라틴아메리카

- 라틴아메리카의 거시 경제 전망

- 브라질

- 멕시코

- 기타 라틴아메리카

- 중동 및 아프리카

- GCC 국가

제10장 경쟁 구도

- 서문

- 주요 진입 기업의 전략 및 강점

- 수익 분석(2020-2024년)

- 시장 점유율 분석(2024년)

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업 평가 매트릭스 : 스타트업 및 중소기업(2024년)

- 기업 평가 및 재무 지표

- 브랜드 및 제품 비교

- 주요 기업의 연구 개발비

- 경쟁 시나리오

제11장 기업 프로파일

- 주요 기업

- KENVUE

- COLGATE-PALMOLIVE COMPANY

- PROCTER & GAMBLE

- HALEON GROUP OF COMPANIES

- UNILEVER

- CHURCH & DWIGHT CO., INC.

- LION CORPORATION

- AMWAY CORP.

- SUNSTAR SUISSE SA

- PERRIGO COMPANY PLC

- DABUR

- HIMALAYA WELLNESS COMPANY

- KAO CORPORATION

- OPELLA HEALTHCARE GROUP SAS

- SMARTMOUTH ORAL HEALTH LABORATORIES

- 기타 기업

- DENTAID

- CLOSYS

- SCANDERRA GMBH

- PEARLIE WHITE

- WILD

- BOKA

- PERFORA

- SALT ORAL CARE

- ORABIO

- LUMINEUX

제12장 부록

AJY 25.09.16The global oral rinses market is projected to reach USD 5.89 billion in 2030 from USD 4.30 billion in 2025, at a CAGR of 6.5% during the forecast period.Growing awareness of advanced oral care products, along with a rising global population, is expected to drive the growth of the oral rinses market. Continuous innovation in formulation technologies, including the use of fluoride variants, essential oils, herbal actives, and alcohol-free bases, is improving product effectiveness, safety, and appeal to consumers. These improvements are increasing the effectiveness, availability, and attractiveness of oral rinses to a broader range of customers and clinical uses.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Product Type, Indication, Distribution Channel, and Region |

| Regions covered | Asia Pacific, North America, Europe, Latin America, Middle East & Africa, and GCC Countries |

Demand is also growing due to an increase in dental diseases and an aging population in need of additional oral care. However, broader market adoption may be limited by the high cost of therapeutic mouthwash and, in some markets, low consumer acceptance or adherence.

By product type, the therapeutic rinses segment had the largest share of the global oral rinses market.

The global oral rinses market is divided into three main segments: therapeutic rinses, cosmetic rinses, and others. The therapeutic rinses segment dominates the oral hygiene market due to their significant functional advantages and clinical endorsement. These formulations are enriched with active agents that effectively lower bacterial loads, mitigate the risk of periodontal diseases, and promote enamel integrity. They are specifically engineered to address the etiology of oral health issues rather than merely alleviating symptoms. Key drivers for their adoption include professional recommendations from dentists, an increasing consumer emphasis on long-term oral health maintenance, and heightened awareness of the correlation between oral health and systemic conditions. The accessibility of these products in both clinical environments and retail outlets further amplifies their market penetration.

The general oral health segment commanded the largest share of the global oral rinses market based on indication.

The global oral rinses market is divided into several categories based on indication: general oral health, gingivitis & periodontal diseases, halitosis, dry mouth, and other conditions. The general oral health segment is anticipated to command the largest share of the market due to its expansive positioning, enabling manufacturers to engage a diverse consumer base, including individuals focused on preventive oral care. Contributing factors to this segment's growth include enhanced accessibility, minimal regulatory constraints, and robust retail visibility. Furthermore, strategic brand-centric marketing initiatives have been pivotal in embedding general-use mouthwashes into daily personal care regimens globally, thereby reinforcing their market dominance. This segment exhibits relatively stable demand trajectories, making it an appealing prospect for long-term investment strategies. Leading industry players have consistently prioritized this category within their portfolios, recognizing it as a principal contributor to sales volume and market share expansion.

By distribution channel, the consumer stores segment accounted for the largest share of the global oral rinses market.

The global oral rinses market is divided by distribution channel into consumer stores, retail pharmacies & dental dispensaries, and online sales. Consumer retail outlets dominate the oral rinses market, attributed to their extensive physical presence, high in-store brand visibility, and the convenience they afford to everyday shoppers. Supermarkets and general retail establishments facilitate direct access to a diverse range of products, enabling consumers to easily compare brands. Additionally, these venues frequently implement promotional strategies and incentives that stimulate impulse purchasing behaviors. The integration of oral care products into routine grocery shopping significantly boosts sales volumes through this channel. Furthermore, established collaborations with fast-moving consumer goods (FMCG) distributors and optimized shelf placement strategies enhance their competitive advantage within the market.

The Asia Pacific is expected to grow at the highest CAGR in the oral rinses market during the forecast period.

The rapid growth of the population in the Asia Pacific region, coupled with a rising demand for sophisticated oral care solutions, is significantly driving the market for oral rinses. As the middle class expands, consumer interest in maintaining oral health has surged, leading to a greater emphasis on the importance of effective oral hygiene products. In response to these trends, leading global companies in the oral care industry are strategically increasing their presence in this dynamic market. They are doing so by introducing innovative formulations that cater to diverse needs, such as whitening, sensitivity relief, and antibacterial properties, as well as launching digitally integrated oral hygiene solutions that promote seamless user experiences. Moreover, indication-specific mouthwashes designed to target particular oral health issues are becoming increasingly popular, further contributing to the robust demand for oral rinses across the region.

A breakdown of the primary participants (supply side) for the oral rinses market referred to in this report is provided below:

- By Company Type: Tier 1 (30%), Tier 2 (35%), and Tier 3 (35%)

- By Designation: C-level Executives (20%), Directors (35%), and Others (45%)

- By Region: North America (30%), Europe (25%), Asia Pacific (20%), Latin America (20%), Middle East & Africa (2%), GCC Countries (3%)

Prominent players in the oral rinses market include Colgate-Palmolive Company (US), Kenvue (US), Procter & Gamble (US), Haleon Group of Companies (UK), Unilever (UK), Church & Dwight Co., Inc. (US), Lion Corporation (Japan), Amway (US), SUNSTAR Suisse S.A. (Switzerland), Perrigo Company plc (Ireland), Dabur (India), Himalaya Wellness Company (India), Kao Corporation (Japan), Opella Healthcare Group SAS (France), SmartMouth Oral Health Laboratories (US), Dentaid Ltd. (Spain), CloSYS (US), SCANDERRA GmbH (Switzerland), Pearlie White (Singapore), Dr. Wild & Co. AG (Switzerland), Boka (US), Perfora (India), Salt Oral Care (India), OraBio, Inc. (US), and Lumineux (US).

Research Coverage

The report offers an analysis of the oral rinses market, focusing on estimating the market size and potential for future growth across various segments, including distribution channels, regions, indications, and product types. Additionally, the report includes a competitive analysis of major market players, detailing their company profiles, product and service offerings, recent developments, and key strategies.

Reasons to Buy the Report

The report delivers critical insights for industry leaders and new entrants within the oral rinses sector, presenting estimated revenue projections for the overall market as well as its distinct segments. It facilitates a comprehensive understanding of the competitive landscape, enabling stakeholders to effectively position their businesses and devise robust go-to-market strategies. Furthermore, the document delineates key market drivers, constraints, challenges, and opportunities, equipping stakeholders to evaluate prevailing market conditions with a high degree of accuracy.

This report provides insights into the following pointers:

- Analysis of key drivers (high incidence of dental diseases, product innovation and advanced formulations), restraints (side effects from prolonged use, competition from alternative products), opportunities (rising trend of online purchasing and e-commerce, growing awareness about oral hygiene), and challenges (limited penetration in rural areas, high price points limit broader consumer adoption).

- Market Penetration: This report provides detailed information on the product portfolios offered by major players in the global oral rinses market. It covers various segments, including product types, indications, distribution channels, and regions.

- Product Enhancement/Innovation: Comprehensive details about new product launches and anticipated trends in the global oral rinses market.

- Market Development: Thorough knowledge and analysis of the profitable rising markets by product type, indication, distribution channel, and region.

- Market Diversification: Comprehensive information about newly launched products and services, expanding markets, current advancements, and investments in the global oral rinses market.

- Competitive Assessment: Thorough evaluation of the market shares, growth plans, offerings of products and services, and capacities of the major competitors in the global oral rinses market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 ORAL RINSES MARKET SEGMENTATION & REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Objectives of primary research

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 REVENUE SHARE ANALYSIS

- 2.2.2 BOTTOM-UP APPROACH (SUPPLY-SIDE ANALYSIS)

- 2.2.3 COMPANY PRESENTATIONS & PRIMARY INTERVIEWS

- 2.2.4 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 MARKET SHARE ESTIMATION

- 2.5 STUDY ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.6.1 SCOPE-RELATED LIMITATIONS

- 2.6.2 METHODOLOGY-RELATED LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ORAL RINSES MARKET OVERVIEW

- 4.2 ASIA PACIFIC: ORAL RINSES MARKET, BY PRODUCT TYPE AND COUNTRY

- 4.3 ORAL RINSES MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- 4.4 ORAL RINSES MARKET: REGIONAL MIX

- 4.5 ORAL RINSES MARKET: DEVELOPED VS. EMERGING MARKETS, 2025 VS. 2030

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 High incidence of chronic dental diseases

- 5.2.1.2 Increasing household purchasing power of middle-class population in emerging economies

- 5.2.1.3 Rising focus on creating public awareness and targeted educational campaigns

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of therapeutic and specialty formula-based oral rinses

- 5.2.2.2 Side effects from prolonged use of therapeutic and alcohol-based mouthwashes

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising trends of online purchasing and e-commerce

- 5.2.4 CHALLENGES

- 5.2.4.1 Rising number of product recalls

- 5.2.4.2 Limited penetration in rural and semi-urban areas in emerging economies

- 5.2.1 DRIVERS

- 5.3 INDUSTRY TRENDS

- 5.3.1 STRATEGIC DEMERGER OF CONSUMER HEALTHCARE DIVISIONS BY LEADING PHARMACEUTICAL COMPANIES

- 5.3.2 RISE OF NATURAL AND HERBAL ORAL RINSES AMID CLEAN-LABEL CONSUMER SHIFT

- 5.4 TECHNOLOGY ANALYSIS

- 5.4.1 KEY TECHNOLOGIES

- 5.4.1.1 Flouride

- 5.4.1.2 Anti-microbial agents

- 5.4.2 COMPLEMENTARY TECHNOLOGIES

- 5.4.2.1 Essential oils

- 5.4.3 ADJACENT TECHNOLOGIES

- 5.4.3.1 Electric dental flossers

- 5.4.1 KEY TECHNOLOGIES

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE TREND OF ORAL RINSES, BY KEY PLAYER, 2022-2024

- 5.5.2 AVERAGE SELLING PRICE TREND OF ORAL RINSES, BY REGION, 2022-2024

- 5.6 ECOSYSTEM ANALYSIS

- 5.6.1 ROLE IN ECOSYSTEM

- 5.7 REIMBURSEMENT SCENARIO ANALYSIS

- 5.8 VALUE CHAIN ANALYSIS

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- 5.9.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.9.2 BARGAINING POWER OF SUPPLIERS

- 5.9.3 BARGAINING POWER OF BUYERS

- 5.9.4 THREAT OF SUBSTITUTES

- 5.9.5 THREAT OF NEW ENTRANTS

- 5.10 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.10.2 KEY BUYING CRITERIA

- 5.11 SUPPLY CHAIN ANALYSIS

- 5.12 TRADE ANALYSIS

- 5.12.1 IMPORT DATA FOR HS CODE 330690, 2020-2024

- 5.12.2 EXPORT DATA FOR HS CODE 330690, 2020-2024

- 5.13 REGULATORY ANALYSIS

- 5.13.1 REGULATORY FRAMEWORK

- 5.13.1.1 North America

- 5.13.1.1.1 US

- 5.13.1.2 European Union

- 5.13.1.3 Asia Pacific

- 5.13.1.3.1 China

- 5.13.1.1 North America

- 5.13.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.1 REGULATORY FRAMEWORK

- 5.14 PATENT ANALYSIS

- 5.14.1 PATENT PUBLICATION TRENDS FOR ORAL RINSES MARKET

- 5.14.2 JURISDICTION ANALYSIS: TOP APPLICANTS FOR PATENTS IN ORAL RINSES MARKET

- 5.14.3 LIST OF MAJOR PATENTS

- 5.15 KEY CONFERENCES & EVENTS, 2025-2026

- 5.16 ADJACENT MARKET ANALYSIS

- 5.17 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.18 UNMET NEEDS/END-USER EXPECTATIONS

- 5.18.1 UNMET NEEDS

- 5.18.2 END-USER EXPECTATIONS

- 5.19 IMPACT OF AI/GEN AI ON ORAL RINSES MARKET

- 5.20 CASE STUDY ANALYSIS

- 5.20.1 CAPHOSOL ORAL RINSE TO EFFECTIVELY MANAGE CHEMOTHERAPY-INDUCED ORAL MUCOSITIS

- 5.20.2 ANTISPECTIC MOUTHWASHES TO PREVENT VENTILATOR-ASSOCIATED PNEUMONIA (VAP) AMONG MECHANICALLY VENTILATED PATIENTS

- 5.20.3 HERBAL MOUTHRINSE TO BE EFFECIVE FOR CHLORHEXIDINE WITHOUT ADVERSE EFFECTS

- 5.21 INVESTMENT & FUNDING SCENARIO

- 5.22 IMPACT OF 2025 US TARIFF ON ORAL RINSES MARKET

- 5.22.1 INTRODUCTION

- 5.22.2 KEY TARIFF RATES

- 5.22.3 KEY TARIFF RATES

- 5.22.4 PRICE IMPACT ANALYSIS

- 5.22.5 IMPACT ON COUNTRY/REGION

- 5.22.5.1 North America

- 5.22.5.1.1 US

- 5.22.5.2 Europe

- 5.22.5.3 Asia Pacific

- 5.22.5.1 North America

- 5.22.6 IMPACT ON END-USE INDUSTRIES

6 ORAL RINSES MARKET, BY PRODUCT TYPE

- 6.1 INTRODUCTION

- 6.2 THERAPEUTIC RINSES

- 6.2.1 INCREASING PREVALENCE OF ORAL DISEASES TO BOOST ADOPTION OF THERAPEUTIC RINSES

- 6.3 COSMETIC RINSES

- 6.3.1 RISE IN AESTHETIC CONSCIOUSNESS TO PROMOTE ADOPTION OF COSMETIC RINSES

- 6.4 OTHER RINSES

7 ORAL RINSES MARKET, BY INDICATION

- 7.1 INTRODUCTION

- 7.2 GENERAL ORAL HEALTH

- 7.2.1 GENERAL USE MOUTHWASHES TO REDUCE PLAQUE, FRESHEN BREATH, SUPPORT GUM HEALTH, AND ENHANCE ORAL CLEANLINESS

- 7.3 GINGIVITIS & PERIODONTAL DISEASES

- 7.3.1 WIDESPREAD PREVALENCE OF GUM-RELATED CONDITIONS AND HIGH DEMAND FOR NON-INVASIVE TREATMENTS TO DRIVE MARKET

- 7.4 HALITOSIS

- 7.4.1 RISING AESTHETIC CONSCIOUSNESS TO FUEL ADOPTION OF ORAL RINSES FOR BAD BREATH

- 7.5 DRY MOUTH

- 7.5.1 RISING GERIATRIC POPULATION WITH CHRONIC DISEASES TO PROPEL SEGMENT GROWTH

- 7.6 OTHER INDICATIONS

8 ORAL RINSES MARKET, BY DISTRIBUTION CHANNEL

- 8.1 INTRODUCTION

- 8.2 CONSUMER STORES

- 8.2.1 BROAD ACCESSIBILITY, IN-STORE MARKETING, AND SEASONAL PROMOTIONS TO INCREASE SALES IN CONSUMER STORE

- 8.3 RETAIL PHARMACIES & DENTAL DISPENSARIES

- 8.3.1 STRONG CLINICAL ENDORSEMENT AND INCREASED CONSUMER TRUST TO FUEL SALES OF ORAL RINSES

- 8.4 ONLINE DISTRIBUTION

- 8.4.1 RISE IN INTERNET USE, EVOLVED DIGITAL SHOPPING HABITS, AND CONVENIENCE OF DIRECT-TO-DOOR DELIVERY TO DRIVE MARKET

9 ORAL RINSES MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 9.2.2 US

- 9.2.2.1 US to dominate North American oral rinses market during forecast period

- 9.2.3 CANADA

- 9.2.3.1 Better network of dental professionals and robust healthcare infrastructure to propel market growth

- 9.3 EUROPE

- 9.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 9.3.2 GERMANY

- 9.3.2.1 High prevalence of edentulism and willingness to invest in advanced personal care products to augment market growth

- 9.3.3 UK

- 9.3.3.1 Rising geriatric population and increasing demand for oral hygiene products to encourage market growth

- 9.3.4 FRANCE

- 9.3.4.1 Persistent burden of dental diseases and favorable government initiatives to spur market growth

- 9.3.5 ITALY

- 9.3.5.1 Aging demographic and prevalence of chronic dental diseases to aid market growth

- 9.3.6 SPAIN

- 9.3.6.1 Strong dental care infrastructure and high focus on quality healthcare to support market growth

- 9.3.7 SWITZERLAND

- 9.3.7.1 Focus on high standard of living to drive popularity of advanced oral hygiene products

- 9.3.8 POLAND

- 9.3.8.1 Strong public healthcare system and wider access to high-quality dental care products to propel market growth

- 9.3.9 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 9.4.2 CHINA

- 9.4.2.1 Focus on oral hygiene and high burden of age-related dental conditions to fuel demand for preventive oral care products

- 9.4.3 JAPAN

- 9.4.3.1 Strong dental health awareness and presence of key players to augment market growth

- 9.4.4 INDIA

- 9.4.4.1 Increasing awareness about dental health and growing consumer purchasing power to support market growth

- 9.4.5 AUSTRALIA

- 9.4.5.1 Favorable government initiatives and high incidence of dental diseases to accelerate market growth

- 9.4.6 SOUTH KOREA

- 9.4.6.1 Rising disposable income and increasing demand for advanced dental care solutions to favor market growth

- 9.4.7 REST OF ASIA PACIFIC

- 9.5 LATIN AMERICA

- 9.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 9.5.2 BRAZIL

- 9.5.2.1 High rate of urbanization to sustain demand for quality oral care products

- 9.5.3 MEXICO

- 9.5.3.1 Easy access to modern dental clinics, pharmacies, and e-commerce platforms to aid market growth

- 9.5.4 REST OF LATIN AMERICA

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 EASY AVAILABILITY OF ORAL CARE PRODUCTS THROUGH URBAN CONVENIENCE STORES AND E-COMMERCE TO DRIVE MARKET

- 9.6.2 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 9.7 GCC COUNTRIES

- 9.7.1 INCREASING DEMAND FOR ADAVNCED DENTAL CARE SERVICES TO AUGMENT MARKET GROWTH

- 9.7.2 MACROECONOMIC OUTLOOK FOR GCC COUNTRIES

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 10.2.1 OVERVIEW OF MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN ORAL RINSES MARKET

- 10.3 REVENUE ANALYSIS, 2020-2024

- 10.4 MARKET SHARE ANALYSIS, 2024

- 10.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- 10.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.5.5.1 Company footprint

- 10.5.5.2 Region footprint

- 10.5.5.3 Product type footprint

- 10.5.5.4 Indication footprint

- 10.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 RESPONSIVE COMPANIES

- 10.6.3 DYNAMIC COMPANIES

- 10.6.4 STARTING BLOCKS

- 10.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.6.5.1 Detailed list of key startups/SMEs

- 10.6.5.2 Competitive benchmarking of key startups/SMEs

- 10.7 COMPANY VALUATION & FINANCIAL METRICS

- 10.7.1 FINANCIAL METRICS

- 10.7.2 COMPANY VALUATION

- 10.8 BRAND/PRODUCT COMPARISON

- 10.9 R&D EXPENDITURE OF KEY PLAYERS

- 10.10 COMPETITIVE SCENARIO

- 10.10.1 PRODUCT LAUNCHES

- 10.10.2 DEALS

- 10.10.3 EXPANSIONS

- 10.10.4 OTHER DEVELOPMENTS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 KENVUE

- 11.1.1.1 Business overview

- 11.1.1.2 Products offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product launches

- 11.1.1.3.2 Deals

- 11.1.1.3.3 Expansions

- 11.1.1.4 MnM view

- 11.1.1.4.1 Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses & competitive threats

- 11.1.2 COLGATE-PALMOLIVE COMPANY

- 11.1.2.1 Business overview

- 11.1.2.2 Products offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Product launches

- 11.1.2.3.2 Deals

- 11.1.2.3.3 Other developments

- 11.1.2.4 MnM view

- 11.1.2.4.1 Right to win

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses & competitive threats

- 11.1.3 PROCTER & GAMBLE

- 11.1.3.1 Business overview

- 11.1.3.2 Products offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Product launches

- 11.1.3.3.2 Deals

- 11.1.3.4 MnM view

- 11.1.3.4.1 Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses & competitive threats

- 11.1.4 HALEON GROUP OF COMPANIES

- 11.1.4.1 Business overview

- 11.1.4.2 Products offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Product launches

- 11.1.4.3.2 Deals

- 11.1.4.3.3 Expansions

- 11.1.4.4 MnM view

- 11.1.4.4.1 Right to win

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses & competitive threats

- 11.1.5 UNILEVER

- 11.1.5.1 Business overview

- 11.1.5.2 Products offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Deals

- 11.1.5.4 MnM view

- 11.1.5.4.1 Right to win

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses & competitive threats

- 11.1.6 CHURCH & DWIGHT CO., INC.

- 11.1.6.1 Business overview

- 11.1.6.2 Products offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Product launches

- 11.1.6.3.2 Deals

- 11.1.7 LION CORPORATION

- 11.1.7.1 Business overview

- 11.1.7.2 Products offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Product launches

- 11.1.7.3.2 Deals

- 11.1.7.3.3 Expansions

- 11.1.8 AMWAY CORP.

- 11.1.8.1 Business overview

- 11.1.8.2 Products offered

- 11.1.9 SUNSTAR SUISSE S.A.

- 11.1.9.1 Business overview

- 11.1.9.2 Products offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Product launches

- 11.1.10 PERRIGO COMPANY PLC

- 11.1.10.1 Business overview

- 11.1.10.2 Products offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Deals

- 11.1.11 DABUR

- 11.1.11.1 Business overview

- 11.1.11.2 Products offered

- 11.1.11.3 Recent developments

- 11.1.11.3.1 Deals

- 11.1.12 HIMALAYA WELLNESS COMPANY

- 11.1.12.1 Business overview

- 11.1.12.2 Products offered

- 11.1.13 KAO CORPORATION

- 11.1.13.1 Business overview

- 11.1.13.2 Products offered

- 11.1.14 OPELLA HEALTHCARE GROUP SAS

- 11.1.14.1 Business overview

- 11.1.14.2 Products offered

- 11.1.14.3 Recent developments

- 11.1.14.3.1 Deals

- 11.1.15 SMARTMOUTH ORAL HEALTH LABORATORIES

- 11.1.15.1 Business overview

- 11.1.15.2 Products offered

- 11.1.15.3 Recent developments

- 11.1.15.3.1 Product launches

- 11.1.1 KENVUE

- 11.2 OTHER PLAYERS

- 11.2.1 DENTAID

- 11.2.2 CLOSYS

- 11.2.3 SCANDERRA GMBH

- 11.2.4 PEARLIE WHITE

- 11.2.5 WILD

- 11.2.6 BOKA

- 11.2.7 PERFORA

- 11.2.8 SALT ORAL CARE

- 11.2.9 ORABIO

- 11.2.10 LUMINEUX

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS