|

시장보고서

상품코드

1808963

산업용 왁스 시장 : 용도별, 유형별, 형상별, 지역별 예측(-2030년)Industrial Wax Market by Type, Form, Application, and Region - Global Forecast to 2030 |

||||||

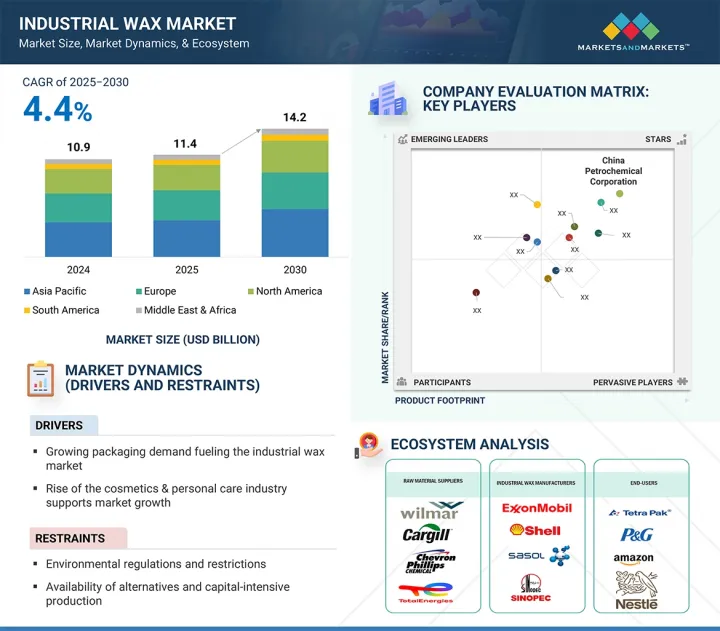

산업용 왁스 시장 규모는 4.4%의 연평균 복합 성장률(CAGR)로 확대될 전망이며, 2025년 114억 달러에서 2030년에는 142억 달러로 성장할 것으로 예측됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2021-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 검토 단위 | 금액(100만 달러)/킬로톤 |

| 부문 | 용도별, 유형별, 형상별, 지역별 |

| 대상 지역 | 북미, 아시아태평양, 유럽, 중동, 아프리카, 남미 |

산업용 왁스 시장은 주택용, 상업용, 산업용에 상관없이 고객이 고성능, 친환경 에너지 절약 솔루션을 찾고 있기 때문에 성장세를 유지하고 있습니다. 개발된 산업용 왁스 제품은 단열 특성, 내습성, 표면 보호 기능과 함께 내구성이 강화되어 포장, 코팅, 화장품, 접착제 용도로 사용이 가능합니다.

제조업계는 현재 지속가능하고 재활용가능한 재료의 사용을 추진하고 있으며 환경과 성능 기준을 모두 충족하는 바이오베이스 및 합성 대체 재료가 요구되고 있습니다. 엄격한 가공 방법과 독자적인 처방을 도입함으로써 기업은 제품의 품질과 사용 편의성을 향상시키고 있습니다. 규정을 준수해야 하는 기업의 경우 산업용 왁스는 귀중한 화합물이며 제품에 시각적 개선뿐만 아니라 실용적인 프리미엄 기능을 제공합니다.

에멀젼과 액체가 가장 급성장하는 이유는 생산자가 VOC, 작업자 안전 및 소방법 규칙을 충족하기 위해 용매 시스템에서 수성 시스템으로 축발을 옮기기 때문입니다. 에멀젼과 액체는 종이 및 포장, 섬유, 목재, 건축용의 수성 코팅제, 접착제, 첨가제에의 주입, 계량, 분산이 용이하고, 처리 온도의 저하, 에너지의 절약, 엄격한 공정 관리가 가능하게 됩니다. 폭발적인 전자상거래 포장, 식품과 접촉하는 종이, 고속 디지털 인쇄는 왁스 에멀젼이 제공하는 발수성, 열 밀봉성, 장벽 코팅에 대한 수요를 높이고 있습니다. 폴리머와 왁스의 하이브리드 화학, 바이오 원료, 나노에멀젼 기술의 진보는 필름의 성능과 적합성을 향상시키고, 이용 사례를 확대하며, 최종 시장에서의 채용을 가속화하고 있습니다.

화장품 및 퍼스널케어 분야는 스킨 케어, 헤어 케어, 그루밍 제품의 세계적인 수요 증가에 견인되어 산업용 왁스 시장에서 가장 빠르게 확대되는 용도 카테고리가 될 것으로 예측되고 있습니다. 왁스는 립크림, 로션, 크림, 마스카라 등의 처방에서 에몰리언트제, 구조제, 트랜스포터로서 널리 이용되고 있습니다. 자연적이고 지속 가능한 성분으로의 전환은 석유 유래의 대체품으로 바이오베이스와 합성 왁스에 대한 관심이 높아지고 있습니다. 게다가 가처분 소득 증가, 도시화, 개인 정리에 대한 의식 증가(특히 신흥 시장)로 소비자층이 확대되고 있습니다. 제품의 질감과 다기능 처방의 진보로 고급 화장품에 특수 왁스의 배합이 증가하고 있습니다.

2024년 아시아태평양은 산업용 왁스의 최대 시장이었습니다. 중국, 인도, 베트남, 인도네시아 등 아시아태평양의 주요 경제 국가들이 급속히 도시화되고 인프라 정비에 박차가 걸려 산업 왁스에 대한 수요가 높아지고 있습니다. 산업용 왁스는 코팅제, 열간압연제, 단열 제품, 접착제 등 다양한 건축 관련 용도 분야에 사용됩니다. 2019-2025년 약 1조 4,000억 달러의 투자를 예정하고 있습니다. 이 거대 투자는 건축자재 소비에 박차가 걸릴 것으로 예측됩니다. 이 지역은 또한 낮은 생산 비용, 교육된 노동력, 건설, 산업화, 자동차 분야에서 성장하는 외국 투자의 혜택을 받고 있습니다.

또한 아시아태평양 패키징 산업, 특히 중국과 인도에서는 전자상거래와 FMCG(Fast-Moving Consumer Goods) 산업이 빠른 속도로 성장하고 있기 때문에 강력한 성장을 이루고 있습니다. 산업용 왁스(파라핀 및 합성 시스템)는 골판지 상자 코팅, 라이너 보드, 보호 필름 등의 포장 제품에 널리 사용됩니다. 예를 들어 2023년 중국 전자상거래 시장은 3조 달러를 넘어선다.

대상 기업 : Exxon Mobil Corporation(미국), Shell plc(영국), Sasol(남아프리카), Numaligarh Refinery Limited(인도), Petrobras(브라질), Moeve(스페인), China Petroleum &Chemical Corporation(중국), HF Sinclair Corporation(미국), Calumet, Inc. 본 조사에는 산업용 왁스 시장에서 이러한 주요 기업의 상세한 경쟁 분석, 기업 프로파일, 최근 동향, 주요 시장 전략 등이 포함되어 있습니다.

조사 대상

이 조사 보고서는 산업용 왁스 시장을 유형별, 형상별, 용도별, 지역별로 분류하고 있습니다. 이 보고서의 조사 범위는 산업용 왁스 시장의 성장에 영향을 미치는 촉진요인, 저해 요인, 시장 성장 촉진요인, 과제에 대한 자세한 정보를 다룹니다. 주요 산업 진출 기업을 상세하게 분석하여 사업 개요, 제공 제품, 산업용 왁스 시장과 관련된 파트너십, 제휴, 합병, 인수, 제품 출시, 사업 확대 등 주요 전략에 대한 인사이트를 제공합니다. 이 보고서는 산업용 왁스 시장 생태계의 미래 신흥 기업의 경쟁 분석을 다룹니다.

이 보고서는 전체 산업용 왁스 시장과 하위 부문 수익의 가장 가까운 근사치에 대한 정보를 시장 리더 및 신규 참가자에게 제공합니다. 이 보고서는 이해관계자가 경쟁 구도를 이해하고 비즈니스를 더 잘 파악하기 위한 고려사항을 심화하고 적절한 시장 진출 전략을 계획하는 데 도움이 됩니다. 본 보고서는 이해관계자가 시장의 박동을 이해하고 주요 시장 성장 촉진요인 및 억제요인과 과제 및 기회에 관한 정보를 제공하는 데 도움을 줍니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요 인사이트

제5장 시장 개요

- 서문

- 시장 역학

- 고객 사업에 영향을 주는 동향 및 혼란

- 생태계 분석

- 밸류체인 분석

- 관세 및 규제 상황

- 가격 분석

- 무역 분석

- 기술 분석

- 특허 분석

- 주된 회의 및 이벤트(2025-2026년)

- 사례 연구 분석

- 투자 및 자금조달 시나리오

- 생성형 AI 및 AI가 산업용 왁스 시장에 미치는 영향

- Porter's Five Forces 분석

- 주요 이해관계자 및 구매 기준

- 거시경제 분석

- 미국 관세가 산업용 왁스 시장에 미치는 영향(2025년)

제6장 산업용 왁스 시장 : 용도별

- 서문

- 양초

- 포장

- 코팅 및 연마

- 핫멜트 접착제

- 타이어 및 고무

- 화장품 및 퍼스널케어

- 식품 및 의약품

- 기타

제7장 산업용 왁스 시장 : 유형별

- 서문

- 화석 유래 왁스

- 합성 왁스

- 바이오 베이스 왁스

제8장 산업용 왁스 시장 : 형상별

- 서문

- 고체

- 에멀젼 및 액체

- 분말

제9장 산업용 왁스 시장 : 지역별

- 서문

- 아시아태평양

- 중국

- 인도

- 일본

- 인도네시아

- 한국

- 기타

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 프랑스

- 영국

- 러시아

- 폴란드

- 기타

- 중동 및 아프리카

- GCC 국가

- 남아프리카

- 기타

- 남미

- 브라질

- 아르헨티나

- 기타

제10장 경쟁 구도

- 개요

- 주요 진입기업의 전략 및 강점

- 시장 점유율 분석

- 수익 분석

- 기업 평가 및 재무지표

- 제품 및 브랜드 비교

- 기업 평가 매트릭스 : 주요 진입기업(2024년)

- 기업 평가 매트릭스 : 스타트업 및 중소기업(2024년)

- 경쟁 시나리오

제11장 기업 프로파일

- 주요 진출기업

- CNPC

- EXXON MOBIL CORPORATION

- SHELL PLC

- SASOL

- NUMALIGARH REFINERY LIMITED

- PETROBRAS

- MOEVE

- CHINA PETROLEUM & CHEMICAL CORPORATION

- HF SINCLAIR CORPORATION

- CALUMET, INC.

- GANDHAR OIL REFINERY(INDIA) LIMITED

- 기타 기업

- EVONIK INDUSTRIES AG

- PROQUINAT

- THE BLAYSON GROUP LTD.

- THE INTERNATIONAL GROUP, INC.

- KERAX

- RAHA PARAFFIN CO.

- STRAHL & PITSCH

- THE DARENT WAX COMPANY LTD.

- SIWAX GROUP

- KOSTER KEUNEN

- SYNTOP CHEMICAL CO., LTD

- CIREBELLE

- ENI

- CANDLE SHACK

- MURPHY'S NATURALS

제12장 인접 시장 및 관련 시장

제13장 부록

AJY 25.09.16The industrial wax market is projected to grow from USD 11.4 billion in 2025 to USD 14.2 billion by 2030, at a CAGR of 4.4%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) / Volume (Kilotons) |

| Segments | Type, Form, Application, and Region |

| Regions covered | North America, Asia Pacific, Europe, Middle East & Africa, and South America |

Industrial wax market growth maintains its momentum because customers seek high-performance environmentally friendly energy-saving solutions across residential commercial and industrial applications. Industrial wax products developed include enhanced durability features together with thermal insulation properties, moisture resistance, and surface protection capabilities, which enable their use in packaging, coating, cosmetic, and adhesive applications.

The manufacturing industry is currently promoting sustainable and recyclable material use, prompting bio-based and synthetic alternative materials that meet both environmental and performance criteria. By implementing rigorous processing methods and tailored formulas, companies have increased quality and usability of products. For companies with requirements to comply with regulatory governance, industrial waxes are valuable compounds, providing premium practical functions as well as visual improvement to products.

"Emulsions & liquids to be the fastest-growing segment in the industrial wax market during the forecast period"

Emulsions & liquids are poised to grow the fastest because producers are pivoting from solvent-borne to water-based systems to meet VOC, worker safety, and fire code rules. These formats are easier to pump, meter, and disperse into aqueous coatings, adhesives, and additives for paper & packaging, textiles, wood, and construction, enabling lower processing temperatures, energy savings, and tighter process control. Explosive e-commerce packaging, food-contact paper, and high-speed digital printing raises demand for repulpable, heat-seal, and barrier coatings that wax emulsions deliver. Advances in polymer-wax hybrid chemistries, bio-based feedstocks, and nanoemulsion technology are improving film performance and compatibility, broadening use cases and accelerating adoption across end markets.

"The cosmetics and personal care segment to be the fastest-growing application"

The cosmetics and personal care segment is anticipated to be the most rapidly expanding application category in the industrial wax market, driven by increasing global demand for skincare, haircare, and grooming products. Waxes are extensively utilized as emollients, structural agents, and transporters in formulations such as lip balms, lotions, creams, and mascaras. The transition to natural and sustainable ingredients has intensified interest in bio-based and synthetic waxes as substitutes for petroleum-derived alternatives. Furthermore, rising disposable incomes, urbanization, and heightened awareness of personal grooming-particularly in emerging markets-are broadening the consumer demographic. The advancement of product textures and multifunctional formulations facilitates the increasing incorporation of specialized waxes in high-end cosmetic products.

"Asia Pacific to be the fastest-growing regional market for industrial wax during the forecast period"

Asia Pacific was the largest market for the industrial wax in 2024. Urbanization of major Asia Pacific economies like China, India, Vietnam, and Indonesia at a fast pace has fueled infrastructure development, thus propeling the requirement for industrial waxes. Industrial waxes find applications in various construction-related uses, such as coatings, polishes, insulation products, and adhesives. A good case in point is India's National Infrastructure Pipeline (NIP), which has scheduled investing around USD 1.4 trillion over the period 2019 to 2025. This mega investment can be anticipated to spur the consumption of building materials. The area also benefits from low production costs, an educated workforce, and foreign investments growing in the construction, industrialization, and automotive fields.

Additionally, the Asia Pacific region's packaging industry, particularly in China and India, is experiencing robust growth because of the fast pace of e-commerce and fast-moving consumer goods (FMCG) industries. Industrial waxes-paraffin and synthetic-are widely used in packaging products like corrugated box coatings, linerboards, and protective films. For instance, China's e-commerce market in 2023 crossed USD 3 trillion.

By Company Type: Tier 1: 25%, Tier 2: 42%, and Tier 3: 33%

By Designation: C-level Executives: 20%, Directors: 30%, and Other Designations: 50%

By Region: North America: 20%, Europe: 10%, Asia Pacific: 40%, South America: 10%, and Middle East & Africa 20%

Note: Other designations include sales, marketing, and product managers.

Tier 1: >USD 1 Billion; Tier 2: USD 500 million: 1 Billion; and Tier 3: <USD 500 million

Companies Covered: Exxon Mobil Corporation (US), Shell plc (UK), Sasol (South Africa), Numaligarh Refinery Limited (India), Petrobras (Brazil), Moeve (Spain), China Petroleum & Chemical Corporation (China), HF Sinclair Corporation (US), Calumet, Inc., and Gandhar Oil Refinery (India) are covered in the report. The study includes an in-depth competitive analysis of these key players in the industrial wax market, as well as their company profiles, recent developments, and key market strategies.

Research Coverage

This research report categorizes the industrial wax market based on Type (Fossil-based wax, Synthetic wax, and Bio-based wax), Form (Solid, Powdered, Emulsions & Liquids), Application (Candles, Packaging, Coatings & Polishing, Hot-melt Adhesive, Tire & Rubber, Cosmetics & Personal Care, Food, and Other Applications ) and Region (Asia Pacific, North America, Europe, South America, and Middle East & Africa). The report's scope covers detailed information regarding the drivers, restraints, challenges, and opportunities influencing the growth of the industrial wax market. A detailed analysis of the key industry players has been done to provide insights into their business overviews, products offered, and key strategies, such as partnerships, collaborations, mergers, acquisitions, product launches, and expansions, associated with the industrial wax market. This report covers a competitive analysis of upcoming startups in the industrial wax market ecosystem.

Reasons to Buy the Report

The report will offer the market leaders/new entrants information on the closest approximations of the revenue numbers for the overall industrial wax market and the subsegments. This report will help stakeholders understand the competitive landscape, gain more insights into positioning their businesses better, and plan suitable go-to-market strategies. The report will help stakeholders understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following points:

- Analysis of key drivers (Growing packaging demand fueling the industrial wax market, Growth of the cosmetics & personal care industry supports market growth, Rising adoption of waxes in the tire & rubber application, and Steady growth in candle production with product advancement across the globe), restraints (Environmental regulations and restrictions, and Availability of alternatives and capital-intensive production), opportunities (Sustainable and bio-based wax innovation, and Emerging markets and urbanization), and challenges (Price volatility of raw materials and Supply-demand imbalance, import dependency, and product performance consistency)

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and product & service launches in the industrial wax market

- Market Development: Comprehensive information about profitable markets-the report analyzes the industrial wax market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the industrial wax market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as Exxon Mobil Corporation (US), Shell plc (UK), Sasol (South Africa), Numaligarh Refinery Limited (India), Petrobras (Brazil), Moeve (Spain), China Petroleum & Chemical Corporation (China), HF Sinclair Corporation (US), Calumet, Inc., and Gandhar Oil Refinery (India), among others

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 RESEARCH LIMITATIONS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.3 BASE NUMBER CALCULATION

- 2.4 MARKET FORECAST APPROACH

- 2.4.1 SUPPLY SIDE

- 2.4.2 DEMAND SIDE

- 2.5 DATA TRIANGULATION

- 2.6 FACTOR ANALYSIS

- 2.7 RESEARCH ASSUMPTIONS

- 2.8 RESEARCH LIMITATIONS AND RISK ASSESSMENT

- 2.9 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN INDUSTRIAL WAX MARKET

- 4.2 ASIA PACIFIC INDUSTRIAL WAX MARKET, BY TYPE AND COUNTRY

- 4.3 INDUSTRIAL WAX MARKET, BY TYPE

- 4.4 INDUSTRIAL WAX MARKET, BY APPLICATION

- 4.5 INDUSTRIAL WAX MARKET, BY FORM

- 4.6 INDUSTRIAL WAX MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing demand in packaging industry

- 5.2.1.2 Expanding cosmetics & personal care industry

- 5.2.1.3 Rising adoption of waxes in tire & rubber application

- 5.2.1.4 Growing demand for candles as lifestyle and decorative products

- 5.2.2 RESTRAINTS

- 5.2.2.1 Environmental regulations and restrictions related to petroleum-based waxes

- 5.2.2.2 Availability of alternatives and capital-intensive production

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Development of sustainable and bio-based wax

- 5.2.3.2 Rapid urbanization and increased consumer spending on personal care and automobile products

- 5.2.4 CHALLENGES

- 5.2.4.1 Volatile raw material prices

- 5.2.4.2 Supply-demand imbalance, import dependency, and product performance consistency

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.3.1 YC SHIFT

- 5.3.2 YCC SHIFT

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 TARIFF AND REGULATORY LANDSCAPE

- 5.6.1 TARIFF ANALYSIS (HS CODE 2712)

- 5.6.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.6.3 REGULATIONS RELATED TO INDUSTRIAL WAX

- 5.7 PRICING ANALYSIS

- 5.7.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY APPLICATION, 2024

- 5.7.2 AVERAGE SELLING PRICE TREND, BY REGION, 2021-2025

- 5.8 TRADE ANALYSIS

- 5.8.1 EXPORT SCENARIO (HS CODE 2712)

- 5.8.2 IMPORT SCENARIO (HS CODE 2712)

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Fischer-tropsch synthesis

- 5.9.1.2 Solvent dewaxing

- 5.9.1.3 Hydrotreating technology

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 Emulsification technology

- 5.9.2.2 Blending and compounding equipment

- 5.9.3 ADJACENT TECHNOLOGIES

- 5.9.3.1 Hot-melt adhesive technology

- 5.9.3.2 Precision casting technology

- 5.9.1 KEY TECHNOLOGIES

- 5.10 PATENT ANALYSIS

- 5.10.1 INTRODUCTION

- 5.10.2 METHODOLOGY

- 5.10.3 TOP APPLICANT ANALYSIS

- 5.11 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.12 CASE STUDY ANALYSIS

- 5.12.1 ENHANCING COSMETIC FORMULATION PERFORMANCE WITH MICROCRYSTALLINE WAX INNOVATION

- 5.12.2 EXTENDING RUBBER PRODUCT LIFESPAN USING FISCHER-TROPSCH WAX-BASED PROTECTIVE SOLUTIONS

- 5.12.3 ENHANCING HOT-MELT ADHESIVE PERFORMANCE WITH MICROCRYSTALLINE WAX FORMULATION

- 5.13 INVESTMENT AND FUNDING SCENARIO

- 5.14 IMPACT OF GEN AI/AI ON INDUSTRIAL WAX MARKET

- 5.14.1 INTRODUCTION

- 5.15 PORTER'S FIVE FORCES ANALYSIS

- 5.15.1 THREAT OF NEW ENTRANTS

- 5.15.2 THREAT OF SUBSTITUTES

- 5.15.3 BARGAINING POWER OF SUPPLIERS

- 5.15.4 BARGAINING POWER OF BUYERS

- 5.15.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.16 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.16.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.16.2 BUYING CRITERIA

- 5.17 MACROECONOMIC ANALYSIS

- 5.17.1 INTRODUCTION

- 5.17.2 GDP TRENDS AND FORECASTS

- 5.18 IMPACT OF 2025 US TARIFF ON INDUSTRIAL WAX MARKET

- 5.18.1 INTRODUCTION

- 5.18.2 KEY TARIFF RATES

- 5.18.3 PRICE IMPACT ANALYSIS

- 5.18.4 IMPACT ON KEY COUNTRIES/REGIONS

- 5.18.4.1 US

- 5.18.4.2 Asia Pacific

- 5.18.4.3 Europe

- 5.18.5 END-USE INDUSTRY IMPACT

6 INDUSTRIAL WAX MARKET, BY APPLICATION

- 6.1 INTRODUCTION

- 6.2 CANDLES

- 6.2.1 INCREASING CONSUMER SPENDING AND CHANGING CONSUMPTION PATTERNS & LIFESTYLES TO DRIVE MARKET

- 6.3 PACKAGING

- 6.3.1 SIGNIFICANT GROWTH OF PACKAGING INDUSTRY TO FUEL MARKET GROWTH

- 6.4 COATINGS & POLISHING

- 6.4.1 STEADY GROWTH OF COATINGS INDUSTRY TO DRIVE DEMAND

- 6.5 HOT-MELT ADHESIVES

- 6.5.1 EXCELLENT SLIP PROPERTY OF INDUSTRIAL WAX TO DRIVE DEMAND

- 6.6 TIRE & RUBBER

- 6.6.1 RISING GLOBAL PRODUCTION OF TIRES AND RUBBER GOODS TO PROPEL DEMAND

- 6.7 COSMETICS & PERSONAL CARE

- 6.7.1 RISING GLOBAL DEMAND FOR COSMETICS & PERSONAL CARE PRODUCTS TO DRIVE MARKET

- 6.8 FOOD & PHARMACEUTICALS

- 6.8.1 RISING DEMAND FOR PACKAGED FOODS AND PHARMACEUTICAL GROWTH TO DRIVE MARKET

- 6.9 OTHER APPLICATIONS

7 INDUSTRIAL WAX MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 FOSSIL-BASED WAX

- 7.2.1 ABUNDANT AVAILABILITY, LOW COST, AND SUITABILITY WITH INDUSTRIAL APPLICATIONS TO DRIVE MARKET

- 7.3 SYNTHETIC WAX

- 7.3.1 GROWING PENETRATION OF SYNTHETIC WAX IN DEVELOPED COUNTRIES TO DRIVE MARKET

- 7.4 BIO-BASED WAX

- 7.4.1 RISING ENVIRONMENTAL CONCERNS, CHANGING CONSUMER PREFERENCES, AND FOCUS ON SUSTAINABLE DEVELOPMENT TO DRIVE DEMAND

8 INDUSTRIAL WAX MARKET, BY FORM

- 8.1 INTRODUCTION

- 8.2 SOLID

- 8.2.1 HIGH DEMAND IN TRADITIONAL APPLICATIONS TO DRIVE MARKET

- 8.3 EMULSIONS & LIQUIDS

- 8.3.1 VERSATILE APPLICATIONS IN EMERGING INDUSTRIES TO PROPEL MARKET

- 8.4 POWDERED

- 8.4.1 HIGH-PERFORMANCE APPLICATIONS IN SPECIALTY INDUSTRIES TO DRIVE MARKET

9 INDUSTRIAL WAX MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 ASIA PACIFIC

- 9.2.1 CHINA

- 9.2.1.1 Regulatory & industrial drivers shaping wax demand

- 9.2.2 INDIA

- 9.2.2.1 Expanding manufacturing base to accelerate demand

- 9.2.3 JAPAN

- 9.2.3.1 Growing cosmetics industry to drive demand

- 9.2.4 INDONESIA

- 9.2.4.1 Industrial growth and consumer markets to boost industrial wax demand

- 9.2.5 SOUTH KOREA

- 9.2.5.1 Surging beauty exports propel industrial wax demand

- 9.2.6 REST OF ASIA PACIFIC

- 9.2.1 CHINA

- 9.3 NORTH AMERICA

- 9.3.1 US

- 9.3.1.1 Steady growth in demand from several industrial applications to drive market

- 9.3.2 CANADA

- 9.3.2.1 Rising demand from candles, packaging, and personal care industries to drive market

- 9.3.3 MEXICO

- 9.3.3.1 Expanding industrial sector and high demand from candles and packaging applications to drive market

- 9.3.1 US

- 9.4 EUROPE

- 9.4.1 GERMANY

- 9.4.1.1 Ongoing transition toward electric vehicles to drive market

- 9.4.2 FRANCE

- 9.4.2.1 Rising demand in candle, cosmetics, and e-commerce packaging industries to fuel market growth

- 9.4.3 UK

- 9.4.3.1 Regulations and sustainability goals encouraging use of low-emission, eco-friendly waxes to drive market

- 9.4.4 RUSSIA

- 9.4.4.1 Booming cosmetics industry to drive market

- 9.4.5 POLAND

- 9.4.5.1 Surge in grave candle production to drive market

- 9.4.6 REST OF EUROPE

- 9.4.1 GERMANY

- 9.5 MIDDLE EAST & AFRICA

- 9.5.1 GCC COUNTRIES

- 9.5.1.1 Saudi Arabia

- 9.5.1.1.1 Vision 2030 to drive market

- 9.5.1.2 UAE

- 9.5.1.2.1 Rising local manufacturing of cosmetics and pharmaceuticals to drive market

- 9.5.1.3 Rest of GCC Countries

- 9.5.1.1 Saudi Arabia

- 9.5.2 SOUTH AFRICA

- 9.5.2.1 Growth of personal care & cosmetics industry to propel market

- 9.5.3 REST OF MIDDLE EAST & AFRICA

- 9.5.1 GCC COUNTRIES

- 9.6 SOUTH AMERICA

- 9.6.1 BRAZIL

- 9.6.1.1 Growing cosmetic industry to drive market

- 9.6.2 ARGENTINA

- 9.6.2.1 Popularity of natural and scented candles to fuel demand

- 9.6.3 REST OF SOUTH AMERICA

- 9.6.1 BRAZIL

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 10.3 MARKET SHARE ANALYSIS

- 10.4 REVENUE ANALYSIS

- 10.5 COMPANY VALUATION AND FINANCIAL METRICS

- 10.6 PRODUCT/BRAND COMPARISON

- 10.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- 10.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.7.5.1 Company footprint

- 10.7.5.2 Regional footprint

- 10.7.5.3 Type footprint

- 10.7.5.4 Form footprint

- 10.7.5.5 Application footprint

- 10.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- 10.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.8.5.1 Detailed list of key startups/SMEs

- 10.8.5.2 Competitive benchmarking of key startups/SMEs

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES

- 10.9.2 DEALS

- 10.9.3 EXPANSIONS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 CNPC

- 11.1.1.1 Business overview

- 11.1.1.2 MnM view

- 11.1.1.2.1 Key strengths/Right to win

- 11.1.1.2.2 Strategic choices

- 11.1.1.2.3 Weaknesses/Competitive threats

- 11.1.2 EXXON MOBIL CORPORATION

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Solutions/Services offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Product launches

- 11.1.2.4 MnM view

- 11.1.2.4.1 Key strengths/Right to win

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses/Competitive threats

- 11.1.3 SHELL PLC

- 11.1.3.1 Business overview

- 11.1.3.2 Products/Solutions/Services offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Product launches

- 11.1.3.3.2 Deals

- 11.1.3.4 MnM view

- 11.1.3.4.1 Key strengths/Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses/Competitive threats

- 11.1.4 SASOL

- 11.1.4.1 Business overview

- 11.1.4.2 Products/Solutions/Services offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Product launches

- 11.1.4.3.2 Others

- 11.1.4.4 MnM view

- 11.1.4.4.1 Key strengths/Right to win

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses/Competitive threats

- 11.1.5 NUMALIGARH REFINERY LIMITED

- 11.1.5.1 Business overview

- 11.1.5.2 Products/Solutions/Services offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Expansions

- 11.1.5.4 MnM view

- 11.1.5.4.1 Key strengths/Right to win

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses/Competitive threats

- 11.1.6 PETROBRAS

- 11.1.6.1 Business overview

- 11.1.6.2 Products/Solutions/Services offered

- 11.1.6.3 MnM view

- 11.1.6.3.1 Key strengths/Right to win

- 11.1.6.3.2 Strategic choices

- 11.1.6.3.3 Weaknesses/Competitive threats

- 11.1.7 MOEVE

- 11.1.7.1 Business overview

- 11.1.7.2 Products/Solutions/Services offered

- 11.1.7.3 MnM view

- 11.1.7.3.1 Key strengths/Right to win

- 11.1.7.3.2 Strategic choices

- 11.1.7.3.3 Weaknesses/Competitive threats

- 11.1.8 CHINA PETROLEUM & CHEMICAL CORPORATION

- 11.1.8.1 Business overview

- 11.1.8.2 Products/Solutions/Services offered

- 11.1.8.3 Recent developments

- 11.1.8.3.1 Deals

- 11.1.8.4 MnM view

- 11.1.8.4.1 Key strengths/Right to win

- 11.1.8.4.2 Strategic choices

- 11.1.8.4.3 Weaknesses/Competitive threats

- 11.1.9 HF SINCLAIR CORPORATION

- 11.1.9.1 Business overview

- 11.1.9.2 Products/Solutions/Services offered

- 11.1.9.3 MnM view

- 11.1.10 CALUMET, INC.

- 11.1.10.1 Business overview

- 11.1.10.2 Products/Solutions/Services offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Product launches

- 11.1.10.3.2 Deals

- 11.1.10.4 MnM view

- 11.1.11 GANDHAR OIL REFINERY (INDIA) LIMITED

- 11.1.11.1 Business overview

- 11.1.11.2 Products/Solutions/Services offered

- 11.1.11.3 MnM view

- 11.1.1 CNPC

- 11.2 OTHER PLAYERS

- 11.2.1 EVONIK INDUSTRIES AG

- 11.2.2 PROQUINAT

- 11.2.3 THE BLAYSON GROUP LTD.

- 11.2.4 THE INTERNATIONAL GROUP, INC.

- 11.2.5 KERAX

- 11.2.6 RAHA PARAFFIN CO.

- 11.2.7 STRAHL & PITSCH

- 11.2.8 THE DARENT WAX COMPANY LTD.

- 11.2.9 SIWAX GROUP

- 11.2.10 KOSTER KEUNEN

- 11.2.11 SYNTOP CHEMICAL CO., LTD

- 11.2.12 CIREBELLE

- 11.2.13 ENI

- 11.2.14 CANDLE SHACK

- 11.2.15 MURPHY'S NATURALS

12 ADJACENT AND RELATED MARKET

- 12.1 INTRODUCTION

- 12.2 POLYETHYLENE WAX MARKET

- 12.2.1 MARKET DEFINITION

- 12.2.2 MARKET OVERVIEW

- 12.2.3 POLYETHYLENE WAX MARKET, BY PROCESS

- 12.2.4 POLYETHYLENE WAX MARKET, BY TYPE

- 12.2.5 POLYETHYLENE WAX MARKET, BY APPLICATION

- 12.2.6 POLYETHYLENE WAX MARKET, BY REGION

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS