|

시장보고서

상품코드

1808968

복강경 기구 시장 : 제품별, 용도별, 사용별, 최종 사용자별, 지역별 세계 예측(-2030년)Laparoscopic Instruments Market by Product (Laparoscope, Insufflator, Suction, Closure Device, Accessory), Application (General, Urology, Colorectal, Bariatric), Usage, End User (Hospital, Ambulatory Surgical Center), Region - Global Forecast to 2030 |

||||||

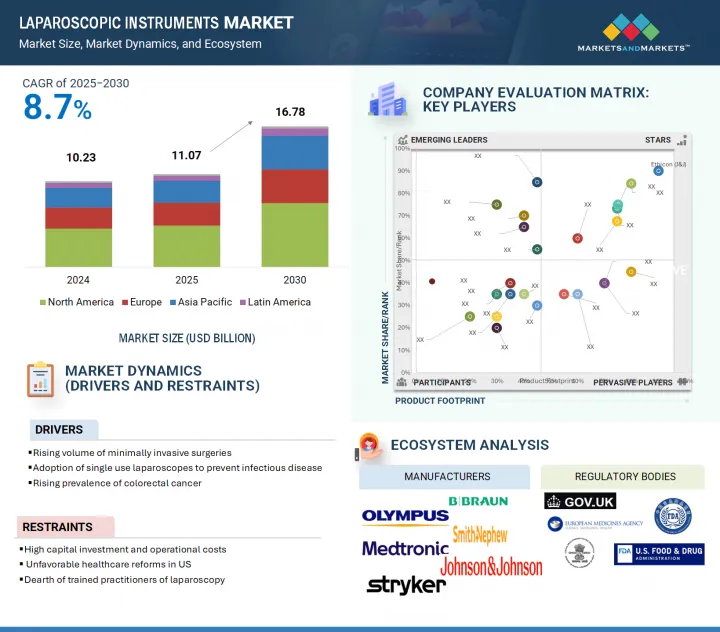

세계의 복강경 기구 시장 규모는 2025년 110억 7,000만 달러에서 2030년까지 167억 8,000만 달러에 이를 것으로 예상되며, 예측 기간에 CAGR는 8.7%를 나타낼 것으로 전망됩니다.

여러 요인이 시장 성장을 가속하고 있습니다. 이 성장을 뒷받침하는 주요 요인 중 하나는 저침습 수술 지향 증가로 절개 창의 축소, 수술 후 통증 경감, 입원 기간 단축, 회복 시간 단축 등의 이점이 평가되고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2024-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 10억 달러 |

| 부문 | 제품, 사용, 용도, 최종 사용자, 지역 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 라틴아메리카, 중동 및 아프리카 |

게다가 복강경하수술을 필요로 하는 대장암, 비만, 담낭질환의 세계적인 증가도 수요를 밀어 올리고 있습니다. 이미징, 에너지 기반 장치, 로봇 지원 등의 향상은 복강경 수술의 정확성 향상과 치료 성적 향상에 기여하며 시장의 급속한 보급을 더욱 뒷받침하고 있습니다. 의료비 증가, 개발도상국에서의 수술 인프라의 개량, 환자나 의료 종사자의 의식의 향상도 시장 확대의 큰 촉진요인이 되고 있습니다.

"제품별로 복강경 부문은 2024년 최대 시장 점유율을 차지했습니다."

저침습 수술 시 선명한 영상을 제공하는 중요한 역할을 하고 있기 때문에 복강경이 복강경 기구 중에서 가장 큰 시장 점유율을 차지하고 있습니다. 첨단 고해상도 복강경은 비뇨기과, 부인과 및 일반 수술을 포함한 다양한 전문 분야에서 복강경 수술의 사용이 증가하고 있기 때문에 높은 수요가 있습니다. 이러한 광범위한 채용은 연성 거울, 3D 비주얼라이제이션, HD/4K 이미징, 통합 카메라 시스템 등의 기술 혁신에 의해 추진되고 있으며, 수술의 정확성과 환자의 결과를 대폭 향상시키고 있습니다. 복강경 시장의 지위는 만성 질환 수술 건수 증가와 의료시설에서 이미징 시스템의 교체 및 업그레이드의 지속적인 요구에 의해 더욱 강화되고 있습니다. 복강경은 실시간 시각화와 진단 정확도 향상에 기여하기 때문에 여전히 현대 수술에 필수적인 존재입니다.

"용도별로 일반 수술 부문은 2024년 최대 시장 점유율을 차지했습니다."

일반 수술은 복강경 기구 시장을 선도하고 있습니다. 이것은 주로 탈장 수복, 맹장, 담낭 적출, 장 절제 등을 포함한 광범위한 절차가 낮은 침습 방식으로 이루어지는 것이 증가하고 있기 때문입니다. 일반 수술에서 복강경 기술에 대한 선호 증가는 더 작은 절개, 더 적은 수술 후 통증, 더 빠른 회복, 더 짧은 입원 기간 등의 이점 때문입니다. 위장질환, 담낭질환, 복부감염증의 세계적인 증가도 일반 수술의 수를 증가시키고 있습니다. 게다가 복강경 기술의 진보, 훈련을 받은 외과의사 증가, 지원적인 상환 정책이 보다 넓은 보급의 촉진에 도움이 되고 있습니다. 일반 수술에서 복강경 수술의 유연성과 일반적인 사용으로 복강경 수술은 시장 성장의 주인으로 확고한 지위를 구축하고 있습니다.

"미국이 북미의 복강경 기구 시장에서 가장 높은 CAGR을 나타낼 전망입니다."

여러 요인으로 인해 미국은 북미의 복강경 기구 시장에서 가장 높은 CAGR을 나타낼 것으로 예상됩니다. 일본의 선진 의료 시스템, 낮은 침습 수술의 높은 채용률, 지속적인 기술의 진보가 시장 성장의 주요 성장 촉진요인이 되고 있습니다. 복강경 수술은 비만, 대장암, 위장장애 등 만성질환의 유병률 증가로 더욱 퍼지고 있습니다. 대규모 R&D 투자와 주요 의료기기 기업의 존재, 유리한 규제 환경은 급속한 제품 혁신과 상업화를 더욱 강화하고 있습니다. 게다가 미국은 발달한 상환제도와 복강경 수술의 이점에 관한 환자나 의료 제공업체의 높은 의식으로부터도 혜택을 받고 있습니다.

이 보고서는 세계의 복강경 기구 시장에 대한 조사 분석을 통해 주요 성장 촉진요인과 억제요인, 경쟁 구도, 미래 동향 등의 정보를 제공합니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요한 지견

- 복강경 기구 시장 개요

- 아시아태평양의 복강경 기구 시장 : 용도별, 사용별

- 복강경 기구 시장 : 지리적 구성

- 복강경 기구 시장 : 지역 구성

- 복강경 기구 시장 : 선진국 시장과 신흥국 시장

제5장 시장 개요

- 서론

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

- 기술 분석

- 주요 기술

- 보완 기술

- 인접 기술

- 밸류체인 분석

- 생태계 분석

- 가격 설정 분석

- 복강경 기구의 평균 판매 가격 : 주요 기업별(2024년)

- 복강경 기구의 평균 판매 가격 동향 : 유형별(2022-2025년)

- 복강경 기구의 평균 판매 가격 동향 : 지역별(2022-2024년)

- 공급망 분석

- Porter's Five Forces 분석

- 주요 이해관계자와 구매 기준

- 규제 분석

- 규제 상황

- 규제기관, 정부기관, 기타 조직

- 무역 분석

- HS코드 300640의 수입 데이터(2019-2023년)

- HS코드 300640의 수출 데이터(2019-2023년)

- 주요 컨퍼런스 및 이벤트(2025-2026년)

- 고객사업에 영향을 주는 동향/혼란

- 특허 분석

- 복강경에 관한 특허 공보의 동향

- 복강경 기구 특허의 주요 출원자(기업/기관)

- 관할 분석 : 복강경 특허의 주요 출원국

- 사례 연구 분석

- ETHICON의 ENSEAL X1 TISSUE SEALER에 의한 자궁근종 치료

- AIRSTERIL의 광촉매 공기 청정기로 복강경 소독 유닛의 공기질 개량

- 원내 감염을 줄이기 위한 수술실에 있어서의 UV-C 소독 시스템

- 투자 및 자금조달 시나리오

- 상환 시나리오 분석

- 최종 사용자의 기대

- 복강경 기구 시장에 대한 AI/생성형 AI의 영향

- 복강경 기구 시장에 대한 미국 관세의 영향(2025년)

- 서론

- 주요 관세율

- 가격의 영향 분석

- 최종 이용 산업에 미치는 영향

제6장 복강경 기구 시장 : 제품별

- 서론

- 복강경

- 에너지 장치

- 폐쇄 장치

- 핸드 인스트루먼트

- 접근 장치

- 액세서리

- 주입기

- 흡인/세척 시스템

제7장 복강경 기구 시장 : 용도별

- 서론

- 재사용 가능한 복강경 기구

- 일회용 복강경 기구

제8장 복강경 기구 시장 : 용도별

- 서론

- 일반 외과

- 부인과

- 대장항문외과

- 비만수술

- 비뇨기과

- 소아외과

- 기타 용도

제9장 복강경 기구 시장 : 최종 사용자별

- 서론

- 병원 및 진료소

- 외래수술센터(ASC)

- 기타 최종 사용자

제10장 복강경 기구 시장 : 지역별

- 서론

- 북미

- 북미의 거시경제 전망

- 미국

- 캐나다

- 유럽

- 유럽의 거시 경제 전망

- 독일

- 프랑스

- 영국

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 아시아태평양의 거시 경제 전망

- 일본

- 중국

- 인도

- 호주

- 한국

- 기타 아시아태평양

- 라틴아메리카

- 라틴아메리카의 거시 경제 전망

- 브라질

- 멕시코

- 기타 라틴아메리카

- 중동 및 아프리카

- 중동 및 아프리카의 거시 경제 전망

- GCC 국가

- 기타 중동 및 아프리카

제11장 경쟁 구도

- 서론

- 주요 진입기업의 전략/강점

- 수익 분석(2020-2024년)

- 시장 점유율 분석(2024년)

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업의 평가 매트릭스 : 스타트업/중소기업(2024년)

- 기업 평가 및 재무 지표

- 재무지표

- 기업의 평가

- 주요 기업의 연구 개발비(2023년·2024년)

- 브랜드/제품 비교

- 경쟁 시나리오

제12장 기업 프로파일

- 주요 기업

- JOHNSON & JOHNSON

- MEDTRONIC

- OLYMPUS CORPORATION

- KARL STORZ SE & CO. KG

- STRYKER

- FUJIFILM HOLDINGS CORPORATION

- HOYA CORPORATION

- SMITH & NEPHEW

- COOK

- B. BRAUN SE

- VICTOR MEDICAL INSTRUMENTS CO., LTD.

- ENDOMED SYSTEMS GMBH

- SCHOLLY FIBEROPTIC GMBH

- BOSTON SCIENTIFIC CORPORATION

- 기타 기업

- CONMED CORPORATION

- CAPSOVISION, INC.

- COOPERCOMPANIES

- TELEFLEX INCORPORATED

- CARL ZEISS AG

- AMBU A/S

- LABORIE

- FORTIMEDIX SURGICAL

- DANTSCHKE MEDIZINTECHNIK GMBH & CO. KG

- MYELOTEC CO., LTD.

- RICHARD WOLF GMBH

- ZHEJIANG GEYI MEDICAL INSTRUMENT CO., LTD.

제13장 부록

KTH 25.09.17The global laparoscopic instruments market is projected to reach USD 16.78 billion by 2030 from USD 11.07 billion in 2025, at a CAGR of 8.7% during the forecast period. Several key factors drive the growth of the laparoscopic instruments market. One of the main factors favoring this growth is the upward trend toward minimally invasive surgical procedures, appreciated for benefits such as smaller incisions, less postoperative pain, shorter hospital stays, and faster recovery times.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Product, Usage, Application, End User, and Region |

| Regions covered | North America, Europe, APAC, LATAM, MEA |

Additionally, the global increase in cases of colorectal cancer, obesity, and gallbladder diseases requiring laparoscopic interventions also boosts demand. Improvements in imaging, energy-based devices, and robotic assistance contribute to increased precision and better outcomes in laparoscopic surgeries, further encouraging rapid adoption in the market. Higher healthcare spending, improved surgical infrastructure in developing countries, and greater awareness among patients and healthcare professionals are also significant drivers of market expansion.

"By product, the laparoscopes segment had the largest market share in 2024."

Because of their vital role in providing clear visuals during minimally invasive surgeries, laparoscopes hold the largest market share among laparoscopic instruments. Advanced, high-resolution laparoscopes are in high demand due to the increased use of laparoscopic procedures across various specialties, including urology, gynecology, and general surgery. This wider adoption has been driven by innovations such as flexible scopes, 3D visualization, HD and 4K imaging, and integrated camera systems, which significantly enhance surgical precision and patient outcomes. The market position of laparoscopes is further reinforced by the rising number of surgeries for chronic conditions and the ongoing need for healthcare facilities to replace or upgrade their imaging systems. They remain indispensable in modern surgical practices because of their contribution to improving real-time visualization and diagnostic accuracy.

"By application, the general surgery segment commanded the largest market share in 2024."

General surgery leads the laparoscopic instruments market, mainly because of the wide range of procedures it includes, such as hernia repairs, appendectomies, cholecystectomies, and bowel resections, which are increasingly being done through minimally invasive methods. The growing preference for laparoscopic techniques in general surgery is driven by benefits like smaller incisions, less postoperative pain, faster recovery, and shorter hospital stays. The global rise in gastrointestinal conditions, gallbladder problems, and abdominal infections has also increased the number of general surgical procedures. Additionally, advances in laparoscopic technology, the expanding pool of trained surgeons, and supportive reimbursement policies have helped promote wider adoption. The flexibility and common use of laparoscopy in general surgery firmly establish it as a key factor in market growth.

"The US is expected to grow at the highest CAGR in the North America laparoscopic instruments market."

Due to several key factors, the U.S. is expected to have the highest compound annual growth rate (CAGR) in the North American laparoscopic instruments market. The country's advanced healthcare system, high adoption of minimally invasive surgeries, and ongoing technological progress are major drivers of market growth. Laparoscopic procedures are becoming more widespread due to the increasing prevalence of chronic diseases such as obesity, colorectal cancer, and gastrointestinal disorders. Rapid product innovation and commercialization are further supported by substantial R&D investments, the presence of major medical device companies, and a favorable regulatory environment. Moreover, the United States benefits from a well-developed reimbursement system and a high level of awareness among patients and healthcare providers about the advantages of laparoscopic surgery.

A breakdown of the primary participants (supply-side) for the laparoscopic instruments market referred to in this report is provided below:

- By Company Type: Tier 1-35%, Tier 2-40%, and Tier 3-25%

- By Designation: C-level-45%, Director Level-35%, and Others-20%

- By Region: North America-27%, Europe-25%, Asia Pacific-30%, Latin America- 8%, Middle East & Africa-10% .

Prominent players in the laparoscopic instruments market are Olympus Corporation (Japan), Karl Storz SE & Co. KG (Germany), Johnson & Johnson (US), Fujifilm Holdings Corporation (Japan), Medtronic plc (Ireland), Stryker Corporation (US), B. Braun Melsungen AG (Germany), Becton, Dickinson and Company (US), Smith & Nephew plc (UK), Hoya Corporation (Japan), Scholly Fiberoptic GmbH (Germany), Victor Medical Instruments Co., Ltd. (China), Emedomed Systems GmbH (Germany), Richard Wolf GmbH (Germany), CONMED Corporation (US), Capsovision, Inc. (US), The Cooper Companies Inc. (US), Teleflex Incorporated (US), Carl Zeiss AG (Germany), Anthrex, Inc. (US), Laborie Medical Technologies, Inc. (Canada), Myolotec Inc. (US), Geyi Medical Instrument Co., Ltd. (China), Fortimedix Surgical B.V. (Netherlands), Dantschke Medizintechnik GmbH & Co. KG (Germany)

Research Coverage:

The report analyzes the laparoscopic instruments market and aims to estimate its market size and future growth potential based on various segments such as product, application, end user, and region. It also includes a competitive analysis of key industry players, detailing their company profiles, service offerings, recent developments, and main market strategies.

Reasons to Buy the Report

The report assists market leaders and new entrants by providing estimates of the revenue for the overall laparoscopic instruments market. It helps stakeholders understand the competitive landscape and gain insights to better position their businesses and develop suitable go-to-market strategies. Additionally, the report offers stakeholders an understanding of the market's pulse by detailing key drivers, restraints, challenges, and opportunities.

This report provides insights into the following pointers:

- Analysis of key drivers (rising volume of minimally invasive surgeries, adoption of single use laparoscopes to prevent infectious disease, rising prevalence of colorectal cancer), restraints (unfavourable healthcare reforms in US, dearth of trained practitioners of laparoscopy, high capital investment and operational costs), opportunities (expansion into emerging markets with growing healthcare infrastructure, growing healthcare market in emerging economies) and challenges (gaps in infrastructural support for laparoscopic procedures in developing countries, regulatory hurdles and compliance complexity).

- Market Penetration: It includes extensive information on products offered by the major players in the global the laparoscopic instruments market. The report includes various segments in product, application, end user and region.

- Product Enhancement/Innovation: Comprehensive details about new product launches and anticipated trends in the global laparoscopic instruments market.

- Market Development: Thorough knowledge and analysis of the profitable rising markets by product, application, end user, and region.

- Market Diversification: Comprehensive information about newly launched products, expanding markets, current advancements, and investments in the global laparoscopic instruments market.

- Competitive Assessment: Thorough evaluation of the market shares, growth plans, offerings of products, and capacities of the major competitors in the global laparoscopic instruments market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 LAPAROSCOPIC INSTRUMENTS MARKET SEGMENTATION & REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key secondary data sources

- 2.1.1.2 Key sources of secondary data

- 2.1.1.3 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key primary data sources

- 2.1.2.2 Objectives of primary research

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Key industry insights

- 2.1.2.5 Breakdown of primaries

- 2.1.3 MARKET SIZE ESTIMATION

- 2.1.4 SUPPLY-SIDE ANALYSIS (REVENUE SHARE ANALYSIS)

- 2.1.5 PARENT MARKET APPROACH

- 2.1.6 COMPANY PRESENTATIONS AND PRIMARY INTERVIEWS

- 2.1.7 DEMAND-SIDE ANALYSIS

- 2.1.8 TOP-DOWN APPROACH (BASED ON UTILIZATION RATE AND ADOPTION PATTERN)

- 2.1.1 SECONDARY DATA

- 2.2 DATA TRIANGULATION

- 2.3 RESEARCH LIMITATIONS

- 2.3.1 SCOPE-RELATED LIMITATIONS

- 2.3.2 METHODOLOGY-RELATED LIMITATIONS

- 2.4 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 LAPAROSCOPIC INSTRUMENTS MARKET OVERVIEW

- 4.2 ASIA PACIFIC: LAPAROSCOPIC INSTRUMENTS MARKET, BY APPLICATION AND USAGE

- 4.3 LAPAROSCOPIC INSTRUMENTS MARKET: GEOGRAPHIC MIX

- 4.4 LAPAROSCOPIC INSTRUMENTS MARKET: REGIONAL MIX

- 4.5 LAPAROSCOPIC INSTRUMENTS MARKET: DEVELOPED VS. EMERGING MARKETS

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing adoption of minimally invasive surgeries over open surgeries

- 5.2.1.2 Rising adoption of single-use laparoscopic instruments

- 5.2.1.3 Growing prevalence of colorectal cancer

- 5.2.2 RESTRAINTS

- 5.2.2.1 Unfavorable healthcare reforms

- 5.2.2.2 Dearth of trained professionals

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Improving healthcare markets in emerging economies

- 5.2.3.2 Technological advancements and innovations in laparoscopic instruments

- 5.2.4 CHALLENGES

- 5.2.4.1 Regulatory hurdles and compliance complexity

- 5.2.1 DRIVERS

- 5.3 TECHNOLOGY ANALYSIS

- 5.3.1 KEY TECHNOLOGIES

- 5.3.1.1 High-definition and 4K imaging systems

- 5.3.2 COMPLEMENTARY TECHNOLOGIES

- 5.3.2.1 Surgical navigation and imaging software

- 5.3.3 ADJACENT TECHNOLOGIES

- 5.3.3.1 Robotic surgical platforms

- 5.3.1 KEY TECHNOLOGIES

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- 5.5.1 ROLE IN ECOSYSTEM

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE OF LAPAROSCOPIC INSTRUMENTS, BY KEY PLAYER, 2024

- 5.6.2 AVERAGE SELLING PRICE TREND OF LAPAROSCOPIC INSTRUMENTS, BY TYPE, 2022-2025

- 5.6.3 AVERAGE SELLING PRICE TREND OF LAPAROSCOPIC INSTRUMENTS, BY REGION, 2022-2024

- 5.7 SUPPLY CHAIN ANALYSIS

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- 5.8.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.8.2 BARGAINING POWER OF SUPPLIERS

- 5.8.3 BARGAINING POWER OF BUYERS

- 5.8.4 THREAT OF SUBSTITUTES

- 5.8.5 THREAT OF NEW ENTRANTS

- 5.9 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.9.2 KEY BUYING CRITERIA

- 5.10 REGULATORY ANALYSIS

- 5.10.1 REGULATORY LANDSCAPE

- 5.10.1.1 North America

- 5.10.1.1.1 US

- 5.10.1.1.2 Canada

- 5.10.1.2 Europe

- 5.10.1.3 Asia Pacific

- 5.10.1.3.1 Japan

- 5.10.1.3.2 China

- 5.10.1.3.3 India

- 5.10.1.4 Latin America

- 5.10.1.5 Middle East & Africa and GCC Countries

- 5.10.1.1 North America

- 5.10.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10.1 REGULATORY LANDSCAPE

- 5.11 TRADE ANALYSIS

- 5.11.1 IMPORT DATA FOR HS CODE 300640, 2019-2023

- 5.11.2 EXPORT DATA FOR HS CODE 300640, 2019-2023

- 5.12 KEY CONFERENCES & EVENTS, 2025-2026

- 5.13 TRENDS/DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

- 5.14 PATENT ANALYSIS

- 5.14.1 PATENT PUBLICATION TRENDS FOR LAPAROSCOPES

- 5.14.2 TOP APPLICANTS (COMPANIES/INSTITUTIONS) FOR LAPAROSCOPIC INSTRUMENT PATENTS

- 5.14.3 JURISDICTION ANALYSIS: TOP APPLICANTS (COUNTRIES) FOR LAPAROSCOPIC PATENTS

- 5.15 CASE STUDY ANALYSIS

- 5.15.1 ETHICON'S ENSEAL X1 TISSUE SEALER TO TREAT UTERINE FIBROIDS

- 5.15.2 AIR QUALITY TO IMPROVE IN LAPAROSCOPIC DISINFECTION UNITS WITH AIRSTERIL PHOTO-CATALYTIC AIR PURIFIERS

- 5.15.3 UV-C DISINFECTION SYSTEMS IN OPERATING THEATRES TO REDUCE HOSPITAL-ACQUIRED INFECTIONS

- 5.16 INVESTMENT & FUNDING SCENARIO

- 5.17 REIMBURSEMENT SCENARIO ANALYSIS

- 5.18 END-USER EXPECTATIONS

- 5.19 IMPACT OF AI/GEN AI ON LAPAROSCOPIC INSTRUMENTS MARKET

- 5.20 IMPACT OF 2025 US TARIFF ON LAPARSCOPIC INSTRUMENTS MARKET

- 5.20.1 INTRODUCTION

- 5.20.2 KEY TARIFF RATES

- 5.20.3 PRICE IMPACT ANALYSIS

- 5.20.4 IMPACT ON END-USE INDUSTRIES

6 LAPAROSCOPIC INSTRUMENTS MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- 6.2 LAPAROSCOPES

- 6.2.1 VIDEO LAPAROSCOPES

- 6.2.1.1 Delivery of brighter and higher-quality images of mucosal surface to propel adoption

- 6.2.2 FIBER LAPAROSCOPES

- 6.2.2.1 Affordability and operational simplicity to aid adoption in resource-limited environments and basic diagnostic procedures

- 6.2.1 VIDEO LAPAROSCOPES

- 6.3 ENERGY DEVICES

- 6.3.1 INCREASING DEMAND FOR REUSABLE MONOPOLAR AND BIPOLAR COAGULATION ENERGY DEVICES TO BOOST MARKET GROWTH

- 6.4 CLOSURE DEVICES

- 6.4.1 TECHNOLOGICAL ADVANCEMENTS AND PRODUCT INNOVATIONS TO FUEL MARKET GROWTH

- 6.5 HAND INSTRUMENTS

- 6.5.1 RISING NUMBER OF GENERAL LAPAROSCOPIC SURGERIES TO FAVOR MARKET GROWTH

- 6.6 ACCESS DEVICES

- 6.6.1 ACCESS DEVICES TO CREATE AND MAINTAIN PORTS OF ENTRANCE FOR OTHER INSTRUMENTS

- 6.7 ACCESSORIES

- 6.7.1 INCREASING SURGICAL VOLUMES TO SUPPORT MARKET GROWTH

- 6.8 INSUFFLATORS

- 6.8.1 RISING NUMBER OF LAPAROSCOPIC SURGERIES TO BOOST DEMAND FOR CO2 INSUFFLATORS

- 6.9 SUCTION/IRRIGATION SYSTEMS

- 6.9.1 POPULARITY OF INTEGRATED FLUID MANAGEMENT SYSTEMS FOR LAPAROSCOPIC PROCEDURES TO DRIVE MARKET

7 LAPAROSCOPIC INSTRUMENTS MARKET, BY USAGE

- 7.1 INTRODUCTION

- 7.2 REUSABLE LAPAROSCOPIC INSTRUMENTS

- 7.2.1 HIGH DURABILITY, COST-EFFECTIVENESS, AND BETTER COMPATIBILITY TO FUEL MARKET GROWTH

- 7.3 DISPOSABLE LAPAROSCOPIC INSTRUMENTS

- 7.3.1 RISING EMPHASIS ON INFECTION PREVENTION AND INCREASING NUMBER OF OUTPATIENT PROCEDURES TO PROPEL MARKET GROWTH

8 LAPAROSCOPIC INSTRUMENTS MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 GENERAL SURGERY

- 8.2.1 PREFERENCE FOR LAPAROSCOPY TECHNIQUES TO INCREASE FOR APPENDECTOMY, CHOLECYSTECTOMY, AND HERNIA REPAIR

- 8.3 GYNECOLOGICAL SURGERY

- 8.3.1 INCREASING DEMAND FOR MINIMALLY INVASIVE GYNECOLOGY SURGERIES TO DRIVE MARKET

- 8.4 COLORECTAL SURGERY

- 8.4.1 INCREASING INCIDENCE OF COLORECTAL CANCER TO AID MARKET GROWTH

- 8.5 BARIATRIC SURGERY

- 8.5.1 GROWING PREVALCENCE OF OBESITY TO AUGMENT MARKET GROWTH

- 8.6 UROLOGICAL SURGERY

- 8.6.1 INCREASING INCIDENCE OF CHRONIC UROLOGICAL DISEASES TO DRIVE MARKET

- 8.7 PEDIATRIC SURGERY

- 8.7.1 PREFERENCE FOR MINIMALLY INVASIVE TECHNIQUES IN TREATING CONGENITAL CONDITIONS IN CHILDREN TO BOOST MARKET GROWTH

- 8.8 OTHER APPLICATIONS

9 LAPAROSCOPIC INSTRUMENTS MARKET, BY END USER

- 9.1 INTRODUCTION

- 9.2 HOSPITALS & CLINICS

- 9.2.1 HIGH INVESTMENTS FROM GOVERNMENT BODIES AND PRIVATE INVESTORS TO DRIVE MARKET

- 9.3 AMBULATORY SURGICAL CENTERS

- 9.3.1 INCREASED ADOPTION OF OUTPATIENT SURGERIES TO BOOST MARKET GROWTH

- 9.4 OTHER END USERS

10 LAPAROSCOPIC INSTRUMENTS MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 10.2.2 US

- 10.2.2.1 US to dominate global laparoscopic instruments market during forecast period

- 10.2.3 CANADA

- 10.2.3.1 Rising incidence of chronic diseases among geriatric population to fuel market growth

- 10.3 EUROPE

- 10.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 10.3.2 GERMANY

- 10.3.2.1 High incidence of cancer and stroke to propel market growth

- 10.3.3 FRANCE

- 10.3.3.1 Favorable health insurance system and increased adoption of minimally invasive surgical procedures to boost market growth

- 10.3.4 UK

- 10.3.4.1 Implementation of National Bowel Cancer Screening Program by NHS to support adoption of laparoscopes

- 10.3.5 ITALY

- 10.3.5.1 Rising prevalence of colorectal cancer to boost market growth

- 10.3.6 SPAIN

- 10.3.6.1 Superior reimbursement scenario for hemodialysis procedures to augment market growth

- 10.3.7 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 10.4.2 JAPAN

- 10.4.2.1 Rapid growth in geriatric population and innovations in laparoscopic surgeries to fuel market growth

- 10.4.3 CHINA

- 10.4.3.1 Rising government healthcare spending to drive adoption of laparoscopic instruments

- 10.4.4 INDIA

- 10.4.4.1 Healthcare infrastructural improvements and implementation of favorable government initiatives to support market growth

- 10.4.5 AUSTRALIA

- 10.4.5.1 Increasing obesity rates and rising number of bariatric surgeries to aid market growth

- 10.4.6 SOUTH KOREA

- 10.4.6.1 High geriatric population and increased number of surgical procedures to propel market growth

- 10.4.7 REST OF ASIA PACIFIC

- 10.5 LATIN AMERICA

- 10.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 10.5.2 BRAZIL

- 10.5.2.1 High demand for advanced surgical technologies to spur adoption of laparoscopic instruments

- 10.5.3 MEXICO

- 10.5.3.1 Increasing incidence of lifestyle-related disorders to augment market growth

- 10.5.4 REST OF LATIN AMERICA

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 10.6.2 GCC COUNTRIES

- 10.6.2.1 Increasing incidence of lifestyle-related disorders and growing disposable income to favor market growth

- 10.6.3 REST OF MIDDLE EAST & AFRICA

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.2.1 OVERVIEW OF MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN LAPAROSCOPIC INSTRUMENTS MARKET

- 11.3 REVENUE ANALYSIS, 2020-2024

- 11.4 MARKET SHARE ANALYSIS, 2024

- 11.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- 11.5.5 COMPANY FOOTPRINT: KEY PLAYERS 2024

- 11.5.5.1 Company footprint

- 11.5.5.2 Region footprint

- 11.5.5.3 Product footprint

- 11.5.5.4 Application footprint

- 11.5.5.5 Usability footprint

- 11.5.5.6 End-user footprint

- 11.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 DYNAMIC COMPANIES

- 11.6.3 RESPONSIVE COMPANIES

- 11.6.4 STARTING BLOCKS

- 11.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.6.5.1 Detailed list of key startups/SMEs

- 11.6.5.2 Competitive benchmarking of startups/SMEs

- 11.7 COMPANY VALUATION & FINANCIAL METRICS

- 11.7.1 FINANCIAL METRICS

- 11.7.2 COMPANY VALUATION

- 11.7.3 R&D EXPENDITURE OF KEY PLAYERS, 2023 VS. 2024

- 11.8 BRAND/PRODUCT COMPARISON

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 DEALS

- 11.9.3 EXPANSIONS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 JOHNSON & JOHNSON

- 12.1.1.1 Business overview

- 12.1.1.2 Products offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Deals

- 12.1.1.4 MnM view

- 12.1.1.4.1 Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses & competitive threats

- 12.1.2 MEDTRONIC

- 12.1.2.1 Business overview

- 12.1.2.2 Products offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Product launches

- 12.1.2.3.2 Deals

- 12.1.2.4 MnM view

- 12.1.2.4.1 Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses & competitive threats

- 12.1.3 OLYMPUS CORPORATION

- 12.1.3.1 Business overview

- 12.1.3.2 Products offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Product launches

- 12.1.3.3.2 Deals

- 12.1.3.3.3 Expansions

- 12.1.3.4 MnM view

- 12.1.3.4.1 Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses & competitive threats

- 12.1.4 KARL STORZ SE & CO. KG

- 12.1.4.1 Business overview

- 12.1.4.2 Products offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Deals

- 12.1.4.4 MnM view

- 12.1.4.4.1 Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses & competitive threats

- 12.1.5 STRYKER

- 12.1.5.1 Business overview

- 12.1.5.2 Products offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Product launches

- 12.1.5.3.2 Deals

- 12.1.5.3.3 Expansions

- 12.1.5.4 MnM view

- 12.1.5.4.1 Right to win

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses & competitive threats

- 12.1.6 FUJIFILM HOLDINGS CORPORATION

- 12.1.6.1 Business overview

- 12.1.6.2 Products offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Deals

- 12.1.7 HOYA CORPORATION

- 12.1.7.1 Business overview

- 12.1.7.2 Products offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Deals

- 12.1.8 SMITH & NEPHEW

- 12.1.8.1 Business overview

- 12.1.8.2 Products offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Deals

- 12.1.9 COOK

- 12.1.9.1 Business overview

- 12.1.9.2 Products offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Product launches

- 12.1.10 B. BRAUN SE

- 12.1.10.1 Business overview

- 12.1.10.2 Products offered

- 12.1.11 VICTOR MEDICAL INSTRUMENTS CO., LTD.

- 12.1.11.1 Business overview

- 12.1.11.2 Products offered

- 12.1.12 ENDOMED SYSTEMS GMBH

- 12.1.12.1 Business overview

- 12.1.12.2 Products offered

- 12.1.13 SCHOLLY FIBEROPTIC GMBH

- 12.1.13.1 Business overview

- 12.1.13.2 Products offered

- 12.1.14 BOSTON SCIENTIFIC CORPORATION

- 12.1.14.1 Business overview

- 12.1.14.2 Products offered

- 12.1.1 JOHNSON & JOHNSON

- 12.2 OTHER PLAYERS

- 12.2.1 CONMED CORPORATION

- 12.2.2 CAPSOVISION, INC.

- 12.2.3 COOPERCOMPANIES

- 12.2.4 TELEFLEX INCORPORATED

- 12.2.5 CARL ZEISS AG

- 12.2.6 AMBU A/S

- 12.2.7 LABORIE

- 12.2.8 FORTIMEDIX SURGICAL

- 12.2.9 DANTSCHKE MEDIZINTECHNIK GMBH & CO. KG

- 12.2.10 MYELOTEC CO., LTD.

- 12.2.11 RICHARD WOLF GMBH

- 12.2.12 ZHEJIANG GEYI MEDICAL INSTRUMENT CO., LTD.

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS