|

시장보고서

상품코드

1808971

포토닉스 시장 : 제품 유형별, 파장별, 용도별, 재료별, 최종 이용 산업별, 지역별 예측(-2030년)Photonics Market by Product Type (LED), Wavelength (Infrared, Visible), Material (Silicon, Glass), Application (Information & Communication Technology), End-use Industry (Industrial, Media & Telecommunication), & Region - Global Forecast to 2030 |

||||||

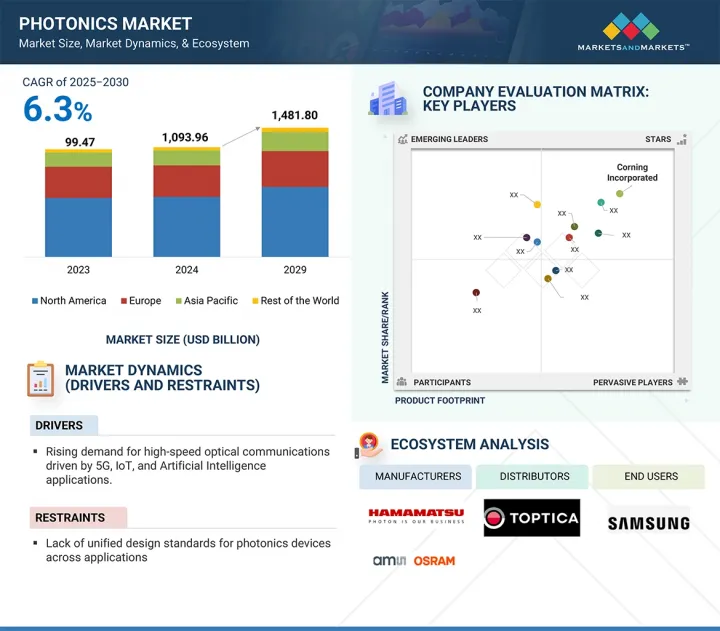

포토닉스 시장 규모는 예측 기간 동안 6.3%의 연평균 복합 성장률(CAGR)로 확대될 전망이며, 2025년 1조 939억 6,000만 달러에서 2030년에는 1조 4,818억 달러로 성장할 것으로 예측됩니다.

포토닉스 시장은 특히 5G 기술, 클라우드 컴퓨팅, 사물인터넷(IoT) 프로토콜 증가로 인한 광대역 통신 솔루션의 요구 증가가 원동력이 되고 있습니다. 이러한 발전에는 데이터 전송 속도를 향상시키는 광섬유 및 송수신기가 필요합니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2021-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 검토 단위 | 금액(100만 달러/10억 달러) |

| 부문 | 제품 유형별, 파장별, 용도별, 재료별, 최종 용도 산업별, 지역별 |

| 대상 지역 | 북미, 유럽, 중동, 아프리카, 남미 |

산업 제조 분야에서 레이저 및 광학 센서는 절단, 용접, 품질 관리 프로세스의 정확성을 향상시키고 Industry 4.0의 영향과 마찬가지로 자동 조립 라인의 상승에 기여합니다. 헬스케어에서는 적외선 분광법 및 바이오포토닉스와 같은 비침습적 진단 기술의 이용이 증가하고 있으며, 고령화 사회를 지원하는 시장 성장을 자극하고 있습니다. 게다가 소비자용 전자기기는 스마트폰, 증강현실(AR), 가상현실(VR) 기기 등의 제품에 대한 수요가 높습니다. 이 수요는 가시 파장 LED와 마이크로 LED 디스플레이의 필요성을 높이고 있습니다.

감지기, 센서 및 이미징 장치 분야는 예측 기간 동안 포토닉스 시장에서 가장 빠른 성장을 기록할 것으로 예측됩니다. 이 성장의 원동력은 자동차, 헬스케어, 가전, 방위, 산업 자동화 등 다양한 고성장 산업에서 널리 채용되고 있는 것입니다. 고정밀 스마트 시스템을 위한 포토닉 센서에 대한 의존도가 높아지고 있는 것은 다양한 용도로 실시간 데이터 취득 수요를 촉진하고 있습니다. 예를 들어 자동차 분야에서는 ADAS(선진운전지원시스템)와 완전 자율주행차의 출현으로 LiDAR 시스템, 적외선 검출기, 3D 이미징 센서의 생산량이 대폭 증가하고 있습니다. 이러한 기술은 장애물을 감지하고 지형을 스캔하며 모든 기상 조건에서 안전성을 높이기 위해 포토닉스에 의존합니다. 헬스케어에서는 광 일관성 조영술(OCT), 형광 이미징, 바이오포토닉 센서 등의 포토닉 이미징 장치가 이전보다 더 빠르고 정확한 질병을 진단할 수 있습니다. 근적외선(NIR)과 가시광선 모달리티 모두를 이용한 비침습적 이미징 및 실시간 모니터링은 수술 및 진단용 포인트 오브 케어 환경에서 필수적입니다. 세계 인구의 고령화와 만성 질환 증가에 따라 고급 진단 기능에 대한 수요가 확대될 것으로 예측됩니다.

유리는 뛰어난 광학 특성, 화학적 내구성 및 광범위한 용도 분야에서 다용도로 포토닉스 시장에서 가장 빠르게 성장하는 재료 분야입니다. 그 성장은 주로 고속 인터넷 서비스, 5G 네트워크, 장거리 데이터 전송 인프라를 가능하게 하는 광섬유 제조에 사용에 의해 초래됩니다. 세계 데이터 전송과 클라우드 컴퓨팅이 급속히 확대되고 있는 가운데, 통신사는 실리카 기반 유리의 낮은 광 감쇠와 높은 전송 효율의 혜택을 받는 광섬유 네트워크에 많은 투자를 해왔습니다. 또한, 유리는 이미징(안용), 센싱(포토닉), 레이저 용도의 고성능 렌즈, 기판, 프리즘, 도파로에 점점 이용되고 있습니다. 붕규산 유리, 석영 유리, 칼코게나이드 유리 등의 특수 유리는 높은 내열성, 자외선 및 적외선 투과성, 저분산성 등 다양한 광학 특성을 갖추고 있으며, 항공우주, 방위, 헬스케어, 산업용 레이저 등 다양한 특수 용도에 적합합니다. 유리 부품이 널리 받아들여지는 배경은 이미징 시스템 및 수술 기구와 같은 고정밀 의료기기의 상승을 포함합니다. 유리는 생체 적합성 및 치수 안정성으로 인해 제조업체에게 필수적입니다.

가시 파장 부문은 이미징, 디스플레이, 조명, 소비자용 전자기기 등 폭넓은 용도가 있기 때문에 포토닉스 시장에서 가장 빠른 성장을 기록할 것으로 예측되고 있습니다. 파장이 약 400-700나노미터인 가시광선은 인간의 상호작용을 촉진하는 가장 관련성이 높은 스펙트럼이며, 사람들의 일상생활에 사용되는 모든 용도 기술에 대한 통합을 가능하게 하기 쉽습니다. OLED, 마이크로 LED, 양자점 디스플레이는 전화, TV, 모니터, AR/VR 디스플레이를 견인하고 있습니다. 이러한 디스플레이 스크린 기술에 대한 확립된 수요가 가시광 포토닉 기술의 채용을 뒷받침하고 있습니다. 한국, 중국, 일본 등 일렉트로닉스와 디스플레이 시장에 익숙한 국가의 기업들은 새로운 디스플레이 기술의 가시광 포토닉스에 많은 투자를 하고 있습니다. 정부가 에너지 효율 지표를 요구하고 상업, 주택, 공공 인프라 프로젝트에 LED를 대량 도입하고 있기 때문에 LED(주로 가시광과 일부 적외광에 영향을 주는)를 포함한 고체 조명(SSL) 기술도 성장의 큰 원동력이 되고 있습니다.

조명은 포토닉스 시장에서 가장 빠르게 성장하는 용도 분야로 부상하고 있습니다. 이것은 에너지 효율적인 조명 광원의 채용 증가, 급속한 도시화, 탄소 중립을 목표로 하는 세계적인 목표 때문입니다. 기존의 백열등과 형광등에서 고체 조명(SSL), 특히 LED와 OLED로의 전환은 포토닉스 기술에 대한 큰 수요를 야기하고 있습니다. 포토닉 기술은 기존의 대체 광원을 훨씬 능가하는 발광 효율, 상당한 긴 수명, 에너지 소비 절감을 실현하여 상업, 주택, 산업, 공공 인프라 등의 용도로 실행 가능한 솔루션이 되고 있습니다. 각국 정부는 아시아태평양, 유럽, 북미에서 LED 기반 조명 솔루션의 채택을 장려하기 위해 엄격한 에너지 효율 규제와 보조금 및 명령을 제정하고 있으며, 이는 또한 시장 예측 성장에 영향을 미칩니다. 포토닉스 기반의 제어 및 센서를 채용한 리얼리티 캡처 스마트 조명 시스템은 스마트 홈과 스마트 시티에서 점점 더 요구되고 소비되고 있습니다. 이러한 스마트 조명 시스템은 광센서, 광검출기, 제어 장치 등의 포토닉스 기반 컴포넌트를 활용하여 점유율과 주변 변화(역학)에 따라 조정 가능하며 밝기 및 색온도를 각각 변경합니다.

미디어 및 통신 부문은 포토닉스 시장에서 가장 급성장하고 있는 최종 용도 부문이며, 원격 고속 데이터 전송, 5G 인프라스트럭처, 광통신 시스템 개척의 요구 증가가 큰 요인이 되고 있습니다. 포토닉스 기술, 특히 광섬유 기술과 광트랜시버는 오늘날의 통신 네트워크를 보다 빠르고 안전하며 대역폭이 적고 손실이 적고 장거리에 걸쳐 운영하는 최첨단 통신 솔루션입니다. 세계 인터넷 사용량이 증가함에 따라 데이터 트래픽의 속도와 양도 증가하고 있으며, 통신 사업자는 현재 구리선 인프라에서 광섬유 네트워크로 전환하고 있습니다. 이러한 마이그레이션은 통신 포토닉 컴포넌트에 대한 큰 요구를 야기합니다. 5G 상용 네트워크의 개발과 6G로의 발전이 예상되므로, 네트워크에 접속되는 디바이스의 수에 대응하는 포토닉 솔루션도 필요합니다. 증강현실(AR), 가상현실(VR), 클라우드 컴퓨팅과 같은 용도의 경우, 컨텐츠를 스트리밍하는 장비의 수와 지연에 대한 요구 사항은 더 넓은 대역폭과 낮은 지연의 통신 인프라를 필요로 합니다. 광 집적 회로(PIC), 레이저 및 광 검출기는 대역폭과 지연의 향후 요구를 충족시키기 위해 최첨단 데이터센터 및 무선 통신 허브에 통합되고 있습니다. 파장 분할 다중화(WDM)와 코히런트 광 시스템의 새로운 개발은 광통신 시스템의 효율성을 크게 향상시켜 미디어 및 통신에 있어서 포토닉 기술의 필요성을 더욱 향상시키고 있습니다.

본 보고서에서는 세계의 포토닉스 시장에 대해 조사했으며, 제품 유형별, 파장별, 용도별, 재료별, 최종 용도 산업별, 지역별 동향 및 시장 진출기업 프로파일 등을 정리했습니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요 인사이트

제5장 시장 개요

- 서문

- 시장 역학

- 포토닉스 시장에서의 생성형 AI의 영향

제6장 업계 동향

- 서문

- 고객사업에 영향을 주는 동향 및 혼란

- 밸류체인 분석

- 투자 및 자금조달 시나리오

- 생태계 분석

- 가격 분석

- 기술 분석

- 특허 분석

- 무역 분석

- 주된 회의 및 이벤트(2024-2025년)

- 관세 및 규제 상황

- Porter's Five Forces 분석

- 주요 이해관계자 및 구매 기준

- 거시경제 전망

- 사례 연구 분석

제7장 포토닉스 시장 : 제품 유형별

- 서문

- 광원

- 레이저 및 레이저 시스템

- 검출기, 센서, 이미징 디바이스

- 광통신 및 네트워크

- 광학 부품 및 시스템

- 광전자 및 집적 광자 회로

제8장 포토닉스 시장 : 파장별

- 서문

- 자외선

- 가시

- 적외선

제9장 포토닉스 시장 : 용도별

- 서문

- 디스플레이

- 정보통신기술

- 태양광 발전

- 의료기술 및 생명과학

- 측정 및 자동 비전

- 조명

- 기타

제10장 포토닉스 시장 : 재료별

- 서문

- 실리콘

- 유리

- 인화인듐(INP)

- 갈륨비소

- 질화갈륨

- 니오브산리튬

- 기타

제11장 포토닉스 시장 : 최종 이용 산업별

- 서문

- 건설

- 미디어 및 통신

- 의료

- 보안 및 방위

- 공업

- 기타

제12장 포토닉스 시장 : 지역별

- 서문

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 대만

- 기타

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 이탈리아

- 프랑스

- 영국

- 네덜란드

- 기타

- 기타 지역

- 사우디아라비아

- 아랍에미리트(UAE)

- 오만

- 이집트

- 남아프리카

- 기타

제13장 경쟁 구도

- 서문

- 주요 진입기업의 전략 및 강점

- 시장 점유율 분석

- 수익 분석

- 브랜드 및 제품 비교

- 기업 평가 매트릭스 : 주요 진입기업(2024년)

- 기업 평가 매트릭스 : 스타트업 및 중소기업(2024년)

- 기업 평가 및 재무지표(2024년)

- 경쟁 시나리오

제14장 기업 프로파일

- 주요 진출기업

- THORALABS, INC.

- AMS-OSRAM

- HAMAMATSU PHOTONICS KK

- LUMENTUM OPERATIONS LLC

- IPG PHOTONICS CORPORATION

- SIGNIFY HOLDING

- CORNING INCORPORATED

- ON SEMICONDUCTOR CORPORATION

- OFS FITEL, LLC

- COHERENT CORP.

- NICHIA CORPORATION

- 기타 기업

- TOPTICA PHOTONICS

- M SQUARED LASERS LIMITED

- FREEDOM PHOTONICS LLC

- SCINTIL PHOTONICS

- PHOTONICS INDUSTRIES INTERNATIONAL. INC.

- LUMILEDS HOLDINGS BV

- EXCELITAS TECHNOLOGIES CORP.

- TRUMPF

- EMERSON ELECTRIC CO

- SAMSUNG ELECTRONICS

제15장 부록

AJY 25.09.16The photonics market is projected to grow from USD 1,093.96 billion in 2025 to USD 1,481.80 billion by 2030, at a CAGR of 6.3% during the forecast period. The photonics market is driven by the growing need for high-bandwidth communication solutions, particularly due to advancements in 5G technology, cloud computing, and the increasing number of Internet of Things (IoT) protocols. These advancements require optical fibers and transceivers to enhance data transmission speeds.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) |

| Segments | Product Type, Material, Wavelength, Application, and End-use Industry, and Region |

| Regions covered | North America, Europe, the Middle East & Africa, and South America |

In the realm of industrial manufacturing, lasers and optical sensors are improving the precision of cutting, welding, and quality control processes, contributing to the rise of automated assembly lines, much like the impact of Industry 4.0. In healthcare, the rising use of non-invasive diagnostic techniques, such as infrared spectroscopy and biophotonics, is stimulating market growth to support an aging population. Additionally, in consumer electronics, there is a high demand for products like smartphones, as well as augmented reality (AR) and virtual reality (VR) devices. This demand is driving the need for visible-wavelength LEDs and micro-LED displays.

"Detectors, sensors, and imaging devices segment to register the fastest growth during the forecast period ."

The detectors, sensors, and imaging devices segment is projected to register the fastest growth in the photonics market during the forecast period. This growth is driven by their widespread adoption in diverse, high-growth industries such as automotive, healthcare, consumer electronics, defense, and industrial automation. The increasing reliance on photonic sensors for high-precision smart systems is fueling the demand for real-time data acquisition across various applications. In the automotive sector, for example, the emergence of advanced driver-assistance systems (ADAS) and fully autonomous vehicles has significantly increased the production volumes of LiDAR systems, infrared detectors, and 3D imaging sensors. These technologies depend on photonics to detect obstacles, scan terrain, and enhance safety in all weather conditions. In healthcare, photonic imaging devices such as optical coherence tomography (OCT), fluorescence imaging, and bio-photonic sensors are enabling earlier and more accurate disease diagnoses than ever before. Non-invasive imaging and real-time monitoring, using both near-infrared (NIR) and visible light modalities, have become essential in surgical applications and diagnostic point-of-care settings. As the global population ages and the prevalence of chronic conditions rises, the demand for advanced diagnostic capabilities is expected to grow.

"Glass segment to register the fastest growth in the photonics market in terms of value."

Glass is the fastest-growing material segment in the photonics market due to its excellent optical properties, chemical durability, and versatility across a wide range of applications. Its growth is primarily driven by its use in the manufacture of optical fibers, which enable high-speed internet services, 5G networks, and long-haul data transmission infrastructures. As global data transfer and cloud computing continue to expand rapidly, telecom companies have made significant investments in fiber optic networks that benefit from the low optical attenuation and high transmission efficiency of silica-based glass. Additionally, glass is increasingly utilized in high-performance lenses, substrates, prisms, and waveguides for imaging (ocular), sensing (photonic), and laser applications. Specialty glasses, such as borosilicate, fused silica, and chalcogenide glass, offer a diverse range of optical properties like high thermal resistance, UV or IR transparency, and low dispersion, making them suitable for various specialized applications in aerospace, defense, healthcare, and industrial lasers. The growing acceptance of glass components is also fueled by the rise of high-precision medical devices, including diagnostic imaging systems and surgical tools. Glass is becoming indispensable for manufacturers due to its biocompatibility and dimensional stability.

"Visible wavelength segment to register the fastest growth in the photonics market in terms of value."

The visible wavelength segment is projected to register the fastest growth in the photonics market due to its wide applications in imaging, display, lighting, and consumer electronics. With wavelengths ranging from roughly 400 to 700 nanometers, visible light is the most relevant spectrum to drive human interactions, making it easier to permit possible integration into any applicable technology that would be used in the daily lives of people. The drive for high-resolution display panels has grown significantly over the past few years, with OLED, micro-LED, and quantum dot displays driving displays in phones, TVs, monitors, and AR/VR. This established demand for display screen technology has driven the adoption of visible light photonic technologies. Companies in countries like South Korea, China, and Japan, familiar with the electronics and display market, are investing heavily in visible-light photonics in new display technologies. Another major driver of growth is solid-state lighting (SSL) technologies, including LEDs (which mostly impact visible light and some IR), as governments are requiring energy efficiency metrics and mass LED adoption in commercial, residential, and public infrastructure projects.

"Lighting segment to register the fastest growth in the photonics market in terms of value."

Lighting is emerging as the fastest-growing application segment of the photonics market, owing to the increased adoption of energy-efficient lighting sources, rapid urbanization, and global goals aimed at carbon neutrality. The conversion from traditional incandescent and fluorescent lighting to solid-state lighting (SSL)-specifically light-emitting diodes (LEDs) and organic LEDs (OLEDs)-has triggered a considerable demand for photonic technologies. Photonic technologies have luminous efficacy that far exceeds traditional light source alternatives, significantly longer operating lives, and reduce energy consumption to become a viable solution in commercial, residential, industrial, and public infrastructure applications. Governments have been instituting stringent energy-efficiency regulations and subsidies/mandates to encourage the adoption of LED-based lighting solutions in the Asia Pacific, Europe, and North America, also impacting the projected growth of the market. Reality capture smart lighting systems that employ photonics-based controls and sensors are becoming increasingly desirable and consumed in smart homes and smart cities. These smart lighting systems are adjustable based on occupancy or ambient changes (dynamics) and modify their brightness and color temperature, respectively, utilizing photonics-based components such as light sensors, photodetectors, and controls.

Media & telecommunication segment to register the fastest growth in the photonics market in terms of value."

The media and telecommunication segment is the fastest-growing end-use segment in the photonics market, largely fueled by the increasing need for remote high-speed data transmission, 5G infrastructure, and the development of optical communication systems. Photonics technologies, particularly fiber optic technologies and optical transceivers, represent the most advanced telecommunications solutions that make today's telecommunications networks operate faster, more securely, and with more bandwidth and less loss, all over long distances. As the quantity of global internet usage increases, along with the speed and quantity of data traffic, telecoms are currently transitioning away from copper infrastructures and toward fiber optic networks. This transition is creating a great need for telecommunication photonic components. The development of 5G commercial networks and the anticipated development towards 6G will also require photonic solutions to accommodate the number of devices connected to the networks. The number of devices streaming content and the latency requirements for applications such as augmented reality (AR), virtual reality (VR), and cloud computing will also require greater bandwidth and a lower latency telecommunication infrastructure. Photonic integrated circuits (PICs), lasers, and photodetectors are being integrated into state-of-the-art data centers and wireless communications hubs in order to meet upcoming demands in bandwidth and latency. New developments in wavelength division multiplexing (WDM) and coherent optical systems significantly increase the efficiency of optical communications systems, furthering the need for photonic technologies in media and telecommunications.

In-depth interviews were conducted with chief executive officers (CEOs), marketing directors, other innovation and technology directors, and executives from various key organizations operating in the photonics market, and information was gathered from secondary research to determine and verify the market size of several segments.

- By Company Type: Tier 1 - 50%, Tier 2 - 30%, and Tier 3 - 20%

- By Designation: Managers- 15%, Directors - 20%, and Others - 65%

- By Region: North America - 14%, Europe - 16%, Asia Pacific - 58%, and the Rest of the World - 12%.

The photonics market comprises Thorlabs, Inc. (US), IPG Photonics Corporation (US), Lumentum Operations LLC (US), ams-OSRAM AG (Austria), Hamamatsu Photonics K.K. (Japan), Corning Incorporated (US), Coherent Corp(US), OFS Fitel, LLC (US), ON SEMICONDUCTOR CORPORATION (US), and Signify Holding (Netherlands). The study includes an in-depth competitive analysis of these key players in the photonics market, with their company profiles, recent developments, and key market strategies.

Research Coverage

This report segments the photonics market on the basis of product type, material, wavelength, application, end-use industry, and region, and provides estimations for the overall value of the market across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, products & services, key strategies, and expansions associated with the photonics market.

Key benefits of buying this report

This research report is focused on various levels of analysis - industry analysis (industry trends), market ranking analysis of top players, and company profiles, which together provide an overall view of the competitive landscape; emerging and high-growth segments of the photonics market; high-growth regions; and market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of drivers: (advancements in photonic-integrated circuits enabling miniaturization and cost-effective high-performance solutions), restraints (high optical losses in silicon nitride and SOI (silicon-on-insulator) waveguide fabrication), opportunities (integration of photonics with artificial intelligence and Internet of things to enable smart cities, precision agriculture, and industrial automation), and challenges (signal distortion from non-linear effects in high-power photonic systems).

- Market Penetration: Comprehensive information on the photonics market offered by top players in the photonics market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, partnerships, agreements, and collaboration in the market.

- Market Development: This report provides comprehensive information about lucrative emerging markets and analyzes the photonics market across regions.

- Market Capacity: Production capacities of companies producing photonics are provided wherever available with upcoming capacities for the photonics market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the photonics market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SNAPSHOT

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 RESEARCH LIMITATIONS

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key primary sources

- 2.1.2.3 Key participants for primary interviews

- 2.1.2.4 Breakdown of primary interviews

- 2.1.2.5 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 BASE NUMBER CALCULATION

- 2.2.1 SUPPLY-SIDE ANALYSIS

- 2.2.2 DEMAND-SIDE ANALYSIS

- 2.3 GROWTH FORECAST

- 2.3.1 SUPPLY SIDE

- 2.3.2 DEMAND SIDE

- 2.4 MARKET SIZE ESTIMATION

- 2.4.1 BOTTOM-UP APPROACH

- 2.4.2 TOP-DOWN APPROACH

- 2.5 DATA TRIANGULATION

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 GROWTH FORECAST

- 2.8 RISK ASSESSMENT

- 2.9 FACTOR ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN PHOTONICS MARKET

- 4.2 PHOTONICS MARKET, BY TYPE

- 4.3 PHOTONICS MARKET, BY MATERIAL

- 4.4 PHOTONICS MARKET, BY APPLICATION

- 4.5 PHOTONICS MARKET, BY WAVELENGTH

- 4.6 PHOTONICS MARKET, BY END-USE INDUSTRY

- 4.7 PHOTONICS MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Advancements in photonic-integrated circuits (PICs)

- 5.2.1.2 Rising demand for high-speed optical communication

- 5.2.1.3 Growth of data-driven economies

- 5.2.2 RESTRAINTS

- 5.2.2.1 High optical losses in silicon nitride and silicon-on-insulator (SOI) waveguide fabrication

- 5.2.2.2 Lack of unified design standards for photonics devices

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Commercialization and innovation in quantum technologies

- 5.2.3.2 Integration of photonics with artificial intelligence and Internet of Things (IoT)

- 5.2.3.3 Expansion of next-generation data centers and telecommunication networks

- 5.2.4 CHALLENGES

- 5.2.4.1 Signal distortion from non-linear effects in high-power photonic systems

- 5.2.4.2 Complexity in integration of photonic sensors into industrial IoT systems

- 5.2.1 DRIVERS

- 5.3 IMPACT OF GENRATIVE AI ON PHOTONICS MARKET

- 5.3.1 INTRODUCTION

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.3 VALUE CHAIN ANALYSIS

- 6.4 INVESTMENT AND FUNDING SCENARIO

- 6.5 ECOSYSTEM ANALYSIS

- 6.6 PRICING ANALYSIS

- 6.6.1 INDICATIVE PRICING ANALYSIS, BY REGION, 2024

- 6.6.2 INDICATIVE PRICING ANALYSIS, BY PRODUCT TYPE, 2024

- 6.7 TECHNOLOGY ANALYSIS

- 6.7.1 KEY TECHNOLOGIES

- 6.7.2 COMPLEMENTARY TECHNOLOGIES

- 6.7.3 ADJACENT TECHNOLOGIES

- 6.8 PATENT ANALYSIS

- 6.8.1 METHODOLOGY

- 6.8.2 PATENTS GRANTED WORLDWIDE

- 6.8.3 PATENT PUBLICATION TRENDS

- 6.8.4 INSIGHTS

- 6.8.5 LEGAL STATUS OF PATENTS

- 6.8.6 JURISDICTION ANALYSIS

- 6.8.7 TOP APPLICANTS

- 6.8.8 LIST OF MAJOR PATENTS

- 6.9 TRADE ANALYSIS

- 6.9.1 IMPORT SCENARIO (HS CODE 854140)

- 6.9.2 EXPORT SCENARIO (HS CODE 854140)

- 6.10 KEY CONFERENCES AND EVENTS, 2024-2025

- 6.11 TARIFF AND REGULATORY LANDSCAPE

- 6.11.1 TARIFFS RELATED TO PHOTONICS

- 6.11.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.11.3 REGULATIONS AND STANDARDS

- 6.12 PORTER'S FIVE FORCES ANALYSIS

- 6.12.1 THREAT OF NEW ENTRANTS

- 6.12.2 THREAT OF SUBSTITUTES

- 6.12.3 BARGAINING POWER OF SUPPLIERS

- 6.12.4 BARGAINING POWER OF BUYERS

- 6.12.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.13.2 BUYING CRITERIA

- 6.14 MACROECONOMIC OUTLOOK

- 6.14.1 GDP TRENDS AND FORECASTS, BY COUNTRY

- 6.15 CASE STUDY ANALYSIS

- 6.15.1 ACCELERATING 5G AND IOT DEPLOYMENT: ACP'S CUSTOMIZED GAIN FLATTENING FILTER SOLUTION FOR A TELECOM LEADER

- 6.15.2 SMART VEHICLES AND SAFER ROADS: HAMAMATSU'S OPTICAL SENSORS POWER AUTOMOTIVE INNOVATION

- 6.15.3 ORCA-QUEST QCMOS CAMERA BY HAMAMATSU PHOTONICS - ENABLING PRECISION IMAGING ACROSS SCIENTIFIC FRONTIERS

7 PHOTONICS MARKET, BY PRODUCT TYPE

- 7.1 INTRODUCTION

- 7.2 LIGHT SOURCES

- 7.2.1 SHIFT TOWARD LED-BASED EFFICIENCY AND SMART ILLUMINATION TO DRIVE MARKET

- 7.3 LASERS AND LASER SYSTEMS

- 7.3.1 HIGH PRECISION, POWER, AND VERSATILITY TO DRIVE DEMAND

- 7.4 DETECTORS, SENSORS & IMAGING DEVICES

- 7.4.1 FOCUS ON ENHANCEMENT OF VISIBILITY, SENSING ACCURACY, AND DATA ACQUISITION ACROSS INDUSTRIES TO DRIVE MARKET

- 7.5 OPTICAL COMMUNICATION & NETWORKING

- 7.5.1 GROWING INTERNET PENETRATION AND 5G EXPANSION TO FUEL DEMAND

- 7.6 OPTICAL COMPONENTS & SYSTEMS

- 7.6.1 INCREASING ADOPTION OF PHOTONIC SYSTEMS IN LIDAR FOR AUTONOMOUS VEHICLES AND ADVANCED DRIVER-ASSISTANCE SYSTEMS TO DRIVE MARKET

- 7.7 OPTOELECTRONICS & INTEGRATED PHOTONIC CIRCUITS

- 7.7.1 MINIATURIZATION AND HIGH-SPEED FUNCTIONALITY IN NEXT-GEN PHOTONIC APPLICATIONS TO PROPEL MARKET

8 PHOTONICS MARKET, BY WAVELENGTH

- 8.1 INTRODUCTION

- 8.2 ULTRAVIOLET

- 8.2.1 RISING DEMAND FOR STERILIZATION AND NANOLITHOGRAPHY TO ACCELERATE ADOPTION

- 8.3 VISIBLE

- 8.3.1 TECHNOLOGICAL ADVANCEMENTS IN DISPLAYS, EXCELLENT LIGHTING EFFICIENCY, AND BOOMING CONSUMER ELECTRONICS INDUSTRY TO DRIVE MARKET

- 8.4 INFRARED

- 8.4.1 RISING SECURITY & SURVEILLANCE REQUIREMENTS, AUTONOMOUS VEHICLE INTEGRATION, AND ENVIRONMENTAL MONITORING NEEDS TO PROPEL MARKET

9 PHOTONICS MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 DISPLAY

- 9.2.1 RISING DEMAND FOR HIGH-RESOLUTION PANELS IN CONSUMER AND INDUSTRIAL INTERFACES TO DRIVE MARKET

- 9.3 INFORMATION & COMMUNICATION TECHNOLOGY

- 9.3.1 RISING OPTICAL DATA TRANSMISSION DEMANDS TO ACCELERATE ADOPTION

- 9.4 PHOTOVOLTAICS

- 9.4.1 ENERGY TRANSITION GOALS AND OFF-GRID ELECTRIFICATION TO DRIVE DEMAND

- 9.5 MEDICAL TECHNOLOGY & LIFE SCIENCES

- 9.5.1 USE IN PRECISION DIAGNOSTICS AND NEXT-GEN MEDICAL TREATMENTS TO DRIVE MARKET

- 9.6 MEASUREMENT & AUTOMATED VISION

- 9.6.1 NEED FOR INDUSTRIAL ACCURACY AND ROBOTICS INTEGRATION TO FUEL DEMAND

- 9.7 LIGHTING

- 9.7.1 GROWTH OF SMART AND HUMAN-CENTRIC LIGHTING TO DRIVE MARKET

- 9.8 OTHER APPLICATIONS

- 9.8.1 ASTRONOMY

- 9.8.2 SEMICONDUCTOR MANUFACTURING

10 PHOTONICS MARKET, BY MATERIAL

- 10.1 INTRODUCTION

- 10.2 SILICON

- 10.2.1 CMOS INTEGRATION, DATA CENTER GROWTH, AND INTEGRATED PHOTONICS DEMAND TO DRIVE MARKET

- 10.3 GLASS

- 10.3.1 RISING OPTICAL FIBER DEMAND, INFRARED TECHNOLOGY GROWTH, AND TELECOM INFRASTRUCTURE NEEDS TO PROPEL MARKET

- 10.4 INDIUM PHOSPHIDE (INP)

- 10.4.1 HIGH-SPEED OPTICAL COMMUNICATION AND QUANTUM ADVANCEMENTS TO DRIVE DEMAND

- 10.5 GALLIUM ARSENIDE

- 10.5.1 ONGOING ADVANCES IN OPTOELECTRONICS DRIVEN BY TELECOM AND AUTOMOTIVE NEEDS TO DRIVE MARKET

- 10.6 GALLIUM NITRIDE

- 10.6.1 RISING DEMAND FOR LIGHTING EFFICIENCY, SUPPORTED BY GLOBAL SUSTAINABILITY GOALS, TO DRIVE MARKET

- 10.7 LITHIUM NIOBATE

- 10.7.1 USE FOR ADVANCING MODULATION, NON-LINEAR OPTICS, AND HIGH-SPEED COMMUNICATION TO PROPEL MARKET

- 10.8 OTHER MATERIALS

- 10.8.1 GALLIUM ALUMINIUM ARSENIDE

- 10.8.2 GERMANIUM

11 PHOTONICS MARKET, BY END-USE INDUSTRY

- 11.1 INTRODUCTION

- 11.2 CONSTRUCTION

- 11.2.1 GREEN BUILDING PRACTICES AND RISING USE IN STRUCTURAL HEALTH MONITORING TO DRIVE MARKET

- 11.3 MEDIA & TELECOMMUNICATION

- 11.3.1 5G NETWORK ROLLOUT, STREAMING SERVICE GROWTH, AND DIGITAL TRANSFORMATION TO DRIVE DEMAND

- 11.4 MEDICAL

- 11.4.1 DIOGNOSTIC IMAGING DEMAND AND MINIMALLY INVASIVE SURGERY TRENDS TO FUEL MARKET GROWTH

- 11.5 SECURITY & DEFENSE

- 11.5.1 ADVANCING DIRECTED ENERGY AND SECURE COMMUNICATIONS THROUGH PHOTONICS TO PROPEL MARKET

- 11.6 INDUSTRIAL

- 11.6.1 FOCUS ON PRECISION MANUFACTURING AND PROCESS OPTIMIZATION TO DRIVE MARKET

- 11.7 OTHER END-USE INDUSTRIES

- 11.7.1 CONSUMER ELECTRONICS

- 11.7.2 AGRICULTURE

12 PHOTONICS MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 ASIA PACIFIC

- 12.2.1 CHINA

- 12.2.1.1 High investments in telecommunications and artificial intelligence (AI) to drive demand

- 12.2.2 JAPAN

- 12.2.2.1 Increased semiconductor manufacturing to propel demand

- 12.2.3 INDIA

- 12.2.3.1 Government-backed digitalization and growth in medical diagnostics to drive market

- 12.2.4 SOUTH KOREA

- 12.2.4.1 High R&D investments in high-quality materials to fuel demand

- 12.2.5 TAIWAN

- 12.2.5.1 Leadership in semiconductor fabrication to drive adoption

- 12.2.6 REST OF ASIA PACIFIC

- 12.2.1 CHINA

- 12.3 NORTH AMERICA

- 12.3.1 US

- 12.3.1.1 Strong federal and private sector R&D funding to drive market

- 12.3.2 CANADA

- 12.3.2.1 Expansion of optical communication networks to boost market growth

- 12.3.3 MEXICO

- 12.3.3.1 Rising electronics manufacturing and demand for LED lighting to propel market

- 12.3.1 US

- 12.4 EUROPE

- 12.4.1 GERMANY

- 12.4.1.1 Industrial automation, smart manufacturing, and automotive LiDAR to drive demand

- 12.4.2 ITALY

- 12.4.2.1 Growing medical imaging and smart lighting needs to drive adoption

- 12.4.3 FRANCE

- 12.4.3.1 Rising demand from aerospace & defense industry to drive market

- 12.4.4 UK

- 12.4.4.1 Government-led funding in quantum technologies to drive market

- 12.4.5 NETHERLANDS

- 12.4.5.1 Growing integrated photonics startups due to strong R&D support and innovation-driven policies to boost market

- 12.4.6 REST OF EUROPE

- 12.4.1 GERMANY

- 12.5 ROW

- 12.5.1 SAUDI ARABIA

- 12.5.1.1 High focus on diversification under Vision 2030 initiative to drive market

- 12.5.2 UAE

- 12.5.2.1 Digitalization and smart governance to accelerate market growth

- 12.5.3 OMAN

- 12.5.3.1 Industrial diversification and maritime security demands to accelerate adoption

- 12.5.4 EGYPT

- 12.5.4.1 Local solar film production and bio-photonics adoption to accelerate market growth

- 12.5.5 SOUTH AFRICA

- 12.5.5.1 Growing use in mining and astronomy applications to drive market

- 12.5.6 OTHERS IN ROW

- 12.5.1 SAUDI ARABIA

13 COMPETITIVE LANDSCAPE

- 13.1 INTRODUCTION

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 13.3 MARKET SHARE ANALYSIS

- 13.4 REVENUE ANALYSIS

- 13.5 BRAND/PRODUCT COMPARISON

- 13.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.6.1 STARS

- 13.6.2 EMERGING LEADERS

- 13.6.3 PERVASIVE PLAYERS

- 13.6.4 PARTICIPANTS

- 13.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.6.5.1 Company footprint

- 13.6.5.2 Product type footprint

- 13.6.5.3 Application footprint

- 13.6.5.4 End-use industry footprint

- 13.6.5.5 Region footprint

- 13.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.7.1 PROGRESSIVE COMPANIES

- 13.7.2 RESPONSIVE COMPANIES

- 13.7.3 DYNAMIC COMPANIES

- 13.7.4 STARTING BLOCKS

- 13.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 13.7.5.1 Detailed list of key startups/SMEs

- 13.7.5.2 Competitive benchmarking of key startups/SMEs

- 13.8 COMPANY VALUATION AND FINANCIAL METRICS, 2024

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 DEALS

- 13.9.2 PRODUCT LAUNCHES

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 THORALABS, INC.

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Solutions/Services offered

- 14.1.1.3 MnM view

- 14.1.1.3.1 Key strengths/Right to win

- 14.1.1.3.2 Strategic choices

- 14.1.1.3.3 Weaknesses/Competitive threats

- 14.1.2 AMS-OSRAM

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Solutions/Services offered

- 14.1.2.3 MnM view

- 14.1.2.3.1 Key strengths/Right to win

- 14.1.2.3.2 Strategic choices

- 14.1.2.3.3 Weaknesses/Competitive threats

- 14.1.3 HAMAMATSU PHOTONICS K.K.

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Solutions/Services offered

- 14.1.3.3 MnM view

- 14.1.3.3.1 Key strengths/Right to win

- 14.1.3.3.2 Strategic choices

- 14.1.3.3.3 Weaknesses/Competitive threats

- 14.1.4 LUMENTUM OPERATIONS LLC

- 14.1.4.1 Business overview

- 14.1.4.2 Products/Solutions/Services offered

- 14.1.4.3 MnM view

- 14.1.4.3.1 Key strengths/Right to win

- 14.1.4.3.2 Strategic choices

- 14.1.4.3.3 Weaknesses/Competitive threats

- 14.1.5 IPG PHOTONICS CORPORATION

- 14.1.5.1 Business overview

- 14.1.5.2 Products/Solutions/Services offered

- 14.1.5.3 MnM view

- 14.1.5.3.1 Key strengths/Right to win

- 14.1.5.3.2 Strategic choices

- 14.1.5.3.3 Weaknesses/Competitive threats

- 14.1.6 SIGNIFY HOLDING

- 14.1.6.1 Business overview

- 14.1.6.2 Products/Solutions/Services offered

- 14.1.7 CORNING INCORPORATED

- 14.1.7.1 Business overview

- 14.1.7.2 Products/Solutions/Services offered

- 14.1.7.3 Recent developments

- 14.1.7.3.1 Product launches

- 14.1.7.3.2 Deals

- 14.1.7.4 MnM view

- 14.1.7.4.1 Key strengths/Right to win

- 14.1.7.4.2 Strategic choices

- 14.1.7.4.3 Weaknesses/Competitive threats

- 14.1.8 ON SEMICONDUCTOR CORPORATION

- 14.1.8.1 Business overview

- 14.1.8.2 Products/Solutions/Services offered

- 14.1.8.3 Recent developments

- 14.1.8.3.1 Deals

- 14.1.9 OFS FITEL, LLC

- 14.1.9.1 Business overview

- 14.1.9.2 Products/Solutions/Services offered

- 14.1.9.3 Recent developments

- 14.1.9.3.1 Product launches

- 14.1.10 COHERENT CORP.

- 14.1.10.1 Business overview

- 14.1.10.2 Products/Solutions/Services offered

- 14.1.11 NICHIA CORPORATION

- 14.1.11.1 Business overview

- 14.1.11.2 Products/Solutions/Services offered

- 14.1.11.3 Recent developments

- 14.1.11.3.1 Product launches

- 14.1.1 THORALABS, INC.

- 14.2 OTHER PLAYERS

- 14.2.1 TOPTICA PHOTONICS

- 14.2.2 M SQUARED LASERS LIMITED

- 14.2.3 FREEDOM PHOTONICS LLC

- 14.2.4 SCINTIL PHOTONICS

- 14.2.5 PHOTONICS INDUSTRIES INTERNATIONAL. INC.

- 14.2.6 LUMILEDS HOLDINGS B.V.

- 14.2.7 EXCELITAS TECHNOLOGIES CORP.

- 14.2.8 TRUMPF

- 14.2.9 EMERSON ELECTRIC CO

- 14.2.10 SAMSUNG ELECTRONICS

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS