|

시장보고서

상품코드

1811730

소매 플랫폼 시장 : 제공 제품별, 전개 모드별, 소매점 유형별, 주력 업계별, 지역별 예측(-2030년)Retail Platform Market by Offering (Supply Chain Management Solutions, Customer Engagement Tools, Retail POS, eCommerce Platform, B2B Commerce Platform, Retail Media Networks) - Global Forecast to 2030 |

||||||

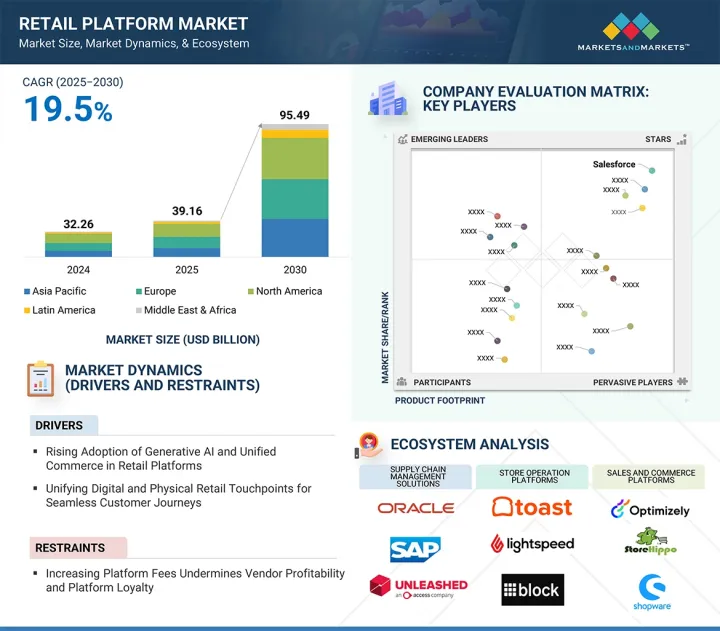

소매 플랫폼 시장 규모는 강력한 성장을 이루고 있으며, 예측 기간 중 연평균 성장률(CAGR)은 19.5%를 나타낼 것으로 예측되며 2025년 391억 6,000만 달러에서 2030년에 954억 9,000만 달러로 증가할 것으로 예측됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2020-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 검토 단위 | 10억 달러 |

| 부문 | 제공 제품별, 전개 모드별, 소매점 유형별, 주력 업계별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 중동, 아프리카, 라틴아메리카 |

소셜 커머스의 부상은 소셜 미디어, 디지털 스토어프론트 및 원활한 결제 솔루션을 통합된 생태계로 통합함으로써 소매 미래 재구성하고 있습니다. 소매업체들은 이러한 플랫폼을 활용하여 맞춤형 콘텐츠, 쇼핑 가능한 게시물, 실시간 상호작용을 통해 소비자와 직접 소통함으로써 전환율과 브랜드 충성도를 높이고 있습니다.

고급 분석 및 AI 기반 추천 기능은 플랫폼이 제품 가시성과 고객 타겟팅을 최적화할 수 있도록 합니다. 또한 소셜 커머스 도입은 소매업체들이 온라인 참여와 매장 내 경험을 연결하는 옴니채널 역량을 강화하도록 장려합니다. 이러한 융합은 디지털 전환을 가속화하고 고객 인사이트를 향상시키며, 소매 플랫폼을 매출 확대와 운영 효율성 증대를 위한 필수 도구로 자리매김하게 합니다.

주요 플랫폼들이 수익성 강화를 위해 수익화 전략을 조정함에 따라, 제3자 판매자들은 점점 더 복잡하고 부담스러운 수수료 구조에 직면하고 있습니다. 상승하는 커미션율, 주문 처리 수수료, 의무적 광고 지출은 운영 비용을 상당하게 증가시켰습니다. 디지털 소매 플랫폼에서의 이러한 사업 비용 급증은 특히 중소기업에게 제약 요인으로 작용합니다.

패션 및 의류 부문은 개인화되고 원활한 쇼핑 경험에 대한 소비자 기대의 변화에 촉진되어 소매 플랫폼 시장에서 가장 빠른 성장을 경험하고 있습니다. 소매 플랫폼은 브랜드가 재고 관리, 전자상거래, 소셜 커머스, 옴니채널 참여를 통합된 시스템으로 통합하여 민첩성과 확장성을 강화할 수 있도록 지원합니다. AI 기반 개인화, 가상 피팅, 데이터 기반 추천은 패션 소매업체의 전환율과 고객 충성도 제고에 기여합니다. 또한 플랫폼은 공급망 운영을 최적화하고 계절적 수요 충족을 위한 신속한 제품 출시를 지원합니다. 디지털 채택률 증가와 소셜 커머스 영향력 확대에 따라 패션 및 의류 브랜드들은 성장과 운영 효율성 제고를 위해 정교한 소매 플랫폼에 점점 더 의존하고 있습니다.

소비자들이 온라인과 오프라인 접점 간 원활한 통합을 점점 더 요구함에 따라, 옴니채널 소매업체들 사이에서 소매 플랫폼 시장 내 가장 큰 성장이 있습니다. 소매 플랫폼은 이러한 소매업체들이 재고, 고객 데이터 및 주문 관리를 통합하여 전자상거래, 모바일 및 오프라인 매장에서 일관된 쇼핑 경험을 창출할 수 있도록 뒷받침한다.

고급 분석 및 AI 촉진 인사이트는 맞춤형 마케팅, 동적 가격 책정 및 수요 예측을 뒷받침하여 운영 효율성을 향상시킵니다. 또한 플랫폼은 변화하는 소비자 행동과 계절적 동향에 신속히 대응할 수 있도록 지원합니다. 워크플로우 간소화, 고객 참여도 향상, 다중 채널 연결을 통해 소매 플랫폼은 옴니채널 소매업체가 효과적으로 규모를 확장하고 매출 성장을 촉진하며 장기적인 브랜드 충성도를 강화할 수 있도록 합니다.

북미는 성숙한 디지털 인프라, 고급 전자상거래 생태계, 재고 관리 및 고객 참여 및 맞춤형 상거래 워크플로우 전반에 걸친 광범위한 AI 통합을 뒷받침받아 AI 기반 소매 플랫폼 도입을 계속 주도하고 있습니다. 선도적 소매업체들은 AI 지원 플랫폼을 활용해 제품 추천을 최적화하고 수요 예측을 강화하며 옴니채널 운영을 간소화합니다. 이 지역의 정교한 분석 역량, 견고한 공급업체 생태계, 혁신을 주력하는 접근법은 실시간 맞춤화, 동적 가격 책정, 지능형 공급망 자동화를 가능하게 합니다.

반면 아시아태평양 지역은 급속한 디지털화, 전자상거래 확산, 소셜 커머스 참여 증가에 촉진되어 소매 플랫폼 시장에서 가장 빠르게 성장하는 시장입니다. 중국, 인도, 한국 등 주요 시장은 온라인과 오프라인 운영 통합, 맞춤형 쇼핑 경험 제공, 대규모 데이터 기반 의사결정 지원을 위해 플랫폼을 도입 중입니다. 모바일 커머스 확대, 도시화, 디지털 소매를 촉진하는 정부 정책이 도입 속도를 가속화하고 있습니다. 소매업체들은 운영 효율성 향상, 고객 참여 증대, 매출 성장 촉진을 위해 확장 가능한 AI 기반 솔루션을 점점 더 많이 찾고 있습니다. 그 결과 아시아태평양 지역은 전 세계 소매 플랫폼 전개의 핵심 성장 허브로 부상하고 있습니다.

본 보고서에서는 세계의 소매 플랫폼 시장에 대해 조사했으며, 제공 제품별, 전개 모드별, 소매점 유형별, 주력 업계별, 지역별 동향 및 시장 진출기업 프로파일 등을 정리했습니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요 인사이트

제5장 시장 개요(정량적인 의미의 전략적 촉진요인)

- 소개

- 시장 역학

- 소매 플랫폼 시장의 진화

- 소매 플랫폼의 기능과 고객 경험 역할

- 공급망 분석

- 생태계 분석

- 미국 관세의 영향(2025년) : 소매 플랫폼 시장

- 투자 및 자금조달 시나리오

- 사례 연구 분석

- 기술 분석

- 규제 상황

- 특허 분석

- 가격 분석

- 주된 회의 및 이벤트(2025-2026년)

- Porter's Five Forces 분석

- 주요 이해관계자와 구매 기준

- 고객사업에 영향을 주는 동향 및 혼란

- 생성형 AI가 소매 플랫폼 시장에 미치는 영향

- 소매 미디어 수익화에 있어서의 성장 기회

- 소매 플랫폼 시장에서 서비스형 시장(MAAS)의 전략적 영향

제6장 소매 플랫폼 시장, 제공 제품별 시장 규모 및 예측(-2030년), 금액(달러)

- 소개

- 플랫폼

- 서비스

제7장 소매 플랫폼 시장, 전개 모드별 시장 규모 및 예측(-2030년), 금액(달러)

- 소개

- 클라우드

- 온프레미스

제8장 소매 플랫폼 시장, 소매점 유형별 시장 규모 및 예측(-2030년), 금액(달러)

- 소개

- 온라인

- 실제 점포

- 옴니채널 소매업체

- 마켓플레이스 운영자

- 프랜차이즈 및 체인 모델

제9장 소매 플랫폼 시장, 주력 업계별 시장 규모 및 예측(-2030년), 금액(달러)

- 소개

- 식품 및 식료품점

- 가전

- 패션 및 의류

- 가구 및 홈 데코레이션

- 레스토랑 및 QSRS(퀵 서비스 레스토랑)

- 미용 및 화장품

- 약국 및 건강식품 판매점

- 기타

제10장 소매 플랫폼 시장, 지역별 시장 규모 및 예측(-2030년), 금액(달러)

- 소개

- 북미

- 북미 : 소매 플랫폼 시장 성장 촉진요인

- 북미 : 거시경제 전망

- 미국

- 캐나다

- 유럽

- 유럽 : 소매 플랫폼 시장 성장 촉진요인

- 유럽 : 거시경제 전망

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 기타

- 아시아태평양

- 아시아태평양 : 소매 플랫폼 시장 성장 촉진요인

- 아시아태평양 : 거시경제 전망

- 중국

- 일본

- 인도

- 한국

- ASEAN

- 기타

- 중동 및 아프리카

- 중동 및 아프리카 : 소매 플랫폼 시장 성장 촉진요인

- 중동 및 아프리카 : 거시경제 전망

- 사우디아라비아

- 아랍에미리트(UAE)

- 카타르

- 남아프리카

- 기타

- 라틴아메리카

- 라틴아메리카 : 소매 플랫폼 시장 성장 촉진요인

- 라틴아메리카 : 거시경제 전망

- 브라질

- 멕시코

- 기타

제11장 경쟁 구도

- 개요

- 주요 참가 기업의 전략 및 강점(2022-2025년)

- 수익 분석(2020-2024년)

- 시장 점유율 분석(2024년)

- 제품 비교

- 기업평가와 재무지표

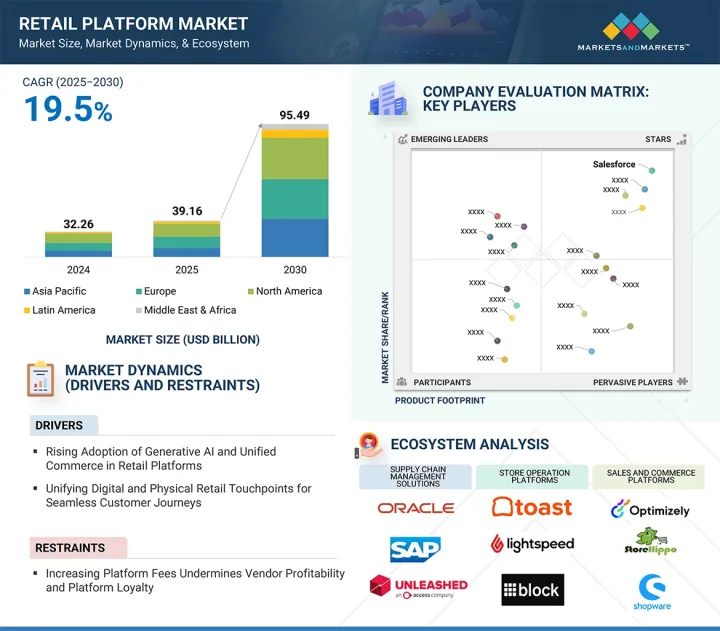

- 기업평가 매트릭스 : 주요 진입기업(2024년)

- 기업평가 매트릭스 : 스타트업, 중소기업(2024년)

- 경쟁 시나리오

제12장 기업 프로파일

- 소개

- 주요 진출기업

- CRITEO

- ORACLE

- SALESFORCE

- ADOBE

- MICROSOFT

- SAP

- INTUIT

- MANHATTAN ASSOCIATES

- SERVICENOW

- AWS

- SHOPIFY

- BLOCK

- TOAST

- APTOS

- LIGHTSPEED

- EPSILON(PUBLICIS GROUPE)

- BIGCOMMERCE

- COMMERCETOOLS

- MIRAKL

- SPRYKER

- VTEX

- PAR TECHNOLOGY

- RITHUM

- OPTIMIZELY

- 기타 기업

- MARKETPLACER

- SHOPWARE

- STOREHIPPO

- AKINON

- SCAYLE

- INTELLIGENCE NODE(INTERPUBLIC GROUP)

- WOOQER

- ZAKYA(ZOHO)

- UNLEASHED(ACCESS GROUP)

- ONE DOOR

- FABRIC

- ELIO

- ELASTIC PATH

- LEXER.IO

제13장 인접 시장과 관련 시장

제14장 부록

HBR 25.09.22The retail platform market is experiencing strong growth, projected to rise from USD 39.16 billion in 2025 to USD 95.49 billion by 2030, at a CAGR of 19.5% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | USD Billion |

| Segments | Offering, Deployment Mode, Retail Store Type, Industry Vertical Focus, and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

The rise in social commerce is reshaping the retail platform landscape by integrating social media, digital storefronts, and seamless payment solutions into unified ecosystems. Retailers leverage these platforms to engage consumers directly through personalized content, shoppable posts, and real-time interactions, driving higher conversion rates and brand loyalty.

Advanced analytics and AI-powered recommendations enable platforms to optimize product visibility and customer targeting. Additionally, social commerce adoption encourages retailers to enhance omnichannel capabilities, linking online engagement with in-store experiences. This convergence accelerates digital transformation, enhances customer insights, and positions retail platforms as essential tools for scaling sales and increasing operational efficiency.

As major platforms adjust their monetization strategies to enhance profitability, third-party sellers encounter increasingly complex and burdensome fee structures. Rising commission rates, fulfillment fees, and mandatory advertising expenditures have significantly increased operational costs. This surge in business expenses on digital retail platforms acts as a restraint, mainly for small and medium-sized enterprises.

"Fashion & apparel segment will account for the fastest growth during the forecast period"

The fashion & apparel segment is experiencing the fastest growth in the retail platform market, driven by evolving consumer expectations for personalized, seamless shopping experiences. Retail platforms enable brands to integrate inventory management, e-commerce, social commerce, and omnichannel engagement into a unified system, enhancing agility and scalability. AI-driven personalization, virtual try-ons, and data-informed recommendations assist fashion retailers in boosting conversion rates and customer loyalty. Furthermore, platforms optimize supply chain operations and facilitate quick product launches to satisfy seasonal demand. With rising digital adoption and social commerce influence, fashion and apparel brands increasingly rely on sophisticated retail platforms to drive growth and operational efficiency.

"Omnichannel retailers segment is expected to hold the largest market share during the forecast period"

Omnichannel retailers are witnessing the largest growth in the retail platform market, as consumers increasingly demand seamless integration across online and offline touchpoints. Retail platforms enable these retailers to unify inventory, customer data, and order management, creating consistent shopping experiences across e-commerce, mobile, and physical stores.

Advanced analytics and AI-driven insights support personalized marketing, dynamic pricing, and demand forecasting, enhancing operational efficiency. Additionally, platforms facilitate rapid adaptation to changing consumer behaviors and seasonal trends. By streamlining workflows, improving customer engagement, and connecting multiple channels, retail platforms empower omnichannel retailers to scale effectively, drive revenue growth, and strengthen long-term brand loyalty.

"AI-driven innovation propels North America's retail platform adoption, while Asia Pacific records fastest growth through rapid digitalization"

North America continues to lead AI-driven retail platform adoption, supported by a mature digital infrastructure, advanced e-commerce ecosystems, and extensive integration of AI across inventory management, customer engagement, and personalized commerce workflows. Leading retailers leverage AI-enabled platforms to optimize product recommendations, enhance demand forecasting, and streamline omnichannel operations. The region's sophisticated analytics capabilities, robust vendor ecosystem, and strong focus on innovation enable real-time personalization, dynamic pricing, and intelligent supply chain automation.

Conversely, Asia Pacific represents the fastest-growing market for retail platforms, propelled by rapid digitalization, rising e-commerce adoption, and increasing social commerce engagement. Key markets such as China, India, and South Korea are adopting platforms to unify online and offline operations, deliver personalized shopping experiences, and enable data-driven decision-making at scale. The expansion of mobile commerce, urbanization, and government initiatives promoting digital retail are driving faster adoption. Retailers are increasingly looking for scalable, AI-powered solutions to improve operational efficiency, enhance customer engagement, and boost revenue growth. As a result, the Asia Pacific region is emerging as a key growth hub for the deployment of retail platforms worldwide.

Breakdown of Primaries

In-depth interviews were conducted with Chief Executive Officers (CEOs), innovation and technology directors, system integrators, and executives from various key organizations operating in the retail platform market.

- By Company: Tier I - 25%, Tier II - 45%, and Tier III - 30%

- By Designation: C-Level Executives - 35%, D-Level Executives - 40%, and Others - 25%

- By Region: North America - 45%, Europe - 25%, Asia Pacific - 15%, Middle East & Africa - 10%, and Latin America - 5%

The report includes a study of key players offering retail platform solutions and services. The major market players include Criteo (France), Oracle (US), Salesforce (US), Adobe (US), Microsoft (US), SAP (Germany), Intuit (US), Manhattan Associate (US), ServiceNow (US), AWS (US), Shopify (US), Block (US), Toast (US), Aptos (US), Lightspeed (Canada), Epsilon (Publicis Groupe) (France), BigCommerce (US), Commercetools (Germany), Mirakl (France), Spryker (Germany), VTEX (UK), PAR Technology (US), Rithum (US), Optimizely (US), Marketplacer (Australia), Shopware (Germany), StoreHippo (India), Akinon (Turkey), SCAYLE (Germany), Intelligent Node (Interpublic Group) (US), Wooqer (US), Zakya (Zoho) (India), Unleashed (Access Group) (New Zealand), One Door (US), Fabric (US)Elio (Germany), Elastic Path (Canada), and Lexer.io (Australia).

Research Coverage

This research report categorizes the retail platform market based on offering [platform (supply chain management solutions {procurement platforms, inventory management systems, demand forecasting tools, others}, store operations platforms {retail point of sale (POS) Systems, in-store management tools, digital shelf and planogram tools, and others}, sales and commerce platforms {e-commerce platforms, marketplace platforms, omnichannel platforms, headless commerce platforms, B2B commerce platforms}, customer engagement tools {personalization engines, loyalty management systems, marketing automation platforms, retail media networks (RMN), others}, analytics and insights platforms {customer analytics tools, sales performance dashboards, retail reporting & analytics, and others}, post-sale service platforms {returns management systems, customer support tools, feedback & experience management platforms, and others}, and other platforms {retail fraud detection & risk management platforms, retail sustainability & ESG platforms}) and services (professional services {training & consulting, system integration & implementation, support & maintenance}, and managed services)], deployment mode (cloud and on-premises), retail store type (online, in-store/physical store, omnichannel retailers, marketplace operators, franchise/chain models), industry vertical focus (food & grocery stores, consumer electronics, fashion & apparel, furniture & home decor, restaurants & QSRs {Quick Service Restaurants}, beauty & cosmetics, pharmacies & health retailers, and others {books, music & entertainment retail, sporting goods & outdoor equipment, jewelry & luxury goods and automotive parts & accessories}), and region (North America, Europe, Asia Pacific, Middle East & Africa, and Latin America).

The scope of the report covers detailed information regarding drivers, restraints, challenges, and opportunities influencing the growth of the retail platform market. A detailed analysis of the key industry players was done to provide insights into their business overview, solutions, and services; key strategies; contracts, partnerships, agreements, product & service launches, and mergers and acquisitions; and recent developments associated with the market. This report also covered the competitive analysis of upcoming startups in the market ecosystem.

Key Benefits of Buying the Report

The report will provide market leaders and new entrants with information on the closest approximations of the revenue numbers for the overall retail platform market and its subsegments. It will help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. It will also help stakeholders understand the market's pulse and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Analysis of key drivers (rising adoption of generative AI and unified commerce in retail platforms, unifying digital and physical retail touchpoints for seamless customer journeys, surging social commerce influence to accelerate digital retail platform growth), restraints (escalating platform fees to undermine vendor profitability and platform loyalty), opportunities (multimodal search interfaces as strategic enablers of retail platform growth, predictive AI driving scalable growth and competitive differentiation for retail platforms), and challenges (inadequate cybersecurity measures undermining reliability of retail platforms, limited supply chain transparency undermining inventory control in retail platforms)

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and product & service launches in the retail platform

- Market Development: Comprehensive information about lucrative markets - analyzing the retail platform market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the retail platform market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players such as Criteo (France), Oracle (US), Salesforce (US), Adobe (US), Microsoft (US), SAP (Germany), Intuit (US), Manhattan Associate (US), ServiceNow (US), AWS (US), Shopify (US), Block (US), Toast (US), Aptos (US), Lightspeed (Canada), Epsilon (Publicis Groupe) (France), BigCommerce (US), Commercetools (Germany), Mirakl (France), Spryker (Germany), VTEX (UK), PAR Technology (US), Rithum (US), Optimizely (US), Marketplacer (Australia), Shopware (Germany), StoreHippo (India), Akinon (Turkey), SCAYLE (Germany), Intelligent Node (Interpublic Group) (US), Wooqer (US), Zakya (Zoho) (India), Unleashed (Access Group) (New Zealand), One Door (US), Fabric (US)Elio (Germany), Elastic Path (Canada), and Lexer.io (Australia)

The report also helps stakeholders understand the pulse of the retail platform market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews

- 2.1.2.2 Breakup of primary profiles

- 2.1.2.3 Key industry insights

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- 2.4 MARKET FORECAST

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN RETAIL PLATFORM MARKET

- 4.2 RETAIL PLATFORM MARKET: TOP PLATFORM TYPES

- 4.3 NORTH AMERICA: RETAIL PLATFORM MARKET, BY RETAIL STORE TYPE AND INDUSTRY VERTICAL FOCUS

- 4.4 RETAIL PLATFORM MARKET, BY REGION

5 MARKET OVERVIEW (STRATEGIC DRIVERS WITH QUANTITATIVE IMPLICATIONS)

Unpacking the Forces Shaping Retail Platform Adoption & Future Growth Opportunities

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising adoption of generative AI and unified commerce in retail platforms

- 5.2.1.2 Increasing demand for seamless omnichannel experiences

- 5.2.1.3 Growing influence of social commerce platforms

- 5.2.2 RESTRAINTS

- 5.2.2.1 Escalating platform fees

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Adoption of voice and visual search technologies

- 5.2.3.2 Advancing retail performance through predictive analytics

- 5.2.4 CHALLENGES

- 5.2.4.1 Inadequate cybersecurity measures

- 5.2.4.2 Limited supply chain transparency

- 5.2.1 DRIVERS

- 5.3 EVOLUTION OF RETAIL PLATFORM MARKET

- 5.4 RETAIL PLATFORM FEATURES AND ROLES IN CUSTOMER JOURNEY

- 5.4.1 AI-POWERED PERSONALIZATION

- 5.4.2 OMNICHANNEL INTEGRATION

- 5.4.3 REAL-TIME ANALYTICS

- 5.4.4 EMBEDDED PAYMENT SYSTEMS

- 5.4.5 CUSTOMER JOURNEY MAPPING TOOLS

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.6.1 PLATFORM PROVIDERS

- 5.6.1.1 Supply chain management solutions

- 5.6.1.2 Store operations platforms

- 5.6.1.3 Sales and commerce platforms

- 5.6.1.4 Customer engagement tools

- 5.6.1.5 Analytics and insights platforms

- 5.6.1.6 Post-sales service platforms

- 5.6.1 PLATFORM PROVIDERS

- 5.7 IMPACT OF 2025 US TARIFFS - RETAIL PLATFORM MARKET

- 5.7.1 INTRODUCTION

- 5.7.2 KEY TARIFF RATES

- 5.7.3 PRICE IMPACT ANALYSIS

- 5.7.3.1 Strategic shifts and emerging trends

- 5.7.4 KEY IMPACT ON VARIOUS REGIONS/COUNTRIES

- 5.7.4.1 US

- 5.7.4.1.1 Strategic shifts and key observations

- 5.7.4.2 China

- 5.7.4.2.1 Strategic shifts and key observations

- 5.7.4.3 Europe

- 5.7.4.3.1 Strategic shifts and key observations

- 5.7.4.4 India

- 5.7.4.4.1 Strategic shifts and key observations

- 5.7.4.1 US

- 5.7.5 IMPACT ON RETAIL INDUSTRY

- 5.8 INVESTMENT AND FUNDING SCENARIO

- 5.9 CASE STUDY ANALYSIS

- 5.9.1 CASE STUDY 1: UBER ADVERTISING ACHIEVES 15% INCREMENTAL CATEGORY REVENUE GROWTH WITH CRITEO'S RETAIL MEDIA SOLUTION

- 5.9.2 CASE STUDY 2: GODREJ & BOYCE AND SALESFORCE DRIVE 10% FASTER OPPORTUNITY-TO-ORDER CONVERSIONS WITH ONE CRM

- 5.9.3 CASE STUDY 3: FORTRESS BUILDING PRODUCTS AND SERVICENOW IMPROVE COMPLEX QUOTING WITH AUTOMATED CPQ AND VISUALIZATION

- 5.9.4 CASE STUDY 4: ASOS ENHANCES CUSTOMER EXPERIENCE AND ACCELERATES AI INNOVATION WITH MICROSOFT AZURE AI STUDIO

- 5.9.5 CASE STUDY 5: HANESBRANDS AND ADOBE DRIVE 57% REVENUE GROWTH WITH ADVANCED PERSONALIZATION AND DATA INTEGRATION

- 5.10 TECHNOLOGY ANALYSIS

- 5.10.1 KEY TECHNOLOGIES

- 5.10.1.1 Artificial intelligence (AI)

- 5.10.1.2 E-commerce engines

- 5.10.1.3 Big data & analytics

- 5.10.1.4 Cloud computing

- 5.10.1.5 Edge computing

- 5.10.2 COMPLEMENTARY TECHNOLOGIES

- 5.10.2.1 Augmented reality and virtual reality (AR and VR)

- 5.10.2.2 Robotic process automation (RPA)

- 5.10.2.3 Blockchain

- 5.10.2.4 Warehouse automation

- 5.10.3 ADJACENT TECHNOLOGIES

- 5.10.3.1 Metaverse

- 5.10.3.2 Internet of Things (IoT)

- 5.10.3.3 Biometric authentication

- 5.10.3.4 5G and advanced connectivity

- 5.10.1 KEY TECHNOLOGIES

- 5.11 REGULATORY LANDSCAPE

- 5.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11.2 REGULATORY FRAMEWORK

- 5.11.2.1 North America

- 5.11.2.1.1 US

- 5.11.2.1.2 Canada

- 5.11.2.2 Europe

- 5.11.2.2.1 UK

- 5.11.2.2.2 Germany

- 5.11.2.2.3 France

- 5.11.2.2.4 Italy

- 5.11.2.2.5 Spain

- 5.11.2.3 Asia Pacific

- 5.11.2.3.1 India

- 5.11.2.3.2 China

- 5.11.2.3.3 Japan

- 5.11.2.3.4 South Korea

- 5.11.2.3.5 Australia

- 5.11.2.4 Middle East & Africa

- 5.11.2.4.1 Saudi Arabia

- 5.11.2.4.2 UAE

- 5.11.2.4.3 Qatar

- 5.11.2.4.4 Turkey

- 5.11.2.4.5 Africa

- 5.11.2.5 Latin America

- 5.11.2.5.1 Brazil

- 5.11.2.5.2 Mexico

- 5.11.2.5.3 Argentina

- 5.11.2.1 North America

- 5.12 PATENT ANALYSIS

- 5.12.1 METHODOLOGY

- 5.12.2 PATENTS FILED, BY DOCUMENT TYPE, 2016-2025

- 5.12.3 INNOVATION AND PATENT APPLICATIONS

- 5.13 PRICING ANALYSIS

- 5.13.1 AVERAGE SELLING PRICE OF OFFERINGS, BY KEY PLAYER, 2025

- 5.13.2 AVERAGE SELLING PRICE, BY PLATFORM, 2025

- 5.14 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.15 PORTER'S FIVE FORCES ANALYSIS

- 5.15.1 THREAT OF NEW ENTRANTS

- 5.15.2 THREAT OF SUBSTITUTES

- 5.15.3 BARGAINING POWER OF SUPPLIERS

- 5.15.4 BARGAINING POWER OF BUYERS

- 5.15.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.16 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.16.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.16.2 BUYING CRITERIA

- 5.17 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.18 IMPACT OF GENERATIVE AI ON RETAIL PLATFORM MARKET

- 5.18.1 TOP USE CASES AND MARKET POTENTIAL

- 5.18.1.1 Key use cases

- 5.18.1.1.1 Automated product content generation

- 5.18.1.1.2 Personalized product recommendations

- 5.18.1.1.3 Dynamic pricing and promotion optimization

- 5.18.1.1.4 Customer support assistants

- 5.18.1.1.5 Visual asset generation and enhancement

- 5.18.1.1.6 Demand forecasting and inventory planning

- 5.18.1.1 Key use cases

- 5.18.1 TOP USE CASES AND MARKET POTENTIAL

- 5.19 GROWTH OPPORTUNITIES IN RETAIL MEDIA MONETIZATION

- 5.20 STRATEGIC IMPLICATIONS OF MARKETPLACE-AS-A-SERVICE (MAAS) IN RETAIL PLATFORM MARKET

6 RETAIL PLATFORM MARKET, BY OFFERING (MARKET SIZE & FORECAST TO 2030 - IN VALUE (USD))

Detailed breakdown of market share and growth across Retail platforms and services

- 6.1 INTRODUCTION

- 6.1.1 OFFERING: RETAIL PLATFORM MARKET DRIVERS

- 6.2 PLATFORMS

- 6.2.1 SUPPLY CHAIN MANAGEMENT SOLUTIONS

- 6.2.1.1 Optimizing retail operations and enhancing efficiency with advanced inventory and logistics solutions

- 6.2.1.2 Procurement platforms

- 6.2.1.3 Inventory management systems

- 6.2.1.4 Demand forecasting tools

- 6.2.1.5 Others

- 6.2.2 STORE OPERATIONS PLATFORMS

- 6.2.2.1 Streamlining in-store efficiency and enhancing customer experience through optimized operations

- 6.2.2.2 Retail Point of Sale (POS) systems

- 6.2.2.3 In-store management tools

- 6.2.2.4 Digital shelf and planogram tools

- 6.2.2.5 Others

- 6.2.3 SALES AND COMMERCE PLATFORMS

- 6.2.3.1 Optimizing retail operations and enhancing customer experience through unified sales solutions

- 6.2.3.2 E-commerce platforms

- 6.2.3.3 Marketplace platforms

- 6.2.3.4 Omnichannel platforms

- 6.2.3.5 Headless commerce platforms

- 6.2.3.6 B2B commerce platforms

- 6.2.4 CUSTOMER ENGAGEMENT TOOLS

- 6.2.4.1 Personalizing experiences and strengthening relationships for sustained business growth

- 6.2.4.2 Personalization engines

- 6.2.4.3 Loyalty management systems

- 6.2.4.4 Retail platforms

- 6.2.4.5 Retail media networks (RMN)

- 6.2.4.5.1 In-store advertising platforms

- 6.2.4.5.2 Online advertising platforms

- 6.2.5 ANALYTICS & INSIGHTS PLATFORMS

- 6.2.5.1 Transforming retail data into actionable intelligence for strategic growth and agility

- 6.2.5.2 Customer analytics tools

- 6.2.5.3 Sales performance dashboards

- 6.2.5.4 Retail reporting & analytics

- 6.2.5.5 Others

- 6.2.6 POST-SALES SERVICE PLATFORMS

- 6.2.6.1 Enhancing customer loyalty through seamless, data-driven post-purchase support and engagement

- 6.2.6.2 Returns management systems

- 6.2.6.3 Customer support tools

- 6.2.6.3.1 Omnichannel ticketing systems

- 6.2.6.3.2 AI-powered chatbots

- 6.2.6.3.3 Agent assist platforms

- 6.2.6.4 Feedback & experience management platforms

- 6.2.6.5 Others

- 6.2.7 OTHER PLATFORMS

- 6.2.1 SUPPLY CHAIN MANAGEMENT SOLUTIONS

- 6.3 SERVICES

- 6.3.1 PROFESSIONAL SERVICES

- 6.3.1.1 Maximizing retail platform efficiency through expert consulting, training, and system implementation

- 6.3.1.2 Training & consulting

- 6.3.1.3 System integration & implementation

- 6.3.1.4 Support & maintenance

- 6.3.2 MANAGED SERVICES

- 6.3.2.1 Ensuring seamless retail platform operations through continuous monitoring and technical support

- 6.3.1 PROFESSIONAL SERVICES

7 RETAIL PLATFORM MARKET, BY DEPLOYMENT MODE (MARKET SIZE & FORECAST TO 2030 - IN VALUE (USD))

Detailed breakdown of market share and growth across Retail Platform Deployment Modes

- 7.1 INTRODUCTION

- 7.1.1 DEPLOYMENT MODE: RETAIL PLATFORM MARKET DRIVERS

- 7.2 CLOUD

- 7.2.1 ENABLING REAL-TIME DATA SYNCHRONIZATION AND SCALABLE ORDER MANAGEMENT IN RETAIL

- 7.3 ON-PREMISES

- 7.3.1 ENSURING MAXIMUM DATA SECURITY AND ADVANCED WORKFLOW CUSTOMIZATION

8 RETAIL PLATFORM MARKET, BY RETAIL STORE TYPE (MARKET SIZE & FORECAST TO 2030 - IN VALUE (USD))

Detailed breakdown of market share and growth across Retail Store Types

- 8.1 INTRODUCTION

- 8.1.1 RETAIL STORE TYPE: RETAIL PLATFORM MARKET DRIVERS

- 8.2 ONLINE

- 8.2.1 EMPOWERING FULLY DIGITAL STORES WITH SCALABLE INFRASTRUCTURE AND ADVANCED PERSONALIZATION TECHNOLOGIES

- 8.3 IN-STORE/PHYSICAL STORES

- 8.3.1 OPTIMIZING IN-STORE TECHNOLOGIES AND REAL-TIME INVENTORY FOR SUPERIOR CUSTOMER ENGAGEMENT

- 8.4 OMNICHANNEL RETAILERS

- 8.4.1 DELIVERING UNIFIED CUSTOMER EXPERIENCES AND REAL-TIME INTEGRATION ACROSS MULTIPLE RETAIL CHANNELS

- 8.5 MARKETPLACE OPERATORS

- 8.5.1 ENABLING SCALABLE MULTI-VENDOR MANAGEMENT AND SEAMLESS TRANSACTIONS IN DIGITAL MARKETPLACES

- 8.6 FRANCHISE/CHAIN MODELS

- 8.6.1 CENTRALIZING OPERATIONS AND ENSURING BRAND CONSISTENCY ACROSS MULTIPLE RETAIL LOCATIONS

9 RETAIL PLATFORM MARKET, BY INDUSTRY VERTICAL FOCUS (MARKET SIZE & FORECAST TO 2030 - IN VALUE (USD))

Industry-specific market sizing, growth, and key trends

- 9.1 INTRODUCTION

- 9.1.1 INDUSTRY VERTICAL FOCUS: RETAIL PLATFORM MARKET DRIVERS

- 9.2 FOOD & GROCERY STORES

- 9.2.1 DRIVING GROCERY EFFICIENCY WITH REAL-TIME INVENTORY AND OMNICHANNEL TOOLS

- 9.3 CONSUMER ELECTRONICS

- 9.3.1 STREAMLINING OMNICHANNEL SALES WITH AI-DRIVEN WARRANTY MANAGEMENT

- 9.4 FASHION & APPAREL

- 9.4.1 DRIVING PERSONALIZATION VIA AI AND STREAMLINED PRODUCT LIFECYCLE MANAGEMENT

- 9.5 FURNITURE & HOME DECOR

- 9.5.1 STREAMLINING PERSONALIZED ORDERS VIA OMNICHANNEL FULFILLMENT SOLUTIONS

- 9.6 RESTAURANTS & QSRS (QUICK SERVICE RESTAURANTS)

- 9.6.1 BOOSTING EFFICIENCY WITH CONTACTLESS ORDERING AND MULTI-CHANNEL INTEGRATION

- 9.7 BEAUTY & COSMETICS

- 9.7.1 TRANSFORMING SHOPPING WITH VIRTUAL TRY-ONS AND DYNAMIC CUSTOMER JOURNEYS

- 9.8 PHARMACIES & HEALTH RETAILERS

- 9.8.1 BOOSTING PATIENT CARE VIA SECURE PRESCRIPTION MANAGEMENT AND HEALTH ANALYTICS

- 9.9 OTHER INDUSTRY VERTICALS

10 RETAIL PLATFORM MARKET, BY REGION (MARKET SIZE & FORECAST TO 2030 - IN VALUE (USD))

Regional market sizing, forecasts, and regulatory landscapes

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 NORTH AMERICA: RETAIL PLATFORM MARKET DRIVERS

- 10.2.2 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 10.2.3 US

- 10.2.3.1 AI-powered omnichannel innovation and strategic partnerships to drive market

- 10.2.4 CANADA

- 10.2.4.1 Unified commerce, targeted investment strategies, and policy reforms to drive market

- 10.3 EUROPE

- 10.3.1 EUROPE: RETAIL PLATFORM MARKET DRIVERS

- 10.3.2 EUROPE: MACROECONOMIC OUTLOOK

- 10.3.3 UK

- 10.3.3.1 Omnichannel integration and robust data privacy compliance to drive market

- 10.3.4 GERMANY

- 10.3.4.1 Increasing adoption of unified commerce through AI, secure payments, and sustainability-driven retail platforms to drive market

- 10.3.5 FRANCE

- 10.3.5.1 Rising focus on French personalization, immersive tech, and sustainability to drive market

- 10.3.6 ITALY

- 10.3.6.1 Growing adoption of digital payments and platform modernization initiatives to drive market

- 10.3.7 SPAIN

- 10.3.7.1 Increasing focus on AI innovation and sustainability to drive market

- 10.3.8 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 ASIA PACIFIC: RETAIL PLATFORM MARKET DRIVERS

- 10.4.2 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 10.4.3 CHINA

- 10.4.3.1 Increasing focus on AI-driven personalization and predictive analytics to drive market

- 10.4.4 JAPAN

- 10.4.4.1 Growing focus on AI-driven personalization and unified commerce to drive market

- 10.4.5 INDIA

- 10.4.5.1 Rising UPI integration and seamless channel integration to drive market

- 10.4.6 SOUTH KOREA

- 10.4.6.1 Increasing optimization of retail ecosystems with intelligent automation and integrated commerce solutions to drive market

- 10.4.7 ASEAN

- 10.4.7.1 Innovation, digital transaction excellence, and rising consumer spending to drive market

- 10.4.8 REST OF ASIA PACIFIC

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 MIDDLE EAST & AFRICA: RETAIL PLATFORM MARKET DRIVERS

- 10.5.2 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 10.5.3 SAUDI ARABIA

- 10.5.3.1 Vision 2030 and rigorous data protection frameworks to drive market

- 10.5.4 UAE

- 10.5.4.1 Increasing e-commerce adoption and advanced customer experience innovation to drive market

- 10.5.5 QATAR

- 10.5.5.1 Rising focus on omnichannel integration, digital payments, and data privacy to drive market

- 10.5.6 SOUTH AFRICA

- 10.5.6.1 Unified commerce, fintech adoption, and sustainability transformation initiatives to drive market

- 10.5.7 REST OF MIDDLE EAST & AFRICA

- 10.6 LATIN AMERICA

- 10.6.1 LATIN AMERICA: RETAIL PLATFORM MARKET DRIVERS

- 10.6.2 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 10.6.3 BRAZIL

- 10.6.3.1 Expanding digital infrastructure and rapid adoption of instant payment solutions to drive market

- 10.6.4 MEXICO

- 10.6.4.1 Growing focus on unified commerce, AI, secure payments, and sustainability to drive market

- 10.6.5 REST OF LATIN AMERICA

11 COMPETITIVE LANDSCAPE

Strategic Profiles of Leading Players & Their Playbooks for Market Dominance

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2025

- 11.3 REVENUE ANALYSIS, 2020-2024

- 11.4 MARKET SHARE ANALYSIS, 2024

- 11.5 PRODUCT COMPARISON

- 11.5.1 PRODUCT COMPARATIVE ANALYSIS, BY OFFERING (SALES AND COMMERCE PLATFORMS)

- 11.5.1.1 Optimizely One (Optimizely)

- 11.5.1.2 StoreHippo Platform (StoreHippo)

- 11.5.1.3 SCAYLE Platform (SCAYLE)

- 11.5.1.4 Mirakl Catalog Platform (Mirakl)

- 11.5.1.5 Enterprise Commerce Platform (Spryker)

- 11.5.2 PRODUCT COMPARATIVE ANALYSIS, BY OFFERING (SUPPLY CHAIN MANAGEMENT SOLUTIONS)

- 11.5.2.1 Oracle Cloud (Oracle)

- 11.5.2.2 SAP Commerce Cloud (SAP)

- 11.5.2.3 Microsoft Cloud for Retail (Microsoft)

- 11.5.2.4 Adobe Commerce (Adobe)

- 11.5.2.5 Manhattan Active Platform (Manhattan Associates)

- 11.5.3 PRODUCT COMPARATIVE ANALYSIS, BY OFFERING (STORE OPERATIONS PLATFORMS)

- 11.5.3.1 Digital Storefront Suite (Toast)

- 11.5.3.2 Retail Inventory Management Software (Lightspeed)

- 11.5.3.3 Aptos One (Aptos)

- 11.5.3.4 Shopify Platform (Shopify)

- 11.5.3.5 POS Software (Block)

- 11.5.1 PRODUCT COMPARATIVE ANALYSIS, BY OFFERING (SALES AND COMMERCE PLATFORMS)

- 11.6 COMPANY VALUATION AND FINANCIAL METRICS

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- 11.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.7.5.1 Company footprint

- 11.7.5.2 Regional footprint

- 11.7.5.3 Offering footprint

- 11.7.5.4 Retail store type footprint

- 11.7.5.5 Industry vertical focus footprint

- 11.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- 11.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.8.5.1 Detailed list of key startups/SMEs

- 11.8.5.2 Competitive benchmarking of key startups/SMEs

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES AND ENHANCEMENTS

- 11.9.2 DEALS

12 COMPANY PROFILES

In-depth look at their Strengths, Weaknesses, Product Portfolios, Recent Developments, and Strategic Moves

- 12.1 INTRODUCTION

- 12.2 KEY PLAYERS

- 12.2.1 CRITEO

- 12.2.1.1 Business overview

- 12.2.1.2 Products/Solutions/Services offered

- 12.2.1.3 Recent developments

- 12.2.1.3.1 Product launches and enhancements

- 12.2.1.3.2 Deals

- 12.2.1.4 MnM view

- 12.2.1.4.1 Key strengths

- 12.2.1.4.2 Strategic choices

- 12.2.1.4.3 Weaknesses and competitive threats

- 12.2.2 ORACLE

- 12.2.2.1 Business overview

- 12.2.2.2 Products/Solutions/Services offered

- 12.2.2.3 Recent developments

- 12.2.2.3.1 Product launches and enhancements

- 12.2.2.3.2 Deals

- 12.2.2.4 MnM view

- 12.2.2.4.1 Key strengths

- 12.2.2.4.2 Strategic choices

- 12.2.2.4.3 Weaknesses and competitive threats

- 12.2.3 SALESFORCE

- 12.2.3.1 Business overview

- 12.2.3.2 Products/Solutions/Services offered

- 12.2.3.3 Recent developments

- 12.2.3.3.1 Product launches and enhancements

- 12.2.3.3.2 Deals

- 12.2.3.4 MnM view

- 12.2.3.4.1 Key strengths

- 12.2.3.4.2 Strategic choices

- 12.2.3.4.3 Weaknesses and competitive threats

- 12.2.4 ADOBE

- 12.2.4.1 Business overview

- 12.2.4.2 Products/Solutions/Services offered

- 12.2.4.3 Recent developments

- 12.2.4.3.1 Product launches and enhancements

- 12.2.4.3.2 Deals

- 12.2.4.4 MnM view

- 12.2.4.4.1 Key strengths

- 12.2.4.4.2 Strategic choices

- 12.2.4.4.3 Weaknesses and competitive threats

- 12.2.5 MICROSOFT

- 12.2.5.1 Business overview

- 12.2.5.2 Products/Solutions/Services offered

- 12.2.5.3 Recent developments

- 12.2.5.3.1 Product launches and enhancements

- 12.2.5.3.2 Deals

- 12.2.5.4 MnM view

- 12.2.5.4.1 Key strengths

- 12.2.5.4.2 Strategic choices

- 12.2.5.4.3 Weaknesses and competitive threats

- 12.2.6 SAP

- 12.2.6.1 Business overview

- 12.2.6.2 Products/Solutions/Services offered

- 12.2.6.3 Recent developments

- 12.2.6.3.1 Product launches and enhancements

- 12.2.6.3.2 Deals

- 12.2.7 INTUIT

- 12.2.7.1 Business overview

- 12.2.7.2 Products/Solutions/Services offered

- 12.2.7.3 Recent developments

- 12.2.7.3.1 Product launches and enhancements

- 12.2.7.3.2 Deals

- 12.2.8 MANHATTAN ASSOCIATES

- 12.2.8.1 Business overview

- 12.2.8.2 Products/Solutions/Services offered

- 12.2.8.3 Recent developments

- 12.2.8.3.1 Product launches and enhancements

- 12.2.8.3.2 Deals

- 12.2.9 SERVICENOW

- 12.2.9.1 Business overview

- 12.2.9.2 Products/Solutions/Services offered

- 12.2.9.3 Recent developments

- 12.2.9.3.1 Product launches and enhancements

- 12.2.9.3.2 Deals

- 12.2.10 AWS

- 12.2.10.1 Business overview

- 12.2.10.2 Products/Solutions/Services offered

- 12.2.11 SHOPIFY

- 12.2.12 BLOCK

- 12.2.13 TOAST

- 12.2.14 APTOS

- 12.2.15 LIGHTSPEED

- 12.2.16 EPSILON (PUBLICIS GROUPE)

- 12.2.17 BIGCOMMERCE

- 12.2.18 COMMERCETOOLS

- 12.2.19 MIRAKL

- 12.2.20 SPRYKER

- 12.2.21 VTEX

- 12.2.22 PAR TECHNOLOGY

- 12.2.23 RITHUM

- 12.2.24 OPTIMIZELY

- 12.2.1 CRITEO

- 12.3 OTHER PLAYERS

- 12.3.1 MARKETPLACER

- 12.3.2 SHOPWARE

- 12.3.3 STOREHIPPO

- 12.3.4 AKINON

- 12.3.5 SCAYLE

- 12.3.6 INTELLIGENCE NODE (INTERPUBLIC GROUP)

- 12.3.7 WOOQER

- 12.3.8 ZAKYA (ZOHO)

- 12.3.9 UNLEASHED (ACCESS GROUP)

- 12.3.10 ONE DOOR

- 12.3.11 FABRIC

- 12.3.12 ELIO

- 12.3.13 ELASTIC PATH

- 12.3.14 LEXER.IO

13 ADJACENT AND RELATED MARKETS

- 13.1 INTRODUCTION

- 13.2 RETAIL ANALYTICS MARKET - GLOBAL FORECAST TO 2029

- 13.2.1 MARKET DEFINITION

- 13.2.2 MARKET OVERVIEW

- 13.2.2.1 Retail analytics market, by offering

- 13.2.2.2 Retail analytics market, by end user

- 13.2.2.3 Retail analytics market, by region

- 13.3 AI FOR SALES AND MARKETING MARKET - GLOBAL FORECAST TO 2030

- 13.3.1 MARKET DEFINITION

- 13.3.2 MARKET OVERVIEW

- 13.3.2.1 AI for sales and marketing market, by offering

- 13.3.2.2 AI for sales and marketing market, by application

- 13.3.2.3 AI for sales and marketing market, by end user

- 13.3.2.4 AI for sales and marketing market, by region

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS