|

시장보고서

상품코드

1811732

필터 백 시장 : 여과 유형별, 필터 유형별, 여과재별, 필터 직물별, 최종 이용 산업별, 지역별 예측(-2030년)Filter Bag Market by Filter Type (Pulse Jet, Reverse Air Bag, Shaker), Filtration Fabric (Polyester, Polypropylene, Fiberglass, Polyimide, Acrylic Fibers, Ceramic, Teflon, Aramid), Media, Filtration Type, and End-use Industry - Global Forecast to 2030 |

||||||

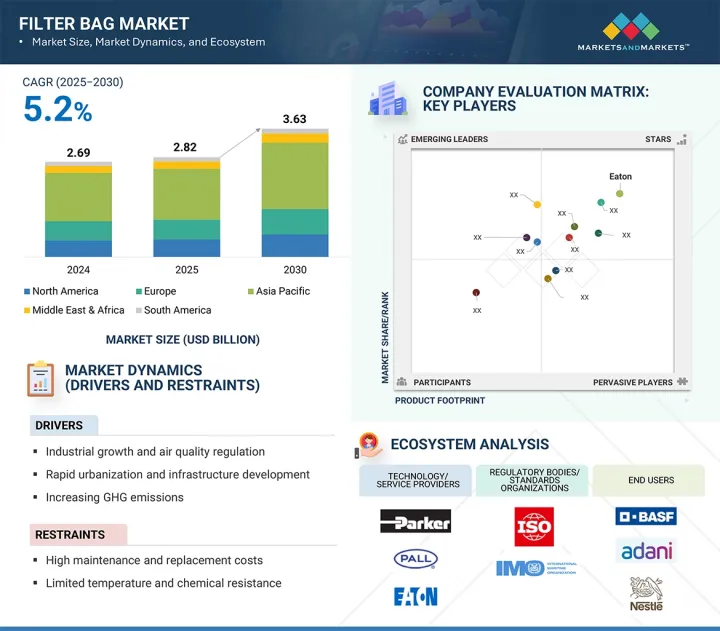

필터 백 시장 규모는 2025년에 28억 2,000만 달러, 2030년에 36억 3,000만 달러로 예측되며, 예측 기간 중 연평균 성장률(CAGR)은 5.2%를 보일 전망입니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2021-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 검토 단위 | 금액(100만 달러/10억 달러) |

| 부문 | 여과 유형별, 필터 유형별, 여과재별, 필터 직물별, 최종 이용 산업별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 남미, 중동 및 아프리카 |

시멘트, 발전, 광업, 화학 및 철강과 같은 여러 산업에서 대기 오염 통제 규제의 시행이 강화되면서 필터 백의 채택이 증가하고 있습니다. 산업 생산량 증가와 미국 환경보호청(EPA), 유럽연합 집행위원회, 중국 생태환경부 등 기관의 미세먼지 배출 규제가 강화되면서, 필터 백은 집진 시스템에서 필수 불가결한 요소로 자리 잡고 있습니다. 또한 지속가능성, 작업자 안전, 운영 효율성에 대한 관심이 높아지면서 산업계는 고온 및 공격적인 화학 환경을 견딜 수 있는 아라미드, PTFE, 유리섬유 등 고급 필터 백 소재를 채택하고 있습니다.

아시아태평양 지역의 신흥 경제국들은 급속한 도시화, 인프라 프로젝트, 정부 지원 청정 공기 프로그램의 촉진으로 도입을 주도하고 있습니다. 그러나 여전히 과제가 남아 있습니다. 필터 백의 높은 유지보수 및 교체 비용과 정전기 집진기, 카트리지 필터 등 대체 여과 기술의 보급 확대는 특정 산업에서의 도입 속도를 저해할 수 있습니다. 이러한 장애물에도 불구하고, 산업계가 비용 효율성과 점점 더 강화되는 전 세계 환경 규범 준수 필요성 사이에서 균형을 맞추면서 장기 수요 전망은 여전히 긍정적입니다.

펄스 제트 부문은 2025년부터 2030년까지 필터 백 시장에서 가장 높은 연평균 복합 성장률(연평균 성장률(CAGR))을 보일 것으로 예상됩니다. 펄스 제트 필터 백은 시멘트, 발전, 철강, 화학 등 산업 분야에서 높은 효율성, 컴팩트한 설계, 대량의 먼지 함유 가스 처리 능력으로 널리 채택됩니다. 역풍 또는 진동식 시스템과 달리 펄스 제트 필터 백은 압축 공기 분사를 이용해 백을 지속적으로 청소하므로 중단 없는 가동이 가능하고 가동 중단 시간을 감축합니다. 이 기술은 우수한 여과 성능, 낮은 운영 비용, 엄격한 배출 규범 준수를 보장하여 수요가 높은 산업 환경에서 선호되는 선택입니다. 에너지 효율성에 대한 강조가 증가하고 대기질 규제가 강화됨에 따라, 펄스 제트 필터 유형은 전 세계, 특히 산업 확장과 규제 시행이 강력한 성장 촉진 요인인 아시아태평양 및 유럽 지역에서 설치를 주도할 것으로 예상됩니다.

가스 여과는 시멘트 킬른, 발전소, 소각장, 철강 생산 및 화학 공정 시설에서 기록된 미세 입자상 물질, 유해 가스 및 독성 배출물을 포집하는 데 핵심적입니다. 전 세계 정부가 미국 환경보호청(EPA)의 청정 공기법 및 유럽의 산업 배출 지침과 같은 더 엄격한 대기 오염 통제 기준을 시행함에 따라, 고급 가스 여과 솔루션에 대한 수요가 급증하고 있습니다. 가스 여과용으로 설계된 필터 백은 고온 내성, 화학적 안정성 및 우수한 먼지 포집 효율을 제공하여 산업 현장이 안전성을 확보하면서 규정을 준수할 수 있도록 지원합니다. 또한 온실가스 감축 및 산업 탈탄소화에 대한 관심이 높아지면서 가스 여과 시스템 도입이 더욱 가속화되고 있습니다. 이러한 우세는 특히 급속한 산업화와 강화된 환경 모니터링이 병행되는 아시아태평양 지역에서 지속될 전망입니다.

유럽은 엄격한 환경 규제, 산업 현대화, 지속 가능성에 대한 강한 강조에 의해 촉진되어 2025년부터 2030년 사이 필터 백 시장에서 두 번째로 큰 점유율을 차지할 것으로 전망됩니다. 유럽연합(EU)은 산업배출지침(IED) 및 대기질지침과 같은 지침 하에 엄격한 배출 기준을 시행하여 시멘트, 발전, 화학, 폐기물 소각 등 산업계가 고급 여과 시스템을 도입하도록 강제하고 있습니다. 순환경제 이니셔티브, 탈탄소화 목표, 친환경 제조 관행에 주력함은 미립자 및 가스 여과를 위한 효율적인 솔루션으로서 필터 백의 성장을 더욱 뒷받침합니다.

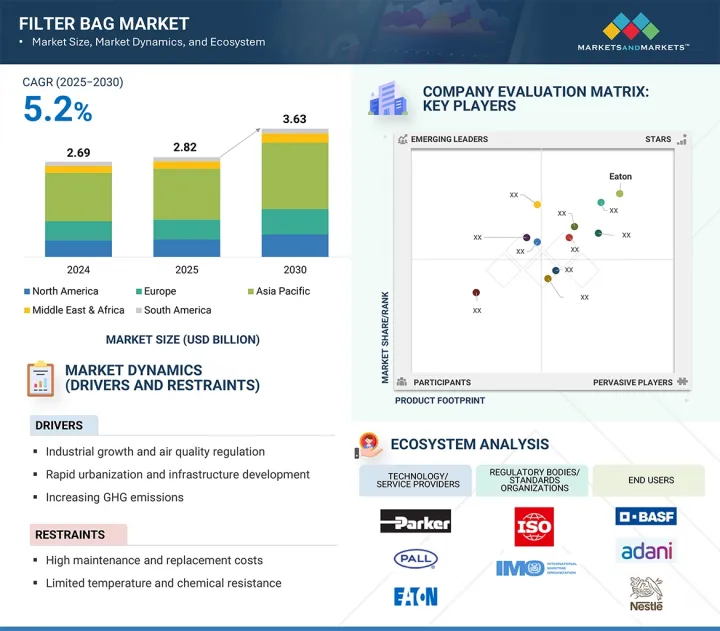

전 세계 주요 업체들이 필터 백 시장을 주도하고 있습니다. 필터 백 시장의 주요 기업은 Eaton(아일랜드), Donaldson Company, Inc.(미국), 3M(미국), Parker Hannifin Corp(미국), Babcock & Wilcox Enterprises, Inc(미국)입니다.

이 보고서는 필터 백 시장을 여과 유형별, 필터 유형별, 여과재별, 필터 직물별, 최종 이용 산업별, 지역별로 정의, 기술, 예측했습니다.

본 보고서에서는 주요 시장 성장 촉진요인, 억제요인, 기회, 과제를 종합적으로 검토하고 있습니다. 또한 경쟁 구도 분석, 시장 역학, 금액 기준 시장 추정 및 동향, 필터 백 시장 전망 동향 등 시장의 다양한 중요한 측면을 다룹니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요 인사이트

제5장 시장 개요

- 소개

- 시장 역학

- 고객사업에 영향을 주는 동향 및 혼란

- 밸류체인 분석

- 생태계 분석

- 기술 분석

- 특허 분석

- 무역 분석

- 주된 회의 및 이벤트(2025-2026년)

- 관세 및 규제 상황

- 가격 분석

- Porter's Five Forces 분석

- 주요 이해관계자와 구매 기준

- 투자 및 자금조달 시나리오

- 사례 연구 분석

- 생성형 AI/AI가 필터 백 시장에 미치는 영향

- 세계 거시경제 전망

- 미국 관세가 필터 백 시장에 미치는 영향(2025년)

제6장 필터 백 시장(여과 유형별)

- 소개

- 가스 여과

- 액체 여과

제7장 필터 백 시장(필터 유형별)

- 소개

- 펄스 제트

- 리버스 에어백

- 셰이커

제8장 필터 백 시장(여재별)

- 소개

- 직포

- 부직포

제9장 필터 백 시장(필터 원단별)

- 소개

- 폴리에스테르

- 폴리프로필렌

- 유리 섬유

- 폴리이미드

- 아크릴 섬유

- 세라믹

- 테플론

- 아라미드

제10장 필터 백 시장(최종 이용 산업별)

- 소개

- 시멘트

- 금속 및 광업

- 발전

- 석유 및 가스

- 식품 및 음료

- 화학 약품

- 페인트 및 코팅

- 의약품

- 자동차

- 기타

제11장 필터 백 시장(지역별)

- 소개

- 아시아태평양

- 중국

- 호주

- 일본

- 인도

- 기타

- 유럽

- 독일

- 러시아

- 이탈리아

- 영국

- 프랑스

- 기타

- 북미

- 미국

- 캐나다

- 멕시코

- 중동 및 아프리카

- GCC

- 남아프리카

- 나이지리아

- 기타

- 남미

- 브라질

- 아르헨티나

- 칠레

- 기타

제12장 경쟁 구도

- 개요

- 주요 참가 기업의 전략 및 강점(2021-2025년)

- 시장 점유율 분석(2024년)

- 수익 분석(2020-2024년)

- 기업평가와 재무지표

- 제품 비교

- 기업평가 매트릭스 : 주요 진입기업(2024년)

- 기업평가 매트릭스 : 스타트업, 중소기업(2024년)

- 경쟁 시나리오

제13장 기업 프로파일

- 주요 진출기업

- EATON

- DONALDSON COMPANY, INC.

- PARKER HANNIFIN CORP

- PALL CORPORATION

- 3M

- THERMAX LIMITED

- PENTAIR

- BABCOCK & WILCOX ENTERPRISES, INC.

- CAMFIL

- WL GORE & ASSOCIATES, INC.

- GENERAL FILTRATION

- BWF OFFERMANN, WALDENFELS & CO. KG

- LENNTECH BV

- ROSEDALE PRODUCTS INC.

- AMERICAN FABRIC FILTER

- 기타 기업

- FILTRATION SYSTEMS PRODUCTS INC.

- AJR FILTRATION

- FAB-TEX FILTRATION

- CUSTOM ADVANCED

- INDUSTRIAL FILTER MANUFACTURING LTD.

- K2TEC

- TEFLO

- PRECISION WIRE PRODUCTS, INC.

- GRIFFIN FILTERS

- SHELCO FILTERS

제14장 부록

HBR 25.09.22The filter bag market is projected to be valued at USD 2.82 billion in 2025 and USD 3.63 billion by 2030, registering a CAGR of 5.2% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) |

| Segments | Filtration Type, Filter Type, Filtration Fabric, Media, and End-use Industry |

| Regions covered | North America, Europe, Asia Pacific, South America, and the Middle East & Africa |

The increasing enforcement of air pollution control regulations across several industries, such as cement, power generation, mining, chemicals, and steel, boosts the adoption of filter bags. With growing industrial output and stricter particulate matter emission norms by agencies such as the EPA, the EU Commission, and China's Ministry of Ecology and Environment, filter bags are becoming indispensable in dust collection systems. Additionally, the rising emphasis on sustainability, worker safety, and operational efficiency pushes industries to adopt advanced filter bag materials, such as aramid, PTFE, and fiberglass, which can withstand high temperatures and aggressive chemical environments.

Emerging economies in Asia Pacific are leading the adoption, driven by rapid urbanization, infrastructure projects, and government-backed clean air programs. However, challenges remain. High maintenance and replacement costs of filter bags, coupled with the growing availability of alternative filtration technologies, such as electrostatic precipitators and cartridge filters, may restrain the pace of adoption in certain industries. Despite these hurdles, the long-term demand outlook remains positive as industries balance cost-efficiency with the need to comply with ever-tightening global environmental norms.

"By filter type, the pulse jet segment is expected to record the highest CAGR from 2025 to 2030."

The pulse jet segment is likely to exhibit the highest CAGR in the filter bag market between 2025 and 2030. Pulse jet filter bags are widely adopted due to their high efficiency, compact design, and ability to handle large volumes of dust-laden gases in industries such as cement, power generation, steel, and chemicals. Unlike reverse air or shaker systems, pulse jet filter bags use compressed air bursts to continuously clean the bags, which enables uninterrupted operation and reduces downtime. This technology ensures better filtration performance, lower operational costs, and compliance with stringent emission norms, making it the preferred choice in high-demand industrial environments. With increasing emphasis on energy efficiency and stricter air quality regulations, the pulse jet filter type is expected to dominate installations globally, particularly across Asia Pacific and Europe, where industrial expansion and regulatory enforcement are strong growth drivers.

"Based on filtration type, the gas filtration segment is anticipated to hold the largest market share in 2030."

Gas filtration is critical in capturing fine particulate matter, hazardous gases, and toxic emissions generated in cement kilns, power plants, incinerators, steel production, and chemical processing units. With governments worldwide imposing stricter air pollution control standards, such as the US EPA's Clean Air Act and Europe's Industrial Emissions Directive, the demand for advanced gas filtration solutions is surging. Filter bags designed for gas filtration provide high-temperature resistance, chemical stability, and superior dust collection efficiency, enabling industries to maintain compliance while ensuring safe workplace environments. Additionally, rising concerns over greenhouse gas reduction and industrial decarbonization further accelerate the adoption of gas filtration systems. This dominance is expected to continue, especially in Asia Pacific, where rapid industrialization is paired with stronger environmental monitoring.

"Europe is likely to be the second-largest-growing region in the filter bag market."

Europe is projected to account for the second-largest share of the filter bag market between 2025 and 2030, driven by its stringent environmental regulations, industrial modernization, and strong emphasis on sustainability. The European Union has enforced rigorous emission standards under directives, such as the Industrial Emissions Directive (IED) and the Ambient Air Quality Directive, compelling industries to adopt advanced filtration systems, including cement, power generation, chemicals, and waste incineration. The focus on circular economy initiatives, decarbonization targets, and green manufacturing practices further supports the growth of filter bags as efficient solutions for particulate and gas filtration.

Breakdown of Primaries:

By Company Type: Tier 1 - 30%, Tier 2 - 55%, and Tier 3 - 15%

By Designation: C-Level Executives - 30%, Directors - 20%, and Others - 50%

By Region: Asia Pacific - 55%, North America - 20%, Europe - 8%, Middle East & Africa - 13%, and South America - 4%

Note: "Others" include sales managers, engineers, and regional managers

The tiers of the companies are defined based on their total revenue as of 2021: Tier 1: >USD 1 billion, Tier 2: USD 500 million-1 billion, and Tier 3: <USD 500 million.

Major globally established players dominate the filter bag market. The leading players in the filter bag market are Eaton (Ireland), Donaldson Company, Inc. (US), 3M (US), Parker Hannifin Corp (US), and Babcock & Wilcox Enterprises, Inc (US).

Study Coverage:

The report defines, describes, and forecasts the filter bag market, by filtration type (gas filtration, liquid filtration), filtration fabric (polyester, polypropylene, fiberglass, polyimide, acrylic fibers, ceramic, Teflon, aramid), media (woven, non-woven), filter type (pulse jet, reverse air bag, shaker), end-use industry (cement, metals & mining, power generation, oil & gas, food & beverages, chemicals, paint & coatings, pharmaceuticals, automotive, other end-use industries), and region.

The report provides a comprehensive review of the major market drivers, restraints, opportunities, and challenges. It also covers various important aspects of the market, which include the analysis of the competitive landscape, market dynamics, market estimates in terms of value, and future trends in the filter bag market.

Key Benefits of Buying the Report

- Key drivers (Rapid industrial growth and implementation of air quality regulations), restraints (High maintenance and replacement costs), opportunities (Technological advancements in filter media), and challenges (Environmental and disposal challenges) influence the growth of the filter bag market.

- Market Development: In April 2024, Eaton's Filtration Division introduced two new liquid filtration solutions, SENTINEL and DURAGAF filter bag ranges. These advanced, fully welded polypropylene needle-felt bags integrate particle retention and oil absorption into a single step.

- Product Innovation/Development: There was significant product innovation in the filter bag market, but notable is the innovation of IoT-enabled diagnostics and predictive maintenance capabilities of the most advanced systems. These trends are geared toward improving reliability, minimizing gas release, and increasing efficiency standards among end users.

- Market Diversification: In July 2025, Siemens acquired the industrial drive technology business of ebm-papst, which is now marketed under the name Mechatronic Systems. The portfolio encompasses built-in smart drive systems such as autonomous transport and extra-low voltage protection.

- Competitive Assessment: The report includes an in-depth assessment of market shares, growth strategies, and service offerings of leading market players, such as Eaton (Ireland), Donaldson Company, Inc. (US), 3M (US), Parker Hannifin Corp (US), and Babcock & Wilcox Enterprises, Inc (US).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of primary interview participants

- 2.1.2.2 Key industry insights

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Breakdown of primaries

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Regional analysis

- 2.2.1.2 Country-level analysis

- 2.2.1.3 Demand-side assumptions

- 2.2.1.4 Demand-side calculations

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Supply-side assumptions

- 2.2.2.2 Supply-side calculations

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 FORECAST

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN FILTER BAG MARKET

- 4.2 FILTER BAG MARKET, BY REGION

- 4.3 FILTER BAG MARKET IN ASIA PACIFIC, BY FILTRATION TYPE AND COUNTRY

- 4.4 FILTER BAG MARKET, BY FILTRATION TYPE

- 4.5 FILTER BAG MARKET, BY MEDIA

- 4.6 FILTER BAG MARKET, BY FILTER TYPE

- 4.7 FILTER BAG MARKET, BY FILTRATION FABRIC

- 4.8 FILTER BAG MARKET, BY END-USE INDUSTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rapid industrial growth and implementation of air quality regulations

- 5.2.1.2 Increasing infrastructure development and urbanization

- 5.2.1.3 Growing emphasis on reducing GHG emissions in industrial sectors

- 5.2.2 RESTRAINTS

- 5.2.2.1 High maintenance and replacement costs

- 5.2.2.2 Limited temperature and chemical resistance

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Technological advances in filter media

- 5.2.4 CHALLENGES

- 5.2.4.1 Environmental and disposal challenges

- 5.2.4.2 Availability of alternate filtration technologies

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 TECHNOLOGY ANALYSIS

- 5.6.1 KEY TECHNOLOGIES

- 5.6.1.1 Pleated filter bag design

- 5.6.1.2 Advanced filter fabrics

- 5.6.2 ADJACENT TECHNOLOGIES

- 5.6.2.1 Cartridge filters

- 5.6.2.2 Electrostatic precipitators

- 5.6.3 COMPLEMENTARY TECHNOLOGIES

- 5.6.3.1 Bag leak detection systems

- 5.6.3.2 Pulse-jet cleaning systems

- 5.6.1 KEY TECHNOLOGIES

- 5.7 PATENT ANALYSIS

- 5.8 TRADE ANALYSIS

- 5.8.1 IMPORT SCENARIO (HS CODE 842199)

- 5.8.2 EXPORT SCENARIO (HS CODE 842199)

- 5.9 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.10 TARIFF AND REGULATORY LANDSCAPE

- 5.10.1 TARIFF ANALYSIS

- 5.10.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11 PRICING ANALYSIS

- 5.11.1 AVERAGE SELLING PRICE TREND OF FILTER BAGS, BY MEDIA, 2021-2024

- 5.11.2 AVERAGE SELLING PRICE TREND OF FILTER BAGS, BY REGION, 2021-2024

- 5.12 PORTER'S FIVE FORCES ANALYSIS

- 5.12.1 THREAT OF SUBSTITUTES

- 5.12.2 BARGAINING POWER OF SUPPLIERS

- 5.12.3 BARGAINING POWER OF BUYERS

- 5.12.4 THREAT OF NEW ENTRANTS

- 5.12.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.13.2 BUYING CRITERIA

- 5.14 INVESTMENT AND FUNDING SCENARIO

- 5.15 CASE STUDY ANALYSIS

- 5.15.1 INDUSTRIAL FACILITY INSTALLS GORE LOW DRAG FILTER BAGS TO ENHANCE DUST COLLECTION EFFICIENCY IN CATALYST CALCINER FEEDBINS

- 5.15.2 US CEMENT PRODUCER USES BHA THERMOPLEAT FILTER ELEMENTS TO RESOLVE ABRASION-DRIVEN FAILURES IN BAGHOUSE

- 5.15.3 STANDARD FILTER PROVIDES CUSTOMIZED FILTER BAG TO BOOST OPERATIONAL PERFORMANCE IN CEMENT FACILITY

- 5.16 IMPACT OF GEN AI/AI ON FILTER BAG MARKET

- 5.16.1 ADOPTION OF GEN AI/AI IN FILTER BAG MARKET

- 5.16.2 IMPACT OF GEN AI/AI ON KEY END-USE INDUSTRIES, BY REGION

- 5.17 GLOBAL MACROECONOMIC OUTLOOK

- 5.17.1 INTRODUCTION

- 5.17.2 GDP TRENDS AND FORECAST

- 5.17.3 INFLATION

- 5.17.4 MANUFACTURING VALUE ADDED (MVA)

- 5.17.5 VALUE ADDED BY INDUSTRY (INCLUDING CONSTRUCTION) (% OF GDP)

- 5.18 IMPACT OF 2025 US TARIFF ON FILTER BAG MARKET

- 5.18.1 INTRODUCTION

- 5.18.2 KEY TARIFF RATES

- 5.18.3 PRICE IMPACT ANALYSIS

- 5.18.4 IMPACT ON COUNTRIES/REGIONS

- 5.18.4.1 US

- 5.18.4.2 Europe

- 5.18.4.3 Asia Pacific

- 5.18.5 IMPACT ON END-USE INDUSTRIES

6 FILTER BAG MARKET, BY FILTRATION TYPE

- 6.1 INTRODUCTION

- 6.2 GAS FILTRATION

- 6.2.1 INCREASING ENFORCEMENT OF STRINGENT AIR POLLUTION CONTROL NORMS TO ACCELERATE SEGMENTAL GROWTH

- 6.3 LIQUID FILTRATION

- 6.3.1 RISING FOCUS ON SUSTAINABLE WATER MANAGEMENT AND INDUSTRIAL WASTEWATER TREATMENT TO BOOST SEGMENTAL GROWTH

7 FILTER BAG MARKET, BY FILTER TYPE

- 7.1 INTRODUCTION

- 7.2 PULSE JET

- 7.2.1 PLEATED

- 7.2.1.1 Rising demand for high-efficiency filtration and compact design to accelerate segmental growth

- 7.2.2 OTHER PULSE JET FILTER BAGS

- 7.2.1 PLEATED

- 7.3 REVERSE AIR BAG

- 7.3.1 GROWING EMPHASIS ON RETROFIT AND MODERNIZATION PROJECTS TO EXPEDITE SEGMENTAL GROWTH

- 7.4 SHAKER

- 7.4.1 RISING FOCUS ON MODERNIZATION TRENDS TO OPTIMIZE CLEANING CYCLES AND REDUCE DOWNTIME TO DRIVE MARKET

8 FILTER BAG MARKET, BY MEDIA

- 8.1 INTRODUCTION

- 8.2 WOVEN

- 8.2.1 INCREASING REQUIREMENT FOR LOW-MAINTENANCE AND DURABLE FILTRATION MEDIA TO FUEL SEGMENTAL GROWTH

- 8.3 NON-WOVEN

- 8.3.1 RISING FOCUS ON HIGH-EFFICIENCY STANDARDS AND ECO-FRIENDLY INDUSTRIAL SOLUTIONS TO AUGMENT SEGMENTAL GROWTH

9 FILTER BAG MARKET, BY FILTRATION FABRIC

- 9.1 INTRODUCTION

- 9.2 POLYESTER

- 9.2.1 STRICT EMISSION DIRECTIVES AND HYGIENE STANDARDS TO BOOST ADOPTION

- 9.3 POLYPROPYLENE

- 9.3.1 CLEAN WATER INITIATIVES, INDUSTRIAL WASTEWATER RECYCLING, AND SAFE CHEMICAL PROCESSING TO AUGMENT SEGMENTAL GROWTH

- 9.4 FIBERGLASS

- 9.4.1 DIMENSIONAL STABILITY, RESISTANCE TO CHEMICAL ATTACK, AND EXCELLENT FILTRATION EFFICIENCY TO FUEL SEGMENTAL GROWTH

- 9.5 POLYIMIDE

- 9.5.1 FOCUS ON SUPERIOR FILTRATION EFFICIENCY AND LOWER EMISSIONS TO ACCELERATE SEGMENTAL GROWTH

- 9.6 ACRYLIC FIBERS

- 9.6.1 ABILITY TO LOWER PRESSURE DROP AND ENERGY CONSUMPTION TO BOOST SEGMENTAL GROWTH

- 9.7 CERAMIC

- 9.7.1 THERMAL STABILITY, HIGH MECHANICAL STRENGTH, AND RESISTANCE TO CONTRIBUTE TO SEGMENTAL GROWTH

- 9.8 TEFLON

- 9.8.1 ABILITY TO PREVENT DUST PARTICLES FROM ADHERING TIGHTLY TO FILTER SURFACE TO BOOST SEGMENTAL GROWTH

- 9.9 ARAMID

- 9.9.1 HIGH THERMAL STABILITY, MECHANICAL STRENGTH, AND RESISTANCE TO ABRASION TO FOSTER SEGMENTAL GROWTH

10 FILTER BAG MARKET, BY END-USE INDUSTRY

- 10.1 INTRODUCTION

- 10.2 CEMENT

- 10.2.1 REQUIREMENT FOR STRINGENT ENVIRONMENTAL COMPLIANCE TO CONTRIBUTE TO SEGMENTAL GROWTH

- 10.3 METALS & MINING

- 10.3.1 DUST-INTENSIVE OPERATIONS AND EMISSION REGULATIONS TO AUGMENT SEGMENTAL GROWTH

- 10.4 POWER GENERATION

- 10.4.1 RISING NEED TO CONTROL PARTICULATE EMISSIONS TO BOLSTER SEGMENTAL GROWTH

- 10.5 OIL & GAS

- 10.5.1 GROWING EMPHASIS ON IMPROVING WORKPLACE AIR QUALITY AND ENSURING STACK COMPLIANCE TO DRIVE MARKET

- 10.6 FOOD & BEVERAGES

- 10.6.1 INCREASING NEED TO MITIGATE IGNITION RISKS FROM COMBUSTIBLE DUSTS TO BOOST SEGMENTAL GROWTH

- 10.7 CHEMICALS

- 10.7.1 RISING FOCUS ON FILTERING AIRBORNE PARTICULATES AND ULTRA-FINE PARTICULATES TO ACCELERATE SEGMENTAL GROWTH

- 10.8 PAINT & COATINGS

- 10.8.1 INCREASING NEED FOR COMPLIANCE WITH PARTICULATE EMISSION NORMS TO CONTRIBUTE TO SEGMENTAL GROWTH

- 10.9 PHARMACEUTICALS

- 10.9.1 STRINGENT REQUIREMENTS FOR AIR PURITY, PRODUCT INTEGRITY, AND REGULATORY COMPLIANCE TO DRIVE MARKET

- 10.10 AUTOMOTIVE

- 10.10.1 IMPLEMENTATION OF SUSTAINABILITY AND WORKER-SAFETY INITIATIVES TO BOLSTER SEGMENTAL GROWTH

- 10.11 OTHER END-USE INDUSTRIES

11 FILTER BAG MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 ASIA PACIFIC

- 11.2.1 CHINA

- 11.2.1.1 Implementation of government-led initiatives to tackle air pollution to drive market

- 11.2.2 AUSTRALIA

- 11.2.2.1 Growing focus on sustainable industrial to support market growth

- 11.2.3 JAPAN

- 11.2.3.1 Increasing enforcement of stringent air quality standards to bolster market growth

- 11.2.4 INDIA

- 11.2.4.1 Rapid industrialization, urbanization, and regulatory pressure to curb air pollution to drive market

- 11.2.5 REST OF ASIA PACIFIC

- 11.2.1 CHINA

- 11.3 EUROPE

- 11.3.1 GERMANY

- 11.3.1.1 Rising need to comply with strict particulate emission standards to bolster market growth

- 11.3.2 RUSSIA

- 11.3.2.1 Increasing focus on modernizing emission control activities at industrial sites to accelerate market growth

- 11.3.3 ITALY

- 11.3.3.1 Ongoing industrial modernization and rising demand for reliable aftermarket services to drive market

- 11.3.4 UK

- 11.3.4.1 Industrial modernization and demand for sustainable filtration solutions to augment market growth

- 11.3.5 FRANCE

- 11.3.5.1 Robust environmental mandates and industry-driven modernization to expedite market growth

- 11.3.6 REST OF EUROPE

- 11.3.1 GERMANY

- 11.4 NORTH AMERICA

- 11.4.1 US

- 11.4.1.1 Growing emphasis on industrial modernization and decarbonization initiatives to boost market growth

- 11.4.2 CANADA

- 11.4.2.1 Strong focus on clean energy transition and industrial sustainability to fuel market growth

- 11.4.3 MEXICO

- 11.4.3.1 Rapid industrial expansion and implementation of environmental regulations to accelerate market growth

- 11.4.1 US

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 GCC

- 11.5.1.1 Saudi Arabia

- 11.5.1.1.1 Strong government support for environmental sustainability and emission reduction to augment market growth

- 11.5.1.2 UAE

- 11.5.1.2.1 Booming construction industry and ambitious sustainability initiatives to fuel market growth

- 11.5.1.3 Rest of GCC

- 11.5.1.1 Saudi Arabia

- 11.5.2 SOUTH AFRICA

- 11.5.2.1 Large-scale mining and power generation activities to contribute to market growth

- 11.5.3 NIGERIA

- 11.5.3.1 Growing health concerns due to pollution to drive market

- 11.5.4 REST OF MIDDLE EAST & AFRICA

- 11.5.1 GCC

- 11.6 SOUTH AMERICA

- 11.6.1 BRAZIL

- 11.6.1.1 Rapid industrial growth and environmental pressures to boost market growth

- 11.6.2 ARGENTINA

- 11.6.2.1 Evolving regulatory frameworks to curb emissions to fuel market growth

- 11.6.3 CHILE

- 11.6.3.1 Growing emphasis on mitigating severe particulate pollution to boost market growth

- 11.6.4 REST OF SOUTH AMERICA

- 11.6.1 BRAZIL

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 12.3 MARKET SHARE ANALYSIS, 2024

- 12.4 REVENUE ANALYSIS, 2020-2024

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS

- 12.6 PRODUCT COMPARISON

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.7.5.1 Company footprint

- 12.7.5.2 Region footprint

- 12.7.5.3 End-use industry footprint

- 12.7.5.4 Filtration fabric footprint

- 12.7.5.5 Filtration type footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.8.5.1 Detailed list of key startups/SMEs

- 12.8.5.2 Competitive benchmarking of key startups/SMEs

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

- 12.9.3 EXPANSIONS

- 12.9.4 OTHER DEVELOPMENTS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 EATON

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths/Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses/Competitive threats

- 13.1.2 DONALDSON COMPANY, INC.

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Deals

- 13.1.2.3.2 Expansions

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths/Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses/Competitive threats

- 13.1.3 PARKER HANNIFIN CORP

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product launches

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths/Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses/Competitive threats

- 13.1.4 PALL CORPORATION

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Expansions

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths/Right to win

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses/Competitive threats

- 13.1.5 3M

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Developments

- 13.1.5.4 MnM view

- 13.1.5.4.1 Key strengths/Right to win

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses/Competitive threats

- 13.1.6 THERMAX LIMITED

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Deals

- 13.1.7 PENTAIR

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.8 BABCOCK & WILCOX ENTERPRISES, INC.

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Deals

- 13.1.9 CAMFIL

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Expansions

- 13.1.10 W. L. GORE & ASSOCIATES, INC.

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.11 GENERAL FILTRATION

- 13.1.11.1 Business overview

- 13.1.11.2 Products/Solutions/Services offered

- 13.1.11.3 Recent developments

- 13.1.11.3.1 Deals

- 13.1.12 BWF OFFERMANN, WALDENFELS & CO. KG

- 13.1.12.1 Business overview

- 13.1.12.2 Products/Solutions/Services offered

- 13.1.12.3 Recent developments

- 13.1.12.3.1 Deals

- 13.1.12.3.2 Expansions

- 13.1.13 LENNTECH B.V.

- 13.1.13.1 Business overview

- 13.1.13.2 Products/Solutions/Services offered

- 13.1.14 ROSEDALE PRODUCTS INC.

- 13.1.14.1 Business overview

- 13.1.14.2 Products/Solutions/Services offered

- 13.1.15 AMERICAN FABRIC FILTER

- 13.1.15.1 Business overview

- 13.1.15.2 Products/Solutions/Services offered

- 13.1.1 EATON

- 13.2 OTHER PLAYERS

- 13.2.1 FILTRATION SYSTEMS PRODUCTS INC.

- 13.2.2 AJR FILTRATION

- 13.2.3 FAB-TEX FILTRATION

- 13.2.4 CUSTOM ADVANCED

- 13.2.5 INDUSTRIAL FILTER MANUFACTURING LTD.

- 13.2.6 K2TEC

- 13.2.7 TEFLO

- 13.2.8 PRECISION WIRE PRODUCTS, INC.

- 13.2.9 GRIFFIN FILTERS

- 13.2.10 SHELCO FILTERS

14 APPENDIX

- 14.1 INSIGHTS FROM INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS