|

시장보고서

상품코드

1812620

지속가능한 접착제 시장 : 유형별, 원재료별, 최종 이용 산업별, 지역별 - 예측(-2030년)Sustainable Adhesives Market by Type, Raw Material, End-use Industry, and Region - Global Forecast to 2030 |

||||||

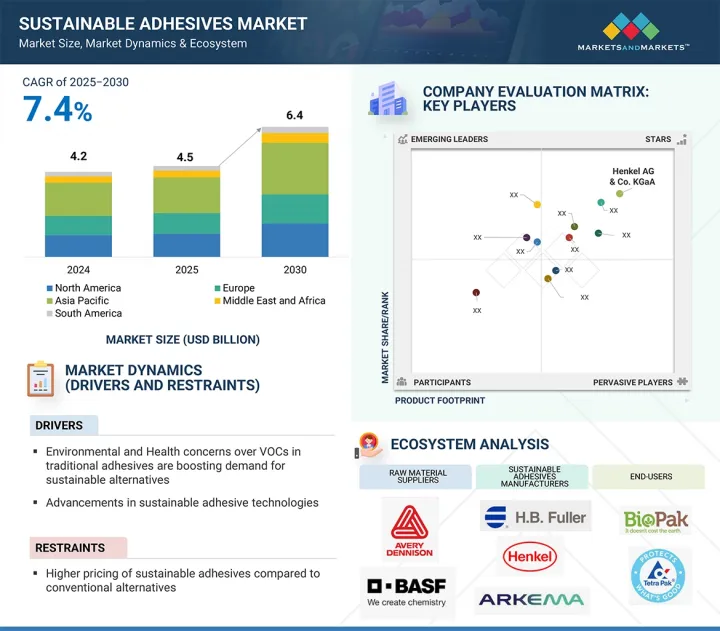

세계의 지속가능한 접착제 시장 규모는 2025년 45억 달러에서 2030년까지 64억 달러에 달할 것으로 예측되며, 예측 기간 동안 연평균 복합 성장률(CAGR) 7.4%의 성장이 예상됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2021-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 100만 달러/10억 달러, 킬로톤 |

| 부문 | 서비스, 기술, 최종 이용 산업, 지역 |

| 대상 지역 | 아시아태평양, 북미, 유럽, 중동 및 아프리카, 남미 |

지속가능한 접착제 시장의 주요 성장 촉진요인은 기존 접착제에 포함된 VOC로 인한 환경 및 건강 피해에 대한 인식이 높아진 것입니다. VOC 배출은 대기오염, 건강 문제, 환경 위험의 주요 원인이며, 산업계는 보다 안전하고 친환경적인 대안을 모색하고 있습니다. 이러한 인식은 유럽의 REACH, 미국의 EPA 규제와 같이 VOC 수준의 감소를 의무화하고 지속가능하고 가능한 친환경적인 재료의 사용을 촉진하는 각 지역의 규제 프레임워크에 의해 촉진되고 있습니다. 기술의 발전으로 바이오 기반 수성 재활용 가능한 점착제의 제법이 개선되어 높은 성능을 유지하면서 지속가능한 점착제를 쉽게 적용할 수 있게 되었습니다.

또한, 포장, 자동차, 건설, 가구 등의 산업은 기업과 고객의 지속가능성 목표를 지원하기 위해 지속가능한 접착제를 채택하고 있습니다. 규제 압력, 기술 발전, 환경 인식의 증가로 인해 잉크 및 접착제 산업에서 성능 손실이 없는 지속가능한 솔루션으로의 전환이 크게 가속화되고 있으며, 지속가능한 접착제는 모든 부문에서 선호되는 선택이 되고 있습니다.

"재활용 가능한 접착제가 수량 기준으로 가장 큰 시장 점유율을 차지할 것으로 보입니다."

재활용 접착제는 세계 순환 경제 목표에 따라 제품 수명이 다한 후 재료의 분리 및 회수를 용이하게 하는 지속가능한 접착 솔루션을 제공하기 때문에 재활용 접착제 시장에서 가장 큰 유형 부문이 될 것입니다. 이 접착제는 사용 중에도 강력한 성능을 유지하면서 열, 습기, 화학적 트리거와 같은 특정 조건 하에서 박리되도록 설계되어 플라스틱, 금속, 유리, 종이와 같은 기판의 효율적인 재활용을 촉진합니다. 엄격한 환경 규제와 기업의 지속가능성 목표를 달성하기 위해 포장 산업, 전자, 자동차 부문에서 이러한 접착제의 채택이 증가하고 있습니다. 친환경 제품에 대한 소비자의 수요 증가는 재활용이 불가능한 재료와 확대된 생산자책임재활용(EPR) 프로그램을 금지하는 정책으로 인해 그 채택을 가속화하고 있습니다. 또한, 접착제 제법의 발전으로 범용성, 자동 제조 적합성, 비용 효율성이 향상되어 시장에서의 우위가 더욱 강화되고 있습니다. 이러한 규제 강화, 기술 혁신, 업계 채택의 조합은 선도적 지위를 보장하고 있습니다.

"수성 부문은 수량 기준으로 지속가능한 접착제 시장에서 가장 큰 원료 부문이었습니다."

수성 원료는 휘발성 유기화합물(VOC) 배출이 적고, 환경에 미치는 영향이 적으며, 유해 화학제품에 대한 엄격한 세계 규제를 준수하기 때문에 지속가능한 접착제 시장에서 가장 큰 점유율을 차지할 것으로 예상됩니다. 이 접착제는 용매 대신 물을 운반체로 사용하기 때문에 화재 위험과 작업장 건강 위험을 최소화하면서 제조업체와 최종사용자 모두에게 더 안전합니다. 그 범용성으로 인해 친환경 접착 솔루션에 대한 수요가 빠르게 증가하고 있는 포장, 목공, 자동차, 건설 등 다양한 산업분야에 적용이 가능합니다. 기술의 발전으로 성능이 향상되어 솔벤트계 대체품에 필적하는 내구성, 빠른 경화, 높은 접착 강도를 실현하고 있습니다. 또한, 친환경 제품에 대한 소비자의 선호도가 높아지고 기업의 지속가능한 제조 방식 채택이 증가함에 따라 수성 접착제에 대한 수요가 더욱 강화되어 지속가능한 접착제 시장에서 선호되는 선택이 되고 있습니다.

"포장은 지속가능한 접착제 시장에서 금액 기준으로 가장 빠르게 성장하는 최종 이용 산업 분야입니다."

식음료, E-Commerce, 소비재 부문에서 친환경적이고 재활용 가능한 포장 솔루션에 대한 수요가 급증함에 따라, 포장 산업은 지속가능한 접착제의 최종 사용 분야로 급성장할 것으로 예상됩니다. 환경 규제의 강화와 플라스틱 폐기물을 줄이기 위한 브랜드들의 노력으로 인해 제조업체들은 종이, 골판지, 퇴비화 가능한 필름에 적합한 바이오 기반 수성 및 무용제 접착제로 전환하고 있습니다. 또한, 온라인 소매업의 급격한 성장으로 인해 골판지 상자 및 연포장용 강력하고 가볍고 지속가능한 접착 솔루션에 대한 수요가 증가하고 있습니다. 이러한 변화는 친환경 포장에 대한 소비자의 선호와 세계 브랜드들이 순환 경제 원칙을 채택함에 따라 더욱 가속화되고 있으며, 포장 분야에서 지속가능한 접착제의 사용이 가속화되고 있습니다.

세계의 지속가능한 접착제 시장에 대해 조사 분석했으며, 주요 촉진요인과 억제요인, 경쟁 상황, 향후 동향 등의 정보를 전해드립니다.

목차

제1장 소개

제2장 조사 방법

제3장 주요 요약

제4장 중요한 인사이트

- 지속가능한 접착제 시장 기업에서 매력적인 기회

- 지속가능한 접착제 시장 : 유형별

- 지속가능한 접착제 시장 : 원재료별

- 지속가능한 접착제 시장 : 최종 이용 산업별

- 지속가능한 접착제 시장 : 국가별

제5장 시장 개요

- 소개

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

- 지속가능한 접착제 시장에서 생성형 AI의 영향

- 소개

- 다양한 사업 분야에서 AI를 도입하는 화학 기업

- 지속가능한 접착제 시장의 생성형 AI 활용

- 지속가능한 접착제 시장에서 생성형 AI의 영향

제6장 산업 동향

- 소개

- 고객 비즈니스에 영향을 미치는 동향/혼란

- 공급망 분석

- 지속가능한 접착제 시장에 대한 2025년 미국 관세의 영향

- 소개

- 주요 관세율

- 가격의 영향 분석

- 국가/지역에 대한 영향

- 북미

- 유럽

- 아시아태평양

- 최종 이용 산업에 대한 영향

- 투자와 자금 조달 시나리오

- 가격 책정 분석

- 평균판매가격 동향 : 지역별

- 평균판매가격 동향 : 원재료별

- 주요 기업 평균판매가격 동향 : 원재료별

- 생태계 분석

- 기술 분석

- 주요 기술

- 보완 기술

- 인접 기술

- 특허 분석

- 조사 방법

- 특허 취득 건수(2015-2024년)

- 인사이트

- 법적 지위

- 관할 분석

- 주요 출원자

- 지속가능한 접착제에 관한 주요 특허

- 무역 분석

- 수입 시나리오

- 수출 시나리오

- 주요 회의와 이벤트(2024-2025년)

- 관세와 규제 상황

- 지속가능한 접착제에 관한 관세

- 규제기관, 정부기관, 기타 조직

- 지속가능한 접착제에 관한 규제

- Porter's Five Forces 분석

- 주요 이해관계자와 구입 기준

- 거시경제 지표

- 사례 연구 분석

- BOSTIK, 고성능 지속가능한 접착제 솔루션을 개발

- 접착제는 이유식 제조업체가 라벨을 효율적으로 갱신하는 데 도움이 된다.

- HENKEL, KRATON, DOW가 접착제 탄소발자국 절감을 위해 제휴

제7장 지속가능한 접착제 시장 : 유형별

- 소개

- 재활용 가능한 접착제

- 재생 가능한 접착제

- 재펄프화 가능한 접착제

- 생분해성 접착제

- 친환경 접착제

- 기타 유형

- 핫멜트 접착제

- UV 경화형 접착제

- 무용제 접착제

제8장 지속가능한 접착제 시장 : 원재료별

- 소개

- 수성

- 식물성

- EVA계

- 아크릴계

- 기타 원재료

- 동물성

- 바이오 기반 폴리우레탄

제9장 지속가능한 접착제 시장 : 최종 이용 산업별

- 소개

- 포장

- 목공

- 의료

- 소비재

- 건설

- 자동차

- 기타 최종 이용 산업

- 전자

- 텍스타일

- 재생에너지

제10장 지속가능한 접착제 시장 : 지역별

- 소개

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 이탈리아

- 프랑스

- 영국

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 기타 아시아태평양

- 중동 및 아프리카

- GCC 국가

- 남아프리카공화국

- 기타 중동 및 아프리카

- 남미

- 아르헨티나

- 브라질

- 기타 남미

제11장 경쟁 구도

- 소개

- 주요 진출 기업의 전략/강점, 2021년 1월-2025년 7월

- 시장 점유율 분석

- 매출 분석(2021-2025년)

- 브랜드/제품의 비교

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업 평가 매트릭스 : 스타트업/중소기업(2024년)

- 경쟁 시나리오와 동향

제12장 기업 개요

- 주요 기업

- BASF

- HENKEL AG & CO. KGAA

- H.B. FULLER COMPANY

- JOWAT SE

- DOW

- DUPONT

- ARKEMA

- AVERY DENNISON CORPORATION

- PARAMELT B.V.

- SYNTHOS

- ARTIENCE CO., LTD.

- SIKA AG

- 3M

- 기타 기업

- ARTIMELT AG

- FOLLMANN GMBH & CO. KG

- LD DAVIS

- EMSLAND GROUP

- ECOSYNTHETIX INC

- WEISS CHEMIE+TECHNIK GMBH & CO. KG

- SELLEYS

- AVEBE

- MASTER BOND

- KLEIBERIT SE & CO. KG

- THE COMPOUND COMPANY

- U.S. ADHESIVES, INC.

- FRANKLIN INTERNATIONAL

- PREMIER STARCH PRODUCTS PVT. LTD

- C.B. ADHESIVES LTD

제13장 부록

KSM 25.09.24The sustainable adhesives market size is projected to grow from USD 4.5 billion in 2025 to USD 6.4 billion in 2030, registering a CAGR of 7.4% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Kiloton) |

| Segments | Service, Technology, End-use Industry, and Region |

| Regions covered | Asia Pacific, North America, Europe, Middle East & Africa, South America |

A key factor driving the growth of the sustainable adhesives market is the increasing awareness of the environmental and health hazards posed by VOCs in traditional adhesives. VOC emissions are a major contributor to air pollution, health issues, and environmental risks, prompting industries to seek safer, greener alternatives. This awareness is boosted by regulatory frameworks across regions, including REACH in Europe and EPA regulations in the United States, which mandate lower VOC levels and promote the use of sustainable, and if possible, eco-friendly materials. Advances in technology improve bio-based, water-based, and recyclable adhesive formulations, all while maintaining high performance, making sustainable adhesives easily applicable.

Additionally, industries such as packaging, automotive, construction, and furniture are adopting sustainable adhesives to support their corporate and customer sustainability goals. A combination of regulatory pressure, technological progress, and increased environmental consciousness is significantly accelerating the shift in ink and adhesive industries toward sustainable solutions without compromising performance, making sustainable adhesives a preferred choice across all sectors.

"Recyclable adhesives will account for the largest share of the sustainable adhesives market in terms of volume."

Recyclable adhesives will be the largest type segment of the recyclable adhesives market because they offer a sustainable bonding solution that enables easier separation and recovery of materials at the end of a product's life, aligning with global circular economy goals. These adhesives are designed to maintain strong performance during use while allowing debonding under specific conditions-such as heat, moisture, or chemical triggers-facilitating efficient recycling of substrates like plastics, metals, glass, and paper. The packaging industry, electronics, and automotive sectors are increasingly adopting these adhesives to meet stringent environmental regulations and corporate sustainability targets. Growing consumer demand for eco-friendly products, combined with policies banning non-recyclable materials and extended producer responsibility (EPR) programs, is accelerating their adoption. Moreover, advancements in adhesive formulations are improving their versatility, compatibility with automated manufacturing, and cost-effectiveness, further driving market dominance. This combination of regulatory push, technological innovation, and industry adoption ensures their leading position.

"The water-based segment was the largest raw material segment of the sustainable adhesives market in terms of volume."

Water-based raw materials are expected to hold the largest share in the sustainable adhesives market due to their low volatile organic compound (VOC) emissions, reduced environmental impact, and compliance with stringent global regulations on harmful chemicals. These adhesives use water as a carrier instead of solvents, making them safer for both manufacturers and end-users while minimizing fire hazards and workplace health risks. Their versatility allows application across diverse industries, including packaging, woodworking, automotive, and construction, where demand for eco-friendly bonding solutions is rapidly increasing. Technological advancements have improved their performance, enabling high bonding strength, fast curing, and durability comparable to solvent-based alternatives. Additionally, the rising consumer preference for green products and increasing adoption of sustainable manufacturing practices by companies further strengthen the demand for water-based adhesives, making them the preferred choice in the sustainable adhesives market.

"Packaging will be the fastest-growing end-use industry segment of the sustainable adhesives market in terms of value."

The packaging industry is expected to be the fastest-growing end-use segment for sustainable adhesives, driven by the surge in demand for eco-friendly and recyclable packaging solutions across food & beverage, e-commerce, and consumer goods sectors. Rising environmental regulations and brand commitments to reduce plastic waste are pushing manufacturers toward bio-based, water-based, and solvent-free adhesive formulations that are compatible with paper, cardboard, and compostable films. Additionally, the rapid growth of online retail is fueling the need for strong, lightweight, and sustainable bonding solutions for corrugated boxes and flexible packaging. This shift is further supported by consumer preference for green packaging and the adoption of circular economy principles by global brands, accelerating the use of sustainable adhesives in packaging applications.

"Asia Pacific is the largest market for sustainable adhesives."

Asia Pacific holds the largest share of the sustainable adhesives market, driven by its rapidly expanding manufacturing base, high consumption of packaged goods, and increasing focus on environmentally friendly production practices. Countries such as China, India, Japan, and South Korea are witnessing strong demand from industries such as packaging, construction, automotive, and woodworking, where adhesives play a crucial role. The region's booming e-commerce sector and fast-growing food & beverage industry are accelerating the need for eco-friendly, recyclable, and water-based adhesives for flexible packaging and corrugated boxes. Moreover, supportive government policies promoting sustainable materials, coupled with rising awareness among manufacturers about reducing volatile organic compound (VOC) emissions, are fueling market growth. Asia Pacific also benefits from lower production costs, easy availability of raw materials, and the presence of major global and regional adhesive manufacturers. Ongoing investments in R&D and advancements in bio-based adhesive technology further strengthen the region's market dominance. This combination of industrial growth, regulatory support, and sustainability-driven innovation positions Asia Pacific as the leading hub for sustainable adhesive adoption and production.

- By Company Type: Tier 1-50%, Tier 2-25%, and Tier 3-25%

- By Designation: Managers-20%, Directors-15%, and Others-65%

- By Region: North America-30%, Europe-30%, Asia Pacific-20%, South America-10%, Middle East & Africa-10%

The sustainable adhesives market comprises major players like BASF (Germany), Henkel AG & Co. KGaA (Germany), H.B. Fuller Company (US), Jowat SE (Germany), Dow (US), DuPont (US), Arkema (France), Avery Dennison Corporation (US), Paramelt B.V (Netherlands), Synthos (Poland), artience Co., Ltd. (Japan), Sika AG (Switzerland), and 3M (US).

The study includes an in-depth competitive analysis of these key players in the sustainable adhesives market, with their company profiles, recent developments, and key market strategies.

Research Coverage

This report segments the sustainable adhesives market by type, raw material, end-use industry, and region, and provides estimations for the overall value of the market across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, products, key strategies, and expansions associated with the sustainable adhesives market.

Key benefits of buying this report

This research report is focused on various levels of analysis - industry analysis (industry trends), market ranking analysis of top players, and company profiles, which together provide an overall view of the competitive landscape; emerging and high-growth segments of the sustainable adhesives market; high-growth regions; and market drivers, restraints, opportunities, and challenges.

The report provides insights into the following pointers:

- Analysis of drivers (Environmental and Health concerns over VOCs in traditional adhesives are boosting demand for sustainable alternatives), restraints ( Higher pricing of sustainable adhesives compared to conventional alternatives), opportunities (Increasing green building initiatives in urban areas), and challenges (Performance limitations and erratic availability of raw materials) influencing the growth of sustainable adhesives market.

- Market Penetration: Comprehensive information on the sustainable adhesives offered by top players in the global sustainable adhesives market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, new product launches, expansions, and partnerships in the sustainable adhesives market.

- Market Development: Comprehensive information about lucrative emerging markets, the report analyzes the markets for sustainable adhesives market across regions.

- Market Capacity: Production capacities of companies producing sustainable adhesives are provided wherever available with upcoming capacities for the sustainable adhesives market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the sustainable adhesives market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 INCLUSIONS AND EXCLUSIONS

- 1.3.2 YEARS CONSIDERED

- 1.3.3 CURRENCY CONSIDERED

- 1.3.4 UNIT CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key participants in primary interviews

- 2.1.2.3 Breakdown of interviews with experts

- 2.1.2.4 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 BASE NUMBER CALCULATION

- 2.2.1 SUPPLY-SIDE APPROACH

- 2.2.2 DEMAND-SIDE APPROACH

- 2.3 FORECAST NUMBER CALCULATION

- 2.3.1 SUPPLY SIDE

- 2.3.2 DEMAND SIDE

- 2.4 MARKET SIZE ESTIMATION

- 2.4.1 BOTTOM-UP APPROACH

- 2.4.2 TOP-DOWN APPROACH

- 2.5 DATA TRIANGULATION

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 GROWTH FORECAST

- 2.8 RISK ASSESSMENT

- 2.9 FACTOR ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SUSTAINABLE ADHESIVES MARKET

- 4.2 SUSTAINABLE ADHESIVES MARKET, BY TYPE

- 4.3 SUSTAINABLE ADHESIVES MARKET, BY RAW MATERIAL

- 4.4 SUSTAINABLE ADHESIVES MARKET, BY END-USE INDUSTRY

- 4.5 SUSTAINABLE ADHESIVES MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Environmental and health concerns over VOCs in traditional adhesives

- 5.2.1.2 Advancements in sustainable adhesive technologies

- 5.2.1.3 Government push to drive adoption of sustainable adhesives

- 5.2.2 RESTRAINTS

- 5.2.2.1 Higher pricing of sustainable adhesives compared to conventional alternatives

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing green building initiatives in urban areas

- 5.2.3.2 Rising demand for recyclable packaging and adoption of circular economy principles

- 5.2.4 CHALLENGES

- 5.2.4.1 Performance limitations and erratic availability of raw materials

- 5.2.1 DRIVERS

- 5.3 IMPACT OF GENERATIVE AI ON SUSTAINABLE ADHESIVES MARKET

- 5.3.1 INTRODUCTION

- 5.3.2 CHEMICAL COMPANIES EMBRACING AI ACROSS VARIOUS BUSINESS AREAS

- 5.3.3 USE OF GENERATIVE AI IN SUSTAINABLE ADHESIVES MARKET

- 5.3.4 IMPACT OF GENERATIVE AI ON SUSTAINABLE ADHESIVES MARKET

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.3 SUPPLY CHAIN ANALYSIS

- 6.4 IMPACT OF 2025 US TARIFF ON SUSTAINABLE ADHESIVES MARKET

- 6.4.1 INTRODUCTION

- 6.4.2 KEY TARIFF RATES

- 6.4.3 PRICE IMPACT ANALYSIS

- 6.5 IMPACT ON COUNTRY/REGION

- 6.5.1 NORTH AMERICA

- 6.5.2 EUROPE

- 6.5.3 ASIA PACIFIC

- 6.6 IMPACT ON END-USE INDUSTRIES

- 6.7 INVESTMENT AND FUNDING SCENARIO

- 6.8 PRICING ANALYSIS

- 6.8.1 AVERAGE SELLING PRICE TREND, BY REGION

- 6.8.2 AVERAGE SELLING PRICE TREND, BY RAW MATERIAL

- 6.8.3 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY RAW MATERIAL

- 6.9 ECOSYSTEM ANALYSIS

- 6.10 TECHNOLOGY ANALYSIS

- 6.10.1 KEY TECHNOLOGIES

- 6.10.2 COMPLEMENTARY TECHNOLOGIES

- 6.10.3 ADJACENT TECHNOLOGIES

- 6.11 PATENT ANALYSIS

- 6.11.1 METHODOLOGY

- 6.11.2 GRANTED PATENTS, 2015-2024

- 6.11.2.1 Patent publication trend of last 10 years

- 6.11.3 INSIGHTS

- 6.11.4 LEGAL STATUS

- 6.11.5 JURISDICTION ANALYSIS

- 6.11.6 TOP APPLICANTS

- 6.11.7 KEY PATENTS FOR SUSTAINABLE ADHESIVES

- 6.12 TRADE ANALYSIS

- 6.12.1 IMPORT SCENARIO

- 6.12.2 EXPORT SCENARIO

- 6.13 KEY CONFERENCES AND EVENTS, 2024-2025

- 6.14 TARIFF AND REGULATORY LANDSCAPE

- 6.14.1 TARIFFS RELATED TO SUSTAINABLE ADHESIVES

- 6.14.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.14.3 REGULATIONS RELATED TO SUSTAINABLE ADHESIVES

- 6.15 PORTER'S FIVE FORCES ANALYSIS

- 6.15.1 THREAT OF NEW ENTRANTS

- 6.15.2 THREAT OF SUBSTITUTES

- 6.15.3 BARGAINING POWER OF SUPPLIERS

- 6.15.4 BARGAINING POWER OF BUYERS

- 6.15.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.16 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.16.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.16.2 BUYING CRITERIA

- 6.17 MACROECONOMIC INDICATORS

- 6.17.1 GDP TRENDS AND FORECAST OF MAJOR ECONOMIES

- 6.18 CASE STUDY ANALYSIS

- 6.18.1 BOSTIK DEVELOPS HIGH-PERFORMANCE SUSTAINABLE ADHESIVE SOLUTIONS

- 6.18.2 APPLIED ADHESIVES HELPS BABY FOOD MANUFACTURER EFFICIENTLY UPDATE LABELS

- 6.18.3 HENKEL, KRATON, AND DOW COLLABORATE TO REDUCE CARBON FOOTPRINT OF ADHESIVES

7 SUSTAINABLE ADHESIVES MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 RECYCLABLE ADHESIVES

- 7.2.1 PRESERVE MATERIAL QUALITY AND SUPPORT CIRCULAR ECONOMY PRACTICES

- 7.3 RENEWABLE ADHESIVES

- 7.3.1 REDUCE DEPENDENCE ON FOSSIL FUELS AND PROMOTE ENVIRONMENTAL SUSTAINABILITY

- 7.4 REPULPABLE ADHESIVES

- 7.4.1 ENSURE CLEAN SEPARATION OF FIBERS AND ENHANCE RECYCLABILITY OF PAPER PRODUCTS

- 7.5 BIODEGRADABLE ADHESIVES

- 7.5.1 REDUCE LONG-TERM ENVIRONMENTAL POLLUTION AND SUPPORT ECO-FRIENDLY PRODUCT LIFE CYCLE MANAGEMENT

- 7.6 GREEN ADHESIVES

- 7.6.1 MINIMIZE ENVIRONMENTAL IMPACT WHILE MAINTAINING STRINGENT REGULATORY STANDARDS FOR SAFETY AND SUSTAINABILITY

- 7.7 OTHER TYPES

- 7.7.1 HOT MELT ADHESIVES

- 7.7.2 UV-CURABLE ADHESIVES

- 7.7.3 SOLVENT-FREE ADHESIVES

8 SUSTAINABLE ADHESIVES MARKET, BY RAW MATERIAL

- 8.1 INTRODUCTION

- 8.2 WATER-BASED

- 8.2.1 FIND WIDE-SCALE USE FOR VERSATILE BONDING APPLICATIONS IN PACKAGING AND WOODWORKING

- 8.3 PLANT-BASED

- 8.3.1 USED AS SUSTAINABLE BONDING SOLUTIONS ACROSS INDUSTRIES, FROM CONSTRUCTION TO PACKAGING

- 8.4 EVA-BASED

- 8.4.1 COMBINE FLEXIBILITY AND DURABILITY WITH RENEWABLE COMPONENTS

- 8.5 ACRYLIC-BASED

- 8.5.1 OFFER ENHANCED DURABILITY, UV RESISTANCE, AND STRONG BONDING CAPABILITIES

- 8.6 OTHER RAW MATERIALS

- 8.6.1 ANIMAL-BASED

- 8.6.2 BIO-BASED POLYURETHANE

9 SUSTAINABLE ADHESIVES MARKET, BY END-USE INDUSTRY

- 9.1 INTRODUCTION

- 9.2 PACKAGING

- 9.2.1 INCREASING DEMAND FOR NON-TOXIC, FOOD-SAFE ADHESIVES TO DRIVE MARKET

- 9.3 WOODWORKING

- 9.3.1 LOW-VOC ADHESIVES CRUCIAL FOR ECO-FRIENDLY FURNITURE MANUFACTURING

- 9.4 MEDICAL

- 9.4.1 NEED FOR BIOCOMPATIBLE AND HYPOALLERGENIC ADHESIVES TO ENSURE SAFETY AND REGULATORY COMPLIANCE TO BOOST MARKET

- 9.5 CONSUMER GOODS

- 9.5.1 ECO-CONSCIOUS BONDING SOLUTIONS SUPPORT SUSTAINABLE PRODUCT LINES, PROMOTING BRAND SUSTAINABILITY

- 9.6 CONSTRUCTION

- 9.6.1 STRONG BONDING CAPABILITIES ENHANCE ENERGY EFFICIENCY THROUGH EFFECTIVE INSULATION AND WEATHER-RESISTANT PROPERTIES

- 9.7 AUTOMOTIVE

- 9.7.1 IMPROVED FUEL EFFICIENCY AND VEHICLE PERFORMANCE WITH REDUCED EMISSIONS TO DRIVE MARKET

- 9.8 OTHER END-USE INDUSTRIES

- 9.8.1 ELECTRONICS

- 9.8.2 TEXTILE

- 9.8.3 RENEWABLE ENERGY

10 SUSTAINABLE ADHESIVES MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 US

- 10.2.1.1 Rising demand in packaging and construction industries to drive market

- 10.2.2 CANADA

- 10.2.2.1 Focus on sustainable development to boost market

- 10.2.3 MEXICO

- 10.2.3.1 Government's sustainability goals to drive demand

- 10.2.1 US

- 10.3 EUROPE

- 10.3.1 GERMANY

- 10.3.1.1 High demand in automotive and packaging industries to drive market

- 10.3.2 ITALY

- 10.3.2.1 Expanding end-use industries to boost demand

- 10.3.3 FRANCE

- 10.3.3.1 Government emphasis on sustainability to bolster market

- 10.3.4 UK

- 10.3.4.1 Rising demand in construction and automotive industries to propel market

- 10.3.5 SPAIN

- 10.3.5.1 Growing packaging industry to drive demand

- 10.3.6 REST OF EUROPE

- 10.3.1 GERMANY

- 10.4 ASIA PACIFIC

- 10.4.1 CHINA

- 10.4.1.1 Growing focus on sustainability across industries to drive demand

- 10.4.2 JAPAN

- 10.4.2.1 Emphasis on innovation and technological advancements to support market

- 10.4.3 INDIA

- 10.4.3.1 Strict environmental regulations to drive market

- 10.4.4 SOUTH KOREA

- 10.4.4.1 Increasing adoption in construction industry to boost market

- 10.4.5 REST OF ASIA PACIFIC

- 10.4.1 CHINA

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 GCC COUNTRIES

- 10.5.1.1 UAE

- 10.5.1.1.1 Growing construction activity to fuel market

- 10.5.1.2 Saudi Arabia

- 10.5.1.2.1 Investments in infrastructure development to bolster market

- 10.5.1.3 Other GCC countries

- 10.5.1.1 UAE

- 10.5.2 SOUTH AFRICA

- 10.5.2.1 Growing demand in various end-use industries to boost market

- 10.5.3 REST OF MIDDLE EAST & AFRICA

- 10.5.1 GCC COUNTRIES

- 10.6 SOUTH AMERICA

- 10.6.1 ARGENTINA

- 10.6.1.1 Availability of natural resources to drive market

- 10.6.2 BRAZIL

- 10.6.2.1 Strict environmental regulations to encourage adoption

- 10.6.3 REST OF SOUTH AMERICA

- 10.6.1 ARGENTINA

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, JANUARY 2021-JULY 2025

- 11.3 MARKET SHARE ANALYSIS

- 11.3.1 MARKET SHARE OF KEY PLAYERS, 2024

- 11.4 REVENUE ANALYSIS, 2021-2025

- 11.5 BRAND/PRODUCT COMPARISON

- 11.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.6.1 STARS

- 11.6.2 EMERGING LEADERS

- 11.6.3 PERVASIVE PLAYERS

- 11.6.4 PARTICIPANTS

- 11.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.6.5.1 Company footprint

- 11.6.5.2 Type footprint

- 11.6.5.3 End-use industry footprint

- 11.6.5.4 Raw material footprint

- 11.6.5.5 Region footprint

- 11.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.7.1 PROGRESSIVE COMPANIES

- 11.7.2 RESPONSIVE COMPANIES

- 11.7.3 DYNAMIC COMPANIES

- 11.7.4 STARTING BLOCKS

- 11.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.7.5.1 Key startups/SMEs

- 11.7.5.2 Competitive benchmarking of startups/SMEs

- 11.7.6 COMPANY VALUATION AND FINANCIAL METRICS

- 11.8 COMPETITIVE SCENARIO AND TRENDS

- 11.8.1 PRODUCT LAUNCHES

- 11.8.2 DEALS

- 11.8.3 EXPANSIONS

- 11.8.4 OTHER DEVELOPMENTS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 BASF

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Product launches

- 12.1.1.3.2 Expansions

- 12.1.1.4 MnM view

- 12.1.1.4.1 Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses & competitive threats

- 12.1.2 HENKEL AG & CO. KGAA

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Product launches

- 12.1.2.3.2 Deals

- 12.1.2.3.3 Expansions

- 12.1.2.4 MnM view

- 12.1.2.4.1 Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses & competitive threats

- 12.1.3 H.B. FULLER COMPANY

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Product launches

- 12.1.3.3.2 Deals

- 12.1.3.3.3 Expansions

- 12.1.3.4 MnM view

- 12.1.3.4.1 Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses & competitive threats

- 12.1.4 JOWAT SE

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Product launches

- 12.1.4.3.2 Deals

- 12.1.4.3.3 Expansions

- 12.1.4.3.4 Other developments

- 12.1.4.4 MnM view

- 12.1.4.4.1 Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses & competitive threats

- 12.1.5 DOW

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Product launches

- 12.1.5.3.2 Deals

- 12.1.5.3.3 Other developments

- 12.1.5.4 MnM view

- 12.1.5.4.1 Right to win

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses & competitive threats

- 12.1.6 DUPONT

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Other developments

- 12.1.6.4 MnM view

- 12.1.6.4.1 Right to win

- 12.1.6.4.2 Strategic choices

- 12.1.6.4.3 Weaknesses & competitive threats

- 12.1.7 ARKEMA

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Services/Solutions offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Product launches

- 12.1.7.3.2 Deals

- 12.1.7.3.3 Other developments

- 12.1.7.4 MnM view

- 12.1.7.4.1 Right to win

- 12.1.7.4.2 Strategic choices

- 12.1.7.4.3 Weaknesses & competitive threats

- 12.1.8 AVERY DENNISON CORPORATION

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Product launches

- 12.1.8.3.2 Deals

- 12.1.8.3.3 Other developments

- 12.1.8.4 MnM view

- 12.1.8.4.1 Right to win

- 12.1.8.4.2 Strategic choices

- 12.1.8.4.3 Weaknesses & competitive threats

- 12.1.9 PARAMELT B.V.

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.9.3 MnM view

- 12.1.9.3.1 Right to win

- 12.1.9.3.2 Strategic choices

- 12.1.9.3.3 Weaknesses & competitive threats

- 12.1.10 SYNTHOS

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Product launches

- 12.1.10.3.2 Other developments

- 12.1.10.4 MnM view

- 12.1.10.4.1 Right to win

- 12.1.10.4.2 Strategic choices

- 12.1.10.4.3 Weaknesses & competitive threats

- 12.1.11 ARTIENCE CO., LTD.

- 12.1.11.1 Business overview

- 12.1.11.2 Products/Solutions/Services offered

- 12.1.11.3 Recent developments

- 12.1.11.3.1 Product launches

- 12.1.11.3.2 Expansions

- 12.1.11.3.3 Other developments

- 12.1.11.4 MnM view

- 12.1.11.4.1 Right to win

- 12.1.11.4.2 Strategic choices

- 12.1.11.4.3 Weaknesses & competitive threats

- 12.1.12 SIKA AG

- 12.1.12.1 Business overview

- 12.1.12.2 Products/Solutions/Services offered

- 12.1.12.3 Recent developments

- 12.1.12.3.1 Product launches

- 12.1.12.3.2 Deals

- 12.1.12.3.3 Expansions

- 12.1.12.3.4 Other developments

- 12.1.12.4 MnM view

- 12.1.12.4.1 Right to win

- 12.1.12.4.2 Strategic choices

- 12.1.12.4.3 Weaknesses & competitive threats

- 12.1.13 3M

- 12.1.13.1 Business overview

- 12.1.13.2 Products/Solutions/Services offered

- 12.1.13.3 Recent developments

- 12.1.13.3.1 Product launches

- 12.1.13.4 MnM view

- 12.1.13.4.1 Right to win

- 12.1.13.4.2 Strategic choices

- 12.1.13.4.3 Weaknesses & competitive threats

- 12.1.1 BASF

- 12.2 OTHER PLAYERS

- 12.2.1 ARTIMELT AG

- 12.2.2 FOLLMANN GMBH & CO. KG

- 12.2.3 LD DAVIS

- 12.2.4 EMSLAND GROUP

- 12.2.5 ECOSYNTHETIX INC

- 12.2.6 WEISS CHEMIE + TECHNIK GMBH & CO. KG

- 12.2.7 SELLEYS

- 12.2.8 AVEBE

- 12.2.9 MASTER BOND

- 12.2.10 KLEIBERIT SE & CO. KG

- 12.2.11 THE COMPOUND COMPANY

- 12.2.12 U.S. ADHESIVES, INC.

- 12.2.13 FRANKLIN INTERNATIONAL

- 12.2.14 PREMIER STARCH PRODUCTS PVT. LTD

- 12.2.15 C.B. ADHESIVES LTD

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS