|

시장보고서

상품코드

1812635

의료용 센서 시장 : 시장 규모 - 센서 유형별, 제품 유형별, 의료기기 분류별, 용도별, 연결성/통합 성별, 기술별, 최종사용자별, 지역별 - 예측(-2030년)Medical Sensors Market Size, by Sensor Type (Biopotential, Biophysical, Image), Product Type (Ingestible, External), Device Classification, Application, Connectivity, Technology, End User, & Region - Global Forecast to 2030 |

||||||

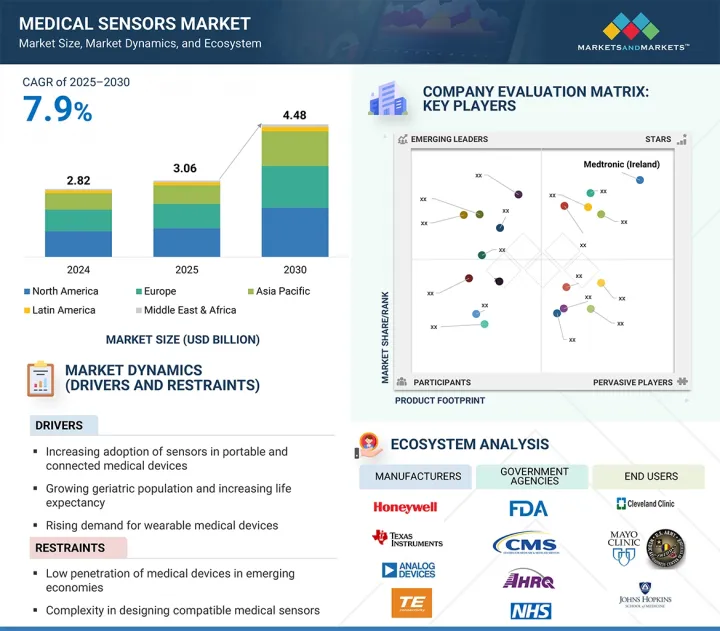

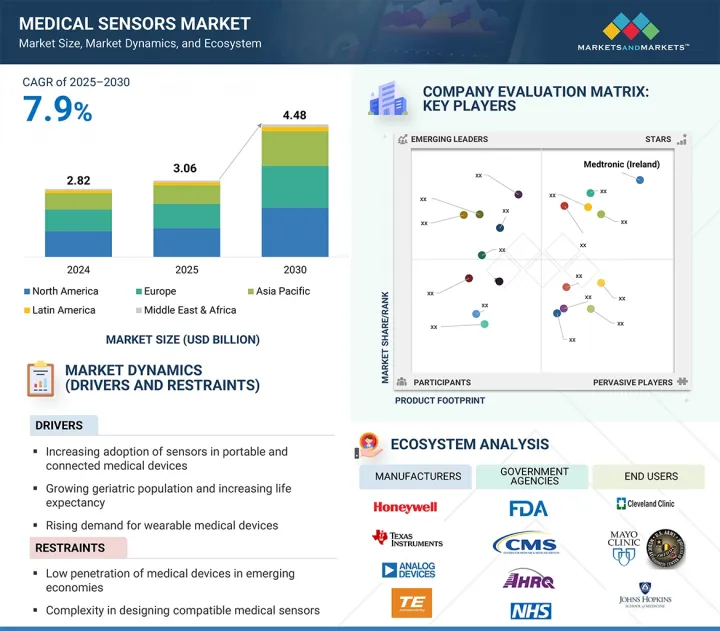

의료용 센서 시장 규모는 7.9%의 CAGR로 확대되어 2025년 30억 6,000만 달러에서 2030년에는 44억 8,000만 달러에 달할 것으로 예측됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2024-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 검토 단위 | 금액(10억 달러) |

| 부문 | 센서 유형별, 제품 유형별, 의료기기 분류별, 용도별, 연결성/통합 성별, 기술별, 최종사용자별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 라틴아메리카, 중동 및 아프리카 |

이러한 강력한 성장은 피트니스 트래커, 스마트 워치, 지속적 혈당 측정기 등 웨어러블 건강 기술의 채택이 증가하고 있으며, 이러한 기술은 소형, 실시간, 고정밀 센서에 크게 의존하고 있습니다. 만성질환 관리, 노인 간호, 예방적 건강 모니터링에 이러한 기기 사용이 증가하면서 센서에 대한 수요가 크게 증가하고 있습니다.

센서 유형별로 의료용 센서 시장은 생체 전위 센서(ECG, EEG, EMG 센서 등), 생체 물리 센서(온도, 압력, 혈압, 혈중 산소 센서 등), 영상 센서(X-ray, MRI, 초음파 센서), 생화학 센서(혈당 센서, 효소 기반 센서), 인체 감지/위치 센서(가속도계, 자이로스코프), 유량 센서, 기타 의료용 센서로 나뉩니다. 특히 고령자 및 만성질환 환자들 사이에서 환자의 이동 추적, 재활 모니터링, 낙상 감지를 위해 웨어러블 및 이식형 장치의 사용이 증가함에 따라 모션 센서와 위치 센서는 예측 기간 동안 큰 시장 성장을 보일 것으로 예상됩니다. 또한, 수술용 로봇, 스마트 의족, 원격 물리치료 등의 분야에서 고정밀 동작 추적에 대한 수요가 증가함에 따라 헬스케어 분야에서 동작 및 위치 센서의 채택이 더욱 가속화되고 있습니다. 마이크로 전기 기계 시스템(MEMS)의 끊임없는 기술 혁신으로 웨어러블 건강 모니터에 쉽게 통합할 수 있는 소형, 저전력 모션 센서의 개발이 가능해졌습니다. 또한, 신경질환 및 근골격계 질환의 유병률 증가로 인해 임상 진단 및 재활에 대한 변동성 분석에 대한 요구도 꾸준히 증가하고 있습니다. 또한, 이러한 센서의 실시간 데이터 수집은 원격 환자 모니터링 및 원격의료 서비스를 향상시킵니다. 홈케어에 대한 규제 지원과 무선 센서 네트워크의 발전은 수요를 더욱 증가시키고 있습니다. 그 결과, 모션 센서와 위치 센서는 차세대 커넥티드 헬스 시스템의 필수적인 구성요소로 자리 잡고 있습니다.

최종사용자별로는 양로원, 요양원, 장기요양센터, 재택케어 부문이 예측 기간 동안 상당한 CAGR로 성장할 것으로 예상됩니다. 이 시설들은 증가하는 노인 인구와 만성질환을 앓고 있는 환자들에게 장기적이고 재택 기반의 지역 중심적인 의료 서비스를 제공하는 주거 케어 커뮤니티의 확장된 네트워크의 일부입니다. 지속적인 환자 모니터링, 원격 치료, 맞춤형 치료에 대한 요구가 증가함에 따라 이러한 환경에서 커넥티드 의료기기의 사용이 증가하고 있습니다. 노인 인구의 증가는 이러한 추세의 중요한 원동력이 되고 있습니다. 유엔의 세계 인구 고령화 보고서에 따르면, 유럽의 65세 이상 인구는 2020년 약 19%에서 2060년 29%로 증가하고, 아시아와 라틴아메리카는 2060년까지 노인 인구가 21%에 달할 것으로 예상됩니다. 고령자나 만성질환 환자들은 퇴원 후에도 장기적인 치료와 지속적인 모니터링이 필요한 경우가 많기 때문에 이러한 시설에서는 생체 신호와 건강 데이터를 효율적으로 모니터링하기 위해 IoT 지원 센서 기반 의료기기에 대한 의존도가 높아지고 있습니다. 환자 수의 증가는 데이터 생성의 급증으로 이어져 실시간 모니터링, 원격 진단, 예측 경보를 가능하게 하는 스마트 의료 인프라에 대한 투자를 촉진하고 있습니다. 스마트폰이나 인터넷을 통해 접속할 수 있는 원격의료 솔루션도 사용 편의성과 유연성으로 인해 이러한 환경에서 널리 보급되고 있습니다. 휴대용, 웨어러블, 센서 내장형 기기에 대한 수요는 특히 환자 중심의 예방적 의료 접근법에 중점을 둔 재택 및 주거 환경에서의 의료용 센서 채택을 크게 촉진할 것으로 예상됩니다.

유럽은 막대한 정부 투자, 고령 인구 증가, 헬스케어 수요 증가를 배경으로 예측 기간 동안 세계 의료용 센서 시장에서 상당한 점유율을 차지할 것으로 예상됩니다. 2023년 9월, 영국 정부는 의료 인프라를 강화하고 병원과 클리닉의 수요 증가에 대응하기 위해 41억 달러를 국민보건서비스(NHS)에 지원했습니다. 이 지역 전체에서 인구 고령화와 당뇨병, 심혈관질환, 수면무호흡증을 포함한 호흡기질환과 같은 만성질환의 유병률 증가는 환자의 지속적인 원격 모니터링을 위한 센서 도입의 주요 요인으로 작용하고 있습니다. Eurostat에 따르면, 2023년 1월 1일 현재 EU 인구의 21.3%가 65세 이상이며, 특히 재택 및 주택 요양 현장에서 장기 요양 및 모니터링 솔루션의 필요성이 부각되고 있습니다. 이러한 인구통계학적 변화로 인해 사용자 친화적인 커넥티드 의료기기, 특히 실시간 데이터 추적 및 관리를 위한 스마트 센서가 탑재된 의료기기의 채택이 증가하고 있습니다. 그러나 유럽 각국의 일관성 없고 불안정한 상환 정책이 여전히 큰 걸림돌로 작용하고 있습니다. 일부 지역에서는 원격 심전도 시스템과 같은 필수 장비가 보험회사에 의해 일률적으로 보장되지 않기 때문에 제조업체는 제품에 대한 접근성을 보장하기 위해 차등적인 가격 전략을 시행하고 있습니다. 또한, 서유럽에서는 경제 문제와 시장 성숙으로 인해 경쟁이 심화되고 특정 하위 부문의 성장이 둔화되고 있습니다. 이러한 어려움에도 불구하고, 이 지역에는 첨단 의료용 센서 개발에 기여하는 유명 대기업과 혁신적 스타트업이 혼재되어 있습니다. 유럽의 주요 기업으로는 TE Connectivity(스위스), Sensirion(스위스), STMicroelectronics(스위스) 등이 있으며, 이 지역의 성장을 더욱 촉진하고 있습니다. AI, IoT, 소형화 기술이 의료기기에 통합됨에 따라 예측 기간 동안 유럽 센서 제조업체들에게 더 많은 성장 기회가 창출될 것으로 예상됩니다. 이러한 요소들이 종합적으로 의료용 센서 시장에서 유럽의 리더십을 강화하고 있습니다.

세계의 의료용 센서 시장을 조사했으며, 센서 종류별, 제품 종류별, 의료기기 분류별, 용도별, 커넥티비티/통합 성별, 기술별, 최종사용자별, 지역별 동향, 시장 진입 기업 프로파일 등의 정보를 정리하여 전해드립니다.

목차

제1장 소개

제2장 조사 방법

제3장 주요 요약

제4장 주요 인사이트

제5장 시장 개요

- 소개

- 시장 역학

- 고객의 비즈니스에 영향을 미치는 동향/디스럽션

- 업계 동향

- 생태계 분석

- 밸류체인 분석

- 기술 분석

- 관세 및 규제 분석

- 무역 분석, 2020-2024년

- 가격 분석

- Porter's Five Forces 분석

- 주요 이해관계자와 구입 기준

- 특허 분석

- 미충족 수요와 최종사용자 기대

- 2025-2026년의 주요 회의와 이벤트

- 사례 연구 분석

- 투자와 자금 조달 시나리오

- 비즈니스 모델

- AI/생성형 AI가 의료용 센서 시장에 미치는 영향

- 2025년 미국 관세가 의료용 센서 시장에 미치는 영향

제6장 의료용 센서 시장(센서 유형별)

- 소개

- 생체 전위 센서

- 생체 물리 센서

- 이미지 센서

- 생화학 센서

- 재실감지 센서/위치 센서

- 플로우 센서

- 기타

제7장 의료용 센서 시장(제품 유형별)

- 소개

- 섭취형 센서

- 이식형 센서

- 외부(비침습) 센서

- 기타

제8장 의료용 센서 시장(의료기기 분류별)

- 소개

- 클래스 I 의료용 센서

- 클래스 II 의료용 센서

- 클래스 III 의료용 센서

제9장 의료용 센서 시장(용도별)

- 소개

- 진단

- 치료

- 모니터링

- 기타

제10장 의료용 센서 시장(연결성/통합성별)

- 소개

- 유선 센서

- 무선 센서

제11장 의료용 센서 시장(기술별)

- 소개

- 미세전자기계 시스템(MEMS)

- 상보형 금속 산화막 반도체(CMOS)

- 나노/그래핀 기반 센서

- 광섬유 센서

- 압전 센서

- 기타

제12장 의료용 센서 시장(최종사용자별)

- 소개

- 병원·클리닉

- 요양시설, 노인 시설, 장기간병 센터, 재택 케어 시설

- 기타

제13장 의료용 센서 시장(지역별)

- 소개

- 북미

- 북미의 거시경제 전망

- 미국

- 캐나다

- 유럽

- 유럽의 거시경제 전망

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 기타

- 아시아태평양

- 아시아태평양의 거시경제 전망

- 일본

- 중국

- 인도

- 한국

- 호주

- 기타

- 라틴아메리카

- 라틴아메리카의 거시경제 전망

- 브라질

- 멕시코

- 기타

- 중동 및 아프리카

- 중동 및 아프리카의 거시경제 전망

- GCC 국가

- 사우디아라비아

- 아랍에미리트

- 기타 GCC 국가

- 기타

제14장 경쟁 구도

- 소개

- 주요 진출 기업의 전략/강점

- 매출 분석, 2020-2024년

- 시장 점유율 분석, 2024년

- 기업 평가 매트릭스 : 주요 진출 기업, 2024년

- 기업 평가 매트릭스 : 스타트업/중소기업, 2024년

- 기업 평가와 재무 지표

- 브랜드/제품 비교

- 경쟁 시나리오

제15장 기업 개요

- 주요 진출 기업

- TE CONNECTIVITY

- MEDTRONIC

- ANALOG DEVICES, INC.

- HONEYWELL INTERNATIONAL INC.

- TEXAS INSTRUMENTS INCORPORATED

- AMPHENOL CORPORATION

- SENSIRION AG

- STMICROELECTRONICS

- AMS-OSRAM AG

- EXCELITAS TECHNOLOGIES CORP.

- TEKSCAN, INC.

- NXP SEMICONDUCTORS

- SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC

- OMNIVISION

- NIHON KOHDEN CORPORATION

- INNOVATIVE SENSOR TECHNOLOGY IST AG

- CTS CORPORATION

- ROHM CO., LTD.

- MURATA MANUFACTURING CO., LTD.

- ANGST+PFISTER

- 기타 기업

- VIVALNK, INC.

- SUPERIOR SENSORS TECHNOLOGY

- XSENSIO

- ALTHEN SENSORS AND CONTROLS

- PROFUSA, INC.

제16장 부록

KSM 25.09.25The medical sensors market is projected to reach USD 4.48 billion by 2030 from USD 3.06 billion in 2025, at a CAGR of 7.9%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Sensor Type, Product Type, Medical Device Classification, Application, Connectivity/Integration, Technology, and End User |

| Regions covered | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

This strong growth is driven by the rising adoption of wearable health technologies such as fitness trackers, smartwatches, and continuous glucose monitors, which depend heavily on compact, real-time, and high-accuracy sensors. The increasing use of these devices in managing chronic diseases, caring for the elderly, and preventive health monitoring is greatly increasing sensor demand.

"The motion/position sensors segment is expected to witness significant market share during the forecast period."

By sensor type, the medical sensors market is divided into biopotential sensors (such as ECG, EEG, and EMG sensors), biophysical sensors (including temperature, pressure, blood pressure, and blood oxygen sensors), image sensors (X-ray, MRI, and ultrasound sensors), biochemical sensors (blood glucose and enzyme-based sensors), motion/position sensors (accelerometers and gyroscopes), flow sensors, and other medical sensors. The motion and position sensors are expected to experience significant market growth during the forecast period due to the increasing use of wearable and implantable devices for patient mobility tracking, rehabilitation monitoring, and fall detection, especially among elderly and chronically ill populations. Additionally, the rising demand for high-precision movement tracking in applications such as surgical robotics, smart prosthetics, and remote physiotherapy is further driving the adoption of motion and position sensors in healthcare. Continuous innovations in microelectromechanical systems (MEMS) have enabled the development of compact, low-power motion sensors that can be easily integrated into wearable health monitors. The increasing prevalence of neurological and musculoskeletal disorders is also creating a steady need for movement analysis in clinical diagnostics and rehabilitation. Moreover, real-time data collection from these sensors improves remote patient monitoring and telehealth services. Regulatory support for home-based care and advancements in wireless sensor networks are further increasing demand. As a result, motion and position sensors are becoming essential components of next-generation connected health systems.

"The nursing homes, assisted living facilities, long-term care centers, and home care settings segment is expected to grow at a considerable CAGR during the forecast period in the medical sensors market."

By end user, the nursing homes, assisted living facilities, long-term care centers, and home care settings segment is expected to grow at a considerable CAGR during the forecast period. These facilities are part of an expanding network of residential care communities providing long-term, home-based, and community-focused healthcare services to an increasing elderly population and patients with chronic conditions. The rising need for continuous patient monitoring, remote care, and personalized treatment is boosting the use of connected medical devices in these environments. The growing geriatric demographic is a significant driver of this trend. According to the UN's World Population Ageing Report, Europe's population aged 65 and older is expected to grow from about 19% in 2020 to 29% by 2060, while Asia and Latin America will see their elderly populations reach 21% by 2060. Since seniors and chronically ill individuals often require long-term care and ongoing monitoring even after leaving the hospital, these facilities increasingly rely on IoT-enabled, sensor-based medical devices to monitor vital signs and health data efficiently. The rise in patient numbers has caused a surge in data generation, prompting investments in smart medical infrastructure that enables real-time monitoring, remote diagnostics, and predictive alerts. Telehealth solutions accessible via smartphones and the internet are also becoming popular in these settings due to their ease of use and flexibility. The demand for portable, wearable, and sensor-embedded devices is expected to significantly boost the adoption of medical sensors, especially in home and residential care settings that focus on patient-centered and preventive healthcare approaches.

"Europe accounted for a substantial share of the medical sensors market in 2024."

Europe is projected to hold a substantial share of the global medical sensors market during the forecast period, driven by significant government investments, a growing elderly population, and increasing healthcare demands. In September 2023, the UK government committed USD 4.1 billion to the National Health Service (NHS) to strengthen healthcare infrastructure and meet rising demands from hospitals and clinics. Across the region, the aging population and increasing prevalence of chronic diseases such as diabetes, cardiovascular disorders, and respiratory conditions, including sleep apnea, are major factors contributing to sensor adoption for continuous and remote patient monitoring. According to Eurostat, 21.3% of the EU population was aged 65 and over as of January 1, 2023, highlighting the need for long-term care and monitoring solutions, especially in home and residential care settings. These demographic shifts are driving greater adoption of user-friendly, connected medical devices-particularly those equipped with smart sensors for real-time data tracking and management. However, inconsistent and unstable reimbursement policies across European countries remain a significant obstacle. In some regions, essential devices like telemetric ECG systems, which are not uniformly covered by insurers, lead manufacturers to implement differential pricing strategies to ensure product access. Additionally, economic challenges and market maturity in Western Europe have resulted in increased competition and slower expansion in certain subsegments. Despite these challenges, the region is home to a mix of established leaders and innovative startups contributing to the development of advanced medical sensors. Key players in Europe include TE Connectivity (Switzerland), Sensirion (Switzerland), and STMicroelectronics (Switzerland), further driving regional growth. The growing integration of AI, IoT, and miniaturized technologies into medical devices is expected to create further growth opportunities for sensor manufacturers in Europe throughout the forecast period. These factors collectively reinforce Europe's leadership in the medical sensors market.

The breakdown of primary participants is as mentioned below:

- By Company Type - Tier 1: 45%, Tier 2: 30%, and Tier 3: 25%

- By Designation - C-level: 42%, Director-level: 31%, and Others: 27%

- By Region - North America: 35%, Europe: 30%, Asia Pacific: 25%, Middle East & Africa: 5%, Latin America: 5%

Key Players in the Medical Sensors Market

The key players functioning in the medical sensors market include TE Connectivity (Ireland), Medtronics (Ireland), Analog Devices, Inc. (US), Honeywell International Inc. (US), Texas Instruments Incorporated (US), Amphenol Advanced Sensors (US), Sensirion (Switzerland), STMicroelectronics (Switzerland), ams-OSRAM AG (Austria), Excelitas Technologies Corp. (US), Tekscan, Inc. (US), NXP Semiconductors (Netherlands), Semiconductor Components Industries, LLC (US), Omnivision (US), Nihon Kohden Corporation (Japan), Innovative Sensor Technology IST AG (Switzerland), CTS Corporation (US), ROHM Co., Ltd. (Japan), Murata Manufacturing Co., Ltd. (Japan), Angst+Pfister Sensors and Power AG (Switzerland), VivaLNK, Inc. (US), Superior Sensors Technology (US), Xsensio (Switzerland), Althen Sensors and Controls (Netherlands), Profusa Inc. (US).

Research Coverage:

The report analyzes the medical sensors market. It aims to estimate the market size and future growth potential of various segments based on sensor type, product type, medical device classification, application, connectivity/integration, technology, end user, and region. The report also provides a competitive analysis of the key players in this market, along with their company profiles, product offerings, recent developments, and key market insights strategies.

Reasons to Buy the Report

This report will help both established companies and new or smaller firms understand the market's pulse, which, in turn, could enable them to capture a larger market share. Companies purchasing the report may use one or a combination of the strategies below to strengthen their positions in the market.

This report provides insights into:

- Analysis of key drivers: Drivers (increasing adoption of sensors in portable and connected medical devices, growing geriatric population and increasing life expectancy, rising demand for wearable medical devices, surging adoption of IOT-based medical devices, burgeoning expenditure on healthcare), restraints (low penetration of medical devices in emerging economies, complexity in designing compatible medical sensors, and high implementation & maintenance costs of medical sensors), opportunities (advancements in sensors and digital technologies, growth outlook of healthcare industry, increased adoption of surgical robots), and challenges (stringent regulatory environment and requirement for product approvals and data leakages associated with connected medical devices) influencing the growth of the medical sensors market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the medical sensors market.

- Market Development: Comprehensive information on the lucrative emerging markets, by sensor type, product type, medical device classification, application, connectivity/integration, technology, end user, and region.

- Market Diversification: Exhaustive information about the product portfolios, growing geographies, recent developments, and investments in the medical sensors market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, and capabilities of the leading players in the medical sensors market such as TE Connectivity (Ireland), Medtronics (Ireland), Analog Devices, Inc. (US), Honeywell International Inc. (US), Texas Instruments Incorporated (US), Amphenol Advanced Sensors (US), Sensirion (Switzerland), STMicroelectronics (Switzerland), ams-OSRAM AG (Austria), Excelitas Technologies Corp. (US), Tekscan, Inc. (US), NXP Semiconductors (Netherlands), Semiconductor Components Industries, LLC (US), Omnivision (US), Nihon Kohden Corporation (Japan), and Innovative Sensor Technology IST AG (Switzerland).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION & REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key primary sources

- 2.1.2.2 Key objectives of primary research

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Key industry insights

- 2.1.2.5 Breakdown of primaries

- 2.1.1 SECONDARY DATA

- 2.2 RESEARCH METHODOLOGY DESIGN

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 REVENUE SHARE ANALYSIS (SUPPLY SIDE)

- 2.3.2 BOTTOM-UP APPROACH

- 2.3.3 TOP-DOWN APPROACH

- 2.3.4 COMPANY PRESENTATIONS & PRIMARY INTERVIEWS

- 2.4 DATA TRIANGULATION

- 2.5 STUDY ASSUMPTIONS

- 2.5.1 MARKET SIZING ASSUMPTIONS

- 2.5.2 RESEARCH ASSUMPTIONS

- 2.6 RISK ANALYSIS

- 2.7 RESEARCH LIMITATIONS

- 2.7.1 METHODOLOGY-RELATED LIMITATIONS

- 2.7.2 SCOPE-RELATED LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 MEDICAL SENSORS MARKET OVERVIEW

- 4.2 NORTH AMERICA: MEDICAL SENSORS MARKET, BY CONNECTIVITY/INTERGRATION AND REGION

- 4.3 MEDICAL SENSORS MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- 4.4 MEDICAL SENSORS MARKET: DEVELOPED VS. EMERGING ECONOMIES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing adoption of sensors in portable and connected medical devices

- 5.2.1.2 Growing geriatric population and increasing life expectancy

- 5.2.1.3 Rising demand for wearable medical devices

- 5.2.1.4 Surging adoption of IoT-based medical devices

- 5.2.1.5 Burgeoning healthcare expenditure

- 5.2.2 RESTRAINTS

- 5.2.2.1 Low penetration of medical devices in emerging economies

- 5.2.2.2 Complexity in designing compatible medical sensors

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Expanding telehealth and remote patient monitoring ecosystem

- 5.2.3.2 Growth of smart hospitals and digital health infrastructure

- 5.2.3.3 Innovations in implantable medical sensors

- 5.2.3.4 Rising adoption of flexible electronics and MEMS technology

- 5.2.4 CHALLENGES

- 5.2.4.1 Stringent regulatory requirements for product approvals

- 5.2.4.2 Lack of data security and patient privacy in IoT-enabled and wireless medical devices

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.4 INDUSTRY TRENDS

- 5.4.1 MINIATURIZATION AND WEARABLE SENSOR DEVELOPMENT FOR REMOTE PATIENT MONITORING

- 5.4.2 AI-ENHANCED SENSOR ANALYTICS AND PREDICTIVE DIAGNOSTICS

- 5.4.3 REGULATORY PUSH TOWARD INTEROPERABILITY AND CONNECTED MEDICAL SENSOR ECOSYSTEMS

- 5.5 ECOSYSTEM ANALYSIS

- 5.5.1 ROLE IN ECOSYSTEM

- 5.6 VALUE CHAIN ANALYSIS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Sensor element technologies

- 5.7.1.2 Signal processing & conditioning electronics

- 5.7.1.3 Sensor materials & packaging technologies

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 Wireless communication & connectivity solutions

- 5.7.2.2 Power management & energy harvesting

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 AI and ML-based sensor data analytics

- 5.7.3.2 Sensor fusion & contextual awareness systems

- 5.7.3.3 Cloud & edge computing

- 5.7.1 KEY TECHNOLOGIES

- 5.8 TARIFF & REGULATORY ANALYSIS

- 5.8.1 TARIFF ANALYSIS

- 5.8.2 REGULATORY ANALYSIS

- 5.8.2.1 Regulatory bodies, government agencies, and other organizations

- 5.8.2.2 Regulatory framework

- 5.8.2.2.1 North America

- 5.8.2.2.2 Europe

- 5.8.2.2.3 Asia Pacific

- 5.8.2.2.4 Middle East & Africa

- 5.8.2.2.5 Latin America

- 5.9 TRADE ANALYSIS, 2020-2024

- 5.9.1 IMPORT DATA FOR HSN CODE 901813, 2020-2024

- 5.9.2 EXPORT DATA FOR HSN CODE 901813, 2020-2024

- 5.10 PRICING ANALYSIS

- 5.10.1 AVERAGE SELLING PRICE TREND OF MEDICAL SENSORS, BY SENSOR TYPE, 2020-2029

- 5.10.2 AVERAGE SELLING PRICE OF MEDICAL SENSORS, BY KEY PLAYER, 2024

- 5.10.3 INDICATIVE PRICING OF MEDICAL SENSORS, BY REGION, 2024

- 5.11 PORTER'S FIVE FORCES ANALYSIS

- 5.11.1 THREAT OF NEW ENTRANTS

- 5.11.2 THREAT OF SUBSTITUTES

- 5.11.3 BARGAINING POWER OF SUPPLIERS

- 5.11.4 BARGAINING POWER OF BUYERS

- 5.11.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.12 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.12.2 KEY BUYING CRITERIA

- 5.13 PATENT ANALYSIS

- 5.13.1 PATENT PUBLICATION TRENDS FOR MEDICAL SENSORS

- 5.13.2 JURISDICTION ANALYSIS: TOP APPLICANT COUNTRIES FOR MEDICAL SENSORS

- 5.13.3 KEY PATENTS IN MEDICAL SENSORS MARKET

- 5.13.4 LIST OF KEY PATENTS/PATENT APPLICATIONS

- 5.14 UNMET NEEDS & END-USER EXPECTATIONS

- 5.14.1 UNMET NEEDS

- 5.14.2 END-USER EXPECTATIONS

- 5.15 KEY CONFERENCES & EVENTS, 2025-2026

- 5.16 CASE STUDY ANALYSIS

- 5.16.1 PROMET OPTICS TO DEVELOP FLEXIBLE OPTICAL SENSING SOLUTION FOR INTERNATIONAL CORPORATION

- 5.16.2 ZOLL MEDICAL TO DEVELOP PALM-SIZED CPR DEVICE USING MOTION SENSORS BY ANALOG DEVICES

- 5.16.3 PEAK SENSORS TO OFFER ERROR-FREE TEMPERATURE SENSORS TO UNDISCLOSED INTERNATIONAL MEDICAL COMPANY

- 5.17 INVESTMENT & FUNDING SCENARIO

- 5.18 BUSINESS MODELS

- 5.18.1 B2B OEM INTEGRATION MODEL

- 5.18.2 SUBSCRIPTION-BASED MODEL (SAAS)

- 5.18.3 VALUE-BASED/OUTCOME-BASED MODEL

- 5.19 IMPACT OF AI/GEN AI ON MEDICAL SENSORS MARKET

- 5.19.1 TOP USE CASES & MARKET POTENTIAL

- 5.19.2 KEY USE CASES

- 5.19.3 CASE STUDIES OF AI/GEN AI IMPLEMENTATION

- 5.19.3.1 AI-powered predictive analytics to enhance medical sensor performance and patient monitoring

- 5.19.4 IMPACT OF AI/GEN AI ON INTERCONNECTED AND ADJACENT ECOSYSTEMS

- 5.19.4.1 Disposable medical device sensors market

- 5.19.4.2 Wearable sensors market

- 5.19.4.3 Medical electronics market

- 5.19.5 USER READINESS & IMPACT ASSESSMENT

- 5.19.5.1 User readiness

- 5.19.5.1.1 User A: Hospitals & clinics

- 5.19.5.1.2 User B: Nursing homes, assisted living facilities, long-term care centers, and home care settings

- 5.19.5.1.3 User C: Other end users

- 5.19.5.2 Impact assessment

- 5.19.5.2.1 User A: Hospitals & clinics

- 5.19.5.2.1.1 Implementation

- 5.19.5.2.1.2 Impact

- 5.19.5.2.2 User B: Nursing homes, assisted living facilities, long-term care centers, and home care settings

- 5.19.5.2.2.1 Implementation

- 5.19.5.2.2.2 Impact

- 5.19.5.2.3 Other end users

- 5.19.5.2.3.1 Implementation

- 5.19.5.2.3.2 Impact

- 5.19.5.2.1 User A: Hospitals & clinics

- 5.19.5.1 User readiness

- 5.20 IMPACT OF 2025 US TARIFF ON MEDICAL SENSORS MARKET

- 5.20.1 INTRODUCTION

- 5.20.2 KEY TARIFF RATES

- 5.20.3 PRICE IMPACT ANALYSIS

- 5.20.3.1 Sensor hardware & components

- 5.20.3.2 AI & analytics integration

- 5.20.3.3 Firmware updates

- 5.20.3.4 Offshore development & support

- 5.20.4 IMPACT ON COUNTRY/REGION

- 5.20.4.1 North America

- 5.20.4.1.1 US

- 5.20.4.2 Europe

- 5.20.4.3 Asia Pacific

- 5.20.4.1 North America

- 5.20.5 IMPACT ON END-USE INDUSTRIES

- 5.20.5.1 Hospitals & clinics

- 5.20.5.2 Nursing homes, assisted living, long-term care, and home care settings

- 5.20.5.3 Other end users

6 MEDICAL SENSORS MARKET, BY SENSOR TYPE

- 6.1 INTRODUCTION

- 6.2 BIOPOTENTIAL SENSORS

- 6.2.1 ECG SENSORS

- 6.2.1.1 Rising demand for remote patient monitoring and AI-integrated wearable technology among cardiovascular patients to drive market

- 6.2.2 EEG SENSORS

- 6.2.2.1 Application in neurofeedback therapy, cognitive enhancement, and brain-computer interface research to aid market growth

- 6.2.3 EMG SENSORS

- 6.2.3.1 Growing adoption for physical rehabilitation, neuroprosthetics, robotics, and sports medicine to augment segment growth

- 6.2.4 OTHER BIOPOTENTIAL SENSORS

- 6.2.1 ECG SENSORS

- 6.3 BIOPHYSICAL SENSORS

- 6.3.1 TEMPERATURE SENSORS

- 6.3.1.1 Thermistors

- 6.3.1.1.1 High sensitivity to fuel thermistor adoption in wearables and critical care

- 6.3.1.2 Infrared sensors

- 6.3.1.2.1 Contactless monitoring to spur demand for infrared sensors

- 6.3.1.3 Other temperature sensors

- 6.3.1.1 Thermistors

- 6.3.2 PRESSURE SENSORS

- 6.3.2.1 Blood pressure sensors

- 6.3.2.1.1 Rising cardiovascular burden to propel demand for blood pressure sensors

- 6.3.2.2 Intracranial pressure sensors

- 6.3.2.2.1 Neurocritical care advancements to augment ICP sensor integration

- 6.3.2.3 Other pressure sensors

- 6.3.2.1 Blood pressure sensors

- 6.3.3 BLOOD OXYGEN SENSORS

- 6.3.3.1 Blood oxygen sensors to detect respiratory deterioration and fuel proactive, home-based disease management

- 6.3.1 TEMPERATURE SENSORS

- 6.4 IMAGE SENSORS

- 6.4.1 X-RAY SENSORS

- 6.4.1.1 Digital radiography and AI-powered screening to bolster demand for X-ray sensors

- 6.4.2 MRI SENSORS

- 6.4.2.1 High-fidelity and non-ionizing imaging to expand MRI sensor integration in neuro and cardiac care

- 6.4.3 ULTRASOUND SENSORS

- 6.4.3.1 Miniaturized piezoelectric arrays to empower ultrasound sensors in point-of-care and wearable imaging

- 6.4.1 X-RAY SENSORS

- 6.5 BIOCHEMICAL SENSORS

- 6.5.1 BLOOD GLUCOSE SENSORS

- 6.5.1.1 Rising diabetes prevalence and non-invasive CGM innovations to fuel adoption in home and clinical settings

- 6.5.2 ENZYME-BASED SENSORS

- 6.5.2.1 Multi-analyte detection and wearable integration to position enzyme-based sensors as core components of next-gen diagnostics

- 6.5.1 BLOOD GLUCOSE SENSORS

- 6.6 MOTION/POSITION SENSORS

- 6.6.1 ACCELEROMETERS

- 6.6.1.1 Accelerometers to enable accurate activity monitoring and fall detection in wearable devices

- 6.6.2 GYROSCOPES

- 6.6.2.1 Gyroscopes to support balance assessment and surgical precision in connected medical systems

- 6.6.1 ACCELEROMETERS

- 6.7 FLOW SENSORS

- 6.7.1 FLOW SENSORS TO POWER PRECISION DOSING AND CONNECTED RESPIRATORY CARE ACROSS CLINICAL AND HOME SETTINGS

- 6.8 OTHER SENSOR TYPES

7 MEDICAL SENSORS MARKET, BY PRODUCT TYPE

- 7.1 INTRODUCTION

- 7.2 INGESTIBLE SENSORS

- 7.2.1 ADVANCED, MINIATURIZED, AND SWALLOWABLE SENSORS TO GAIN TRACTION IN PERSONALIZED AND PREVENTIVE HEALTHCARE

- 7.3 IMPLANTABLE SENSORS

- 7.3.1 IMPLANTABLE SENSORS TO IMPROVE PRECISION DIAGNOSTICS THROUGH REAL-TIME MONITORING OF INTERNAL PHYSIOLOGICAL PARAMETERS

- 7.4 EXTERNAL (NON-INVASIVE) SENSORS

- 7.4.1 EASE OF USE, HIGH PATIENT COMPLIANCE, AND EXPANDING DEMAND FOR REMOTE MONITORING TO SPUR MARKET GROWTH

- 7.5 OTHER SENSORS

8 MEDICAL SENSORS MARKET, BY MEDICAL DEVICE CLASSIFICATION

- 8.1 INTRODUCTION

- 8.2 CLASS I MEDICAL SENSORS

- 8.2.1 RISING ADOPTION OF LOW-RISK SENSORS IN PREVENTIVE AND HOME-BASED CARE TO SUPPORT MARKET GROWTH

- 8.3 CLASS II MEDICAL SENSORS

- 8.3.1 EXPANDING WEARABLES ECOSYSTEM AND CHRONIC DISEASE MONITORING TO PROPEL MARKET GROWTH

- 8.4 CLASS III MEDICAL SENSORS

- 8.4.1 ADVANCEMENTS IN IMPLANTABLE AND LIFE-SUSTAINING TECHNOLOGIES TO AID MARKET GROWTH

9 MEDICAL SENSORS MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 DIAGNOSTICS

- 9.2.1 RISING DEMAND FOR EARLY & ACCURATE DISEASE DETECTION AND PERSONALIZED HEALTH INSIGHTS TO FUEL MARKET GROWTH

- 9.3 THERAPEUTICS

- 9.3.1 GROWTH IN SENSOR-ENABLED DRUG DELIVERY AND IMPLANTS TO DRIVE MARKET

- 9.4 MONITORING

- 9.4.1 SURGING ADOPTION OF WEARABLES AND REMOTE PATIENT MONITORING PLATFORMS TO ACCELERATE MARKET GROWTH

- 9.5 OTHER APPLICATIONS

10 MEDICAL SENSORS MARKET, BY CONNECTIVITY/INTEGRATION

- 10.1 INTRODUCTION

- 10.2 WIRED SENSORS

- 10.2.1 UNINTERRUPTED, REAL-TIME, AND HIGH-PRECISION PHYSIOLOGICAL MONITORING IN HIGH-ACUITY SETTINGS TO FAVOR MARKET GROWTH

- 10.3 WIRELESS SENSORS

- 10.3.1 SEAMLESS, REAL-TIME MONITORING OF VITAL PHYSIOLOGICAL PARAMETERS WITHOUT PHYSICAL CONNECTIONS TO DRIVE MARKET

11 MEDICAL SENSORS MARKET, BY TECHNOLOGY

- 11.1 INTRODUCTION

- 11.2 MICRO-ELECTRO-MECHANICAL SYSTEMS (MEMS)

- 11.2.1 COMPACT SIZE, LOW POWER CONSUMPTION, AND HIGH SENSITIVITY TO AID ADOPTION IN RESPIRATORY AND CARDIOVASCULAR MONITORING

- 11.3 COMPLEMENTARY METAL-OXIDE-SEMICONDUCTOR (CMOS)

- 11.3.1 EFFECIENT REAL-TIME IMAGING AND DIAGNOSTICS IN PORTABLE MEDICAL EQUIPMENT TO AID MARKET GROWTH

- 11.4 NANO/GRAPHENE-BASED SENSORS

- 11.4.1 NANO AND GRAPHENE-BASED SENSORS TO DRIVE PRECISION IN MOLECULAR AND BIOMARKER DETECTION

- 11.5 FIBER-OPTIC SENSORS

- 11.5.1 FIBER OPTIC SENSORS TO OFFER HIGH SENSITIVITY FOR REMOTE AND IMPLANTABLE HEALTH MONITORING

- 11.6 PIEZOELECTRIC SENSORS

- 11.6.1 BETTER REAL-TIME BIOMECHANICAL AND BIOSIGNAL MONITORING TO AUGMENT ADOPTION IN NEXT-GENERATION SENSOR PLATFORMS

- 11.7 OTHER TECHNOLOGIES

12 MEDICAL SENSORS MARKET, BY END USER

- 12.1 INTRODUCTION

- 12.2 HOSPITALS & CLINICS

- 12.2.1 INTEGRATION OF SENSOR-ENABLED DEVICES TO MANAGE PATIENT DATA AND ENHANCE CARE DELIVERY

- 12.3 NURSING HOMES, ASSISTED LIVING FACILITIES, LONG-TERM CARE CENTERS, AND HOME CARE SETTINGS

- 12.3.1 HIGH COST OF HOSPITAL-BASED CARE AND NEED FOR LONG-TERM PREVENTIVE AND PARTICIPATORY CARE TO PROPEL MARKET GROWTH

- 12.4 OTHER END USERS

13 MEDICAL SENSORS MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 NORTH AMERICA

- 13.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 13.2.2 US

- 13.2.2.1 US to dominate global medical sensors market during study period

- 13.2.3 CANADA

- 13.2.3.1 Strong government support and digital health adoption to propel market growth

- 13.3 EUROPE

- 13.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 13.3.2 UK

- 13.3.2.1 Digital health infrastructure and clinical innovation to fuel sensor integration

- 13.3.3 GERMANY

- 13.3.3.1 Favorable government reimbursement and increased focus on industrial innovation to accelerate sensor-based care

- 13.3.4 FRANCE

- 13.3.4.1 Strong emphasis on hospital modernization and home-based chronic disease management to drive biosensor use

- 13.3.5 ITALY

- 13.3.5.1 Expansion of telemedicine and enhanced focus on regional pilot programs to boost market growth

- 13.3.6 SPAIN

- 13.3.6.1 Proactive chronic disease management and regional innovation to propel sensor adoption

- 13.3.7 REST OF EUROPE

- 13.4 ASIA PACIFIC

- 13.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 13.4.2 JAPAN

- 13.4.2.1 High geriatric population to spur adoption of medical sensors in advanced diagnostics and minimally invasive surgical equipment

- 13.4.3 CHINA

- 13.4.3.1 Surging adoption of advanced sensor-enabled diagnostic, monitoring, and therapeutic devices to propel market growth

- 13.4.4 INDIA

- 13.4.4.1 High private healthcare investment and affordability-focused innovation to accelerate market growth

- 13.4.5 SOUTH KOREA

- 13.4.5.1 Innovation-led ecosystem to support medical sensor adoption

- 13.4.6 AUSTRALIA

- 13.4.6.1 Need to enhance healthcare delivery in remote, rural, and indigenous communities to aid sensor demand

- 13.4.7 REST OF ASIA PACIFIC

- 13.5 LATIN AMERICA

- 13.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 13.5.2 BRAZIL

- 13.5.2.1 Extensive healthcare infrastructure, regulatory modernization, and domestic manufacturing base to spur market growth

- 13.5.3 MEXICO

- 13.5.3.1 Increased integration into global supply chain and robust regional manufacturing capabilities to drive market

- 13.5.4 REST OF LATIN AMERICA

- 13.6 MIDDLE EAST & AFRICA

- 13.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 13.6.2 GCC COUNTRIES

- 13.6.3 SAUDI ARABIA

- 13.6.3.1 Regulatory reforms and Vision 2030 investments to make Saudi Arabia regional leader in medical sensors

- 13.6.4 UAE

- 13.6.4.1 Digital-first ecosystem to drive medical sensor adoption in digital health and smart healthcare devices

- 13.6.5 REST OF GCC COUNTRIES

- 13.6.6 REST OF MIDDLE EAST & AFRICA

14 COMPETITIVE LANDSCAPE

- 14.1 INTRODUCTION

- 14.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 14.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN MEDICAL SENSORS MARKET

- 14.3 REVENUE ANALYSIS, 2020-2024

- 14.4 MARKET SHARE ANALYSIS, 2024

- 14.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 14.5.1 STARS

- 14.5.2 EMERGING LEADERS

- 14.5.3 PERVASIVE PLAYERS

- 14.5.4 PARTICIPANTS

- 14.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 14.5.5.1 Company footprint

- 14.5.5.2 Region footprint

- 14.5.5.3 Sensor type footprint

- 14.5.5.4 Product type footprint

- 14.5.5.5 Application footprint

- 14.5.5.6 Connectivity/Integration footprint

- 14.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 14.6.1 PROGRESSIVE COMPANIES

- 14.6.2 RESPONSIVE COMPANIES

- 14.6.3 DYNAMIC COMPANIES

- 14.6.4 STARTING BLOCKS

- 14.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SME PLAYERS, 2024

- 14.6.5.1 Detailed list of key startups/SMEs

- 14.6.5.2 Competitive benchmarking of startups/SMEs

- 14.7 COMPANY VALUATION & FINANCIAL METRICS

- 14.7.1 FINANCIAL METRICS

- 14.7.2 COMPANY VALUATION

- 14.8 BRAND/PRODUCT COMPARISON

- 14.9 COMPETITIVE SCENARIO

- 14.9.1 PRODUCT LAUNCHES & APPROVALS

- 14.9.2 DEALS

- 14.9.3 EXPANSIONS

- 14.9.4 OTHER DEVELOPMENTS

15 COMPANY PROFILE

- 15.1 KEY PLAYERS

- 15.1.1 TE CONNECTIVITY

- 15.1.1.1 Business overview

- 15.1.1.2 Products/Services/Solutions offered

- 15.1.1.3 Recent developments

- 15.1.1.3.1 Product launches

- 15.1.1.3.2 Deals

- 15.1.1.3.3 Expansions

- 15.1.1.3.4 Other developments

- 15.1.1.4 MnM view

- 15.1.1.4.1 Right to win

- 15.1.1.4.2 Strategic choices

- 15.1.1.4.3 Weaknesses & competitive threats

- 15.1.2 MEDTRONIC

- 15.1.2.1 Business overview

- 15.1.2.2 Products/Services/Solutions offered

- 15.1.2.3 Recent developments

- 15.1.2.3.1 Product approvals

- 15.1.2.3.2 Deals

- 15.1.2.4 MnM view

- 15.1.2.4.1 Right to win

- 15.1.2.4.2 Strategic choices

- 15.1.2.4.3 Weaknesses & competitive threats

- 15.1.3 ANALOG DEVICES, INC.

- 15.1.3.1 Business overview

- 15.1.3.2 Products/Services/Solutions offered

- 15.1.3.3 Recent developments

- 15.1.3.3.1 Deals

- 15.1.3.3.2 Expansions

- 15.1.3.3.3 Other developments

- 15.1.3.4 MnM view

- 15.1.3.4.1 Right to win

- 15.1.3.4.2 Strategic choices

- 15.1.3.4.3 Weaknesses & competitive threats

- 15.1.4 HONEYWELL INTERNATIONAL INC.

- 15.1.4.1 Business overview

- 15.1.4.2 Products/Services/Solutions offered

- 15.1.4.3 Recent developments

- 15.1.4.3.1 Product launches

- 15.1.4.3.2 Deals

- 15.1.4.4 MnM view

- 15.1.4.4.1 Right to win

- 15.1.4.4.2 Strategic choices

- 15.1.4.4.3 Weaknesses & competitive threats

- 15.1.5 TEXAS INSTRUMENTS INCORPORATED

- 15.1.5.1 Business overview

- 15.1.5.2 Products/Services/Solutions offered

- 15.1.5.3 Recent developments

- 15.1.5.3.1 Expansions

- 15.1.5.4 MnM view

- 15.1.5.4.1 Right to win

- 15.1.5.4.2 Strategic choices

- 15.1.5.4.3 Weaknesses & competitive threats

- 15.1.6 AMPHENOL CORPORATION

- 15.1.6.1 Business overview

- 15.1.6.2 Products/Services/Solutions offered

- 15.1.6.3 Recent developments

- 15.1.6.3.1 Product launches

- 15.1.6.3.2 Deals

- 15.1.7 SENSIRION AG

- 15.1.7.1 Business overview

- 15.1.7.2 Products/Services/Solutions offered

- 15.1.7.3 Recent developments

- 15.1.7.3.1 Product launches & approvals

- 15.1.7.3.2 Deals

- 15.1.7.3.3 Expansions

- 15.1.8 STMICROELECTRONICS

- 15.1.8.1 Business overview

- 15.1.8.2 Products/Services/Solutions offered

- 15.1.8.3 Recent developments

- 15.1.8.3.1 Product launches

- 15.1.8.3.2 Deals

- 15.1.9 AMS-OSRAM AG

- 15.1.9.1 Business overview

- 15.1.9.2 Products/Services/Solutions offered

- 15.1.9.3 Recent developments

- 15.1.9.3.1 Product launches

- 15.1.9.3.2 Deals

- 15.1.9.3.3 Other developments

- 15.1.10 EXCELITAS TECHNOLOGIES CORP.

- 15.1.10.1 Business overview

- 15.1.10.2 Products/Services/Solutions offered

- 15.1.10.3 Recent developments

- 15.1.10.3.1 Other developments

- 15.1.11 TEKSCAN, INC.

- 15.1.11.1 Business overview

- 15.1.11.2 Products/Services/Solutions offered

- 15.1.11.3 Recent developments

- 15.1.11.3.1 Deals

- 15.1.11.3.2 Other developments

- 15.1.12 NXP SEMICONDUCTORS

- 15.1.12.1 Business overview

- 15.1.12.2 Products/Services/Solutions offered

- 15.1.12.3 Recent developments

- 15.1.12.3.1 Product launches

- 15.1.13 SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC

- 15.1.13.1 Business overview

- 15.1.13.2 Products/Services/Solutions offered

- 15.1.13.3 Recent developments

- 15.1.13.3.1 Product launches

- 15.1.14 OMNIVISION

- 15.1.14.1 Business overview

- 15.1.14.2 Products/Services/Solutions offered

- 15.1.14.3 Recent developments

- 15.1.14.3.1 Product launches

- 15.1.14.3.2 Deals

- 15.1.15 NIHON KOHDEN CORPORATION

- 15.1.15.1 Business overview

- 15.1.15.2 Products/Services/Solutions offered

- 15.1.15.3 Recent developments

- 15.1.15.3.1 Deals

- 15.1.16 INNOVATIVE SENSOR TECHNOLOGY IST AG

- 15.1.16.1 Business overview

- 15.1.16.2 Products/Services/Solutions offered

- 15.1.17 CTS CORPORATION

- 15.1.17.1 Business overview

- 15.1.17.2 Products/Services/Solutions offered

- 15.1.17.3 Recent developments

- 15.1.17.3.1 Deals

- 15.1.18 ROHM CO., LTD.

- 15.1.18.1 Business overview

- 15.1.18.2 Products/Services/Solutions offered

- 15.1.18.3 Recent developments

- 15.1.18.3.1 Product launches

- 15.1.19 MURATA MANUFACTURING CO., LTD.

- 15.1.19.1 Business overview

- 15.1.19.2 Products/Services/Solutions offered

- 15.1.19.3 Recent developments

- 15.1.19.3.1 Expansions

- 15.1.19.3.2 Other developments

- 15.1.20 ANGST+PFISTER

- 15.1.20.1 Business overview

- 15.1.20.2 Products/Services/Solutions offered

- 15.1.20.3 Recent developments

- 15.1.20.3.1 Product launches

- 15.1.1 TE CONNECTIVITY

- 15.2 OTHER PLAYERS

- 15.2.1 VIVALNK, INC.

- 15.2.2 SUPERIOR SENSORS TECHNOLOGY

- 15.2.3 XSENSIO

- 15.2.4 ALTHEN SENSORS AND CONTROLS

- 15.2.5 PROFUSA, INC.

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS