|

시장보고서

상품코드

1816005

정밀 축산 시장 예측(-2030년) : 시스템 유형별, 농장 유형별, 농장 규모별, 용도별, 오퍼링별, 지역별Precision Livestock Farming Market by System Type (Milking Robotic Systems, Precision Feeding Systems, Livestock Monitoring Systems), Application, Offering, Farm Type (Dairy, Swine, Poultry), Farm Size, and Region - Global Forecast to 2030 |

||||||

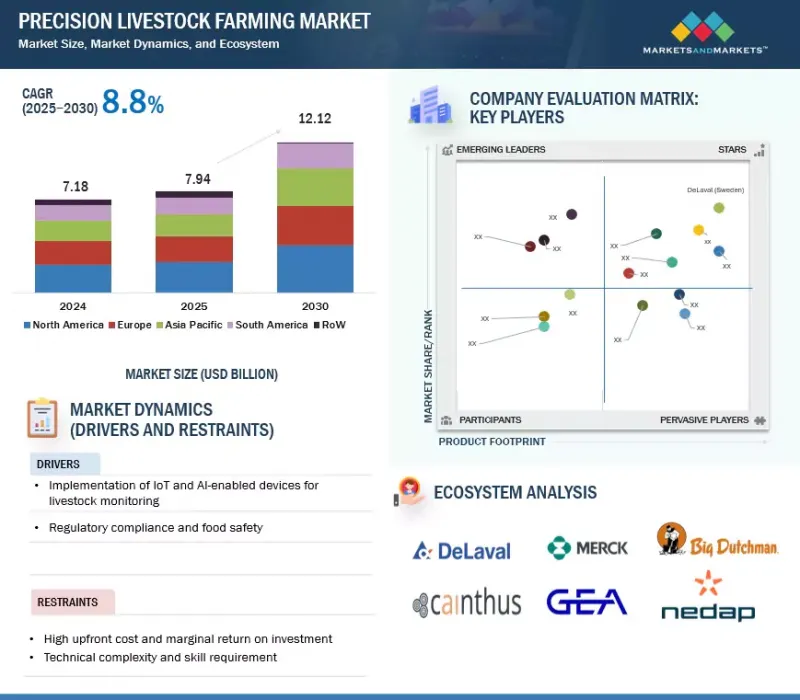

세계의 정밀 축산 시장 규모는 2025년에 79억 4,000만 달러로 예측되며, 예측 기간 중 CAGR은 8.8%로 전망되고 있으며, 2030년에는 121억 2,000만 달러에 달할 것으로 예측됩니다.

정밀축산 시장은 IoT, AI, 스마트 센서 기술의 발전에 힘입어 생산성 향상, 동물 건강, 농장 효율화에 대한 수요가 증가하면서 활성화되고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상연도 | 2025-2030년 |

| 기준연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 검토 단위 | 금액(달러) |

| 부문별 | 시스템 유형별, 농장 유형별, 농장 규모별, 용도별, 오퍼링별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 남미, 기타 지역 |

지속가능하고 복지 중심의 가축 관리에 대한 관심이 높아지면서 자동 모니터링 및 정밀 사료 공급 솔루션의 채택이 더욱 가속화되고 있습니다. 데이터베이스 의사결정 툴와 클라우드 기반 플랫폼의 이용이 증가하면서 통합형 가축 모니터링 시스템에 대한 요구가 증가하고 있습니다.

또한 정부의 우호적인 정책과 인센티브에 힘입어 지속가능한 축산업으로 전환하는 세계적인 추세는 첨단 PLF 기술의 채택을 가속화하고 있습니다. 대규모 상업 농장의 확대와 낙농 및 양계 사업의 디지털화로 인해 농장 전체의 생산성과 자원 효율성이 향상되고 있습니다. 중요한 동향은 규제 당국과 소비자가 요구하는 지속가능성 및 복지 기준에 따라 로봇 공학, 자동화, AI 기반 분석의 통합이 진행되고 있다는 점입니다.

신흥 시장의 중소규모 농가의 경우, 정밀축산에 대한 장점이 입증되었음에도 불구하고 낮은 인지도, 높은 도입 비용, 접근성 문제 등으로 인해 보급에 어려움을 겪고 있으며, 전체 시장 성장을 저해하고 있습니다.

하드웨어, 소프트웨어, 서비스를 포함한 정밀 축산 시장의 제품별 부문은 예측 기간 중 큰 성장률을 나타낼 것으로 예측됩니다. 생산성 향상, 자원 활용의 최적화, 가축의 건강 유지에 대한 요구가 증가함에 따라 이러한 솔루션의 채택이 증가하고 있습니다. 하드웨어는 로봇 시스템, RFID 태그, 센서, 카메라, GPS 장치 등의 기술을 통해 가축의 자동화와 실시간 모니터링을 가능하게 하는 하드웨어가 여전히 지배적인 구성 요소입니다. 클라우드 기반 및 On-Premise 플랫폼에서 AI 기반 데이터 분석에 이르기까지 소프트웨어 솔루션은 예측적 인사이트와 근거에 기반한 의사결정에 필수적인 요소로 자리 잡고 있으며, 업무 효율성을 더욱 향상시키고 있습니다.

이러한 기술을 보완하는 서비스 부문은 시스템 통합, 컨설팅, 매니지드 서비스, 원활한 배포와 안정성을 보장하기 위한 유지보수 및 지원을 제공하는 등 점점 더 중요한 역할을 하고 있습니다. 하드웨어, 소프트웨어, 서비스를 종합하면 인건비 절감, 가축군 생산성 향상, 지속가능한 농업 관행의 지원으로 가축 관리의 형태가 변화하고 있으며, 서비스 부문은 중요한 촉진요인으로 자리매김하고 있습니다.

예측 기간 중 대규모 농장 부문이 가장 큰 점유율을 차지할 것으로 예측됩니다. 일반적으로 1,000마리 이상의 가축을 관리하는 대규모 농장은 규모의 경제와 자금 조달의 용이성으로 인해 중소형 농장보다 더 빠른 속도로 첨단 PLF 솔루션을 도입할 수 있습니다. 자동 사료 공급기, 스마트 건강 모니터링 장치, 통합 데이터 분석 플랫폼에 투자할 수 있으며, 생산성 향상, 노동력 최적화, 동물 복지를 보다 대규모로 개선할 수 있습니다.

이러한 강력한 도입률로 인해 대규모 농장은 농장 규모 부문에서 주요 매출 기여자로 자리매김하고 있습니다. 또한 첨단 자동화 시스템 및 AI 지원 모니터링 툴 출시 등 업계 선도 기업의 지속적인 혁신이 대규모 경영의 우위를 더욱 강화하고 있습니다. 그 결과, 대규모 농장은 앞으로도 PLF 기술의 주요 채택자가 되어 성장을 주도하고, 전 세계 축산 부문의 효율성과 지속가능성의 벤치마크를 설정하게 될 것입니다.

북미는 현재 정밀 축산 시장에서 가장 큰 점유율을 차지하고 있으며, 그 배경에는 첨단화된 농업 인프라, 주요 기술 프로바이더의 강력한 존재감, 대규모 상업용 농장의 디지털 솔루션 조기 도입 등이 있습니다. 이 지역은 작업 효율성, 동물 복지, 추적성에 중점을 두고 있으며, IoT 지원 센서, 자동화 시스템, 데이터베이스 농장 관리 플랫폼의 광범위한 배포를 지속적으로 추진하고 있습니다.

한편, 아시아태평양은 예측 기간 중 가장 빠르게 성장하는 시장이 될 것으로 예측됩니다. 단백질이 풍부한 사료에 대한 수요 증가, 상업적 낙농 및 양계 사업의 급속한 확장, 축산 현대화를 위한 정부의 구상은 중국, 인도, 일본, 호주 등 주요 국가들의 기술 채택에 박차를 가하고 있습니다. AI 기반 모니터링, 스마트 사료 공급 시스템, 가축 헬스케어 솔루션에 대한 세계 기업 및 지역 스타트업의 투자 확대는 성장을 더욱 가속화할 것으로 보입니다. 이를 통해 아시아태평양은 북미의 확고한 시장 지배력을 보완하는 중요한 성장 프런티어로서 자리매김할 수 있습니다.

세계의 정밀 축산 시장에 대해 조사했으며, 시스템 유형별, 농장 유형별, 농장 규모별, 용도별, 오퍼링별, 지역별 동향 및 시장에 참여하는 기업의 개요 등을 정리하여 전해드립니다.

목차

제1장 서론

제2장 조사 방법

제3장 개요

제4장 주요 인사이트

제5장 시장 개요

- 서론

- 거시경제 전망

- 시장 역학

- AI/생성형 AI의 영향

제6장 업계 동향

- 서론

- 2025년 미국 관세의 영향

- 밸류체인 분석

- 무역 분석

- 기술 분석

- 가격 분석

- 에코시스템 분석

- 고객 비즈니스에 영향을 미치는 동향/혼란

- 특허 분석

- 2025-2026년의 주요 컨퍼런스와 이벤트

- 규제 상황

- Porter's Five Forces 분석

- 주요 이해관계자와 구입 기준

- 투자와 자금조달 시나리오

- 사례 연구 분석

제7장 정밀 축산 시장(시스템 유형별)

- 서론

- 착유 로봇 시스템

- 정밀 급이 시스템

- 가축 감시 시스템

- 가금 감시 및 로봇 시스템

제8장 정밀 축산 시장(농장 유형별)

- 서론

- 유제품

- 돼지

- 가금

- 기타

제9장 정밀 축산 시장(농장 규모별)

- 서론

- 소규모

- 중규모

- 대규모

제10장 정밀 축산 시장(용도별)

- 서론

- 착유

- 급이관리

- 가축 행동과 건강 모니터링

- 기타

제11장 정밀 축산 시장(오퍼링별)

- 서론

- 하드웨어

- 소프트웨어

- 서비스

제12장 정밀 축산 시장(지역별)

- 서론

- 북미

- 유럽

- 아시아태평양

- 남미

- 기타 지역

제13장 경쟁 구도

- 개요

- 주요 참여 기업의 전략/강점

- 매출 분석, 2020-2024년

- 시장 점유율 분석, 2024년

- DELAVAL

- GEA GROUP

- MERCK & CO., INC.

- LELY

- NEDAP N.V.

- 기업 평가 매트릭스 : 주요 참여 기업, 2024년

- 기업 평가 매트릭스 : 스타트업/중소기업, 2024년

- 기업 평가와 재무 지표

- 브랜드/제품 비교

- 경쟁 시나리오

제14장 기업 개요

- 주요 참여 기업

- DELAVAL

- GEA GROUP

- AFIMILK LTD.

- MERCK & CO. INC.

- NEDAP N.V.

- LELY

- WAIKATO MILKING SYSTEMS

- LIC

- BOUMATIC

- FANCOM BV

- HOKOFARM GROUP

- TRIOLIET

- BIG DUTCHMAN

- VDL AGROTECH(VDL GROEP)

- HID GLOBAL

- 기타 기업

- NEXA

- PEACOCK TECHNOLOGY LTD

- CONNECTERRA

- EVER. AG

- FAROMATICS

- TIBOT OCTUPUS BIOSAFETY

- MIROBOT

- FARMCONTROL

- MOOCALL

- SCIO+

제15장 인접 시장과 관련 시장

제16장 부록

KSA 25.09.25The global market for precision livestock farming is estimated to be valued at USD 7.94 billion in 2025 and is projected to reach USD 12.12 billion by 2030, at a CAGR of 8.8% during the forecast period. The precision livestock farming market is being fueled by the growing demand for improved productivity, animal health, and farm efficiency, supported by advancements in IoT, AI, and smart sensor technologies.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2025-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD) |

| Segments | By Application, System Type, Offering, Farm Type, Farm Size, and Region |

| Regions covered | North America, Europe, Asia Pacific, South America, and RoW |

Increasing focus on sustainable and welfare-driven livestock management has further accelerated the adoption of automated monitoring and precision feeding solutions. The rising use of data-driven decision-making tools and cloud-based platforms has amplified the need for integrated livestock monitoring systems.

Additionally, a global shift toward sustainable animal farming, supported by favorable government policies and incentives, is accelerating the adoption of advanced PLF technologies. Expanding large-scale commercial farms and digitalized dairy and poultry operations are improving the overall farm productivity and resource efficiency. A key trend is the growing integration of robotics, automation, and AI-based analytics, aligning with sustainability and welfare standards demanded by regulators and consumers.

Limited awareness, high implementation costs, and accessibility challenges among small and medium-sized farmers in developing regions hinder widespread adoption despite the proven benefits of precision livestock farming, restraining overall market growth.

"The offering segment will grow at a significant rate during the forecast period"

The offering segment of the precision livestock farming market, which includes hardware, software, and services, is projected to record a significant growth rate during the forecast period. The increasing need to enhance productivity, optimize resource utilization, and ensure herd health is driving the adoption of these solutions. Hardware remains the dominant component, with technologies such as robotic systems, RFID tags, sensors, cameras, and GPS devices enabling automation and real-time monitoring of livestock. Software solutions, ranging from cloud-based and on-premise platforms to AI-driven data analytics, are becoming essential for predictive insights and evidence-based decision-making, further enhancing operational efficiency.

Complementing these technologies, the services segment plays an increasingly important role, offering system integration, consultation, managed services, and maintenance support to ensure smooth deployment and reliability. Collectively, hardware, software, and services are reshaping livestock management by reducing labor costs, improving herd productivity, and supporting sustainable farming practices, positioning the offering segment as a critical growth driver.

"The large farm segment will hold the largest share during forecast period"

The large farm size segment is expected to hold the largest share during the forecast period. Large farms, typically managing more than 1,000 animals, benefit from economies of scale and greater capital availability, enabling them to adopt advanced PLF solutions at a faster pace compared to small and mid-sized farms. Their ability to invest in automated feeding systems, smart health monitoring devices, and integrated data analytics platforms allows them to enhance productivity, optimize labor use, and improve animal welfare on a larger scale.

This strong adoption rate positions large farms as the primary revenue contributors within the farm size segment. Furthermore, ongoing innovations by leading industry players, such as the launch of advanced automated systems and AI-enabled monitoring tools, are further strengthening the dominance of large-scale operations. As a result, large farms are set to remain the leading adopters of PLF technologies, driving growth and setting benchmarks for efficiency and sustainability in the global livestock sector.

"North America holds the largest share, while Asia Pacific is expected to be the fastest-growing market during the forecast period"

North America currently holds the largest share of the precision livestock farming market, supported by its advanced agricultural infrastructure, strong presence of leading technology providers, and early adoption of digital solutions by large-scale commercial farms. The region's focus on operational efficiency, animal welfare, and traceability continues to drive widespread deployment of IoT-enabled sensors, automated systems, and data-driven farm management platforms.

In contrast, Asia Pacific is expected to emerge as the fastest-growing market during the forecast period. Rising demand for protein-rich diets, rapid expansion of commercial dairy and poultry operations, and government initiatives to modernize livestock production are fueling technology adoption across key countries such as China, India, Japan, and Australia. Growing investment from global players and regional startups in AI-driven monitoring, smart feeding systems, and livestock health management solutions will further accelerate growth. This positions Asia Pacific as a key growth frontier, complementing North America's established market dominance.

Break-up of primaries

In-depth interviews were conducted with chief executive officers (CEOs), directors, and other executives from various key organizations operating in the precision livestock farming market:

- By Company Type: Tier 1 - 25%, Tier 2 - 45%, and Tier 3 - 30%

- By Designation: Directors- 20%, Managers - 50%, Executives - 30%

- By Region: North America - 25%, Europe - 30%, Asia Pacific - 20%, South America - 15%, and Rest of the World - 10%

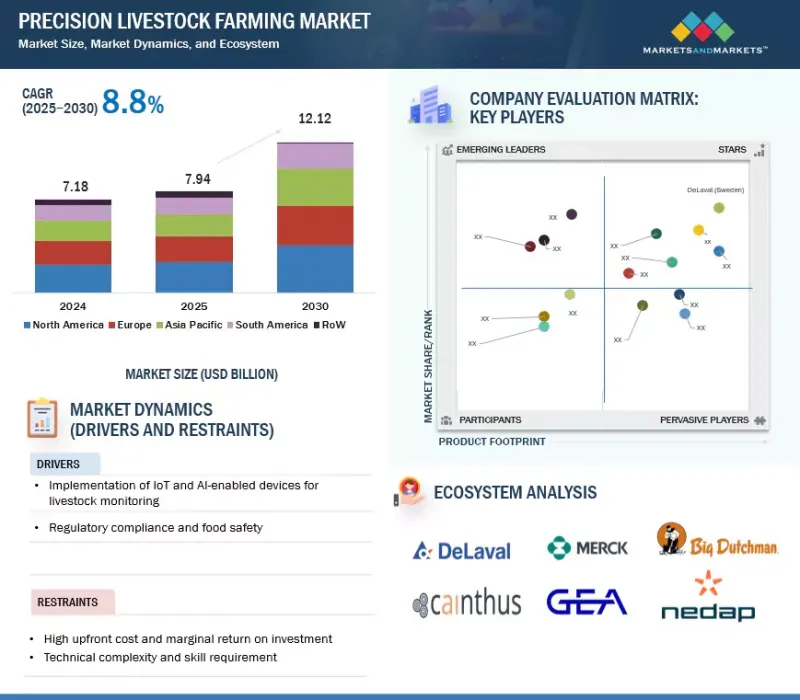

Prominent companies in the market include DeLaval (Sweden), GEA Group (Germany), Merck & Co., Inc. (Israel), Allflex Livestock (US), Nedap N.V. (Netherlands), Lely International (Netherlands), Waikato Milking Systems (New Zealand), Livestock Improvement (New Zealand), Boumatic (US), and Fancom B.V. (Netherlands).

Other players include Hokofarm Group (Netherlands), Trioliet (Netherlands), Big Dutchman (Germany), VDL Agrotech (Netherlands), HID Global (US), Neva (US), Ice Robotics (UK), Connecterra (Netherlands), Cainthus (Ireland), Faromatics (Spain), Tibot (France), Mirobot (Israel), Farmcontrol (Portugal), Moocall (Ireland), and Scio+ (Denmark).

Research Coverage

This research report categorizes the precision livestock farming market by offering (hardware, software & services), application (milk harvesting, feeding management, livestock behavior & health monitoring), farm type (dairy farm, swine far & poultry farm), system type (milking robotic system, precision feeding system, livestock monitoring system, poultry monitoring and robotic system), farm size (small-farms, mid-sized farms, large farms), and region (North America, Europe, Asia Pacific, South America, and Rest of the World). The scope of the report covers detailed information regarding drivers, restraints, challenges, and opportunities influencing the growth of the precision livestock farming market.

A detailed analysis of the key industry players was done to provide insights into their business overview, services, key strategies, contracts, partnerships, agreements, new service launches, mergers and acquisitions, and recent developments associated with the precision livestock farming market. This report covers a competitive analysis of upcoming startups in the applied technologies market ecosystem. Furthermore, the study also covers industry-specific trends such as technology analysis, ecosystem and market mapping, and patent and regulatory landscape.

Reasons to buy this report

The report will help market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall precision livestock farming and the subsegments. It will help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

It provides insights into the following pointers:

- Analysis of key drivers (Implementation of IoT- and AI-enabled devices for livestock monitoring), restraints (High upfront cost and marginal return on investment), opportunities (Rising adoption of livestock monitoring technology in developing countries), and challenges (Global warming and other environmental concerns) influencing the growth of the precision livestock farming market

- New Product Launch/Innovation: Detailed insights into research & development activities and new product launches in the precision livestock farming market

- Market Development: Comprehensive information about lucrative markets - analysis of the precision livestock farming market across varied regions

- Market Diversification: Exhaustive information about new services, untapped geographies, recent developments, and investments in the precision livestock farming market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, brand/product comparisons, and product footprints of leading players such as DeLaval (Sweden), GEA Group (Germany), Merck & Co., Inc. (Israel), Allflex Livestock (US), Nedap N.V. (Netherlands), and others in the precision livestock farming market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.1.1 MARKET DEFINITION

- 1.2 MARKET SCOPE

- 1.2.1 MARKET SEGMENTATION

- 1.2.2 INCLUSIONS AND EXCLUSIONS

- 1.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primaries

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN PRECISION LIVESTOCK FARMING MARKET

- 4.2 EUROPE: PRECISION LIVESTOCK FARMING MARKET, BY OFFERING AND COUNTRY

- 4.3 PRECISION LIVESTOCK FARMING MARKET, BY COUNTRY

- 4.4 PRECISION LIVESTOCK FARMING MARKET, BY SYSTEM TYPE AND REGION

- 4.5 PRECISION LIVESTOCK FARMING MARKET, BY OFFERING AND REGION

- 4.6 PRECISION LIVESTOCK FARMING MARKET, BY APPLICATION AND REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC OUTLOOK

- 5.2.1 LIVESTOCK POPULATION TRENDS

- 5.2.2 TECHNOLOGY PENETRATION IN PRECISION LIVESTOCK FARMING

- 5.2.3 SUSTAINABILITY AND ENVIRONMENTAL METRICS IN PRECISION LIVESTOCK FARMING

- 5.3 MARKET DYNAMICS

- 5.3.1 DRIVERS

- 5.3.1.1 Implementation of IoT- and AI-enabled devices for livestock monitoring

- 5.3.1.2 Evolution of precision livestock farming into decision-support systems

- 5.3.1.3 Surging labor costs and rising demand for automation in livestock industry

- 5.3.1.4 Regulatory compliance and food safety

- 5.3.1.5 Growing demand for protein and dairy products

- 5.3.1.6 Focus on animal health and welfare

- 5.3.2 RESTRAINTS

- 5.3.2.1 High upfront cost and marginal return on investment

- 5.3.2.2 Technical complexity and limited technological awareness

- 5.3.2.3 High initial investment cost

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Rising adoption of livestock monitoring technology in emerging economies

- 5.3.3.2 Increasing number of dairy, poultry, and swine farms

- 5.3.3.3 Strategic opportunities in Asia Pacific and Latin America

- 5.3.4 CHALLENGES

- 5.3.4.1 Global warming and other environmental concerns

- 5.3.4.2 Resistance toward antibiotics leading to uncontrolled spread of several diseases

- 5.3.4.3 High maintenance and operational costs

- 5.3.1 DRIVERS

- 5.4 IMPACT OF AI/GEN AI

- 5.4.1 INTRODUCTION

- 5.4.2 USE OF GEN AI IN PRECISION LIVESTOCK FARMING MARKET

- 5.4.3 CASE STUDY ANALYSIS

- 5.4.3.1 Connecterra's Copilot AI assistant & analytics dashboard upgrade

- 5.4.3.2 MagStream Milkmeter: Pioneering wireless precision in dairy farming

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 IMPACT OF 2025 US TARIFFS

- 6.2.1 INTRODUCTION

- 6.2.2 KEY TARIFF RATES

- 6.2.3 PRICE IMPACT ANALYSIS

- 6.2.4 IMPACT ON COUNTRY/REGION

- 6.2.4.1 US

- 6.2.4.2 Europe

- 6.2.4.3 Asia Pacific

- 6.2.5 IMPACT ON END-USE INDUSTRIES

- 6.3 VALUE CHAIN ANALYSIS

- 6.3.1 RESEARCH & DEVELOPMENT

- 6.3.2 MANUFACTURING

- 6.3.3 TECHNOLOGY PROVIDERS

- 6.3.4 OEM & SYSTEM INTEGRATORS

- 6.3.5 MARKETING & SALES

- 6.3.6 END USERS

- 6.4 TRADE ANALYSIS

- 6.4.1 EXPORT SCENARIO OF HS CODE 8434

- 6.4.2 IMPORT SCENARIO OF HS CODE 8434

- 6.5 TECHNOLOGY ANALYSIS

- 6.5.1 KEY TECHNOLOGIES

- 6.5.1.1 Automated feeding and milking systems

- 6.5.2 COMPLEMENTARY TECHNOLOGIES

- 6.5.2.1 Farm management software and cloud platforms

- 6.5.3 ADJACENT TECHNOLOGIES

- 6.5.3.1 Blockchain and digital traceability technologies

- 6.5.1 KEY TECHNOLOGIES

- 6.6 PRICING ANALYSIS

- 6.6.1 INTRODUCTION

- 6.6.2 AVERAGE SELLING PRICE TREND OF MILKING ROBOTS, BY SYSTEM TYPE, 2020-2024

- 6.6.3 AVERAGE SELLING PRICE TREND, BY REGION, 2020-2024

- 6.6.4 AVERAGE SELLING PRICE TREND OF MILKING ROBOTS OFFERED BY KEY PLAYERS, BY SYSTEM TYPE, 2024

- 6.7 ECOSYSTEM ANALYSIS

- 6.7.1 DEMAND SIDE

- 6.7.2 SUPPLY SIDE

- 6.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.9 PATENT ANALYSIS

- 6.10 KEY CONFERENCES AND EVENTS, 2025-2026

- 6.11 REGULATORY LANDSCAPE

- 6.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.11.2 REGULATIONS

- 6.11.2.1 International Organization of Standardization

- 6.11.2.2 North America

- 6.11.2.3 Asia Pacific

- 6.11.2.3.1 China

- 6.11.2.3.2 India

- 6.11.2.3.3 Australia

- 6.11.2.4 Europe

- 6.12 PORTER'S FIVE FORCES ANALYSIS

- 6.12.1 THREAT OF NEW ENTRANTS

- 6.12.2 THREAT OF SUBSTITUTES

- 6.12.3 BARGAINING POWER OF BUYERS

- 6.12.4 BARGAINING POWER OF SUPPLIERS

- 6.12.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.13.2 BUYING CRITERIA

- 6.14 INVESTMENT AND FUNDING SCENARIO

- 6.15 CASE STUDY ANALYSIS

- 6.15.1 TRANSFORMING CATTLE FARMING WITH PRECISION LIVESTOCK SOLUTIONS BY FARMONAUT

- 6.15.2 FANCOM'S AUTOMATED MONITORING SYSTEMS DRIVING ANIMAL WELFARE IN LIVESTOCK FARMING

- 6.15.3 DELAVAL'S VMS V300 2025 MODEL - REDEFINING ROBOTIC MILKING EFFICIENCY AND ANIMAL WELFARE

7 PRECISION LIVESTOCK FARMING MARKET, BY SYSTEM TYPE

- 7.1 INTRODUCTION

- 7.2 MILKING ROBOTIC SYSTEMS

- 7.2.1 SINGLE-STALL MILKING UNITS

- 7.2.1.1 Used across small and mid-sized dairy farms

- 7.2.2 MULTI-STALL MILKING UNITS

- 7.2.2.1 Suitable for mid-sized dairy farms

- 7.2.3 AUTOMATED MILKING ROTARY

- 7.2.3.1 Provides information necessary to monitor and analyze herd performance

- 7.2.1 SINGLE-STALL MILKING UNITS

- 7.3 PRECISION FEEDING SYSTEMS

- 7.3.1 INCREASING SMARTER FEEDING FOR EFFICIENT LIVESTOCK PRODUCTION TO DRIVE GROWTH

- 7.4 LIVESTOCK MONITORING SYSTEMS

- 7.4.1 GROWING DEVELOPMENT OF ACTIVE RFID TAGS IN MEDIUM-SIZED AND LARGE LIVESTOCK FARMS TO DRIVE DEMAND

- 7.5 POULTRY MONITORING AND ROBOTIC SYSTEMS

- 7.5.1 RISING EFFORTS TO IMPROVE POULTRY FARM OPERATIONS TO DRIVE GROWTH

8 PRECISION LIVESTOCK FARMING MARKET, BY FARM TYPE

- 8.1 INTRODUCTION

- 8.2 DAIRY

- 8.2.1 SIGNIFICANT USE OF ROBOTIC MILKING SYSTEMS IN LARGE FARMS

- 8.3 SWINE

- 8.3.1 HIGH ADOPTION OF RFID AND CAMERAS TO MONITOR SWINE HEALTH AND BODY TEMPERATURE

- 8.4 POULTRY

- 8.4.1 PREDOMINANT USE OF SEVERAL FARMING SOLUTIONS INCLUDING CAMERAS IN POULTRY FARMS

- 8.5 OTHERS

9 PRECISION LIVESTOCK FARMING MARKET, BY FARM SIZE

- 9.1 INTRODUCTION

- 9.2 SMALL

- 9.2.1 WIDESPREAD IN EMERGING ECONOMIES

- 9.3 MID-SIZED

- 9.3.1 EXTENSIVE USE IN DEVELOPED ECONOMIES

- 9.4 LARGE

- 9.4.1 ECONOMICALLY VIABLE TO IMPLEMENT SOPHISTICATED PRECISION LIVESTOCK FARMING SYSTEMS

10 PRECISION LIVESTOCK FARMING MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- 10.2 MILK HARVESTING

- 10.2.1 RISING DEMAND FOR MILKING ROBOTS ON DAIRY FARMS

- 10.3 FEEDING MANAGEMENT

- 10.3.1 GROWING AWARENESS AMONG LIVESTOCK FARM OWNERS FOR BETTER MANAGEMENT OF FEED INVENTORY AND ANIMAL DIETS

- 10.4 LIVESTOCK BEHAVIOR & HEALTH MONITORING

- 10.4.1 INCREASING AWARENESS AMONG RANCHERS AND DAIRY FARM OWNERS TO TRACK HEAT DETECTION AND EARLY DISEASE IDENTIFICATION

- 10.5 OTHERS

11 PRECISION LIVESTOCK FARMING MARKET, BY OFFERING

- 11.1 INTRODUCTION

- 11.2 HARDWARE

- 11.2.1 ROBOTICS HARDWARE

- 11.2.1.1 Increasing herd size of dairy farms and rising labor costs

- 11.2.2 RFID TAGS & READERS

- 11.2.2.1 Rising adoption of low-frequency RFID tags to identify & track livestock

- 11.2.3 SENSORS

- 11.2.3.1 Ensure continuous productivity of healthy herd

- 11.2.3.2 Temperature sensors

- 11.2.3.3 Accelerometer sensors

- 11.2.3.4 Motion sensors

- 11.2.3.5 Environmental humidity sensors

- 11.2.3.6 Others

- 11.2.4 CAMERA SYSTEMS

- 11.2.4.1 Increasing awareness among ranchers regarding remote livestock monitoring technology to drive demand

- 11.2.5 GPS

- 11.2.5.1 Surging demand for livestock location tracking to drive growth

- 11.2.6 OTHERS

- 11.2.1 ROBOTICS HARDWARE

- 11.3 SOFTWARE

- 11.3.1 ON-CLOUD

- 11.3.1.1 Provides flexibility and scalability

- 11.3.2 ON-PREMISE

- 11.3.2.1 Beneficial for organizations migrating from one system to another

- 11.3.3 AI AND DATA ANALYTICS

- 11.3.3.1 Drives decision-making of livestock farm owners

- 11.3.1 ON-CLOUD

- 11.4 SERVICES

- 11.4.1 INCREASING DEPLOYMENT OF LIVESTOCK FARMING DEVICES AND EQUIPMENT TO DRIVE GROWTH

- 11.4.2 SYSTEM INTEGRATION & CONSULTING

- 11.4.3 MANAGED SERVICES

- 11.4.4 MAINTENANCE & SUPPORT

12 PRECISION LIVESTOCK FARMING MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.1.1 NORTH AMERICA

- 12.1.1.1 US

- 12.1.1.1.1 Largest market for precision livestock farming in North America

- 12.1.1.2 Canada

- 12.1.1.2.1 Dairy industry to drive demand

- 12.1.1.3 Mexico

- 12.1.1.3.1 Growing cattle industry to drive market

- 12.1.1.1 US

- 12.1.2 EUROPE

- 12.1.2.1 Netherlands

- 12.1.2.1.1 Surging adoption of precision livestock farming solutions in milk harvesting and feeding management applications to drive market

- 12.1.2.2 Spain

- 12.1.2.2.1 Implementation of sensor-based and data-driven management solutions to drive market

- 12.1.2.3 Italy

- 12.1.2.3.1 Integration of sensor-based monitoring and data analytics for better herd management to drive market

- 12.1.2.4 Denmark

- 12.1.2.4.1 Adoption of AI and IoT technologies in livestock industry to drive market

- 12.1.2.5 Germany

- 12.1.2.5.1 Largest dairy producer in Europe

- 12.1.2.6 France

- 12.1.2.6.1 Growing number of livestock farms to contribute to market growth

- 12.1.2.7 UK

- 12.1.2.7.1 Established milk and meat industries to support market growth

- 12.1.2.8 Rest of Europe

- 12.1.2.1 Netherlands

- 12.1.3 ASIA PACIFIC

- 12.1.3.1 China

- 12.1.3.1.1 Modern farm practices for sustainable development in dairy farm yield to drive growth

- 12.1.3.2 Japan

- 12.1.3.2.1 Aging agriculture workforce and government support to drive growth

- 12.1.3.3 India

- 12.1.3.3.1 Proliferation of commercial farms with deployment of modern technologies to drive market

- 12.1.3.4 Australia & New Zealand

- 12.1.3.4.1 High awareness among dairy farm owners to drive market

- 12.1.3.5 Rest of Asia Pacific

- 12.1.3.1 China

- 12.1.4 SOUTH AMERICA

- 12.1.4.1 Brazil

- 12.1.4.1.1 Rapid adoption of precision livestock farming technology by commercial farmers to drive market

- 12.1.4.2 Argentina

- 12.1.4.2.1 Large cattle population to accelerate demand for livestock identification, monitoring, and tracking

- 12.1.4.3 Rest of South America

- 12.1.4.1 Brazil

- 12.1.5 REST OF THE WORLD (ROW)

- 12.1.5.1 Middle East

- 12.1.5.1.1 Growing adoption of smart agriculture solutions by large farmlands to drive market

- 12.1.5.2 Africa

- 12.1.5.2.1 Digital innovations to fuel transformation in livestock industry

- 12.1.5.1 Middle East

- 12.1.1 NORTH AMERICA

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 13.3 REVENUE ANALYSIS, 2020-2024

- 13.4 MARKET SHARE ANALYSIS, 2024

- 13.4.1 DELAVAL

- 13.4.2 GEA GROUP

- 13.4.3 MERCK & CO., INC.

- 13.4.4 LELY

- 13.4.5 NEDAP N.V.

- 13.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.5.1 STARS

- 13.5.2 EMERGING LEADERS

- 13.5.3 PERVASIVE PLAYERS

- 13.5.4 PARTICIPANTS

- 13.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.5.5.1 Company footprint

- 13.5.5.2 Region footprint

- 13.5.5.3 System type footprint

- 13.5.5.4 Application footprint

- 13.5.5.5 Farm type footprint

- 13.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.6.1 PROGRESSIVE COMPANIES

- 13.6.2 RESPONSIVE COMPANIES

- 13.6.3 DYNAMIC COMPANIES

- 13.6.4 STARTING BLOCKS

- 13.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 13.6.5.1 List of key startups/SMEs

- 13.6.5.2 Competitive benchmarking of key startups/SMEs

- 13.7 COMPANY VALUATION AND FINANCIAL METRICS

- 13.8 BRAND/PRODUCT COMPARISON

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 PRODUCT LAUNCHES

- 13.9.2 DEALS

- 13.9.3 EXPANSIONS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 DELAVAL

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Solutions/Services offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Product/Solutions/Service launches

- 14.1.1.3.2 Deals

- 14.1.1.3.3 Expansions

- 14.1.1.4 MnM view

- 14.1.1.4.1 Right to win

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses and competitive threats

- 14.1.2 GEA GROUP

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Solutions/Services offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Product/Solution/Service launches

- 14.1.2.3.2 Deals

- 14.1.2.3.3 Expansions

- 14.1.2.4 MnM view

- 14.1.2.4.1 Right to win

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses and competitive threats

- 14.1.3 AFIMILK LTD.

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Solutions/Services offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Product/Solution/Service launches

- 14.1.3.3.2 Deals

- 14.1.3.4 MnM view

- 14.1.3.4.1 Right to win

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses and competitive threats

- 14.1.4 MERCK & CO. INC.

- 14.1.4.1 Business overview

- 14.1.4.2 Products/Solutions/Services offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Product/Solution/Service launches

- 14.1.4.3.2 Deals

- 14.1.4.4 MnM view

- 14.1.4.4.1 Right to win

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses and competitive threats

- 14.1.5 NEDAP N.V.

- 14.1.5.1 Business overview

- 14.1.5.2 Products/Solutions/Services offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Deals

- 14.1.5.4 MnM view

- 14.1.5.4.1 Right to win

- 14.1.5.4.2 Strategic choices

- 14.1.5.4.3 Weaknesses and competitive threats

- 14.1.6 LELY

- 14.1.6.1 Business overview

- 14.1.6.2 Products/Solutions/Services offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Product/Solution/Service Launches

- 14.1.6.3.2 Deals

- 14.1.6.4 MnM view

- 14.1.7 WAIKATO MILKING SYSTEMS

- 14.1.7.1 Business overview

- 14.1.7.2 Products/Solutions/Services offered

- 14.1.7.3 Recent developments

- 14.1.7.3.1 Product/Solution/Service launches

- 14.1.7.3.2 Deals

- 14.1.7.4 MnM view

- 14.1.8 LIC

- 14.1.8.1 Business overview

- 14.1.8.2 Products/Solutions/Services offered

- 14.1.8.3 Recent developments

- 14.1.8.3.1 Deals

- 14.1.8.4 MnM view

- 14.1.9 BOUMATIC

- 14.1.9.1 Business overview

- 14.1.9.2 Products/Solutions/Services offered

- 14.1.9.3 Recent developments

- 14.1.9.3.1 Product/Solution/Service launches

- 14.1.9.3.2 Deals

- 14.1.9.4 MnM view

- 14.1.10 FANCOM BV

- 14.1.10.1 Business overview

- 14.1.10.2 Products/Solutions/Services offered

- 14.1.10.3 Recent developments

- 14.1.10.3.1 Product/Solution/Service launches

- 14.1.10.3.2 Deals

- 14.1.10.4 MnM view

- 14.1.11 HOKOFARM GROUP

- 14.1.11.1 Business overview

- 14.1.11.2 Products/Solutions/Services offered

- 14.1.11.3 MnM view

- 14.1.12 TRIOLIET

- 14.1.12.1 Business overview

- 14.1.12.2 Products/Solutions/Services offered

- 14.1.12.3 Recent developments

- 14.1.12.3.1 Product/Solution/Service launches

- 14.1.12.3.2 Expansions

- 14.1.12.4 MnM view

- 14.1.13 BIG DUTCHMAN

- 14.1.13.1 Business overview

- 14.1.13.2 Products/Solutions/Services offered

- 14.1.13.2.1 Product/Solution/Service launches

- 14.1.13.2.2 Deals

- 14.1.13.3 MnM view

- 14.1.14 VDL AGROTECH (VDL GROEP)

- 14.1.14.1 Business overview

- 14.1.14.2 Products/Solutions/Services offered

- 14.1.14.3 Recent developments

- 14.1.14.3.1 Product/Solution/Service launches

- 14.1.14.3.2 Deals

- 14.1.14.4 MnM view

- 14.1.15 HID GLOBAL

- 14.1.15.1 Business overview

- 14.1.15.2 Products/Solutions/Services offered

- 14.1.15.3 Recent developments

- 14.1.15.3.1 Deals

- 14.1.15.4 MnM view

- 14.1.1 DELAVAL

- 14.2 OTHER PLAYERS

- 14.2.1 NEXA

- 14.2.2 PEACOCK TECHNOLOGY LTD

- 14.2.3 CONNECTERRA

- 14.2.4 EVER. AG

- 14.2.5 FAROMATICS

- 14.2.6 TIBOT OCTUPUS BIOSAFETY

- 14.2.7 MIROBOT

- 14.2.8 FARMCONTROL

- 14.2.9 MOOCALL

- 14.2.10 SCIO+

15 ADJACENT AND RELATED MARKETS

- 15.1 INTRODUCTION

- 15.2 LIMITATIONS

- 15.3 MILKING ROBOTS MARKET

- 15.3.1 MARKET DEFINITION

- 15.3.2 MARKET OVERVIEW

- 15.4 MILKING AUTOMATION MARKET

- 15.4.1 MARKET DEFINITION

- 15.4.2 MARKET OVERVIEW

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS