|

시장보고서

상품코드

1816009

영상 진단 시장 예측(-2030년) : 용도별, 모달리티별, 최종사용자별, 지역별Diagnostic Imaging Market by Modality (MRI, Ultrasound (3D/4D, Doppler, Contrast), CT, X-Ray (Digital, Portable), Mammography, SPECT, PET), Application (OB/Gyn, CVD, Onco, Neuro) & End User-Global Forecast to 2030 |

||||||

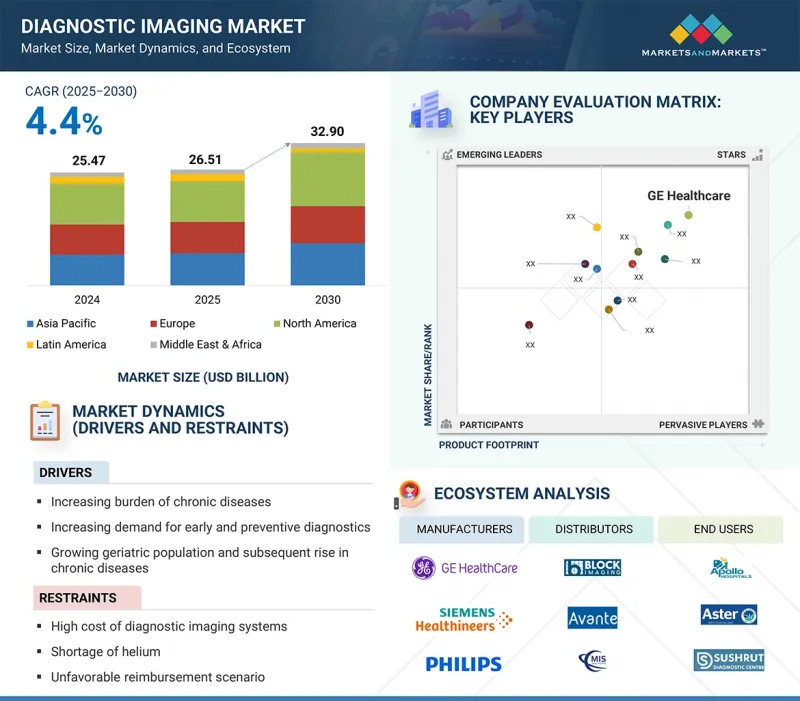

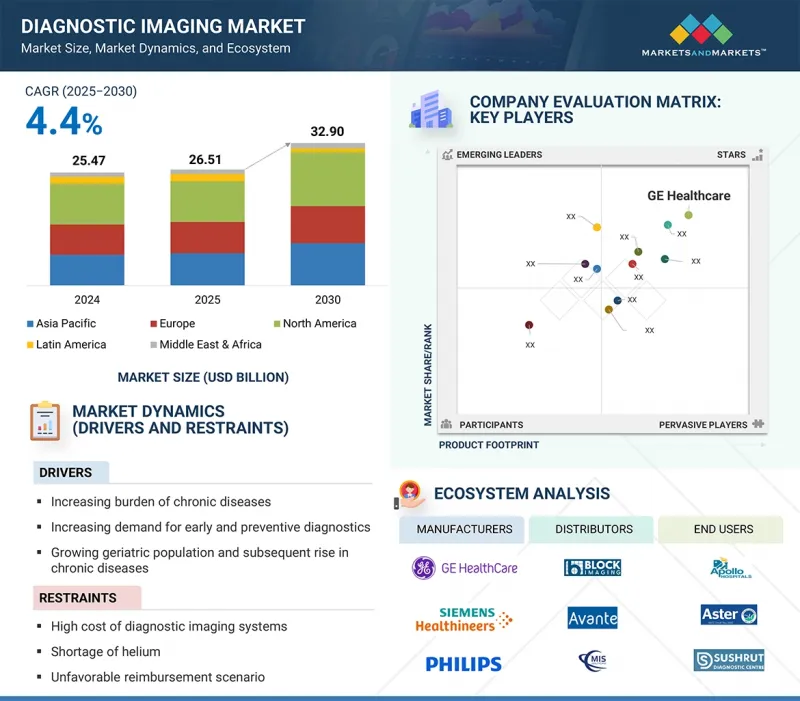

세계의 영상 진단 시장 규모는 2025년 265억 1,000만 달러에서 2030년에는 329억 달러에 달할 것으로 예측되며, 2025-2030년의 CAGR은 4.4%에 달할 것으로 보이고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상연도 | 2024-2030년 |

| 기준연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 검토 단위 | 금액(10억 달러) |

| 부문 | 용도별, 모달리티별, 최종사용자별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 라틴아메리카, 중동 및 아프리카 |

비침습적 기술의 사용 증가로 시장이 확대되고 있습니다. 영상 진단 시장의 확대는 정부 구상 증가, 임상시험, 연구개발의 중요성 증가로 이어지고 있습니다.

영상 진단 시장은 CT 스캐너, MRI 시스템, 초음파 시스템, 엑스레이 영상 시스템, 핵의학 영상 시스템, 유방촬영 시스템 등으로 구분됩니다. 2024년 시장 점유율은 초음파 진단 장비가 가장 클 것입니다. 3D 및 4D 영상 진단의 발전은 AI 기능과 휴대성의 향상과 함께 현장 진료 및 응급상황에서 초음파의 사용을 강화하여 초음파를 더욱 친숙하게 만들고 있습니다. 만성질환의 유병률 증가와 조기 및 정확한 진단에 대한 수요 증가는 초음파 진단 시스템 시장에서의 우위를 확고히 하고 있습니다.

초음파 진단 시스템 시장은 영상의학과/일반영상 진단, 순환기내과, 산부인과, 혈관외과, 비뇨기과, 기타로 구분됩니다. 2025-2030년까지 방사선과/일반영상 진단 분야가 가장 큰 점유율을 차지할 것으로 예측됩니다. 이 시장 수요를 견인하는 것은 내과, 응급의학과, 일반 개업의들 사이에서 POCUS(Point of Care Ultrasound) 사용이 증가하고 있다는 점입니다.

아시아태평양의 영상 진단 시장은 예측 기간 중 가장 높은 CAGR을 나타낼 것으로 예측됩니다. 이러한 성장의 주요 원동력은 진화하는 헬스케어 인프라와 이 지역에 진출한 주요 기업의 집중도 증가에 기인합니다.

병원과 진단 시설, 특히 중국이나 인도와 같이 빠르게 발전하고 있는 국가에서는 최신 영상 진단 장비에 많은 투자를 하고 있습니다. 이러한 요인들은 이 지역의 영상 진단 시장 확대에 기여할 것으로 예측됩니다.

세계의 영상 진단 시장에 대해 조사했으며, 용도별, 모달리티별, 최종사용자별, 지역별 동향 및 시장에 참여하는 기업의 개요 등을 정리하여 전해드립니다.

목차

제1장 서론

제2장 조사 방법

제3장 개요

제4장 주요 인사이트

제5장 시장 개요

- 서론

- 시장 역학

- 가격 분석

- 밸류체인 분석

- 에코시스템 분석

- 공급망 분석

- Porter's Five Forces 분석

- 규제 상황

- 고객 비즈니스에 영향을 미치는 동향

- 기술 분석

- 상환 시나리오

- 무역 분석

- 특허 분석

- 사례 연구 분석

- 주요 컨퍼런스와 이벤트(2025-2026년)

- 미충족 요구

- AI가 영상 진단 시장에 미치는 영향

- 2025년 미국 관세의 영향

제6장 영상 진단 시장(용도별)

- 서론

- X선 영상 시스템

- MRI 시스템

- 초음파 시스템

- CT 스캐너

- 핵이미징 시스템

- 맘모그래피 시스템

제7장 영상 진단 시장(모달리티별)

- 서론

- CT 스캐너

- 초음파 시스템

- X선 영상 시스템

- MRI 시스템

- 핵이미징 시스템

- 맘모그래피 시스템

제8장 영상 진단 시장(최종사용자별)

- 서론

- 병원

- 영상 진단 센터

- 기타

제9장 영상 진단 시장(지역별)

- 서론

- 북미

- 북미 : 거시경제 전망

- 미국

- 캐나다

- 아시아태평양

- 아시아태평양 : 거시경제 전망

- 일본

- 중국

- 인도

- 한국

- 호주

- 기타

- 유럽

- 유럽 : 거시경제 전망

- 독일

- 영국

- 이탈리아

- 스페인

- 기타

- 라틴아메리카

- 라틴아메리카 : 거시경제 전망

- 브라질

- 멕시코

- 기타

- 중동 및 아프리카

- 중동 및 아프리카 : 거시경제 전망

- GCC 국가

- 기타

제10장 경쟁 구도

- 서론

- 주요 참여 기업의 전략/강점

- 매출 분석, 2022-2024년

- 시장 점유율 분석

- 2024년의 주요 참여 기업 순위

- 기업 평가와 재무 지표

- 브랜드/제품 비교

- 기업 평가 매트릭스 : 주요 참여 기업, 2024년

- 기업 평가 매트릭스 : 스타트업/중소기업, 2024년

- 경쟁 시나리오

제11장 기업 개요

- 주요 참여 기업

- SIEMENS HEALTHINEERS

- GE HEALTHCARE

- KONINKLIJKE PHILIPS N.V.

- FUJIFILM CORPORATION

- CANON

- SHENZHEN MINDRAY BIO-MEDICAL ELECTRONICS CO., LTD.

- ESAOTE S.P.A

- SAMSUNG HEALTHCARE

- SHIMADZU CORPORATION

- CARESTREAM HEALTH

- PLANMED OY

- HOLOGIC, INC.

- AGFA-GEVAERT GROUP

- CURVEBEAM AI, LTD.

- UNITED IMAGING HEALTHCARE CO., LTD.

- 기타 기업

- ALLENGERS MEDICAL SYSTEMS LTD.

- ANALOGIC CORPORATION

- ASPECT IMAGING LTD.

- BEIJING WANDONG MEDICAL TECHNOLOGY CO., LTD.

- CHISON MEDICAL TECHNOLOGIES CO., LTD.

- KONICA MINOLTA, INC.

- MEDGYN PRODUCTS, INC.

- NEUSOFT MEDICAL SYSTEMS CO., LTD.

- PROMED TECHNOLOGY CO., LTD.

- CMR NAVISCAN

- CLARIUS

- SHENZHEN BASDA MEDICAL APPARATUS CO., LTD.

- SHENZHEN ANKE HIGH-TECH., LTD.

- STERNMED GMBH

- TIME MEDICAL SYSTEMS

제12장 부록

KSA 25.09.25The global diagnostic imaging market is projected to reach USD 32.90 billion by 2030 from USD 26.51 billion in 2025, at a CAGR of 4.4% from 2025 to 2030.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Product, Application, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

The market is growing due to the increased use of non-invasive technology. The expansion of the diagnostic imaging market is also linked to heightened government initiatives, clinical trials, and a strong emphasis on research and development.

"The ultrasound systems segment held the largest share of the market in 2024."

Based on modality, the diagnostic imaging market is segmented into CT scanners, MRI systems, ultrasound systems, X-ray imaging systems, nuclear imaging systems, and mammography systems. The ultrasound systems segment held the largest market share in 2024. Advancements in 3D and 4D imaging, along with AI features and improved portability, are enhancing the use of ultrasound in point-of-care and emergency settings, making it even more accessible. The rising prevalence of chronic diseases and the increasing demand for early and accurate diagnoses are solidifying the dominance of ultrasound systems in the market.

"The radiology/general imaging applications segment held the largest share of the ultrasound systems market during the forecast period."

The ultrasound systems market is segmented by applications: radiology/general imaging, cardiology, obstetrics/gynecology, vascular applications, urology, and other applications. From 2025 to 2030, the radiology/general imaging application segment held the largest share of the market. Demand in this market is driven by the increasing use of point-of-care ultrasonography (POCUS) among internal medicine, emergency departments, and general practitioners.

"The market in the Asia Pacific region is expected to witness the highest growth during the forecast period."

The diagnostic imaging market in the APAC region is projected to register the highest CAGR during the forecast period. This growth is primarily driven by the evolving healthcare infrastructure and the increasing focus of major players in the region.

Hospitals and diagnostic facilities are making significant investments in modern imaging equipment, particularly in rapidly developing countries like China and India. These factors are expected to contribute to the expansion of the diagnostic imaging market in this area.

A breakdown of the primary participants referred to for this report is provided below:

- By Company Type: Tier 1 (48%), Tier 2 (36%), and Tier 3 (16%)

- By Designation: D-level Executives (14%), C-level Executives (10%), and Others (76%)

- By Region: North America (40%), Europe (32%), Asia Pacific (20%), Latin America (5%), and the Middle East & Africa (3%)

The prominent players in the diagnostic imaging market are Siemens Healthineers (Germany), GE HealthCare (US), Koninklijke Philips N.V. (Netherlands), and FUJIFILM Corporation (Japan), among others.

Research Coverage

This report studies the diagnostic imaging market based on modality, application, end user, and region. It also covers the factors affecting market growth, analyzes the various opportunities and challenges in the market, and provides details of the competitive landscape for market leaders. Furthermore, the report analyzes micromarkets with respect to their growth trends and forecasts the revenue of the industry for five leading geographies, along with corresponding countries

Reasons to Buy the Report

The report will help market leaders and new entrants with information on the closest approximations of the revenue numbers for the overall diagnostic imaging market and its subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

This report provides insights on the following pointers:

- Analysis of key drivers (growing geriatric population and subsequent rise in chronic diseases, increasing demand for early diagnosis across clinical applications, technological advancements in diagnostic imaging modalities, and increasing funding and investments by public-private organizations), restraints (high cost of diagnostic imaging systems, technological limitations associated with standalone systems, unfavorable reimbursement scenario, and inadequate supply of helium), opportunities (emerging economies offer high growth potential, increasing establishment of hospitals and diagnostic imaging centers, adoption of AI and analytics in diagnostic imaging, growing adoption of teleradiology, and contract-based radiology solutions and mobile solutions), and challenges (hospital budget cuts, increasing adoption of refurbished diagnostic imaging systems, and shortage of trained professionals) influencing the growth of the diagnostic imaging market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the diagnostic imaging market

- Market Development: Comprehensive information about lucrative markets. The report analyzes the diagnostic imaging market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the diagnostic imaging market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like GE HealthCare (US), Siemens Healthineers (Germany), Koninklijke Philips N.V. (Netherlands), and FUJIFILM Corporation (Japan).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS CONSIDERED AND REGIONS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY RESEARCH

- 2.1.2 PRIMARY RESEARCH

- 2.1.2.1 Primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primaries

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 APPROACH 1: COMPANY REVENUE ESTIMATION

- 2.2.2 APPROACH 2: CUSTOMER-BASED MARKET ESTIMATION

- 2.2.3 GROWTH FORECAST

- 2.2.4 CAGR PROJECTIONS

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION APPROACH

- 2.4 MARKET SHARE ESTIMATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RISK ASSESSMENT

- 2.7 GROWTH RATE ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 DIAGNOSTIC IMAGING MARKET OVERVIEW

- 4.2 NORTH AMERICA: DIAGNOSTIC IMAGING MARKET, BY REGION AND END USER, 2025

- 4.3 REGIONAL SNAPSHOT OF DIAGNOSTIC IMAGING MARKET

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing geriatric population and the rising prevalence of associated diseases

- 5.2.1.2 Increasing demand for early diagnosis and widening scope of clinical applications

- 5.2.1.3 Technological advancements in diagnostic imaging modalities

- 5.2.1.4 Increasing investments, funds, and grants by public-private organizations

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of diagnostic imaging systems

- 5.2.2.2 Technological limitations associated with standalone systems

- 5.2.2.3 Unfavorable reimbursement scenario

- 5.2.2.4 Shortage of helium

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Emerging economies offer high growth potential

- 5.2.3.2 Adoption of AI and analytics in diagnostic imaging

- 5.2.3.3 Increasing establishment of hospitals and diagnostic imaging centers

- 5.2.3.4 Increasing adoption of teleradiology

- 5.2.3.5 Contract-based radiology solutions and mobile solutions

- 5.2.4 CHALLENGES

- 5.2.4.1 Hospital budget cuts

- 5.2.4.2 Increasing adoption of refurbished diagnostic imaging systems

- 5.2.4.3 Dearth of trained professionals

- 5.2.1 DRIVERS

- 5.3 PRICING ANALYSIS

- 5.4 VALUE CHAIN ANALYSIS

- 5.4.1 RESEARCH & DEVELOPMENT

- 5.4.2 MANUFACTURING & ASSEMBLY

- 5.4.3 DISTRIBUTION, MARKETING & SALES, AND POST-SALE SERVICES

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.6.1 PROMINENT COMPANIES

- 5.6.2 SMALL & MEDIUM-SIZED ENTERPRISES

- 5.6.3 END USERS

- 5.7 PORTER'S FIVE FORCES ANALYSIS

- 5.7.1 BARGAINING POWER OF BUYERS

- 5.7.2 BARGAINING POWER OF SUPPLIERS

- 5.7.3 THREAT OF NEW ENTRANTS

- 5.7.4 THREAT OF SUBSTITUTES

- 5.7.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.8 REGULATORY LANDSCAPE

- 5.8.1 NORTH AMERICA

- 5.8.1.1 US

- 5.8.1.2 Canada

- 5.8.2 EUROPE

- 5.8.3 ASIA PACIFIC

- 5.8.3.1 Japan

- 5.8.3.2 China

- 5.8.3.3 India

- 5.8.1 NORTH AMERICA

- 5.9 TRENDS IMPACTING CUSTOMER BUSINESS

- 5.9.1 INCREASING ADOPTION OF HYBRID DIAGNOSTIC IMAGING MODALITIES

- 5.10 TECHNOLOGY ANALYSIS

- 5.10.1 KEY TECHNOLOGIES

- 5.10.1.1 Magnetic resonance imaging (MRI)

- 5.10.1.2 Computed tomography (CT)

- 5.10.1.3 Ultrasound imaging

- 5.10.2 COMPLEMENTARY TECHNOLOGIES

- 5.10.2.1 Picture archiving and communication systems (PACS)

- 5.10.2.2 Artificial intelligence (AI) for image analysis

- 5.10.2.3 Radiology information systems (RIS)

- 5.10.3 ADJACENT TECHNOLOGIES

- 5.10.3.1 Digital pathology

- 5.10.3.2 Molecular imaging/PET-CT

- 5.10.3.3 Wearable imaging sensors

- 5.10.1 KEY TECHNOLOGIES

- 5.11 REIMBURSEMENT SCENARIO

- 5.12 TRADE ANALYSIS

- 5.12.1 IMPORT DATA FOR COMPUTED TOMOGRAPHY SYSTEMS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- 5.12.2 EXPORT DATA FOR COMPUTED TOMOGRAPHY SYSTEMS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- 5.12.3 TRADE ANALYSIS FOR ULTRASOUND SYSTEMS

- 5.12.3.1 Import data for ultrasound systems, by country, 2020-2024 (USD Thousand)

- 5.12.3.2 Export data for ultrasound systems, by country, 2020-2024 (USD Thousand)

- 5.12.4 TRADE ANALYSIS FOR MAGNETIC RESONANCE IMAGING SYSTEMS

- 5.12.4.1 Import data for magnetic resonance imaging systems, by country, 2020-2024 (USD Thousand)

- 5.12.4.2 Export data for magnetic resonance imaging systems, by country, 2020-2024 (USD Thousand)

- 5.12.5 TRADE ANALYSIS FOR X-RAY SYSTEMS

- 5.12.5.1 Import data for X-ray systems, by country, 2020-2024 (USD Thousand)

- 5.12.5.2 Export data for X-ray systems, by country, 2020-2024 (USD Thousand)

- 5.13 PATENT ANALYSIS

- 5.14 CASE STUDY ANALYSIS

- 5.15 KEY CONFERENCES AND EVENTS (2025-2026)

- 5.16 UNMET NEEDS

- 5.17 IMPACT OF AI ON DIAGNOSTIC IMAGING MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 MARKET POTENTIAL OF AI IN DIAGNOSTIC IMAGING

- 5.17.3 AI USE CASES

- 5.17.4 KEY COMPANIES IMPLEMENTING AI

- 5.17.5 FUTURE OF GENERATIVE AI IN DIAGNOSTIC IMAGING

- 5.18 IMPACT OF 2025 US TARIFF

- 5.18.1 INTRODUCTION

- 5.18.2 KEY TARIFF RATES

- 5.18.3 PRICE IMPACT ANALYSIS

- 5.18.4 IMPACT ON COUNTRY/REGION

- 5.18.4.1 United States

- 5.18.4.2 Europe

- 5.18.4.3 Asia Pacific

- 5.18.5 IMPACT ON END-USE INDUSTRIES

6 DIAGNOSTIC IMAGING MARKET, BY APPLICATION

- 6.1 INTRODUCTION

- 6.2 X-RAY IMAGING SYSTEMS

- 6.2.1 GENERAL RADIOGRAPHY

- 6.2.1.1 Wide-scale application in chest imaging to drive market

- 6.2.2 DENTISTRY

- 6.2.2.1 High prevalence of dental disorders to drive market

- 6.2.3 FLUOROSCOPY

- 6.2.3.1 Rising use in gastrointestinal imaging to support market growth

- 6.2.1 GENERAL RADIOGRAPHY

- 6.3 MRI SYSTEMS

- 6.3.1 BRAIN & NEUROLOGICAL MRI

- 6.3.1.1 Rising incidence of neurodegenerative diseases to drive market

- 6.3.2 SPINE & MUSCULOSKELETAL MRI

- 6.3.2.1 Ability to diagnose musculoskeletal disorders to drive market

- 6.3.3 VASCULAR MRI

- 6.3.3.1 Adoption of AI to support market growth

- 6.3.4 PELVIC & ABDOMINAL MRI

- 6.3.4.1 Ability to detect prostate and cervical cancer to propel market

- 6.3.5 BREAST MRI

- 6.3.5.1 Growing awareness about early breast cancer screening to drive market

- 6.3.6 CARDIAC MRI

- 6.3.6.1 Rising incidence of CVD to support market growth

- 6.3.1 BRAIN & NEUROLOGICAL MRI

- 6.4 ULTRASOUND SYSTEMS

- 6.4.1 RADIOLOGY/GENERAL IMAGING

- 6.4.1.1 Extensive use in image-guided radiotherapy and radiology ultrasound to drive market

- 6.4.2 OBSTETRICS/GYNECOLOGY

- 6.4.2.1 Advancements in AI models for image guidance to support market growth

- 6.4.3 CARDIOLOGY

- 6.4.3.1 Rising prevalence of cardiovascular diseases to drive market

- 6.4.4 VASCULAR

- 6.4.4.1 Identification of vessel blockages and blot clots for early disease diagnosis to support market growth

- 6.4.5 UROLOGY

- 6.4.5.1 Growing awareness about therapeutic benefits of urological ultrasound to propel market

- 6.4.6 OTHER APPLICATIONS

- 6.4.1 RADIOLOGY/GENERAL IMAGING

- 6.5 CT SCANNERS

- 6.5.1 CARDIOLOGY

- 6.5.1.1 Rising incidence of obesity and hypertension to propel market

- 6.5.2 ONCOLOGY

- 6.5.2.1 Rising burden of cancer to drive market

- 6.5.3 NEUROLOGY

- 6.5.3.1 Increasing incidence of dementia and Alzheimer's to fuel market

- 6.5.4 OTHER APPLICATIONS

- 6.5.1 CARDIOLOGY

- 6.6 NUCLEAR IMAGING SYSTEMS

- 6.6.1 ONCOLOGY

- 6.6.1.1 Ability to distinguish between benign and malignant tumors to drive market

- 6.6.2 CARDIOLOGY

- 6.6.2.1 Rising incidence of coronary heart disease to support market

- 6.6.3 NEUROLOGY

- 6.6.3.1 Rising use of SPECT and PET systems for brain perfusion imaging to drive market

- 6.6.4 OTHER APPLICATIONS

- 6.6.1 ONCOLOGY

- 6.7 MAMMOGRAPHY SYSTEMS

- 6.7.1 TECHNOLOGICAL ADVANCEMENTS IN MAMMOGRAPHY SYSTEMS TO SUPPORT MARKET GROWTH

7 DIAGNOSTIC IMAGING MARKET, BY MODALITY

- 7.1 INTRODUCTION

- 7.2 CT SCANNERS

- 7.2.1 CONVENTIONAL CT SCANNERS

- 7.2.1.1 High-slice CT scanners

- 7.2.1.1.1 High image resolution to drive market

- 7.2.1.2 Mid-slice CT scanners

- 7.2.1.2.1 Increasing affordability to propel market

- 7.2.1.3 Low-slice CT scanners

- 7.2.1.3.1 Low costs and rising adoption in emerging economies to drive market

- 7.2.1.1 High-slice CT scanners

- 7.2.2 CONE-BEAM CT SCANNERS

- 7.2.2.1 Growing applications in dental & ENT scanning to drive market

- 7.2.1 CONVENTIONAL CT SCANNERS

- 7.3 ULTRASOUND SYSTEMS

- 7.3.1 ULTRASOUND SYSTEMS MARKET, BY TECHNOLOGY

- 7.3.2 2D ULTRASOUND SYSTEMS

- 7.3.2.1 Rise in demand for minimal invasive surgeries leading to increased use of 2D ultrasound

- 7.3.3 3D AND 4D ULTRASOUND

- 7.3.3.1 IMPROVED DIAGNOSIS WITH 3D ULTRASOUND TECHNOLOGY

- 7.3.4 DOPPLER ULTRASOUND

- 7.3.4.1 Growing application in cardiology and vascular to drive market growth

- 7.3.4.2 Contrast-enhanced ultrasound systems

- 7.3.4.2.1 Innovative product launches offering real-time monitoring capabilities to fuel market

- 7.3.5 ULTRASOUND SYSTEMS MARKET, BY PORTABILITY

- 7.3.5.1 Trolley/Cart-based ultrasound systems

- 7.3.5.1.1 Utilization in pediatric and abdominal applications to propel market

- 7.3.5.2 Compact/Handheld ultrasound systems

- 7.3.5.2.1 High portability and user-friendly features to drive market

- 7.3.5.1 Trolley/Cart-based ultrasound systems

- 7.4 X-RAY IMAGING SYSTEMS

- 7.4.1 X-RAY IMAGING SYSTEMS MARKET, BY TYPE

- 7.4.1.1 Digital X-ray imaging systems

- 7.4.1.2 Analog X-ray imaging systems

- 7.4.1.2.1 High risk of radiation exposure and limitations to impede market growth

- 7.4.2 X-RAY IMAGING SYSTEMS MARKET, BY PORTABILITY

- 7.4.2.1 Stationary X-ray imaging systems

- 7.4.2.1.1 Efficient configuration integration in diagnostic clinics to propel market

- 7.4.2.2 Portable X-ray imaging systems

- 7.4.2.2.1 Rising use in trauma care and emergency departments to boost adoption

- 7.4.2.1 Stationary X-ray imaging systems

- 7.4.1 X-RAY IMAGING SYSTEMS MARKET, BY TYPE

- 7.5 MRI SYSTEMS

- 7.5.1 MRI SYSTEMS MARKET, BY ARCHITECTURE

- 7.5.1.1 Closed MRI systems

- 7.5.1.1.1 Reduced examination time and improved image quality to drive market

- 7.5.1.2 Open MRI systems

- 7.5.1.2.1 High patient comfort to boost adoption

- 7.5.1.1 Closed MRI systems

- 7.5.2 MRI SYSTEMS MARKET, BY FIELD STRENGTH

- 7.5.2.1 High and very-high-field MRI systems

- 7.5.2.1.1 High safety & image resolution to drive market

- 7.5.2.2 Low-to-mid-field MRI systems

- 7.5.2.2.1 Technological limitations to restrain market

- 7.5.2.3 Ultra-high-field MRI systems

- 7.5.2.3.1 High utilization in musculoskeletal & neurological applications to support market growth

- 7.5.2.1 High and very-high-field MRI systems

- 7.5.1 MRI SYSTEMS MARKET, BY ARCHITECTURE

- 7.6 NUCLEAR IMAGING SYSTEMS

- 7.6.1 SPECT SYSTEMS

- 7.6.2 PET SYSTEMS

- 7.6.3 HYBRID SPECT SYSTEMS

- 7.6.3.1 Enhanced resolution to support market growth

- 7.7 MAMMOGRAPHY SYSTEMS

- 7.7.1 RISING AWARENESS ABOUT BREAST CANCER TO SUPPORT MARKET GROWTH

8 DIAGNOSTIC IMAGING MARKET, BY END USER

- 8.1 INTRODUCTION

- 8.2 HOSPITALS

- 8.2.1 INCREASED NUMBER OF MRI, PET, CT SCANS TO PROPEL DIAGNOSTIC IMAGING MARKET

- 8.3 DIAGNOSTIC IMAGING CENTERS

- 8.3.1 RISING ESTABLISHMENT OF PRIVATE IMAGING CENTERS TO FUEL MARKET

- 8.4 OTHER END USERS

9 DIAGNOSTIC IMAGING MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 9.2.2 US

- 9.2.2.1 High incidence of chronic diseases to drive market

- 9.2.3 CANADA

- 9.2.3.1 Rising cases of chronic disease to support market growth

- 9.3 ASIA PACIFIC

- 9.3.1 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 9.3.2 JAPAN

- 9.3.2.1 Presence of universal healthcare coverage to fuel market

- 9.3.3 CHINA

- 9.3.3.1 Government initiatives for establishment of hospitals to drive market

- 9.3.4 INDIA

- 9.3.4.1 Improvements in healthcare infrastructure and rising incidence of CVD to drive market

- 9.3.5 SOUTH KOREA

- 9.3.5.1 Growing access to advanced ultrasound systems to support market growth

- 9.3.6 AUSTRALIA

- 9.3.6.1 Increasing healthcare spending to propel market

- 9.3.7 REST OF ASIA PACIFIC

- 9.4 EUROPE

- 9.4.1 EUROPE: MACROECONOMIC OUTLOOK

- 9.4.2 GERMANY

- 9.4.2.1 High number of MRI units to drive the market

- 9.4.3 UK

- 9.4.3.1 Increasing investments in diagnostic imaging to drive market

- 9.4.4 ITALY

- 9.4.4.1 Established healthcare infrastructure to support market growth

- 9.4.5 SPAIN

- 9.4.5.1 Growing access to advanced cancer diagnostics to propel market

- 9.4.6 REST OF EUROPE

- 9.5 LATIN AMERICA

- 9.5.1 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 9.5.2 BRAZIL

- 9.5.2.1 High export of medical devices to propel market

- 9.5.3 MEXICO

- 9.5.3.1 Rising R&D initiatives on oncology imaging to support market growth

- 9.5.4 REST OF LATIN AMERICA

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 9.6.2 GCC COUNTRIES

- 9.6.2.1 Integration of AI to support market growth

- 9.6.3 REST OF MIDDLE EAST & AFRICA

- 9.6.3.1 Advancements in healthcare sector to support market growth

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 KEY PLAYERS' STRATEGIES/RIGHT TO WIN

- 10.3 REVENUE ANALYSIS, 2022-2024

- 10.4 MARKET SHARE ANALYSIS

- 10.5 RANKING OF KEY PLAYERS, 2024

- 10.6 COMPANY VALUATION AND FINANCIAL METRICS

- 10.7 BRAND/PRODUCT COMPARISON

- 10.8 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.8.1 STARS

- 10.8.2 PERVASIVE PLAYERS

- 10.8.3 EMERGING LEADERS

- 10.8.4 PARTICIPANTS

- 10.8.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.8.5.1 Company footprint

- 10.8.5.2 Modality footprint

- 10.8.5.3 Application footprint

- 10.8.5.4 End user footprint

- 10.8.5.5 Region footprint

- 10.9 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.9.1 PROGRESSIVE COMPANIES

- 10.9.2 RESPONSIVE COMPANIES

- 10.9.3 DYNAMIC COMPANIES

- 10.9.4 STARTING BLOCKS

- 10.9.5 COMPETITIVE BENCHMARKING OF STARTUPS/SMES, 2024

- 10.9.5.1 Detailed list of key startups/SMEs

- 10.9.5.2 Competitive benchmarking of key startups/SMEs

- 10.10 COMPETITIVE SCENARIO

- 10.10.1 PRODUCT LAUNCHES AND APPROVALS

- 10.10.2 DEALS

- 10.10.3 EXPANSIONS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 SIEMENS HEALTHINEERS

- 11.1.1.1 Business overview

- 11.1.1.2 Products offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product launches, upgrades, and approvals

- 11.1.1.3.2 Deals

- 11.1.1.3.3 Expansions

- 11.1.1.4 MnM view

- 11.1.1.4.1 Key strengths

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses & competitive threats

- 11.1.2 GE HEALTHCARE

- 11.1.2.1 Business overview

- 11.1.2.2 Products offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Product launches, upgrades, and approvals

- 11.1.2.3.2 Deals

- 11.1.2.3.3 Expansions

- 11.1.2.3.4 Other developments

- 11.1.2.4 MnM view

- 11.1.2.4.1 Key strengths

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses and competitive threats

- 11.1.3 KONINKLIJKE PHILIPS N.V.

- 11.1.3.1 Business overview

- 11.1.3.2 Products offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Product launches, upgrades, and approvals

- 11.1.3.3.2 Deals

- 11.1.3.3.3 Expansions

- 11.1.3.4 MnM view

- 11.1.3.4.1 Key strengths

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses and competitive threats

- 11.1.4 FUJIFILM CORPORATION

- 11.1.4.1 Business overview

- 11.1.4.2 Products offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Product launches, upgrades, and approvals

- 11.1.4.3.2 Deals

- 11.1.4.3.3 Expansions

- 11.1.4.4 MnM view

- 11.1.4.4.1 Right to win

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses & competitive threats.

- 11.1.5 CANON

- 11.1.5.1 Business overview

- 11.1.5.2 Products offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Product launches, upgrades, and approvals

- 11.1.5.3.2 Deals

- 11.1.5.3.3 Expansions

- 11.1.6 SHENZHEN MINDRAY BIO-MEDICAL ELECTRONICS CO., LTD.

- 11.1.6.1 Business overview

- 11.1.6.2 Products offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Product launches, upgrades, and approvals

- 11.1.6.3.2 Deals

- 11.1.7 ESAOTE S.P.A

- 11.1.7.1 Business overview

- 11.1.7.2 Products offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Product launches, upgrades, and approvals

- 11.1.7.3.2 Deals

- 11.1.8 SAMSUNG HEALTHCARE

- 11.1.8.1 Business overview

- 11.1.8.2 Products offered

- 11.1.8.3 Recent developments

- 11.1.8.3.1 Product launches, upgrades, and approvals

- 11.1.8.3.2 Deals

- 11.1.8.3.3 Other developments

- 11.1.9 SHIMADZU CORPORATION

- 11.1.9.1 Business overview

- 11.1.9.2 Products offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Product launches, upgrades, and approvals

- 11.1.9.3.2 Deals

- 11.1.10 CARESTREAM HEALTH

- 11.1.10.1 Business overview

- 11.1.10.2 Products offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Product launches, upgrades, and approvals

- 11.1.10.3.2 Deals

- 11.1.11 PLANMED OY

- 11.1.11.1 Business overview

- 11.1.11.2 Products offered

- 11.1.12 HOLOGIC, INC.

- 11.1.12.1 Business overview

- 11.1.12.2 Products offered

- 11.1.12.3 Recent developments

- 11.1.12.3.1 Deals

- 11.1.13 AGFA-GEVAERT GROUP

- 11.1.13.1 Business overview

- 11.1.13.2 Products offered

- 11.1.14 CURVEBEAM AI, LTD.

- 11.1.14.1 Business overview

- 11.1.14.2 Products offered

- 11.1.14.3 Recent developments

- 11.1.14.3.1 Deals

- 11.1.15 UNITED IMAGING HEALTHCARE CO., LTD.

- 11.1.15.1 Business overview

- 11.1.15.2 Products offered

- 11.1.15.3 Recent developments

- 11.1.15.3.1 Product launches, upgrades, and approvals

- 11.1.15.3.2 Deals

- 11.1.15.3.3 Expansions

- 11.1.1 SIEMENS HEALTHINEERS

- 11.2 OTHER PLAYERS

- 11.2.1 ALLENGERS MEDICAL SYSTEMS LTD.

- 11.2.2 ANALOGIC CORPORATION

- 11.2.3 ASPECT IMAGING LTD.

- 11.2.4 BEIJING WANDONG MEDICAL TECHNOLOGY CO., LTD.

- 11.2.5 CHISON MEDICAL TECHNOLOGIES CO., LTD.

- 11.2.6 KONICA MINOLTA, INC.

- 11.2.7 MEDGYN PRODUCTS, INC.

- 11.2.8 NEUSOFT MEDICAL SYSTEMS CO., LTD.

- 11.2.9 PROMED TECHNOLOGY CO., LTD.

- 11.2.10 CMR NAVISCAN

- 11.2.11 CLARIUS

- 11.2.12 SHENZHEN BASDA MEDICAL APPARATUS CO., LTD.

- 11.2.13 SHENZHEN ANKE HIGH-TECH., LTD.

- 11.2.14 STERNMED GMBH

- 11.2.15 TIME MEDICAL SYSTEMS

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS