|

시장보고서

상품코드

1819099

산업용 산소 발생기 시장 : 가스 유형 및 유량별, 사이즈별, 디자인별, 기술별, 최종 이용 산업별, 지역별 - 예측(-2030년)Industrial Oxygen Generator Market by Gas Type and Flow Rate, Size, Design, Technology, End-Use Industry, and Region - Global Forecast to 2030 |

||||||

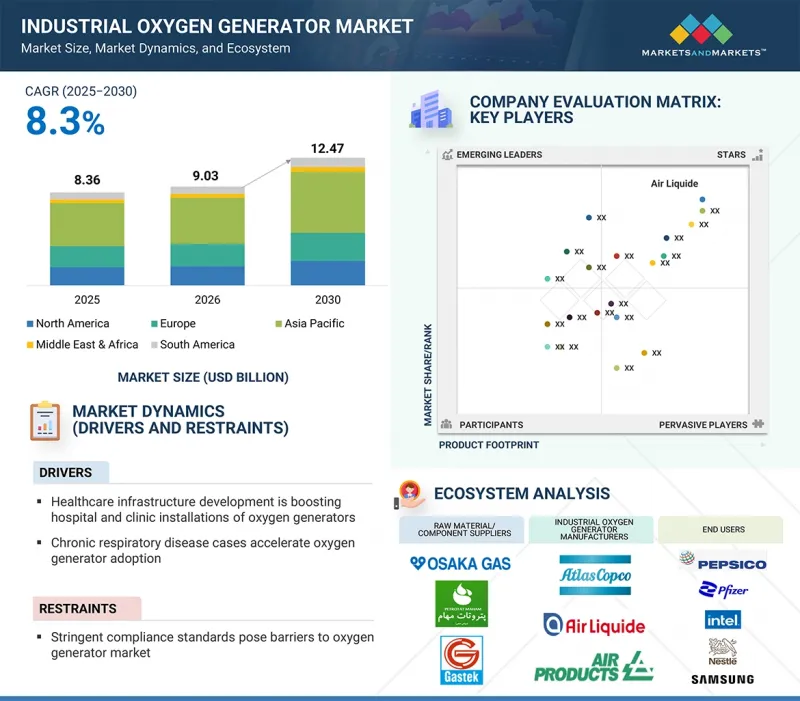

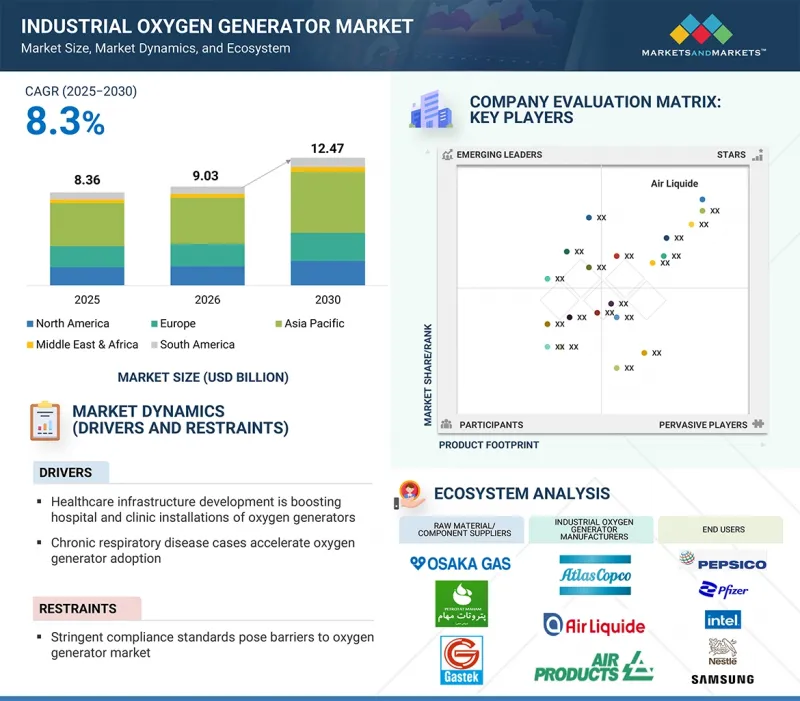

산업용 산소 발생기 시장 규모는 8.3%의 CAGR로 확대되어 2025년 83억 6,000만 달러에서 2030년에는 124억 7,000만 달러로 성장할 것으로 예측됩니다.

플러그 앤 플레이 산소 발생기는 디자인 부문에서 2위를 차지하고 있습니다. 이 산소 발생기는 신속한 배치, 최소한의 설치 복잡성, 간단한 작동을 위해 만들어졌으며, 대규모 기술 인프라가 없는 시설에 이상적입니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2022-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 대상 대수 | 금액(100만 달러), 수량(대) |

| 부문별 | 가스 유형 및 유량별, 사이즈별, 디자인별, 기술별, 최종 이용 산업별, 지역별 |

| 대상 지역 | 유럽, 북미, 아시아태평양, 중동 및 아프리카, 남미 |

제조업체에게 유리한 부문을 대표하는 이 시스템은 현장에서 쉽게 설치할 수 있도록 컨테이너 조립식 또는 스키드 장착식으로 제작되어 최소한의 노력으로 설치가 가능한 경우가 많습니다. 이러한 설계 방식은 최종사용자의 설치 시간과 비용을 크게 줄여주며, 특히 신속한 배치를 원하는 시설에 매우 매력적인 제품입니다. 안전성의 향상도 장점 중 하나이며, 자가용 산소 발생장치에서는 위험한 산소 실린더를 취급하거나 보관할 필요가 없습니다. 이 분야의 제조업체들은 컴팩트한 조립식 설계에 중점을 두고, 컴프레서, 자동 제어판, 내후성 및 내진동성 인클로저를 통합하여 다양한 환경에서의 신뢰성을 보장하는 데 주력하고 있습니다.

멤브레인 기반 산소 발생기는 PSA 장치에 비해 설계 및 성능에 대한 고려 사항이 다릅니다. 이러한 시스템은 고분자막을 통한 선택적 투과에 의존하고 있으며, 제조의 주요 초점은 오랜 기간 동안 안정적인 선택성과 유량 성능을 갖춘 멤브레인 섬유의 개발이라는 재료 과학에 있습니다. 에어리퀴드와 같은 기업들은 움직이는 부품 없이 안정적인 산소 스트림을 공급하는 소형 멤브레인 모듈을 최적화하여 기계적 마모와 유지보수의 필요성을 줄였습니다. 제조 관점에서 볼 때, 엔지니어링의 과제는 다양한 공급 공기의 질과 환경 조건에서 일관된 분리 효율을 보장하는 것입니다. 제조업체는 멤브레인 무결성을 보호하기 위해 사전 여과 및 컨디셔닝 서브시스템에 투자하는 한편, 이동식 및 공간 제약이 있는 시설에 적합한 소형 경량 하우징을 설계하고 있습니다.

양식업에서 산소 발생기는 최적의 용존 산소 수준을 유지하는 데 필수적이며, 이는 물고기의 건강, 성장률 및 생산 효율에 직접적인 영향을 미칩니다. 최신 시스템은 다양한 환경 조건에서 안정적인 산소 공급을 실현하도록 설계되어 육상 및 해상 양식 작업을 지원합니다. Atlas Copco의 OGV+VPSA 산소 발생 시스템은 양식 시설에 광범위하게 적용되고 있으며, 견고하고 에너지 효율적인 산소 발생 기능을 통해 탱크와 해상 케이지에 안정적인 산소 공급을 가능하게 합니다. Linde PLC의 ADSOSS-O VPSA 장치는 대규모 양식 사업에 사용되며, 산소 분배 네트워크와 통합되어 균일한 폭기와 최소한의 산소 손실을 보장합니다. 이 시스템은 통합이 쉽고, 유지보수가 적으며, 안정적인 성능을 제공하도록 설계되어 양식업자들이 대량 산소 공급에 대한 의존도를 낮추고 장기적인 비용 효율성을 향상시키면서 보다 건강하고 생산적인 수생 생태계를 지원할 수 있도록 돕습니다.

유럽은 선진화된 헬스케어 인프라, 탄탄한 산업 기반, 엄격한 환경 규제로 인해 산소발생기 분야에서 가장 큰 시장 중 하나입니다. 특히 COPD나 천식과 같은 호흡기질환의 높은 유병률로 인해 이 지역의 큰 수요는 고령화 및 만성질환을 앓고 있는 인구를 위해 신뢰할 수 있는 고순도 산소를 필요로 하는 병원, 진료소, 장기 요양 시설에서 발생합니다. 금속 가공에서 폐수처리, 제약에 이르기까지 유럽에는 의료용 및 산업용 산소 발생기의 지속적인 수요를 주도하는 산업이 있습니다. 유럽 정부와 규제 기관은 대기 질 및 배출물에 대한 엄격한 기준을 시행하고 있으며, 이는 모든 산업 분야에서 더 깨끗한 현장 산소 발생 기술에 대한 투자를 촉진하고 있습니다.

세계의 산업용 산소 발생기 시장에 대해 조사했으며, 가스 종류 및 유량별, 크기별, 디자인별, 기술별, 최종 이용 산업별, 지역별 동향, 시장 진입 기업 프로파일 등의 정보를 정리하여 전해드립니다.

목차

제1장 소개

제2장 조사 방법

제3장 주요 요약

제4장 주요 인사이트

제5장 시장 개요

- 소개

- 시장 역학

- Porter's Five Forces 분석

- 주요 이해관계자와 구입 기준

- 거시경제 지표

- 밸류체인 분석

- 생태계 분석

- 사례 연구 분석

- 규제 상황

- 기술 분석

- 고객 비즈니스에 영향을 미치는 동향/혼란

- 무역 분석

- 2025-2026년의 주요 회의와 이벤트

- 가격 분석

- 투자와 자금 조달 시나리오

- 특허 분석

- 2025년 미국 관세가 산업용 산소 발생기 시장에 미치는 영향

제6장 산업용 산소 발생기 시장(가스 유형 및 유량별)

- 소개

- 산업용

- 의료용

제7장 산업용 산소 발생기 시장(사이즈별)

- 소개

- 고정형

- 가동형

제8장 산업용 산소 발생기 시장(디자인별)

- 소개

- 실린더

- 플러그 앤 플레이

제9장 산업용 산소 발생기 시장(기술별)

- 소개

- 압력 스윙 흡착(PSA) 기반

- 막 기반

- 극저온 기반

제10장 산업용 산소 발생기 시장(최종 이용 산업별)

- 소개

- 의료·헬스케어

- 화학제품·석유화학제품

- 광업·금속 가공

- 발전

- 양식업

- 수처리

- 기타

제11장 산업용 산소 발생기 시장(지역별)

- 소개

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 프랑스

- 영국

- 이탈리아

- 스페인

- 기타

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 호주

- 기타

- 남미

- 브라질

- 아르헨티나

- 콜롬비아

- 칠레

- 기타

- 중동 및 아프리카

- GCC 국가

- 남아프리카공화국

- 기타

제12장 경쟁 구도

- 개요

- 주요 진출 기업의 전략/강점

- 매출 분석

- 시장 점유율 분석

- 기업 평가와 재무 지표

- 브랜드/제품 비교 분석

- 기업 평가 매트릭스 : 주요 진출 기업, 2024년

- 기업 평가 매트릭스 : 스타트업/중소기업, 2024년

- 경쟁 시나리오

제13장 기업 개요

- 주요 진출 기업

- AIR LIQUIDE

- AIR PRODUCTS AND CHEMICALS, INC.

- ATLAS COPCO GROUP

- LINDE PLC

- OXYMAT

- CAIRE INC.

- INMATEC GASETECHNOLOGIE GMBH & CO. KG

- OXYGEN GENERATING SYSTEMS

- PCI GASES

- GENERON

- SYSADVANCE

- SUMER A.S.

- OXYVITAL

- ORECO A/S

- FRITZ STEPHAN GMBH

- OZCAN KARDESLER

- BEACONMEDAES

- GAZ SYSTEMES

- MIL'S

- 기타 기업

- NOXERIOR

- ADVANCED GAS TECHNOLOGIES INC.

- PNEUMATECH

- AMCAREMED MEDICAL GAS SYSTEM

- SUMITOMO SEIKA CHEMICALS CO., LTD.

- INGERSOLL RAND

제14장 부록

KSM 25.09.29The industrial oxygen generator market is estimated to grow from USD 8.36 billion in 2025 to USD 12.47 billion in 2030, at a CAGR of 8.3%. Plug & play oxygen generators hold the second-largest position in the design segment. These oxygen generators are built for rapid deployment, minimal installation complexity, and straightforward operation, ideal for facilities lacking extensive technical infrastructure.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million), Volume (units) |

| Segments | By Gas Type and Flow Rate, By Size, By Design, By Technology, By End-Use Industry, And Region |

| Regions covered | Europe, North America, Asia Pacific, the Middle East & Africa, and South America |

Representing a lucrative segment for manufacturers, these systems are often container-assembled or skid-mounted for straightforward on-site installation, requiring minimal effort, and this design approach significantly reduces installation time and costs for end-users, making the products highly attractive, particularly for facilities seeking rapid deployment. Improved safety is another advantage, as in-house oxygen generators eliminate the need for handling and storing hazardous oxygen cylinders. Manufacturers in this segment focus on compact, preassembled designs that can be operational within hours of delivery, integrating compressors, automated control panels, and weatherproof, vibration-resistant enclosures to ensure reliability across varied environments.

''In terms of value, membrane-based technology type accounted for the third-largest share of the overall industrial oxygen generator market.''

Membrane-based oxygen generators present a different set of design and performance considerations compared to PSA units. These systems rely on selective permeation through polymeric membranes, and the key manufacturing focus is on material science - developing membrane fibers with stable selectivity and flow performance over years of operation. Companies like Air Liquide have optimized compact membrane modules that deliver steady oxygen streams without moving parts, reducing mechanical wear and maintenance needs. From a production standpoint, the engineering challenge lies in ensuring consistent separation efficiency across varying feed air qualities and environmental conditions. Manufacturers invest in pre-filtration and conditioning subsystems to protect membrane integrity, while designing compact, lightweight housings that appeal to mobile or space-constrained installations.

"During the forecast period, the aquaculture end-use industry is projected to witness the third-largest share."

In aquaculture, oxygen generators are critical for maintaining optimal dissolved oxygen levels, which directly impact fish health, growth rates, and production efficiency. Modern systems are designed to deliver a stable oxygen supply under varying environmental conditions, supporting both land-based and offshore farming operations. Atlas Copco's OGV+ VPSA oxygen generators are widely deployed in aquaculture facilities, offering robust and energy-efficient oxygen generation for consistent oxygenation of tanks and sea cages. Linde PLC's ADSOSS-O VPSA units serve large-scale fish farming operations, integrating with oxygen distribution networks to ensure uniform aeration and minimal oxygen loss. These systems are designed for ease of integration, low maintenance, and reliable performance, enabling aquaculture operators to reduce reliance on bulk oxygen deliveries and improve long-term cost efficiency while supporting healthier and more productive aquatic ecosystems.

"During the forecast period, the industrial oxygen generator market in the European region is projected to witness the second-largest market share."

Europe is one of the largest markets in the oxygen generator sector due to its advanced healthcare infrastructure, robust industrial base, and strict environmental regulations. The region's substantial demand comes from hospitals, clinics, and long-term care facilities that require reliable, high-purity oxygen for a large aging and chronically ill population, especially given the high prevalence of respiratory diseases like COPD and asthma. Europe's well-established industries, ranging from metal processing to wastewater treatment and pharmaceuticals, drive continuous demand for both medical and industrial oxygen generators. Governments and regulatory bodies in Europe enforce rigorous standards for air quality and emissions, which have encouraged investment in cleaner, on-site oxygen generation technologies across sectors.

This study has been validated through primary interviews with industry experts globally. These primary sources have been divided into the following three categories:

- By Company Type- Tier 1 - 60%, Tier 2 - 20%, and Tier 3 - 20%

- By Designation- C Level - 33%, Director Level - 33%, and Managers - 34%

- By Region- North America - 20%, Europe - 25%, Asia Pacific - 25%, Middle East & Africa - 15%, and Latin America - 15%

The report provides a comprehensive analysis of company profiles:

Prominent companies include Air Liquide (France), Air Products and Chemicals, Inc. (US), Atlas Copco (Sweden), Linde plc (UK), OXYMAT (Denmark), CAIRE Inc. (US), INMATEC GaseTechnologie GmbH & Co. KG (Germany), Oxygen Generating Systems International (US), PCI Gases (US), GENERON (US), and SYSADVANCE (Portugal).

Research Coverage

This research report categorizes the industrial oxygen generator market by gas type and flow rate (Industrial oxygen, Medical Oxygen), Size (Stationary, Portable), Design (Cylinder, Plug & Play), Technology (Pressure Swing Adsorption (PSA) Based Generator, Membrane-Based Generator, Cryogenic-Based Industrial Generator), End-Use Industry Region (North America, Europe, Asia Pacific, Middle East & Africa, and South America). The scope of the report includes detailed information about the major factors influencing the growth of the industrial oxygen generator market, such as drivers, restraints, challenges, and opportunities. A thorough examination of the key industry players has been conducted in order to provide insights into their business overview, solutions, and services, key strategies, contracts, partnerships, and agreements. Product launches, mergers and acquisitions, and recent developments in the industrial oxygen generator market are all covered. This report includes a competitive analysis of upcoming startups in the industrial oxygen generator market ecosystem.

Reasons to buy this report:

The report will help market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall industrial oxygen generator market and the subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Analysis of key drivers (Healthcare infrastructure development boosting hospital and clinic installations of oxygen generators, Chronic respiratory disease cases accelerate oxygen generator adoption, Reducing energy footprints in industrial and medical oxygen supply, stell capacity expansion demands smarter oxygen supply ), restraints (stringent compliance standards pose barriers to oxygen generator market), opportunities (rising aquaculture demand positions oxygen generators for market growth, expanding, ozone applications with high-purity oxygen technology) and challenges (installation and integration costs slowing market expansion, specialized maintenance needs create barriers in oxygen generator operations).

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and service launches in the industrial oxygen generator market

- Market Development: Comprehensive information about lucrative markets - the report analyses the industrial oxygen generator market across varied regions

- Market Diversification: Exhaustive information about services, untapped geographies, recent developments, and investments in the industrial oxygen generator market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as (France), Air Products and Chemicals, Inc. (US), Atlas Copco (Sweden), Linde plc (UK), OXYMAT (Denmark), CAIRE Inc. (US), INMATEC GaseTechnologie GmbH & Co. KG (Germany), Oxygen Generating Systems International (US), PCI Gases (US), GENERON (US), and SYSADVANCE (Portugal) among others in the industrial oxygen generator market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNIT CONSIDERED

- 1.4 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 List of primary interview participants-demand and supply sides

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of interviews with experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 FORECAST NUMBER CALCULATION

- 2.4 DATA TRIANGULATION

- 2.5 FACTOR ANALYSIS

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 RESEARCH LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN INDUSTRIAL OXYGEN GENERATOR MARKET

- 4.2 INDUSTRIAL OXYGEN GENERATOR MARKET, BY GAS TYPE AND FLOW RATE

- 4.3 INDUSTRIAL OXYGEN GENERATOR MARKET, BY SIZE

- 4.4 INDUSTRIAL OXYGEN GENERATOR MARKET, BY DESIGN

- 4.5 INDUSTRIAL OXYGEN GENERATOR MARKET, BY TECHNOLOGY

- 4.6 INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY

- 4.7 INDUSTRIAL OXYGEN GENERATOR MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising development of healthcare infrastructure

- 5.2.1.2 Increasing prevalence of chronic respiratory diseases

- 5.2.1.3 Sustainable oxygen supply through reduced energy use

- 5.2.1.4 Expanding steel production capacity

- 5.2.2 RESTRAINTS

- 5.2.2.1 Stringent compliance standards

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing demand in aquaculture industry

- 5.2.3.2 Rising demand for high-purity oxygen in ozone generation

- 5.2.3.3 Modernization of power infrastructure

- 5.2.4 CHALLENGES

- 5.2.4.1 High installation and integration costs

- 5.2.4.2 Specialized maintenance needs

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 BARGAINING POWER OF SUPPLIERS

- 5.3.2 BARGAINING POWER OF BUYERS

- 5.3.3 THREAT OF NEW ENTRANTS

- 5.3.4 THREAT OF SUBSTITUTES

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.4.2 BUYING CRITERIA

- 5.5 MACROECONOMIC INDICATORS

- 5.5.1 GLOBAL GDP TRENDS

- 5.6 VALUE CHAIN ANALYSIS

- 5.7 ECOSYSTEM ANALYSIS

- 5.8 CASE STUDY ANALYSIS

- 5.8.1 ATLAS COPCO OXYGEN GENERATOR ENHANCES BIOGAS STABILITY AT LEEMING FACILITY

- 5.8.2 SEMP OPTIMIZES WASTEWATER TREATMENT WITH NOVAIR ON-SITE OXYGEN GENERATION

- 5.8.3 ATLAS COPCO OGP2 SECURES RELIABLE OXYGEN SUPPLY FOR UK VETERINARY CENTRE

- 5.9 REGULATORY LANDSCAPE

- 5.9.1 REGULATIONS

- 5.9.1.1 Europe

- 5.9.1.2 Asia Pacific

- 5.9.1.3 North America

- 5.9.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.9.1 REGULATIONS

- 5.10 TECHNOLOGY ANALYSIS

- 5.10.1 KEY TECHNOLOGIES

- 5.10.1.1 Pressure swing adsorption (PSA)

- 5.10.1.2 Membrane separation

- 5.10.1.3 Cryogenic oxygen generation

- 5.10.2 COMPLEMENTARY TECHNOLOGIES

- 5.10.2.1 IoT and smart monitoring systems

- 5.10.2.2 Energy recovery systems

- 5.10.1 KEY TECHNOLOGIES

- 5.11 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.12 TRADE ANALYSIS

- 5.12.1 EXPORT SCENARIO (HS CODE 840510)

- 5.12.2 IMPORT SCENARIO (HS CODE 840510)

- 5.13 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.14 PRICING ANALYSIS

- 5.14.1 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2024

- 5.14.2 AVERAGE SELLING PRICE TREND, BY END-USE INDUSTRY, 2022-2030

- 5.14.3 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY END-USE INDUSTRY, 2024

- 5.15 INVESTMENT AND FUNDING SCENARIO

- 5.16 PATENT ANALYSIS

- 5.16.1 APPROACH

- 5.16.2 DOCUMENT TYPES

- 5.16.3 PUBLICATION TRENDS

- 5.16.4 INSIGHTS

- 5.16.5 LEGAL STATUS OF PATENTS

- 5.16.6 JURISDICTION ANALYSIS

- 5.16.7 TOP COMPANIES/APPLICANTS

- 5.16.8 TOP 10 PATENT OWNERS (US)

- 5.17 IMPACT OF 2025 US TARIFF ON INDUSTRIAL OXYGEN GENERATOR MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 IMPACT ON KEY COUNTRIES/REGIONS

- 5.17.4.1 North America

- 5.17.4.2 Europe

- 5.17.4.3 Asia Pacific

- 5.17.5 IMPACT ON END-USE INDUSTRIES

6 INDUSTRIAL OXYGEN GENERATOR MARKET, BY GAS TYPE AND FLOW RATE

- 6.1 INTRODUCTION

- 6.2 INDUSTRIAL

- 6.2.1 FOCUS ON ENHANCING OXYGEN SUPPLY EFFICIENCY ACROSS INDUSTRIAL FLOW RATES TO BOOST DEMAND

- 6.2.2 UP TO 50 NM3/HR

- 6.2.3 50-200 NM3/HR

- 6.2.4 200-1,000 NM3/HR

- 6.2.5 ABOVE 1,000 NM3/HR

- 6.3 MEDICAL

- 6.3.1 NEED TO ENSURE CONSISTENT AND SAFE OXYGEN SUPPLY ACROSS MEDICAL FACILITIES TO FUEL DEMAND

- 6.3.2 UP TO 2 NM3/HR

- 6.3.3 2.1-14 NM3/HR

- 6.3.4 15-50 NM3/HR

- 6.3.5 ABOVE 50 NM3/HR

7 INDUSTRIAL OXYGEN GENERATOR MARKET, BY SIZE

- 7.1 INTRODUCTION

- 7.2 STATIONARY

- 7.2.1 HIGH-PURITY AND CONTINUOUS OXYGEN SUPPLY FEATURES TO DRIVE DEMAND

- 7.3 PORTABLE 93 7.3.1 RISING USE OF PORTABLE OXYGEN GENERATORS FOR DECENTRALIZED AND REMOTE APPLICATIONS TO DRIVE MARKET

8 INDUSTRIAL OXYGEN GENERATOR MARKET, BY DESIGN

- 8.1 INTRODUCTION

- 8.2 CYLINDER

- 8.2.1 INCREASING INDUSTRIAL APPLICATIONS TO DRIVE MARKET

- 8.3 PLUG & PLAY

- 8.3.1 GROWING USE IN MEDICAL AND INDUSTRIAL APPLICATIONS TO PROPEL MARKET

9 INDUSTRIAL OXYGEN GENERATOR MARKET, BY TECHNOLOGY

- 9.1 INTRODUCTION

- 9.2 PRESSURE SWING ADSORPTION (PSA)-BASED

- 9.2.1 HIGH EFFICIENCY, OPERATIONAL RELIABILITY, AND ABILITY TO CONSISTENTLY PROVIDE OXYGEN AT DESIRED PURITY LEVEL TO FUEL DEMAND

- 9.3 MEMBRANE-BASED

- 9.3.1 HIGH POWER EFFICIENCY IN MEMBRANE OXYGEN GENERATION TO PROPEL DEMAND

- 9.4 CRYOGENIC-BASED

- 9.4.1 GROWING USE OF CRYOGENIC SOLUTIONS IN ENERGY & POWER INDUSTRY TO DRIVE MARKET

10 INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY

- 10.1 INTRODUCTION

- 10.2 MEDICAL & HEALTHCARE

- 10.2.1 RISING OXYGEN GENERATION FOR EMERGENCY, INSTITUTIONAL, AND HOME CARE NEEDS TO DRIVE MARKET

- 10.3 CHEMICALS & PETROCHEMICALS

- 10.3.1 NEED TO MEET HIGH-PURITY, HIGH-VOLUME OXYGEN DEMAND IN HARSH INDUSTRIAL ENVIRONMENTS TO PROPEL MARKET

- 10.4 MINING & METAL PROCESSING

- 10.4.1 RISING NEED FOR OXYGEN IN MINERAL PROCESSING AND SMELTING TO DRIVE DEMAND

- 10.5 POWER GENERATION

- 10.5.1 SHIFT TOWARD OXYGEN-ENRICHED COMBUSTION FOR HIGHER EFFICIENCY AND LOWER EMISSIONS TO PROPEL DEMAND

- 10.6 AQUACULTURE

- 10.6.1 USE TO MAINTAIN OPTIMAL DISSOLVED OXYGEN LEVELS TO FUEL MARKET GROWTH

- 10.7 WATER TREATMENT

- 10.7.1 RISING DEMAND IN HIGH-PURITY PROCESSES TO DRIVE MARKET

- 10.8 OTHER END-USE INDUSTRIES

11 INDUSTRIAL OXYGEN GENERATOR MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 US

- 11.2.1.1 Rising demand from aquaculture and power generation industries to drive market

- 11.2.2 CANADA

- 11.2.2.1 Infrastructure upgrades and expanding healthcare sector to boost market growth

- 11.2.3 MEXICO

- 11.2.3.1 Increasing adoption in energy and aquaculture industries to drive market

- 11.2.1 US

- 11.3 EUROPE

- 11.3.1 GERMANY

- 11.3.1.1 Rising demand from aquaculture industry to drive market

- 11.3.2 FRANCE

- 11.3.2.1 Enhancement of efficiency in power generation using oxygen technologies to drive demand

- 11.3.3 UK

- 11.3.3.1 Booming healthcare sector to fuel demand

- 11.3.4 ITALY

- 11.3.4.1 Expanding on-site oxygen generator market to fuel demand

- 11.3.5 SPAIN

- 11.3.5.1 Growing industrial sector to fuel demand

- 11.3.6 REST OF EUROPE

- 11.3.1 GERMANY

- 11.4 ASIA PACIFIC

- 11.4.1 CHINA

- 11.4.1.1 Expanding healthcare industry to fuel demand

- 11.4.2 JAPAN

- 11.4.2.1 Increasing industrial demand to drive market

- 11.4.3 INDIA

- 11.4.3.1 Growing medical & healthcare industries to propel market

- 11.4.4 SOUTH KOREA

- 11.4.4.1 Stringent government policies regarding medical equipment to drive market

- 11.4.5 AUSTRALIA

- 11.4.5.1 Growing use in mining & metals industry to boost market

- 11.4.6 REST OF ASIA PACIFIC

- 11.4.1 CHINA

- 11.5 SOUTH AMERICA

- 11.5.1 BRAZIL

- 11.5.1.1 Increasing demand across healthcare, metal, chemical, aquaculture, and water treatment industries to drive market

- 11.5.2 ARGENTINA

- 11.5.2.1 Modernization of industrial sector to drive market

- 11.5.3 COLUMBIA

- 11.5.3.1 Booming industrial sector to fuel demand

- 11.5.4 CHILE

- 11.5.4.1 Increased demand in aquaculture industry to drive market

- 11.5.5 REST OF SOUTH AMERICA

- 11.5.1 BRAZIL

- 11.6 MIDDLE EAST & AFRICA

- 11.6.1 GCC COUNTRIES

- 11.6.1.1 Saudi Arabia

- 11.6.1.1.1 Vision 2030 and NEOM megaproject to support market growth

- 11.6.1.2 UAE

- 11.6.1.2.1 Government-led initiatives for industrial diversification, healthcare expansion, and sustainability to drive market

- 11.6.1.3 Rest of GCC countries

- 11.6.1.1 Saudi Arabia

- 11.6.2 SOUTH AFRICA

- 11.6.2.1 Enhancement of sustainability through on-site oxygen generation to fuel demand

- 11.6.3 REST OF MIDDLE EAST & AFRICA

- 11.6.1 GCC COUNTRIES

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.3 REVENUE ANALYSIS

- 12.4 MARKET SHARE ANALYSIS

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS

- 12.6 BRAND/PRODUCT COMPARISON ANALYSIS

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.7.5.1 Company footprint

- 12.7.5.2 Region footprint

- 12.7.5.3 Gas type and flow rate footprint

- 12.7.5.4 Size footprint

- 12.7.5.5 Design footprint

- 12.7.5.6 Technology footprint

- 12.7.5.7 End-use industry footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING: KEY STARTUPS/SMES, 2024

- 12.8.5.1 Detailed list of key startups/SMEs

- 12.8.5.2 Competitive benchmarking of key startups/SMEs

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 EXPANSIONS

- 12.9.3 DEALS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 AIR LIQUIDE

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Expansions

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths/Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses/Competitive threats

- 13.1.2 AIR PRODUCTS AND CHEMICALS, INC.

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Deals

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths/Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses/Competitive threats

- 13.1.3 ATLAS COPCO GROUP

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Deals

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths/Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses/Competitive threats

- 13.1.4 LINDE PLC

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Deals

- 13.1.4.4 Recent developments

- 13.1.4.4.1 Expansions

- 13.1.4.5 MnM view

- 13.1.4.5.1 Key strengths/Right to win

- 13.1.4.5.2 Strategic choices

- 13.1.4.5.3 Weaknesses/Competitive threats

- 13.1.5 OXYMAT

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Deals

- 13.1.5.4 MnM view

- 13.1.5.4.1 Key strengths/Right to win

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses/Competitive threats

- 13.1.6 CAIRE INC.

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Product launches

- 13.1.6.3.2 Expansions

- 13.1.6.4 MnM view

- 13.1.7 INMATEC GASETECHNOLOGIE GMBH & CO. KG

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.7.3 MnM view

- 13.1.8 OXYGEN GENERATING SYSTEMS

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 MnM view

- 13.1.9 PCI GASES

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.9.3 MnM view

- 13.1.10 GENERON

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.10.3 MnM view

- 13.1.11 SYSADVANCE

- 13.1.11.1 Business overview

- 13.1.11.2 Products/Solutions/Services offered

- 13.1.11.3 MnM view

- 13.1.12 SUMER A.S.

- 13.1.12.1 Business overview

- 13.1.12.2 Products/Solutions/Services offered

- 13.1.12.3 MnM view

- 13.1.13 OXYVITAL

- 13.1.13.1 Business overview

- 13.1.13.2 Products/Solutions/Services offered

- 13.1.13.3 MnM view

- 13.1.14 ORECO A/S

- 13.1.14.1 Business overview

- 13.1.14.2 Products/Solutions/Services offered

- 13.1.14.3 MnM view

- 13.1.15 FRITZ STEPHAN GMBH

- 13.1.15.1 Business overview

- 13.1.15.2 Products/Solutions/Services offered

- 13.1.15.3 MnM view

- 13.1.16 OZCAN KARDESLER

- 13.1.16.1 Business overview

- 13.1.16.2 Products/Solutions/Services offered

- 13.1.16.3 MnM view

- 13.1.17 BEACONMEDAES

- 13.1.17.1 Business overview

- 13.1.17.2 Products/Solutions/Services offered

- 13.1.17.3 MnM view

- 13.1.18 GAZ SYSTEMES

- 13.1.18.1 Business overview

- 13.1.18.2 Products/Solutions/Services offered

- 13.1.18.3 MnM view

- 13.1.19 MIL'S

- 13.1.19.1 Business overview

- 13.1.19.2 Products/Solutions/Services offered

- 13.1.19.3 MnM view

- 13.1.1 AIR LIQUIDE

- 13.2 OTHER PLAYERS

- 13.2.1 NOXERIOR

- 13.2.2 ADVANCED GAS TECHNOLOGIES INC.

- 13.2.3 PNEUMATECH

- 13.2.4 AMCAREMED MEDICAL GAS SYSTEM

- 13.2.5 SUMITOMO SEIKA CHEMICALS CO., LTD.

- 13.2.6 INGERSOLL RAND

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS