|

시장보고서

상품코드

1823732

재활용 탄소섬유 시장 예측(-2030년) : 유형별, 원료별, 제조 공정별, 최종 용도 산업별, 지역별Recycled Carbon Fiber Market by Type (Milled, Chopped), Source, Manufacturing Process, End-use Industry (Automotive & Transportation, Consumer Goods, Sporting Goods, Industrial, Aerospace & Defense, Marine), and Region - Global Forecast to 2030 |

||||||

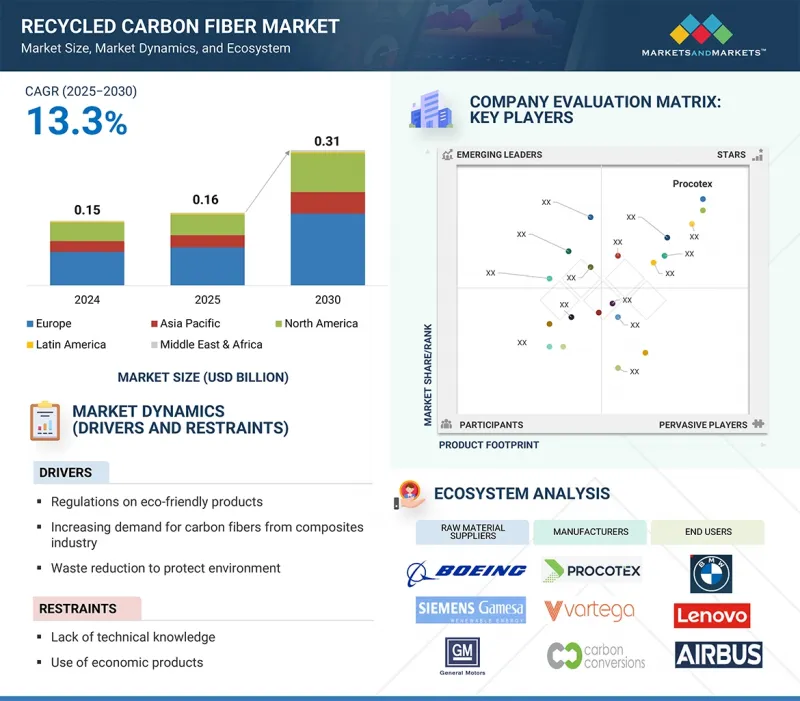

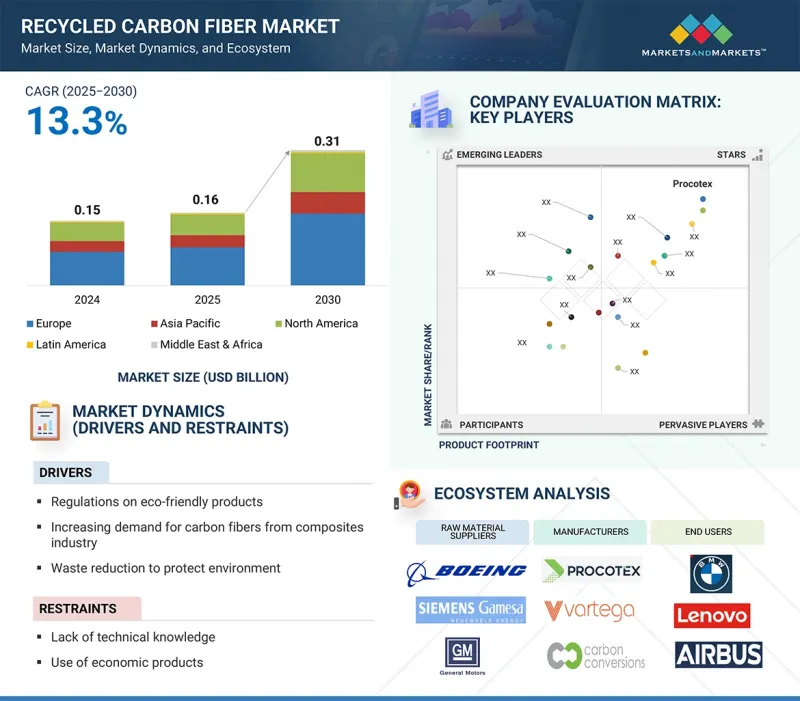

세계의 재활용 탄소섬유 시장 규모는 2025년에 1억 6,000만 달러, 2030년까지 3억 1,000만 달러에 달할 것으로 추정되며, CAGR로 13.3%의 성장이 전망됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2022-2030년 |

| 기준연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 1,000달러, 톤 |

| 부문 | 유형, 원료, 제조 공정, 최종 용도 산업, 지역 |

| 대상 지역 | 북미, 아시아태평양, 중동 및 아프리카, 라틴아메리카 |

밀드 유형은 버진 탄소섬유와 거의 동일한 특성을 나타내며, 열가소성 및 열경화성 복합재료의 기계적 특성, 전도성, 내화학성을 강화하기 위해 사용되며, 다양한 산업 용도에 맞게 치수 안정성과 전도성을 향상시켜 재생 탄소섬유 시장에서 가장 큰 점유율을 차지하고 있습니다. 밀드 재생 탄소섬유는 탄소섬유 폐기물을 매우 짧은 섬유나 미세 분말로 가공한 것으로, 일반적으로 길이는 60-300마이크로미터 정도입니다. 이 소재는 주로 항공우주, 자동차 등 산업에서 배출되는 재생 탄소섬유 스크랩에서 얻어집니다.

"자동차 스크랩은 예측 기간 중 두 번째로 높은 성장률을 나타낼 것으로 예측됩니다. "

자동차 스크랩은 자동차 산업의 경량, 고강도, 친환경 소재에 대한 높은 수요로 인해 시장에서 두 번째로 높은 성장률을 나타낼 것으로 예측됩니다. 독일, 미국, 일본을 포함한 선진국은 친환경 제품을 널리 사용하고 있습니다. EU는 자동차에 사용되는 재료의 85%를 재활용하도록 의무화하고 있습니다. 이들은 스틸이나 알루미늄과 같은 기존 금속에 비해 강도 대비 중량비와 내식성이 뛰어나 보닛, 휠, 엔진 부품, 구조 보강재 등 다양한 자동차 부품의 제조에 점점 더 많이 사용되고 있습니다. 이는 차량 전체의 경량화에 도움이 되며, 연비를 직접적으로 개선하여 엄격한 연비 및 배기가스 규제를 충족시킵니다. 전기자동차의 등장은 경량 소재가 배터리의 항속거리를 연장하고 차량 성능을 향상시키기 때문에 이 수요를 더욱 증가시킬 것입니다.

"소비재 산업은 전체 재생 탄소섬유 시장에서 두 번째 점유율을 차지했습니다. "

다양한 제품 제조에 사용되는 경량, 고성능, 비용 효율적인 소재에 대한 수요가 증가함에 따라 소비재 산업은 재생 탄소섬유 시장에서 두 번째 점유율을 차지했습니다. 재생 탄소섬유는 마이크로 전자제품에 사용되는 폴리머 조성물 및 코팅에 전도성 및 정전기 방지 특성을 부여합니다. 탄소섬유의 전도성은 플라스틱 소재에 정전기 부하를 방지하고 전자기 간섭으로부터 차폐를 제공하는 성능을 제공합니다. 재생 탄소섬유는 성능상의 장점으로 인해 노트북, LCD 프로젝터, 카메라 본체, 렌즈 등 전자기기용 플라스틱 복합재료에 많이 사용되고 있습니다. 예를 들어 Toray Industries, Inc.2023년에는 Lenovo와 협력하여 재생 탄소섬유를 열가소성 펠릿의 보강 충전재로 Lenovo ThinkPad X1 Carbon Gen 12에 통합했습니다.

"유럽이 예측 기간 중 재생 탄소섬유 시장에서 가장 높은 성장률을 나타낼 것으로 예측됩니다. "

유럽은 지속가능성을 중시하고, 환경 규제가 엄격하며, 순환 경제에 대한 노력이 확립되어 있으며, 예측 기간 중 재생 탄소섬유 시장에서 가장 높은 CAGR을 나타낼 것으로 예측됩니다. 유럽연합(EU)은 자동차 및 운송, 항공우주 및 방위, 풍력에너지, 건설 등의 산업에서 이산화탄소 배출 감소와 폐기물 재활용을 추진하고 있으며, 이 지역은 녹색 제조 관행 채택의 최전선에 서 있습니다. 최근에는 2025년 6월에 벨기에 대한 Syensqo가 미국 Vartega와 제휴하여 탄소섬유 재활용의 획기적인 발전을 통해 지속가능한 고성능 플라스틱을 추진하고 있습니다. 이번 파트너십을 통해 강도, 비용, 내구성을 희생하지 않고 고품질의 재생 탄소섬유를 생산할 수 있는 확장 가능하고 비용 효율적인 폐쇄 루프 재활용이 가능해졌습니다. 또한 재활용 기술에 대한 대규모 투자와 정부 지원 연구 프로그램, 제조업체와 재활용 기업의 협력으로 유럽에서 급속한 시장 확대를 지원하는 견고한 생태계가 구축되고 있습니다.

세계의 재활용 탄소섬유 시장에 대해 조사분석했으며, 주요 촉진요인과 억제요인, 경쟁 구도, 향후 동향 등의 정보를 제공하고 있습니다.

목차

제1장 서론

제2장 조사 방법

제3장 개요

제4장 중요 인사이트

- 재활용 탄소섬유 시장의 기업에 매력적인 기회

- 재활용 탄소섬유 시장 : 최종 용도 산업별, 지역별

- 재활용 탄소섬유 시장 : 유형별

- 재활용 탄소섬유 시장 : 원료별

- 재활용 탄소섬유 시장 : 제조 공정별

- 재활용 탄소섬유 시장 : 최종 용도 산업별

- 재활용 탄소섬유 시장 : 주요 국가별

제5장 시장 개요

- 서론

- 시장 역학

- 촉진요인

- 억제요인

- 기회

- 과제

제6장 산업 동향

- Porter's Five Forces 분석

- 주요 이해관계자와 구입 기준

- 가격결정 분석

- 주요 기업이 제공하는 재활용 탄소섬유의 평균 판매 가격 : 최종 용도 산업별(2024년)

- 평균 판매 가격 동향 : 지역별(2022-2024년)

- 거시경제 분석

- 서론

- GDP의 동향과 예측

- 세계의 재활용 탄소섬유 시장 동향

- 밸류체인 분석

- 에코시스템 분석

- 무역 분석(2022-2024년)

- 수입 시나리오(HS 코드 681511)

- 수출 시나리오(HS 코드 681511)

- 기술 분석

- 주요 기술

- 보완 기술

- 특허 분석

- 서론

- 조사 방법

- 문헌의 유형

- 인사이트

- 법적 지위

- 관할 분석

- 주요 출원자 분석

- 규제 상황

- 주요 컨퍼런스와 이벤트(2025-2026년)

- 사례 연구 분석

- 고객 비즈니스에 영향을 미치는 동향과 혼란

- 재활용 탄소섬유 시장에 대한 AI/생성형 AI의 영향

- 투자와 자금조달 시나리오

- 2025년 미국 관세 재활용 탄소섬유 시장에 대한 영향

- 서론

- 주요 관세율

- 가격의 영향 분석

- 국가/지역에 대한 영향

- 최종 용도 산업에 대한 영향

제7장 재활용 탄소섬유 시장 : 원료별

- 서론

- 항공우주 스크랩

- 자동차 스크랩

- 기타 원료

제8장 재활용 탄소섬유 시장 : 제조 공정별

- 서론

- 기계

- 열

- 화학

제9장 재활용 탄소섬유 시장 : 유형별

- 서론

- 촙드(CHOPPED)

- 밀드

제10장 재활용 탄소섬유 시장 : 최종 용도 산업별

- 서론

- 자동차·운송

- 소비재

- 스포츠 용품

- 산업

- 항공우주·방위

- 해사

- 기타 최종 용도 산업

제11장 재활용 탄소섬유 시장 : 지역별

- 서론

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 프랑스

- 이탈리아

- 영국

- 스페인

- 러시아

- 기타 유럽

- 아시아태평양

- 일본

- 중국

- 한국

- 기타 아시아태평양

- 중동 및 아프리카

- GCC 국가

- 남아프리카공화국

- 기타 중동 및 아프리카

- 라틴아메리카

- 브라질

- 멕시코

- 기타 라틴아메리카

제12장 경쟁 구도

- 서론

- 주요 참여 기업의 전략/강점(2020-2025년)

- 매출 분석(2020-2024년)

- 시장 점유율 분석(2024년)

- 브랜드/제품 비교

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업 평가 매트릭스 : 스타트업/중소기업(2024년)

- 기업의 평가와 재무 지표

- 경쟁 시나리오

제13장 기업 개요

- 주요 기업

- TORAY INDUSTRIES, INC.

- MITSUBISHI CHEMICAL GROUP CORPORATION

- PROCOTEX

- VARTEGA INC.

- CARBON CONVERSIONS

- GEN 2 CARBON LIMITED

- SHOCKER COMPOSITES

- CARBON FIBER RECYCLING

- ALPHA RECYCLING COMPOSITES

- CARBON FIBER REMANUFACTURING

- CATACK-H

- HERA SPA

- PYRUM INNOVATIONS AG

- 기타 기업

- SIGMATEX

- CARBON FIBER RECYCLE INDUSTRY CO. LTD.

- TEIJIN CARBON EUROPE GMBH

- BCIRCULAR

- ASAHI KASEI

- FAIRMAT

- THERMOLYSIS CO., LTD.

- RYMYC S.R.L.

- MALLINDA

- COMPOSITE RECYCLING

- CARBON CLEANUP

- EXTRACTHIVE

제14장 부록

KSA 25.10.02The recycled carbon fiber market is estimated to be valued at USD 0.16 billion in 2025 and reach USD 0.31 billion by 2030, at a CAGR of 13.3%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Thousand) and Volume (Ton) |

| Segments | Type, Source, Manufacturing Process, End-use Industry, and Region |

| Regions covered | Europe, North America, Asia Pacific, Middle East & Africa, and Latin America |

Milled type accounted for the largest share in the recycled carbon fiber market as they exhibit properties nearly identical to virgin carbon fibers and are used to enhance the mechanical, conductive, and chemical resistance properties of thermoplastic and thermoset composites, providing improved dimensional stability and conductivity for diverse industrial applications. Milled recycled carbon fiber is a form of carbon fiber waste that has been processed into very short fibers or fine powder, typically around 60 to 300 micrometers in length. This material is derived from recycled carbon fiber scraps primarily sourced from industries such as aerospace and automotive.

"Automotive scrap is projected to register second-highest growth rate during forecast period."

Automotive scrap is expected to register the second-highest growth rate in the market due to the automotive industry's increasing demand for lightweight, strong, and eco-friendly materials. Developed countries, including Germany, the US, and Japan, are widely using eco-friendly products. The EU has mandated that 85% of the materials used in vehicles need to be recycled. They are increasingly used in manufacturing various automotive parts like hoods, wheels, engine components, and structural reinforcements because they offer superior strength-to-weight ratio and corrosion resistance compared to traditional metals such as steel and aluminum. This helps reduce the overall vehicle weight, which directly improves fuel economy and meets stringent fuel efficiency and emission regulations. The rise in electric vehicles amplifies this demand further, as lightweight materials extend battery range and enhance vehicle performance.

"Consumer goods industry accounted for the second-largest share in the overall recycled carbon fiber market."

Consumer goods industry accounted for the second-largest share in the recycled carbon fiber market due to the increasing demand for lightweight, high-performance, and cost-effective materials used in manufacturing a wide range of products. Recycled carbon fiber provides electrical conductivity and antistatic characteristics to polymer compositions and coatings used in microelectronics products. The electric conductivity of carbon fiber provides additional performance to plastic material to prevent static load and offer a shield from electromagnetic interference. Due to its performance advantages, recycled carbon fiber is more frequently used in plastic composites for electronics, including notebook PCs, LCD projectors, camera bodies, and lenses. For instance, in 2023 Toray Industries, Inc., collaborated with Lenovo to integrate recycled carbon fiber into the Lenovo ThinkPad X1 Carbon Gen 12 as reinforcement filler for thermoplastic pellets.

"Europe is projected to register the highest growth rate in the recycled carbon fiber market during forecast period."

Europe is anticipated to register the highest CAGR in the recycled carbon fiber market during the forecast period due to its strong emphasis on sustainability, stringent environmental regulations, and well-established circular economy initiatives. The region has been at the forefront of adopting green manufacturing practices, with the European Union pushing for reduced carbon emissions and waste recycling across industries such as automotive & transportation, aerospace & defense, wind energy, and construction. Recently, in June 2025, Syensqo (Belgium) has partnered with Vartega Inc. (US) to advance sustainable high-performance plastics through a breakthrough in carbon fiber recycling. This partnership enables scalable, cost-effective closed-loop recycling that produces high-quality recycled carbon fiber without sacrificing strength, cost, or durability. Additionally, significant investments in recycling technologies, coupled with government-backed research programs and collaborations between manufacturers and recycling firms, are creating a robust ecosystem that supports rapid market expansion in Europe.

This study has been validated through interviews with industry experts globally. The primary sources have been divided into the following three categories:

- By Company Type: Tier 1 - 40%, Tier 2 - 33%, and Tier 3 - 27%

- By Designation: C-level - 50%, Director-level - 30%, and Managers - 20%

- By Region: North America - 20%, Europe - 50%, Asia Pacific - 15%, the Middle East & Africa - 10%, and Latin America - 5%

The report provides a comprehensive analysis of the following companies:

Prominent companies in this market include Toray Industries, Inc. (Japan), Mitsubishi Chemical Group Corporation (Japan), Procotex (Belgium), Vartega Inc. (US), Carbon Conversions (US), Gen 2 Carbon Limited (UK), Shocker Composites (US), Carbon Fiber Recycling (US), Alpha Recycling Composites (France), Carbon Fiber Remanufacturing (US), CATACK-H (South Korea), Hera SpA (Italy), and Pyrum Innovations AG (Germany).

Research Coverage

This research report categorizes the recycled carbon fiber market by type (milled, chopped), source (aerospace scrap, automotive scrap, and other sources), manufacturing process (mechanical, thermal, and chemical), end-use industry (automotive & transportation, consumer goods, sporting goods, industrial, aerospace & defense, marine, and other end-use industries), and region (North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America). The scope of the report includes detailed information about the major factors influencing the growth of the recycled carbon fiber market, such as drivers, restraints, challenges, and opportunities. A thorough examination of the key industry players has been conducted to provide insights into their business overviews, solutions and services, key strategies, and recent developments in the recycled carbon fiber market are all covered. This report includes a competitive analysis of upcoming startups in the recycled carbon fiber market ecosystem.

Reasons to buy this report

The report will help market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall recycled carbon fiber market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Regulations on eco-friendly products, Increasing demand for carbon fibers from composites industry, Waste reduction to protect environment, Development of eco-friendly carbon fibers from composites), restraints (Lack of technical knowledge, Use of economic products, Test procedures for recycled carbon fiber composites), opportunities (Use of recyclable and lightweight materials in automotive & transportation sectors, Rising demand for recycled carbon from emerging markets, Increasing use of recycled carbon fiber in aerospace sector, Revolutionizing carbon fiber waste for sustainable pressure vessels), and challenges (Promoting recycled carbon fiber for commercial application, Difficulty in recycling, Length constraints in recycled carbon fiber utilization) are influencing the growth of the recycled carbon fiber market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and product launches in the recycled carbon fiber market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the recycled carbon fiber market across varied regions.

- Market Diversification: Exhaustive information about services, untapped geographies, recent developments, and investments in the recycled carbon fiber market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players like Toray Industries, Inc. (Japan), Mitsubishi Chemical Group Corporation (Japan), Procotex (Belgium), Vartega Inc. (US), Carbon Conversions (US), Gen 2 Carbon Limited (UK), Shocker Composites (US), Carbon Fiber Recycling (US), Alpha Recycling Composites (France), Carbon Fiber Remanufacturing (US), CATACK-H (South Korea), Hera SpA (Italy), and Pyrum Innovations AG (Germany).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNIT CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key primary participants

- 2.1.2.3 Breakdown of primary interviews

- 2.1.2.4 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 BASE NUMBER CALCULATION

- 2.3.1 APPROACH 1: SUPPLY-SIDE ANALYSIS

- 2.3.2 APPROACH 2: DEMAND-SIDE ANALYSIS

- 2.4 MARKET FORECAST APPROACH

- 2.4.1 SUPPLY SIDE

- 2.4.2 DEMAND SIDE

- 2.5 DATA TRIANGULATION

- 2.6 FACTOR ANALYSIS

- 2.7 RESEARCH ASSUMPTIONS

- 2.8 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN RECYCLED CARBON FIBER MARKET

- 4.2 RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY AND REGION

- 4.3 RECYCLED CARBON FIBER MARKET, BY TYPE

- 4.4 RECYCLED CARBON FIBER MARKET, BY SOURCE

- 4.5 RECYCLED CARBON FIBER MARKET, BY MANUFACTURING PROCESS

- 4.6 RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY

- 4.7 RECYCLED CARBON FIBER MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Regulations on eco-friendly products

- 5.2.1.2 Increasing demand for carbon fibers from composites industry

- 5.2.1.3 Waste reduction to protect environment

- 5.2.1.4 Developing eco-friendly carbon fibers from composites

- 5.2.2 RESTRAINTS

- 5.2.2.1 Lack of technical knowledge

- 5.2.2.2 Use of economic products

- 5.2.2.3 Test procedures for recycled carbon fiber composites

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Use of recyclable and lightweight materials in automotive & transportation sectors

- 5.2.3.2 Rising demand for recycled carbon from emerging markets

- 5.2.3.3 Increased use of recycled carbon fiber in aerospace sector

- 5.2.3.4 Revolutionizing carbon fiber waste for sustainable pressure vessels

- 5.2.4 CHALLENGES

- 5.2.4.1 Promoting recycled carbon fiber for commercial applications

- 5.2.4.2 Difficulty in recycling

- 5.2.4.3 Length constraints in recycled carbon fiber utilization

- 5.2.1 DRIVERS

6 INDUSTRY TRENDS

- 6.1 PORTER'S FIVE FORCES ANALYSIS

- 6.1.1 THREAT OF NEW ENTRANTS

- 6.1.2 THREAT OF SUBSTITUTES

- 6.1.3 BARGAINING POWER OF SUPPLIERS

- 6.1.4 BARGAINING POWER OF BUYERS

- 6.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.2 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.2.2 BUYING CRITERIA

- 6.3 PRICING ANALYSIS

- 6.3.1 AVERAGE SELLING PRICE OF RECYCLED CARBON FIBERS OFFERED BY KEY PLAYERS, BY END-USE INDUSTRY, 2024

- 6.3.2 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2024

- 6.4 MACROECONOMIC ANALYSIS

- 6.4.1 INTRODUCTION

- 6.4.2 GDP TRENDS AND FORECAST

- 6.4.3 TRENDS IN GLOBAL RECYCLED CARBON FIBER MARKET

- 6.5 VALUE CHAIN ANALYSIS

- 6.6 ECOSYSTEM ANALYSIS

- 6.7 TRADE ANALYSIS, 2022-2024

- 6.7.1 IMPORT SCENARIO (HS CODE 681511)

- 6.7.2 EXPORT SCENARIO (HS CODE 681511)

- 6.8 TECHNOLOGY ANALYSIS

- 6.8.1 KEY TECHNOLOGIES

- 6.8.1.1 Mechanical recycling

- 6.8.1.2 Thermal recycling

- 6.8.1.3 Chemical recycling

- 6.8.2 COMPLEMENTARY TECHNOLOGIES

- 6.8.2.1 Microwave recycling

- 6.8.1 KEY TECHNOLOGIES

- 6.9 PATENT ANALYSIS

- 6.9.1 INTRODUCTION

- 6.9.2 METHODOLOGY

- 6.9.3 DOCUMENT TYPES

- 6.9.4 INSIGHTS

- 6.9.5 LEGAL STATUS

- 6.9.6 JURISDICTION ANALYSIS

- 6.9.7 TOP APPLICANT ANALYSIS

- 6.10 REGULATORY LANDSCAPE

- 6.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.11 KEY CONFERENCES AND EVENTS, 2025-2026

- 6.12 CASE STUDY ANALYSIS

- 6.12.1 DRIVING PERFORMANCE AND SUSTAINABILITY WITH MITSUBISHI'S CARBONXT RECYCLED CARBON FIBER

- 6.12.2 KTM TECHNOLOGIES AND CARBON CLEANUP'S ECO-FRIENDLY BRAKE LEVER PROJECT

- 6.12.3 ADVANCING WIND TOOLING WITH RECYCLED CARBON FIBER AND ADDITIVE MANUFACTURING

- 6.13 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.14 IMPACT OF AI/GEN AI ON RECYCLED CARBON FIBER MARKET

- 6.15 INVESTMENT AND FUNDING SCENARIO

- 6.16 IMPACT OF 2025 US TARIFF-RECYCLED CARBON FIBER MARKET

- 6.16.1 INTRODUCTION

- 6.16.2 KEY TARIFF RATES

- 6.16.3 PRICE IMPACT ANALYSIS

- 6.16.4 IMPACTS ON COUNTRY/REGION

- 6.16.4.1 US

- 6.16.4.2 Europe

- 6.16.4.3 Asia Pacific

- 6.16.5 IMPACT ON END-USE INDUSTRIES

7 RECYCLED CARBON FIBER MARKET, BY SOURCE

- 7.1 INTRODUCTION

- 7.2 AEROSPACE SCRAP

- 7.2.1 RECYCLING INITIATIVES BY AIRCRAFT MANUFACTURERS TO DRIVE MARKET

- 7.3 AUTOMOTIVE SCRAP

- 7.3.1 STRINGENT REGULATIONS TO FUEL DEMAND FOR RECYCLING SCRAP

- 7.4 OTHER SOURCES

8 RECYCLED CARBON FIBER MARKET, BY MANUFACTURING PROCESS

- 8.1 INTRODUCTION

- 8.2 MECHANICAL

- 8.3 THERMAL

- 8.4 CHEMICAL

9 RECYCLED CARBON FIBER MARKET, BY TYPE

- 9.1 INTRODUCTION

- 9.2 CHOPPED

- 9.2.1 USED IN INDUSTRIAL MIXING AND COMPOUNDING

- 9.3 MILLED

- 9.3.1 EXCELLENT DIMENSIONAL STABILITY AND ELECTRICAL CONDUCTIVITY

10 RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY

- 10.1 INTRODUCTION

- 10.2 AUTOMOTIVE & TRANSPORTATION

- 10.2.1 USE OF RECYCLED CARBON FIBER IN AUTOMOTIVE PARTS TO PROPEL MARKET

- 10.3 CONSUMER GOODS

- 10.3.1 USE OF RECYCLED CARBON FIBER IN PLASTIC COMPOSITES TO DRIVE MARKET

- 10.4 SPORTING GOODS

- 10.4.1 RESISTANCE TO CORROSION TO FUEL DEMAND FOR RECYCLED CARBON FIBER IN SPORTING GOODS

- 10.5 INDUSTRIAL

- 10.5.1 USE OF RECYCLED CARBON FIBER IN INDUSTRIAL APPLICATIONS TO FUEL MARKET GROWTH

- 10.6 AEROSPACE & DEFENSE

- 10.6.1 INCREASED USE OF RECYCLED CARBON COMPOSITES IN COMMERCIAL AIRCRAFT TO DRIVE MARKET

- 10.7 MARINE

- 10.7.1 RESISTANCE TO ENVIRONMENTAL CONDITIONS TO FUEL DEMAND FOR RECYCLED CARBON FIBER

- 10.8 OTHER END-USE INDUSTRIES

11 RECYCLED CARBON FIBER MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 US

- 11.2.1.1 Consumption of recycled carbon composites in automotive parts to drive market

- 11.2.2 CANADA

- 11.2.2.1 Establishment of aerospace industry to fuel demand for recycled carbon fiber

- 11.2.1 US

- 11.3 EUROPE

- 11.3.1 GERMANY

- 11.3.1.1 Growth of automotive and aerospace sectors to drive market

- 11.3.2 FRANCE

- 11.3.2.1 Recycling of composite scrap to fuel market growth

- 11.3.3 ITALY

- 11.3.3.1 Rise in end-use industries to fuel demand for recycled carbon fiber

- 11.3.4 UK

- 11.3.4.1 Increasing demand for lightweight and cost-effective materials to drive market

- 11.3.5 SPAIN

- 11.3.5.1 High demand for recycled carbon fiber from industrial and wind energy sectors to propel market

- 11.3.6 RUSSIA

- 11.3.6.1 Development of fiber-reinforced technologies to drive market

- 11.3.7 REST OF EUROPE

- 11.3.1 GERMANY

- 11.4 ASIA PACIFIC

- 11.4.1 JAPAN

- 11.4.1.1 Increasing use of consumer goods to fuel demand for recycled carbon fiber

- 11.4.2 CHINA

- 11.4.2.1 Growth of composite product manufacturers to propel market

- 11.4.3 SOUTH KOREA

- 11.4.3.1 Rise of consumer goods industry to fuel demand for recycled carbon fiber

- 11.4.4 REST OF ASIA PACIFIC

- 11.4.1 JAPAN

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 GCC COUNTRIES

- 11.5.1.1 UAE

- 11.5.1.2 Demand for fuel-efficient and high-performance materials to drive market

- 11.5.1.3 Saudi Arabia

- 11.5.1.3.1 Growth of automotive sector to propel market

- 11.5.1.4 Rest of GCC Countries

- 11.5.2 SOUTH AFRICA

- 11.5.2.1 Growth of aerospace sector to boost demand for recycled carbon fiber

- 11.5.3 REST OF MIDDLE EAST & AFRICA

- 11.5.1 GCC COUNTRIES

- 11.6 LATIN AMERICA

- 11.6.1 BRAZIL

- 11.6.1.1 Growth of transportation industry to propel market

- 11.6.2 MEXICO

- 11.6.2.1 Need for high-strength products to fuel demand for recycled carbon fiber

- 11.6.3 REST OF LATIN AMERICA

- 11.6.1 BRAZIL

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2025

- 12.3 REVENUE ANALYSIS, 2020-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.5 BRAND/PRODUCT COMPARISON

- 12.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.6.1 STARS

- 12.6.2 EMERGING LEADERS

- 12.6.3 PERVASIVE PLAYERS

- 12.6.4 PARTICIPANTS

- 12.6.5 COMPANY FOOTPRINT

- 12.6.5.1 Company footprint

- 12.6.5.2 Region footprint

- 12.6.5.3 Type footprint

- 12.6.5.4 Source footprint

- 12.6.5.5 Manufacturing process footprint

- 12.6.5.6 End-use industry footprint

- 12.7 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2024

- 12.7.1 PROGRESSIVE COMPANIES

- 12.7.2 RESPONSIVE COMPANIES

- 12.7.3 DYNAMIC COMPANIES

- 12.7.4 STARTING BLOCKS

- 12.7.5 COMPETITIVE BENCHMARKING

- 12.7.5.1 Detailed list of startups/SMEs

- 12.7.5.2 Competitive benchmarking of startups/SMEs

- 12.8 COMPANY VALUATION AND FINANCIAL METRICS

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

- 12.9.3 EXPANSIONS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 TORAY INDUSTRIES, INC.

- 13.1.1.1 Business overview

- 13.1.1.2 Products offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Deals

- 13.1.1.4 MnM view

- 13.1.1.4.1 Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 MITSUBISHI CHEMICAL GROUP CORPORATION

- 13.1.2.1 Business overview

- 13.1.2.2 Products offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Deals

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses & competitive threats

- 13.1.3 PROCOTEX

- 13.1.3.1 Business overview

- 13.1.3.2 Products offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Deals

- 13.1.3.3.2 Expansions

- 13.1.3.4 MnM view

- 13.1.3.4.1 Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 VARTEGA INC.

- 13.1.4.1 Business overview

- 13.1.4.2 Products offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Product launches

- 13.1.4.3.2 Deals

- 13.1.4.3.3 Expansions

- 13.1.4.4 MnM view

- 13.1.4.4.1 Right to win

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 CARBON CONVERSIONS

- 13.1.5.1 Business overview

- 13.1.5.2 Products offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Deals

- 13.1.5.4 MnM view

- 13.1.5.4.1 Right to win

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses and competitive threats

- 13.1.6 GEN 2 CARBON LIMITED

- 13.1.6.1 Business overview

- 13.1.6.2 Products offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Product launches

- 13.1.6.3.2 Deals

- 13.1.6.4 MnM view

- 13.1.6.4.1 Right to win

- 13.1.6.4.2 Strategic choices

- 13.1.6.4.3 Weaknesses and competitive threats

- 13.1.7 SHOCKER COMPOSITES

- 13.1.7.1 Business overview

- 13.1.7.2 Products offered

- 13.1.8 CARBON FIBER RECYCLING

- 13.1.8.1 Business overview

- 13.1.8.2 Products offered

- 13.1.9 ALPHA RECYCLING COMPOSITES

- 13.1.9.1 Business overview

- 13.1.9.2 Products offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Deals

- 13.1.10 CARBON FIBER REMANUFACTURING

- 13.1.10.1 Business overview

- 13.1.10.2 Products offered

- 13.1.11 CATACK-H

- 13.1.11.1 Business overview

- 13.1.11.2 Products offered

- 13.1.11.3 Recent developments

- 13.1.11.3.1 Deals

- 13.1.11.3.2 Expansions

- 13.1.12 HERA SPA

- 13.1.12.1 Business overview

- 13.1.12.2 Products offered

- 13.1.12.3 Recent developments

- 13.1.12.3.1 Deals

- 13.1.12.3.2 Expansions

- 13.1.13 PYRUM INNOVATIONS AG

- 13.1.13.1 Business overview

- 13.1.13.2 Products offered

- 13.1.1 TORAY INDUSTRIES, INC.

- 13.2 OTHER PLAYERS

- 13.2.1 SIGMATEX

- 13.2.2 CARBON FIBER RECYCLE INDUSTRY CO. LTD.

- 13.2.3 TEIJIN CARBON EUROPE GMBH

- 13.2.4 BCIRCULAR

- 13.2.5 ASAHI KASEI

- 13.2.6 FAIRMAT

- 13.2.7 THERMOLYSIS CO., LTD.

- 13.2.8 RYMYC S.R.L.

- 13.2.9 MALLINDA

- 13.2.10 COMPOSITE RECYCLING

- 13.2.11 CARBON CLEANUP

- 13.2.12 EXTRACTHIVE

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS