|

시장보고서

상품코드

1823734

캔 코팅 시장 예측(-2030년) : 유형별, 용도별, 지역별Can Coatings Market by Type (Epoxy, Acrylic, Polyester, Other Types), Application (Food Cans, Beverage Cans, Aerosol Cans, Other Applications), and Region - Global Forecast to 2030 |

||||||

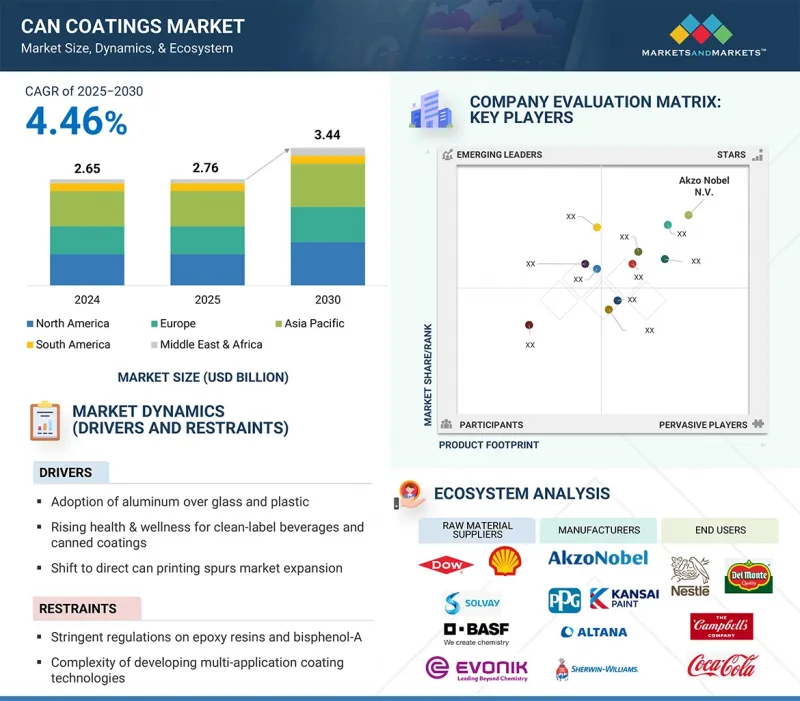

세계의 캔 코팅 시장 규모는 2025년에 27억 6,000만 달러, 2030년까지 34억 4,000만 달러에 달할 것으로 추정되며, 2025-2030년에 CAGR로 4.46%의 성장이 전망됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2020-2030년 |

| 기준연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 100만 달러, 킬로톤 |

| 부문 | 유형, 용도, 지역 |

| 대상 지역 | 아시아태평양, 유럽, 북미, 중동 및 아프리카, 남미 |

캔 코팅 시장을 주도하는 코팅 기술 및 재료의 발전

코팅의 혁신은 더 빠른 경화, 더 높은 유연성, 환경에 미치는 영향 감소 등 다양한 이점을 창출하고 있습니다. 솔벤트 기반 코팅 시스템은 수성 시스템, UV 경화 시스템, 분체 코팅 시스템을 대체하고 있으며, 지속가능성 및 에너지 효율 기준을 충족해야 합니다. 나노 기술은 더 나은 장벽 보호, 더 얇은 도포, 더 긴 내구성을 제공합니다. 이러한 발전은 생산 시간 단축, 비용 절감, 제조업체의 작업 효율성 향상에 도움이 되고 있습니다. 식품 및 음료에 특화된 맞춤형 코팅에 대한 인식이 확산되고 있습니다. 더 나은 성능과 지속가능성에 기여하는 기술을 통해 첨단 코팅은 더 높은 품질과 효율성을 추구하는 시시각각 변화하는 시장 수요 속에서 기준을 설정하고 더 나은 경쟁 우위를 제공합니다.

아크릴 부문은 전 세계 캔 코팅 시장에서 금액 기준으로 3위를 차지했습니다.

아크릴 캔 코팅은 투명하므로 금속 기판이나 코팅 아래에 인쇄된 디자인을 볼 수 있으므로 점점 더 중요성이 커지고 있습니다. 이러한 투명성은 캔의 미적 매력을 향상시킬 뿐만 아니라 브랜드가 고급 마감의 이점을 보다 유연하게 보여주고 진열대에서 독특한 존재감을 드러낼 수 있게 해줍니다. 불투명 코팅에 비해 아크릴 제제는 소비자에게 금속성 광택이나 장식적인 오버레이를 보여줄 수 있으며, 고급 음료 및 특수 식품에 이상적인 솔루션입니다. 소비자는 일반적으로 시각적 매력에 따라 구매를 결정하므로 아크릴 코팅은 선반에서 눈에 띄는 브랜드 아이덴티티와 차별화를 적극적으로 지원하고 촉진하여 경쟁이 치열한 포장 시장에서 이러한 코팅에 대한 수요가 증가하는 요인이 되었습니다.

2024년, 식품 캔 부문은 금액 기준으로 두 번째 시장 점유율을 차지했습니다.

캔 코팅 시장에서는 식품 캔 용도가 2024년에 두 번째 점유율을 차지했습니다. 식품 캔은 외부 오염 물질과 오염 수준, 영양 품질 저하로부터 식품을 보호하기 위해 캔의 금속과 식품 내용물 사이에 매우 강력한 장벽을 제공할 수 있는 코팅이 필요합니다. 이러한 캔의 코팅은 일정한 보관 기간과 조건 후에도 캔에 담긴 식품이 안전하고 풍미가 풍부하며 외관이 아름답다는 것을 보장하는 데 도움이 됩니다. 세계 공급망이 전 세계 구석구석으로 뻗어나가고 포장 식품에 대한 세계 수요가 증가함에 따라 코팅은 일정 기간 중 식품을 보호함으로써 오염 문제를 지속적으로 해결하고 있습니다.

남미는 캔 코팅 시장에서 금액 기준으로 가장 빠르게 성장하는 지역이 될 것으로 예측됩니다.

남미가 2025-2030년 가장 높은 CAGR을 나타낼 것으로 예측됩니다. 정부 및 민간 투자자의 지원을 받아 건설된 지역내 캔 제조 시설의 확장이 캔 코팅 시장을 촉진하고 있습니다. 브라질이나 콜롬비아 같은 국가에서는 국내 소비와 수출을 염두에 두고 시설을 신설하거나 기존 시설을 업그레이드하고 있습니다. 공급망을 개선하고, 수입 의존도를 낮추고, 최신 코팅 기술을 채택하는 현지 제조 시설에 대한 투자는 어느 국가에서나 성장을 가속하고 있습니다. 생산 능력을 구축하기 위한 투자는 현지 제조가 지역적 해석뿐만 아니라 지역 기후 조건에 맞는 맞춤형 제제를 생산한다는 것을 의미합니다. 현지 생산 능력의 강화는 신속한 대응, 낮은 비용, 시장 변화에 따른 위험 감소를 가능하게 하여 세계 캔 코팅 분야에서 남미의 입지를 더욱 강화하고 있습니다.

세계의 캔 코팅 시장에 대해 조사분석했으며, 주요 촉진요인과 억제요인, 경쟁 구도, 향후 동향 등의 정보를 제공하고 있습니다.

목차

제1장 서론

제2장 조사 방법

제3장 개요

제4장 중요 인사이트

- 캔 코팅 시장에서 매력적인 기회

- 캔 코팅 시장 : 지역별

- 아시아태평양의 캔 코팅 시장 : 용도별, 국가별

- 캔 코팅 시장, 용도 vs. 지역

- 캔 코팅 시장 : 주요 국가별

제5장 시장 개요

- 서론

- 시장 역학

- 촉진요인

- 억제요인

- 기회

- 과제

- Porter's Five Forces 분석

- 주요 이해관계자와 구입 기준

- 거시경제 전망

제6장 산업 동향

- 공급망 분석

- 원재료 공급업체

- 제조업체

- 유통 네트워크

- 최종 용도 산업

- 가격결정 분석

- 용도의 평균 판매 가격 : 주요 기업별(2024년)

- 캔 코팅의 평균 판매 가격 동향 : 지역별(2022-2030년)

- 고객 비즈니스에 영향을 미치는 동향/혼란

- 에코시스템 분석

- 기술 분석

- 주요 기술

- 보완 기술

- 사례 연구 분석

- 무역 분석

- 수입 시나리오(HS 코드 320820)

- 수출 시나리오(HS 코드 320820)

- 규제 상황

- 규제기관, 정부기관, 기타 조직

- 규제 구조

- 주요 컨퍼런스와 이벤트(2025-2026년)

- 투자와 자금조달 시나리오

- 특허 분석

- 어프로치

- 문헌 유형

- 주요 출원자

- 관할 분석

- 2025년 미국 관세의 영향 - 개요

- 서론

- 주요 관세율

- 가격의 영향 분석

- 국가/지역에 대한 영향

- 최종 용도 산업에 대한 영향

- 캔 코팅 시장에 대한 AI/생성형 AI의 영향

제7장 캔 코팅 시장 : 유형별

제8장 캔 코팅 시장 : 용도별

- 서론

- 음료 캔

- 식품 캔

- 에어로졸 캔

- 기타 용도

제9장 캔 코팅 시장 : 지역별

- 서론

- 아시아태평양

- 중국

- 일본

- 인도

- 태국

- 호주

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 프랑스

- 영국

- 스페인

- 이탈리아

- 중동 및 아프리카

- 남미

제10장 경쟁 구도

- 서론

- 주요 참여 기업의 전략/강점

- 시장 점유율 분석

- 매출 분석

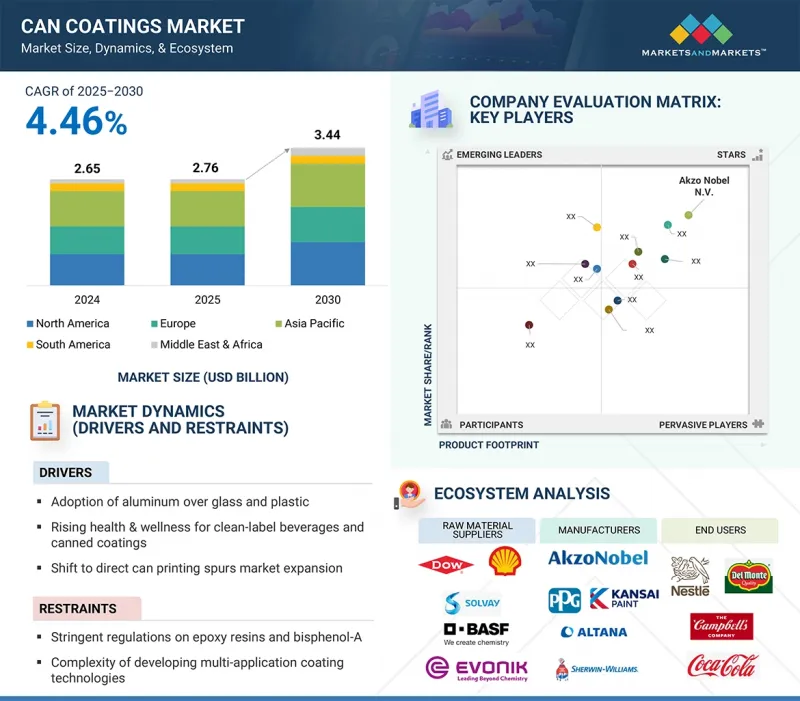

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업 평가 매트릭스 : 스타트업/중소기업(2024년)

- 브랜드/제품 비교 분석

- 기업의 평가와 재무 지표

- 경쟁 시나리오

제11장 기업 개요

- 주요 기업

- THE SHERWIN-WILLIAMS COMPANY

- PPG INDUSTRIES, INC.

- AKZO NOBEL N.V.

- ALTANA AG

- KANSAI PAINT CO., LTD.

- TOYO INK GROUP

- SUZHOU 3N PACKAGING COATINGS CO., LTD.

- BERGER PAINTS INDIA LIMITED

- TIGER COATINGS

- SALCHI METALCOAT S.R.L.

- 스타트업/중소기업

- SAKATA INX

- VPL COATINGS GMBH & CO KG

- LANKWITZER LACKFABRIK GMBH

- SPECTRUM INDUSTRIES LLC

- DIOSTYL COATING

- IPC GMBH & CO. KG

- FOSHAN SHENGRUN METAL PACKAGING MATERIALS CO., LTD.

- KUPSA COATINGS PVT. LTD.

- PEARL COATING

- FINE CHEMICAL INDUSTRIES

- MIDAD PRINTING INK

- TARA PAINTS PVT. LTD.

- ROCKLINK SCIENCE & TECHNOLOGY(FOSHAN) CO. LTD

- FOSHAN FAXUS NEW MATERIALS CO., LTD.

- GUANGZHOU HUMAN NEW MATERIAL SCIENCE AND TECHNOLOGY CO., LTD.

제12장 인접 시장과 관련 시장

- 서론

- 제한

- 산업용 코팅 시장

- 시장의 정의

- 시장의 개요

- 산업용 코팅 시장 : 지역별

- 아시아태평양

- 북미

- 유럽

- 중동 및 아프리카

- 남미

제13장 부록

KSA 25.10.02Can coatings market is estimated to be valued at USD 2.76 billion in 2025 and reach USD 3.44 billion by 2030, at a CAGR of 4.46% between 2025 and 2030.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) and Volume (Kiloton) |

| Segments | Type, Application, and Region |

| Regions covered | Asia Pacific, Europe, North America, Middle East & Africa, and South America |

Advancements in coating technologies and materials to drive can coating market

Innovation in coatings are creating multi-functional benefits, such as faster curing, higher flexibility, and reduced environmental impact. Solvent-based coating systems are being replaced with water-based systems, UV-curable systems, and powder coating systems and are required to meet sustainability and energy efficiency standards. Nanotechnology is allowing for superior barrier protection and thinner application with longer durability. These advancements assist in limiting production time, reducing costs, and providing manufacturers operational efficiency. Customizable coatings that are specific to foods or beverages are being more widely recognized. With technology contributing to better performance and sustainability, advanced coatings are setting standards and offering better competitive advantages in an ever-changing market demand for higher quality and efficiency.

The acrylic segment was the third-largest segment, in terms of value, of the global can coatings market

Acrylic can coatings have become increasingly important because they are transparent, which allows the visibility of the metal substrate or any printed designs beneath the coating. Such transparency not only enhances the esthetic appeal of the can but also allows brands to be more flexible in showing benefits of premium finishes and creating a unique shelf presence. Compared to opaque coatings, acrylic formulations allow the consumer to see the metallic luster or decorative overlays, which makes them a perfect solution for luxury beverage and specialty food products. As consumers typically make purchasing decisions based on visual appeal, acrylic coating positively supports and encourages distinctive brand identity and differentiation on the shelf, which is a large part of the reason for the increase in the demand for these coatings in competitive packaging markets.

The food cans segment accounted for the second-largest share of the can coatings market, in terms of value, in 2024

The food cans application held the second-largest share of the can coatings market in 2024. Food cans require coatings that can provide very strong barriers between the can metal, and whatever the food contents are, for the protection of the food contents from external contaminates or levels of contamination, and degradation of nutritional quality. These can coatings help to ensure that the food within the can is still safe, flavor-rich, and visually appealing even after certain storage periods or conditions. With global supply chains that are reaching all corners of the world, and global demand for packaged foods increasing, coatings continue to bridge contamination issues by protecting the food for a specified period of time.

South America is expected to be the fastest-growing region in the can coatings market, in terms of value

South America is projected to witness the highest CAGR between 2025 and 2030. The expansion of regional can manufacturing facilities, built with the support of governments and private investors, is fueling the can coatings market. New facilities and upgrades to existing facilities are underway in countries like Brazil and Colombia with domestic consumption and exports in mind. Investments in local manufacturing facilities, which improve supply chains, decrease reliance on imports, and adopt the latest coating technologies, are bolstering growth in all countries. Investments to build capacities mean localized manufacturing can create custom formulations tailored not only to regional interpretation but to regional climatic conditions. Enhanced local capability allows for faster responsiveness, lower costs, and less risk associated with changing markets, furthering South America's position in global can coatings.

- By Company Type: Tier 1 - 55%, Tier 2 - 25%, and Tier 3 - 20%

- By Designation: Directors - 50%, Managers - 30%, and Others - 20%

- By Region: North America - 40%, Europe - 35%, Asia Pacific - 20%, Rest of the World - 5%

The key players profiled in the report include The Sherwin-Williams Company (US), PPG Industries, Inc. (US), Akzo Nobel N.V. (Netherlands), Kansai Paint Co., Ltd. (Japan), ALTANA AG (Germany), Toyo Ink Group (Japan), Suzhou 3N Packaging Coatings (China), Berger Paints (India), Tiger Coatings (Austria), and Salchi Metalcoat S.r.l. (Italy).

Research Coverage

This report segments the market for can coatings based on type, application, and region and provides estimations of value (USD Million) for the overall market size across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, services, and key strategies, associated with the market for can coatings.

Reasons to Buy this Report

This research report is focused on various levels of analysis - industry analysis (industry trends), market share analysis of top players, and company profiles, which together provide an overall view of the competitive landscape, emerging and high-growth segments of the can coatings market, high-growth regions, and market drivers, restraints, and opportunities.

The report provides insights into the following points:

- Market Penetration: Comprehensive information on can coatings offered by top players in the global market.

- Analysis of key drivers: (Adoption of aluminum over glass and plastic, rising health & wellness for clean-label beverages and canned coatings, shift to direct can printing spurs market expansion, and growth in flexible packaging formats fuels can coatings market), restraints (Stringent regulations on epoxy resins and bisphenol-A and complexity of developing multi-application coating technologies), opportunities (Growth in emerging economies and eco-friendly raw materials and BPA-NI-based coatings), and challenges (Slow technological adoption in emerging markets) influencing the growth of the can coatings market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and product & service launches in the can coatings market.

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the markets for can coatings across regions.

- Market Diversification: Exhaustive information about new products, untapped regions, and recent developments in the global can coatings market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the can coatings market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 CAN COATINGS MARKET: DEFINITION AND INCLUSIONS, BY TYPE

- 1.3.4 CAN COATINGS MARKET: DEFINITION AND INCLUSIONS, BY APPLICATION

- 1.3.5 YEARS CONSIDERED

- 1.3.6 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Data from key secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews - demand and supply sides

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 GROWTH RATE ASSUMPTIONS/GROWTH FORECASTS

- 2.4.1 SUPPLY SIDE

- 2.4.2 DEMAND SIDE

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN CAN COATINGS MARKET

- 4.2 CAN COATINGS MARKET, BY REGION

- 4.3 ASIA PACIFIC CAN COATINGS MARKET, BY APPLICATION AND COUNTRY

- 4.4 CAN COATINGS MARKET, APPLICATION VS. REGION

- 4.5 CAN COATINGS MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Adoption of aluminum over glass and plastic

- 5.2.1.2 Rising health & wellness for clean-label beverages and canned coatings

- 5.2.1.3 Shift to direct can printing driving expansion

- 5.2.1.4 Growth in flexible packaging formats

- 5.2.2 RESTRAINTS

- 5.2.2.1 Stringent regulations on epoxy resins and bisphenol-A

- 5.2.2.2 Complexity of developing multi-application coating technologies

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growth in emerging economies

- 5.2.3.2 Eco-friendly raw materials and BPA-NI-based coatings

- 5.2.4 CHALLENGES

- 5.2.4.1 Slow technological adoption in emerging markets

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF SUBSTITUTES

- 5.3.2 THREAT OF NEW ENTRANTS

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.4.2 BUYING CRITERIA

- 5.5 MACROECONOMIC OUTLOOK

- 5.5.1 GDP TRENDS AND FORECAST FOR MAJOR ECONOMIES

6 INDUSTRY TRENDS

- 6.1 SUPPLY CHAIN ANALYSIS

- 6.1.1 RAW MATERIAL SUPPLIERS

- 6.1.2 MANUFACTURERS

- 6.1.3 DISTRIBUTION NETWORKS

- 6.1.4 END-USE INDUSTRIES

- 6.2 PRICING ANALYSIS

- 6.2.1 AVERAGE SELLING PRICE OF APPLICATIONS, BY KEY PLAYERS, 2024

- 6.2.2 AVERAGE SELLING PRICE TREND OF CAN COATINGS, BY REGION, 2022-2030

- 6.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

- 6.4 ECOSYSTEM ANALYSIS

- 6.5 TECHNOLOGY ANALYSIS

- 6.5.1 KEY TECHNOLOGIES

- 6.5.1.1 ELECTROCOATING TECHNOLOGY

- 6.5.1.2 SPRAY COATING TECHNOLOGY

- 6.5.2 COMPLIMENTARY TECHNOLOGIES

- 6.5.2.1 ROLL COATING TECHNOLOGY

- 6.5.1 KEY TECHNOLOGIES

- 6.6 CASE STUDY ANALYSIS

- 6.6.1 CASE STUDY ON BPA-NI COATING ADOPTION IN FOOD CANS

- 6.6.2 CASE STUDY OF AKZONOBEL N.V. ON CAN COATINGS IN BEVERAGE AND AEROSOL CANS

- 6.7 TRADE ANALYSIS

- 6.7.1 IMPORT SCENARIO (HS CODE 320820)

- 6.7.2 EXPORT SCENARIO (HS CODE 320820)

- 6.8 REGULATORY LANDSCAPE

- 6.8.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.8.2 REGULATORY FRAMEWORK

- 6.8.2.1 International Organization for Standardization (ISO)

- 6.9 KEY CONFERENCES & EVENTS IN 2025-2026

- 6.10 INVESTMENT AND FUNDING SCENARIO

- 6.11 PATENT ANALYSIS

- 6.11.1 APPROACH

- 6.11.2 DOCUMENT TYPES

- 6.11.3 TOP APPLICANTS

- 6.11.4 JURISDICTION ANALYSIS

- 6.12 IMPACT OF 2025 US TARIFF - OVERVIEW

- 6.12.1 INTRODUCTION

- 6.12.2 KEY TARIFF RATES

- 6.12.3 PRICE IMPACT ANALYSIS

- 6.12.4 IMPACT ON COUNTRY/REGION

- 6.12.4.1 US

- 6.12.4.2 Europe

- 6.12.4.3 Asia Pacific

- 6.12.5 IMPACT ON END-USE INDUSTRIES

- 6.13 IMPACT OF AI/GEN AI ON CAN COATINGS MARKET

7 CAN COATINGS MARKET, BY TYPE

- 7.1 INTRODUCTION

8 CAN COATINGS MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 BEVERAGE CANS

- 8.2.1 GROWING PREFERENCE FOR CONVENIENT AND SUSTAINABLE PACKAGING TO DRIVE DEMAND

- 8.3 FOOD CANS

- 8.3.1 NEED FOR EXTENDED SHELF LIFE AND PROTECTION AGAINST MICROBIAL CONTAMINATION TO DRIVE DEMAND

- 8.4 AEROSOL CANS

- 8.4.1 EXPANDING PERSONAL CARE AND HOUSEHOLD PRODUCTS MARKET TO DRIVE DEMAND

- 8.5 OTHER APPLICATIONS

9 CAN COATINGS MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 ASIA PACIFIC

- 9.2.1 CHINA

- 9.2.1.1 Growing demand for canned food & beverage to drive market

- 9.2.2 JAPAN

- 9.2.2.1 Strong packaging demand to drive market

- 9.2.3 INDIA

- 9.2.3.1 Packaging innovation and FMCG boom to fuel demand

- 9.2.4 THAILAND

- 9.2.4.1 Government and investment support to boost demand

- 9.2.5 AUSTRALIA

- 9.2.5.1 Increasing exports of premium food and beverage products

- 9.2.1 CHINA

- 9.3 NORTH AMERICA

- 9.3.1 US

- 9.3.1.1 Strong industrial infrastructure to fuel growth

- 9.3.2 CANADA

- 9.3.2.1 Focus on advanced research & development to drive demand

- 9.3.3 MEXICO

- 9.3.3.1 Expanding manufacturing sector to support market growth

- 9.3.1 US

- 9.4 EUROPE

- 9.4.1 GERMANY

- 9.4.1.1 Strong industrial base to fuel demand

- 9.4.2 FRANCE

- 9.4.2.1 Stringent food safety regulations and strong packaged food demand to drive market

- 9.4.3 UK

- 9.4.3.1 Stringent regulatory framework to propel market

- 9.4.4 SPAIN

- 9.4.4.1 Rising food exports and sustainable packaging to drive market

- 9.4.5 ITALY

- 9.4.5.1 Robust food industry and sustainability push driving can coatings growth in Italy

- 9.4.1 GERMANY

- 9.5 MIDDLE EAST & AFRICA

- 9.6 SOUTH AMERICA

- 9.6.1 BRAZIL

- 9.6.1.1 Growing demand for beverage cans to drive market

- 9.6.1 BRAZIL

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 10.3 MARKET SHARE ANALYSIS

- 10.4 REVENUE ANALYSIS

- 10.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- 10.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.5.5.1 Company footprint

- 10.5.5.2 Region footprint

- 10.5.5.3 Type footprint

- 10.5.5.4 Application footprint

- 10.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 RESPONSIVE COMPANIES

- 10.6.3 DYNAMIC COMPANIES

- 10.6.4 STARTING BLOCKS

- 10.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.6.5.1 Detailed list of key startups/SMEs

- 10.6.5.2 Competitive benchmarking of key startups/SMEs

- 10.7 BRAND/PRODUCT COMPARISON ANALYSIS

- 10.8 COMPANY VALUATION AND FINANCIAL METRICS

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 DEALS

- 10.9.2 EXPANSIONS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 THE SHERWIN-WILLIAMS COMPANY

- 11.1.1.1 Business overview

- 11.1.1.2 Products/Solutions/Services offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Expansions

- 11.1.1.4 MnM View

- 11.1.1.4.1 Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses and competitive threats

- 11.1.2 PPG INDUSTRIES, INC.

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Solutions/Services offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Deals

- 11.1.2.3.2 Expansions

- 11.1.2.4 MnM View

- 11.1.2.4.1 Right to win

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses and competitive threats

- 11.1.3 AKZO NOBEL N.V.

- 11.1.3.1 Business overview

- 11.1.3.2 Products/Solutions/Services offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Deals

- 11.1.3.3.2 Expansions

- 11.1.3.4 MnM View

- 11.1.3.4.1 Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses and competitive threats

- 11.1.4 ALTANA AG

- 11.1.4.1 Business overview

- 11.1.4.2 Products/Solutions/Services offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Deals

- 11.1.4.4 MnM View

- 11.1.4.4.1 Right to Win

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses and competitive threats

- 11.1.5 KANSAI PAINT CO., LTD.

- 11.1.5.1 Business overview

- 11.1.5.2 Products/Solutions/Services offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Deals

- 11.1.5.4 MnM View

- 11.1.5.4.1 Right to win

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses and competitive threats

- 11.1.6 TOYO INK GROUP

- 11.1.6.1 Business overview

- 11.1.6.2 Products/Solutions/Services offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Deals

- 11.1.7 SUZHOU 3N PACKAGING COATINGS CO., LTD.

- 11.1.7.1 Business overview

- 11.1.7.2 Products/Solutions/Services offered

- 11.1.8 BERGER PAINTS INDIA LIMITED

- 11.1.8.1 Business Overview

- 11.1.8.2 Products/Solutions/Services offered

- 11.1.9 TIGER COATINGS

- 11.1.9.1 Business overview

- 11.1.9.2 Products/Solutions/Services offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Expansions

- 11.1.10 SALCHI METALCOAT S.R.L.

- 11.1.10.1 Business overview

- 11.1.10.2 Products/Solutions/Services offered

- 11.1.1 THE SHERWIN-WILLIAMS COMPANY

- 11.2 START-UP/SMES

- 11.2.1 SAKATA INX

- 11.2.2 VPL COATINGS GMBH & CO KG

- 11.2.3 LANKWITZER LACKFABRIK GMBH

- 11.2.4 SPECTRUM INDUSTRIES LLC

- 11.2.5 DIOSTYL COATING

- 11.2.6 IPC GMBH & CO. KG

- 11.2.7 FOSHAN SHENGRUN METAL PACKAGING MATERIALS CO., LTD.

- 11.2.8 KUPSA COATINGS PVT. LTD.

- 11.2.9 PEARL COATING

- 11.2.10 FINE CHEMICAL INDUSTRIES

- 11.2.11 MIDAD PRINTING INK

- 11.2.12 TARA PAINTS PVT. LTD.

- 11.2.13 ROCKLINK SCIENCE & TECHNOLOGY (FOSHAN) CO. LTD

- 11.2.14 FOSHAN FAXUS NEW MATERIALS CO., LTD.

- 11.2.15 GUANGZHOU HUMAN NEW MATERIAL SCIENCE AND TECHNOLOGY CO., LTD.

12 ADJACENT & RELATED MARKETS

- 12.1 INTRODUCTION

- 12.2 LIMITATION

- 12.3 INDUSTRIAL COATINGS MARKET

- 12.3.1 MARKET DEFINITION

- 12.3.2 MARKET OVERVIEW

- 12.4 INDUSTRIAL COATINGS MARKET, BY REGION

- 12.4.1 ASIA PACIFIC

- 12.4.2 NORTH AMERICA

- 12.4.3 EUROPE

- 12.4.4 MIDDLE EAST & AFRICA

- 12.4.5 SOUTH AMERICA

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS