|

시장보고서

상품코드

1826557

세균 검사 시장(-2030년) : 세균, 최종사용자 산업, 기술, 컴포넌트, 지역별Bacteriological Testing Market by Bacterium, End-Use Industry, Technology, Component, and Region - Global Forecast to 2030 |

||||||

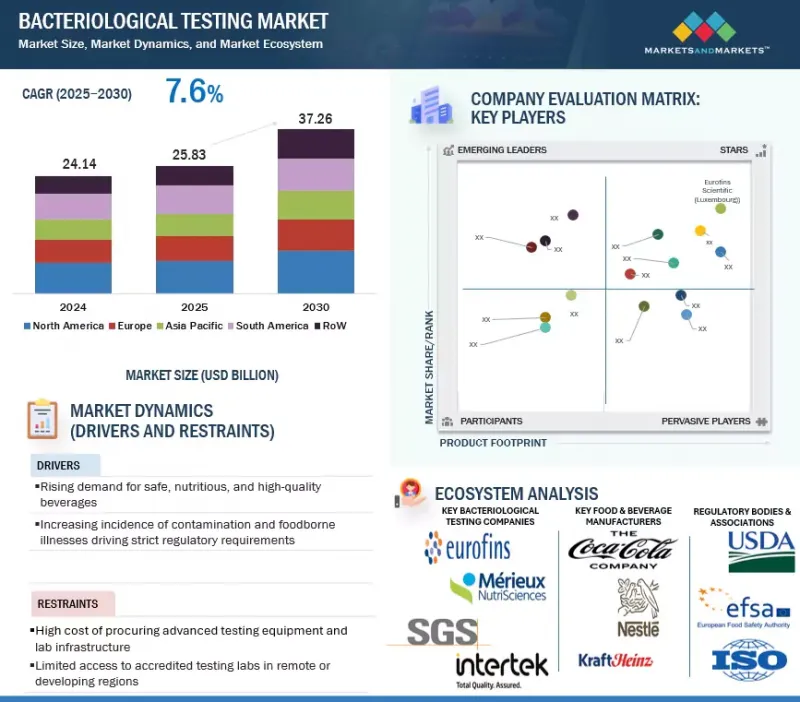

세균 검사 시장 규모는 2025년 258억 3,000만 달러에서 CAGR 7.6%로 성장을 지속하여, 2030년에는 372억 6,000만 달러에 이를 것으로 예측됩니다.

또한, 세균 검사 장비 시장 규모는 2025년 159억 5,000만 달러에서 연평균 7.1% 성장하여 2030년에는 224억 8,000만 달러에 달할 것으로 예측됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2021-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 금액(달러), 검사 건수 |

| 부문 | 세균, 최종사용자 산업, 기술, 컴포넌트, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 남미, 기타 지역 |

세균 검사 시장은 식음료, 물, 의약품, 화장품, 퍼스널케어 등 주요 산업에서 공중 보건을 보호하고 제품 품질을 유지하기 위한 기반이 되고 있습니다. 식중독, 수돗물 오염, 의료 및 소비재 분야의 미생물 안전에 대한 우려가 높아지면서 전 세계적으로 첨단 검사 솔루션의 채택이 증가하고 있습니다. 시장은 빠르게 진화하고 있으며, 기존의 배양 기반 방법을 넘어 PCR, 면역측정법, 차세대 시퀀싱 등 보다 신속하고 정밀한 기술로 전환하고 있습니다. 엄격한 규제 기준, 높아진 소비자 인식, 지속적인 기술 발전에 힘입어 세균 검사는 이제 전 세계적으로 품질 관리, 규정 준수 및 위험 감소 관행에 필수적인 요소로 자리 잡았습니다.

최종 사용자 산업별로는 식음료 분야가 2025년 시장을 주도할 것으로 추정됩니다. 전 세계적으로 식중독 발생이 증가하고 식품 안전에 대한 소비자 인식이 높아지면서 신선식품, 가공식품, 유제품, 음료, 조리식품에 대한 철저한 검사의 필요성이 높아지고 있습니다. 각국 정부와 규제 당국은 HACCP 및 ISO 표준에 따라 정기적인 세균 검사를 의무화하고 있으며, 식품 제조업체, 가공업체, 소매업체에 미생물 검사 솔루션의 대규모 사용을 강력히 권장하고 있습니다. 이러한 지속적인 요구와 제품 회수에 따른 풍문 및 재무적 위험과 함께 식음료 분야는 물, 의약품, 화장품 및 퍼스널케어와 같은 다른 최종 사용자 산업을 능가하는 성장세를 보일 것으로 예측됩니다.

세균별로는 대장균군 부문이 2025년 시장을 주도할 것으로 추정됩니다. 대장균군은 물, 식품, 음료의 위생 품질을 평가하는 지표 생물로 널리 사용되고 있으며, 일상적인 미생물 검사에서 중요한 파라미터가 되고 있습니다. 각 지역 규제 당국은 식수, 가공식품, 유제품의 오염 수준을 모니터링하기 위해 정기적인 대장균군 검사를 의무화하고 있으며, 이로 인해 전 세계적으로 높은 검사 건수를 유지하고 있습니다. 다른 박테리아도 시장에서 중요한 초점 분야가 되고 있습니다. 살모넬라균 검사는 특히 식음료 산업에서 수요가 많은데, 이는 심각한 식중독 발생 및 높은 공중 보건 위험과 관련이 있기 때문입니다. 리스테리아균 검사는 병원체가 저온 저장 조건에서도 생존하기 때문에 유제품, 육류, 조리된 식품에서 우선순위가 높아지고 있습니다. 캄필로박터균 검사는 전 세계적으로 가장 흔한 위장 감염의 원인 중 하나이기 때문에 닭고기 제품에서 그 중요성이 커지고 있습니다. 한편, 레지오넬라균 검사는 주로 수계 시스템(냉각탑, 공공 수도망, 의료시설 등)에서 실시되고 있으며, 통제되지 않을 경우 심각한 위험을 초래할 수 있습니다.

지역별로는 유럽이 2025년 시장에서 가장 규모가 큰 지역이 될 것으로 추정됩니다. 이 시장의 지위는 엄격한 식품 및 물 안전 규제, 강력한 제약 산업, 소비재에서 미생물 품질 보증에 대한 수요 증가에 의해 뒷받침되고 있습니다. 이 지역은 잘 정비된 검사 인프라, 높은 대중의식, 유럽식품안전청(EFSA) 및 유럽의약품청(EMA)과 같은 규제 당국의 적극적인 태도의 혜택을 누리고 있습니다. 특히 EU 통합 시장 내 식품 수출에 대한 엄격한 준수 요건은 검사 건수를 더욱 증가시키고 있습니다. 유럽은 선진화된 실험실, 탄탄한 규제 환경, 높은 품질 기준 유지에 중점을 두어 세균 검사 시장에서 세계 리더로 자리매김하고 있습니다.

세계의 세균 검사 시장을 조사했으며, 시장 개요, 시장 성장에 영향을 미치는 각종 영향요인 분석, 기술 및 특허 동향, 법 및 규제 환경, 사례 분석, 시장 규모 추이 및 예측, 각종 부문별/지역별/주요 국가별 상세 분석, 경쟁 구도, 주요 기업 개요 등의 정보를 정리하여 전해드립니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 프리미엄 인사이트

제5장 시장 개요

- 거시경제 전망

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

- 생성형 AI가 세균 검사 시장에 미치는 영향

제6장 업계 동향

- 규제 상황

- 미국 관세

- 특허 분석

- 무역 분석

- 가격 분석

- 고객 사업에 영향을 미치는 동향/혼란

- 밸류체인 분석

- 생태계 분석

- 사례 연구 분석

- Porter의 Five Forces 분석

- 기술 분석

- 2025-2026년 주요 컨퍼런스 및 이벤트

- 투자 및 자금조달 시나리오

제7장 세균 검사 시장 : 세균별

- 대장균

- 일반적 대장균군/대장균

- 병원성 대장균(O157 : H7, STEC)

- 살모네라균

- 캄필로박터

- CAMPYLOBACTER JEJUNI

- 기타 캄필로박터 속

- 리스테리아

- 레지오넬라

- 기타

제8장 세균 검사 시장 : 기술별

- 기존

- 신속 검사

- 편리성 기반 검사

- PC

- 면역측정법

- 크로마토그래피 및 분광 분석

- 기타

제9장 세균 검사 장비 시장 : 컴포넌트별

- 기기

- 테스트 키트

- 시약 및 소모품

제10장 세균 검사 시장 : 최종사용자 산업별

- 식품 및 음료

- 어개류

- 유제품

- 가공식품

- 과일 및 채소

- 곡물

- 기타 식품

- 음료

- 수

- 식수

- 산업 폐수

- 의약품

- 화장품 및 퍼스널케어

- 기타

제11장 세균 검사 장비 시장 : 사용 형태별

- 휴대용/필드용 디바이스

- 실험실 기반 시스템

제12장 세균 검사 시장 : 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 폴란드

- 기타

- 아시아태평양

- 중국

- 일본

- 호주 및 뉴질랜드

- 인도

- 동남아시아

- 기타

- 남미

- 브라질

- 아르헨티나

- 기타

- 세계 기타 지역

- 아프리카

- 중동

제13장 경쟁 구도

- 개요

- 주요 시장 진출기업의 전략/강점

- 매출 분석

- 세균 검사 시장 주요 기업의 시장 점유율 분석

- 세균 검사 장비 시장 시장 순위 분석

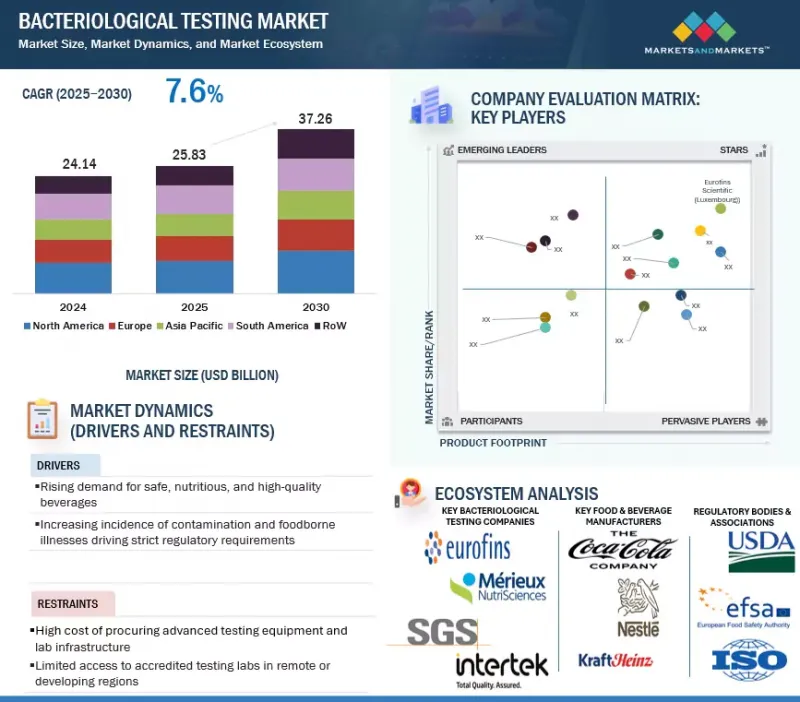

- 기업 평가 매트릭스 : 주요 기업(세균 검사 시장)

- 기업 평가 매트릭스 : 주요 기업(세균 검사 장비 시장)

- 기업 평가와 재무 지표

- 브랜드/제품 비교

- 경쟁 시나리오

제14장 기업 개요

- 주요 기업 : 세균 검사 시장

- SGS SOCIETE GENERALE DE SURVEILLANCE SA

- INTERTEK GROUP PLC

- EUROFINS SCIENTIFIC

- ALS

- MERIEUX NUTRISCIENCES

- CERTIFIED GROUP

- SYMBIO LABS

- TUV SUD

- FOODCHAIN ID

- TENTAMUS

- ALFA CHEMISTRY

- AGQ LABS

- CENTRE TESTING INTERNATIONAL

- MICROBAC

- VIMTA LABS LTD.

- 주요 기업 : 세균 검사 장비 시장

- NEOGEN CORPORATION

- BIO-RAD LABORATORIES, INC.

- BIOMERIEUX

- THERMO FISHER SCIENTIFIC INC.

- MERCK & CO., INC.

- BD

- 3M

- HARDY DIAGNOSTICS

- HIMEDIA LABORATORIES

- AGILENT TECHNOLOGIES, INC.

제15장 인접 시장과 관련 시장

제16장 부록

LSH 25.10.10The bacteriological testing market is estimated to be valued at USD 25.83 billion in 2025. It is projected to reach USD 37.26 billion by 2030 at a CAGR of 7.6%. The bacteriological testing equipment market is estimated to be valued at USD 15.95 billion in 2025. It is projected to reach USD 22.48 billion by 2030 at a CAGR of 7.1%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD), Volume (No. of tests) |

| Segments | By Bacterium, End-Use Industry, technology, Component, and Region |

| Regions covered | North America, Europe, Asia Pacific, South America, and RoW |

The bacteriological testing market has become a cornerstone in safeguarding public health and maintaining product quality across critical industries, including food & beverage, water, pharmaceuticals, and cosmetics & personal care. Growing concerns over foodborne diseases, contaminated water supplies, and microbial safety in healthcare and consumer goods are driving the adoption of advanced testing solutions worldwide. The market is evolving rapidly, moving beyond conventional culture-based methods toward faster and more precise technologies, such as PCR, immunoassays, and next-generation sequencing. Backed by stringent regulatory standards, heightened consumer awareness, and continuous technological progress, bacteriological testing is now integral to global quality control, compliance, and risk mitigation practices.

By industry, the food & beverage segment is estimated to lead the bacteriological testing market in 2025. Rising global cases of foodborne infections and heightened consumer awareness around food safety have amplified the need for robust testing across raw materials, processed foods, dairy, beverages, and ready-to-eat products. Governments and regulatory authorities have mandated routine bacteriological testing under frameworks, such as HACCP and ISO standards, pushing food manufacturers, processors, and retailers to use microbial testing solutions heavily. This consistent requirement, combined with the reputational and financial risks of product recalls, ensures the food & beverage sector outpaces other end-use industries, such as water, pharmaceuticals, and cosmetics & personal care.

By bacterium, the coliform segment is estimated to lead the bacteriological testing market in 2025. Coliforms are widely used as indicator organisms to assess the hygienic quality of water, food, and beverages, which makes them an essential parameter in routine microbial testing. Regulatory bodies across regions require regular coliform testing to monitor contamination levels in drinking water, processed food, and dairy products, which sustains their high testing volume globally. Other bacteria also represent critical focus areas within the market. Salmonella testing is in strong demand, particularly in the food & beverage industry, given its association with severe foodborne outbreaks and high public health risks. Listeria testing is increasingly prioritized in dairy, meat, and ready-to-eat products due to the pathogen's resilience in cold storage conditions. Campylobacter testing has gained importance in poultry products, as it is among the most common causes of gastrointestinal infections worldwide. Meanwhile, Legionella testing is primarily conducted in water systems-including cooling towers, public water supply networks, and healthcare facilities-where the pathogen poses serious risks if uncontrolled.

Europe is estimated to be the largest regional market for bacteriological testing in 2025. The position of this market is driven by stringent food and water safety regulations, a strong pharmaceutical industry, and growing demand for microbiological quality assurance across consumer goods. The region benefits from well-established testing infrastructure, high levels of public awareness, and the proactive stance of regulatory authorities, such as the European Food Safety Authority (EFSA) and the European Medicines Agency (EMA). Strict compliance requirements for food exports, particularly within the EU's harmonized market, further increase testing volumes. With its advanced laboratories, robust regulatory environment, and focus on maintaining high-quality standards, Europe has cemented its position as the global leader in the bacteriological testing market.

In-depth interviews were conducted with chief executive officers (CEOs), directors, and other executives from various key organizations operating in the bacteriological testing market.

- By Company Type: Tier 1 - 25%, Tier 2 - 45%, and Tier 3 - 30%

- By Designation: Directors - 20%, Managers - 50%, Others - 30%

- By Region: North America - 25%, Europe - 30%, Asia Pacific - 20%, South America - 15%, and Rest of the World - 10%

Key players providing bacteriological testing services include SGS (Switzerland), Eurofins (Luxembourg), Intertek (UK), TUV SUD (Germany), and ALS Limited (Australia). Additionally, key bacteriological safety testing equipment providers include 3M (US), Thermo Fisher Scientific (US), Merck KGaA (Germany), Bio-Rad Laboratories (United States), and Romer Labs (Austria).

Research Coverage:

This research report categorizes the bacteriological safety testing market by bacterium (Coliform, Salmonella, Campylobacter, Listeria, Legionella, Other Bacteria), end-use industry (Food & Beverage, Water, Pharmaceutical, Cosmetics & Personal Care, Other End-Use Industries), technology (Traditional, Rapid), component (Instruments, Test Kits, Reagents & Consumables), and Region (North America, Europe, Asia Pacific, South America, RoW).

The scope of the report covers detailed information regarding the major factors (drivers, restraints, challenges, and opportunities) influencing the growth of the bacteriological testing market. A detailed analysis of the key industry players has been done to provide insights into their business overview; services; and key strategies like contracts, partnerships, agreements, service launches, and mergers and acquisitions associated with the bacteriological testing market. Also, this report covers a competitive analysis of upcoming startups in the bacteriological testing market ecosystem. Furthermore, industry-specific trends, such as technology analysis, ecosystem and market mapping, and patent and regulatory landscape, are also covered in the study.

Reasons to buy this report:

The report will help market leaders/new entrants in this market with information on the closest approximations of revenue numbers for the overall bacteriological testing market and its subsegments. Additionally, this report will help stakeholders understand the competitive landscape and gain more insights to position their businesses and plan suitable go-to-market strategies. The report will also help stakeholders understand the pulse of the market and will provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Analysis of key drivers (Rising prevalence of foodborne and waterborne illnesses; rising demand from cosmetics & personal care industry), restraints (High cost of advanced rapid testing; complexity in testing techniques), opportunities (Advances in rapid, portable, and automated testing; popularity of digital & automated testing platforms), and challenges (Lack of harmonized global regulations; high cost of advanced technologies) influencing the growth of the bacteriological testing market

- Service Launch/Innovation: Detailed insights into research & development activities and service launches in the bacteriological testing market

- Market Development: Comprehensive information about lucrative markets across varied regions

- Market Diversification: Exhaustive information about new services, untapped geographies, recent developments, and investments in the bacteriological testing market

- Competitive Assessment: In-depth assessment of market share, growth strategies, product offerings, product/service comparison, and product/service footprints of leading bacteriological testing service providers, namely SGS (Switzerland), Eurofins (Luxembourg), Intertek (UK), TUV SUD (Germany), and ALS Limited (Australia); major equipment providers, namely 3M (US), Thermo Fisher Scientific (US), Merck KGaA (Germany), Agilent Technologies (US), Bio-Rad Laboratories (US), and Romer Labs (Austria); and other players.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 BACTERIOLOGICAL TESTING MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 VOLUME UNIT CONSIDERED

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primary profiles

- 2.1.2.3 Key insights from industry experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- 2.2.2 SUPPLY-SIDE ANALYSIS

- 2.2.3 BOTTOM-UP APPROACH (DEMAND SIDE)

- 2.3 DATA TRIANGULATION AND MARKET BREAKUP

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 LIMITATIONS & RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN BACTERIOLOGICAL TESTING MARKET

- 4.2 BACTERIOLOGICAL TESTING MARKET, BY COUNTRY

- 4.3 EUROPE: BACTERIOLOGICAL TESTING MARKET, BY BACTERIUM AND COUNTRY

- 4.4 BACTERIOLOGICAL TESTING MARKET, BY BACTERIUM

- 4.5 BACTERIOLOGICAL TESTING MARKET, BY TECHNOLOGY

- 4.6 BACTERIOLOGICAL TESTING MARKET, BY END-USE INDUSTRY

- 4.7 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN BACTERIOLOGICAL TESTING EQUIPMENT MARKET

- 4.8 BACTERIOLOGICAL TESTING EQUIPMENT MARKET, BY COUNTRY

- 4.9 EUROPE: BACTERIOLOGICAL TESTING EQUIPMENT MARKET, BY COMPONENT AND COUNTRY

- 4.10 BACTERIOLOGICAL TESTING EQUIPMENT MARKET, BY COMPONENT

- 4.11 BACTERIOLOGICAL TESTING EQUIPMENT MARKET, BY MODE OF USE

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC OUTLOOK

- 5.2.1 INCREASING GLOBAL OUTBREAKS OF FOODBORNE ILLNESSES

- 5.2.2 INCREASED GLOBAL FOOD TRADE

- 5.3 MARKET DYNAMICS

- 5.3.1 DRIVERS

- 5.3.1.1 Cross-contamination of food products due to complex processes

- 5.3.1.2 Technological advancements in bacteriological testing

- 5.3.1.3 Increasing demand for convenience and packaged food products

- 5.3.1.4 Rising food recalls due to non-compliant food products

- 5.3.1.5 Rising consumer awareness regarding food safety

- 5.3.1.6 Rising demand from cosmetics & personal care industry

- 5.3.2 RESTRAINTS

- 5.3.2.1 Improper enforcement of regulatory laws and supporting infrastructure

- 5.3.2.2 Complexity in testing techniques

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Technological advancements in testing industry

- 5.3.3.2 Popularity of digital and automated testing platforms

- 5.3.3.3 Rising demand for portable and field-based testing

- 5.3.4 CHALLENGES

- 5.3.4.1 Increasing cost of procuring bacteriological testing equipment

- 5.3.1 DRIVERS

- 5.4 IMPACT OF GEN AI ON BACTERIOLOGICAL TESTING MARKET

- 5.4.1 USE OF GEN AI IN BACTERIOLOGICAL TESTING

- 5.4.2 USE CASE

- 5.4.2.1 Adoption of Gen AI by CarbConnect to achieve accuracy and consistency in diagnostics

- 5.4.3 EVOLVING ADJACENT ECOSYSTEM THROUGH ADOPTION OF GEN AI

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 REGULATORY LANDSCAPE

- 6.2.1 REGULATORY FRAMEWORK FOR FOOD & BEVERAGE INDUSTRY

- 6.2.1.1 North America

- 6.2.1.1.1 US

- 6.2.1.1.2 Canada

- 6.2.1.1.3 Mexico

- 6.2.1.2 Europe

- 6.2.1.2.1 European Union

- 6.2.1.2.2 Germany

- 6.2.1.2.3 UK

- 6.2.1.2.4 France

- 6.2.1.2.5 Italy

- 6.2.1.2.6 Poland

- 6.2.1.3 Asia Pacific

- 6.2.1.3.1 China

- 6.2.1.3.2 Japan

- 6.2.1.3.3 India

- 6.2.1.3.4 Australia & New Zealand

- 6.2.1.4 South America

- 6.2.1.4.1 Brazil

- 6.2.1.4.2 Argentina

- 6.2.1.5 Rest of the World

- 6.2.1.5.1 South Africa

- 6.2.1.1 North America

- 6.2.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.2.1 REGULATORY FRAMEWORK FOR FOOD & BEVERAGE INDUSTRY

- 6.3 US 2025 TARIFF

- 6.3.1 INTRODUCTION

- 6.3.2 KEY TARIFF RATES

- 6.3.3 DISRUPTION IN BACTERIOLOGICAL TESTING INDUSTRY

- 6.3.4 PRICE IMPACT ANALYSIS

- 6.3.5 IMPACT ON COUNTRY/REGION

- 6.3.5.1 US

- 6.3.5.2 Europe

- 6.3.5.3 Asia Pacific

- 6.3.6 IMPACT ON END-USE INDUSTRIES

- 6.4 PATENT ANALYSIS

- 6.5 TRADE ANALYSIS

- 6.5.1 IMPORT SCENARIO

- 6.5.2 EXPORT SCENARIO

- 6.6 PRICING ANALYSIS

- 6.6.1 AVERAGE SELLING PRICE OF BACTERIOLOGICAL TESTING TECHNOLOGIES, BY KEY PLAYER

- 6.6.2 AVERAGE SELLING PRICE OF BACTERIOLOGICAL TESTING SERVICES, BY END-USE INDUSTRY

- 6.6.3 AVERAGE SELLING PRICE OF BACTERIOLOGICAL TESTING SERVICES, BY REGION

- 6.6.4 AVERAGE SELLING PRICE OF BACTERIOLOGICAL TESTING EQUIPMENT, BY KEY PLAYER

- 6.6.5 AVERAGE SELLING PRICE OF BACTERIOLOGICAL TESTING INSTRUMENTS, BY REGION

- 6.6.6 AVERAGE SELLING PRICE OF BACTERIOLOGICAL TESTING KITS, BY REGION

- 6.6.7 AVERAGE SELLING PRICE OF BACTERIOLOGICAL TESTING REAGENTS & CONSUMABLES, BY REGION

- 6.6.8 KEY STAKEHOLDERS & BUYING CRITERIA

- 6.6.8.1 Key stakeholders in buying process

- 6.6.8.2 Key buying criteria

- 6.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.8 VALUE CHAIN ANALYSIS

- 6.8.1 SAMPLE COLLECTION

- 6.8.2 TRANSPORTATION AND HANDLING

- 6.8.3 LABORATORY TESTING

- 6.8.4 DATA ANALYSIS AND INTERPRETATION

- 6.8.5 REGULATORY COMPLIANCE

- 6.8.6 CONSULTATION AND ADVISORY SERVICES

- 6.8.7 COLLABORATION AND NETWORKING

- 6.9 ECOSYSTEM ANALYSIS

- 6.10 CASE STUDY ANALYSIS

- 6.11 PORTER'S FIVE FORCES ANALYSIS

- 6.11.1 INTENSITY OF COMPETITIVE RIVALRY

- 6.11.2 BARGAINING POWER OF SUPPLIERS

- 6.11.3 BARGAINING POWER OF BUYERS

- 6.11.4 THREAT FROM SUBSTITUTES

- 6.11.5 THREAT FROM NEW ENTRANTS

- 6.12 TECHNOLOGY ANALYSIS

- 6.12.1 KEY TECHNOLOGIES

- 6.12.1.1 Molecular diagnostics

- 6.12.1.2 Immunological methods

- 6.12.1.3 Biosensors

- 6.12.2 ADJACENT TECHNOLOGIES

- 6.12.2.1 Automation & robotics

- 6.12.2.2 Data analysis & bioinformatics

- 6.12.2.3 Advanced imaging

- 6.12.2.4 Sterility & contamination control

- 6.12.3 COMPLEMENTARY TECHNOLOGIES

- 6.12.3.1 IoT & connected devices

- 6.12.3.2 Food & water safety monitoring tools

- 6.12.3.3 Antimicrobial resistance testing

- 6.12.3.4 Predictive analytics & AI

- 6.12.1 KEY TECHNOLOGIES

- 6.13 KEY CONFERENCES & EVENTS, 2025-2026

- 6.14 INVESTMENT & FUNDING SCENARIO

7 BACTERIOLOGICAL TESTING MARKET, BY BACTERIUM

- 7.1 INTRODUCTION

- 7.2 COLIFORM

- 7.2.1 NEED TO ENSURE COMPLIANCE WITH SAFETY STANDARDS ACROSS DAIRY, MEAT, BEVERAGES, AND PROCESSED FOOD INDUSTRIES TO DRIVE MARKET

- 7.2.2 GENERIC COLIFORMS/E. COLI

- 7.2.3 PATHOGENIC E. COLI (O157:H7, STEC)

- 7.3 SALMONELLA

- 7.3.1 DEMAND FOR CONSISTENT TESTING SOLUTIONS FOR HIGH-RISK FOOD CATEGORIES TO DRIVE DEMAND

- 7.4 CAMPYLOBACTER

- 7.4.1 RISING CASES OF GASTROINTESTINAL INFECTIONS TO DRIVE MARKET

- 7.4.2 CAMPYLOBACTER JEJUNI

- 7.4.3 OTHER CAMPYLOBACTER SPP.

- 7.5 LISTERIA

- 7.5.1 RISING CONTAMINATION IN WELL-MAINTAINED PRODUCTION ENVIRONMENTS TO DRIVE GROWTH

- 7.6 LEGIONELLA

- 7.6.1 NEED TO ENSURE COMPLIANCE IN WATER AND ENVIRONMENTAL TESTING TO BOOST GROWTH

- 7.7 OTHER BACTERIA

8 BACTERIOLOGICAL TESTING MARKET, BY TECHNOLOGY

- 8.1 INTRODUCTION

- 8.2 TRADITIONAL

- 8.2.1 POPULARITY OF CULTURE-BASED TESTING TECHNIQUES TO DRIVE MARKET

- 8.3 RAPID

- 8.3.1 NEED FOR ACCELERATING BACTERIOLOGICAL TESTING TO BOOST MARKET

- 8.3.2 CONVENIENCE-BASED TESTING

- 8.3.3 PCR-BASED TESTING

- 8.3.4 IMMUNOASSAY-BASED TESTING

- 8.3.5 CHROMATOGRAPHY & SPECTROMETRY

- 8.3.6 OTHER RAPID TECHNOLOGIES

9 BACTERIOLOGICAL TESTING EQUIPMENT MARKET, BY COMPONENT

- 9.1 INTRODUCTION

- 9.2 INSTRUMENTS

- 9.2.1 GROWING ADOPTION OF REAL-TIME AND DIGITAL PCR TO DRIVE MARKET

- 9.3 TEST KITS

- 9.3.1 HIGH LEVEL OF PRACTICALITY AND TIME EFFICIENCY TO BOOST DEMAND

- 9.4 REAGENTS & CONSUMABLES

- 9.4.1 FOCUS ON OPTIMIZING PERFORMANCE OF ANALYTICAL INSTRUMENTS TO SPUR DEMAND

10 BACTERIOLOGICAL TESTING MARKET, BY END-USE INDUSTRY

- 10.1 INTRODUCTION

- 10.2 FOOD & BEVERAGE

- 10.2.1 NEED TO DETECT PATHOGENIC AND SPOILAGE ORGANISMS TO DRIVE MARKET

- 10.2.2 MEAT & POULTRY

- 10.2.3 FISH & SEAFOOD

- 10.2.4 DAIRY

- 10.2.5 PROCESSED FOODS

- 10.2.6 FRUITS & VEGETABLES

- 10.2.7 CEREALS & GRAINS

- 10.2.8 OTHER FOOD PRODUCTS

- 10.2.9 BEVERAGES

- 10.3 WATER

- 10.3.1 RISING CONTAMINATION OF WATER TO DRIVE DEMAND FOR TESTING SERVICES

- 10.3.2 DRINKING WATER

- 10.3.3 INDUSTRIAL WASTEWATER

- 10.4 PHARMACEUTICAL

- 10.4.1 RISING GLOBAL CONSUMPTION OF PHARMACEUTICAL PRODUCTS TO BOOST GROWTH

- 10.5 COSMETICS & PERSONAL CARE

- 10.5.1 NEED TO PREVENT MICROBIAL GROWTH IN COSMETICS AND PERSONAL CARE PRODUCTS TO DRIVE MARKET

- 10.6 OTHER END-USE INDUSTRIES

11 BACTERIOLOGICAL TESTING EQUIPMENT MARKET, BY MODE OF USE

- 11.1 INTRODUCTION

- 11.1.1 PORTABLE/FIELD-USE DEVICES

- 11.1.1.1 Demand for testing services in remote or resource-limited settings to drive market

- 11.1.2 LABORATORY-BASED SYSTEMS

- 11.1.2.1 Demand for advanced testing services in research and healthcare facilities to drive popularity

- 11.1.1 PORTABLE/FIELD-USE DEVICES

12 BACTERIOLOGICAL TESTING MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 NORTH AMERICA

- 12.2.1 US

- 12.2.1.1 Demand for advanced surveillance networks to spur growth

- 12.2.2 CANADA

- 12.2.2.1 Focus on effective water quality monitoring to boost demand

- 12.2.3 MEXICO

- 12.2.3.1 Expanding bacteriological testing capacity through trade and food safety enforcement to drive market

- 12.2.1 US

- 12.3 EUROPE

- 12.3.1 GERMANY

- 12.3.1.1 Presence of testing agencies with robust surveillance systems to drive market

- 12.3.2 UK

- 12.3.2.1 Need for foodborne outbreak tracking to bolster demand for testing equipment

- 12.3.3 FRANCE

- 12.3.3.1 Demand for food safety alerts to fuel market

- 12.3.4 ITALY

- 12.3.4.1 Need for safety compliance to propel demand for bacteriological testing

- 12.3.5 SPAIN

- 12.3.5.1 Seafood exports and foodborne outbreak surveillance to drive demand

- 12.3.6 POLAND

- 12.3.6.1 Rising food safety standards to propel market

- 12.3.7 REST OF EUROPE

- 12.3.1 GERMANY

- 12.4 ASIA PACIFIC

- 12.4.1 CHINA

- 12.4.1.1 High-profile contamination events and export standards to propel market

- 12.4.2 JAPAN

- 12.4.2.1 Stringent safety laws and foodborne outbreaks to accelerate market

- 12.4.3 AUSTRALIA & NEW ZEALAND

- 12.4.3.1 Need to strengthen testing capacity to uphold supplement quality to boost market

- 12.4.4 INDIA

- 12.4.4.1 Rising bacterial disease burden and regulatory oversight to drive market expansion

- 12.4.5 SOUTHEAST ASIA

- 12.4.5.1 Rising bacterial disease burden to drive market

- 12.4.6 REST OF ASIA PACIFIC

- 12.4.1 CHINA

- 12.5 SOUTH AMERICA

- 12.5.1 BRAZIL

- 12.5.1.1 Need for manufacturers to comply with ANVISA's rules to drive demand

- 12.5.2 ARGENTINA

- 12.5.2.1 Need to improve pharma quality to drive demand for testing services

- 12.5.3 REST OF SOUTH AMERICA

- 12.5.1 BRAZIL

- 12.6 REST OF THE WORLD

- 12.6.1 AFRICA

- 12.6.1.1 Regulatory attention on safety of drinking water and food hygiene to drive market

- 12.6.2 MIDDLE EAST

- 12.6.2.1 Increased investment in bacteriological testing, driven by food import/export controls, to boost market

- 12.6.1 AFRICA

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 13.3 REVENUE ANALYSIS, 2021-2024

- 13.4 MARKET SHARE ANALYSIS OF KEY PLAYERS IN BACTERIOLOGICAL TESTING MARKET, 2024

- 13.5 MARKET RANKING ANALYSIS OF BACTERIOLOGICAL TESTING EQUIPMENT MARKET, 2024

- 13.6 COMPANY EVALUATION MATRIX: KEY PLAYERS (BACTERIOLOGICAL TESTING MARKET), 2024

- 13.6.1 STARS

- 13.6.2 EMERGING LEADERS

- 13.6.3 PERVASIVE PLAYERS

- 13.6.4 PARTICIPANTS

- 13.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.6.5.1 Company footprint

- 13.6.5.2 Region footprint

- 13.6.5.3 Bacterium footprint

- 13.6.5.4 End-use industry footprint

- 13.7 COMPANY EVALUATION MATRIX: KEY PLAYERS (BACTERIOLOGICAL TESTING EQUIPMENT MARKET), 2024

- 13.7.1 STARS

- 13.7.2 EMERGING LEADERS

- 13.7.3 PERVASIVE PLAYERS

- 13.7.4 PARTICIPANTS

- 13.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.7.5.1 Company footprint

- 13.7.5.2 Region footprint

- 13.7.5.3 Component footprint

- 13.7.5.4 Mode of use footprint

- 13.8 COMPANY VALUATION AND FINANCIAL METRICS

- 13.9 BRAND/PRODUCT COMPARISON

- 13.10 COMPETITIVE SCENARIO

- 13.10.1 PRODUCT/SERVICE LAUNCHES

- 13.10.2 DEALS

- 13.10.3 EXPANSIONS

- 13.10.4 OTHER DEVELOPMENTS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS: BACTERIOLOGICAL TESTING MARKET

- 14.1.1 SGS SOCIETE GENERALE DE SURVEILLANCE SA

- 14.1.1.1 Business overview

- 14.1.1.2 Services offered

- 14.1.1.3 Recent developments

- 14.1.1.4 MnM view

- 14.1.1.4.1 Right to win

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses and competitive threats

- 14.1.2 INTERTEK GROUP PLC

- 14.1.2.1 Business overview

- 14.1.2.2 Services offered

- 14.1.2.3 Recent developments

- 14.1.2.4 MnM view

- 14.1.2.4.1 Right to win

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses and competitive threats

- 14.1.3 EUROFINS SCIENTIFIC

- 14.1.3.1 Business overview

- 14.1.3.2 Services offered

- 14.1.3.3 Recent developments

- 14.1.3.4 MnM view

- 14.1.3.4.1 Right to win

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses and competitive threats

- 14.1.4 ALS

- 14.1.4.1 Business overview

- 14.1.4.2 Services offered

- 14.1.4.3 Recent developments

- 14.1.4.4 MnM view

- 14.1.4.4.1 Right to win

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses and competitive threats

- 14.1.5 MERIEUX NUTRISCIENCES

- 14.1.5.1 Business overview

- 14.1.5.2 Services offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Expansions

- 14.1.5.4 MnM view

- 14.1.5.4.1 Right to win

- 14.1.5.4.2 Strategic choices

- 14.1.5.4.3 Weaknesses and competitive threats

- 14.1.6 CERTIFIED GROUP

- 14.1.6.1 Business overview

- 14.1.6.2 Services offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Expansions

- 14.1.6.4 MnM view

- 14.1.7 SYMBIO LABS

- 14.1.7.1 Business overview

- 14.1.7.2 Services offered

- 14.1.7.3 Recent developments

- 14.1.7.3.1 Other developments

- 14.1.7.4 MnM view

- 14.1.8 TUV SUD

- 14.1.8.1 Business overview

- 14.1.8.2 Services offered

- 14.1.8.3 MnM view

- 14.1.9 FOODCHAIN ID

- 14.1.9.1 Business overview

- 14.1.9.2 Services offered

- 14.1.9.3 MnM view

- 14.1.10 TENTAMUS

- 14.1.10.1 Business overview

- 14.1.10.2 Services offered

- 14.1.10.3 Recent developments

- 14.1.10.3.1 Service launches

- 14.1.10.4 MnM view

- 14.1.11 ALFA CHEMISTRY

- 14.1.11.1 Business overview

- 14.1.11.2 Services offered

- 14.1.11.3 MnM view

- 14.1.12 AGQ LABS

- 14.1.12.1 Business overview

- 14.1.12.2 Services offered

- 14.1.12.3 Recent developments

- 14.1.12.3.1 Expansions

- 14.1.12.3.2 Deals

- 14.1.12.4 MnM view

- 14.1.13 CENTRE TESTING INTERNATIONAL

- 14.1.13.1 Business overview

- 14.1.13.2 Services offered

- 14.1.13.3 MnM view

- 14.1.14 MICROBAC

- 14.1.14.1 Business overview

- 14.1.14.2 Services offered

- 14.1.14.3 MnM view

- 14.1.15 VIMTA LABS LTD.

- 14.1.15.1 Business overview

- 14.1.15.2 Services offered

- 14.1.15.3 Recent developments

- 14.1.15.3.1 Other developments

- 14.1.15.4 MnM view

- 14.1.1 SGS SOCIETE GENERALE DE SURVEILLANCE SA

- 14.2 KEY PLAYERS: BACTERIOLOGICAL TESTING EQUIPMENT MARKET

- 14.2.1 NEOGEN CORPORATION

- 14.2.1.1 Business overview

- 14.2.1.2 Products offered

- 14.2.1.3 Recent developments

- 14.2.1.3.1 Product launches

- 14.2.1.3.2 Deals

- 14.2.1.4 MnM view

- 14.2.2 BIO-RAD LABORATORIES, INC.

- 14.2.2.1 Business overview

- 14.2.2.2 Products offered

- 14.2.2.3 Recent developments

- 14.2.2.4 MnM view

- 14.2.3 BIOMERIEUX

- 14.2.3.1 Business overview

- 14.2.3.2 Products offered

- 14.2.3.3 MnM view

- 14.2.4 THERMO FISHER SCIENTIFIC INC.

- 14.2.4.1 Business overview

- 14.2.4.2 Products offered

- 14.2.4.3 MnM view

- 14.2.5 MERCK & CO., INC.

- 14.2.5.1 Business overview

- 14.2.5.2 Products offered

- 14.2.5.3 MnM view

- 14.2.6 BD

- 14.2.6.1 Business overview

- 14.2.6.2 Products offered

- 14.2.6.3 MnM view

- 14.2.7 3M

- 14.2.7.1 Business overview

- 14.2.7.2 Products offered

- 14.2.7.3 MnM view

- 14.2.8 HARDY DIAGNOSTICS

- 14.2.8.1 Business overview

- 14.2.8.2 Products offered

- 14.2.8.3 MnM view

- 14.2.9 HIMEDIA LABORATORIES

- 14.2.9.1 Business overview

- 14.2.9.2 Products offered

- 14.2.9.3 MnM view

- 14.2.10 AGILENT TECHNOLOGIES, INC.

- 14.2.10.1 Business overview

- 14.2.10.2 Products offered

- 14.2.10.3 Recent developments

- 14.2.10.3.1 Expansions

- 14.2.10.3.2 Deals

- 14.2.10.4 MnM view

- 14.2.1 NEOGEN CORPORATION

15 ADJACENT & RELATED MARKETS

- 15.1 INTRODUCTION

- 15.2 LIMITATIONS

- 15.3 FOOD SAFETY TESTING MARKET

- 15.3.1 MARKET DEFINITION

- 15.3.2 MARKET OVERVIEW

- 15.4 FOOD PATHOGEN TESTING MARKET

- 15.4.1 MARKET DEFINITION

- 15.4.2 MARKET OVERVIEW

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS