|

시장보고서

상품코드

1826559

탱크 레벨 모니터링 시스템 시장 : 기술별, 제품별, 유체 유형별, 컴포넌트별, 최종 사용자별 예측(-2030년)Tank Level Monitoring System Market by Technology, Product, Fluid Type, Component, End User - Global Forecast to 2030 |

||||||

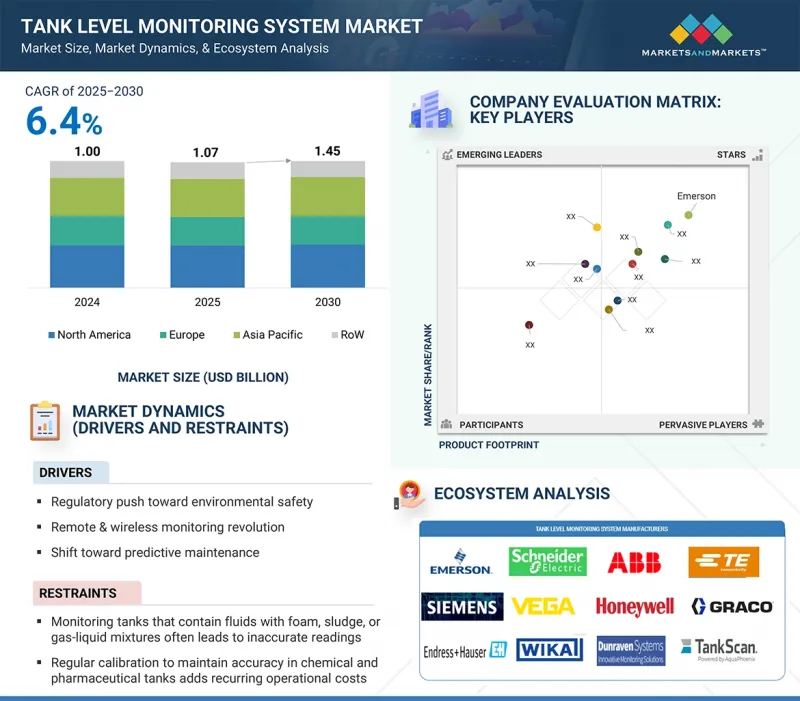

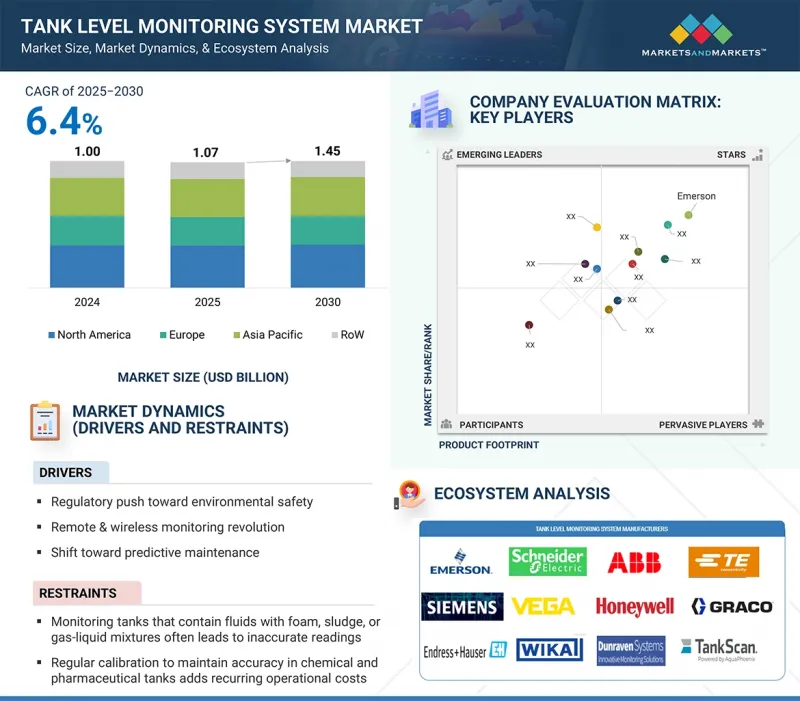

세계의 탱크 레벨 모니터링 시스템 시장 규모는 2025년에 10억 7,000만 달러이며, 2030년까지 14억 5,000만 달러에 이를 것으로 예측되며, CAGR로 6.4%의 성장이 예상됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2021-2030년 |

| 기준연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 10억 달러 |

| 부문 | 기술, 제품, 유체 유형, 부품, 지역 |

| 대상 지역 | 북미, 유럽, 아시아태평양 및 기타 지역 |

세계의 탱크 레벨 모니터링 시스템 시장은 정확하고 신뢰할 수 있는 자동 액면 측정에 대한 수요가 증가함에 따라 산업 전반에서 꾸준한 성장을 보이고 있습니다. 안전하고 효율적인 유체관리의 중요한 인에이블러로 평가되고 있는 이 시장은 석유·연료, 화학, 물 및 폐수, 농업, 발전, 식품 및 음료 등의 부문에서의 채용 증가에 의해 크게 성장할 것으로 예측되고 있습니다. 실시간 모니터링, 규제 준수, 업무 효율화의 요구가 세계 전개를 가속화하고 있습니다. 탱크 레벨 모니터링 시스템은 공정의 연속성을 보장하고 오버플로우 및 부족을 방지하며 연료, 화학물질 및 기타 액체의 안전한 저장을 지원하는 데 중요합니다.

스마트 인프라, 디지털 전환, 산업 및 지자체 부문의 자동화에 대한 투자 증가는 시장 확대를 더욱 뒷받침합니다. IoT 지원 센서, 무선 연결성, 클라우드 기반 플랫폼의 활용 확대로 원격 모니터링, 예측 유지 보수 및 재고 관리 개선이 가능합니다. 레이더, 초음파 및 레이저 센서의 기술 혁신으로 정확성, 신뢰성 및 다양한 보관 환경에 대한 적응성이 향상되었습니다. 동시에 석유 터미널의 위험한 액체 모니터링에서 식품 및 제약 응용 분야의 위생 시스템에 이르기까지 수요는 맞춤형 특정 용도 솔루션으로 이동하고 있습니다. 지속가능성, 환경 컴플라이언스, 비용 최적화에 대한 관심 증가가 더욱 채용을 뒷받침하고 있습니다.

플로트 테이프 게이징 기술이 2024년에 큰 시장 점유율을 차지했습니다.

플로트 테이프 게이징 시스템은 2024년 탱크 레벨 모니터링 시스템 시장에서 상당한 점유율을 차지하며 특히 비용 효율적이고 신뢰성 있는 벌크 액체 측정 솔루션을 요구하는 산업에서 채택되었습니다. 이 기술은 석유·연료, 화학, 수도, 농업 등에서 사용되는 대형 저장 탱크에서 그 알기 쉬운 설계, 기계적 신뢰성, 입증된 정밀도에 의해 널리 채용되고 있습니다. 내구성과 조작성의 높이로 알려진 플로트 테이프 시스템은 전력이나 디지털 인프라가 한정된 원격지에서도 안정된 계측이 가능합니다. 가혹한 산업 환경을 견디고 복잡한 교정 없이 신뢰할 수 있는 측정을 제공하는 능력은 연료, 용매 등 액체 제품을 관리하는 시설에 특히 매력적입니다. 기계적 설계, 내식성 재료 및 디지털 디스플레이 카운터와의 통합의 발전은 이러한 시스템의 수명과 기능성을 향상시키고 새로운 전자 기술과 병행하여 지속적인 타당성을 보장합니다. 또한 설치 및 유지 보수 비용이 낮고 다양한 유형의 탱크에 대응할 수 있기 때문에 산업용도 및 지자체 용도의 매력도 높아지고 있습니다. 안전하고 효율적인 저장 관리에 대한 세계 수요가 증가함에 따라, 플로트 테이프 게이징 시스템은 간편성, 정확성 및 비용 효율성의 균형을 추구하는 사업자에게 계속 선호되고 있습니다. 그 실적과 적응성은 탱크 레벨 모니터링 시스템 시장에서 중요한 기술 부문으로서의 역할을 강화하고 있습니다.

"화학 산업은 탱크 레벨 모니터링 시스템 시장에서 높은 CAGR을 나타냅니다."

탱크 레벨 모니터링 시스템 시장의 화학 최종 사용자 부문은 세심한 주의를 요하는 환경에서 정확하고 안전하며 신뢰할 수 있는 액체 저장 관리에 대한 요구가 증가함에 따라 예측 기간에 상당한 CAGR을 기록할 전망입니다. 화학 플랜트는 다양한 부식성, 독성 및 휘발성 물질을 다루기 위해 정확성, 컴플라이언스 및 작업 안전을 보장하는 모니터링 시스템이 필요합니다. 이 부문의 탱크 레벨 모니터링 솔루션은 공격적인 매체, 극단적인 온도 및 가압 상태를 견딜 수 있도록 설계되어 벌크 저장, 혼합 및 유통 공정에서 중단 없는 성능을 보장합니다. 첨단 모니터링 기술은 오버플로우, 누출 및 오염 위험을 방지하는 데 도움이 되는 동시에 직원이 재고를 관리하고 공정 효율을 최적화할 수 있습니다.

이 보고서는 세계의 탱크 레벨 모니터링 시스템 시장에 대한 조사 분석을 통해 주요 촉진요인 및 억제요인, 경쟁 구도, 미래 동향 등의 정보를 제공합니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요한 지견

- 탱크 레벨 모니터링 시스템 시장의 매력적인 기회

- 탱크 레벨 모니터링 시스템 시장 : 제품별

- 탱크 레벨 모니터링 시스템 시장 : 기술별

- 탱크 레벨 모니터링 시스템 시장 : 최종 사용자별

- 탱크 레벨 모니터링 시스템 시장 : 유체 유형별

- 탱크 레벨 모니터링 시스템 시장 : 컴포넌트별

- 탱크 레벨 모니터링 시스템 시장 : 국가별

제5장 시장 개요

- 소개

- 시장 역학

- 성장 촉진요인

- 억제요인

- 기회

- 과제

- 밸류체인 분석

- 생태계 분석

- 가격 설정 분석

- 가격 동향 : 주요 기업별

- 가격 동향 : 유형별

- 가격 동향 : 지역별

- 고객사업에 영향을 주는 동향/혼란

- 사례 연구 분석

- 무역 분석

- 수입 데이터(HS 코드 902610)

- 수출 데이터(HS 코드 902610)

- 특허 분석

- 규제 상황

- 규제기관, 정부기관, 기타 조직

- 규제 틀

- 탱크 레벨 모니터링 시스템 시장에 대한 AI/생성형 AI의 영향

- 소개

- 영향 분석

- 주요 이용 사례와 시장의 장래성

- 탱크 레벨 모니터링 시스템 시장에 대한 2025년 미국 관세의 영향

- 소개

- 주요 관세율

- 가격의 영향 분석

- 국가/지역에 미치는 영향

- 최종 이용 산업에 미치는 영향

제6장 탱크 레벨 모니터링 시스템 : 유체별

- 소개

- 탱크 레벨 모니터링 시스템 : 액체 유형별

- 연료

- 기름

- 물

- 화학

- 기타 유체 유형

제7장 탱크 레벨 모니터링 시스템 시장 : 컴포넌트별

- 소개

- 센서

- 추적 장치

- 전원

- 모니터링 스테이션

제8장 탱크 레벨 모니터링 시스템 : 최종 사용자별

- 소개

- 석유 및 연료

제9장 탱크 레벨 모니터링 시스템 시장 : 제품별

- 소개

- 침습형

- 비침습형

제10장 탱크 레벨 모니터링 시스템 시장 : 기술별

- 소개

- 플로트 테이프 게이지

- 도전율식 레벨 모니터링

- 초음파식 레벨 모니터링

- 정전용량식 레벨 모니터링

- 레이더식 레벨 모니터링

- 기타 기술

- 데이터 전송

제11장 탱크 레벨 모니터링 시스템 : 지역별

- 소개

- 북미

- 북미의 마이크로 경제 전망

- 미국

- 캐나다

- 멕시코

- 유럽

- 유럽의 마이크로 경제 전망

- 영국

- 독일

- 프랑스

- 기타 유럽

- 아시아태평양

- 아시아태평양의 거시 경제 전망

- 중국

- 일본

- 인도

- 한국

- 기타 아시아태평양

- 기타 지역

- 아프리카

- 중동

- 남미

제12장 경쟁 구도

- 소개

- 주요 참가 기업의 전략/강점(2023-2025년)

- 수익 분석(2020-2024년)

- 시장 점유율 분석(2024년)

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업의 평가 매트릭스 : 스타트업/중소기업(2024년)

- 경쟁 시나리오

제13장 기업 프로파일

- 주요 기업

- EMERSON ELECTRIC CO.

- HONEYWELL INTERNATIONAL INC.

- SIEMENS

- ENDRESS HAUSER GROUP SERVICES AG

- SCHNEIDER ELECTRIC

- GRACO INC.

- DG INTERNATIONAL INC

- OTODATA WIRELESS NETWORK

- VEGA

- PIUSI SPA

- GAUGING SYSTEMS INC.

- BANNER ENGINEERING CORP.

- THE VEEDER-ROOT COMPANY

- VAREC, INC.

- OMNTEC MFG., INC.

- 기타 기업

- PNEUMERCATOR

- SKYBITZ INC.

- ROCHESTER SENSORS

- RUGGED TELEMETRY

- PULSA

- SCHMITT INDUSTRIES INC.

- ORIEL SYSTEMS LIMITED

- MOPEKA PRODUCTS, LLC

- TANKSCAN

- INPRO GROUP

제14장 부록

JHS 25.10.10The global tank level monitoring system market was valued at USD 1.07 billion in 2025 and is projected to reach USD 1.45 billion by 2030, registering a CAGR of 6.4%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Technology, Product, Fluid Type, Component and Region |

| Regions covered | North America, Europe, APAC, RoW |

The global tank level monitoring system market is witnessing steady growth, supported by rising demand for accurate, reliable, and automated liquid level measurement across industries. Valued as a vital enabler of safe and efficient fluid management, the market is projected to grow significantly, driven by increasing adoption in sectors such as oil & fuel, chemicals, water & wastewater, agriculture, power generation, and food & beverages. The need for real-time monitoring, regulatory compliance, and operational efficiency is accelerating deployment worldwide. Tank level monitoring systems are critical in ensuring process continuity, preventing overflows or shortages, and supporting safe storage of fuels, chemicals, and other liquids.

Rising investments in smart infrastructure, digital transformation, and automation across industrial and municipal sectors further boost market expansion. The growing use of IoT-enabled sensors, wireless connectivity, and cloud-based platforms enables remote monitoring, predictive maintenance, and improved inventory control. Technological innovations in radar, ultrasonic, and laser-based sensors have enhanced accuracy, reliability, and adaptability across diverse storage environments. At the same time, demand is shifting toward customized, application-specific solutions from hazardous liquid monitoring in oil terminals to hygienic systems in food and pharmaceutical applications. The increasing focus on sustainability, environmental compliance, and cost optimization further drives adoption.

"Float and tape gauging technology held significant market share in 2024"

Float and tape gauging systems accounted for a notable share of the tank level monitoring system market in 2024, particularly in industries requiring cost-effective and dependable solutions for bulk liquid measurement. This technology continues to be widely adopted due to its straightforward design, mechanical reliability, and proven accuracy in large storage tanks used across oil & fuel, chemicals, water utilities, and agriculture. Known for their durability and ease of operation, float and tape systems provide consistent measurement even in remote locations with limited power or digital infrastructure. Their ability to withstand harsh industrial environments and deliver reliable readings without complex calibration makes them particularly attractive for facilities managing fuels, solvents, and other liquid commodities. Advancements in mechanical design, corrosion-resistant materials, and integration with digital readouts have enhanced the longevity and functionality of these systems, ensuring continued relevance alongside emerging electronic technologies. Furthermore, their lower installation and maintenance costs and compatibility across various tank types strengthen their appeal in industrial and municipal applications. As global demand for secure and efficient storage management grows, float and tape gauging systems remain preferred for operators seeking a balance of simplicity, accuracy, and cost efficiency. Their proven track record and adaptability reinforce their role as a critical technology segment within the tank level monitoring system market.

"Chemicals industry to exhibit significant CAGR in tank level monitoring system market"

The chemical end-user segment of the tank level monitoring system market is projected to record a significant CAGR during the forecast period, driven by the growing need for accurate, safe, and reliable liquid storage management in highly sensitive environments. Chemical plants handle diverse corrosive, toxic, and volatile substances, necessitating monitoring systems that ensure precision, compliance, and operational safety. Tank level monitoring solutions in this sector are designed to withstand aggressive media, extreme temperatures, and pressurized conditions, ensuring uninterrupted performance in bulk storage, blending, and distribution processes. Advanced monitoring technologies help prevent overflows, leakages, and contamination risks while enabling operators to control inventories and optimize process efficiency. The segment benefits from increasing global chemical production, rising safety regulations, and stricter environmental compliance standards. Applications extend across specialty chemicals, petrochemicals, agrochemicals, and pharmaceutical intermediates, where continuous and accurate monitoring is mission-critical. Recent innovations, such as corrosion-resistant sensor materials, non-contact radar, and ultrasonic technologies, and integration with IoT-enabled platforms, are enhancing durability and enabling real-time remote supervision. These developments improve reliability and support predictive maintenance and risk mitigation. As the chemical industry expands worldwide, tank level monitoring systems will play a vital role in ensuring safe storage, regulatory adherence, and operational continuity, positioning this segment as one of the fastest-growing contributors to overall market growth.

"Fuel segment accounted for significant market share in 2024"

The fuel fluid type segment held a substantial share of the tank level monitoring system market in 2024 and is expected to maintain strong momentum during the forecast period. Rising global demand for petroleum products, coupled with the need for efficient storage and distribution, has accelerated the adoption of advanced monitoring solutions in this category. Fuel tanks, widely used in refineries, fuel stations, aviation depots, and large-scale transportation hubs, require continuous and precise measurements to ensure uninterrupted operations and prevent costly discrepancies. Monitoring systems in this segment are tailored to manage diverse fuels such as gasoline, diesel, aviation turbine fuel, and biodiesel blends with high accuracy and reliability. The segment benefits from the growing expansion of global logistics, aviation, and automotive industries, which depend heavily on secure and transparent fuel management. The integration of tank monitoring with digital inventory control systems helps operators streamline supply chains, reduce wastage, and enhance profitability. Recent advancements such as wireless telemetry, cloud-based dashboards, and ATEX/IECEx-certified monitoring devices have increased safety and enabled remote visibility, even in hazardous or high-risk environments. Additionally, the emphasis on preventing fuel theft, minimizing losses, and adhering to international quality standards reinforces demand for these solutions. As global energy consumption continues to expand, particularly in emerging economies, the fuel segment is positioned to remain a key revenue contributor to the tank level monitoring system market, backed by its critical role in ensuring efficiency, transparency, and operational reliability.

Extensive primary interviews were conducted with key industry experts in the tank level monitoring system market space to determine and verify the market size for various segments and subsegments gathered through secondary research. The breakdown of primary participants for the report is shown below.

The study contains insights from various industry experts, from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: Tier 1 - 25%, Tier 2 - 45%, and Tier 3 - 30%

- By Designation: Directors - 20%, C-level Executives - 50%, and Others - 30%

- By Region: Asia Pacific - 35%, Europe - 25%, North America - 30%, and RoW - 10%

Notes: RoW comprises the Middle East, Africa, and South America.

Other designations include product managers, sales managers, and marketing managers.

Three tiers of companies have been defined based on their total revenue as of 2024: tier 3: revenue less than USD 500 million; tier 2: revenue between USD 500 million and USD 1 billion; and tier 1: revenue more than USD 1 billion.

The tank level monitoring system market is dominated by a few globally established players, such as Emerson Electric Co. (US), Schneider Electric (France), Siemens (Germany), Honeywell International Inc. (US), TE Connectivity (Switzerland), and ABB (Switzerland). The study includes an in-depth competitive analysis of these key players, with their company profiles, recent developments, and key market strategies.

Research Coverage:

The report segments the tank level monitoring system market and forecasts its size by technology (float & tape gauging, conductivity level monitoring, ultrasonic level monitoring, capacitance level monitoring, radar-based level monitoring, data transmission), by product (invasive type, non-invasive type), By component (sensors, tracking device, power supply, monitoring stations), by fluid type (fuel, oil, water, chemical, other fluid), by end users (oil & fuel, chemicals, energy & power, mining, automotive, agriculture & husbandry, other industries). The report includes a supply chain analysis of the key players and their competitive analysis in the tank level monitoring system ecosystem.

Key Benefits of Buying the Report:

- Analysis of key drivers (regulatory push toward environmental safety, remote & wireless monitoring revolution, shift toward predictive maintenance), restraint (monitoring tanks that contain fluids with foam, sludge, or gas-liquid mixtures often leads to inaccurate readings, regular calibration to maintain accuracy in chemical and pharmaceutical tanks adds recurring operational costs), opportunities (leveraging AI with tank level monitoring system allows companies to automate replenishment cycles), challenges (ensuring stable and reliable wireless or networked communication between devices, especially in large-scale or remote facilities, can be complex).

- Service Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and product launches in the tank level monitoring system market

- Market Development: Comprehensive information about lucrative markets by analyzing across varied regions

- Market Diversification: Exhaustive information about new products and services, untapped geographies, recent developments, and investments in the tank level monitoring system market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product and service offerings of leading players, such as Emerson Electric Co. (US), Honeywell International Inc. (US), Endress+Hauser Group Services AG, Siemens (Germany), Schneider Electric (France).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 List of key secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 List of primary interview participants

- 2.1.3.2 Key data from primary sources

- 2.1.3.3 Key industry insights

- 2.1.3.4 Breakdown of interviews with experts

- 2.2 MARKET SIZE ESTIMATION METHODOLOGY

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to estimate market size using bottom-up analysis

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to estimate market size using top-down analysis

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN TANK LEVEL MONITORING SYSTEM MARKET

- 4.2 TANK LEVEL MONITORING SYSTEM MARKET, BY PRODUCT

- 4.3 TANK LEVEL MONITORING SYSTEM MARKET, BY TECHNOLOGY

- 4.4 TANK LEVEL MONITORING SYSTEM MARKET, BY END USER

- 4.5 TANK LEVEL MONITORING SYSTEM MARKET, BY FLUID TYPE

- 4.6 TANK LEVEL MONITORING SYSTEM MARKET, BY COMPONENT

- 4.7 TANK LEVEL MONITORING SYSTEM MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising adoption of remote & wireless monitoring

- 5.2.1.2 Rising importance of predictive maintenance in enhancing monitoring efficiency

- 5.2.1.3 Environmental safety compliance through advanced monitoring

- 5.2.2 RESTRAINTS

- 5.2.2.1 Complex fluid conditions causing measurement limitations

- 5.2.2.2 Operational overheads from regular calibration in sensitive industries

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 AI-integrated systems to streamline replenishment and strengthen supply chain reliability

- 5.2.3.2 Decentralized monitoring-as-a-service (MaaS) driving flexible adoption

- 5.2.4 CHALLENGES

- 5.2.4.1 Stable and reliable communication between devices

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 PRICING ANALYSIS

- 5.5.1 INDICATIVE PRICING TREND, BY KEY PLAYER

- 5.5.2 INDICATIVE PRICING TREND, BY TYPE

- 5.5.3 INDICATIVE PRICING TREND, BY REGION

- 5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.7 CASE STUDY ANALYSIS

- 5.7.1 CASE STUDY 1: PHILLIPS 66 COMPANY BAYWAY REFINERY TRANSFORMS TANK GAUGING WITH VAREC'S COST-EFFECTIVE RELIABILITY SOLUTION

- 5.7.2 CASE STUDY 2: ENHANCED EFFICIENCY AND SALES WITH AQUAPHOENIX TANKSCAN DIGITAL MONITORING

- 5.7.3 CASE STUDY 3: INNOTEK INCORPORATED TRANSFORMS STRIPPER WELL MONITORING WITH DIGI INTERNATIONAL INC. POWERED OVERWATCH SOLUTION

- 5.7.4 CASE STUDY 4: WESTAIR BOOSTS EFFICIENCY AND CUSTOMER VALUE THROUGH PULSA TANK MONITORING

- 5.7.5 CASE STUDY 5: CHEMICAL TERMINAL ENHANCES SAFETY AND UTILIZATION WITH 2-IN-1 RADAR LEVEL GAUGE FROM EMERSON ELECTRIC CO.

- 5.8 TRADE ANALYSIS

- 5.8.1 IMPORT DATA (HS CODE 902610)

- 5.8.2 EXPORT DATA (HS CODE 902610)

- 5.9 PATENT ANALYSIS

- 5.10 REGULATORY LANDSCAPE

- 5.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10.2 REGULATORY FRAMEWORK

- 5.10.2.1 North America

- 5.10.2.1.1 US

- 5.10.2.1.2 Canada

- 5.10.2.2 Europe

- 5.10.2.2.1 European Union

- 5.10.2.2.2 Germany

- 5.10.2.3 Asia Pacific

- 5.10.2.3.1 China

- 5.10.2.3.2 India

- 5.10.2.3.3 Japan

- 5.10.2.3.4 Rest of the World

- 5.10.2.3.5 Brazil

- 5.10.2.1 North America

- 5.11 IMPACT OF AI/GENERATIVE AI ON TANK LEVEL MONITORING SYSTEM MARKET

- 5.11.1 INTRODUCTION

- 5.11.2 IMPACT ANALYSIS

- 5.11.3 TOP USE CASES AND MARKET POTENTIAL

- 5.12 IMPACT OF 2025 US TARIFFS ON TANK LEVEL MONITORING SYSTEM MARKET

- 5.12.1 INTRODUCTION

- 5.12.2 KEY TARIFF RATES

- 5.12.3 PRICE IMPACT ANALYSIS

- 5.12.4 IMPACT ON COUNTRIES/REGIONS

- 5.12.4.1 US

- 5.12.4.2 Europe

- 5.12.4.3 Asia Pacific

- 5.12.5 IMPACT ON END-USE INDUSTRIES

- 5.12.5.1 Oil & Fuel

- 5.12.5.2 Chemicals

6 TANK LEVEL MONITORING SYSTEM, BY FLUID TYPE

- 6.1 INTRODUCTION

- 6.2 TANK LEVEL MONITORING SYSTEM, BY FLUID TYPE

- 6.2.1 FUEL

- 6.2.1.1 Automation regulation and digital innovation to drive market

- 6.2.2 OIL

- 6.2.2.1 Automation compliance and digital technologies to drive market

- 6.2.3 WATER

- 6.2.3.1 Need for sustainable water management to drive intelligent tank monitoring solutions segment

- 6.2.4 CHEMICAL

- 6.2.4.1 Need for enhanced safety and efficiency to drive demand

- 6.2.5 OTHER FLUID TYPES

- 6.2.1 FUEL

7 TANK LEVEL MONITORING SYSTEM MARKET, BY COMPONENT

- 7.1 INTRODUCTION

- 7.2 SENSORS

- 7.2.1 REVOLUTIONIZING INDUSTRIAL TANK MONITORING THROUGH AI-POWERED, CONNECTED, AND PREDICTIVE SENSOR TECHNOLOGIES

- 7.3 TRACKING DEVICES

- 7.3.1 DRIVING OPERATIONAL EFFICIENCY THROUGH IOT-ENABLED TRACKING DEVICES FOR SMARTER TANK ASSET MANAGEMENT

- 7.4 POWER SUPPLY

- 7.4.1 POWERING SMARTER TANK MONITORING WITH ENERGY HARVESTING, WIRELESS TRANSFER, AND SUSTAINABLE BATTERY-FREE SOLUTIONS

- 7.5 MONITORING STATIONS

- 7.5.1 CENTRALIZING TANK INTELLIGENCE WITH SMART MONITORING STATIONS FOR REAL-TIME CONTROL AND ANALYTICS

8 TANK LEVEL MONITORING SYSTEM, BY END USER

- 8.1 INTRODUCTION

- 8.2 OIL & FUEL

- 8.2.1 GOVERNMENT INVESTMENTS AND TECHNOLOGY INNOVATION TO DRIVE DEMAND

- 8.2.2 CHEMICALS

- 8.2.2.1 Rising chemical production and safety regulations to drive demand

- 8.2.3 ENERGY & POWER

- 8.2.3.1 Powering efficiency and resilience with intelligent tank level monitoring in next-generation energy & power sector

- 8.2.4 MINING

- 8.2.4.1 Unlocking mining efficiency and safety with intelligent tank level monitoring systems

- 8.2.5 AUTOMOTIVE

- 8.2.5.1 Automotive innovation and sustainability to drive demand

- 8.2.6 AGRICULTURE & HUSBANDRY

- 8.2.6.1 Empowering modern farming operations with precision tank monitoring for water and feed management

- 8.2.7 OTHER END USERS

9 TANK LEVEL MONITORING SYSTEM MARKET, BY PRODUCT

- 9.1 INTRODUCTION

- 9.2 INVASIVE TYPE

- 9.2.1 DRIVING INDUSTRIAL PRECISION AND SAFETY WITH ADVANCED INVASIVE TANK LEVEL MONITORING SYSTEMS

- 9.3 NON-INVASIVE TYPE

- 9.3.1 ADVANCING INDUSTRIAL EFFICIENCY AND SAFETY WITH SMART NON-INVASIVE TANK LEVEL MONITORING SYSTEMS

10 TANK LEVEL MONITORING SYSTEM MARKET, BY TECHNOLOGY

- 10.1 INTRODUCTION

- 10.2 FLOAT & TAPE GAUGING

- 10.2.1 FLOAT & TAPE GAUGING DELIVERS RELIABLE, ACCURATE, AND COST-EFFECTIVE TANK MEASUREMENT

- 10.3 CONDUCTIVITY LEVEL MONITORING

- 10.3.1 LEVEL MONITORING TECHNOLOGY DELIVERS RELIABLE, ACCURATE, AND MAINTENANCE-FREE LIQUID MEASUREMENT

- 10.4 ULTRASONIC LEVEL MONITORING

- 10.4.1 ULTRASONIC LEVEL MONITORING DELIVERS PRECISION EFFICIENCY AND SMART NON-CONTACT TANK MEASUREMENT

- 10.5 CAPACITANCE LEVEL MONITORING

- 10.5.1 CAPACITANCE LEVEL MONITORING DRIVES PRECISION, RELIABILITY, AND SMART CONTINUOUS TANK INSIGHTS

- 10.6 RADAR-BASED LEVEL MONITORING

- 10.6.1 RADAR-BASED LEVEL MONITORING DELIVERS SMART, PRECISE, AND RELIABLE TANK INSIGHTS FOR CRITICAL OPERATIONS

- 10.7 OTHER TECHNOLOGIES

- 10.8 DATA TRANSMISSION

- 10.8.1 CELLULAR DATA TRANSMISSION TECHNOLOGY PREFERRED FOR ITS LOW COST AND EASY INSTALLATION

11 TANK LEVEL MONITORING SYSTEM, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 MICROECONOMIC OUTLOOK FOR NORTH AMERICA

- 11.2.2 US

- 11.2.2.1 Precision performance and profitability tank monitoring catalyzes industrial innovation in America

- 11.2.3 CANADA

- 11.2.3.1 Unlocking industrial resilience drives growth in intelligent tank monitoring adoption

- 11.2.4 MEXICO

- 11.2.4.1 From energy strength to manufacturing power, Mexico accelerates tank monitoring adoption

- 11.3 EUROPE

- 11.3.1 MICROECONOMIC OUTLOOK FOR EUROPE

- 11.3.2 UK

- 11.3.2.1 From regulation to innovation, tank monitoring unlocks strategic value

- 11.3.3 GERMANY

- 11.3.3.1 Germany fuels market leadership in tank level monitoring systems through industrial innovation

- 11.3.4 FRANCE

- 11.3.4.1 Government's initiatives supporting green energy to drive tank level monitoring demand

- 11.3.5 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 MACROECONOMIC OUTLOOK IN ASIA PACIFIC

- 11.4.2 CHINA

- 11.4.2.1 China powers growth in tank level monitoring with expanding energy and industrial base

- 11.4.3 JAPAN

- 11.4.3.1 Japan accelerates tank monitoring to drive efficiency and carbon neutrality

- 11.4.4 INDIA

- 11.4.4.1 Tank level monitoring systems powering next phase of growth in India's manufacturing and industrial expansion

- 11.4.5 SOUTH KOREA

- 11.4.5.1 South Korea fuels industrial reliability and energy security with next-generation tank level monitoring solutions

- 11.4.6 REST OF ASIA PACIFIC

- 11.5 REST OF WORLD

- 11.5.1 AFRICA

- 11.5.1.1 Government initiatives supporting industrial growth and modernization to stimulate demand

- 11.5.2 MIDDLE EAST

- 11.5.2.1 Accelerating adoption of tank level monitoring systems in industries

- 11.5.3 SOUTH AMERICA

- 11.5.3.1 Rapid industrial growth and increasing investments to drive adoption of tank level monitoring systems

- 11.5.1 AFRICA

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2023-2025

- 12.3 REVENUE ANALYSIS, 2020-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- 12.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.5.5.1 Company footprint

- 12.5.5.2 Region footprint

- 12.5.5.3 End user footprint

- 12.5.5.4 Component footprint

- 12.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 RESPONSIVE COMPANIES

- 12.6.3 DYNAMIC COMPANIES

- 12.6.4 STARTING BLOCKS

- 12.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.6.5.1 Detailed list of key startup/SMEs

- 12.6.5.2 Competitive benchmarking of key startup/SMEs

- 12.7 COMPETITIVE SCENARIO

- 12.7.1 PRODUCT LAUNCHES

- 12.7.2 DEALS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 EMERSON ELECTRIC CO.

- 13.1.1.1 Business overview

- 13.1.1.2 Products offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths/Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses/Competitive threats

- 13.1.2 HONEYWELL INTERNATIONAL INC.

- 13.1.2.1 Business overview

- 13.1.2.2 Products offered

- 13.1.2.3 MnM view

- 13.1.2.3.1 Key strengths/Right to win

- 13.1.2.3.2 Strategic choices

- 13.1.2.3.3 Weaknesses/Competitive threats

- 13.1.3 SIEMENS

- 13.1.3.1 Business overview

- 13.1.3.2 Products offered

- 13.1.3.3 MnM view

- 13.1.3.3.1 Key strengths/Right to win

- 13.1.3.3.2 Strategic choices

- 13.1.3.3.3 Weaknesses/Competitive threats

- 13.1.4 ENDRESS+HAUSER GROUP SERVICES AG

- 13.1.4.1 Business overview

- 13.1.4.2 Products offered

- 13.1.4.3 MnM view

- 13.1.4.3.1 Key strengths/Right to win

- 13.1.4.3.2 Strategic choices

- 13.1.4.3.3 Weaknesses/Competitive threats

- 13.1.5 SCHNEIDER ELECTRIC

- 13.1.5.1 Business overview

- 13.1.5.2 Products offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Deals

- 13.1.5.4 MnM view

- 13.1.5.4.1 Key strengths/Right to win

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses/Competitive threats

- 13.1.6 GRACO INC.

- 13.1.6.1 Business overview

- 13.1.6.2 Products offered

- 13.1.7 DG INTERNATIONAL INC

- 13.1.7.1 Business overview

- 13.1.7.2 Products offered

- 13.1.8 OTODATA WIRELESS NETWORK

- 13.1.8.1 Business overview

- 13.1.8.2 Products offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Deals

- 13.1.9 VEGA

- 13.1.9.1 Business overview

- 13.1.9.2 Products offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Product launches

- 13.1.10 PIUSI S.P.A

- 13.1.10.1 Business overview

- 13.1.10.2 Products offered

- 13.1.11 GAUGING SYSTEMS INC.

- 13.1.11.1 Business overview

- 13.1.11.2 Products offered

- 13.1.12 BANNER ENGINEERING CORP.

- 13.1.12.1 Business overview

- 13.1.12.2 Products offered

- 13.1.13 THE VEEDER-ROOT COMPANY

- 13.1.13.1 Business overview

- 13.1.13.2 Products offered

- 13.1.13.3 Recent developments

- 13.1.13.3.1 Product launches

- 13.1.14 VAREC, INC.

- 13.1.14.1 Business overview

- 13.1.14.2 Products offered

- 13.1.15 OMNTEC MFG., INC.

- 13.1.15.1 Business overview

- 13.1.15.2 Products offered

- 13.1.1 EMERSON ELECTRIC CO.

- 13.2 OTHER PLAYERS

- 13.2.1 PNEUMERCATOR

- 13.2.2 SKYBITZ INC.

- 13.2.3 ROCHESTER SENSORS

- 13.2.4 RUGGED TELEMETRY

- 13.2.5 PULSA

- 13.2.6 SCHMITT INDUSTRIES INC.

- 13.2.7 ORIEL SYSTEMS LIMITED

- 13.2.8 MOPEKA PRODUCTS, LLC

- 13.2.9 TANKSCAN

- 13.2.10 INPRO GROUP

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS