|

시장보고서

상품코드

1826563

세라믹 타일 시장 : 유형별, 용도별, 최종 용도 부문별, 마무리별, 건설 유형별, 지역별 - 예측(-2030년)Ceramic Tiles Market by Type (Porcelain, Ceramic), Application (Floor Tiles, Internal Wall Tiles, External Wall Tiles), End-use Sector (Residential, Non-residential), Finish (Matt, Gloss), Construction Type, and Region - Global Forecast to 2030 |

||||||

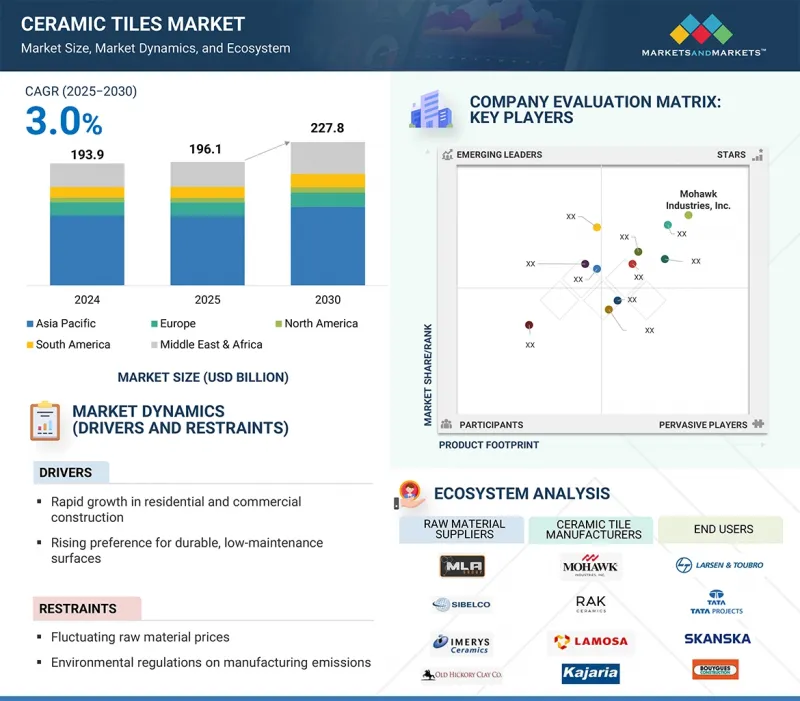

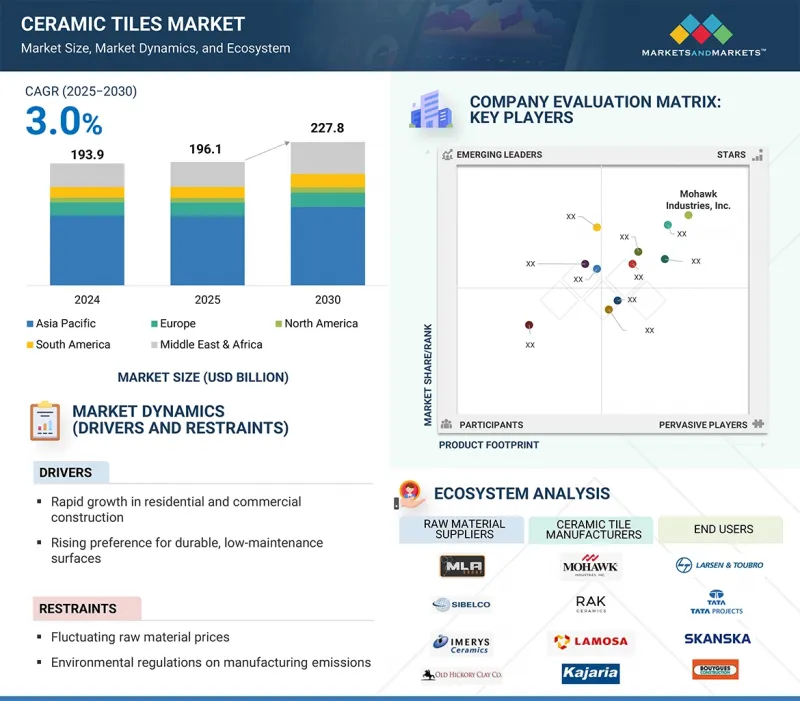

세계의 세라믹 타일 시장 규모는 2025년 1,962억 달러에서 2030년까지 2,278억 달러에 이르고, 예측 기간에 CAGR로 3.0%의 성장이 전망됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2021-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 100만 달러, 100만 평방미터 |

| 부문 | 유형, 용도, 최종 용도 부문, 지역 |

| 대상 지역 | 북미, 아시아태평양, 유럽, 중동 및 아프리카, 남미 |

세라믹 타일 시장은 제조 기술 혁신, 도시화, 인프라 개발, 내구성이 뛰어나고 스타일리시하며 유지 보수가 적은 건축자재에 대한 소비자 수요 증가로 인해 성장하고 있습니다. 또한, 지속 가능한 건축법에 대한 관심과 가계 소득 증가는 시장 성장을 더욱 촉진하고 있습니다.

유형별로는 세라믹 타일이 예측 기간 동안 큰 시장 점유율을 차지할 것으로 예측됩니다.

세라믹 타일은 뛰어난 내구성, 내수성, 다용도성으로 세라믹 타일을 능가합니다. 세라믹 타일은 고밀도 점토로 만들어져 고온에서 소성됩니다. 이 타일은 다공성이 적고 습기, 얼룩, 마모에 강해 유동인구가 많은 장소나 실내외에서 사용하기에 적합합니다. 그 강도와 긴 수명은 장기적인 바닥재 및 표면재 솔루션을 찾는 소비자를 끌어들이고 있습니다.

용도별로는 바닥재 부문이 2024년 큰 시장 점유율을 차지했습니다.

2024년, 바닥재 부문이 세라믹 타일 시장을 장악했습니다. 이러한 장점은 고유한 내구성과 유지보수의 용이성으로 인해 유동인구가 많은 곳에서 선호되는 선택이 되고 있습니다. 습기, 얼룩, 스크래치에 강해 내구성과 위생이 중요한 주방, 욕실, 상업공간에 특히 유리합니다.

최종 용도별로는 주택 부문이 예측 기간 동안 가장 큰 시장 점유율을 차지할 것으로 예측됩니다.

매력적이고 기능적인 바닥재와 벽면 옵션에 대한 강한 수요로 인해 주거 부문이 세라믹 타일 시장을 주도하고 있습니다. 세라믹 타일은 내구성이 뛰어나고, 관리가 쉽고, 디자인이 풍부해 많은 사람들이 선택하는 소재입니다. 이 타일은 주방, 욕실, 거실 등 다양한 공간에 적합합니다. 소비자들이 생활공간을 새롭게 꾸미고 맞춤화하는 것을 목적으로 하는 주택 리노베이션 트렌드가 수요를 크게 끌어올리고 있습니다. 또한, 세라믹 타일의 저렴한 가격과 가용성은 많은 가정에 매력적인 선택이 되고 있습니다. 편안하고 스타일리시한 주택 인테리어에 대한 관심이 시장을 주도하고 있습니다.

지역별로는 중동 및 아프리카가 예측 기간 동안 가장 높은 성장률을 나타낼 것으로 보입니다.

중동 및 아프리카는 세라믹 타일의 가장 빠르게 성장하는 시장입니다. 사우디아라비아와 아랍에미리트와 같은 국가에서는 대규모 프로젝트가 진행 중이며, 중동 및 아프리카의 건설 부문은 호황을 누리고 있습니다. 이들 국가는 인프라 개발, 도시 확장, 대규모 프로젝트에 많은 투자를 하고 있습니다. 여기에는 고급 공동주택, 상업시설, 공공시설 등이 포함됩니다. 이러한 건설 활동의 급증은 내구성, 미적 매력, 다재다능함으로 평가받는 세라믹 타일에 대한 높은 수요를 촉진하고 있습니다. 이 지역은 도시 지역의 현대화와 생활 수준 향상에 주력하고 있으며, 세라믹 타일 시장을 더욱 강화하고 있습니다.

세계의 세라믹 타일 시장에 대해 조사 분석했으며, 주요 촉진요인과 억제요인, 경쟁 구도, 향후 동향 등의 정보를 전해드립니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요 지견

- 세라믹 타일 시장 기업에 있어서 매력적인 기회

- 세라믹 타일 시장 : 유형별

- 세라믹 타일 시장 : 용도별

- 세라믹 타일 시장 : 최종 용도별

- 세라믹 타일 시장 : 지역별, 유형별

- 세라믹 타일 시장 : 국가별

제5장 시장 개요

- 서론

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

제6장 산업 동향

- 고객의 비즈니스에 영향을 미치는 동향/혼란

- 가격 결정 분석

- 주요 기업의 평균 판매 가격 : 유형별

- 평균 판매 가격 동향 : 지역별

- 밸류체인 분석

- 생태계 분석

- 기술 분석

- 주요 기술

- 보완 기술

- 인접 기술

- 특허 분석

- 서론

- 조사 방법

- 세라믹 타일에 관한 특허

- 무역 분석

- 수출 시나리오(HS코드 6904)

- 수입 시나리오(HS코드 6904)

- 수출 시나리오(HS코드 6907)

- 수입 시나리오(HS코드 6907)

- 주요 컨퍼런스 및 이벤트(2025년-2026년)

- 관세 및 규제 상황

- 관세 분석

- 규제기관, 정부기관, 기타 조직

- 세라믹 타일 시장 규제

- Porter의 Five Forces 분석

- 주요 이해관계자와 구입 기준

- 사례 연구 분석

- 투자 및 자금조달 시나리오

- 세라믹 타일 시장에 대한 생성형 AI/AI의 영향

- 거시경제 지표

- 서론

- GDP 동향과 예측

- 산업(건설 포함), 부가가치(GDP비)

제7장 세라믹 타일 시장 : 마무리별

- 서론

- 매트

- 광택

제8장 세라믹 타일 시장 : 건설 유형별

- 서론

- 신축

- 개보수

제9장 세라믹 타일 시장 : 용도별

- 서론

- 바닥재

- 내벽

- 외벽

- 기타 용도

제10장 세라믹 타일 시장 : 유형별

- 서론

- 자기질

- 도기질

제11장 세라믹 타일 시장 : 최종 용도별

- 서론

- 주택

- 비주택

제12장 세라믹 타일 시장 : 지역별

- 서론

- 아시아태평양

- 중국

- 인도

- 일본

- 베트남

- 태국

- 인도네시아

- 기타 아시아태평양

- 유럽

- 독일

- 영국

- 프랑스

- 러시아

- 스페인

- 이탈리아

- 기타 유럽

- 북미

- 미국

- 캐나다

- 멕시코

- 중동 및 아프리카

- GCC 국가

- 튀르키예

- 이집트

- 이란

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

제13장 경쟁 구도

- 개요

- 주요 시장 진출기업의 전략

- 시장 점유율 분석

- 매출 분석

- 기업 평가와 재무 지표

- 제품/브랜드 비교

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업 평가 매트릭스 : 스타트업/중소기업(2024년)

- 경쟁 시나리오와 동향

제14장 기업 개요

- 주요 기업

- MOHAWK INDUSTRIES, INC.

- GRUPO LAMOSA

- RAK CERAMICS

- SIAM CEMENT PUBLIC COMPANY LIMITED

- PRISM JOHNSON LIMITED

- KAJARIA CERAMICS

- PAMESA CERAMICA

- SOMANY CERAMICS LIMITED

- CERAMICA CARMELO FIOR

- CEDASA GROUP

- ASIAN GRANITO INDIA LTD.(AGL)

- 기타 기업

- STN CERAMICA

- PT ARWANA CITRAMULIA TBK

- CERSANIT S.A.

- LASSELSBERGER GROUP GMBH

- NITCO

- WHITE HORSE CERAMIC INDUSTRIES SDN BHD

- CERAMIC INDUSTRIES LIMITED

- KALE GROUP

- ELIZABETH GROUP

- SAUDI CERAMICS

- INTERCERAMIC

- VICTORIA PLC

- HALCON CERAMICAS

- PORTOBELLO S.A.

- VIGLACERA CORPORATION

- 스타트업/기술 제공업체

- TILES WALE

- KORE ITALIA

- SACMI GROUP

제15장 인접 시장과 관련 시장

- 서론

- 라그쥬아리비닐 타일(LVT) 시장

- 시장의 정의

- 시장 개요

- 라그쥬아리비닐 타일(LVT) 시장 : 유형별

- 라그쥬아리비닐 타일(LVT) 시장 : 최종 용도별

- 라그쥬아리비닐 타일(LVT) 시장 : 유통 채널별

- 라그쥬아리비닐 타일(LVT) 시장 : 제품 유형별

제16장 부록

LSH 25.10.02The global ceramic tiles market size is projected to grow from USD 196.2 billion in 2025 to USD 227.8 billion by 2030, at a CAGR of 3.0% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million)/ Volume (Million square meters) |

| Segments | Type, Application, End-use sector, and Region |

| Regions covered | North America, Asia Pacific, Europe, Middle East & Africa, and South America |

The ceramic tiles market is expanding due to technological innovations in manufacturing, urbanization, infrastructure development, and increasing consumer demand for durable, stylish, and low-maintenance building materials. Additionally, the focus on sustainable construction practices and rising household incomes are further propelling market growth.

By type, porcelain segment to account for major market share during forecast period

Porcelain tiles outshine ceramic tiles in the market because of their superior durability, water resistance, and versatility. They are made from denser clay and fired at higher temperatures. These tiles are less porous and more resistant to moisture, stains, and wear, making them perfect for high-traffic areas and both indoor and outdoor uses. Their strength and longevity attract consumers looking for long-term flooring and surface solutions.

By application, flooring segment accounted for major market share in 2024

In 2024, the flooring segment dominated the ceramic tiles market. This dominance is due to the inherent durability and ease of maintenance, which make them a preferred choice for high-traffic areas. Their resistance to moisture, stains, and scratches makes them especially advantageous for kitchens, bathrooms, and commercial spaces where durability and hygiene are vital.

By end-use sector, residential segment to account for the largest market share during forecast period

The residential sector leads the ceramic tiles market because of the strong demand for attractive and functional flooring and wall options in homes. People often choose ceramic tiles for their durability, easy upkeep, and wide variety of designs. These tiles are perfect for spaces like kitchens, bathrooms, and living rooms. The rising trend of home renovation projects significantly boosts demand, as consumers aim to refresh and customize their living areas. Additionally, the affordability and accessibility of ceramic tiles make them an attractive choice for many households. The focus on creating comfortable and stylish home interiors propels the market forward.

By region, Middle East & Africa to register highest growth rate during forecast period

The Middle East & Africa is the fastest-growing market for ceramic tiles. The construction sector in MEA is thriving, with significant projects underway in countries like Saudi Arabia and the UAE. These nations are investing heavily in infrastructure development, urban expansion, and large-scale projects. These include luxury residential complexes, commercial spaces, and public facilities. This surge in construction activity drives high demand for ceramic tiles, valued for their durability, aesthetic appeal, and versatility. The region's focus on modernizing urban areas and enhancing living standards further strengthens the ceramic tiles market.

By Company: Tier1: 40%, Tier 2: 25%, Tier3: 4: 35%

By Designation: C-Level: 35%, Director Level: 30%, Others: 35%

By Region: North America: 25%, Europe: 20%, Asia Pacific: 45%, South America: 5%, and Middle East & Africa: 5%.

Companies Covered:

Mohawk Industries Inc. (US), Grupo Lamosa (Mexico), Pamesa Ceramica (Spain), RAK Ceramics (UAE), Siam Cement Public Company Limited (Thailand), Kajaria Ceramics (India), Ceramica Carmelo For (Brazil), and others are key players in the ceramic tiles market.

Research Coverage

The market study examines the ceramic tiles industry across various segments. It aims to estimate the market size and growth potential in different segments based on type, application, end-use sector, finish, construction type, and region. The study also provides a detailed competitive analysis of key market players, including their company profiles, insights into their products and services, recent developments, and major growth strategies to strengthen their position in the ceramic tiles market.

Key Benefits of Buying Report

The report is expected to assist market leaders and new entrants in approximating the revenue figures of the overall ceramic tiles market, along with its segments and sub-segments. It aims to help stakeholders understand the competitive landscape, gain insights to enhance their business positions, and develop appropriate go-to-market strategies. Additionally, the report seeks to provide stakeholders with an understanding of the market's dynamics, including key drivers, challenges, and opportunities.

The report provides insights into the following points:

- Analysis of key drivers (Urbanization and infrastructure development, increasing population), restraints (Volatile raw material prices), opportunities (Strong demand from Asia Pacific, rising demand in emerging markets), and challenges (Intense competition) influencing the growth of the ceramic tiles market.

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and product launches in the ceramic tiles market

- Market Development: Comprehensive information about lucrative markets - the report analyses the ceramic tiles market across varied regions

Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the ceramic tiles market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Mohawk Industries Inc. (US), Grupo Lamosa (Mexico), Pamesa Ceramica (Spain), RAK Ceramics (UAE), Siam Cement Public Company Limited (Thailand), Kajaria Ceramics (India), Ceramica Carmelo For (Brazil) among others in the ceramic tiles market. The report also helps stakeholders understand the pulse of the ceramic tiles market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primaries

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.3 BASE NUMBER CALCULATION

- 2.4 MARKET FORECAST APPROACH

- 2.4.1 SUPPLY SIDE

- 2.4.2 DEMAND SIDE

- 2.5 DATA TRIANGULATION

- 2.6 FACTOR ANALYSIS

- 2.7 RESEARCH ASSUMPTIONS

- 2.8 RISKS ASSESSMENT

- 2.9 RESEARCH LIMITATIONS

- 2.10 GROWTH RATE ASSUMPTIONS/FORECAST

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN CERAMIC TILES MARKET

- 4.2 CERAMIC TILES MARKET, BY TYPE

- 4.3 CERAMIC TILES MARKET, BY APPLICATION

- 4.4 CERAMIC TILES MARKET, BY END-USE SECTOR

- 4.5 CERAMIC TILES MARKET, BY REGION AND TYPE

- 4.6 CERAMIC TILES MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Aesthetic appeal and functional durability fuel demand for large-format tiles

- 5.2.1.2 Increasing population & urbanization

- 5.2.1.3 Growing investments in construction industry

- 5.2.1.4 Rising number of renovation activities

- 5.2.1.5 Increasing industrialization

- 5.2.2 RESTRAINTS

- 5.2.2.1 Volatile raw material prices

- 5.2.2.2 Increasing regulations, tariffs, and anti-dumping measures

- 5.2.2.3 Combined effect of recession and Russia-Ukraine conflict in Europe

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising trend of office-to-residential conversion

- 5.2.3.2 Introduction of 3D tiles and digital printing technologies

- 5.2.3.3 Rapidly progressing organized retail sector

- 5.2.3.4 Increase in demand from emerging economies

- 5.2.4 CHALLENGES

- 5.2.4.1 Extremely competitive market

- 5.2.4.2 Gas crisis in different regions

- 5.2.1 DRIVERS

6 INDUSTRY TRENDS

- 6.1 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.2 PRICING ANALYSIS

- 6.2.1 AVERAGE SELLING PRICE OF KEY PLAYERS, BY TYPE

- 6.2.2 AVERAGE SELLING PRICE TREND, BY REGION

- 6.3 VALUE CHAIN ANALYSIS

- 6.4 ECOSYSTEM ANALYSIS

- 6.5 TECHNOLOGY ANALYSIS

- 6.5.1 KEY TECHNOLOGIES

- 6.5.1.1 Digital printing

- 6.5.1.2 Spray drying

- 6.5.2 COMPLEMENTARY TECHNOLOGIES

- 6.5.2.1 Adhesives and grouts

- 6.5.2.2 Smart tiles

- 6.5.3 ADJACENT TECHNOLOGIES

- 6.5.3.1 3D printing

- 6.5.3.2 Germ-free tiles

- 6.5.1 KEY TECHNOLOGIES

- 6.6 PATENT ANALYSIS

- 6.6.1 INTRODUCTION

- 6.6.2 METHODOLOGY

- 6.6.3 PATENTS RELATED TO CERAMIC TILES

- 6.7 TRADE ANALYSIS

- 6.7.1 EXPORT SCENARIO (HS CODE 6904)

- 6.7.2 IMPORT SCENARIO (HS CODE 6904)

- 6.7.3 EXPORT SCENARIO (HS CODE 6907)

- 6.7.4 IMPORT SCENARIO (HS CODE 6907)

- 6.8 KEY CONFERENCES AND EVENTS, 2025-2026

- 6.9 TARIFF AND REGULATORY LANDSCAPE

- 6.9.1 TARIFF ANALYSIS

- 6.9.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.9.3 REGULATIONS IN CERAMIC TILES MARKET

- 6.9.3.1 EN 14411 - (CE Certification for Ceramic tiles)

- 6.9.3.2 ANSI A137

- 6.10 PORTER'S FIVE FORCES ANALYSIS

- 6.10.1 THREAT OF NEW ENTRANTS

- 6.10.2 THREAT OF SUBSTITUTES

- 6.10.3 BARGAINING POWER OF SUPPLIERS

- 6.10.4 BARGAINING POWER OF BUYERS

- 6.10.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.11 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.11.2 BUYING CRITERIA

- 6.12 CASE STUDY ANALYSIS

- 6.12.1 CASE STUDY 1: DEAKINBIO'S SUSTAINABLE BIO-BASED TILES

- 6.12.2 CASE STUDY 2: DESIGN WITH 1M X 1M LARGE PORCELAIN TILES

- 6.12.3 CASE STUDY 3: ENHANCED OUTDOOR SPACES WITH OUTDOOR PORCELAIN TILES

- 6.13 INVESTMENT AND FUNDING SCENARIO

- 6.14 IMPACT OF GEN AI/AI ON CERAMIC TILES MARKET

- 6.14.1 INTRODUCTION

- 6.15 MACROECONOMIC INDICATORS

- 6.15.1 INTRODUCTION

- 6.15.2 GDP TRENDS AND FORECASTS

- 6.15.3 INDUSTRY (INCLUDING CONSTRUCTION), VALUE ADDED (% OF GDP)

7 CERAMIC TILES MARKET, BY FINISH

- 7.1 INTRODUCTION

- 7.2 MATT

- 7.3 GLOSS

8 CERAMIC TILES MARKET, BY CONSTRUCTION TYPE

- 8.1 INTRODUCTION

- 8.2 NEW CONSTRUCTION

- 8.3 RENOVATION

9 CERAMIC TILES MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 FLOORING

- 9.2.1 LOW MAINTENANCE REQUIREMENTS AND HIGH DURABILITY TO DRIVE DEMAND

- 9.3 INTERNAL WALLS

- 9.3.1 WIDE-SCALE USE IN HOMES, OFFICES, HOSPITALS, AND LABORATORIES TO DRIVE MARKET

- 9.4 EXTERNAL WALLS

- 9.4.1 USE OF CERAMIC TILES IN EXTERIOR CLADDINGS TO DRIVE MARKET

- 9.5 OTHER APPLICATIONS

10 CERAMIC TILES MARKET, BY TYPE

- 10.1 INTRODUCTION

- 10.2 PORCELAIN

- 10.2.1 LOW WATER ABSORPTION RATE OF 0.5% OR BELOW TO DRIVE DEMAND

- 10.3 CERAMIC

- 10.3.1 ASSOCIATED COST-EFFECTIVENESS AND DURABILITY TO FUEL DEMAND

11 CERAMIC TILES MARKET, BY END-USE SECTOR

- 11.1 INTRODUCTION

- 11.2 RESIDENTIAL

- 11.2.1 EXPANDING RESIDENTIAL SECTOR TO DRIVE DEMAND

- 11.3 NON-RESIDENTIAL

- 11.3.1 INCREASING SPENDING ON CONSTRUCTION OF OFFICES AND OTHER COMMERCIAL & INSTITUTIONAL SPACES TO FUEL DEMAND

- 11.3.1.1 Commercial

- 11.3.1.2 Institutional and healthcare spaces

- 11.3.1.3 Public facilities

- 11.3.1 INCREASING SPENDING ON CONSTRUCTION OF OFFICES AND OTHER COMMERCIAL & INSTITUTIONAL SPACES TO FUEL DEMAND

12 CERAMIC TILES MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 ASIA PACIFIC

- 12.2.1 CHINA

- 12.2.1.1 Expanding construction industry to drive demand

- 12.2.2 INDIA

- 12.2.2.1 Government-led initiatives to promote sanitation and infrastructure development to fuel demand

- 12.2.3 JAPAN

- 12.2.3.1 Government initiatives and private investments to revitalize construction industry to drive demand

- 12.2.4 VIETNAM

- 12.2.4.1 Easy availability of raw materials to drive market

- 12.2.5 THAILAND

- 12.2.5.1 Economic stability and increasing residential construction to fuel demand

- 12.2.6 INDONESIA

- 12.2.6.1 High growth of construction industry to propel market

- 12.2.7 REST OF ASIA PACIFIC

- 12.2.1 CHINA

- 12.3 EUROPE

- 12.3.1 GERMANY

- 12.3.1.1 Rise in non-residential construction to drive demand

- 12.3.2 UK

- 12.3.2.1 Decline in residential and non-residential construction projects to hamper demand

- 12.3.3 FRANCE

- 12.3.3.1 Bleak prospects for market growth due to housing crisis

- 12.3.4 RUSSIA

- 12.3.4.1 Growing construction industry to drive market

- 12.3.5 SPAIN

- 12.3.5.1 High export of ceramic tiles to fuel market growth

- 12.3.6 ITALY

- 12.3.6.1 Increase in new non-residential surface construction to fuel market growth

- 12.3.7 REST OF EUROPE

- 12.3.1 GERMANY

- 12.4 NORTH AMERICA

- 12.4.1 US

- 12.4.1.1 High infrastructure development and technological advancements to drive market

- 12.4.2 CANADA

- 12.4.2.1 Rising spending on residential and non-residential construction activities to fuel demand

- 12.4.3 MEXICO

- 12.4.3.1 Slow growth of construction industry due to slow economic recovery to hamper market growth

- 12.4.1 US

- 12.5 MIDDLE EAST & AFRICA

- 12.5.1 GCC COUNTRIES

- 12.5.1.1 UAE

- 12.5.1.1.1 Rise in construction activities to drive market

- 12.5.1.2 Saudi Arabia

- 12.5.1.2.1 Government-led initiatives for infrastructure development to propel market

- 12.5.1.3 Other GCC countries

- 12.5.1.1 UAE

- 12.5.2 TURKEY

- 12.5.2.1 Rising use of advanced tile production technologies to drive market

- 12.5.3 EGYPT

- 12.5.3.1 Increasing investments in reconstruction activities to drive market

- 12.5.4 IRAN

- 12.5.4.1 Delayed construction projects to restrain demand

- 12.5.5 REST OF MIDDLE EAST & AFRICA

- 12.5.1 GCC COUNTRIES

- 12.6 SOUTH AMERICA

- 12.6.1 BRAZIL

- 12.6.1.1 High adoption of porcelain tiles and recovery of construction industry to fuel market growth

- 12.6.2 ARGENTINA

- 12.6.2.1 Rising public-private partnerships in construction industry to drive demand

- 12.6.3 REST OF SOUTH AMERICA

- 12.6.1 BRAZIL

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 KEY PLAYER STRATEGIES

- 13.3 MARKET SHARE ANALYSIS

- 13.4 REVENUE ANALYSIS

- 13.5 COMPANY VALUATION AND FINANCIAL METRICS

- 13.6 PRODUCT/BRAND COMPARISON

- 13.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.7.1 STARS

- 13.7.2 EMERGING LEADERS

- 13.7.3 PERVASIVE PLAYERS

- 13.7.4 PARTICIPANTS

- 13.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.7.5.1 Company footprint

- 13.7.5.2 Region footprint

- 13.7.5.3 Type footprint

- 13.7.5.4 Application footprint

- 13.7.5.5 End-use sector footprint

- 13.7.5.6 Finish footprint

- 13.7.5.7 Construction type footprint

- 13.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.8.1 PROGRESSIVE COMPANIES

- 13.8.2 RESPONSIVE COMPANIES

- 13.8.3 DYNAMIC COMPANIES

- 13.8.4 STARTING BLOCKS

- 13.8.5 COMPETITIVE BENCHMARKING: KEY STARTUP/SMES, 2024

- 13.8.5.1 Detailed list of key startups/SMEs

- 13.8.5.2 Competitive benchmarking of startups/SMEs

- 13.9 COMPETITIVE SCENARIOS AND TRENDS

- 13.9.1 PRODUCT LAUNCHES

- 13.9.2 DEALS

- 13.9.3 EXPANSIONS

- 13.9.4 OTHER DEVELOPMENTS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 MOHAWK INDUSTRIES, INC.

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Solutions/Services offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Product launches

- 14.1.1.3.2 Deals

- 14.1.1.3.3 Expansions

- 14.1.1.3.4 Other developments

- 14.1.1.4 MnM view

- 14.1.1.4.1 Right to win

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses & competitive threats

- 14.1.2 GRUPO LAMOSA

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Solutions/Services offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Deals

- 14.1.2.4 MnM view

- 14.1.2.4.1 Right to win

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses & competitive threats

- 14.1.3 RAK CERAMICS

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Solutions/Services offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Product launches

- 14.1.3.3.2 Deals

- 14.1.3.3.3 Expansions

- 14.1.3.3.4 Other developments

- 14.1.3.4 MnM view

- 14.1.3.4.1 Right to win

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses & competitive threats

- 14.1.4 SIAM CEMENT PUBLIC COMPANY LIMITED

- 14.1.4.1 Business overview

- 14.1.4.2 Products/Solutions/Services offered

- 14.1.4.3 Brands offered

- 14.1.4.4 Recent developments

- 14.1.4.5 Expansions

- 14.1.4.6 MnM view

- 14.1.4.6.1 Right to win

- 14.1.4.6.2 Strategic choices

- 14.1.4.6.3 Weaknesses & competitive threats

- 14.1.5 PRISM JOHNSON LIMITED

- 14.1.5.1 Business overview

- 14.1.5.2 Products/Solutions/Services offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Expansions

- 14.1.5.4 MnM view

- 14.1.5.4.1 Right to win

- 14.1.5.4.2 Strategic choices

- 14.1.5.4.3 Weaknesses & competitive threats

- 14.1.6 KAJARIA CERAMICS

- 14.1.6.1 Business overview

- 14.1.6.2 Products/Solutions/Services offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Product launches

- 14.1.6.3.2 Expansions

- 14.1.6.4 MnM view

- 14.1.6.4.1 Right to win

- 14.1.6.4.2 Strategic choices

- 14.1.6.4.3 Weaknesses & competitive threats

- 14.1.7 PAMESA CERAMICA

- 14.1.7.1 Business overview

- 14.1.7.2 Products/Solutions/Services offered

- 14.1.7.3 Recent developments

- 14.1.7.3.1 Deals

- 14.1.7.4 Expansions

- 14.1.7.5 MnM view

- 14.1.8 SOMANY CERAMICS LIMITED

- 14.1.8.1 Business overview

- 14.1.8.2 Products/Solutions/Services offered

- 14.1.8.3 Recent developments

- 14.1.8.3.1 Product launches

- 14.1.8.3.2 Expansions

- 14.1.8.4 MnM view

- 14.1.9 CERAMICA CARMELO FIOR

- 14.1.9.1 Business overview

- 14.1.9.2 Products/solutions/services offered

- 14.1.9.3 Recent developments

- 14.1.9.3.1 Product launches

- 14.1.9.3.2 Expansions

- 14.1.9.4 MnM view

- 14.1.10 CEDASA GROUP

- 14.1.10.1 Business overview

- 14.1.10.2 Products/solutions/services offered

- 14.1.10.3 Recent developments

- 14.1.10.3.1 Product launches

- 14.1.10.4 MnM view

- 14.1.11 ASIAN GRANITO INDIA LTD. (AGL)

- 14.1.11.1 Business overview

- 14.1.11.2 Products/Solutions/Services offered

- 14.1.11.3 Recent developments

- 14.1.11.3.1 Product launches

- 14.1.11.3.2 Deals

- 14.1.11.3.3 Expansions

- 14.1.11.4 MnM view

- 14.1.1 MOHAWK INDUSTRIES, INC.

- 14.2 OTHER PLAYERS

- 14.2.1 STN CERAMICA

- 14.2.2 PT ARWANA CITRAMULIA TBK

- 14.2.3 CERSANIT S.A.

- 14.2.4 LASSELSBERGER GROUP GMBH

- 14.2.5 NITCO

- 14.2.6 WHITE HORSE CERAMIC INDUSTRIES SDN BHD

- 14.2.7 CERAMIC INDUSTRIES LIMITED

- 14.2.8 KALE GROUP

- 14.2.9 ELIZABETH GROUP

- 14.2.10 SAUDI CERAMICS

- 14.2.11 INTERCERAMIC

- 14.2.12 VICTORIA PLC

- 14.2.13 HALCON CERAMICAS

- 14.2.14 PORTOBELLO S.A.

- 14.2.15 VIGLACERA CORPORATION

- 14.3 STARTUPS/TECHNOLOGY PROVIDERS

- 14.3.1 TILES WALE

- 14.3.2 KORE ITALIA

- 14.3.3 SACMI GROUP

15 ADJACENT & RELATED MARKET

- 15.1 INTRODUCTION

- 15.2 LUXURY VINYL TILES MARKET

- 15.2.1 MARKET DEFINITION

- 15.2.2 MARKET OVERVIEW

- 15.2.3 LUXURY VINYL TILES MARKET, BY TYPE

- 15.3 LUXURY VINYL TILES MARKET, BY END-USE SECTOR

- 15.4 LUXURY VINYL TILES MARKET, BY DISTRIBUTION CHANNEL

- 15.5 LUXURY VINYL TILES MARKET, BY PRODUCT TYPE

- 15.5.1 LUXURY VINYL TILES MARKET, BY REGION

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS