|

시장보고서

상품코드

1826564

항공우주 재료 시장(-2030년) : 유형(알루미늄 합금, 스틸 합금, 티타늄 합금, 초합금, 복합재료), 항공기 유형(민간 항공기, 비즈니스&일반 항공기, 헬리콥터), 지역별Aerospace Materials Market by Type (Aluminum Alloys, Steel Alloys, Titanium Alloys, Super Alloys, Composite Materials), Aircraft Type (Commercial Aircraft, Business & General Aviation, Helicopters), and Region - Global Forecast to 2030 |

||||||

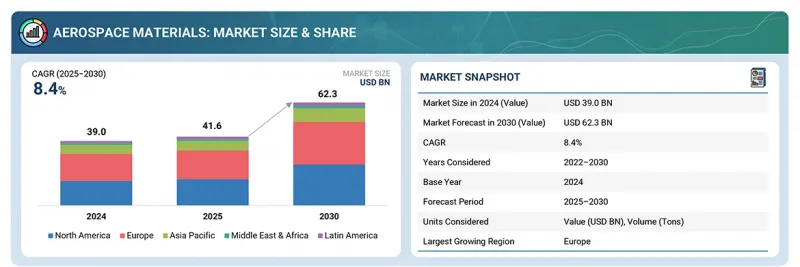

항공우주 재료 시장 규모는 2025년 430억 달러에서 2025-2030년 CAGR 7.7%로 성장을 지속하여, 2030년에는 623억 달러에 이를 것으로 추정되고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2022-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 금액(달러), 킬로톤 |

| 부문 | 유형, 항공기 유형, 용도, 지역별 |

| 대상 지역 | 유럽, 북미, 아시아태평양, 남미, 중동 및 아프리카 |

알루미늄 부문은 비용 효율성, 강도 대 중량 성능의 독특한 균형, 민간 항공기, 국방 항공기, 비즈니스 항공기에 대한 광범위한 적용 가능성으로 인해 시장에서 가장 큰 점유율을 차지하고 있습니다. 알루미늄 합금은 기체, 동체 구조, 날개, 리브, 패스너 등에 광범위하게 사용되고 있으며, 티타늄이나 복합재에 비해 훨씬 더 많은 수요가 있습니다. 알루미늄의 확립된 공급망, 재활용성, 수리 용이성, 수년간의 규제 당국의 인증은 알루미늄의 우위를 더욱 강화하여 OEM과 MRO 모두 알루미늄을 선택하는 재료가 되었습니다. 알루미늄의 규모 우위는 항공기 생산 증가, 항공기 현대화, 애프터마켓 수요, 성능과 가치를 지속적으로 향상시키는 고강도 알루미늄 합금의 발전에 힘입어 이러한 성장의 상당 부분을 차지할 수 있었습니다.

''항공기 유형별로는 비즈니스 및 일반 항공 부문이 시장에서 두 번째로 큰 점유율을 차지한다''.

비즈니스 및 일반 항공 부문에는 개인 제트기, 전세 항공기, 터보프롭 항공기 등 다양한 항공기가 포함되며, 이는 전체적으로 고부가가치 재료에 대한 큰 수요를 창출하고 있습니다. 이러한 항공기는 일반적으로 안전, 편안함, 효율성에 대한 고객의 기대에 부합하는 우수한 성능, 내구성, 미학을 구현하기 위해 고급 알루미늄 합금, 티타늄, 복합재 등 프리미엄 품질의 재료를 필요로 합니다. 이 부문은 부유층 소유 증가, 기업용 제트기 이용, 특히 신흥 시장에서의 에어택시 및 전세기의 성장으로 인한 안정적인 수요의 혜택을 누리고 있습니다. 또한, 비즈니스 제트기의 경우 커스터마이징 및 애프터마켓 개조가 빈번하게 이루어지기 때문에 항공기 1대당 자재 소비량이 상업용 제트기에 비해 증가합니다. 연비 효율을 높이기 위한 경량 구조와 승객의 편안함을 높이기 위한 고급스러운 내장재에 대한 관심이 높아짐에 따라 비즈니스 및 일반 항공 부문은 금액 기준 2위를 유지하고 있습니다.

"유럽은 예측 기간 동안 가장 큰 시장으로 남을 전망"

유럽에서 항공우주 소재에 대한 수요 증가는 몇 가지 주요 요인에 의해 주도되고 있습니다. 여기에는 고성능 소재 연구개발에 대한 투자 확대, 우주 탐사 이니셔티브에 대한 정부 및 민간 지출 증가 등이 포함됩니다. 또한, 지역 관광 및 항공 여행 산업의 확대는 상업용 항공기 생산 증가를 촉진하여 복합재 수요를 더욱 증가시키고 있습니다. 유럽은 또한 Airbus, Rolls-Royce, Dassault Aviation과 같은 주요 항공우주 제조업체의 존재와 더불어 첨단 복합재 기술에 중점을 둔 연구 기관 및 혁신 센터의 탄탄한 네트워크를 갖춘 강력한 산업 기반의 혜택을 누리고 있습니다.

클린 스카이(Clean Sky), 호라이즌 유럽(Horizon Europe)과 같은 공동 프로그램도 차세대 경량화 및 지속 가능한 항공우주 소재 개발에 박차를 가하고 있습니다. 이러한 전략적 투자, 산업 역량, 혁신 기반이 결합되어 유럽은 항공우주 소재 성장의 선도적인 허브로서의 지위를 계속 유지하고 있습니다.

세계의 항공우주재료(Aerospace Materials) 시장을 조사했으며, 시장 개요, 시장 성장에 영향을 미치는 각종 영향요인 분석, 기술 및 특허 동향, 법 및 규제 환경, 사례 분석, 시장 규모 추이 및 예측, 각종 부문별/지역별/주요 국가별 상세 분석, 경쟁 구도, 주요 기업 개요 등의 정보를 정리하여 전해드립니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 프리미엄 인사이트

제5장 시장 개요

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

- Porter의 Five Forces 분석

- 주요 이해관계자와 구입 기준

- 에코시스템

- 가격 분석

- 밸류체인 분석

- 무역 분석

- 기술 분석

- 거시경제 전망

- 특허 분석

- 규제 상황

- 2025-2026년 주요 컨퍼런스 및 이벤트

- 사례 연구 분석

- 고객 사업에 영향을 미치는 동향/혼란

- 투자 및 자금조달 시나리오

- AI/생성형 AI가 항공우주 재료 시장에 미치는 영향

- 2025년 미국 관세의 영향-항공우주 재료 시장

제6장 항공우주 재료 시장 : 유형별

- 알루미늄 합금

- 복합재료

- 티타늄 합금

- 강철 합금

- 초합금

- 기타

제7장 항공우주 재료 시장 : 항공기 유형별

- 민간 항공기

- 단통로기

- 광폭동체 항공기

- 리저널 제트기

- 비즈니스 및 일반 항공

- 비즈니스 제트

- 피스톤 및 터보프롭

- 민간 헬리콥터

- 군용기

- 기타

- 무인항공기(UAV)

- 우주선

제8장 항공우주 재료 시장 : 용도별

- 외관

- 기체

- 엔진

- 낡개

- 로터 블레이드

- 테일 붐

- 인테리어

- 캐빈

- 샌드위치 패널

- 환경 제어 시스템(ECS) 덕트

제9장 항공우주 재료 시장 : 지역별

- 북미

- 유럽

- 아시아태평양

- 남미

- 중동 및 아프리카

- 유형별

- 항공기 유형별

- 용도별

- 국가별

제10장 경쟁 구도

- 개요

- 주요 시장 진출기업의 전략/강점

- 매출 분석

- 시장 점유율 분석

- 제품 비교

- 기업 평가 매트릭스 : 주요 기업

- 기업 평가 매트릭스 : 스타트업/중소기업

- 항공우주 재료 벤더 평가와 재무 지표

- 경쟁 시나리오

제11장 기업 개요

- 주요 기업

- HEXCEL CORPORATION

- TORAY INDUSTRIES, INC.

- TEIJIN LIMITED

- SGL CARBON

- MITSUBISHI CHEMICAL GROUP CORPORATION

- SYENSQO

- HUNTSMAN INTERNATIONAL LLC

- DUPONT DE NEMOURS, INC.

- SABIC

- ALCOA CORPORATION

- ATI

- VSMPO-AVISMA CORPORATION

- SWISS STEEL GROUP(SSG)

- CHINA ANSTEEL GROUP CORPORATION LIMITED

- PRECISION CASTPARTS CORP.

- 기타 기업

- ARRIS COMPOSITES, INC.

- VICTREX PLC

- ALBANY INTERNATIONAL CORPORATION

- CARPENTER TECHNOLOGY CORPORATION

- VOESTALPINE BOHLER EDELSTAHL GMBH

- OUTOKUMPU OYJ

- WESTERN SUPERCONDUCTING TECHNOLOGIES

- BAOJI TITANIUM INDUSTRY(BAOTI)

- KAISER ALUMINUM CORPORATION

- NOVELIS INC.

제12장 부록

LSH 25.10.10The aerospace materials market is estimated to be valued at USD 43.0 billion in 2025 and reach USD 62.3 billion by 2030, at a CAGR of 7.7% between 2025 and 2030.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Kiloton) |

| Segments | By Type, By Aircraft Type, By Application, and Region |

| Regions covered | Europe, North America, Asia Pacific, South America, Middle East, and Africa |

The aluminum segment accounts for the largest share of the aerospace materials market due to its unique balance of cost-effectiveness, strength-to-weight performance, and wide applicability across commercial, defense, and business aircraft. Aluminum alloys are extensively used in airframes, fuselage structures, wings, ribs, and fasteners, giving them far higher volume demand compared to titanium or composites. Their well-established supply chain, recyclability, ease of repair, and long-standing regulatory certification further reinforce aluminum's dominance, making it the material of choice for both OEMs and MROs. aluminum's scale advantage ensures it captures a significant portion of this growth, supported by rising aircraft production, fleet modernization, aftermarket demand, and advancements in high-strength aluminum alloys that continue to enhance performance and value.

''Business and general aviation segment accounts for the second-largest share of the aerospace materials market.''

Business and general aviation segment includes a wide fleet of private jets, charter aircraft, and turboprops, which collectively generate substantial demand for high-value materials. These aircraft typically require premium-quality materials such as advanced aluminum alloys, titanium, and composites to deliver superior performance, durability, and aesthetics tailored to customer expectations of safety, comfort, and efficiency. The segment benefits from steady demand driven by rising high-net-worth individual (HNWI) ownership, corporate jet usage, and growth in air taxi and charter services, especially in emerging markets. Furthermore, frequent customization and aftermarket retrofitting activities in business jets lead to higher per-aircraft material consumption in value terms compared to commercial fleets. Combined with increasing focus on lightweight structures for fuel efficiency and luxury interior materials for passenger experience, business and general aviation continues to hold the second-largest share of the overall aerospace materials market in terms of value.

"Europe is projected to remain the largest market for aerospace composites during the forecast period."

The growing demand for aerospace materials in Europe is driven by several key factors, including increased investment in high-performance material R&D and rising government and private spending on space exploration initiatives. Additionally, the expansion of the regional tourism and air travel industry is prompting higher production of commercial aircraft, further fueling composite demand. Europe also benefits from a strong industrial base, with the presence of leading aerospace manufacturers such as Airbus, Rolls-Royce, and Dassault Aviation, alongside a robust network of research institutions and innovation centers focused on advanced composite technologies.

Collaborative programs like Clean Sky and Horizon Europe are further accelerating the development of next-generation, lightweight, and sustainable aerospace materials. This combination of strategic investment, industrial capability, and innovation infrastructure continues to position Europe as a leading hub for aerospace materials growth.

This study has been validated through primary interviews with industry experts globally. These primary sources have been divided into the following three categories:

- By Company Type - Tier 1 - 40%, Tier 2 - 33%, and Tier 3 - 27%

- By Designation - C Level - 50%, Director Level - 30%, and Others - 20%

- By Region - North America - 15%, Europe - 50%, Asia Pacific - 20%, Middle East & Africa (MEA) -5%, Latin America - 10%

The report provides a comprehensive analysis of company profiles:

Prominent companies include Syensqo (Belgium), Toray Industries, Inc. (Japan), Hexcel Corporation (US), Teijin Limited (Japan), Huntsman International LLC (US), VSMPO-AVISMA Corporation (Russia), SGL Carbon (Germany), Mitsubishi Chemical Advanced Materials (Japan), DuPont (US), SABIC (Saudi Arabia), Swiss Steel Group (Switzerland), ATI (US), Alcoa Corporation (US), China Ansteel Group Corporation Limited (China), and Precision Castparts Corp. (PCC) (US).

Research Coverage

This research report categorizes the Aerospace materials market , By Type (Aluminum Alloys, Steel Alloys, Titanium Alloys, Super Alloys, Composite Materials and Others), Aircraft Type (Commercial Aircraft, Business & General Aviation, Helicopters, And Others), Applications (Interior, Exterior), and Region (North America, Europe, Asia Pacific, Middle East & Africa, And South America). The scope of the report includes detailed information about the major factors influencing the growth of the aerospace materials market, such as drivers, restraints, challenges, and opportunities. A thorough examination of the key industry players has been conducted to provide insights into their business overview, solutions, and services, key strategies, contracts, partnerships, and agreements. New product and service launches, mergers & acquisitions, and recent developments in the aerospace materials market are all covered. This report includes a competitive analysis of upcoming startups in the aerospace materials market ecosystem.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall aerospace materials market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Increasing adoption of lightweight alloys (aluminum, titanium) and composites to enhance aircraft performance, fuel efficiency, and reduce emissions. and Rising production and modernization of commercial, business, and defense aircraft, supported by fleet expansion and military spending), restraints (Volatile raw material prices (titanium, aluminum, and specialty alloys) impacting production costs and profitability and Stringent certification and regulatory requirements slowing down material adoption and increasing R&D costs), opportunities (Growing demand for next-generation, fuel-efficient aircraft creating scope for advanced lightweight materials, and Increasing investment in sustainable and recyclable aerospace materials to address environmental concerns and regulatory pressures), and challenges (Supply chain vulnerabilities for critical raw materials, especially titanium and rare alloys, due to geopolitical risks, and High manufacturing complexity and scalability issues, particularly in balancing advanced material performance with cost-effectiveness) influencing the growth of the aerospace materials market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the aerospace materials market

- Market Development: Comprehensive information about lucrative markets - the report analyses the aerospace materials market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the aerospace materials market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players such as Syensqo (Belgium), Toray Industries, Inc. (Japan), Hexcel Corporation (US), Teijin Limited (Japan), Huntsman International LLC (US), VSMPO-AVISMA Corporation (Russia), SGL Carbon (Germany), Mitsubishi Chemical Advanced Materials (Japan), DuPont (US), SABIC (Saudi Arabia), Swiss Steel Group (Switzerland), ATI (US), Alcoa Corporation (US), China Ansteel Group Corporation Limited (China), and Precision Castparts Corp. (PCC) (US), among others, in the aerospace materials market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key primary interview participants

- 2.1.2.3 Breakdown of interviews with experts

- 2.1.2.4 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 BASE NUMBER CALCULATION

- 2.3.1 APPROACH 1: SUPPLY-SIDE ANALYSIS

- 2.3.2 APPROACH 2: DEMAND-SIDE ANALYSIS

- 2.4 FORECAST NUMBER CALCULATION

- 2.5 DATA TRIANGULATION

- 2.6 FACTOR ANALYSIS

- 2.7 RESEARCH ASSUMPTIONS

- 2.8 RESEARCH LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AEROSPACE MATERIALS MARKET

- 4.2 AEROSPACE MATERIALS MARKET, BY TYPE AND REGION, 2024

- 4.3 AEROSPACE MATERIALS MARKET, BY TYPE

- 4.4 AEROSPACE MATERIALS MARKET, BY APPLICATION

- 4.5 AEROSPACE MATERIALS MARKET, BY AIRCRAFT TYPE

- 4.6 AEROSPACE MATERIALS MARKET, BY KEY COUNTRIES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 High demand due to rising household income and urbanization

- 5.2.1.2 Rising demand for structural and performance-driven advanced composites in aerospace applications

- 5.2.1.3 Increasing demand due to fuel efficiency, enhanced cabin environments, greater design flexibility, and extended aircraft lifespans

- 5.2.2 RESTRAINTS

- 5.2.2.1 Surge in tariffs due to global trade war

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Sustainability-driven innovation creating growth opportunities

- 5.2.3.2 Development of advanced software for aerospace composites

- 5.2.3.3 Increased demand for commercial aircraft

- 5.2.4 CHALLENGES

- 5.2.4.1 Supply chain vulnerabilities and production inefficiencies

- 5.2.4.2 Liquidity crunch plaguing airlines

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.4.2 BUYING CRITERIA

- 5.5 ECOSYSTEM

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE OF AEROSPACE MATERIALS OFFERED BY KEY PLAYERS, BY APPLICATION, 2024

- 5.6.2 AVERAGE SELLING PRICE TREND OF AEROSPACE MATERIALS, BY REGION, 2022-2024 (USD/KG)

- 5.7 VALUE CHAIN ANALYSIS

- 5.8 TRADE ANALYSIS

- 5.8.1 EXPORT SCENARIO (HS CODE 7019)

- 5.8.2 IMPORT SCENARIO (HS CODE 7019)

- 5.8.3 EXPORT SCENARIO (HS CODE 681511)

- 5.8.4 IMPORT SCENARIO (HS CODE 681511)

- 5.8.5 EXPORT SCENARIO (HS CODE 722410)

- 5.8.6 IMPORT SCENARIO (HS CODE 722410)

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Selective laser melting

- 5.9.1.2 Lay-up

- 5.9.1.3 Resin Transfer Molding

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 Friction Stir Welding

- 5.9.1 KEY TECHNOLOGIES

- 5.10 MACROECONOMIC OUTLOOK

- 5.10.1 INTRODUCTION

- 5.10.2 GDP TRENDS AND FORECAST

- 5.10.3 TRENDS IN GLOBAL AEROSPACE INDUSTRY

- 5.11 PATENT ANALYSIS

- 5.11.1 INTRODUCTION

- 5.11.2 METHODOLOGY

- 5.11.3 DOCUMENT TYPES

- 5.11.4 INSIGHTS

- 5.11.5 LEGAL STATUS

- 5.11.6 JURISDICTION ANALYSIS

- 5.11.7 TOP APPLICANTS

- 5.11.8 PATENTS BY HARBIN INST TECHNOLOGY

- 5.11.9 PATENTS BY UNIV BEIHANG

- 5.12 REGULATORY LANDSCAPE

- 5.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13 KEY CONFERENCES AND EVENTS IN 2025-2026

- 5.14 CASE STUDY ANALYSIS

- 5.14.1 CASE STUDY 1: VELOCITY COMPOSITES EXPANDS INTO US MARKET AND SUPPORTS GKN AEROSTRUCTURES

- 5.14.2 CASE STUDY 2: GKN AEROSPACE AND GE AEROSPACE EXTEND PARTNERSHIP FOR AEROENGINE DEVELOPMENT AND PRODUCTION

- 5.14.3 CASE STUDY 3: HEXCEL INTRODUCES LATEST HEXTOW CARBON FIBER INNOVATION

- 5.15 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESS

- 5.16 INVESTMENT AND FUNDING SCENARIO

- 5.17 IMPACT OF AI/GEN AI ON AEROSPACE MATERIALS MARKET

- 5.17.1 TOP USE CASES AND MARKET POTENTIAL

- 5.17.2 CASE STUDIES OF AI IMPLEMENTATION IN AEROSPACE MATERIALS MARKET

- 5.18 IMPACT OF 2025 US TARIFF - AEROSPACE MATERIALS MARKET

- 5.18.1 INTRODUCTION

- 5.18.2 KEY TARIFF RATES

- 5.18.3 PRICE IMPACT ANALYSIS

- 5.18.4 IMPACT ON COUNTRIES/REGIONS

- 5.18.4.1 US

- 5.18.4.2 Europe

- 5.18.4.3 Asia Pacific

- 5.18.5 IMPACT ON END-USE INDUSTRIES

6 AEROSPACE MATERIALS MARKET, BY TYPE

- 6.1 INTRODUCTION

- 6.2 ALUMINUM ALLOYS

- 6.2.1 LIGHTWEIGHT STRENGTH AND COST EFFICIENCY OF ALUMINIUM ALLOYS TO DRIVE MARKET

- 6.3 COMPOSITE MATERIALS

- 6.3.1 NEED FOR HIGH-TEMPERATURE RESISTANCE AND WEIGHT REDUCTION TO DRIVE MARKET

- 6.4 TITANIUM ALLOYS

- 6.4.1 NON-FLAMMABILITY AND CORROSION RESISTANCE TO BOOST DEMAND

- 6.5 STEEL ALLOYS

- 6.5.1 HIGH-STRENGTH, CORROSION-RESISTANT MATERIALS ESSENTIAL FOR AIRCRAFT COMPONENTS TO DRIVE DEMAND

- 6.6 SUPER ALLOYS

- 6.6.1 ULTRA HIGH-STRENGTH, HEAT-RESISTANT MATERIALS TO BOOST DEMAND OF SUPER ALLOYS

- 6.7 OTHER TYPES

7 AEROSPACE MATERIALS MARKET, BY AIRCRAFT TYPE

- 7.1 INTRODUCTION

- 7.2 COMMERCIAL AIRCRAFT

- 7.2.1 INCREASING DEMAND FOR NEW AIRPLANES TO DRIVE MARKET

- 7.2.2 SINGLE-AISLE AIRCRAFT

- 7.2.3 WIDE-BODY AIRCRAFT

- 7.2.4 REGIONAL JETS

- 7.3 BUSINESS & GENERAL AVIATION

- 7.3.1 SURGING DEMAND FOR ADVANCED MATERIALS IN BUSINESS JETS TO BOOST MARKET

- 7.3.2 BUSINESS JETS

- 7.3.3 PISTON & TURBOPROP

- 7.4 CIVIL HELICOPTER

- 7.4.1 ADVANCED MATERIALS INTEGRATION IN CIVIL HELICOPTERS AMID REGULATORY AND COST CHALLENGES TO DRIVE DEMAND

- 7.5 MILITARY AIRCRAFT

- 7.5.1 NEED FOR ENHANCED AIRCRAFT PERFORMANCE TO DRIVE DEMAND FOR MATERIALS

- 7.6 OTHER AIRCRAFT TYPES

- 7.6.1 UNMANNED AERIAL VEHICLE (UAV)

- 7.6.2 SPACECRAFT

8 AEROSPACE MATERIALS MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 EXTERIOR

- 8.2.1 RISING DEMAND FOR ADVANCED MATERIALS IN AIRCRAFT WINGS AND FUSELAGE TO BOOST MARKET

- 8.2.2 FUSELAGE

- 8.2.3 ENGINE

- 8.2.4 WINGS

- 8.2.5 ROTOR BLADES

- 8.2.6 TAIL BOOM

- 8.3 INTERIOR

- 8.3.1 INCREASING DEMAND FOR LOW-MAINTENANCE MATERIALS IN AIRCRAFT CABINS TO BOOST MARKET

- 8.3.2 SEATS

- 8.3.3 CABIN

- 8.3.4 SANDWICH PANELS

- 8.3.5 ENVIRONMENTAL CONTROL SYSTEM (ECS) DUCTING

9 AEROSPACE MATERIALS MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 AEROSPACE MATERIALS MARKET IN NORTH AMERICA, BY TYPE

- 9.2.2 AEROSPACE MATERIALS MARKET IN NORTH AMERICA, BY AIRCRAFT TYPE

- 9.2.3 AEROSPACE MATERIALS MARKET IN NORTH AMERICA, BY APPLICATION

- 9.2.4 AEROSPACE MATERIALS MARKET IN NORTH AMERICA, BY COUNTRY

- 9.2.4.1 US

- 9.2.4.1.1 Surging demand for composites in aerospace & defense sector to drive market

- 9.2.4.2 Canada

- 9.2.4.2.1 Increasing demand for aerospace materials from prominent airplane manufacturers to drive market

- 9.2.4.3 Mexico

- 9.2.4.3.1 Duty-free access to key aerospace segments to drive the market

- 9.2.4.1 US

- 9.3 EUROPE

- 9.3.1 AEROSPACE MATERIALS MARKET IN EUROPE, BY TYPE

- 9.3.2 AEROSPACE MATERIALS MARKET IN EUROPE, BY AIRCRAFT TYPE

- 9.3.3 AEROSPACE MATERIALS MARKET IN EUROPE, BY APPLICATION

- 9.3.4 AEROSPACE MATERIALS MARKET IN EUROPE, BY COUNTRY

- 9.3.4.1 Germany

- 9.3.4.1.1 High demand for advanced materials from commercial aircraft manufacturers to boost market

- 9.3.4.2 France

- 9.3.4.2.1 Presence of strong manufacturing base to boost market

- 9.3.4.3 UK

- 9.3.4.3.1 High volume of composite exports to drive market

- 9.3.4.4 Turkey

- 9.3.4.4.1 Rising demand for advanced materials in aircraft designs to drive market

- 9.3.4.5 Russia

- 9.3.4.5.1 Increased production of defense helicopters and aircraft to fuel demand for aerospace material

- 9.3.4.6 Rest of Europe

- 9.3.4.1 Germany

- 9.4 ASIA PACIFIC

- 9.4.1 AEROSPACE MATERIALS MARKET IN ASIA PACIFIC, BY TYPE

- 9.4.2 AEROSPACE MATERIALS MARKET IN ASIA PACIFIC, BY AIRCRAFT TYPE

- 9.4.3 AEROSPACE MATERIALS MARKET IN ASIA PACIFIC, BY APPLICATION

- 9.4.4 AEROSPACE MATERIALS MARKET IN ASIA PACIFIC, BY COUNTRY

- 9.4.4.1 China

- 9.4.4.1.1 Rising demand for composites from commercial airlines to drive market

- 9.4.4.2 Japan

- 9.4.4.2.1 High demand for carbon fiber composites from OEMs to drive market

- 9.4.4.3 India

- 9.4.4.3.1 Development of economic zones and aerospace parks to foster growth

- 9.4.4.4 South Korea

- 9.4.4.4.1 Surging demand for lightweight aircraft parts to drive market

- 9.4.4.5 Indonesia

- 9.4.4.5.1 High volume of air travel to boost market growth

- 9.4.4.6 Rest of Asia Pacific

- 9.4.4.6.1 Fleet growth, MRO expansion, and government initiatives to drive market

- 9.4.4.1 China

- 9.5 SOUTH AMERICA

- 9.5.1 AEROSPACE MATERIALS MARKET SIZE IN SOUTH AMERICA, BY TYPE

- 9.5.2 AEROSPACE MATERIALS MARKET SIZE IN SOUTH AMERICA, BY AIRCRAFT TYPE

- 9.5.3 AEROSPACE MATERIALS MARKET SIZE IN SOUTH AMERICA, BY APPLICATION

- 9.5.4 AEROSPACE MATERIALS MARKET SIZE IN SOUTH AMERICA, BY COUNTRY

- 9.5.4.1 Brazil

- 9.5.4.1.1 Increasing demand for lightweight and medium-sized airplanes to boost market

- 9.5.4.2 Argentina

- 9.5.4.2.1 Macroeconomic reforms and national ambition propel demand

- 9.5.4.3 Rest of South America

- 9.5.4.1 Brazil

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 AEROSPACE MATERIALS MARKET IN MIDDLE EAST & AFRICA, BY TYPE

- 9.6.2 AEROSPACE MATERIALS MARKET IN MIDDLE EAST & AFRICA, BY AIRCRAFT TYPE

- 9.6.3 AEROSPACE MATERIALS MARKET IN MIDDLE EAST & AFRICA, BY APPLICATION

- 9.6.4 AEROSPACE MATERIALS MARKET IN MIDDLE EAST & AFRICA, BY COUNTRY

- 9.6.4.1 GCC countries

- 9.6.4.1.1 UAE

- 9.6.4.1.1.1 Privatization initiatives and infrastructural developments to boost market

- 9.6.4.1.2 Rest of GCC countries

- 9.6.4.1.1 UAE

- 9.6.4.2 Israel

- 9.6.4.2.1 Strong base of established manufacturing companies to drive market

- 9.6.4.3 South Africa

- 9.6.4.3.1 Local and international investments to boost market

- 9.6.4.4 Rest of Middle East & Africa

- 9.6.4.1 GCC countries

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2019-2025

- 10.3 REVENUE ANALYSIS

- 10.4 MARKET SHARE ANALYSIS

- 10.5 PRODUCT COMPARISON

- 10.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.6.1 STARS

- 10.6.2 EMERGING LEADERS

- 10.6.3 PERVASIVE PLAYERS

- 10.6.4 PARTICIPANTS

- 10.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.6.5.1 Company footprint

- 10.6.5.2 Region footprint

- 10.6.5.3 Type footprint

- 10.6.5.4 Aircraft type footprint

- 10.6.5.5 Application footprint

- 10.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.7.1 PROGRESSIVE COMPANIES

- 10.7.2 RESPONSIVE COMPANIES

- 10.7.3 DYNAMIC COMPANIES

- 10.7.4 STARTING BLOCKS

- 10.7.5 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 10.8 VALUATION AND FINANCIAL METRICS OF AEROSPACE MATERIALS VENDORS

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES

- 10.9.2 DEALS

- 10.9.3 EXPANSIONS

- 10.9.4 OTHER DEVELOPMENTS

11 COMPANY PROFILE

- 11.1 KEY PLAYERS

- 11.1.1 HEXCEL CORPORATION

- 11.1.1.1 Business overview

- 11.1.1.2 Products offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product launches

- 11.1.1.3.2 Deals

- 11.1.1.3.3 Expansions

- 11.1.1.4 MnM view

- 11.1.1.4.1 Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses and competitive threats

- 11.1.2 TORAY INDUSTRIES, INC.

- 11.1.2.1 Business overview

- 11.1.2.2 Products offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Product launches

- 11.1.2.3.2 Deals

- 11.1.2.3.3 Expansions

- 11.1.2.4 MnM view

- 11.1.2.4.1 Right to win

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses and competitive threats

- 11.1.3 TEIJIN LIMITED

- 11.1.3.1 Business overview

- 11.1.3.2 Products offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Product launches

- 11.1.3.3.2 Deals

- 11.1.3.3.3 Expansions

- 11.1.3.4 MnM view

- 11.1.3.4.1 Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses and competitive threats

- 11.1.4 SGL CARBON

- 11.1.4.1 Business overview

- 11.1.4.2 Products offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Product launches

- 11.1.4.3.2 Deals

- 11.1.4.3.3 Expansions

- 11.1.4.3.4 Other developments

- 11.1.4.4 MnM view

- 11.1.4.4.1 Right to win

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses and competitive threats

- 11.1.5 MITSUBISHI CHEMICAL GROUP CORPORATION

- 11.1.5.1 Business overview

- 11.1.5.2 Products offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Product launches

- 11.1.5.3.2 Deals

- 11.1.5.3.3 Expansions

- 11.1.5.4 MnM view

- 11.1.5.4.1 Right to win

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses and competitive threats

- 11.1.6 SYENSQO

- 11.1.6.1 Business overview

- 11.1.6.2 Products offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Deals

- 11.1.6.3.2 Other developments

- 11.1.6.4 MnM view

- 11.1.6.4.1 Right to win

- 11.1.6.4.2 Strategic choices

- 11.1.6.4.3 Weaknesses and competitive threats

- 11.1.7 HUNTSMAN INTERNATIONAL LLC

- 11.1.7.1 Business overview

- 11.1.7.2 Products offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Deals

- 11.1.7.3.2 Other developments

- 11.1.7.4 MnM view

- 11.1.7.4.1 Right to win

- 11.1.7.4.2 Strategic choices

- 11.1.7.4.3 Weaknesses and competitive threats

- 11.1.8 DUPONT DE NEMOURS, INC.

- 11.1.8.1 Business overview

- 11.1.8.2 Products offered

- 11.1.8.3 Recent developments

- 11.1.8.3.1 Other developments

- 11.1.8.4 MnM view

- 11.1.8.4.1 Right to win

- 11.1.8.4.2 Strategic choices

- 11.1.8.4.3 Weaknesses and competitive threats

- 11.1.9 SABIC

- 11.1.9.1 Business overview

- 11.1.9.2 Products offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Deals

- 11.1.9.4 MnM view

- 11.1.9.4.1 Right to win

- 11.1.9.4.2 Strategic choices

- 11.1.9.4.3 Weaknesses and competitive threats

- 11.1.10 ALCOA CORPORATION

- 11.1.10.1 Business overview

- 11.1.10.2 Products offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Deals

- 11.1.10.3.2 Other developments

- 11.1.10.4 MnM view

- 11.1.10.4.1 Right to win

- 11.1.10.4.2 Strategic choices

- 11.1.10.4.3 Weaknesses and competitive threats

- 11.1.11 ATI

- 11.1.11.1 Business overview

- 11.1.11.2 Products offered

- 11.1.11.3 Recent developments

- 11.1.11.3.1 Deals

- 11.1.11.3.2 Other developments

- 11.1.11.4 MnM view

- 11.1.11.4.1 Right to win

- 11.1.11.4.2 Strategic choices

- 11.1.11.4.3 Weaknesses and competitive threats

- 11.1.12 VSMPO-AVISMA CORPORATION

- 11.1.12.1 Business overview

- 11.1.12.2 Products offered

- 11.1.12.3 MnM view

- 11.1.12.3.1 Right to win

- 11.1.12.3.2 Strategic choices

- 11.1.12.3.3 Weaknesses and competitive threats

- 11.1.13 SWISS STEEL GROUP (SSG)

- 11.1.13.1 Business overview

- 11.1.13.2 Products offered

- 11.1.13.3 Recent developments

- 11.1.13.3.1 Expansions

- 11.1.13.3.2 Other developments

- 11.1.13.4 MnM view

- 11.1.13.4.1 Right to win

- 11.1.13.4.2 Strategic choices

- 11.1.13.4.3 Weaknesses and competitive threats

- 11.1.14 CHINA ANSTEEL GROUP CORPORATION LIMITED

- 11.1.14.1 Business overview

- 11.1.14.2 Products offered

- 11.1.14.3 MnM view

- 11.1.14.3.1 Right to win

- 11.1.14.3.2 Strategic choices

- 11.1.14.3.3 Weaknesses and competitive threats

- 11.1.15 PRECISION CASTPARTS CORP.

- 11.1.15.1 Business overview

- 11.1.15.2 Products offered

- 11.1.15.3 MnM view

- 11.1.15.3.1 Right to win

- 11.1.15.3.2 Strategic choices

- 11.1.15.3.3 Weaknesses and competitive threats

- 11.1.1 HEXCEL CORPORATION

- 11.2 OTHER PLAYERS

- 11.2.1 ARRIS COMPOSITES, INC.

- 11.2.2 VICTREX PLC

- 11.2.3 ALBANY INTERNATIONAL CORPORATION

- 11.2.4 CARPENTER TECHNOLOGY CORPORATION

- 11.2.5 VOESTALPINE BOHLER EDELSTAHL GMBH

- 11.2.6 OUTOKUMPU OYJ

- 11.2.7 WESTERN SUPERCONDUCTING TECHNOLOGIES

- 11.2.8 BAOJI TITANIUM INDUSTRY (BAOTI)

- 11.2.9 KAISER ALUMINUM CORPORATION

- 11.2.10 NOVELIS INC.

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS