|

시장보고서

상품코드

1829981

항공기용 배터리 시장 : 화학별, 밀도별, 용량별, 추진별, 플랫폼별, 용도별, 지역별 - 예측(-2030년)Aircraft Battery Market by Chemistry (Lead-Acid, Nickel, Lithium), Density (<100, 100-300, >300 Wh/Kg), Capacity (<20, >20Ah), Propulsion (Conventional, Hybrid, Electric), Platform (Commercial, Military, UAV, AAM), Application Region - Forecast to 2030 |

||||||

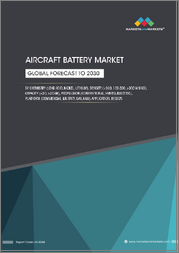

세계의 항공기용 배터리 시장 규모는 2025년 16억 1,000만 달러에서 2030년까지 24억 달러에 이를 것으로 예측되며, CAGR 8.3%의 성장이 전망됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2021-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 10억 달러 |

| 부문 | 화학, 밀도, 용량, 추진, 플랫폼, 지역 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 기타 지역 |

항공기용 배터리 시장은 항공기의 전기화, 지속가능성, 운항 효율성으로의 전환과 함께 빠르게 발전하고 있습니다. MEA 및 하이브리드 전기 항공기의 채택이 증가함에 따라 더 높은 에너지 밀도, 경량화, 안전성 향상, 추진 및 보조 기능을 지원하는 배터리에 대한 수요가 증가하고 있습니다. eVTOL과 도심 항공 모빌리티 솔루션의 확대는 성장을 더욱 촉진하고 있습니다. 이러한 플랫폼은 단거리 및 고주파 비행에서 고성능 리튬 기반 기술에 전적으로 의존하고 있기 때문입니다. 민간 사업자들은 배출가스 및 운항 비용 절감을 위해 항공기 업데이트를 강화하고 있으며, 보조 동력 장치, 비상용 백업 및 주 시동 시스템용 배터리에 대한 의존도를 높이고 있습니다.

국방 분야에서 배터리는 무인 항공기, 정찰기, 차세대 전투 플랫폼에 필수적인 요소로 자리 잡고 있으며, 중요한 작전 전반에 걸쳐 일관된 채택이 추진되고 있습니다. 배터리 관리, 열 제어 및 인증 표준의 동시 발전은 신뢰성을 향상시키는 동시에 라이프사이클 비용을 절감하고 폭넓은 채택을 촉진하고 있습니다. 동시에 탈탄소화를 위한 규제와 고체 리튬 및 리튬 황과 같은 차세대 화학에 대한 강력한 투자가 장기적인 기회를 형성하고 있습니다. 이러한 역학으로 인해 배터리는 항공기의 지속가능성 로드맵에 필수적인 원동력이 되어 상업용, 국방 및 첨단 항공 모빌리티 용도 전반에 걸쳐 안정적인 성장을 보장합니다.

"추진 유형별로는 재래식 항공기 부문이 2025년 항공기 배터리 시장에서 가장 큰 비중을 차지할 것으로 예측됩니다. "

상업용, 비즈니스 및 방위 부문이 전 세계 항공기 운항을 지배하고 있기 때문에 재래식 항공기는 항공기용 배터리에 대한 가장 높은 수요를 지속적으로 창출하고 있습니다. 이러한 플랫폼은 보조 동력 장치에 전력을 공급하고, 주 엔진 시동을 지원하며, 신뢰할 수 있는 비상용 백업을 보장하기 위해 배터리에 크게 의존하고 있으며, 배터리는 일상적인 운영에 필수적인 요소로 자리 잡았습니다. 전 세계적으로 수천 대의 협폭동체 및 광폭동체 항공기가 운항되고 있으며, 대규모의 지역 제트기 및 비즈니스 제트기가 운항되고 있기 때문에 그 운항 대수의 규모에 따라 교체 주기와 애프터마켓 서비스에 대한 안정적인 수요가 보장됩니다. 항공사는 또한 항공기 현대화 프로그램에 우선순위를 두고 있으며, 새로운 항공기가 기존 화학 물질에 비해 효율성을 높이고 유지보수를 줄이는 데 도움이 되는 첨단 리튬 이온 솔루션을 통합함에 따라 배터리 채택을 더욱 강화하고 있습니다.

"이륙 기술별로는 VTOL 부문이 예측 기간 동안 항공기용 배터리 시장에서 가장 높은 성장률을 나타낼 것으로 예상했습니다. "

수직이착륙(VTOL) 부문은 도심 항공 모빌리티, 국방 및 지역 운송용 eVTOL 항공기의 개발 가속화에 힘입어 배터리 수요의 주요 촉진요인으로 빠르게 부상하고 있습니다. 이러한 플랫폼은 1차 전원으로 첨단 배터리 기술에 전적으로 의존하고 있으며, 높은 에너지 밀도와 경량 구조, 빠른 충전 기능을 필요로 합니다. 항공우주 OEM, 스타트업, 기술 기업의 강력한 투자로 특히 북미, 유럽, 아시아에서 대규모 프로토타이핑 및 파일럿 프로그램이 추진되고 있습니다. VTOL 항공기의 매력은 점대점 연결성을 제공하고, 도시 혼잡을 완화하며, 헬리콥터에 비해 저배출 및 저소음으로 운항할 수 있어 지속가능성 및 규제 목표에 부합한다는 점에 있습니다. 이 독특한 운영 프로파일은 신뢰할 수 있는 배터리 성능에 중점을 두어 단거리 및 고주파 비행에 맞게 조정된 리튬 이온, 전고체 및 리튬 황 화학의 혁신을 촉진하고 있습니다.

세계의 항공기용 배터리 시장에 대해 조사 분석했으며, 주요 촉진요인과 억제요인, 경쟁 구도, 향후 동향 등의 정보를 전해드립니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요 인사이트

- 항공기용 배터리 시장 기업의 매력적인 기회

- 항공기용 배터리 시장 : 용도별

- 항공기용 배터리 시장 : 판매 시점별

- 항공기용 배터리 시장 : 국가별

제5장 시장 개요

- 서론

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

- 운영 데이터

- 수량 데이터

- 고객의 비즈니스에 영향을 미치는 동향과 혼란

- 생태계 분석

- 저명 기업

- 민간기업과 중소기업

- 최종사용자

- 밸류체인 분석

- 가격 결정 분석

- 주요 기업이 제공하는 항공기용 배터리 평균 판매 가격

- 참고 가격 분석 : 플랫폼별

- 이용 사례 분석

- 무역 분석

- 수입 시나리오(HS코드 8507)

- 수출 시나리오(HS코드 8507)

- 주요 컨퍼런스 및 이벤트

- 관세 및 규제 상황

- 관세 데이터

- 규제기관, 정부기관 및 기타 조직

- 규제 구조

- 주요 이해관계자와 구입 기준

- 기술 분석

- 주요 기술

- 보완 기술

- 인접 기술

- 투자 및 자금조달 시나리오

- 기술 로드맵

- 거시경제 전망

- 북미

- 유럽

- 아시아태평양

- 중동

- 라틴아메리카

- 아프리카

- 미국 관세(2025년)

- 서론

- 주요 관세율

- 가격 영향 분석

- 국가/지역에 대한 영향

- 최종 이용 산업에 대한 영향

- 총소유 비용

- 비즈니스 모델

- 부품 표

- AI의 영향

- 서론

- 민간 항공 AI 채택 : 주요 국가별

- 항공기용 배터리 시장에 대한 AI의 영향

- 메가트렌드의 영향

- 항공 전력화

- 에너지 밀도 기술 혁신

- 첨단 에어 모빌리티의 부상

- 특허 분석

- 항공 배터리 구성과 화학 동향

- 항공 배터리 설계 형식

- 항공용 배터리 전해질 유형

제6장 항공기용 배터리 시장 : 배터리 화학별

- 서론

- 납축전지 기반

- 니켈 기반

- 리튬 기반

제7장 항공기용 배터리 시장 : 배터리 컴포넌트별

- 서론

- 배터리 셀

- 배터리 관리 시스템

- 열관리 시스템

- 인클루저 및 커넥터

제8장 항공기용 배터리 시장 : 에너지 밀도별

- 서론

- 100WH/KG 미만

- 100-300WH/KG

- 300WH/KG 이상

제9장 항공기용 배터리 시장 : 전력 용량별

- 서론

- 20AH 미만

- 20AH 이상

제10장 항공기용 배터리 시장 : 용도별

- 서론

- 추진

- 보조 동력 장치

- 비상용 전력

- 메인 스타터

제11장 항공기용 배터리 시장 : 추진 기술별

- 서론

- 기존 항공기

- 하이브리드 항공기

- MEA

- 전기 항공기

제12장 항공기용 배터리 시장 : 이륙 기술별

- 서론

- CTOL

- STOL

- VTOL

제13장 항공기용 배터리 시장 : 판매 시점별

- 서론

- OEM

- 애프터마켓

제14장 항공기용 배터리 시장 : 플랫폼별

- 서론

- 민간 항공

- 비즈니스 및 일반 항공

- 군용 항공

- 무인항공기

- 첨단 에어 모빌리티

제15장 항공기용 배터리 시장 : 지역별

- 서론

- 북미

- PESTLE 분석

- 미국

- 캐나다

- 유럽

- PESTLE 분석

- 영국

- 독일

- 스페인

- 프랑스

- 이탈리아

- 아시아태평양

- PESTLE 분석

- 중국

- 인도

- 일본

- 호주

- 한국

- 중동

- PESTLE 분석

- GCC

- 이스라엘

- 튀르키예

- 라틴아메리카

- PESTLE 분석

- 브라질

- 멕시코

- 아프리카

- PESTLE 분석

- 남아프리카공화국

- 나이지리아

제16장 경쟁 구도

- 서론

- 주요 시장 진출기업의 전략/강점(2021년-2025년)

- 매출 분석(2021년-2024년)

- 시장 점유율 분석(2024년)

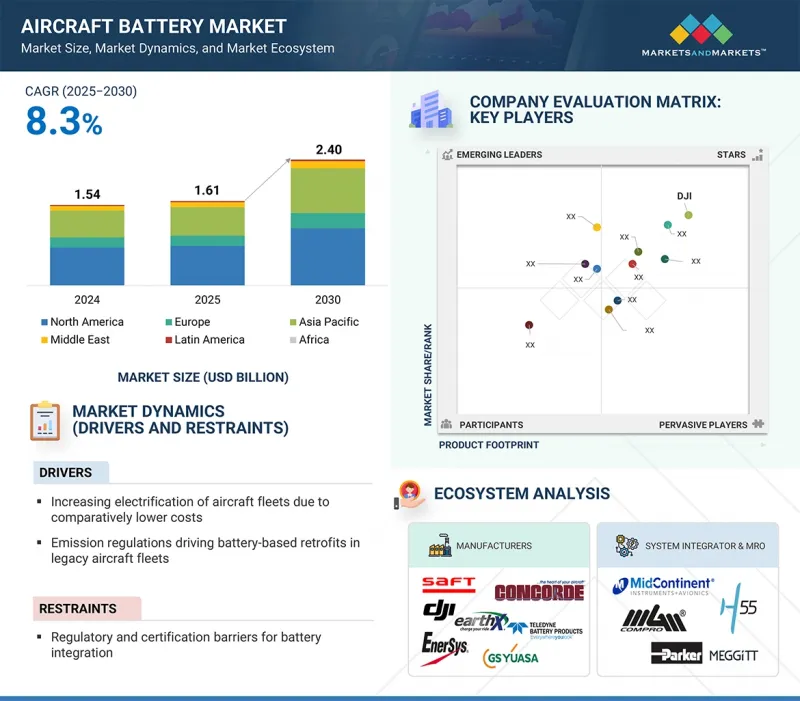

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업 평가 매트릭스 : 스타트업/중소기업(2024년)

- 기업 평가와 재무 지표

- 브랜드 및 제품 비교

- 경쟁 시나리오

제17장 기업 개요

- 주요 기업

- DJI

- EAGLEPICHER TECHNOLOGIES

- SAFT

- ENERSYS

- CONCORDE BATTERY CORPORATION

- TELEDYNE BATTERY PRODUCTS

- GS YUASA CORPORATION

- ELECTRIC POWER SYSTEMS, INC.

- MGM COMPRO

- AMPRIUS TECHNOLOGIES

- AEROVOLTZ

- EARTHX BATTERIES

- MID-CONTINENT INSTRUMENT CO., LTD.

- H55

- SION POWER

- MARATHONNORCO AEROSPACE

- HBL ENGINEERING LIMITED

- 기타 기업

- LYTEN INC.

- INOBAT

- IONBLOX INC.

- MAGNIX

- SICHUAN CHANGHONG BATTERY CO., LTD.

- MAXAMPS LITHIUM BATTERIES

- SECURAPLANE TECHNOLOGIES

- LIMATECH

제18장 부록

LSH 25.10.15The aircraft battery market is projected to grow from USD 1.61 billion in 2025 to USD 2.40 billion by 2030 at a CAGR of 8.3%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Chemistry, Density, Capacity, Propulsion, Platform and Region |

| Regions covered | North America, Europe, APAC, RoW |

The aircraft battery market is advancing rapidly as aviation shifts toward electrification, sustainability, and operational efficiency. The growing adoption of more-electric and hybrid-electric aircraft creates strong demand for batteries that provide higher energy density, reduced weight, and improved safety, supporting propulsion and auxiliary functions. Expanding deployment of eVTOLs and urban air mobility solutions is further fueling growth, as these platforms are entirely dependent on high-performance lithium-based technologies for short-range, high-frequency missions. Commercial operators are intensifying fleet renewal efforts to cut emissions and operating expenses, increasing reliance on batteries for auxiliary power units, emergency backup, and main starting systems.

On the defense side, batteries are becoming integral to unmanned aerial vehicles, surveillance aircraft, and next-generation combat platforms, driving consistent adoption across critical missions. Parallel advancements in battery management, thermal regulation, and certification standards are improving reliability while reducing lifecycle costs, encouraging wider uptake. At the same time, regulatory commitments to decarbonization and strong investment in next-generation chemistries such as solid-state and lithium-sulfur are shaping long-term opportunities. Collectively, these dynamics position batteries as an essential enabler of aviation's sustainability roadmap, ensuring steady growth across commercial, defense, and advanced air mobility applications.

"By propulsion type, the conventional aircraft segment is projected to account for the largest share in the aircraft battery market in 2025."

Conventional aircraft continue to generate the highest demand for aviation batteries as they dominate global fleet operations across commercial, business, and defense segments. These platforms rely heavily on batteries to power auxiliary units, support main engine starts, and ensure reliable emergency backup, making them indispensable for day-to-day operations. With thousands of narrow-bodies and wide-body aircraft in service worldwide, along with large regional and business jet fleets, the scale of installed base ensures consistent demand for replacement cycles and aftermarket services. Airlines are also prioritizing fleet modernization programs, which further reinforce battery adoption as newer aircraft integrate advanced lithium-ion solutions for improved efficiency and reduced maintenance compared to traditional chemistries.

"By lift technology, the VTOL segment is projected to register the highest growth in the aircraft battery market during the forecast period."

The vertical take-off and landing (VTOL) segment is rapidly emerging as a key driver of battery demand, supported by the accelerating development of eVTOL aircraft for urban air mobility, defense, and regional transport applications. These platforms depend entirely on advanced battery technologies as their primary power source, requiring high energy density, lightweight construction, and fast-charging capabilities to achieve operational feasibility. Strong investments from aerospace OEMs, startups, and technology companies are fueling large-scale prototyping and pilot programs, particularly in North America, Europe, and Asia, where governments are actively supporting electric aviation initiatives. The appeal of VTOL aircraft lies in their ability to provide point-to-point connectivity, reduce urban congestion, and operate with lower emissions and noise compared to helicopters, aligning closely with sustainability and regulatory objectives. This unique operational profile places significant emphasis on reliable battery performance, driving innovation in lithium-ion, solid-state, and lithium-sulfur chemistries tailored for short-haul, high-frequency missions.

"By energy density, the 100-300 Wh/Kg segment is projected to account for the largest share during the forecast period."

The 100-300 Wh/Kg is projected to account for the largest share of the aircraft battery market during the forecast period because it represents the most commercially viable balance between performance, safety, and cost for aviation applications, which is why they dominate adoption across existing and emerging aircraft platforms. This range is well suited for powering auxiliary power units, main engine starting systems, and emergency backup functions in conventional aircraft, while also meeting the requirements of eVTOLs, regional electric aircraft, and unmanned aerial vehicles. Batteries within this category provide sufficient energy storage to support reliable operations while maintaining compliance with strict aviation safety standards related to thermal stability and lifecycle performance. Additionally, they offer a cost-effective solution compared to higher-density chemistries, which remain in the research phase and face challenges with thermal runaway and certification readiness. Many aerospace-certified lithium-ion solutions currently fall within this bracket, making them a natural fit for OEM integration and aftermarket replacement.

"The Asia Pacific is projected to be the fastest-growing regional market in the aircraft battery market during the forecast period."

The Asia Pacific is projected to be the fastest-growing regional market in the aircraft battery industry during the forecast period because it is a pivotal growth hub for aircraft batteries, supported by rapid fleet expansion, rising defense budgets, and strong government backing for aviation electrification initiatives. Countries such as China, India, Japan, and South Korea drive commercial aircraft deliveries to meet growing passenger traffic, directly boosting demand for battery systems integrated into auxiliary power units, emergency backup, and main starting applications. In parallel, regional defense modernization programs are accelerating the adoption of advanced batteries for unmanned aerial vehicles, surveillance platforms, and next-generation combat aircraft, further strengthening market potential.

The region is also positioning itself at the forefront of advanced air mobility, with China and Japan investing heavily in eVTOL development and urban air mobility ecosystems that are fully dependent on high-density lithium-based chemistries. Additionally, favorable regulatory frameworks, local manufacturing capabilities, and strategic partnerships between global OEMs and regional suppliers are enhancing production scalability and reducing supply chain constraints. With a combination of strong passenger growth, government-driven sustainability policies, and accelerating deployment of electric and hybrid platforms, the APAC region is becoming a critical driver of global aircraft battery adoption, creating significant opportunities for both established players and emerging innovators in the sector.

The study contains insights from various industry experts, from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: Tier 1-35%; Tier 2-45%; and Tier 3-20%

- By Designation: C-Level Designations-25%; Directors-30%; and Others-45%

- By Region: North America-42%; Europe-18%; Asia Pacific-14%; Middle East-10%; Latin America - 9%; and Africa - 7%

DJI (China), EaglePicher Technologies (US), Saft (France), EnerSys (US), and Concorde Battery Corporation (US) are some of the leading players operating in the aircraft battery market.

Research Coverage

The study covers the aircraft battery market across various segments and subsegments. It aims to estimate this market's size and growth potential across different segments based on battery chemistry, battery component, energy density, power capacity, application, propulsion technology, lift technology, point of sale, platform, and region. This study also includes an in-depth competitive analysis of the key players in the market, their company profiles, key observations related to their solutions and business offerings, recent developments, and key market strategies they adopted.

Key Benefits of Buying this Report

This report will help market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall aircraft battery market and its subsegments, as it covers the entire ecosystem of the aircraft battery market. It will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report will also help stakeholders understand the market's pulse and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report offers insights into the following points:

- Analysis of key drivers and factors, such as increasing electrification of aircraft fleets due to comparatively lower costs, emission regulations driving battery-based retrofits in legacy aircraft fleets, enhancements in battery design for electric and hybrid aircraft integration, and increasing deliveries of commercial and military aircraft worldwide

- Product Development: In-depth product innovation/development analysis by companies across various regions

- Market Development: Comprehensive information about lucrative markets-the report analyses the aircraft battery market across various regions

- Market Diversification: Exhaustive information about new solutions, untapped geographies, recent developments, and investments in the aircraft battery market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players, such as DJI (China), EaglePicher Technologies (US), Saft (France), EnerSys (US), and Concorde Battery Corporation (US), among others, in the aircraft battery market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary sources

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 FACTOR ANALYSIS

- 2.2.1 DEMAND-SIDE INDICATORS

- 2.2.2 SUPPLY-SIDE INDICATORS

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Market size estimation methodology

- 2.3.1.2 Regional split

- 2.3.2 TOP-DOWN APPROACH

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AIRCRAFT BATTERY MARKET

- 4.2 AIRCRAFT BATTERY MARKET, BY APPLICATION

- 4.3 AIRCRAFT BATTERY MARKET, BY POINT OF SALE

- 4.4 AIRCRAFT BATTERY MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising electrification of aircraft fleets

- 5.2.1.2 Emission regulations driving battery-based retrofits in legacy aircraft fleets

- 5.2.1.3 Enhancements in battery design for electric and hybrid aircraft

- 5.2.1.4 Increasing deliveries of commercial and military aircraft worldwide

- 5.2.2 RESTRAINTS

- 5.2.2.1 Regulatory and certification barriers for battery integration

- 5.2.2.2 Fire hazards and thermal runaway risks in aviation battery systems

- 5.2.2.3 Supply chain vulnerabilities in critical battery materials

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Advancements in chemicals and battery technologies

- 5.2.3.2 Elevated demand for electric and hybrid regional aircraft

- 5.2.3.3 Government incentives and green aviation policy

- 5.2.3.4 Growing R&D into hydrogen aircraft-specific fuel systems

- 5.2.4 CHALLENGES

- 5.2.4.1 Safeguarding batteries against probable operational failures

- 5.2.4.2 Frequent battery replacements due to degradation

- 5.2.4.3 Difficulty in manufacturing to aerospace standards

- 5.2.4.4 Cross-sector competition for battery components

- 5.2.1 DRIVERS

- 5.3 OPERATIONAL DATA

- 5.4 VOLUME DATA

- 5.5 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.6 ECOSYSTEM ANALYSIS

- 5.6.1 PROMINENT COMPANIES

- 5.6.2 PRIVATE AND SMALL ENTERPRISES

- 5.6.3 END USERS

- 5.7 VALUE CHAIN ANALYSIS

- 5.8 PRICING ANALYSIS

- 5.8.1 AVERAGE SELLING PRICE OF AIRCRAFT BATTERIES OFFERED BY KEY PLAYERS

- 5.8.2 INDICATIVE PRICING ANALYSIS, BY PLATFORM

- 5.9 USE CASE ANALYSIS

- 5.9.1 SAFT'S LI-ION BATTERIES FOR AIRBUS A350

- 5.9.2 CONCORDE BATTERY'S VRLA BATTERIES FOR GENERAL AVIATION

- 5.9.3 ELECTROFLIGHT'S BATTERY PACKS FOR ROLLS-ROYCE SPIRIT OF INNOVATION AIRCRAFT

- 5.9.4 KOKAM'S LI-PO BATTERIES FOR UNMANNED AERIAL VEHICLES

- 5.10 TRADE ANALYSIS

- 5.10.1 IMPORT SCENARIO (HS CODE 8507)

- 5.10.2 EXPORT SCENARIO (HS CODE 8507)

- 5.11 KEY CONFERENCES AND EVENTS

- 5.12 TARIFF AND REGULATORY LANDSCAPE

- 5.12.1 TARIFF DATA

- 5.12.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12.3 REGULATORY FRAMEWORK

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.13.2 BUYING CRITERIA

- 5.14 TECHNOLOGY ANALYSIS

- 5.14.1 KEY TECHNOLOGIES

- 5.14.1.1 Battery cell chemistries

- 5.14.1.2 Thermal management systems

- 5.14.1.3 High-energy-density cells

- 5.14.2 COMPLEMENTARY TECHNOLOGIES

- 5.14.2.1 Advanced charging systems

- 5.14.3 ADJACENT TECHNOLOGIES

- 5.14.3.1 Hybrid-electric and all-electric propulsion systems

- 5.14.3.2 Wireless charging and inductive power transfer

- 5.14.1 KEY TECHNOLOGIES

- 5.15 INVESTMENT AND FUNDING SCENARIO

- 5.16 TECHNOLOGY ROADMAP

- 5.17 MACROECONOMIC OUTLOOK

- 5.17.1 NORTH AMERICA

- 5.17.2 EUROPE

- 5.17.3 ASIA PACIFIC

- 5.17.4 MIDDLE EAST

- 5.17.5 LATIN AMERICA

- 5.17.6 AFRICA

- 5.18 2025 US TARIFF

- 5.18.1 INTRODUCTION

- 5.18.2 KEY TARIFF RATES

- 5.18.3 PRICE IMPACT ANALYSIS

- 5.18.4 IMPACT ON COUNTRY/REGION

- 5.18.4.1 US

- 5.18.4.2 Europe

- 5.18.4.3 Asia Pacific

- 5.18.5 IMPACT ON END-USE INDUSTRIES

- 5.18.5.1 Commercial aviation

- 5.18.5.2 Government & military aviation

- 5.18.5.3 Dual-use applications

- 5.19 TOTAL COST OF OWNERSHIP

- 5.20 BUSINESS MODELS

- 5.21 BILL OF MATERIALS

- 5.22 IMPACT OF AI

- 5.22.1 INTRODUCTION

- 5.22.2 ADOPTION OF AI IN COMMERCIAL AVIATION BY TOP COUNTRIES

- 5.22.3 IMPACT OF AI ON AIRCRAFT BATTERY MARKET

- 5.23 IMPACT OF MEGATRENDS

- 5.23.1 ELECTRIFICATION OF AVIATION

- 5.23.2 TECHNOLOGICAL BREAKTHROUGHS IN ENERGY DENSITY

- 5.23.3 RISE OF ADVANCED AIR MOBILITY

- 5.24 PATENT ANALYSIS

- 5.25 BATTERY CONFIGURATION AND CHEMISTRY TRENDS IN AVIATION

- 5.25.1 BATTERY DESIGN FORMS IN AVIATION

- 5.25.2 ELECTROLYTE TYPES IN AVIATION BATTERIES

6 AIRCRAFT BATTERY MARKET, BY BATTERY CHEMISTRY

- 6.1 INTRODUCTION

- 6.1.1 USE CASE: LI-ION IN HYBRID/ELECTRIC AIRCRAFT

- 6.1.2 USE CASE: NI-CD AND NIMH IN ENGINE STARTING/EMERGENCIES

- 6.1.3 USE CASE: LFP IN AIRCRAFT AUXILIARY/AVIONICS

- 6.2 LEAD ACID-BASED

- 6.2.1 ESTABLISHED CERTIFICATION FRAMEWORK AND LOWER ACQUISITION COST TO DRIVE MARKET

- 6.2.2 SEALED LEAD ACID

- 6.2.3 FLOODED LEAD ACID

- 6.3 NICKEL-BASED

- 6.3.1 RELIABILITY AND LONG SERVICE LIFE UNDER DIVERSE OPERATIONAL CONDITIONS TO DRIVE MARKET

- 6.3.2 NICKEL CADMIUM

- 6.3.3 NICKEL METAL HYDRIDE

- 6.4 LITHIUM-BASED

- 6.4.1 DELIVERY OF RAPID CHARGE ACCEPTANCE AND ENHANCED POWER RETENTION TO DRIVE MARKET

- 6.4.2 LITHIUM ION

- 6.4.3 LITHIUM POLYMER

- 6.4.4 LITHIUM METAL

- 6.4.4.1 Lithium Metal Oxide

- 6.4.4.2 Lithium Sulfur

7 AIRCRAFT BATTERY MARKET, BY BATTERY COMPONENT

- 7.1 INTRODUCTION

- 7.1.1 USE CASE: MAGNIX'S SAMSON300 BATTERY LINE

- 7.1.2 USE CASE: SAFRAN AND CUBERG'S INTEGRATED PACKS AND MODULES WITH ADVANCED SAFETY

- 7.2 BATTERY CELL

- 7.2.1 ADVANCEMENTS IN CELL CHEMISTRY AND MANUFACTURING PRECISION TO DRIVE MARKET

- 7.3 BATTERY MANAGEMENT SYSTEM

- 7.3.1 EXPANSION OF MORE-ELECTRIC AIRCRAFT PROGRAMS TO DRIVE MARKET

- 7.4 THERMAL MANAGEMENT SYSTEM

- 7.4.1 INCREASED ADOPTION OF LITHIUM-BASED CHEMISTRIES TO DRIVE MARKET

- 7.5 ENCLOSURE & CONNECTOR

- 7.5.1 SURGE IN DEMAND FOR HIGH-ENERGY-DENSITY BATTERIES TO DRIVE MARKET

8 AIRCRAFT BATTERY MARKET, BY ENERGY DENSITY

- 8.1 INTRODUCTION

- 8.1.1 USE CASE: AMPRIUS' SILICON-ANODE LI-ION CELLS FOR DRONES

- 8.1.2 USE CASE: EHANG AND INX'S SOLID-STATE BATTERIES FOR EVTOL

- 8.2 <100 WH/KG

- 8.2.1 NEED FOR DEPENDABLE AUXILIARY SYSTEMS ACROSS COMMERCIAL AND MILITARY FLEETS TO DRIVE MARKET

- 8.3 100-300 WH/KG

- 8.3.1 ELECTRIFICATION INITIATIVES IN COMMERCIAL AND BUSINESS AVIATION TO DRIVE MARKET

- 8.4 >300 WH/KG

- 8.4.1 STRONG INVESTMENT IN URBAN AIR MOBILITY TO DRIVE MARKET

9 AIRCRAFT BATTERY MARKET, BY POWER CAPACITY

- 9.1 INTRODUCTION

- 9.1.1 USE CASE: CONCORDE BATTERY' RG SERIES VRLA

- 9.1.2 USE CASE: EAGLEPICHER'S LITHIUM-ION PACKS

- 9.2 <20 AH

- 9.2.1 COMPACT ENERGY DELIVERY FOR AUXILIARY AND EMERGENCY AIRCRAFT SYSTEMS TO DRIVE MARKET

- 9.3 >20 AH

- 9.3.1 HIGH-CAPACITY ENERGY STORAGE SUPPORTING PROPULSION ASSIST TO DRIVE MARKET

10 AIRCRAFT BATTERY MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- 10.1.1 USE CASE: TRUE BLUE POWER'S EMERGENCY POWER BATTERIES

- 10.1.2 USE CASE: EAGLEPICHER'S MAIN STARTER BATTERIES

- 10.2 PROPULSION

- 10.2.1 HIGH CURRENT OUTPUT AND SUSTAINED ENERGY DENSITY TO DRIVE MARKET

- 10.3 AUXILIARY POWER UNIT

- 10.3.1 NEED FOR CONTINUOUS POWER IN AUXILIARY AIRCRAFT SYSTEMS TO DRIVE MARKET

- 10.4 EMERGENCY POWER

- 10.4.1 IMMEDIATE BACKUP POWER FOR CRITICAL AIRCRAFT FUNCTIONS TO DRIVE MARKET

- 10.5 MAIN STARTER

- 10.5.1 STABLE CURRENT DELIVERY FOR TURBINE SPOOL-UP TO DRIVE MARKET

11 AIRCRAFT BATTERY MARKET, BY PROPULSION TECHNOLOGY

- 11.1 INTRODUCTION

- 11.1.1 USE CASE: GS YUASA LI-ION BATTERIES IN BOEING 787

- 11.1.2 USE CASE: EMBRAER'S ENERGIA PROGRAM

- 11.2 CONVENTIONAL AIRCRAFT

- 11.2.1 STABLE AUXILIARY AND ENGINE START POWER TO DRIVE MARKET

- 11.3 HYBRID AIRCRAFT

- 11.3.1 SUPPLEMENTAL HIGH-DENSITY ENERGY TO DRIVE MARKET

- 11.4 MORE ELECTRIC AIRCRAFT

- 11.4.1 HIGH-EFFICIENCY ENERGY STORAGE FOR FULLY OR PARTIALLY ELECTRIFIED AIRCRAFT SYSTEMS TO DRIVE MARKET

- 11.5 ELECTRIC AIRCRAFT

- 11.5.1 LOW INTERNAL RESISTANCE AND RELIABLE VOLTAGE OUTPUT UNDER HIGH-CURRENT OPERATIONS TO DRIVE MARKET

12 AIRCRAFT BATTERY MARKET, BY LIFT TECHNOLOGY

- 12.1 INTRODUCTION

- 12.1.1 USE CASE: SAFT'S LI-ION BATTERIES IN AIRBUS A320NEO CTOL

- 12.1.2 USE CASE: CONCORDE'S VRLA AND LITHIUM BATTERIES IN TECNAM P2012 STOL

- 12.2 CTOL

- 12.2.1 LOW INTERNAL RESISTANCE AND COMPACT FORM FACTOR TO DRIVE MARKET

- 12.3 STOL

- 12.3.1 HIGH-CURRENT AND RAPID RESPONSE POWER TO DRIVE MARKET

- 12.4 VTOL

- 12.4.1 HIGH ENERGY AND FAST DISCHARGE POWER TO DRIVE MARKET

13 AIRCRAFT BATTERY MARKET, BY POINT OF SALE

- 13.1 INTRODUCTION

- 13.1.1 USE CASE: AFTERMARKET REPLACEMENT IN ATR FLEET

- 13.1.2 USE CASE: OEM SUPPLY OF LI-ION BATTERIES FOR EMBRAER E-JET E2

- 13.2 OEM

- 13.2.1 INTEGRATED POWER SOLUTIONS SUPPORTING AIRCRAFT PRODUCTION REQUIREMENTS TO DRIVE MARKET

- 13.3 AFTERMARKET

- 13.3.1 NEED FOR REPLACEMENT AND UPGRADE BATTERIES TO MAINTAIN OPERATIONAL RELIABILITY TO DRIVE MARKET

14 AIRCRAFT BATTERY MARKET, BY PLATFORM

- 14.1 INTRODUCTION

- 14.1.1 USE CASE: TRUE BLUE POWER'S LIFEPO4 BATTERIES FOR TEXTRON CITATION SERIES

- 14.1.2 USE CASE: AMPRIUS' SILICON-ANODE LI-ION BATTERIES FOR MQ-9B SKYGUARDIAN

- 14.1.3 USE CASE: LI-ION BATTERIES FOR JOBY AVIATION EVTOL

- 14.2 COMMERCIAL AVIATION

- 14.2.1 NARROW-BODY AIRCRAFT

- 14.2.2 WIDE-BODY AIRCRAFT

- 14.2.3 REGIONAL TRANSPORT AIRCRAFT

- 14.2.4 HELICOPTER

- 14.3 BUSINESS & GENERAL AVIATION

- 14.3.1 BUSINESS JET

- 14.3.2 LIGHT AIRCRAFT

- 14.4 MILITARY AVIATION

- 14.4.1 FIGHTER AIRCRAFT

- 14.4.2 MILITARY HELICOPTER

- 14.4.3 TRANSPORT AIRCRAFT

- 14.4.4 SPECIAL MISSION AIRCRAFT

- 14.5 UNMANNED AERIAL VEHICLE

- 14.5.1 FIXED-WING

- 14.5.2 ROTARY-WING

- 14.5.3 HYBRID

- 14.6 ADVANCED AIR MOBILITY

- 14.6.1 AIR TAXI

- 14.6.2 AIR SHUTTLE & AIR METRO

- 14.6.3 PERSONAL AIR VEHICLE

- 14.6.4 CARGO AIR VEHICLE

- 14.6.5 AIR AMBULANCE & MEDICAL EMERGENCY VEHICLE

15 AIRCRAFT BATTERY MARKET, BY REGION

- 15.1 INTRODUCTION

- 15.2 NORTH AMERICA

- 15.2.1 PESTLE ANALYSIS

- 15.2.2 US

- 15.2.2.1 Innovations in battery technology to drive market

- 15.2.3 CANADA

- 15.2.3.1 Government support for sustainable aviation to drive market

- 15.3 EUROPE

- 15.3.1 PESTLE ANALYSIS

- 15.3.2 UK

- 15.3.2.1 National civil and defense programs to drive market

- 15.3.3 GERMANY

- 15.3.3.1 Government support for electrification to drive market

- 15.3.4 SPAIN

- 15.3.4.1 Ongoing defense modernization to drive market

- 15.3.5 FRANCE

- 15.3.5.1 Regional electrification programs to drive market

- 15.3.6 ITALY

- 15.3.6.1 Focus on defense modernization and hybrid propulsion to drive market

- 15.4 ASIA PACIFIC

- 15.4.1 PESTLE ANALYSIS

- 15.4.2 CHINA

- 15.4.2.1 Government-backed electrification programs to drive market

- 15.4.3 INDIA

- 15.4.3.1 Indigenous aerospace development to drive market

- 15.4.4 JAPAN

- 15.4.4.1 Government funding for aviation battery research to drive market

- 15.4.5 AUSTRALIA

- 15.4.5.1 Emerging electric aviation programs to drive market

- 15.4.6 SOUTH KOREA

- 15.4.6.1 Electrification programs and defense upgrades to drive market

- 15.5 MIDDLE EAST

- 15.5.1 PESTLE ANALYSIS

- 15.5.2 GCC

- 15.5.2.1 UAE

- 15.5.2.1.1 Urban air mobility and net-zero targets to drive market

- 15.5.2.2 Saudi Arabia

- 15.5.2.2.1 Vision 2030 localization targets to drive market

- 15.5.2.1 UAE

- 15.5.3 ISRAEL

- 15.5.3.1 Investments in aerospace R&D to drive market

- 15.5.4 TURKEY

- 15.5.4.1 Indigenous aircraft development and electrification initiatives to drive market

- 15.6 LATIN AMERICA

- 15.6.1 PESTLE ANALYSIS

- 15.6.2 BRAZIL

- 15.6.2.1 Emphasis on aerospace electrification to drive market

- 15.6.3 MEXICO

- 15.6.3.1 Growing aerospace activity to drive market

- 15.7 AFRICA

- 15.7.1 PESTLE ANALYSIS

- 15.7.2 SOUTH AFRICA

- 15.7.2.1 Strategic positioning as regional MRO hub to drive market

- 15.7.3 NIGERIA

- 15.7.3.1 Growth of domestic MRO facilities to drive market

16 COMPETITIVE LANDSCAPE

- 16.1 INTRODUCTION

- 16.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 16.3 REVENUE ANALYSIS, 2021-2024

- 16.4 MARKET SHARE ANALYSIS, 2024

- 16.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 16.5.1 STARS

- 16.5.2 EMERGING LEADERS

- 16.5.3 PERVASIVE PLAYERS

- 16.5.4 PARTICIPANTS

- 16.5.5 COMPANY FOOTPRINT

- 16.5.5.1 Company footprint

- 16.5.5.2 Region footprint

- 16.5.5.3 Application footprint

- 16.5.5.4 Platform footprint

- 16.5.5.5 Battery chemistry footprint

- 16.6 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2024

- 16.6.1 PROGRESSIVE COMPANIES

- 16.6.2 RESPONSIVE COMPANIES

- 16.6.3 DYNAMIC COMPANIES

- 16.6.4 STARTING BLOCKS

- 16.6.5 COMPETITIVE BENCHMARKING

- 16.6.5.1 List of start-ups/SMEs

- 16.6.5.2 Competitive benchmarking of start-ups/SMEs

- 16.7 COMPANY VALUATION AND FINANCIAL METRICS

- 16.8 BRAND/PRODUCT COMPARISON

- 16.9 COMPETITIVE SCENARIO

- 16.9.1 PRODUCT LAUNCHES

- 16.9.2 DEALS

- 16.9.3 OTHERS

17 COMPANY PROFILES

- 17.1 KEY PLAYERS

- 17.1.1 DJI

- 17.1.1.1 Business overview

- 17.1.1.2 Products offered

- 17.1.1.3 MnM view

- 17.1.1.3.1 Right to win

- 17.1.1.3.2 Strategic choices

- 17.1.1.3.3 Weaknesses and competitive threats

- 17.1.2 EAGLEPICHER TECHNOLOGIES

- 17.1.2.1 Business overview

- 17.1.2.2 Products offered

- 17.1.2.3 Recent developments

- 17.1.2.3.1 Others

- 17.1.2.4 MnM view

- 17.1.2.4.1 Right to win

- 17.1.2.4.2 Strategic choices

- 17.1.2.4.3 Weaknesses and competitive threats

- 17.1.3 SAFT

- 17.1.3.1 Business overview

- 17.1.3.2 Products offered

- 17.1.3.3 Recent developments

- 17.1.3.3.1 Product launches

- 17.1.3.3.2 Deals

- 17.1.3.3.3 Others

- 17.1.3.4 MnM view

- 17.1.3.4.1 Right to win

- 17.1.3.4.2 Strategic choices

- 17.1.3.4.3 Weaknesses and competitive threats

- 17.1.4 ENERSYS

- 17.1.4.1 Business overview

- 17.1.4.2 Products offered

- 17.1.4.3 Recent developments

- 17.1.4.3.1 Product launches

- 17.1.4.3.2 Deals

- 17.1.4.4 MnM View

- 17.1.4.4.1 Right to win

- 17.1.4.4.2 Strategic choices

- 17.1.4.4.3 Weaknesses and competitive threats

- 17.1.5 CONCORDE BATTERY CORPORATION

- 17.1.5.1 Business overview

- 17.1.5.2 Products offered

- 17.1.5.3 Recent developments

- 17.1.5.3.1 Deals

- 17.1.5.4 MnM view

- 17.1.5.4.1 Right to win

- 17.1.5.4.2 Strategic choices

- 17.1.5.4.3 Weaknesses and competitive threats

- 17.1.6 TELEDYNE BATTERY PRODUCTS

- 17.1.6.1 Business overview

- 17.1.6.2 Product offered

- 17.1.7 GS YUASA CORPORATION

- 17.1.7.1 Business overview

- 17.1.7.2 Products offered

- 17.1.8 ELECTRIC POWER SYSTEMS, INC.

- 17.1.8.1 Business overview

- 17.1.8.2 Products offered

- 17.1.8.3 Recent developments

- 17.1.8.3.1 Product launches

- 17.1.8.3.2 Deals

- 17.1.8.3.3 Others

- 17.1.9 MGM COMPRO

- 17.1.9.1 Business overview

- 17.1.9.2 Products offered

- 17.1.9.3 Recent developments

- 17.1.9.3.1 Deals

- 17.1.9.3.2 Others

- 17.1.10 AMPRIUS TECHNOLOGIES

- 17.1.10.1 Business overview

- 17.1.10.2 Products offered

- 17.1.10.3 Recent developments

- 17.1.10.3.1 Product launches

- 17.1.10.3.2 Deals

- 17.1.10.3.3 Others

- 17.1.11 AEROVOLTZ

- 17.1.11.1 Business overview

- 17.1.11.2 Products offered

- 17.1.12 EARTHX BATTERIES

- 17.1.12.1 Business overview

- 17.1.12.2 Products offered

- 17.1.12.3 Recent developments

- 17.1.12.3.1 Others

- 17.1.13 MID-CONTINENT INSTRUMENT CO., LTD.

- 17.1.13.1 Business overview

- 17.1.13.2 Products offered

- 17.1.13.3 Recent developments

- 17.1.13.3.1 Others

- 17.1.14 H55

- 17.1.14.1 Business overview

- 17.1.14.2 Products offered

- 17.1.14.3 Recent developments

- 17.1.14.3.1 Deals

- 17.1.14.3.2 Others

- 17.1.15 SION POWER

- 17.1.15.1 Business overview

- 17.1.15.2 Products offered

- 17.1.16 MARATHONNORCO AEROSPACE

- 17.1.16.1 Business overview

- 17.1.16.2 Products offered

- 17.1.17 HBL ENGINEERING LIMITED

- 17.1.17.1 Business overview

- 17.1.17.2 Products offered

- 17.1.1 DJI

- 17.2 OTHER PLAYERS

- 17.2.1 LYTEN INC.

- 17.2.2 INOBAT

- 17.2.3 IONBLOX INC.

- 17.2.4 MAGNIX

- 17.2.5 SICHUAN CHANGHONG BATTERY CO., LTD.

- 17.2.6 MAXAMPS LITHIUM BATTERIES

- 17.2.7 SECURAPLANE TECHNOLOGIES

- 17.2.8 LIMATECH

18 APPENDIX

- 18.1 DISCUSSION GUIDE

- 18.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 18.3 CUSTOMIZATION OPTIONS

- 18.4 RELATED REPORTS

- 18.5 AUTHOR DETAILS