|

시장보고서

상품코드

1829984

백신 시장 : 적응 질환별, 기술별, 유형별, 투여 경로별, 최종사용자별, 지역별 - 예측(-2030년)Vaccines Market by Technology (Conjugate, Recombinant, Inactivated, Live Attenuated, Viral Vector, mRNA), Type (Monovalent, Multivalent), Disease (Pneumococcal, Flu, Hepatitis, MMR, RSV), Route of Administration (IM, SC, Oral)-Global Forecast to 2030 |

||||||

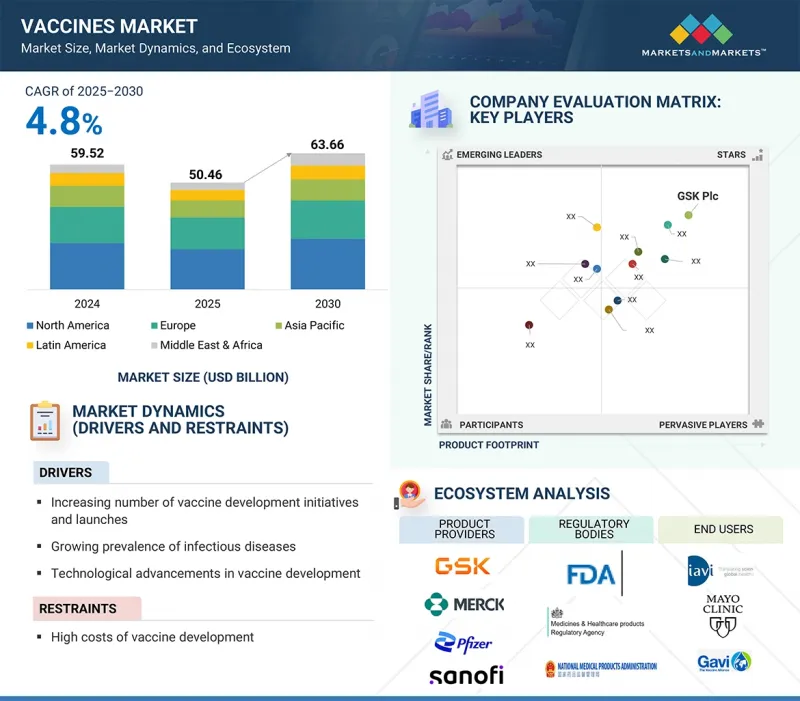

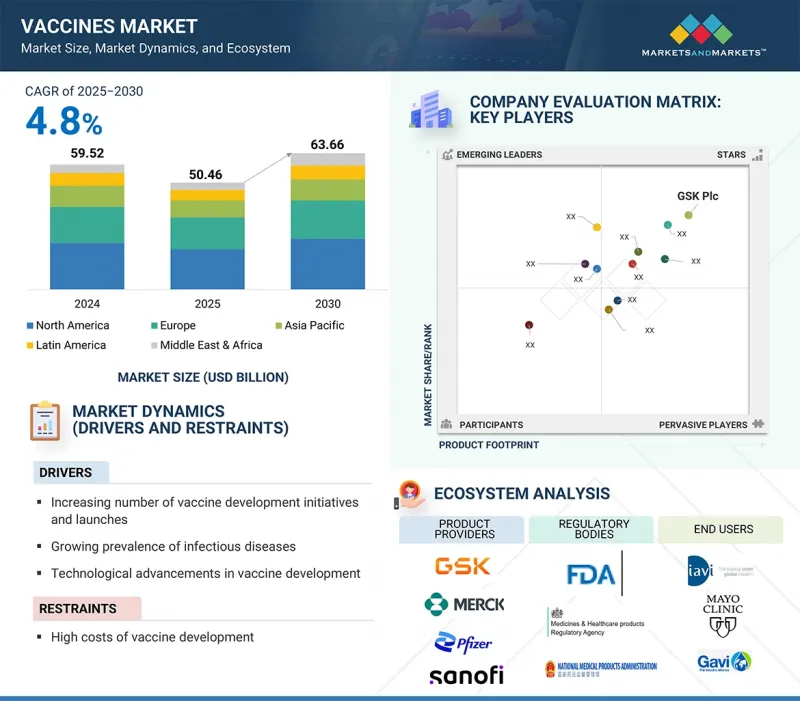

백신 시장 규모는 2025년 504억 6,000만 달러에서 2030년에는 636억 6,000만 달러에 이르고, 예측 기간 중 연평균 복합 성장률(CAGR)은 4.8%를 보일 것으로 예측됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2024-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 검토 단위 | 금액(10억 달러) |

| 부문 | 적응 질환별, 기술별, 유형별, 투여 경로별, 최종사용자별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 라틴아메리카, 중동 및 아프리카 |

높은 전염병 발생률, 백신 기술 혁신, 백신 개발에 대한 정부 지원과 막대한 자금 지원, 백신 접종 이니셔티브 증가, 혁신적인 제품에 대한 투자와 출시에 대한 강한 집중 등이 백신 성장의 원동력이 되고 있습니다.

2024년 적응증별로는 폐렴구균 부문이 백신 시장에서 가장 큰 점유율을 차지할 것으로 예측됩니다.

적응증 질환별로는 혼합백신, HPV, 수막염균성 질환, 대상포진, 로타바이러스, MMR, 폐렴구균성 질환, 인플루엔자, 수두, 간염, DTP, 소아마비, 기타 적응증 질환으로 구분됩니다. 2022년에는 폐렴구균 부문이 백신 시장에서 가장 큰 점유율을 차지했습니다. 이러한 배경에는 전 세계적인 폐렴구균 감염률 증가, 백신 접종 프로그램에 대한 정부 자금 지원 증가, 폐렴, 수막염, 혈류 감염 등 폐렴구균 관련 합병증에 따른 심각한 건강 위험에 대한 대중의 인식 증가 등 몇 가지 중요한 요인이 있습니다. 또한, 최근 승인된 20가 및 21가 결합형 백신 등 차세대 폐렴구균 백신의 개발 및 기술 혁신이 진행됨에 따라 예방접종 선택의 폭이 넓어지고, 시장 성장과 공중보건 성과가 더욱 높아질 것으로 기대됩니다.

2024년 백신 유형별로는 다가백신 분야가 가장 큰 점유율을 차지할 것으로 예측됩니다.

백신 시장은 유형별로 일가 백신과 다가 백신으로 나뉩니다. 2024년에는 다가 백신 부문이 백신 시장에서 가장 큰 비중을 차지했습니다. 이러한 장점은 다가백신이 한 번의 접종으로 여러 질병에 대한 예방 효과를 발휘하기 때문입니다. 따라서 주사 횟수가 줄어들고, 예방접종이 간소화되어 환자의 순응도가 향상되고, 물류상의 문제도 감소합니다. 또한, 호흡기 감염이나 특정 암과 같이 광범위한 면역을 필요로 하는 질병의 유행이 확대되고 있는 것도 이러한 백신에 대한 수요를 증가시키고 있습니다. 이러한 추세를 더욱 부추기는 것은 다가백신의 효율적인 제조를 위한 기술 발전과 투자 증가로 대규모의 신속한 생산이 가능해졌습니다는 점입니다. 백신 접종 일정이 간소화되면 접종률이 향상되고 공중보건 성과가 높아지기 때문에 의료 접근성이 제한된 지역의 정부 및 의료 서비스 제공업체는 특히 다가 백신을 선호하고 있습니다.

2024년에는 아시아태평양이 백신 시장에서 가장 빠르게 성장하는 지역이 될 것입니다.

백신 시장 지역은 북미, 유럽, 아시아태평양, 라틴아메리카, 중동 및 아프리카로 구분됩니다. 아시아태평양은 예측 기간 동안 상당한 CAGR로 성장할 것으로 예측됩니다. 이러한 성장의 배경에는 공중보건에 대한 인식 증가, 국가 예방접종 프로그램의 확대, 의료 인프라에 대한 정부의 투자 증가 등이 있습니다. 이러한 노력을 뒷받침하는 것은 민관 파트너십, 백신의 형평성 제고를 위한 국제 협력, 첨단 백신 개발 및 보다 저렴한 생산이 가능한 기술 발전입니다. 또한, 이 지역, 특히 중국, 인도 등의 국가에서는 인구가 증가하는 추세로 기존 백신과 신규 백신 모두에 있어 큰 타겟 시장이 되고 있습니다. 이러한 요인들은 백신 산업 시장에서 아시아태평양의 리더십을 더욱 돋보이게 하고 있습니다.

세계의 백신 시장에 대해 조사했으며, 적응질환별, 기술별, 유형별, 투여경로별, 최종사용자별, 지역별 동향, 시장에 진출한 기업 프로파일 등을 정리하여 전해드립니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 프리미엄 인사이트

제5장 시장 개요

- 서론

- 시장 역학

제6장 업계 동향

- 고객의 비즈니스에 영향을 미치는 동향/혼란

- 가격 분석

- 기술 분석

- 밸류체인 분석

- 파이프라인 분석

- 생태계 분석

- 규제 분석

- 무역 분석

- Porter의 Five Forces 분석

- 특허 분석

- 2025-2026년 주요 컨퍼런스 및 이벤트

- 주요 이해관계자와 구입 기준

- 투자 및 자금조달 시나리오

- AI/생성형 AI가 백신 시장에 미치는 영향

- 2025년 미국 관세가 백신 시장에 미치는 영향

- 백신 조달 데이터

- 백신 제조 공정

제7장 백신 시장(적응 질환별)

- 서론

- 폐렴구균 감염증

- 인플루엔자

- 혼합 백신

- HPV

- 수막염균 감염증

- 대상포진

- 로타바이러스

- MMR

- 수두

- 간염

- DTP

- 폴리오

- RSV

- COVID-19

- 기타

제8장 백신 시장(기술별)

- 서론

- 백신 시장(COVID-19 백신 제외), 기술별

- COVID-19 백신 시장(기술별)

제9장 백신 시장(COVID-19 백신 제외), 유형별

- 서론

- 다가 백신

- 단일가 백신

제10장 백신 시장(COVID-19 백신 제외), 투여 경로별

- 서론

- 근육내 및 피하 투여

- 경구 투여

- 기타

제11장 백신 시장(COVID-19 백신 제외), 최종사용자별

- 서론

- 성인용 백신

- 소아용 백신

제12장 백신 시장(COVID-19 백신 제외), 지역별

- 서론

- 북미

- 북미의 거시경제 전망

- 미국

- 캐나다

- 유럽

- 유럽의 거시경제 전망

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타

- 아시아태평양

- 아시아태평양의 거시경제 전망

- 중국

- 일본

- 인도

- 한국

- 기타

- 라틴아메리카

- 라틴아메리카의 거시경제 전망

- 브라질

- 멕시코

- 기타

- 중동

- 감염증 만연이 시장 성장 견인

- 중동의 거시경제 전망

- 아프리카

- 시장을 활성화 시키기 위한 선진국에서의 자금과 보조금 가용성

- 아프리카의 거시경제 전망

제13장 경쟁 구도

- 서론

- 주요 시장 진출기업의 전략/강점

- 매출 분석, 2020년-2024년

- 시장 점유율 분석, 2024년

- 기업 평가 매트릭스 : 주요 시장 진출기업, 2024년

- 기업 평가 매트릭스 : 스타트업/중소기업, 2024년

- 기업 평가와 재무 지표

- 브랜드 및 제품 비교

- 경쟁 시나리오

제14장 기업 개요

- 주요 시장 진출기업

- GSK PLC

- MERCK & CO., INC.

- PFIZER INC.

- SANOFI

- CSL

- EMERGENT

- JOHNSON & JOHNSON SERVICES, INC.

- ASTRAZENECA

- SERUM INSTITUTE OF INDIA PVT., LTD.

- BAVARIAN NORDIC

- MITSUBISHI TANABE PHARMA CORPORATION

- DAIICHI SANKYO COMPANY, LIMITED

- PANACEA BIOTEC

- BIOLOGICAL E LIMITED

- BHARAT BIOTECH

- NOVAVAX

- INOVIO PHARMACEUTICALS

- 기타 기업

- SINOVAC

- INCEPTA PHARMACEUTICALS LTD.

- VALNEVA SE

- VBI VACCINE INC.

- BIO FARMA

- MICROGEN

- ZHI FEI BIOLOGICAL

- INDIAN IMMUNOLOGICALS LIMITED

제15장 부록

LSH 25.10.15The vaccines market is expected to reach 63.66 billion USD in 2030, up from 50.46 billion USD in 2025, growing at a CAGR of 4.8% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Technology, Type, Disease Indication, Route of Administration, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. |

Factors such as the high incidence of contagious diseases, innovation in vaccine technology, government support and substantial funding for vaccine development, increasing vaccination initiatives, and a strong focus on investing in and launching innovative products are driving this growth vaccines.

In 2024, by disease indication, the pneumococcal segment accounted for the largest share of the vaccines market.

Based on disease indication, the vaccines market is segmented into combination vaccines, HPV, meningococcal disease, herpes zoster, rotavirus, MMR, pneumococcal disease, influenza, varicella, hepatitis, DTP, polio, and other disease indications. In 2022, the pneumococcal segment held the largest share of the vaccines market. This is due to several key factors: a rising incidence of pneumococcal infections worldwide; increased government funding for vaccination programs; and heightened public awareness of the serious health risks associated with pneumococcal-related complications such as pneumonia, meningitis, and bloodstream infections. Additionally, ongoing innovation and the development of next-generation pneumococcal vaccines, such as the recently approved 20-valent and 21-valent conjugate vaccines, are expanding immunization options, further boosting market growth and public health benefits outcomes.

In 2024, by type, the multivalent vaccines segment accounted for the largest share of the vaccines market.

The vaccines market is divided into monovalent vaccines and multivalent vaccines, based on type. In 2024, the multivalent vaccines segment held the largest portion of the Vaccines market. This dominance comes from the ability of multivalent vaccines to provide protection against multiple diseases with a single dose-simplifying immunization by reducing the number of injections needed, which increases patient compliance and decreases logistical challenges. Additionally, the growing prevalence of diseases that require broad-spectrum immunity, such as respiratory infections and certain cancers, has increased demand for these vaccines. Further supporting this trend are technological advances and increased investment in efficient manufacturing of multivalent vaccines, enabling larger and faster production. Governments and healthcare providers in regions with limited healthcare access particularly favor them because simplified vaccination schedules improve coverage and boost public health outcomes.

In 2024, the Asia Pacific was the fastest growing region in the Vaccines market.

The vaccines market region is divided into North America, Europe, the Asia Pacific, Latin America, the Middle East & Africa. The Asia Pacific region is expected to grow at a significant CAGR during the forecast period. This increase is driven by greater public health awareness, expanding national immunization programs, and increased government investment in healthcare infrastructure. Supporting these efforts are public-private partnerships, international collaborations aimed at improving vaccine equity, and technological advancements that enable advanced vaccine development and more affordable production. Additionally, the region's large and growing populations, especially in countries such as China and India, present a substantial target market for both established and new vaccines. These factors highlight the Asia Pacific's leadership in the vaccine industry market.

The primary interviews conducted for this report can be categorized as follows:

- By Respondent: Tier 1-25%, Tier 2-35%, and Tier 3- 40%

- By Designation: C-level Executives - 55%, Directors- 20%, and Others- 25%

- By Region: North America -35%, Europe - 25%, Asia Pacific -20%, Latin America -10%, the Middle East & Africa- 10%

GSK plc (UK), Merck & Co., Inc. (US), Pfizer, Inc. (US), Sanofi (France), CSL (Australia), Emergent (US), Johnson & Johnson Services Inc. (US), AstraZeneca (UK), Serum Institute of India Pvt. Ltd. (India), Bavarian Nordic (Denmark), Mitsubishi Tanabe Pharma Corporation (Japan), Daiichi Sankyo Company, Limited (Japan), Panacea Biotec (India), Biological E. Limited (India), Bharat Biotech (India), Novavax (US), Inovio Pharmaceuticals (US), Sinovac (China), Incepta Pharmaceuticals (Bangladesh), Valneva SE (France), VBI Vaccines Inc. (US), Bio Farma (Indonesia), FSUE NPO Microgen (Russia), Zhi fei Biological (China), Indian Immunologicals Ltd (India) are some of the key companies offering Vaccines.

Research Coverage

This research report categorizes the Vaccines market by technology (conjugate vaccine, recombinant vaccine, inactivated & subunit vaccine, live attenuated vaccine, toxoid vaccine, viral vector vaccine, mRNA vaccine, and other vaccines), type (monovalent vaccines, multivalent vaccines), indication (pneumococcal disease, influenza, combination vaccine, HPV, meningococcal disease, herpes zoster, rotavirus, MMR, varicella, hepatitis, DTP, polio, RSA, other disease indications), route of administration (intramuscular & subcutaneous, oral, other routes), end user (pediatric vaccines, adult vaccines), and by region (North America, Europe, Asia Pacific, Latin America, Middle East, and Africa). The scope of the report provides detailed information on major factors such as drivers, challenges, opportunities, and restraints that influence the growth of the vaccines market. A comprehensive analysis of key industry players has been conducted to offer insights into their business overview, product portfolios, and key strategies, including collaborations, partnerships, expansions, agreements, acquisitions, and recent developments related to the vaccines market. Competitive analysis of top players and upcoming startups within the vaccines market ecosystem is included in this report. The report also details primary factors like drivers, restraints, challenges, and opportunities shaping the market growth, along with an in-depth review of key industry players' solutions, products, recent product launches, mergers, acquisitions, and emerging market trends ecosystem.

Key Benefits of Buying the Report

This report offers a comprehensive overview of the Vaccines market. It aims to assess the size and future growth opportunities of the market across various segments, such as technology, type, indication, route of administration, end user, and region. The report also features an in-depth competitive analysis of the major market players, including their company profiles, recent developments, and key market strategies.

The report provides insights into the following pointers:

Analysis of key drivers (strong emphasis on investment and launch of novel vaccines, rising prevalence of infectious disease, expanding immunization programs, advancements in vaccine technology and robust government support & funding for the development of vaccines), restraints (High development cost, patent expiry ), opportunities (Increased focus on therapeutic vaccines, robust & strong pipeline) and challenges (Stringent regulatory processes, vaccine supply shortage, frequent product recall)

- Product Development/Innovation: Detailed insights on newly launched Products, and technological assessment of the Vaccines market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the Vaccines market across varied regions.

- Market Diversification: Exhaustive information about new, untapped geographies, recent developments, and investments in the Vaccines market

Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players such as GSK plc (UK), Merck & Co., Inc. (US), Pfizer, Inc. (US), Sanofi (France), CSL (Australia), Emergent (US), Johnson & Johnson Services Inc. (US), AstraZeneca (UK), Serum Institute of India Pvt. Ltd. (India), Bavarian Nordic (Denmark), Mitsubishi Tanabe Pharma Corporation (Japan), Daiichi Sankyo Company, Limited (Japan), Panacea Biotec (India), Biological E. Limited (India), Bharat Biotech (India), Novavax (US), Inovio Pharmaceuticals (US), Sinovac (China), Incepta Pharmaceuticals (Bangladesh), Valneva SE (France), VBI Vaccines Inc. (US), Bio Farma (Indonesia), FSUE NPO Microgen (Russia), Zhi fei Biological (China), Indian Immunologicals Ltd (India), among others, in the vaccines market. The report also helps stakeholders understand the trends of the vaccines market and provides information on key market drivers, restraints, challenges, and opportunities. A detailed analysis of the key industry players has been conducted to offer insights into their key strategies, product launches and approvals, pipeline developments, acquisitions, partnerships, collaborations, recent activities, investments, and funding activities, brand and product comparisons, vendor evaluations, and financial metrics of the vaccines sector market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION & REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key sources of secondary data

- 2.1.1.2 Key objectives of secondary research

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakdown of primaries

- 2.1.2.2 Key objectives of primary research

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 GLOBAL MARKET SIZE ESTIMATION, 2024

- 2.2.1.1 Company revenue analysis (bottom-up approach)

- 2.2.1.2 MarketsandMarkets repository analysis

- 2.2.1.3 Secondary analysis

- 2.2.1.4 Bottom-up approach (disease indication-based analysis)

- 2.2.1.5 Primary research

- 2.2.1.5.1 Insights from primary sources

- 2.2.2 SEGMENTAL MARKET SIZE ESTIMATION (TOP-DOWN APPROACH)

- 2.2.1 GLOBAL MARKET SIZE ESTIMATION, 2024

- 2.3 MARKET GROWTH RATE PROJECTIONS

- 2.4 DATA TRIANGULATION

- 2.5 STUDY ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

- 3.1 KEY INSIGHTS & MARKET HIGHLIGHTS

- 3.2 STRATEGIC IMPERATIVES FOR STAKEHOLDERS IN VACCINES MARKET

- 3.3 DISRUPTIVE TRENDS SHAPING VACCINES MARKET

- 3.4 HIGH-GROWTH SEGMENTS & EMERGING FRONTIERS

4 PREMIUM INSIGHTS

- 4.1 GLOBAL VACCINES MARKET SNAPSHOT

- 4.2 NORTH AMERICA: VACCINES MARKET (EXCLUDING COVID-19 VACCINES), BY TYPE AND COUNTRY, 2024

- 4.3 VACCINES MARKET (EXCLUDING COVID-19 VACCINES): GEOGRAPHIC GROWTH OPPORTUNITIES

- 4.4 UNMET NEEDS & WHITE SPACES

- 4.5 STRATEGIC ANALYSIS OF GROWTH OPPORTUNITIES

- 4.6 EMERGING BUSINESS MODELS & ECOSYSTEM SHIFTS

- 4.7 INTERCONNECTED MARKETS & CROSS-SECTOR OPPORTUNITIES

- 4.8 SUSTAINABILITY IMPACT & REGULATORY POLICY INITIATIVES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Focus on vaccine development and launches

- 5.2.1.2 Rising prevalence of infectious diseases

- 5.2.1.3 Increasing immunization programs

- 5.2.1.4 Advancements in vaccine technology

- 5.2.1.5 Government support and funding for vaccine development

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of vaccine development

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising focus on therapeutic vaccines

- 5.2.3.2 Extensive R&D for vaccines and increased investments in clinical trials

- 5.2.4 CHALLENGES

- 5.2.4.1 Stringent regulatory processes

- 5.2.4.2 Product recalls

- 5.2.1 DRIVERS

6 INDUSTRY TRENDS

- 6.1 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 6.2 PRICING ANALYSIS

- 6.2.1 AVERAGE SELLING PRICE TREND OF VACCINES, BY KEY PLAYER, 2023-2025

- 6.2.2 AVERAGE SELLING PRICE TREND OF VACCINES, BY DISEASE INDICATION, 2023-2025

- 6.2.3 AVERAGE SELLING PRICE TREND OF VACCINES, BY REGION, 2021-2023

- 6.3 TECHNOLOGY ANALYSIS

- 6.3.1 KEY TECHNOLOGIES

- 6.3.1.1 Recombinant technology

- 6.3.1.2 Conjugation technology

- 6.3.1.3 Viral vector technology

- 6.3.2 COMPLEMENTARY TECHNOLOGIES

- 6.3.2.1 Encapsulation & delivery technology

- 6.3.2.2 Automation & control

- 6.3.2.3 AI & machine learning for vaccine design

- 6.3.3 ADJACENT TECHNOLOGIES

- 6.3.3.1 Single-use technology

- 6.3.3.2 Cell line development

- 6.3.1 KEY TECHNOLOGIES

- 6.4 VALUE CHAIN ANALYSIS

- 6.5 PIPELINE ANALYSIS

- 6.5.1 VACCINES MARKET: CLINICAL TRIALS, BY PHASE

- 6.5.2 VACCINES MARKET: CLINICAL TRIALS, BY DISEASE INDICATION

- 6.5.3 VACCINES MARKET: PHASE 2/3 CLINICAL TRIALS, BY COMPANY

- 6.6 ECOSYSTEM ANALYSIS

- 6.6.1 VACCINES MARKET: ROLE IN ECOSYSTEM

- 6.7 REGULATORY ANALYSIS

- 6.7.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.7.2 REGULATORY FRAMEWORK

- 6.7.2.1 North America

- 6.7.2.2 Europe

- 6.7.2.3 Asia Pacific

- 6.7.2.4 Latin America

- 6.7.2.5 Middle East & Africa

- 6.7.3 REGULATORY CHALLENGES IN VACCINES MARKET

- 6.8 TRADE ANALYSIS

- 6.8.1 IMPORT DATA (HS CODE 300220)

- 6.8.2 EXPORT DATA (HS CODE 300220)

- 6.9 PORTER'S FIVE FORCES ANALYSIS

- 6.9.1 THREAT OF NEW ENTRANTS

- 6.9.2 THREAT OF SUBSTITUTES

- 6.9.3 BARGAINING POWER OF SUPPLIERS

- 6.9.4 BARGAINING POWER OF BUYERS

- 6.9.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.10 PATENT ANALYSIS

- 6.10.1 TOP APPLICANTS/OWNERS (COMPANIES) FOR VACCINE PATENTS, 2014-2024

- 6.11 KEY CONFERENCES & EVENTS, 2025-2026

- 6.12 KEY STAKEHOLDERS & BUYING CRITERIA

- 6.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.12.2 KEY BUYING CRITERIA

- 6.13 INVESTMENT & FUNDING SCENARIO

- 6.14 IMPACT OF AI/GENERATIVE AI ON VACCINES MARKET

- 6.14.1 INTRODUCTION

- 6.14.2 MARKET POTENTIAL OF AI IN VACCINES MARKET

- 6.14.3 AI USE CASES

- 6.14.4 KEY COMPANIES IMPLEMENTING AI

- 6.14.5 FUTURE OF GENERATIVE AI IN VACCINES ECOSYSTEM

- 6.15 IMPACT OF 2025 US TARIFFS ON VACCINES MARKET

- 6.15.1 INTRODUCTION

- 6.15.2 KEY TARIFF RATES

- 6.15.3 PRICE IMPACT ANALYSIS

- 6.15.4 IMPACT ON COUNTRY/REGION

- 6.15.4.1 US

- 6.15.4.2 Europe

- 6.15.4.3 Asia Pacific

- 6.15.5 IMPACT ON END-USE INDUSTRIES

- 6.15.5.1 Public health & government bodies

- 6.15.5.2 Healthcare providers & institutions

- 6.16 VACCINE PROCUREMENT DATA

- 6.16.1 NUMBER OF VACCINES DELIVERED BY UNICEF, 2023-2025

- 6.16.2 WHO: VACCINE PURCHASE DATABASE, 2021-2023

- 6.17 VACCINE MANUFACTURING PROCESS

- 6.17.1 OVERVIEW

- 6.17.1.1 R&D and process development

- 6.17.1.2 Upstream production (antigen generation)

- 6.17.1.3 Downstream processing

- 6.17.1.4 Formulation & fill-finish

- 6.17.1.5 Quality control & regulatory release

- 6.17.1.6 Packaging, cold chain, and distribution

- 6.17.2 MANUFACTURING MODELS & CAPACITY DYNAMICS

- 6.17.1 OVERVIEW

7 VACCINES MARKET, BY DISEASE INDICATION

- 7.1 INTRODUCTION

- 7.2 PNEUMOCOCCAL DISEASE

- 7.2.1 INCREASING INCIDENCE OF PNEUMONIA IN CHILDREN TO DRIVE MARKET

- 7.3 INFLUENZA

- 7.3.1 RISING NEED FOR IMMUNIZATION AGAINST VIRAL INFECTIONS TO DRIVE MARKET

- 7.4 COMBINATION VACCINES

- 7.4.1 GROWING DEMAND FOR ALL-IN-ONE VACCINES TO DRIVE MARKET GROWTH

- 7.5 HPV

- 7.5.1 RISING FOCUS ON CERVICAL CANCER PREVENTION TO DRIVE HPV VACCINE UPTAKE

- 7.6 MENINGOCOCCAL DISEASE

- 7.6.1 INCREASING INITIATIVES BY GOVERNMENT AND NON-GOVERNMENT ORGANIZATIONS TO SUPPORT MARKET GROWTH

- 7.7 HERPES ZOSTER

- 7.7.1 RISING AGING POPULATION TO DRIVE DEMAND FOR HERPES ZOSTER VACCINES

- 7.8 ROTAVIRUS

- 7.8.1 RISING INFANT IMMUNIZATION PROGRAMS TO DRIVE ROTAVIRUS VACCINE MARKET GROWTH

- 7.9 MMR

- 7.9.1 RISING INCIDENCE OF MEASLES, MUMPS, AND RUBELLA TO BOOST DEMAND

- 7.10 VARICELLA

- 7.10.1 INCREASING PROMOTION OF IMMUNIZATION PROGRAMS TO SUPPORT MARKET GROWTH

- 7.11 HEPATITIS

- 7.11.1 LOW SOCIO-ECONOMIC STANDARDS OF LIVING AND HIGH CONTAMINATION IN DRINKING WATER TO DRIVE MARKET

- 7.12 DTP

- 7.12.1 STRONG INTEGRATION INTO NATIONAL IMMUNIZATION PROGRAMS TO SUSTAIN DTP VACCINE DEMAND

- 7.13 POLIO

- 7.13.1 INCREASING GOVERNMENT INITIATIVES AND IMMUNIZATION PROGRAMS TO DRIVE MARKET

- 7.14 RSV

- 7.14.1 STRONG PRODUCT PIPELINE AND NEW PRODUCT LAUNCHES TO PROPEL MARKET GROWTH

- 7.15 COVID-19

- 7.15.1 DECLINING DEMAND DUE TO HIGH POPULATION COVERAGE AND REDUCED SEVERITY OF VARIANTS TO SLOW DOWN MARKET GROWTH

- 7.16 OTHER DISEASE INDICATIONS

8 VACCINES MARKET, BY TECHNOLOGY

- 8.1 INTRODUCTION

- 8.2 VACCINES MARKET (EXCLUDING COVID-19 VACCINES), BY TECHNOLOGY

- 8.2.1 CONJUGATE VACCINES

- 8.2.1.1 Increasing public-private partnerships to drive market growth

- 8.2.2 RECOMBINANT VACCINES

- 8.2.2.1 Low post-vaccination reactions and reduced need for booster doses to drive market

- 8.2.3 INACTIVATED & SUBUNIT VACCINES

- 8.2.3.1 Ease of storage and transportation to support growth

- 8.2.4 LIVE ATTENUATED VACCINES

- 8.2.4.1 High cost of storage and limited financial resources of distributors to restrain market

- 8.2.5 TOXOID VACCINES

- 8.2.5.1 Rising prevalence of bacterial infections among infants and children to drive market

- 8.2.6 OTHER VACCINES

- 8.2.1 CONJUGATE VACCINES

- 8.3 COVID-19 VACCINES MARKET, BY TECHNOLOGY

- 8.3.1 MRNA VACCINES

- 8.3.1.1 Increasing focus on mRNA vaccine development to drive market

- 8.3.2 VIRAL VECTOR VACCINES

- 8.3.2.1 Rising investment in vaccine development to drive market

- 8.3.3 OTHER COVID-19 VACCINES

- 8.3.1 MRNA VACCINES

9 VACCINES MARKET (EXCLUDING COVID-19 VACCINES), BY TYPE

- 9.1 INTRODUCTION

- 9.2 MULTIVALENT VACCINES

- 9.2.1 INCREASED NEED FOR IMMUNIZATION AND COST-EFFECTIVENESS TO DRIVE MARKET

- 9.3 MONOVALENT VACCINES

- 9.3.1 RISING R&D INVESTMENTS AND PREVALENCE OF INFECTIOUS DISEASES TO SUPPORT MARKET GROWTH

10 VACCINES MARKET (EXCLUDING COVID-19 VACCINES), BY ROUTE OF ADMINISTRATION

- 10.1 INTRODUCTION

- 10.2 INTRAMUSCULAR & SUBCUTANEOUS ADMINISTRATION

- 10.2.1 EASE OF ABSORPTION AND BETTER IMMUNE RESPONSE TO DRIVE ADOPTION

- 10.3 ORAL ADMINISTRATION

- 10.3.1 REDUCED RISK OF BLOOD-TRANSMITTED INFECTIONS TO DRIVE ADOPTION

- 10.4 OTHER ROUTES OF ADMINISTRATION

11 VACCINES MARKET (EXCLUDING COVID-19 VACCINES), BY END USER

- 11.1 INTRODUCTION

- 11.2 ADULT VACCINES

- 11.2.1 ADULT VACCINES TO COMMAND LARGER MARKET SHARE DURING FORECAST PERIOD

- 11.3 PEDIATRIC VACCINES

- 11.3.1 SUPPORT FROM GOVERNMENT AND NON-GOVERNMENT BODIES TO DRIVE MARKET

12 VACCINES MARKET (EXCLUDING COVID-19 VACCINES), BY REGION

- 12.1 INTRODUCTION

- 12.2 NORTH AMERICA

- 12.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 12.2.2 US

- 12.2.2.1 US to dominate North American market during forecast period

- 12.2.3 CANADA

- 12.2.3.1 High incidence of infectious diseases to drive market growth

- 12.3 EUROPE

- 12.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 12.3.2 GERMANY

- 12.3.2.1 Significant R&D investments and growing biotechnology industry to drive market

- 12.3.3 UK

- 12.3.3.1 Launch of new products and increased funding by government and non-government organizations to drive market

- 12.3.4 FRANCE

- 12.3.4.1 Favorable government initiatives for mass immunization to drive market

- 12.3.5 ITALY

- 12.3.5.1 Higher investments by companies for increased production capacities to drive market

- 12.3.6 SPAIN

- 12.3.6.1 Rising investments in vaccine development by private organizations to drive market

- 12.3.7 REST OF EUROPE

- 12.4 ASIA PACIFIC

- 12.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 12.4.2 CHINA

- 12.4.2.1 China to hold largest share of APAC vaccines market

- 12.4.3 JAPAN

- 12.4.3.1 Favorable government initiatives to support market growth

- 12.4.4 INDIA

- 12.4.4.1 Increasing government initiatives and development of new and improved vaccines to drive market

- 12.4.5 SOUTH KOREA

- 12.4.5.1 Strong government strategies for improved vaccine hubs to drive market

- 12.4.6 REST OF ASIA PACIFIC

- 12.5 LATIN AMERICA

- 12.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 12.5.2 BRAZIL

- 12.5.2.1 Rising focus on immunization programs to drive market

- 12.5.3 MEXICO

- 12.5.3.1 Trained workforce and ethnically varied population base for clinical trials to propel market growth

- 12.5.4 REST OF LATIN AMERICA

- 12.6 MIDDLE EAST

- 12.6.1 INCREASING PREVALENCE OF INFECTIOUS DISEASES TO DRIVE MARKET

- 12.6.2 MACROECONOMIC OUTLOOK FOR MIDDLE EAST

- 12.7 AFRICA

- 12.7.1 AVAILABILITY OF FUNDS AND GRANTS FROM DEVELOPED ECONOMIES TO DRIVE MARKET

- 12.7.2 MACROECONOMIC OUTLOOK FOR AFRICA

13 COMPETITIVE LANDSCAPE

- 13.1 INTRODUCTION

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 13.2.1 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN VACCINES MARKET

- 13.3 REVENUE ANALYSIS, 2020-2024

- 13.4 MARKET SHARE ANALYSIS, 2024

- 13.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.5.1 STARS

- 13.5.2 EMERGING LEADERS

- 13.5.3 PERVASIVE PLAYERS

- 13.5.4 PARTICIPANTS

- 13.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.5.5.1 Company footprint

- 13.5.5.2 Region footprint

- 13.5.5.3 Technology footprint

- 13.5.5.4 Type footprint

- 13.5.5.5 Route of administration footprint

- 13.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.6.1 PROGRESSIVE COMPANIES

- 13.6.2 RESPONSIVE COMPANIES

- 13.6.3 DYNAMIC COMPANIES

- 13.6.4 STARTING BLOCKS

- 13.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES

- 13.6.5.1 Detailed list of key startups/SMEs

- 13.6.5.2 Competitive benchmarking of key startups/SMEs

- 13.7 COMPANY VALUATION & FINANCIAL METRICS

- 13.7.1 FINANCIAL METRICS

- 13.7.2 COMPANY VALUATION

- 13.8 BRAND/PRODUCT COMPARISON

- 13.8.1 BRAND/PRODUCT COMPARATIVE ANALYSIS

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 PRODUCT LAUNCHES & APPROVALS

- 13.9.2 DEALS

- 13.9.3 EXPANSIONS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 GSK PLC

- 14.1.1.1 Business overview

- 14.1.1.2 Products offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Product launches & approvals

- 14.1.1.3.2 Deals

- 14.1.1.3.3 Expansions

- 14.1.1.4 MnM view

- 14.1.1.4.1 Key strengths

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses & competitive threats

- 14.1.2 MERCK & CO., INC.

- 14.1.2.1 Business overview

- 14.1.2.2 Products offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Product approvals

- 14.1.2.3.2 Deals

- 14.1.2.3.3 Expansions

- 14.1.2.4 MnM view

- 14.1.2.4.1 Key strengths

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses & competitive threats

- 14.1.3 PFIZER INC.

- 14.1.3.1 Business overview

- 14.1.3.2 Products offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Product approvals

- 14.1.3.3.2 Deals

- 14.1.3.4 MnM view

- 14.1.3.4.1 Key strengths

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses & competitive threats

- 14.1.4 SANOFI

- 14.1.4.1 Business overview

- 14.1.4.2 Products offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Product approvals

- 14.1.4.3.2 Deals

- 14.1.4.3.3 Expansions

- 14.1.4.3.4 Other developments

- 14.1.4.4 MnM view

- 14.1.4.4.1 Key strengths

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses & competitive threats

- 14.1.5 CSL

- 14.1.5.1 Business overview

- 14.1.5.2 Products offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Product approvals

- 14.1.5.3.2 Deals

- 14.1.5.3.3 Expansions

- 14.1.5.4 MnM view

- 14.1.5.4.1 Key strengths

- 14.1.5.4.2 Strategic choices

- 14.1.5.4.3 Weaknesses & competitive threats

- 14.1.6 EMERGENT

- 14.1.6.1 Business overview

- 14.1.6.2 Products offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Product approvals

- 14.1.6.3.2 Other developments

- 14.1.7 JOHNSON & JOHNSON SERVICES, INC.

- 14.1.7.1 Business overview

- 14.1.7.2 Products offered

- 14.1.7.3 Recent developments

- 14.1.7.3.1 Deals

- 14.1.8 ASTRAZENECA

- 14.1.8.1 Business overview

- 14.1.8.2 Products offered

- 14.1.8.3 Recent developments

- 14.1.8.3.1 Deals

- 14.1.8.3.2 Expansions

- 14.1.8.3.3 Other developments

- 14.1.9 SERUM INSTITUTE OF INDIA PVT., LTD.

- 14.1.9.1 Business overview

- 14.1.9.2 Products offered

- 14.1.9.3 Recent developments

- 14.1.9.3.1 Product launches & approvals

- 14.1.9.3.2 Deals

- 14.1.9.3.3 Expansions

- 14.1.10 BAVARIAN NORDIC

- 14.1.10.1 Business overview

- 14.1.10.2 Products offered

- 14.1.10.3 Recent developments

- 14.1.10.3.1 Product approvals

- 14.1.10.3.2 Deals

- 14.1.10.3.3 Other developments

- 14.1.11 MITSUBISHI TANABE PHARMA CORPORATION

- 14.1.11.1 Business overview

- 14.1.11.2 Products offered

- 14.1.11.3 Recent developments

- 14.1.11.3.1 Product launches & approvals

- 14.1.11.3.2 Deals

- 14.1.12 DAIICHI SANKYO COMPANY, LIMITED

- 14.1.12.1 Business overview

- 14.1.12.2 Products offered

- 14.1.12.3 Recent developments

- 14.1.12.3.1 Deals

- 14.1.13 PANACEA BIOTEC

- 14.1.13.1 Business overview

- 14.1.13.2 Products offered

- 14.1.13.3 Recent developments

- 14.1.13.3.1 Deals

- 14.1.14 BIOLOGICAL E LIMITED

- 14.1.14.1 Business overview

- 14.1.14.2 Products offered

- 14.1.14.3 Recent developments

- 14.1.14.3.1 Product approvals

- 14.1.14.3.2 Deals

- 14.1.14.3.3 Other developments

- 14.1.15 BHARAT BIOTECH

- 14.1.15.1 Business overview

- 14.1.15.2 Products offered

- 14.1.15.3 Recent developments

- 14.1.15.3.1 Product launches & approvals

- 14.1.15.3.2 Deals

- 14.1.16 NOVAVAX

- 14.1.16.1 Business overview

- 14.1.16.2 Products offered

- 14.1.16.3 Recent developments

- 14.1.16.3.1 Product approvals

- 14.1.17 INOVIO PHARMACEUTICALS

- 14.1.17.1 Business overview

- 14.1.17.2 Products offered

- 14.1.17.3 Recent developments

- 14.1.17.3.1 Other developments

- 14.1.1 GSK PLC

- 14.2 OTHER PLAYERS

- 14.2.1 SINOVAC

- 14.2.2 INCEPTA PHARMACEUTICALS LTD.

- 14.2.3 VALNEVA SE

- 14.2.4 VBI VACCINE INC.

- 14.2.5 BIO FARMA

- 14.2.6 MICROGEN

- 14.2.7 ZHI FEI BIOLOGICAL

- 14.2.8 INDIAN IMMUNOLOGICALS LIMITED

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS