|

시장보고서

상품코드

1829985

배터리 기술 시장 : 유형별, 리튬 이온 배터리 유형별 - 예측(-2030년)Battery Technology Market by Type (Lithium-ion Battery, Lead Acid, NiMh, NiCd, Sodium-ion, Solid-state Battery, Redox Flow Battery, Lithium Silicon, Lithium Sulfur Battery), Li-ion Battery Type (LFP, NMC, LCO, LTO, LMO, NCA) - Global Forecast to 2030 |

||||||

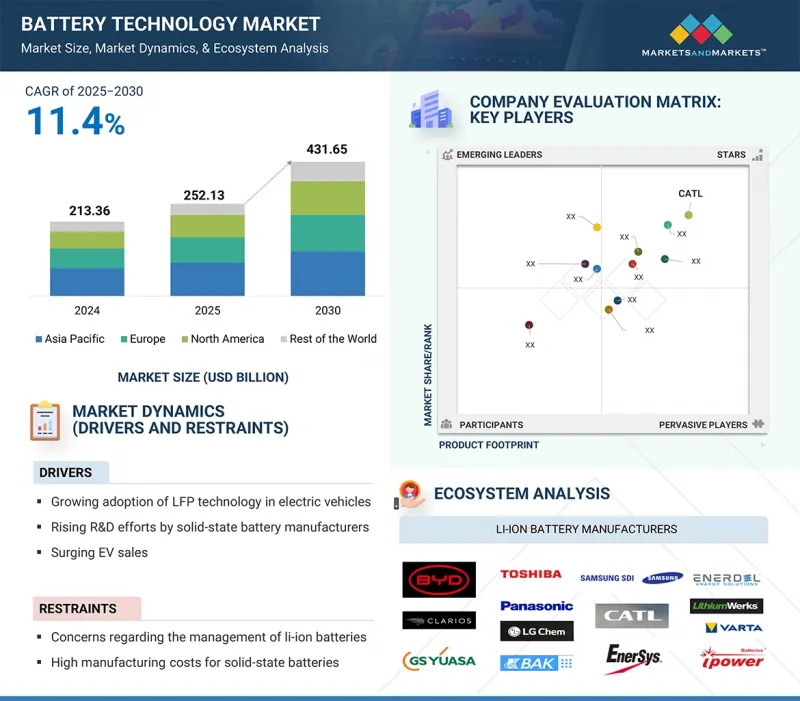

세계의 배터리 기술 시장 규모는 2025년 2,521억 3,000만 달러에서 2030년까지 4,316억 5,000만 달러에 이를 것으로 예측되며, CAGR 11.4%의 성장이 전망됩니다.

성장의 원동력은 모빌리티, 에너지, 산업 각 부문에서 전기화를 실현하는 데 있어 배터리의 역할이 중요하다는 점입니다. 교통 분야에서는 전기자동차의 보급과 충전 인프라의 발전으로 첨단 전기 저장 솔루션에 대한 대규모 수요가 발생하고 있습니다. 에너지 부문에서는 전력 기업 및 재생 에너지 개발 기업이 전력망 안정화, 피크 부하 관리, 태양광 및 풍력 발전의 통합을 지원하기 위해 대규모 배터리 시스템에 투자하고 있습니다. 소비자 가전 및 산업용도에서 휴대용 전원 공급 장치 및 백업 시스템은 성능과 신뢰성을 위해 필수적이며, 이에 대한 수요가 증가하고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2021-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 10억 달러 |

| 부문 | 배터리 유형, 지역 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 기타 지역 |

이 시장에는 리튬 이온, 납축전지, 니켈 기반, 플로우, 전고체, 나트륨 이온 등 다양한 기술이 포함되며, 각 기술은 특정 작동 조건과 비용 요구 사항에 적합합니다. 에너지 밀도, 수명, 안전성에 대한 지속적인 개선과 재활용 및 2차 활용에 대한 투자가 채택을 가속화하고 있습니다. 전 세계 산업이 저탄소화 및 디지털화로 전환하는 가운데, 배터리는 지속 가능한 성장과 튼튼한 에너지 인프라를 위한 필수적인 자산으로 부상하고 있습니다.

"플로우 배터리 부문은 배터리 기술 시장에서 상당한 CAGR로 성장할 것입니다. "

배터리 기술 시장의 플로우 배터리 부문은 그리드 및 산업용도에 확장 가능하고 오래 지속되는 에너지 저장을 제공할 수 있는 능력으로 인해 예측 기간 동안 상당한 CAGR로 성장할 것으로 예측됩니다. 기존 배터리와 달리 플로우 배터리는 액체 전해질에 에너지를 저장하기 때문에 유연한 용량 확장, 깊은 방전 능력, 긴 수명을 가능하게 합니다. 이러한 특징은 안정성, 부하 이동, 백업 전력이 중요한 재생 에너지 통합, 마이크로그리드, 유틸리티 규모의 전력 저장 프로젝트에 특히 적합합니다. 태양광 발전소 및 풍력 발전소 설치가 증가하고 스마트 그리드 및 분산형 에너지 시스템에 대한 투자가 증가하면서 채택에 박차를 가하고 있습니다. 바나듐 산화 환원 및 아연 브롬 플로우 배터리 기술의 지속적인 발전은 효율을 개선하고, 비용을 절감하고, 내구성을 향상시켜 특정 응용 분야에서 리튬 이온을 대체할 수 있는 대안이 될 수 있습니다. 지속 가능한 장주기 에너지 저장 솔루션에 대한 수요가 가속화됨에 따라, 플로우 배터리 부문은 배터리 기술 시장 생태계에서 중요한 성장 분야로 부상하고 있습니다.

"정부 정책과 기가팩토리 투자는 유럽 배터리 기술 시장의 강력한 성장을 가속할 것입니다. "

예측 기간 동안 유럽은 강력한 규제 프레임워크, 전기화 목표, 청정 에너지 인프라에 대한 투자 증가에 힘입어 배터리 기술 시장에서 상당한 CAGR로 성장할 것으로 예측됩니다. 유럽연합(EU)의 그린딜(Green Deal)과 엄격한 배출가스 감축 정책으로 인해 전기자동차 및 고정식 에너지 저장 시스템의 채택이 가속화되고 있으며, 이는 첨단 배터리 솔루션에 대한 안정적인 수요를 창출하고 있습니다. 독일, 프랑스, 영국 등의 국가들은 민관 파트너십과 현지 공급망 강화를 위한 자금 지원 프로그램을 통해 기가팩토리 개발을 주도하고 있습니다. 이 지역은 또한 학계와 산업계가 협력하여 전고체 및 기타 차세대 화학 연구의 최전선에 있습니다. 지속가능성, 재활용, 순환경제에 대한 관심이 높아지면서 유럽은 배터리 기술의 주요 시장으로 자리매김하고 있으며, 세계 에너지 전환의 혁신과 회복탄력성 모두에 기여하고 있습니다.

세계의 배터리 기술 시장에 대해 조사 분석했으며, 주요 촉진요인과 억제요인, 경쟁 구도, 향후 동향 등의 정보를 전해드립니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요 인사이트

- 배터리 기술 시장 기업에 있어서 매력적인 기회

- 배터리 기술 시장 : 유형별

- 리튬 이온 배터리 시장 : 설치용량별

- 아시아태평양의 배터리 기술 시장 : 유형별, 국가별

- 배터리 기술 시장 : 국가별

제5장 시장 개요

- 서론

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

- 밸류체인 분석

- 생태계 분석

- 가격 결정 분석

- 리튬 이온 배터리 평균 판매 가격 동향(2021년-2033년)

- 리튬 이온 배터리 팩 가격대 : 주요 기업별(2024년)

- LFP·NMC 배터리 평균 판매 가격 동향(2021년-2024년)

- 리튬 이온 배터리 평균 판매 가격 동향 : 지역별(2021년-2024년)

- 전고체 배터리 가격대(2024년)

- 전고체 배터리 가격대 : 지역별(2024년)

- 플로우 배터리 참고 가격 : 주요 기업별(2024년)

- 리튬 이온 배터리 산업에 관한 중요 인사이트

- 주요 리튬 생산국

- 리튬 이온 배터리 제조능력 : 국가별(2022년·2025년·2030년)

- 현재 가동중 및 향후 가동 예정 기가 팩토리 리스트

- 고객의 비즈니스에 영향을 미치는 동향/혼란

- 투자 및 자금조달 시나리오

- 기술 분석

- 주요 기술

- 보완 기술

- 인접 기술

- Porter의 Five Forces 분석

- 주요 이해관계자와 구입 기준

- 사례 연구 분석

- 무역 분석

- 수입 시나리오(HS코드 850650)

- 수출 시나리오(HS코드 850650)

- 특허 분석

- 주요 컨퍼런스 및 이벤트(2025년-2026년)

- 규제 상황

- 규제기관, 정부기관, 기타 조직

- 표준

- AI/생성형 AI의 영향

- 서론

- 배터리 기술 시장에 대한 AI의 영향

- 주요 이용 사례와 시장 장래성

- 2025년 미국 관세의 영향

- 서론

- 주요 관세율

- 가격 영향 분석

- 국가/지역에 대한 영향

- 용도에 대한 영향

제6장 배터리 기술 시장 : 배터리 유형별

- 서론

- 리튬 이온 배터리

- 납축전지

- 니켈계 배터리

- 전고체 배터리

- 플로우 배터리

- 나트륨 이온

- 새로운 배터리 유형

제7장 배터리 기술 시장 : 지역별

- 서론

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 기타 아시아태평양

- 기타 지역

- 중동

- 아프리카

- 남미

제8장 경쟁 구도

- 서론

- 주요 시장 진출기업의 전략/강점(2021년-2024년)

- 매출 분석(2021년-2024년)

- 시장 점유율 분석(2024년)

- 리튬 이온 배터리 시장 : 시장 점유율 분석

- 전고체 배터리 시장 : 시장 점유율 분석

- 기업 평가와 재무 지표

- 브랜드 비교

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업 평가 매트릭스 : 스타트업/중소기업(2024년)

- 경쟁 시나리오

제9장 기업 개요

- 주요 기업

- CONTEMPORARY AMPEREX TECHNOLOGY CO., LIMITED

- BYD COMPANY LTD.

- LG ENERGY SOLUTION

- SAMSUNG SDI

- PANASONIC HOLDINGS CORPORATION

- EVE ENERGY CO., LTD.

- TESLA

- GS YUASA CORPORATION

- SK INNOVATION CO., LTD.

- TOSHIBA CORPORATION

- SUNWODA ELECTRONIC CO., LTD.

- MITSUBISHI ELECTRIC CORPORATION

- GOTION

- ENERSYS

- VARTA AG

- CALB

- 기타 주요 기업

- EXIDE INDUSTRIES LTD.

- INVINITY ENERGY SYSTEMS

- SUMITOMO ELECTRIC INDUSTRIES, LTD.

- ILIKA

- SOLID POWER, INC.

- KANADEVIA CORPORATION

- FACTORIAL INC.

- DURACELL INC.

- 기타 기업

- AMPEREX TECHNOLOGY LIMITED

- CLARIOS

- BAK POWER

- BLUE SOLUTIONS

- PROLOGIUM TECHNOLOGY CO., LTD.

- FACTORIAL INC

- SAKUU CORPORATION

- HINA BATTERY TECHNOLOGY CO., LTD.

- ENEROX GMBH

- FARASIS ENERGY(GANZHOU) CO., LTD.

- ZONERGY CORPORATION

제10장 부록

LSH 25.10.15With a CAGR of 11.4%, the global battery technology market is projected to increase from USD 252.13 billion in 2025 to USD 431.65 billion by 2030. Growth is fueled by batteries' critical role in enabling electrification across mobility, energy, and industrial sectors. In transportation, rising electric vehicle adoption and the rollout of charging infrastructure are creating large-scale demand for advanced storage solutions. In the energy sector, utilities and renewable developers invest in large battery systems to stabilize grids, manage peak loads, and support solar and wind integration. Consumer electronics and industrial applications strengthen demand, where portable power and backup systems are essential for performance and reliability.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Battery Type and Region |

| Regions covered | North America, Europe, APAC, RoW |

The market includes various technologies such as lithium-ion, lead acid, nickel-based, flow, solid-state, and sodium-ion, each suited to specific operating conditions and cost requirements. Continuous improvements in energy density, cycle life, and safety, alongside investments in recycling and second-life use, are accelerating adoption. As global industries shift toward low-carbon and digitalized operations, batteries emerge as indispensable assets for powering sustainable growth and resilient energy infrastructure.

" Flow Battery Segment to Grow with a Significant CAGR in the Battery Technology Market."

The flow battery segment in the battery technology market is expected to grow with a significant CAGR during the forecast period, driven by its ability to provide scalable and long-duration energy storage for grid and industrial applications. Unlike conventional batteries, flow batteries store energy in liquid electrolytes, enabling flexible capacity expansion, deep discharge capability, and extended operational life. These features make them particularly suitable for renewable energy integration, microgrids, and utility-scale storage projects where stability, load shifting, and backup power are critical. Increasing deployment of solar and wind power plants and rising investments in smart grids and decentralized energy systems are fueling adoption. Continuous advancements in vanadium redox and zinc-bromine flow battery technologies improve efficiency, reduce costs, and enhance durability, positioning flow batteries as a viable alternative to lithium-ion in specific applications. As demand for sustainable and long-cycle energy storage solutions accelerates, the flow battery segment is emerging as a key growth area within the battery technology market ecosystem.

" Government Policies and Gigafactory Investments to Drive Strong Growth of the Battery Technology Market in Europe"

During the forecast period, Europe is expected to grow with a significant CAGR in the battery technology market, supported by strong regulatory frameworks, electrification targets, and rising investments in clean energy infrastructure. The European Union's Green Deal and strict emission reduction policies are accelerating the adoption of electric vehicles and stationary energy storage systems, creating consistent demand for advanced battery solutions. Countries including Germany, France, and the United Kingdom are leading gigafactory developments, backed by public-private partnerships and funding programs aimed at strengthening local supply chains. The region is also at the forefront of research in solid-state and other next-generation chemistries, driven by collaborations between academic institutions and industry players. With a growing focus on sustainability, recycling, and circular economy practices, Europe is positioning itself as a key market for battery technologies, contributing to both innovation and resilience in the global energy transition.

Breakdown of primaries

A variety of executives from key organizations operating in the battery technology market were interviewed in-depth, including CEOs, marketing directors, and innovation and technology directors.

- By Company Type: Tier 1 -45%, Tier 2 - 35%, and Tier 3 - 20%

- By Designation: Directors - 45%, C-level - 30%, and Others - 25%

- By Region: Asia Pacific - 45%, North America - 25%, Europe - 20%, and RoW - 10%

Note: Other designations include sales and product managers. The three tiers of the companies are defined based on their total revenue in 2024: Tier 1 - revenue greater than or equal to USD 5 billion; Tier 2 - revenue between USD 500 million and USD 5 billion; and Tier 3 revenue less than or equal to USD 500 million.

Major players profiled in this report are as follows: LG Energy Solution (South Korea), SAMSUNG SDI (South Korea), Panasonic Holdings Corporation (Japan), BYD Company Ltd. (China), Contemporary Amperex Technology Co., Limited (China), BAK Power (China), CALB (China), CLARIOS (US), EnerSys (US), EVE Energy Co., Ltd. (China), Gotion (China), GS Yuasa Corporation (Japan), Mitsubishi Electric Corporation (Japan), SK Innovation Co., Ltd. (South Korea), Tesla (US), Toshiba Corporation (Japan), Sunwoda Electronic Co., Ltd. (China), Blue Solutions (France), Solid Power, Inc. (US), ProLogium Technology Co, Ltd. (Taiwan), Ilika plc (UK), Factorial Energy (US), EXIDE INDUSTRIES LIMITED (India), QuantumScape Battery, Inc. (US), Sakuu Corporation(US), Kanadevia Corporation (Japan), Sumitomo Electric Industries, Ltd. (Japan), HiNa Battery Technology Co., Ltd. (China), Invinity Energy Systems (UK), VARTA AG (Germany), DURACELL (US) and Enerox GmbH (Austria). These leading companies possess a wide portfolio of products, establishing a prominent presence in established as well as emerging markets.

The study provides a detailed competitive analysis of these key players in the battery technology market, presenting their company profiles, most recent developments, and key market strategies.

Research Coverage

In this report, the battery technology market has been segmented based on battery type and region. The battery type segment includes lithium-ion, lead acid, nickel-based, flow, solid state, and sodium-ion. The regional analysis covers North America, Europe, Asia Pacific, and RoW.

Reasons to buy the report

The report will help the leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall market and the sub-segments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the battery technology market's pulse and provides information on key market drivers, restraints, challenges, and opportunities.

Key Benefits of Buying the Report

- Analysis of key drivers (Rising EV sales boost battery demand, Growing adoption of LFP technology in electric vehicles, Widespread adoption of battery-operated material handling equipment is accelerating Li-ion battery demand, Rising research and development efforts by solid-state battery manufacturers), restraints (Concerns in managing spent li-ion batteries, High manufacturing costs for solid-state batteries, Standardization challenges associated with flow battery), opportunities (BESS expansion and renewable integration accelerate Lithium-Ion battery market growth, Innovation and technological advances in sodium-ion batteries, Significant decline in costs of Lithium-Ion Battery, Progress in medical devices powered by solid-state batteries, Rising interest in residential energy storage solutions using flow batteries), and challenges (Intricate production processes of solid-state batteries, Increased tariffs on Chinese EVs in Europe and North America, Managing financial risks and market disruptions in the global battery industry, Limited usage capacity of lead acid batteries) influencing the growth of the battery technology market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and new product launches in the battery technology market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the battery technology market across varied regions.

- Market Diversification: Exhaustive information about new products/services, untapped geographies, recent developments, and investments in the battery technology market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Contemporary Amperex Technology Co., Limited. (China), LG Energy Solution (South Korea), Panasonic Holdings Corporation (Japan), BYD Company Ltd. (China), SAMSUNG SDI (South Korea), and others.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 YEARS CONSIDERED

- 1.3.3 INCLUSIONS AND EXCLUSIONS

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 List of major secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 Primary interviews with experts

- 2.1.3.2 Key primary interview participants

- 2.1.3.3 Key data from primary sources

- 2.1.3.4 Key industry insights

- 2.1.3.5 Breakdown of primaries

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- 2.2.1.1 Estimation of market size using top-down approach

- 2.2.2 BOTTOM-UP APPROACH

- 2.2.2.1 Estimation of market size using bottom-up approach

- 2.2.1 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN BATTERY TECHNOLOGY MARKET

- 4.2 BATTERY TECHNOLOGY MARKET, BY TYPE

- 4.3 LITHIUM-ION BATTERY MARKET, BY INSTALLED CAPACITY

- 4.4 BATTERY TECHNOLOGY MARKET IN ASIA PACIFIC, BY TYPE AND COUNTRY

- 4.5 BATTERY TECHNOLOGY MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing EV sales

- 5.2.1.2 Increasing adoption of LFP chemistry in electric vehicles

- 5.2.1.3 Expanding use of battery-powered material handling equipment boosts Li-ion uptake

- 5.2.1.4 Rising R&D investments accelerate solid-state battery advancements

- 5.2.1.5 Rising demand for sustainable energy storage solutions

- 5.2.1.6 Growing adoption of flow batteries for utility and smart grid applications

- 5.2.2 RESTRAINTS

- 5.2.2.1 Challenges in recycling and managing end-of-life Li-ion batteries

- 5.2.2.2 Solid-state batteries face high production costs

- 5.2.2.3 Flow batteries encounter standardization and commercialization hurdles

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Expansion of energy storage systems and renewable integration driving Li-ion growth

- 5.2.3.2 Advancements in sodium-ion technologies

- 5.2.3.3 Falling Li-ion production costs

- 5.2.3.4 Solid-state powering innovation in medical devices

- 5.2.3.5 Increasing residential energy storage demand benefiting flow batteries

- 5.2.4 CHALLENGES

- 5.2.4.1 Trade tariffs on Chinese EVs in Europe and North America

- 5.2.4.2 Financial risks and market volatility

- 5.2.4.3 Complex and costly manufacturing processes for solid-state batteries

- 5.2.4.4 Limited application scope restricting lead acid battery growth

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE TREND OF LITHIUM-ION BATTERIES, 2021-2033

- 5.5.2 PRICING RANGE OF LITHIUM-ION BATTERY PACKS, BY KEY PLAYER, 2024

- 5.5.3 AVERAGE SELLING PRICE TREND OF LFP AND NMC BATTERIES, 2021-2024

- 5.5.4 AVERAGE SELLING PRICE TREND OF LITHIUM-ION BATTERIES, BY REGION, 2021-2024

- 5.5.5 PRICING RANGE OF SOLID-STATE BATTERIES, 2024

- 5.5.6 PRICING RANGE OF SOLID-STATE BATTERIES, BY REGION, 2024

- 5.5.7 INDICATIVE PRICING OF FLOW BATTERIES OFFERED BY KEY PLAYERS, 2024

- 5.6 KEY INSIGHTS RELATED TO LITHIUM-ION BATTERY INDUSTRY

- 5.6.1 TOP LITHIUM-PRODUCING COUNTRIES

- 5.6.2 LITHIUM-ION BATTERY MANUFACTURING CAPACITY, BY COUNTRY, 2022 VS. 2025 VS. 2030

- 5.6.3 LIST OF CURRENTLY OPERATIONAL AND UPCOMING GIGAFACTORIES

- 5.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.8 INVESTMENT AND FUNDING SCENARIO

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Lithium-silicon batteries

- 5.9.1.2 Lithium-sulfur batteries

- 5.9.1.3 Secondary zinc-air batteries

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 Liquid-metal batteries

- 5.9.2.2 Flywheel batteries

- 5.9.3 ADJACENT TECHNOLOGIES

- 5.9.3.1 Fuel cells

- 5.9.3.2 Supercapacitors

- 5.9.1 KEY TECHNOLOGIES

- 5.10 PORTER'S FIVE FORCES ANALYSIS

- 5.10.1 BARGAINING POWER OF SUPPLIERS

- 5.10.2 BARGAINING POWER OF BUYERS

- 5.10.3 THREAT OF NEW ENTRANTS

- 5.10.4 THREAT OF SUBSTITUTES

- 5.10.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.11 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.11.2 BUYING CRITERIA

- 5.12 CASE STUDY ANALYSIS

- 5.12.1 TOYOTA MATERIAL HANDLING HELPS REDUCE EQUIPMENT DOWNTIME BY REPLACING LEAD-ACID BATTERIES WITH LITHIUM-ION TECHNOLOGY

- 5.12.2 GEORGIA TECH RESEARCHERS DEVELOP LOW-MELTING CERAMIC ELECTROLYTES TO REDUCE SOLID-STATE BATTERY MANUFACTURING COSTS

- 5.12.3 SAMSUNG ELECTRONICS TESTS SILVER-CARBON COMPOSITE TO SUPPRESS DENDRITIC AND IMPROVE SOLID-STATE BATTERY LIFE AND SAFETY

- 5.12.4 REDFLOW PROVIDES OPTUS TELECOMMUNICATIONS WITH FLOW BATTERIES TO REDUCE CO2 EMISSIONS

- 5.13 TRADE ANALYSIS

- 5.13.1 IMPORT SCENARIO (HS CODE 850650)

- 5.13.2 EXPORT SCENARIO (HS CODE 850650)

- 5.14 PATENT ANALYSIS

- 5.15 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.16 REGULATORY LANDSCAPE

- 5.16.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.16.2 STANDARDS

- 5.17 IMPACT OF AI/GEN AI

- 5.17.1 INTRODUCTION

- 5.17.2 IMPACT OF AI ON BATTERY TECHNOLOGY MARKET

- 5.17.3 TOP USE CASES AND MARKET POTENTIAL

- 5.18 IMPACT OF 2025 US TARIFF

- 5.18.1 INTRODUCTION

- 5.18.2 KEY TARIFF RATES

- 5.18.3 PRICE IMPACT ANALYSIS

- 5.18.4 IMPACT ON COUNTRY/REGION

- 5.18.4.1 US

- 5.18.4.2 Europe

- 5.18.4.3 Asia Pacific

- 5.18.5 IMPACT ON APPLICATIONS

6 BATTERY TECHNOLOGY MARKET, BY BATTERY TYPE

- 6.1 INTRODUCTION

- 6.2 LITHIUM-ION BATTERY

- 6.2.1 EXPANDING ELECTRIC MOBILITY AND ENERGY STORAGE INTEGRATION TO DRIVE MARKET GROWTH

- 6.2.2 LITHIUM-ION BATTERY, BY TYPE

- 6.2.2.1 NMC

- 6.2.2.1.1 Enhanced thermal stability driving widespread NMC battery deployment

- 6.2.2.2 LFP

- 6.2.2.2.1 Extended lifespan and affordability driving LFP battery market expansion

- 6.2.2.3 LCO

- 6.2.2.3.1 High energy density in portable electronics sustaining lco battery demand

- 6.2.2.4 LTO

- 6.2.2.4.1 High security and stability of LTO batteries to drive strong adoption across advanced energy applications

- 6.2.2.5 LMO

- 6.2.2.5.1 High thermal stability and safety driving LMO battery adoption across industrial and EV applications

- 6.2.2.6 NCA

- 6.2.2.6.1 High energy density and durability driving NCA battery adoption in EVs and power sector

- 6.2.2.1 NMC

- 6.2.3 LITHIUM-ION BATTERY, BY APPLICATION

- 6.2.3.1 EVs

- 6.2.3.1.1 Rising electric vehicle penetration fueling market growth

- 6.2.3.1.2 By battery capacity

- 6.2.3.1.2.1 Below 50 kWh

- 6.2.3.1.2.2 50-100 kWh

- 6.2.3.1.2.3 Above 100 kWh

- 6.2.3.1.3 By battery type

- 6.2.3.1.4 By battery form

- 6.2.3.1.4.1 Prismatic

- 6.2.3.1.4.2 Pouch

- 6.2.3.1.4.3 Cylindrical

- 6.2.3.2 Energy storage

- 6.2.3.2.1 Rising deployment of Li-ion batteries in residential and grid-scale storage driving market growth

- 6.2.3.2.2 By battery capacity

- 6.2.3.2.2.1 Below 30 kWh

- 6.2.3.2.2.2 30 kWh-10 MWh

- 6.2.3.2.2.3 Above 10 MWh

- 6.2.3.2.3 By battery type

- 6.2.3.2.4 By connection type

- 6.2.3.3 Industrial

- 6.2.3.3.1 Rising adoption of electrified systems for automated operations driving market growth

- 6.2.3.3.2 By type

- 6.2.3.3.2.1 Material handling equipment

- 6.2.3.3.2.2 Mining equipment

- 6.2.3.3.2.3 Low-speed electric vehicles

- 6.2.3.3.2.4 Industrial tools

- 6.2.3.3.3 By battery capacity

- 6.2.3.3.3.1 Below 50 kWh

- 6.2.3.3.3.2 50-100 kWh

- 6.2.3.3.3.3 Above 100 kWh

- 6.2.3.3.4 Battery type

- 6.2.3.4 Consumer electronics

- 6.2.3.4.1 Long lifespan, high energy density, low self-discharge rate to increase integration into electronic devices

- 6.2.3.4.2 By product type

- 6.2.3.4.2.1 Smartphones

- 6.2.3.4.2.2 Laptops & tablets

- 6.2.3.4.2.3 Wearables

- 6.2.3.4.3 By battery capacity

- 6.2.3.4.3.1 Below 10 Wh

- 6.2.3.4.3.2 10-30 Wh

- 6.2.3.4.3.3 Above 30 Wh

- 6.2.3.4.4 By battery type

- 6.2.3.5 Medical

- 6.2.3.5.1 Growing demand for reliable power in life-saving devices driving adoption

- 6.2.3.5.2 By device type

- 6.2.3.5.2.1 Portable & diagnostic devices

- 6.2.3.5.2.2 Wearable & implantable devices

- 6.2.3.5.3 By battery capacity

- 6.2.3.5.3.1 Below 10 Wh

- 6.2.3.5.3.2 10-50 Wh

- 6.2.3.5.3.3 Above 50 Wh

- 6.2.3.5.4 By battery type

- 6.2.3.6 Other applications

- 6.2.3.6.1 Telecommunications

- 6.2.3.6.1.1 Enhanced performance and low maintenance features accelerating adoption

- 6.2.3.6.2 Marine

- 6.2.3.6.2.1 Resilience against high discharge currents and mechanical stress driving demand

- 6.2.3.6.3 Aerospace

- 6.2.3.6.3.1 Increasing priority on lightweight design and high power in aerospace to boost adoption

- 6.2.3.6.4 By battery type

- 6.2.3.6.1 Telecommunications

- 6.2.3.1 EVs

- 6.3 LEAD ACID

- 6.3.1 SUSTAINED DEMAND IN AUTOMOTIVE AND BACKUP POWER APPLICATIONS TO SUPPORT MARKET EXPANSION

- 6.3.2 LEAD ACID, BY APPLICATION

- 6.3.2.1 Power & utility

- 6.3.2.1.1 Rising grid modernization initiatives to drive lead acid battery deployment in power & utility

- 6.3.2.2 Transportation

- 6.3.2.2.1 Continued dominance of SLI batteries to sustain transportation demand

- 6.3.2.3 Industrial

- 6.3.2.3.1 Growing industrial automation accelerates adoption of lead acid batteries

- 6.3.2.4 Commercial & residential

- 6.3.2.4.1 Commercial expansion and backup needs strengthen lead acid battery utilization

- 6.3.2.1 Power & utility

- 6.4 NICKEL-BASED BATTERIES

- 6.4.1 RISING INDUSTRIAL AND AEROSPACE APPLICATIONS TO STRENGTHEN MARKET ADOPTION

- 6.4.2 NICKEL-BASED BATTERY, BY BATTERY TYPE

- 6.4.2.1 NiMh

- 6.4.2.1.1 Growing hybrid vehicle adoption sustains demand for NiMH batteries

- 6.4.2.2 NiCd

- 6.4.2.2.1 Reliability in extreme environments drives NiCd battery utilization

- 6.4.2.1 NiMh

- 6.4.3 NICKEL-BASED BATTERY, BY APPLICATION

- 6.4.3.1 Aerospace

- 6.4.3.1.1 Nickel-based batteries ensure mission-critical power reliability

- 6.4.3.2 Automotive & transportation

- 6.4.3.2.1 Rising hybrid vehicle adoption drives demand

- 6.4.3.3 Consumer electronics

- 6.4.3.3.1 Continued demand for cost-efficient power sustains nickel-based batteries

- 6.4.3.4 Healthcare

- 6.4.3.4.1 Increasing demand for reliable backup power strengthens nickel-based battery adoption

- 6.4.3.5 Industrial

- 6.4.3.5.1 Rising automation and backup needs fuel nickel-based battery demand

- 6.4.3.6 Marine

- 6.4.3.6.1 Safety and durability in harsh environments sustain NiCd demand

- 6.4.3.7 Commercial

- 6.4.3.7.1 Expanding infrastructure needs to strengthen nickel-based battery utilization

- 6.4.3.8 Residential

- 6.4.3.8.1 Cost-efficiency and availability to drive demand for nickel-based batteries

- 6.4.3.9 Other Nickel-based battery applications

- 6.4.3.9.1 Nickel-based batteries enable reliable power for telecom and infrastructure networks

- 6.4.3.1 Aerospace

- 6.5 SOLID-STATE BATTERY

- 6.5.1 ENHANCED SAFETY AND HIGH ENERGY DENSITY REQUIREMENTS TO PROPEL MARKET DEVELOPMENT

- 6.5.2 SOLID-STATE BATTERY, BY BATTERY TYPE

- 6.5.2.1 Primary

- 6.5.2.1.1 Market growth encouraged by environmental and health safety considerations

- 6.5.2.2 Secondary

- 6.5.2.2.1 Rising use in electric vehicles and consumer electronics drives market growth

- 6.5.2.1 Primary

- 6.5.3 SOLID-STATE BATTERY, BY CAPACITY

- 6.5.3.1 Below 20 mAh

- 6.5.3.1.1 Expanding use in packaging, smart cards, and cosmetic patches to drive demand

- 6.5.3.2 20-500 mAh

- 6.5.3.2.1 Rising global demand for IoT and wearable devices to fuel market growth

- 6.5.3.3 Above 500 mAh

- 6.5.3.3.1 Combined advancements, partnerships, and pilot-scale investments to offer lucrative growth opportunities

- 6.5.3.1 Below 20 mAh

- 6.5.4 SOLID-STATE BATTERY, BY APPLICATION

- 6.5.4.1 Consumer electronics

- 6.5.4.1.1 Increasing focus on slim and lightweight products to propel market growth

- 6.5.4.1.2 Smartphones

- 6.5.4.1.3 Wearables

- 6.5.4.1.4 Other consumer electronics

- 6.5.4.2 Electric vehicles

- 6.5.4.2.1 Rising focus on solid-state battery development and research supports market expansion

- 6.5.4.3 Medical devices

- 6.5.4.3.1 Capability to prolong battery life in compact medical devices to drive market growth

- 6.5.4.4 Energy harvesting

- 6.5.4.4.1 Adoption of solid-state batteries in environmental energy storage to drive market growth

- 6.5.4.5 Wireless sensors

- 6.5.4.5.1 Rising demand for compact and high-energy-density batteries to fuel market growth

- 6.5.4.6 Packaging

- 6.5.4.6.1 Growing demand for long-life of tags and labels to fuel drive market

- 6.5.4.7 Other applications

- 6.5.4.1 Consumer electronics

- 6.6 FLOW BATTERY

- 6.6.1 INCREASING RENEWABLE ENERGY DEPLOYMENT AND LONG-DURATION STORAGE NEEDS TO ACCELERATE GROWTH

- 6.6.2 FLOW BATTERY, BY BATTERY TYPE

- 6.6.2.1 Redox

- 6.6.2.1.1 Cost-effectiveness and convenience in large-scale energy storage applications to spike demand

- 6.6.2.2 Hybrid

- 6.6.2.2.1 Extended operational lifespan and convenient maintenance features to boost demand

- 6.6.2.1 Redox

- 6.6.3 FLOW BATTERY, BY MATERIAL

- 6.6.3.1 Vanadium

- 6.6.3.1.1 Growing demand for low-carbon energy storage solutions to drive adoption

- 6.6.3.2 Zinc-bromine

- 6.6.3.2.1 Easy availability and flexible design to foster segmental growth

- 6.6.3.3 Other materials

- 6.6.3.1 Vanadium

- 6.6.4 FLOW BATTERY, BY APPLICATION

- 6.6.4.1 Utilities

- 6.6.4.1.1 Peak capacity management

- 6.6.4.1.1.1 Pressing need to harness off-peak power for peak demand to drive market

- 6.6.4.1.2 Energy shifting

- 6.6.4.1.2.1 Increasing focus on optimizing grid operations to boost demand

- 6.6.4.1.3 Transmission

- 6.6.4.1.3.1 Escalating demand for highly efficient and reliable power grid to fuel market growth

- 6.6.4.1.4 Distribution

- 6.6.4.1.4.1 Urgent requirement to address voltage fluctuations and power outage issues to accelerate demand

- 6.6.4.1.5 Frequency regulation

- 6.6.4.1.5.1 Heightened need for consistent and reliable power to facilitate adoption

- 6.6.4.1.1 Peak capacity management

- 6.6.4.2 Commercial & industrial

- 6.6.4.2.1 Need for emergency backup power to prevent production loss during power outages to accelerate deployment

- 6.6.4.3 EV charging stations

- 6.6.4.3.1 Government-led funding to expand electric vehicle charging infrastructure to create growth opportunities

- 6.6.4.4 Other applications

- 6.6.4.1 Utilities

- 6.7 SODIUM-ION

- 6.7.1 ADVANCEMENTS IN COST-EFFECTIVE ALTERNATIVES AND MATERIAL AVAILABILITY TO BOOST MARKET POTENTIAL

- 6.7.2 SODIUM-ION BATTERY, BY APPLICATION

- 6.7.2.1 Energy storage

- 6.7.2.1.1 Accelerated deployment of sodium-ion batteries for renewable energy storage

- 6.7.2.2 Automotive

- 6.7.2.2.1 Rising adoption of sodium-ion batteries in hybrid and electric vehicles

- 6.7.2.3 Industrial

- 6.7.2.3.1 Growing industrial reliance on sodium-ion batteries for reliable energy management

- 6.7.2.4 Others

- 6.7.2.4.1 Expansion of sodium-ion battery applications in consumer and remote energy solutions

- 6.7.2.1 Energy storage

- 6.8 EMERGING BATTERY TYPES

- 6.8.1 LITHIUM-SILICON BATTERIES

- 6.8.2 LITHIUM-SULFUR BATTERIES

7 BATTERY TECHNOLOGY MARKET, BY REGION

- 7.1 INTRODUCTION

- 7.2 NORTH AMERICA

- 7.2.1 US

- 7.2.1.1 Strategic investments and innovation drive US battery technology growth

- 7.2.2 CANADA

- 7.2.2.1 Technological innovation and clean energy policies drive growth

- 7.2.3 MEXICO

- 7.2.3.1 Rising capital inflows boost Mexico's lithium-ion battery production

- 7.2.1 US

- 7.3 EUROPE

- 7.3.1 GERMANY

- 7.3.1.1 Clean energy targets drive battery demand growth

- 7.3.2 UK

- 7.3.2.1 Increasing emphasis on renewable electricity to drive market growth

- 7.3.3 FRANCE

- 7.3.3.1 Government initiatives and EV demand drive France's battery ecosystem expansion

- 7.3.4 ITALY

- 7.3.4.1 EV adoption and energy storage expansion drive growth in Italy's battery market

- 7.3.5 REST OF EUROPE

- 7.3.1 GERMANY

- 7.4 ASIA PACIFIC

- 7.4.1 CHINA

- 7.4.1.1 Strategic integration of storage, manufacturing, and EV adoption propels China's battery market

- 7.4.2 JAPAN

- 7.4.2.1 Significant presence of prominent lithium-ion manufacturers expected to support market growth

- 7.4.3 INDIA

- 7.4.3.1 Growing lithium reserves, EV uptake, and grid modernization fuel India's battery market expansion

- 7.4.3.2 Recent strategic developments accelerating India's battery technology market growth

- 7.4.4 SOUTH KOREA

- 7.4.4.1 Strategic investments in advanced battery technologies to drive market growth

- 7.4.5 REST OF ASIA PACIFIC

- 7.4.1 CHINA

- 7.5 ROW

- 7.5.1 MIDDLE EAST

- 7.5.1.1 Renewable energy expansion and smart technology adoption fueling battery demand

- 7.5.1.2 GCC countries

- 7.5.1.3 Rest of Middle East

- 7.5.2 AFRICA

- 7.5.2.1 Rising mining activities and flow battery projects strengthening Africa's role in battery technology market

- 7.5.3 SOUTH AMERICA

- 7.5.3.1 Favorable manufacturing hub for lithium-ion battery producers driving market growth

- 7.5.1 MIDDLE EAST

8 COMPETITIVE LANDSCAPE

- 8.1 INTRODUCTION

- 8.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2024

- 8.3 REVENUE ANALYSIS, 2021-2024

- 8.4 MARKET SHARE ANALYSIS, 2024

- 8.4.1 LITHIUM-ION BATTERY MARKET: MARKET SHARE ANALYSIS

- 8.4.2 SOLID-STATE BATTERY MARKET: MARKET SHARE ANALYSIS

- 8.5 COMPANY VALUATION AND FINANCIAL METRICS

- 8.6 BRAND COMPARISON

- 8.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 8.7.1 STARS

- 8.7.2 EMERGING LEADERS

- 8.7.3 PERVASIVE PLAYERS

- 8.7.4 PARTICIPANTS

- 8.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 8.7.5.1 Company footprint

- 8.7.5.2 Region footprint

- 8.7.5.3 Battery type footprint

- 8.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 8.8.1 PROGRESSIVE COMPANIES

- 8.8.2 RESPONSIVE COMPANIES

- 8.8.3 DYNAMIC COMPANIES

- 8.8.4 STARTING BLOCKS

- 8.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 8.8.5.1 Detailed list of key startups/SMEs

- 8.8.5.2 Competitive benchmarking of key startups/SMEs

- 8.8.6 STARTUP LANDSCAPE ACROSS KEY SEGMENTS OF LITHIUM BATTERY VALUE CHAIN

- 8.9 COMPETITIVE SCENARIO

- 8.9.1 PRODUCT LAUNCHES

- 8.9.2 DEALS

- 8.9.3 EXPANSIONS

- 8.9.4 OTHER DEVELOPMENTS

9 COMPANY PROFILES

- 9.1 KEY PLAYERS

- 9.1.1 CONTEMPORARY AMPEREX TECHNOLOGY CO., LIMITED

- 9.1.1.1 Business overview

- 9.1.1.2 Products/Solutions/Services offered

- 9.1.1.3 Recent developments

- 9.1.1.3.1 Product launches

- 9.1.1.3.2 Deals

- 9.1.1.4 MnM view

- 9.1.1.4.1 Key strengths

- 9.1.1.4.2 Strategic choices

- 9.1.1.4.3 Weaknesses and competitive threats

- 9.1.2 BYD COMPANY LTD.

- 9.1.2.1 Business overview

- 9.1.2.2 Products/Solutions/Services offered

- 9.1.2.3 Recent developments

- 9.1.2.3.1 Deals

- 9.1.2.4 MnM view

- 9.1.2.4.1 Key strengths

- 9.1.2.4.2 Strategic choices

- 9.1.2.4.3 Weaknesses and competitive threats

- 9.1.3 LG ENERGY SOLUTION

- 9.1.3.1 Business overview

- 9.1.3.2 Products/Solutions/Services offered

- 9.1.3.3 Recent developments

- 9.1.3.3.1 Product launches

- 9.1.3.3.2 Deals

- 9.1.3.3.3 Expansions

- 9.1.3.4 MnM view

- 9.1.3.4.1 Key strengths

- 9.1.3.4.2 Strategic choices

- 9.1.3.4.3 Weaknesses and competitive threats

- 9.1.4 SAMSUNG SDI

- 9.1.4.1 Business overview

- 9.1.4.2 Products/Solutions/Services offered

- 9.1.4.3 Recent developments

- 9.1.4.3.1 Deals

- 9.1.4.3.2 Expansions

- 9.1.4.3.3 Other developments

- 9.1.4.4 MnM view

- 9.1.4.4.1 Key strengths

- 9.1.4.4.2 Strategic choices

- 9.1.4.4.3 Weaknesses and competitive threats

- 9.1.5 PANASONIC HOLDINGS CORPORATION

- 9.1.5.1 Business overview

- 9.1.5.2 Products/Solutions/Services offered

- 9.1.5.3 Recent developments

- 9.1.5.3.1 Deals

- 9.1.5.3.2 Expansions

- 9.1.5.3.3 Other developments

- 9.1.5.4 MnM view

- 9.1.5.4.1 Key strengths

- 9.1.5.4.2 Strategic choices

- 9.1.5.4.3 Weaknesses and competitive threats

- 9.1.6 EVE ENERGY CO., LTD.

- 9.1.6.1 Business overview

- 9.1.6.2 Products/Solutions/Services offered

- 9.1.6.3 Recent developments

- 9.1.6.3.1 Product launches

- 9.1.6.3.2 Deals

- 9.1.7 TESLA

- 9.1.7.1 Business overview

- 9.1.7.2 Products/Solutions/Services offered

- 9.1.7.3 Recent developments

- 9.1.7.3.1 Developments

- 9.1.8 GS YUASA CORPORATION

- 9.1.8.1 Business overview

- 9.1.8.2 Products/Solutions/Services offered

- 9.1.8.3 Recent developments

- 9.1.8.3.1 Deals

- 9.1.8.3.2 Other developments

- 9.1.9 SK INNOVATION CO., LTD.

- 9.1.9.1 Business overview

- 9.1.9.2 Products/Solutions/Services offered

- 9.1.9.3 Recent developments

- 9.1.9.3.1 Deals

- 9.1.10 TOSHIBA CORPORATION

- 9.1.10.1 Business overview

- 9.1.10.2 Products/Solutions/Services offered

- 9.1.10.3 Recent developments

- 9.1.10.3.1 Product launches

- 9.1.10.3.2 Deals

- 9.1.11 SUNWODA ELECTRONIC CO., LTD.

- 9.1.11.1 Business overview

- 9.1.11.2 Products/Solutions/Services offered

- 9.1.11.3 Recent developments

- 9.1.11.3.1 Deals

- 9.1.12 MITSUBISHI ELECTRIC CORPORATION

- 9.1.12.1 Business overview

- 9.1.12.2 Products/Solutions/Services offered

- 9.1.13 GOTION

- 9.1.13.1 Business overview

- 9.1.13.2 Products/Solutions/Services offered

- 9.1.13.3 Recent developments

- 9.1.13.3.1 Deals

- 9.1.14 ENERSYS

- 9.1.14.1 Business overview

- 9.1.14.2 Products/Solutions/Services offered

- 9.1.14.3 Recent developments

- 9.1.14.3.1 Deals

- 9.1.14.3.2 Expansions

- 9.1.15 VARTA AG

- 9.1.15.1 Business overview

- 9.1.15.2 Products/Solutions/Services offered

- 9.1.16 CALB

- 9.1.16.1 Business overview

- 9.1.16.2 Products/Solutions/Services offered

- 9.1.16.3 Recent developments

- 9.1.16.3.1 Product launches

- 9.1.1 CONTEMPORARY AMPEREX TECHNOLOGY CO., LIMITED

- 9.2 OTHER KEY PLAYERS

- 9.2.1 EXIDE INDUSTRIES LTD.

- 9.2.2 INVINITY ENERGY SYSTEMS

- 9.2.3 SUMITOMO ELECTRIC INDUSTRIES, LTD.

- 9.2.4 ILIKA

- 9.2.5 SOLID POWER, INC.

- 9.2.6 KANADEVIA CORPORATION

- 9.2.7 FACTORIAL INC.

- 9.2.8 DURACELL INC.

- 9.3 OTHER PLAYERS

- 9.3.1 AMPEREX TECHNOLOGY LIMITED

- 9.3.2 CLARIOS

- 9.3.3 BAK POWER

- 9.3.4 BLUE SOLUTIONS

- 9.3.5 PROLOGIUM TECHNOLOGY CO., LTD.

- 9.3.6 FACTORIAL INC

- 9.3.7 SAKUU CORPORATION

- 9.3.8 HINA BATTERY TECHNOLOGY CO., LTD.

- 9.3.9 ENEROX GMBH

- 9.3.10 FARASIS ENERGY(GANZHOU)CO., LTD.

- 9.3.11 ZONERGY CORPORATION

10 APPENDIX

- 10.1 DISCUSSION GUIDE

- 10.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 10.3 CUSTOMIZATION OPTIONS

- 10.4 RELATED REPORTS

- 10.5 AUTHOR DETAILS