|

시장보고서

상품코드

1829986

실리콘 시장 : 유형별, 최종 이용 산업별, 지역별 - 예측(-2030년)Silicone Market by Type (Elastomer, Fluid, Resin, Gel, & Other), End-use Industry (Industrial Process, Building & Construction, Transportation, Personal Care & Consumer, Electronic, Medical & Healthcare, Energy), and Region - Global Forecast to 2030 |

||||||

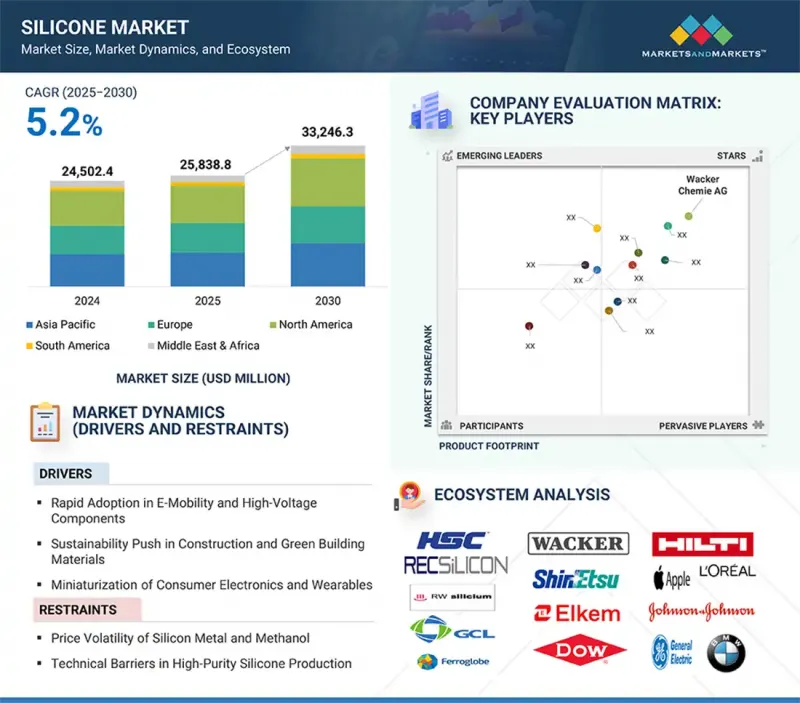

실리콘 시장 규모는 2024년에 245억 240만 달러로 평가되었습니다.

이 시장은 2030년 332억 4,630만 달러에 달할 것으로 예상되며, 예측 기간 동안 5.2%의 연평균 복합 성장률(CAGR)을 보일 것으로 예측됩니다. 실리콘 수요는 유연성, 강도, 다양한 산업분야에서의 응용으로 인해 증가하고 있습니다. 실리콘은 증가하는 도시화와 인프라를 견디기 위해 실링재, 접착제, 코팅제 등 건축 분야에서 사용이 증가하고 있습니다. 자동차 산업에서는 전기자동차 제조용 경량 부품, 개스킷, 절연체에 실리콘이 사용되고 있습니다. 화장품 및 퍼스널케어 분야에서 실리콘은 제품에 부드럽고 끈적이지 않는 질감과 매끄러운 느낌을 줄 수 있어 소비자들에게 인기를 끌고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2021-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 검토 단위 | 금액(100만 달러), 수량(1,000톤) |

| 부문 | 유형별, 최종 이용 산업별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 중동 및 아프리카, 남미 |

실리콘은 전자 및 헬스케어 산업에서 열 관리, 단열, 의료용으로 사용되고 있습니다. 실리콘은 내구성이 뛰어나고, 열화가 적고, 유지보수가 필요 없어 지속가능성 트렌드와도 관련이 있습니다. 일반적으로 급속한 산업화, 급속한 기술 개발, 고성능 및 신뢰할 수 있는 재료에 대한 최종 사용자의 요구는 잠재적인 성장 촉진요인이 되고 있습니다.

실리콘 시장의 유체 분야는 다양한 산업에서 채택되고 있기 때문에 두 번째 점유율을 차지할 것으로 예측됩니다. 실리콘 오일, 예를 들어 폴리디메틸실록산(PDMS) 오일은 낮은 표면 장력, 우수한 윤활성, 높은 열 안정성으로 인해 각광받고 있습니다. 실리콘 오일은 일반적으로 스킨 크림, 데오도란트, 헤어 케어와 같은 퍼스널케어 및 화장품 산업에서 신축성, 촉감 및 부드러움을 향상시키기 위해 사용됩니다. 실리콘 오일은 산업 분야에서 이형제 및 유압유압유의 윤활제로 사용되며, 사용 기계의 효율과 제품의 품질을 보장하기 위한 소포제로도 사용됩니다. 실리콘 오일은 전자 산업에서도 특히 고성능 부품의 냉각 및 절연 에어 갭으로 사용됩니다. 또한, 튜브, 코팅제, 약물 전달 시스템의 액체 기반 제형 등 의료용 실리콘에 대한 수요도 증가하고 있으며, 이 또한 시장을 주도하고 있습니다. 실리콘 오일은 극한의 열에서도 성능을 발휘하고 대부분의 화학물질의 영향을 받지 않아 안정성과 긴 수명도 매력적입니다. 전반적으로, 유체 부문은 다용도성, 기능적 효율성 및 산업 전반에 걸친 응용 분야로 인해 예측 기간 동안 세계 실리콘 시장의 주요 기여자 중 하나입니다.

최종 사용 산업별로는 산업 공정 분야가 예측 기간 동안 실리콘 시장에서 두 번째로 큰 점유율을 차지할 것으로 예측됩니다. 이는 이 소재의 광범위한 응용 분야와 산업 공정에 사용함으로써 얻을 수 있는 운영상의 이점 때문입니다. 실리콘은 우수한 열 안정성, 내화학성, 제조 공정에서 우수한 윤활 특성을 가지고 있습니다. 자동차 산업 및 항공우주 산업에서 실란트, 코팅, 유체로 사용되어 기계의 성능을 최적화하고 부품의 수명을 연장합니다. 전자 및 전기 분야에서 실리콘은 절연체 및 열 계면 화합물로 사용되어 고열 및 스트레스 환경에서 신뢰성을 보장하는 보호 코팅을 제공합니다. 또한, 건설 및 건축 산업에서는 인프라의 내구성과 관련된 건설 공정에서 실리콘을 사용하여 실링재, 접착제, 소포제를 제조하고 있습니다. 또한, 산업계는 현재 환경 지속가능성과 업무 효율성에 중점을 두고 있어 업무 최적화, 유지 보수 작업, 제품 생산성 측면에서 실리콘의 통합이 진행되고 있습니다. 산업 공정 분야는 다양한 공정 환경에 대응할 수 있는 범용성과 공정에 있어 성능이 중요한 주요 용도의 규제 승인으로 인해 예측 기간 동안 실리콘의 성장을 뒷받침할 것으로 예측됩니다.

아시아태평양은 산업화, 도시화, 다양한 산업 분야의 소비자 수요가 빠르게 증가함에 따라 예측 기간 동안 실리콘 산업에서 가장 큰 점유율을 차지할 것으로 예측됩니다. 중국, 일본, 한국, 인도 등의 국가들이 주요 기여국이며, 자동차, 전자제품, 퍼스널케어, 건설사업 등의 성장도 확대되고 있습니다. 자동차 산업에서는 전기자동차 및 경량화 부품의 채용 추세로 인해 실리콘 실란트, 개스킷, 유체의 사용이 증가하고 있습니다. 실리콘은 또한 전자 산업에서 열에 민감한 하드웨어의 열 관리, 섬세한 전자 제품의 절연 및 보호에 널리 사용됩니다. 퍼스널케어 및 화장품의 경우, 가처분 소득 증가와 고객 트렌드의 변화로 인해 헤어 케어 제품 및 스킨 케어 제품 등 실리콘 기반 포뮬러의 사용이 촉진되고 있습니다. 또한, 실리콘 실란트, 접착제, 코팅제는 이 지역의 건설에 따른 정부 인프라 프로젝트와 이니셔티브의 지원을 받고 있습니다. 실리콘은 또한 원료의 가용성, 비용 우위, 이 지역의 주요 맞춤형 실리콘 제조 회사를 기반으로 이 지역에서 우위를 점하고 있습니다. 따라서 아시아태평양은 견고한 산업 성장, 기술 활용, 광범위한 최종 용도 등으로 인해 예측 기간 동안 가장 크고 빠르게 성장하는 실리콘 시장이 될 것으로 예측됩니다.

세계의 실리콘 시장에 대해 조사했으며, 유형별/최종 이용 산업별/지역별 동향, 시장 진출기업 프로파일 등의 정보를 정리하여 전해드립니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 프리미엄 인사이트

제5장 시장 개요

- 서론

- 시장 역학

제6장 업계 동향

- 고객의 비즈니스에 영향을 미치는 동향/파괴적 변화

- 가격 분석

- 밸류체인 분석

- 생태계 분석

- 기술 분석

- 생성형 AI가 실리콘 시장에 미치는 영향

- 특허 분석

- 무역 분석

- 주요 컨퍼런스 및 이벤트

- 규제 상황

- Porter의 Five Forces 분석

- 주요 이해관계자와 구입 기준

- 사례 연구 분석

- 거시경제 분석

- 투자 및 자금조달 시나리오

- 2025년 미국 관세가 실리콘 시장에 미치는 영향

- 가격 영향 분석

제7장 실리콘 시장(유형별)

- 서론

- 엘라스토머

- 유체

- 수지

- 젤 및 기타 제품

제8장 실리콘 시장(최종 이용 산업별)

- 서론

- 산업 프로세스

- 건축 및 건설

- 운송

- 퍼스널케어 및 소비재

- 일렉트로닉스

- 의료 및 헬스케어

- 에너지

- 기타

제9장 실리콘 시장(지역별)

- 서론

- 북미

- 미국

- 캐나다

- 멕시코

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 호주

- 기타

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 튀르키예

- 러시아

- 기타

- 남미

- 브라질

- 아르헨티나

- 기타

- 중동 및 아프리카

- GCC 국가

- 남아프리카공화국

- 기타

제10장 경쟁 구도

- 개요

- 주요 시장 진출기업의 전략/강점

- 매출 분석

- 시장 점유율 분석

- 기업 평가와 재무 지표

- 기업 평가 매트릭스 : 주요 시장 진출기업, 2024년

- 기업 평가 매트릭스 : 스타트업/중소기업, 2024년

- 경쟁 시나리오

제11장 기업 개요

- 주요 시장 진출기업

- WACKER CHEMIE AG

- SHIN-ETSU CHEMICAL CO., LTD.

- ELKEM ASA

- DOW

- MOMENTIVE PERFORMANCE MATERIALS, INC.

- EVONIK INDUSTRIES AG

- GELEST INC.

- INNOSPEC INC.

- SPECIALTY SILICONE PRODUCTS, INC.

- HOSHINE SILICON INDUSTRY CO., LTD.

- 기타 기업

- ZHEJIANG XIN'AN CHEMICAL INDUSTRY GROUP CO., LTD.

- REISS MANUFACTURING, INC.

- SILTECH CORPORATION

- KANEKA CORPORATION

- CHT GROUP

- GENESEE POLYMERS CORPORATION

- SILICONE SOLUTIONS, INC.

- SILICONE ENGINEERING LTD

- ZHEJIANG SUCON SILICONE CO., LTD.

- SILTEQ LTD

- KONARK SILICONE TECHNOLOGIES

- SUPREME SILICONES INDIA PVT. LTD.

- SHENZHEN SQUARE SILICONE CO., LTD.

- GUANGZHOU OTT NEW MATERIALS CO., LTD.

- CSL SILICONES INC.

제12장 인접 시장과 관련 시장

제13장 부록

LSH 25.10.15The silicone market was valued at USD 24,502.4 million in 2024 and is projected to reach USD 33,246.3 million by 2030, growing at a CAGR of 5.2% during the forecast period. Demand in silicones is increasing due to their flexibility, strength, and applications in the various industries. They are increasingly used in construction in sealants & adhesives and coatings to withstand increasing urbanization and infrastructure. The automotive industry is including silicones in lightweight parts, gaskets, and insulators for the manufacture of electric vehicles. In cosmetics and personal care, silicones can impart a soft, non-tacky texture and smooth feeling to a product, which contributes to their popularity with consumers.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million), Volume (Thousand Ton) |

| Segments | Type, End-use Industry, and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, South America |

Silicones are used in thermal management, insulation, and medical applications in the electronics and healthcare industries. Sustainability trends also come into play since silicones are durable, degradation-resistant, and eliminate the need to engage in maintenance. In general, fast industrialization, rapid technological development, and the demands of end users who want high-performance and reliable materials are the potential growth drivers.

By type, fluid segment to account for second-largest market share during forecast period

The fluid segment of the silicone market is expected to hold second-largest share due to the extent to which it has been adopted in various industries. Silicone fluids, e.g., polydimethylsiloxane (PDMS) oils, are prized because of their low surface tensions combined with excellent lubricity and their high thermal stability. Silicone fluids are commonly used in the personal care and cosmetics industry as skin creams, deodorants, and hair care, to improve spread ability, sensory feel, and smoothness. Silicone fluids are used as lubricants in the industrial sector, as release agents and hydraulic fluids, as well as anti-foaming agents to ensure the efficiency of machinery used and the quality of their products. Silicone fluids are also used in the electronics industry as cooling and insulating air gaps on sensitive electronics, particularly high-performance parts. There is also increasing demand for the medical-grade silicones such as fluid-based formulations in tubing, coatings, and drug delivery systems that also drive the market. Stability and long lifespan also add to their attractiveness since silicone fluids perform well in extreme heat and are not affected by most chemicals. On the whole, the fluid segment is one of the key contributors to the global silicone market during the forecast period, due to its versatility, functional efficiency, and applications across industries.

By end-use industry, industrial process segment to account for second-largest market share during the forecast period

By end-use industry, the industrial process segment is expected to hold the second-largest share in the silicone market during the forecast period, owing to the wide applicability of this material and the operational benefits that it offers due to its use in industrial processes. Silicones have superior thermal stability, chemical resistance, and good lubrication properties in manufacturing processes. They find applications in the automotive and aerospace industries as sealants, coatings, and fluids to optimize the effectiveness of machinery and increase component life. In the electronics and electrical sector, silicones are used as insulators, thermal interface compounds and provide protective coatings, guaranteeing dependability in high heat and in stress environments. The construction/building industry also uses silicones to make sealants, adhesives, and anti-foaming products in construction processes related to the durability of infrastructure. Moreover, the current focus on environmental sustainability and operational efficiency in industrial firms has led to an augmented integration of silicones in operational optimization, maintenance operations, as well as in terms of the productivity of products. The industrial process segment is expected to support silicone growth over the forecast period due to its versatility across a variety of process environments, and regulatory approvals in key applications where their performance is critical to the process.

Asia Pacific to account for largest market share during forecast period

Asia Pacific is expected to command the largest share of the silicone industry over the forecast period with industrialization, urbanization, and consumer demand in various industries increasing at a rapid rate. Countries like China, Japan, South Korea, and India have been the main contributors and the growth in automotive, electronics, personal care, and construction business is also expanding. In the automotive industry, there has been an increase in the use of silicone sealants, gaskets, and fluids because of the trend toward adopting electric vehicles and lightweight parts. Silicone is also used extensively in the electronics industry in thermal management of heat sensitive hardware, to insulate and protect sensitive electronics. In personal care and cosmetics, increasing disposable income and changing customer trends are promoting the use of silicone-based formulations, such as hair and skin care products. Also, silicone sealants, adhesives, and coatings are assisted by government infrastructure projects and initiatives along with construction in the region. Silicones also substantiate their dominance in the region based on the availability of raw materials, cost advantages, and major custom silicone production companies in the region. Hence, robust industrial growth, technology usage, and a wide array of end-use applications are expected to make the Asia Pacific region the largest and the fastest-growing silicone market during the forecast period.

- By Company Type: Tier 1: 40%, Tier 2: 25%, Tier 3: 35%

- By Designation: C Level: 35%, Director Level: 30%, Others: 35%

- By Region: North America: 25%, Europe: 20%, Asia Pacific: 45%, Middle East & Africa: 5%, and South America: 5%

Companies Covered:

Wacker Chemie AG (Germany), Shin-Etsu Chemical Co., Ltd. (Japan), Elkem ASA (Norway), DOW (US), Momentive Performance Materials, Inc. (US), Gelest Inc. (US), Evonik Industries AG (Germany), Innospec Inc. (US), Specialty Silicone Products, Inc. (US), and Hesheng Silicon Industry Co., Ltd. (China) are some of the key players in the silicone market.

Research Coverage

The market study examines the silicone market across various segments. It aims to estimate the market size and growth potential in different segments based on type, end-use industry, and region. The study also features an in-depth competitive analysis of key market players, including their company profiles, product and business offering insights, recent developments, and key growth strategies to enhance their market positions.

Key Benefits of Buying the Report

The report is designed to help market leaders and new entrants approximate the revenue figures of the overall silicone market, along with its segments and subsegments. It aims to assist stakeholders in understanding the competitive landscape, gaining insights to strengthen their business positions, and developing effective go-to-market strategies. Additionally, the report seeks to provide stakeholders with a pulse on the market by offering information on key drivers, challenges, and opportunities.

The report provides insights into the following pointers:

- Analysis of key drivers (Rapid Adoption in E-Mobility and High-Voltage Components & Sustainability Push in Construction and Green Building Materials), restraints (Price Volatility of Silicon Metal and Methanol & Technical Barriers in High-Purity Silicone Production), opportunities (Development of Silicone-Based Thermal Management Materials for EV Fast-Charging & Additive Manufacturing of Silicone Components), and challenges (Meeting Stricter VOC and Emission Standards & Supply Chain Localization Pressure) influencing the growth of the silicone market.

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and product & service launches in the silicone market.

- Market Development: Comprehensive information about profitable markets - the report analyzes the silicone market across varied regions.

Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the silicone market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like as Wacker Chemie AG (Germany), Shin-Etsu Chemical Co., Ltd. (Japan), Elkem ASA (Norway), DOW (US), Momentive Performance Materials, Inc. (US), Gelest Inc. (US), Evonik Industries AG (Germany), Innospec Inc. (US), Specialty Silicone Products, Inc. (US), Hesheng Silicon Industry Co., Ltd. (China), and Others in the silicone market. The report also helps stakeholders understand the pulse of the silicone market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.1.2 List of secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key primary participants

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Breakdown of interviews with experts

- 2.1.2.4 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- 2.2.2 BOTTOM-UP APPROACH

- 2.3 BASE NUMBER CALCULATION

- 2.3.1 SUPPLY-SIDE APPROACH

- 2.4 GROWTH FORECAST

- 2.5 DATA TRIANGULATION

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 FACTOR ANALYSIS

- 2.8 RESEARCH LIMITATIONS

- 2.9 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SILICONE MARKET

- 4.2 SILICONE MARKET, BY TYPE

- 4.3 SILICONE MARKET, BY END-USE INDUSTRY

- 4.4 ASIA PACIFIC: SILICONE MARKET, BY TYPE AND COUNTRY

- 4.5 SILICONE MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rapid adoption in E-mobility and high-voltage components

- 5.2.1.2 Sustainability push in construction and green building materials

- 5.2.1.3 Miniaturization of consumer electronics and wearables

- 5.2.1.4 Growing market for high-performance lubricants

- 5.2.2 RESTRAINTS

- 5.2.2.1 Price volatility of silicon metal and methanol

- 5.2.2.2 Technical barriers in high-purity silicone production

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Development of silicone-based thermal management materials for EV fast-charging

- 5.2.3.2 Additive manufacturing of silicone components

- 5.2.3.3 Medical-grade silicones for next-generation implantable and wearable health devices

- 5.2.4 CHALLENGES

- 5.2.4.1 Meeting stricter VOC and emission standards

- 5.2.4.2 Supply chain localization pressure

- 5.2.1 DRIVERS

6 INDUSTRY TRENDS

- 6.1 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 6.2 PRICING ANALYSIS

- 6.2.1 AVERAGE SELLING PRICE OF KEY PLAYERS, BY TYPE

- 6.2.2 AVERAGE SELLING PRICE TREND, BY REGION

- 6.3 VALUE CHAIN ANALYSIS

- 6.4 ECOSYSTEM ANALYSIS

- 6.5 TECHNOLOGY ANALYSIS

- 6.5.1 KEY TECHNOLOGIES

- 6.5.1.1 Direct process (Rochow/Muller Process)

- 6.5.1.2 Addition curing (platinum-catalyzed)

- 6.5.2 COMPLEMENTARY TECHNOLOGIES

- 6.5.2.1 Silicone coating technology

- 6.5.3 ADJACENT TECHNOLOGIES

- 6.5.3.1 Fluoropolymer technologies

- 6.5.3.2 3D printing of elastomers

- 6.5.1 KEY TECHNOLOGIES

- 6.6 IMPACT OF GEN AI ON SILICONE MARKET

- 6.7 PATENT ANALYSIS

- 6.7.1 INTRODUCTION

- 6.7.2 APPROACH

- 6.7.3 TOP APPLICANTS

- 6.8 TRADE ANALYSIS

- 6.8.1 IMPORT DATA RELATED TO HS CODE 3910, BY COUNTRY

- 6.8.2 EXPORT DATA RELATED TO HS CODE 3910, BY COUNTRY

- 6.9 KEY CONFERENCES AND EVENTS

- 6.10 REGULATORY LANDSCAPE

- 6.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.10.2 REGULATORY FRAMEWORK

- 6.11 PORTER'S FIVE FORCES' ANALYSIS

- 6.11.1 THREAT OF NEW ENTRANTS

- 6.11.2 THREAT OF SUBSTITUTES

- 6.11.3 BARGAINING POWER OF SUPPLIERS

- 6.11.4 BARGAINING POWER OF BUYERS

- 6.11.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.12 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.12.2 BUYING CRITERIA

- 6.13 CASE STUDY ANALYSIS

- 6.13.1 DOW - FIRST CARBON-NEUTRAL SILICONE FACADE PROJECT

- 6.13.2 ELKEM - MEDICAL-GRADE SILICONE UNDER TIGHTENING REGULATIONS

- 6.13.3 WACKER - 20-YEAR EXPOSURE OF SILICONE RESIN EMULSION PAINT (SILRES(R))

- 6.14 MACROECONOMIC ANALYSIS

- 6.14.1 INTRODUCTION

- 6.14.2 GDP TRENDS AND FORECASTS

- 6.14.3 INFRASTRUCTURE DEVELOPMENT AND URBANIZATION

- 6.14.4 EXPANSION OF ELECTRIC VEHICLE (EV) ADOPTION

- 6.15 INVESTMENT AND FUNDING SCENARIO

- 6.16 IMPACT OF 2025 US TARIFF ON SILICONE MARKET

- 6.16.1 INTRODUCTION

- 6.16.2 KEY TARIFF RATES

- 6.17 PRICE IMPACT ANALYSIS

- 6.17.1 KEY IMPACT ON VARIOUS REGIONS

- 6.17.1.1 US

- 6.17.1.2 Europe

- 6.17.1.3 Asia Pacific

- 6.17.2 END-USE INDUSTRY IMPACT

- 6.17.1 KEY IMPACT ON VARIOUS REGIONS

7 SILICONE MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 ELASTOMERS

- 7.2.1 SUPERIOR STABILITY THROUGH ADVANCED CROSSLINKING AND MOLECULAR DESIGN TO DRIVE DEMAND

- 7.3 FLUIDS

- 7.3.1 HIGH STABILITY THROUGH ADVANCED MOLECULAR DESIGN AND INNOVATION TO DRIVE ADOPTION

- 7.4 RESINS

- 7.4.1 SUPERIOR THERMAL ENDURANCE THROUGH HIGHLY CROSSLINKED MOLECULAR STRUCTURES TO FUEL SEGMENT GROWTH

- 7.5 GELS & OTHER PRODUCTS

- 7.5.1 FLEXIBILITY AND THERMAL STABILITY THROUGH ADVANCED CROSSLINKING TECHNIQUES TO DRIVE DEMAND

8 SILICONE MARKET, BY END-USE INDUSTRY

- 8.1 INTRODUCTION

- 8.2 INDUSTRIAL PROCESS

- 8.2.1 ADVANCED THERMAL AND CHEMICAL PERFORMANCE IN INDUSTRIAL APPLICATIONS TO FUEL DEMAND

- 8.3 BUILDING & CONSTRUCTION

- 8.3.1 ENHANCED WEATHERABILITY AND STRUCTURAL INTEGRITY IN BUILDING & CONSTRUCTION APPLICATIONS TO DRIVE DEMAND

- 8.4 TRANSPORTATION

- 8.4.1 HIGH-PERFORMANCE THERMAL AND MECHANICAL SOLUTIONS IN TRANSPORTATION APPLICATIONS TO SUPPORT SEGMENT GROWTH

- 8.5 PERSONAL CARE AND CONSUMER PRODUCTS

- 8.5.1 ADVANCED SENSORY AND PERFORMANCE ENHANCEMENTS IN PERSONAL CARE APPLICATIONS TO DRIVE DEMAND

- 8.6 ELECTRONICS

- 8.6.1 ADVANCED THERMAL AND ELECTRICAL PROTECTION SOLUTIONS IN ELECTRONICS APPLICATIONS TO PROPEL DEMAND

- 8.7 MEDICAL & HEALTHCARE

- 8.7.1 BIOCOMPATIBLE AND DURABLE MATERIAL SOLUTIONS IN HEALTHCARE APPLICATIONS TO DRIVE GROWTH

- 8.8 ENERGY

- 8.8.1 HIGH-PERFORMANCE INSULATION AND THERMAL SOLUTIONS IN ENERGY APPLICATIONS TO PROPEL SEGMENT

- 8.9 OTHER END-USE INDUSTRIES

9 SILICONE MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 US

- 9.2.1.1 Largest global healthcare sector and growth in shift toward EVs to drive demand

- 9.2.2 CANADA

- 9.2.2.1 Demand for safe, durable, and flexible solutions for high-value medical technologies in Canada to propel market

- 9.2.3 MEXICO

- 9.2.3.1 Automotive, healthcare, electronics, and cosmetics expansion in Mexico to drive growth

- 9.2.1 US

- 9.3 ASIA PACIFIC

- 9.3.1 CHINA

- 9.3.1.1 Rise in EV sales, medical exports, and electronics growth in China to propel demand

- 9.3.2 JAPAN

- 9.3.2.1 Robust automotive base, combined with Japan's accelerated shift toward hybrid and electric vehicles, to support demand

- 9.3.3 INDIA

- 9.3.3.1 Rapid economic transformation and growth of construction, automotive, electronics, energy, and beauty sectors to propel Indian market

- 9.3.4 SOUTH KOREA

- 9.3.4.1 Rapid EV adoption, semiconductor expansion, and urban redevelopment to fuel market growth

- 9.3.5 AUSTRALIA

- 9.3.5.1 Massive infrastructure, housing, energy, and automotive investments in Australia to drive adoption

- 9.3.6 REST OF ASIA PACIFIC

- 9.3.1 CHINA

- 9.4 EUROPE

- 9.4.1 GERMANY

- 9.4.1.1 Automotive industry remaining key growth engine and strong focus on energy efficiency renovations in Germany to drive market

- 9.4.2 UK

- 9.4.2.1 Infrastructure renewal, healthcare expansion, and advanced electronics and automotive manufacturing to propel demand

- 9.4.3 FRANCE

- 9.4.3.1 Rise in housing construction, medical instruments trade, and cosmetics expansion in France to propel growth

- 9.4.4 ITALY

- 9.4.4.1 Investment in electronics, construction, automotive, and cosmetics industries in Italy to drive demand

- 9.4.5 TURKEY

- 9.4.5.1 Strong construction growth, expanding automotive production, and increasing electronics exports in Turkey to drive adoption

- 9.4.6 RUSSIA

- 9.4.6.1 Automotive resurgence, housing development, and infrastructure upgrades, accelerating domestic electronics manufacturing in Russia to propel growth

- 9.4.7 REST OF EUROPE

- 9.4.1 GERMANY

- 9.5 SOUTH AMERICA

- 9.5.1 BRAZIL

- 9.5.1.1 Growth of demand in construction, automotive, electronics, and healthcare industries in Brazil to drive market

- 9.5.2 ARGENTINA

- 9.5.2.1 Infrastructure investments, EV growth, and healthcare advancements in Argentina to propel demand

- 9.5.3 REST OF SOUTH AMERICA

- 9.5.1 BRAZIL

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 GCC COUNTRIES

- 9.6.1.1 Saudi Arabia

- 9.6.1.1.1 Massive infrastructure investments and industrial diversification in Saudi Arabia to drive demand

- 9.6.1.2 UAE

- 9.6.1.2.1 UAE's real estate expansion and sustainable mobility transition to fuel growth

- 9.6.1.3 Rest of GCC Countries

- 9.6.1.1 Saudi Arabia

- 9.6.2 SOUTH AFRICA

- 9.6.2.1 Expansion of real estate, healthcare, automotive, and beauty industries in South Africa to drive steady demand

- 9.6.3 REST OF MIDDLE EAST & AFRICA

- 9.6.1 GCC COUNTRIES

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYERS STRATEGIES/RIGHT TO WIN

- 10.3 REVENUE ANALYSIS

- 10.4 MARKET SHARE ANALYSIS

- 10.5 COMPANY VALUATION AND FINANCIAL METRICS

- 10.5.1 COMPANY VALUATION

- 10.5.2 FINANCIAL METRICS

- 10.5.3 BRAND/PRODUCT COMPARISON

- 10.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.6.1 STARS

- 10.6.2 EMERGING LEADERS

- 10.6.3 PERVASIVE PLAYERS

- 10.6.4 PARTICIPANTS

- 10.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.6.5.1 Company footprint

- 10.6.5.2 Regional footprint

- 10.6.5.3 Type footprint

- 10.6.5.4 End-use industry footprint

- 10.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.7.1 PROGRESSIVE COMPANIES

- 10.7.2 RESPONSIVE COMPANIES

- 10.7.3 DYNAMIC COMPANIES

- 10.7.4 STARTING BLOCKS

- 10.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.7.5.1 Detailed list of key startups/SMEs

- 10.7.5.2 Competitive benchmarking of key startups/SMEs

- 10.8 COMPETITIVE SCENARIO

- 10.8.1 PRODUCT LAUNCHES

- 10.8.2 DEALS

- 10.8.3 EXPANSIONS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 WACKER CHEMIE AG

- 11.1.1.1 Business overview

- 11.1.1.2 Products/Solutions/Services offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product launches

- 11.1.1.3.2 Deals

- 11.1.1.3.3 Expansions

- 11.1.1.3.4 Other developments

- 11.1.1.4 MnM view

- 11.1.1.4.1 Key strengths/Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses and competitive threats

- 11.1.2 SHIN-ETSU CHEMICAL CO., LTD.

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Solutions/Services offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Product launches

- 11.1.2.3.2 Expansions

- 11.1.2.4 MnM view

- 11.1.2.4.1 Key strengths/Right to win

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses and competitive threats

- 11.1.3 ELKEM ASA

- 11.1.3.1 Business overview

- 11.1.3.2 Products/Solutions/Services offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Product launches

- 11.1.3.3.2 Deals

- 11.1.3.3.3 Expansions

- 11.1.3.4 MnM view

- 11.1.3.4.1 Key strengths/Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses and competitive threats

- 11.1.4 DOW

- 11.1.4.1 Business overview

- 11.1.4.2 Products/Solutions/Services offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Product launches

- 11.1.4.3.2 Expansions

- 11.1.4.4 MnM view

- 11.1.4.4.1 Key strengths/Right to win

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses and competitive threats

- 11.1.5 MOMENTIVE PERFORMANCE MATERIALS, INC.

- 11.1.5.1 Business overview

- 11.1.5.2 Products/Solutions/Services offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Product launches

- 11.1.5.3.2 Deals

- 11.1.5.3.3 Expansions

- 11.1.5.4 MnM view

- 11.1.5.4.1 Key strengths/Right to win

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses and competitive threats

- 11.1.6 EVONIK INDUSTRIES AG

- 11.1.6.1 Business overview

- 11.1.6.2 Products/Solutions/Services offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Product launches

- 11.1.6.3.2 Deals

- 11.1.6.3.3 Expansions

- 11.1.6.4 MnM view

- 11.1.7 GELEST INC.

- 11.1.7.1 Business overview

- 11.1.7.2 Products/Solutions/Services offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Deals

- 11.1.7.3.2 Expansions

- 11.1.7.4 MnM view

- 11.1.8 INNOSPEC INC.

- 11.1.8.1 Business overview

- 11.1.8.2 Products/Solutions/Services offered

- 11.1.8.3 Recent developments

- 11.1.8.3.1 Expansions

- 11.1.8.4 MnM view

- 11.1.9 SPECIALTY SILICONE PRODUCTS, INC.

- 11.1.9.1 Business overview

- 11.1.9.2 Products/Solutions/Services offered

- 11.1.9.3 MnM view

- 11.1.10 HOSHINE SILICON INDUSTRY CO., LTD.

- 11.1.10.1 Business overview

- 11.1.10.2 Products/Solutions/Services offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Deals

- 11.1.10.3.2 Expansions

- 11.1.10.4 MnM view

- 11.1.1 WACKER CHEMIE AG

- 11.2 OTHER PLAYERS

- 11.2.1 ZHEJIANG XIN'AN CHEMICAL INDUSTRY GROUP CO., LTD.

- 11.2.2 REISS MANUFACTURING, INC.

- 11.2.3 SILTECH CORPORATION

- 11.2.4 KANEKA CORPORATION

- 11.2.5 CHT GROUP

- 11.2.6 GENESEE POLYMERS CORPORATION

- 11.2.7 SILICONE SOLUTIONS, INC.

- 11.2.8 SILICONE ENGINEERING LTD

- 11.2.9 ZHEJIANG SUCON SILICONE CO., LTD.

- 11.2.10 SILTEQ LTD

- 11.2.11 KONARK SILICONE TECHNOLOGIES

- 11.2.12 SUPREME SILICONES INDIA PVT. LTD.

- 11.2.13 SHENZHEN SQUARE SILICONE CO., LTD.

- 11.2.14 GUANGZHOU OTT NEW MATERIALS CO., LTD.

- 11.2.15 CSL SILICONES INC.

12 ADJACENT & RELATED MARKET

- 12.1 INTRODUCTION

- 12.2 LIMITATIONS

- 12.3 SILICONE ELASTOMERS MARKET

- 12.3.1 MARKET DEFINITION

- 12.3.2 MARKET OVERVIEW

- 12.3.3 SILICONE ELASTOMERS MARKET, BY TYPE

- 12.3.4 SILICONE ELASTOMERS MARKET, BY PROCESS

- 12.3.5 SILICONE ELASTOMERS MARKET, BY END-USE INDUSTRY

- 12.3.6 SILICONE ELASTOMERS MARKET, BY REGION

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS