|

시장보고서

상품코드

1830047

전자식 주차 브레이크(EPB) 시스템 시장 : 유형별, 차량 클래스별, 컴포넌트별, 차량 유형별, EV 유형별, 판매채널별, 지역별 - 예측(-2032년)Electronic Parking Brake System Market by Type (Cable Pull, Electric-hydraulic Caliper, Brake-by-Wire System), Vehicle Class (A&B, C&D, E&F), Component (ECU, Actuator), Vehicle Type (PC, CV), EV Type, Sales Channel, and Region - Global Forecast to 2032 |

||||||

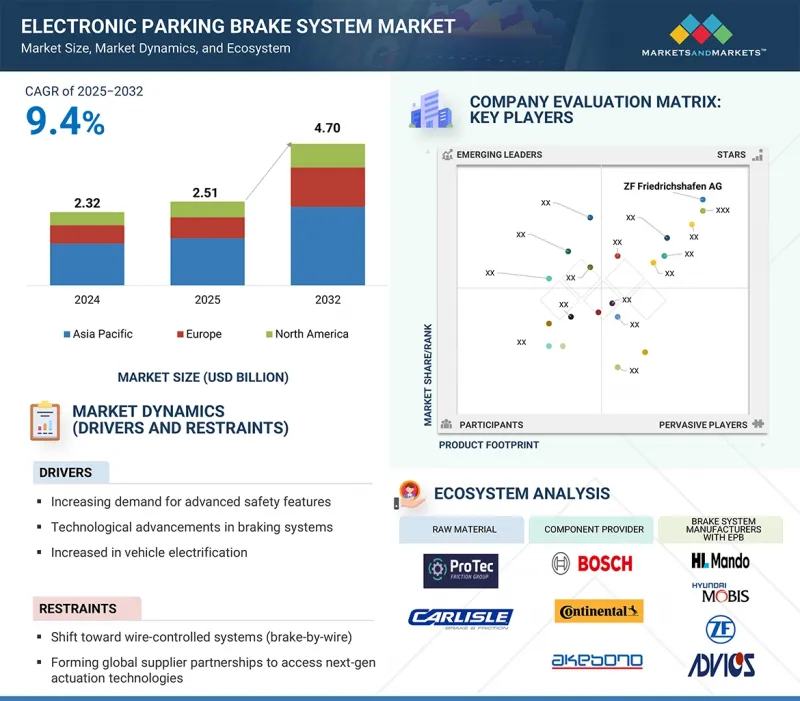

세계의 전자식 주차 브레이크(EPB) 시스템 시장 규모는 2025년에 약 25억 1,000만 달러, 2032년까지 47억 달러에 이를 것으로 예측되며, 2025년-2032년 CAGR 9.4%의 성장이 전망됩니다.

자동 주차 보조, 자동 긴급 제동, 힐 스타트 어시스트 등 ADAS 기능의 채용 확대가 EPB 시장을 견인하고 있습니다. 전자식 주차 브레이크(EPB)를 이러한 시스템에 통합하면 원활한 전자 제어가 가능해져 안전 자동화가 강화되고, 차량 자율성 향상을 위한 전환을 지원할 수 있기 때문입니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2021-2032년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2032년 |

| 단위 | 100만 달러, 1,000대 |

| 부문 | 차량 유형, 차량 클래스, EPB 유형, 컴포넌트, EV 유형, 판매채널, 지역 |

| 대상 지역 | 아시아태평양, 유럽, 북미 |

Brake-by-wire 기술은 정밀한 전자 제어를 가능하게 하고, 기계적 복잡성을 줄이고, 자동 홀드 및 비상 브레이크와 같은 안전 기능을 강화하기 때문에 채택이 가속화되고 있습니다.

또한, 경량 캘리퍼 설계, 스마트 진단, OTA(Over-The-Air) 소프트웨어 업데이트와 같은 기술 혁신으로 신뢰성이 향상되고 유지보수가 줄어들어 EPB는 OEM에게 선호되는 선택이 되고 있습니다. 높은 수준의 자동화를 갖춘 중급 및 고급 차량에 대한 수요 증가와 안전 및 에너지 효율 향상에 대한 규제 강화로 인해, 첨단 EPB 기술은 앞으로도 시장에서의 입지를 지속적으로 확대할 것입니다.

"엔트리 레벨 차량 부문은 예측 기간 동안 높은 CAGR로 성장할 것으로 예측됩니다. "

엔트리 레벨 부문에서는 비용을 크게 높이지 않고도 소형차에 첨단 안전과 편의성을 제공하려는 OEM의 노력이 EPB의 채택을 촉진하고 있습니다. i20의 현대, Sonet의 기아, Polo의 폭스바겐, Dolphin의 BYD, 1 Series의 BMW, Focus의 Ford 등의 제조업체와 현대 Kona Electric, Volkswagen ID.3와 같은 EV 모델은 EPB를 일부 트림에 EPB를 도입하여 저렴한 가격대의 차량에도 신기술을 기대하는 도심의 젊은 구매층에게 어필하고 있습니다. 르노-닛산의 CMF-A와 현대-기아차의 K2 플랫폼에서 볼 수 있듯이, 플랫폼 표준화 움직임은 EPB 모듈을 여러 컴팩트 모델에서 공유할 수 있게 하여 시스템 비용을 절감할 수 있습니다. 또한, 유럽과 아시아에서는 안전 규제가 강화되고 있으며, 언덕길 출발 보조 및 ESP(미끄럼 방지 장치)와의 통합 요건을 충족하기 위해 OEM은 소형 해치백 및 엔트리 세단에 EPB를 장착해야 합니다. 이러한 규제 강화, 편의성을 추구하는 소비자 수요, OEM의 플랫폼 공유 전략이 결합되어 보급형 EPB의 보급이 가속화되고 있습니다.

"Brake-by-wire 시스템은 예측 기간 동안 높은 CAGR로 성장할 것입니다. "

Brake-by-wire(BBW) 전자식 주차 브레이크(EPB)의 채택은 자동차 부문의 차량 생산, 경량화, 첨단운전자보조시스템(ADAS)와의 통합 추진으로 촉진되고 있습니다. BBW EPB는 기계적 연결을 제거하여 보다 빠르고 정확한 제동 제어와 자동 운전 시스템 및 회생 제동 시스템과의 원활한 통합을 가능하게 합니다. OEM은 차내 공간 최적화, 부품 마모 감소, 자동 홀드 및 힐 스타트 어시스트와 같은 안전 기능 강화를 위해 고급차 및 전기자동차에 BBW의 채택을 늘리고 있습니다. 예를 들어, 넥스티어 오토모티브(Nexteer Automotive)는 2025년 4월 안전, 편안함, 유지보수성을 높이고 소프트웨어 정의 섀시 통합을 지원하는 첨단 BBW(Brake-by-Wire) 솔루션인 Electro-Mechanical Brake를 발표하였습니다. 이 회사는 이러한 기술 구성 요소를 활용하여 모듈식 고정밀 브레이크 시스템을 구축하여 "모션 바이 와이어" 섀시 제어로 전략적으로 확장할 계획입니다. 2025년 3월, ZF Friedrichshafen과 Brembo는 기존의 유압 브레이크를 전자 부품으로 대체하는 Brake-by-wire 시스템을 도입할 계획을 세웠습니다. 이러한 시스템은 안전성 향상, 응답 시간 단축, 유지보수 감소를 약속합니다. 이러한 발전은 예측 기간 동안 시장을 주도할 것으로 예측됩니다.

세계의 전자식 주차 브레이크(EPB) 시스템(EPB) 시장에 대해 조사 분석했으며, 주요 촉진요인과 억제요인, 경쟁 구도, 향후 동향 등의 정보를 전해드립니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요 인사이트

- 전자식 주차 브레이크(EPB) 시스템 시장의 매력적인 기회

- 전자식 주차 브레이크(EPB) 시스템 시장 : 차량 유형별

- 전자식 주차 브레이크(EPB) 시스템 시장 : 차량 유형별

- 전자식 주차 브레이크(EPB) 시스템 시장 : 유형별

- 전자식 주차 브레이크(EPB) 시스템 시장 : 컴포넌트별

- 전자식 주차 브레이크(EPB) 시스템 시장 : EV 유형별

- 전자식 주차 브레이크(EPB) 시스템 시장 : 판매채널별

- 전자식 주차 브레이크(EPB) 시스템 시장 : 지역별

제5장 시장 개요

- 서론

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

- 시장 역학의 영향

- 고객의 비즈니스에 영향을 미치는 동향과 혼란

- 가격 결정 분석

- 평균 판매 가격 동향 : 유형별

- 평균 판매 가격 동향 : 지역별

- 평균 판매 가격 동향 : 인도, 유형별

- 생태계 분석

- 공급망 분석

- 기술 로드맵

- 규제 상황

- 차량 안전기준

- 규제기관, 정부기관 및 기타 조직

- 전자식 주차 브레이크(EPB) 시스템에 관한 규제

- 전자 브레이크 시스템 의무화

- 차량 브레이크 안전기준

- 브레이크 시스템 규제기관

- 주요 컨퍼런스 및 이벤트

- 사례 연구 분석

- 투자 및 자금조달 시나리오

- 특허 분석

- 무역 분석

- 수입 시나리오(870,830)

- 수출 시나리오(870,830)

- AI/생성형 AI의 영향

- 기술 분석

- 주요 기술

- 보완 기술

- 인접 기술

- 공급업체 분석

- 부품 표

- 세계의 전자식 주차 브레이크(EPB) 시스템 채택

- 세계의 Brake-by-Wire나 기타 전자식 주차 브레이크(EPB) 시스템 보급

- 전자식 주차 브레이크(EPB) 시스템 기술 성숙도에 관한 인사이트

- 기술 성숙도

- 서브 테크놀러지 성숙도

- 주요 OEM 기술 성숙도

- 세계의 전자식 주차 브레이크(EPB) 시스템 수요 핫스팟

- Brake-by-Wire 채택에 관한 인사이트 : 주요 OEM별

- Brake-by-Wire 채택에 대한 단중기적인 장벽에 관한 인사이트

- Brake-by-Wire 채택에 대한 단중기적인 장벽과 전략적 대응

- 인도의 Brake-by-Wire 작용에 대한 단중기적인 장벽

- 인도의 OEM 기술 통합 능력에 관한 인사이트

- 채택 타임라인과 투자 시그널에 관한 인사이트 : 인도 OEM별

- 주요 이해관계자와 구입 기준

제6장 전자식 주차 브레이크(EPB) 시스템 시장 : 유형별

- 서론

- CABLE PULL

- ELECTRIC-HYDRAULIC CALIPER

- BRAKE-BY-WIRE

- 중요 인사이트

제7장 전자식 주차 브레이크(EPB) 시스템 시장 : 차량 유형별

- 서론

- 승용차

- 상용차

- 중요 인사이트

제8장 전자식 주차 브레이크(EPB) 시스템 시장 : 차량 클래스별

- 서론

- 엔트리 레벨

- 중급

- 고급

- 중요 인사이트

제9장 전자식 주차 브레이크(EPB) 시스템 시장 : EV 유형별

- 서론

- 전기자동차

- PHEV

- 중요 인사이트

제10장 전자식 주차 브레이크(EPB) 시스템 시장 : 컴포넌트별

- 서론

- ECU

- 액추에이터

- 스위치

- 기타 컴포넌트

- 중요 인사이트

제11장 전자식 주차 브레이크(EPB) 시스템 시장 : 판매채널별

- 서론

- OEM

- 애프터마켓

- 중요 인사이트

제12장 전자식 주차 브레이크(EPB) 시스템 시장 : 지역별

- 서론

- 아시아태평양

- 거시경제 전망

- 중국

- 인도

- 일본

- 한국

- 유럽

- 거시경제 전망

- 프랑스

- 독일

- 스페인

- 영국

- 러시아

- 북미

- 거시경제 전망

- 미국

- 캐나다

제13장 경쟁 구도

- 서론

- 주요 시장 진출기업의 전략/강점(2021년-2025년)

- 시장 점유율 분석(2024년)

- 세계

- 중국

- 인도

- 매출 분석(2020년-2024년)

- 기업 평가와 재무 지표

- 브랜드 및 제품 비교

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업 평가 매트릭스 : 스타트업/중소기업(2024년)

- 경쟁 시나리오

제14장 기업 개요

- 주요 기업

- ZF FRIEDRICHSHAFEN AG

- CONTINENTAL AG

- ASTEMO, LTD.

- BREMBO N.V.

- ADVICS CO., LTD.

- HYUNDAI MOBIS

- HL MANDO CORP.

- WANXIANG QIANCHAO CO., LTD.

- BRAKES INDIA

- ANAND GROUP

- AKEBONO BRAKE INDUSTRY CO., LTD.

- DURA|SHILOH

- BEIJING YINGCHUANGHUIZHI AUTOMOTIVE TECHNOLOGY CO., LTD.

- BETHEL AUTOMOTIVE SAFETY SYSTEMS CO., LTD.

- 기타 기업

- ZHEJIANG ASIA PACIFIC MECHANICAL & ELECTRICAL CO., LTD.

- KUSTER HOLDING GMBH

- ROBERT BOSCH GMBH

- VALEO

- INFAC CORPORATION

- HUGO BENZING GMBH & CO. KG

- KEYANG ELECTRIC CO., LTD.

제15장 MARKETSANDMARKETS의 제안

- 아시아태평양은 전자식 주차 브레이크(EPB) 시스템에 있어서 유리한 시장이 된다

- 예측 기간에 중급차가 보급할 전망

- 브레이크 시스템 기술적 진보

- 결론

제16장 부록

LSH 25.10.15The electronic parking brake (EPB) system market is estimated to be USD 2.51 billion in 2025 and is projected to reach USD 4.70 billion by 2032 at a CAGR of 9.4% from 2025 to 2032. The growing adoption of ADAS features such as automated parking assist, autonomous emergency braking, and hill-start assist is driving the EPB market, as the integration of electronic parking brakes with these systems enables seamless electronic control, enhances safety automation, and supports the shift toward higher vehicle autonomy.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Million), Volume (Thousand Units) |

| Segments | Vehicle Type, Vehicle Class, EPB Type, Component, EV Type, Sales Channel, and Region |

| Regions covered | Asia Pacific, Europe, and North America |

The adoption of brake-by-wire technology is accelerating as it enables precise electronic control, reduces mechanical complexity, and enhances safety features such as automatic hold and emergency braking.

Additionally, innovations such as lightweight caliper designs, smart diagnostics, and over-the-air software updates are enhancing reliability and reducing maintenance, making EPBs a preferred choice for OEMs. The increasing demand for mid-sized and premium vehicles with higher levels of automation, coupled with regulatory pushes for improved safety and energy efficiency, ensures that advanced EPB technologies continue to expand their market footprint.

"The Entry-level vehicle segment is projected to grow at a higher CAGR during the forecast period."

The entry-level (A&B) segment is projected to grow at a higher CAGR during the forecast period. In the entry-level segment, the adoption of EPB is being driven by OEMs' efforts to offer advanced safety and comfort features to compact cars without significantly raising costs. Manufacturers like Hyundai with the i20, Kia with the Sonet, Volkswagen with the Polo, BYD with the Dolphin, BMW with the 1 Series, Ford with the Focus, and EV models such as the Hyundai Kona Electric and Volkswagen ID.3 have begun introducing EPB in select trims to appeal to young urban buyers who expect modern technology even in affordable cars. The move toward platform standardization, as seen in Renault-Nissan's CMF-A and Hyundai-Kia's K2 platforms, allows EPB modules to be shared across multiple compact models, reducing system cost. In addition, stricter safety regulations in Europe and Asia are compelling OEMs to include EPB in small hatchbacks and entry sedans to comply with requirements for hill-start assist and integration with electronic stability programs. This combination of regulatory push, consumer demand for convenience, and OEM platform-sharing strategies is accelerating EPB penetration in the entry-level class.

"Brake-by-Wire system will grow at a higher CAGR during the forecast period."

The adoption of brake-by-wire (BBW) electronic parking brakes is driven by the automotive sector's push for vehicle production, weight reduction, and integration with advanced driver-assistance systems (ADAS). BBW EPBs eliminate mechanical linkages, enabling faster, more precise braking control and smoother integration with autonomous driving and regenerative braking systems. OEMs are increasingly deploying BBW in premium and electric vehicles to optimize cabin space, reduce component wear, and enhance safety features such as automatic hold and hill-start assist. For instance, in April 2025, Nexteer Automotive launches its Electro-Mechanical Brake system, an advanced Brake-by-Wire (BBW) solution that enhances safety, comfort, serviceability, and supports software-defined chassis integration. The company leveraged its technology building blocks to create a modular, high-precision braking system and strategically expand into "Motion-by-Wire" chassis control. In March 2025, ZF Friedrichshafen and Brembo planned to introduce a brake-by-wire system, replacing traditional hydraulic brakes with electronic components. These systems promise improved safety, faster response times, and reduced maintenance. Such developments are projected to drive the market during the forecast period.

"India is projected to grow at a high CAGR in the Asia Pacific electronic parking brake system market."

India is projected to grow at a high CAGR in the Asia Pacific EPB market as domestic OEMs accelerate the integration of electronic parking brakes into mid-size SUVs and EVs to meet evolving safety norms. The government's Bharat NCAP crash safety framework and increasing alignment with global safety standards are compelling automakers like Tata Motors, Mahindra & Mahindra, and Hyundai India to adopt advanced braking technologies beyond conventional systems. Additionally, companies in the region are pursuing strategic development, such as in June 2024, ADVICS signed a joint venture agreement with Brakes India Pvt. Ltd., to produce and localize advanced braking products in India, with production slated for around 2027. Also, in July 2025, ZF Group started the production of its EPB in India, marking the first time this technology is being produced locally for a passenger vehicle. The EPB will be supplied to a passenger car OEM for its newly launched electric vehicle. Further, with the rising demand for connected and feature-rich vehicles among India's expanding middle-class buyers, EPBs are increasingly being offered as standard in premium trims of models like Tata Harrier, Mahindra XUV700, and Hyundai Creta, further strengthening India's position as the fastest-growing market in the region.

Breakup of Primaries:

In-depth interviews were conducted with CEOs, marketing directors, other innovation and technology directors, and executives from various key organizations operating in this market.

- By Company Type: OEMs- 41%, Tier I- 35%, and Tier II - 24%

- By Designation: CXOs - 60%, Managers - 10%, and Executives- 30%

- By Region: Asia Pacific-41%, Europe-34%, North America-25%

The electronic parking brake system market is dominated by major players, including ZF Friedrichshafen AG (Germany), Continental AG (Germany), Astemo, Ltd. (Japan), Brembo N.V. (Italy), and ADVICS Co., Ltd. (Japan).

The study includes an in-depth competitive analysis of these key players in the electronic parking brake system market, with their company profiles, recent developments, and key market strategies.

Research Coverage:

This research report categorizes the electronic parking brake system market by type (cable pull, electric-hydraulic caliper, brake-by-wire system), vehicle class (entry, mid, premium), components (ECUs, actuators, switches, others), vehicle type (passenger cars and commercial vehicles), EV Type (BEV, PHEV), sales channel (OEM, Aftermarket), and region (Asia Pacific, Europe, and North America). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the market. This report covers a detailed analysis of OEMs' strategies toward the adoption of the EPB by key OEMs, strategic insights on the technology maturity of the EPB, and strategic insights on short-to-mid-term barriers to brake-by-wire adoption. Analysis of the key industry players has been done to provide insights into their business overview, solutions & services, key strategies, contracts, partnerships, agreements, new product & service launches, mergers & acquisitions, and recent developments associated with the electronic parking brake system market. Competitive analysis of upcoming startups in the electronic parking brake system market ecosystem has been covered in this report.

Reasons to Buy this Report

The report will help the market leaders/new entrants in this market with information on the OEMs' strategies toward adoption of the EPB, strategic insights on the technology maturity of the EPB, and supplier analysis. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Analysis of key drivers (Increasing demand for advanced safety features, technological advancements in braking systems, increased in vehicle electrification, strict government regulations towards braking system, growing mid- and high-end vehicle sales), restraints (dependence on vehicle electronic architecture, limited aftermarket potential), opportunities (shift toward wire-controlled systems [brake-by-wire], Forming global supplier partnerships to access next-gen actuation technologies, establishing or expanding R&D centers for cost-effective innovation, joint ventures with EV startups and mobility OEMS), and challenges (integration challenges in existing platforms, Limited penetration in low-cost vehicles, lack of localized manufacturing ecosystem) influencing the growth of the electronic parking brake market

- Product Development/Innovation: Detailed insights on upcoming technologies and research & development activities in the electronic parking brake market

- Market Development: Comprehensive information about lucrative markets (the report analyses the electronic parking brake system market across varied regions)

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the electronic parking brake market

Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players, ZF Friedrichshafen AG (Germany), Continental AG (Germany), Astemo, Ltd. (Japan), Brembo N.V. (Italy), and ADVICS Co., Ltd. (Japan), among others, in the electronic parking brake market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews: demand and supply sides

- 2.1.2.2 Breakdown of primary interviews

- 2.1.2.3 Primary interview participants

- 2.1.2.4 Objectives of primary research

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 FACTOR ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ELECTRONIC PARKING BRAKE SYSTEM MARKET

- 4.2 ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY VEHICLE TYPE

- 4.3 ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY VEHICLE CLASS

- 4.4 ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY TYPE

- 4.5 ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY COMPONENT

- 4.6 ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY EV TYPE

- 4.7 ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY SALES CHANNEL

- 4.8 ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Surge in demand for advanced safety and convenience features

- 5.2.1.2 Technological advancements in braking systems

- 5.2.1.3 Rise of vehicle electrification

- 5.2.1.4 Stringent government regulations for braking systems

- 5.2.1.5 Increase in mid- and high-end vehicle sales

- 5.2.2 RESTRAINTS

- 5.2.2.1 Reliance on vehicle electronic architecture

- 5.2.2.2 Limited aftermarket potential

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Shift toward wire-controlled systems

- 5.2.3.2 Rise in global supplier partnerships to access next-generation actuation technologies

- 5.2.3.3 Establishment of R&D centers for cost-effective innovation

- 5.2.3.4 Joint ventures with EV start-ups and mobility OEMS

- 5.2.4 CHALLENGES

- 5.2.4.1 Integration challenges in existing platforms

- 5.2.4.2 Limited penetration in low-cost vehicles

- 5.2.4.3 Lack of localized manufacturing ecosystem

- 5.2.5 IMPACT OF MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.3 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE TREND, BY TYPE

- 5.4.2 AVERAGE SELLING PRICE TREND, BY REGION

- 5.4.3 AVERAGE SELLING PRICE TREND IN INDIA, BY TYPE

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.7 TECHNOLOGY ROADMAP

- 5.8 REGULATORY LANDSCAPE

- 5.8.1 VEHICLE SAFETY STANDARDS

- 5.8.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.8.3 REGULATIONS FOR ELECTRONIC PARKING BRAKE SYSTEMS

- 5.8.4 ELECTRONIC BRAKE SYSTEM MANDATES

- 5.8.5 VEHICLE BRAKE SAFETY STANDARDS

- 5.8.6 REGULATORY AUTHORITIES FOR BRAKE SYSTEMS

- 5.9 KEY CONFERENCES AND EVENTS

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 ADOPTION OF SIEMENS SIMCENTER AMESIM SOFTWARE TO DESIGN ACTUATORS

- 5.10.2 REDUCTION OF WEAR ON SWITCHES WITH RHEOLUBE 362HB

- 5.10.3 DEVELOPMENT OF END-TO-END ASIL-D COMPLIANT ELECTRONIC PARKING BRAKE SYSTEM

- 5.11 INVESTMENT AND FUNDING SCENARIO

- 5.12 PATENT ANALYSIS

- 5.13 TRADE ANALYSIS

- 5.13.1 IMPORT SCENARIO (870830)

- 5.13.2 EXPORT SCENARIO (870830)

- 5.14 IMPACT OF AI/GEN AI

- 5.15 TECHNOLOGY ANALYSIS

- 5.15.1 KEY TECHNOLOGIES

- 5.15.1.1 Electronic parking brake system with lightweight drum

- 5.15.1.2 Front electric park brake

- 5.15.1.3 Software-defined functionality and remote update

- 5.15.2 COMPLEMENTARY TECHNOLOGIES

- 5.15.2.1 Electronic stability control

- 5.15.2.2 Electric actuator/caliper motor technology

- 5.15.3 ADJACENT TECHNOLOGIES

- 5.15.3.1 Copper-free XTRA brake pad

- 5.15.3.2 Anti-lock braking system

- 5.15.1 KEY TECHNOLOGIES

- 5.16 SUPPLIER ANALYSIS

- 5.17 BILL OF MATERIALS

- 5.18 GLOBAL ADOPTION OF ELECTRONIC PARKING BRAKE SYSTEMS

- 5.19 GLOBAL PENETRATION OF BRAKE-BY-WIRE AND OTHER ELECTRONIC PARKING BRAKE SYSTEMS

- 5.20 INSIGHTS ON TECHNOLOGY MATURITY OF ELECTRONIC PARKING BRAKE SYSTEMS

- 5.20.1 TECHNOLOGY MATURITY

- 5.20.2 SUB-TECHNOLOGY MATURITY

- 5.20.3 TECHNOLOGY MATURITY BY KEY OEMS

- 5.21 GLOBAL ELECTRONIC PARKING BRAKE SYSTEM DEMAND HOTSPOTS

- 5.22 INSIGHTS ON BRAKE-BY-WIRE ADOPTION BY KEY OEMS

- 5.23 INSIGHTS ON SHORT-TO-MID-TERM BARRIERS TO BRAKE-BY-WIRE ADOPTION

- 5.23.1 SHORT-TO-MID-TERM BARRIERS TO BRAKE-BY-WIRE ADOPTION AND STRATEGIC RESPONSES

- 5.23.2 SHORT-TO-MID TERM BARRIERS TO BRAKE-BY-WIRE ADOPTION IN INDIA

- 5.24 INSIGHTS ON TECHNICAL INTEGRATION CAPABILITY OF INDIAN OEMS

- 5.25 INSIGHTS ON ADOPTION TIMELINES AND INVESTMENT SIGNALS BY INDIAN OEMS

- 5.26 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.26.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.26.2 BUYING CRITERIA

6 ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY TYPE

- 6.1 INTRODUCTION

- 6.2 CABLE PULL

- 6.2.1 PREFERENCE FOR ADVANCED SAFETY AND CONVENIENCE FEATURES TO DRIVE MARKET

- 6.3 ELECTRIC-HYDRAULIC CALIPER

- 6.3.1 TECHNICAL REQUIREMENTS AND OEM DEMANDS TO DRIVE MARKET

- 6.4 BRAKE-BY-WIRE

- 6.4.1 PUSH FOR VEHICLE ELECTRIFICATION TO DRIVE MARKET

- 6.5 PRIMARY INSIGHTS

7 ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY VEHICLE TYPE

- 7.1 INTRODUCTION

- 7.2 PASSENGER CAR

- 7.2.1 SHIFT IN SUPPLIER CHOICES AND SPECIFICATIONS TO DRIVE MARKET

- 7.3 COMMERCIAL VEHICLE

- 7.3.1 HIGHER LOAD CAPACITY REQUIREMENTS IN ICE TRUCKS TO DRIVE MARKET

- 7.4 PRIMARY INSIGHTS

8 ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY VEHICLE CLASS

- 8.1 INTRODUCTION

- 8.2 ENTRY LEVEL

- 8.2.1 REGULATORY PUSH AND CONSUMER DEMAND FOR CONVENIENCE TO DRIVE MARKET

- 8.3 MID-SIZED

- 8.3.1 STANDARDIZATION OF EPB IN HIGH-VOLUME SEDANS AND SUVS TO DRIVE MARKET

- 8.4 PREMIUM

- 8.4.1 ELECTRIFICATION OF LUXURY VEHICLES TO DRIVE MARKET

- 8.5 PRIMARY INSIGHTS

9 ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY EV TYPE

- 9.1 INTRODUCTION

- 9.2 BEV

- 9.2.1 SUPPLIERS' TAILORING EPB MODULES FOR BATTERY PACKAGING TO DRIVE MARKET

- 9.3 PHEV

- 9.3.1 OEMS' FOCUS ON ENHANCING SAFETY AND WEIGHT OPTIMIZATION TO DRIVE MARKET

- 9.4 PRIMARY INSIGHTS

10 ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY COMPONENT

- 10.1 INTRODUCTION

- 10.2 ELECTRONIC CONTROL UNIT

- 10.2.1 TREND OF ELECTRIFIED VEHICLES TO DRIVE MARKET

- 10.3 ACTUATOR

- 10.3.1 VEHICLES' TRANSITION TOWARD ADVANCED BRAKE-BY-WIRE ARCHITECTURES TO DRIVE MARKET

- 10.4 SWITCH

- 10.4.1 REPLACEMENT OF MECHANICAL LEVERS WITH ELECTRONIC ALTERNATIVES TO DRIVE MARKET

- 10.5 OTHER COMPONENTS

- 10.6 PRIMARY INSIGHTS

11 ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY SALES CHANNEL

- 11.1 INTRODUCTION

- 11.2 OEM

- 11.2.1 SURGE IN COLLABORATION WITH TIER-1 SUPPLIERS TO DRIVE MARKET

- 11.3 AFTERMARKET

- 11.3.1 NEED FOR REPLACEMENT PARTS DUE TO AGING OF VEHICLES TO DRIVE MARKET

- 11.4 PRIMARY INSIGHTS

12 ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 ASIA PACIFIC

- 12.2.1 MACROECONOMIC OUTLOOK

- 12.2.2 CHINA

- 12.2.2.1 Strategic supplier partnerships and model-specific adoption to drive market

- 12.2.3 INDIA

- 12.2.3.1 Focus of OEMs on vehicle safety and convenience to drive market

- 12.2.4 JAPAN

- 12.2.4.1 Compliance with stringent safety regulations to drive market

- 12.2.5 SOUTH KOREA

- 12.2.5.1 Collaborations between OEMs and local suppliers to drive market

- 12.3 EUROPE

- 12.3.1 MACROECONOMIC OUTLOOK

- 12.3.2 FRANCE

- 12.3.2.1 Regulatory push for vehicle safety and accident prevention to drive market

- 12.3.3 GERMANY

- 12.3.3.1 OEM adoption in mainstream ICE models and supplier-driven innovation to drive market

- 12.3.4 SPAIN

- 12.3.4.1 Rapid integration of advanced safety and convenience features in mid-sized and compact vehicles to drive market

- 12.3.5 UK

- 12.3.5.1 Increased adoption of mid- to large-sized passenger cars with advanced safety features to drive market

- 12.3.6 RUSSIA

- 12.3.6.1 Trend of advanced braking technologies to drive market

- 12.4 NORTH AMERICA

- 12.4.1 MACROECONOMIC OUTLOOK

- 12.4.2 US

- 12.4.2.1 Tightening federal safety and efficiency regulations to drive market

- 12.4.3 CANADA

- 12.4.3.1 Emphasis on reducing mechanical complexity and maintenance costs to drive market

13 COMPETITIVE LANDSCAPE

- 13.1 INTRODUCTION

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 13.3 MARKET SHARE ANALYSIS, 2024

- 13.3.1 GLOBAL

- 13.3.2 CHINA

- 13.3.3 INDIA

- 13.4 REVENUE ANALYSIS, 2020-2024

- 13.5 COMPANY VALUATION AND FINANCIAL METRICS

- 13.6 BRAND/PRODUCT COMPARISON

- 13.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.7.1 STARS

- 13.7.2 EMERGING LEADERS

- 13.7.3 PERVASIVE PLAYERS

- 13.7.4 PARTICIPANTS

- 13.7.5 COMPANY FOOTPRINT

- 13.7.5.1 Company footprint

- 13.7.5.2 Region footprint

- 13.7.5.3 Type footprint

- 13.7.5.4 Vehicle type footprint

- 13.8 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2024

- 13.8.1 PROGRESSIVE COMPANIES

- 13.8.2 RESPONSIVE COMPANIES

- 13.8.3 DYNAMIC COMPANIES

- 13.8.4 STARTING BLOCKS

- 13.8.5 COMPETITIVE BENCHMARKING

- 13.8.5.1 List of start-ups/SMEs

- 13.8.5.2 Competitive benchmarking of start-ups/SMEs

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 PRODUCT LAUNCHES

- 13.9.2 DEALS

- 13.9.3 EXPANSIONS

- 13.9.4 OTHER DEVELOPMENTS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 ZF FRIEDRICHSHAFEN AG

- 14.1.1.1 Business overview

- 14.1.1.2 Supplier analysis

- 14.1.1.3 Products offered

- 14.1.1.4 Recent developments

- 14.1.1.4.1 Product launches

- 14.1.1.4.2 Other developments

- 14.1.1.5 MnM view

- 14.1.1.5.1 Key strengths

- 14.1.1.5.2 Strategic choices

- 14.1.1.5.3 Weaknesses and competitive threats

- 14.1.2 CONTINENTAL AG

- 14.1.2.1 Business overview

- 14.1.2.2 Supplier analysis

- 14.1.2.3 Products offered

- 14.1.2.4 Recent developments

- 14.1.2.4.1 Deals

- 14.1.2.4.2 Expansions

- 14.1.2.5 MnM view

- 14.1.2.5.1 Key strengths

- 14.1.2.5.2 Strategic choices

- 14.1.2.5.3 Weaknesses and competitive threats

- 14.1.3 ASTEMO, LTD.

- 14.1.3.1 Business overview

- 14.1.3.2 Supplier analysis

- 14.1.3.3 Products offered

- 14.1.3.4 Recent developments

- 14.1.3.4.1 Product launches

- 14.1.3.5 MnM view

- 14.1.3.5.1 Key strengths

- 14.1.3.5.2 Strategic choices

- 14.1.3.5.3 Weaknesses and competitive threats

- 14.1.4 BREMBO N.V.

- 14.1.4.1 Business overview

- 14.1.4.2 Supplier analysis

- 14.1.4.3 Products offered

- 14.1.4.4 Recent developments

- 14.1.4.4.1 Deals

- 14.1.4.4.2 Other developments

- 14.1.4.5 MnM view

- 14.1.4.5.1 Key strengths

- 14.1.4.5.2 Strategic choices

- 14.1.4.5.3 Weaknesses and competitive threats

- 14.1.5 ADVICS CO., LTD.

- 14.1.5.1 Business overview

- 14.1.5.2 Supplier analysis

- 14.1.5.3 Products offered

- 14.1.5.4 Recent developments

- 14.1.5.4.1 Product launches

- 14.1.5.4.2 Deals

- 14.1.5.5 MnM view

- 14.1.5.5.1 Key strengths

- 14.1.5.5.2 Strategic choices

- 14.1.5.5.3 Weaknesses and competitive threats

- 14.1.6 HYUNDAI MOBIS

- 14.1.6.1 Business overview

- 14.1.6.2 Supplier analysis

- 14.1.6.3 Products offered

- 14.1.6.4 Recent developments

- 14.1.6.4.1 Expansions

- 14.1.7 HL MANDO CORP.

- 14.1.7.1 Business overview

- 14.1.7.2 Supplier analysis

- 14.1.7.3 Products offered

- 14.1.7.4 Recent developments

- 14.1.7.4.1 Deals

- 14.1.7.4.2 Other developments

- 14.1.8 WANXIANG QIANCHAO CO., LTD.

- 14.1.8.1 Business overview

- 14.1.8.2 Products offered

- 14.1.9 BRAKES INDIA

- 14.1.9.1 Business overview

- 14.1.9.2 Products offered

- 14.1.9.3 Recent developments

- 14.1.9.3.1 Other developments

- 14.1.10 ANAND GROUP

- 14.1.10.1 Business overview

- 14.1.10.2 Products offered

- 14.1.11 AKEBONO BRAKE INDUSTRY CO., LTD.

- 14.1.11.1 Business overview

- 14.1.11.2 Products offered

- 14.1.11.3 Recent developments

- 14.1.11.3.1 Other developments

- 14.1.12 DURA | SHILOH

- 14.1.12.1 Business overview

- 14.1.12.2 Supplier analysis

- 14.1.12.3 Products offered

- 14.1.12.4 Recent developments

- 14.1.12.4.1 Deals

- 14.1.13 BEIJING YINGCHUANGHUIZHI AUTOMOTIVE TECHNOLOGY CO., LTD.

- 14.1.13.1 Business overview

- 14.1.13.2 Products offered

- 14.1.14 BETHEL AUTOMOTIVE SAFETY SYSTEMS CO., LTD.

- 14.1.14.1 Business overview

- 14.1.14.2 Supplier analysis

- 14.1.14.3 Products offered

- 14.1.14.4 Recent developments

- 14.1.14.4.1 Product launches

- 14.1.1 ZF FRIEDRICHSHAFEN AG

- 14.2 OTHER PLAYERS

- 14.2.1 ZHEJIANG ASIA PACIFIC MECHANICAL & ELECTRICAL CO., LTD.

- 14.2.2 KUSTER HOLDING GMBH

- 14.2.3 ROBERT BOSCH GMBH

- 14.2.4 VALEO

- 14.2.5 INFAC CORPORATION

- 14.2.6 HUGO BENZING GMBH & CO. KG

- 14.2.7 KEYANG ELECTRIC CO., LTD.

15 RECOMMENDATIONS BY MARKETSANDMARKETS

- 15.1 ASIA PACIFIC TO BE LUCRATIVE MARKET FOR ELECTRONIC PARKING BRAKE SYSTEMS

- 15.2 MID-SIZED VEHICLES TO BE PREVALENT DURING FORECAST PERIOD

- 15.3 TECHNOLOGICAL ADVANCEMENTS IN BRAKING SYSTEMS

- 15.4 CONCLUSION

16 APPENDIX

- 16.1 INSIGHTS FROM INDUSTRY EXPERTS

- 16.2 DISCUSSION GUIDE

- 16.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.4 CUSTOMIZATION OPTIONS

- 16.4.1 COMPANY PROFILE

- 16.4.1.1 Profiling of up to five additional market players

- 16.4.2 ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY VEHICLE CLASS, AT COUNTRY LEVEL

- 16.4.3 ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY COMPONENT, AT COUNTRY LEVEL

- 16.4.4 ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY EV TYPE, AT COUNTRY LEVEL

- 16.4.1 COMPANY PROFILE

- 16.5 RELATED REPORTS

- 16.6 AUTHOR DETAILS