|

시장보고서

상품코드

1836423

초음파 AI 시장 : 제품별, 브랜드별, 용도별, 최종 사용자별 - 예측(-2030년)Ultrasound AI Market by Product (AI-enabled System, Solutions ), Brand, Application, End User - Global Forecast to 2030 |

||||||

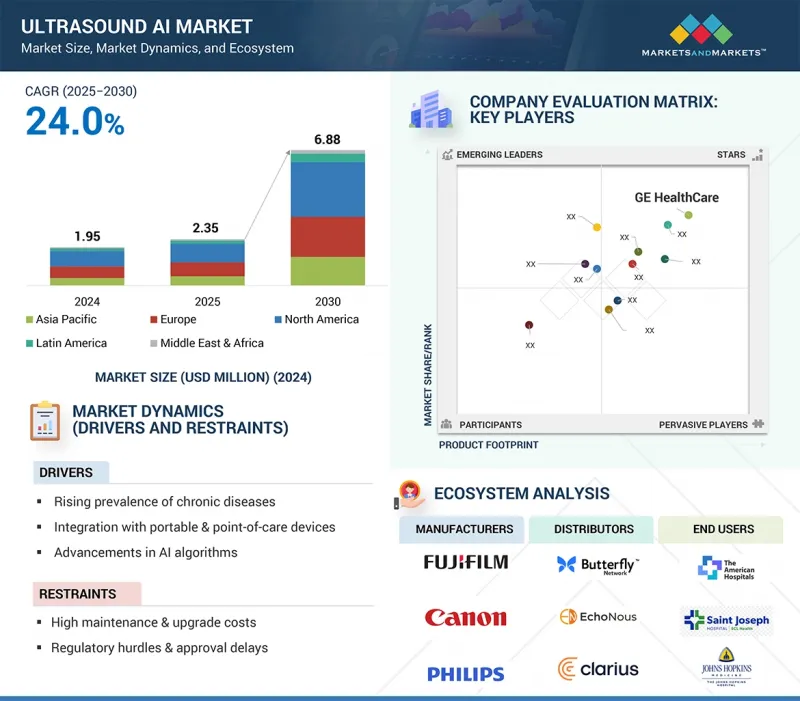

세계 초음파 AI 시장 규모는 2025년 23억 5,000만 달러, 2030년까지 68억 8,000만 달러에 이르고, 예측 기간 동안 CAGR 24.0%로 성장할 전망입니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2024-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 10억 달러 |

| 부문 | 제품 유형, 브랜드, 용도, 최종 사용자, 지역 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 라틴아메리카, 중동 및 아프리카 |

시장 성장 촉진요인은 정확하고 조기 질병 진단에 대한 수요가 증가하고 이미지 분석에 사용되는 머신러닝 알고리즘의 진보, 워크 플로우의 효율화 및 휴먼 오류 감소를 목표로 한 AI 통합입니다. 휴대용 초음파 디바이스와 포인트 오브 케어 초음파 디바이스의 채택 증가, 순환기과, 산부인과, 종양과, 응급 의료에서의 이용이 확대에 의해 시장의 확대가 한층 더 뒷받침될 것으로 예측됩니다.

제품 유형별로 AI 대응 솔루션/소프트웨어 부문이 예측 기간에 가장 높은 CAGR을 기록할 전망입니다.

제품 유형별로 AI 대응 솔루션/소프트웨어 부문이 예측 기간에 가장 높은 CAGR을 나타낼 전망입니다. 이 부문의 높은 성장률은 주요 하드웨어 업그레이드 없이 진단 정확도와 워크플로우 효율을 높이는 비용 효율성과 유연한 프로비저닝으로 인해 발생합니다. AI 소프트웨어는 확장성과 지속적인 혁신의 혜택을 누리고 있습니다. 엄청난 투자주기가 필요한 하드웨어와는 달리 소프트웨어는 새로운 알고리즘, 임상적 용도 및 규정을 준수하는 기능으로 쉽게 업데이트할 수 있습니다. 클라우드 기반 플랫폼, 원격 의료, 원격 진단 채택의 확대도 의료 에코시스템에서 AI 소프트웨어의 역할을 확대하고 시장 성장을 가속하고 있습니다.

브랜드별로 EchoPAC 부문은 2024년 시장에서 가장 큰 점유율을 차지했습니다.

브랜드별로 EchoPAC 부문은 초음파 AI 시장에서 가장 높은 시장 점유율을 차지합니다. 이는 EchoPAC 부문이 GE Healthcare의 고급 분석 소프트웨어로 널리 채택되어 심혈관 초음파를 위해 특별히 설계되었기 때문입니다. EchoPAC은 스트레인 이미징, 3D/4D 정량화, 자동 측정에 사용되는 견고한 AI 구동 도구를 제공하여 진단 정확도와 워크플로우 효율을 크게 향상시킵니다. EchoPAC은 가동중인 GE의 대규모 초음파 시스템과의 원활한 통합, 강력한 임상 검증, 세계 주요 병원 및 심장병 센터의 광범위한 사용으로 경쟁 우위를 발휘하고 AI 대응 초음파 부문에서 시장 점유율을 독점하고 있습니다.

최종 사용자별로 2024년 병원 및 수술센터 부문이 가장 큰 점유율을 차지했습니다.

2024년 병원 및 수술센터 부문은 높은 환자 유입, 광범위한 진단 및 수술, 고급 이미지 기술의 광범위한 채택으로 최대 시장 점유율을 차지했습니다. 이러한 시설에서는 심장학, 산부인과, 종양학, 응급의료 등 다양한 전문 분야에 걸쳐 정확하고 효율적인 실시간 영상 진단을 위한 AI 대응 초음파 시스템을 활용하고 있습니다. 강력한 자금력, 숙련된 근로자, 일상적인 워크플로우에 AI 도구를 통합하면 업무 효율성과 환자 결과가 더욱 향상되어 연구 기관 및 소규모 클리닉과 같은 다른 최종 사용자 부문에 대한 우위가 확고해졌습니다.

지역별로는 아시아태평양이 예측기간에 시장에서 가장 높은 성장률을 기록할 전망입니다.

아시아태평양은 의료 인프라의 급속한 진보, 첨단 영상 기술 채택 증가, AI 기반 의료 솔루션에 대한 투자 증가로 초음파 AI 시장에서 가장 높은 성장률을 나타낼 것으로 예측됩니다. 중국, 인도, 일본 등의 국가에서는 수많은 인구와 고령화, 만성 질환 및 생활 습관병의 유병률 증가, 의료 서비스 접근의 확대 등 요인이 수요를 촉진하고 있습니다. 게다가 디지털 건강을 추진하는 정부의 이니셔티브, 질병의 조기 발견에 대한 의식 증가, 세계/로컬 초음파 AI 제조업체의 진입이 이 지역에서 시장 확대를 더욱 가속화하고 있습니다.

이 보고서는 세계 초음파 AI 시장에 대한 조사 분석을 통해 주요 촉진요인과 억제요인, 경쟁 구도, 미래 동향 등의 정보를 제공합니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요한 지견

- 초음파 AI 시장 개요

- 북미의 초음파 AI 시장 : 국가별, 최종 사용자별(2025년)

- 초음파 AI 시장의 지리적 스냅샷

제5장 시장 개요

- 소개

- 시장 역학

- 성장 촉진요인

- 억제요인

- 기회

- 과제

- 밸류체인 분석

- 공급망 분석

- 저명 기업

- 중소 기업

- 최종 사용자

- Porter's Five Forces 분석

- 주요 이해관계자와 구매 기준

- 특허 분석

- 무역 데이터 애널리틱스

- 수입 데이터

- 수출 데이터

- 주요 컨퍼런스 및 이벤트(2025년-2026년)

- 미충족 수요와 주요 문제점

- 생태계 분석

- 2025년 미국 관세가 초음파 AI 시장에 미치는 영향

- 소개

- 주요 관세율

- 가격의 영향 분석

- 국가/지역에 미치는 영향

- 최종 사용자에게 미치는 영향

- 고객사업에 영향을 주는 동향/혼란

- 기술 분석

- 주요 기술

- 보완 기술

- 인접 기술

- 사례 연구 분석

- 규제 분석

- 북미

- 유럽

- 아시아태평양

- 규제기관, 정부기관, 기타 조직

- 투자 및 자금조달 시나리오

- 가격 설정 분석

- 초음파 AI의 평균 판매 가격 : 지역별(2022년-2024년)

- 평균 판매 가격 : 주요 기업별

- 상환 시나리오

제6장 초음파 AI 시장 : 제품 유형별

- 소개

- AI 대응 초음파 시스템

- AI 대응 초음파 솔루션/소프트웨어

제7장 초음파 AI 시장 : 브랜드별

- 소개

- EchoPAC

- Aplio

- ACUSON

- Butterfly

- 기타 브랜드

제8장 초음파 AI 시장 : 용도별

- 소개

- 산부인과

- 방사선과/일반 화상 진단

- 정형외과 및 근골격계

- 심장학

- 비뇨기과

- 기타 용도

제9장 초음파 AI 시장 : 최종 사용자별

- 소개

- 병원 및 외과 센터

- 영상 및 전문 클리닉

- 외래 케어 센터

- 산부인과 및 불임 클리닉

- 기타 최종 사용자

제10장 초음파 AI 시장 : 지역별

- 소개

- 북미

- 북미의 거시경제 전망

- 미국

- 캐나다

- 유럽

- 유럽의 거시 경제 전망

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 아시아태평양의 거시 경제 전망

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타 아시아태평양

- 라틴아메리카

- 라틴아메리카의 거시 경제 전망

- 브라질

- 멕시코

- 기타 라틴아메리카

- 중동 및 아프리카

- 거시경제 전망

- GCC 국가

- 기타 중동 및 아프리카

제11장 경쟁 구도

- 소개

- 주요 진입기업의 전략

- 수익 분석(2021년-2024년)

- 시장 점유율 분석(2024년)

- 기업의 평가 매트릭스 : 초음파 AI 시장(2024년)

- 기업의 평가 매트릭스 : 스타트업/중소기업(2024년)

- 기업 평가 및 재무 지표

- 브랜드/제품 비교

- 경쟁 시나리오

제12장 기업 프로파일

- 주요 기업

- GE HEALTHCARE

- PHILIPS HEALTHCARE

- CANON MEDICAL SYSTEMS CORPORATION

- SIEMENS HEALTHINEERS AG

- FUJIFILM CORPORATION

- HOLOGIC, INC.

- SAMSUNG ELECTRONICS CO., LTD.

- MINDRAY MEDICAL INTERNATIONAL LIMITED

- SONOSCAPE

- KONICA MINOLTA, INC

- BUTTERFLY NETWORK

- 기타 기업

- EXO IMAGING

- CHISON MEDICAL TECHNOLOGIES CO., LTD

- ESASOTE

- CLARIUS

- EVIDENT VASCULAR

- SMARTALPHA

- TELEMED, MEDICAL IMAGING EQUIPMENT DESIGN & MANUFACTURING

- FRONTWAVE IMAGING

- DELFT IMAGING

- EDAN INSTRUMENTS, INC

- ECHONOUS INC.

- KOIOS MEDICAL

- BIOTICS AI

- TERASON

- BK MEDICAL

- MAUI IMAGING

- SONOLOGIC

- CONTEXTVISION

제13장 부록

SHW 25.10.20The global Ultrasound AI market is projected to reach USD 6.88 billion by 2030 from USD 2.35 billion in 2025, growing at a CAGR of 24.0% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Product Type, Brand, Application, End User, and Region |

| Regions covered | North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa |

The growth of the market is driven by the increasing demand for accurate and early disease diagnosis, advancements in machine learning algorithms for image analysis, and the integration of AI to enhance workflow efficiency and reduce human error. The rising adoption of portable and point-of-care ultrasound devices, coupled with growing applications in cardiology, obstetrics/gynecology, oncology, and emergency care, is further expected to fuel market expansion.

By product type, the AI-enabled solutions/software segment is expected to register the highest CAGR during the forecast period.

By product type, the AI-enabled solutions/software segment is expected to grow at the highest CAGR during the forecast period. The high growth rate of this segment is attributed to the cost-efficiency and flexible provision to enhance diagnostic accuracy and workflow efficiency without the requirement of primary hardware upgrades. AI software benefits from scalability and continuous innovation. Unlike hardware, which requires significant investment cycles, software can be easily updated with new algorithms, clinical applications, and regulatory-compliant features. The growing adoption of cloud-based platforms, telemedicine, and remote diagnostics also expands the role of AI software in healthcare ecosystems, fueling market growth.

By brand, the EchoPAC segment accounted for the largest share of the market in 2024.

By brand, the EchoPAC segment accounts for the highest market share in the ultrasound AI market by brand because it is GE Healthcare's widely adopted advanced analysis software, specifically designed for cardiovascular ultrasound. It offers robust AI-driven tools for strain imaging, 3D/4D quantification, and automated measurements, which significantly improve diagnostic accuracy and workflow efficiency. Its seamless integration with GE's large installed base of ultrasound systems, strong clinical validation, and broad use across leading hospitals and cardiology centers worldwide give EchoPAC a competitive edge, enabling it to dominate market share in the AI-enabled ultrasound segment.

By end user, the hospitals & surgical centers segment accounted for the largest share of the market in 2024.

In 20254, the hospitals & surgical centers segment accounted for the largest share of the market due to its high patient inflow, broad range of diagnostic and interventional procedures, and extensive adoption of advanced imaging technologies. These facilities leverage AI-enabled ultrasound systems for accurate, efficient, and real-time imaging across various specialties, including cardiology, obstetrics/gynecology, oncology, and emergency care. The strong financial capacity, skilled workforce, and integration of AI tools into routine workflows further enhance operational efficiency and patient outcomes, solidifying their dominant position over other end-user segments such as research institutes or smaller clinics.

By region, the Asia Pacific is expected to register the highest growth rate in the market during the forecast period.

The Asia Pacific region is expected to witness the highest growth rate in the Ultrasound AI market due to rapid advancements in healthcare infrastructure, increasing adoption of advanced imaging technologies, and rising investments in AI-driven medical solutions. Factors such as a large and aging population, growing prevalence of chronic and lifestyle-related diseases, and expanding access to healthcare services in countries like China, India, and Japan are driving demand. Additionally, government initiatives promoting digital health, increasing awareness of early disease detection, and the entry of global and local Ultrasound AI manufacturers are further accelerating market expansion in the region.

A breakdown of the primary participants referred to for this report is provided below:

- By Company Type: Tier 1 (40%), Tier 2 (30%), and Tier 3 (30%)

- By Designation: C-level Executives (55%), Directors (27%), and Others (18%)

By Region: North America (35%), Europe (32%), Asia Pacific (25%), Latin America (6%), and the Middle East & Africa (2%)

The prominent players in this market are Philips Healthcare (Netherlands), GE Healthcare (US), Canon Medical Systems Corporation (Japan), Siemens Healthineers (Germany), FUJIFILM Corporation (Japan), Hologic Inc. (US), Samsung Electronics Co., Ltd (South Korea), Butterfly Network (US), Chison Medical Technologies Co., Ltd (China), and Clarius (Canada), among others.

Research Coverage

The ultrasound AI market is segmented by product type, brand, application, end user, and region. Key factors influencing market growth include driving forces, restraints, opportunities, and challenges for stakeholders. The report also reviews the leading companies competing in the Ultrasound AI market. A micro-level analysis can be conducted to examine trends, growth opportunities, and contributions to the market. Additionally, it highlights potential revenue growth opportunities across various market segments in five major regions.

Key Benefits of Buying the Report

The report is valuable for new entrants in the Ultrasound AI market as it provides comprehensive information about the market. This information is essential for understanding various investment opportunities. The report offers insights into both key and smaller players in the market, which can help in creating a solid basis for risk analysis when making investment decisions. It accurately segments the market by end users and regions, providing focused insights into specific market segments. Additionally, the report highlights key trends, challenges, growth drivers, and opportunities to support strategic decision-making through a thorough analysis.

The report provides insights into the following points:

- Key drivers (rising prevalence of chronic diseases, integration with portable and point-of-care devices, advancements in AI algorithms, rising healthcare expenditure and supportive government policies, rising collaborations between med-tech companies and ai startups), restraints (high maintenance and upgrade costs, regulatory hurdles and approval delays), opportunities (expansion of portable ultrasound, integration with electronic health records), and challenges (resistance to adoption among clinicians, data privacy and security concerns) fueling the market growth of ultrasound ai market.

- Product Development/Innovation: Emerging technologies in space, R&D, recent product & service launches in the Ultrasound AI market.

- Market Growth: In-depth insights into remunerative markets report analyze the Ultrasound AI market across varied geographies.

- Market Diversification: Detailed analysis of new products, unexplored geographies, latest trends, and investments in the Ultrasound AI market

- Competitive Assessment: Detailed assessment of market share, service offerings, leading strategies of key players such as Philips Healthcare (Netherlands), GE Healthcare (US), Canon Medical Systems Corporation (Japan), Siemens Healthineers (Germany), and FUJIFILM Corporation (Japan), among others.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 ULTRASOUND AI MARKET SEGMENTATION

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 MARKET STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY RESEARCH

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY RESEARCH

- 2.1.2.1 Key industry insights

- 2.1.1 SECONDARY RESEARCH

- 2.2 MARKET SIZE ESTIMATION APPROACH

- 2.2.1 APPROACH 1: COMPANY REVENUE ESTIMATION APPROACH

- 2.2.2 APPROACH 2: CUSTOMER-BASED MARKET ESTIMATION

- 2.3 MARKET FORECASTING APPROACH

- 2.4 DATA TRIANGULATION AND MARKET BREAKDOWN

- 2.5 MARKET SHARE ASSESSMENT

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 RESEARCH LIMITATIONS

- 2.8 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ULTRASOUND AI MARKET OVERVIEW

- 4.2 NORTH AMERICA: ULTRASOUND AI MARKET, BY COUNTRY AND END USER, 2025

- 4.3 GEOGRAPHIC SNAPSHOT OF ULTRASOUND AI MARKET

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Integration with portable and point-of-care devices

- 5.2.1.2 Advancements in AI algorithms

- 5.2.1.3 Rising healthcare expenditure and supportive government policies

- 5.2.1.4 Rising collaboration between MedTech companies and AI startups

- 5.2.2 RESTRAINTS

- 5.2.2.1 High maintenance and upgrade costs

- 5.2.2.2 Regulatory hurdles and approval delays

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Expansion of portable ultrasound with AI integration

- 5.2.3.2 AI-driven fetal health monitoring

- 5.2.4 CHALLENGES

- 5.2.4.1 Resistance to adoption among clinicians

- 5.2.4.2 Data privacy and security concerns

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 SUPPLY CHAIN ANALYSIS

- 5.4.1 PROMINENT COMPANIES

- 5.4.2 SMALL AND MEDIUM-SIZED ENTERPRISES

- 5.4.3 END USERS

- 5.5 PORTER'S FIVE FORCES ANALYSIS

- 5.5.1 THREAT OF NEW ENTRANTS

- 5.5.2 BARGAINING POWER OF SUPPLIERS

- 5.5.3 BARGAINING POWER OF BUYERS

- 5.5.4 THREAT OF SUBSTITUTES

- 5.5.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.6 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.6.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.6.2 BUYING CRITERIA

- 5.7 PATENT ANALYSIS

- 5.8 TRADE DATA ANALYSIS

- 5.8.1 IMPORT DATA

- 5.8.2 EXPORT DATA

- 5.9 KEY CONFERENCES & EVENTS, 2025-2026

- 5.10 UNMET NEEDS AND KEY PAIN POINTS

- 5.11 ECOSYSTEM ANALYSIS

- 5.12 IMPACT OF 2025 US TARIFF-ULTRASOUND AI MARKET

- 5.12.1 INTRODUCTION

- 5.12.2 KEY TARIFF RATES

- 5.12.3 PRICE IMPACT ANALYSIS

- 5.12.4 IMPACT ON COUNTRY/REGION

- 5.12.4.1 US

- 5.12.4.2 Europe

- 5.12.4.3 Asia Pacific

- 5.12.5 IMPACT ON END USERS

- 5.13 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.14 TECHNOLOGY ANALYSIS

- 5.14.1 KEY TECHNOLOGIES

- 5.14.1.1 3D/4D imaging with AI enhancement

- 5.14.1.2 Cloud computing & data analytics

- 5.14.2 COMPLEMENTARY TECHNOLOGIES

- 5.14.2.1 Wearable devices & IoMT

- 5.14.3 ADJACENT TECHNOLOGIES

- 5.14.3.1 Positron emission tomography (PET) and molecular imaging

- 5.14.1 KEY TECHNOLOGIES

- 5.15 CASE STUDY ANALYSIS

- 5.15.1 IMV OFFERS EFFICIENT POWER FOR HANDHELD ULTRASOUND UNITS

- 5.15.2 ADVANCEMENTS IN USE OF ULTRASOUND AI PRE-HOSPITAL EMERGENCIES AND DISASTER RESPONSE SETTINGS

- 5.15.3 USE OF HANDHELD ULTRASOUND AI IN RURAL HOSPITAL IN GUATEMALA

- 5.16 REGULATORY ANALYSIS

- 5.16.1 NORTH AMERICA

- 5.16.1.1 US

- 5.16.1.2 Canada

- 5.16.2 EUROPE

- 5.16.3 ASIA PACIFIC

- 5.16.3.1 Japan

- 5.16.3.2 China

- 5.16.3.3 India

- 5.16.4 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.16.1 NORTH AMERICA

- 5.17 INVESTMENT & FUNDING SCENARIO

- 5.18 PRICING ANALYSIS

- 5.18.1 AVERAGE SELLING PRICE OF ULTRASOUND AI, BY REGION, 2022-2024 (USD)

- 5.18.2 AVERAGE SELLING PRICE OFFERED BY KEY PLAYERS, 2024 (USD)

- 5.19 REIMBURSEMENT SCENARIO

6 ULTRASOUND AI MARKET, BY PRODUCT TYPE

- 6.1 INTRODUCTION

- 6.2 AI-ENABLED ULTRASOUND SYSTEMS

- 6.2.1 HANDHELD ULTRASOUND

- 6.2.1.1 Rapid diagnostic capabilities to drive market

- 6.2.2 CART-BASED ULTRASOUND

- 6.2.2.1 Enhanced clinical imaging to fuel growth

- 6.2.3 POINT OF CARE ULTRASOUND

- 6.2.3.1 Support for diverse clinical applications to lead market growth

- 6.2.1 HANDHELD ULTRASOUND

- 6.3 AI-ENABLED ULTRASOUND SOLUTIONS/SOFTWARE

- 6.3.1 IMAGE EVALUATION SOFTWARE

- 6.3.1.1 Enhanced clinical precision with ultrasound AI image analysis

- 6.3.2 RADIOLOGY SOFTWARE

- 6.3.2.1 Smart ultrasound diagnostics to boost growth

- 6.3.3 WORKFLOW PLANNING & SUPPORT SOFTWARE

- 6.3.3.1 Optimization of ultrasound workflow for better patient outcomes - key driver

- 6.3.4 OTHER AI SOLUTIONS

- 6.3.1 IMAGE EVALUATION SOFTWARE

7 ULTRASOUND AI MARKET, BY BRAND

- 7.1 INTRODUCTION

- 7.2 ECHOPAC

- 7.2.1 IMPROVED PATIENT EXPERIENCE WITH ECHOPAC SOFTWARE IN HOSPITALS AND SURGICAL CENTERS

- 7.3 APLIO

- 7.3.1 IMAGE OPTIMIZATION AND REAL-TIME DECISION SUPPORT TO FUEL MARKET GROWTH

- 7.4 ACUSON

- 7.4.1 ADVANCED DIAGNOSTICS WITH AI-BASED ACUSON SYSTEM

- 7.5 BUTTERFLY

- 7.5.1 INTEGRATION OF AI IN SMARTPHONES & TABLETS TO DRIVE MARKET GROWTH

- 7.6 OTHER BRANDS

8 ULTRASOUND AI MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 OBSTETRICS/GYNECOLOGY

- 8.2.1 HIGH LEVEL OF INNOVATION TO DRIVE MARKET

- 8.3 RADIOLOGY/GENERAL IMAGING

- 8.3.1 TRANSFORMING DIAGNOSTIC WORKFLOWS WITH INTEGRATED AI MODEL

- 8.4 ORTHOPEDIC & MUSCULOSKELETAL

- 8.4.1 RISING PREVALENCE OF OSTEOARTHRITIS TO LEAD MARKET GROWTH

- 8.5 CARDIOLOGY

- 8.5.1 ACCELERATED CARDIAC ASSESSMENTS WITH AI BORDER MAPPING TO DRIVE SEGMENT

- 8.6 UROLOGICAL

- 8.6.1 WIDE USE IN DIAGNOSIS AND TREATMENT OF VARIOUS UROLOGICAL DISORDERS TO BOOST MARKET

- 8.7 OTHER APPLICATIONS

9 ULTRASOUND AI MARKET, BY END USER

- 9.1 INTRODUCTION

- 9.2 HOSPITALS & SURGICAL CENTERS

- 9.2.1 HIGH ADOPTION OF AI-INTEGRATED ULTRASOUND TO BOOST MARKET

- 9.3 IMAGING & SPECIALTY CLINICS

- 9.3.1 EARLY DISEASE DETECTION AND PERSONALIZED TREATMENT LEAD TO MARKET GROWTH

- 9.4 AMBULATORY CARE CENTERS

- 9.4.1 SUPPORTIVE EARLY DETECTION & PREVENTIVE CARE TO PROPEL MARKET GROWTH

- 9.5 MATERNITY & FERTILITY CLINICS

- 9.5.1 AI INTEGRATION SYSTEMS LEAD TO PRECISE AND EFFICIENT TREATMENT

- 9.6 OTHER END USERS

10 ULTRASOUND AI MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 10.2.2 US

- 10.2.2.1 Presence of advanced healthcare infrastructure to drive market

- 10.2.3 CANADA

- 10.2.3.1 Investments in healthcare AI to drive market

- 10.3 EUROPE

- 10.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 10.3.2 GERMANY

- 10.3.2.1 Favorable healthcare policies and regulatory landscape to drive market

- 10.3.3 UK

- 10.3.3.1 Funding by government bodies to drive market

- 10.3.4 FRANCE

- 10.3.4.1 Increasing demand for routine health check-ups, prenatal care, and diagnostic procedures to drive market

- 10.3.5 ITALY

- 10.3.5.1 Increased availability of reimbursement coverage to drive market

- 10.3.6 SPAIN

- 10.3.6.1 Growing adoption of point-of-care ultrasound AI to drive market

- 10.3.7 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 10.4.2 CHINA

- 10.4.2.1 Emphasis on modernization and expansion of healthcare infrastructure to drive market

- 10.4.3 JAPAN

- 10.4.3.1 Rise in breast cancer diagnosis using ultrasound AI to boost market

- 10.4.4 INDIA

- 10.4.4.1 Investments and funding activities to drive market

- 10.4.5 AUSTRALIA

- 10.4.5.1 Increasing investments in healthcare infrastructure to drive market

- 10.4.6 SOUTH KOREA

- 10.4.6.1 Rising investments in AI & conference events to drive market

- 10.4.7 REST OF ASIA PACIFIC

- 10.5 LATIN AMERICA

- 10.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 10.5.2 BRAZIL

- 10.5.2.1 Growing adoption of healthcare insurance to drive market

- 10.5.3 MEXICO

- 10.5.3.1 Investment in ultrasound AI devices to drive market

- 10.5.4 REST OF LATIN AMERICA

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 MACROECONOMIC OUTLOOK

- 10.6.2 GCC COUNTRIES

- 10.6.2.1 Government initiatives aimed at digital health and telemedicine to drive market

- 10.6.3 REST OF MIDDLE EAST & AFRICA

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES

- 11.2.1 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN ULTRASOUND AI MARKET

- 11.3 REVENUE ANALYSIS, 2021-2024

- 11.4 MARKET SHARE ANALYSIS, 2024

- 11.4.1 RANKING OF KEY MARKET PLAYERS

- 11.5 COMPANY EVALUATION MATRIX: ULTRASOUND AI MARKET, 2024

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- 11.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 11.5.5.1 Company footprint

- 11.5.5.2 Region footprint

- 11.5.5.3 Product footprint

- 11.5.5.4 Application footprint

- 11.5.5.5 End user footprint

- 11.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES (2024)

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- 11.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2025

- 11.6.5.1 Detailed list of key startups/SMEs

- 11.6.5.2 Competitive benchmarking of key startups/SMEs

- 11.7 COMPANY VALUATION & FINANCIAL METRICS

- 11.7.1 FINANCIAL METRICS

- 11.7.2 COMPANY VALUATION

- 11.8 BRAND/PRODUCT COMPARISON

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 DEALS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 GE HEALTHCARE

- 12.1.1.1 Business overview

- 12.1.1.2 Products offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Product launches & approvals

- 12.1.1.3.2 Deals

- 12.1.1.3.3 Other developments

- 12.1.1.4 MnM view

- 12.1.1.4.1 Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses & competitive threats

- 12.1.2 PHILIPS HEALTHCARE

- 12.1.2.1 Business overview

- 12.1.2.2 Products offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Product launches & approvals

- 12.1.2.3.2 Deals

- 12.1.2.4 MnM view

- 12.1.2.4.1 Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses & competitive threats

- 12.1.3 CANON MEDICAL SYSTEMS CORPORATION

- 12.1.3.1 Business overview

- 12.1.3.2 Products offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Product launches

- 12.1.3.3.2 Deals

- 12.1.3.3.3 Expansions

- 12.1.3.4 MnM view

- 12.1.3.4.1 Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses & competitive threats

- 12.1.4 SIEMENS HEALTHINEERS AG

- 12.1.4.1 Business overview

- 12.1.4.2 Products offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Product launches

- 12.1.4.3.2 Deals

- 12.1.4.3.3 Expansions

- 12.1.4.4 MnM view

- 12.1.4.4.1 Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses & competitive threats

- 12.1.5 FUJIFILM CORPORATION

- 12.1.5.1 Business overview

- 12.1.5.2 Products offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Product launches

- 12.1.5.3.2 Deals

- 12.1.5.3.3 Expansions

- 12.1.5.4 MnM view

- 12.1.5.4.1 Right to win

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses & competitive threats

- 12.1.6 HOLOGIC, INC.

- 12.1.6.1 Business overview

- 12.1.6.2 Products offered

- 12.1.6.2.1 Deals

- 12.1.6.2.2 Expansions

- 12.1.7 SAMSUNG ELECTRONICS CO., LTD.

- 12.1.7.1 Business overview

- 12.1.7.2 Products offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Product launches

- 12.1.7.3.2 Deals

- 12.1.7.3.3 Other developments

- 12.1.8 MINDRAY MEDICAL INTERNATIONAL LIMITED

- 12.1.8.1 Business overview

- 12.1.8.2 Products offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Product launches

- 12.1.8.3.2 Deals

- 12.1.8.3.3 Other developments

- 12.1.9 SONOSCAPE

- 12.1.9.1 Business overview

- 12.1.9.2 Products offered

- 12.1.10 KONICA MINOLTA, INC

- 12.1.10.1 Business overview

- 12.1.10.2 Products offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Product launches & approvals

- 12.1.10.3.2 Deals

- 12.1.11 BUTTERFLY NETWORK

- 12.1.11.1 Business overview

- 12.1.11.2 Products offered

- 12.1.11.3 Recent developments

- 12.1.11.3.1 Product launches

- 12.1.11.3.2 Deals

- 12.1.11.3.3 Expansions

- 12.1.1 GE HEALTHCARE

- 12.2 OTHER PLAYERS

- 12.2.1 EXO IMAGING

- 12.2.2 CHISON MEDICAL TECHNOLOGIES CO., LTD

- 12.2.3 ESASOTE

- 12.2.4 CLARIUS

- 12.2.5 EVIDENT VASCULAR

- 12.2.6 SMARTALPHA

- 12.2.7 TELEMED, MEDICAL IMAGING EQUIPMENT DESIGN & MANUFACTURING

- 12.2.8 FRONTWAVE IMAGING

- 12.2.9 DELFT IMAGING

- 12.2.10 EDAN INSTRUMENTS, INC

- 12.2.11 ECHONOUS INC.

- 12.2.12 KOIOS MEDICAL

- 12.2.13 BIOTICS AI

- 12.2.14 TERASON

- 12.2.15 BK MEDICAL

- 12.2.16 MAUI IMAGING

- 12.2.17 SONOLOGIC

- 12.2.18 CONTEXTVISION

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS