|

시장보고서

상품코드

1838151

잔디깎기기계 시장(-2032년) : 유형별(승용, 워크 비하인드, 로봇), 추진별(ICE, EV), 최종사용자별(가정용, 상용), 자율성별(자동, 비자동), 잔디 면적별(소규모, 중규모, 대규모), 하드웨어별, 소프트웨어별, 지역별Lawn Mower Market by Type (Riding, Walk-behind, Robotic), Propulsion (ICE, EV), End-user (Residential, Commercial), Autonomy (Autonomous, Non-autonomous), Lawn Size (Small, Medium, Large), Hardware, Software, and Region - Global Forecast to 2032 |

||||||

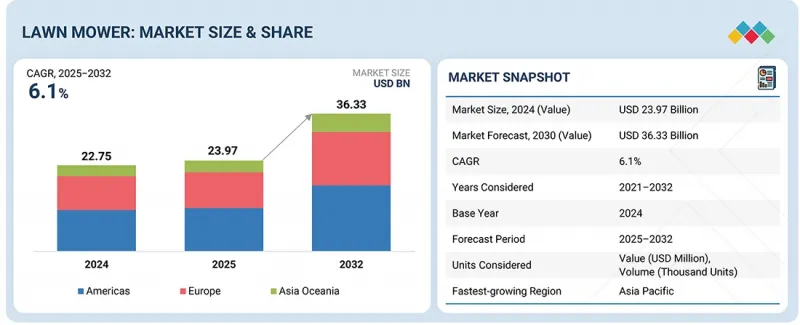

세계의 잔디깎기기계 시장 규모는 2025년 239억 7,000만 달러에서 2032년에는 363억 3,000만 달러로 성장할 것으로 예측되고 있으며, CAGR은 6.1%에 이를 전망입니다.

효율적이고 유지보수 부담이 적은 잔디 관리 솔루션에 대한 수요 증가로 북미 및 중남미를 중심으로 시장이 급속히 확대되고 있습니다. 미국과 캐나다에서는 고에너지 밀도의 리튬 이온 배터리와 인산철 리튬 배터리와 브러쉬리스 모터의 조합으로 가동 시간의 연장과 고신뢰성을 실현하여 가정용 및 상용 잔디깎기기계를 지원하고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2021-2032년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2032년 |

| 단위 | 금액?수량 |

| 부문별 | 유형, 추진 구분, 최종 사용자, 자율성, 잔디 면적, 하드웨어, 소프트웨어, 지역별 |

| 대상 지역 | 아시아 및 오세아니아, 유럽, 아메리카 |

AI 네비게이션과 멀티센서 시스템을 탑재한 자율주행형 잔디깎기기계는 고정밀 깎기와 지형 적응 관리가 요구되는 도시 및 교외 지역에서 급속히 보급되고 있습니다. 첨단 블레이드 설계, 멀칭 시스템, 가변 속도 구동을 채택하여 깎기 효율을 높이면서 에너지 소비를 줄입니다. 특히 멕시코와 브라질 골프 코스 등 광대한 부지와 상업용 경관에서는 그 효과가 현저합니다. 또한 클라우드 기반 진단 및 함대 관리 플랫폼을 통해 예지 보전 및 배터리 사용 최적화가 가능해 상업 사업자에게 총소유비용(TCO) 절감과 운영효율 향상을 실현하고 있습니다. 또한 모듈식 업그레이드 지원 플랫폼과 액세서리 에코시스템은 확장성과 기술 통합을 추진해 주요 지역에서 시장 확대를 더욱 강화하고 있습니다.

"워크 비하인드형이 예측 기간 동안 최대 시장이 될 전망"

워크 비하인드형은 가격의 저렴함, 조작성, 다용도성, 소-중규모의 잔디 면적에 적합한 점에서 세계 시장에서 가장 많이 사용되고 있는 유형입니다. 낮은 초기 비용과 간단한 유지 보수, 가솔린식 및 전동식 대응, 수납 용이성이 평가되어 특히 주택용이나 소규모 상업용도로 높은 인기를 자랑합니다. 최근에는 배터리 성능 향상으로 가동 시간이 늘어나 배터리가 경량화되어 있어 저렴한 가격대의 전동 모델의 매력이 늘어나고 있습니다. 게다가 자주식 드라이브, 깎기 조정 기능, 조용한 설계 등의 기능에 의해 좁은 정원이나 소음 규제가 엄격한 주택지에서도 사용의 용이성이 향상하고 있습니다.

워크 비하인드형은 주로 개인 가정의 정원이나 뒤뜰의 정기적인 잔디 관리에 사용되는 것 외에, 소규모 조원업자나 지자체도 보도나 소형 공원등에서 업무용 고내구 모델을 사용하고 있습니다. 가솔린식 모델은 기복이 많은 지형이나 장시간 작업이 뛰어나지만, 전동식 모델은 배출 가스나 소음, 환경 규제 배려가 요구되는 지역에서 채용이 진행되고 있습니다. 워크 비하인드형 잔디깎기기계는 비용과 성능의 밸런스가 최적이며, 특히 주택용 시장의 중심 제품으로서 앞으로도 리더적 지위를 유지할 전망입니다.

"로봇 잔디깎기기계는 예측 기간 동안 최대 점유율을 보여줄 전망"

로봇 잔디깎기기계는 전동 잔디깎기기계 분야에서 가장 강한 성장 기세를 보여주며 자율 주행 네비게이션, 센서 퓨전 및 AI 제어 시스템의 진화에 의해 지원됩니다. RTK 측위, 컴퓨터 비전, LiDAR 매핑을 활용한 경계가 없는 네비게이션 기술로 설치 수고를 대폭 줄이고 채용률이 급속히 상승하고 있습니다. 또한 리튬 이온과 LFP 배터리의 충방전 효율 향상, 급속 충전 대응, 장수명화가 진행되어 가동 정지 시간의 단축과 수명 연장이 실현되고 있습니다. 도시 및 교외에서의 소음 및 배출 규제에도 적합하고 있어 보급이 더욱 가속하고 있습니다. 게다가 IoT 대응의 플릿 관리 및 예지 보전 기능이 세미프로페셔널 조원 시장에서의 도입을 뒷받침하고 있습니다. Segway-Ninebot, Ecovacs 등의 제조업체는 모듈러 구조를 채용한 다존 대응 모델, OTA(무선) 소프트웨어 갱신, 스마트 홈 제휴 기능을 탑재해, 생산 체제를 확대하고 있습니다. 이러한 혁신으로 로봇 잔디깎기기계는 주택 에너지 및 홈 오토메이션 영역의 핵심 스마트 기기로 자리매김하고 있습니다.

본 보고서에서는 세계 잔디깎기기계 시장을 조사했으며, 시장 개요, 시장 성장에 대한 각종 영향요인 분석, 기술 및 특허 동향, 법규제 환경, 사례 연구, 시장 규모 추이와 예측, 각종 구분 및 지역/주요 국가별 상세 분석, 경쟁 구도, 주요 기업 프로파일 등을 정리했습니다.

자주 묻는 질문

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요 인사이트

제5장 시장 개요

- 시장 역학

- 성장 촉진요인

- 억제요인

- 기회

- 과제

제6장 업계 동향

- AI/생성형 AI의 영향

- 무역 분석

- 고객의 사업에 영향을 미치는 동향과 혼란

- 공급망 분석

- 생태계 분석

- 투자 및 자금조달 시나리오

- 특허 분석

- 사례 연구 분석

- 기술 분석

- 가격 분석

- 규제 상황

- 주요 회의 및 이벤트

- 주요 이해관계자와 구매 기준

- 잔디깎기기계의 리베이트 프로그램

- 총소유비용

- 총 소유 비용과 투자 수익률 : ICE 잔디깎기기계 vs 전동 잔디깎기기계

- 배출분석

- 잔디깎기기계의 전동화

- OEM 분석

- 비용과 수익성 전망 : ICE 잔디깎기기계 vs 전동 잔디깎기기계

제7장 잔디깎기기계 시장 : 유형별

- 승용 잔디깎기기계

- 워크 비하인드 잔디깎기기계

- 로봇 잔디깎기기계

- 주요 인사이트

제8장 잔디깎기 시장 : 추진 구분별

- 전동

- ICE

- 주요 인사이트

제9장 잔디깎기 시장 : 자율성별

- 자율형

- 비자율형

- 주요 인사이트

제10장 잔디깎기 시장 : 잔디 면적별

- 소규모

- 중규모

- 대규모

- 주요 인사이트

제11장 잔디깎기 시장 : 최종 사용자별

- 주택

- 상용

- 주요 인사이트

제12장 로봇 잔디깎기기계 하드웨어 시장 : 컴포넌트별

- 초음파 센서

- 리프트 센서

- 기울기 센서

- 모터

- 블레이드 모터

- 휠 모터

- 마이크로컨트롤러

- 배터리

- 주요 인사이트

제13장 로봇 잔디깎기 소프트웨어 시장 : 지역별

- 주요 인사이트

제14장 잔디깎기 시장 : 유통 채널별

- 온라인

- 소매

제15장 잔디깎기 시장 : 지역별

- 아시아 및 오세아니아

- 거시경제 전망

- 중국

- 인도

- 일본

- 한국

- 호주

- 뉴질랜드

- 유럽

- 거시경제 전망

- 독일

- 프랑스

- 영국

- 이탈리아

- 스웨덴

- 러시아

- 스페인

- 기타

- 미국 대륙

- 거시경제 전망

- 미국

- 캐나다

- 멕시코

- 브라질

제16장 경쟁 구도

- 주요 진입기업의 전략/강점

- 시장 점유율 분석

- 수익 분석

- 기업 평가 매트릭스 : 잔디깎기기계 제조

- 기업 평가 매트릭스 : 전동 잔디깎기기계 제조

- 기업평가와 재무지표

- 브랜드/제품 비교

- 경쟁 시나리오

제17장 기업 프로파일

- 주요 기업

- DEERE & COMPANY

- HUSQVARNA GROUP

- STANLEY BLACK & DECKER, INC.

- KUBOTA CORPORATION

- THE TORO COMPANY

- HONDA MOTOR CO., LTD.

- YAMABIKO CORPORATION

- ROBERT BOSCH GMBH

- STIHL INCORPORATED

- ARIENS CO

- 기타 기업

- IROBOT CORPORATION

- GREENWORKS NORTH AMERICA LLC

- EGO POWER

- AMERICAN LAWN MOWER CO.

- BRIGGS & STRATTON, LLC

- BAD BOY MOWERS

- LASTEC LLC

- TEXTRON SPECIALIZED VEHICLES

- AL-KO GERATE GMBH

- STIGA SPA

- MAMIBOT MANUFACTURING USA INC.

- ZUCCHETTI CENTRO SISTEMI SPA

- TECHTRONIC INDUSTRIES CO. LTD.

- GRAZE ROBOTICS

제18장 MARKETSANDMARKETS의 권고

- 아시아 및 오세아니아 지역이 잔디깎기기계 시장의 성장 거점으로

- 전동화, 자동화 및 디지털 접속에 전략적 초점

- 로봇 잔디깎기기계 분야에 대한 연구 개발 투자가 가속

- 결론

제19장 부록

JHS 25.10.22The lawn mower market is projected to reach USD 36.33 billion by 2032, from USD 23.97 billion in 2025, at a CAGR of 6.1%. Due to the increasing demand for efficient and low-maintenance lawn care solutions, the lawn mower market is growing rapidly across North America and Latin America. In the US and Canada, high-energy-density Li-ion and LFP batteries, combined with brushless motors, enable longer runtime and higher reliability, supporting residential lawns and commercial landscaping fleets.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value, Volume (Thousand Units) |

| Segments | by Type, Propulsion, End-user, Autonomy, Lawn Size, Hardware, Software, and Region |

| Regions covered | Asia Oceania, Europe, and the Americas |

Autonomous mowers, equipped with AI navigation and multi-sensor systems, are gaining traction in urban and suburban areas where precision cutting and adaptive terrain management are critical. Advanced blade geometries, mulching systems, and variable-speed drives improve cutting efficiency while reducing energy use, particularly in regions with large property sizes or commercial landscapes, such as golf courses in Mexico and Brazil. Cloud-based diagnostics and fleet management platforms allow predictive maintenance and optimized battery utilization, lowering the total cost of ownership for commercial operators and driving adoption in regions with high operational demands. Modular, upgradable platforms with accessory ecosystems facilitate scalability and technology integration, further strengthening market expansion across these key regions.

"Walk-behind lawn mowers are projected to be the largest market during the forecast period."

The walk-behind type leads to the global market demand for lawn mowers in terms of volume due to their affordability, maneuverability, versatile nature, and suitability for small to medium-sized lawn sizes. The comparatively lower upfront cost with simpler maintenance, gasoline & electrical options availability, and ease of storage make this mower type highly effective for residential & small commercial sectors. The noticeable improvement in the battery-powered walk-behind mowers improves with longer run times and lighter batteries; the electric models are increasingly attractive at an affordable price bracket. Moreover, features like self-propelled drives, adjustable cutting heights, and quieter operation add to their usability in tighter yards and noise-sensitive neighborhoods.

These walk-behind lawn mowers are primarily purchased, contributing to the maximum end-user segment for regular backyard & garden maintenance. On the other hand, small landscaping businesses and municipal authorities use heavy-duty walk-behinds for sidewalks, small parks, etc. The gasoline-powered walk-behinds deliver better performance in more challenging terrain and longer continuous operation, while electric models gain where emissions, noise, and environmental regulation matter. Hence, walk-behind lawn mowers continue to be in the leading position as they hit a sweet spot of cost vs. capability, mainly for residential users.

"Robotic lawn mowers are projected to show the largest share during the forecast period."

The robotic lawn mower segment shows the strongest growth momentum within the electric mower industry, supported by advancements in autonomous navigation, sensor fusion, and AI-based control systems. Boundary-free navigation platforms that use RTK positioning, computer vision, and LiDAR-based mapping have eliminated the installation complexity of perimeter wires and are significantly improving adoption rates. Improvements in battery management are also critical, as lithium-ion and LFP systems now support higher charge-discharge efficiency, faster charging, and longer operational cycles, reducing downtime and extending overall service life. In urban and suburban deployments, regulatory compliance with noise and emission limits is accelerating adoption. IoT-enabled fleet management and predictive maintenance features are beginning to drive uptake in semi-professional landscaping. Manufacturers such as Segway-Ninebot and Ecovacs are scaling production with modular architectures that support multi-zone mapping, over-the-air software updates, and smart home integration. This positions robotic mowers as connected and upgradable platforms within the broader residential energy and automation ecosystem.

"Europe is estimated to be one of the prominent markets during the forecast period."

Europe is estimated to be one of the largest lawn mower markets under the review period. The growth of the European lawn mower market is driven by high homeownership and the widespread presence of private and commercial green spaces, creating steady demand for efficient lawn maintenance solutions. The adoption of electric and battery-powered mowers is increasing, and environmental regulations and consumer preference for low-emission equipment support this. Technological improvements, including AI-enabled robotic mowers, autonomous navigation, and high-performance batteries, enhance efficiency and reduce labor requirements. The rise of compact urban gardens and landscaped commercial properties is further driving demand for precise, automated, and low-maintenance lawn care solutions. The market is becoming increasingly technology-driven, environmentally focused, and aligned with evolving operational and regulatory needs. Leading European lawn mower manufacturers include Husqvarna, which is recognized for its high-quality robotic and traditional mowers; Bosch, known for innovative electric and battery-powered solutions; Stihl, offering durable and reliable residential and commercial equipment; Honda, providing a wide range of petrol and electric models with advanced features; and Makita, specializing in cordless and battery-operated mowers that combine efficiency with ease of use.

In-depth interviews were conducted with CEOs, marketing directors, other innovation and technology directors, and executives from various key organizations operating in this market.

- By Company Type: OEMs - 40%, Tier 1 & Tier 2 - 40%, and Others - 20%

- By Designation: CXOs - 35%, Managers - 25%, and Executives - 40%

- By Region: Americas - 30%, Europe - 20%, and Asia Oceania - 50%

The lawn mower market is dominated by established players such as Deere & Company (US), Husqvarna AB (Sweden), Stanley Black & Decker, Inc. (US), The Toro Company (US), and Kubota Corporation (Japan). These companies actively manufacture and develop new and advanced connectors. They have set up R&D facilities and offer best-in-class products to their customers.

Research Coverage

The market study covers the lawn mower market by type (riding lawn mower, walk-behind lawn mower, robotic lawn mower), autonomy (autonomous lawn mower, non-autonomous lawn mower), propulsion (electric lawn mower, internal combustion engine lawn mowers), end-user (residential, commercial), hardware (ultrasonic sensors, lift sensors, tilt sensors, motors, microcontrollers, batteries), lawn size (small lawn size, medium lawn size, large lawn size), distribution channel, and region (Americas, Europe, Asia Oceania). It also covers the competitive landscape and company profiles of the major players in the lawn mower market.

Key Benefits of Purchasing this Report

The study offers a detailed competitive analysis of the key players in the market, including their company profiles, important insights into product and business offerings, recent developments, and main market strategies. The report will assist market leaders and new entrants with estimates of revenue figures for the overall lawn mower market and its subsegments. It helps stakeholders understand the competitive landscape and gain additional insights to better position their businesses and develop effective go-to-market strategies. Additionally, the report provides information on key market drivers, restraints, challenges, and opportunities, helping stakeholders keep track of market dynamics.

The report provides insights into the following points:

- Analysis of key drivers (increase in demand for lawn mowers in residential and commercial purpose, increase in demand for eco-friendly (battery) mowers, smart city integration & commercial landscaping uptake), restraints (high cost of lawn mowers, competition from artificial/synthetic grass), opportunities [Robotic Lawn Car-as-a-Service (RaaS)], and challenges (seasonal dependency of lawn mowers, technological gap between key players and smaller players) influencing the growth of the lawn mower market

- Product Development/Innovation: Detailed insights on upcoming technologies, R&D activities, and product launches in the lawn mower market

- Market Development: Comprehensive information about lucrative markets - the report analyses the lawn mowers across various regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the lawn mower market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Deere & Company (US), Husqvarna AB (Sweden), Stanley Black & Decker, Inc. (US), The Toro Company (US), Kubota Corporation (Japan), in the lawn mower market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviewees from demand and supply sides

- 2.1.2.2 Breakdown of primary interviews

- 2.1.2.3 Sampling techniques and data collection methods

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 FACTOR ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN LAWN MOWER MARKET

- 4.2 LAWN MOWER MARKET, BY TYPE

- 4.3 LAWN MOWER MARKET, BY PROPULSION

- 4.4 LAWN MOWER MARKET, BY AUTONOMY

- 4.5 LAWN MOWER MARKET, BY END USER

- 4.6 LAWN MOWER MARKET, BY LAWN SIZE

- 4.7 ROBOTIC LAWN MOWER HARDWARE MARKET, BY COMPONENT

- 4.8 ROBOTIC LAWN MOWER SOFTWARE MARKET, BY REGION

- 4.9 LAWN MOWER MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Surge in demand from residential and commercial sectors

- 5.2.1.2 Elevated demand for eco-friendly mowers

- 5.2.1.3 Rise of smart city initiatives

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of lawn mowers

- 5.2.2.2 Rapid adoption of synthetic grass

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Introduction of subscription-driven services

- 5.2.4 CHALLENGES

- 5.2.4.1 Seasonal dependency of lawn mowers

- 5.2.4.2 Technological gap between large OEMs and smaller players

- 5.2.1 DRIVERS

6 INDUSTRY TRENDS

- 6.1 IMPACT OF AI/GEN AI

- 6.2 TRADE ANALYSIS

- 6.2.1 IMPORT SCENARIO (HS CODE 843110)

- 6.2.2 EXPORT SCENARIO (HS CODE 8433110)

- 6.3 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.4 SUPPLY CHAIN ANALYSIS

- 6.5 ECOSYSTEM ANALYSIS

- 6.6 INVESTMENT AND FUNDING SCENARIO

- 6.7 PATENT ANALYSIS

- 6.8 CASE STUDY ANALYSIS

- 6.8.1 THINGSCOPE'S BATTERY-POWERED RIDING MOWER PLATFORM

- 6.8.2 BATTERY-POWERED EQUIPMENT FOR KENDAL AT LONGWOOD

- 6.8.3 OXFORD COMPANIES AND A&H LAWN SERVICE'S PHASED ELECTRIFICATION INITIATIVE

- 6.8.4 FMG AND SRS' RESEARCH ON RESIDENTIAL RIDING LAWN MOWERS

- 6.8.5 TORO GROUNDSMASTER 4700-D MOWER FOR HAGLEY PARK

- 6.9 TECHNOLOGY ANALYSIS

- 6.9.1 KEY TECHNOLOGIES

- 6.9.1.1 Robotic automation with AI

- 6.9.1.2 Battery-powered efficiency

- 6.9.1.3 Smart lawn monitoring

- 6.9.2 COMPLIMENTARY TECHNOLOGIES

- 6.9.2.1 Precision mowing with zero-turn technology

- 6.9.2.2 Integrated GPS navigation

- 6.9.3 ADJACENT TECHNOLOGIES

- 6.9.3.1 Smart home integration

- 6.9.3.2 Solar-powered operation

- 6.9.1 KEY TECHNOLOGIES

- 6.10 PRICING ANALYSIS

- 6.10.1 AVERAGE SELLING PRICE TREND, BY REGION

- 6.10.2 AVERAGE SELLING PRICE OF LAWN MOWERS OFFERED BY KEY PLAYERS

- 6.11 REGULATORY LANDSCAPE

- 6.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.11.2 KEY REGULATIONS

- 6.12 KEY CONFERENCE AND EVENTS

- 6.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.13.2 BUYING CRITERIA

- 6.14 REBATE PROGRAM FOR LAWN MOWERS

- 6.14.1 BY KEY PLAYERS

- 6.14.2 BY GOVERNING BODIES

- 6.15 TOTAL COST OF OWNERSHIP

- 6.16 TOTAL COST OF OWNERSHIP AND RETURN ON INVESTMENT: ICE VS. ELECTRIC LAWN MOWERS

- 6.17 EMISSIONS ANALYSIS

- 6.17.1 ICE VS. ELECTRIC LAWN MOWERS

- 6.17.2 GASOLINE/LP VS. DIESEL LAWN MOWERS

- 6.18 ELECTRIFICATION IN LAWN MOWERS

- 6.19 OEM ANALYSIS

- 6.19.1 BY PROPULSION

- 6.19.2 BY AUTONOMY

- 6.19.3 BY DISTRIBUTION CHANNEL

- 6.20 COST AND PROFITABILITY OUTLOOK: ICE VS. ELECTRIC LAWN MOWERS

7 LAWN MOWER MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 RIDING LAWN MOWERS

- 7.2.1 INVESTMENTS IN R&D BY PROMINENT MANUFACTURERS TO DRIVE MARKET

- 7.3 WALK-BEHIND LAWN MOWERS

- 7.3.1 PREDOMINANT USE IN ASIA OCEANIA TO DRIVE MARKET

- 7.4 ROBOTIC LAWN MOWERS

- 7.4.1 RISE OF NEW RESIDENTIAL PROPERTIES TO DRIVE MARKET

- 7.5 PRIMARY INSIGHTS

8 LAWN MOWER MARKET, BY PROPULSION

- 8.1 INTRODUCTION

- 8.2 ELECTRIC

- 8.2.1 STRINGENT GOVERNMENT REGULATIONS TO DRIVE MARKET

- 8.3 ICE

- 8.3.1 ELEVATED DEMAND FOR HIGHER ENGINE TO DECK RATIO TO DRIVE MARKET

- 8.4 PRIMARY INSIGHTS

9 LAWN MOWER MARKET, BY AUTONOMY

- 9.1 INTRODUCTION

- 9.2 AUTONOMOUS

- 9.2.1 ADVANCEMENTS IN ROBOTIC LAWN MOWING SOLUTIONS TO DRIVE MARKET

- 9.3 NON-AUTONOMOUS

- 9.3.1 LOWER COST AND HIGHER POWER OUTPUT TO DRIVE MARKET

- 9.4 PRIMARY INSIGHTS

10 LAWN MOWER MARKET, BY LAWN SIZE

- 10.1 INTRODUCTION

- 10.2 SMALL

- 10.2.1 RAPID URBANIZATION TO DRIVE MARKET

- 10.3 MEDIUM

- 10.3.1 EXPANSION OF COMMERCIAL SPACES TO DRIVE MARKET

- 10.4 LARGE

- 10.4.1 WIDE AVAILABILITY OF GOLF CLUBS TO DRIVE MARKET

- 10.5 PRIMARY INSIGHTS

11 LAWN MOWER MARKET, BY END USER

- 11.1 INTRODUCTION

- 11.2 RESIDENTIAL

- 11.2.1 RISE IN URBAN SPACES AND LAWN AREAS TO DRIVE MARKET

- 11.3 COMMERCIAL

- 11.3.1 GROWTH OF LANDSCAPING INDUSTRY TO DRIVE MARKET

- 11.4 PRIMARY INSIGHTS

12 ROBOTIC LAWN MOWER HARDWARE MARKET, BY COMPONENT

- 12.1 INTRODUCTION

- 12.2 ULTRASONIC SENSORS

- 12.2.1 SAFETY COMPLIANCE AND LIABILITY REGULATIONS TO DRIVE MARKET

- 12.3 LIFT SENSORS

- 12.3.1 PREFERENCE FOR MORE SAFETY FEATURES IN ROBOTIC LAWN MOWERS TO DRIVE MARKET

- 12.4 TILT SENSORS

- 12.4.1 CONSUMER DEMAND FOR PREMIUM MOWERS TO DRIVE MARKET

- 12.5 MOTORS

- 12.5.1 DURABILITY, EFFICIENCY, AND EXCELLENT PERFORMANCE OF WHEEL AND BLADE MOTORS TO DRIVE MARKET

- 12.5.2 BLADE MOTORS

- 12.5.3 WHEEL MOTORS

- 12.6 MICROCONTROLLERS

- 12.6.1 HEIGHTENED DEMAND FOR AUTOMATION AND AI-BASED DECISION-MAKING TO DRIVE MARKET

- 12.7 BATTERIES

- 12.7.1 SUSTAINABILITY REQUIREMENTS TO REDUCE FUEL CONSUMPTION TO DRIVE MARKET

- 12.8 PRIMARY INSIGHTS

13 ROBOTIC LAWN MOWER SOFTWARE MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 PRIMARY INSIGHTS

14 LAWN MOWER MARKET, BY DISTRIBUTION CHANNEL

- 14.1 INTRODUCTION

- 14.2 ONLINE

- 14.3 RETAIL

15 LAWN MOWER MARKET, BY REGION

- 15.1 INTRODUCTION

- 15.2 ASIA OCEANIA

- 15.2.1 MACROECONOMIC OUTLOOK

- 15.2.2 CHINA

- 15.2.2.1 Increasing partnership between lawn mowing service providers and manufacturers to drive market

- 15.2.3 INDIA

- 15.2.3.1 Rise in urban landscaping projects and gated communities to drive market

- 15.2.4 JAPAN

- 15.2.4.1 Labor shortages and supportive government initiatives to drive market

- 15.2.5 SOUTH KOREA

- 15.2.5.1 Expansion of green spaces to drive market

- 15.2.6 AUSTRALIA

- 15.2.6.1 Vast residential properties and commercial landscaping demand to drive market

- 15.2.7 NEW ZEALAND

- 15.2.7.1 Need for durable and high-performance mowing solutions to drive market

- 15.3 EUROPE

- 15.3.1 MACROECONOMIC OUTLOOK

- 15.3.2 GERMANY

- 15.3.2.1 Consumer preference for high-performance and technologically integrated equipment to drive market

- 15.3.3 FRANCE

- 15.3.3.1 Increased adoption of walk-behind mowers to drive market

- 15.3.4 UK

- 15.3.4.1 Introduction of new technologies and products to drive market

- 15.3.5 ITALY

- 15.3.5.1 Transition toward autonomous mowing solutions to drive market

- 15.3.6 SWEDEN

- 15.3.6.1 Significant presence of robotic lawn mower manufacturers to drive market

- 15.3.7 RUSSIA

- 15.3.7.1 Diverse applications of riding lawn mowers to drive market

- 15.3.8 SPAIN

- 15.3.8.1 Popularity of robotic models to drive market

- 15.3.9 REST OF EUROPE

- 15.4 AMERICAS

- 15.4.1 MACROECONOMIC OUTLOOK

- 15.4.2 US

- 15.4.2.1 Rising integration of advanced technologies to drive market

- 15.4.3 CANADA

- 15.4.3.1 Growing demand for lawn-care maintenance to drive market

- 15.4.4 MEXICO

- 15.4.4.1 Smart home integration and expansion of residential landscapes to drive market

- 15.4.5 BRAZIL

- 15.4.5.1 Increasing demand from commercial and residential segments to drive market

16 COMPETITIVE LANDSCAPE

- 16.1 INTRODUCTION

- 16.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 16.3 MARKET SHARE ANALYSIS, 2024

- 16.4 REVENUE ANALYSIS, 2020-2024

- 16.5 COMPANY EVALUATION MATRIX: LAWN MOWER MANUFACTURERS, 2024

- 16.5.1 STARS

- 16.5.2 EMERGING LEADERS

- 16.5.3 PERVASIVE PLAYERS

- 16.5.4 PARTICIPANTS

- 16.5.5 COMPANY FOOTPRINT

- 16.5.5.1 Company footprint

- 16.5.5.2 Region footprint

- 16.5.5.3 End user footprint

- 16.5.5.4 Propulsion footprint

- 16.6 COMPANY EVALUATION MATRIX: ELECTRIC LAWN MOWER MANUFACTURERS, 2024

- 16.6.1 STARS

- 16.6.2 EMERGING LEADERS

- 16.6.3 PERVASIVE PLAYERS

- 16.6.4 PARTICIPANTS

- 16.6.5 COMPANY FOOTPRINT

- 16.6.5.1 Company footprint

- 16.6.5.2 Region footprint

- 16.6.5.3 Autonomy footprint

- 16.7 COMPANY VALUATION AND FINANCIAL METRICS

- 16.8 BRAND/PRODUCT COMPARISON

- 16.9 COMPETITIVE SCENARIO

- 16.9.1 PRODUCT LAUNCHES/DEVELOPMENTS

- 16.9.2 DEALS

- 16.9.3 OTHERS

17 COMPANY PROFILES

- 17.1 KEY PLAYERS

- 17.1.1 DEERE & COMPANY

- 17.1.1.1 Business overview

- 17.1.1.2 Products offered

- 17.1.1.3 Recent developments

- 17.1.1.3.1 Product launches/developments

- 17.1.1.3.2 Deals

- 17.1.1.3.3 Others

- 17.1.1.4 MnM view

- 17.1.1.4.1 Right to win

- 17.1.1.4.2 Strategic choices

- 17.1.1.4.3 Weaknesses and competitive threats

- 17.1.2 HUSQVARNA GROUP

- 17.1.2.1 Business overview

- 17.1.2.2 Products offered

- 17.1.2.3 Recent developments

- 17.1.2.3.1 Product launches/developments

- 17.1.2.3.2 Deals

- 17.1.2.4 MnM view

- 17.1.2.4.1 Right to win

- 17.1.2.4.2 Strategic choices

- 17.1.2.4.3 Weaknesses and competitive threats

- 17.1.3 STANLEY BLACK & DECKER, INC.

- 17.1.3.1 Business overview

- 17.1.3.2 Products offered

- 17.1.3.3 Recent developments

- 17.1.3.3.1 Product launches/developments

- 17.1.3.3.2 Deals

- 17.1.3.3.3 Others

- 17.1.3.4 MnM view

- 17.1.3.4.1 Right to win

- 17.1.3.4.2 Strategic choices

- 17.1.3.4.3 Weaknesses and competitive threats

- 17.1.4 KUBOTA CORPORATION

- 17.1.4.1 Business overview

- 17.1.4.2 Products offered

- 17.1.4.3 Recent developments

- 17.1.4.3.1 Product launches/developments

- 17.1.4.3.2 Deals

- 17.1.4.3.3 Others

- 17.1.4.4 MnM view

- 17.1.4.4.1 Right to win

- 17.1.4.4.2 Strategic choices

- 17.1.4.4.3 Weaknesses and competitive threats

- 17.1.5 THE TORO COMPANY

- 17.1.5.1 Business overview

- 17.1.5.2 Products offered

- 17.1.5.3 Recent developments

- 17.1.5.3.1 Product launches/developments

- 17.1.5.3.2 Deals

- 17.1.5.3.3 Others

- 17.1.5.4 MnM view

- 17.1.5.4.1 Right to win

- 17.1.5.4.2 Strategic choices

- 17.1.5.4.3 Weaknesses and competitive threats

- 17.1.6 HONDA MOTOR CO., LTD.

- 17.1.6.1 Business overview

- 17.1.6.2 Products offered

- 17.1.6.3 Recent developments

- 17.1.6.3.1 Product launches/developments

- 17.1.6.3.2 Deals

- 17.1.6.3.3 Others

- 17.1.7 YAMABIKO CORPORATION

- 17.1.7.1 Business overview

- 17.1.7.2 Products offered

- 17.1.7.3 Recent developments

- 17.1.7.3.1 Product launches/developments

- 17.1.7.3.2 Deals

- 17.1.8 ROBERT BOSCH GMBH

- 17.1.8.1 Business overview

- 17.1.8.2 Products offered

- 17.1.8.3 Recent developments

- 17.1.8.3.1 Product launches/developments

- 17.1.8.3.2 Deals

- 17.1.9 STIHL INCORPORATED

- 17.1.9.1 Business overview

- 17.1.9.2 Products offered

- 17.1.9.3 Recent developments

- 17.1.9.3.1 Product launches/developments

- 17.1.9.3.2 Deals

- 17.1.9.3.3 Others

- 17.1.10 ARIENS CO

- 17.1.10.1 Business overview

- 17.1.10.2 Products offered

- 17.1.10.3 Recent developments

- 17.1.10.3.1 Product launches/developments

- 17.1.1 DEERE & COMPANY

- 17.2 OTHER PLAYERS

- 17.2.1 IROBOT CORPORATION

- 17.2.2 GREENWORKS NORTH AMERICA LLC

- 17.2.3 EGO POWER+

- 17.2.4 AMERICAN LAWN MOWER CO.

- 17.2.5 BRIGGS & STRATTON, LLC

- 17.2.6 BAD BOY MOWERS

- 17.2.7 LASTEC LLC

- 17.2.8 TEXTRON SPECIALIZED VEHICLES

- 17.2.9 AL-KO GERATE GMBH

- 17.2.10 STIGA S.P.A

- 17.2.11 MAMIBOT MANUFACTURING USA INC.

- 17.2.12 ZUCCHETTI CENTRO SISTEMI S.P.A

- 17.2.13 TECHTRONIC INDUSTRIES CO. LTD.

- 17.2.14 GRAZE ROBOTICS

18 RECOMMENDATIONS BY MARKETSANDMARKETS

- 18.1 ASIA OCEANIA TO BE GROWTH HUB FOR LAWN MOWERS

- 18.2 STRATEGIC FOCUS ON ELECTRIFICATION, AUTOMATION, AND DIGITAL CONNECTIVITY

- 18.3 INVESTMENTS IN R&D FOR ROBOTIC LAWN MOWERS

- 18.4 CONCLUSION

19 APPENDIX

- 19.1 INSIGHTS FROM INDUSTRY EXPERTS

- 19.2 DISCUSSION GUIDE

- 19.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 19.4 CUSTOMIZATION OPTIONS

- 19.4.1 ROBOTIC LAWN MOWER MARKET, BY TYPE, AT COUNTRY LEVEL

- 19.4.2 LAWN MOWER MARKET, BY END USER, AT COUNTRY LEVEL

- 19.4.3 COMPANY INFORMATION

- 19.4.3.1 Profiling of up to three additional players

- 19.5 RELATED REPORTS

- 19.6 AUTHOR DETAILS