|

시장보고서

상품코드

1840076

3D 프린팅 재료 시장 : 유형별, 형상별, 용도별, 기술별, 최종 이용 산업별, 지역별 예측(-2030년)3D Printing Materials Market by Type, Form, Technology, Application, End-use Industry, & Region - Global Forecast to 2030 |

||||||

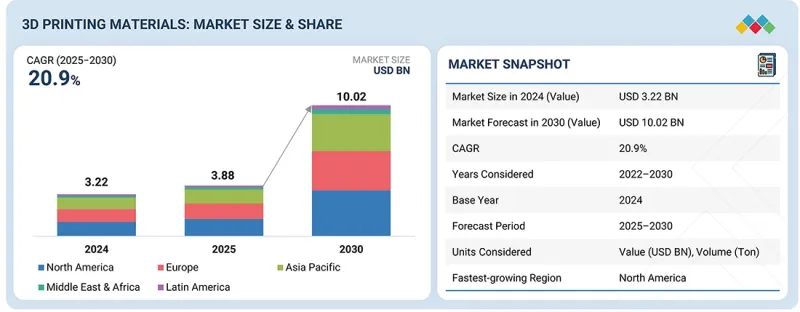

3D 프린팅 재료 시장 규모는 2025년에 38억 8,000만 달러로 추정되고, 2025년부터 2030년까지의 CAGR은 20.9%를 나타낼 것으로 전망되고 있으며, 2030년 에는 100억 2,000만 달러에 달할 것으로 예상됩니다.

3D 프린팅 재료 시장은 커스터마이징, 경량화, 신속한 프로토타이핑이 필수적인 항공우주, 자동차, 헬스케어, 소비자 제품 등 산업에서 부가제조의 이용 증가에 의해 크게 촉진되고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2022-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 검토 단위 | 금액(100만 달러) 및 톤 |

| 부문 | 유형별, 형상별, 용도별, 기술별, 최종 이용 산업별, 지역별 |

| 대상 지역 | 유럽, 북미, 아시아태평양, 중동, 아프리카, 라틴아메리카 |

금속, 복합재료, 첨단 폴리머와 같은 고성능 재료에 대한 수요가 증가함에 따라 제조업체는 더 짧은 리드 타임과 저렴한 비용으로 강하고 복잡한 부품을 생산할 수 있습니다. 또한 강도, 내열성, 생체적합성을 향상시키는 재료 과학의 진보와 함께 온디맨드로 지속 가능한 제조로의 전환이 시장 성장을 가속하고 있습니다. Industry 4.0과 정부공급망 현지화 지원은 수요를 더욱 강화하고 있습니다.

3D 프린팅 재료 산업의 필라멘트 부문은 주로 자재관리의 용이성, 일반적으로 사용되는 FDM/FFF 프린터와의 호환성, 데스크톱 수준의 저비용 프린팅 솔루션에 대한 관심 증가에 따라 가장 높은 성장 CAGR을 보여줍니다. 필라멘트 기반 재료 인쇄는 제조 공정을 간소화하기 때문에 치과, 전자 장비, 연구 등 다양한 산업에서 프로토타이핑 및 소규모 생산 목적으로 사용할 수 있습니다. 그럼에도 불구하고 충족되지 않은 수요도 성장을 뒷받침하고 있으며, 새로운 진입과 기술 혁신을 위한 공급 갭과 높은 시장 가능성이 남아 있습니다.

헬스케어 분야는 치과 수복물, 뼈 임플란트, 외과 기구에 생체적합성 재료의 사용이 증가하고 있기 때문에 3D 프린팅 재료 시장에서 두 번째로 높은 CAGR을 나타내고 있습니다. 지르코니아나 알루미나 등의 재료는 생체 적합성이 높고, 내마모성, 강도가 뛰어나므로, 주문제작의 치관이나 정형외과용 임플란트에 적합합니다. 3D 프린터는 정확하고 환자에게 맞는 설계를 가능하게 하여 수술 시간 단축과 치료 성적 향상을 실현합니다. 게다가 의료가 개인화 및 저침습 치료를 향해 진화함에 따라 맞춤형 고성능 3D 프린팅 부품의 요구가 커지고 있습니다. 세라믹 인쇄 기술에 사용되는 공정과 재료의 진보로 치과 및 정형외과 용도에서의 채용이 가속화되고 있습니다.

유럽은 적층 성형에 대한 정부의 강력한 백업, 확립된 산업 기반, 첨단 재료의 R&D 비용 증가로 3D 프린팅 재료 시장에서 세 번째로 높은 CAGR을 나타낼 것으로 예측됩니다. 독일, 프랑스, 러시아는 3D 프린팅 기술 혁신을 주도하고 있으며, 특히 항공우주, 의료 및 자동차 산업에 중점을 둡니다. 또한 이 지역은 내일의 첨단 소재 인쇄 기술을 창출하기 위해 산업계의 지도자와 협력하는 대학과 연구 기관의 강력한 기반을 뒷받침하고 있습니다. 또한 디지털 제조와 지속가능성에 중점을 둔 EU는 저폐기물, 효율적, 경량 생산을 위한 3D 프린팅 재료의 응용을 추진하고 있습니다.

본 보고서에서는 세계의 3D 프린팅 재료 시장에 대해 조사했으며, 유형별, 형상별, 용도별, 기술별, 최종 이용 산업별, 지역별 동향 및 시장 진출기업 프로파일 등을 정리했습니다.

자주 묻는 질문

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요 인사이트

제5장 시장 개요

- 서론

- 시장 역학

제6장 업계 동향

- Porter's Five Forces 분석

- 주요 이해관계자와 구매 기준

- 가격 분석

- 거시경제 전망

- 밸류체인 분석

- 생태계 분석

- 무역 분석

- 기술 분석

- 특허 분석

- 규제 상황

- 주요 컨퍼런스 및 행사(2025-2026년)

- 사례 연구 분석

- 고객사업에 영향을 주는 동향/파괴적 변화

- 생성형 AI/AI가 3D 프린팅 재료 시장에 미치는 영향

- 투자 및 자금조달 시나리오

- 미국 관세가 3D 프린팅 재료 시장에 미치는 영향(2025년)

제7장 3D 프린팅 재료 시장(유형별)

- 서론

- 플라스틱

- 금속

- 세라믹

제8장 3D 프린팅 재료 시장(형상별)

- 서론

- 필라멘트

- 액체

- 분말

제9장 3D 프린팅 재료 시장(용도별)

- 서론

- 프로토타이핑

- 제조

- 기타

제10장 3D 프린팅 재료 시장(기술별)

- 서론

- 융착 적층 모델링(FDM)

- 선택적 레이저 소결(SLS)

- 스테레오 리소그래피/디지털 라이트 프로세싱(SLA/DLP)

- 직접 금속 레이저 소결(DMLS)

- 기타

제11장 3D 프린팅 재료 시장(최종 이용 산업별)

- 서론

- 항공우주 및 방위

- 헬스케어

- 자동차

- 소비재

- 기타

제12장 3D 프린팅 재료 시장(지역별)

- 서론

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 프랑스

- 영국

- 이탈리아

- 기타

- 아시아태평양

- 중국

- 일본

- 한국

- 인도

- 기타

- 중동 및 아프리카

- GCC 국가

- 남아프리카

- 기타

- 라틴아메리카

- 브라질

- 멕시코

- 기타

제13장 경쟁 구도

- 개요

- 주요 진입기업의 전략/강점

- 수익 분석(2020-2024년)

- 시장 점유율 분석(2024년)

- 브랜드/제품 비교 분석

- 기업평가 매트릭스 : 주요 진입기업(2024년)

- 기업평가 매트릭스 : 스타트업/중소기업(2024년)

- 3D 프린팅 재료 벤더의 평가와 재무 지표

- 경쟁 시나리오

제14장 기업 프로파일

- 주요 진출기업

- 3D SYSTEMS, INC.

- ARKEMA

- SYENSQO

- STRATASYS

- EVONIK INDUSTRIES AG

- GE AEROSPACE

- CARPENTER TECHNOLOGY CORPORATION

- HOGANAS AB

- SANDVIK AB

- NANO DIMENSION

- SINTOKOGIO, LTD.

- NANOE

- CERAMTEC GMBH

- LITHOZ GMBH

- TETHON 3D

- 기타 기업

- GKN POWDER METALLURGY

- TRUMPF

- VICTREX PLC

- ULTIMAKER

- ETEC

- STEINBACH AG

- INTERNATIONAL SYALONS

- ALMIGHTYFILA

- DREAM POLYMERS

- WOL3D

제15장 부록

KTH 25.10.22The 3D printing materials market is estimated at USD 3.88 billion in 2025 and is projected to reach USD 10.02 billion by 2030, at a CAGR of 20.9% from 2025 to 2030. The market for 3D printing materials is largely fueled by increased usage of additive manufacturing in industries including aerospace, automotive, healthcare, and consumer products, where customization, lightweighting, and quick prototyping are essential.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) and Volume (Ton) |

| Segments | Type, Form, Technology, Application, End-use Industry, and Region |

| Regions covered | Europe, North America, Asia Pacific, the Middle East & Africa, and Latin America |

Rising demand for high-performance materials such as metals, composites, and advanced polymers is making manufacturers capable of creating tough, complex components with less lead time and lower costs. Also, the transition toward on-demand and sustainable manufacturing, along with advances in material science that enhance strength, heat resistance, and biocompatibility, is driving market growth. Industry 4.0 and supply chain localization support from governments further bolsters demand.

"Filament segment is projected to be the second-fastest-growing segment during the forecast period."

The filament segment of the 3D printing materials industry is exhibiting the highest-growing CAGR, based mainly on its handling ease, compatibility with commonly utilized FDM/FFF printers, and growing interest in low-cost printing solutions at the desktop level. Filament-based material printing streamlines the manufacturing process, allowing it to be made accessible for prototyping and small-scale production purposes in various industries such as dental, electronics, and research. Nonetheless, the unmet demand also fuels growth, leaving a supply gap and high market potential for new entrants and innovations.

"The healthcare segment is projected to register the second-highest growth rate during the forecast period."

The healthcare sector has the second-best CAGR in the 3D printing materials market because of the increasing use of biocompatible materials for dental restorations, bone implants, and surgical instruments. Materials such as zirconia and alumina are highly biocompatible, resistant to wear, and strong, and hence can be well-suited for tailor-made dental crowns and orthopedic implants. 3D printing allows for accurate, patient-specific designs that save surgery time and enhance outcomes. Further, as medicine evolves toward personalized care and minimally invasive treatments, the need for tailored, high-performance 3D printed parts is growing. Advances in the processes and materials used in ceramic printing technologies are accelerating adoption in dental and orthopedic applications.

"Europe is projected to register the third-highest growth rate in the 3D printing materials market during the forecast period."

Europe is projected to register the third-highest CAGR in the 3D printing materials market because of robust government backing of additive manufacturing, an established industrial foundation, and rising R&D spending in advanced materials. Germany, France, and Russia are leading the charge in 3D printing innovation, with specific emphasis in the aerospace, healthcare, and automotive industries, where there is a high demand for precision and material performance. The area is also underpinned by a strong base of universities and research institutes cooperating with industry leaders to create tomorrow's advanced material printing technologies. In addition, the EU's focus on digital manufacturing and sustainability drives the application of 3D printed materials for low-waste, efficient, and lightweight production.

This study has been validated through primary interviews with industry experts globally. The primary sources have been divided into the following three categories:

- By Company Type: Tier 1 - 40%, Tier 2 - 33%, and Tier 3 - 27%

- By Designation: C-level - 50%, Director-level - 30%, and Managers - 20%

- By Region: North America - 15%, Europe - 50%, Asia Pacific - 20%, the Middle East & Africa - 10%, and Latin America - 5%

The report provides a comprehensive analysis of the following companies:

Prominent companies in this market include 3D Systems, Inc. (US), Stratasys (US), Arkema (France), Evonik Industries AG (Germany), GE Aerospace (US), Sintokogio, Ltd. (Japan), Syensqo (Belgium), Sandvik AB (Sweden), Hoganas AB (Sweden), Nano Dimension (US), Lithoz GmbH (Austria), CeramTec GmbH (Germany), Tethon 3D (US), and Nanoe (France).

Research Coverage

This research report categorizes the 3D printing materials market by type (plastics, metals, and ceramics), form (liquid, filament, and powder), technology (FDM, SLS, SLA, DMLS, and other technologies), application (prototyping, manufacturing, and other applications), end-use industry (aerospace & defense, healthcare, automotive, consumer goods, other end-use industries), and region (North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America). The scope of the report includes detailed information about the major factors influencing the growth of the 3D printing materials market, such as drivers, restraints, challenges, and opportunities. A thorough examination of the key industry players has been conducted to provide insights into their business overview, solutions and services, key strategies, and recent developments in the 3D printing materials market. This report includes a competitive analysis of upcoming startups in the 3D printing materials market ecosystem.

Reasons to buy this report

The report will help market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall 3D printing materials market and the subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (increasing research & development activities in 3D printing materials), restraints (lack of standard process control), opportunities (growing investments and funding in the market), and challenges (high cost and lack of scalability) are influencing the growth of the 3D printing materials market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and product launches in the 3D printing materials market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the 3D printing materials market across varied regions.

- Market Diversification: Exhaustive information about services, untapped geographies, recent developments, and investments in the 3D printing materials market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players like 3D Systems, Inc. (US), Stratasys (US), Arkema (France), Evonik Industries AG (Germany), GE Aerospace (US), Sintokogio, Ltd. (Japan), Syensqo (Belgium), Sandvik AB (Sweden), Hoganas AB (Sweden), Nano Dimension (US), Lithoz GmbH (Austria), CeramTec GmbH (Germany), Tethon 3D (US), and Nanoe (France).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS OF STUDY

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Interviews with top 3D printing material providers

- 2.1.2.3 Breakdown of interviews with experts

- 2.1.2.4 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 BASE NUMBER CALCULATION

- 2.2.1 APPROACH 1: SUPPLY-SIDE APPROACH

- 2.2.2 APPROACH 2: DEMAND-SIDE APPROACH

- 2.3 GROWTH FORECAST

- 2.3.1 SUPPLY SIDE

- 2.3.2 DEMAND SIDE

- 2.4 MARKET SIZE ESTIMATION

- 2.4.1 BOTTOM-UP APPROACH

- 2.4.2 TOP-DOWN APPROACH

- 2.5 DATA TRIANGULATION

- 2.6 FACTOR ANALYSIS

- 2.7 RESEARCH ASSUMPTIONS

- 2.8 RESEARCH LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN 3D PRINTING MATERIALS MARKET

- 4.2 3D PRINTING MATERIALS MARKET, BY END-USE INDUSTRY AND REGION

- 4.3 3D PRINTING MATERIALS MARKET, BY TYPE

- 4.4 3D PRINTING MATERIALS MARKET, BY FORM

- 4.5 3D PRINTING MATERIALS MARKET, BY TECHNOLOGY

- 4.6 3D PRINTING MATERIALS MARKET, BY APPLICATION

- 4.7 3D PRINTING MATERIALS MARKET, BY END-USE INDUSTRY

- 4.8 3D PRINTING MATERIALS MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increased supply of 3D printing materials due to forward integration of key polymer companies

- 5.2.1.2 Development of new industrial-grade 3D printing materials

- 5.2.1.3 Government-led initiatives to boost adoption of 3D printing technologies

- 5.2.2 RESTRAINTS

- 5.2.2.1 Lack of mass production

- 5.2.2.2 Lack of standard process control

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Penetration of 3D printing in emerging countries

- 5.2.3.2 Emerging applications of 3D printing metals

- 5.2.4 CHALLENGES

- 5.2.4.1 High cost and lack of scalability

- 5.2.4.2 Reduction of lead time

- 5.2.1 DRIVERS

6 INDUSTRY TRENDS

- 6.1 PORTER'S FIVE FORCES ANALYSIS

- 6.1.1 BARGAINING POWER OF BUYERS

- 6.1.2 BARGAINING POWER OF SUPPLIERS

- 6.1.3 THREAT OF NEW ENTRANTS

- 6.1.4 THREAT OF SUBSTITUTES

- 6.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.2 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.2.2 BUYING CRITERIA

- 6.3 PRICING ANALYSIS

- 6.3.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY END-USE INDUSTRY, 2024

- 6.3.2 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2024

- 6.4 MACROECONOMIC OUTLOOK

- 6.4.1 INTRODUCTION

- 6.4.2 GDP TRENDS AND FORECAST

- 6.4.3 TRENDS IN GLOBAL AEROSPACE & DEFENSE INDUSTRY

- 6.4.4 TRENDS IN GLOBAL HEALTHCARE INDUSTRY

- 6.5 VALUE CHAIN ANALYSIS

- 6.6 ECOSYSTEM ANALYSIS

- 6.7 TRADE ANALYSIS

- 6.7.1 EXPORT SCENARIO (HS CODE 848520)

- 6.7.2 IMPORT SCENARIO (HS CODE 848520)

- 6.7.3 EXPORT SCENARIO (HS CODE 848510)

- 6.7.4 IMPORT SCENARIO (HS CODE 848510)

- 6.8 TECHNOLOGY ANALYSIS

- 6.8.1 KEY TECHNOLOGIES

- 6.8.1.1 Material extrusion

- 6.8.1.2 Vat polymerization

- 6.8.1.3 Power bed fusion

- 6.8.1.4 Material jetting

- 6.8.1.5 Direct energy deposition

- 6.8.2 COMPLEMENTARY TECHNOLOGIES

- 6.8.2.1 Micro 3D printing

- 6.8.2.2 Binder jetting

- 6.8.1 KEY TECHNOLOGIES

- 6.9 PATENT ANALYSIS

- 6.9.1 INTRODUCTION

- 6.9.2 METHODOLOGY

- 6.9.3 DOCUMENT TYPES

- 6.9.4 INSIGHTS

- 6.9.5 LEGAL STATUS

- 6.9.6 JURISDICTION ANALYSIS

- 6.9.7 TOP APPLICANTS

- 6.10 REGULATORY LANDSCAPE

- 6.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.11 KEY CONFERENCES AND EVENTS, 2025-2026

- 6.12 CASE STUDY ANALYSIS

- 6.12.1 AIRBUS: 3D PRINTED POLYMER PARTS FOR AIRCRAFT INTERIORS

- 6.12.2 BOLLINGER GROUP PARTNERED WITH MATERIALISE TO REDUCE SUPPORT STRUCTURES IN METAL ADDITIVE MANUFACTURING

- 6.12.3 DENBY POTTERY AND UWE BRISTOL: TRANSFORMING TABLEWARE PROTOTYPING WITH 3D PRINTED CERAMICS

- 6.13 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.14 IMPACT OF GEN AI/AI ON 3D PRINTING MATERIALS MARKET

- 6.14.1 TOP USE CASES AND MARKET POTENTIAL

- 6.14.2 CASE STUDIES OF AI IMPLEMENTATION IN 3D PRINTING MATERIALS MARKET

- 6.15 INVESTMENT AND FUNDING SCENARIO

- 6.16 IMPACT OF 2025 US TARIFF ON 3D PRINTING MATERIALS MARKET

- 6.16.1 INTRODUCTION

- 6.16.2 KEY TARIFF RATES

- 6.16.3 PRICE IMPACT ANALYSIS

- 6.16.4 KEY IMPACT ON COUNTRIES/REGIONS

- 6.16.4.1 US

- 6.16.4.2 Europe

- 6.16.4.3 Asia Pacific

- 6.16.5 IMPACT ON END-USE INDUSTRIES

7 3D PRINTING MATERIALS MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 PLASTICS

- 7.2.1 INCREASING DEMAND FOR BIO-BASED PLASTIC GRADES TO DRIVE MARKET

- 7.2.2 PHOTOPOLYMERS

- 7.2.3 ACRYLONITRILE BUTADIENE STYRENE (ABS)

- 7.2.4 POLYLACTIC ACID (PLA)

- 7.2.5 POLYAMIDE (NYLON)

- 7.2.6 OTHER PLASTICS

- 7.3 METALS

- 7.3.1 INCREASING DEMAND FROM AEROSPACE & DEFENSE AND AUTOMOTIVE INDUSTRIES TO FUEL MARKET GROWTH

- 7.3.2 TITANIUM

- 7.3.3 ALUMINUM

- 7.3.4 STAINLESS STEEL

- 7.3.5 NICKEL & COBALT

- 7.3.6 OTHER METALS

- 7.4 CERAMICS

- 7.4.1 ADVANCEMENTS IN BIOCOMPATIBLE CERAMICS TO FUEL MARKET GROWTH

- 7.4.2 OXIDES

- 7.4.3 NON-OXIDES

8 3D PRINTING MATERIALS MARKET, BY FORM

- 8.1 INTRODUCTION

- 8.2 FILAMENT

- 8.2.1 HIGH DEMAND FOR PLASTIC FILAMENTS TO DRIVE MARKET

- 8.3 LIQUID

- 8.3.1 SIGNIFICANT USE IN HEALTHCARE, AEROSPACE & DEFENSE, AND ELECTRICAL & ELECTRONICS INDUSTRIES TO DRIVE MARKET

- 8.4 POWDER

- 8.4.1 RISING ADOPTION IN VARIOUS 3D PRINTING TECHNOLOGIES TO DRIVE MARKET

9 3D PRINTING MATERIALS MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 PROTOTYPING

- 9.2.1 DEMAND FROM AUTOMOTIVE SECTOR TO BUILD PARTS TO PROPEL MARKET GROWTH

- 9.3 MANUFACTURING

- 9.3.1 ADVANCED MATERIALS TO DRIVE 3D PRINTING ADOPTION IN MANUFACTURING

- 9.4 OTHER APPLICATIONS

10 3D PRINTING MATERIALS MARKET, BY TECHNOLOGY

- 10.1 INTRODUCTION

- 10.2 FUSED DEPOSITION MODELING (FDM)

- 10.2.1 COMPATIBILITY WITH DIVERSE MATERIAL OPTIONS TO DRIVE DEMAND

- 10.3 SELECTIVE LASER SINTERING (SLS)

- 10.3.1 INCREASING NEED FOR PRODUCTION OF COMPLEX GEOMETRIC PARTS WITH PLASTICS IN POWDER FORM TO PROPEL MARKET

- 10.4 STEREOLITHOGRAPHY/DIGITAL LIGHT PROCESSING (SLA/DLP)

- 10.4.1 PRODUCTION OF OBJECTS WITH HIGH-DIMENSIONAL ACCURACY AND INTRICATE DETAILS TO DRIVE DEMAND

- 10.5 DIRECT METAL LASER SINTERING (DMLS)

- 10.5.1 RISING ADOPTION TO CREATE 3D OBJECTS USING METAL ALLOYS TO FUEL MARKET GROWTH

- 10.6 OTHER TECHNOLOGIES

11 3D PRINTING MATERIALS MARKET, BY END-USE INDUSTRY

- 11.1 INTRODUCTION

- 11.2 AEROSPACE & DEFENSE

- 11.2.1 INCREASING USE IN MANUFACTURING COMPLEX COMPONENTS AND EQUIPMENT TO DRIVE MARKET

- 11.3 HEALTHCARE

- 11.3.1 TECHNOLOGICAL ADVANCEMENTS IN PLASTIC GRADES TO DRIVE MARKET

- 11.4 AUTOMOTIVE

- 11.4.1 HIGH DEMAND FOR PROTOTYPING AUTOMOBILE COMPONENTS TO DRIVE MARKET

- 11.5 CONSUMER GOODS

- 11.5.1 RISING DEMAND FOR MANUFACTURING COMPLEX DESIGNS TO AUGMENT MARKET GROWTH

- 11.6 OTHER END-USE INDUSTRIES

12 3D PRINTING MATERIALS MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 NORTH AMERICA

- 12.2.1 US

- 12.2.1.1 Growing strategic partnerships to drive market

- 12.2.2 CANADA

- 12.2.2.1 Adoption of 3D printing technology in consumer goods industry to drive market

- 12.2.1 US

- 12.3 EUROPE

- 12.3.1 GERMANY

- 12.3.1.1 Large presence of 3D printed material manufacturers to drive market

- 12.3.2 FRANCE

- 12.3.2.1 Increasing demand from aerospace & defense industry to propel market

- 12.3.3 UK

- 12.3.3.1 Rising number of research & development centers to drive market

- 12.3.4 ITALY

- 12.3.4.1 Adoption of 3D printing materials in various sectors to drive market

- 12.3.5 REST OF EUROPE

- 12.3.1 GERMANY

- 12.4 ASIA PACIFIC

- 12.4.1 CHINA

- 12.4.1.1 Rapid industrialization and investments to drive market

- 12.4.2 JAPAN

- 12.4.2.1 Ongoing research collaborations in 3D printing ceramics to accelerate demand

- 12.4.3 SOUTH KOREA

- 12.4.3.1 Strong government support to drive market

- 12.4.4 INDIA

- 12.4.4.1 Government-led initiatives and substantial foreign investments to drive market

- 12.4.5 REST OF ASIA PACIFIC

- 12.4.1 CHINA

- 12.5 MIDDLE EAST & AFRICA

- 12.5.1 GCC COUNTRIES

- 12.5.1.1 UAE

- 12.5.1.1.1 High demand from end-use industries to propel market

- 12.5.1.2 Saudi Arabia

- 12.5.1.2.1 Growing government initiatives to drive market

- 12.5.1.3 Rest of GCC Countries

- 12.5.1.1 UAE

- 12.5.2 SOUTH AFRICA

- 12.5.2.1 Growing adoption of 3D printing materials in various sectors to drive market

- 12.5.3 REST OF MIDDLE EAST & AFRICA

- 12.5.1 GCC COUNTRIES

- 12.6 LATIN AMERICA

- 12.6.1 BRAZIL

- 12.6.1.1 Government support and technological advancements to propel market for 3D printing materials

- 12.6.2 MEXICO

- 12.6.2.1 Increasing innovations to propel market growth

- 12.6.3 REST OF LATIN AMERICA

- 12.6.1 BRAZIL

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 13.3 REVENUE ANALYSIS, 2020-2024

- 13.4 MARKET SHARE ANALYSIS, 2024

- 13.5 BRAND/PRODUCT COMPARATIVE ANALYSIS

- 13.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.6.1 STARS

- 13.6.2 EMERGING LEADERS

- 13.6.3 PERVASIVE PLAYERS

- 13.6.4 PARTICIPANTS

- 13.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.6.5.1 Company footprint

- 13.6.5.2 Region footprint

- 13.6.5.3 Type footprint

- 13.6.5.4 Form footprint

- 13.6.5.5 Technology footprint

- 13.6.5.6 Application footprint

- 13.6.5.7 End-use industry footprint

- 13.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.7.1 PROGRESSIVE COMPANIES

- 13.7.2 RESPONSIVE COMPANIES

- 13.7.3 DYNAMIC COMPANIES

- 13.7.4 STARTING BLOCKS

- 13.7.5 COMPETITIVE BENCHMARKING: KEY STARTUPS/SMES, 2024

- 13.7.5.1 Detailed list of key startups/SMEs

- 13.7.5.2 Competitive benchmarking of key startups/SMEs

- 13.8 VALUATION AND FINANCIAL METRICS OF 3D PRINTING MATERIAL VENDORS

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 PRODUCT LAUNCHES

- 13.9.2 DEALS

- 13.9.3 EXPANSIONS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 3D SYSTEMS, INC.

- 14.1.1.1 Business overview

- 14.1.1.2 Products offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Product launches

- 14.1.1.3.2 Deals

- 14.1.1.4 MnM view

- 14.1.1.4.1 Key strengths/Right to win

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses/Competitive threats

- 14.1.2 ARKEMA

- 14.1.2.1 Business overview

- 14.1.2.2 Products offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Deals

- 14.1.2.3.2 Product launches

- 14.1.2.3.3 Expansions

- 14.1.2.3.4 Other developments

- 14.1.2.4 MnM view

- 14.1.2.4.1 Key strengths/Right to win

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses/Competitive threats

- 14.1.3 SYENSQO

- 14.1.3.1 Business overview

- 14.1.3.2 Products offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Product launches

- 14.1.3.4 MnM view

- 14.1.3.4.1 Key strengths/Right to win

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses/Competitive threats

- 14.1.4 STRATASYS

- 14.1.4.1 Business overview

- 14.1.4.2 Products offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Deals

- 14.1.4.3.2 Expansions

- 14.1.4.3.3 Other developments

- 14.1.4.4 MnM view

- 14.1.4.4.1 Key strength/Right to win

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses/Competitive threats

- 14.1.5 EVONIK INDUSTRIES AG

- 14.1.5.1 Business overview

- 14.1.5.2 Products offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Product launches

- 14.1.5.3.2 Deals

- 14.1.5.4 MnM view

- 14.1.5.4.1 Key strengths/Right to win

- 14.1.5.4.2 Strategic choices

- 14.1.5.4.3 Weaknesses/Competitive threats

- 14.1.6 GE AEROSPACE

- 14.1.6.1 Business overview

- 14.1.6.2 Products offered

- 14.1.6.3 MnM view

- 14.1.6.3.1 Key strengths/Right to win

- 14.1.6.3.2 Strategic choices

- 14.1.6.3.3 Weaknesses/Competitive threats

- 14.1.7 CARPENTER TECHNOLOGY CORPORATION

- 14.1.7.1 Business overview

- 14.1.7.2 Products offered

- 14.1.7.3 MnM view

- 14.1.7.3.1 Key strengths/Right to win

- 14.1.7.3.2 Strategic choices

- 14.1.7.3.3 Weaknesses/Competitive threats

- 14.1.8 HOGANAS AB

- 14.1.8.1 Business overview

- 14.1.8.2 Products offered

- 14.1.8.3 Recent developments

- 14.1.8.3.1 Expansions

- 14.1.8.4 MnM view

- 14.1.8.4.1 Key strengths/Right to win

- 14.1.8.4.2 Strategic choices

- 14.1.8.4.3 Weaknesses/Competitive threats

- 14.1.9 SANDVIK AB

- 14.1.9.1 Business overview

- 14.1.9.2 Products offered

- 14.1.9.3 Recent developments

- 14.1.9.3.1 Product launches

- 14.1.9.3.2 Deals

- 14.1.9.3.3 Expansions

- 14.1.9.4 MnM view

- 14.1.9.4.1 Key strengths/Right to win

- 14.1.9.4.2 Strategic choices

- 14.1.9.4.3 Weaknesses/Competitive threats

- 14.1.10 NANO DIMENSION

- 14.1.10.1 Business overview

- 14.1.10.2 Products offered

- 14.1.10.3 MnM view

- 14.1.10.3.1 Key strengths/Right to win

- 14.1.10.3.2 Strategic choices

- 14.1.10.3.3 Weaknesses/Competitive threats

- 14.1.11 SINTOKOGIO, LTD.

- 14.1.11.1 Business overview

- 14.1.11.2 Products offered

- 14.1.11.3 Recent developments

- 14.1.11.3.1 Deals

- 14.1.11.3.2 Expansions

- 14.1.11.3.3 Other developments

- 14.1.11.4 MnM view

- 14.1.11.4.1 Key strengths/Right to win

- 14.1.11.4.2 Strategic choices

- 14.1.11.4.3 Weaknesses/Competitive threats

- 14.1.12 NANOE

- 14.1.12.1 Business overview

- 14.1.12.2 Products offered

- 14.1.12.3 Recent developments

- 14.1.12.3.1 Product launches

- 14.1.12.3.2 Deals

- 14.1.12.3.3 Expansions

- 14.1.12.4 MnM view

- 14.1.12.4.1 Key strengths/Right to win

- 14.1.12.4.2 Strategic choices

- 14.1.12.4.3 Weaknesses/Competitive threats

- 14.1.13 CERAMTEC GMBH

- 14.1.13.1 Business overview

- 14.1.13.2 Products offered

- 14.1.13.3 Recent developments

- 14.1.13.3.1 Deals

- 14.1.13.3.2 Expansions

- 14.1.13.4 MnM view

- 14.1.13.4.1 Key strengths/Right to win

- 14.1.13.4.2 Strategic choices

- 14.1.13.4.3 Weaknesses/Competitive threats

- 14.1.14 LITHOZ GMBH

- 14.1.14.1 Business overview

- 14.1.14.2 Products offered

- 14.1.14.3 Recent developments

- 14.1.14.3.1 Product launches

- 14.1.14.3.2 Other developments

- 14.1.14.4 MnM view

- 14.1.14.4.1 Key strengths/Right to win

- 14.1.14.4.2 Strategic choices

- 14.1.14.4.3 Weaknesses/Competitive threats

- 14.1.15 TETHON 3D

- 14.1.15.1 Business overview

- 14.1.15.2 Products offered

- 14.1.15.3 Recent developments

- 14.1.15.3.1 Product launches

- 14.1.15.3.2 Deals

- 14.1.15.3.3 Other developments

- 14.1.15.4 MnM view

- 14.1.15.4.1 Key strengths/Right to win

- 14.1.15.4.2 Strategic choices

- 14.1.15.4.3 Weaknesses/Competitive threats

- 14.1.1 3D SYSTEMS, INC.

- 14.2 OTHER PLAYERS

- 14.2.1 GKN POWDER METALLURGY

- 14.2.2 TRUMPF

- 14.2.3 VICTREX PLC

- 14.2.4 ULTIMAKER

- 14.2.5 ETEC

- 14.2.6 STEINBACH AG

- 14.2.7 INTERNATIONAL SYALONS

- 14.2.8 ALMIGHTYFILA

- 14.2.9 DREAM POLYMERS

- 14.2.10 WOL3D

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS